Santos Ltd. - Die letzten 30 Beiträge

eröffnet am 25.02.17 09:30:04 von

neuester Beitrag 07.12.23 12:52:08 von

neuester Beitrag 07.12.23 12:52:08 von

Beiträge: 16

ID: 1.247.560

ID: 1.247.560

Aufrufe heute: 0

Gesamt: 2.008

Gesamt: 2.008

Aktive User: 0

ISIN: AU000000STO6 · WKN: 863403

4,6945

EUR

+0,25 %

+0,0115 EUR

Letzter Kurs 25.04.24 Lang & Schwarz

Neuigkeiten

31.05.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 75,38 | +19,99 | |

| 16,530 | +9,98 | |

| 5,2000 | +9,47 | |

| 3,9000 | +8,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,080 | -12,27 | |

| 1,2501 | -15,25 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

7.12.

Woodside Energy, Santos in Merger Talks to Create Global Energy Giant

https://www.msn.com/en-us/money/markets/woodside-energy-sant…

...

Woodside Energy and Santos said they are discussing a merger that could result in a new global giant worth around $52 billion, illustrating how rising demand for natural gas in the wake of the Ukraine war is reshaping the energy sector.

Woodside and Santos said talks are at an early stage and there is no agreement over a deal that would rank as one of the largest in the energy sector this year. Santos, whose stock has declined about 5% over the past 12 months, said it was weighing the merger alongside other options to boost value for shareholders.

A combination of Woodside, which has a market value of $37.3 billion, and Santos, worth some $14.6 billion, would bring together Australia’s two largest energy companies as the country vies with Qatar to be the world’s top exporter of liquefied natural gas.

Joining with Santos would represent the second major transaction completed by Woodside in recent years after it acquired the petroleum business of BHP Group in 2022. Woodside operates LNG export terminals in Australia, and it acquired assets in the Gulf of Mexico and Caribbean through the BHP deal.

...

Woodside Energy, Santos in Merger Talks to Create Global Energy Giant

https://www.msn.com/en-us/money/markets/woodside-energy-sant…

...

Woodside Energy and Santos said they are discussing a merger that could result in a new global giant worth around $52 billion, illustrating how rising demand for natural gas in the wake of the Ukraine war is reshaping the energy sector.

Woodside and Santos said talks are at an early stage and there is no agreement over a deal that would rank as one of the largest in the energy sector this year. Santos, whose stock has declined about 5% over the past 12 months, said it was weighing the merger alongside other options to boost value for shareholders.

A combination of Woodside, which has a market value of $37.3 billion, and Santos, worth some $14.6 billion, would bring together Australia’s two largest energy companies as the country vies with Qatar to be the world’s top exporter of liquefied natural gas.

Joining with Santos would represent the second major transaction completed by Woodside in recent years after it acquired the petroleum business of BHP Group in 2022. Woodside operates LNG export terminals in Australia, and it acquired assets in the Gulf of Mexico and Caribbean through the BHP deal.

...

Santos ups Buyback Scheme with US$350 Million Increase

Auszug"The simplified capital management framework

Santos explained that its key strategy is maintaining a ‘disciplined, low-cost operating model to deliver strong cash flows through the commodity price cycle’.

The changes to its capital framework include the increased share buyback today, which is said to target a suitable capital structure and allows the company to strike a balance in capital allocation between various business investments.

Such investments include its backfill projects, decarbonisation projects, developments in growth and clean fuel projects, and, as already stated today, allowing sustainable returns to shareholders based on its free cash flow.

STO’s simplified capital management framework includes the policy of at least a 40% payout to shareholders based on its annual generated cash flow, which could soon be upped to 50%.

It also includes cash dividends or buybacks to shareholders based on market conditions and Board discretion and its existing target gearing range of 15–25%.

