Clearwire Corp. (CLWR) ... jetzt geht´s wieder los ?!?! - 500 Beiträge pro Seite

eröffnet am 20.08.11 00:31:20 von

neuester Beitrag 26.10.20 17:38:01 von

neuester Beitrag 26.10.20 17:38:01 von

Beiträge: 1.140

ID: 1.168.462

ID: 1.168.462

Aufrufe heute: 1

Gesamt: 44.623

Gesamt: 44.623

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 7 Minuten | 18569 | |

| vor 8 Minuten | 3597 | |

| vor 22 Minuten | 3380 | |

| vor 16 Minuten | 2644 | |

| vor 16 Minuten | 1620 | |

| heute 13:29 | 1431 | |

| vor 1 Stunde | 1239 | |

| vor 6 Minuten | 992 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.082,74 | -0,44 | 224 | |||

| 2. | 2. | 163,82 | +13,23 | 204 | |||

| 3. | 8. | 9,3450 | -35,60 | 175 | |||

| 4. | 3. | 0,1995 | +4,45 | 40 | |||

| 5. | 5. | 0,0160 | -48,88 | 39 | |||

| 6. | 9. | 777,07 | +2,00 | 38 | |||

| 7. | 12. | 19,300 | -1,08 | 30 | |||

| 8. | 10. | 7,1100 | -1,66 | 28 |

Clearwire Announces Intent to Add LTE to Its Network to Accelerate Wholesale Business

Date : 08/03/2011 @ 4:01PM

Source : GlobeNewswire Inc.

Stock : Clearwire Corporation (CLWR)

Quote : 3.01 0.7 (30.30%) @ 6:00PM

* Company Will Leverage Deep Spectrum Resources and All-IP Network to Meet Long-Term Mobile Broadband Demands

* Unmatched LTE Network Capable of Serving Current and Future Wholesale and Retail Customers

* Initial LTE Rollout Will Target High-Demand Areas of Current 4G Markets, Leverage Existing 4G Infrastructure for Minimal Capital Expense

* Download Speeds Exceed 120 Mbps in Successful Network Technology Trial

* Support for WiMAX 4G Network Technology to Continue

http://ih.advfn.com/p.php?pid=nmona&article=48684585

http://ih.advfn.com/p.php?pid=squote&symbol=CLWR

Hab vor einigen Tagen noch an einen Zock geglaubt, sieht aber doch nach mehr aus ... super hohes Volumen, starke Hände und absolut gegen den sehr schwachen Gesamtmarkt !

Weiter im Auge behalten !

Weiter im Auge behalten !

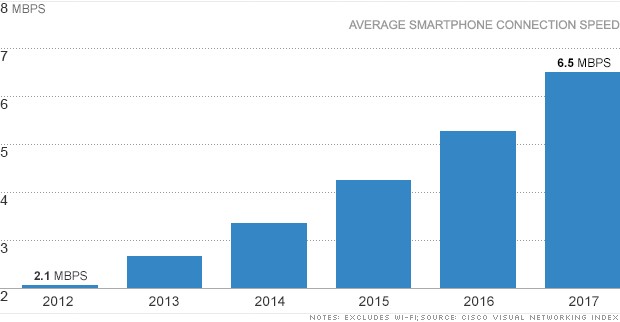

This is the future of mobile broadband

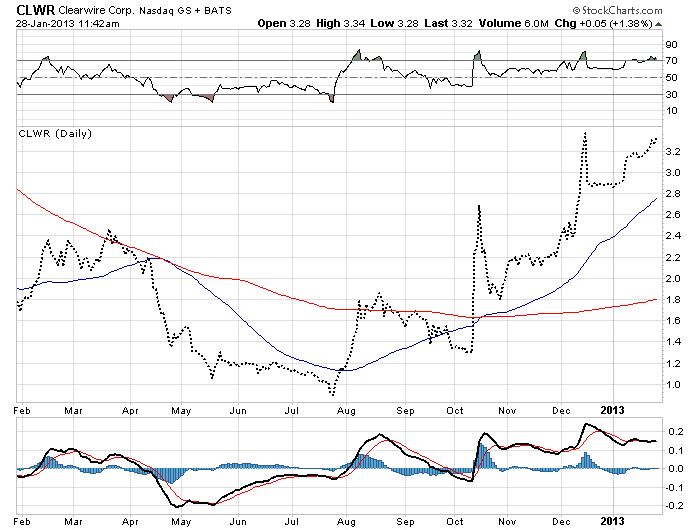

Schneller geht´s kaum zur Zeit !!!

Schneller geht´s kaum zur Zeit !!!

Schau dir mal die Erfahrungberichte in ihrem Unternehmens-Forum an.

Scheint als wär die Firma mehr Schein als Sein, fast nur beschwerden wegen Geschindigkeitskappung, hohe Vertragsauflösungskosten und schlechten Kundenservice.

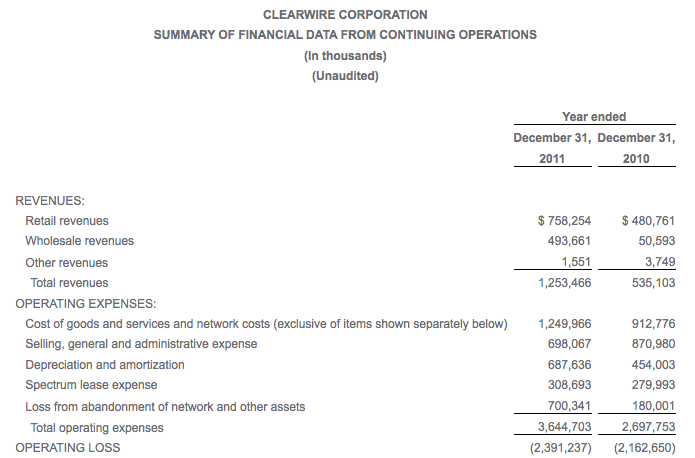

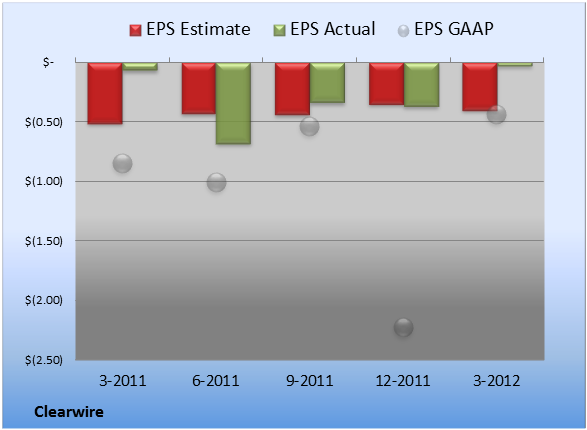

Die Financial Reports der letzten 4 Quartale sehen auch nicht einladend aus.

Scheint als wär die Firma mehr Schein als Sein, fast nur beschwerden wegen Geschindigkeitskappung, hohe Vertragsauflösungskosten und schlechten Kundenservice.

Die Financial Reports der letzten 4 Quartale sehen auch nicht einladend aus.

Antwort auf Beitrag Nr.: 41.980.070 von Cashing am 20.08.11 14:14:25Und dazu kommen noch 45.15 Millionen Aktien die short sind. Die werden das Teil schon schön unten halten.

Alles möglich an der Börse ... so Firmen werden oft nach unten geprügelt, dann sichern sich Investoren große Anteile und dann

gibt es Übernahmen / Verschmelzungen !

Wenn man die Aktie unten halten will ... warum will man das ?

So Argumente " ... fast nur beschwerden wegen Geschindigkeitskappung, hohe Vertragsauflösungskosten und schlechten Kundenservice ... " sehe

ich als uninteressant an und wird auch Investoren / Übernehmer nicht

interessieren. Technik interessiert, die kann man in ein gutes Serviceunternehmen

einbringen ... Apple zum Bleistift !

gibt es Übernahmen / Verschmelzungen !

Wenn man die Aktie unten halten will ... warum will man das ?

So Argumente " ... fast nur beschwerden wegen Geschindigkeitskappung, hohe Vertragsauflösungskosten und schlechten Kundenservice ... " sehe

ich als uninteressant an und wird auch Investoren / Übernehmer nicht

interessieren. Technik interessiert, die kann man in ein gutes Serviceunternehmen

einbringen ... Apple zum Bleistift !

Einfach mal recherchieren:

Apple / Clearwire / Motorola (jetzt Google)

Viel Fantasie !!!

Apple / Clearwire / Motorola (jetzt Google)

Viel Fantasie !!!

Clearwire Buyout Rumored

http://www.dailywireless.org/

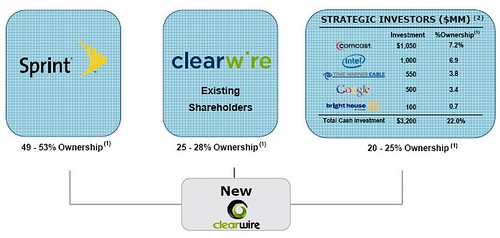

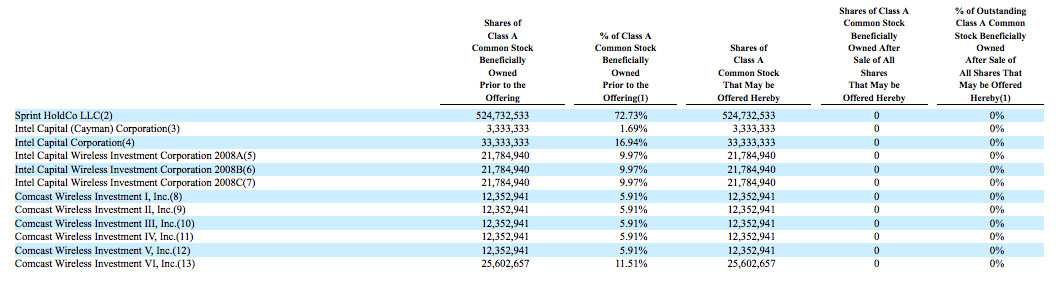

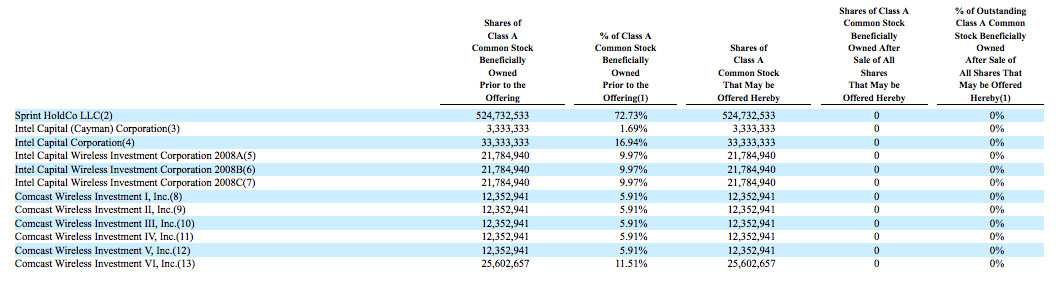

Sprint, the third-largest U.S. wireless operator, is discussing an investment in Clearwire with cable companies like Comcast, reports Bloomberg. Under one scenario being discussed, Sprint would use the money to buy the equity in Clearwire it doesn’t own. Talks are preliminary and no deal is imminent, reports Bloomberg.

