Rohstoffe, Angebot/Nachfrage - 500 Beiträge pro Seite

eröffnet am 11.09.14 08:32:17 von

neuester Beitrag 02.11.19 22:08:46 von

neuester Beitrag 02.11.19 22:08:46 von

Beiträge: 2.052

ID: 1.198.959

ID: 1.198.959

Aufrufe heute: 0

Gesamt: 67.810

Gesamt: 67.810

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 24 Minuten | 7113 | |

| vor 32 Minuten | 4316 | |

| vor 37 Minuten | 2460 | |

| vor 50 Minuten | 2458 | |

| heute 09:10 | 2089 | |

| vor 41 Minuten | 1940 | |

| heute 12:24 | 1807 | |

| vor 29 Minuten | 1513 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.881,00 | -1,15 | 228 | |||

| 2. | 3. | 149,78 | -1,17 | 96 | |||

| 3. | 2. | 9,4100 | -2,44 | 90 | |||

| 4. | 4. | 0,1885 | -2,84 | 76 | |||

| 5. | 6. | 0,0211 | -32,59 | 53 | |||

| 6. | 34. | 0,6300 | -55,00 | 49 | |||

| 7. | 14. | 6,9260 | +2,79 | 48 | |||

| 8. | 13. | 391,10 | -15,26 | 44 |

im Endeffekt alles -auch warum eingestelltes vielleicht falsch sein sollte, und so- zum Thema kann hier rein.

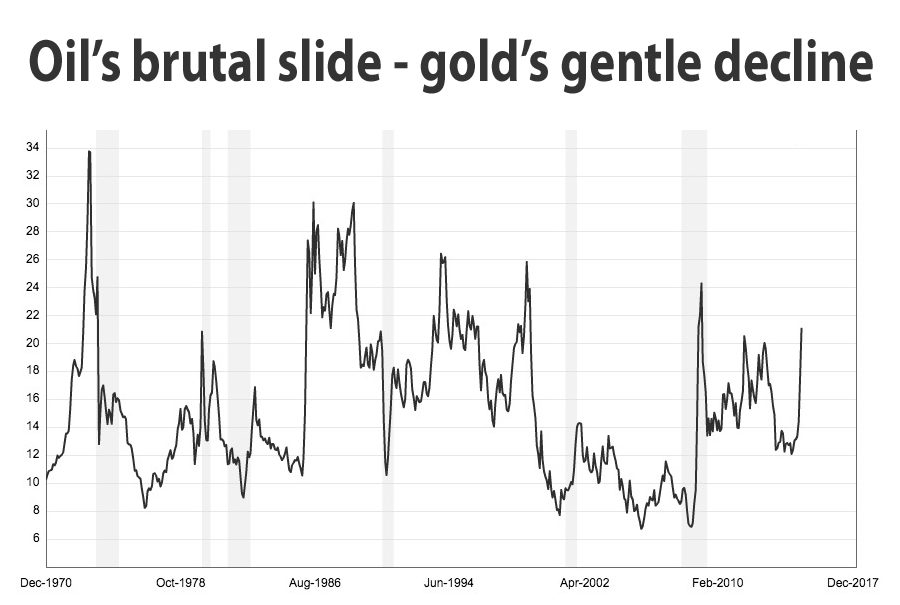

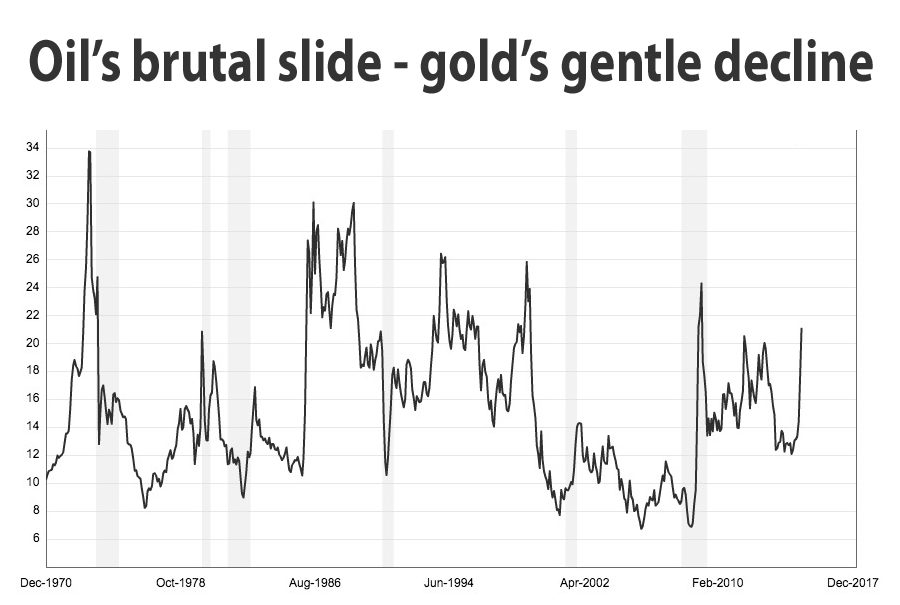

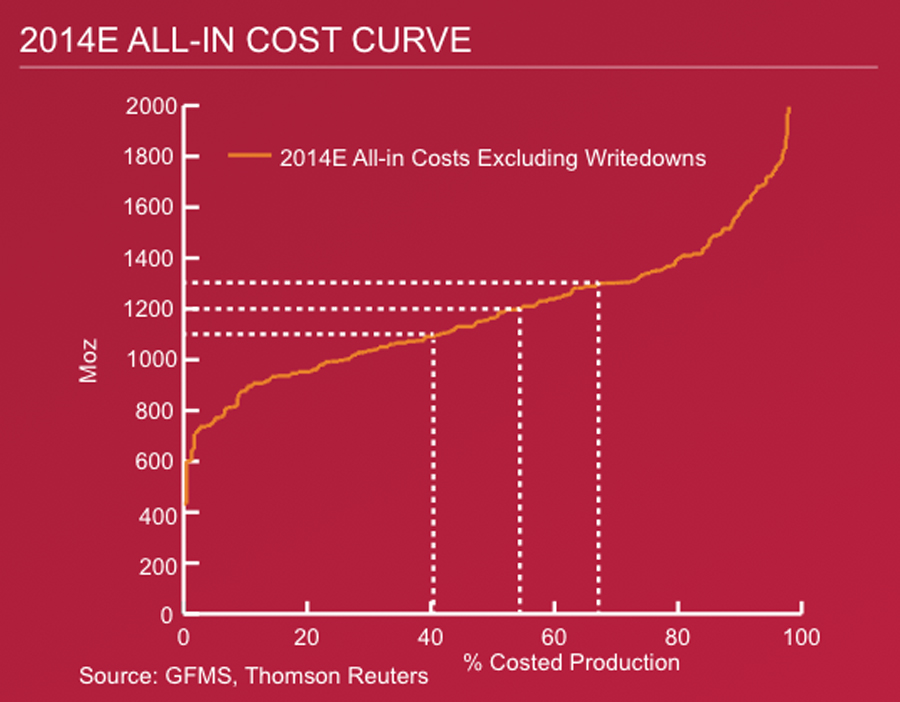

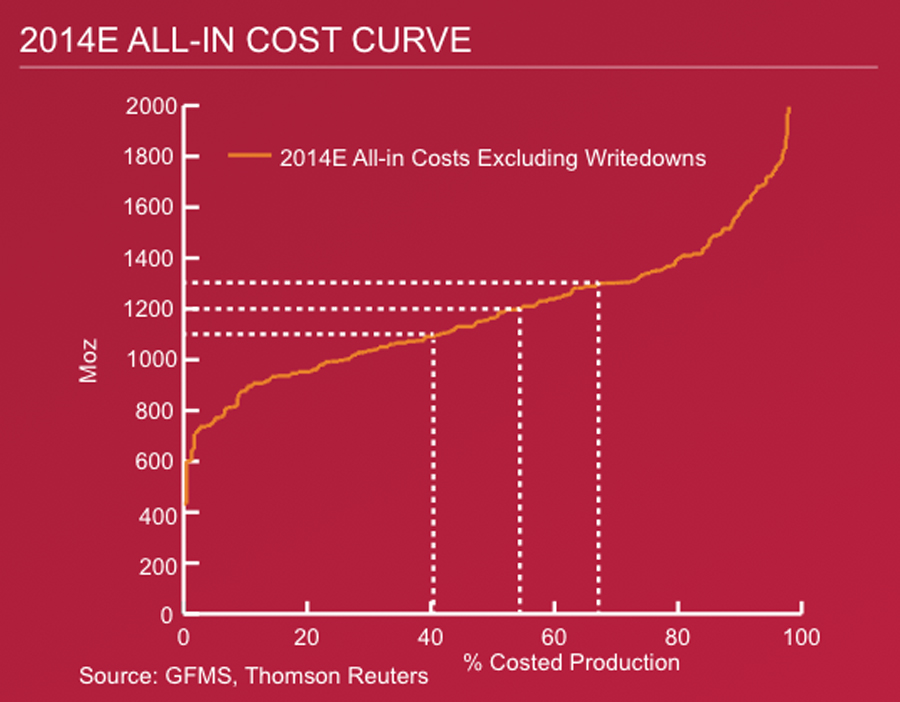

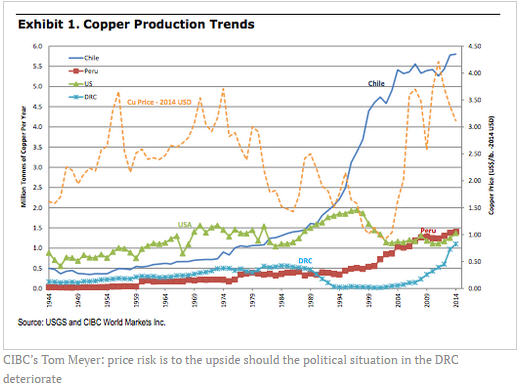

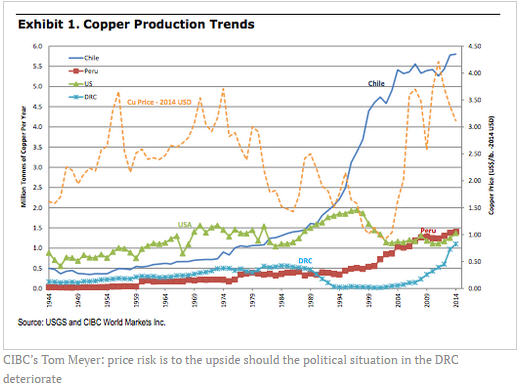

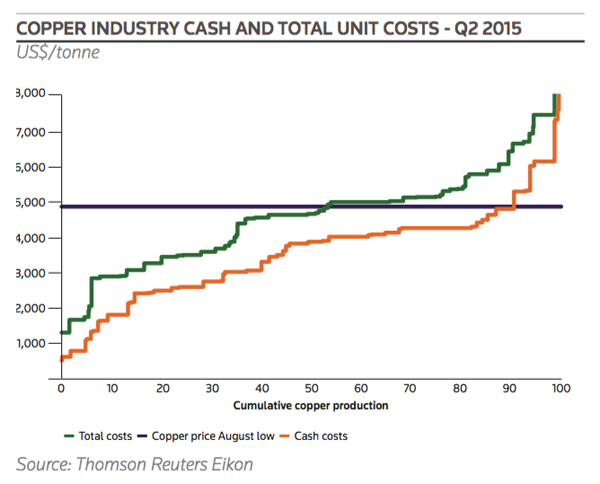

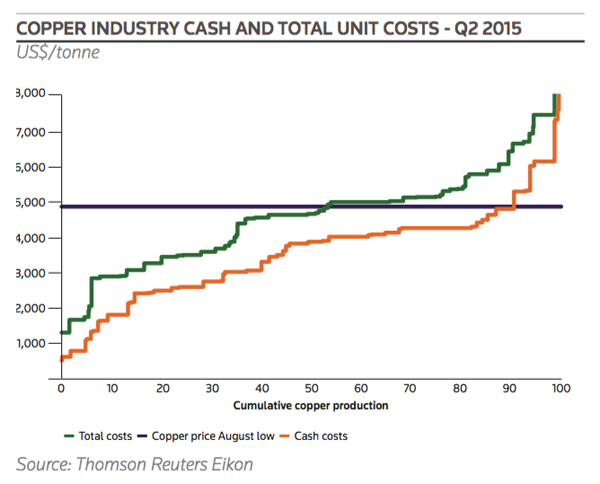

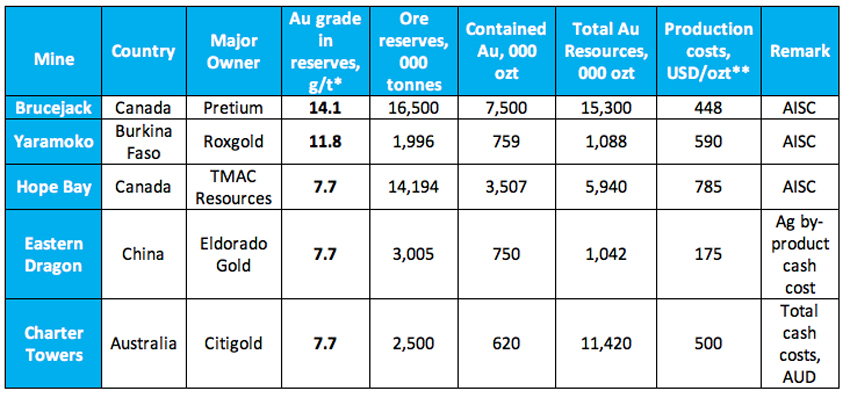

Auch (durchschnittliche?)Kostenstrukturen der Förderer, und so Zeug.

