2013 FCEL Jahr ! - 500 Beiträge pro Seite

eröffnet am 02.01.13 17:12:38 von

neuester Beitrag 08.11.14 15:18:37 von

neuester Beitrag 08.11.14 15:18:37 von

Beiträge: 1.497

ID: 1.178.600

ID: 1.178.600

Aufrufe heute: 1

Gesamt: 141.303

Gesamt: 141.303

Aktive User: 0

ISIN: US35952H6018 · WKN: A2PKHA · Symbol: FEY2

0,8740

EUR

+1,82 %

+0,0156 EUR

Letzter Kurs 12:41:42 Tradegate

Neuigkeiten

08.03.24 · wallstreetONLINE Redaktion |

20.12.23 · Roland Jegen Anzeige |

20.12.23 · Der Finanzinvestor |

18.12.23 · Der Aktionär TV |

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,1500 | +21,05 | |

| 8,5000 | +12,58 | |

| 1,3700 | +12,30 | |

| 6,2000 | +11,71 | |

| 1,6400 | +9,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7050 | -4,21 | |

| 97,25 | -8,31 | |

| 0,7120 | -9,18 | |

| 1,2350 | -12,41 | |

| 1,3701 | -23,03 |

hier nur mal ein paar Mega Aufträge letzten Wochen.

http://finance.yahoo.com/news/fuelcell-energy-acquires-remai…

http://finance.yahoo.com/news/dominion-develop-largest-fuel-…

http://finance.yahoo.com/news/fuelcell-energy-acquires-remai…

http://finance.yahoo.com/news/dominion-develop-largest-fuel-…

http://www.bloomberg.com/news/2012-11-05/fuelcell-surgest-on…denn größten vergessen

Energize Your Portfolio With FuelCell

January 1, 2013 | 11 comments | about: FCEL

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

FuelCell Energy Inc. (FCEL) reported 4th quarter and full-year results on December 20th of a loss of 5 cents per share for the quarter and 21 cents per share for the year, on an adjusted basis. These results were in line with analyst estimates for the quarter. In the quarter, the company announced a 121.8 megawatt order and licensing agreement for manufacturing of fuel cell components in South Korea by partner POSCO Energy, a division of POSCO (PKX). The company also announced an order from Microsoft (MSFT) to provide power to a data center in Wyoming. The order from Microsoft is important for FuelCell as data centers are a fast growing business that could provide future orders for the company. Microsoft is committed to becoming carbon neutral. The company also acquired the remaining shares of Versa Power Systems, a leader in solid oxide fuel cells. This technology pairs well with FuelCell's technology as it is best suited to sub 1 megawatt projects, whereas FuelCell's technology is better for multi-megawatt projects.

In the quarter, the company's production run rate was 56 megawatt, and FuelCell needs production of 80 to 90 megawatts to achieve positive net income. New orders have expanded FuelCell's backlog, which now stands at 151 megawatts, and the company is working to ramp up production to a run rate of 70 megawatts. The company believes the current backlog will support a base level of production at 50 to 55 megawatts. This will allow FuelCell to be gross margin positive. Production levels of 80 megawatts would produce positive EBITDA.

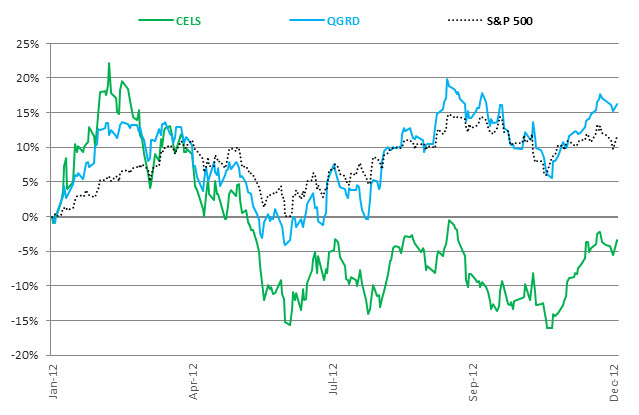

(click to enlarge)When you look at FuelCell compared to some its competitors, it appears fairly valued. On an EV/Revenue ratio basis, it is in line with competitors as it is right at the average. One concern is the company's cash conversion cycle, which you can see lags the group. The main drag on cash conversion is FuelCell's high inventory levels. The company has 141 days of inventory outstanding compared to Plug Power Inc. (PLUG) with 112 days of inventory outstanding and Capstone Turbine Corp. (CPST) with only 65 days of inventory outstanding. FuelCell falls more in the middle of the road when it comes to the time it takes to collect from customers with about 73 days of sales outstanding compared to over 100 at Ballard Power Systems, Inc. (BLDP) and only 52 days at Capstone. FuelCell has the lowest days of payables outstanding and I believe this while hurting their cash conversion cycle is not a bad thing, as it gives them greater flexibility. Ballard Power already has 166 days of payables outstanding, so Ballard has little room to improve its cash situation by delaying payments, whereas FuelCell has only 43 days outstanding, and this should give the company more flexibility, should it have to work with suppliers. FuelCell believes it will convert $11.3 million of inventory to cash in the early part of 2013. I believe the company will benefit from improving working capital management in 2013 and this paired with ramping product will bring the company close to being cash flow positive.FuelCell's stock has found strong support around 85 cents per share, and I believe this area is a good entry point in the stock. Baring the country falling apart from the fiscal cliff, this company has improving prospects and I believe it will be able to hold support at 85 cents. If the current move down is reversed, I believe the company's strengthening financial position will allow the stock to rally. With that said, the company is still a speculative investment and presents a fair amount of risk for investors. The company should have plenty of capital for the next year; however, it is dependent on future orders. FuelCell needs to be on the edge of being cash flow positive by the end of next year if it is going to produce sizeable returns for investors.

January 1, 2013 | 11 comments | about: FCEL

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

FuelCell Energy Inc. (FCEL) reported 4th quarter and full-year results on December 20th of a loss of 5 cents per share for the quarter and 21 cents per share for the year, on an adjusted basis. These results were in line with analyst estimates for the quarter. In the quarter, the company announced a 121.8 megawatt order and licensing agreement for manufacturing of fuel cell components in South Korea by partner POSCO Energy, a division of POSCO (PKX). The company also announced an order from Microsoft (MSFT) to provide power to a data center in Wyoming. The order from Microsoft is important for FuelCell as data centers are a fast growing business that could provide future orders for the company. Microsoft is committed to becoming carbon neutral. The company also acquired the remaining shares of Versa Power Systems, a leader in solid oxide fuel cells. This technology pairs well with FuelCell's technology as it is best suited to sub 1 megawatt projects, whereas FuelCell's technology is better for multi-megawatt projects.

In the quarter, the company's production run rate was 56 megawatt, and FuelCell needs production of 80 to 90 megawatts to achieve positive net income. New orders have expanded FuelCell's backlog, which now stands at 151 megawatts, and the company is working to ramp up production to a run rate of 70 megawatts. The company believes the current backlog will support a base level of production at 50 to 55 megawatts. This will allow FuelCell to be gross margin positive. Production levels of 80 megawatts would produce positive EBITDA.

(click to enlarge)When you look at FuelCell compared to some its competitors, it appears fairly valued. On an EV/Revenue ratio basis, it is in line with competitors as it is right at the average. One concern is the company's cash conversion cycle, which you can see lags the group. The main drag on cash conversion is FuelCell's high inventory levels. The company has 141 days of inventory outstanding compared to Plug Power Inc. (PLUG) with 112 days of inventory outstanding and Capstone Turbine Corp. (CPST) with only 65 days of inventory outstanding. FuelCell falls more in the middle of the road when it comes to the time it takes to collect from customers with about 73 days of sales outstanding compared to over 100 at Ballard Power Systems, Inc. (BLDP) and only 52 days at Capstone. FuelCell has the lowest days of payables outstanding and I believe this while hurting their cash conversion cycle is not a bad thing, as it gives them greater flexibility. Ballard Power already has 166 days of payables outstanding, so Ballard has little room to improve its cash situation by delaying payments, whereas FuelCell has only 43 days outstanding, and this should give the company more flexibility, should it have to work with suppliers. FuelCell believes it will convert $11.3 million of inventory to cash in the early part of 2013. I believe the company will benefit from improving working capital management in 2013 and this paired with ramping product will bring the company close to being cash flow positive.FuelCell's stock has found strong support around 85 cents per share, and I believe this area is a good entry point in the stock. Baring the country falling apart from the fiscal cliff, this company has improving prospects and I believe it will be able to hold support at 85 cents. If the current move down is reversed, I believe the company's strengthening financial position will allow the stock to rally. With that said, the company is still a speculative investment and presents a fair amount of risk for investors. The company should have plenty of capital for the next year; however, it is dependent on future orders. FuelCell needs to be on the edge of being cash flow positive by the end of next year if it is going to produce sizeable returns for investors.

Antwort auf Beitrag Nr.: 43.974.727 von paula5 am 02.01.13 17:13:48http://globenewswire.com/news-release/2012/12/20/513109/1001… vielleicht auch noch interessant

Antwort auf Beitrag Nr.: 43.974.766 von Spike33 am 02.01.13 17:21:01wenn alles gut läuft könnten sie schon im ersten quartal die gewinnschwelle erreichen. weil von posco die 10 mio zahlung erst ende des jahres kam.

Hier wacht doch jemand auf!!!

FuelCell Energy Up 5.7%, Penny Stock Attracts Attention (FCEL)

FuelCell Energy (NASDAQ:FCEL) is one of today's best performing penny stocks, up 5.7% to $1.00 on 1.6x average daily volume. FuelCell Energy has traded 1.8 million shares thus far today, vs. average volume of 1.1 million shares per day. The stock has outperformed the Dow (5.7% to the Dow's 0.5%) and outperformed the S&P 500 (5.7% to the S&P's 0.8%) during today's trading.

FuelCell Energy has overhead space with shares priced $1.00, or 58.4% below the average consensus analyst price target of $2.40. The stock should find resistance at its 200-day moving average (MA) of $1.09, as well as support at its 50-day MA of $0.91.

