Aphria läuft und läuft und.....der stärkste Wert unter den Cannabis Herstellern mit Quartals Gewinne - 500 Beiträge pro Seite

eröffnet am 16.11.16 00:33:20 von

neuester Beitrag 20.05.21 17:44:04 von

neuester Beitrag 20.05.21 17:44:04 von

Beiträge: 8.005

ID: 1.241.544

ID: 1.241.544

Aufrufe heute: 0

Gesamt: 1.053.282

Gesamt: 1.053.282

Aktive User: 0

ISIN: CA03765K1049 · WKN: A12HM0 · Symbol: APHA

12,790

EUR

+0,43 %

+0,055 EUR

Letzter Kurs 01.05.21 Tradegate

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5800 | +922,86 | |

| 1,0400 | +48,57 | |

| 50,80 | +40,72 | |

| 0,5400 | +38,46 | |

| 0,8912 | +27,50 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7500 | -21,05 | |

| 28,18 | -32,62 | |

| 100,00 | -37,50 | |

| 3,6400 | -38,62 | |

| 0,5660 | -40,42 |

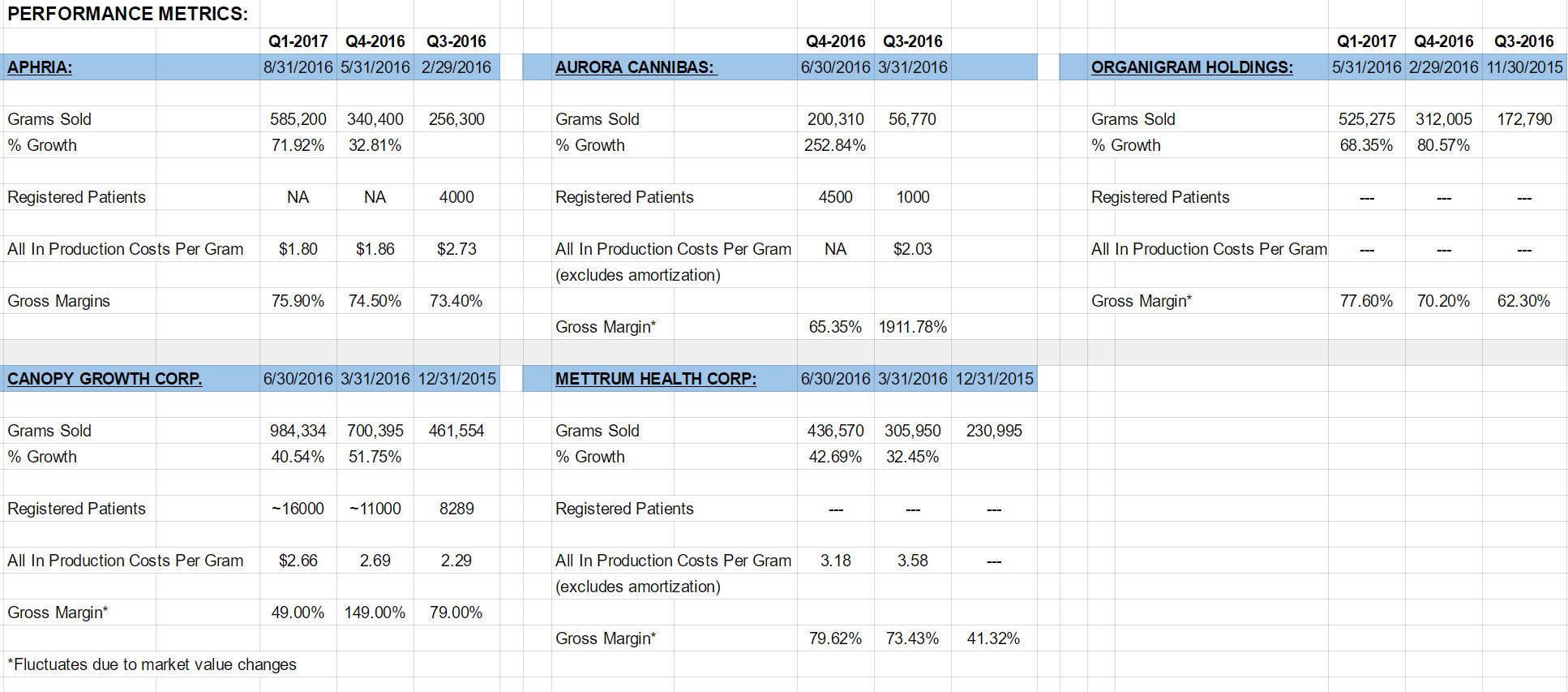

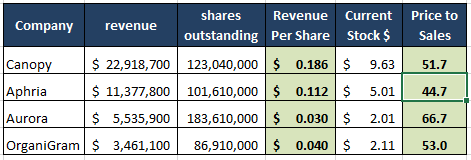

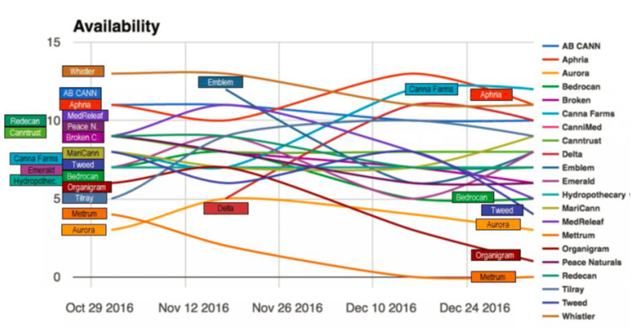

Habe die starken Cannabis Werte: Aphria, Canopy Growth, Aurora und Mettrum uvm verglichen!

Aphria scheint noch das größte Potential zu besitzen.

Canopy MK= 1,8Mrd; Aurora =665 und Aphria =680 Mio. Mettrum über 300 MK. APH hat aber bereits in USA Partnerschaften angekündigt siehe weiter unten!

https://www.aphria.com Ich rechne hier die größte Chancen im Wachstum ein. Aphria hat bereits die Fühler nach USA Arizona und Mexico ausgestreckt! Professioneles Management sehr agil in allen Bereichen!

www.canopygrowth.com Canopy Growth aktuell höchste MK sehr professionelles Management!

https://auroramj.com Ein gutes Management

https://www.mettrum.com Nachzügler

Es gibt noch viele andere.....mit Sicherheit auch gutem Potential nur....Aphria schmiedet starke Partnerschaften.

Aphria hat mit Massroots eine Partnerschaft und wird dort wohl zusätzlich Zuspruch bekommen!

Apps zu den Werten gibt es auch einige, da hat wohl Aurora die Nase vorn mit einer eigenen!

Canopy Growth baut mit Tweed - Snoopdog - Bedrocan und vielen anderen schon Markennamen auf!

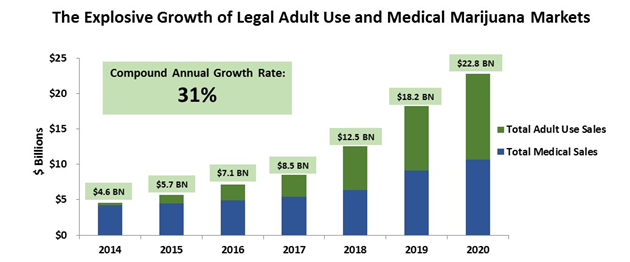

Da dürfte noch eine Weile was gehen nach der Wahl in den USA! Marktanalysen zu Folge (in 2020) mindestens ein Marktumsatz von 21,7 Mrd US Dollar + X. Kanada 5 Mrd + X + Rest der Welt ansteht!

