Dream Global REIT - 500 Beiträge pro Seite

eröffnet am 18.10.16 12:15:23 von

neuester Beitrag 16.09.19 08:10:30 von

neuester Beitrag 16.09.19 08:10:30 von

Beiträge: 19

ID: 1.240.020

ID: 1.240.020

Aufrufe heute: 0

Gesamt: 1.056

Gesamt: 1.056

Aktive User: 0

ISIN: CA26154A1066 · WKN: A1131Y

11,330

EUR

-0,61 %

-0,070 EUR

Letzter Kurs 11.12.19 Xetra

Neuigkeiten

Werte aus der Branche Immobilien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,3400 | +62,93 | |

| 0,9000 | +38,46 | |

| 0,6327 | +34,62 | |

| 0,5100 | +30,77 | |

| 2,4000 | +20,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,8500 | -11,04 | |

| 1,4090 | -11,69 | |

| 17,875 | -13,43 | |

| 0,51 | -13,56 | |

| 0,7333 | -63,15 |

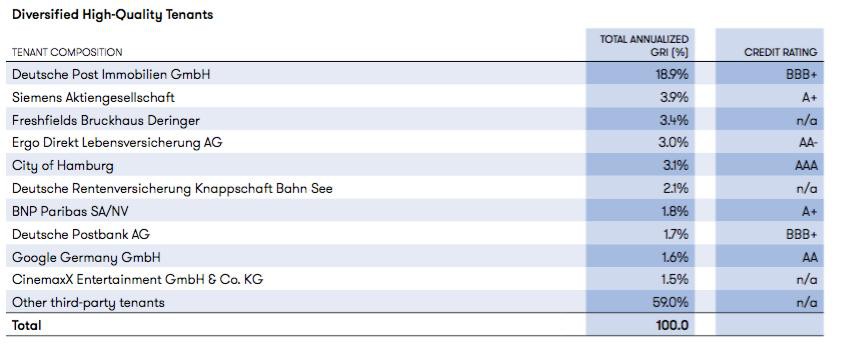

...hält ausschließlich deutsche und ein paar österreichische Gewerbeimmobilien;

notiert deutlich unter Buch, hat eine für Immoverhältnisse ordentliche EK-Rendite und schüttet sogar noch >8% aus.

Frage mich, ob/wo es da einen Haken gibt.

Der hier auch: http://seekingalpha.com/article/4012521-german-real-estate-2…

notiert deutlich unter Buch, hat eine für Immoverhältnisse ordentliche EK-Rendite und schüttet sogar noch >8% aus.

Frage mich, ob/wo es da einen Haken gibt.

Der hier auch: http://seekingalpha.com/article/4012521-german-real-estate-2…

Antwort auf Beitrag Nr.: 53.497.764 von R-BgO am 18.10.16 12:15:23

-monatliche Dividende, macht kombiniert mit kanadischer Quellensteuer einen Scheiß-Cocktail für die Nettorendite

2 Wermutstropfen:

-anscheinend relativ ausgeprägte Dilution, der unit-count geht ständig rauf-monatliche Dividende, macht kombiniert mit kanadischer Quellensteuer einen Scheiß-Cocktail für die Nettorendite

Antwort auf Beitrag Nr.: 53.498.088 von R-BgO am 18.10.16 12:40:33ein Weiterer welcher zu der akt. Bewertung beiträgt ist denke ich, dass 2018 knapp 30% der Mietverträge auslaufen / Mieter ist DHL, Post und Postbank...

Ich bin auch über den seeking alpha Artikel gestoßen und habe mir hier:

http://value-shares.de/2016/10/31/dream-global-kanadisch-deu…

ein paar eigene Gedanken zu Dream Global gemacht...

http://value-shares.de/2016/10/31/dream-global-kanadisch-deu…

ein paar eigene Gedanken zu Dream Global gemacht...

gute Zahlen

http://www.dgap.de/dgap/News/corporate/dream-global-reit-and…OUTLOOK

The German economy continues to benefit from a very robust labour market, fueled by domestic demand and government spending. Germany's unemployment rate reached a new record low of 3.5% at the end of 2016, further dropping from 3.9% a month earlier and 4.5% at the end of 2015. German GDP grew by 1.9% in 2016, ahead of expectations.