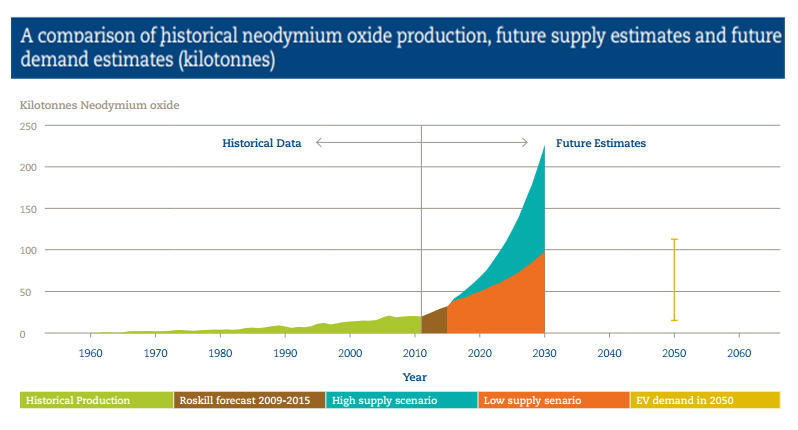

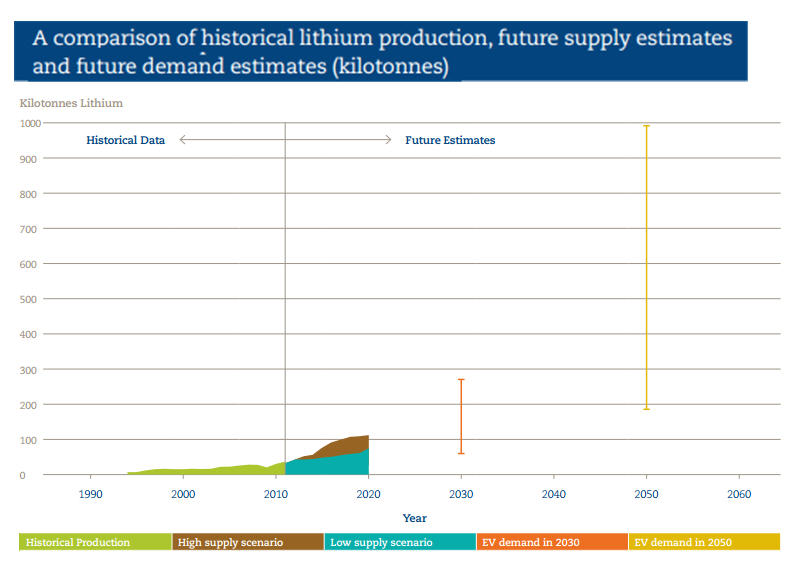

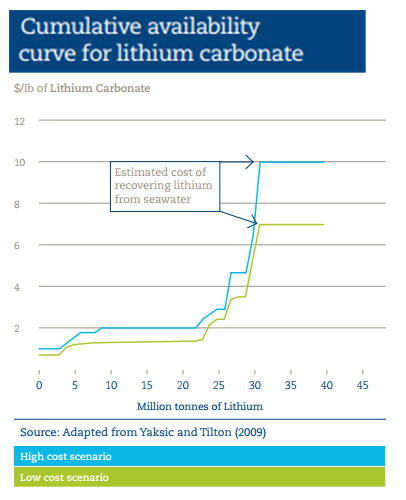

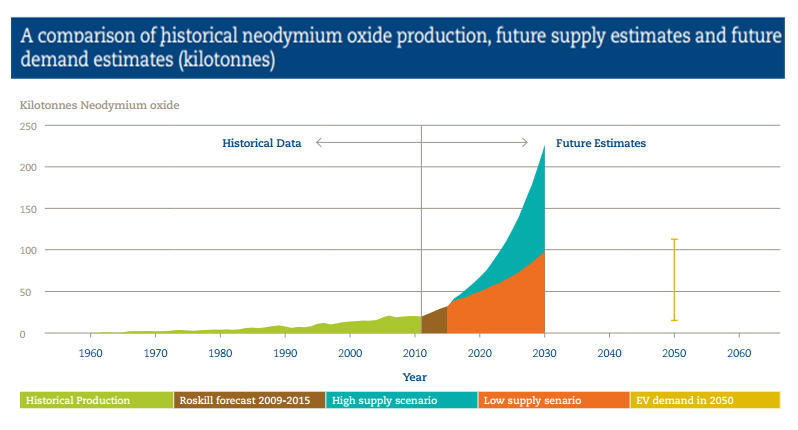

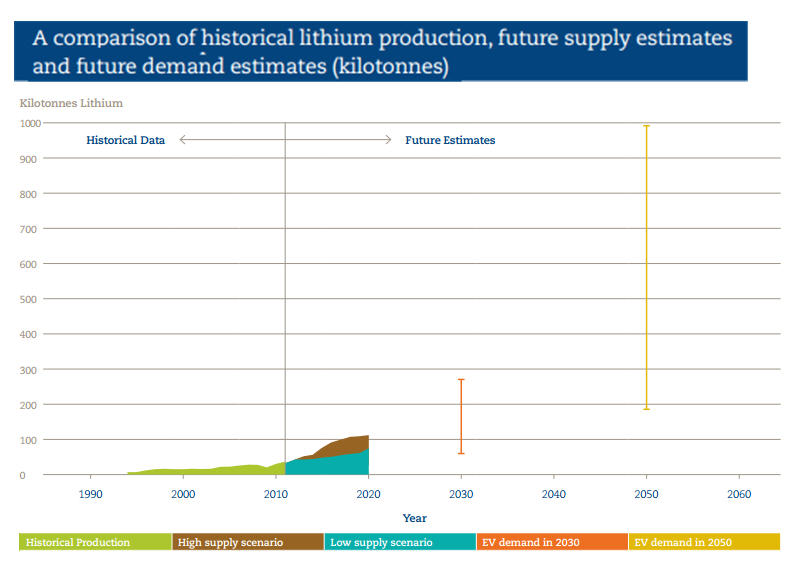

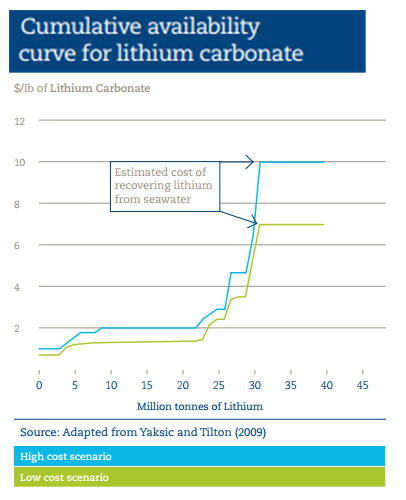

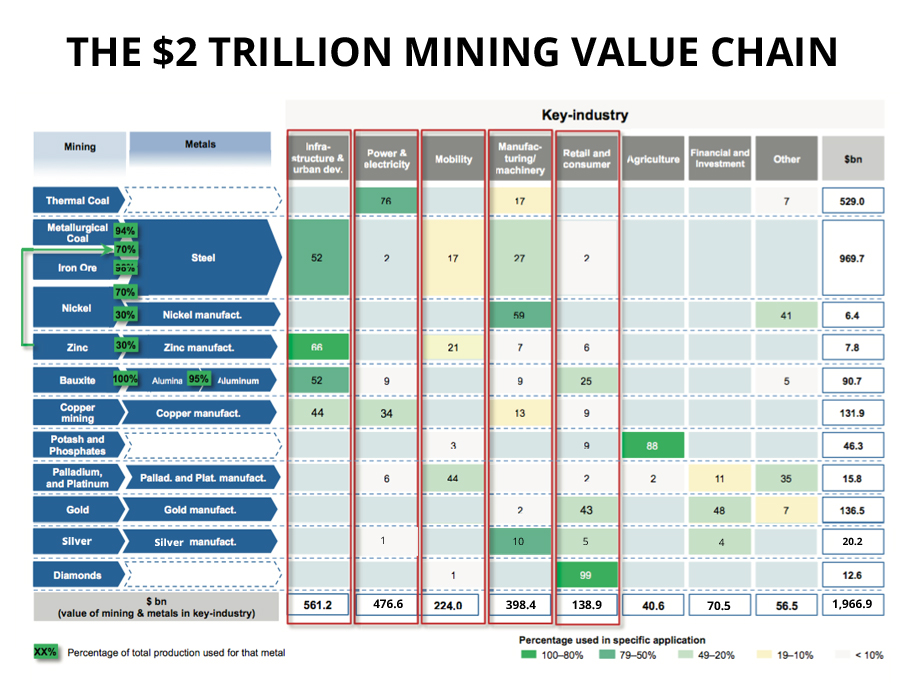

Folgend einige Graphiken, Langzeitbetrachtungen und Schätzungen.

www.mining.com/charts-chasm-between-future-lithium-supply-de…

Auch (durchschnittliche?)Kostenstrukturen der Förderer, und so Zeug.

Folgend einige Graphiken, Langzeitbetrachtungen und Schätzungen.

www.mining.com/charts-chasm-between-future-lithium-supply-de…

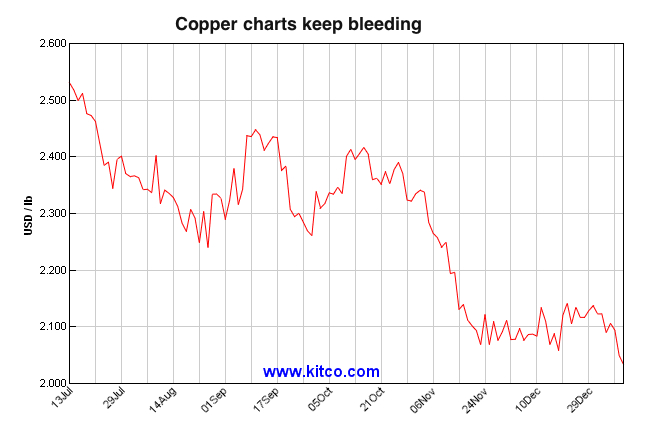

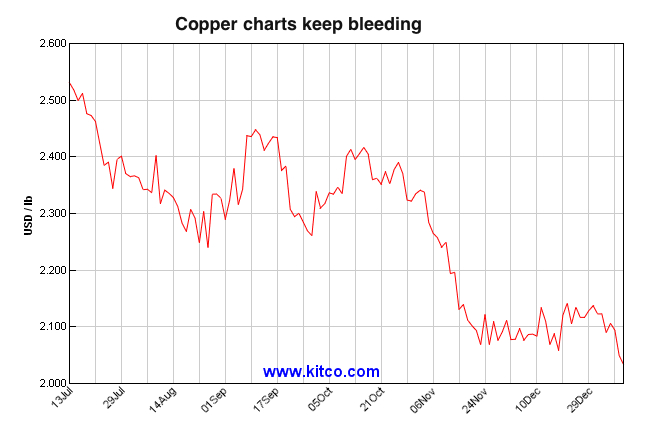

Kupfer: Das Ende der Preisschmelze

Wirtschaftsaufschwung und Angebotsengpässe könnten bei Kupfer & Co für höhere Notierungen sorgen. Mit einem Zertifikat lässt sich auf den Preisanstieg wetten.

von Andreas Höß, Euro am Sonntag

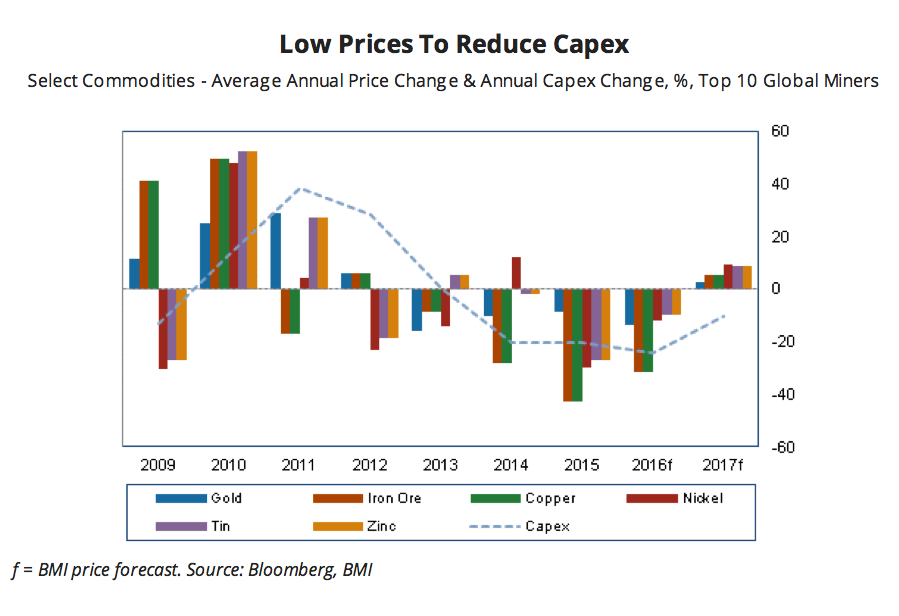

Von 2011 bis 2013 sind die Preise für Industriemetalle drastisch gefallen. Seit Jahresanfang stabilisierten sich die Notierungen für die konjunkturabhängigen Metalle wieder und haben in den vergangenen Wochen sogar angezogen. Der Grund: Das jahrelange Überangebot scheint vorbei. Zugleich könnte die Nachfrage zunehmen, weil sich neben der US-Wirtschaft auch China erholt.

Man halte am Wachstumsziel von 7,5 Prozent in diesem Jahr fest, sagte Ministerpräsident Li Keqiang am Montag am Rande des Besuchs von Kanzlerin Angela Merkel in Peking. Das heißt: China könnte erneut riesige Konjunkturpakete auflegen. Schon im Juni war bekannt geworden, dass die Regierung die Wirtschaft mit Milliarden stützt und die Staatsausgaben um knapp ein Viertel gesteigert hat. Die Geldspritze spürt man bereits. Die Stimmung unter Chinas Einkaufsmanagern ist gestiegen, was auf höhere Industrieproduktion schließen lässt.