Mr Spence believes Santos is currently creating healthy cash flow with present commodity prices, and the Santos Board is reinforcing his confidence by agreeing to raise shareholder returns."

mehr

https://www.moneymorning.com.au/20221207/santos-ups-buyback-…

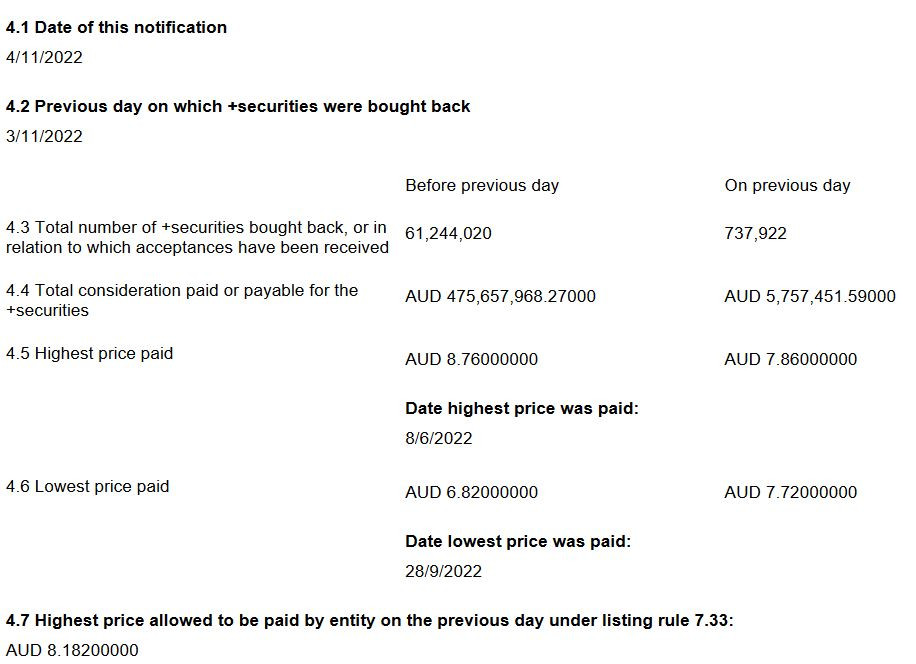

JP Morgan / Buy Back

Auszug25.10.

According to a note out of Morgans, its analysts have retained their add rating on the company’s shares and lifted their price target to $9.40.

Based on the current Santos share price, this implies potential upside of 23% for investors over the next 12 months.

In addition, the broker is expecting a dividend of approximately 27 cents per share in FY 2023, which equates to an attractive 3.5% yield.

Why is Santos an ASX 200 energy share to buy?

Morgans was pleased with Santos’ recent quarterly update and highlights that it “continues to unlock healthy synergies from its merger with OSH, so far achieving savings of US$112m during the 9 months since the merger completed.”

The broker believes that the “post-merger STO is starting to really stretch its legs in terms of quality of earnings and cash flow” and expects its gearing to continue to lower, which “will increase STO’s investment appeal.”

*****

Buy Back

https://hotcopper.com.au/threads/ann-update-notification-of-…

*****

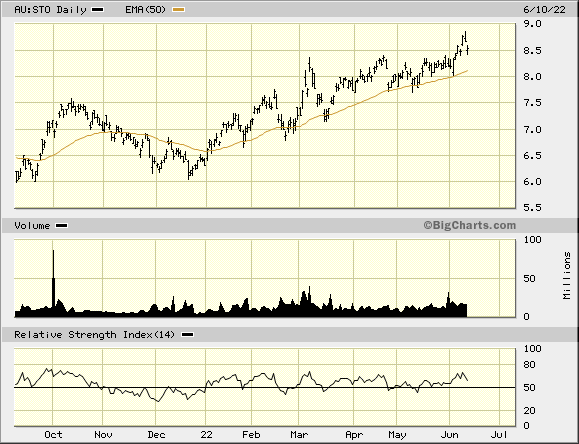

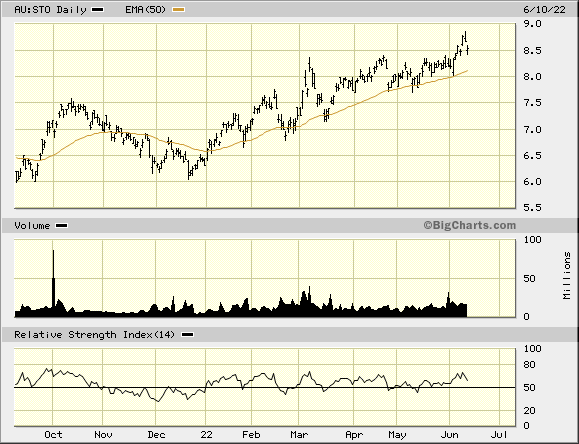

Erster Kauf für das Value Depot

SL 7,5

17.8.