In the past 52 weeks, FuelCell Energy share prices have been bracketed by a low of $0.83 and a high of $1.95 and are now at $1.00, 20% above that low price. In the last five trading sessions, the 50-day moving average (MA) has climbed 0.2% while the 200-day MA has slid 1.4%.

FuelCell Energy, Inc. develops and commercializes fuel cell power plants for electric power generation. The Company also has contracts to develop its fuel cells for use of alternative fuels and for marine transportation applications. FuelCell has research and development contracts with government and industry.

SmarTrend is tracking the current trend status for FuelCell Energy and will alert subscribers who have FCEL in their portfolio or watchlist when shares have changed trend direction.

FuelCell Energy Up 5.7%, Penny Stock Attracts Attention (FCEL)

FuelCell Energy (NASDAQ:FCEL) is one of today's best performing penny stocks, up 5.7% to $1.00 on 1.6x average daily volume. FuelCell Energy has traded 1.8 million shares thus far today, vs. average volume of 1.1 million shares per day. The stock has outperformed the Dow (5.7% to the Dow's 0.5%) and outperformed the S&P 500 (5.7% to the S&P's 0.8%) during today's trading.

FuelCell Energy has overhead space with shares priced $1.00, or 58.4% below the average consensus analyst price target of $2.40. The stock should find resistance at its 200-day moving average (MA) of $1.09, as well as support at its 50-day MA of $0.91.

In the past 52 weeks, FuelCell Energy share prices have been bracketed by a low of $0.83 and a high of $1.95 and are now at $1.00, 20% above that low price. In the last five trading sessions, the 50-day moving average (MA) has climbed 0.2% while the 200-day MA has slid 1.4%.

FuelCell Energy, Inc. develops and commercializes fuel cell power plants for electric power generation. The Company also has contracts to develop its fuel cells for use of alternative fuels and for marine transportation applications. FuelCell has research and development contracts with government and industry.

SmarTrend is tracking the current trend status for FuelCell Energy and will alert subscribers who have FCEL in their portfolio or watchlist when shares have changed trend direction.

na mal schaun wann wir die 1$ knacken .

na schaffen wir heut etwa schon die 1$ rt 0.98 0.04(3.91%)

FuelCell Energy ready to power up Connecticut project

Boston Business Journal by Patricia Resende, Managing Editor MHT

Date: Thursday, January 3, 2013, 10:45am EST

Enlarge Image

Patricia Resende

Managing Editor MHT- Boston Business Journal

Email

It has been under development for six years, and now FuelCell Energy Inc. (Nasdaq: FCEL) is ready to flip the switch on its 15-megawatt project in Connecticut.

FuelCell Energy’s power plants have generated more than a billion kilowatt hours of ultra-clean power, and now the Bridgeport Fuel Cell project, a project developed and manufactured by FuelCell and owned by Dominion (NYSE ) and considered the largest fuel cell park in the U.S., will be fully operational and begin producing electricity by December 2013.

) and considered the largest fuel cell park in the U.S., will be fully operational and begin producing electricity by December 2013.

The fuel cell park is located on approximately 1.7 acres of land leased from the City of Bridgeport. The Connecticut Light and Power Company (CL&P) will buy electricity generated by the facility under a 15-year fixed price energy purchase agreement.

The installation, consisting of the five fuel cell power plants, was developed to power approximately 15,000 average size homes.

Peabody-based Energi, People’s United Insurance Agency of Bridgeport, Conn. and Hannover Re Group, together announced that the companies have finalized coverage for the project, which has been in development for six years.

“This is the largest project that we have developed to date in the USA, working with three utilities, local, and state government to enhance the reliability of the electric grid with clean distributed power generation,” said Chip Bottone, president and CEO of FuelCell Energy.

The project is supported by the Clean Energy Finance and Investment Authority (CEFIA) and will increase product and service backlog for FuelCell Energy by approximately $125 million, according to the company.

Related links: Fuel Cells, Connecticut

Industries: Energy

Boston Business Journal by Patricia Resende, Managing Editor MHT

Date: Thursday, January 3, 2013, 10:45am EST

Enlarge Image

Patricia Resende

Managing Editor MHT- Boston Business Journal

It has been under development for six years, and now FuelCell Energy Inc. (Nasdaq: FCEL) is ready to flip the switch on its 15-megawatt project in Connecticut.

FuelCell Energy’s power plants have generated more than a billion kilowatt hours of ultra-clean power, and now the Bridgeport Fuel Cell project, a project developed and manufactured by FuelCell and owned by Dominion (NYSE

) and considered the largest fuel cell park in the U.S., will be fully operational and begin producing electricity by December 2013.

) and considered the largest fuel cell park in the U.S., will be fully operational and begin producing electricity by December 2013.The fuel cell park is located on approximately 1.7 acres of land leased from the City of Bridgeport. The Connecticut Light and Power Company (CL&P) will buy electricity generated by the facility under a 15-year fixed price energy purchase agreement.

The installation, consisting of the five fuel cell power plants, was developed to power approximately 15,000 average size homes.

Peabody-based Energi, People’s United Insurance Agency of Bridgeport, Conn. and Hannover Re Group, together announced that the companies have finalized coverage for the project, which has been in development for six years.

“This is the largest project that we have developed to date in the USA, working with three utilities, local, and state government to enhance the reliability of the electric grid with clean distributed power generation,” said Chip Bottone, president and CEO of FuelCell Energy.

The project is supported by the Clean Energy Finance and Investment Authority (CEFIA) and will increase product and service backlog for FuelCell Energy by approximately $125 million, according to the company.

Related links: Fuel Cells, Connecticut

Industries: Energy

hab sie mir auch mal auf die wl gelegt!

auch in Deutschland tut sich was in dieser richtung

Dresdner Fraunhofer-Institut IKTS baut Batterie-Technikum in Thüringen

Posted by admin on 6. Dezember 2012

Modell einer vom IKTS Dresden konzipierten tragbaren Hochtemperatur-Brennstoffzelle. Abb.: Fraunhofer IKTS

Hermsdorf/Dresden, 6. Dezember 2012: Die Fraunhofergesellschaft hat mit dem Bau eines vier Millionen Euro teuren Technikums für neuartige Batterie -Systeme im thüringischen Hermsdorf begonnen. Dort will das „Fraunhofer-Institut für Keramische Technologien und Systeme“ (IKTS) aus Dresden keramische Hochtemperatur-Batterien und Lithium-Ionen-Akkus testen und gemeinsam mit der Uni Jena und Industriepartnern in die Produktionsreife überführen. Das Batterie-Technikum soll Mitte 2014 den Betrieb aufnehmen.

Millionenförderung vom Land

Damit hat Dresden, wo diese Technologien ursprünglich entwickelt wurden, beim Schritt zur Produktion dieser Systeme den Kürzeren gezogen: Thüringens Wirtschaftsminister Matthias Machnig (SPD) will die Hälfte der Investition aus Landesmitteln zuschießen und übergab den Fraunhofer-Forschern am 5. Dezember einen entsprechenden Förderbescheid. „Unser Ziel ist die Schaffung eines bundesweit bedeutsamen Zentrums der Energie- und Umwelttechnik“, betonte er.

Erdgas-Netz als Energiespeicher: Brennstoffzellen-Technikum in Aussicht gestellt

Das Batterietechnikum soll perspektivisch zu einem knapp 8000 Quadratmeter großen „Green-Tech-Campus“ erweitert werden. Unter anderem stellte Fraunhofer ein späteres Brennstoffzellen-Technikum mit einem Investitionsvolumen von rund 4,4 Millionen Euro –komplett finanziert aus Landesmitteln – in Aussicht, in dem großem, stationäre Brennstoffzellen-Systeme in Aussicht. Dort wollen die Forscher Brennstoffzellen entwickeln, die aus Erdgas Strom oder wahlweise Wasserstoff erzeugen – „eine zentrale Voraussetzung zur Nutzung des Erdgasnetzes als effektiven Großspeicher“, wie es hieß.

Zudem erwägt auch der IKTS-Partner „Fuel Cell Energy Solutions GmbH“ (FCES) auf dem „Green-Tech-Campus“ eine größere Ansiedlung zur Produktion von Brennstoffzellen-Kraftwerken. Heiko Weckbrodt

Dresdner Fraunhofer-Institut IKTS baut Batterie-Technikum in Thüringen

Posted by admin on 6. Dezember 2012

Modell einer vom IKTS Dresden konzipierten tragbaren Hochtemperatur-Brennstoffzelle. Abb.: Fraunhofer IKTS

Hermsdorf/Dresden, 6. Dezember 2012: Die Fraunhofergesellschaft hat mit dem Bau eines vier Millionen Euro teuren Technikums für neuartige Batterie -Systeme im thüringischen Hermsdorf begonnen. Dort will das „Fraunhofer-Institut für Keramische Technologien und Systeme“ (IKTS) aus Dresden keramische Hochtemperatur-Batterien und Lithium-Ionen-Akkus testen und gemeinsam mit der Uni Jena und Industriepartnern in die Produktionsreife überführen. Das Batterie-Technikum soll Mitte 2014 den Betrieb aufnehmen.

Millionenförderung vom Land

Damit hat Dresden, wo diese Technologien ursprünglich entwickelt wurden, beim Schritt zur Produktion dieser Systeme den Kürzeren gezogen: Thüringens Wirtschaftsminister Matthias Machnig (SPD) will die Hälfte der Investition aus Landesmitteln zuschießen und übergab den Fraunhofer-Forschern am 5. Dezember einen entsprechenden Förderbescheid. „Unser Ziel ist die Schaffung eines bundesweit bedeutsamen Zentrums der Energie- und Umwelttechnik“, betonte er.

Erdgas-Netz als Energiespeicher: Brennstoffzellen-Technikum in Aussicht gestellt

Das Batterietechnikum soll perspektivisch zu einem knapp 8000 Quadratmeter großen „Green-Tech-Campus“ erweitert werden. Unter anderem stellte Fraunhofer ein späteres Brennstoffzellen-Technikum mit einem Investitionsvolumen von rund 4,4 Millionen Euro –komplett finanziert aus Landesmitteln – in Aussicht, in dem großem, stationäre Brennstoffzellen-Systeme in Aussicht. Dort wollen die Forscher Brennstoffzellen entwickeln, die aus Erdgas Strom oder wahlweise Wasserstoff erzeugen – „eine zentrale Voraussetzung zur Nutzung des Erdgasnetzes als effektiven Großspeicher“, wie es hieß.

