TechnipFMC

eröffnet am 19.01.17 11:42:30 von

neuester Beitrag 26.10.23 21:29:38 von

neuester Beitrag 26.10.23 21:29:38 von

Beiträge: 29

ID: 1.245.095

ID: 1.245.095

Aufrufe heute: 1

Gesamt: 4.312

Gesamt: 4.312

Aktive User: 0

ISIN: GB00BDSFG982 · WKN: A2DJQK · Symbol: 1T1

23,825

EUR

+0,68 %

+0,160 EUR

Letzter Kurs 22.04.24 Tradegate

Neuigkeiten

15.04.24 · Business Wire (engl.) |

20.03.24 · Business Wire (engl.) |

15.03.24 · Business Wire (engl.) |

22.02.24 · Business Wire (engl.) |

20.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 0,8200 | +41,38 | |

| 0,5070 | +31,52 | |

| 2.272,50 | +13,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,760 | -9,76 | |

| 6,7000 | -11,26 | |

| 150,00 | -11,76 | |

| 13,510 | -12,84 | |

| 1,2100 | -13,57 |

Beitrag zu dieser Diskussion schreiben

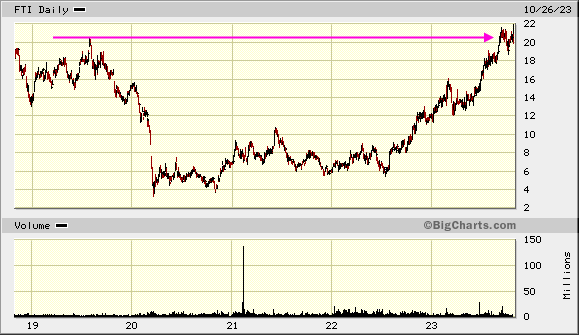

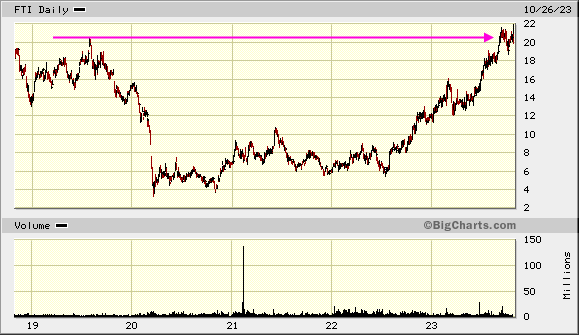

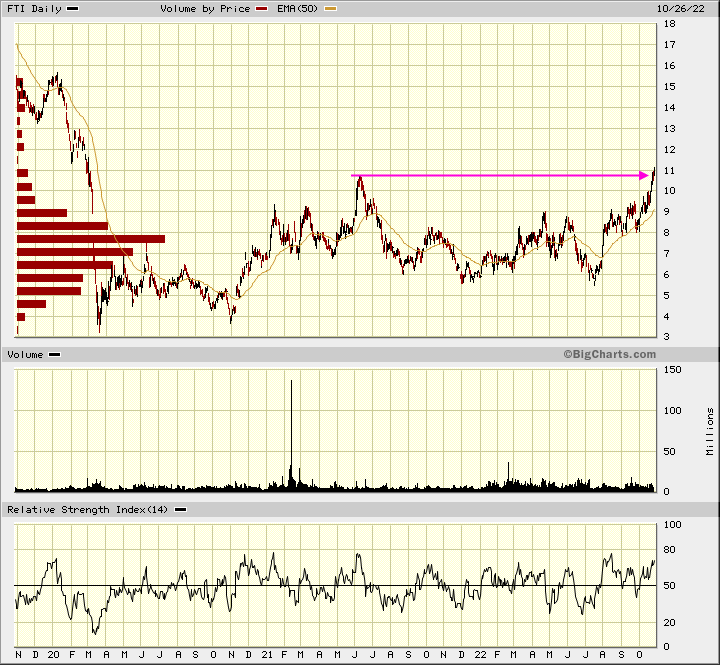

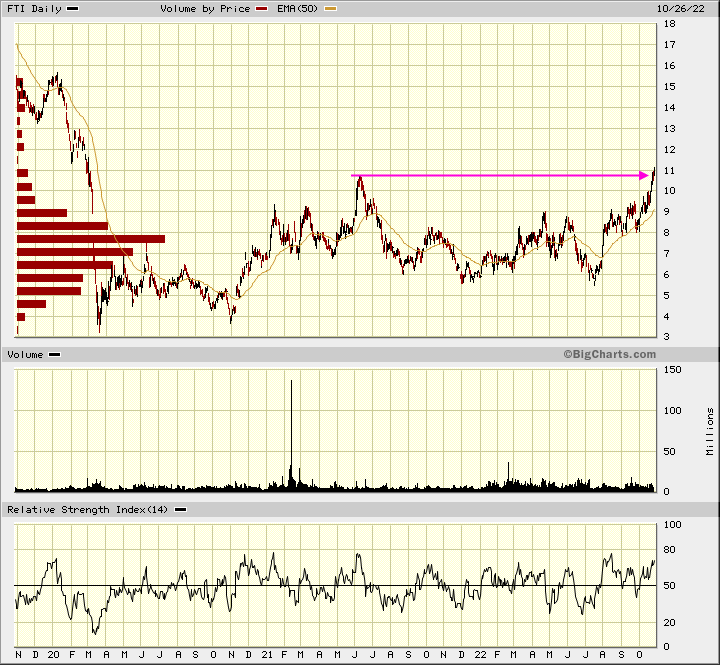

Antwort auf Beitrag Nr.: 74.088.673 von faultcode am 30.06.23 19:19:325-Jahreshoch:

26.10.

Q3: https://www.wallstreet-online.de/nachricht/17470656-technipf…

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “Subsea inbound orders in the quarter came in strong at $1.8 billion. Adjusted EBITDA improved sequentially for both Subsea and Surface Technologies, exceeding the guidance we provided on our second quarter call. This momentum is also driving our full-year expectations higher.”

...

26.10.

Q3: https://www.wallstreet-online.de/nachricht/17470656-technipf…

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “Subsea inbound orders in the quarter came in strong at $1.8 billion. Adjusted EBITDA improved sequentially for both Subsea and Surface Technologies, exceeding the guidance we provided on our second quarter call. This momentum is also driving our full-year expectations higher.”

...

Ich habe gerade diese tolle Aktie entdeckt und frage mich, ob sie noch Potential nach oben hat, wenn jetzt Jahreshoch...

