OmniVision Technologies(OVTI) - 500 Beiträge pro Seite

eröffnet am 26.09.02 15:56:59 von

neuester Beitrag 23.02.04 23:44:14 von

neuester Beitrag 23.02.04 23:44:14 von

Beiträge: 87

ID: 639.227

ID: 639.227

Aufrufe heute: 0

Gesamt: 4.158

Gesamt: 4.158

Aktive User: 0

ISIN: US6821281036 · WKN: 936737

29,38

USD

0,00 %

0,00 USD

Letzter Kurs 28.01.16 Nasdaq

Neuigkeiten

Werte aus der Branche Halbleiter

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4.005,00 | +300,50 | |

| 8,4500 | +16,55 | |

| 23,600 | +12,38 | |

| 33,95 | +11,09 | |

| 26,48 | +10,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,1100 | -17,80 | |

| 2,3000 | -23,08 | |

| 6,3200 | -23,75 | |

| 5,8900 | -35,94 | |

| 0,5530 | -38,56 |

Profile:OmniVision Technologies, Inc. designs, develops and markets high performance, high quality and cost efficient semiconductor imaging devices for computing, communications, industrial, automotive and consumer electronics applications. The Company`s main product, an image sensing device called a CameraChip, is used to capture an image in cameras and camera related products in high-volume imaging applications such as personal computer cameras, digital still cameras, security and surveillance cameras, personal digital assistant cameras and mobile phone cameras and cameras for automobiles and toys for both still picture and live video applications.

http://www.ovt.com

http://www.ovt.com

Venture capitalist criticizes SME fund as handout

2002-09-13 / Taiwan News, Staff Reporter / By Marie Feliciano

Venture capitalist Ben C.B. Chang, president of Hotung International Co. Ltd., explains why he remains upbeat on Taiwan`s IT sector.(Henry Tan, Taiwan News)

The government should get its act together and focus on creating a business environment that would stimulate innovation and entrepreneurship, a venture capitalist managing a NT$16.43 billion-fund said yesterday.

Ben C.B. Chang, president of Hotung International Co. Ltd., said giving Taiwan`s dying manufacturers and sunset industries handouts was not the answer to Taiwan`s economic woes.

"Recently, the government announced it was working on a NT$100 billion-fund for Taiwan`s small- and medium-sized enterprises," Chang told the Taiwan News. "Unless the money is given to the right companies, the fund will go to waste."

Chang said the SMEs of the past decades succeeded because they had a product and a service to sell.

When the American companies shifted their production facilities to Asia, they gave their orders to the nimble original equipment manufacturers of Taiwan because they offered low-cost and just-in-time production and assembly, he said.

These OEMs are now Taiwan`s flagship companies, Chang said.

"Acer, Quanta and Hon Hai," he said, "they all started small and are now among Taiwan`s success stories."

When Taiwan lost its competitiveness in labor-intensive assembly and processing, these companies shifted gears and restructured their companies, he said. Value-added and technology-intensive production became their focus.

"Enterprises can do without government intervention. In fact, all that they need are clear-cut policies that will make it easier for them to do business - not handouts," said Chang.

The venture capitalist added that offering subsidies to companies that did not possess "critical" intellectual properties would nothing be more than a waste of resources.

"The government is already broke," he noted. "Let those companies go to China and to Asia`s low-cost manufacturing centers. This is nothing more than a phase in Taiwan`s attempt to reach a higher value-added industrial profile."

The executive also brushed aside fears that China would drive Taiwan out of business.

"Yes, 60 to 70 percent of Taiwan`s IT hardware are made in China now but many of these companies have kept their R&D hubs in Taiwan," said Chang.

Hotung International is currently investing in TSMC, Acer, Chunghwa Picture Tubes, Macronix, Mosel Vitelic, D-Link, Unipac Optoelectronics, and OmniVision Technologies among others. Sixty percent of the companies in its portfolio are Taiwan-grown.

Asked what were the qualities that Hotung was looking for in a technology start-up, Chang said the product`s potential commercial applications, market positioning, and growth prospects topped his list.

"Right now, the hottest sectors that we are looking at are wireless communication and IC design," he said.

The life sciences sector was also on his shopping list, Chang said. These would include biomedical products such as anti-cancer drugs, bio-informatics, and gene therapies.

2002-09-13 / Taiwan News, Staff Reporter / By Marie Feliciano

Venture capitalist Ben C.B. Chang, president of Hotung International Co. Ltd., explains why he remains upbeat on Taiwan`s IT sector.(Henry Tan, Taiwan News)

The government should get its act together and focus on creating a business environment that would stimulate innovation and entrepreneurship, a venture capitalist managing a NT$16.43 billion-fund said yesterday.

Ben C.B. Chang, president of Hotung International Co. Ltd., said giving Taiwan`s dying manufacturers and sunset industries handouts was not the answer to Taiwan`s economic woes.

"Recently, the government announced it was working on a NT$100 billion-fund for Taiwan`s small- and medium-sized enterprises," Chang told the Taiwan News. "Unless the money is given to the right companies, the fund will go to waste."

Chang said the SMEs of the past decades succeeded because they had a product and a service to sell.

When the American companies shifted their production facilities to Asia, they gave their orders to the nimble original equipment manufacturers of Taiwan because they offered low-cost and just-in-time production and assembly, he said.

These OEMs are now Taiwan`s flagship companies, Chang said.

"Acer, Quanta and Hon Hai," he said, "they all started small and are now among Taiwan`s success stories."

When Taiwan lost its competitiveness in labor-intensive assembly and processing, these companies shifted gears and restructured their companies, he said. Value-added and technology-intensive production became their focus.

"Enterprises can do without government intervention. In fact, all that they need are clear-cut policies that will make it easier for them to do business - not handouts," said Chang.

The venture capitalist added that offering subsidies to companies that did not possess "critical" intellectual properties would nothing be more than a waste of resources.

"The government is already broke," he noted. "Let those companies go to China and to Asia`s low-cost manufacturing centers. This is nothing more than a phase in Taiwan`s attempt to reach a higher value-added industrial profile."

The executive also brushed aside fears that China would drive Taiwan out of business.

"Yes, 60 to 70 percent of Taiwan`s IT hardware are made in China now but many of these companies have kept their R&D hubs in Taiwan," said Chang.

Hotung International is currently investing in TSMC, Acer, Chunghwa Picture Tubes, Macronix, Mosel Vitelic, D-Link, Unipac Optoelectronics, and OmniVision Technologies among others. Sixty percent of the companies in its portfolio are Taiwan-grown.

Asked what were the qualities that Hotung was looking for in a technology start-up, Chang said the product`s potential commercial applications, market positioning, and growth prospects topped his list.

"Right now, the hottest sectors that we are looking at are wireless communication and IC design," he said.

The life sciences sector was also on his shopping list, Chang said. These would include biomedical products such as anti-cancer drugs, bio-informatics, and gene therapies.

Adams Harkness Coverage Reiterated at Buy

Adams, Harkness sees opportunity in OmniVision (OVTI)

By Michael Baron

Adams, Harkness & Hill is out with a research note reiterating its "buy" rating on shares of the Sunnyvale, Calif., maker of chip imaging devices, saying that the recent pullback represents a buying opportunity. The firm cited its belief that OmniVision is experiencing `considerable` traction in the digital still camera market, and that the company is seeing increased momentum in its digital cell phone product segment, as positives for the stock.

09-17-2002 DA Davidson Coverage Initiated at Buy

06-12-2002 Needham & Co Coverage Reiterated at Buy

06-12-2002 Prudential Coverage Reiterated at Buy

Earnings growth 253%

PE = 22

Consensus Target Price = $17.00

Adams, Harkness sees opportunity in OmniVision (OVTI)

By Michael Baron

Adams, Harkness & Hill is out with a research note reiterating its "buy" rating on shares of the Sunnyvale, Calif., maker of chip imaging devices, saying that the recent pullback represents a buying opportunity. The firm cited its belief that OmniVision is experiencing `considerable` traction in the digital still camera market, and that the company is seeing increased momentum in its digital cell phone product segment, as positives for the stock.

09-17-2002 DA Davidson Coverage Initiated at Buy

06-12-2002 Needham & Co Coverage Reiterated at Buy

06-12-2002 Prudential Coverage Reiterated at Buy

Earnings growth 253%

PE = 22

Consensus Target Price = $17.00

OmniVision Technologies: Automobiles to be the latest application for CMOS sensors

Katherine Chiu, Taipei; Chou Hua-hsin, DigiTimes.com [Tuesday 1 October 2002]

Automobiles are soon to become the next major application after cameras for CMOS image sensors, according to OmniVision Technologies.

With rapidly evolving computer and imaging technology, a new class of CMOS sensor applications has emerged to increase safety and comfort in driving, beyond the traditional areas of digital cameras and mobiles phones, said Paul Hsu, the company’s engineering manager.

