Copper Fox mit grossen Reserven --> Verfolgt Produktionsaufnahme systematisch (CUU.V) - 500 Beiträge pro Seite

eröffnet am 23.08.06 19:05:03 von

neuester Beitrag 02.05.15 22:00:23 von

neuester Beitrag 02.05.15 22:00:23 von

Beiträge: 1.322

ID: 1.078.602

ID: 1.078.602

Aufrufe heute: 0

Gesamt: 119.587

Gesamt: 119.587

Aktive User: 0

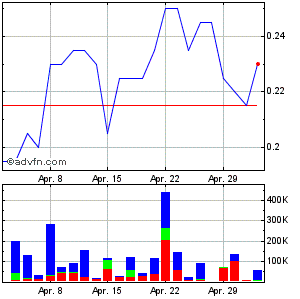

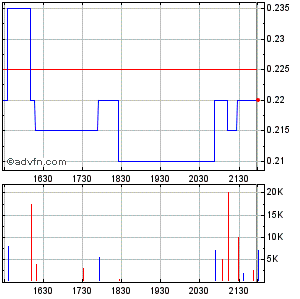

ISIN: CA21749Q1046 · WKN: A0HNEG · Symbol: CUU

0,2350

CAD

+4,44 %

+0,0100 CAD

Letzter Kurs 19.04.24 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,1600 | -8,67 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 0,7997 | -12,16 | |

| 4,2300 | -17,86 |

ist in Cad auf 0.54 bei grossem Umsatz gestiegen

ast Trade: 0.54

Trade Time: 12:46PM ET

Change: Up 0.09 (20.00%)Prev Close: 0.45

52wk Range: 0.17 - 0.90

Volume: 1,016,368

- sieht Charttechnisch gut aus

• Copper Fox Starts Environmental Permitting Process

CNW Group (Thu, Aug 17)

• Copper Fox Metals Inc. announces $500,000 Flow-Through Financing

CNW Group (Wed, Aug 16)

ast Trade: 0.54

Trade Time: 12:46PM ET

Change: Up 0.09 (20.00%)Prev Close: 0.45

52wk Range: 0.17 - 0.90

Volume: 1,016,368

- sieht Charttechnisch gut aus

• Copper Fox Starts Environmental Permitting Process

CNW Group (Thu, Aug 17)

• Copper Fox Metals Inc. announces $500,000 Flow-Through Financing

CNW Group (Wed, Aug 16)

da tut sich wasssss

grosse Summen stehen drin

Vol. Geld Vol. Brief Geldkurs Briefkurs

50'000 44'000 ¨¨¨¨¨¨0.59 ¨¨¨¨¨¨0.59

grosse Summen stehen drin

Vol. Geld Vol. Brief Geldkurs Briefkurs

50'000 44'000 ¨¨¨¨¨¨0.59 ¨¨¨¨¨¨0.59

schöner Uptrend mit grossem Volumen,

WO stimmt wieder mal nicht

Datum Zeit National # Veränderung

25-08-2006 10:23:08 (16:23:08 CET) 0.07 (12.73%) Volumen Schlusskurs Eröffnungskurs Letzter

¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨¨333'300 ¨¨0.55 ¨¨¨¨¨¨¨¨0.58 ¨¨¨¨¨¨¨¨0.62 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

7'000 25'500 ¨¨¨¨¨¨¨¨¨¨0.61 ¨¨¨¨¨¨¨¨¨¨¨0.62

Kupfer, man wird als Produzent gewinnen

Erfreulicher Anstieg bei hohem Umsatz

Datum Zeit National # Veränderung

25-08-2006 15:59:47 (21:59:47 CET) 0.12 (21.82%)

Volumen Schlusskurs Eröffnungskurs Letzter

1'014'411 0.55 0.58 0.67 CAD

dies ist erst der Start dieser Firma !!!

Erfreulicher Anstieg bei hohem Umsatz

Datum Zeit National # Veränderung

25-08-2006 15:59:47 (21:59:47 CET) 0.12 (21.82%)

Volumen Schlusskurs Eröffnungskurs Letzter

1'014'411 0.55 0.58 0.67 CAD

dies ist erst der Start dieser Firma !!!

auch heute mit weiterem Anstieg

leider heute ein gew. Rückschlag auf 0.58 cad

aber

American Bulls hatte am 08.25.06 ¨¨ 0.5800 ¨¨ Buy

dies könnte die Wende sein.

aber

American Bulls hatte am 08.25.06 ¨¨ 0.5800 ¨¨ Buy

dies könnte die Wende sein.

hier die ersehnten guuten Resultate

natürlich nicht nur Kupfer

--------------------------------------------------------------------------------

Re: News Releases - Tuesday, January 16, 2007

Title: Copper Fox announces the final assay results for the 2006 season which include a 67.1 m intersection grading 0.74% copper and 1.32 g/t gold

--------------------------------------------------------------------------------

Calgary Alberta-January 16, 2007 -- Copper Fox Metals Inc. ("Copper Fox" or "the Company") (TSX-V: CUU) is pleased to release the final batch of assay results for the final six drill holes from the 2006 drilling program at the Schaft Creek deposit located in northwestern British Columbia, Canada. These holes are part of a program designed to confirm the grade of historic drilling, delineate higher grade zones, and to collect representative metallurgical samples. All assay summaries are detailed in the enclosed Table.

Guillermo Salazar, President and CEO of Copper Fox states, "The Company is pleased with the results achieved from the 2006 field program. The new drill results continue to exceed historic results. For example, an intersection in hole DDH 06CF277 assayed 0.74% copper, 0.02% molybdenum, 1.32 g/t g gold and 4.84 g/t silver over 67.10 m. This section is flanked by 32.6 m grading 0.59% copper, 0.02% molybdenum, 0.78 g/t gold and 3.62 g/t silver, and by 12.2 m grading 0.48% copper, 0.02% molybdenum, 0.26 g/t gold and 3.58 g/t silver, which confirms the presence of high grade material close to the surface. We expect this to have an impact on the economic potential of the deposit." Mr. Salazar goes on to say, "This is a very exciting way of ending the 2006 season. Hole 06CF277 was drilled from the same site, but in the opposite direction, as the historic hole H72CH101 (which returned 362.74 m grading 0.21% copper, 0.01% molybdenum, 0.10 g/t gold and 0.36 g/t silver). The values returned by 06CF277 indicate the variability expected in such stockwork mineralization. The extent of mineralization reported in this hole (332 m grading 0.44% copper, 0.01% molybdenum, 0.54 g/t gold and 2.97 g/t silver) confirms the presence of high grades at Schaft Creek."

Drill hole 06CF263 twinned hole H71CH072 and returned a lower copper grade (0.32% copper vs. 0.44% in the historic drill hole). Two higher grade sections were returned (0.49% copper and 0.44 g/t gold over 6.1m starting at 61.0m, and 0.47% copper and 0.16 g/t gold over 15.2m starting at 100.7m).

Drill hole 06CF265 returned 0.35% copper, 0.31 g/t gold, 0.02% molybdenum and 1.52 g/t silver over 249 m including three sections that assayed 0.51% copper and 0.67 g/t gold over 6.1m 0.50% copper and 0.65 g/t gold over 24.4m and 0.69% copper and 0.41 g/t gold over 9.2m .

Drill Hole 06CF270 twinned hole T81CH220 and returned lower grades than the historic hole. (0.26% copper and 0.14 g/t gold compared to 0.38% copper and 0.28 g/t gold). Two higher grade sections from the new drill hole returned 0.44% copper and 0.24 g/t gold over 67.1m and 0.57% copper and 0.32 g/t gold over 33.6m.

Drill hole 06CF271 was drilled from the site of historic hole T81CH220 at a bearing of 090° and dip of -60°. The new hole returned an average grade over the entire hole of 0.26% copper and 0.10 g/t gold. Four higher grade sections returned 0.52% copper and 0.30 g/t gold over 15.4m , 0.49% copper and 0.31 g/t gold over 6.1m, 0.73% copper and 0.26 g/t gold over 9.15m, and 0.45% copper and 0.18 g/t gold over 9.2m.

Drill hole 06CF277 returned an average grade of 0.44% copper and 0.54 g/t gold over its entire 332 m length. The hole contained several higher grade sections including 0.59% copper and 0.78 g/t gold over 32.6m, a highly significant 0.74% copper and 1.32 g/t gold over 67.1m, 0.50% copper and 0.41 g/t gold over 33.6m.

Drill hole 06CF278 returned an average grade of 0.27% copper and 0.13 g/t gold including a section 0.40% copper and 0.14 g/t gold over 43.25m .

Guillermo Salazar, President and CEO of Copper Fox Metals Inc. and Qualified Person as defined by NI 43-101 has reviewed and approved the information contained in this news release

The Company continues with its work to complete a new NI 43-101 compliant Resource Calculation, perform bulk metallurgical testing, engineering and Scoping Study work

Copper Fox is a Junior Resource Mining Company listed on the TSX-Venture Exchange (CUU). The company is involved in the exploration and development of a world class copper/gold porphyry mineral deposit located in north western B.C. at Schaft Creek. Under the terms of an option agreement negotiated with Teck Cominco Limited, Copper Fox can acquire up to a 94.3% aggregate (direct and indirect) interest in the Schaft Creek mineral resource.