Comcast, Time Warner Cable, and Bright House Networks are already investors in Clearwire. They, along with Sprint, might help fund the money-losing Kirkland, Washington-based company so it can build out its high-speed wireless network.

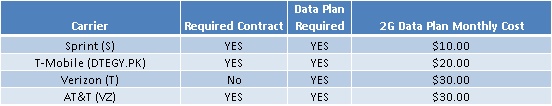

While Comcast and Time Warner already resell Clearwire’s WiMax, a Sprint wholesale agreement may allow cable companies utilize TD-LTE. Currently, if cable subscribers also want wireless voice service, they must use a different spectrum segment, for example Sprint’s 3G CDMA band. In the future, Voice over LTE may integrate both services into one 10-20 MHz band.

Clearwire plans to spend about $600 million to upgrade its network to so-called long-term evolution, or LTE, technology.

The size and timing of the investment in Sprint haven’t yet been determined, Bloomberg reports. The discussions involve various scenarios, including a Clearwire buyout or an investment in the company through Sprint, the people said. Cox Communications and Cablevision Systems have also been in discussions with Sprint, two of the people said.

Sprint has not yet announced official support for TD-LTE, but the company is widely expected to make an official announcement in early October.

Related Dailywireless articles include; Clearwire Chooses LTE Advanced, Sprint: New Investment in Clearwire?, Google & Motorola: A Wireless Cable Play? , Spectrum Drama: Made for TV, LTE Spectrum: It’s War, German 4G Auction: It’s Done, Auctions Winding Down in Germany & India, Germany 4G Auctions Begin, Europe to Follow, EU: Global LTE Roaming at 1.8 GHz, T-Mobile Makes Its (4G) Move, End Near for Indian WiMAX?, WiMAX & LTE: Policy Vs Pragmatism, India’s Broadband Auction: It’s Done, TD-LTE Gains Momentum, WiMAX Forum: Not Dead Yet, Yota Dumps WiMAX, UK Getting LTE, WiMAX to TD-LTE: Everybody’s Doin’ It, Speculation on Sprint Infrastructure, Sprint’s LTE Advantage, LTE-Advanced Tested in Korea, ITU: The “Official” 4G Standard Approved, IEEE Submits 802.16m to ITU for 4G, LTE-Advanced Submitted to ITU

Corporate News, LTE, WiMAX Deployments, WiMAX News

http://www.dailywireless.org/

Sprint, the third-largest U.S. wireless operator, is discussing an investment in Clearwire with cable companies like Comcast, reports Bloomberg. Under one scenario being discussed, Sprint would use the money to buy the equity in Clearwire it doesn’t own. Talks are preliminary and no deal is imminent, reports Bloomberg.

Comcast, Time Warner Cable, and Bright House Networks are already investors in Clearwire. They, along with Sprint, might help fund the money-losing Kirkland, Washington-based company so it can build out its high-speed wireless network.

While Comcast and Time Warner already resell Clearwire’s WiMax, a Sprint wholesale agreement may allow cable companies utilize TD-LTE. Currently, if cable subscribers also want wireless voice service, they must use a different spectrum segment, for example Sprint’s 3G CDMA band. In the future, Voice over LTE may integrate both services into one 10-20 MHz band.

Clearwire plans to spend about $600 million to upgrade its network to so-called long-term evolution, or LTE, technology.

The size and timing of the investment in Sprint haven’t yet been determined, Bloomberg reports. The discussions involve various scenarios, including a Clearwire buyout or an investment in the company through Sprint, the people said. Cox Communications and Cablevision Systems have also been in discussions with Sprint, two of the people said.

Sprint has not yet announced official support for TD-LTE, but the company is widely expected to make an official announcement in early October.

Related Dailywireless articles include; Clearwire Chooses LTE Advanced, Sprint: New Investment in Clearwire?, Google & Motorola: A Wireless Cable Play? , Spectrum Drama: Made for TV, LTE Spectrum: It’s War, German 4G Auction: It’s Done, Auctions Winding Down in Germany & India, Germany 4G Auctions Begin, Europe to Follow, EU: Global LTE Roaming at 1.8 GHz, T-Mobile Makes Its (4G) Move, End Near for Indian WiMAX?, WiMAX & LTE: Policy Vs Pragmatism, India’s Broadband Auction: It’s Done, TD-LTE Gains Momentum, WiMAX Forum: Not Dead Yet, Yota Dumps WiMAX, UK Getting LTE, WiMAX to TD-LTE: Everybody’s Doin’ It, Speculation on Sprint Infrastructure, Sprint’s LTE Advantage, LTE-Advanced Tested in Korea, ITU: The “Official” 4G Standard Approved, IEEE Submits 802.16m to ITU for 4G, LTE-Advanced Submitted to ITU

Corporate News, LTE, WiMAX Deployments, WiMAX News

Okay der Tag heute ... !!!

Antwort auf Beitrag Nr.: 41.979.059 von TimeFactor am 20.08.11 00:31:2012.10.2011 09:54

US-Regulierer peilt universelles Breitbandnetz für 2020 an

Die Federal Communications Commission (FCC) will den 8 Milliarden US-Dollar schweren Topf für den sogenannten Universaldienst umwidmen. Künftig soll das Geld laut einem Plan der Regulierungsbehörde nicht mehr in den Ausbau des klassischen Telefon-, sondern des Breitbandnetzes fließen. Das schnelle Internet habe sich "von einem Luxus zu einer Notwendigkeit für die volle Beteiligung an unserer Wirtschaft und Gesellschaft entwickelt", erklärte FCC-Chef Julius Genachowski in einer Rede in Washington. Es sei daher nicht mehr zeitgemäß, ein technisch veraltetes Netz zu fördern. Zudem würden die Mittel aus dem bestehenden Universaldienstfonds derzeit ungerecht verteilt. Die neue Initiative bringe dagegen enorme Vorteile für den einzelnen Verbraucher und fördere die globale Wettbewerbskraft der USA.

Die bisherige Kasse zum Anschluss unterversorgter, meist ländlicher Gebiete an Telefonleitungen speist sich aus Aufschlägen auf die Preise für Ferngespräche. Allein im vergangenen Jahr flossen daraus rund 4,3 Milliarden US-Dollar an Telekommunikationsfirmen und Netzausrüster zum Schließen von Lücken bei der Telefonversorgung. Mit dem geplanten Nachfolger, dem "Connect America Fund", will Genachowski die Zahl der rund 18 Millionen US-Haushalte, die 2010 keinen Breitbandzugang hatten, bis 2017 zunächst halbieren. 2020 sieht der FCC-Vorsitzende dann eine universelle Versorgung in den USA mit dem Hochgeschwindigkeitsinternet in greifbare Nähe rücken. Von einer Mindestbandbreite, über die entsprechende Anschlüsse verfügen sollen, sprach der den Demokraten angehörende Politiker nicht.

Zugleich kündigte Genachowski an, mit dem neuen Breitbandfonds erstmals auch den Ausbau mobiler Netze vorantreiben zu wollen. Entlang einer Strecke von über hunderttausend Straßenmeilen solle eine entsprechende Versorgung mit Funklösung gemäß dem aktuellen Stand der Technik gewährleistet werden. Den Anfang solle ein einmaliger Zuschuss für die Einführung drahtloser Netze der vierten Generation machen. Unterstützt würden damit auch die Flächen von Indianerreservaten, die bislang von Breitband und Mobilfunk noch weitgehend ausgeschlossen seien.

Erste Reaktionen auf das Vorhaben fallen gemischt aus. Die Breitbandvereinigung USTelecom begrüßte die Zielsetzung prinzipiell, möchte aber noch einige Bedenken ausgeräumt wissen. Die Verbraucherschutzgruppe Consumers Union befürwortete den Kern der Initiative ebenfalls. Sie warnte jedoch davor, die Ausbreitung von Breitbandanbietern, die bereits gute Umsätze machten, auf dem Rücken der Konsumenten zu finanzieren. David Mitchell, Wirtschaftsforscher an der Missouri State University, gab zu bedenken, dass mit der Umschichtung viele kleine Telefonanbieter in ländlichen Regionen bankrott gehen könnten. Ein Sprecher der zivilrechtlichen Organisation Public Knowledge verwies auf die noch offene Frage, ob die FCC überhaupt für die Breitbandregulierung zuständig sei.

Hierzulande sorgte die Frage der Ausweitung der bestehenden Universaldienstverpflichtung auf einen leistungsfähigen Internetzugang im Rahmen der laufenden Novellierung des Telekommunikationsgesetzes (TKG) für heftige Auseinandersetzungen. Die Opposition befürwortet die Einführung entsprechender Breitbandauflagen generell genauso wie Teile der CDU/CSU-Fraktion. Die Grünen legten jüngst ein Gutachten vor, wonach eine entsprechende, von der Industrie abgelehnte Auflage rechtlich machbar und volkswirtschaftlich sinnvoll sei. Laut FDP-Verhandlungspartnern ist eine solche Verpflichtung im Rahmen der TKG-Reform, die in der kommenden Woche vom Bundestag verabschiedet werden soll, aber "vom Tisch". (Stefan Krempl) / (jk)

US-Regulierer peilt universelles Breitbandnetz für 2020 an

Die Federal Communications Commission (FCC) will den 8 Milliarden US-Dollar schweren Topf für den sogenannten Universaldienst umwidmen. Künftig soll das Geld laut einem Plan der Regulierungsbehörde nicht mehr in den Ausbau des klassischen Telefon-, sondern des Breitbandnetzes fließen. Das schnelle Internet habe sich "von einem Luxus zu einer Notwendigkeit für die volle Beteiligung an unserer Wirtschaft und Gesellschaft entwickelt", erklärte FCC-Chef Julius Genachowski in einer Rede in Washington. Es sei daher nicht mehr zeitgemäß, ein technisch veraltetes Netz zu fördern. Zudem würden die Mittel aus dem bestehenden Universaldienstfonds derzeit ungerecht verteilt. Die neue Initiative bringe dagegen enorme Vorteile für den einzelnen Verbraucher und fördere die globale Wettbewerbskraft der USA.