For the Sunnyvale, California-based chip designer, it is also one promising spot upon which to expand share for its CMOS sensor chip business.

The company started 0.25-micron process volume production of 1.3-megapixel CMOS sensors in March, using Taiwan Semiconductor Manufacturing Company (TSMC) and Powerchip Semiconductor Corporation (PSC) as contract manufacturers. The sensors are sold in conjunction with Sunplus Technology’s digital signal processors (DSPs).

As the popularity of digital devices with built-in cameras is building, so is the pricing pressure facing chip designers. After Motorola launched the world’s first 1.3-megapixel CMOS sensor in late 2001, per-unit prices have fallen to US$8-9 from US$13.

To firm up margins, the company is moving into high-end, high-resolution products such as the 2.1-megapixel CMOS sensors that began volume production this month. It expects customers to start designing in its three-megapixel products early next year.

Looking ahead, Hsu said he is confident to see CMOS sensor production value worldwide grow sequentially until 2006 on vehicle-related applications.

Already, some new car models in the US last year started coming equipped with CMOS sensors in their rear-view mirrors to enable a wide-angle rear view.

Demand for “smart” functions using CMOS sensors and other integrated circuit components to detect changes in surroundings, handle sensor information and even perform driver-assisting tasks will also continue to grow strongly, Hsu added.

Katherine Chiu, Taipei; Chou Hua-hsin, DigiTimes.com [Tuesday 1 October 2002]

Automobiles are soon to become the next major application after cameras for CMOS image sensors, according to OmniVision Technologies.

With rapidly evolving computer and imaging technology, a new class of CMOS sensor applications has emerged to increase safety and comfort in driving, beyond the traditional areas of digital cameras and mobiles phones, said Paul Hsu, the company’s engineering manager.

For the Sunnyvale, California-based chip designer, it is also one promising spot upon which to expand share for its CMOS sensor chip business.

The company started 0.25-micron process volume production of 1.3-megapixel CMOS sensors in March, using Taiwan Semiconductor Manufacturing Company (TSMC) and Powerchip Semiconductor Corporation (PSC) as contract manufacturers. The sensors are sold in conjunction with Sunplus Technology’s digital signal processors (DSPs).

As the popularity of digital devices with built-in cameras is building, so is the pricing pressure facing chip designers. After Motorola launched the world’s first 1.3-megapixel CMOS sensor in late 2001, per-unit prices have fallen to US$8-9 from US$13.

To firm up margins, the company is moving into high-end, high-resolution products such as the 2.1-megapixel CMOS sensors that began volume production this month. It expects customers to start designing in its three-megapixel products early next year.

Looking ahead, Hsu said he is confident to see CMOS sensor production value worldwide grow sequentially until 2006 on vehicle-related applications.

Already, some new car models in the US last year started coming equipped with CMOS sensors in their rear-view mirrors to enable a wide-angle rear view.

Demand for “smart” functions using CMOS sensors and other integrated circuit components to detect changes in surroundings, handle sensor information and even perform driver-assisting tasks will also continue to grow strongly, Hsu added.

Chips With Muscle Set Off a Market Tug of War

By WILLIAM J. HOLSTEIN

n the early 1990`s, Sabrina Kemeny was among the researchers at NASA`s Jet Propulsion Laboratory in Southern California who made spacecraft smaller and cheaper. The key was discovering how to build an optical sensor on a single semiconductor, allowing for smaller components that consumed less power.

Advertisement

"That was the breakthrough," Ms. Kemeny recalled. "It was a dislocating kind of technology."

Ms. Kemeny and a handful of colleagues were so excited about the photographic applications of this semiconductor that in 1995, over a kitchen table, they created a company to design it for other companies. But their start-up, called Photobit, lacked the size and capital to go ahead and make this "camera on a chip," a type known in the semiconductor industry as a CMOS (pronounced SEE-moss), which stands for complementary metal oxide semiconductor.

The destiny of Photobit changed nine months ago, when Micron Technology, the large semiconductor maker based in Boise, Idaho, bought the company and renamed it Micron Imaging. Ms. Kemeny is director for technical marketing there.

That decade-long journey from the laboratory is part of a new race in the chip industry, where growth in demand has been disappointingly slow for nearly everything. A notable exception is the photographic applications of CMOS. These chips are responsible for products that are just beginning to reach consumers — including cameras within cellphones, cameras in tiny capsules that can pass through the body to diagnose disease and tiny cameras mounted on personal computers. The chips have many other uses in security systems and industry.

Unlike the technology bubble of the late 1990`s, a time when fanciful dot-coms without real products raced to overpriced initial public offerings, the race to dominate the market for cameras on chips is an old-fashioned kind of technology battle: Real companies are vying to invent real products that touch millions of consumers.

The older technology that CMOS is beginning to displace is called the charge-coupled device, or C.C.D., invented at Bell Labs in the late 1960`s and first used in products like fax machines.

The C.C.D. uses passive sensors, or tiny eyes, that detect light. An outside source of power is required to get the image from the devices, and other circuitry is needed, too. That makes them relatively big and expensive. CMOS chips, by contrast, consist of active sensors that have tiny transistors as power sources. Because of the way CMOS chips are made, sensors and many other processing functions can be placed on one chip.

CMOS technology greatly reduces the amount of power used, allowing batteries to last longer in hand-held devices, but it also provides photographic image quality almost as good as that of charge-coupled devices.

N-STAT/MDR, a Scottsdale, Ariz., unit of the Reed Elsevier Group, a publishing and industry research company, says the number of CMOS chips made each year will triple from current levels by 2006. But In-Stat/MDR said sales, which totaled $1.2 billion last year, were expected to rise only to $1.6 billion in 2006 because the price of each chip would decline as production accelerated.

Micron and others define the market more broadly, putting its potential at $4 billion in annual sales. Whichever figures are correct, it`s clear that solid growth is occurring in one area of the otherwise depressed semiconductor industry.

Micron, a relatively late entry to the field, has tried to leapfrog toward the front with the technology expertise gained from buying Photobit. Three other major American companies are also in the battle. Agilent Technologies, a Palo Alto, Calif., spinoff of Hewlett-Packard, learned from the published research on CMOS done at the Jet Propulsion Laboratory in the 90`s. Its biggest customer is Logitech International, of Fremont, Calif., which makes PC cameras for Dell Computer and others.

The two other companies, Eastman Kodak and Motorola, started a technology alliance in 1997 that makes and sells CMOS chips. The Kodak-Motorola unit sells chips primarily for industrial uses like machine vision, but also for some Kodak digital still cameras.

Two Japanese competitors, Toshiba and Sharp, which have developed their own CMOS manufacturing processes, are generally believed to have a significant advantage. If there is a top potential application for the chips, it could be teenagers` swapping of pictures on their cellphones — already a pastime in Japan. Because Japan has more advanced network systems for its cellphones, service providers like J-Phone can offer camera-equipped cellphones from different Japanese manufacturers.

On long subway and train rides, teenagers while away the time by snapping pictures of their companions and transmitting them to other friends on their phones. "The target market is a 15-year-old Japanese girl with pink hair and a cellphone," said Shawn Maloney, director of marketing for Micron Imaging. "The whole world is watching Japan."

The fact that Japan`s chip makers sell to handset manufacturers who, in turn, sell to service providers could give them an important edge, particularly if the market takes off as expected. "Right now, the leaders for CMOS telephones are in Japan," said Brian O`Rourke, a senior analyst at In-Stat/MDR. "Toshiba is probably the leader."

South Korea is also ahead of the United States in cellphone sophistication, and a Korean company, Samsung Electronics, is a major CMOS competitor. In late September, Samsung formed a CMOS manufacturing alliance with Mitsubishi Electric of Japan.

In the United States, a moment of truth may be at hand for CMOS. Several wireless service providers like Sprint PCS and Cingular Wireless offer small cameras that can be attached to cellphones to take pictures and transmit them. But Sprint PCS is expected to start marketing a Samsung mobile device with an embedded camera in time for the Christmas season.

Nokia of Finland is pushing its camera-equipped cellphone, and an alliance of Sony of Japan and Ericsson of Sweden known as Sony Ericsson Mobile Communications says its camera phone will hit the United States market in the fourth quarter.

UNDERLYING cellphone networks are still slower in the United States than elsewhere, but consumers can still capture single still images in color and transmit them. All these new devices use CMOS.

"We have a lot of hopes for this product," said Jason Hartlove, vice president and general manager of Agilent`s sensor solutions division. Manufacturers are shipping nearly 400 million cellphones worldwide each year, and Mr. Hartlove expressed hope that a growing number would include CMOS-based cameras at an additional cost of about $5 each.

Aside from finding uses for CMOS, the manufacturers are also trying to make the chips more efficiently. That is where Micron hopes to excel. It is the only American maker of dynamic random access memory, or DRAM, chips, a basic in consumer electronics. Micron survived a battle with the Japanese in the 1980`s, only to watch as Samsung Electronics became No. 1 in the world in DRAM chips.