Die heutige News war dann wohl der nächste Katalysator:

Meldung von Heute Partnerschaft auch noch mit Phytopain: PhytoPain und Arlene Dickinson (Direktor)

http://www.mmjobserver.com/aphria-inc-npv-otcmktsaphqf-signs…

Arlene Dickinson: Selfmademillionärin und bei der Dragons Den = Höhle der Löwen Sendung in Kanada für 8 Jahre dabei.

https://en.wikipedia.org/wiki/Arlene_Dickinson

Mit Copper State Farm ein Medical Pharma Hersteller in Arizona-USA, haben sie eine IP Transfer Vereinbarung und die Rechte auf mindestens 5% der Flächen der größten Farm gesichert!

https://www.newcannabisventures.com/aphria-partners-with-40-…

Auszug:

The remaining membership interests of Copperstate will be held by Copperstate Farms Investors LLC (“Investors”). The General Partners of Investors are Fife Symington and Scott Barker. Mr. Symington, a 20-year veteran of greenhouse growing, owns over 850 covered acres of greenhouses (equivalent to 37 million square feet) in Mexico and ships over 175 million pounds of vegetables to the United States annually. As part of the transaction, Aphria invested as a Limited Partner, purchasing sufficient membership interests in Investors to bring Aphria’s total flow-thru ownership in Copperstate to 10%.

Aphria Homepage: https://www.aphria.com/strains

Alle Aphria news: https://www.aphria.com/press

Umsatz und Gewinnreport mit mehreren Quartalen Gewinn: https://aphria.com/assets/reports/2016_10_October_6_-_Q1_res…

Es gibt sicher auch noch versteckte Perlen unter den Cannabis Herstellern - nur der schnellste und agilste mit ausreichend Kapital als FIRST MOVER wird wohl den Markt überrollen.

Hoffe das dies Aphria wird!

Es sollte dennoch jeder seine eigene Analyse und DD für sein Invest machen.

Aphria scheint noch das größte Potential zu besitzen.

Canopy MK= 1,8Mrd; Aurora =665 und Aphria =680 Mio. Mettrum über 300 MK. APH hat aber bereits in USA Partnerschaften angekündigt siehe weiter unten!

https://www.aphria.com Ich rechne hier die größte Chancen im Wachstum ein. Aphria hat bereits die Fühler nach USA Arizona und Mexico ausgestreckt! Professioneles Management sehr agil in allen Bereichen!

www.canopygrowth.com Canopy Growth aktuell höchste MK sehr professionelles Management!

https://auroramj.com Ein gutes Management

https://www.mettrum.com Nachzügler

Es gibt noch viele andere.....mit Sicherheit auch gutem Potential nur....Aphria schmiedet starke Partnerschaften.

Aphria hat mit Massroots eine Partnerschaft und wird dort wohl zusätzlich Zuspruch bekommen!

Apps zu den Werten gibt es auch einige, da hat wohl Aurora die Nase vorn mit einer eigenen!

Canopy Growth baut mit Tweed - Snoopdog - Bedrocan und vielen anderen schon Markennamen auf!

Da dürfte noch eine Weile was gehen nach der Wahl in den USA! Marktanalysen zu Folge (in 2020) mindestens ein Marktumsatz von 21,7 Mrd US Dollar + X. Kanada 5 Mrd + X + Rest der Welt ansteht!

Die heutige News war dann wohl der nächste Katalysator:

Meldung von Heute Partnerschaft auch noch mit Phytopain: PhytoPain und Arlene Dickinson (Direktor)

http://www.mmjobserver.com/aphria-inc-npv-otcmktsaphqf-signs…

Arlene Dickinson: Selfmademillionärin und bei der Dragons Den = Höhle der Löwen Sendung in Kanada für 8 Jahre dabei.

https://en.wikipedia.org/wiki/Arlene_Dickinson

Mit Copper State Farm ein Medical Pharma Hersteller in Arizona-USA, haben sie eine IP Transfer Vereinbarung und die Rechte auf mindestens 5% der Flächen der größten Farm gesichert!

https://www.newcannabisventures.com/aphria-partners-with-40-…

Auszug:

The remaining membership interests of Copperstate will be held by Copperstate Farms Investors LLC (“Investors”). The General Partners of Investors are Fife Symington and Scott Barker. Mr. Symington, a 20-year veteran of greenhouse growing, owns over 850 covered acres of greenhouses (equivalent to 37 million square feet) in Mexico and ships over 175 million pounds of vegetables to the United States annually. As part of the transaction, Aphria invested as a Limited Partner, purchasing sufficient membership interests in Investors to bring Aphria’s total flow-thru ownership in Copperstate to 10%.

Aphria Homepage: https://www.aphria.com/strains

Alle Aphria news: https://www.aphria.com/press

Umsatz und Gewinnreport mit mehreren Quartalen Gewinn: https://aphria.com/assets/reports/2016_10_October_6_-_Q1_res…

Es gibt sicher auch noch versteckte Perlen unter den Cannabis Herstellern - nur der schnellste und agilste mit ausreichend Kapital als FIRST MOVER wird wohl den Markt überrollen.

Hoffe das dies Aphria wird!

Es sollte dennoch jeder seine eigene Analyse und DD für sein Invest machen.

Auch die Grünen wollen Cannabis über den Bundesrat legalisieren...

.....damit sollte auch der Schwarzmarkt und damit die Kriminalität bei Cannabis zurückgehen.https://www.deutsche-apotheker-zeitung.de/news/artikel/2016/…

Zu der Meldung von Heute noch....

....Arlene Dickinson Selfmademillionärin und bei der Dragons Den = Höhle der Löwen Sendung in Kanada für 8 Jahre dabei.Ihre Homepage..... http://arlenedickinson.com/

Ich hatte auch mal die Facebook Zahlen und....

.......Wachstum an Likes verglichen, da lagen Aurora/Mettrum vorn, jedoch holt Aphria schnell auf: Aurora Cannabis: https://www.facebook.com/pg/aurorammj/likes/?ref=page_intern…

Mettrum: https://www.facebook.com/pg/mettrum/likes/?ref=page_internal

Aphria: https://www.facebook.com/pg/AphriaMMJ/likes/?ref=page_intern…

Canopy Growth: https://www.facebook.com/pg/canopygrowth/likes/?ref=page_int…

Cannabis Lockerungen in den USA von 1970....

...bis 2013 und letzte Woche ging es munter weiter mit 8X "Ja" von 9 in den Staaten.

Und die 2016er Wahlen....

....haben gar in einigen Staaten die freie Nutzung "Recreational" erlaubt....Dieses Bild ist nicht SSL-verschlüsselt: [url]http://encdn02.mundotkm.com/2016/11/Screen-Shot-2016-11-09-at-3.28.16-PM.png

[/url] Bei freie Nutzung "Recreational" erlaubt....

.....reden wir von 65 Millionen Amerikaner + die freie medizinische Nutzung in vielen weiteren Staaten!Hier die Info! http://www.mundotkm.com/en/life/10797/grab-drink-doobie-denv…

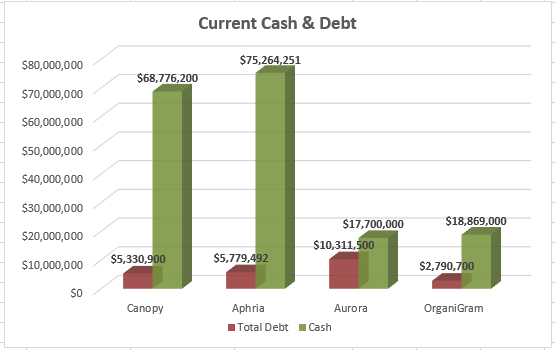

Aphria dürfte die größte Kriegskasse unter den....

....großen Marihuana Herstellern haben!https://www.insiderfinancial.com/aphria-inc-boosts-its-war-c…

Auszug: 90 Mio cash + eine weitere Partnerschaft mit Tetra Bio-Pharma Inc. !

Currently trading with a market cap of C$438 million, Aphria will have roughly C$90 million in cash on its books by the end of this month. We believe the company is on the verge of some major developments in terms of production and M&A activities. With smart money coming in at C$4 a share, we believe this bull run could just be getting started in Aphria. Aphria is certainly a must-own in the cannabis space. We will be updating our subscribers with the latest on Aphria and other cannabis names. For complete coverage, sign up below!