Die bisherige Kasse zum Anschluss unterversorgter, meist ländlicher Gebiete an Telefonleitungen speist sich aus Aufschlägen auf die Preise für Ferngespräche. Allein im vergangenen Jahr flossen daraus rund 4,3 Milliarden US-Dollar an Telekommunikationsfirmen und Netzausrüster zum Schließen von Lücken bei der Telefonversorgung. Mit dem geplanten Nachfolger, dem "Connect America Fund", will Genachowski die Zahl der rund 18 Millionen US-Haushalte, die 2010 keinen Breitbandzugang hatten, bis 2017 zunächst halbieren. 2020 sieht der FCC-Vorsitzende dann eine universelle Versorgung in den USA mit dem Hochgeschwindigkeitsinternet in greifbare Nähe rücken. Von einer Mindestbandbreite, über die entsprechende Anschlüsse verfügen sollen, sprach der den Demokraten angehörende Politiker nicht.

Zugleich kündigte Genachowski an, mit dem neuen Breitbandfonds erstmals auch den Ausbau mobiler Netze vorantreiben zu wollen. Entlang einer Strecke von über hunderttausend Straßenmeilen solle eine entsprechende Versorgung mit Funklösung gemäß dem aktuellen Stand der Technik gewährleistet werden. Den Anfang solle ein einmaliger Zuschuss für die Einführung drahtloser Netze der vierten Generation machen. Unterstützt würden damit auch die Flächen von Indianerreservaten, die bislang von Breitband und Mobilfunk noch weitgehend ausgeschlossen seien.

Erste Reaktionen auf das Vorhaben fallen gemischt aus. Die Breitbandvereinigung USTelecom begrüßte die Zielsetzung prinzipiell, möchte aber noch einige Bedenken ausgeräumt wissen. Die Verbraucherschutzgruppe Consumers Union befürwortete den Kern der Initiative ebenfalls. Sie warnte jedoch davor, die Ausbreitung von Breitbandanbietern, die bereits gute Umsätze machten, auf dem Rücken der Konsumenten zu finanzieren. David Mitchell, Wirtschaftsforscher an der Missouri State University, gab zu bedenken, dass mit der Umschichtung viele kleine Telefonanbieter in ländlichen Regionen bankrott gehen könnten. Ein Sprecher der zivilrechtlichen Organisation Public Knowledge verwies auf die noch offene Frage, ob die FCC überhaupt für die Breitbandregulierung zuständig sei.

Hierzulande sorgte die Frage der Ausweitung der bestehenden Universaldienstverpflichtung auf einen leistungsfähigen Internetzugang im Rahmen der laufenden Novellierung des Telekommunikationsgesetzes (TKG) für heftige Auseinandersetzungen. Die Opposition befürwortet die Einführung entsprechender Breitbandauflagen generell genauso wie Teile der CDU/CSU-Fraktion. Die Grünen legten jüngst ein Gutachten vor, wonach eine entsprechende, von der Industrie abgelehnte Auflage rechtlich machbar und volkswirtschaftlich sinnvoll sei. Laut FDP-Verhandlungspartnern ist eine solche Verpflichtung im Rahmen der TKG-Reform, die in der kommenden Woche vom Bundestag verabschiedet werden soll, aber "vom Tisch". (Stefan Krempl) / (jk)

Antwort auf Beitrag Nr.: 41.979.059 von TimeFactor am 20.08.11 00:31:20LTE Markt vervierfacht sich im Jahr 2012

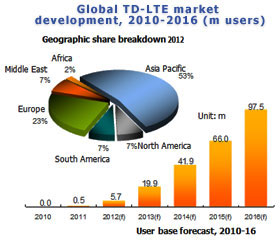

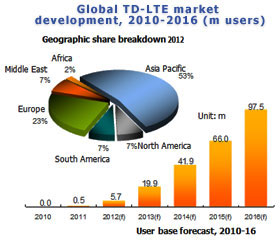

Die nächste Generation für mobile Datenkommunikation beginnt im nächsten Jahr mit rasantem Wachstum. Analysten erwarten, dass 32 Millionen LTE Geräte verkauft werden.

(13.10.2011, 07:00) Der weltweite Markt für die nächste Generation des Standards für mobile Datenübertragung LTE (Long Term Evolution) soll im nächsten Jahr auf das Vierfache anwachsen. Es sollen bei Mobiltelefonen rund 32 Millionen Einheiten, durch die starke Nachfrage der Verbraucher angeheizt, verkauft werden, sagt ein neuer Branchenreport.

Der Bericht von Strategy Analytics (SA), einem globalen Forschungs-und Beratungsunternehmen, prognostiziert, dass das Marktvolumen mit durchschnittlich 103,5 Prozent jährlich bis 2016 wachsen wird, da Handy-User Geräte mit schnellerer Datenübertragung suchen.

Es wird auch erwartet, dass der Marktanteil der Handys der vierten Generation (4G) mit LTE-Technologie von derzeit 0,5 Prozent aller Mobiltelefone weltweit auf 15,6 Prozent im Jahr 2016 wachsen wird. Für 2011 prognostiziert SA einen Verkauf von LTE Handsets von 8 Millionen, gegenüber nur 100.000 Stück im vergangenen Jahr. Laut dem Bericht wird es 4G LTE wahrscheinlich gelingen alle derzeitigen Handy-Technologien zu ersetzen, die derzeit globale Standards für mobile Kommunikation sind, wie Code Division Multiple Access und Wideband Code Division Multiple Access.

Als Vorreiter bei der Schaffung einer LTE-Infrastruktur sieht der Bericht Südkorea zusammen mit den Vereinigten Staaten und Japan.

SA sagt in seinem jüngsten Bericht auch, dass der weltweite Handy Markt auf 1,8 Milliarden Einheiten in 2016 ansteigen wird von rund 1,6 Milliarden in 2012. Allerdings wird eine Abnahme im Umsatzwachstum in den kommenden Jahren erwartet, verursacht durch die allgemeine Verlangsamung der globalen Wirtschaft und weil die meisten Handy-Nutzer bereits auf die neueste Geräte der dritten Generation aufgerüstet haben.

----------------------------------------------------------------------------

Studie: 4G-Smartphone-Verkäufe steigen auf 245 Millionen im Jahr 2016

von Lance Whitney und Stefan Beiersmann, 11. Oktober 2011, 14:42 Uhr

ABI Research erwartet, dass 2016 245 Millionen 4G-Smartphones ausgeliefert werden. 2010 verkaufte die Branche lediglich 4,6 Millionen Smartphones, die die vierte Mobilfunkgeneration unterstützen. Das entspricht einem durchschnittlichen jährlichen Wachstum von 72 Prozent.

Obwohl auch immer mehr Tablets und andere mobile Geräte dem 4G-Trend folgten, sei es wahrscheinlich, dass Smartphones die treibende Kraft blieben, da die Verkäufe in dieser Kategorie die anderer Geräte deutlich überträfen, heißt es weiter in der Studie. Smartphones ebneten so den Weg für andere Firmen, die 4G-Produkte und Dienste auf den Markt bringen wollten.

ABI Research sagt zudem voraus, dass LTE (Long Term Evolution) die dominierende 4G-Technik sein wird. Schon in diesem Jahr sollen mehr LTE-Smartphones in den Handel kommen als Smartphones, die die konkurrierende Wimax-Technologie unterstützen.

Wimax-Bauteile kosten weniger, und es bietet eine bessere Möglichkeit, die in unterschiedlichen Ländern zur Verfügung stehenden Funkfrequenzen aneinander anzupassen. Allerdings setzten inzwischen weltweit die führenden Mobilfunkanbieter auf LTE, weil sie die Technologie als das bessere Ökosystem betrachteten, so ABI Research.

"Mobilfunkprovider unterstützen lieber LTE als Wimax, da sie strategisch ihr Gewicht lieber hinter die Technik stellen, die sich am besten eignet, ihren Status quo als etablierter Anbieter zu erhalten", wird Kevin Burden, Vizepräsident und Practice Director für mobile Netzwerke bei ABI Research, in einer Pressemitteilung zitiert. Ein Hindernis bei der Einführung beider Technologien sei die Vergabe und Zuordnung der Funkspektren, da Betreiber und Gerätehersteller bemüht seien, bei möglichst geringen Kosten möglichst viele Märkte anzusprechen.

Einem Bericht der Citigroup zufolge gibt es beispielsweise in den USA ausreichend ungenutztes Spektrum. Viele Anbieter haben demnach aber noch keine Pläne für die Einführung von 4G - oder dem Ausbau ihrer Netze stehen finanzielle und geschäftliche Probleme im Weg.

Bisher sind es vor allem Android-Smartphones, die 4G unterstützen. Microsoft hatte zwar kürzlich Windows-Phone Handys mit LTE in Aussicht gestellt, ließ aber offen, ob sie noch in diesem Jahr oder erst 2012 erhältlich sein werden. Apple-CEO Tim Cook erteilte 4G hingegen im April eine deutliche Absage. Als Grund nannte er einen hohen Stromverbrauch und andere "Kompromisse beim Design", die Apple nicht eingehen wolle.

Die nächste Generation für mobile Datenkommunikation beginnt im nächsten Jahr mit rasantem Wachstum. Analysten erwarten, dass 32 Millionen LTE Geräte verkauft werden.

(13.10.2011, 07:00) Der weltweite Markt für die nächste Generation des Standards für mobile Datenübertragung LTE (Long Term Evolution) soll im nächsten Jahr auf das Vierfache anwachsen. Es sollen bei Mobiltelefonen rund 32 Millionen Einheiten, durch die starke Nachfrage der Verbraucher angeheizt, verkauft werden, sagt ein neuer Branchenreport.

Der Bericht von Strategy Analytics (SA), einem globalen Forschungs-und Beratungsunternehmen, prognostiziert, dass das Marktvolumen mit durchschnittlich 103,5 Prozent jährlich bis 2016 wachsen wird, da Handy-User Geräte mit schnellerer Datenübertragung suchen.

Es wird auch erwartet, dass der Marktanteil der Handys der vierten Generation (4G) mit LTE-Technologie von derzeit 0,5 Prozent aller Mobiltelefone weltweit auf 15,6 Prozent im Jahr 2016 wachsen wird. Für 2011 prognostiziert SA einen Verkauf von LTE Handsets von 8 Millionen, gegenüber nur 100.000 Stück im vergangenen Jahr. Laut dem Bericht wird es 4G LTE wahrscheinlich gelingen alle derzeitigen Handy-Technologien zu ersetzen, die derzeit globale Standards für mobile Kommunikation sind, wie Code Division Multiple Access und Wideband Code Division Multiple Access.

Als Vorreiter bei der Schaffung einer LTE-Infrastruktur sieht der Bericht Südkorea zusammen mit den Vereinigten Staaten und Japan.

SA sagt in seinem jüngsten Bericht auch, dass der weltweite Handy Markt auf 1,8 Milliarden Einheiten in 2016 ansteigen wird von rund 1,6 Milliarden in 2012. Allerdings wird eine Abnahme im Umsatzwachstum in den kommenden Jahren erwartet, verursacht durch die allgemeine Verlangsamung der globalen Wirtschaft und weil die meisten Handy-Nutzer bereits auf die neueste Geräte der dritten Generation aufgerüstet haben.