Micron had sales of $2.6 billion in the fiscal year ended Aug. 29, down from $3.9 billion the previous year. It had a net loss of more than $900 million for the year just ended, largely because of falling prices, but the company has $1 billion in cash and is expected to emerge from the current downturn in relatively strong shape because it has kept a strict grip on costs.

DRAM chips are often dismissed as a commodity, but they are a building block of countless electronics devices, including personal computers, personal organizers, set-top boxes, cellphones and game consoles. They are made in a process similar to that used for CMOS. "Our goal is to leverage our advanced CMOS technology and existing infrastructure to establishing a leading position in the expanding imaging markets," said Steven R. Appleton, the chief executive of Micron.

The company is also betting that marrying its mass manufacturing capability with the best CMOS designs from the technology`s inventors will raise the quality of images captured on the chips.

Skeptics said "we could never get to the next level of resolution," said Mr. Maloney of Micron. "But we`re working our way up the resolution ladder."

Things could still go wrong. Manufacturers could charge too much for their camera phones — Nokia`s camera phone, the 7650, is selling for a steep $500 after rebates in Europe. It is also not clear yet whether consumers in the United States will want to snap pictures and send them directly to other mobile devices or to store them first on the Internet.

But after a brutal couple of years in the chip industry, CMOS makers are allowing themselves a measure of hope. Even Kodak, the largest maker of charge-coupled devices in the United States, acknowledges that CMOS chips are improving in quality. Christopher McNiffe, the sales and marketing manager for Kodak`s image sensor solutions division, said that "over time, they will clearly become the dominant technology."

By WILLIAM J. HOLSTEIN

n the early 1990`s, Sabrina Kemeny was among the researchers at NASA`s Jet Propulsion Laboratory in Southern California who made spacecraft smaller and cheaper. The key was discovering how to build an optical sensor on a single semiconductor, allowing for smaller components that consumed less power.

Advertisement

"That was the breakthrough," Ms. Kemeny recalled. "It was a dislocating kind of technology."

Ms. Kemeny and a handful of colleagues were so excited about the photographic applications of this semiconductor that in 1995, over a kitchen table, they created a company to design it for other companies. But their start-up, called Photobit, lacked the size and capital to go ahead and make this "camera on a chip," a type known in the semiconductor industry as a CMOS (pronounced SEE-moss), which stands for complementary metal oxide semiconductor.

The destiny of Photobit changed nine months ago, when Micron Technology, the large semiconductor maker based in Boise, Idaho, bought the company and renamed it Micron Imaging. Ms. Kemeny is director for technical marketing there.

That decade-long journey from the laboratory is part of a new race in the chip industry, where growth in demand has been disappointingly slow for nearly everything. A notable exception is the photographic applications of CMOS. These chips are responsible for products that are just beginning to reach consumers — including cameras within cellphones, cameras in tiny capsules that can pass through the body to diagnose disease and tiny cameras mounted on personal computers. The chips have many other uses in security systems and industry.

Unlike the technology bubble of the late 1990`s, a time when fanciful dot-coms without real products raced to overpriced initial public offerings, the race to dominate the market for cameras on chips is an old-fashioned kind of technology battle: Real companies are vying to invent real products that touch millions of consumers.

The older technology that CMOS is beginning to displace is called the charge-coupled device, or C.C.D., invented at Bell Labs in the late 1960`s and first used in products like fax machines.

The C.C.D. uses passive sensors, or tiny eyes, that detect light. An outside source of power is required to get the image from the devices, and other circuitry is needed, too. That makes them relatively big and expensive. CMOS chips, by contrast, consist of active sensors that have tiny transistors as power sources. Because of the way CMOS chips are made, sensors and many other processing functions can be placed on one chip.

CMOS technology greatly reduces the amount of power used, allowing batteries to last longer in hand-held devices, but it also provides photographic image quality almost as good as that of charge-coupled devices.

N-STAT/MDR, a Scottsdale, Ariz., unit of the Reed Elsevier Group, a publishing and industry research company, says the number of CMOS chips made each year will triple from current levels by 2006. But In-Stat/MDR said sales, which totaled $1.2 billion last year, were expected to rise only to $1.6 billion in 2006 because the price of each chip would decline as production accelerated.

Micron and others define the market more broadly, putting its potential at $4 billion in annual sales. Whichever figures are correct, it`s clear that solid growth is occurring in one area of the otherwise depressed semiconductor industry.

Micron, a relatively late entry to the field, has tried to leapfrog toward the front with the technology expertise gained from buying Photobit. Three other major American companies are also in the battle. Agilent Technologies, a Palo Alto, Calif., spinoff of Hewlett-Packard, learned from the published research on CMOS done at the Jet Propulsion Laboratory in the 90`s. Its biggest customer is Logitech International, of Fremont, Calif., which makes PC cameras for Dell Computer and others.

The two other companies, Eastman Kodak and Motorola, started a technology alliance in 1997 that makes and sells CMOS chips. The Kodak-Motorola unit sells chips primarily for industrial uses like machine vision, but also for some Kodak digital still cameras.

Two Japanese competitors, Toshiba and Sharp, which have developed their own CMOS manufacturing processes, are generally believed to have a significant advantage. If there is a top potential application for the chips, it could be teenagers` swapping of pictures on their cellphones — already a pastime in Japan. Because Japan has more advanced network systems for its cellphones, service providers like J-Phone can offer camera-equipped cellphones from different Japanese manufacturers.

On long subway and train rides, teenagers while away the time by snapping pictures of their companions and transmitting them to other friends on their phones. "The target market is a 15-year-old Japanese girl with pink hair and a cellphone," said Shawn Maloney, director of marketing for Micron Imaging. "The whole world is watching Japan."

The fact that Japan`s chip makers sell to handset manufacturers who, in turn, sell to service providers could give them an important edge, particularly if the market takes off as expected. "Right now, the leaders for CMOS telephones are in Japan," said Brian O`Rourke, a senior analyst at In-Stat/MDR. "Toshiba is probably the leader."

South Korea is also ahead of the United States in cellphone sophistication, and a Korean company, Samsung Electronics, is a major CMOS competitor. In late September, Samsung formed a CMOS manufacturing alliance with Mitsubishi Electric of Japan.

In the United States, a moment of truth may be at hand for CMOS. Several wireless service providers like Sprint PCS and Cingular Wireless offer small cameras that can be attached to cellphones to take pictures and transmit them. But Sprint PCS is expected to start marketing a Samsung mobile device with an embedded camera in time for the Christmas season.

Nokia of Finland is pushing its camera-equipped cellphone, and an alliance of Sony of Japan and Ericsson of Sweden known as Sony Ericsson Mobile Communications says its camera phone will hit the United States market in the fourth quarter.

UNDERLYING cellphone networks are still slower in the United States than elsewhere, but consumers can still capture single still images in color and transmit them. All these new devices use CMOS.

"We have a lot of hopes for this product," said Jason Hartlove, vice president and general manager of Agilent`s sensor solutions division. Manufacturers are shipping nearly 400 million cellphones worldwide each year, and Mr. Hartlove expressed hope that a growing number would include CMOS-based cameras at an additional cost of about $5 each.

Aside from finding uses for CMOS, the manufacturers are also trying to make the chips more efficiently. That is where Micron hopes to excel. It is the only American maker of dynamic random access memory, or DRAM, chips, a basic in consumer electronics. Micron survived a battle with the Japanese in the 1980`s, only to watch as Samsung Electronics became No. 1 in the world in DRAM chips.

Micron had sales of $2.6 billion in the fiscal year ended Aug. 29, down from $3.9 billion the previous year. It had a net loss of more than $900 million for the year just ended, largely because of falling prices, but the company has $1 billion in cash and is expected to emerge from the current downturn in relatively strong shape because it has kept a strict grip on costs.

DRAM chips are often dismissed as a commodity, but they are a building block of countless electronics devices, including personal computers, personal organizers, set-top boxes, cellphones and game consoles. They are made in a process similar to that used for CMOS. "Our goal is to leverage our advanced CMOS technology and existing infrastructure to establishing a leading position in the expanding imaging markets," said Steven R. Appleton, the chief executive of Micron.

The company is also betting that marrying its mass manufacturing capability with the best CMOS designs from the technology`s inventors will raise the quality of images captured on the chips.

Skeptics said "we could never get to the next level of resolution," said Mr. Maloney of Micron. "But we`re working our way up the resolution ladder."

Things could still go wrong. Manufacturers could charge too much for their camera phones — Nokia`s camera phone, the 7650, is selling for a steep $500 after rebates in Europe. It is also not clear yet whether consumers in the United States will want to snap pictures and send them directly to other mobile devices or to store them first on the Internet.