Santos to Boost Oil Output With $2.6 Billion Alaskan Project

https://uk.news.yahoo.com/santos-boost-oil-output-2-01054602…

...

Santos Ltd. has given the go-ahead for a $2.6 billion oil field project in Alaska to expand its production beyond the Asia-Pacific region.

The producer and joint venture partner Repsol SA took a final investment decision on phase 1 of the Pikka development on Wednesday, Adelaide, South Australia-based Santos said in an earnings statement. The project is expected to produce 80,000 barrels a day of oil from 2026.

Santos, which became one of the world’s top 20 producers following its merger with domestic rival Oil Search Ltd. last year, has been seen as overly dependent on the Asia-Pacific region, with all its major developments in Australia and Papua New Guinea. The company on Wednesday said net profit in the first half more than tripled from a year earlier to $1.2 billion on the back of higher prices for oil and natural gas.

“The project will add further diversification to our portfolio and reduces geographic concentration risk,” Santos Chief Executive Officer Kevin Galllagher said in a statement. “Santos has emission reduction plans to achieve scope 1 and 2 net-zero emissions by 2040 and in-line with that commitment, Pikka will be a net-zero project.”

Santos has entered into memorandums of understanding with Alaska Native Corporations to deliver carbon offset projects, it said. The company is the operator of Pikka and has a 51% stake while Repsol holds the rest.

Santos to Boost Oil Output With $2.6 Billion Alaskan Project

https://uk.news.yahoo.com/santos-boost-oil-output-2-01054602…

...

Santos Ltd. has given the go-ahead for a $2.6 billion oil field project in Alaska to expand its production beyond the Asia-Pacific region.

The producer and joint venture partner Repsol SA took a final investment decision on phase 1 of the Pikka development on Wednesday, Adelaide, South Australia-based Santos said in an earnings statement. The project is expected to produce 80,000 barrels a day of oil from 2026.

Santos, which became one of the world’s top 20 producers following its merger with domestic rival Oil Search Ltd. last year, has been seen as overly dependent on the Asia-Pacific region, with all its major developments in Australia and Papua New Guinea. The company on Wednesday said net profit in the first half more than tripled from a year earlier to $1.2 billion on the back of higher prices for oil and natural gas.

“The project will add further diversification to our portfolio and reduces geographic concentration risk,” Santos Chief Executive Officer Kevin Galllagher said in a statement. “Santos has emission reduction plans to achieve scope 1 and 2 net-zero emissions by 2040 and in-line with that commitment, Pikka will be a net-zero project.”

Santos has entered into memorandums of understanding with Alaska Native Corporations to deliver carbon offset projects, it said. The company is the operator of Pikka and has a 51% stake while Repsol holds the rest.

Aktienrückkauf und Dividendenpolitik

https://www.santos.com/news/santos-announces-new-capital-man…

+40% seitdem (in AUD):

die Aktie ist nicht besonders volatil (mMn); selbst Woodside ist etwas volatiler mit 43%|250d (FactSet) zu 35%|250d.

Das liegt auf dem Niveau einer ConocoPhillips z.B., die 7x so groß ist (Enterprise Value) und auch noch weniger Dividende bezahlt!

Vielleicht der allerletzte Geheimtipp bei den größeren Ölfirmen im derzeitigen Zyklus.

die Aktie ist nicht besonders volatil (mMn); selbst Woodside ist etwas volatiler mit 43%|250d (FactSet) zu 35%|250d.

Das liegt auf dem Niveau einer ConocoPhillips z.B., die 7x so groß ist (Enterprise Value) und auch noch weniger Dividende bezahlt!