----------------------------------------------------------------------------

Studie: 4G-Smartphone-Verkäufe steigen auf 245 Millionen im Jahr 2016

von Lance Whitney und Stefan Beiersmann, 11. Oktober 2011, 14:42 Uhr

ABI Research erwartet, dass 2016 245 Millionen 4G-Smartphones ausgeliefert werden. 2010 verkaufte die Branche lediglich 4,6 Millionen Smartphones, die die vierte Mobilfunkgeneration unterstützen. Das entspricht einem durchschnittlichen jährlichen Wachstum von 72 Prozent.

Obwohl auch immer mehr Tablets und andere mobile Geräte dem 4G-Trend folgten, sei es wahrscheinlich, dass Smartphones die treibende Kraft blieben, da die Verkäufe in dieser Kategorie die anderer Geräte deutlich überträfen, heißt es weiter in der Studie. Smartphones ebneten so den Weg für andere Firmen, die 4G-Produkte und Dienste auf den Markt bringen wollten.

ABI Research sagt zudem voraus, dass LTE (Long Term Evolution) die dominierende 4G-Technik sein wird. Schon in diesem Jahr sollen mehr LTE-Smartphones in den Handel kommen als Smartphones, die die konkurrierende Wimax-Technologie unterstützen.

Wimax-Bauteile kosten weniger, und es bietet eine bessere Möglichkeit, die in unterschiedlichen Ländern zur Verfügung stehenden Funkfrequenzen aneinander anzupassen. Allerdings setzten inzwischen weltweit die führenden Mobilfunkanbieter auf LTE, weil sie die Technologie als das bessere Ökosystem betrachteten, so ABI Research.

"Mobilfunkprovider unterstützen lieber LTE als Wimax, da sie strategisch ihr Gewicht lieber hinter die Technik stellen, die sich am besten eignet, ihren Status quo als etablierter Anbieter zu erhalten", wird Kevin Burden, Vizepräsident und Practice Director für mobile Netzwerke bei ABI Research, in einer Pressemitteilung zitiert. Ein Hindernis bei der Einführung beider Technologien sei die Vergabe und Zuordnung der Funkspektren, da Betreiber und Gerätehersteller bemüht seien, bei möglichst geringen Kosten möglichst viele Märkte anzusprechen.

Einem Bericht der Citigroup zufolge gibt es beispielsweise in den USA ausreichend ungenutztes Spektrum. Viele Anbieter haben demnach aber noch keine Pläne für die Einführung von 4G - oder dem Ausbau ihrer Netze stehen finanzielle und geschäftliche Probleme im Weg.

Bisher sind es vor allem Android-Smartphones, die 4G unterstützen. Microsoft hatte zwar kürzlich Windows-Phone Handys mit LTE in Aussicht gestellt, ließ aber offen, ob sie noch in diesem Jahr oder erst 2012 erhältlich sein werden. Apple-CEO Tim Cook erteilte 4G hingegen im April eine deutliche Absage. Als Grund nannte er einen hohen Stromverbrauch und andere "Kompromisse beim Design", die Apple nicht eingehen wolle.

Kurs ist schön zurückgekommen ... langsam kann man wieder reingehen in die Aktie ! Werde morgen mal eine Order reinstellen, aber drüben US-Markt. Heute lohnt nicht mehr nach dem 20%-Anstieg. Wollte gestern eigentlich vor den Zahlen schon !

Clearwire Reports Selected Preliminary Third Quarter 2011 Results

Date : 10/13/2011 @ 9:00AM

Source : GlobeNewswire Inc.

Stock : Clearwire Corporation (CLWR)

Quote : 1.53 0.23 (17.69%) @ 12:17PM

http://ih.advfn.com/p.php?pid=nmona&article=49527828

Die 3 USD durchaus mittelfristig schnell wieder möglich, also 100% Chance !

Gruss

TF

Clearwire Reports Selected Preliminary Third Quarter 2011 Results

Date : 10/13/2011 @ 9:00AM

Source : GlobeNewswire Inc.

Stock : Clearwire Corporation (CLWR)

Quote : 1.53 0.23 (17.69%) @ 12:17PM

http://ih.advfn.com/p.php?pid=nmona&article=49527828

Die 3 USD durchaus mittelfristig schnell wieder möglich, also 100% Chance !

Gruss

TF

Antwort auf Beitrag Nr.: 42.209.531 von TimeFactor am 13.10.11 18:35:50+ 30%

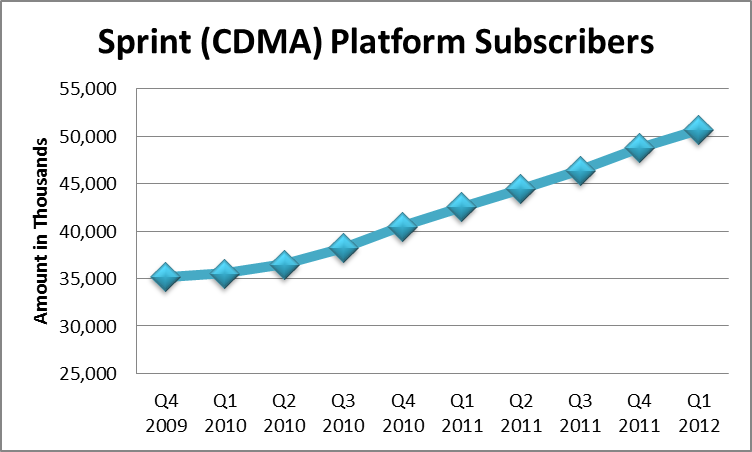

... Clearwire said it will likely report 9.5 million customers as of the end of September, up 1.9 million from the end of the second quarter. ...

Die Nachricht das T-Mobile 1,2 Millionen Kunden verloren hat war für mich ein Signal einzusteigen und das T-Mobil verkauft werden soll, wahrscheinlich springen deshalb die Kunden schneller ab. Das andere das Sprint ca. $5-10 Mrd. für sein Netz braucht und Clear weit aus weniger um von Wimax auf LTE umzustellen.

mal schaun was das noch bringt

Bellevue, Wash., Oct. 11, 2011 (GLOBE NEWSWIRE) -- Clearwire Corporation (NASDAQ: CLWR - News) today announced that Hope Cochran, Clearwire's CFO, will speak at the Deutsche Bank Nineteenth Annual Leveraged Finance Conference in Scottsdale, Arizona, on Thursday, October 13, 2011, at 10:35 a.m. Pacific.

... Clearwire said it will likely report 9.5 million customers as of the end of September, up 1.9 million from the end of the second quarter. ...

Die Nachricht das T-Mobile 1,2 Millionen Kunden verloren hat war für mich ein Signal einzusteigen und das T-Mobil verkauft werden soll, wahrscheinlich springen deshalb die Kunden schneller ab. Das andere das Sprint ca. $5-10 Mrd. für sein Netz braucht und Clear weit aus weniger um von Wimax auf LTE umzustellen.

mal schaun was das noch bringt

Bellevue, Wash., Oct. 11, 2011 (GLOBE NEWSWIRE) -- Clearwire Corporation (NASDAQ: CLWR - News) today announced that Hope Cochran, Clearwire's CFO, will speak at the Deutsche Bank Nineteenth Annual Leveraged Finance Conference in Scottsdale, Arizona, on Thursday, October 13, 2011, at 10:35 a.m. Pacific.

Sprint’s Debt Cut by Moody’s, May Face Further Downgrade

By Sarah Frier and Tim Catts - Oct 14, 2011 10:52 PM GMT+0200 .

Sprint Nextel Corp. (S), the third- largest U.S. wireless operator, had its credit rating cut further into junk by Moody’s Investors Service and may face more downgrades due to risks related to a planned network upgrade.

The ranking was cut to B1, four steps below investment grade, from Ba3, New York-based Moody’s said today in a statement. The company is on review for an additional possible downgrade as there are “significant execution risks” related to Sprint’s plans to upgrade its wireless network, Moody’s said.

“The management team has outlined very aggressive buildout targets for a company that has historically failed to realize the full benefits from previous major strategic initiatives,” Dennis Saputo and John Diaz said in the statement for Moody’s.

The downgrade reflects Sprint’s decision to invest in its own fourth-generation, or 4G, wireless network and likely shift away from the partnership with Clearwire Corp. (CLWR), the ratings firm said. Sprint’s planned network investments, combined with the financial expense of selling Apple Inc. (AAPL)’s iPhone, will strain liquidity before the benefits come, Moody’s said.

Sprint, based in Overland Park, Kansas, may need $6 billion to $8 billion in additional capital to pay for 4G, iPhone subsidies and debt maturities, the credit-rating firm said. Sprint has $19.8 billion in outstanding debt, more than half of which is due in the next five years, according to data compiled by Bloomberg.

Greg Miller, an analyst at Collins Stewart LLC, said the downgrade wasn’t a surprise.

Clearwire Downgrade

“I think everyone expected it,” said Miller, who is based in New York and has a “neutral” rating on the stock.

Sprint rose 0.4 percent to $2.79 at the close in New York and has dropped 34 percent this year.

Moody’s also downgraded Clearwire’s debt to Caa2, eight steps below investment grade. Sprint is unlikely to extend an existing wholesale agreement with Clearwire, which means Clearwire needs to find alternative wholesale partners or sell spectrum to make interest payments after 2012, Moody’s said.

Clearwire fell 3.6 percent to $1.59 and has declined 69 percent this year.

To contact the reporter on this story: Sarah Frier in New York at sfrier1@bloomberg.net; Tim Catts in New York at tcatts1@bloomberg.net.

To contact the editor responsible for this story: Peter Elstrom at pelstrom@bloomberg.net

-------------

... ... ein runterstufen bedeutet das sprint & clearwire mehr zinsen auf neue finanzinfusionen zahlen muß. jetzt wo das geschäft anspringt ist eine so hohe herabstufung anscheinend verkraftbar, an eine insolvenz ist eigentlich keiner interessiert, so verdient man money.

... ein runterstufen bedeutet das sprint & clearwire mehr zinsen auf neue finanzinfusionen zahlen muß. jetzt wo das geschäft anspringt ist eine so hohe herabstufung anscheinend verkraftbar, an eine insolvenz ist eigentlich keiner interessiert, so verdient man money.

-------------

Sprint: Buy, Says Credit Suisse, iPhone Math Not That Bad

By Tiernan Ray

In contrast to a slew of negative notes on Sprint-Nextel (S) this week, Credit Suisse’s Jonathan Chaplin today reiterates an Outperform rating on the stock, writing that the impact of Apple’s (AAPL) iPhone on Sprint’s profit is not as bad as some believe.

The iPhone 4S went on sale today at Sprint stores nationwide, and there were lines at some outlets to buy it.