For further information please contact Jason Shepherd investor relations toll free at telephone 1 866 913 1910, Email investor@copperfoxmetals.com or visit our web site at http://www.copperfoxmetals.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Guillermo Salazar S., P. Geol.

President and CEO

The TSX Venture exchange has not reviewed the contents of this news release and accepts no responsibility for the adequacy or the accuracy thereof.

This news release may contain forward - looking information including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward - looking information includes disclosure regarding possible future events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action, and therefore, involves inherent risks and uncertainties. For any forward looking information given, management has assumed that the assay results it has received are reliable, and has applied geological interpretation methodologies which are consistent with industry standards. Although management has a reasonable basis for the conclusions drawn, actual results may differ materially from those currently anticipated in such statements.

--------------------------------------------------------------------------------

Copyright © 2007 COPPER FOX METALS INC. (CUU) All rights reserved. For more information visit our website at http://www.copperfoxmetals.com/ or send email to investor@copperfoxmetals.com .

--------------------------------------------------------------------------------

natürlich nicht nur Kupfer

--------------------------------------------------------------------------------

Re: News Releases - Tuesday, January 16, 2007

Title: Copper Fox announces the final assay results for the 2006 season which include a 67.1 m intersection grading 0.74% copper and 1.32 g/t gold

--------------------------------------------------------------------------------

Calgary Alberta-January 16, 2007 -- Copper Fox Metals Inc. ("Copper Fox" or "the Company") (TSX-V: CUU) is pleased to release the final batch of assay results for the final six drill holes from the 2006 drilling program at the Schaft Creek deposit located in northwestern British Columbia, Canada. These holes are part of a program designed to confirm the grade of historic drilling, delineate higher grade zones, and to collect representative metallurgical samples. All assay summaries are detailed in the enclosed Table.

Guillermo Salazar, President and CEO of Copper Fox states, "The Company is pleased with the results achieved from the 2006 field program. The new drill results continue to exceed historic results. For example, an intersection in hole DDH 06CF277 assayed 0.74% copper, 0.02% molybdenum, 1.32 g/t g gold and 4.84 g/t silver over 67.10 m. This section is flanked by 32.6 m grading 0.59% copper, 0.02% molybdenum, 0.78 g/t gold and 3.62 g/t silver, and by 12.2 m grading 0.48% copper, 0.02% molybdenum, 0.26 g/t gold and 3.58 g/t silver, which confirms the presence of high grade material close to the surface. We expect this to have an impact on the economic potential of the deposit." Mr. Salazar goes on to say, "This is a very exciting way of ending the 2006 season. Hole 06CF277 was drilled from the same site, but in the opposite direction, as the historic hole H72CH101 (which returned 362.74 m grading 0.21% copper, 0.01% molybdenum, 0.10 g/t gold and 0.36 g/t silver). The values returned by 06CF277 indicate the variability expected in such stockwork mineralization. The extent of mineralization reported in this hole (332 m grading 0.44% copper, 0.01% molybdenum, 0.54 g/t gold and 2.97 g/t silver) confirms the presence of high grades at Schaft Creek."

Drill hole 06CF263 twinned hole H71CH072 and returned a lower copper grade (0.32% copper vs. 0.44% in the historic drill hole). Two higher grade sections were returned (0.49% copper and 0.44 g/t gold over 6.1m starting at 61.0m, and 0.47% copper and 0.16 g/t gold over 15.2m starting at 100.7m).

Drill hole 06CF265 returned 0.35% copper, 0.31 g/t gold, 0.02% molybdenum and 1.52 g/t silver over 249 m including three sections that assayed 0.51% copper and 0.67 g/t gold over 6.1m 0.50% copper and 0.65 g/t gold over 24.4m and 0.69% copper and 0.41 g/t gold over 9.2m .

Drill Hole 06CF270 twinned hole T81CH220 and returned lower grades than the historic hole. (0.26% copper and 0.14 g/t gold compared to 0.38% copper and 0.28 g/t gold). Two higher grade sections from the new drill hole returned 0.44% copper and 0.24 g/t gold over 67.1m and 0.57% copper and 0.32 g/t gold over 33.6m.

Drill hole 06CF271 was drilled from the site of historic hole T81CH220 at a bearing of 090° and dip of -60°. The new hole returned an average grade over the entire hole of 0.26% copper and 0.10 g/t gold. Four higher grade sections returned 0.52% copper and 0.30 g/t gold over 15.4m , 0.49% copper and 0.31 g/t gold over 6.1m, 0.73% copper and 0.26 g/t gold over 9.15m, and 0.45% copper and 0.18 g/t gold over 9.2m.

Drill hole 06CF277 returned an average grade of 0.44% copper and 0.54 g/t gold over its entire 332 m length. The hole contained several higher grade sections including 0.59% copper and 0.78 g/t gold over 32.6m, a highly significant 0.74% copper and 1.32 g/t gold over 67.1m, 0.50% copper and 0.41 g/t gold over 33.6m.

Drill hole 06CF278 returned an average grade of 0.27% copper and 0.13 g/t gold including a section 0.40% copper and 0.14 g/t gold over 43.25m .

Guillermo Salazar, President and CEO of Copper Fox Metals Inc. and Qualified Person as defined by NI 43-101 has reviewed and approved the information contained in this news release

The Company continues with its work to complete a new NI 43-101 compliant Resource Calculation, perform bulk metallurgical testing, engineering and Scoping Study work

Copper Fox is a Junior Resource Mining Company listed on the TSX-Venture Exchange (CUU). The company is involved in the exploration and development of a world class copper/gold porphyry mineral deposit located in north western B.C. at Schaft Creek. Under the terms of an option agreement negotiated with Teck Cominco Limited, Copper Fox can acquire up to a 94.3% aggregate (direct and indirect) interest in the Schaft Creek mineral resource.

For further information please contact Jason Shepherd investor relations toll free at telephone 1 866 913 1910, Email investor@copperfoxmetals.com or visit our web site at http://www.copperfoxmetals.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Guillermo Salazar S., P. Geol.

President and CEO

The TSX Venture exchange has not reviewed the contents of this news release and accepts no responsibility for the adequacy or the accuracy thereof.

This news release may contain forward - looking information including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward - looking information includes disclosure regarding possible future events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action, and therefore, involves inherent risks and uncertainties. For any forward looking information given, management has assumed that the assay results it has received are reliable, and has applied geological interpretation methodologies which are consistent with industry standards. Although management has a reasonable basis for the conclusions drawn, actual results may differ materially from those currently anticipated in such statements.

--------------------------------------------------------------------------------

Copyright © 2007 COPPER FOX METALS INC. (CUU) All rights reserved. For more information visit our website at http://www.copperfoxmetals.com/ or send email to investor@copperfoxmetals.com .

--------------------------------------------------------------------------------

Copper Fox heute im Aufwärtstrend

COPPER FOX MTLS (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 12:33:21 Veränderung

Venture CAD .67 +0.06 (+9.8%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

53'000 .66 .67 24'000

Real time prices

COPPER FOX MTLS (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 12:33:21 Veränderung

Venture CAD .67 +0.06 (+9.8%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

53'000 .66 .67 24'000

Real time prices

sieht aber gut aus in Cad

"They had a very nice presentation at the Gold Show on Sunday."

Datum Zeit National # Veränderung

22-01-2007 12:29:05 (18:29:05 CET) 0.05 (8.20%) Volumen Schlusskurs Eröffnungskurs Letzter

594'844 0.61 0.65 0.66 CAD

0.61 0.65 0.66 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

44'000 ¨¨¨¨¨¨36'000 ¨¨¨¨0.66 ¨¨¨¨0.67

"They had a very nice presentation at the Gold Show on Sunday."

Datum Zeit National # Veränderung

22-01-2007 12:29:05 (18:29:05 CET) 0.05 (8.20%) Volumen Schlusskurs Eröffnungskurs Letzter

594'844

0.61 0.65 0.66 CAD

0.61 0.65 0.66 CAD Vol. Geld Vol. Brief Geldkurs Briefkurs

44'000 ¨¨¨¨¨¨36'000 ¨¨¨¨0.66 ¨¨¨¨0.67

Kupferpreis geht rauf ????

war dies ebenfalls die Wende ?

jedenfalls CUU macht mit, wenn auch bei 0.69 offenbar ein grosser Widerstand ist.

Datum Zeit National # Veränderung

23-01-2007 11:10:23 (17:10:23 CET) 0.01 (1.49%)

Volumen Schlusskurs Eröffnungskurs Letzter

201'185 0.67 0.68 0.68 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

10'000¨¨¨¨ 64'000¨¨¨¨ 0.68 ¨¨¨¨0.69

war dies ebenfalls die Wende ?

jedenfalls CUU macht mit, wenn auch bei 0.69 offenbar ein grosser Widerstand ist.