The fundamentals in the office sector are strong, with office vacancy rates continuing to decline across the major office markets. In the Big 7 German office markets, vacancy rates declined to a record low of 5.5% at the end of 2016, a 90 basis point decline since the end of 2015. Fueled by strong market fundamentals, in-place and committed occupancy in the Trust's portfolio rose to 90% for the first time in Dream Global REIT's history. Q4 2016 also marked the Trust's eighth consecutive quarter of occupancy growth.

Throughout the fourth quarter of 2016 and the beginning of 2017, management of the REIT has continued its discussions with Deutsche Post with respect to the tenant's 2018 lease expiries. Drawing on past experience and preliminary feedback from the tenant to date, the Trust expects to retain a significant portion of the expiring GRI and will continue its strategy with respect to this expiry. This includes our ongoing asset recycling plan, active leasing and pursuing redevelopment opportunities in addition to proactive retention discussions with Deutsche Post.

Dream Global REIT reached a number of significant milestones in 2016, including: the refinancing of $332.0 million of mortgages at lower rates and with a longer term; the early redemption of the Trust's $161.0 million convertible debenture to achieve interest rate savings; a dual listing for Dream Global REIT's units on the Frankfurt Stock Exchange under the trading symbol DRG; and obtaining an investment grade credit rating from Moody's, recognizing record low vacancy rates, low unemployment and moderate new supply of office space, the quality of our assets, our track record in Europe, strong German economic fundamentals as well as a solid balance sheet.

With the momentum created in 2016 through a number of key strategic initiatives, supported by solid economic conditions and strong real estate fundamentals in our target markets, we are well positioned to strengthen the stability of our cash flow in 2017 and beyond.

Management will provide further details on the Trust's performance and outlook on its conference call tomorrow.

TORONTO, (February 28, 2017

DREAM GLOBAL REIT (TSX RG.UN. FRA

RG.UN. FRA RG, "Dream

RG, "Dream

Global" or the "Trust") announced today that it has entered into an

agreement to sell 10,420,000 units of the Trust (the "Units") on a bought

deal basis at a price of $9.60 per Unit to a syndicate of underwriters led

by TD Securities Inc. (the "Underwriters") for gross proceeds of

$100,032,000 (the "Offering").

In addition, Dream Global has granted the

Underwriters an over-allotment option, exercisable for a period of 30 days

following closing of the Offering, to purchase up to an additional

1,563,000 Units which, if exercised in full, would increase the gross

proceeds of the Offering to $115,036,800. Closing of the Offering is

expected to occur on or about March 21, 2017. The Offering is subject to

certain customary conditions, including the approval of the Toronto Stock

Exchange.

The Trust intends to use the net proceeds from the Offering to fund

potential future acquisitions and for general trust purposes. The Trust has

bid on, and is currently in varying stages of negotiations with vendors on

four potential acquisitions of office properties located in its target

markets in Europe. The combined expected purchase price of these properties

would exceed EUR200 million ($281 million).

The Units will be offered by way of a short form prospectus to be filed on

or about March 13, 2017 with the securities commissions and other similar

regulatory authorities in each of the provinces of Canada.

DREAM GLOBAL REIT (TSX

RG.UN. FRA

RG.UN. FRA RG, "Dream

RG, "DreamGlobal" or the "Trust") announced today that it has entered into an

agreement to sell 10,420,000 units of the Trust (the "Units") on a bought

deal basis at a price of $9.60 per Unit to a syndicate of underwriters led

by TD Securities Inc. (the "Underwriters") for gross proceeds of

$100,032,000 (the "Offering").