“It is time to buy Sprint again,” writes Chaplin, who argues that because investors didn’t have enough information about the cost of the iPhone to Sprint, they over-reacted about the funding gap Sprint will face for its network expansion.

Sprint a week ago held an analyst meeting at which it said it would spend billions more to upgrade its network to “4G” capabilities. At the same time, the company frustrated investors by failing to disclose how much it would have to spend in subsidies to support Apple’s phone. The stock received six downgrades this past Monday in response, and its chairman told Bloomberg the company erred in not providing more information. FBR Capital’s David Dixon stepped in on Tuesday to say the funding gap wasn’t as bad as some might think. But criticism and worry persisted, and today, Moody’s cut its rating on Sprint’s debt.

Chaplin’s calculation assumes Sprint adds 1.5 million iPhone subscribers this quarter on a “gross” basis, and 870,000 each quarter thereafter, to arrive at 9.92 million subscribers by the end of 2014, and 12.1 million by the end of 2015.

He bases those numbers on the report from The Wall Street Journal two weeks ago that said that Sprint had to commit to buying around 30.5 million devices over four years. Hence, by his metrics, a total iPhone subscriber base of 12.1 million by 2015 would assure Sprint the necessary purchases, based on both new subs and those who will buy additional iPhone units.

The cost is not as bad as some would believe, he writes:

Management suggested they need $3BN in additional funding to maintain an adequate liquidity cushion over the next two years, before the impact of the iPhone. 13.5MM iPhone sales over the next two years would increase the funding need by $0.9BN to $3.9BN.

By 2014, those 9.92 million cumulative iPhone subs will surpass the cost of the subsidy, Chaplin writes, and the company will be bringing in incremental Ebitda of $152 million. That will double the following year, to $350 million.

That $350 million would boost the value of Sprint’s stock by 46 cents per share, he believes. He currently values the core business at $1 per share. Add to that $3.50 per share in value for the “Network Vision” infrastructure, once it’s completed, and you’ll have a stock approaching $5, though Chaplin’s actual price target is just $4.50.

Still, “$4.50 is a long way from $2.78,” he concludes.

Sprint shares today are up 6 cents, or almost 2%, at $2.84.

-------------

5 Stocks To Short Now?

by: Vatalyst October 14, 2011 | includes: AOL, CLWR, FSLR, LVLT, YGE

... Clearwire Corporation (CLWR)

CLWR, which has fallen almost 70% on a year to date basis, seemed a prime candidate to take a short position in until it pre-released certain 3rd quarter performance metrics, which topped analyst estimates by a significant margin. Sales of $332 million topped Wall Street consensus of almost $322 million. The pre-release of performance information was important for the company as it needed to halt the freefall in share price that had been brought on by a decision from Sprint Nextel (S) to move forward on network updates without CLWR.

The company is still not out of the woods and needs a significant amount of capital for growth but there are certainly competitors that appear to be on more unstable ground for the foreseeable future. At this point wireless companies like Leap Wireless (LEAP), with short interest of almost 15%, and InterDigital (IDCC), at almost 17%, look like better candidates to fall further from here.

By Sarah Frier and Tim Catts - Oct 14, 2011 10:52 PM GMT+0200 .

Sprint Nextel Corp. (S), the third- largest U.S. wireless operator, had its credit rating cut further into junk by Moody’s Investors Service and may face more downgrades due to risks related to a planned network upgrade.

The ranking was cut to B1, four steps below investment grade, from Ba3, New York-based Moody’s said today in a statement. The company is on review for an additional possible downgrade as there are “significant execution risks” related to Sprint’s plans to upgrade its wireless network, Moody’s said.

“The management team has outlined very aggressive buildout targets for a company that has historically failed to realize the full benefits from previous major strategic initiatives,” Dennis Saputo and John Diaz said in the statement for Moody’s.

The downgrade reflects Sprint’s decision to invest in its own fourth-generation, or 4G, wireless network and likely shift away from the partnership with Clearwire Corp. (CLWR), the ratings firm said. Sprint’s planned network investments, combined with the financial expense of selling Apple Inc. (AAPL)’s iPhone, will strain liquidity before the benefits come, Moody’s said.

Sprint, based in Overland Park, Kansas, may need $6 billion to $8 billion in additional capital to pay for 4G, iPhone subsidies and debt maturities, the credit-rating firm said. Sprint has $19.8 billion in outstanding debt, more than half of which is due in the next five years, according to data compiled by Bloomberg.

Greg Miller, an analyst at Collins Stewart LLC, said the downgrade wasn’t a surprise.

Clearwire Downgrade

“I think everyone expected it,” said Miller, who is based in New York and has a “neutral” rating on the stock.

Sprint rose 0.4 percent to $2.79 at the close in New York and has dropped 34 percent this year.

Moody’s also downgraded Clearwire’s debt to Caa2, eight steps below investment grade. Sprint is unlikely to extend an existing wholesale agreement with Clearwire, which means Clearwire needs to find alternative wholesale partners or sell spectrum to make interest payments after 2012, Moody’s said.

Clearwire fell 3.6 percent to $1.59 and has declined 69 percent this year.

To contact the reporter on this story: Sarah Frier in New York at sfrier1@bloomberg.net; Tim Catts in New York at tcatts1@bloomberg.net.

To contact the editor responsible for this story: Peter Elstrom at pelstrom@bloomberg.net

-------------

...

... ein runterstufen bedeutet das sprint & clearwire mehr zinsen auf neue finanzinfusionen zahlen muß. jetzt wo das geschäft anspringt ist eine so hohe herabstufung anscheinend verkraftbar, an eine insolvenz ist eigentlich keiner interessiert, so verdient man money.

... ein runterstufen bedeutet das sprint & clearwire mehr zinsen auf neue finanzinfusionen zahlen muß. jetzt wo das geschäft anspringt ist eine so hohe herabstufung anscheinend verkraftbar, an eine insolvenz ist eigentlich keiner interessiert, so verdient man money.-------------

Sprint: Buy, Says Credit Suisse, iPhone Math Not That Bad

By Tiernan Ray

In contrast to a slew of negative notes on Sprint-Nextel (S) this week, Credit Suisse’s Jonathan Chaplin today reiterates an Outperform rating on the stock, writing that the impact of Apple’s (AAPL) iPhone on Sprint’s profit is not as bad as some believe.

The iPhone 4S went on sale today at Sprint stores nationwide, and there were lines at some outlets to buy it.

“It is time to buy Sprint again,” writes Chaplin, who argues that because investors didn’t have enough information about the cost of the iPhone to Sprint, they over-reacted about the funding gap Sprint will face for its network expansion.

Sprint a week ago held an analyst meeting at which it said it would spend billions more to upgrade its network to “4G” capabilities. At the same time, the company frustrated investors by failing to disclose how much it would have to spend in subsidies to support Apple’s phone. The stock received six downgrades this past Monday in response, and its chairman told Bloomberg the company erred in not providing more information. FBR Capital’s David Dixon stepped in on Tuesday to say the funding gap wasn’t as bad as some might think. But criticism and worry persisted, and today, Moody’s cut its rating on Sprint’s debt.

Chaplin’s calculation assumes Sprint adds 1.5 million iPhone subscribers this quarter on a “gross” basis, and 870,000 each quarter thereafter, to arrive at 9.92 million subscribers by the end of 2014, and 12.1 million by the end of 2015.

He bases those numbers on the report from The Wall Street Journal two weeks ago that said that Sprint had to commit to buying around 30.5 million devices over four years. Hence, by his metrics, a total iPhone subscriber base of 12.1 million by 2015 would assure Sprint the necessary purchases, based on both new subs and those who will buy additional iPhone units.

The cost is not as bad as some would believe, he writes:

Management suggested they need $3BN in additional funding to maintain an adequate liquidity cushion over the next two years, before the impact of the iPhone. 13.5MM iPhone sales over the next two years would increase the funding need by $0.9BN to $3.9BN.

By 2014, those 9.92 million cumulative iPhone subs will surpass the cost of the subsidy, Chaplin writes, and the company will be bringing in incremental Ebitda of $152 million. That will double the following year, to $350 million.

That $350 million would boost the value of Sprint’s stock by 46 cents per share, he believes. He currently values the core business at $1 per share. Add to that $3.50 per share in value for the “Network Vision” infrastructure, once it’s completed, and you’ll have a stock approaching $5, though Chaplin’s actual price target is just $4.50.

Still, “$4.50 is a long way from $2.78,” he concludes.

Sprint shares today are up 6 cents, or almost 2%, at $2.84.

-------------

5 Stocks To Short Now?

by: Vatalyst October 14, 2011 | includes: AOL, CLWR, FSLR, LVLT, YGE

... Clearwire Corporation (CLWR)

CLWR, which has fallen almost 70% on a year to date basis, seemed a prime candidate to take a short position in until it pre-released certain 3rd quarter performance metrics, which topped analyst estimates by a significant margin. Sales of $332 million topped Wall Street consensus of almost $322 million. The pre-release of performance information was important for the company as it needed to halt the freefall in share price that had been brought on by a decision from Sprint Nextel (S) to move forward on network updates without CLWR.

The company is still not out of the woods and needs a significant amount of capital for growth but there are certainly competitors that appear to be on more unstable ground for the foreseeable future. At this point wireless companies like Leap Wireless (LEAP), with short interest of almost 15%, and InterDigital (IDCC), at almost 17%, look like better candidates to fall further from here.

19.10.2011 11:20

Flaches Android-Smartphone: Motorola erfindet das Razr neu

Motorolas erstes Razr mit Android punktet

mit flachem Gehäuse und farbkräftigem Display.

Bild: Motorola

Motorola belebt seinen erfolgreichsten Markennamen aus Klapphandy-Zeiten: Das neue Razr tritt als High-End-Smartphone mit flachem Gehäuse und Doppelkern-Prozessor an. Sein 4,3-Zoll-Display löst fein auf (540 × 960 Pixel) und zeigt dank Super-AMOLED-Technik kräftige Farben. Als Betriebssystem dient noch Android 2.3.5, während Konkurrent Samsung sein Galaxy Nexus bereits mit Android 4.0 ins Rennen schickt. Falls die Übernahme durch Google wie geplant verläuft, dürfte Motorola die aktuelle Android-Version vergleichsweise zügig nachliefern – versprochen hat der Hersteller das Update jedoch bislang nicht.

Stattdessen trommelt er mit den äußeren Werten des Razr. Das Gehäuse ist mit 7,1 Millimetern besonders flach und nur am oberen Ende etwas dicker (das iPhone 4S und das Galaxy Nexus sind rund 9 Millimeter dick). Gorilla-Glas schützt wie bei den meisten High-End-Smartphones das Display, außerdem soll das Gehäuse dank Kevlar-Verstärkung besonders viel aushalten.

Als Betriebssystem dient noch Android 2.3.5 –

deshalb finden sich am unteren Rand Sensortasten,

die Android 4 nicht benötigt.