But after a brutal couple of years in the chip industry, CMOS makers are allowing themselves a measure of hope. Even Kodak, the largest maker of charge-coupled devices in the United States, acknowledges that CMOS chips are improving in quality. Christopher McNiffe, the sales and marketing manager for Kodak`s image sensor solutions division, said that "over time, they will clearly become the dominant technology."

http://wearcam.org/seatsale/programs/www.beyondlogic.org/ima…

CMOS Digital Image Sensors

--------------------------------------------------------------------------------

Adding vision to your projects needs not be a difficult task. Whether its machine vision for robot control or the sampling and storage of images for security, CMOS images sensors can offer many advantages over traditional CCD sensors. Just some of the technical advantages of CMOS sensors are,

No Blooming

Low power consumption. Ideal for battery operated devices

Direct digital Output (Incorporates ADC and associated circuitry)

Small size and little support circuitry. Often just a crystal and some decoupling is all that is needed.

Simple to design with.

There are many manufacturers making CMOS Image Sensors. Just some of the more notable ones are Photobit, OmniVision, Agilent (formally known as HP), ST who acquired VLSI Vision and Mitsubishi.

There are two different categories of CMOS Sensors based on their output. One type will have a analog signal out encoded in a video format such as PAL, NTSC, S-Video etc which are designed for camera on a chip applications. With these devices you simply supply power and feed the output straight into you AV Equipment. Others will have a digital out, typically a 4/8 or 16 bit data bus. These `digital` sensors simplify designs, where once a traditional `analog` camera was feed into a video capture card for conversion to digital. Today, digital data can be pulled straight from the sensor.

The main components to a Digital Video Camera design are

CMOS Image Sensor. The heart of the camera. It produces a digital/analog output representing each pixel. It`s support circuitry will normally include a Crystal Oscillator and power supply decoupling. Some sensors may need a resistive bias network of some type. All of these components are normally surface mounted on the back of the PCB and occupies very little real estate.

The lens Holder. This will be either a plastic or metal mount which attaches to your PCB and allows a standard size lens to be screwed in. The screw thread facilitates focusing for fixed lens systems. The base of the lens mount may also have a IR (Infra Red) filter.

The Lens. This will determine your Field of view among other things. Lenses range from fish-eye to telescopic and need to be purchased to fit the parameters of your sensor and lens holder.

Once you have completed the above, you have yourself a imaging system which constantly spits out a pixel data stream synchronised to a pixel, frame and/or line clocks. Connecting this directly to a microcontroller/processor system will cause headaches. Trying to clock this raw data in will use up great amounts of CPU time, if your uC could do it in the first place. If you drop a pixel because an ISR is doing some thing more privileged, then you have no ability to sample that location again, and thus no method of error correction.

While the frame rate on many devices can be slowed down by using internal divisors, it still doesn`t reach an acceptable speed nor allow random access to pixels. Reducing the master clock rate of the device will effect exposure times and other time dependent settings, thus is not an option. Clearly some additional circuitry will need to be designed.

By using a CPLD/FPGA and RAM, you can program the CPLD to dump the data straight into RAM. Your micro could then read this RAM through the PLD which could be memory mapped. If you really want performance (And budget is not a problem), you could use Dual Port RAM. If however you only want to capture one frame, then the PLD could copy one frame into memory and ignore subsequent pixel data until an event such as when your device has read all the data out of RAM. Other options are to use a LVDS (Low Voltage Differential Signalling) serial bus, to relay your data over a few metres or more. At a high enough clock rate, you won`t wait all day for a frame.

The other thing you must not forget is how to control the sensor. Most of it`s internal parameters are controlled by a serial bus, typically I2C for the majority of sensors. This can either be controlled through a memory mapped Register programmed into your PLD or via an I2C port straight from your uC. All up this makes quite a cheap way to capture video. Ideal for your Embedded Linux Systems.

Photobit Corporation

--------------------------------------------------------------------------------

Photobit have many CMOS Image Sensors. CMOS APS (CMOS active pixel sensor) was first created by a team of JPL engineers lead by Dr Eric Fossum. Dr Fossum is now the Chief Scientist and Chairman of Photobit. Two of Photobit’s more common sensors are the PB-100 and PB-300. Other sizes can be sought from Photobit`s Product Matrix

PB-100

CIF Resolution - 360 x 304 Colour or Monochrome

1/5 Inch Optical Format

0-39 Frames a Second, 6 Megabyte Data Rate

Output 8 Bit Serial Digital Video, I2C Control

3.3V Supply, 30mA (100mW)

28-pin CLCC

PB-300

VGA Resolution - 640 x 487 Colour or Monochrome

1/3 Inch Optical Format

0-39 Frames a Second, 24 Megabyte Data Rate

Output 8 Bit Digital Video Data Bus, I2C Control

5V Supply, 60mA (<300mW)

44-pin CLCC

OmniVision Technologies

--------------------------------------------------------------------------------

OmniVision not only develops CMOS Image Sensors, but also support circuitry such as the OV-511 Advanced Camera to USB Bridge. OmniVision is one of the more popular manufacturers with devices such as the OV7910 NTSC/PAL Camera on a Chip being used in many small analog camera modules around the world. This would be the recommended starting point if you are starting out designing with CMOS Image Sensors.

OV6620

352 x 488 Colour(OV6620) or Monochrome(OV6120)

1/3 Inch Optical Format

0-39 Frames a Second, 24 Megabyte Data Rate

Output 8 Bit Digital Video Data Bus, I2C Control

5V Supply, 60mA (<300mW)

44-pin CLCC

OV7620

664 x 492 Colour (OV7620) or Monochrome(OV7110)

1/3 Inch Optical Format

0.5- 30 Frames per Second

Output , I2C Control

5V Supply <120mW

48-pin LCC

OmniVision and some third part vendors have evaluation modules for the OmniVision sensors. This allows you to get up to speed with the sensor, incorporating a PCB with de-coupling, a Lens and Lens Holder. The majority of the sensor`s signals are broken out to a header which you can use to interface to your own designs. The evaluation modules in small quantities are normally much easier to obtain than the sensors themselves, and are typically cheaper as a result.

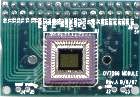

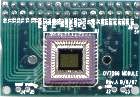

A picture of the M3188 Evaluation Module with

A picture of the M3188 Evaluation Module with

the lens holder removed. The signals can be obtained

from the 32 pin header on the top of the module

DIY Electronics (http://www.kitsrus.com) are just one outlet which sells the third party evaluation boards.

1/3" B/W Camera VGA Module M3188 with Digital Output (OV7110 Sensor)

1/3" Colour Camera VGA Module C3188 with Digital Output (OV7610 Sensor)

1/3" Colour Camera Module NTSC/PAL Out (OV7910 Sensor)

Mitsubishi Chips

--------------------------------------------------------------------------------

Mitsubishi have broken the pack, to produce smaller resolution sensors. These sensors can typically be used for a range of applications such as finger print sensing, motor detection, gaming, tracing of moving parts etc. Just one application is the new optical mice flooding the market place. They use a low resolution Image Sensor to track movement on a wide variety of surfaces.

Also unique to these sensors is in-built image processing. Both sensors can output edge enhanced or extracted data, making them ideal for tracking on small robots, industrial control etc. The sensors can also process 2D images into 1D. The output of each pixel is by the means of a analog potential, thus this must be fed into an ADC to return digital image data.

M64285FP CMOS Image Sensor

32 x 32 Pixel Black & White, 1/6" Optical Format

5V Supply < 15mW

In Built Edge Extraction

Max 5000 frames per second

Analog Output to uC ADC

10pin SO Package

M64282FP Artificial Retina LSI

128 x 128 Pixel Black & White, 1/4" Optical Format

5V Supply < 15mW

Positive and negative image output, Edge enhancement / extraction

10 to 30 frames per second

16pin TSOP Package

ST Microelectronics Imaging Division

--------------------------------------------------------------------------------

Spectronix have used the ST Sensors in their RoboCam Series. ST also offer a couple of CoProcessors, a STV0657 Digital CoProcessor, a STV0672 USB CoProcessor and a STV0680 DSC (Digital Still Camera) CoProcessor. The DSC CoProcessor offers an RS-232 / USB Interface and on board SDRAM Storage.

VV5301/VV6301

VV5500 Monochrome / VV6500 Colour 648 x 484 VGA Sensor

10bit ADC Output RAW

3.3V-6.0V (Built In Regulator) <25mA

48 LCC Package

Agilent Technolgies

--------------------------------------------------------------------------------

HDCS-2000

VGA 640x480 Colour

10 Bit ADC

3.3V <200mW

44Pin PQFP Package

HDCS-1000/HDCS-1100

CIF 352 x 288 Colour (HDCS-1000) & Monochrome (HDCS-1100)

10 Bit ADC

3.3V <200mW

44Pin PQFP

Digital Imaging Optics

--------------------------------------------------------------------------------

Choosing a CMOS Image Sensor is the easy bit. Once you have chosen your sensor a suitable lens and lens assembly needs to be found. A PCB mount lens holder will screw to the PCB, covering up your sensor from light. The top of the holder will have a standard thread which will allow you to screw in a lens with the same thread type. The lens holder may also incorporate a Infra-Red Cut Off filter and is typically made of Black ABS Plastic or Black Anodised Diecast Aluminium.