In addition, Dream Global has granted the

Underwriters an over-allotment option, exercisable for a period of 30 days

following closing of the Offering, to purchase up to an additional

1,563,000 Units which, if exercised in full, would increase the gross

proceeds of the Offering to $115,036,800. Closing of the Offering is

expected to occur on or about March 21, 2017. The Offering is subject to

certain customary conditions, including the approval of the Toronto Stock

Exchange.

The Trust intends to use the net proceeds from the Offering to fund

potential future acquisitions and for general trust purposes. The Trust has

bid on, and is currently in varying stages of negotiations with vendors on

four potential acquisitions of office properties located in its target

markets in Europe. The combined expected purchase price of these properties

would exceed EUR200 million ($281 million).

The Units will be offered by way of a short form prospectus to be filed on

or about March 13, 2017 with the securities commissions and other similar

regulatory authorities in each of the provinces of Canada.

Antwort auf Beitrag Nr.: 54.437.028 von R-BgO am 01.03.17 10:10:42Das Portfolio gefällt mir ausgesprochen gut und im Vergleich zu Unibail Rodamco sogar besser.

Die Börsenumsätze in D sind allerdings zu gering um mit einer Position einzusteigen.

Ich beobachte den Wert mal....

Die Börsenumsätze in D sind allerdings zu gering um mit einer Position einzusteigen.

Ich beobachte den Wert mal....

DREAM GLOBAL REIT EXPANDS INTO BRUSSELS, BELGIUM WITH EUR95.9 MILLION ACQUISITION

DGAP-News: Dream Global Real Estate Investment Trust / Key word(s): Acquisition

16.05.2017 / 23:24

The issuer is solely responsible for the content of this announcement.

DREAM GLOBAL REIT EXPANDS INTO BRUSSELS, BELGIUM WITH EUR95.9 MILLION ACQUISITION

TORONTO, MAY 16, 2017

DREAM GLOBAL REIT (TSX RG.UN, FRA

RG.UN, FRA RG) today announced that it has completed the acquisition of all the shares issued by SPE III Runway SPRL, a Belgian entity that holds as its main asset Airport Plaza, a multi-tenant office complex located in Brussels, Belgium. The purchase price was approximately EUR95.9 million ($143.0 million), representing a going in capitalization rate of 7.1%. The purchase price was funded with proceeds from the Trust's March equity offering and its revolving credit facility. The REIT is in negotiations to place long-term mortgage financing for a term of up to seven years and an interest rate of approximately 1.8% based on the current market rates. The acquisition further expands the REIT's geographic presence which also includes properties throughout Germany as well as in Vienna.

RG) today announced that it has completed the acquisition of all the shares issued by SPE III Runway SPRL, a Belgian entity that holds as its main asset Airport Plaza, a multi-tenant office complex located in Brussels, Belgium. The purchase price was approximately EUR95.9 million ($143.0 million), representing a going in capitalization rate of 7.1%. The purchase price was funded with proceeds from the Trust's March equity offering and its revolving credit facility. The REIT is in negotiations to place long-term mortgage financing for a term of up to seven years and an interest rate of approximately 1.8% based on the current market rates. The acquisition further expands the REIT's geographic presence which also includes properties throughout Germany as well as in Vienna.

The Trust remains in exclusive negotiations on an additional acquisition in Stuttgart, Germany, which is expected to close by the end of Q2 2017. Following this acquisition, the Trust will have fully deployed the proceeds raised in its most recent public offering of units.

"We are excited to have entered into the compelling Brussels market with this high-quality acquisition" said Jane Gavan, Chief Executive Officer of Dream Global REIT. "Brussels, headquarters of the European Union, is amongst the largest office markets in Europe and a strategic location for many multinational companies, making it an ideal location for the Trust's expansion. We have now entered into our second market outside of Germany, further solidifying our reputation as a local European investor with a strong management platform."