Vielleicht der allerletzte Geheimtipp bei den größeren Ölfirmen im derzeitigen Zyklus.

Antwort auf Beitrag Nr.: 63.090.802 von texas2 am 22.03.20 09:43:48Santos und Oilsearch könnten als Firmen tatsächlich gut zusammenpassen und sich ergänzen

https://www.santos.com/wp-content/uploads/2021/09/210907-CEO…

https://www.santos.com/wp-content/uploads/2021/09/210907-CEO…

Antwort auf Beitrag Nr.: 57.476.006 von R-BgO am 06.04.18 00:50:26Wieder auf dem 2015, 2016 niveau

Antwort auf Beitrag Nr.: 58.810.757 von R-BgO am 27.09.18 09:35:53https://www.santos.com/media/4655/2018-shareholder-review.pd…

Harbour Energy spurs Santos’ interest with $10.4 bln bid

Australia’s Santos, the operator of the GLNG project on Curtis Island, received a new takeover proposal Harbour Energy valued at A$13.5 billion (US$10.4 billion).

Santos said that the indicative offer price is US$4.98 per share or A$6.50, representing a 28 percent premium to the last closing price of Santos A$5.07 per share on March 29.

This is the fourth Harbour proposal following those in August last year and two in March this year, and after rejecting earlier proposals, Santos formed a board committee to consider the new approach as it has raised enough interest of shareholders to engage with Harbour Energy.

The indicative offer price is comprised of a cash price of US$4.7 per share plus a special dividend of US$0.28 per share.

The proposal made by Harbour, a US investment firm led by Linda Cook who is a former top executive of LNG giant Royal Dutch Shell, also provides for a fixed Australian dollar offer price for the first 10,000 shares held by each individual shareholder.

Harbour has indicated that funding for the transaction is to be provided in the form of US$7.75 billion debt that is to be underwritten by J.P. Morgan and Morgan Stanley and the balance in equity from Harbour, other EIG managed funds and Mercuria Global Energy.

Harbour has also entered into a confidentiality agreement with Santos to allow Harbour the opportunity to undertake confirmatory due diligence.

In its proposal, Harbour also noted that, while it has made no agreements with ENN and Hony Capital, both shareholders in Santos, both companies may wish to rollover their existing shares into Harbour RollCo, a special purpose company that will own a minimum of 15 and up to 20 percent of Santos shares.

Australia’s Santos, the operator of the GLNG project on Curtis Island, received a new takeover proposal Harbour Energy valued at A$13.5 billion (US$10.4 billion).

Santos said that the indicative offer price is US$4.98 per share or A$6.50, representing a 28 percent premium to the last closing price of Santos A$5.07 per share on March 29.

This is the fourth Harbour proposal following those in August last year and two in March this year, and after rejecting earlier proposals, Santos formed a board committee to consider the new approach as it has raised enough interest of shareholders to engage with Harbour Energy.

The indicative offer price is comprised of a cash price of US$4.7 per share plus a special dividend of US$0.28 per share.

The proposal made by Harbour, a US investment firm led by Linda Cook who is a former top executive of LNG giant Royal Dutch Shell, also provides for a fixed Australian dollar offer price for the first 10,000 shares held by each individual shareholder.

Harbour has indicated that funding for the transaction is to be provided in the form of US$7.75 billion debt that is to be underwritten by J.P. Morgan and Morgan Stanley and the balance in equity from Harbour, other EIG managed funds and Mercuria Global Energy.

Harbour has also entered into a confidentiality agreement with Santos to allow Harbour the opportunity to undertake confirmatory due diligence.

In its proposal, Harbour also noted that, while it has made no agreements with ENN and Hony Capital, both shareholders in Santos, both companies may wish to rollover their existing shares into Harbour RollCo, a special purpose company that will own a minimum of 15 and up to 20 percent of Santos shares.