Warum Aphria bald bis zu 2 Mrd. Marktkapitalsierung haben könnte....

....Aphria Secures Immediate Access to Eight-Fold Production Increase, With Fully Built-Out Capacity of 1,000,000 Square Feet, Supporting $700 Million in Annualized Revenue!News aus April!

https://aphria.com/assets/reports/PR_10_-_April_7_2016_-_CF_…

Was ist das denn für eine Schrottaktie? Kursziel 0.0001.

*JOOOKKKEEE*

Einer der besten Cannabis-Aktien. Gute Umsätze, schon in den grünen Zahlen. Dürfte noch viel höher gehen. Fragt sich nur, wann man einsteigt. Erscheint mir zur Zeit etwas zu hoch. Klar, ich will günstig rein.

*JOOOKKKEEE*

Einer der besten Cannabis-Aktien. Gute Umsätze, schon in den grünen Zahlen. Dürfte noch viel höher gehen. Fragt sich nur, wann man einsteigt. Erscheint mir zur Zeit etwas zu hoch. Klar, ich will günstig rein.

Mal ne Frage. Wie siehst du den Trump-Sieg in Bezug auf Legalisierung von Cannabis? Hat er sich in irgendeiner Weise dazu geäußert?

Antwort auf Beitrag Nr.: 53.705.070 von jhackel am 16.11.16 11:30:23

Die Legalisierung von Marihuana schreitet immer weiter voran!

In mehreren Bundesstaaten der USA ist nun der Verkauf, Erwerb und Konsum legal, sodass nun mittlerweile jeder fünfte Amerikaner die Möglichkeit hat, Marihuana legal zu kaufen. Der legale Anbau und Verkauf in Colorado ist beispielsweise bereits ein voller Erfolg und auch andere Bundesstaaten folgen dem guten Beispiel. In allen anderen Bundesstaaten gilt jedoch nach wie vor das Drogenverbot aus unterschiedlichen Gründen. Seit der Wahlnacht und dem Sieg von Donald Trump fragen sich nun aber doch einige, ob sich daran nicht doch in naher Zukunft etwas ändern könnte.

Die Wahlnacht - ein Erfolg für die Marihuana-Lobby

Kalifornien hat nun als bevölkerungsreichster Bundesstaat die Legalisierung von Marihuana als reines Genussmittel beschlossen und auch in Massachusetts, Nevada und Maine waren die Wähler für eine Freigabe. In Florida darf Marihuana zwar noch nicht für den privaten Genussgebrauch gekauft und geraucht werden, für medizinische Zwecke ist hier aber eine Freigabe erteilt worden. Arizona hängt während dessen noch am Bürgerentscheid zur Legalisierung fest, aber auch das ist nur eine Frage der Zeit. Aber was hat das nun mit der Wahlnacht zu tun?

Marihuana darf nun auch zum purem Genuss in allen Bundesstaaten konsumiert werden, in denen mehr als 20 Prozent der Bevölkerung stehen. Das bedeutet, dass die gesamte Westküste legal Marihuana kaufen und anbauen darf. Für weitere 30 Bundesstaaten wird es als Therapiemittel anerkannt werden. Und genau dies ist ein mega Erfolg für die Reformbewegung von Marihuana. Denn nur wenn es endlich mehr gute Beispiele gibt, an denen wir uns orientieren können, kann auch bei uns ein Umdenken stattfinden. So bleiben Staaten wie Kalifornien oder Colorado keine Ausnahme mehr, sondern ganz Amerika könnte in dieser Sache zum Vorbild werden. Und wir alle wissen, dass wir bereits so einiges von den Amis übernommen haben.

Colorado ging mit bestem Beispiel voran

Colorado war der erste Bundesstaat, der 2014 Marihuana offiziell als Genussmittel erlaubte. Ihm folgen Bundesstaaten wie Washington, Oregon und Alaska. Seit 1996 ist an der Westküste Marihuana für medizinische Zwecke zwar erlaubt, dennoch dauerte es weitere 20 Jahre, ehe die Freigabe auch als Genussmittel folgte. Es war allerdings bereits davor ziemlich leicht, dort eine ärztliche Genehmigung zu bekommen.

Erfolgsmodell Colorado, so nennen es Befürworter der Legalisierung, wenn es um die Legalisierung anderer Staaten und Länder geht. Die Zahl der Drogendelikte ist seit 2014 massiv gesunken, die zusätzlichen Steuereinnahmen waren und sind ein weiterer positiver Aspekt. In Kalifornien könnten Schätzungen zufolge knapp eine Milliarde Dollar Steuern pro Jahr zusammen kommen, Colorado brachte es im vergangenen Jahr auf 135 Millionen Dollar Steuern. Aber wie das eben immer so ist, gibt es dennoch immer noch Kritiker, die sich nach wie vor gegen eine Freigabe aussprechen. Die negativen Auswirkungen auf die Gesundheit seien ihrer Meinung nach immer noch nicht ausreichend untersucht und auch für den Straßenverkehr bedeutet die Legalisierung eine zusätzliche Gefahr.

Auf Bundesebene betrachtet ist die Substanz nach wie vor verboten und wird auf eine Stufe mit Heroin gestellt, nur steigt die Zahl der einzelnen Gegenden, in denen der Konsum erlaubt ist. Und das ist leider immer noch mehr als widersprüchlich und daran muss sich auch etwas ändern. Und das wird es auch, jetzt, wo auch Kalifornien mit im Geschäft ist.

Der Krieg gegen die Drogen ist und bleibt unproduktiv und wird auch sonst nichts bewirken, außer noch mehr Widerstand. Das sehen einige Parteien und Kongressabgeordnete mittlerweile auch so. Barack Obama lies verkünden, dass die Position gegen die Drogen immer unhaltbarer werden, je mehr Bundesstaaten die Verbote fallen ließen. Und jetzt müssen sich die Amerikaner mit Donald Trump auseinandersetzen, der sich im Wahlkampf für die Genehmigung von Marihuana als Therapiemittel aussprach. Typisch Trump überlässt er es jedoch den einzelnen Bundesstaaten, ob und inwiefern eine Legalisierung statt finden solle.

Link dazu:

http://www.hanf-magazin.com/news/neuer-us-praesident-trump-e…

» Hanf News » Neuer US-Präsident Trump - ein Erfolg für die Legalisierung von Marihuana?

Neuer US-Präsident Trump - ein Erfolg für die Legalisierung von Marihuana?Die Legalisierung von Marihuana schreitet immer weiter voran!

In mehreren Bundesstaaten der USA ist nun der Verkauf, Erwerb und Konsum legal, sodass nun mittlerweile jeder fünfte Amerikaner die Möglichkeit hat, Marihuana legal zu kaufen. Der legale Anbau und Verkauf in Colorado ist beispielsweise bereits ein voller Erfolg und auch andere Bundesstaaten folgen dem guten Beispiel. In allen anderen Bundesstaaten gilt jedoch nach wie vor das Drogenverbot aus unterschiedlichen Gründen. Seit der Wahlnacht und dem Sieg von Donald Trump fragen sich nun aber doch einige, ob sich daran nicht doch in naher Zukunft etwas ändern könnte.

Die Wahlnacht - ein Erfolg für die Marihuana-Lobby

Kalifornien hat nun als bevölkerungsreichster Bundesstaat die Legalisierung von Marihuana als reines Genussmittel beschlossen und auch in Massachusetts, Nevada und Maine waren die Wähler für eine Freigabe. In Florida darf Marihuana zwar noch nicht für den privaten Genussgebrauch gekauft und geraucht werden, für medizinische Zwecke ist hier aber eine Freigabe erteilt worden. Arizona hängt während dessen noch am Bürgerentscheid zur Legalisierung fest, aber auch das ist nur eine Frage der Zeit. Aber was hat das nun mit der Wahlnacht zu tun?