Zudem erwägt auch der IKTS-Partner „Fuel Cell Energy Solutions GmbH“ (FCES) auf dem „Green-Tech-Campus“ eine größere Ansiedlung zur Produktion von Brennstoffzellen-Kraftwerken. Heiko Weckbrodt

ein sk über 1,05 $ wäre super heut

Heute fällt die 1,05!!

ich hoffe, wird aber schwer bei dem markt

is auch 200 line

is auch 200 line

Glaube auch dazu brauch es noch etwas mehr Momentum

Zitat von garbicz

schon wieder nicht direkt über FCEL aber die Hinweise verdichten sich...

Wasserstoff aus Strom: RWE Power testet neue Elektrolyse-Technik zur Stromspeicherung

http://www.presseportal.de/pm/25081/2392436/wasserstoff-aus-…

schon wieder nicht direkt über FCEL aber die Hinweise verdichten sich...

Wasserstoff aus Strom: RWE Power testet neue Elektrolyse-Technik zur Stromspeicherung

http://www.presseportal.de/pm/25081/2392436/wasserstoff-aus-…

Was meint er damit?

gelungen 1,11 $

Meine Rede...

Meine Rede...

so bis 1,30$ wäre das erste Ziel denke ich

luft könnte jetzt bei 1,35 reichen

luft könnte jetzt bei 1,35 reichen

Denke hier werden auch noch ein paar Shorts gegrillt.

Stock Watch Wednesday, 9 January

Industry, Clean Energy:

FuelCell Energy Off To A Strong Start

Shares of FuelCell Energy (FCEL) jumped by five percent on Tuesday and have risen by over 15 percent already on the year. No significant news was released in conjunction with the five percent, high-volumed spike, although a company insider was noted to have made a modest share purchase. The quick start this year could be a precursor for what's to come, as the company announced numerous solid developments last year that have it positioned for success and growth in 2013. The most significant of the most recent developments may have been the news that FuelCell -- in collaboration with Dominion Resources (D) -- would develop the largest fuel cell power project in North America. This deal, according to Bloomberg reporting, increased the company's backlog of orders to over $125 million and provided a testament to FCEL's ability to supply power independent of the national or regional grids -- a big deal in the aftermath of Hurricane Sandy. Also in 2012, FuelCell secured a deal with South Korea's POSCO Energy, a deal that brought with it $30 million of up-front financing and laid the groundwork for future -- and potentially more lucrative -- collaborative efforts.

With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note. What has held this company back thus far is the slow trek towards profitability, but as investors become convinced that profitability is on the horizon, volume may start to trickle in at a higher rate and the share price could follow. Until profitability is met, however, the threat of a stock offering does exist -- one such deal was struck last year around the time of the Posco announcement -- but the company has also demonstrated its ability to raise funds through partnerships and other collaborative efforts.

Industry, Clean Energy:

FuelCell Energy Off To A Strong Start

Shares of FuelCell Energy (FCEL) jumped by five percent on Tuesday and have risen by over 15 percent already on the year. No significant news was released in conjunction with the five percent, high-volumed spike, although a company insider was noted to have made a modest share purchase. The quick start this year could be a precursor for what's to come, as the company announced numerous solid developments last year that have it positioned for success and growth in 2013. The most significant of the most recent developments may have been the news that FuelCell -- in collaboration with Dominion Resources (D) -- would develop the largest fuel cell power project in North America. This deal, according to Bloomberg reporting, increased the company's backlog of orders to over $125 million and provided a testament to FCEL's ability to supply power independent of the national or regional grids -- a big deal in the aftermath of Hurricane Sandy. Also in 2012, FuelCell secured a deal with South Korea's POSCO Energy, a deal that brought with it $30 million of up-front financing and laid the groundwork for future -- and potentially more lucrative -- collaborative efforts.

With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note. What has held this company back thus far is the slow trek towards profitability, but as investors become convinced that profitability is on the horizon, volume may start to trickle in at a higher rate and the share price could follow. Until profitability is met, however, the threat of a stock offering does exist -- one such deal was struck last year around the time of the Posco announcement -- but the company has also demonstrated its ability to raise funds through partnerships and other collaborative efforts.

Meine rede, hier hängen noch einige Shorts drin die geschüttelt werden müssen With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note.

With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note.

With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note.

With a quick start to the year underway, FCEL will be a hot story to watch moving forward. Add in a fairly significant amount of short interest, and things could get exciting quick, should those shorts look to cover as developments continue to unfold on a positive note.

@weed37 denke die fallen erst so gegen 1,30$ aus den bäumen

http://www.nasdaq.com/symbol/fcel/premarket 1,19 Vorbörse

Der Chef kauft auch selber FuelCell Energy CEO Buys 5K Shares and 3 Insider Buys to Track

By Alex Capel | More Articles

January 10, 2013

Bottone Arthur A. Jr. who is President and CEO at FuelCell Energy Inc. (NASDAQ:FCEL), bought 5,000 shares at $1.03 per share for a total value of $5,150. The shares recently traded at $1.16, up $0.13, or 12.62% since the insider buy.

By Alex Capel | More Articles

January 10, 2013

Bottone Arthur A. Jr. who is President and CEO at FuelCell Energy Inc. (NASDAQ:FCEL), bought 5,000 shares at $1.03 per share for a total value of $5,150. The shares recently traded at $1.16, up $0.13, or 12.62% since the insider buy.

200 k in den ersten 45 sec meine fresse nicht schlecht

Ich glaube der ganz Sektor wird ins Auge genommen

scheint so weed37, aber nur FCEL ist so na am Breakeven und hat so hohe Auftragseingänge.

selbst Plug Power geht ab

@weed37 Beitrag Nr.38 (44.005.946)

Vorbörse 1,26$

Vorbörse 1,26$

Sie rennt weiter und sogar gegen den Markt.

hier gut zu sehn

hey weed37 das volumen ist beachtlich , hier steigen auch big boys ein so wie das aus sieht!! aber luft holen sollte sie auch mal.

Richtig paula aber die haut jetzt sogar gerade die 1,30$ weg.

FuelCell Energy Inc. (FCEL) -NasdaqGM

1.30 0.09(7.44%) 11:26AM EST - Nasdaq Real Time Price

1.30 0.09(7.44%) 11:26AM EST - Nasdaq Real Time Price

Upcoming Events

Jan 16, 2013

15th Annual Needham Growth Conference

Speaker: Chip Bottone, President & CEO

Location: New York, New York

Jan 16, 2013

15th Annual Needham Growth Conference

Speaker: Chip Bottone, President & CEO

Location: New York, New York

Dann lassen wir uns mal alle überaschen, was diese Woche so bringt.

Ich bin ja immer noch sehr positiv gestimmt und sehe ein Ende dieser kleinen Ralley noch lange nicht!!!

Ich bin ja immer noch sehr positiv gestimmt und sehe ein Ende dieser kleinen Ralley noch lange nicht!!!

also vom MACD wäre noch viel Luft

jede wette heut wird luft geholt für den nächsten ritt

treffer paula, mal schaun wie es heut weiter geht

denke wir werden uns zw. 1,15$ und 1,20$ einpendeln

Oho hier wurd SL ausgelöst und ich hab noch welche bekommen

und ich hab noch welche bekommen

und ich hab noch welche bekommen

und ich hab noch welche bekommen

zack und schon wieder oben 1,14 $ sah aus wie Short angriff die haben noch nicht zurück gedeckt

1,14 $ sah aus wie Short angriff die haben noch nicht zurück gedeckt

1,14 $ sah aus wie Short angriff die haben noch nicht zurück gedeckt

1,14 $ sah aus wie Short angriff die haben noch nicht zurück gedeckt

Wow das ging ja bis 1,01 runter im pick. 750000 stk insgesamt.Ja die haben sich abbürsten lassen.

bin echt mal gespannt heut

10 Days over 1,00 $

für alle die wissen wollen was der Boss sagt  ) http://wsw.com/webcast/needham55/register.aspx?conf=needham5…

) http://wsw.com/webcast/needham55/register.aspx?conf=needham5…

) http://wsw.com/webcast/needham55/register.aspx?conf=needham5…

) http://wsw.com/webcast/needham55/register.aspx?conf=needham5…

Fuel Cell Energy (FCEL) = Präsentation heute nach Börsenschluss (heute Mittwoch, 16.01.2013, um 04:10h US-Ostküstenzeit => Also 22:10h MEZ und NACH Börsenschluss)

Na mal schaun was der Tag bringt heute

denk heut wirds noch brauchen

wird die 1,17 - 1,18 $ nach oben gebrochen könnt ihr davon ausgehn das die nächste welle anläuft

hier die Präsentation vom 16.1 sollte jeder gelesen haben http://files.shareholder.com/downloads/FCEL/2274990114x0x628…

danke sehr informativ

so neue Woche mal schaun ob die nächste Welle anläuft

Antwort auf Beitrag Nr.: 44.043.719 von weed37 am 21.01.13 09:59:56Bin auch wieder eingestiegen.

Die Delisting-Abmahnung ist vom Tisch und die Präsi sieht auch ganz gut aus.

Bin auch mal gespannt wie nachher das Echo aus den USA sein wird.

Die Delisting-Abmahnung ist vom Tisch und die Präsi sieht auch ganz gut aus.

Bin auch mal gespannt wie nachher das Echo aus den USA sein wird.

soweit ich weis is heut dicht in usa!? feiertag!

Antwort auf Beitrag Nr.: 44.045.020 von paula5 am 21.01.13 15:07:25tatsächlich..Martin Luther King Day...zu früh gefreut =)

Danke für die Info

Danke für die Info

1,17 sollte jetzt fallen

so jetzt wird die Schweiz aufgerollt FuelCell Energy Solutions gibt den Abschluss eines Service Vertrages fur ein Brennstoffzellen-Kraftwerk des Schweizer Energiedienstleisters ewz bekannt

FuelCell Energy Solutions gibt den Abschluss eines Service Vertrages fur ein Brennstoffzellen-Kraftwerk des Schweizer Energiedienstleisters ewz bekannt

FuelCell Energy, Inc.