Datum Zeit National # Veränderung

23-01-2007 11:10:23 (17:10:23 CET) 0.01 (1.49%)

Volumen Schlusskurs Eröffnungskurs Letzter

201'185 0.67 0.68 0.68 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

10'000¨¨¨¨ 64'000¨¨¨¨ 0.68 ¨¨¨¨0.69

auch heute erfreulich in cad

Datum Zeit National # Veränderung

25-01-2007 11:10:09 (17:10:09 CET) 0.02 (3.03%)

Volumen Schlusskurs Eröffnungskurs Letzter

136'600 0.66 0.67 0.68 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

34'000 49'000 0.66 0.68

Datum Zeit National # Veränderung

25-01-2007 11:10:09 (17:10:09 CET) 0.02 (3.03%)

Volumen Schlusskurs Eröffnungskurs Letzter

136'600 0.66 0.67 0.68 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

34'000 49'000 0.66 0.68

da bin ich sehr zufrieden, und das schöne Volumen

Datum Zeit National # Veränderung

26-01-2007 15:42:19 (21:42:19 CET) 0.03 (4.48%)

Volumen Schlusskurs Eröffnungskurs Letzter

370'583 0.67 0.66 0.70 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

20'000 300'000 0.68 0.70

bei American Bulls

BUY

CONFIRMED

0.7000

+0.0300 +4.48%

Datum Zeit National # Veränderung

26-01-2007 15:42:19 (21:42:19 CET) 0.03 (4.48%)

Volumen Schlusskurs Eröffnungskurs Letzter

370'583 0.67 0.66 0.70 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

20'000 300'000 0.68 0.70

bei American Bulls

BUY

CONFIRMED

0.7000

+0.0300 +4.48%

Ohne news steigt sie schon wieder

da ist doch was los

COPPER FOX MTLS (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 11:45:32 Veränderung

Venture CAD .75 +0.05 (+7.1%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

10'000 .74 .75 5'000

Real time prices

im Übrigen noch auf American Bulls

BUY

CONFIRMED

0.7000

+0.0300 +4.48%

BUY

CONFIRMED

0.7000

+0.0300 +4.48%

Es haut hin

und siehe das schöne Bid Volumen !!!!

COPPER FOX MTLS (CUU)

Börsenplatz Währung Letzter Preis 15:12:39 Veränderung

Venture CAD .82 +0.09 (+12.3%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

28'000 ¨¨¨¨¨¨¨¨ .8 ¨¨¨¨¨¨ .82 ¨¨¨¨¨¨¨¨3'000

Real time prices

und siehe das schöne Bid Volumen !!!!

COPPER FOX MTLS (CUU)

Börsenplatz Währung Letzter Preis 15:12:39 Veränderung

Venture CAD .82 +0.09 (+12.3%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

28'000 ¨¨¨¨¨¨¨¨ .8 ¨¨¨¨¨¨ .82 ¨¨¨¨¨¨¨¨3'000

Real time prices

es wird auch vermutet, dass sie übernommen werden könnte, da nicht genügend Geld in der Kasse wäre !!

ist mir sicher auch recht

CUU Company Snapshot

BullBoards Member Forums My BullBoards

Jump to CUU Forum

SUBJECT: CUU has to hope Posted By: Kyle6

Post Time: 1/30/2007 13:35

« Previous Message Next Message »

that Teck will buy them. They won't have the $$$ to build the mine.

ist mir sicher auch recht

CUU Company Snapshot

BullBoards Member Forums My BullBoards

Jump to CUU Forum

SUBJECT: CUU has to hope Posted By: Kyle6

Post Time: 1/30/2007 13:35

« Previous Message Next Message »

that Teck will buy them. They won't have the $$$ to build the mine.

Eine Empfehlung gesichtet

Copper fox Resource Opportunities: Enormous Potential on Undervalued Company

In Lawrence Roulston's January newsletter, he notes that "many investors remain skeptical of Copper Fox's Schaft Creek deposit ("It sounds too good to be true" seems to be the prevalent approach). We have seen exactly the same attitude at this stage towards other projects that have become enormous successes."

Click here to read more about this project with potential for enormous success

"A preliminary economic assessment of the project showed a net present value of $583 million, based on copper at $1.00 per pound and gold at $500 an ounce. A $2 copper price would generate a $1.2 billion net present value for the project. Those figures are preliminary, but demonstrate the enormous upside potential for a company with a current market value of C$39 million."

Click here to read about the enormous upside potential on this undervalued company

"An independent resource study estimated that the deposit contains 9.1 billion pounds of copper, 8.6 million ounces of gold, 620 million pounds of molybdenum, and 82 million ounces of silver. The Schaft Creek deposit is one of the largest underdeveloped copper-gold deposits in Canada".

Click here to read about one of the largest underdeveloped copper-gold deposits in Canada

"Investors prepared to take a position now stand to realize significant gains over the coming months as the value of the company moves toward the potential value of the project

Copper fox Resource Opportunities: Enormous Potential on Undervalued Company

In Lawrence Roulston's January newsletter, he notes that "many investors remain skeptical of Copper Fox's Schaft Creek deposit ("It sounds too good to be true" seems to be the prevalent approach). We have seen exactly the same attitude at this stage towards other projects that have become enormous successes."

Click here to read more about this project with potential for enormous success

"A preliminary economic assessment of the project showed a net present value of $583 million, based on copper at $1.00 per pound and gold at $500 an ounce. A $2 copper price would generate a $1.2 billion net present value for the project. Those figures are preliminary, but demonstrate the enormous upside potential for a company with a current market value of C$39 million."

Click here to read about the enormous upside potential on this undervalued company

"An independent resource study estimated that the deposit contains 9.1 billion pounds of copper, 8.6 million ounces of gold, 620 million pounds of molybdenum, and 82 million ounces of silver. The Schaft Creek deposit is one of the largest underdeveloped copper-gold deposits in Canada".

Click here to read about one of the largest underdeveloped copper-gold deposits in Canada

"Investors prepared to take a position now stand to realize significant gains over the coming months as the value of the company moves toward the potential value of the project

habe eine super Studie gefunden

sehr euch mal den Vergleich mit Novagold an !!!!

Novagold ist etwa 60 mal höher bewertet als CUU

mal höher bewertet als CUU

das Aufholpotentail von Cuu ist wahnsinnig

(die Grafiken kommen leider nicht mit, bitte im Orignal anschauen)

http://www.resourceinvestor.com/pebble.asp?relid=25170

Revaluing Copper Fox's Schaft Creek

By Alan Leishman

28 Oct 2006 at 03:37 PM EDT

SWITZERLAND (ResourceInvestor.com) -- Guillermo Salazar, President and CEO of Copper Fox [TSXv:CUU] likes to tell the story of his first job in the mining business several decades ago. Arriving at Butte Montana as a fresh nosed graduate in Geology, he recalls his first month working for the legendary Anaconda Copper Mining Company. He was told he would be assigned to a difficult manager for a one-month trial period, and that most greenhorns usually only survived an average of 20 days before being booted out!

His first job was to descend to the working faces of the various underground levels in production and estimate the value of the ore in dollars/tonne. He not only survived the difficult first 30 days but ever since has been able to look at ore samples and estimate the dollar value without recourse to lab assay results or other aids!

The Richest Mine on Earth

The history of the copper mines at Butte, Montana is a fascinating story, and well worth a quick revisit before looking at Copper Fox’s Schaft Creek project today.

Butte, Montana at its peak in the 1890’s was described by Irish immigrant Marcus Daly, who along with fellow Irishman William Clark and the German F. Augustus Heinze, made their fortune with the copper mines there, as “the richest hill on earth!”

Annual production of refined metals - chiefly copper but also zinc, lead, silver, and gold - was worth $50 million and enough to load a freight train 20 miles long!

In mid-October 1895, the Rothschilds, French and British bought one quarter of the stock in Anaconda for $7.5 million. By the late 1890s, the Rothschilds probably had control over the sale of about 40% of the world’s copper production. During that decade Anaconda was the premier copper producer in the world and therefore an important link in that control.

This was sufficient to attract the attention of Henry H. Rogers, CEO of the Standard Oil Trust, of J.D. Rockefeller fame.

In 1898 Daly, in declining health (and later Clark, more interested in his political career to become a Senator) commenced negotiations to sell out his stake in “the richest hill on earth” to the “greatest trust on earth.”

The Amalgated Copper Company, the holding company organised, took over the Anaconda properties, (and eventually became The Anaconda Copper Mining Company). The most interesting aspect of the deal was how it was financed. They acquired Anaconda - the company worth millions - without the expenditure of a single dollar of their own.

In order to pay Daly and his associates the agreed $39 million, ACC’s public offer to raise $75 million at $100 per share was more than five times oversubscribed at $412 million. Subscriptions of only $130 million were accepted, and 1 share for each five sought was allocated. This provided the promoters with $26 million in cash and left them with 500,000 shares in the company, equivalent to two thirds of the stock, valued the day after the transaction at $70 million.