Antwort auf Beitrag Nr.: 55.948.190 von abgemeldet568354 am 13.10.17 16:02:51Denke dass die LNG Beteiligungen mittel- und langfristig gut brummende cash cows werden bzw. nicht umsonst gibt es verschiedene take over ambitionen

Antwort auf Beitrag Nr.: 55.887.691 von Ausgangssperre am 05.10.17 17:00:42

Benchmark

https://www.fool.com.au/2017/10/04/are-these-3-top-resources…

4 € kurzfristig ?

Antwort auf Beitrag Nr.: 54.409.111 von R-BgO am 25.02.17 09:30:04Higher LNG prices boost Santos’ revenue

Australian LNG operator Santos has seen an increase in sales volumes as well as sales revenue on the back of higher LNG prices and the timing of liftings.

Sales volumes reached 21.5 mmboe during the second quarter, 16 percent up from 18.6 mmboe reported in the first quarter. Santos’ s quarterly report shows that in the first six months, the sales volume dipped 2 percent from 40.9 mmboe in 2016 to 40.1 mmboe this year.

Higher LNG prices also had an impact on sales revenue that rose 12 percent quarter on quarter reaching Us$769 million. Sales revenue also rose for the first six months period, up 22 percent from $1.19 billion in 2016 to 1.45 billion this year.

As a result of this solid operational performance, Santos has increased its production and sales volume guidance for 2017 to 57-60 mmboe and 75-80 mmboe respectively.

Speaking of the results, Santos managing director and CEO, Kevin Gallagher said the company made “further progress on reducing costs, lowering net debt and improving the free cash flow position.”

“Compared to the end of 2016, our net debt position is $600 million lower to $2.9 billion and our forecast free cash flow breakeven for 2017 now sits at $33 per barrel, well below the $47 per barrel at the beginning of 2016,” according to Gallagher.

In addition, lower cost operations had enabled Santos to increase drilling activity in both the Cooper basin and across its GLNG acreage, he said.

These additional wells will help boost production over the next few years so Santos can deliver increased gas supply for the domestic market.

Santos noted in its report that sales gas delivered to the Gladstone LNG facility as well as LNG production were lower compared to the first quarter due to the planned four-week statutory inspection shutdown of LNG train 2 in June combined with the processing of GLNG gas at APLNG during their two-train completion test.

The company also said that a planned three-week maintenance shutdown of LNG train 1 commenced in July. The facility shipped 21 LNG cargoes during the second quarter, the same as the previous quarter. In the first six months 2017, Santos GLNG plant shipped 42 cargoes, 10 more compared to the first six months last year.

Planned maintenance also impacted Darwin LNG sales volumes and production which resulted in 12 cargoes being shipped from the facility, two less compared to the first quarter. Year to date, Darwin LNG plant shipped 26 cargoes, three less compared to the corresponding period in 2016.

Australian LNG operator Santos has seen an increase in sales volumes as well as sales revenue on the back of higher LNG prices and the timing of liftings.

Sales volumes reached 21.5 mmboe during the second quarter, 16 percent up from 18.6 mmboe reported in the first quarter. Santos’ s quarterly report shows that in the first six months, the sales volume dipped 2 percent from 40.9 mmboe in 2016 to 40.1 mmboe this year.

Higher LNG prices also had an impact on sales revenue that rose 12 percent quarter on quarter reaching Us$769 million. Sales revenue also rose for the first six months period, up 22 percent from $1.19 billion in 2016 to 1.45 billion this year.

As a result of this solid operational performance, Santos has increased its production and sales volume guidance for 2017 to 57-60 mmboe and 75-80 mmboe respectively.

Speaking of the results, Santos managing director and CEO, Kevin Gallagher said the company made “further progress on reducing costs, lowering net debt and improving the free cash flow position.”

“Compared to the end of 2016, our net debt position is $600 million lower to $2.9 billion and our forecast free cash flow breakeven for 2017 now sits at $33 per barrel, well below the $47 per barrel at the beginning of 2016,” according to Gallagher.

In addition, lower cost operations had enabled Santos to increase drilling activity in both the Cooper basin and across its GLNG acreage, he said.

These additional wells will help boost production over the next few years so Santos can deliver increased gas supply for the domestic market.