Corporate Gateway and International Hub - Belgium is centrally located in Europe and is a corporate gateway serving as the European and regional headquarters for many international companies. Belgium boasts a robust and highly developed transportation network, with extensive connections to neighbouring countries, including Germany. The capital city of Brussels is a top six European office market, a preferred location for international organizations and among the largest global centres for international cooperation, serving as the headquarters for both NATO and the European Union. Brussels is at the heart of one of the wealthiest regions in Europe and has office inventory totalling 143 million square feet, comparable in size to Hamburg or Frankfurt in Germany. For reference, Brussels ranks behind only Toronto in terms of total office market size relative to Canadian cities.

"With strong corporate demand, a rising rent environment and compressing yields, Brussels shares similar favourable characteristics with both Germany and Vienna" said Alex Sannikov, SVP Commercial Properties. "We have been looking for opportunities to enter this market and believe that Airport Plaza is an excellent first step, with a strong yield and great tenant roster."

Well Located Suburban Office Complex with Strong Diversified Tenant Base - Airport Plaza was built in 2011 and is currently 97% occupied, with a weighted average lease term of 8.1 years. The complex consists of five multi-story office buildings with underground parking, totalling 387,500 square feet of gross leasable area. The buildings are linked by means of a shared lobby, providing internal access to restaurants and amenities. In addition, the complex features significant outdoor amenities including terraces and patios located at grade level as well as on several rooftops. Airport Plaza has obtained BREEAM environmental certification in recognition of the sustainability of the complex.

The complex is located in the Airport district, a preferred location for many international companies that offers lower corporate tax, convenient access and rent advantages relative to the inner city. Airport Plaza is home to a high-profile tenant base that includes Samsung, Levi Strauss, Air Products, Estée Lauder, Sanofi, McDonalds, Chevron and NN Belgium (the insurance arm of ING). The property is situated next to the Brussels International Airport with excellent access to major motorways and public transportation.

Dream Global REIT is an unincorporated, open-ended real estate investment trust that provides investors with the opportunity to invest in commercial real estate exclusively outside of Canada. Dream Global REIT's portfolio currently consists of approximately 13.3 million square feet of gross leasable area of office, industrial and mixed-use properties across Germany, Austria and Belgium. For more information, please visit www.dream.ca/global.

DGAP-News: Dream Global Real Estate Investment Trust / Key word(s): Acquisition

16.05.2017 / 23:24

The issuer is solely responsible for the content of this announcement.

DREAM GLOBAL REIT EXPANDS INTO BRUSSELS, BELGIUM WITH EUR95.9 MILLION ACQUISITION

TORONTO, MAY 16, 2017

DREAM GLOBAL REIT (TSX

RG.UN, FRA

RG.UN, FRA RG) today announced that it has completed the acquisition of all the shares issued by SPE III Runway SPRL, a Belgian entity that holds as its main asset Airport Plaza, a multi-tenant office complex located in Brussels, Belgium. The purchase price was approximately EUR95.9 million ($143.0 million), representing a going in capitalization rate of 7.1%. The purchase price was funded with proceeds from the Trust's March equity offering and its revolving credit facility. The REIT is in negotiations to place long-term mortgage financing for a term of up to seven years and an interest rate of approximately 1.8% based on the current market rates. The acquisition further expands the REIT's geographic presence which also includes properties throughout Germany as well as in Vienna.

RG) today announced that it has completed the acquisition of all the shares issued by SPE III Runway SPRL, a Belgian entity that holds as its main asset Airport Plaza, a multi-tenant office complex located in Brussels, Belgium. The purchase price was approximately EUR95.9 million ($143.0 million), representing a going in capitalization rate of 7.1%. The purchase price was funded with proceeds from the Trust's March equity offering and its revolving credit facility. The REIT is in negotiations to place long-term mortgage financing for a term of up to seven years and an interest rate of approximately 1.8% based on the current market rates. The acquisition further expands the REIT's geographic presence which also includes properties throughout Germany as well as in Vienna.The Trust remains in exclusive negotiations on an additional acquisition in Stuttgart, Germany, which is expected to close by the end of Q2 2017. Following this acquisition, the Trust will have fully deployed the proceeds raised in its most recent public offering of units.