Marihuana darf nun auch zum purem Genuss in allen Bundesstaaten konsumiert werden, in denen mehr als 20 Prozent der Bevölkerung stehen. Das bedeutet, dass die gesamte Westküste legal Marihuana kaufen und anbauen darf. Für weitere 30 Bundesstaaten wird es als Therapiemittel anerkannt werden. Und genau dies ist ein mega Erfolg für die Reformbewegung von Marihuana. Denn nur wenn es endlich mehr gute Beispiele gibt, an denen wir uns orientieren können, kann auch bei uns ein Umdenken stattfinden. So bleiben Staaten wie Kalifornien oder Colorado keine Ausnahme mehr, sondern ganz Amerika könnte in dieser Sache zum Vorbild werden. Und wir alle wissen, dass wir bereits so einiges von den Amis übernommen haben.

Colorado ging mit bestem Beispiel voran

Colorado war der erste Bundesstaat, der 2014 Marihuana offiziell als Genussmittel erlaubte. Ihm folgen Bundesstaaten wie Washington, Oregon und Alaska. Seit 1996 ist an der Westküste Marihuana für medizinische Zwecke zwar erlaubt, dennoch dauerte es weitere 20 Jahre, ehe die Freigabe auch als Genussmittel folgte. Es war allerdings bereits davor ziemlich leicht, dort eine ärztliche Genehmigung zu bekommen.

Erfolgsmodell Colorado, so nennen es Befürworter der Legalisierung, wenn es um die Legalisierung anderer Staaten und Länder geht. Die Zahl der Drogendelikte ist seit 2014 massiv gesunken, die zusätzlichen Steuereinnahmen waren und sind ein weiterer positiver Aspekt. In Kalifornien könnten Schätzungen zufolge knapp eine Milliarde Dollar Steuern pro Jahr zusammen kommen, Colorado brachte es im vergangenen Jahr auf 135 Millionen Dollar Steuern. Aber wie das eben immer so ist, gibt es dennoch immer noch Kritiker, die sich nach wie vor gegen eine Freigabe aussprechen. Die negativen Auswirkungen auf die Gesundheit seien ihrer Meinung nach immer noch nicht ausreichend untersucht und auch für den Straßenverkehr bedeutet die Legalisierung eine zusätzliche Gefahr.

Auf Bundesebene betrachtet ist die Substanz nach wie vor verboten und wird auf eine Stufe mit Heroin gestellt, nur steigt die Zahl der einzelnen Gegenden, in denen der Konsum erlaubt ist. Und das ist leider immer noch mehr als widersprüchlich und daran muss sich auch etwas ändern. Und das wird es auch, jetzt, wo auch Kalifornien mit im Geschäft ist.

Der Krieg gegen die Drogen ist und bleibt unproduktiv und wird auch sonst nichts bewirken, außer noch mehr Widerstand. Das sehen einige Parteien und Kongressabgeordnete mittlerweile auch so. Barack Obama lies verkünden, dass die Position gegen die Drogen immer unhaltbarer werden, je mehr Bundesstaaten die Verbote fallen ließen. Und jetzt müssen sich die Amerikaner mit Donald Trump auseinandersetzen, der sich im Wahlkampf für die Genehmigung von Marihuana als Therapiemittel aussprach. Typisch Trump überlässt er es jedoch den einzelnen Bundesstaaten, ob und inwiefern eine Legalisierung statt finden solle.

Link dazu:

http://www.hanf-magazin.com/news/neuer-us-praesident-trump-e…

Antwort auf Beitrag Nr.: 53.705.070 von jhackel am 16.11.16 11:30:23

Auszug aus dem Bericht:

Und jetzt müssen sich die Amerikaner mit Donald Trump auseinandersetzen, der sich im Wahlkampf für die Genehmigung von Marihuana als Therapiemittel aussprach. Typisch Trump überlässt er es jedoch den einzelnen Bundesstaaten, ob und inwiefern eine Legalisierung statt finden solle.

Meine Meinung:

Bis Trump im Januar zum Präsident vereidigt wird, wird er sich ein demokratisches Grundverständnis anlegen müssen.

Dazu kommt das der Sektor bis 2020 über 20 Mrd $ Umsatz generieren kann, die da aus Schwarzmarkt Steuergerld machen können!

Trump ist Unternehmer und sein "Make Amerika Big Again" wird gegen die Stimme des Volkes nicht regierbar und haltbar sein.

Also wird der sonst so beratungsresistente Donald wohl die Stimme des Volkes die ihn gewählt hat auch gelten lassen müssen!

Wenn Trump sich mit mindestens 65 Mio Amerikaner anlegen will.....?

Zitat von jhackel: Mal ne Frage. Wie siehst du den Trump-Sieg in Bezug auf Legalisierung von Cannabis? Hat er sich in irgendeiner Weise dazu geäußert?

Auszug aus dem Bericht:

Und jetzt müssen sich die Amerikaner mit Donald Trump auseinandersetzen, der sich im Wahlkampf für die Genehmigung von Marihuana als Therapiemittel aussprach. Typisch Trump überlässt er es jedoch den einzelnen Bundesstaaten, ob und inwiefern eine Legalisierung statt finden solle.

Meine Meinung:

Bis Trump im Januar zum Präsident vereidigt wird, wird er sich ein demokratisches Grundverständnis anlegen müssen.

Dazu kommt das der Sektor bis 2020 über 20 Mrd $ Umsatz generieren kann, die da aus Schwarzmarkt Steuergerld machen können!

Trump ist Unternehmer und sein "Make Amerika Big Again" wird gegen die Stimme des Volkes nicht regierbar und haltbar sein.

Also wird der sonst so beratungsresistente Donald wohl die Stimme des Volkes die ihn gewählt hat auch gelten lassen müssen!

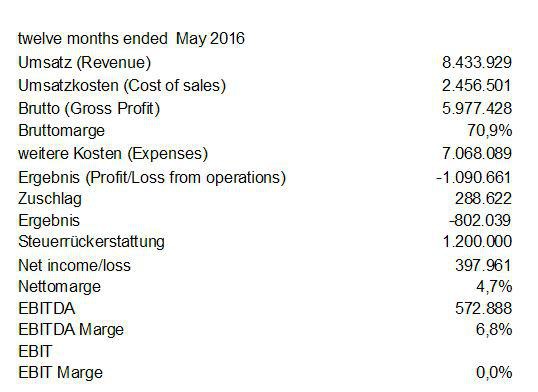

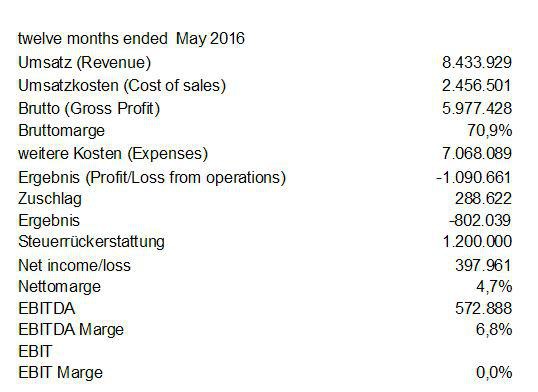

Noch ein paar Zahlen, wie z.B.: Gross Profit von über 80%....

und zum Management mit "Management Circular" vom 27.10.https://aphria.com/assets/reports/Management_Information_Cir…

Quartalszahlen:

https://aphria.com/assets/reports/9_-_Aphria-Q1_2017_FS-AUG_…

Analyst Coverage:

https://www.aphria.com/investors/analystcoverage

Clarus Securities Inc Noel Atkinson

Dundee Capital Markets Daniel Pearlstein

GM Securities Inc. Martin Landry

Mackie Research Capital Corporation

P I Financial Jason Zandberg

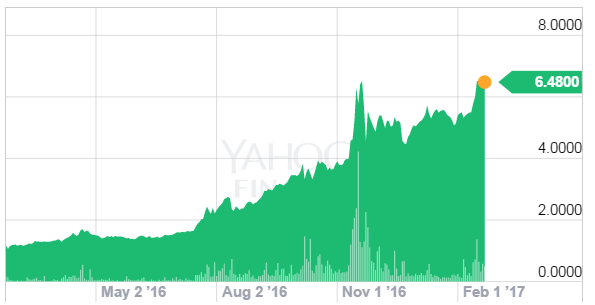

Chart sieht bis jetzt und heute wieder gut aus!