The typical thread sizes are detailed below,

A S-mount glass lens

A S-mount glass lens

encased in aluminium

Mount Type Thread Distance from Back Flange to Image Sensor

C 1 – 32 (1 Inch/32 Threads Per Inch) 17.526 mm

CS 1 – 32 (1 Inch/32 Threads Per Inch) 12.5 mm

S M12x0.5 Not Specified

X M10x0.5 Not Specified

C & CS Mount Lens are typically used by the CCTV Market. Being an inch in diameter they take up quite a bit of real estate but give a better result. S and X mount lens are more typically used on the eyeball PC Cameras being only 12mm in Diameter. S Mount (M12x0.5) Lens are the more dominant standard in eyeball / small cameras sacrificing image clarity for size.

The Lens will screw into your PCB mount thus ensure it has the same thread. You will be able to purchase lenses of different focal lengths, made of either glass or plastic. Plastic are cheaper and typically of lower quality than multi element glass lenses. Lens can also come housed in plastic or aluminium. Beware of inferior quality.

There are a number of parameters associated with the lens. The Focal Length expressed in millimetres determines the field of view. A typical human perception is about 40 degrees, thus this is targeted as the normal view. They can range from telescopic at approximately 20 degrees field of view which has a high image magnification to fish-eye at approximately 110 degrees or more. The field of view can be calculated from the focal length and diameter of the sensor, but most vendors will normally specify both the field of view and focus length.

The aperture number, f Number or f / # specifies the amount of light which passes through the lens. The lower the number, the more light that will pass through the lens, thus the better performance in low light conditions. Every time the f number doubles, the light is reduced by a factor of 4. A lower f-number requires more precise adjustment of focus, where as a lens with a high f-number will be easier to focus. Eyeball cameras for PC imaging have a typical f-number of 1.8 to 2.0 where 2.0 is standard for most S-Mount Lenses. Pinhole lens, while having the ability to be concealed behind a hole have a high f-number thus are not as effective in low light environments.

The inside view of a lens holder showing the IR Filter.

The inside view of a lens holder showing the IR Filter.

B/W sensors do not require the filter.

The pixel element of a CMOS sensor is normally susceptible to a greater span of the electromagnetic spectrum than the human eye. The sensors ability will range from the deep blues to almost infra-red. To get a more accurate measure of what the human eye is seeing, an IR Cut Off filter is included with most lens mounts or lenses. Colour aliasing and blurring can be a consequence of omitting the IR Cut Filter on a colour imaging system.

As the IR cut off filter can either be part of the lens or lens assembly this will need to check on purchasing. The filter present on a lens mount looks like a bit of thick glass mounted to the bottom of the mount. This is normally made up of several layers of optical crystal with a IR Cut Crystal layer. Beware of some lens having a film on the back of the lens as these are easy to scratch.

Another example of a Lens Holder

Another example of a Lens Holder

with IR Filter.

Typical lens and lens mount vendors are

Sunex Inc

Mini & Micro Digital Imaging Lenses (PC Cam Lenses)

C/CS-Mount Lenses

CMT-002 OffSet M12x0.5 Lens Mount Black ABS

CMT-003 M12x0.5 Lens Mount Black Anodised Diecast Al.

Marshall Electronics Optical Systems Division

V-LH3A Lens Holder M12x0.5

V-LH05-2 Lens Holder M12x0.5

Miniature Lenses

International Space Optics / Rainbow

Lenses

Smart Vision Products

Lenses

PCB Mount Lens Holders & Lenses

Sources of additional information

Allthings Lens Selection Guide

Allthings - 1/3" Board Fixed Iris Lenses

Photobit Photobit`s Lens Selection Guide

Working Technologies A source of lenses and PCB lens mounts with IR filters

DIY Electronics - CMOS Video Camera Modules & Evaluation Boards

Pre-Build Modules

--------------------------------------------------------------------------------

For the faint hearted or strapped for time (but not for cash) you can get pre-build modules from Spectronix which terminates to a Ribbon Cable and can provide a RAM based memory mapped interface. Spectronix’s RoboCam I (164x124) and RoboCam II (356x292) come in both B&W and Colour Versions based on ST/Visions VV5404/VV6404/VV5300/VV6300 CMOS Images Sensors.

RoboCam RC-1

160 x 120 Pixels

Monochrome and Bayer Colour

8 or 4 bit data output, frame and pixel clock and I2C control interface

Single 2x2 Inch PCB

RoboCam RC-2

356 x 292 Pixels

Monochrome and Bayer Colour

8 or 4 bit data output, frame and pixel clock and I2C control interface

Single 2x2 Inch PCB

RamCams RCM-1/RCM-2

160 x 120 and 356 x 292 pixel versions

Monochrome or Bayer Colour

Flexible 8-bit RAM interface, 3 modes + int

Double 2x2 Inch PCB - Ribbon Cable Interface

Photo of the Spectronix RAMCAM2

Photo of the Spectronix RAMCAM2

CMOS Digital Image Sensors

--------------------------------------------------------------------------------

Adding vision to your projects needs not be a difficult task. Whether its machine vision for robot control or the sampling and storage of images for security, CMOS images sensors can offer many advantages over traditional CCD sensors. Just some of the technical advantages of CMOS sensors are,

No Blooming

Low power consumption. Ideal for battery operated devices

Direct digital Output (Incorporates ADC and associated circuitry)

Small size and little support circuitry. Often just a crystal and some decoupling is all that is needed.

Simple to design with.

There are many manufacturers making CMOS Image Sensors. Just some of the more notable ones are Photobit, OmniVision, Agilent (formally known as HP), ST who acquired VLSI Vision and Mitsubishi.

There are two different categories of CMOS Sensors based on their output. One type will have a analog signal out encoded in a video format such as PAL, NTSC, S-Video etc which are designed for camera on a chip applications. With these devices you simply supply power and feed the output straight into you AV Equipment. Others will have a digital out, typically a 4/8 or 16 bit data bus. These `digital` sensors simplify designs, where once a traditional `analog` camera was feed into a video capture card for conversion to digital. Today, digital data can be pulled straight from the sensor.

The main components to a Digital Video Camera design are

CMOS Image Sensor. The heart of the camera. It produces a digital/analog output representing each pixel. It`s support circuitry will normally include a Crystal Oscillator and power supply decoupling. Some sensors may need a resistive bias network of some type. All of these components are normally surface mounted on the back of the PCB and occupies very little real estate.

The lens Holder. This will be either a plastic or metal mount which attaches to your PCB and allows a standard size lens to be screwed in. The screw thread facilitates focusing for fixed lens systems. The base of the lens mount may also have a IR (Infra Red) filter.

The Lens. This will determine your Field of view among other things. Lenses range from fish-eye to telescopic and need to be purchased to fit the parameters of your sensor and lens holder.

Once you have completed the above, you have yourself a imaging system which constantly spits out a pixel data stream synchronised to a pixel, frame and/or line clocks. Connecting this directly to a microcontroller/processor system will cause headaches. Trying to clock this raw data in will use up great amounts of CPU time, if your uC could do it in the first place. If you drop a pixel because an ISR is doing some thing more privileged, then you have no ability to sample that location again, and thus no method of error correction.

While the frame rate on many devices can be slowed down by using internal divisors, it still doesn`t reach an acceptable speed nor allow random access to pixels. Reducing the master clock rate of the device will effect exposure times and other time dependent settings, thus is not an option. Clearly some additional circuitry will need to be designed.

By using a CPLD/FPGA and RAM, you can program the CPLD to dump the data straight into RAM. Your micro could then read this RAM through the PLD which could be memory mapped. If you really want performance (And budget is not a problem), you could use Dual Port RAM. If however you only want to capture one frame, then the PLD could copy one frame into memory and ignore subsequent pixel data until an event such as when your device has read all the data out of RAM. Other options are to use a LVDS (Low Voltage Differential Signalling) serial bus, to relay your data over a few metres or more. At a high enough clock rate, you won`t wait all day for a frame.

The other thing you must not forget is how to control the sensor. Most of it`s internal parameters are controlled by a serial bus, typically I2C for the majority of sensors. This can either be controlled through a memory mapped Register programmed into your PLD or via an I2C port straight from your uC. All up this makes quite a cheap way to capture video. Ideal for your Embedded Linux Systems.