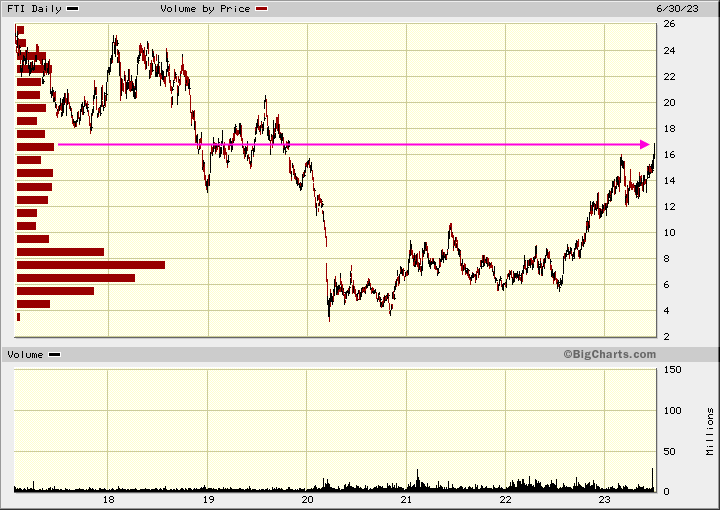

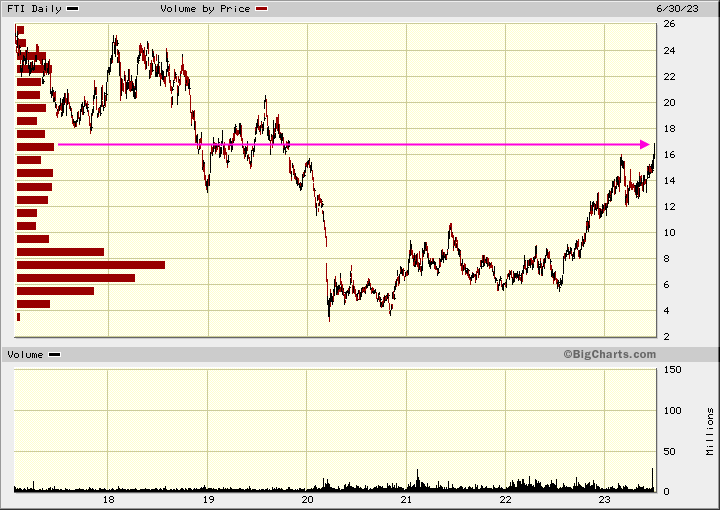

3-Jahreshoch:

16.6.

TechnipFMC Awarded Significant Contract by Woodside for Julimar Phase 3 Development

https://www.wallstreet-online.de/nachricht/17054574-technipf…

...

TechnipFMC (NYSE: FTI) has been awarded a significant(1) contract by Woodside Energy(2) (LON: WDS) to engineer, procure, construct, and install flexible pipes and umbilicals for the Julimar Phase 3 development, offshore Western Australia.

The Company will tie back four subsea gas wells in the Carnarvon Basin to the existing Julimar subsea infrastructure producing to the Wheatstone platform, using high pressure, high temperature (HPHT) flexible pipe and steel tube umbilicals.

Jonathan Landes, President, Subsea at TechnipFMC, commented: “We have a strong history of solid project execution with Woodside as demonstrated by the successful delivery of the Pyxis, Lambert Deep, and Greater Western Flank Phase 3 projects. We look forward to continuing this collaborative relationship with this award on Julimar Phase 3 as part of our framework agreement.”

(1) For TechnipFMC, a “significant” contract is between $75 million and $250 million. This award will be included in inbound orders in the second quarter of 2023.

(2) Woodside Energy Julimar Pty Ltd (Woodside Energy) is operator on behalf of the Julimar joint venture participants. The participants are Woodside Energy (65%) and KUFPEC Australia (Julimar) Pty Ltd (35%).

...

TechnipFMC Awarded Significant Contract by Woodside for Julimar Phase 3 Development

https://www.wallstreet-online.de/nachricht/17054574-technipf…

...

TechnipFMC (NYSE: FTI) has been awarded a significant(1) contract by Woodside Energy(2) (LON: WDS) to engineer, procure, construct, and install flexible pipes and umbilicals for the Julimar Phase 3 development, offshore Western Australia.

The Company will tie back four subsea gas wells in the Carnarvon Basin to the existing Julimar subsea infrastructure producing to the Wheatstone platform, using high pressure, high temperature (HPHT) flexible pipe and steel tube umbilicals.

Jonathan Landes, President, Subsea at TechnipFMC, commented: “We have a strong history of solid project execution with Woodside as demonstrated by the successful delivery of the Pyxis, Lambert Deep, and Greater Western Flank Phase 3 projects. We look forward to continuing this collaborative relationship with this award on Julimar Phase 3 as part of our framework agreement.”

(1) For TechnipFMC, a “significant” contract is between $75 million and $250 million. This award will be included in inbound orders in the second quarter of 2023.

(2) Woodside Energy Julimar Pty Ltd (Woodside Energy) is operator on behalf of the Julimar joint venture participants. The participants are Woodside Energy (65%) and KUFPEC Australia (Julimar) Pty Ltd (35%).

...