Bild: Motorola

Das Razr passt wie das Atrix zu Motorolas Lapdock und Entertainment-Dock, lässt sich also in ein Netbook und einen TV-Zuspieler verwandeln. Im c't-Test ließ das Zusammenspiel zwischen Atrix und Lapdock allerdings viele Wünsche offen.

Motorola hat zwei Varianten des Razr angekündigt: Die Version mit LTE soll von November an beim US-Provider Verizon erhältlich sein, die UMTS-Version vor Weihnachten beim kanadischen Provider Rogers. Den angepeilte Starttermin und Preis für Deutschland verriet der Hersteller nicht. (cwo)

Flaches Android-Smartphone: Motorola erfindet das Razr neu

Motorolas erstes Razr mit Android punktet

mit flachem Gehäuse und farbkräftigem Display.

Bild: Motorola

Motorola belebt seinen erfolgreichsten Markennamen aus Klapphandy-Zeiten: Das neue Razr tritt als High-End-Smartphone mit flachem Gehäuse und Doppelkern-Prozessor an. Sein 4,3-Zoll-Display löst fein auf (540 × 960 Pixel) und zeigt dank Super-AMOLED-Technik kräftige Farben. Als Betriebssystem dient noch Android 2.3.5, während Konkurrent Samsung sein Galaxy Nexus bereits mit Android 4.0 ins Rennen schickt. Falls die Übernahme durch Google wie geplant verläuft, dürfte Motorola die aktuelle Android-Version vergleichsweise zügig nachliefern – versprochen hat der Hersteller das Update jedoch bislang nicht.

Stattdessen trommelt er mit den äußeren Werten des Razr. Das Gehäuse ist mit 7,1 Millimetern besonders flach und nur am oberen Ende etwas dicker (das iPhone 4S und das Galaxy Nexus sind rund 9 Millimeter dick). Gorilla-Glas schützt wie bei den meisten High-End-Smartphones das Display, außerdem soll das Gehäuse dank Kevlar-Verstärkung besonders viel aushalten.

Als Betriebssystem dient noch Android 2.3.5 –

deshalb finden sich am unteren Rand Sensortasten,

die Android 4 nicht benötigt.

Bild: Motorola

Das Razr passt wie das Atrix zu Motorolas Lapdock und Entertainment-Dock, lässt sich also in ein Netbook und einen TV-Zuspieler verwandeln. Im c't-Test ließ das Zusammenspiel zwischen Atrix und Lapdock allerdings viele Wünsche offen.

Motorola hat zwei Varianten des Razr angekündigt: Die Version mit LTE soll von November an beim US-Provider Verizon erhältlich sein, die UMTS-Version vor Weihnachten beim kanadischen Provider Rogers. Den angepeilte Starttermin und Preis für Deutschland verriet der Hersteller nicht. (cwo)

Posted on Thu, Oct. 20, 2011 09:03 AM

Sprint partner Clearwire looking gloomy

Bloomberg News

Clearwire Corp. is the second- biggest loser this month in the U.S. corporate bond market on rising speculation that the company won’t be able to make interest payments after Sprint Nextel Corp. indicated it may stop buying service from the wireless provider after next year.

The company’s $500 million of 12 percent notes due in 2017 have tumbled 23.5 percent since September, according to Bank of America Merrill Lynch’s U.S Corporate & High Yield Master Index, which tracks more than 7,000 debt issues. The securities yield 34 percent, according to data compiled by Bloomberg, more than twice the index average for all debt rated CCC or lower.

Clearwire’s operating unit, Clearwire Communications LLC, had its credit rating cut to Caa2 last week by Moody’s Investors Service, which said the Kirkland, Washington-based company will have to find new partners or sell spectrum to meet obligations if Sprint dumps it. Clearwire is unlikely to be able to raise capital through new stock or bonds based on current prices, said Marc Gross of RS Investments.

“It just looks like they are hung out to dry by Sprint and their other investors,” said Gross, a money manager who helps oversee $3 billion in fixed-income funds in New York. “They have huge financing needs and nowhere to get the money from.”

Shift to LTE

Sprint, which uses Clearwire’s WiMax network to offer high- speed services, said at its Oct. 7 investor day it will stop selling devices that employ that technology after 2012 as it focuses on a competing system called long-term evolution, or LTE. Sprint is building out its own LTE network and also has a partnership with LTE carrier LightSquared Inc.

Clearwire will get at least $1 billion from Sprint this year and next under an April agreement. Sprint held 53.6 percent of Clearwire’s equity and about 49.7 percent of its voting rights at the end of the second quarter, according to a regulatory filing.

While Clearwire also plans to shift to LTE, it has yet to gain funding for an upgrade. Sprint Chief Executive Officer Dan Hesse said the carrier may extend its relationship with Clearwire beyond the end of next year, without committing to provide money for its LTE expansion.

Clearwire, which needs almost $1 billion to continue operations and to upgrade its network, said it’s looking at signing additional wholesale agreements, selling spectrum and vendor financing as potential options.

*Huge Error’

Sprint used Clearwire to avoid spending on fourth- generation network expansion “but wasted many years and billions of dollars on Clearwire and are going to build out their own 4G network anyway,” Gross said. “It is a huge error on their part.”

Clearwire’s shares plunged 32 percent on Oct. 7, the Sprint investor day. The stock, which fell an additional 3.6 percent after the Oct. 14 downgrade from Moody’s, closed at $1.39 yesterday in New York from $2.05 on Oct. 6. The shares are down 73 percent this year.

Relative yields on Clearwire’s bonds, including its second- lien debt, have soared to 21.9 percentage points above Treasuries on average as of Oct. 18 from 17.5 at the end of last month, Bank of America Merrill Lynch index data show.

The company’s $1.78 billion of 12 percent first-lien debt due in 2015 fell to 76 cents on the dollar on Oct. 18 from 86.8 cents in August, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority.

Company Statements

“Clearwire continues to focus on growing our business, raising capital and successfully executing our plan,” Jeremy Pemble, a spokesman for the company, said in a statement. “We aren’t going to speculate or provide additional financial information or commentary until our next earnings call in the coming weeks.”

Scott Sloat, a spokesman for Sprint, said in an e-mailed message that his company plans to launch 4G devices that run on Clearwire’s WiMAX network through 2012. “We continue to hold discussions with CLWR but have nothing to announce at this time.”

Clearwire had $700 million of cash, cash equivalents and investments at the end of the third quarter, which will be depleted in 2012 because the company’s annual fixed costs are more than $1.2 billion, according to Moody’s.

There is a “good chance” the company may miss $222 million of interest payments it has coming due in December, Moody’s senior credit offer Gerald Granovsky, who’s based in New York, said in a telephone interview.

*Different Predators’

“One thing a bankruptcy could achieve for Sprint if everything goes well, it would gain control of the company, gain control of the spectrum,” he said. “The downside of a bankruptcy is you don’t know what that is going to entail once you file, especially given an asset like this. You’re going to have a lot of different predators coming to the game trying to put in their claim, try to push Sprint to the sidelines.”

Standard & Poor’s has a CCC+ rating on Clearwire with a “negative” outlook.

The plunge in the Clearwire debt this month is exceeded only by the 42.5 percent for the $300 million of General Maritime Corp.’s 12 percent notes due in November 2017 among bonds in the Bank of America Merrill Lynch U.S. Corporate and High Yield index.

Sprint’s failure to reach an agreement with Clearwire shows cooperation between the two companies has deteriorated from May 2008, when Sprint became a 51 percent equity owner of the company.

Previous Financing

Clearwire obtained $3.2 billion in funding from Intel Corp., Google Inc., Comcast Corp., Time Warner Cable Inc. and Bright House Networks LLC to build a nationwide WiMax network. In November 2009, Sprint, Comcast, Intel and others agreed to provide $1.56 billion in additional capital.

Confidence weakened as the company has posted losses every quarter starting in the first three months of 2009, laid off workers and cut operating costs.

“It’s unlikely they are going to receive more capital from their current strategic investors,” Michael Nelson, an analyst at Mizuho Securities USA Inc. in New York, said in a telephone interview.

Intel sold some of its Clearwire shares in May, a result of the decision to move from WiMax network technology to LTE, according to Nelson. Google may be less interested in propping up the company as well, as the original investment was a hedge against AT&T Inc. and Verizon Communications Inc. closing off networks to the world’s biggest search-engine provider, he said.

It’s also “just not a top priority” for cable companies, Nelson said.

*Lots of Options’

Barry Allan, founder of Marret Asset Management Inc., which has held Clearwire bonds in the past, said he believes bankruptcy is not imminent, and “there are lots of options” for the company, including a financing deal with Sprint.

“Sprint is a large shareholder of Clearwire, and a lot of things could happen in bankruptcy court,” Sergey Dluzhevskiy, an analyst at Gabelli & Co., whose funds had owned Clearwire debt in the past, said in an interview. “The question is whether Sprint wants to go that route or find a solution. It doesn’t have to be grandiose. They may want to extend their agreement with Clearwire beyond 2012.”

Sprint also was downgraded by Moody’s last week to B1 from Ba3 with a “negative” outlook in part because of risks related to planned network upgrades.

Fitch Ratings cut the company to B+ from BB- on Oct. 18 and said without a spectrum agreement with Clearwire, Sprint will be challenged in handling future capacity and bandwidth demands for unlimited data plan users.

MetroPCS Interest

Clearwire’s bonds dropped even after it reported sales more than doubled to $332 million in the third quarter, according to a statement with preliminary results for the period last week. Analysts projected $321.6 million, according to the average estimate in a Bloomberg survey.

The same day, MetroPCS Wireless Inc. finance chief Braxton Carter said at a conference that his company may consider buying the spectrum for use in metropolitan areas.

“While there’s no denying that the operating results and interest in its spectrum are good news, what Clearwire really needs is some cash to upgrade its network and to replenish working capital,” David Novosel, an analyst at Gimme Credit in Chicago, wrote in an Oct. 14 note. “Current partners, particularly Sprint are not showing interest in injecting additional capital.”

Equity investors in Clearwater are viewed by Moody’s “as essentially being underwater,” Granovsky said.

“They would have to issue equity, essentially to build first-lien capacity, and they have no second-lien capacity,” he said in a telephone interview. “That gets to the problem of who in the world is going to put in junior capital at this point. So from an investor standpoint, you’re looking at the situation and you’re staying away from this until you get the resolution of the partnership or it files.”

Copyright 2011 . All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Sprint partner Clearwire looking gloomy

Bloomberg News

Clearwire Corp. is the second- biggest loser this month in the U.S. corporate bond market on rising speculation that the company won’t be able to make interest payments after Sprint Nextel Corp. indicated it may stop buying service from the wireless provider after next year.

The company’s $500 million of 12 percent notes due in 2017 have tumbled 23.5 percent since September, according to Bank of America Merrill Lynch’s U.S Corporate & High Yield Master Index, which tracks more than 7,000 debt issues. The securities yield 34 percent, according to data compiled by Bloomberg, more than twice the index average for all debt rated CCC or lower.