Kanada:USA:

Vielleicht ist er ja selbst Kunde. Gibt es zu der Aktie auch Ergebniszahlen?

Antwort auf Beitrag Nr.: 53.708.283 von sdaktien am 16.11.16 17:06:59

Quartalszahlen: 2 Beiträge vorher....oder hier https://aphria.com/assets/reports/9_-_Aphria-Q1_2017_FS-AUG_…

Zitat von sdaktien: Vielleicht ist er ja selbst Kunde. Gibt es zu der Aktie auch Ergebniszahlen?

Quartalszahlen: 2 Beiträge vorher....oder hier https://aphria.com/assets/reports/9_-_Aphria-Q1_2017_FS-AUG_…

Nur Zahlen Q3. Das ist etwas wenig, auch wenn die auf den ersten Blick gut aussehen.

Beim Überfliegen hab ich gesehen, dass es da wohl noch Optionsprogramme für weitere Aktien gibt. Weisst du, wieviele Aktien da noch dazukommen können? Das ist nicht unwichtig, wenn es darum geht, wie ein eventuell anfallender Gewinn verteilt wird.

Beim Überfliegen hab ich gesehen, dass es da wohl noch Optionsprogramme für weitere Aktien gibt. Weisst du, wieviele Aktien da noch dazukommen können? Das ist nicht unwichtig, wenn es darum geht, wie ein eventuell anfallender Gewinn verteilt wird.

Antwort auf Beitrag Nr.: 53.708.547 von sdaktien am 16.11.16 17:30:59Steht im MDA: http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=…

Common stock 90,196,539 90,196,539

Stock options -- 3,917,436 3,917,436 5,083,454

Warrants -- 14,306,359 14,306,359 14,306,359

Compensation warrants -- 1,739,070 1,739,070 1,739,070

Warrants on exercise of compensation warrants -- 265,391

Fully diluted 90,196,539 111,590,813

Fully diluted nach der Finanzierung im Nov. mit Bought Deal von 35 Mio + 5 Mio ca. weitere 10 Mio Aktien.

Common stock 90,196,539 90,196,539

Stock options -- 3,917,436 3,917,436 5,083,454

Warrants -- 14,306,359 14,306,359 14,306,359

Compensation warrants -- 1,739,070 1,739,070 1,739,070

Warrants on exercise of compensation warrants -- 265,391

Fully diluted 90,196,539 111,590,813

Fully diluted nach der Finanzierung im Nov. mit Bought Deal von 35 Mio + 5 Mio ca. weitere 10 Mio Aktien.

!

Dieser Beitrag wurde von MagicMOD moderiert. Grund: auf eigenen Wunsch des UsersShort Attack nach Trading Halt für alle "Gras" ....

...Aktien, die wurden heute von IIROC ausgesetzt und plötzlich brach Panik aus. Typisches Short Szenario, bei dem die großen Ihren Reibach machen!http://business.financialpost.com/investing/market-moves/mar…

Es war wohl Canopy Growth der den ersten Halt verursacht hat....

Da gibt es wohl auch ein Gesetz, das Aktien die innerhalb weniger Minuten +/-10 % machen oder über 30% steigen ausgesetzt werden können nennt sich "single stock circuit breakers".Einige der Werte haben die Marijuana - Blase erzeugt, Aphria gehört wohl nicht dazu.

Mit knapp 90 Mio $ cash und 1 Mio EBITDA also Gewinn im letzten Quartal, dürfte sie bald wieder zurück zu alter Stärke finden.

http://business.financialpost.com/news/fp-street/canada-impl…

Video dazu zum Thema.....

...die haben Aphria jedoch nicht mal im Fokus.http://www.bnn.ca/the-close/marijuana-stock-highs-scaring-of…

Hier steht es zu Aphria nochmal geschrieben:

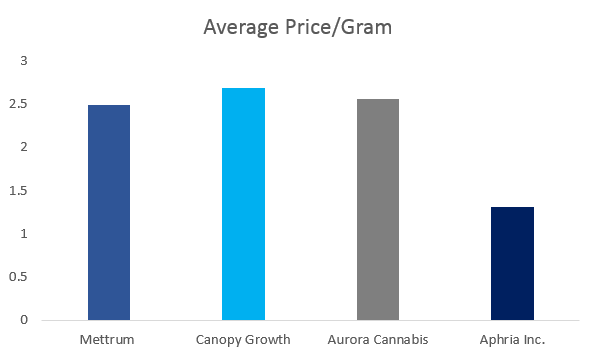

Of all marijuana producers, Aphria Inc. stands apart as the only company to be turning a profit from the production and sale of medical marijuana. This is partly due to them being the most cost effective producer in the industry with an “all-in” cost of $1.80/ gram. This makes you wonder just how low prices will go when the marijuana industry shifts to awholesale distribution model. Readers should note that LPs have been selling marijuana atabout $8.00/g.In addition, Aphria has one of the most well-equipped leadership team, which will continue to drive value for its shareholders. Led by President and CEO Vic Neufeld,who was previously CEO of Jamieson Laboratories Canada, Aphria has solidified its operational excellence and is in the best position to grow its value for shareholders through expansion, as it holds one of the largest cash positions in the industry, supported by positive operating cash flow.Based on this analysis, Maple Leaf Green, Supreme Pharma, Aphria, and Aurora come out on top.

Aphria Inc. stands apart as the only company to be turning a…

Antwort auf Beitrag Nr.: 53.715.246 von sunny3999 am 17.11.16 13:27:14

Link dazu:

http://smallcappower.com/wp-content/uploads/2016/11/Marijuan… APHRIA INC NPV (OTCMKTS:APHQF) Head of the Cannabis Class

By Jermaine Farmer - November 17, 2016APHRIA INC NPV (OTCMKTS:APHQF) is a stock that’s been powering in an uptrend on the strength of legislative changes here and in Canada, and the anticipation of more to come. In addition, according to Benzinga.com, APHQF is currently at the top of the list “of all the stocks in the The Marijuana Index’s comprehensive list of North American marijuana-related stocks” as far as total performance this year.

Traders will note 52% added to share values of the company over the past month of action. Market participants may want to pay attention to this stock. APHQF is a stock whose past is littered with sudden rips. Moreover, the company has benefitted from a jump in recent trading volume to the tune of just shy of 490% above its longer run average levels.

APHRIA INC NPV (OTCMKTS:APHQF) trumpets itself as a company that produces, supplies, and sells medical cannabis in Canada. Its cannabis products include dried flowers and cannabis oils.

The company sells its products through its online store and telephone orders, as well as MMPR licenced producers. Aphria Inc. is headquartered in Leamington, Canada.