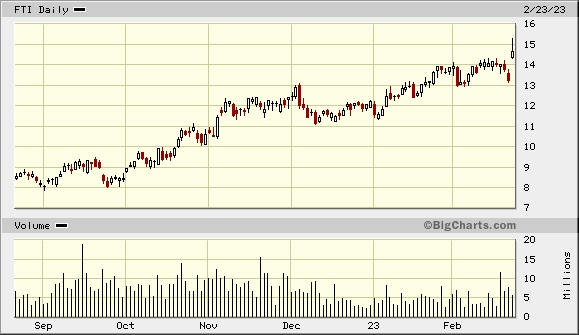

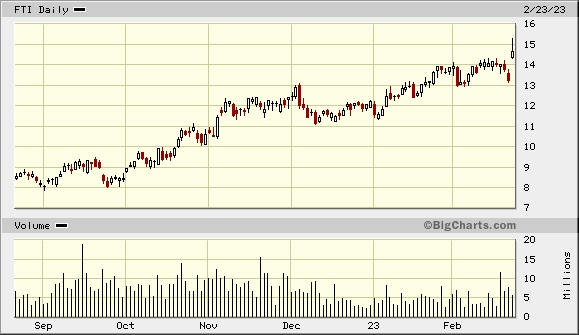

23.2.

TechnipFMC Announces Fourth Quarter 2022 Results

https://www.wallstreet-online.de/nachricht/16597239-technipf…

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “We are in the midst of a multi-year growth cycle. Full-year inbound orders grew 20% versus 2021 to $8.1 billion, driven by Subsea inbound of $6.7 billion. This strong inbound resulted in 24% growth in Subsea backlog, helping drive total Company backlog to $9.4 billion at year-end.”

“Total Company adjusted EBITDA increased nearly 20% to $670 million versus the prior year, when excluding the impact of foreign exchange. Our results demonstrate further improvement in revenue and adjusted EBITDA margin in both operating segments and illustrate our strong commitment to deliver on our financial objectives.”

Pferdehirt continued, “In 2022, we materially improved our financial position. Cash provided by operating activities was $352 million, with free cash flow of $194 million. Gross debt declined by $638 million, a reduction of nearly one-third for the year.”

“These actions enabled us to accelerate the timeline for shareholder distributions by twelve months with the authorization of a $400 million share buyback program in July. We repurchased $100 million of our shares in 2022, representing just over 50% of our free cash flow generation. We also remain committed to a quarterly dividend, which we intend to initiate in the second half of this year.”

Pferdehirt added, “Looking beyond 2022, we remain confident in the strength of this upcycle and continue to believe that international markets will lead the next leg of expansion, driven by offshore and the Middle East. More than 90% of our revenue is generated outside of North America land, and we have leading positions that are geographically levered to these important growth markets.”

...

=>

TechnipFMC Announces Fourth Quarter 2022 Results

https://www.wallstreet-online.de/nachricht/16597239-technipf…

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “We are in the midst of a multi-year growth cycle. Full-year inbound orders grew 20% versus 2021 to $8.1 billion, driven by Subsea inbound of $6.7 billion. This strong inbound resulted in 24% growth in Subsea backlog, helping drive total Company backlog to $9.4 billion at year-end.”

“Total Company adjusted EBITDA increased nearly 20% to $670 million versus the prior year, when excluding the impact of foreign exchange. Our results demonstrate further improvement in revenue and adjusted EBITDA margin in both operating segments and illustrate our strong commitment to deliver on our financial objectives.”

Pferdehirt continued, “In 2022, we materially improved our financial position. Cash provided by operating activities was $352 million, with free cash flow of $194 million. Gross debt declined by $638 million, a reduction of nearly one-third for the year.”

“These actions enabled us to accelerate the timeline for shareholder distributions by twelve months with the authorization of a $400 million share buyback program in July. We repurchased $100 million of our shares in 2022, representing just over 50% of our free cash flow generation. We also remain committed to a quarterly dividend, which we intend to initiate in the second half of this year.”

Pferdehirt added, “Looking beyond 2022, we remain confident in the strength of this upcycle and continue to believe that international markets will lead the next leg of expansion, driven by offshore and the Middle East. More than 90% of our revenue is generated outside of North America land, and we have leading positions that are geographically levered to these important growth markets.”

...