Heinze, through skilful use of the Apex laws fought an ongoing legal, political and sometimes physical battle with ACC until he also eventually sold out his interests to the Cole/Ryan Butte Coalition in 1906 for $10 million, including in the deal the dismissal of 100 law suits involving property worth $50 million. He later caused the financial crash of 1907 which brought another well known character to the rescue, namely J.P.Morgan.

Present Day Copper Mines

Most copper mines in the late 20th and early 21st centuries have much lower grades than Butte; for example, Bisbee in Arizona, yielded over 100 years ago, but modern technology and the current ascending copper prices still enable them to be very profitable today.

Mining grades of less than 1 % Cu can now be mined profitably, compared to the bonanza high grades of over 10% sporadically found in Butte in its hay days. Mechanisation and huge scale operations have reduced inflation adjusted costs dramatically compared to 100 years ago.

For example, Teck Cominco's [NYSE:TCK; TSX:TCK-B] last 6-month report as of 30 June 2006, reported their operating profit, from milling an average of 124,309 tonnes per day of 0.394 % copper ore, with by-product molybdenum production of 1/10 pounds per tonne, at 531 million Canadian dollars or some C$23.60 per tonne.

Copper Market Trends

Copper prices have risen from 10-25 cents/lb in the 1890’s era to $3.40/lb today. However, inflation adjusted prices are still moderate and demand is outstripping supply.

Source: Copper Fox.

Some Wall Street analysts claim the commodities boom is already over after only 5 years, but others such as Jim Rogers maintain we are only in the middle of the latest one, and previous commodities bull markets have averaged about 19 years or so whenever supply and demand have gotten out of balance.

China and India going through a fast-track industrial revolution will provide substantial demand for copper for many years to come.

Schaft Creek Overview

The main asset of Copper Fox is its Schaft Creek project described as follows on its website:

“The Schaft Creek Property comprises 12 mineral claims covering an area of 10,269.3 hectares. It was discovered in 1957 and has been investigated by prospecting, geological mapping, geophysical surveys, diamond and percussion drilling. A large volume of technical data, including assays, analyses and preliminary engineering studies, has been amassed. This copper-gold-molybdenum-silver deposit is located in the Liard District of Northwestern British Columbia, Canada.

“Copper Fox Metals entered into an option agreement with Teck Cominco to acquire up to 93.4% interest (70% direct, 23.4 indirect) in the Schaft Creek copper property located in northwestern British Columbia. The porphyry copper deposit at the Schaft Creek Property comprises a large ‘porphyry copper’ resource. Past expenditures on the property exceed C$10 million. The Schaft Creek Property’s mineral inventory has been defined with 63,200 metres of diamond drilling at 76 meter (250 ft) spacing.

“Pre-1982 metallurgical testing on core by Teck Cominco and Hecla Mining [NYSE:HL] indicate recoveries of 85% of the copper, 90% of the molybdenite and 50% of the gold. The core is stored on the property with the resulting database being very well preserved. During the 2005 season, Copper Fox completed a 3,000 metre, 15 hole PQWL (3.5'' diamond core) program to confirm:

1. The integrity of the data base received from Teck Cominco;

2. The repeatability of the assay results and ;

3. To conduct its first floatation test on fresh rock.”

Guillermo Salazar worked as a geologist for Hecla Mining at the Schaft Creek project during 1970-1973. During that time, his re-interpretation of the geological model of the deposit allowed Hecla Mining and Teck Cominco to expand the potential resources of the deposit from a maximum of 300 million tonnes to a minimum of 2.5 billion tonnes of the same grade. Today’s geological models being used for the deposit are slight variations to the one developed by Salazar at that time.

Schaft Creek is a neighbour of NovaGold’s [AMEX:NG; TSX:NG] Galore Creek project, so it is interesting to compare the two projects and attempt a comparative evaluation. Taking figures from a recent Copper Fox presentation (page 5).

Comparison

Source: Copper Fox.

NovaGold of course has other major assets, Donlin Creek and Ambler, plus several smaller projects including Rock Creek at Nome, which explain the much larger market cap.

Conventional value assessments of Schaft Creek by Copper Fox show solid valuations compared to the present market cap.

Potential Project Economics

Source: Copper Fox.

The often recently quoted method of the late Julius Baring for investors to evaluate a company against its current share price was described as: “Buy up to 10% of the in situ value of a deposit using current metal prices, hold up to 40% and sell above 40% taking no prisoners!”

The remaining 90% of in the ground metal not valued accounts for capital and cash costs of extraction, and all the many risks of bringing a mine along the 7-year (minimum) path from exploration through pre-feasibility, feasibility, permitting, financing and construction into production.

Other risks include access, location, country, environment, local population, climate, currency exchange rates and metal prices to name only a few of the better known ones!

The following table compares four similar projects in the same proximity in BC.

Conclusion

From the table above we see that Copper Fox has a Julian Baring valuation ratio from 80 times down to 20 times the current market valuation, depending on the back-in scenario.

This corresponds to C$ 46.40 per share against its current price of C$0.58 (if we assume CUU retains its 93.4 % share of Schaft Creek). The worst case scenario, if Teck were to earn the maximum back-in of 75% still leaves a theoretical share price value of C$11.60 per share.

The extreme undervaluation of CUU is not unique in the market place, and comparative figures shown in the table above show quite a range of valuations depending on the project itself and also alternative back-in scenarios in the case of Schaft Creek.

In my recent essay on NovaGold we see similar figures, which tempted their JV partner at Donlin Creek, Barrick [NYSE:ABX; TSX:ABX] to launch a hostile take over bid for NovaGold in July, which NG is still fighting off today. Thus a similar danger lurks for Copper Fox at its current market share price.

It would cost Teck under the option agreement in a worst case scenario 4 x C$15 million = C$60 million to earn its 75% back-in. This is more than the current C$42 mill market cap, or in other words Teck could pay up to C$0.83 per share in a takeover of Copper Fox to gain 100% of the company for the same outlay.

From this standpoint, the current CUU share price is well underpinned by the back-in terms.

Copper Fox needs to not only focus on their business plan, (which appears to be well on schedule) but also to adopt an investment relations strategy to increase their share price. Perhaps they should also consider introducing some kind of poison pill, such as the Shareholders Rights Plan of NovaGold, and also just introduced by BcMetals [TSXv:C].

An SRP does nothing to prevent a hostile takeover, but it does provide some time, usually at least 60 days, for the company subject to a hostile takeover to look for a white knight or some other method to fend off the bid and maximise shareholder value.

Copyright © 2006 Alan Leishman

http://www.resourceinvestor.com/pebble.asp?relid=25170

Disclaimer: Alan Leishman is not a registered Investment Advisor or a Broker/Dealer. Readers are advised that the information contained herein is issued solely for information purposes and is not constructed as an offer to sell or the solicitation of an offer to buy. The author is a shareholder of Copper Fox and NovaGold.

sehr euch mal den Vergleich mit Novagold an !!!!

Novagold ist etwa 60

mal höher bewertet als CUU

mal höher bewertet als CUU das Aufholpotentail von Cuu ist wahnsinnig

(die Grafiken kommen leider nicht mit, bitte im Orignal anschauen)

http://www.resourceinvestor.com/pebble.asp?relid=25170

Revaluing Copper Fox's Schaft Creek

By Alan Leishman

28 Oct 2006 at 03:37 PM EDT

SWITZERLAND (ResourceInvestor.com) -- Guillermo Salazar, President and CEO of Copper Fox [TSXv:CUU] likes to tell the story of his first job in the mining business several decades ago. Arriving at Butte Montana as a fresh nosed graduate in Geology, he recalls his first month working for the legendary Anaconda Copper Mining Company. He was told he would be assigned to a difficult manager for a one-month trial period, and that most greenhorns usually only survived an average of 20 days before being booted out!

His first job was to descend to the working faces of the various underground levels in production and estimate the value of the ore in dollars/tonne. He not only survived the difficult first 30 days but ever since has been able to look at ore samples and estimate the dollar value without recourse to lab assay results or other aids!

The Richest Mine on Earth

The history of the copper mines at Butte, Montana is a fascinating story, and well worth a quick revisit before looking at Copper Fox’s Schaft Creek project today.

Butte, Montana at its peak in the 1890’s was described by Irish immigrant Marcus Daly, who along with fellow Irishman William Clark and the German F. Augustus Heinze, made their fortune with the copper mines there, as “the richest hill on earth!”

Annual production of refined metals - chiefly copper but also zinc, lead, silver, and gold - was worth $50 million and enough to load a freight train 20 miles long!

In mid-October 1895, the Rothschilds, French and British bought one quarter of the stock in Anaconda for $7.5 million. By the late 1890s, the Rothschilds probably had control over the sale of about 40% of the world’s copper production. During that decade Anaconda was the premier copper producer in the world and therefore an important link in that control.

This was sufficient to attract the attention of Henry H. Rogers, CEO of the Standard Oil Trust, of J.D. Rockefeller fame.

In 1898 Daly, in declining health (and later Clark, more interested in his political career to become a Senator) commenced negotiations to sell out his stake in “the richest hill on earth” to the “greatest trust on earth.”