Photobit Corporation

--------------------------------------------------------------------------------

Photobit have many CMOS Image Sensors. CMOS APS (CMOS active pixel sensor) was first created by a team of JPL engineers lead by Dr Eric Fossum. Dr Fossum is now the Chief Scientist and Chairman of Photobit. Two of Photobit’s more common sensors are the PB-100 and PB-300. Other sizes can be sought from Photobit`s Product Matrix

PB-100

CIF Resolution - 360 x 304 Colour or Monochrome

1/5 Inch Optical Format

0-39 Frames a Second, 6 Megabyte Data Rate

Output 8 Bit Serial Digital Video, I2C Control

3.3V Supply, 30mA (100mW)

28-pin CLCC

PB-300

VGA Resolution - 640 x 487 Colour or Monochrome

1/3 Inch Optical Format

0-39 Frames a Second, 24 Megabyte Data Rate

Output 8 Bit Digital Video Data Bus, I2C Control

5V Supply, 60mA (<300mW)

44-pin CLCC

OmniVision Technologies

--------------------------------------------------------------------------------

OmniVision not only develops CMOS Image Sensors, but also support circuitry such as the OV-511 Advanced Camera to USB Bridge. OmniVision is one of the more popular manufacturers with devices such as the OV7910 NTSC/PAL Camera on a Chip being used in many small analog camera modules around the world. This would be the recommended starting point if you are starting out designing with CMOS Image Sensors.

OV6620

352 x 488 Colour(OV6620) or Monochrome(OV6120)

1/3 Inch Optical Format

0-39 Frames a Second, 24 Megabyte Data Rate

Output 8 Bit Digital Video Data Bus, I2C Control

5V Supply, 60mA (<300mW)

44-pin CLCC

OV7620

664 x 492 Colour (OV7620) or Monochrome(OV7110)

1/3 Inch Optical Format

0.5- 30 Frames per Second

Output , I2C Control

5V Supply <120mW

48-pin LCC

OmniVision and some third part vendors have evaluation modules for the OmniVision sensors. This allows you to get up to speed with the sensor, incorporating a PCB with de-coupling, a Lens and Lens Holder. The majority of the sensor`s signals are broken out to a header which you can use to interface to your own designs. The evaluation modules in small quantities are normally much easier to obtain than the sensors themselves, and are typically cheaper as a result.

A picture of the M3188 Evaluation Module with

A picture of the M3188 Evaluation Module withthe lens holder removed. The signals can be obtained

from the 32 pin header on the top of the module

DIY Electronics (http://www.kitsrus.com) are just one outlet which sells the third party evaluation boards.

1/3" B/W Camera VGA Module M3188 with Digital Output (OV7110 Sensor)

1/3" Colour Camera VGA Module C3188 with Digital Output (OV7610 Sensor)

1/3" Colour Camera Module NTSC/PAL Out (OV7910 Sensor)

Mitsubishi Chips

--------------------------------------------------------------------------------

Mitsubishi have broken the pack, to produce smaller resolution sensors. These sensors can typically be used for a range of applications such as finger print sensing, motor detection, gaming, tracing of moving parts etc. Just one application is the new optical mice flooding the market place. They use a low resolution Image Sensor to track movement on a wide variety of surfaces.

Also unique to these sensors is in-built image processing. Both sensors can output edge enhanced or extracted data, making them ideal for tracking on small robots, industrial control etc. The sensors can also process 2D images into 1D. The output of each pixel is by the means of a analog potential, thus this must be fed into an ADC to return digital image data.

M64285FP CMOS Image Sensor

32 x 32 Pixel Black & White, 1/6" Optical Format

5V Supply < 15mW

In Built Edge Extraction

Max 5000 frames per second

Analog Output to uC ADC

10pin SO Package

M64282FP Artificial Retina LSI

128 x 128 Pixel Black & White, 1/4" Optical Format

5V Supply < 15mW

Positive and negative image output, Edge enhancement / extraction

10 to 30 frames per second

16pin TSOP Package

ST Microelectronics Imaging Division

--------------------------------------------------------------------------------

Spectronix have used the ST Sensors in their RoboCam Series. ST also offer a couple of CoProcessors, a STV0657 Digital CoProcessor, a STV0672 USB CoProcessor and a STV0680 DSC (Digital Still Camera) CoProcessor. The DSC CoProcessor offers an RS-232 / USB Interface and on board SDRAM Storage.

VV5301/VV6301

VV5500 Monochrome / VV6500 Colour 648 x 484 VGA Sensor

10bit ADC Output RAW

3.3V-6.0V (Built In Regulator) <25mA

48 LCC Package

Agilent Technolgies

--------------------------------------------------------------------------------

HDCS-2000

VGA 640x480 Colour

10 Bit ADC

3.3V <200mW

44Pin PQFP Package

HDCS-1000/HDCS-1100

CIF 352 x 288 Colour (HDCS-1000) & Monochrome (HDCS-1100)

10 Bit ADC

3.3V <200mW

44Pin PQFP

Digital Imaging Optics

--------------------------------------------------------------------------------

Choosing a CMOS Image Sensor is the easy bit. Once you have chosen your sensor a suitable lens and lens assembly needs to be found. A PCB mount lens holder will screw to the PCB, covering up your sensor from light. The top of the holder will have a standard thread which will allow you to screw in a lens with the same thread type. The lens holder may also incorporate a Infra-Red Cut Off filter and is typically made of Black ABS Plastic or Black Anodised Diecast Aluminium.

The typical thread sizes are detailed below,

A S-mount glass lens

A S-mount glass lens encased in aluminium

Mount Type Thread Distance from Back Flange to Image Sensor

C 1 – 32 (1 Inch/32 Threads Per Inch) 17.526 mm

CS 1 – 32 (1 Inch/32 Threads Per Inch) 12.5 mm

S M12x0.5 Not Specified

X M10x0.5 Not Specified

C & CS Mount Lens are typically used by the CCTV Market. Being an inch in diameter they take up quite a bit of real estate but give a better result. S and X mount lens are more typically used on the eyeball PC Cameras being only 12mm in Diameter. S Mount (M12x0.5) Lens are the more dominant standard in eyeball / small cameras sacrificing image clarity for size.

The Lens will screw into your PCB mount thus ensure it has the same thread. You will be able to purchase lenses of different focal lengths, made of either glass or plastic. Plastic are cheaper and typically of lower quality than multi element glass lenses. Lens can also come housed in plastic or aluminium. Beware of inferior quality.

There are a number of parameters associated with the lens. The Focal Length expressed in millimetres determines the field of view. A typical human perception is about 40 degrees, thus this is targeted as the normal view. They can range from telescopic at approximately 20 degrees field of view which has a high image magnification to fish-eye at approximately 110 degrees or more. The field of view can be calculated from the focal length and diameter of the sensor, but most vendors will normally specify both the field of view and focus length.

The aperture number, f Number or f / # specifies the amount of light which passes through the lens. The lower the number, the more light that will pass through the lens, thus the better performance in low light conditions. Every time the f number doubles, the light is reduced by a factor of 4. A lower f-number requires more precise adjustment of focus, where as a lens with a high f-number will be easier to focus. Eyeball cameras for PC imaging have a typical f-number of 1.8 to 2.0 where 2.0 is standard for most S-Mount Lenses. Pinhole lens, while having the ability to be concealed behind a hole have a high f-number thus are not as effective in low light environments.

The inside view of a lens holder showing the IR Filter.

The inside view of a lens holder showing the IR Filter.B/W sensors do not require the filter.

The pixel element of a CMOS sensor is normally susceptible to a greater span of the electromagnetic spectrum than the human eye. The sensors ability will range from the deep blues to almost infra-red. To get a more accurate measure of what the human eye is seeing, an IR Cut Off filter is included with most lens mounts or lenses. Colour aliasing and blurring can be a consequence of omitting the IR Cut Filter on a colour imaging system.

As the IR cut off filter can either be part of the lens or lens assembly this will need to check on purchasing. The filter present on a lens mount looks like a bit of thick glass mounted to the bottom of the mount. This is normally made up of several layers of optical crystal with a IR Cut Crystal layer. Beware of some lens having a film on the back of the lens as these are easy to scratch.

Another example of a Lens Holder

Another example of a Lens Holderwith IR Filter.

Typical lens and lens mount vendors are

Sunex Inc

Mini & Micro Digital Imaging Lenses (PC Cam Lenses)

C/CS-Mount Lenses

CMT-002 OffSet M12x0.5 Lens Mount Black ABS

CMT-003 M12x0.5 Lens Mount Black Anodised Diecast Al.

Marshall Electronics Optical Systems Division

V-LH3A Lens Holder M12x0.5

V-LH05-2 Lens Holder M12x0.5

Miniature Lenses

International Space Optics / Rainbow

Lenses

Smart Vision Products

Lenses

PCB Mount Lens Holders & Lenses

Sources of additional information

Allthings Lens Selection Guide

Allthings - 1/3" Board Fixed Iris Lenses

Photobit Photobit`s Lens Selection Guide

Working Technologies A source of lenses and PCB lens mounts with IR filters

DIY Electronics - CMOS Video Camera Modules & Evaluation Boards

Pre-Build Modules

--------------------------------------------------------------------------------

For the faint hearted or strapped for time (but not for cash) you can get pre-build modules from Spectronix which terminates to a Ribbon Cable and can provide a RAM based memory mapped interface. Spectronix’s RoboCam I (164x124) and RoboCam II (356x292) come in both B&W and Colour Versions based on ST/Visions VV5404/VV6404/VV5300/VV6300 CMOS Images Sensors.