Glaubt man der Investmentbank Morgan Stanley, würden von weiteren Geldspritzen vor allem die Industriemetalle profitieren. China ist der größte Rohstoffimporteur der Welt und braucht beispielsweise Zink und Nickel für die Stahlproduktion. Bei beiden Metallen gab es bereits wegen Minenschließungen und einem Exportstopp in Indonesien Angebotsengpässe. Auch bei Kupfer und Aluminium sinkt das Angebot, während die Nachfrage beispielsweise aus der Automobilindustrie und dem Technologiesektor steigt.

Anleger können mit einem Zertifikat (ISIN: DE 000 A0K RKG 7), das den Bloomberg Industrial Metals Subindex abbildet, auf einen Preisanstieg bei Kupfer & Co setzen.

Gute Idee, ich habe mich vor ein paar Monaten in den Rohstoffsektor eigekauft und mein Depot zu 25 % umgestellt

- Gold ETF, Iamgold

- Silber ETF

- Zink (Nyrstar)

- Kupfer (KAZ..)

- Einsenerz (Vale)

- Molydaenium (China Moly)

Wirtschaftsaufschwung und Angebotsengpässe könnten bei Kupfer & Co für höhere Notierungen sorgen. Mit einem Zertifikat lässt sich auf den Preisanstieg wetten.

von Andreas Höß, Euro am Sonntag

Von 2011 bis 2013 sind die Preise für Industriemetalle drastisch gefallen. Seit Jahresanfang stabilisierten sich die Notierungen für die konjunkturabhängigen Metalle wieder und haben in den vergangenen Wochen sogar angezogen. Der Grund: Das jahrelange Überangebot scheint vorbei. Zugleich könnte die Nachfrage zunehmen, weil sich neben der US-Wirtschaft auch China erholt.

Man halte am Wachstumsziel von 7,5 Prozent in diesem Jahr fest, sagte Ministerpräsident Li Keqiang am Montag am Rande des Besuchs von Kanzlerin Angela Merkel in Peking. Das heißt: China könnte erneut riesige Konjunkturpakete auflegen. Schon im Juni war bekannt geworden, dass die Regierung die Wirtschaft mit Milliarden stützt und die Staatsausgaben um knapp ein Viertel gesteigert hat. Die Geldspritze spürt man bereits. Die Stimmung unter Chinas Einkaufsmanagern ist gestiegen, was auf höhere Industrieproduktion schließen lässt.

Glaubt man der Investmentbank Morgan Stanley, würden von weiteren Geldspritzen vor allem die Industriemetalle profitieren. China ist der größte Rohstoffimporteur der Welt und braucht beispielsweise Zink und Nickel für die Stahlproduktion. Bei beiden Metallen gab es bereits wegen Minenschließungen und einem Exportstopp in Indonesien Angebotsengpässe. Auch bei Kupfer und Aluminium sinkt das Angebot, während die Nachfrage beispielsweise aus der Automobilindustrie und dem Technologiesektor steigt.

Anleger können mit einem Zertifikat (ISIN: DE 000 A0K RKG 7), das den Bloomberg Industrial Metals Subindex abbildet, auf einen Preisanstieg bei Kupfer & Co setzen.

Gute Idee, ich habe mich vor ein paar Monaten in den Rohstoffsektor eigekauft und mein Depot zu 25 % umgestellt

- Gold ETF, Iamgold

- Silber ETF

- Zink (Nyrstar)

- Kupfer (KAZ..)

- Einsenerz (Vale)

- Molydaenium (China Moly)

Sehr interessant !

12.09.2014 11:11

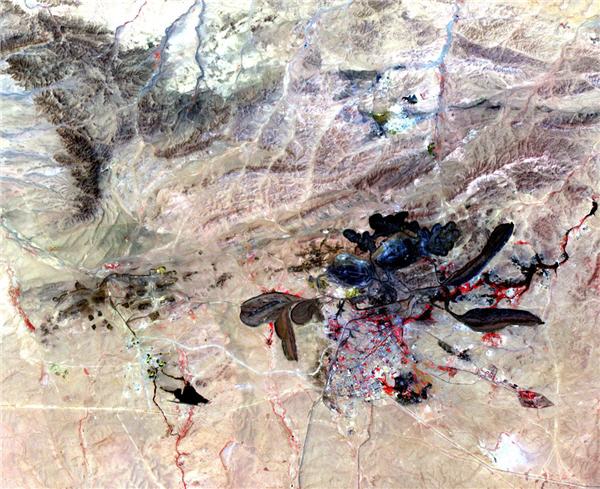

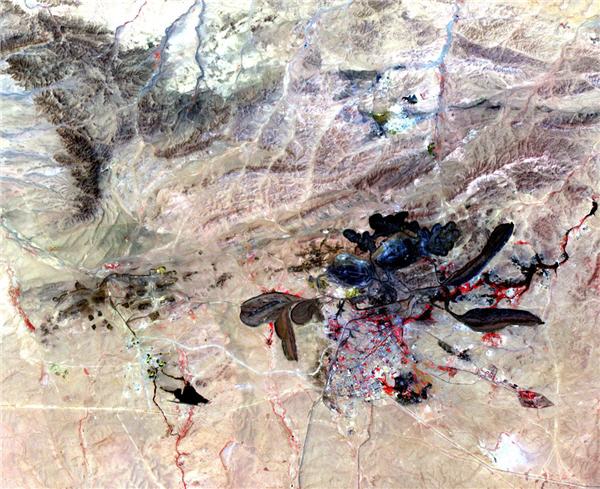

Chinas globaler Rohstoffplan geht nicht auf

Von Wayne Arnold

CAPE PRESTON, Australien--Eine Mine in einem abgelegenen Teil Australiens ist ein gutes Beispiel dafür, was bei Chinas jahrzehntelangem Versuch, sich auf der ganzen Welt mit Rohstoffen einzudecken, alles schief gegangen ist. Es hat mehr als acht Jahre und den Einsatz von etwa 10 Milliarden US-Dollar gebraucht, um die Mine in der Nähe eines abgelegenen Hafens in Betrieb zu nehmen.

Die Eisenerzmine von Citic Pacific hat am Ende fast das Vierfache des ursprünglich veranschlagten Budgets gekostet. Analysten, die das Projekt verfolgen, rechnen damit, dass es in seinem ersten vollen Betriebsjahr 2014 Hunderte von Millionen Dollar an Verlust machen wird.

Das alles kommt nicht von ungefähr. Citic Pacific, ein in Hongkong beheimatetes Tochterunternehmen der staatseigenen chinesischen Finanz- und Investmentgesellschaft Citic Group, hat sich zusammen mit ein paar Auftragsfirmen eine Reihe von groben Schnitzern bei dem Projekt erlaubt. So glaubte man, einfach Arbeiter aus China zu Dumping-Löhnen vor Ort beschäftigen zu können. Und dann verbockte Citic Pacific auch noch eine Wette auf Währungsentwicklungen und war am Ende gezwungen, sich von der Muttergesellschaft mit Rettungsgeldern in Höhe von 1,5 Milliarden Dollar aus der Patsche helfen zu lassen.

Jetzt endlich exportiert die Sino Mine Eisenerz - aber gleichzeitig ist Citic immer noch in einen Rechtsstreit mit einem lokalen Partner verwickelt. Der Immobilien- und Bergbaumogul Clive Palmer, der inzwischen als Führer einer von ihm gegründeten Partei im australischen Parlament sitzt, wirft den Chinesen vor, australische Rohstoffe aus dem Land zu schaffen, ohne dafür angemessen zu bezahlen.

"Es war ein schmerzhafter Lernprozess für uns", sagt Zhang Jijing, der 16 Jahre lang das gesamte Australiengeschäft der Muttergesellschaft Citic Group geleitet hatte, ehe er Ende 2009 zum Präsident und Vorstandschef von Citic Pacific ernannt wurde. "Wenn ich heute so zurückblicke, realisiere ich erst, wie schwierig es wirklich war.

China kauft sich Rohstoffe und Firmen im großen Stil

Im zurückliegenden Jahrzehnt hat sich China angesichts der boomenden Wirtschaft weltweit in großem Maßstab Rohstoffe gesichert, um die eigenen Fabriken zu füttern und dabei nicht von westlichen Mächten abhängig zu werden. Im vergangenen Jahr stiegen die Auslandsinvestitionen der Volksrepublik in Rohstoffe auf 53,3 Milliarden Dollar. 2005 hatten sie gerade einmal bei 8,2 Milliarden Dollar gelegen, wie aus Daten hervorgeht, die das American Enterprise Institute und die Heritage Foundation zusammengestellt haben.

Inzwischen wird klar, dass China auf seiner Einkaufstour etliche Fehlkäufe getätigt hat. Viele der großen Deals schreiben Verluste, produzieren unerwartet Kosten oder bringen erheblich weniger Ausstoß als erwartet. Einige der chinesischen Anleger ziehen sich bereits aus dem Rohstoffsektor zurück - ein Trend, der am Ende dazu führen dürfte, dass weniger chinesisches Geld nach Afrika, Lateinamerika und in den Nahen Osten fließt.

Die Gründe für die Probleme Chinas sind ganz unterschiedlicher Natur. Das Land ist erst spät in den Rohstoffboom der vergangenen Jahre eingestiegen und hat nicht selten überhöhte Preise für Lagerstätten und Anlagen bezahlt, die westliche Unternehmen bereits verschmäht hatten oder die sie gerne verkaufen wollten. China hat im Normalfall ein Fünftel mehr für Öl- und Gasvorkommen bezahlt als im Branchendurchschnitt, schätzt Scott Darling, Chef für Öl- und Gas-Research in Asien bei J.P. Morgan Chase & Co.

Der Energieriese China Petroleum & Chemical Corp, besser bekannt unter dem Kürzel Sinopec, zahlte 2010 satte 4,65 Milliarden Dollar für den Anteil von Conoco Phillips am kanadischen Ölsandspezialisten Syncrude Canada. Der Preis entsprach zu jenem Zeitpunkt einem Aufschlag von 10 Prozent auf den Marktwert, nimmt man die Marktbewertung des größten Anteilseigners Canadian Oil Sands zum Maßstab. In der Folgezeit litt das Projekt unter steigenden Kosten und fallender Förderung, wie aus Pflichtmitteilungen von Canadian Oil Sands zu entnehmen ist.

Sinopec erklärte damals, dass das Syncrude-Projekt das einzig verfügbare in seiner Größe und der Preis vernünftig gewesen sei. Bis vor kurzem seien Produktion und Profitabilität von Syncrude stabil gewesen, sagt das Unternehmen, das davon ausgeht, dass die Produktion noch 60 Jahre lang laufen wird. "Langfristig könnte das Projekt also durchaus noch als profitabel bezeichnet werden", heißt es.

Ein weiteres Beispiel: CNOOC bezahlte im Jahr 2012 für den Energiekonzern Nexen 15,1 Milliarden Dollar. Heute verdient das Unternehmen nur noch ein Fünftel des Nettogewinns des Jahres 2010. Nexen leidet unter den niedrigeren Erdgas-Preisen, rückläufigen Fördermengen auf einigen Schlüsselfeldern und weiteren Problemen. CNOOC erklärte, die Entwicklung von Nexen seit der Fusion liege im Rahmen der Erwartungen, die Anlagen arbeiteten reibungslos.

Iran kündigte Verträge mit chinesischen Firmen

Im April wiederum widerrief der Iran einen Auftrag im Wert von 2,5 Milliarden Dollar an China National Petroleum. Das Unternehmen sollte ein Ölfeld namens South Azadegan erschließen. Iranische Offizielle warfen China vor, es rechne Bohrausrüstung und -dienste zu teuer ab und verursache Verzögerungen bei dem Projekt.

Einen Monat später drohte Irans stellvertretender Ölminister Mansour Moazzami CNPC mit dem Entzug des 4,7 Milliarden Dollar schweren Vertrags über die Entwicklung des riesigen Gasfelds South Pars, da der Konzern keine zufriedenstellenden Fortschritte mache. CNPC wollte sich dazu auf Anfrage nicht äußern.

Bergbau- und Energieprojekte sind von Natur aus schwierig und auch westliche Rohstoffunternehmen geraten oft aus eigenem Verschulden in Probleme. Einige Analysten sagen daher, China lerne jetzt erstmals die harten Realitäten kennen, mit denen westliche Unternehmen bei derartigen Projekten schon lange zu kämpfen haben. "Die Welt ist übersät mit Projekten mit massiven Kostenüberschreitungen", sagt Megan Anwyl, leitende Direktorin bei der Bergbaulobby Magnetite Network in Perth.

Einige der schlechten Deals chinesischer Firmen könnten sich noch auszahlen, wenn das globale Rohstoffangebot knapp werden und die Preise steigen sollten. Einige der Großübernahmen aus China, darunter Sinopecs Kauf von Ölanlagen des russischen Rosneft-Konzerns im Jahr 2006 im Wert von 3,5 Milliarden Dollar, scheinen profitabel oder zumindest nahe der Gewinnschwelle zu sein, wie Unternehmensveröffentlichungen und Medienberichten zu entnehmen ist.

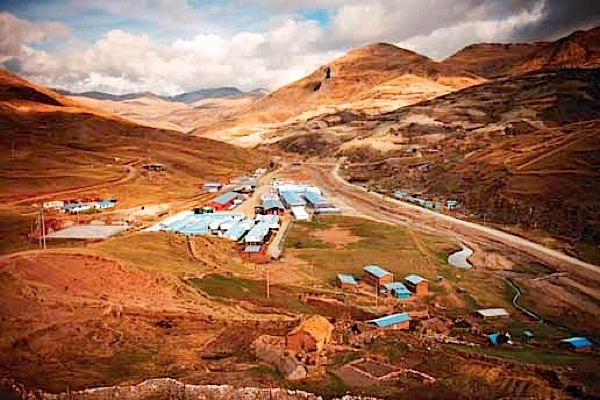

Und die Zeit großer chinesischer Deals ist noch nicht vorbei. Im April führte eine Sparte von China Minmetals ein Konsortium an, das für 5,85 Milliarden Dollar eine Kupfermine von Glencore Xstrata in Peru erwarb.