The Amalgated Copper Company, the holding company organised, took over the Anaconda properties, (and eventually became The Anaconda Copper Mining Company). The most interesting aspect of the deal was how it was financed. They acquired Anaconda - the company worth millions - without the expenditure of a single dollar of their own.

In order to pay Daly and his associates the agreed $39 million, ACC’s public offer to raise $75 million at $100 per share was more than five times oversubscribed at $412 million. Subscriptions of only $130 million were accepted, and 1 share for each five sought was allocated. This provided the promoters with $26 million in cash and left them with 500,000 shares in the company, equivalent to two thirds of the stock, valued the day after the transaction at $70 million.

Heinze, through skilful use of the Apex laws fought an ongoing legal, political and sometimes physical battle with ACC until he also eventually sold out his interests to the Cole/Ryan Butte Coalition in 1906 for $10 million, including in the deal the dismissal of 100 law suits involving property worth $50 million. He later caused the financial crash of 1907 which brought another well known character to the rescue, namely J.P.Morgan.

Present Day Copper Mines

Most copper mines in the late 20th and early 21st centuries have much lower grades than Butte; for example, Bisbee in Arizona, yielded over 100 years ago, but modern technology and the current ascending copper prices still enable them to be very profitable today.

Mining grades of less than 1 % Cu can now be mined profitably, compared to the bonanza high grades of over 10% sporadically found in Butte in its hay days. Mechanisation and huge scale operations have reduced inflation adjusted costs dramatically compared to 100 years ago.

For example, Teck Cominco's [NYSE:TCK; TSX:TCK-B] last 6-month report as of 30 June 2006, reported their operating profit, from milling an average of 124,309 tonnes per day of 0.394 % copper ore, with by-product molybdenum production of 1/10 pounds per tonne, at 531 million Canadian dollars or some C$23.60 per tonne.

Copper Market Trends

Copper prices have risen from 10-25 cents/lb in the 1890’s era to $3.40/lb today. However, inflation adjusted prices are still moderate and demand is outstripping supply.

Source: Copper Fox.

Some Wall Street analysts claim the commodities boom is already over after only 5 years, but others such as Jim Rogers maintain we are only in the middle of the latest one, and previous commodities bull markets have averaged about 19 years or so whenever supply and demand have gotten out of balance.

China and India going through a fast-track industrial revolution will provide substantial demand for copper for many years to come.

Schaft Creek Overview

The main asset of Copper Fox is its Schaft Creek project described as follows on its website:

“The Schaft Creek Property comprises 12 mineral claims covering an area of 10,269.3 hectares. It was discovered in 1957 and has been investigated by prospecting, geological mapping, geophysical surveys, diamond and percussion drilling. A large volume of technical data, including assays, analyses and preliminary engineering studies, has been amassed. This copper-gold-molybdenum-silver deposit is located in the Liard District of Northwestern British Columbia, Canada.

“Copper Fox Metals entered into an option agreement with Teck Cominco to acquire up to 93.4% interest (70% direct, 23.4 indirect) in the Schaft Creek copper property located in northwestern British Columbia. The porphyry copper deposit at the Schaft Creek Property comprises a large ‘porphyry copper’ resource. Past expenditures on the property exceed C$10 million. The Schaft Creek Property’s mineral inventory has been defined with 63,200 metres of diamond drilling at 76 meter (250 ft) spacing.

“Pre-1982 metallurgical testing on core by Teck Cominco and Hecla Mining [NYSE:HL] indicate recoveries of 85% of the copper, 90% of the molybdenite and 50% of the gold. The core is stored on the property with the resulting database being very well preserved. During the 2005 season, Copper Fox completed a 3,000 metre, 15 hole PQWL (3.5'' diamond core) program to confirm:

1. The integrity of the data base received from Teck Cominco;

2. The repeatability of the assay results and ;

3. To conduct its first floatation test on fresh rock.”

Guillermo Salazar worked as a geologist for Hecla Mining at the Schaft Creek project during 1970-1973. During that time, his re-interpretation of the geological model of the deposit allowed Hecla Mining and Teck Cominco to expand the potential resources of the deposit from a maximum of 300 million tonnes to a minimum of 2.5 billion tonnes of the same grade. Today’s geological models being used for the deposit are slight variations to the one developed by Salazar at that time.

Schaft Creek is a neighbour of NovaGold’s [AMEX:NG; TSX:NG] Galore Creek project, so it is interesting to compare the two projects and attempt a comparative evaluation. Taking figures from a recent Copper Fox presentation (page 5).

Comparison

Source: Copper Fox.

NovaGold of course has other major assets, Donlin Creek and Ambler, plus several smaller projects including Rock Creek at Nome, which explain the much larger market cap.

Conventional value assessments of Schaft Creek by Copper Fox show solid valuations compared to the present market cap.

Potential Project Economics

Source: Copper Fox.

The often recently quoted method of the late Julius Baring for investors to evaluate a company against its current share price was described as: “Buy up to 10% of the in situ value of a deposit using current metal prices, hold up to 40% and sell above 40% taking no prisoners!”

The remaining 90% of in the ground metal not valued accounts for capital and cash costs of extraction, and all the many risks of bringing a mine along the 7-year (minimum) path from exploration through pre-feasibility, feasibility, permitting, financing and construction into production.

Other risks include access, location, country, environment, local population, climate, currency exchange rates and metal prices to name only a few of the better known ones!

The following table compares four similar projects in the same proximity in BC.

Conclusion

From the table above we see that Copper Fox has a Julian Baring valuation ratio from 80 times down to 20 times the current market valuation, depending on the back-in scenario.

This corresponds to C$ 46.40 per share against its current price of C$0.58 (if we assume CUU retains its 93.4 % share of Schaft Creek). The worst case scenario, if Teck were to earn the maximum back-in of 75% still leaves a theoretical share price value of C$11.60 per share.

The extreme undervaluation of CUU is not unique in the market place, and comparative figures shown in the table above show quite a range of valuations depending on the project itself and also alternative back-in scenarios in the case of Schaft Creek.

In my recent essay on NovaGold we see similar figures, which tempted their JV partner at Donlin Creek, Barrick [NYSE:ABX; TSX:ABX] to launch a hostile take over bid for NovaGold in July, which NG is still fighting off today. Thus a similar danger lurks for Copper Fox at its current market share price.

It would cost Teck under the option agreement in a worst case scenario 4 x C$15 million = C$60 million to earn its 75% back-in. This is more than the current C$42 mill market cap, or in other words Teck could pay up to C$0.83 per share in a takeover of Copper Fox to gain 100% of the company for the same outlay.

From this standpoint, the current CUU share price is well underpinned by the back-in terms.

Copper Fox needs to not only focus on their business plan, (which appears to be well on schedule) but also to adopt an investment relations strategy to increase their share price. Perhaps they should also consider introducing some kind of poison pill, such as the Shareholders Rights Plan of NovaGold, and also just introduced by BcMetals [TSXv:C].

An SRP does nothing to prevent a hostile takeover, but it does provide some time, usually at least 60 days, for the company subject to a hostile takeover to look for a white knight or some other method to fend off the bid and maximise shareholder value.

Copyright © 2006 Alan Leishman

http://www.resourceinvestor.com/pebble.asp?relid=25170

Disclaimer: Alan Leishman is not a registered Investment Advisor or a Broker/Dealer. Readers are advised that the information contained herein is issued solely for information purposes and is not constructed as an offer to sell or the solicitation of an offer to buy. The author is a shareholder of Copper Fox and NovaGold.

hier noch eine Supermeldung vom 16.1.07

so leicht lass ich mich nicht abschütteln !!!

Here's another estimate:

http://metalsplace.com/metalsnews/?a=9572

"Another Galore Creek neighbor is the Schaft Creek project being developed by Copper Fox [CVE:CUU]. Schaft Creek is only 36km from Galore Creek, but it is on the BC side of the mountains, thus no tunnel or Alaskan environmentalists. The deposit is every bit as big as GC and they have a top notch CEO. The life of mine strip ratio is a much cleaner 0.7:1. The gold grades are higher and it also has molybdenum. The 2004 capital costs were $600MM. While the cost is sure to increase it will still be much less than GC. Copper Fox optioned the property from Teck Cominco in 2002, but Teck retained a back in right for up to 75%. Teck would have to contribute 4 times all prior expenditures and arrange financing after CUU delivers the feasibility study. A preliminary feasibility study and an updated resource estimate were ordered last month. At $2 copper and $500 gold the NPV is $1.2B discounted at 8%. So CUU has arguably a better project and a strong partner already in place. They will undoubtedly have to dilute shareholders to complete the FS, but then they get four times their expenditures to help pay for their 25% of capital costs. The entire market cap of Copper Fox is currently about $40MM

. Twenty five percent of Galore Creek would run about $600MM

. Twenty five percent of Galore Creek would run about $600MM

."

."

so leicht lass ich mich nicht abschütteln !!!