RoboCam RC-1

160 x 120 Pixels

Monochrome and Bayer Colour

8 or 4 bit data output, frame and pixel clock and I2C control interface

Single 2x2 Inch PCB

RoboCam RC-2

356 x 292 Pixels

Monochrome and Bayer Colour

8 or 4 bit data output, frame and pixel clock and I2C control interface

Single 2x2 Inch PCB

RamCams RCM-1/RCM-2

160 x 120 and 356 x 292 pixel versions

Monochrome or Bayer Colour

Flexible 8-bit RAM interface, 3 modes + int

Double 2x2 Inch PCB - Ribbon Cable Interface

Photo of the Spectronix RAMCAM2

Photo of the Spectronix RAMCAM2

HighTech Investor: Ein gutes Bild

Die Omnivision Inc. zählt zu den eher kleinen US-Werten – noch, denn das Unternehmen ist gerade mitten im Turnaround und seine Schlüsseltechnologie kurz vor dem Durchbruch.

Schalow Communications

Martin Brust

23. August 2002

Omnivision Technologies Inc.

WKN 936737

Branche Halbleiterindustrie

Land USA

Kurs bei Besprechung 9,90 Euro

Datum 23.08.2002

Börsenkennzahlen

Unternehmen Omnivision Technologies Inc.

52 Wochen Hoch 15,20 Euro

52 Wochen Tief 2,80 Euro

Marktkapitalisierung 227 Mio. Euro

Erwähnte Unternehmen

Name WKN Kauf Verk. News

Omnivision Technologies Inc. 936737

Vodafone plc 875999

Frankfurt – Im europäischen Telekomsektor gelten zur Zeit der SMS-Nachfolger MMS und i-Mode als kommende Killerapplikation im Vorfeld der im kommenden Jahr startenden UMTS-Technologie. Alle drei Techniken versprechen vor allem eins: Bilder, die mobil übertragen werden können. Dazu muss der User sie aber zunächst mal aufnehmen, er braucht also eine Kamera, die möglichst einfach in das Telefon integriert werden kann. Also klein und leicht sein muss und wenig Strom verbraucht. Das neue T68-Handy von SonyEricsson ist bereits auf dem Markt und Deutschlands Mobilfunker Nummer zwei, Vodafone, promotet Gerät und MMS-Service bereits stark, die Konkurrenz wird nachziehen. Und E-Plus versucht sein Glück mit dem in Japan so erfolgreichen i-Mode. Soll der Aktionär also in Telekomaktien investieren, wenn er an diesem Trend partizipieren will? Zu dieser momentan nicht sehr beliebten Möglichkeit gibt es eine Alternative: die Aktien der Omnivision Technologies Inc.

Das 1995 gegründete und seit dem Jahr 2000 an der NASDAQ notierte Unternehmen aus Kalifornien könnte stark von diesem Trend profitieren, denn es produziert sogenannte Single-Chip-CMOS-Kameras. Da die komplette Optik der Kamera und alle ihre Funktionen auf einem Chip konzentriert sind, können die Kunden von Omnivision trotz guter Performance der Kamera und hoher Auflösung – das aktuelle Spitzenprodukt bietet über zwei Mio. Pixel und steht damit handelsüblichen Digitalkameras im Kompaktformat kaum nach – von geringem Platz- und Stromverbrauch sowie Kostenvorteilen profitieren.

Die Einsatzmöglichkeiten der Omnivision-Produkte sind übrigens keineswegs auf Mobiltelefone und andere mobile Geräte beschränkt. Sie kommen auch in Automobilen, zur biometrischen Sicherheitserkennung, bei Überwachungsaufgaben, in Videotelefonen, Strichcodelesern, Spielzeugen oder medizinischen Geräten zum Einsatz. Das Fraunhofer-Institut schreibt zum Vergleich zwischen CMOS- und herkömmlicher CCD-Technik: „Die CMOS-Technik bietet bei vergleichbarer Bildqualität weitgehende Blendfreiheit, hohe Temperaturfestigkeit, wahlfreien Pixelzugriff und geringeren Stromverbrauch und ist zudem kostengünstiger zu fertigen.“

Omnivision macht bereits gute Geschäfte mit seinen Kameras. Im Geschäftsjahr 2002 (zum 30. April) sank zwar der Umsatz von 53,7 Mio. USD im Vorjahr auf 46,5 Mio. USD, aber das Unternehmen konnte einen Bruttogewinn von 20,5 Mio. USD erzielen. Unter dem Strich wurde zwar noch immer ein Verlust ausgewiesen, dieser war aber mit 0,06 USD je Aktie deutlich niedriger als im Vorjahr, als der Verlust 0,67 USD je Aktie betrug. Die Zahlen des vierten Quartals 2002 dokumentieren den Aufwärtstrend: Von Februar bis April wurden 13,1 Mio. USD Umsatz gemacht und ein Reingewinn von 1,6 Mio. USD erwirtschaftet. Und die allerneusten Quartalszahlen für die ersten drei Monate im laufenden Geschäftsjahr 2003 zeigen, dass sich dieser Trend zumindest hält. Bei einem auf 16,7 Mio. USD gewachsenen Umsatz wurde ein sequentiell stabiler Reingewinn von wiederum 1,6 Mio. USD oder sieben us-cts je Aktie erzielt. Analysten hatten nur 0,05 USD Gewinn je Aktie erwartet.

Auch die Bilanz des Unternehmens scheint solide, es werden 56,3 Mio. USD Barmittel ausgewiesen, außerdem ist Omnivision schuldenfrei. Bei Vorlage der Quartalszahlen zu Wochenbeginn sagte CEO Shaw Hong: „Wir sind weiterhin sehr zufrieden mit dem Wachstum unseres Geschäfts und wir sind auch in der aktuellen Situation optimistisch, dass wir während des Geschäftsjahres 2003 weiteres Wachstum von Quartal zu Quartal sehen werden.“ Für das laufende Quartal erwartet der Vorstand einen Nettogewinn von 1,7 bis 2,2 Mio. USD, entsprechend 0,07 bis 0,09 USD je Aktie, bei Erlösen zwischen 18 und 19 Mio. USD. Die us-amerikanischen Analysten, die das Unternehmen beobachten, raten zum Kauf der Aktie und erwarten im laufenden Jahr einen Gewinn von 0,29 USD je Aktie. Für das aktuelle Quartal hatten die Schätzungen vor Bekanntgabe der Unternehmensprognosen bei fünf us-cts gelegen.

Derzeit errechnet sich für das Omnivision-Papier ein laufendes KGV von 32 – das ist nicht gerade ein Schnäppchen. Die aktuelle Marktkapitalisierung von 211 Mio. USD verstärkt diesen Eindruck. Die Aktie hat im Jahresverlauf den NASDAQ Composite Index dauerhaft übertroffen, abgesehen von einer kurzen Phase Ende Februar. Und alleine in den ersten drei August-Wochen einen Kursanstieg von 50 Prozent gesehen, ehe dann nach den Quartalszahlen deutliche Kursverluste gemacht wurden. Diese scheinen auf Gewinnmitnahmen zurück zu führen sein, denn direkt nach Veröffentlichung der Zahlen hatte es noch Gewinne von fast fünf Prozent gegeben. Der Anleger kann also angesichts der aktuell nervösen Börsensituation möglicherweise noch auf günstigere Einstiegskurse hoffen – obwohl fundamental eigentlich alles für einen weiteren Kursanstieg spricht.

© 2001 schalow communications GmbH

Consors und schalow communications übernehmen keine Haftung für die Richtigkeit der Angaben!

Die Omnivision Inc. zählt zu den eher kleinen US-Werten – noch, denn das Unternehmen ist gerade mitten im Turnaround und seine Schlüsseltechnologie kurz vor dem Durchbruch.

Schalow Communications

Martin Brust

23. August 2002

Omnivision Technologies Inc.

WKN 936737

Branche Halbleiterindustrie

Land USA

Kurs bei Besprechung 9,90 Euro

Datum 23.08.2002

Börsenkennzahlen

Unternehmen Omnivision Technologies Inc.