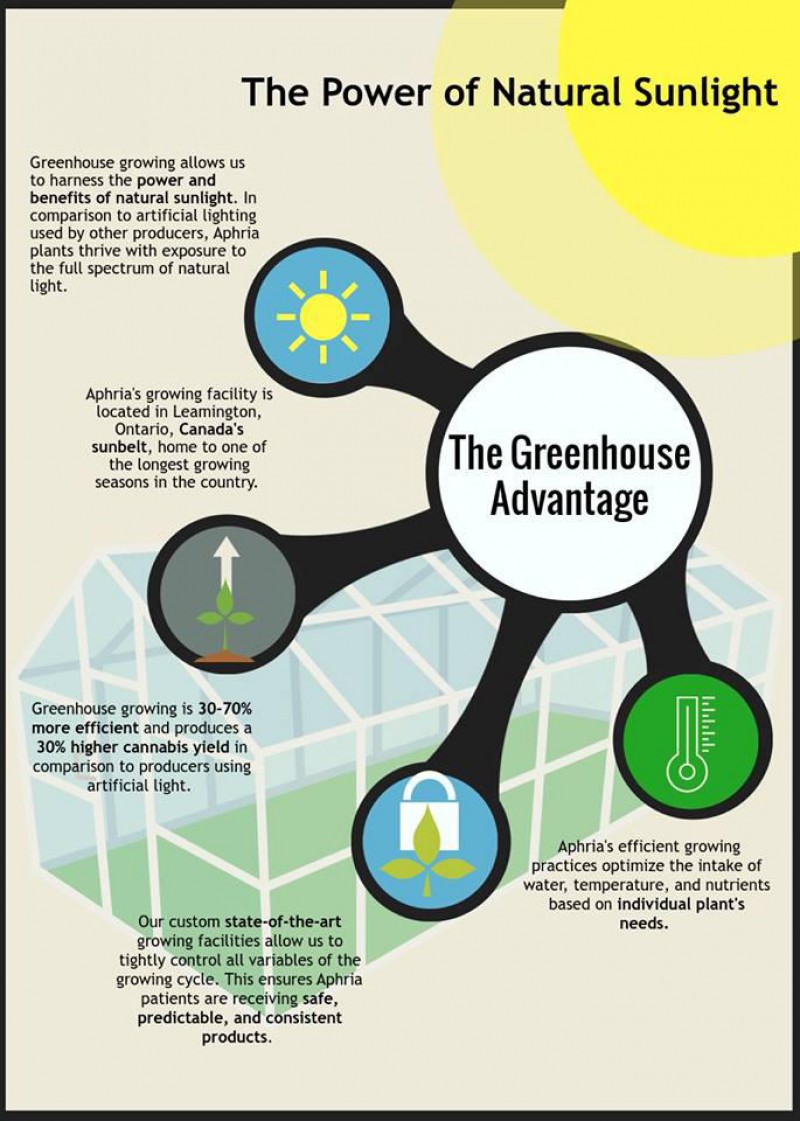

According to company press materials, “Aphria Inc., one of Canada’s lowest cost producers, produces, supplies and sells medical cannabis. Located in Leamington, Ontario, the greenhouse capital of Canada. Aphria is truly powered by sunlight, allowing for the most natural growing conditions available. We are committed to providing pharma-grade medical cannabis, superior patient care while balancing patient economics and returns to shareholders. We are the first public licensed producer to report positive cash flow from operations and the first to report positive earnings in consecutive quarters.”

Clearly, with exposure to the cannabis marketplace in North America, this is another stock that greatly benefited from both the anticipation and outcome of the huge US referendum on pot legalization that took place across nine states on November 8 (last Tuesday). The voting went well, with 8 of 9 states moving forward on the legislative path toward greater legal sales. Industry analysts have posted expectations of somewhere on the order of a 3-4x growth in legal sales footprint in the US as a result.

However, the Canadian cannabis story may even be hotter right now than the US one, and in fact may provide a model for what we will eventually see here in the states. In Canada, legislation is likely to be on the table sometime next year to fully legalize pot on a national basis for all conceivable consumers, according to a promise made by the country’s PM Trudeau.

In addition, the company just announced that it has entered into an agreement with Clarus Securities Inc., on behalf of a syndicate of underwriters, pursuant to which the Underwriters have agreed to purchase, on a “bought deal” basis, 8,750,000 Common Shares of the Company at a price of C$4.00 per Common Share for aggregate gross proceeds to the Company of C$35,000,000.

The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 1,312,500 Common Shares at the Offering Price, exercisable in whole or in part at any time for a period ending 30 days from the closing of the Offering. In the event the over-allotment option is exercised in full, the aggregate gross proceeds of the Offering will be C$40,250,000.

According to the release, “The Company intends to use the net proceeds from the Offering for the development of infrastructure, purchase of capital equipment, capacity expansion, strategic investments, and general working capital purposes.”

At this time, carrying a capital value in the market of $319.3M, APHQF has a significant war chest ($39.63M) of cash on the books, in a pool of total assets approaching $63M, which leans against an appreciable load ($5.73M) of total accumulated debt.

The bottom line is; APHQF is making real money, with trailing revs already coming in at $8.79M. In addition, the company is starting to see major topline growth, with quarterly y/y revs increasing at 360%. In other words, this is a top performer with a great balance sheet, great financials, and likely strong catalysts ahead. We will continue to follow it closely.

http://oracledispatch.com/2016/11/17/aphria-inc-npv-otcmktsa…

Arlene Dickinson joins board of medical marijuana player Aphria (Cantech Oct. 28th)

Medical marijuana pubco Aphria (TSX:APH) today announced that former Dragons Den star Arlene Dickinson has joined its board.

“We are very pleased to have Arlene join the board. The former Dragon will provide valuable marketing experience and a no holds barred approach to future strategic directions,” said Vic Neufeld, Chief Executive Officer of Aphria.

Dickinson is the CEO of Venture Communications. Under her leadership, the Toronto-based firm has become one of Canadas biggest marketing and communication firms. She is the author of two books, “Persuasion” and, the more recent “All In..”. Dickinson is the recipient of honorary degrees from Mount Saint Vincent University, Saint Mary’s University and the Northern Alberta Institute of Technology. She sits on the Leadership Council of the Perimeter Institute for Theoretical Physics and is the recipient of The Queen Elizabeth II Diamond Jubilee Medal.

Today’s news follows on a report earlier this week from Clarus Securities analyst Noel Atkinson, who says Aphria is the company best positioned to serve the potential pharmacy market in Canada. On Tuesday, Shoppers Drug Mart submitted a Licensed Producer (LP) sales license application to Health Canada to dispense medical cannabis prescriptions.

“We see Aphria as the best-situated of the publicly-traded LPs to thrive as a wholesaler in a pharmacy dominated medical cannabis market,” said Atkinson. “The Company has the lowest known production costs per gram in the industry, has been able to scale successfully to 43,000 sq. ft. of production with zero crop failures, its management has extensive experience in selling large quantities of health products to Canadian pharmacy chains, and the Company appears to be at least as focused on the medical market as the rec market. Canopy Growth is at a much larger production scale than Aphria and its Bedrocan and Tweed units have been selling into the medical market for quite a while, but it remains to be seen whether Canopy would be willing to allocate a large portion of capacity to wholesale for pharmacies when it has the largest direct-to-patient revenue of the public LPs and is so heavily investing in its recreational strategy. We know of no other public LPs producing at scale in-house. Of the privately-held LPs, only a few appear to be successfully growing at high capacity utilization in larger facilities and focused on the medical market, most notably MedReleaf, CanniMed and CannTrust.”

Atkinson has a “Buy” rating and one-year price target of $5.00 on Aphria, which closed Friday at $3.65.

http://www.cantechletter.com/2016/10/arlene-dickinson-joins-…

Marijuana Dominates Canada: Supreme Pharmaceuticals, Canopy Growth, Aphria Inc

Aphria Inc. is in a similar situation, but its valuation has increased even more dramatically. On October 19, 2016, Aphria closed at $3.82. At the time of writing on November 18 at noon on the east coast, Aphria’s share price was $6.78. In the last thirty days, it has traded a total of 70.1 million shares, just under Supreme’s volumes, and its up by 77 per cent..

.

That’s the kind of win most investors only dream about. Is it going to happen again? You bet it is. But you’ll have to be a subscriber to the premium edition if you want to find out who it’s going to be.

http://www.midasletter.com/2016/11/sptsx-composite-index-and…

[/url]

Financial Post schreibt:

Marijuana stocks stealing all of the action in Canada by unprecedented volumes. Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]http://business.financialpost.com/midas-letter/marijuana-sto…

Der liberale Premierminister Kanadas JUSTIN TRUDEAU sagt:

We will legalize, regulate, and restrict access to marijuana.Canada’s current system of marijuana prohibition does not work. It does not prevent young people from using marijuana and too many Canadians end up with criminal records for possessing small amounts of the drug.