=>

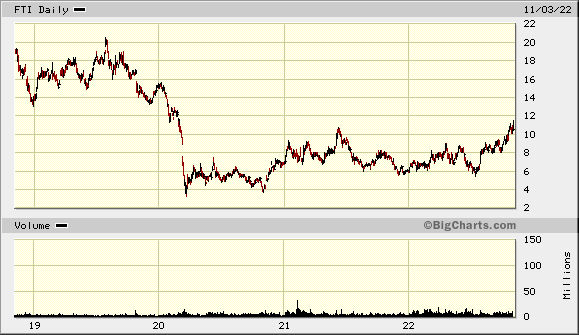

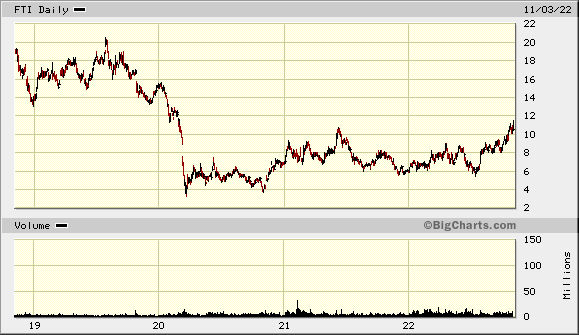

Antwort auf Beitrag Nr.: 72.644.513 von faultcode am 26.10.22 20:14:36und durch:

hier kann das Share repurchase program eine Rolle spielen, so wie zum Q3 am 26.10. berichtet: https://www.technipfmc.com/en/investors/financial-news-relea…

Further demonstrating our confidence in this outlook, we announced a new $400 million share buyback program in July, which we quickly put into action with the repurchase of $50 million of our ordinary shares in the third quarter.”

hier kann das Share repurchase program eine Rolle spielen, so wie zum Q3 am 26.10. berichtet: https://www.technipfmc.com/en/investors/financial-news-relea…

Further demonstrating our confidence in this outlook, we announced a new $400 million share buyback program in July, which we quickly put into action with the repurchase of $50 million of our ordinary shares in the third quarter.”

2-Jahres-Hoch:

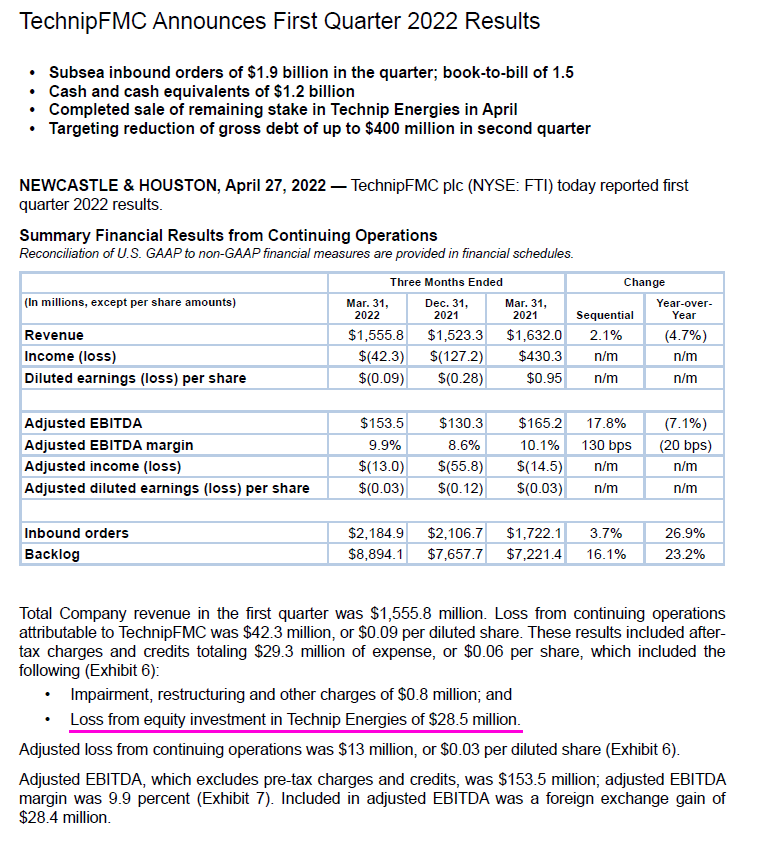

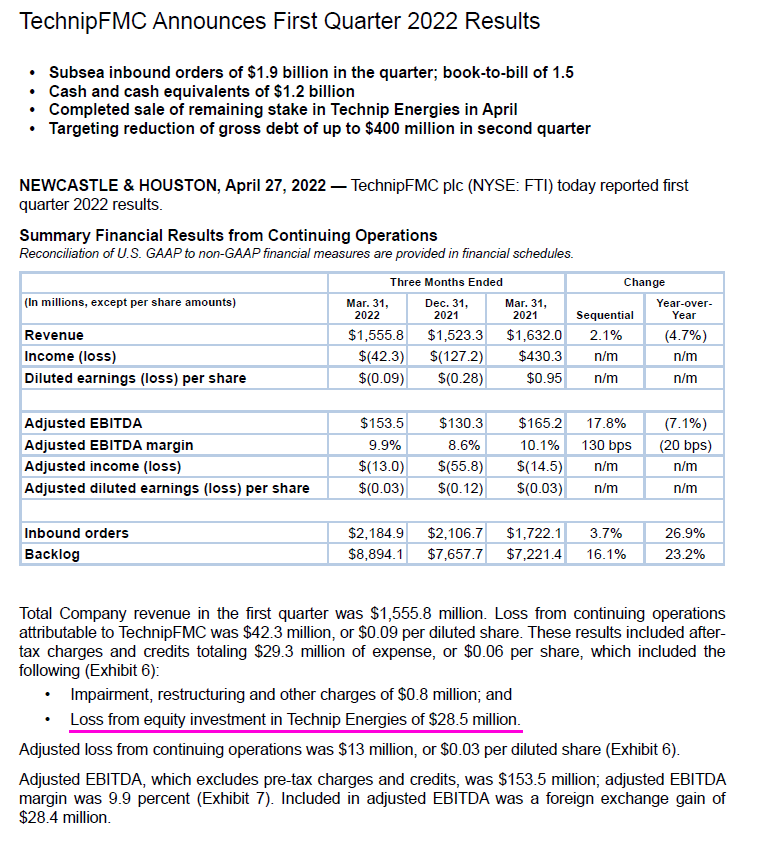

https://www.technipfmc.com/en/investors/financial-news-relea…

...

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “Looking at the first quarter, total Company revenue was $1.6 billion, with adjusted EBITDA of $154 million. Total Company inbound orders were $2.2 billion, driving sequential growth in backlog.

With cash and cash equivalents totaling $1.2 billion and our confidence that we will generate strong free cash flow in the second half of the year, we are taking aggressive steps to further reduce debt in the second quarter. This is another important milestone on our path to shareholder distributions.”

...

Pferdehirt concluded, “We are in the midst of a multi-year upcycle for oil and gas investment. Our Subsea Opportunity List highlights this very robust market outlook, representing an opportunity set of larger projects that totals more than $20 billion in potential industry awards over the next 24 months. In the current environment, we are also experiencing improvements in pricing and contractual arrangements that more appropriately balance the terms and conditions needed to support this growth.”

...

...

...

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “Looking at the first quarter, total Company revenue was $1.6 billion, with adjusted EBITDA of $154 million. Total Company inbound orders were $2.2 billion, driving sequential growth in backlog.

With cash and cash equivalents totaling $1.2 billion and our confidence that we will generate strong free cash flow in the second half of the year, we are taking aggressive steps to further reduce debt in the second quarter. This is another important milestone on our path to shareholder distributions.”

...

Pferdehirt concluded, “We are in the midst of a multi-year upcycle for oil and gas investment. Our Subsea Opportunity List highlights this very robust market outlook, representing an opportunity set of larger projects that totals more than $20 billion in potential industry awards over the next 24 months. In the current environment, we are also experiencing improvements in pricing and contractual arrangements that more appropriately balance the terms and conditions needed to support this growth.”

...

An so einem Tag nicht im Minus zu schließen. Ein starkes Zeichen. Mal sehen wann die Märkte sich wieder beruhigen.