22.01.2013 09:00

DRESDEN, Deutschland, 2013-01-22 09:00 CET (GLOBE NEWSWIRE) -- FuelCell Energy Solutions, GmbH, ein Anbieter von sauberen, effizienten und zuverlassigen Brennstoffzellen-Kraftwerken, kundigte heute eine mehrjahrige Service-Vereinbarung fur ein stationares Brennstoffzellen-Kraftwerk des Elektrizitatswerks der Stadt Zurich (ewz), einem Energiedienstleistungsunternehmen in der Schweiz, an. FuelCell Energy Solutions (FCES) wird den Betrieb und die Wartung des Kraftwerks zusammen mit ewz durchfuhren und von einem in Europa ansassigen Service Center aus uberwachen, welches 24 Stunden am Tag, sieben Tage die Woche besetzt ist.

ewz verfolgt und engagiert sich aktiv bei der Entwicklung von neuen Technologien zur Energieerzeugung. ewz zahlt zu umsatzstarksten Energiedienstleistungsunternehmen in der Schweiz und versorgt seit 1892 die Stadt Zurich und Teile des Kantons Graubunden mit Strom.

Bei diesem im November 2010 in Betrieb genommenen Brennstoffzellen-Kraftwerk handelt es sich um die erste in der Schweiz eingesetzte Schmelzkarbonat-Brennstoffzelle.<>, sagt ewz-Direktor Marcel Frei. 'In dieser Pilotanlageuntersuchen wir, wie sich die Brennstoffzelle in einem realen Warme-, Strom- und Erdgasnetz im Dauerbetrieb bewahrt und wie sich die Betriebskosten entwickeln.'

Die Mitarbeitenden von ewz sind eng in den Betrieb und die Evaluierung des stationaren Schmelzkarbonat-Brennstoffzellen-Kraftwerkes eingebunden, um die nahezu emissionsfreie, elektrisch hocheffiziente Energieerzeugung sowie die Flexibilitat des Kraftwerkes im Betrieb zu untersuchen.

'Die Kundenzufriedenheit steht im Mittelpunkt unseres Handelns. Unsere Service-Vereinbarungen ermoglichen es unseren Kunden, sich auf ihr eigenes Geschaft zu konzentrieren, wahrend wir uns auf unsere Kernkompetenzen konzentrieren, um sauberen Strom effizient und zuverlassig zu liefern ', sagt Chip Bottone, Prasident und Vorstandsvorsitzender, FuelCell Energy, Inc. und Geschaftsfuhrer, FuelCell Energy Solutions GmbH. 'Die hocheffiziente und umweltfreundliche Stromerzeugung unserer Kraftwerke stellt eine gute Losung zur Unterstutzung der Grundlastversorgung der Stromnetze dar und ermoglicht es Energieversorgern Kapazitaten zur Stromerzeugung in kostengunstigen Schritten hinzuzufugen, wann und wo sie jeweils benotigt werden.'

FCES wird die Wartung der bestehenden Anlagen, einschliesslich der geplanten Wechsel der Brennstoffzellen-Stapel wahrend der 10 Jahre Laufzeit der Service-Vereinbarung wahrnehmen.

FCES bietet ein umfassendes Portfolio von Dienstleistungen fur stationare Brennstoffzellen-Kraftwerke mit mehrjahrigen Service-Vereinbarungen. Die Techniker und Ingenieure bedienen und warten die Brennstoffzellen-Kraftwerke aus der Ferne, 24 Stunden pro Tag, 365 Tage pro Jahr. Ausserdem stehen Field Service Techniker fur den Vor-Ort-Service bereit. Diese Service-Angebote ermoglichen den Betrieb der Anlage in der Verantwortung von FCES, um die Kunden zu entlasten, Kosten zu sparen und die Sicherheit der Stromversorgung zu gewahrleisten.

Brennstoffzellen wandeln den Brennstoff in einem hoch effizienten Prozess, der aufgrund der fehlenden Verbrennung praktisch keine Schadstoffe emittiert, elektrochemisch in Strom und Warme um. Die stationaren Brennstoffzellen-Kraftwerke, hergestellt und vertrieben von FCES, arbeiten flexibel mit unterschiedlichen Kraftstoffen und eignen sich fur den Betrieb mit Erdgas oder erneuerbarem Biogas. Die Kraftwerke liefern kontinuierlich Grundlast-Strom und konnen verbrauchernah errichtet werden, entweder zur Vor-Ort-Anwendung oder zur Unterstutzung des Stromnetzes. Die Kombination von nahezu keinen Schadstoffemissionen, geringem Platzbedarf und dem leisen Betrieb dieser stationaren Brennstoffzellen-Kraftwerke erleichtert ihre Standortwahl in stadtischen Lagen.

Die FCES ist mit ihrem Produktionsstandort in Deutschland der Vertriebs-, Produktions- und Servicebetrieb der FuelCell Energy, Inc., fur Europa.

Uber die FuelCell Energy Solutions GmbH

Die FuelCell Energy Solutions GmbH produziert, vertreibt, installiert und wartet stationare Brennstoffzellenkraftwerke, die effizient und wirtschaftlich Strom und zur Erzeugung von Dampf nutzbare, hochwertige Warme produzieren. Der Sitz des Unternehmens befindet sich in Dresden (Deutschland), der Produktionsstandort ist Ottobrunn (Deutschland). Kontinuierliche, verbrauchsnahe Stromerzeugung bietet Sicherheit und Zuverlassigkeit der Energieversorgung bei praktisch fehlendem Schadstoffausstoss und unterstutzt Nachhaltigkeitsinitiativen. Saubere, dezentrale Energieerzeugung ist interessant fur Energieversorger, Universitaten, Krankenhauser, Regierungsgebaude, Industrieanlagen und andere Einrichtungen mit hohem Energiebedarf. Fur weitergehende Informationen besuchen Sie bitte unsere Webseite unter der Adresse www.fces.de.

Diese Pressemitteilung beinhaltet vorausschauende Aussagen, einschliesslich von Aussagen uber die Plane und Erwartungen der FuelCell Energy Inc./ FuelCell Energy Solutions GmbH zu laufender Entwicklung, Vermarktung und Finanzierung ihrer Brennstoffzellentechnologie und Geschaftsplanen. Alle vorausschauenden Aussagen unterliegen Risiken und Ungewissheiten, die dazu fuhren konnen, dass die tatsachlichen Ergebnisse sich wesentlich von den Erwartungen unterscheiden. Faktoren, die einen solchen Unterschied bewirken konnen, sind unter anderem, aber nicht ausschliesslich, allgemeine Risiken im Zusammenhang mit der Produktentwicklung und -herstellung, Veranderungen im rechtlichen Umfeld und bei Kundenstrategien, Unbestandigkeit der Preise fur Energie, rapide technologische Veranderungen, Konkurrenz sowie die Moglichkeiten der FuelCell Energy Inc., / FuelCell Energy Solutions ihren Absatzplan und die Kostensenkungsziele zu erreichen, sowie andere Risiken, die in den von der FuelCell Energy Inc. bei der U.S. Securities and Exchange Commission (SEC) hinterlegten Unterlagen dargestellt sind. Die hier enthaltenen vorausschauenden Aussagen gelten ausschliesslich zum Datum dieser Pressemitteilung. Die FuelCell Energy Inc. / FuelCell Energy Solutions lehnt ausdrucklich jegliche Verpflichtung zur Veroffentlichung von Aktualisierungen oder Anderungen einer jeglichen solchen Aussage ab, in denen Veranderungen bei den Erwartungen der FuelCell Energy Inc. / FuelCell Energy Solutions oder beliebige Anderungen der Ereignisse, Konditionen und Umstande reflektiert werden, welche einer jeglichen solchen Aussage zugrunde liegen.

Direct FuelCell, DFC, DFC/T, DFC-H2 und FuelCell Energy Inc. sind in den USA eingetragene Markenzeichen der FuelCell Energy Inc. DFC-ERG ist ein von der Enbridge Inc. und der FuelCell Energy Inc. gemeinsam eingetragenes Markenzeichen.

Kontakt: FuelCell Energy Solutions GmbH Andreas Froemmel Kaufmannischer Leiter + 49 800 1 81 88 90 afroemmel@fces.de FuelCell Energy, Inc. Kurt Goddard Vice President Investor Relations (+001) 203-830-7494

ir@fce.com News Source: NASDAQ OMX

22.01.2013 Veröffentlichung einer Corporate News/Finanznachricht, übermittelt durch die DGAP - ein Unternehmen der EquityStory AG. Für den Inhalt der Mitteilung ist der Emittent / Herausgeber verantwortlich.

Die DGAP Distributionsservices umfassen gesetzliche Meldepflichten, Corporate News/Finanznachrichten und Pressemitteilungen. DGAP-Medienarchive unter www.dgap-medientreff.de und www.dgap.de

Sprache: Deutsch Unternehmen: FuelCell Energy, Inc.

Vereinigte Staaten von Amerika Telefon: Fax: E-Mail: Internet:

ISIN: US35952H1068 WKN: Ende der Mitteilung DGAP News-Service

ISIN US35952H1068

AXC0040 2013-01-22/09:01

© 2013 dpa-AFX

FuelCell Energy Solutions gibt den Abschluss eines Service Vertrages fur ein Brennstoffzellen-Kraftwerk des Schweizer Energiedienstleisters ewz bekannt

FuelCell Energy, Inc.