Arresting and prosecuting these offenses is expensive for our criminal justice system. It traps too many Canadians in the criminal justice system for minor, non-violent offenses. At the same time, the proceeds from the illegal drug trade support organized crime and greater threats to public safety, like human trafficking and hard drugs.

To ensure that we keep marijuana out of the hands of children, and the profits out of the hands of criminals, we will legalize, regulate, and restrict access to marijuana.

We will remove marijuana consumption and incidental possession from the Criminal Code, and create new, stronger laws to punish more severely those who provide it to minors, those who operate a motor vehicle while under its influence, and those who sell it outside of the new regulatory framework.

We will create a federal/provincial/territorial task force, and with input from experts in public health, substance abuse, and law enforcement, will design a new system of strict marijuana sales and distribution, with appropriate federal and provincial excise taxes applied.

https://www.liberal.ca/realchange/marijuana/

Canadian marijuana producers eye U.S. market to have their weed and smoke it too

Video Link dazu: http://business.financialpost.com/news/agriculture/canadian-…The groundswell of American states that bent toward legalization last week may give a big boost to Canada’s marijuana industry — not because Canadian producers want to move south, but because the drug’s murky U.S. legal status positions them to have their weed and smoke it too.

California, Nevada, Massachusetts and Maine voted to legalize recreational marijuana last Tuesday and four more states voted in favour of medical marijuana use.

The vote sent cannabis stocks in Canada and the U.S. soaring. Shares of Los Angeles-based Pineapple Express Inc. rose 29 per cent Wednesday while the legalization news pushed Canada’s largest marijuana company, Canopy Growth Corp., to a billion-dollar valuation.

Antwort auf Beitrag Nr.: 53.702.421 von sunny3999 am 16.11.16 01:39:09

Mal sehen wer das Rennen in der nächsten Woche macht!

Auch diese Woche wieder, das prozentuell größte Wachstum an LIKES für Aphria auf Facebook!

Zitat von sunny3999: .......Wachstum an Likes verglichen, da lagen Aurora/Mettrum vorn, jedoch holt Aphria schnell auf:[/url]

1. Aphria: https://www.facebook.com/pg/AphriaMMJ/likes/?ref=page_intern…Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

2. Aurora Cannabis: https://www.facebook.com/pg/aurorammj/likes/?ref=page_intern…

3. Canopy Growth: https://www.facebook.com/pg/canopygrowth/likes/?ref=page_int…

4. Mettrum: https://www.facebook.com/pg/mettrum/likes/?ref=page_internal

Mal sehen wer das Rennen in der nächsten Woche macht!

Canada’s cheapest pot producer sees sunshine as the secret to dominating legalization era

....mit Video vom CEO Vic Neufeld.http://business.financialpost.com/news/agriculture/canadas-c…

Aphria Inc.’s marijuana greenhouse is probably a space as different as it could be from a drug dealer’s dingy basement. But it is home to some of the lowest-priced commercial pot in the country.

Canada’s budding marijuana industry could blossom into a $5-billion market if Liberals make recreational pot legal

Associated Press

It is already being compared to the end of prohibition.

Justin Trudeau’s majority win paves the way for Canada to legalize recreational marijuana, a move that would transform the country’s nascent pot industry overnight. But while that is extremely exciting news for the licensed producers in the space, it would bring plenty of challenges as well.

Nothing here screams “cheap,” however. The spotless 22,000-square-foot facility is lined with more than 20,000 cannabis plants at various stages of development. Automated lighting and roofing systems ensure that plants receive exactly the right amount of light. A water system provides flood irrigation for stock plants, and drip water for the plants nearing harvesting. Scientists and other workers mill about inspecting plants, rooting and cataloguing specimens and collecting clippings.

Once the buds are harvested, they are sent through a sealed door into the “vault” next door, where computers control airflow and humidity to allow the product to dry by just the right amount. A machine tests moisture levels, and the dried plant is moved to another room with controlled temperature and humidity, where it is stored and ready to ship.

Aphria was founded by two agri-business experts, and they have come up with many creative ways to improve efficiency and keep operating costs down. Instead of buying fertilizer, they purchase the root chemicals (such as ammonium nitrate and potassium sulphate) and make their own. That means their fertilizer costs just half-a-cent per litre, or one per cent of their growing costs. Since pesticides are verboten, to get rid of pests, they fight fire with fire by releasing predator bugs into the greenhouse to kill the pot-eating insects. Just the use of a greenhouse itself is a big part of Aphria’s low-cost secret weapon.

“Nobody believed us when we said what we could do,” co-founder Cole Cacciavillani said.

People are paying attention now. Aphria was the first of Canada’s major marijuana companies to try producing pot in a greenhouse. But rivals have started to follow suit, including industry leader Canopy Growth Corp., formerly known as Tweed Marijuana.

More greenhouse production seems certain in the future, thanks in part to the new prime minister, Justin Trudeau. If he keeps his pledge to legalize recreational marijuana, he’s likely to turn a tiny commercial pot market into a much larger one. And once that happens, success in this business will be all about expanding scale and lowering costs.

Dax Melmer for National PostA cannabis plant grows in a greenhouse at Aphria Inc. in Leamington, Ont.

The easiest way to achieve both is by using greenhouses, rather than grow-op warehouses strung end to end with energy-sucking electric lamps. Leamington enjoys bright, sunny weather — it’s known not just as the Tomato Capital of Canada, but because it’s in the southernmost part of the country’s mainland, also as the Sun Parlour of Canada. And it has more acres of greenhouse space than anywhere else in Canada or the United States. That puts the town of 28,000 in the sweet spot to become a key North American weed hub.

“Over the long term, the greenhouse is the way to go,” said Aaron Salz, an analyst at Dundee Capital Markets. “It’s so much easier to scale a greenhouse than an indoor (facility).”

Leamington is still reeling from the partial closure of a 105-year-old Heinz tomato-processing plant last year. But the booming agri-business and greenhouse industry is a major bright spot.

Aphria low cost production gives high returns - mit Bildern und Zahlen!

http://seekingalpha.com/article/4022790-aphria-low-cost-prod…

Liste aller von Health Canada freigegebenen Cannabis-Hersteller:

http://www.hc-sc.gc.ca/dhp-mps/marihuana/info/list-eng.php

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://www.hc-sc.gc.ca/dhp-mps/images/marihuana/info/map_2016-600px-eng.jpg

[/url] The Marijuana Revolution - CNN Special Report by Dr. Sanjay Gupta

Die Marihuana Revolution auf CNN:Aphria still in technical breakout mode!

Ab 4:00 min!Colorado Marijuana Country: The Cannabis Boom (2015)

Inside America's Billion-Dollar Weed Business: The Grass is Greener!

Wettbewerbsvorteil startet mit günstigsten Herstellungskosten....

....also Preisdruck auf die Konkurrenz um Marktanteile zu sichern! CEO Vic Neufeld sagte, auch mancher WB kaufe bei Aphria...

Jeder sucht das "NEXT BIG THING" zum Anlegen!

Dieses wird aktuell auf der ganzen Welt ganz heiß diskutiert: Aktueller Bericht aus "Die Zeit" Cannabis Legalize it! Und dann?

http://www.zeit.de/wissen/gesundheit/2016-11/cannabis-drogen…

Der Wettbewerbsvorteil von Aphria und seinem starken Team!

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://www.nanalyze.com/app/uploads/2016/11/Cannabis-Stock-Costs.jpg

[/url] Studie zum Cannabis Markt: Recreational weed could be a $22.6B industry

https://www.thestar.com/news/queenspark/2016/10/27/recreatio…Sales of legalized recreational marijuana would surpass combined sales of beer, wine, and spirits, it says.