"We are excited to have entered into the compelling Brussels market with this high-quality acquisition" said Jane Gavan, Chief Executive Officer of Dream Global REIT. "Brussels, headquarters of the European Union, is amongst the largest office markets in Europe and a strategic location for many multinational companies, making it an ideal location for the Trust's expansion. We have now entered into our second market outside of Germany, further solidifying our reputation as a local European investor with a strong management platform."

Corporate Gateway and International Hub - Belgium is centrally located in Europe and is a corporate gateway serving as the European and regional headquarters for many international companies. Belgium boasts a robust and highly developed transportation network, with extensive connections to neighbouring countries, including Germany. The capital city of Brussels is a top six European office market, a preferred location for international organizations and among the largest global centres for international cooperation, serving as the headquarters for both NATO and the European Union. Brussels is at the heart of one of the wealthiest regions in Europe and has office inventory totalling 143 million square feet, comparable in size to Hamburg or Frankfurt in Germany. For reference, Brussels ranks behind only Toronto in terms of total office market size relative to Canadian cities.

"With strong corporate demand, a rising rent environment and compressing yields, Brussels shares similar favourable characteristics with both Germany and Vienna" said Alex Sannikov, SVP Commercial Properties. "We have been looking for opportunities to enter this market and believe that Airport Plaza is an excellent first step, with a strong yield and great tenant roster."

Well Located Suburban Office Complex with Strong Diversified Tenant Base - Airport Plaza was built in 2011 and is currently 97% occupied, with a weighted average lease term of 8.1 years. The complex consists of five multi-story office buildings with underground parking, totalling 387,500 square feet of gross leasable area. The buildings are linked by means of a shared lobby, providing internal access to restaurants and amenities. In addition, the complex features significant outdoor amenities including terraces and patios located at grade level as well as on several rooftops. Airport Plaza has obtained BREEAM environmental certification in recognition of the sustainability of the complex.

The complex is located in the Airport district, a preferred location for many international companies that offers lower corporate tax, convenient access and rent advantages relative to the inner city. Airport Plaza is home to a high-profile tenant base that includes Samsung, Levi Strauss, Air Products, Estée Lauder, Sanofi, McDonalds, Chevron and NN Belgium (the insurance arm of ING). The property is situated next to the Brussels International Airport with excellent access to major motorways and public transportation.

Dream Global REIT is an unincorporated, open-ended real estate investment trust that provides investors with the opportunity to invest in commercial real estate exclusively outside of Canada. Dream Global REIT's portfolio currently consists of approximately 13.3 million square feet of gross leasable area of office, industrial and mixed-use properties across Germany, Austria and Belgium. For more information, please visit www.dream.ca/global.

TORONTO, ONTARIO--(Marketwired - July 27, 2017) -

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

DREAM GLOBAL REIT (TSX RG.UN)(FRANKFURT

RG.UN)(FRANKFURT RG), "Dream Global" or the "REIT")

RG), "Dream Global" or the "REIT")

today announced that it has completed the previously announced transaction (the "Transaction") relating to a portfolio of 135 office and light industrial properties located in the Netherlands, expanding the REIT's geographic presence in Europe and complementing the REIT's existing platform with an experienced management team.

The Transaction is expected to be accretive by over 10% to both the REIT's estimated 2018 FFO per unit and estimated 2018 AFFO per unit.(1) In order to partially fund the purchase price for the Transaction, the REIT completed its previously announced equity offering of units of the REIT at a price of $10.50 per unit for total gross proceeds of approximately $300 million, and also completed its previously announced European debt offering of EUR375 million aggregate principal amount of senior unsecured notes issued by a finance subsidiary of the REIT and guaranteed by the REIT. Moody's Investors Service assigned a rating to the notes of Baa3 with a stable outlook.

The syndicate of underwriters for the equity offering was led by TD Securities Inc., while Morgan Stanley & Co. International plc acted as the underwriter and sole lead manager for the offering of notes. The REIT also satisfied EUR60 million of the purchase price for the Transaction through the issuance of 7,935,395 units to the vendors, on a private placement basis, at an agreed upon value of $10.99 per unit.