Here's another estimate:

http://metalsplace.com/metalsnews/?a=9572

"Another Galore Creek neighbor is the Schaft Creek project being developed by Copper Fox [CVE:CUU]. Schaft Creek is only 36km from Galore Creek, but it is on the BC side of the mountains, thus no tunnel or Alaskan environmentalists. The deposit is every bit as big as GC and they have a top notch CEO. The life of mine strip ratio is a much cleaner 0.7:1. The gold grades are higher and it also has molybdenum. The 2004 capital costs were $600MM. While the cost is sure to increase it will still be much less than GC. Copper Fox optioned the property from Teck Cominco in 2002, but Teck retained a back in right for up to 75%. Teck would have to contribute 4 times all prior expenditures and arrange financing after CUU delivers the feasibility study. A preliminary feasibility study and an updated resource estimate were ordered last month. At $2 copper and $500 gold the NPV is $1.2B discounted at 8%. So CUU has arguably a better project and a strong partner already in place. They will undoubtedly have to dilute shareholders to complete the FS, but then they get four times their expenditures to help pay for their 25% of capital costs. The entire market cap of Copper Fox is currently about $40MM

. Twenty five percent of Galore Creek would run about $600MM

. Twenty five percent of Galore Creek would run about $600MM

."

."

hab ichs doch gedacht,

gestern ein wenig runterdrücken und heute

siehe auch schönes Bid

Datum Zeit National # Veränderung

01-02-2007 12:41:03 (18:41:03 CET) 0.04 (5.19%)

Volumen Schlusskurs Eröffnungskurs Letzter

179'000 0.77 0.80 0.81 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

66'000 46'000 0.81 0.82

gestern ein wenig runterdrücken und heute

siehe auch schönes Bid

Datum Zeit National # Veränderung

01-02-2007 12:41:03 (18:41:03 CET) 0.04 (5.19%)

Volumen Schlusskurs Eröffnungskurs Letzter

179'000 0.77 0.80 0.81 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

66'000 46'000 0.81 0.82

Antwort auf Beitrag Nr.: 27.353.088 von hasi22 am 01.02.07 18:58:50Hallo, wo kaufst Du? Bei der DAB wird keine Bank angezeigt.

Frieder

Frieder

Antwort auf Beitrag Nr.: 27.442.331 von Frieder2901 am 05.02.07 13:57:46Hallo Frieder,

kann Dir wahrscheinlich nicht helfen, da ich in der Schweiz wohne

(für mich UBS oder Swissquote)

Denke Kupfer könnte langsam wieder drehen, mal schauen wie's heute weiter geht.

Gut Trade Hasi

kann Dir wahrscheinlich nicht helfen, da ich in der Schweiz wohne

(für mich UBS oder Swissquote)

Denke Kupfer könnte langsam wieder drehen, mal schauen wie's heute weiter geht.

Gut Trade Hasi

sieht weiter sehr gut aus für unseren Fox

" Last Trade: 0.80

Trade Time: 3:42PM ET

Change: Up 0.02 (2.56%)

CUU Company Snapshot

It looks like a really nice flag is forming. If it plays out we should see a really nice pop over $1.25 in the next week."

hier noch optimistischer !!

NG's Galore Creek Feasibility Study from a few months ago establishes a production cost of $1.22/tonne. With an insitu metal value of about $40/tonne, the production cost per ounce of gold is negative $847/ounce, using other metals as credits of course.

Schaft Creek's Scoping study says $6.10/tonne production cost (probably conservative due to its early stage) which is alot higher than Galore Creek but still well below its insitu metal value of $20/tonne (taken from the most recent resource estimate). Taking metal prices from 2001 results in an insitu metal value pretty much the same as the scoping study level production cost.

Another good comparison is NDM's Pebble deposit, which has a metal value of about $30/tonne. No production cost established yet though, but at $10/share investors as well as Rio Tinto (recent 20% purchase) are betting it's economic.

Majors look at risk far more than any other factor, and I think that Schaft Creek needs to establish better economics at the bottom end of the spectrum, during lower metal prices, etc. This is why the deposit is not yet in production despite being discovered in 1957. Recent news releases have alluded to drill holes showing higher grades near surface. If the soon-to-come resource calculation confirms this, CUU could go much higher very quickly.

On another interesting note, NDM's biggest moves have always come on resource calculations, not drill results. It's the same story - CUU is virtually the exact same company as NDM was in 2003, except that Teck Cominco has a 75% back-in right. Maybe they learned from the NDM experience. Nonetheless, NDM drilled and provided Resource Calculations that defined the deposit and the stock went from the pennies to $10. Schaft Creek has additional positives over Pebble like environmental issues that could offset the 75% back-in-right and propel the stock to $10

just like NDM.

just like NDM.

Whew, enough said. I have done my DD and I am buying CUU.

" Last Trade: 0.80

Trade Time: 3:42PM ET

Change: Up 0.02 (2.56%)

CUU Company Snapshot

It looks like a really nice flag is forming. If it plays out we should see a really nice pop over $1.25 in the next week."

hier noch optimistischer !!

NG's Galore Creek Feasibility Study from a few months ago establishes a production cost of $1.22/tonne. With an insitu metal value of about $40/tonne, the production cost per ounce of gold is negative $847/ounce, using other metals as credits of course.

Schaft Creek's Scoping study says $6.10/tonne production cost (probably conservative due to its early stage) which is alot higher than Galore Creek but still well below its insitu metal value of $20/tonne (taken from the most recent resource estimate). Taking metal prices from 2001 results in an insitu metal value pretty much the same as the scoping study level production cost.

Another good comparison is NDM's Pebble deposit, which has a metal value of about $30/tonne. No production cost established yet though, but at $10/share investors as well as Rio Tinto (recent 20% purchase) are betting it's economic.

Majors look at risk far more than any other factor, and I think that Schaft Creek needs to establish better economics at the bottom end of the spectrum, during lower metal prices, etc. This is why the deposit is not yet in production despite being discovered in 1957. Recent news releases have alluded to drill holes showing higher grades near surface. If the soon-to-come resource calculation confirms this, CUU could go much higher very quickly.

On another interesting note, NDM's biggest moves have always come on resource calculations, not drill results. It's the same story - CUU is virtually the exact same company as NDM was in 2003, except that Teck Cominco has a 75% back-in right. Maybe they learned from the NDM experience. Nonetheless, NDM drilled and provided Resource Calculations that defined the deposit and the stock went from the pennies to $10. Schaft Creek has additional positives over Pebble like environmental issues that could offset the 75% back-in-right and propel the stock to $10

just like NDM.

just like NDM.Whew, enough said. I have done my DD and I am buying CUU.

das Jahresresultat wurde veröffentlicht, ddieses endete mit einem Verlust von 0.04 cad. Dabei zeichnet sich eine Verbesserung des Resultates ab, im letzten Quartal wurde eine schwarze Null erreicht. Mit dem wahrscheinlich wieder steigenden Kupferpreis und den fixen Einnahmen die sie erzielen, wird es bergauf gehen

Es beeindrucken auch die hohen Investitionen von 5.9 mio mit Hilfe von Teck-Cominco

Announces Year-end 2006 Financial Results

Highlights -- In 2006, Copper Fox spent a further $5.9 million of

additional expenditures on the Schaft Creek Property and satisfied the

first obligation of earning its 94.3% option interest from Teck-Cominco

by spending $5,000,000 of expenditures on the Schaft Creek deposit by

December 31, 2006. The Company also completed over $9.7 million of

equity financings during the year. The corporation's working capital

position at October 31, 2006 was $2.6 million. The Company incurred a

loss of $1,656,713 for the year ended October 31, 2006 ($0.04 per

share) compared to a loss of $590,637 ($0.04 per share) for the year

ended October 31, 2005 and losses of $193,356 for the three months

period ended October 31, 2006 ($0.00 per share) compared to a loss of

$202,831 ($0.00 per share) for the three months ended October 31, 2005.

Subsequent to year end, the Company completed financing in December

2006 for gross proceeds of $3.1 million.

Copper Fox is a Junior Resource Mining Company listed on the

TSX-Venture Exchange (CUU). The company is involved in the exploration

and development of a world class copper/gold porphyry mineral deposit

located in north western B.C. at Schaft Creek. Under the terms of an

option agreement negotiated with Teck Cominco Limited, Copper Fox can

acquire up to a 94.3% aggregate (direct and indirect) interest in the

Schaft Creek mineral resource.

Es beeindrucken auch die hohen Investitionen von 5.9 mio mit Hilfe von Teck-Cominco

Announces Year-end 2006 Financial Results

Highlights -- In 2006, Copper Fox spent a further $5.9 million of

additional expenditures on the Schaft Creek Property and satisfied the

first obligation of earning its 94.3% option interest from Teck-Cominco

by spending $5,000,000 of expenditures on the Schaft Creek deposit by

December 31, 2006. The Company also completed over $9.7 million of

equity financings during the year. The corporation's working capital

position at October 31, 2006 was $2.6 million. The Company incurred a

loss of $1,656,713 for the year ended October 31, 2006 ($0.04 per

share) compared to a loss of $590,637 ($0.04 per share) for the year

ended October 31, 2005 and losses of $193,356 for the three months

period ended October 31, 2006 ($0.00 per share) compared to a loss of

$202,831 ($0.00 per share) for the three months ended October 31, 2005.