Chinesische Vertreter streiten dabei gar nicht ab, dass es Schwierigkeiten bei einigen Projekten gebe. Nach Berichten der chinesischen Staatsmedien schätzte der Leiter des chinesischen Bergbau-Verbandes, dass 80 Prozent aller Bergbau-Deals im Ausland gescheitert seien. Weitere Details nannte er allerdings nicht.

Im Juni machte Chinas staatlicher Rechnungshof Missmanagement für Verluste bei mindestens zehn Auslands-Anlagen der China Investment Corp. (CIC) verantwortlich. Der 600 Milliarden Dollar schwere Staatsfonds hatte zwischen 2009 und 2012 zig Milliarden Dollar in Rohstoffanlagen gesteckt. Um welche Geschäfte es sich handelte, führte der Rechnungshof nicht näher aus.

Chinesischer Staatsfonds wendet sich von Rohstoffanlagen ab

Inzwischen hat CIC angefangen, statt in Energieanlagen in andere Sektoren zu investieren, wie Personen aus dem Umfeld des Fonds berichten. Der Anteil von Energie- und Metall-Investitionen an den Auslandsgeschäften fiel im Jahr 2013 auf zwei Drittel, nachdem er 2005 noch bei 80 Prozent gelegen hatte. Das zeigen Daten des American Enterprise Institute und der Heritage Foundation. Mit 53,3 Milliarden Dollar lagen Chinas Rohstoffinvestitionen 2013 auch unter dem Rekordwert von 57,5 Milliarden aus dem Jahr 2011.

Chinas Handelsministerium führt in diesem Zusammenhang an, dass es seine Bemühungen zur Prüfung von Auslandsinvestitionen verstärkt habe und das Bewusstsein der Firmen darüber gestärkt habe, welche Risiken und Verantwortlichkeiten sie im Ausland erwarten. "Die Regierung hat erklärt, dass die Zeit des 'Kauf einen Rohstoff zu jedem Preis' vorbei ist", sagt Por Yiang-liang, Analyst bei BNP Paribas. "Es ist eine komplette Kehrtwende zum vergangenen Jahrzehnt".

Die Fehlschläge von Citic Pacific in Nordwestaustralien geben einen Eindruck davon, warum China seinen Kurs geändert hat.

Citic Pacific unterzeichnete den Vertrag mit Clive Palmer, dem australischen Milliardär aus der Bergbau-Branche, im März 2006. Palmer besaß die Lizenz, rund um Cape Preston Eisenerz abzubauen. Citic Pacific wollte drei Stahlöfen in der Volksrepublik füttern.

Seinerzeit stieg der Preis für Eisenerz, und Peking war daran interessiert, die Dominanz der großen Minenkonzerne BHP Billiton, Rio Tinto und Vale zu brechen, die zusammen mehr als 70 Prozent des seegebundenen Handels mit Eisenerz kontrollierten.

Citic Pacific zahlte Palmers Unternehmen Mineralogy Pty. Ltd. anfänglich 415 Millionen Dollar und vereinbarte, 2,5 Milliarden Dollar in das Projekt und einen Hafen zu stecken. Im Jahr 2009 sollte die Förderung beginnen. Für gefördertes Eisenerz sollte Mineralogy Lizenzzahlungen erhalten. Für den Fall, dass bis 2013 nicht wenigstens 6 Millionen Tonnen Eisenerz jährlich abgebaut würden, wurden Strafzahlungen vereinbart.

(MORE TO FOLLOW) Dow Jones Newswires

September 12, 2014 05:11 ET (09:11 GMT)

© 2014 Dow Jones & Company, Inc.

12.09.2014 11:11

Chinas globaler Rohstoffplan geht nicht auf

Von Wayne Arnold

CAPE PRESTON, Australien--Eine Mine in einem abgelegenen Teil Australiens ist ein gutes Beispiel dafür, was bei Chinas jahrzehntelangem Versuch, sich auf der ganzen Welt mit Rohstoffen einzudecken, alles schief gegangen ist. Es hat mehr als acht Jahre und den Einsatz von etwa 10 Milliarden US-Dollar gebraucht, um die Mine in der Nähe eines abgelegenen Hafens in Betrieb zu nehmen.

Die Eisenerzmine von Citic Pacific hat am Ende fast das Vierfache des ursprünglich veranschlagten Budgets gekostet. Analysten, die das Projekt verfolgen, rechnen damit, dass es in seinem ersten vollen Betriebsjahr 2014 Hunderte von Millionen Dollar an Verlust machen wird.

Das alles kommt nicht von ungefähr. Citic Pacific, ein in Hongkong beheimatetes Tochterunternehmen der staatseigenen chinesischen Finanz- und Investmentgesellschaft Citic Group, hat sich zusammen mit ein paar Auftragsfirmen eine Reihe von groben Schnitzern bei dem Projekt erlaubt. So glaubte man, einfach Arbeiter aus China zu Dumping-Löhnen vor Ort beschäftigen zu können. Und dann verbockte Citic Pacific auch noch eine Wette auf Währungsentwicklungen und war am Ende gezwungen, sich von der Muttergesellschaft mit Rettungsgeldern in Höhe von 1,5 Milliarden Dollar aus der Patsche helfen zu lassen.

Jetzt endlich exportiert die Sino Mine Eisenerz - aber gleichzeitig ist Citic immer noch in einen Rechtsstreit mit einem lokalen Partner verwickelt. Der Immobilien- und Bergbaumogul Clive Palmer, der inzwischen als Führer einer von ihm gegründeten Partei im australischen Parlament sitzt, wirft den Chinesen vor, australische Rohstoffe aus dem Land zu schaffen, ohne dafür angemessen zu bezahlen.

"Es war ein schmerzhafter Lernprozess für uns", sagt Zhang Jijing, der 16 Jahre lang das gesamte Australiengeschäft der Muttergesellschaft Citic Group geleitet hatte, ehe er Ende 2009 zum Präsident und Vorstandschef von Citic Pacific ernannt wurde. "Wenn ich heute so zurückblicke, realisiere ich erst, wie schwierig es wirklich war.

China kauft sich Rohstoffe und Firmen im großen Stil

Im zurückliegenden Jahrzehnt hat sich China angesichts der boomenden Wirtschaft weltweit in großem Maßstab Rohstoffe gesichert, um die eigenen Fabriken zu füttern und dabei nicht von westlichen Mächten abhängig zu werden. Im vergangenen Jahr stiegen die Auslandsinvestitionen der Volksrepublik in Rohstoffe auf 53,3 Milliarden Dollar. 2005 hatten sie gerade einmal bei 8,2 Milliarden Dollar gelegen, wie aus Daten hervorgeht, die das American Enterprise Institute und die Heritage Foundation zusammengestellt haben.

Inzwischen wird klar, dass China auf seiner Einkaufstour etliche Fehlkäufe getätigt hat. Viele der großen Deals schreiben Verluste, produzieren unerwartet Kosten oder bringen erheblich weniger Ausstoß als erwartet. Einige der chinesischen Anleger ziehen sich bereits aus dem Rohstoffsektor zurück - ein Trend, der am Ende dazu führen dürfte, dass weniger chinesisches Geld nach Afrika, Lateinamerika und in den Nahen Osten fließt.

Die Gründe für die Probleme Chinas sind ganz unterschiedlicher Natur. Das Land ist erst spät in den Rohstoffboom der vergangenen Jahre eingestiegen und hat nicht selten überhöhte Preise für Lagerstätten und Anlagen bezahlt, die westliche Unternehmen bereits verschmäht hatten oder die sie gerne verkaufen wollten. China hat im Normalfall ein Fünftel mehr für Öl- und Gasvorkommen bezahlt als im Branchendurchschnitt, schätzt Scott Darling, Chef für Öl- und Gas-Research in Asien bei J.P. Morgan Chase & Co.

Der Energieriese China Petroleum & Chemical Corp, besser bekannt unter dem Kürzel Sinopec, zahlte 2010 satte 4,65 Milliarden Dollar für den Anteil von Conoco Phillips am kanadischen Ölsandspezialisten Syncrude Canada. Der Preis entsprach zu jenem Zeitpunkt einem Aufschlag von 10 Prozent auf den Marktwert, nimmt man die Marktbewertung des größten Anteilseigners Canadian Oil Sands zum Maßstab. In der Folgezeit litt das Projekt unter steigenden Kosten und fallender Förderung, wie aus Pflichtmitteilungen von Canadian Oil Sands zu entnehmen ist.

Sinopec erklärte damals, dass das Syncrude-Projekt das einzig verfügbare in seiner Größe und der Preis vernünftig gewesen sei. Bis vor kurzem seien Produktion und Profitabilität von Syncrude stabil gewesen, sagt das Unternehmen, das davon ausgeht, dass die Produktion noch 60 Jahre lang laufen wird. "Langfristig könnte das Projekt also durchaus noch als profitabel bezeichnet werden", heißt es.

Ein weiteres Beispiel: CNOOC bezahlte im Jahr 2012 für den Energiekonzern Nexen 15,1 Milliarden Dollar. Heute verdient das Unternehmen nur noch ein Fünftel des Nettogewinns des Jahres 2010. Nexen leidet unter den niedrigeren Erdgas-Preisen, rückläufigen Fördermengen auf einigen Schlüsselfeldern und weiteren Problemen. CNOOC erklärte, die Entwicklung von Nexen seit der Fusion liege im Rahmen der Erwartungen, die Anlagen arbeiteten reibungslos.

Iran kündigte Verträge mit chinesischen Firmen

Im April wiederum widerrief der Iran einen Auftrag im Wert von 2,5 Milliarden Dollar an China National Petroleum. Das Unternehmen sollte ein Ölfeld namens South Azadegan erschließen. Iranische Offizielle warfen China vor, es rechne Bohrausrüstung und -dienste zu teuer ab und verursache Verzögerungen bei dem Projekt.

Einen Monat später drohte Irans stellvertretender Ölminister Mansour Moazzami CNPC mit dem Entzug des 4,7 Milliarden Dollar schweren Vertrags über die Entwicklung des riesigen Gasfelds South Pars, da der Konzern keine zufriedenstellenden Fortschritte mache. CNPC wollte sich dazu auf Anfrage nicht äußern.

Bergbau- und Energieprojekte sind von Natur aus schwierig und auch westliche Rohstoffunternehmen geraten oft aus eigenem Verschulden in Probleme. Einige Analysten sagen daher, China lerne jetzt erstmals die harten Realitäten kennen, mit denen westliche Unternehmen bei derartigen Projekten schon lange zu kämpfen haben. "Die Welt ist übersät mit Projekten mit massiven Kostenüberschreitungen", sagt Megan Anwyl, leitende Direktorin bei der Bergbaulobby Magnetite Network in Perth.

Einige der schlechten Deals chinesischer Firmen könnten sich noch auszahlen, wenn das globale Rohstoffangebot knapp werden und die Preise steigen sollten. Einige der Großübernahmen aus China, darunter Sinopecs Kauf von Ölanlagen des russischen Rosneft-Konzerns im Jahr 2006 im Wert von 3,5 Milliarden Dollar, scheinen profitabel oder zumindest nahe der Gewinnschwelle zu sein, wie Unternehmensveröffentlichungen und Medienberichten zu entnehmen ist.

Und die Zeit großer chinesischer Deals ist noch nicht vorbei. Im April führte eine Sparte von China Minmetals ein Konsortium an, das für 5,85 Milliarden Dollar eine Kupfermine von Glencore Xstrata in Peru erwarb.

Chinesische Vertreter streiten dabei gar nicht ab, dass es Schwierigkeiten bei einigen Projekten gebe. Nach Berichten der chinesischen Staatsmedien schätzte der Leiter des chinesischen Bergbau-Verbandes, dass 80 Prozent aller Bergbau-Deals im Ausland gescheitert seien. Weitere Details nannte er allerdings nicht.

Im Juni machte Chinas staatlicher Rechnungshof Missmanagement für Verluste bei mindestens zehn Auslands-Anlagen der China Investment Corp. (CIC) verantwortlich. Der 600 Milliarden Dollar schwere Staatsfonds hatte zwischen 2009 und 2012 zig Milliarden Dollar in Rohstoffanlagen gesteckt. Um welche Geschäfte es sich handelte, führte der Rechnungshof nicht näher aus.

Chinesischer Staatsfonds wendet sich von Rohstoffanlagen ab

Inzwischen hat CIC angefangen, statt in Energieanlagen in andere Sektoren zu investieren, wie Personen aus dem Umfeld des Fonds berichten. Der Anteil von Energie- und Metall-Investitionen an den Auslandsgeschäften fiel im Jahr 2013 auf zwei Drittel, nachdem er 2005 noch bei 80 Prozent gelegen hatte. Das zeigen Daten des American Enterprise Institute und der Heritage Foundation. Mit 53,3 Milliarden Dollar lagen Chinas Rohstoffinvestitionen 2013 auch unter dem Rekordwert von 57,5 Milliarden aus dem Jahr 2011.

Chinas Handelsministerium führt in diesem Zusammenhang an, dass es seine Bemühungen zur Prüfung von Auslandsinvestitionen verstärkt habe und das Bewusstsein der Firmen darüber gestärkt habe, welche Risiken und Verantwortlichkeiten sie im Ausland erwarten. "Die Regierung hat erklärt, dass die Zeit des 'Kauf einen Rohstoff zu jedem Preis' vorbei ist", sagt Por Yiang-liang, Analyst bei BNP Paribas. "Es ist eine komplette Kehrtwende zum vergangenen Jahrzehnt".

Die Fehlschläge von Citic Pacific in Nordwestaustralien geben einen Eindruck davon, warum China seinen Kurs geändert hat.

Citic Pacific unterzeichnete den Vertrag mit Clive Palmer, dem australischen Milliardär aus der Bergbau-Branche, im März 2006. Palmer besaß die Lizenz, rund um Cape Preston Eisenerz abzubauen. Citic Pacific wollte drei Stahlöfen in der Volksrepublik füttern.