Clearwire’s operating unit, Clearwire Communications LLC, had its credit rating cut to Caa2 last week by Moody’s Investors Service, which said the Kirkland, Washington-based company will have to find new partners or sell spectrum to meet obligations if Sprint dumps it. Clearwire is unlikely to be able to raise capital through new stock or bonds based on current prices, said Marc Gross of RS Investments.

“It just looks like they are hung out to dry by Sprint and their other investors,” said Gross, a money manager who helps oversee $3 billion in fixed-income funds in New York. “They have huge financing needs and nowhere to get the money from.”

Shift to LTE

Sprint, which uses Clearwire’s WiMax network to offer high- speed services, said at its Oct. 7 investor day it will stop selling devices that employ that technology after 2012 as it focuses on a competing system called long-term evolution, or LTE. Sprint is building out its own LTE network and also has a partnership with LTE carrier LightSquared Inc.

Clearwire will get at least $1 billion from Sprint this year and next under an April agreement. Sprint held 53.6 percent of Clearwire’s equity and about 49.7 percent of its voting rights at the end of the second quarter, according to a regulatory filing.

While Clearwire also plans to shift to LTE, it has yet to gain funding for an upgrade. Sprint Chief Executive Officer Dan Hesse said the carrier may extend its relationship with Clearwire beyond the end of next year, without committing to provide money for its LTE expansion.

Clearwire, which needs almost $1 billion to continue operations and to upgrade its network, said it’s looking at signing additional wholesale agreements, selling spectrum and vendor financing as potential options.

*Huge Error’

Sprint used Clearwire to avoid spending on fourth- generation network expansion “but wasted many years and billions of dollars on Clearwire and are going to build out their own 4G network anyway,” Gross said. “It is a huge error on their part.”

Clearwire’s shares plunged 32 percent on Oct. 7, the Sprint investor day. The stock, which fell an additional 3.6 percent after the Oct. 14 downgrade from Moody’s, closed at $1.39 yesterday in New York from $2.05 on Oct. 6. The shares are down 73 percent this year.

Relative yields on Clearwire’s bonds, including its second- lien debt, have soared to 21.9 percentage points above Treasuries on average as of Oct. 18 from 17.5 at the end of last month, Bank of America Merrill Lynch index data show.

The company’s $1.78 billion of 12 percent first-lien debt due in 2015 fell to 76 cents on the dollar on Oct. 18 from 86.8 cents in August, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority.

Company Statements

“Clearwire continues to focus on growing our business, raising capital and successfully executing our plan,” Jeremy Pemble, a spokesman for the company, said in a statement. “We aren’t going to speculate or provide additional financial information or commentary until our next earnings call in the coming weeks.”

Scott Sloat, a spokesman for Sprint, said in an e-mailed message that his company plans to launch 4G devices that run on Clearwire’s WiMAX network through 2012. “We continue to hold discussions with CLWR but have nothing to announce at this time.”

Clearwire had $700 million of cash, cash equivalents and investments at the end of the third quarter, which will be depleted in 2012 because the company’s annual fixed costs are more than $1.2 billion, according to Moody’s.

There is a “good chance” the company may miss $222 million of interest payments it has coming due in December, Moody’s senior credit offer Gerald Granovsky, who’s based in New York, said in a telephone interview.

*Different Predators’

“One thing a bankruptcy could achieve for Sprint if everything goes well, it would gain control of the company, gain control of the spectrum,” he said. “The downside of a bankruptcy is you don’t know what that is going to entail once you file, especially given an asset like this. You’re going to have a lot of different predators coming to the game trying to put in their claim, try to push Sprint to the sidelines.”

Standard & Poor’s has a CCC+ rating on Clearwire with a “negative” outlook.

The plunge in the Clearwire debt this month is exceeded only by the 42.5 percent for the $300 million of General Maritime Corp.’s 12 percent notes due in November 2017 among bonds in the Bank of America Merrill Lynch U.S. Corporate and High Yield index.

Sprint’s failure to reach an agreement with Clearwire shows cooperation between the two companies has deteriorated from May 2008, when Sprint became a 51 percent equity owner of the company.

Previous Financing

Clearwire obtained $3.2 billion in funding from Intel Corp., Google Inc., Comcast Corp., Time Warner Cable Inc. and Bright House Networks LLC to build a nationwide WiMax network. In November 2009, Sprint, Comcast, Intel and others agreed to provide $1.56 billion in additional capital.

Confidence weakened as the company has posted losses every quarter starting in the first three months of 2009, laid off workers and cut operating costs.

“It’s unlikely they are going to receive more capital from their current strategic investors,” Michael Nelson, an analyst at Mizuho Securities USA Inc. in New York, said in a telephone interview.

Intel sold some of its Clearwire shares in May, a result of the decision to move from WiMax network technology to LTE, according to Nelson. Google may be less interested in propping up the company as well, as the original investment was a hedge against AT&T Inc. and Verizon Communications Inc. closing off networks to the world’s biggest search-engine provider, he said.

It’s also “just not a top priority” for cable companies, Nelson said.

*Lots of Options’

Barry Allan, founder of Marret Asset Management Inc., which has held Clearwire bonds in the past, said he believes bankruptcy is not imminent, and “there are lots of options” for the company, including a financing deal with Sprint.

“Sprint is a large shareholder of Clearwire, and a lot of things could happen in bankruptcy court,” Sergey Dluzhevskiy, an analyst at Gabelli & Co., whose funds had owned Clearwire debt in the past, said in an interview. “The question is whether Sprint wants to go that route or find a solution. It doesn’t have to be grandiose. They may want to extend their agreement with Clearwire beyond 2012.”

Sprint also was downgraded by Moody’s last week to B1 from Ba3 with a “negative” outlook in part because of risks related to planned network upgrades.

Fitch Ratings cut the company to B+ from BB- on Oct. 18 and said without a spectrum agreement with Clearwire, Sprint will be challenged in handling future capacity and bandwidth demands for unlimited data plan users.

MetroPCS Interest

Clearwire’s bonds dropped even after it reported sales more than doubled to $332 million in the third quarter, according to a statement with preliminary results for the period last week. Analysts projected $321.6 million, according to the average estimate in a Bloomberg survey.

The same day, MetroPCS Wireless Inc. finance chief Braxton Carter said at a conference that his company may consider buying the spectrum for use in metropolitan areas.

“While there’s no denying that the operating results and interest in its spectrum are good news, what Clearwire really needs is some cash to upgrade its network and to replenish working capital,” David Novosel, an analyst at Gimme Credit in Chicago, wrote in an Oct. 14 note. “Current partners, particularly Sprint are not showing interest in injecting additional capital.”

Equity investors in Clearwater are viewed by Moody’s “as essentially being underwater,” Granovsky said.

“They would have to issue equity, essentially to build first-lien capacity, and they have no second-lien capacity,” he said in a telephone interview. “That gets to the problem of who in the world is going to put in junior capital at this point. So from an investor standpoint, you’re looking at the situation and you’re staying away from this until you get the resolution of the partnership or it files.”

Copyright 2011 . All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Antwort auf Beitrag Nr.: 42.204.742 von teecee1 am 12.10.11 20:00:51Oct. 20, 2011, 9:00 a.m. EDT

ooVoo Expands Its Multi-Person, Cross-Platform Video Chat Service to More Than 200 Android Devices

ooVoo users can now connect on Samsung Galaxy S2, Samsung Charge, HTC Sensation 4G, Motorola Droid Bionic and LG Optimus 2X / T-Mobile G2X smartphones

NEW YORK, Oct. 20, 2011 /PRNewswire via COMTEX/-- ooVoo, the leading high quality video calling service allowing multiple callers to chat together for a unique social video chat experience across Android, iOS, PC and Web platforms, today announced the expansion of ooVoo Mobile to more than 200 Android-supported devices worldwide. This includes the newest Android offerings from Samsung, HTC, Motorola, LG and Verizon LTE smartphones, plus Lenovo and VIZIO tablets. The video chat service is available as a free download from the Android Market. ...

----------------------------------------------------------------------------

Netflix on Android Now with Honeycomb Support [Have A Honeycomb Tablet? Now It Can Support The Netflix App]

Published on TFTS by Mariella Moon, 20 October, 2011 at 12:19 pm

... Also, Android app support is now also available to people in Canada and Latin America. So if you’re from the US or the two aforementioned places, you can stream Netflix on your Honeycomb tablets! The app itself is available from the Android market for free. Enjoy!

----------------------------------------------------------------------------

VIZIO giving away 3 months of free Hulu Plus

George Wong 10/20/2011 07:49 PDT

VIZIO Tablet Hulu PlusIn its latest promotional stunt to sell more of its Android tablets, VIZIO announced today that its VIZIO Tablet owners are all entitled to three free months of a Hulu Plus subscription. Hulu Plus, one of the most popular video streaming services on the internet has a native Android app that comes preloaded on the VIZIO Tablet. This new promotion benefits both VIZIO and Hulu as consumers have an incentive to purchase the Android tablet, and Hulu gets the opportunity to convert a free viewer into a paying subscriber (for $7.99 a month).

And if you’ve read our review of the VIZIO Tablet, despite its weak benchmark results, the tablet actually performs well when used for playing back HD video, so you know that the tablet will function well as a device for streaming your Hulu programs. The updated Hulu Plus app that gives 3-months of free service to new users will start rolling out to VIZIO Tablets today.

ooVoo Expands Its Multi-Person, Cross-Platform Video Chat Service to More Than 200 Android Devices

ooVoo users can now connect on Samsung Galaxy S2, Samsung Charge, HTC Sensation 4G, Motorola Droid Bionic and LG Optimus 2X / T-Mobile G2X smartphones

NEW YORK, Oct. 20, 2011 /PRNewswire via COMTEX/-- ooVoo, the leading high quality video calling service allowing multiple callers to chat together for a unique social video chat experience across Android, iOS, PC and Web platforms, today announced the expansion of ooVoo Mobile to more than 200 Android-supported devices worldwide. This includes the newest Android offerings from Samsung, HTC, Motorola, LG and Verizon LTE smartphones, plus Lenovo and VIZIO tablets. The video chat service is available as a free download from the Android Market. ...

----------------------------------------------------------------------------

Netflix on Android Now with Honeycomb Support [Have A Honeycomb Tablet? Now It Can Support The Netflix App]

Published on TFTS by Mariella Moon, 20 October, 2011 at 12:19 pm

... Also, Android app support is now also available to people in Canada and Latin America. So if you’re from the US or the two aforementioned places, you can stream Netflix on your Honeycomb tablets! The app itself is available from the Android market for free. Enjoy!