52 Wochen Hoch 15,20 Euro

52 Wochen Tief 2,80 Euro

Marktkapitalisierung 227 Mio. Euro

Erwähnte Unternehmen

Name WKN Kauf Verk. News

Omnivision Technologies Inc. 936737

Vodafone plc 875999

Frankfurt – Im europäischen Telekomsektor gelten zur Zeit der SMS-Nachfolger MMS und i-Mode als kommende Killerapplikation im Vorfeld der im kommenden Jahr startenden UMTS-Technologie. Alle drei Techniken versprechen vor allem eins: Bilder, die mobil übertragen werden können. Dazu muss der User sie aber zunächst mal aufnehmen, er braucht also eine Kamera, die möglichst einfach in das Telefon integriert werden kann. Also klein und leicht sein muss und wenig Strom verbraucht. Das neue T68-Handy von SonyEricsson ist bereits auf dem Markt und Deutschlands Mobilfunker Nummer zwei, Vodafone, promotet Gerät und MMS-Service bereits stark, die Konkurrenz wird nachziehen. Und E-Plus versucht sein Glück mit dem in Japan so erfolgreichen i-Mode. Soll der Aktionär also in Telekomaktien investieren, wenn er an diesem Trend partizipieren will? Zu dieser momentan nicht sehr beliebten Möglichkeit gibt es eine Alternative: die Aktien der Omnivision Technologies Inc.

Das 1995 gegründete und seit dem Jahr 2000 an der NASDAQ notierte Unternehmen aus Kalifornien könnte stark von diesem Trend profitieren, denn es produziert sogenannte Single-Chip-CMOS-Kameras. Da die komplette Optik der Kamera und alle ihre Funktionen auf einem Chip konzentriert sind, können die Kunden von Omnivision trotz guter Performance der Kamera und hoher Auflösung – das aktuelle Spitzenprodukt bietet über zwei Mio. Pixel und steht damit handelsüblichen Digitalkameras im Kompaktformat kaum nach – von geringem Platz- und Stromverbrauch sowie Kostenvorteilen profitieren.

Die Einsatzmöglichkeiten der Omnivision-Produkte sind übrigens keineswegs auf Mobiltelefone und andere mobile Geräte beschränkt. Sie kommen auch in Automobilen, zur biometrischen Sicherheitserkennung, bei Überwachungsaufgaben, in Videotelefonen, Strichcodelesern, Spielzeugen oder medizinischen Geräten zum Einsatz. Das Fraunhofer-Institut schreibt zum Vergleich zwischen CMOS- und herkömmlicher CCD-Technik: „Die CMOS-Technik bietet bei vergleichbarer Bildqualität weitgehende Blendfreiheit, hohe Temperaturfestigkeit, wahlfreien Pixelzugriff und geringeren Stromverbrauch und ist zudem kostengünstiger zu fertigen.“

Omnivision macht bereits gute Geschäfte mit seinen Kameras. Im Geschäftsjahr 2002 (zum 30. April) sank zwar der Umsatz von 53,7 Mio. USD im Vorjahr auf 46,5 Mio. USD, aber das Unternehmen konnte einen Bruttogewinn von 20,5 Mio. USD erzielen. Unter dem Strich wurde zwar noch immer ein Verlust ausgewiesen, dieser war aber mit 0,06 USD je Aktie deutlich niedriger als im Vorjahr, als der Verlust 0,67 USD je Aktie betrug. Die Zahlen des vierten Quartals 2002 dokumentieren den Aufwärtstrend: Von Februar bis April wurden 13,1 Mio. USD Umsatz gemacht und ein Reingewinn von 1,6 Mio. USD erwirtschaftet. Und die allerneusten Quartalszahlen für die ersten drei Monate im laufenden Geschäftsjahr 2003 zeigen, dass sich dieser Trend zumindest hält. Bei einem auf 16,7 Mio. USD gewachsenen Umsatz wurde ein sequentiell stabiler Reingewinn von wiederum 1,6 Mio. USD oder sieben us-cts je Aktie erzielt. Analysten hatten nur 0,05 USD Gewinn je Aktie erwartet.

Auch die Bilanz des Unternehmens scheint solide, es werden 56,3 Mio. USD Barmittel ausgewiesen, außerdem ist Omnivision schuldenfrei. Bei Vorlage der Quartalszahlen zu Wochenbeginn sagte CEO Shaw Hong: „Wir sind weiterhin sehr zufrieden mit dem Wachstum unseres Geschäfts und wir sind auch in der aktuellen Situation optimistisch, dass wir während des Geschäftsjahres 2003 weiteres Wachstum von Quartal zu Quartal sehen werden.“ Für das laufende Quartal erwartet der Vorstand einen Nettogewinn von 1,7 bis 2,2 Mio. USD, entsprechend 0,07 bis 0,09 USD je Aktie, bei Erlösen zwischen 18 und 19 Mio. USD. Die us-amerikanischen Analysten, die das Unternehmen beobachten, raten zum Kauf der Aktie und erwarten im laufenden Jahr einen Gewinn von 0,29 USD je Aktie. Für das aktuelle Quartal hatten die Schätzungen vor Bekanntgabe der Unternehmensprognosen bei fünf us-cts gelegen.

Derzeit errechnet sich für das Omnivision-Papier ein laufendes KGV von 32 – das ist nicht gerade ein Schnäppchen. Die aktuelle Marktkapitalisierung von 211 Mio. USD verstärkt diesen Eindruck. Die Aktie hat im Jahresverlauf den NASDAQ Composite Index dauerhaft übertroffen, abgesehen von einer kurzen Phase Ende Februar. Und alleine in den ersten drei August-Wochen einen Kursanstieg von 50 Prozent gesehen, ehe dann nach den Quartalszahlen deutliche Kursverluste gemacht wurden. Diese scheinen auf Gewinnmitnahmen zurück zu führen sein, denn direkt nach Veröffentlichung der Zahlen hatte es noch Gewinne von fast fünf Prozent gegeben. Der Anleger kann also angesichts der aktuell nervösen Börsensituation möglicherweise noch auf günstigere Einstiegskurse hoffen – obwohl fundamental eigentlich alles für einen weiteren Kursanstieg spricht.

© 2001 schalow communications GmbH

Consors und schalow communications übernehmen keine Haftung für die Richtigkeit der Angaben!

OmniVision Announces Volume Orders and Shipments of 2M Pixel CMOS CameraChips

Friday October 11, 8:01 am ET

SUNNYVALE, Calif.--(BUSINESS WIRE)--Oct. 11, 2002--OmniVision Technologies, Inc. (Nasdaq:OVTI - News), a market-leading independent supplier of CameraChip(TM) solutions for high-volume imaging applications, today announced it is shipping 2Mega-Pixel CameraChips in volume. The 2M Pixel OV2610 CameraChip is designed to replace Charge Coupled Device (CCD) image sensors and is used by volume manufacturers of Digital Still Cameras where high image quality and low power constraints place stringent demands on CameraChip providers.

ADVERTISEMENT

"OmniVision has already shipped hundreds of thousands of our 2M Pixel CameraChips for the Christmas shopping season and we have orders for hundreds of thousands more," stated John Lynch, Vice President Sales and Marketing at OmniVision, "With more than a dozen individually branded cameras coming to market with our CameraChips inside, we see this as strong market validation of our technology."

The OV2610 is a 1/2 inch optical format CMOS CameraChip with 1200 x 1600 pixels. 1200 x 1600 pixels is generally considered the resolution needed to produce quality 8" x 10" prints. Manufactured using standard CMOS fabrication technology, the OV2610 does not have the production capacity limitations of traditional CCD image sensors which are manufactured in dedicated fabrication plants. This latest CameraChip offering by Omnivision outputs Bayer Pattern raw RGB data and integrates auto-white balance, auto-exposure, auto-gain control and performs correlated double sampling. The OV2610 is pin-for-pin compatible with OmniVision`s currently shipping 48-pin package OV9620 1.3M Pixel CameraChip. It draws less than 50mA at 3.3 volts, significantly less than comparable CCD based multi-chip image sensor solutions currently available on the market. CMOS CameraChips generally require fewer supporting components than comparable CCD offerings. This allows manufacturers to reduce the overall size and complexity of their camera design and speed the camera manufacturers` time-to-market.

For More Information

For more information on OmniVision`s OV2610 CameraChip or the Early Access Partner program, please contact OmniVision by phoning 408-733-3030, via e-mail at sales@ovt.com or visit our website at www.ovt.com.

About OmniVision

OmniVision Technologies, Inc. is an independent CameraChip(TM) solutions provider. Utilizing proprietary design technology for its highly integrated still-photo and video camera solutions for high-volume imaging applications, OmniVision integrates multiple image processing and capture functions into a single CameraChip design. With the addition of only a lens, the result is a low-cost CameraChip that consumes less power, has a greater environmental functioning range and has a smaller footprint than typical CMOS multi-chip image sensor solutions. Omnivision`s CameraChip solutions are in cell phones, personal digital assistants, automobiles and industrial machine vision applications, as well as surveillance and biometric security applications. OmniVision is based in Sunnyvale, California. For more information about the company, visit our Website at www.ovt.com.

NOTE: OmniVision and CameraChip are trademarks of OmniVision Technologies, Inc.

Safe Harbor Language