Seinerzeit stieg der Preis für Eisenerz, und Peking war daran interessiert, die Dominanz der großen Minenkonzerne BHP Billiton, Rio Tinto und Vale zu brechen, die zusammen mehr als 70 Prozent des seegebundenen Handels mit Eisenerz kontrollierten.

Citic Pacific zahlte Palmers Unternehmen Mineralogy Pty. Ltd. anfänglich 415 Millionen Dollar und vereinbarte, 2,5 Milliarden Dollar in das Projekt und einen Hafen zu stecken. Im Jahr 2009 sollte die Förderung beginnen. Für gefördertes Eisenerz sollte Mineralogy Lizenzzahlungen erhalten. Für den Fall, dass bis 2013 nicht wenigstens 6 Millionen Tonnen Eisenerz jährlich abgebaut würden, wurden Strafzahlungen vereinbart.

(MORE TO FOLLOW) Dow Jones Newswires

September 12, 2014 05:11 ET (09:11 GMT)

© 2014 Dow Jones & Company, Inc.

12.09.2014 11:11

Chinas globaler Rohstoffplan geht nicht auf -2-

Lange hatten sich die Bergbauunternehmen in der Region auf Eisenerz in der mineralischen Form von Hämatit konzentriert, das ohne weitere Bearbeitung sofort verschifft werden kann. Am Cape Preston findet sich jedoch Magnetit von schlechterer Qualität, das vor dem Verkauf noch angereichert werden muss. Citic Pacific musste sechs Verarbeitungsanlagen bauen, auch ein Kraftwerk und eine Entsalzungsanlage für Wasser waren nötig.

Gewaltige Fehlrechnungen chinesischer Bergbaufirmen

Binnen sechs Monaten, nachdem die australische Regierung die Investition genehmigt hatte, vergab Citic Pacific einen 1,75 Milliarden Dollar schweren Vertrag zum Bau des Projektes an die Metallurgical Corp. of China (MCC).

"Ich weiß nicht, warum alles zu Beginn mit einer derartigen Eile vorangetrieben wurde", sagt Citic-Manager Zhang heute. Die Vorbereitung eines Projektes mit einem derartigen Ausmaß würde normalerweise zwei Jahre in Anspruch nehmen.

Australische Berater hatten erklärt, sie würden für ein Projekt, das nur halb so groß ist, Kosten von 5 Milliarden Dollar und eine Bauzeit von fünf Jahren bis zur Fertigstellung ansetzen. MCC aus China versprach allerdings, man könne das gesamte Projekt für 2,5 Milliarden Dollar umsetzen, und das in nur drei Jahren.

Vertreter von MCC reagierten nicht auf die Bitte nach einer Stellungnahme. Im Jahresbericht des Unternehmens für 2012 heißt es, die "vorbereitenden Arbeiten waren von beiden Seiten aus ungenügend" und dass das "Projekt hastig und ohne volle Kenntnisse der australischen Bestimmungen begonnen" worden sei - neben anderen Problemen.

Sino Iron war nach Angaben von Manager Zhang größer als alles, was MCC bislang in China gebaut hatte. Die Mine betreibt einen Erzbrecher, der sieben Stockwerke groß ist und Förderbänder von einer Meile Länge, auf denen das Gestein für die Weiterverarbeitung zu den Anlagen transportiert wird.

Das geförderte Magnetit erwies sich als weitaus härter als das gleiche Mineral, wie es in China vorkommt, und zerstörte die Anlagen. Überdies erwies sich das Eisenerz vom Kap als mit Asbest durchsetzt, wie sich aus Finanzberichten von Citic Pacific entnehmen lässt. Deshalb musste das Unternehmen in luftdichte Fahrzeuge für die Arbeiter investieren, damit sie die krebserregenden Asbestfasern nicht in ihre Lunge bekommen.

Vertreter von MCC wollten billige chinesische Arbeiter vor Ort einsetzen, trafen damit aber auf Hürden, berichtet Manager Zhang.

Australien verhindert Import von Arbeitern zu Dumpinglöhnen

Australien vergibt Visa nur an Arbeiter, die Englisch sprechen und einen australischen Eignungstest bestehen. Diejenigen, die sich qualifizieren, dürfen nicht schlechter bezahlt werden als gleich qualifizierte Australier. Auch Vergünstigungen wie eine Woche frei nach drei Wochen auf der Anlage sowie Flüge von und nach Perth sind ihnen zu gewähren.

MCC gelang es am Ende lediglich, wenige hundert Chinesen ins Land zu bringen. Jeder der 1.000 Bergleute, die bei Sino Iron arbeiten, koste das Unternehmen über 200.000 Dollar im Jahr, berichtet Zhang.

Ein anderes Problem sind Australiens Umwelt- und Kulturvorschriften. Sino Iron etwa musste mit Aborigine-Stämmen eine Lösung finden, wie ihre heiligen Stätten geschützt oder verlagert werden können.

Sämtliche Kosten fielen in australischen Dollar an, der zwischen 2007 und dem Baubeginn im August 2008 gegenüber dem US-Dollar aufwertete. Citic Pacific versuchte sich mit Währungsderivaten abzusichern. Doch das ging nach hinten los, als die weltweite Finanzkrise ausbrach.

Im Oktober 2008 sah sich Citic Pacific möglichen Verlusten in Höhe von 2 Milliarden Dollar gegenüber. Mit einer Geldspritze über 1,5 Milliarden Dollar von seiner Mutterfirma Citic Group hielt sich das Unternehmen über Wasser.

Citic Pacific verpflichtete Zhang, der bis dahin nichts mit dem Projekt zu tun gehabt hatte, als Leitenden Direktor. Zhang stimmte zu, die Zahlungen von Citic Pacific an MCC zu erhöhen. Letztlich summierten sich diese auf 3,4 Milliarden Dollar.

Hässliche Schlammschlacht vor Gericht

Sino Iron geriet auch mit Immobilienmogul Palmer aneinander, der nach dem Verkauf an Citic Pacific in ein Fußball-Team, eine Nickel-Raffinerie und ein Golfressort investiert hatte, das er in einen Dinosaurier-Themenparkt umwandelte. 2012 kündigte er Pläne zum Bau einer Titanic-Nachbildung an. Im vergangenen Jahr gründete er seine eigene Partei, die Palmer United Party, und gewann einen Sitz im Parlament.

Analysten schätzen, dass die Verzögerungen von Sino Iron Palmer jährlich hunderte Millionen Dollar an Förderabgaben kosteten.

Im Oktober 2012 teilte Mineralogy mit, dass es Citic Pacific die Förderrechte entzogen habe und warf dem Unternehmen vor, dass es fällige Abgaben nicht bezahlt habe. Citic Pacific bestätigt die ausbleibenden Zahlungen, betont aber, dass es diese nicht habe leisten müssen, da es bisher noch kein verarbeitetes Erz ausgeliefert habe.

Ein Gericht entschied letztlich, dass Citic Pacific zahlen müsse. Als im Jahr darauf eine zusätzliche Strafe dafür fällig wurde, dass Citic Pacific keine 6 Millionen Tonnen im Jahr produziert habe - die Strafe entsprach etwa 10 Prozent des erwarteten Verkaufswerts des verarbeiteten Erzes -- weigerten sich das Unternehmen zu zahlen, so lange sich beide Seiten nicht auf eine Preisformel geeinigt hätten. Derzeit läuft ein Schlichtungsverfahren.

"Wir sind vor Gericht zuversichtlich", sagt Andrew Cork, ein Sprecher von Palmer. "Wir sorgen dafür, dass sie das in Ordnung bringen." Palmer selbst lehnte eine Stellungnahme ab.

Im Juli verklagte Citic Pacific Palmer wegen Betrugs. Der Vorwurf: Er soll 11,2 Millionen Dollar von einem Konto für den Betrieb des Hafens abgezwackt haben. Ein Teil des Geldes soll in den Wahlkampf seiner Partei im vergangenen Jahr geflossen sein. Palmer hat jegliches Fehlverhalten von sich gewiesen.

Dafür sorgte er im August für diplomatische Aufregungen: Als er im australischen TV-Sender ABC zu den Vorwürfen befragt wurde, warf er den Chinesen unter anderem vor, dass sie chinesische Arbeiter nach Australien bringen wollten. "Mir macht es nichts aus, mich gegen die chinesischen Bastarde zu erheben und sie davon abzuhalten", sagte er und bezeichnete Citic Pacific als "Straßenköter". Weiter polterte er: "Ich sage das, da sie Kommunisten sind, da sie ihre eigenen Leute erschießen, sie kein Rechtssystem haben und sie dieses Land übernehmen wollen."

Jahrelanges Warten auf volle Auslastung

Citic Pacific wollte sich zu den Aussagen Palmers nicht äußern, für die er sich nachträglich entschuldigte. Palmer sagte, seine Bemerkungen seien "nicht gegen die chinesische Gemeinschaft oder die chinesische Regierung gerichtet".

Im vergangenen Dezember feuerte Citic Pacific MCC und übernahm den Bau er letzten vier Produktionslinien der Mine selbst. Zur Feier der ersten Erzlieferung von Cape Preston nach China gab es nur eine schlichte Feier.

Im Februar legte Citic Pacific die jüngste Rechnung für das Projekt vor: 9,9 Milliarden Dollar an Investitionen und 3,6 Milliarden Dollar an Schulden für den Bau einer Anlage, die das Unternehmen mit weniger als 7 Milliarden Dollar bewertet.

Seine Eisenerzsparte, die einzig die Mine in Australien umfasst, verlor im vergangenen Jahr mehr als 208 Millionen Dollar. Und der Chef des Bereichs kündigte an, dass weitere Verluste wahrscheinlich seien, weil die Ausgaben steigen.

Zhang sagt, die Kosten würden sinken, wenn die restlichen vier Fertigungsstraßen erst einmal vollendet seien. Bis die Mine mit voll ausgelasteten Kapazitäten laufe, werde es noch ein paar weitere Jahre dauern. Die schlimmsten Probleme, orakelt er, habe die Mine aber hinter sich.

Mitarbeit: Chester Dawson, Benoît Faucon, Ned Levin, Drew Hinshaw, Joy Ma, Wayne Ma, Brian Spegele, Lingling Wei und Kersten Zhang

Kontakt zum Autor: redaktion@wsj.de

DJG/WSJ

(END) Dow Jones Newswires

September 12, 2014 05:11 ET (09:11 GMT)

© 2014 Dow Jones & Company, Inc.

Einfach lesenswert, wie gross die Probleme selbst für China bei Rohstoffprojekten sind....

Chinas globaler Rohstoffplan geht nicht auf -2-

Lange hatten sich die Bergbauunternehmen in der Region auf Eisenerz in der mineralischen Form von Hämatit konzentriert, das ohne weitere Bearbeitung sofort verschifft werden kann. Am Cape Preston findet sich jedoch Magnetit von schlechterer Qualität, das vor dem Verkauf noch angereichert werden muss. Citic Pacific musste sechs Verarbeitungsanlagen bauen, auch ein Kraftwerk und eine Entsalzungsanlage für Wasser waren nötig.

Gewaltige Fehlrechnungen chinesischer Bergbaufirmen

Binnen sechs Monaten, nachdem die australische Regierung die Investition genehmigt hatte, vergab Citic Pacific einen 1,75 Milliarden Dollar schweren Vertrag zum Bau des Projektes an die Metallurgical Corp. of China (MCC).

"Ich weiß nicht, warum alles zu Beginn mit einer derartigen Eile vorangetrieben wurde", sagt Citic-Manager Zhang heute. Die Vorbereitung eines Projektes mit einem derartigen Ausmaß würde normalerweise zwei Jahre in Anspruch nehmen.

Australische Berater hatten erklärt, sie würden für ein Projekt, das nur halb so groß ist, Kosten von 5 Milliarden Dollar und eine Bauzeit von fünf Jahren bis zur Fertigstellung ansetzen. MCC aus China versprach allerdings, man könne das gesamte Projekt für 2,5 Milliarden Dollar umsetzen, und das in nur drei Jahren.

Vertreter von MCC reagierten nicht auf die Bitte nach einer Stellungnahme. Im Jahresbericht des Unternehmens für 2012 heißt es, die "vorbereitenden Arbeiten waren von beiden Seiten aus ungenügend" und dass das "Projekt hastig und ohne volle Kenntnisse der australischen Bestimmungen begonnen" worden sei - neben anderen Problemen.

Sino Iron war nach Angaben von Manager Zhang größer als alles, was MCC bislang in China gebaut hatte. Die Mine betreibt einen Erzbrecher, der sieben Stockwerke groß ist und Förderbänder von einer Meile Länge, auf denen das Gestein für die Weiterverarbeitung zu den Anlagen transportiert wird.

Das geförderte Magnetit erwies sich als weitaus härter als das gleiche Mineral, wie es in China vorkommt, und zerstörte die Anlagen. Überdies erwies sich das Eisenerz vom Kap als mit Asbest durchsetzt, wie sich aus Finanzberichten von Citic Pacific entnehmen lässt. Deshalb musste das Unternehmen in luftdichte Fahrzeuge für die Arbeiter investieren, damit sie die krebserregenden Asbestfasern nicht in ihre Lunge bekommen.

Vertreter von MCC wollten billige chinesische Arbeiter vor Ort einsetzen, trafen damit aber auf Hürden, berichtet Manager Zhang.

Australien verhindert Import von Arbeitern zu Dumpinglöhnen

Australien vergibt Visa nur an Arbeiter, die Englisch sprechen und einen australischen Eignungstest bestehen. Diejenigen, die sich qualifizieren, dürfen nicht schlechter bezahlt werden als gleich qualifizierte Australier. Auch Vergünstigungen wie eine Woche frei nach drei Wochen auf der Anlage sowie Flüge von und nach Perth sind ihnen zu gewähren.