Subsequent to year end, the Company completed financing in December

2006 for gross proceeds of $3.1 million.

Copper Fox is a Junior Resource Mining Company listed on the

TSX-Venture Exchange (CUU). The company is involved in the exploration

and development of a world class copper/gold porphyry mineral deposit

located in north western B.C. at Schaft Creek. Under the terms of an

option agreement negotiated with Teck Cominco Limited, Copper Fox can

acquire up to a 94.3% aggregate (direct and indirect) interest in the

Schaft Creek mineral resource.

Copper Fox zeigt heute Stärke !!! bei schönem Volumen

das Vorantreiben der Mine wird systematisch angegangen

das Vorantreiben der Mine wird systematisch angegangen

Last Trade: 0.74

Trade Time: 9:53AM ET

Change: Up 0.03 (4.23%)

Prev Close: 0.71

Open: 0.73

Bid: 0.73

Ask: 0.74

Day's Range: 0.73 - 0.75

52wk Range: 0.36 - 0.90

Volume: 113,100

Avg Vol (3m): 322,697

our leader, Guillermo, graduated from Harvard..

CUU recently did PP for 3.2 million.

And there is the contract with Teck. If Teck buys back 75% of Schaft Creek, it will pay 4 time exploration costs, and also will pay all financing of production.

So I do not see that much dilution any more in the future.

See also article from ResourceInvestor in url below, that will explain more of the details:

http://www.resourceinvestor.com/pebble.asp?relid=25170

das Vorantreiben der Mine wird systematisch angegangen

das Vorantreiben der Mine wird systematisch angegangenLast Trade: 0.74

Trade Time: 9:53AM ET

Change: Up 0.03 (4.23%)

Prev Close: 0.71

Open: 0.73

Bid: 0.73

Ask: 0.74

Day's Range: 0.73 - 0.75

52wk Range: 0.36 - 0.90

Volume: 113,100

Avg Vol (3m): 322,697

our leader, Guillermo, graduated from Harvard..

CUU recently did PP for 3.2 million.

And there is the contract with Teck. If Teck buys back 75% of Schaft Creek, it will pay 4 time exploration costs, and also will pay all financing of production.

So I do not see that much dilution any more in the future.

See also article from ResourceInvestor in url below, that will explain more of the details:

http://www.resourceinvestor.com/pebble.asp?relid=25170

Freunde, sie dreht auf !!

Last Trade: 0.78

Trade Time: 11:16AM ET

Change: Up 0.07 (9.86%)

übrigens noch

With a great resource and as we move towards a feasibility study, there is a great opportunity to enter with a great risk/reward ratio looking forward, however; a $3.4M private placement will only cover a fraction of the FS cost.

Last Trade: 0.78

Trade Time: 11:16AM ET

Change: Up 0.07 (9.86%)

übrigens noch

With a great resource and as we move towards a feasibility study, there is a great opportunity to enter with a great risk/reward ratio looking forward, however; a $3.4M private placement will only cover a fraction of the FS cost.

man ist der Ansicht, grosse Käufer oder Fonds seien am Einkaufen

aus Stockhousboard:

"Good thing I filled my order yesterday at the low. I had a feeling this would bounce off the 50% sto, however, I did not expect this to rocket 15% in one day, either institutions are in the know or someone recommended this today. Does anyone know who was on the buy today? Or if anyone recommended this? Was shoveling snow all day hahaha."

aus Stockhousboard:

"Good thing I filled my order yesterday at the low. I had a feeling this would bounce off the 50% sto, however, I did not expect this to rocket 15% in one day, either institutions are in the know or someone recommended this today. Does anyone know who was on the buy today? Or if anyone recommended this? Was shoveling snow all day hahaha."

News zum Aufbau der Produktion !!

this new employee, is he for bringing our property into production? if so, do we get 400% of his cost if tech takes its 75 %

Copper Fox Welcomes New Executive to the Team

CALGARY, Feb. 21 /CNW/ - Guillermo Salazar S, President and CEO of Copper

Fox Metals Inc. ("Copper Fox" or the "Company") is pleased to announce the

appointment of Cam Grundstrom as Vice President - Operations and a member of

the Copper Fox Executive Team. Cam is a Mining Engineer with extensive

operations and development experience having held key management positions in

large mining projects in Canada, USA, and overseas during his 26 year career.

His experience includes assignments in world class underground and open pit

mines, where he led teams in attaining production records while ensuring safe

and efficient operations. He comes to Copper Fox from BHPBilliton Diamonds

Inc. where he held the position of Mining Coordinator at the Ekati Diamond

Mine. As Vice President - Operations with Copper Fox, Cam will have a major

role in the development of the Company's world class mineral deposit located

at Schaft Creek, British Columbia, Canada.

About Copper Fox

Copper Fox is a Canadian based Junior Natural Resource mining company

listed on the TSX-Venture exchange trading under the symbol (CUU). The Company

is focused on the acquisition of advanced exploration and or near production

precious and base metal deposits. The Company holds an option agreement with

Teck Cominco Limited to acquire up to a 93.4% direct and indirect interest in

the Schaft Creek copper-gold-molybdenum mineral deposit in northwest British

Columbia, Canada.

On behalf of the Board of Directors

this new employee, is he for bringing our property into production? if so, do we get 400% of his cost if tech takes its 75 %

Copper Fox Welcomes New Executive to the Team

CALGARY, Feb. 21 /CNW/ - Guillermo Salazar S, President and CEO of Copper

Fox Metals Inc. ("Copper Fox" or the "Company") is pleased to announce the

appointment of Cam Grundstrom as Vice President - Operations and a member of

the Copper Fox Executive Team. Cam is a Mining Engineer with extensive

operations and development experience having held key management positions in

large mining projects in Canada, USA, and overseas during his 26 year career.

His experience includes assignments in world class underground and open pit

mines, where he led teams in attaining production records while ensuring safe

and efficient operations. He comes to Copper Fox from BHPBilliton Diamonds

Inc. where he held the position of Mining Coordinator at the Ekati Diamond

Mine. As Vice President - Operations with Copper Fox, Cam will have a major

role in the development of the Company's world class mineral deposit located

at Schaft Creek, British Columbia, Canada.

About Copper Fox

Copper Fox is a Canadian based Junior Natural Resource mining company

listed on the TSX-Venture exchange trading under the symbol (CUU). The Company

is focused on the acquisition of advanced exploration and or near production

precious and base metal deposits. The Company holds an option agreement with

Teck Cominco Limited to acquire up to a 93.4% direct and indirect interest in

the Schaft Creek copper-gold-molybdenum mineral deposit in northwest British

Columbia, Canada.

On behalf of the Board of Directors

eine super Reaktion heute

CCU TSX $1.42 +0.11 +8.40%

1.42(69) 1.43(175) 1.45 1.32 1.32 Volume 14,414,561

1.42(69) 1.43(175) 1.45 1.32 1.32 Volume 14,414,561

CCU TSX $1.42 +0.11 +8.40%

1.42(69) 1.43(175) 1.45 1.32 1.32 Volume 14,414,561

1.42(69) 1.43(175) 1.45 1.32 1.32 Volume 14,414,561

schon wieder sehr schöner Start

COPPER FOX MTLS ORD (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 10:25:30 Veränderung

Venture CAD .9 +0.04 (+4.7%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

27'000 .89 .9 39'000

Real time prices Volumen 502,005

COPPER FOX MTLS ORD (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 10:25:30 Veränderung

Venture CAD .9 +0.04 (+4.7%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

27'000 .89 .9 39'000

Real time prices Volumen 502,005

unglaubliche Stärke

und dies ohne BB push

Last Trade: 0.95

Trade Time: 2:09PM ET

Change: Up 0.09 (10.47%)

Prev Close: 0.86

Open: 0.89

Bid: 0.95

Ask: 0.97

Day's Range: 0.87 - 0.98

52wk Range: 0.36 - 0.90

Volume: 984,476

und dies ohne BB push

Last Trade: 0.95

Trade Time: 2:09PM ET

Change: Up 0.09 (10.47%)

Prev Close: 0.86

Open: 0.89

Bid: 0.95

Ask: 0.97

Day's Range: 0.87 - 0.98

52wk Range: 0.36 - 0.90

Volume: 984,476

übrigens noch

BUY-IF

0.8600

+0.0700 +8.86%

bei American Bulls !!!!!!!!!!!!!!!!!!!!!!!!!!!!

BUY-IF

0.8600

+0.0700 +8.86%

bei American Bulls !!!!!!!!!!!!!!!!!!!!!!!!!!!!

hier noch eine etwas apokalyptische

Sichtweise eines Stockhouse borders.

SUBJECT: Upside Gold Price Unstoppable! Posted By: quest11

Post Time: 2/23/2007 22:31

Expect lower US interest rates to cause the US Dollar to plummet. Chinese are buying gold as presents for newborn children. Housing bubble is going to self-destruct. US war with Iran is inevitable. US trade deficit with China is going ballistic........................