Santos noted in its report that sales gas delivered to the Gladstone LNG facility as well as LNG production were lower compared to the first quarter due to the planned four-week statutory inspection shutdown of LNG train 2 in June combined with the processing of GLNG gas at APLNG during their two-train completion test.

The company also said that a planned three-week maintenance shutdown of LNG train 1 commenced in July. The facility shipped 21 LNG cargoes during the second quarter, the same as the previous quarter. In the first six months 2017, Santos GLNG plant shipped 42 cargoes, 10 more compared to the first six months last year.

Planned maintenance also impacted Darwin LNG sales volumes and production which resulted in 12 cargoes being shipped from the facility, two less compared to the first quarter. Year to date, Darwin LNG plant shipped 26 cargoes, three less compared to the corresponding period in 2016.

writes down GLNG project, reports US$1bn net loss

posted 21 hours ago

Australia’s Santos reported a full-year net loss of US$1.05 billion, mainly because of the US$1.1 billion write-down in the value of its US$18.5 billion Gladstone GLNG project in Queensland, the company said last week.

Analysts said the loss was expected and lower than the US$1.95 billion loss incurred in 2015. Though Santos is an Australian-listed company it reports its financials in US dollars.

Santos also cut its net debt by 26% to US$3.5 billion in the 12 months to December 31.

On an upbeat note, the company said that it could resume dividend payments as it recovers from the recent crash in oil prices.

In December, the company announced a new strategy which included selling off its non-core assets as a way to trim net debt by US$1.5 billion in three years. Gallagher became the company’s new chief executive at the beginning of the year.

“In 2016, the Santos leadership team took tough and decisive action to stabilise the business and build the foundations for future growth. We restructured the business, removed substantial costs, all while maintaining safety and delivering record production and sales volumes,” he said. “As a result our turnaround strategy is starting to deliver.”

In 2016, Santos was free cash flow positive at US$36.50 per barrel and generated US$370 million in free cash flow over the last eight months of the year.

“This is pleasing progress but there is still more to be done,” Gallagher said. Santos cut 580 jobs in 2016 as it sought to slash costs and bring down its break-even price, while the company’s capex plunged by 51% to US$625 million. “Our aim is to transform Santos into a low cost, reliable and high performance business that delivers sustainable shareholder value,” Gallagher said.

He added that “the heart of our strategy is portfolio simplification and focused growth across five core, long-life natural gas assets: Cooper Basin, GLNG, PNG, Northern Australia and Western Australia Gas. Each asset has significant upside potential.”

posted 21 hours ago

Australia’s Santos reported a full-year net loss of US$1.05 billion, mainly because of the US$1.1 billion write-down in the value of its US$18.5 billion Gladstone GLNG project in Queensland, the company said last week.

Analysts said the loss was expected and lower than the US$1.95 billion loss incurred in 2015. Though Santos is an Australian-listed company it reports its financials in US dollars.

Santos also cut its net debt by 26% to US$3.5 billion in the 12 months to December 31.

On an upbeat note, the company said that it could resume dividend payments as it recovers from the recent crash in oil prices.

In December, the company announced a new strategy which included selling off its non-core assets as a way to trim net debt by US$1.5 billion in three years. Gallagher became the company’s new chief executive at the beginning of the year.

“In 2016, the Santos leadership team took tough and decisive action to stabilise the business and build the foundations for future growth. We restructured the business, removed substantial costs, all while maintaining safety and delivering record production and sales volumes,” he said. “As a result our turnaround strategy is starting to deliver.”

In 2016, Santos was free cash flow positive at US$36.50 per barrel and generated US$370 million in free cash flow over the last eight months of the year.

“This is pleasing progress but there is still more to be done,” Gallagher said. Santos cut 580 jobs in 2016 as it sought to slash costs and bring down its break-even price, while the company’s capex plunged by 51% to US$625 million. “Our aim is to transform Santos into a low cost, reliable and high performance business that delivers sustainable shareholder value,” Gallagher said.

He added that “the heart of our strategy is portfolio simplification and focused growth across five core, long-life natural gas assets: Cooper Basin, GLNG, PNG, Northern Australia and Western Australia Gas. Each asset has significant upside potential.”

Santos Ltd.