22.01.2013 09:00

DRESDEN, Deutschland, 2013-01-22 09:00 CET (GLOBE NEWSWIRE) -- FuelCell Energy Solutions, GmbH, ein Anbieter von sauberen, effizienten und zuverlassigen Brennstoffzellen-Kraftwerken, kundigte heute eine mehrjahrige Service-Vereinbarung fur ein stationares Brennstoffzellen-Kraftwerk des Elektrizitatswerks der Stadt Zurich (ewz), einem Energiedienstleistungsunternehmen in der Schweiz, an. FuelCell Energy Solutions (FCES) wird den Betrieb und die Wartung des Kraftwerks zusammen mit ewz durchfuhren und von einem in Europa ansassigen Service Center aus uberwachen, welches 24 Stunden am Tag, sieben Tage die Woche besetzt ist.

ewz verfolgt und engagiert sich aktiv bei der Entwicklung von neuen Technologien zur Energieerzeugung. ewz zahlt zu umsatzstarksten Energiedienstleistungsunternehmen in der Schweiz und versorgt seit 1892 die Stadt Zurich und Teile des Kantons Graubunden mit Strom.

Bei diesem im November 2010 in Betrieb genommenen Brennstoffzellen-Kraftwerk handelt es sich um die erste in der Schweiz eingesetzte Schmelzkarbonat-Brennstoffzelle.<>, sagt ewz-Direktor Marcel Frei. 'In dieser Pilotanlageuntersuchen wir, wie sich die Brennstoffzelle in einem realen Warme-, Strom- und Erdgasnetz im Dauerbetrieb bewahrt und wie sich die Betriebskosten entwickeln.'

Die Mitarbeitenden von ewz sind eng in den Betrieb und die Evaluierung des stationaren Schmelzkarbonat-Brennstoffzellen-Kraftwerkes eingebunden, um die nahezu emissionsfreie, elektrisch hocheffiziente Energieerzeugung sowie die Flexibilitat des Kraftwerkes im Betrieb zu untersuchen.

'Die Kundenzufriedenheit steht im Mittelpunkt unseres Handelns. Unsere Service-Vereinbarungen ermoglichen es unseren Kunden, sich auf ihr eigenes Geschaft zu konzentrieren, wahrend wir uns auf unsere Kernkompetenzen konzentrieren, um sauberen Strom effizient und zuverlassig zu liefern ', sagt Chip Bottone, Prasident und Vorstandsvorsitzender, FuelCell Energy, Inc. und Geschaftsfuhrer, FuelCell Energy Solutions GmbH. 'Die hocheffiziente und umweltfreundliche Stromerzeugung unserer Kraftwerke stellt eine gute Losung zur Unterstutzung der Grundlastversorgung der Stromnetze dar und ermoglicht es Energieversorgern Kapazitaten zur Stromerzeugung in kostengunstigen Schritten hinzuzufugen, wann und wo sie jeweils benotigt werden.'

FCES wird die Wartung der bestehenden Anlagen, einschliesslich der geplanten Wechsel der Brennstoffzellen-Stapel wahrend der 10 Jahre Laufzeit der Service-Vereinbarung wahrnehmen.

FCES bietet ein umfassendes Portfolio von Dienstleistungen fur stationare Brennstoffzellen-Kraftwerke mit mehrjahrigen Service-Vereinbarungen. Die Techniker und Ingenieure bedienen und warten die Brennstoffzellen-Kraftwerke aus der Ferne, 24 Stunden pro Tag, 365 Tage pro Jahr. Ausserdem stehen Field Service Techniker fur den Vor-Ort-Service bereit. Diese Service-Angebote ermoglichen den Betrieb der Anlage in der Verantwortung von FCES, um die Kunden zu entlasten, Kosten zu sparen und die Sicherheit der Stromversorgung zu gewahrleisten.

Brennstoffzellen wandeln den Brennstoff in einem hoch effizienten Prozess, der aufgrund der fehlenden Verbrennung praktisch keine Schadstoffe emittiert, elektrochemisch in Strom und Warme um. Die stationaren Brennstoffzellen-Kraftwerke, hergestellt und vertrieben von FCES, arbeiten flexibel mit unterschiedlichen Kraftstoffen und eignen sich fur den Betrieb mit Erdgas oder erneuerbarem Biogas. Die Kraftwerke liefern kontinuierlich Grundlast-Strom und konnen verbrauchernah errichtet werden, entweder zur Vor-Ort-Anwendung oder zur Unterstutzung des Stromnetzes. Die Kombination von nahezu keinen Schadstoffemissionen, geringem Platzbedarf und dem leisen Betrieb dieser stationaren Brennstoffzellen-Kraftwerke erleichtert ihre Standortwahl in stadtischen Lagen.

Die FCES ist mit ihrem Produktionsstandort in Deutschland der Vertriebs-, Produktions- und Servicebetrieb der FuelCell Energy, Inc., fur Europa.

Uber die FuelCell Energy Solutions GmbH

Die FuelCell Energy Solutions GmbH produziert, vertreibt, installiert und wartet stationare Brennstoffzellenkraftwerke, die effizient und wirtschaftlich Strom und zur Erzeugung von Dampf nutzbare, hochwertige Warme produzieren. Der Sitz des Unternehmens befindet sich in Dresden (Deutschland), der Produktionsstandort ist Ottobrunn (Deutschland). Kontinuierliche, verbrauchsnahe Stromerzeugung bietet Sicherheit und Zuverlassigkeit der Energieversorgung bei praktisch fehlendem Schadstoffausstoss und unterstutzt Nachhaltigkeitsinitiativen. Saubere, dezentrale Energieerzeugung ist interessant fur Energieversorger, Universitaten, Krankenhauser, Regierungsgebaude, Industrieanlagen und andere Einrichtungen mit hohem Energiebedarf. Fur weitergehende Informationen besuchen Sie bitte unsere Webseite unter der Adresse www.fces.de.

Diese Pressemitteilung beinhaltet vorausschauende Aussagen, einschliesslich von Aussagen uber die Plane und Erwartungen der FuelCell Energy Inc./ FuelCell Energy Solutions GmbH zu laufender Entwicklung, Vermarktung und Finanzierung ihrer Brennstoffzellentechnologie und Geschaftsplanen. Alle vorausschauenden Aussagen unterliegen Risiken und Ungewissheiten, die dazu fuhren konnen, dass die tatsachlichen Ergebnisse sich wesentlich von den Erwartungen unterscheiden. Faktoren, die einen solchen Unterschied bewirken konnen, sind unter anderem, aber nicht ausschliesslich, allgemeine Risiken im Zusammenhang mit der Produktentwicklung und -herstellung, Veranderungen im rechtlichen Umfeld und bei Kundenstrategien, Unbestandigkeit der Preise fur Energie, rapide technologische Veranderungen, Konkurrenz sowie die Moglichkeiten der FuelCell Energy Inc., / FuelCell Energy Solutions ihren Absatzplan und die Kostensenkungsziele zu erreichen, sowie andere Risiken, die in den von der FuelCell Energy Inc. bei der U.S. Securities and Exchange Commission (SEC) hinterlegten Unterlagen dargestellt sind. Die hier enthaltenen vorausschauenden Aussagen gelten ausschliesslich zum Datum dieser Pressemitteilung. Die FuelCell Energy Inc. / FuelCell Energy Solutions lehnt ausdrucklich jegliche Verpflichtung zur Veroffentlichung von Aktualisierungen oder Anderungen einer jeglichen solchen Aussage ab, in denen Veranderungen bei den Erwartungen der FuelCell Energy Inc. / FuelCell Energy Solutions oder beliebige Anderungen der Ereignisse, Konditionen und Umstande reflektiert werden, welche einer jeglichen solchen Aussage zugrunde liegen.

Direct FuelCell, DFC, DFC/T, DFC-H2 und FuelCell Energy Inc. sind in den USA eingetragene Markenzeichen der FuelCell Energy Inc. DFC-ERG ist ein von der Enbridge Inc. und der FuelCell Energy Inc. gemeinsam eingetragenes Markenzeichen.

Kontakt: FuelCell Energy Solutions GmbH Andreas Froemmel Kaufmannischer Leiter + 49 800 1 81 88 90 afroemmel@fces.de FuelCell Energy, Inc. Kurt Goddard Vice President Investor Relations (+001) 203-830-7494

ir@fce.com News Source: NASDAQ OMX

22.01.2013 Veröffentlichung einer Corporate News/Finanznachricht, übermittelt durch die DGAP - ein Unternehmen der EquityStory AG. Für den Inhalt der Mitteilung ist der Emittent / Herausgeber verantwortlich.

Die DGAP Distributionsservices umfassen gesetzliche Meldepflichten, Corporate News/Finanznachrichten und Pressemitteilungen. DGAP-Medienarchive unter www.dgap-medientreff.de und www.dgap.de

Sprache: Deutsch Unternehmen: FuelCell Energy, Inc.

Vereinigte Staaten von Amerika Telefon: Fax: E-Mail: Internet:

ISIN: US35952H1068 WKN: Ende der Mitteilung DGAP News-Service

ISIN US35952H1068

AXC0040 2013-01-22/09:01

© 2013 dpa-AFX

und das ist erst der anfang, fcel kommt gerade erst ins rollen!

Bin mal gespannt wann RWE;Eon usw..... aufwachen

Wow nettes Volumen zum Start

Ja das Volumen war beachtlich vor allem die vielen fetten Blöcke die ins Ask gekauft wurden. Hier steigen warscheinlich Big Boys ein!

wird spannend die nächsten tage! 5 tagetrend gestern nach oben verlassen

Für jeden der sich mal näher mit dieser Industrie beschäftigen will! http://www.fuelcelltoday.com/

Pre-Market Volume: Pre-Market High: Pre-Market Low:

110,805 $ 1.15

(09:12:25 AM) $ 1.15

(09:12:25 AM)

Read more: http://www.nasdaq.com/symbol/fcel/premarket#ixzz2JNHbl8mk

110,805 $ 1.15

(09:12:25 AM) $ 1.15

(09:12:25 AM)

Read more: http://www.nasdaq.com/symbol/fcel/premarket#ixzz2JNHbl8mk

auch hier ergibt sich ein neuer markt für fcel, autobauer fangen an umzudenken

http://www.fool.com/investing/general/2013/02/01/electric-ve…

http://www.fool.com/investing/general/2013/02/01/electric-ve…

Antwort auf Beitrag Nr.: 44.100.603 von Spike33 am 04.02.13 15:27:01Nordamerikas größte Brennstoffzellenanlage

http://www.yourpublicmedia.org/content/wnpr/north-america-s-…

http://www.yourpublicmedia.org/content/wnpr/north-america-s-…

Antwort auf Beitrag Nr.: 44.107.968 von Spike33 am 06.02.13 09:19:31jetzt kommen die fonds und kaufen  !!!!

