YanCoal Australia (Seite 2)

eröffnet am 24.09.16 16:22:21 von

neuester Beitrag 03.03.24 13:52:13 von

neuester Beitrag 03.03.24 13:52:13 von

Beiträge: 15

ID: 1.238.757

ID: 1.238.757

Aufrufe heute: 2

Gesamt: 1.845

Gesamt: 1.845

Aktive User: 0

ISIN: AU000000YAL0 · WKN: A1JZHX

3,3710

EUR

+0,10 %

+0,0035 EUR

Letzter Kurs 24.04.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 | |

| 0,5500 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7145 | -8,92 | |

| 2,1800 | -9,17 | |

| 17,310 | -9,98 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 |

Beitrag zu dieser Diskussion schreiben

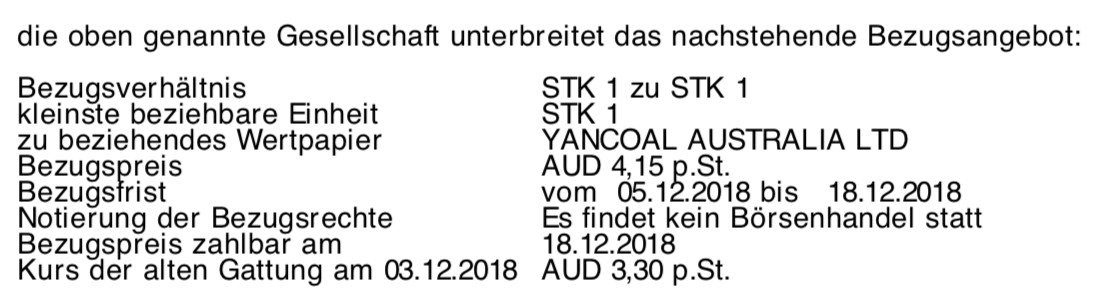

KE

=> frage mich, wie das gehen soll...

heute reverse-split 1:35 eingebucht

trotz absurdem Spread mal eine Kauforder für Ansichtsstücke gelegt

Antwort auf Beitrag Nr.: 53.341.407 von R-BgO am 24.09.16 16:22:21

frage mich, welcher der richtige ist:

...ist die australische Tochter des chinesischen Yangzhou Coal-Konzerns;

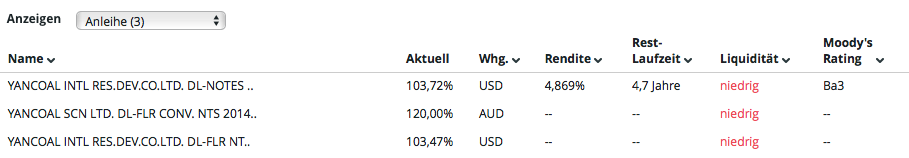

überlege ob der Hybrid-Bond was sein könnte:

SUBORDINATED CAPITAL NOTES

On 31 December 2014, Yancoal reduced its interest-bearing liabilities following the issue, by Yancoal SCN Limited, of US$1.8 billion of Subordinated Capital Notes (SCNs), with the proceeds applied to repay existing senior loans, reducing Yancoal’s gearing (debt/debt plus equity) from 84% at 30 June 2014 to 59% at 31 December 2014.

Concurrent with, and in support of, the SCN issue, Yancoal secured two new lines of additional financial support from Yanzhou: up to A$1.4 billion to be progressively drawn down to fund Yancoal’s cash flow requirements for operations and the development of major projects; and up to a further US$630 million to fund SCN distributions for a five-year period, if required.

Following on from the SCN issue, the Bank of China and the China Construction Bank also provided an extension to the repayment of their US$2.7 billion syndicated debt facility of three years, now maturing in three broadly equal tranches in 2020, 2021 and 2022.

Based on the latest long-term financial modelling, the increase in equity by A$2.1 billion will enable Yancoal to meet Bank of China’s covenants (interest cover, gearing and net worth covenants) and provide a more stable balance sheet platform for Yancoal operations going forward.

Via the Bank of China’s debt maturity extension and repayment of US$1.8 billion of Yanzhou shareholder debt via the Yanzhou subscription for the SCNs, Yancoal has established a significantly improved debt repayment profile, with no material debt maturing until 2020. This five-year window provides Yancoal with the opportunity to continue to develop its operations and brownfield strategy during the sustained market downturn.

Yancoal SCN Limited is listed on the Australian Securities Exchange.

überlege ob der Hybrid-Bond was sein könnte:

SUBORDINATED CAPITAL NOTES

On 31 December 2014, Yancoal reduced its interest-bearing liabilities following the issue, by Yancoal SCN Limited, of US$1.8 billion of Subordinated Capital Notes (SCNs), with the proceeds applied to repay existing senior loans, reducing Yancoal’s gearing (debt/debt plus equity) from 84% at 30 June 2014 to 59% at 31 December 2014.

Concurrent with, and in support of, the SCN issue, Yancoal secured two new lines of additional financial support from Yanzhou: up to A$1.4 billion to be progressively drawn down to fund Yancoal’s cash flow requirements for operations and the development of major projects; and up to a further US$630 million to fund SCN distributions for a five-year period, if required.

Following on from the SCN issue, the Bank of China and the China Construction Bank also provided an extension to the repayment of their US$2.7 billion syndicated debt facility of three years, now maturing in three broadly equal tranches in 2020, 2021 and 2022.

Based on the latest long-term financial modelling, the increase in equity by A$2.1 billion will enable Yancoal to meet Bank of China’s covenants (interest cover, gearing and net worth covenants) and provide a more stable balance sheet platform for Yancoal operations going forward.

Via the Bank of China’s debt maturity extension and repayment of US$1.8 billion of Yanzhou shareholder debt via the Yanzhou subscription for the SCNs, Yancoal has established a significantly improved debt repayment profile, with no material debt maturing until 2020. This five-year window provides Yancoal with the opportunity to continue to develop its operations and brownfield strategy during the sustained market downturn.

Yancoal SCN Limited is listed on the Australian Securities Exchange.