MCC gelang es am Ende lediglich, wenige hundert Chinesen ins Land zu bringen. Jeder der 1.000 Bergleute, die bei Sino Iron arbeiten, koste das Unternehmen über 200.000 Dollar im Jahr, berichtet Zhang.

Ein anderes Problem sind Australiens Umwelt- und Kulturvorschriften. Sino Iron etwa musste mit Aborigine-Stämmen eine Lösung finden, wie ihre heiligen Stätten geschützt oder verlagert werden können.

Sämtliche Kosten fielen in australischen Dollar an, der zwischen 2007 und dem Baubeginn im August 2008 gegenüber dem US-Dollar aufwertete. Citic Pacific versuchte sich mit Währungsderivaten abzusichern. Doch das ging nach hinten los, als die weltweite Finanzkrise ausbrach.

Im Oktober 2008 sah sich Citic Pacific möglichen Verlusten in Höhe von 2 Milliarden Dollar gegenüber. Mit einer Geldspritze über 1,5 Milliarden Dollar von seiner Mutterfirma Citic Group hielt sich das Unternehmen über Wasser.

Citic Pacific verpflichtete Zhang, der bis dahin nichts mit dem Projekt zu tun gehabt hatte, als Leitenden Direktor. Zhang stimmte zu, die Zahlungen von Citic Pacific an MCC zu erhöhen. Letztlich summierten sich diese auf 3,4 Milliarden Dollar.

Hässliche Schlammschlacht vor Gericht

Sino Iron geriet auch mit Immobilienmogul Palmer aneinander, der nach dem Verkauf an Citic Pacific in ein Fußball-Team, eine Nickel-Raffinerie und ein Golfressort investiert hatte, das er in einen Dinosaurier-Themenparkt umwandelte. 2012 kündigte er Pläne zum Bau einer Titanic-Nachbildung an. Im vergangenen Jahr gründete er seine eigene Partei, die Palmer United Party, und gewann einen Sitz im Parlament.

Analysten schätzen, dass die Verzögerungen von Sino Iron Palmer jährlich hunderte Millionen Dollar an Förderabgaben kosteten.

Im Oktober 2012 teilte Mineralogy mit, dass es Citic Pacific die Förderrechte entzogen habe und warf dem Unternehmen vor, dass es fällige Abgaben nicht bezahlt habe. Citic Pacific bestätigt die ausbleibenden Zahlungen, betont aber, dass es diese nicht habe leisten müssen, da es bisher noch kein verarbeitetes Erz ausgeliefert habe.

Ein Gericht entschied letztlich, dass Citic Pacific zahlen müsse. Als im Jahr darauf eine zusätzliche Strafe dafür fällig wurde, dass Citic Pacific keine 6 Millionen Tonnen im Jahr produziert habe - die Strafe entsprach etwa 10 Prozent des erwarteten Verkaufswerts des verarbeiteten Erzes -- weigerten sich das Unternehmen zu zahlen, so lange sich beide Seiten nicht auf eine Preisformel geeinigt hätten. Derzeit läuft ein Schlichtungsverfahren.

"Wir sind vor Gericht zuversichtlich", sagt Andrew Cork, ein Sprecher von Palmer. "Wir sorgen dafür, dass sie das in Ordnung bringen." Palmer selbst lehnte eine Stellungnahme ab.

Im Juli verklagte Citic Pacific Palmer wegen Betrugs. Der Vorwurf: Er soll 11,2 Millionen Dollar von einem Konto für den Betrieb des Hafens abgezwackt haben. Ein Teil des Geldes soll in den Wahlkampf seiner Partei im vergangenen Jahr geflossen sein. Palmer hat jegliches Fehlverhalten von sich gewiesen.

Dafür sorgte er im August für diplomatische Aufregungen: Als er im australischen TV-Sender ABC zu den Vorwürfen befragt wurde, warf er den Chinesen unter anderem vor, dass sie chinesische Arbeiter nach Australien bringen wollten. "Mir macht es nichts aus, mich gegen die chinesischen Bastarde zu erheben und sie davon abzuhalten", sagte er und bezeichnete Citic Pacific als "Straßenköter". Weiter polterte er: "Ich sage das, da sie Kommunisten sind, da sie ihre eigenen Leute erschießen, sie kein Rechtssystem haben und sie dieses Land übernehmen wollen."

Jahrelanges Warten auf volle Auslastung

Citic Pacific wollte sich zu den Aussagen Palmers nicht äußern, für die er sich nachträglich entschuldigte. Palmer sagte, seine Bemerkungen seien "nicht gegen die chinesische Gemeinschaft oder die chinesische Regierung gerichtet".

Im vergangenen Dezember feuerte Citic Pacific MCC und übernahm den Bau er letzten vier Produktionslinien der Mine selbst. Zur Feier der ersten Erzlieferung von Cape Preston nach China gab es nur eine schlichte Feier.

Im Februar legte Citic Pacific die jüngste Rechnung für das Projekt vor: 9,9 Milliarden Dollar an Investitionen und 3,6 Milliarden Dollar an Schulden für den Bau einer Anlage, die das Unternehmen mit weniger als 7 Milliarden Dollar bewertet.

Seine Eisenerzsparte, die einzig die Mine in Australien umfasst, verlor im vergangenen Jahr mehr als 208 Millionen Dollar. Und der Chef des Bereichs kündigte an, dass weitere Verluste wahrscheinlich seien, weil die Ausgaben steigen.

Zhang sagt, die Kosten würden sinken, wenn die restlichen vier Fertigungsstraßen erst einmal vollendet seien. Bis die Mine mit voll ausgelasteten Kapazitäten laufe, werde es noch ein paar weitere Jahre dauern. Die schlimmsten Probleme, orakelt er, habe die Mine aber hinter sich.

Mitarbeit: Chester Dawson, Benoît Faucon, Ned Levin, Drew Hinshaw, Joy Ma, Wayne Ma, Brian Spegele, Lingling Wei und Kersten Zhang

Kontakt zum Autor: redaktion@wsj.de

DJG/WSJ

(END) Dow Jones Newswires

September 12, 2014 05:11 ET (09:11 GMT)

© 2014 Dow Jones & Company, Inc.

Einfach lesenswert, wie gross die Probleme selbst für China bei Rohstoffprojekten sind....

Antwort auf Beitrag Nr.: 47.764.638 von codiman am 12.09.14 12:34:49

interessante Artikel Codiman.

Finde vor allem weil sie eben nicht nur Summen, sondern eben auch Gründe nennen.

Hatte vor einiger Zeit mal vom Dosto gelesen wo er irgendwo geschrieben hatte bei Rohstoffunternehmen ist 'für Fehler keiiin Platz, mehr'.

Dem schliesse ich mmich im Prinzip vollkommen an.

Und in dem Artikel sieht man dass die Auswahl reichlich ist, welche machen zu können.

interessante Artikel Codiman.

Finde vor allem weil sie eben nicht nur Summen, sondern eben auch Gründe nennen.

Hatte vor einiger Zeit mal vom Dosto gelesen wo er irgendwo geschrieben hatte bei Rohstoffunternehmen ist 'für Fehler keiiin Platz, mehr'.

Dem schliesse ich mmich im Prinzip vollkommen an.

Und in dem Artikel sieht man dass die Auswahl reichlich ist, welche machen zu können.

@codiman: Danek für den Artikel!

ein Bekannter betreibt da seit 20 Jahren eine Farm und ist schon Australier, trotzdem wird auch er noch abgezockt

ja, in Australien ist es nicht einfach, die f...en die Ausländer anders als die USamis, die Australier zocken über ihre diversen regulations regelmässige laufende Zahlungen ab während die USamis eher (mehrmals) einmalige Zahlungen über ihre Gerichte festsetzen lassen

niemals, ich widerhole, niemals in angelsächsischen Ländern eigenes Geld investieren!!!

die deutschen Firmen verlieren da jedes Jahr Milliardenbeträge

es ist in der Regel klüger sich vor Ort von einer Bank einen Kredit für die Investition zu holen, wenn es den Kredit nicht gibt ist etwas faul

als Sicherheit nur das was vor Ort ist

besser man zahlt der Bank 3% und verdient 7% oder auch nicht als dass man verliert

ein Bekannter betreibt da seit 20 Jahren eine Farm und ist schon Australier, trotzdem wird auch er noch abgezockt

ja, in Australien ist es nicht einfach, die f...en die Ausländer anders als die USamis, die Australier zocken über ihre diversen regulations regelmässige laufende Zahlungen ab während die USamis eher (mehrmals) einmalige Zahlungen über ihre Gerichte festsetzen lassen

niemals, ich widerhole, niemals in angelsächsischen Ländern eigenes Geld investieren!!!

die deutschen Firmen verlieren da jedes Jahr Milliardenbeträge

es ist in der Regel klüger sich vor Ort von einer Bank einen Kredit für die Investition zu holen, wenn es den Kredit nicht gibt ist etwas faul

als Sicherheit nur das was vor Ort ist

besser man zahlt der Bank 3% und verdient 7% oder auch nicht als dass man verliert

sollte man glaube ich nicht 'zu eng' verstehen, aber als Tendenz auf jeden Fall.

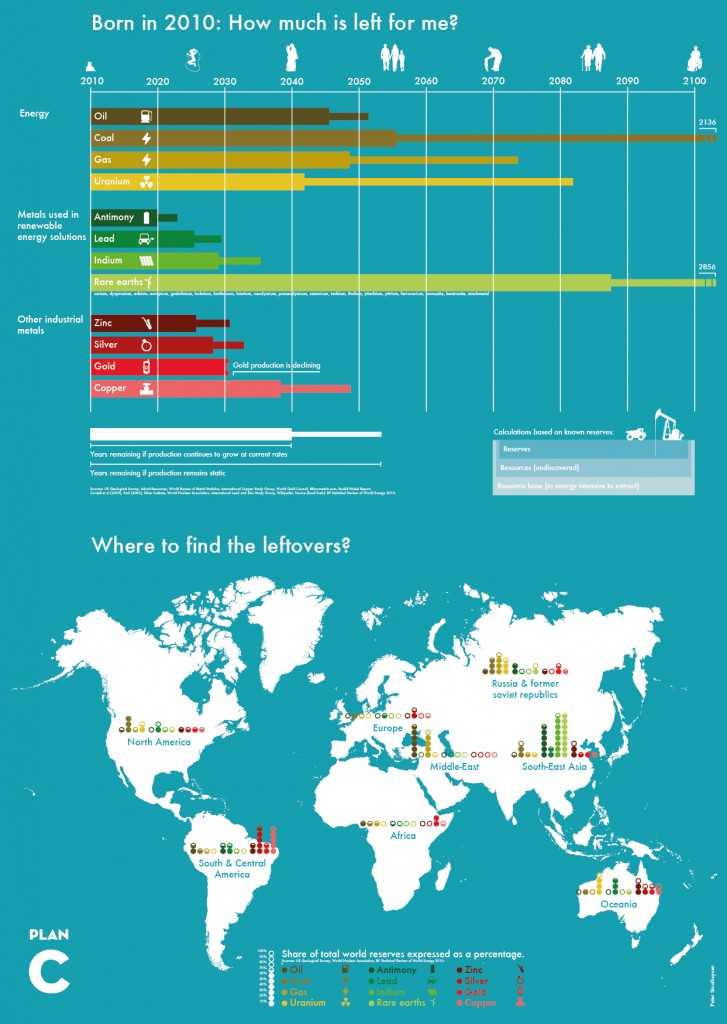

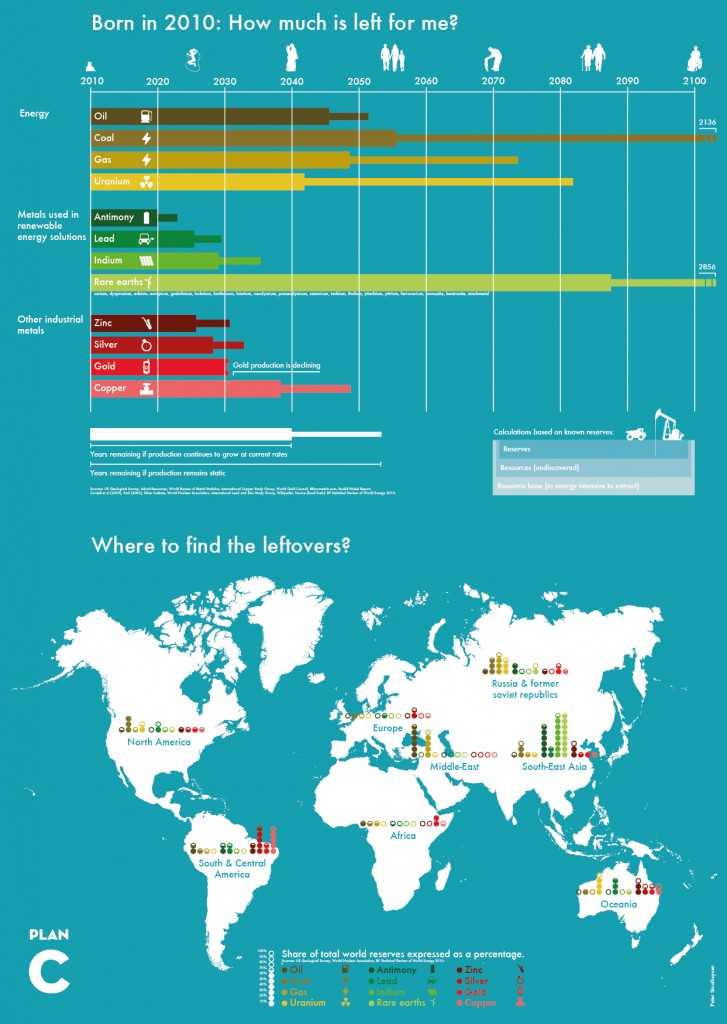

A "forecast of when the world’s resources will run out"

www.minefocus.com/2014/09/forecast-worlds-resources-will-run…

www.mining.com/infographic-here-is-when-the-worlds-resources…

A "forecast of when the world’s resources will run out"

www.minefocus.com/2014/09/forecast-worlds-resources-will-run…

www.mining.com/infographic-here-is-when-the-worlds-resources…

man sollte nicht ausser Acht lassen dass er da(mit) quasi auch auf Promotour ist, aber trotzdem.