CUU will explode

in value as the word gets out!!!!!!!!!!!!!!!!

in value as the word gets out!!!!!!!!!!!!!!!!

quest11

Sichtweise eines Stockhouse borders.

SUBJECT: Upside Gold Price Unstoppable! Posted By: quest11

Post Time: 2/23/2007 22:31

Expect lower US interest rates to cause the US Dollar to plummet. Chinese are buying gold as presents for newborn children. Housing bubble is going to self-destruct. US war with Iran is inevitable. US trade deficit with China is going ballistic........................

CUU will explode

in value as the word gets out!!!!!!!!!!!!!!!!

in value as the word gets out!!!!!!!!!!!!!!!!quest11

es geht weiter aufwärts und guten Nachrichten !!!

Datum Zeit National # Veränderung

26-02-2007 9:37:02 (15:37:02 CET) 0.05 (5.15%) Volumen Schlusskurs Eröffnungskurs Letzter

Volumen Schlusskurs Eröffnungskurs Letzter

70'500 0.97 1.02 1.02 CAD

Copper Fox Metals Inc. announces the renewal of its engagement of Scott F. Gibson & Company Inc.

CALGARY, Feb. 26, 2007 (Canada NewsWire via COMTEX News Network) --

Guillermo Salazar S President and CEO of Copper Fox Metals Inc. ("Copper Fox" or the "Company") (TSX-V:CUU) is pleased to announce Copper Fox has renewed the engagement of Scott F. Gibson & Company Inc. to assist in the design and implementation of a comprehensive marketing and investor communications program for the company.

Gibson & Company is based in Vancouver, BC and provides marketing and investor communication services to public companies in the resource sector. It will be responsible for advising the company with respect to corporate development, increasing the company's exposure to potential investors and maximizing the effectiveness of the company's marketing and communications materials.

Under the agreement, Gibson & company will receive a fee of $5,000 per month for a term of one year and incentive options to purchase 578,000 common shares of the company at an exercise price of $0.78 per share, which represents a 20% discount to the market price on February 23, 2007 of $0.97, and is the maximum allowed pursuant to the rules of the TSX-Venture Exchange. The options will vest over a period of 12 months and be subject to the terms and conditions of the company's stock option plan. The options will expire on the earliest of the 30th day following termination of the agreement or Feb. 1, 2012. Both Gibson & Company, and its principal, Scott Gibson, are at arms-length to the Copper Fox.

About Copper Fox

Copper Fox is a Canadian based Junior Natural Resource mining company listed on the TSX-Venture exchange trading under the symbol (CUU). The Company is working towards the economic development of the world class copper-gold-molybdenum mineral deposit located at Schaft Creek situated in North West British Columbia, Canada. The Company holds an option agreement with Teck Cominco Limited to acquire up to a 93.4% direct and indirect (carried) interest in the Schaft Creek mineral deposit

On behalf of the Board of Directors

Guillermo Salazar S

President & CEO

The TSX Venture Exchange has not reviewed the contents of this news

release and accepts no responsibility for the adequacy or the accuracy

thereof.

This news release may contain forward-looking information including but not limited to comments regarding the timing and content of upcoming financings, work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking information includes disclosure regarding possible future events, or conditions or results of operations that is based on assumptions about future economic conditions and courses of action, and therefore, involves inherent risks and uncertainties. Although management has a reasonable basis for the conclusions drawn, actual results may differ materially from those currently anticipated in such statements.

SOURCE: Copper Fox Metals Inc.

Datum Zeit National # Veränderung

26-02-2007 9:37:02 (15:37:02 CET) 0.05 (5.15%)

Volumen Schlusskurs Eröffnungskurs Letzter

Volumen Schlusskurs Eröffnungskurs Letzter 70'500 0.97 1.02 1.02 CAD

Copper Fox Metals Inc. announces the renewal of its engagement of Scott F. Gibson & Company Inc.

CALGARY, Feb. 26, 2007 (Canada NewsWire via COMTEX News Network) --

Guillermo Salazar S President and CEO of Copper Fox Metals Inc. ("Copper Fox" or the "Company") (TSX-V:CUU) is pleased to announce Copper Fox has renewed the engagement of Scott F. Gibson & Company Inc. to assist in the design and implementation of a comprehensive marketing and investor communications program for the company.

Gibson & Company is based in Vancouver, BC and provides marketing and investor communication services to public companies in the resource sector. It will be responsible for advising the company with respect to corporate development, increasing the company's exposure to potential investors and maximizing the effectiveness of the company's marketing and communications materials.

Under the agreement, Gibson & company will receive a fee of $5,000 per month for a term of one year and incentive options to purchase 578,000 common shares of the company at an exercise price of $0.78 per share, which represents a 20% discount to the market price on February 23, 2007 of $0.97, and is the maximum allowed pursuant to the rules of the TSX-Venture Exchange. The options will vest over a period of 12 months and be subject to the terms and conditions of the company's stock option plan. The options will expire on the earliest of the 30th day following termination of the agreement or Feb. 1, 2012. Both Gibson & Company, and its principal, Scott Gibson, are at arms-length to the Copper Fox.

About Copper Fox

Copper Fox is a Canadian based Junior Natural Resource mining company listed on the TSX-Venture exchange trading under the symbol (CUU). The Company is working towards the economic development of the world class copper-gold-molybdenum mineral deposit located at Schaft Creek situated in North West British Columbia, Canada. The Company holds an option agreement with Teck Cominco Limited to acquire up to a 93.4% direct and indirect (carried) interest in the Schaft Creek mineral deposit

On behalf of the Board of Directors

Guillermo Salazar S

President & CEO

The TSX Venture Exchange has not reviewed the contents of this news

release and accepts no responsibility for the adequacy or the accuracy

thereof.

This news release may contain forward-looking information including but not limited to comments regarding the timing and content of upcoming financings, work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking information includes disclosure regarding possible future events, or conditions or results of operations that is based on assumptions about future economic conditions and courses of action, and therefore, involves inherent risks and uncertainties. Although management has a reasonable basis for the conclusions drawn, actual results may differ materially from those currently anticipated in such statements.

SOURCE: Copper Fox Metals Inc.

mein Liebling (und erst noch selber rausgefunden und keine BB Pushs usw.)

und dieses Volumen

und dieses Volumen

OPPER FOX METALS INC. (Tier2) (CDNX:CUU.V) Delayed quote data Edit

Last Trade: 1.19

Trade Time: 3:59PM ET

Change: Up 0.22 (22.68%)

Prev Close: 0.97

Day's Range: 1.00 - 1.20

52wk Range: 0.36 - 1.02

Volume: 1,230,687

Avg Vol (3m): 359,361

nach diesem Schreck macht sich der Fox schon wieder sehr gut !!

siehe auch Bid Volumen

COPPER FOX MTLS ORD (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 10:02:40 Veränderung

Venture CAD 1 +0.06 (+6.4%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

8'000 .96 1 3'000

Real time prices

siehe auch Bid Volumen

COPPER FOX MTLS ORD (CUU) Aktualisieren

Börsenplatz Währung Letzter Preis 10:02:40 Veränderung

Venture CAD 1 +0.06 (+6.4%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

8'000 .96 1 3'000

Real time prices

denke, 0.95 war defintiv der Boden

Datum Zeit National # Veränderung

28-02-2007 11:33:17 (17:33:17 CET) 0.12 (12.77%)

Volumen Schlusskurs Eröffnungskurs Letzter

378'230 0.94 0.95 1.06 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

17'000 12'000 1.04 1.06

Datum Zeit National # Veränderung

28-02-2007 11:33:17 (17:33:17 CET) 0.12 (12.77%)

Volumen Schlusskurs Eröffnungskurs Letzter

378'230 0.94 0.95 1.06 CAD

Vol. Geld Vol. Brief Geldkurs Briefkurs

17'000 12'000 1.04 1.06

der Copper Fox ist bombig dran !!!

Copper Rises in London as Chinese Buyers Return From HolidayBy Brett Foley

Feb. 26 (Bloomberg) -- Copper rose in London amid signs that demand from Asian buyers for the metal used in pipes and wires would remain buoyant as they returned from a weeklong holiday.

Copper futures in Shanghai gained the daily limit of 4 percent to the highest in seven weeks as trading resumed after the Lunar New Year holiday. Imports of copper and copper products into China, the world's biggest user of the metal, jumped 44 percent in January from a year earlier, customs data showed on Feb. 12. The customs office will issue data for imports of refined copper on Feb. 28.

``Its no surprise given the price rally in London last week,'' Peter Fertig, a commodity analyst with Dresdner Kleinwort in Frankfurt, said today by phone. ``There has already been significant restocking in China, but we think strong demand will ensure that continues.''

Copper for delivery in three months on the LME advanced $39, or 0.6 percent, to $6,345 a ton as of 8:53 a.m. local time. Last week it had rose 8.6 percent, the largest weekly gain since July.