This news release is not an offer of securities for sale in the United States. The securities being offered have not been and will not be registered under the United States Securities Act of 1933, as amended, and accordingly are not being offered for sale and may not be offered, sold or delivered, directly or indirectly within the United States, its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a U.S. person, except pursuant to an exemption from the registration requirements of that Act.

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

DREAM GLOBAL REIT (TSX

RG.UN)(FRANKFURT

RG.UN)(FRANKFURT RG), "Dream Global" or the "REIT")

RG), "Dream Global" or the "REIT") today announced that it has completed the previously announced transaction (the "Transaction") relating to a portfolio of 135 office and light industrial properties located in the Netherlands, expanding the REIT's geographic presence in Europe and complementing the REIT's existing platform with an experienced management team.

The Transaction is expected to be accretive by over 10% to both the REIT's estimated 2018 FFO per unit and estimated 2018 AFFO per unit.(1) In order to partially fund the purchase price for the Transaction, the REIT completed its previously announced equity offering of units of the REIT at a price of $10.50 per unit for total gross proceeds of approximately $300 million, and also completed its previously announced European debt offering of EUR375 million aggregate principal amount of senior unsecured notes issued by a finance subsidiary of the REIT and guaranteed by the REIT. Moody's Investors Service assigned a rating to the notes of Baa3 with a stable outlook.

The syndicate of underwriters for the equity offering was led by TD Securities Inc., while Morgan Stanley & Co. International plc acted as the underwriter and sole lead manager for the offering of notes. The REIT also satisfied EUR60 million of the purchase price for the Transaction through the issuance of 7,935,395 units to the vendors, on a private placement basis, at an agreed upon value of $10.99 per unit.

This news release is not an offer of securities for sale in the United States. The securities being offered have not been and will not be registered under the United States Securities Act of 1933, as amended, and accordingly are not being offered for sale and may not be offered, sold or delivered, directly or indirectly within the United States, its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a U.S. person, except pursuant to an exemption from the registration requirements of that Act.

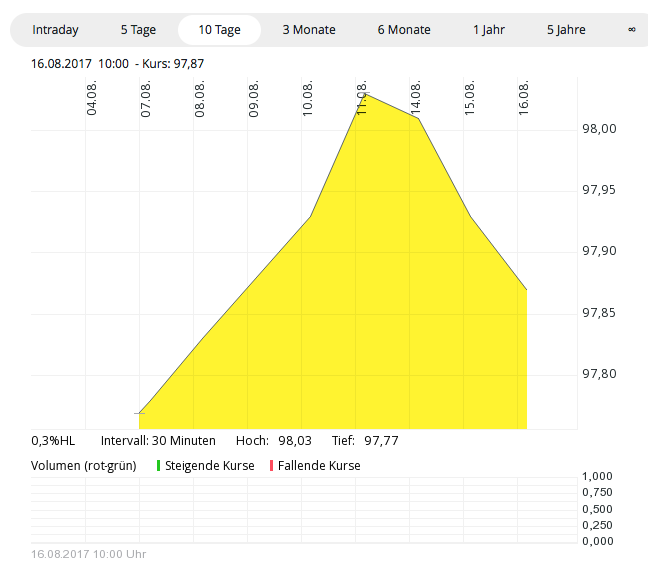

Antwort auf Beitrag Nr.: 55.534.008 von R-BgO am 16.08.17 11:02:21

der Bond hat einen 1,375% Kupon

und -bisher- keinen Handel:

das hier ist der Manager

Thread: Dream Unlimited

Antwort auf Beitrag Nr.: 53.498.088 von R-BgO am 18.10.16 12:40:33

Heute (!) erst gesehen, dass es noch viel schlimmer ist:

Schäuble/Altmaier rechnen einfach gar nix von der kanadischen QSt. an, so daß die effektive Steuerquote 51,375% ist.