Mining legend Friedland makes case for platinum, @gold forum

www.miningweekly.com/article/mining-legend-friedland-makes-c…

" DENVER, Colorado (miningweekly.com) – Billionaire mining legend Robert Friedland on Monday made the case for platinum at the Denver Gold Forum, saying that while he was a known gold bear, platinum was the only precious metal that had disruptive medium-term demand dynamics in the cards, boding well for pricing upside.

“It is critical that investors gain exposure to platinum, as this is where the disruptive medium-term catalyst is that would drive prices up,” he told delegates attending the forum.

Friedland, who is chairperson of Ivanhoe Mines, founded his bullish platinum scenario on the hazards that air pollution caused through automotive emissions and the burning of fossil fuels in urban spaces, pointing to London as being the recent European Union leader in air pollution and Paris as having earlier this summer placed public transport restrictions on its citizens to combat high pollution levels.

The World Health Organisation had also declared that urban air pollution was the number one public health risk, owing to the increased incidences of respiratory diseases.

And globally, air pollution was only set to get worse.

For instance, China currently had about 90-million private passenger vehicles on its roads, but the government was expecting this to rise to more than 400-million by 2030.

“The future lies in electric vehicles (EVs), and especially in hydrogen fuel cells,” Friedland stated, pointing to Japanese automaker Honda as being the near-term catalyst that would spark disruptive demand trends for platinum.

Honda plans to introduce the first commercial hydrogen fuel cell-powered vehicle in February next year. “Honda is about to unleash a revolution,” he declared.

Friedland said the progressive auto industry was presently debating whether to go down the Elon Musk EV route, or whether to embrace hydrogen fuel cells, noting that whichever way the global auto industry eventually preferred, it would bode well for Ivanhoe Mines' Platreef flagship, in South Africa. He also said that, as more US states were legislating for more emissions-free vehicles, there would eventually come a tipping point in the auto industry, when traditional automakers would also adopt EV or hydrogen fuel cells to drive their vehicles.

Other demand drivers were also boding well for platinum prices. The intensifying global trend of urbanisation was a critical driver behind the potential impending switch to hydrogen fuel cell-powered vehicles.

“With Japan being on board, we stand on the verge of something serious. Hydrogen fuel cells constitute a new and fundamental use for platinum, which bodes incredibly well for South Africa, owing to it supplying about 79% of the world’s platinum,” he said.

A stack of fuel cells for one automobile in general contains about 30 g of platinum, about eight to ten times the amount currently used in catalytic converters on conventional internal combustion-powered automobiles.

Countries around the globe, especially in the East, were also increasingly keen to tighten legislation to remove sulphur from fuel, opening up the auto market to the increased use of catalytic converters, which rely on platinum-group metals to clean emissions.

Other technologies, such as the escalating implementation of superfast magnetic-levitation trains, especially in Japan and the manufacture of photovoltaic panels would also need significant quantities of the white metal.

‘THINKING PERSON’S MINE’

Friedland pointed out that Platreef had several attributes in Ivanhoe's favour. Some of the positives included the fact that the deposit was flat, thick and high grade, that the mine could be fully mechanised, and that the deposit held five metals.

“Platreef is the thinking person’s platinum mine. It will be the largest platinum mine in the world, and at $341/oz, would be the lowest-cost producer globally.

“We will supply the platinum-fuelled hydrogen fuel cell revolution coming soon to a ‘theatre near you’,” he said.

He added that when the mechanised operation was running at capacity, and aided by the weakening South African rand, Platreef would likely change the traditional platinum-mining industry, making traditional labour-intensive mines obsolete.

The mining legend, known for his pivotal role in the discovery of megadeposits such as Kinross’ Fort Knox mine, in Alaska, Vale’s Voisey’s Bay mine, in Newfoundland and Labrador, and Rio Tinto’s Oyu Tolgoi mine, in Mongolia, said the same team that had worked on these projects were now focused on Platreef.

The Platreef project, on the northern limb of the Bushveld Igneous Complex, in Limpopo, involves the development and construction of a highly mechanised underground mine to access the underground Flatreef discovery. Ivanhoe has started the sinking of Shaft No 1 to obtain a mineralised bulk sample to complete the development assessment of the Flatreef.

The Flatreef mineral resource, with a strike length of 6 km, predominantly lies within a flat to gently-dipping portion of the Platreef mineralised belt at relatively shallow depths of about 700 m to 1 100 m below surface.

A preliminary economic assessment recommended a phased approach to the development of a large, mechanised, underground mine. Ivanhoe's plan for the project entailed three phases of potential development for an underground mine and the concentrator processing facility. The first phase comprises a four-million-tonne-a-year mine and concentrator; the second phase an eight-million-tonne-a-year mine and concentrator (base case); and Phase 3 contemplated a 12-million-tonne-a-year mine and concentrator.

The base case scenario was targeting 785 000 oz/y of platinum, palladium, rhodium and gold output, with significant amounts of copper and nickel by-product. Friedland noted that should EV gain traction in coming years, copper was still a significant component of lithium-ion batteries, making up about 70% of the batteries’ weight.

Platreef’s development phases would be implemented depending on market demand, smelting and refining capacity and capital availability. It could even consider an expansion beyond the third phase, subject to further study.

The base case scenario was targeting an estimated preproduction capital requirement of about $1.7-billion, including $381-million in contingencies.

Ivanhoe had finalised a broad-based black economic-empowerment (BBBEE) deal, giving 20 local communities a 26% interest in the project.

The deal paved the way for South Africa's Department of Mineral Resources to formalise and execute the mining right granted to Ivanhoe in May.

Friedland said that about 150 000 people live in the 20 host communities that form part of the groundbreaking BBBEE transaction. A total of 187 local entrepreneurial companies, representing a combined 333 individual shareholders, participated in the entrepreneurial subscription.

Upon execution of the mining right, a community trust for the 20 host communities will receive a yearly fixed contribution of R11-million (about C$1.1-million) while the mine was being developed.

Friedland said the BBBEE ownership stake was a landmark for the Platreef project, demonstrating Ivanhoe's commitment to the empowerment of black, historically disadvantaged South Africans.

The Platreef project was on target for initial underground development in 2018 and concentrator startup in the fourth quarter of 2019.

Edited by: Creamer Media Reporter "

Mining legend Friedland makes case for platinum, @gold forum

www.miningweekly.com/article/mining-legend-friedland-makes-c…

" DENVER, Colorado (miningweekly.com) – Billionaire mining legend Robert Friedland on Monday made the case for platinum at the Denver Gold Forum, saying that while he was a known gold bear, platinum was the only precious metal that had disruptive medium-term demand dynamics in the cards, boding well for pricing upside.

“It is critical that investors gain exposure to platinum, as this is where the disruptive medium-term catalyst is that would drive prices up,” he told delegates attending the forum.

Friedland, who is chairperson of Ivanhoe Mines, founded his bullish platinum scenario on the hazards that air pollution caused through automotive emissions and the burning of fossil fuels in urban spaces, pointing to London as being the recent European Union leader in air pollution and Paris as having earlier this summer placed public transport restrictions on its citizens to combat high pollution levels.

The World Health Organisation had also declared that urban air pollution was the number one public health risk, owing to the increased incidences of respiratory diseases.

And globally, air pollution was only set to get worse.

For instance, China currently had about 90-million private passenger vehicles on its roads, but the government was expecting this to rise to more than 400-million by 2030.

“The future lies in electric vehicles (EVs), and especially in hydrogen fuel cells,” Friedland stated, pointing to Japanese automaker Honda as being the near-term catalyst that would spark disruptive demand trends for platinum.

Honda plans to introduce the first commercial hydrogen fuel cell-powered vehicle in February next year. “Honda is about to unleash a revolution,” he declared.

Friedland said the progressive auto industry was presently debating whether to go down the Elon Musk EV route, or whether to embrace hydrogen fuel cells, noting that whichever way the global auto industry eventually preferred, it would bode well for Ivanhoe Mines' Platreef flagship, in South Africa. He also said that, as more US states were legislating for more emissions-free vehicles, there would eventually come a tipping point in the auto industry, when traditional automakers would also adopt EV or hydrogen fuel cells to drive their vehicles.

Other demand drivers were also boding well for platinum prices. The intensifying global trend of urbanisation was a critical driver behind the potential impending switch to hydrogen fuel cell-powered vehicles.

“With Japan being on board, we stand on the verge of something serious. Hydrogen fuel cells constitute a new and fundamental use for platinum, which bodes incredibly well for South Africa, owing to it supplying about 79% of the world’s platinum,” he said.

A stack of fuel cells for one automobile in general contains about 30 g of platinum, about eight to ten times the amount currently used in catalytic converters on conventional internal combustion-powered automobiles.

Countries around the globe, especially in the East, were also increasingly keen to tighten legislation to remove sulphur from fuel, opening up the auto market to the increased use of catalytic converters, which rely on platinum-group metals to clean emissions.

Other technologies, such as the escalating implementation of superfast magnetic-levitation trains, especially in Japan and the manufacture of photovoltaic panels would also need significant quantities of the white metal.

‘THINKING PERSON’S MINE’

Friedland pointed out that Platreef had several attributes in Ivanhoe's favour. Some of the positives included the fact that the deposit was flat, thick and high grade, that the mine could be fully mechanised, and that the deposit held five metals.

“Platreef is the thinking person’s platinum mine. It will be the largest platinum mine in the world, and at $341/oz, would be the lowest-cost producer globally.

“We will supply the platinum-fuelled hydrogen fuel cell revolution coming soon to a ‘theatre near you’,” he said.

He added that when the mechanised operation was running at capacity, and aided by the weakening South African rand, Platreef would likely change the traditional platinum-mining industry, making traditional labour-intensive mines obsolete.

The mining legend, known for his pivotal role in the discovery of megadeposits such as Kinross’ Fort Knox mine, in Alaska, Vale’s Voisey’s Bay mine, in Newfoundland and Labrador, and Rio Tinto’s Oyu Tolgoi mine, in Mongolia, said the same team that had worked on these projects were now focused on Platreef.

The Platreef project, on the northern limb of the Bushveld Igneous Complex, in Limpopo, involves the development and construction of a highly mechanised underground mine to access the underground Flatreef discovery. Ivanhoe has started the sinking of Shaft No 1 to obtain a mineralised bulk sample to complete the development assessment of the Flatreef.

The Flatreef mineral resource, with a strike length of 6 km, predominantly lies within a flat to gently-dipping portion of the Platreef mineralised belt at relatively shallow depths of about 700 m to 1 100 m below surface.

A preliminary economic assessment recommended a phased approach to the development of a large, mechanised, underground mine. Ivanhoe's plan for the project entailed three phases of potential development for an underground mine and the concentrator processing facility. The first phase comprises a four-million-tonne-a-year mine and concentrator; the second phase an eight-million-tonne-a-year mine and concentrator (base case); and Phase 3 contemplated a 12-million-tonne-a-year mine and concentrator.

The base case scenario was targeting 785 000 oz/y of platinum, palladium, rhodium and gold output, with significant amounts of copper and nickel by-product. Friedland noted that should EV gain traction in coming years, copper was still a significant component of lithium-ion batteries, making up about 70% of the batteries’ weight.

Platreef’s development phases would be implemented depending on market demand, smelting and refining capacity and capital availability. It could even consider an expansion beyond the third phase, subject to further study.

The base case scenario was targeting an estimated preproduction capital requirement of about $1.7-billion, including $381-million in contingencies.

Ivanhoe had finalised a broad-based black economic-empowerment (BBBEE) deal, giving 20 local communities a 26% interest in the project.

The deal paved the way for South Africa's Department of Mineral Resources to formalise and execute the mining right granted to Ivanhoe in May.

Friedland said that about 150 000 people live in the 20 host communities that form part of the groundbreaking BBBEE transaction. A total of 187 local entrepreneurial companies, representing a combined 333 individual shareholders, participated in the entrepreneurial subscription.

Upon execution of the mining right, a community trust for the 20 host communities will receive a yearly fixed contribution of R11-million (about C$1.1-million) while the mine was being developed.

Friedland said the BBBEE ownership stake was a landmark for the Platreef project, demonstrating Ivanhoe's commitment to the empowerment of black, historically disadvantaged South Africans.

The Platreef project was on target for initial underground development in 2018 and concentrator startup in the fourth quarter of 2019.

Edited by: Creamer Media Reporter "

Antwort auf Beitrag Nr.: 47.790.912 von Popeye82 am 16.09.14 10:53:12

Zimbabwe, Russia sign $3,000,000,000 deal to develop platinum mine, Zimbabwe +Russia on Tuesday signed a $3,000,000,000 deal to develop a platinum mine in Darwendale, targeting production of 250.000 oz/y within three years, a presentation by the Zimbabwean ministry of mines showed. The presentation said the mine "would" have peak production of 800.000 oz/y, which should help Zimbabwe produce 1,000,000 ounces a year, in five years' time - MW/R, HARARE - Sep 16, 2014

www.miningweekly.com/article/zimbabwe-russia-sign-3bn-deal-t…

Zimbabwe, Russia sign $3,000,000,000 deal to develop platinum mine, Zimbabwe +Russia on Tuesday signed a $3,000,000,000 deal to develop a platinum mine in Darwendale, targeting production of 250.000 oz/y within three years, a presentation by the Zimbabwean ministry of mines showed. The presentation said the mine "would" have peak production of 800.000 oz/y, which should help Zimbabwe produce 1,000,000 ounces a year, in five years' time - MW/R, HARARE - Sep 16, 2014

www.miningweekly.com/article/zimbabwe-russia-sign-3bn-deal-t…

China seeks cleaner coal imports, China will ban the import +local sale of coal with high ash +sulphur content starting from 2015, in a bid to tackle air pollution, with tough requirements in major coastal cities set to hit Australian miners. The National Development +Reform Commission policy comes as prices on the GlobalCOAL Newcastle index slump to a five-year low, amid a supply glut +slowing demand from China, the world's top importer - MW/R/NDRC, SHANGHAI - Sep 16, 2014

www.miningweekly.com/article/china-seeks-cleaner-coal-import…

"China will ban the import and local sale of coal with high ash and sulphur content starting from 2015 in a bid to tackle air pollution, with tough requirements in major coastal cities set to hit Australian miners.