!!!!

http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…" target="_blank" rel="nofollow ugc noopener">http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…

!!!!

!!!!http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…" target="_blank" rel="nofollow ugc noopener">http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…

Antwort auf Beitrag Nr.: 44.107.978 von Spike33 am 06.02.13 09:21:55Hier noch einmal der korrekte Link ;-)

http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…

http://fcel.client.shareholder.com/secfiling.cfm?filingID=11…

Klingt alles sehr gut zur Zeit, ich leg sie mir auch mal auf die WL.

Aktie fällt gerade über 8%

Wo schaust du denn Xarb!? FuelCell Energy Inc. (FCEL) -NasdaqGM

1.12 + 0.01(0.90%) Feb 11, 4:00PM ES

Nachbörse geht es sogar auf 1,14 $ hoch

1.12 + 0.01(0.90%) Feb 11, 4:00PM ES

Nachbörse geht es sogar auf 1,14 $ hoch

so bin jetzt mit der ersten Posi. auch an Board

An Asuro

das war bei der Nasdaq

das war bei der Nasdaq

Xarb nix da schwankung war gerademal 2%

An asuro78

Richtig war von mir total verwechselt

Richtig war von mir total verwechselt

California Governor Issues Executive Order for Fuel Cell Cars

Will these companies now expand their efforts for new hydrogen refueling stations?

Air Products and Fuel Cell Energy have signed a Memorandum of Understanding to market a fuel cell power plant to commercial enterprises, which will pave the way for the tri-generation system to be used to create a network of hydrogen fueling stations for consumers.

Two key players in the hydrogen manufacturing arena will be working together to make hydrogen fueling stations a reality for the fuel cell vehicles that should be coming to market in the second half of this decade.

Air Products and Fuel Cell Energy have signed a Memorandum of Understanding to market stationary Direct Fuel Cell (DFC) power plants. These systems, manufactured by Fuel Cell Energy, are designed to take natural gas or renewable biogas and produce hydrogen, electricity, and heat. The three energy byproducts can be used to power and heat the production facility or nearby homes or businesses while creating hydrogen fuel for industrial fleet or consumer vehicle use.

The companies are already working together to operate a pilot facility near Los Angeles, Calif. Using captured methane generated by sewage waiting for processing at the an Orange County Sanitation District wastewater treatment facility, the DFC power plant produces hydrogen for a nearby fueling station operated by Air Products. The agreement formalizes their effort to develop a market for this clean energy solution with a low carbon footprint.

The DFC power plant is a standalone solution for companies using hydrogen-powered fleet and commercial equipment in warehouses. It offers organizations a steady supply of hydrogen fuel that doesn't require electricity to produce, and is more energy efficient than powering vehicles and equipment with natural gas. BMW is conducting a similar pilot program that converts methane from a nearby landfill to hydrogen so the auto manufacturer can power equipment and machinery at its Spartanburg, South Carolina manufacturing facility.

Initially, the DFC power plants will be used by similar industrial customers to power commercial fleets, such as hydrogen-fueled forklifts or passenger busses, that have predictable driving routes and return to the same location at night for refueling. Eventually, these systems will be built in areas that have consumer demand, such as hydrogen vehicle testing regions in California and Hawaii.

Fuel Cell Energy is also a key participant in GM's Hawaii Hydrogen Initiative. The Hawaiian island's high energy and gasoline costs in addition to its closed geographic area make it an attractive location for DFC power plants, said a Fuel Cell Energy spokesperson. However, specific locations and launch dates for consumer fueling stations were not given. The partnership is also exploring the possibility of creating a network of fueling stations in Japan and Europe.

Will these companies now expand their efforts for new hydrogen refueling stations?

Air Products and Fuel Cell Energy have signed a Memorandum of Understanding to market a fuel cell power plant to commercial enterprises, which will pave the way for the tri-generation system to be used to create a network of hydrogen fueling stations for consumers.

Two key players in the hydrogen manufacturing arena will be working together to make hydrogen fueling stations a reality for the fuel cell vehicles that should be coming to market in the second half of this decade.

Air Products and Fuel Cell Energy have signed a Memorandum of Understanding to market stationary Direct Fuel Cell (DFC) power plants. These systems, manufactured by Fuel Cell Energy, are designed to take natural gas or renewable biogas and produce hydrogen, electricity, and heat. The three energy byproducts can be used to power and heat the production facility or nearby homes or businesses while creating hydrogen fuel for industrial fleet or consumer vehicle use.

The companies are already working together to operate a pilot facility near Los Angeles, Calif. Using captured methane generated by sewage waiting for processing at the an Orange County Sanitation District wastewater treatment facility, the DFC power plant produces hydrogen for a nearby fueling station operated by Air Products. The agreement formalizes their effort to develop a market for this clean energy solution with a low carbon footprint.

The DFC power plant is a standalone solution for companies using hydrogen-powered fleet and commercial equipment in warehouses. It offers organizations a steady supply of hydrogen fuel that doesn't require electricity to produce, and is more energy efficient than powering vehicles and equipment with natural gas. BMW is conducting a similar pilot program that converts methane from a nearby landfill to hydrogen so the auto manufacturer can power equipment and machinery at its Spartanburg, South Carolina manufacturing facility.

Initially, the DFC power plants will be used by similar industrial customers to power commercial fleets, such as hydrogen-fueled forklifts or passenger busses, that have predictable driving routes and return to the same location at night for refueling. Eventually, these systems will be built in areas that have consumer demand, such as hydrogen vehicle testing regions in California and Hawaii.

Fuel Cell Energy is also a key participant in GM's Hawaii Hydrogen Initiative. The Hawaiian island's high energy and gasoline costs in addition to its closed geographic area make it an attractive location for DFC power plants, said a Fuel Cell Energy spokesperson. However, specific locations and launch dates for consumer fueling stations were not given. The partnership is also exploring the possibility of creating a network of fueling stations in Japan and Europe.

From an article in Jakarta newspaper Feb 15:

...... South Korea's ambassador Kim vowed that South Korea was committed to enhancing cooperations with Jakarta, especially to deal with the floods and traffic congestion.

The ambassador added that Korea would build an environmentally-friendly pure cell power plant in Ancol, North Jakarta.

"We are currently building that power plant and it may be soon completed. We will be able to produce electricity for Jakarta," Kim said, adding that he hoped it would be done in two to three months.

In a fuel cell power plant, the chemical energy from fuel, most commonly hydrogen, natural gas and methanol, is converted into electricity through a chemical reaction with oxygen or another oxidizing agent. Less

...... South Korea's ambassador Kim vowed that South Korea was committed to enhancing cooperations with Jakarta, especially to deal with the floods and traffic congestion.

The ambassador added that Korea would build an environmentally-friendly pure cell power plant in Ancol, North Jakarta.

"We are currently building that power plant and it may be soon completed. We will be able to produce electricity for Jakarta," Kim said, adding that he hoped it would be done in two to three months.

In a fuel cell power plant, the chemical energy from fuel, most commonly hydrogen, natural gas and methanol, is converted into electricity through a chemical reaction with oxygen or another oxidizing agent. Less

Antwort auf Beitrag Nr.: 44.152.093 von asuro78 am 18.02.13 07:37:23Hoffentlich steigt bald mal das Volumen wieder. Bei den Meldungen sollte hier doch etwas drin sein...

Es wird ein riesen Markt : http://www.fortmilltimes.com/2013/02/19/2505575/research-and…

Research and Markets: Analyzing the US Fuel Cell Market: The Fuel Cell Industry Expected To Generate More Than $18.6 Billion In 2013

DUBLIN --

Research and Markets (http://www.researchandmarkets.com/research/qc828x/analyzing_…)" target="_blank" rel="nofollow ugc noopener">http://www.researchandmarkets.com/research/qc828x/analyzing_…) has announced the addition of the updated "Analyzing the US Fuel Cell Market" report to their offering.

The world's growing dependency on fossil fuels led to the development of the fuel cell industry! The advent of the fuel cells and the recent commercialization of fuel cells in the last couple of years have changed the energy landscape of the United States.

Fuel cells are being used in the US for cogeneration to transportation. From portable power to stationary usage, the applications of fuel cells can be found in almost every industry today.

With the fuel cell industry expected to generate more than $18.6 billion in 2013, the US government has put in place several programs and initiatives to boost the development of this industry.

In this research offering, This R'search analyzes the fuel cells market in the US.

The analysis of the fuel cells market in the US includes a basic analysis of fuel cell design and technologies along with the investment profile of the industry as well. The various types of fuel cells such as alkaline, direct borohydride fuel cells, direct methanol, direct ethanol, formic acid fuel cells, and many others are profiled comprehensively in the report.

The challenges facing the US fuel cells market such as design issues, cost issues, and many other problems are analyzed, followed by an analysis of fuel cell initiatives by state.

Market outlook for the sector and an analysis of the major players in the market such as Altergy, Astris Energi, Canon, Casio, Eneos, Entegris, Cellex Power, Jadoo Power, P21, Plug Power, and many others wrap up the report on the fuel cells market in the US.

Companies Mentioned:

Altergy Systems

Astris Energi Inc.

Ballard Power Systems

California Fuel Cell Partnership

Canon

Casio

Ceramic Fuel Cells

Cellex Power

Commonwealth Scientific and Industrial Research Organization

Daimler AG

Entegris, Inc.

Eneos Celltech

Fuel Cell Technologies Ltd.

FuelCell Energy, Inc.

Hitachi

IdaTech LLC

Jadoo Power

Motorola

MTI Micro Fuel Cells

NTT DoCoMo Inc.