----------------------------------------------------------------------------

VIZIO giving away 3 months of free Hulu Plus

George Wong 10/20/2011 07:49 PDT

VIZIO Tablet Hulu PlusIn its latest promotional stunt to sell more of its Android tablets, VIZIO announced today that its VIZIO Tablet owners are all entitled to three free months of a Hulu Plus subscription. Hulu Plus, one of the most popular video streaming services on the internet has a native Android app that comes preloaded on the VIZIO Tablet. This new promotion benefits both VIZIO and Hulu as consumers have an incentive to purchase the Android tablet, and Hulu gets the opportunity to convert a free viewer into a paying subscriber (for $7.99 a month).

And if you’ve read our review of the VIZIO Tablet, despite its weak benchmark results, the tablet actually performs well when used for playing back HD video, so you know that the tablet will function well as a device for streaming your Hulu programs. The updated Hulu Plus app that gives 3-months of free service to new users will start rolling out to VIZIO Tablets today.

Antwort auf Beitrag Nr.: 42.238.888 von teecee1 am 20.10.11 19:32:28

Antwort auf Beitrag Nr.: 42.239.366 von teecee1 am 20.10.11 20:56:1620.10.2011, 18:12

T-Mobile-Käufer: AT&T schwächelt im Festnetz

Wie mobil die Welt geworden ist, spüren die Telekom-Unternehmen besonders, die neben einer Mobilfunksparte ein Festnetz betreiben. Der Boom bei Smartphones beschert dem designierten Käufer von T-Mobile USA neue Kunden. Doch das netzgebundene Geschäft drückt den Umsatz von AT&T.

Der US-Telekomkonzern AT&T profitiert vom Boom der Smartphones. Im dritten Quartal konnte der designierte Käufer von T-Mobile USA die Marke von 100 Millionen Mobilfunkkunden überspringen. Binnen dreier Monate kamen unterm Strich 2,1 Millionen Nutzer hinzu, womit die Gesamtzahl auf 100,7 Millionen stieg. Vergleichbar groß ist in den Vereinigten Staaten nur noch Verizon ; der Rivale legt seine Geschäftszahlen am Freitag vor.

AT&T-Chef Stephenson ist mit dem Smartphoneboom zufrieden

"Smartphones, Tablet-Computer und andere Geräte, die sich ins mobile Internet einwählen, wachsen auf beeindruckende Weise", sagte AT&T-Chef Randall Stevenson am Donnerstag in New York. Weil gleichzeitig aber das Festnetzgeschäft weiter schrumpfte, stagnierte der Konzernumsatz im Jahresvergleich bei 31,5 Mrd. Dollar. Die Aktie fiel zwischenzeitlich um 1,4 Prozent.

Beim Gewinn konnte AT&T ohnehin nicht mit dem Vorjahr mithalten. Damals hatten der Verkauf einer Tochterfirma und eine Steuergutschrift das Ergebnis auf ungewöhnliche 12,3 Mrd. Dollar hochgetrieben. Nun kamen unterm Strich 3,6 Mrd. Dollar heraus.

Mit dem Kauf von T-Mobile USA von der Deutschen Telekom will AT&T sein Geschäft ausbauen, allerdings haben die US-Wettbewerbshüter die 39 Mrd. Dollar schwere Übernahme vorerst blockiert.

Das US-Justizministerium hatte Klage eingereicht, da die US-Regierung eine "substanzielle" Einschränkung des Wettbewerbs auf dem Mobilfunkmarkt befürchtet. Vorstand und Aufsichtsrat der Telekom glauben, dass die Regierung AT&T mit der Klage zu weitreichenden Zugeständnissen zwingen will. Möglich wäre, dass AT&T einen Teil seiner Kunden ( ... ... bzw. T-Mobil USA seine Kunden verliert.) oder aber Mobilfunkfrequenzen abgibt. Der geplante Verkauf beschäftigt Anfang 2012 die US-Justiz. Als Termin für die Verhandlung setzte eine Richterin den 13. Februar fest.

... bzw. T-Mobil USA seine Kunden verliert.) oder aber Mobilfunkfrequenzen abgibt. Der geplante Verkauf beschäftigt Anfang 2012 die US-Justiz. Als Termin für die Verhandlung setzte eine Richterin den 13. Februar fest.

Lange Verfahrensdauer schadet der Telekom ... ...

...

Je länger sich das Verfahren hinzieht, umso schlechter für die Telekom. Denn solange nichts entschieden ist, wird auch eine milliardenschwere Entschädigungszahlung nicht fällig, die die Deutschen mit AT&T für den Fall eines Scheiterns des Deals ausgehandelt haben. Das Paket, das aus einer Break-up-Fee und Mobilfunklizenzen besteht, hat einen Wert von etwa 6 Mrd. Dollar und würde der Telekom in den USA Luft verschaffen.

Inzwischen hat aber auch der Wettbewerber Sprint Nextel vor dem US-Gericht Klage eingereicht. Offenbar will sich der US-Mobilfunker absichern, sollten sich das Justizministerium und AT&T doch einigen. Die Nummer drei auf dem US-Mobilfunkmarkt macht seit Bekanntwerden des Übernahmeversuchs Front gegen den Kauf.

Sollte AT&T den deutschen Rivalen schlucken dürfen, hätten der Branchenführer und der größte Konkurrent Verizon, gemeinsam einen Marktanteil von fast 80 Prozent. Sprint hatte sich lange Zeit selbst Hoffnungen auf ein Zusammengehen mit T-Mobile gemacht. Die Argumentation des Justizministeriums in der Klage zeigt jedoch, dass den Kartellwächtern eine Kombination der Nummer drei und vier in den USA womöglich ebenfalls zu mächtig wäre.

----------------------------------------------------------------------------

20.10.2011 | 17:56

Strategy Analytics: 4G and AT&T/T-Mobile Deal Dominates US Wireless Carriers

Further Consolidation in World's Largest 4G Market

The expected completion of T-Mobile USA being acquired by AT&T will only be the first of several carrier consolidations to shape the US 4G landscape. As rivals look to catch up with the early LTE lead of Verizon Wireless, Sprint will dictate the viability of wholesale ventures at LightSquared and Clearwire. The Strategy Analytics Wireless Operator Strategies (WOS) service report, "US Wireless Market Outlook 2011-2016," forecasts that LTE will account for half of all wireless connections by 2016.

Strategy Analytics foresees success for AT&T in its acquisition of T-Mobile, though concessions will need to be made. AT&T will need to work hard to turn around T-Mobile's stagnating operations and marry the two distinct brands. The additional market concentration will raise the stakes in an increasingly cost-conscious carrier landscape, but also offers opportunities for AT&T's rivals.

"This is not going to be a simple rebranding exercise for AT&T, it will require considerable skill to retain T-Mobile customers over the next two years," comments Phil Kendall, Director of Wireless Operator Strategies. "A strong 4G smartphone focus will help to keep Verizon and Sprint at bay. More significantly, smaller carriers and MVNOs, such as MetroPCS, Leap Wireless and Tracfone, will widen their assault on the more price sensitive customers of T-Mobile."

Sue Rudd, Director of Service Provider Analysis, adds, "The strong 4G dynamic in the US – driven by PC, modem and consumer electronics subscription growth – will rapidly broaden opportunities in this market. To meet demand, carriers must address not only network coverage and quality but also deficiencies in data pricing in order to support the needs of users with multiple devices."

4G World 2011 takes place October 24 through October 27, 2011 at McCormick Place in Chicago.

T-Mobile-Käufer: AT&T schwächelt im Festnetz

Wie mobil die Welt geworden ist, spüren die Telekom-Unternehmen besonders, die neben einer Mobilfunksparte ein Festnetz betreiben. Der Boom bei Smartphones beschert dem designierten Käufer von T-Mobile USA neue Kunden. Doch das netzgebundene Geschäft drückt den Umsatz von AT&T.

Der US-Telekomkonzern AT&T profitiert vom Boom der Smartphones. Im dritten Quartal konnte der designierte Käufer von T-Mobile USA die Marke von 100 Millionen Mobilfunkkunden überspringen. Binnen dreier Monate kamen unterm Strich 2,1 Millionen Nutzer hinzu, womit die Gesamtzahl auf 100,7 Millionen stieg. Vergleichbar groß ist in den Vereinigten Staaten nur noch Verizon ; der Rivale legt seine Geschäftszahlen am Freitag vor.

AT&T-Chef Stephenson ist mit dem Smartphoneboom zufrieden

"Smartphones, Tablet-Computer und andere Geräte, die sich ins mobile Internet einwählen, wachsen auf beeindruckende Weise", sagte AT&T-Chef Randall Stevenson am Donnerstag in New York. Weil gleichzeitig aber das Festnetzgeschäft weiter schrumpfte, stagnierte der Konzernumsatz im Jahresvergleich bei 31,5 Mrd. Dollar. Die Aktie fiel zwischenzeitlich um 1,4 Prozent.

Beim Gewinn konnte AT&T ohnehin nicht mit dem Vorjahr mithalten. Damals hatten der Verkauf einer Tochterfirma und eine Steuergutschrift das Ergebnis auf ungewöhnliche 12,3 Mrd. Dollar hochgetrieben. Nun kamen unterm Strich 3,6 Mrd. Dollar heraus.

Mit dem Kauf von T-Mobile USA von der Deutschen Telekom will AT&T sein Geschäft ausbauen, allerdings haben die US-Wettbewerbshüter die 39 Mrd. Dollar schwere Übernahme vorerst blockiert.

Das US-Justizministerium hatte Klage eingereicht, da die US-Regierung eine "substanzielle" Einschränkung des Wettbewerbs auf dem Mobilfunkmarkt befürchtet. Vorstand und Aufsichtsrat der Telekom glauben, dass die Regierung AT&T mit der Klage zu weitreichenden Zugeständnissen zwingen will. Möglich wäre, dass AT&T einen Teil seiner Kunden ( ...

... bzw. T-Mobil USA seine Kunden verliert.) oder aber Mobilfunkfrequenzen abgibt. Der geplante Verkauf beschäftigt Anfang 2012 die US-Justiz. Als Termin für die Verhandlung setzte eine Richterin den 13. Februar fest.

... bzw. T-Mobil USA seine Kunden verliert.) oder aber Mobilfunkfrequenzen abgibt. Der geplante Verkauf beschäftigt Anfang 2012 die US-Justiz. Als Termin für die Verhandlung setzte eine Richterin den 13. Februar fest.Lange Verfahrensdauer schadet der Telekom ...

...

... Je länger sich das Verfahren hinzieht, umso schlechter für die Telekom. Denn solange nichts entschieden ist, wird auch eine milliardenschwere Entschädigungszahlung nicht fällig, die die Deutschen mit AT&T für den Fall eines Scheiterns des Deals ausgehandelt haben. Das Paket, das aus einer Break-up-Fee und Mobilfunklizenzen besteht, hat einen Wert von etwa 6 Mrd. Dollar und würde der Telekom in den USA Luft verschaffen.