The National Development and Reform Commission policy comes as prices on the GlobalCOAL Newcastle index slump to a five-year low amid a supply glut and slowing demand from China, the world's top importer.

China accounts for about a quarter of Australia's coal exports. It took 54-million tonnes of thermal coal and 30-million tonnes of metallurgical coal from Australia in 2013. All the thermal coal exceeded the new ash limit, while the metallurgical coal was below the limit, according to consultants Wood Mackenzie.

Under the new regulations, previously reported by Reuters and due to come into effect in January, the government has set different level of requirements on coal grades for mining, local sales and imports.

The most stringent requirements are for cities in the southern Pearl River Delta, the eastern Yangtze River Delta and three northern cities including Beijing, Tianjin and Hebei. These will be banned from burning coal that has more than 16% ash and 1% sulphur, according to a statement on the NDRC website.

Since the coastal regions such as Guangdong and Zhejiang province are some of China's top coal importers, the regulations are set to block a sizeable amount of imports.

"Coal that does not meet these requirements must not be imported, sold nor transported for long distances," the NDRC said, adding that the customs authority will check the quality of coal imports.

Much of the high ash coal from Australia was developed specifically for the Chinese market and could now be washed to meet the tighter limit on ash, said Rohan Kendall, Wood Mackenzie's metals and mining manager for eastern Asia.

"The uncertainty is whether the Chinese market will be willing to pay a bit extra for that lower ash product from Australia," he said.

Among the larger mines that would not meet restrictions on ash content are BHP Billiton's Mount Arthur operations, which produce about 16-million tonnes a year, Glencore's Mangoola mine, Rio Tinto's Hunter Valley operations and Bengalla mine, but it was not clear how much of that goes to China.

The Minerals Council of Australia, which represents the coal industry, and Australia's official resources forecaster disputed the view of Chinese traders that the new restrictions would hit Australian exporters hardest.

"There is nothing in the information released to date to suggest that Australian coal exporters will be disadvantaged and we are confident that we can meet the proposed specifications," Minerals Council executive director Greg Evans said in an email to Reuters.

Glencore, the world's biggest thermal coal exporter said it was reviewing the proposed restrictions. BHP, the world's biggest metallurgical coal exporter, which gets about a fifth of its coal revenue from China, said it expects to be able to meet the rules and does not expect a big impact on its business.

Rio Tinto had no immediate comment on the policy.

China will also implement a blanket ban on domestic mining, sale, transportation and imports of coal with ash and sulphur content exceeding 40% and 3% respectively.

For coal that will be transported more than 600 kms (373 miles) from the production site or receiving ports, the minimum energy requirement was set at 3,940 kcal/kg, with a maximum ash and sulphur content of 20% and 1% respectively.

When the regulation is implemented, Australian and South African coal with a heating value of 5 500 kcal/kg will be worst hit, since their ash content hovers around 23% to 25% and they contain sulphur of 0.8% to 1%, traders have said.

Top steam coal exporter Indonesia, which largely ships fuel with low heating value, sulphur and ash content, will be the least affected.

"It looks unambiguously positive for Indonesia. Almost all of Indonesian coal can meet these limits," Kendall said.

Edited by: Reuters "

www.miningweekly.com/article/china-seeks-cleaner-coal-import…

"China will ban the import and local sale of coal with high ash and sulphur content starting from 2015 in a bid to tackle air pollution, with tough requirements in major coastal cities set to hit Australian miners.

The National Development and Reform Commission policy comes as prices on the GlobalCOAL Newcastle index slump to a five-year low amid a supply glut and slowing demand from China, the world's top importer.

China accounts for about a quarter of Australia's coal exports. It took 54-million tonnes of thermal coal and 30-million tonnes of metallurgical coal from Australia in 2013. All the thermal coal exceeded the new ash limit, while the metallurgical coal was below the limit, according to consultants Wood Mackenzie.

Under the new regulations, previously reported by Reuters and due to come into effect in January, the government has set different level of requirements on coal grades for mining, local sales and imports.

The most stringent requirements are for cities in the southern Pearl River Delta, the eastern Yangtze River Delta and three northern cities including Beijing, Tianjin and Hebei. These will be banned from burning coal that has more than 16% ash and 1% sulphur, according to a statement on the NDRC website.

Since the coastal regions such as Guangdong and Zhejiang province are some of China's top coal importers, the regulations are set to block a sizeable amount of imports.

"Coal that does not meet these requirements must not be imported, sold nor transported for long distances," the NDRC said, adding that the customs authority will check the quality of coal imports.

Much of the high ash coal from Australia was developed specifically for the Chinese market and could now be washed to meet the tighter limit on ash, said Rohan Kendall, Wood Mackenzie's metals and mining manager for eastern Asia.

"The uncertainty is whether the Chinese market will be willing to pay a bit extra for that lower ash product from Australia," he said.

Among the larger mines that would not meet restrictions on ash content are BHP Billiton's Mount Arthur operations, which produce about 16-million tonnes a year, Glencore's Mangoola mine, Rio Tinto's Hunter Valley operations and Bengalla mine, but it was not clear how much of that goes to China.

The Minerals Council of Australia, which represents the coal industry, and Australia's official resources forecaster disputed the view of Chinese traders that the new restrictions would hit Australian exporters hardest.

"There is nothing in the information released to date to suggest that Australian coal exporters will be disadvantaged and we are confident that we can meet the proposed specifications," Minerals Council executive director Greg Evans said in an email to Reuters.

Glencore, the world's biggest thermal coal exporter said it was reviewing the proposed restrictions. BHP, the world's biggest metallurgical coal exporter, which gets about a fifth of its coal revenue from China, said it expects to be able to meet the rules and does not expect a big impact on its business.

Rio Tinto had no immediate comment on the policy.

China will also implement a blanket ban on domestic mining, sale, transportation and imports of coal with ash and sulphur content exceeding 40% and 3% respectively.

For coal that will be transported more than 600 kms (373 miles) from the production site or receiving ports, the minimum energy requirement was set at 3,940 kcal/kg, with a maximum ash and sulphur content of 20% and 1% respectively.

When the regulation is implemented, Australian and South African coal with a heating value of 5 500 kcal/kg will be worst hit, since their ash content hovers around 23% to 25% and they contain sulphur of 0.8% to 1%, traders have said.

Top steam coal exporter Indonesia, which largely ships fuel with low heating value, sulphur and ash content, will be the least affected.

"It looks unambiguously positive for Indonesia. Almost all of Indonesian coal can meet these limits," Kendall said.

Edited by: Reuters "

Antwort auf Beitrag Nr.: 47.799.027 von Popeye82 am 17.09.14 05:39:16

" This "Just Sent Shockwaves, Through The Coal Market"

Breaking news: the thermal coal market is reeling this week. After the world's biggest consumer of the commodity announced some sweeping changes to its rules.

That's of course China. Where officials have finally moved on an import ban for shipments of certain types of coal coming into the country.

A notice of new rules around the coal ban was officially posted on the website of the National Development and Reform Commission on Monday. Here's how the ban breaks down (summary courtesy of the keen China-watchers at the Black China blog).

There are three levels to the ban. Under the first level, coastal Chinese cities are restricted from importing coal with sulfur levels above 1%, and ash content greater than 20%.

Level two prohibits the transport of coal for over 600 kilometres inland if it has a calorific value of 3,940 kcal/kg or less. Or if the coal has sulfur content exceeding 1%, or ash content above 20%.

Level three applies a total ban across the country to coal with a sulphur content greater than 3% and ash content greater than 40%.

The new rules are interesting in a couple of ways.

First, as expected, authorities largely went after sulfur and ash content--rather than overall calorific value, as was originally the plan according to reports. This was apparently in response to objections from coal consumers. Who felt that an outright ban on low heat-content coal would make it too hard to find supply.

But the government didn't totally let buyers off the hook here. Coastal cities will still be able to use all varieties of heat-content coal. But inland consumers will be restricted to higher-calorie products.

Analysis is that these rules will hit Australian coal the hardest. Although there are still plenty of mines in that nation producing coal that would pass spec.

A final part of the rules is an outright ban on low-calorie lignite coal, with a sulfur content greater than 1.5% and ash greater than 30%. Which could affect Indonesia--currently the largest supplier of lignite to China.

The ban comes into effect on January 1. But it appears imports could start dropping during the fourth quarter, ahead of the rules being implemented.

Whatever the case, the global coal market has been changed in a big way.

Here's to banning the burn,

Dave Forest

dforest@piercepoints.com

http://piercepoints.com/?p=1308 "

" This "Just Sent Shockwaves, Through The Coal Market"

Breaking news: the thermal coal market is reeling this week. After the world's biggest consumer of the commodity announced some sweeping changes to its rules.

That's of course China. Where officials have finally moved on an import ban for shipments of certain types of coal coming into the country.

A notice of new rules around the coal ban was officially posted on the website of the National Development and Reform Commission on Monday. Here's how the ban breaks down (summary courtesy of the keen China-watchers at the Black China blog).

There are three levels to the ban. Under the first level, coastal Chinese cities are restricted from importing coal with sulfur levels above 1%, and ash content greater than 20%.

Level two prohibits the transport of coal for over 600 kilometres inland if it has a calorific value of 3,940 kcal/kg or less. Or if the coal has sulfur content exceeding 1%, or ash content above 20%.

Level three applies a total ban across the country to coal with a sulphur content greater than 3% and ash content greater than 40%.

The new rules are interesting in a couple of ways.

First, as expected, authorities largely went after sulfur and ash content--rather than overall calorific value, as was originally the plan according to reports. This was apparently in response to objections from coal consumers. Who felt that an outright ban on low heat-content coal would make it too hard to find supply.

But the government didn't totally let buyers off the hook here. Coastal cities will still be able to use all varieties of heat-content coal. But inland consumers will be restricted to higher-calorie products.

Analysis is that these rules will hit Australian coal the hardest. Although there are still plenty of mines in that nation producing coal that would pass spec.

A final part of the rules is an outright ban on low-calorie lignite coal, with a sulfur content greater than 1.5% and ash greater than 30%. Which could affect Indonesia--currently the largest supplier of lignite to China.

The ban comes into effect on January 1. But it appears imports could start dropping during the fourth quarter, ahead of the rules being implemented.

Whatever the case, the global coal market has been changed in a big way.

Here's to banning the burn,

Dave Forest

dforest@piercepoints.com

http://piercepoints.com/?p=1308 "

Global diamond demand reaches record levels, Diamonds Insight Report

www.debeersgroup.com/content/de-beers/corporate/en/news/comp…

www.miningreview.com/global-diamond-demand-reaches-record-le…

"Global demand for diamond jewellery reached a record high of US$79 billion in 2013 according to the inaugural Diamond Insight Report, published by The De Beers Group of Companies.

Demand is expected to continue to grow over the long-term, driven by the ongoing economic recovery in the US (the world’s largest diamond jewellery market) and the growth of the middle classes in developing markets such as China and India. Sales of polished diamonds in the US increased seven per cent in 2013, while both India and China have seen their domestic diamond jewellery markets grow by a compound annual growth rate of 12 per cent in local currency terms between 2008 and 2013.

The report cautions that while diamonds retain their special allure with consumers around the world, future demand levels cannot be taken for granted. The overall category is facing increasingly strong and sophisticated competition from other luxury categories, with diamonds’ share of advertising voice in the US market having reduced within its competitive set.

Global rough diamond production in 2013 increased by seven per cent in carat terms over 2012 levels to a total of around 145 million carats. However, this remains well below the 2005 peak of around 175 million carats. The report further highlights that a forecast reduction in supply from existing sources will likely not be matched by new production coming on-stream in the years ahead and diamond supply is expected to plateau in the second half of the decade before declining from 2020 onwards.

Meanwhile, as mining moves deeper into the earth and towards more remote locations, the extraction process is becoming increasingly complex and costly. The three principal input costs – labour, electricity and diesel – have all seen increases well above local inflation levels in the main diamond producing countries over the last decade and this trend is set to continue.

Substantial investment will be required in diamond production, technology and branding, marketing and retail standards if the industry is to sustain its recent levels of success into the future, the report says.

The report also reveals thaaaaat:

- China is the world’s fastest growing market for diamond jewellery sales, with the number of diamond jewellery retail doors in the country increasing by almost 30 per cent between 2010 and 2013.

- Online has become an increasingly important channel for the diamond industry. Over one in six diamond jewellery purchases in the US was made online in 2013 and in China the internet is already used by a quarter of acquirers for research purposes before purchase.

- Diamonds were a major contributor to the economic performance of producing nations in 2013. In Botswana, diamonds represented more than 25 per cent of GDP and over 75 per cent of overall exports, whereas in Namibia they represented eight per cent of GDP and almost 20 per cent of all exports.

Philippe Mellier, Chief Executive, De Beers Group, said: “Consumer demand remains the one true source of value for the diamond industry. With demand forecast to increase further from 2013’s record levels, the opportunity for growth is clear. But this must not be seen as cause for complacency. The industry will continue to lose ground to other categories if it does not invest significantly in production, marketing and technology.” "

www.debeersgroup.com/content/de-beers/corporate/en/news/comp…

www.miningreview.com/global-diamond-demand-reaches-record-le…

"Global demand for diamond jewellery reached a record high of US$79 billion in 2013 according to the inaugural Diamond Insight Report, published by The De Beers Group of Companies.