P21

Palcan Fuel Cells

Plug Power

Proton Energy Systems

For more information visit http://www.researchandmarkets.com/research/qc828x/analyzing_…

Research and Markets: Analyzing the US Fuel Cell Market: The Fuel Cell Industry Expected To Generate More Than $18.6 Billion In 2013

DUBLIN --

Research and Markets (http://www.researchandmarkets.com/research/qc828x/analyzing_…)" target="_blank" rel="nofollow ugc noopener">http://www.researchandmarkets.com/research/qc828x/analyzing_…) has announced the addition of the updated "Analyzing the US Fuel Cell Market" report to their offering.

The world's growing dependency on fossil fuels led to the development of the fuel cell industry! The advent of the fuel cells and the recent commercialization of fuel cells in the last couple of years have changed the energy landscape of the United States.

Fuel cells are being used in the US for cogeneration to transportation. From portable power to stationary usage, the applications of fuel cells can be found in almost every industry today.

With the fuel cell industry expected to generate more than $18.6 billion in 2013, the US government has put in place several programs and initiatives to boost the development of this industry.

In this research offering, This R'search analyzes the fuel cells market in the US.

The analysis of the fuel cells market in the US includes a basic analysis of fuel cell design and technologies along with the investment profile of the industry as well. The various types of fuel cells such as alkaline, direct borohydride fuel cells, direct methanol, direct ethanol, formic acid fuel cells, and many others are profiled comprehensively in the report.

The challenges facing the US fuel cells market such as design issues, cost issues, and many other problems are analyzed, followed by an analysis of fuel cell initiatives by state.

Market outlook for the sector and an analysis of the major players in the market such as Altergy, Astris Energi, Canon, Casio, Eneos, Entegris, Cellex Power, Jadoo Power, P21, Plug Power, and many others wrap up the report on the fuel cells market in the US.

Companies Mentioned:

Altergy Systems

Astris Energi Inc.

Ballard Power Systems

California Fuel Cell Partnership

Canon

Casio

Ceramic Fuel Cells

Cellex Power

Commonwealth Scientific and Industrial Research Organization

Daimler AG

Entegris, Inc.

Eneos Celltech

Fuel Cell Technologies Ltd.

FuelCell Energy, Inc.

Hitachi

IdaTech LLC

Jadoo Power

Motorola

MTI Micro Fuel Cells

NTT DoCoMo Inc.

P21

Palcan Fuel Cells

Plug Power

Proton Energy Systems

For more information visit http://www.researchandmarkets.com/research/qc828x/analyzing_…

PIKE RESEARCH ON STATIONARY FUEL CELLS

January 9, 2013 Over the past year, the stationary fuel cell industry has experienced healthy growth due to a surge in U.S. and

foreign government interest in reliable and resilient energy sources. The sector is now at a point where, if all government policy relevant to stationary fuel cells was carried out, the global market potential would surpass three gigawatts (GW) in 2013, and increasing to more than 50 GW by 2020. According to a new report from Pike Research, a part of Navigant"s Energy Practice, the number of stationary fuel cells shipped annually will increase from 21,000 in 2012 to more than 350,000 by 2020!!!!

January 9, 2013 Over the past year, the stationary fuel cell industry has experienced healthy growth due to a surge in U.S. and

foreign government interest in reliable and resilient energy sources. The sector is now at a point where, if all government policy relevant to stationary fuel cells was carried out, the global market potential would surpass three gigawatts (GW) in 2013, and increasing to more than 50 GW by 2020. According to a new report from Pike Research, a part of Navigant"s Energy Practice, the number of stationary fuel cells shipped annually will increase from 21,000 in 2012 to more than 350,000 by 2020!!!!

News aus Canada !

FuelCell Energy kündigt Vertrag zur Methan-Gas-Ultra-Clean Elektrizität, Wärme und EE-Wasserstoff umwandeln

Tri-Generation Brennstoffzellen-Anlage auf einer Deponie in Vancouver, Kanada

Press Release : FuelCell Energy, Inc. - vor 12 Minuten

E-Mail

Drucken

ÄHNLICHE KURSE

Symbol Preis Ändern

VFF.TO 0,91 0,00

Danbury, Connecticut, 28. Februar 2013 (GLOBE NEWSWIRE) - FuelCell Energy, Inc. ( FCEL ) ein weltweit führendes Unternehmen in der Entwicklung, Herstellung, Betrieb und Service von ultra-saubere, effiziente und zuverlässige Brennstoffzellen-Kraftwerke heute kündigte einen Vertrag über eine Tri-Generation stationärer Brennstoffzellen-Kraftwerk in der Nähe Vancouver, British Columbia, Kanada zeigen, Nutzung Deponiegas als Energiequelle. Das Deponiegas clean-up wird durch Quadrogen Power Systems, Inc., der Hauptauftragnehmer durchgeführt werden, und die gereinigte Deponiegas wird von der Brennstoffzellen-Kraftwerk genutzt werden, um mehrere Einnahmequellen, einschließlich ultra-sauberen Strom erzeugen nutzbare hohe Qualität Wärme-und EE-Wasserstoff. Die Wärme in Form von heißem Wasser zu Village Farms, ein führender Hydrokultur Gewächshaus Betreiber in Nordamerika geliefert werden. Erneuerbare Wasserstoff wird auch für Fahrzeug-Betankung oder industrielle Anwendungen exportiert werden.

"Ein Teil unserer Unternehmensstrategie als sehr nachhaltige und verantwortungsvolle Verwalter der natürlichen Ressourcen", sagte Jonathan Bos, Development Director, Village Farms International, Inc. "Wir freuen uns, den Teilnehmern in der Brennstoffzelle Deponiegas-Projekt sein, um seine Vorteile zu ermitteln sowohl für unser Unternehmen durch die Umwandlung schädlicher Abgase in Lebensmittelqualität Kohlendioxid, sowie andere Geschäftsmöglichkeiten kommen aus anderen Wert-Streams aus dem Abfalldeponien Gas. "

"Diese Technologie wird dazu beitragen, Treibhausgase Betreiber ihre Wettbewerbsfähigkeit verbessern, indem sie ihre Operationen mehr ökologisch und ökonomisch nachhaltig durch den Einsatz von Biogas", sagte der kanadische Landwirtschaftsminister Gerry Ritz. "Wir sind stolz darauf, ein Partner in diesen Arten von innovativen Energie-Lösungen, die die Rentabilität der Landwirtschaft zu erhöhen."

"Die Partnerschaft mit FuelCell Energy vereint unser Gas clean-up Expertise mit dem Tri-Generation Leistung der stationären Brennstoffzellen, wie wir eine schädliche Nebenprodukt der Deponien zu konvertieren in mehrere Einnahmequellen", sagte Alakh Prasad, President & CEO, Quadrogen Power Systems, Inc. "Reinigung Deponiegas, bevor es von den Brennstoffzellen verwendet wird, stellt besondere Herausforderungen zur Entfernung von Verunreinigungen, die Brennstoffzellen-Leistung auswirken, sowie das Entfernen schädlicher organischer Chemikalien, die keinen Einfluss auf die Brennstoffzellen kann aber nicht in die Atmosphäre freigesetzt werden können. "

"Dieses Projekt bietet die erste Gelegenheit, um die Anwendung unserer Direct FuelCell Technologie mit erneuerbaren Deponiegas zu demonstrieren, zusätzlich zur Weiterentwicklung unserer Wasserstoff-Co-Produktion-Technologie", sagte Tony Leo, Vice President Application Engineering & Advanced Technology Development, FuelCell Energy, Inc . "Deponiegas ist ein großes Marktpotenzial, das einzigartig Gasreinigung Anforderungen stellt. Unser Partner in diesem Projekt, Quadrogen Power Systems, hat eine effektive Beseitigung Technologie entwickelt, was durch die hohe Leistung ihrer Geräte an einem bestehenden gezeigt Wasserstoff Koproduktion Brennstoffzellen-Anlage in Kalifornien, die Bereitstellung von ultra-sauberen Strom und Wasserstoff für Fahrzeuge Betankung aus erneuerbaren Biogas durch eine Kläranlage erzeugt wird. "

Die Deponie für die Stadt Vancouver, Kanada hat eine erweiterte Gassammelsystem. Ein Teil des Gases wird aufgeweitet, Auszehrung ein Potential Brennstoffquelle und Erzeugen Schadstoffe wie Smog produzierenden Stickoxid (NOx). Mit dem Deponiegas ultra-sauberen Strom erzeugen wandelt ein Entsorgungsproblem in eine umweltfreundliche Einnahmequelle. Stromerzeugung wird voraussichtlich im Frühjahr 2014 beginnen. Ein erfolgreiches Projekt Demonstration könnte weitere Projekte in dieser Deponie sowie andere Deponien führen.

Agriculture and Agri-Food Canada ist in diesem Projekt zu investieren, indem sie einen rückzahlbaren Beitrag über die Regierung der kanadischen Landwirtschaft Kanadas Adaptation Program, das zur Unterstützung der kanadischen Landwirtschaft anpassen und wettbewerbsfähig bleiben will. In British Columbia, wird dieses Programm durch die Investition Landwirtschaft Foundation ausgeliefert.

Weitere Projektpartner sind Sustainable Development Technology Canada (SDTC), National Research Council of Canada (NRC) und BC Bioenergie Netzwerk.

Direct FuelCell (R) (DFC (R)) Kraftwerke erzeugen kontinuierliche Grundlast Macht in einer hocheffizienten und umweltfreundlichen Verfahren. Aufgrund der Abwesenheit einer Verbrennung in dem Brennstoffzellenleistungserzeugungsschritt Verfahren werden praktisch keine Schadstoffe wie Stickoxide (NOx), Schwefeldioxid (SO x) oder Partikeln (PM emittierten 10 ), was zu ultrareine Stromerzeugung. Die Kraftwerke sind Kraftstoff flexible, mit leicht verfügbaren Energiequellen wie Erdgas, erneuerbare Biogas, gerichtet Biogas oder für dieses Projekt, Deponiegas. Der elektro-chemischen Verfahren zur Energiegewinnung verwendet nicht den gesamten Wasserstoff aus dem Brennstoff-Quelle erzeugt werden, so die nicht verwendete Wasserstoff für andere Zwecke wie Fahrzeugs Betankung oder industrielle Zwecke, wie diese Anwendung verwendet werden kann, zu demonstrieren.