Antwort auf Beitrag Nr.: 56.337.314 von R-BgO am 01.12.17 13:18:57

deswegen verkauft

bis aufs Erinnerungsstück

Antwort auf Beitrag Nr.: 56.337.314 von R-BgO am 01.12.17 13:18:57

effektiv also wie bei normaler AbgSt

seit Anfang 2018

lassen sie den nach kanadischer QSt verbleibenden Betrag in Frieden;effektiv also wie bei normaler AbgSt

24.05.2019

XETR DRG: AUSSETZUNG/SUSPENSION

DAS/ DIE FOLGENDE(N) INSTRUMENT(E) IST/ SIND AB SOFORT AUSGESETZT:

THE FOLLOWING INSTRUMENT(S) IS/ ARE SUSPENDED WITH IMMEDIATE EFFECT:

INSTRUMENT NAME KUERZEL/SHORTCODE ISIN BIS/UNTIL

DREAM GL.REAL EST.I.TR.U. DRG CA26154A1066 BAW/UFN

https://www.finanznachrichten.de/nachrichten-2019-05/4679966…

@R-BgO

Hattest du direkt in Toronto gehandelt oder in DE. Was passiert jetzt mit deinem Erinnerungsstück?

XETR DRG: AUSSETZUNG/SUSPENSION

DAS/ DIE FOLGENDE(N) INSTRUMENT(E) IST/ SIND AB SOFORT AUSGESETZT:

THE FOLLOWING INSTRUMENT(S) IS/ ARE SUSPENDED WITH IMMEDIATE EFFECT:

INSTRUMENT NAME KUERZEL/SHORTCODE ISIN BIS/UNTIL

DREAM GL.REAL EST.I.TR.U. DRG CA26154A1066 BAW/UFN

https://www.finanznachrichten.de/nachrichten-2019-05/4679966…

@R-BgO

Hattest du direkt in Toronto gehandelt oder in DE. Was passiert jetzt mit deinem Erinnerungsstück?

Antwort auf Beitrag Nr.: 60.738.978 von Stille_Reserve am 05.06.19 12:15:53

-auf der IR-Seite der Gesellschaft finde ich nix Auffälliges

-in Toronto wurde durchgehend gehandelt

Mein Erinnerungsstück liegt übrigens in Canada und ich erhalte monatlich ein paar Cent als Divi

keine Ahnung, was die Xetra-Info bedeutet(e):

-es wird (wieder) gehandelt:

-auf der IR-Seite der Gesellschaft finde ich nix Auffälliges

-in Toronto wurde durchgehend gehandelt

Mein Erinnerungsstück liegt übrigens in Canada und ich erhalte monatlich ein paar Cent als Divi

Danke für die Antwort. Ja, gestern wurde plötzlich wieder der Handel aufgenommen.

Warum wurde denn überhaupt der Handel an allen DE-Börsen für zwei Wochen ausgesetz? Zu geringe Umsätze? An 'extremen' Kursbewegungen kann es ja nicht gelegen haben ...

Kommt es bei solchen Werten öfters zu Handelsaussetzungen?

Warum wurde denn überhaupt der Handel an allen DE-Börsen für zwei Wochen ausgesetz? Zu geringe Umsätze? An 'extremen' Kursbewegungen kann es ja nicht gelegen haben ...

Kommt es bei solchen Werten öfters zu Handelsaussetzungen?

auch eine Lösung:

Übernahme durch Blackstone http://www.dream.ca/wp-content/uploads/2019/09/DRG-DRM-Sept-… Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -1,63 | |

| -0,82 | |

| -0,22 | |

| -0,13 | |

| 0,00 | |

| +0,28 | |

| 0,00 | |

| -0,22 | |

| +10,00 | |

| +0,89 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 215 | ||

| 196 | ||

| 192 | ||

| 59 | ||

| 36 | ||

| 28 | ||

| 27 | ||

| 25 | ||

| 24 | ||

| 24 |