Der hohe Wirkungsgrad der Brennstoffzelle Stromerzeugung resultiert in niedrigen Kohlendioxid-Emissionen, insbesondere wenn die Verbrennung Stromerzeugung Alternativen verglichen. Stromerzeugung von einer Brennstoffquelle, wie Deponiegas wird typischerweise als klimaneutrale aufgrund der Natur der erneuerbaren Energiequelle.

Dieses Projekt wird FuelCell Energy Solid-State elektrochemischen Wasserstoff-Abtrennung und-Komprimierung (EHSC)-Technologie Anwendung, die effizient und kostengünstig reinigt und komprimiert Wasserstoff für industrielle Zwecke oder Fahrzeug Betankung.

Dorf Farms International, Inc. ( VFF.TO ) wächst und vermarktet Gewächshaus Gemüse aus eigenem Anbau in Nordamerika. Mit mehr als 200 Hektar Gewächshäuser, ist Village Farms führend in der Hydrokultur Gewächshaus Industrie.

Quadrogen Power Systems, Inc. baut und installiert Hochleistungs Biogas clean-up-Lösungen in der Lage Reinigung erneuerbaren Kraftstoffen aus jeder beliebigen Quelle. Die Clean-up-Technologien sind modular aufgebaut und lassen sich effektiv reinigen Deponiegas, Klärgas oder Synthesegas kosten. Das Unternehmen ist in Vancouver, BC, Kanada. Weitere Informationen finden Sie unterwww.quadrogen.com

Über FuelCell Energy

Direct FuelCell (R)-Kraftwerke erzeugen ultra-saubere, effiziente und zuverlässige Leistung bei mehr als 50 Standorten weltweit. Mit mehr als 300 Megawatt Kraftwerkskapazität installiert oder im Auftragsbestand ist FuelCell Energy ein weltweit führendes Unternehmen bei der Bereitstellung von ultra-clean Grundlast dezentrale Erzeugung Versorgungsunternehmen, Industriebetriebe, Universitäten, kommunale Kläranlagen, Regierungseinrichtungen und andere Kunden auf der ganzen Welt. Die Gesellschaft Kraftwerke haben mehr als 1,5 Milliarden Kilowattstunden von ultra-sauberen Strom erzeugt mit einer Vielzahl von Brennstoffen einschließlich erneuerbarer Biogas aus Abwasser-und Nahrungsmittelindustrie, sowie saubere Erdgas. Für weitere Informationen, besuchen Sie bitte unsere Website unterwww.fuelcellenergy.com

Besuchen Sie uns auf YouTube unter www.youtube.com/user/FuelCellEnergyInc?feature=watch

Die FuelCell Energy, Inc. logo finden Sie unter http://www.globenewswire.com/newsroom/prs/?pkgid=3284

Diese Pressemitteilung enthält zukunftsgerichtete Aussagen, darunter Aussagen über die Pläne des Unternehmens sowie die Erwartungen über die weitere Entwicklung, Vermarktung und Finanzierung der Brennstoffzellen-Technologie und Business-Pläne. Alle zukunftsgerichteten Aussagen unterliegen Risiken und Unsicherheiten, aufgrund derer die tatsächlichen Ergebnisse erheblich von den Prognosen abweichen können. Faktoren, die solche Abweichungen verursachen können, gehören, ohne Einschränkung, ob das Unternehmen in der Lage, definitive Vereinbarungen über die Bedingungen in den Memoranden der Vereinbarung mit POSCO Energie, allgemeine Risiken im Zusammenhang mit Produktentwicklung, Herstellung, Änderungen im regulatorischen Umfeld, Kunden zugeordnet Betracht zu erreichen ist Strategien, die potenzielle Volatilität der Energiepreise, des raschen technologischen Wandels, Wettbewerb und die Fähigkeit des Unternehmens, seine Verkäufe Pläne und Kosten Reduktionsziele, sowie andere Risiken, die in den Einreichungen des Unternehmens bei der Securities and Exchange Commission zu erreichen. Die zukunftsgerichteten Aussagen enthaltenen sprechen nur ab dem Datum dieser Pressemitteilung. Das Unternehmen lehnt ausdrücklich jegliche Verpflichtung oder Absicht zur Veröffentlichung von Aktualisierungen oder Revisionen dieser zukunftsbezogenen Aussagen hinsichtlich geänderter Erwartungen der Gesellschaft oder Veränderungen bei Geschehnissen, Bedingungen oder Umstände, auf denen diese Aussagen beruhen.

Direct FuelCell, DFC, DFC / T, DFC-H2 und FuelCell Energy, Inc. sind registrierte Warenzeichen der FuelCell Energy, Inc. DFC-ERG ist ein eingetragenes Warenzeichen gemeinsam von Enbridge, Inc. und FuelCell Energy, Inc.

Kontakt:

FuelCell Energy, Inc.

Kurt Goddard, Vice President Investor Relations

203-830-7494

ir@fce.com

Quadrogen Power Systems, Inc.

Darren Jang, Project Engineer

604-221-7170

@ Yahoofinance auf Twitter, ein Fan auf sich Facebook

FuelCell Energy kündigt Vertrag zur Methan-Gas-Ultra-Clean Elektrizität, Wärme und EE-Wasserstoff umwandeln

Tri-Generation Brennstoffzellen-Anlage auf einer Deponie in Vancouver, Kanada

Press Release : FuelCell Energy, Inc. - vor 12 Minuten

ÄHNLICHE KURSE

Symbol Preis Ändern

VFF.TO 0,91 0,00

Danbury, Connecticut, 28. Februar 2013 (GLOBE NEWSWIRE) - FuelCell Energy, Inc. ( FCEL ) ein weltweit führendes Unternehmen in der Entwicklung, Herstellung, Betrieb und Service von ultra-saubere, effiziente und zuverlässige Brennstoffzellen-Kraftwerke heute kündigte einen Vertrag über eine Tri-Generation stationärer Brennstoffzellen-Kraftwerk in der Nähe Vancouver, British Columbia, Kanada zeigen, Nutzung Deponiegas als Energiequelle. Das Deponiegas clean-up wird durch Quadrogen Power Systems, Inc., der Hauptauftragnehmer durchgeführt werden, und die gereinigte Deponiegas wird von der Brennstoffzellen-Kraftwerk genutzt werden, um mehrere Einnahmequellen, einschließlich ultra-sauberen Strom erzeugen nutzbare hohe Qualität Wärme-und EE-Wasserstoff. Die Wärme in Form von heißem Wasser zu Village Farms, ein führender Hydrokultur Gewächshaus Betreiber in Nordamerika geliefert werden. Erneuerbare Wasserstoff wird auch für Fahrzeug-Betankung oder industrielle Anwendungen exportiert werden.

"Ein Teil unserer Unternehmensstrategie als sehr nachhaltige und verantwortungsvolle Verwalter der natürlichen Ressourcen", sagte Jonathan Bos, Development Director, Village Farms International, Inc. "Wir freuen uns, den Teilnehmern in der Brennstoffzelle Deponiegas-Projekt sein, um seine Vorteile zu ermitteln sowohl für unser Unternehmen durch die Umwandlung schädlicher Abgase in Lebensmittelqualität Kohlendioxid, sowie andere Geschäftsmöglichkeiten kommen aus anderen Wert-Streams aus dem Abfalldeponien Gas. "

"Diese Technologie wird dazu beitragen, Treibhausgase Betreiber ihre Wettbewerbsfähigkeit verbessern, indem sie ihre Operationen mehr ökologisch und ökonomisch nachhaltig durch den Einsatz von Biogas", sagte der kanadische Landwirtschaftsminister Gerry Ritz. "Wir sind stolz darauf, ein Partner in diesen Arten von innovativen Energie-Lösungen, die die Rentabilität der Landwirtschaft zu erhöhen."

"Die Partnerschaft mit FuelCell Energy vereint unser Gas clean-up Expertise mit dem Tri-Generation Leistung der stationären Brennstoffzellen, wie wir eine schädliche Nebenprodukt der Deponien zu konvertieren in mehrere Einnahmequellen", sagte Alakh Prasad, President & CEO, Quadrogen Power Systems, Inc. "Reinigung Deponiegas, bevor es von den Brennstoffzellen verwendet wird, stellt besondere Herausforderungen zur Entfernung von Verunreinigungen, die Brennstoffzellen-Leistung auswirken, sowie das Entfernen schädlicher organischer Chemikalien, die keinen Einfluss auf die Brennstoffzellen kann aber nicht in die Atmosphäre freigesetzt werden können. "

"Dieses Projekt bietet die erste Gelegenheit, um die Anwendung unserer Direct FuelCell Technologie mit erneuerbaren Deponiegas zu demonstrieren, zusätzlich zur Weiterentwicklung unserer Wasserstoff-Co-Produktion-Technologie", sagte Tony Leo, Vice President Application Engineering & Advanced Technology Development, FuelCell Energy, Inc . "Deponiegas ist ein großes Marktpotenzial, das einzigartig Gasreinigung Anforderungen stellt. Unser Partner in diesem Projekt, Quadrogen Power Systems, hat eine effektive Beseitigung Technologie entwickelt, was durch die hohe Leistung ihrer Geräte an einem bestehenden gezeigt Wasserstoff Koproduktion Brennstoffzellen-Anlage in Kalifornien, die Bereitstellung von ultra-sauberen Strom und Wasserstoff für Fahrzeuge Betankung aus erneuerbaren Biogas durch eine Kläranlage erzeugt wird. "

Die Deponie für die Stadt Vancouver, Kanada hat eine erweiterte Gassammelsystem. Ein Teil des Gases wird aufgeweitet, Auszehrung ein Potential Brennstoffquelle und Erzeugen Schadstoffe wie Smog produzierenden Stickoxid (NOx). Mit dem Deponiegas ultra-sauberen Strom erzeugen wandelt ein Entsorgungsproblem in eine umweltfreundliche Einnahmequelle. Stromerzeugung wird voraussichtlich im Frühjahr 2014 beginnen. Ein erfolgreiches Projekt Demonstration könnte weitere Projekte in dieser Deponie sowie andere Deponien führen.