In partnership with RIWI Corp., Deloitte surveyed 5,000 Canadians this past summer — including 1,000 identified as recreational marijuana users — and calculated that the base retail market alone would be worth $4.9 billion to $8.7 billion annually. (BLAIR GABLE / REUTERS)

Canada could thrive from marijuana legalization in U.S. states

Brendan Kennedy, the CEO of Privateer Holdings, says he expects Canadian producers will enter into partnerships and joint ventures with their neighbours.https://www.thestar.com/news/canada/2016/11/10/canada-could-…

The Dragon of Aphria - Arlene Dickinson joins Aphria board....

...Leamington pot producer adds former Dragons’ Den star Arlene Dickinson to board of directorsDieses Bild ist nicht SSL-verschlüsselt: [url]http://dopechef.com/wp-content/uploads/2016/11/Arlene-the-magic-dragon.jpg

[/url] Erst im August hatte Aphria die Lizenz zum Cannabis Öl Verkauf erhalten und schon....

...mischen sie unter den Besten im Preissegment mit und werden wohl noch einiges optimieren!https://news.lift.co/acmpr-oil-price-scan-nov-10th/

Antwort auf Beitrag Nr.: 53.731.545 von sunny3999 am 19.11.16 19:01:16

Wachstumsrate

Die Growth-Rate ist beeindruckend. Danke Sunny, für die Informationen

BNN Video zu volatilen Marihuana Werten...

Marijuana stocks: Volatility baked in for nowShares in Canadian cannabis producers soared and fell yesterday in a speculative frenzy. Then they were up again this morning. Khurram Malik of Jacob Capital Management says the advent of a large recreational market should see these stocks higher in a year's time but during the next six months, there will probably be some alarming dips and steep rises.

http://www.bnn.ca/commodities/video/marijuana-stocks-volatil…

Antwort auf Beitrag Nr.: 53.735.196 von sunny3999 am 20.11.16 20:18:55Im Klartext, also ein sehr volatiler Anstieg, mit immer wiederkehrenden Kaufmöglichkeiten.

Legal pot in Canada could sell for $5 a gram — or less

Aphria sollte die unter 5$ erreichen können...http://globalnews.ca/news/3070170/legal-pot-could-sell-for-5…

5 Besten Marihuana Aktien in 2016

5 Best Marijuana Stocks Of 2016.....http://www.benzinga.com/general/education/16/11/8708311/5-be…

Das ist keine heiße Luft - über 200 Mio Cannabis Umsatz in den USA!

212 Mio Marihuana zu 246 Mio alkoholischen Getränken! Tendenz steigend...2016 is a milestone year for sales of pot in state

Editor’s note: An earlier version of this story contained incorrect information. Marijuana sales did not eclipse sales of hard alcohol. Marijuana sales in the second quarter of 2016 amounted to nearly $212 million. Spirits sales in the same period amounted to almost $249 million.

Read more here: http://www.thenewstribune.com/news/business/article115802063…

http://www.thenewstribune.com/news/business/article115802063…

Video zu Kalifornien nach der Wahl zur Legalisierung von Cannabis!

http://globalnews.ca/video/3057574/multiple-u-s-states-vote-…Diskussion und Bericht zur Freigabe in Kanada - Alkohol hinter dem Steuer ist 20x gefährlicher als THC!

http://globalnews.ca/video/3066894/caa-and-ama-warning-publi…

Berlin: Rot-Rot-Grün macht neuen Anlauf für Cannabis-Modellprojekt

USA: Nicht nur Kalifornien legalisiert Cannabis

Legalisierte Weltbevölkerung wächst!

Zeiten ändern sich: Über 70 Millionen Menschen leben seit dem 10.11.2016 in einem Staat mit legalem Cannabis als Genussmittel!https://hanfverband.de/

Antwort auf Beitrag Nr.: 53.737.818 von sunny3999 am 21.11.16 11:14:39Du machst Dir echt viele Mühe hier........mal ein Dankeschön....viele interessante Sachen dabei.

bin seit 3.11....hier dabei und 75% im Plus das kann sich sehen lassen.......wobei ich bei anderen Werte wie z.B. Marapharm im Minus liege ........mal sehen on der Cannabis Zock aufgeht.

Viel Glück an Alle Investierten!

bin seit 3.11....hier dabei und 75% im Plus das kann sich sehen lassen.......wobei ich bei anderen Werte wie z.B. Marapharm im Minus liege ........mal sehen on der Cannabis Zock aufgeht.

Viel Glück an Alle Investierten!

Antwort auf Beitrag Nr.: 53.738.550 von Aktiengeier_1 am 21.11.16 12:40:02

1996

Legalisiert Holland (16,8 Mio Einwohner fehlt in der Darstellung)

2012

Legalisierung in Colorado (USA, 5,4*)

Legalisierung in Washington State (USA, 7,0*)

Legalisierte Weltbevölkerung: 12,4*

2013

Legalisierung in Uruguay (3,4*)

Legalisierte Weltbevölkerung: 15,8*

2014

Legalisierung in Alaska (USA, 0,7*)

Legalisierung in Oregon (USA, 4,0*)

Gesamt: 4,7*

Legalisierte Weltbevölkerung: 20,5*

2016

Legalisierung in Kalifornien (USA, 38,8*)

Legalisierung in Massachusetts (USA, 6,7*)

Legalisierung in Nevada (USA, 2,8*)

Legalisierung in Maine (USA, 1,3*)

Gesamt: 49,6*

Legalisierte Weltbevölkerung: 86,9*

2017 ff..

Wie geht es weiter?

Kanada hat schon die Legalisierung für 2017 angekündigt (35,2*). Allein das lässt die Zahl der legalisierten Weltbevölkerung auf über 120 Millionen ansteigen...

* Millionen Einwohner

Quelle: https://hanfverband.de/themen/weltweit/legalisierte_weltbevo…

Bin auch schon eine Weile dabei....

....mußte aber die US - Wahl abwarten um offiziell das Thema auszurollen. Ohne die Legalisierung in den USA sehe es hier nicht so GRÜN im Depot aus. 1996

Legalisiert Holland (16,8 Mio Einwohner fehlt in der Darstellung)

2012

Legalisierung in Colorado (USA, 5,4*)

Legalisierung in Washington State (USA, 7,0*)

Legalisierte Weltbevölkerung: 12,4*

2013

Legalisierung in Uruguay (3,4*)

Legalisierte Weltbevölkerung: 15,8*

2014

Legalisierung in Alaska (USA, 0,7*)

Legalisierung in Oregon (USA, 4,0*)

Gesamt: 4,7*

Legalisierte Weltbevölkerung: 20,5*

2016

Legalisierung in Kalifornien (USA, 38,8*)

Legalisierung in Massachusetts (USA, 6,7*)

Legalisierung in Nevada (USA, 2,8*)

Legalisierung in Maine (USA, 1,3*)

Gesamt: 49,6*

Legalisierte Weltbevölkerung: 86,9*

2017 ff..

Wie geht es weiter?

Kanada hat schon die Legalisierung für 2017 angekündigt (35,2*). Allein das lässt die Zahl der legalisierten Weltbevölkerung auf über 120 Millionen ansteigen...

* Millionen Einwohner

Quelle: https://hanfverband.de/themen/weltweit/legalisierte_weltbevo…

Ob es 'der' stärkste Cana-Wert ist sei mal dahingestellt, mir persönlich gefällt aber Aphria auch sehr. Ganz stark positioniert hat sich meiner Meinung nach aber auch Canopy, durch die globale Ausrichtung. Und da ist auch meine erste Frage zu Aphria. Es gibt ja die Zusammenarbeit mit Massroots, einem cana-social-network aber was machen die genau? Ist das ein Distributor? Und wie läuft eine Lieferung in die USA ab, ist das ohne Weiteres möglich?

Canopy positioniert sich zB. auch in Australien und Deutschland, allgemein in Regionen wo die Legalisierung oder ein anderen Umgang mit Cana vor der Tür steht.

Wie gesagt, grundsätzlich bin ich von Aphria überzeugt und auch nur dort investiert aber um alle Märkte zu erobern muss wohl noch ein wenig getan werden. Was denkt ihr dazu?

Canopy positioniert sich zB. auch in Australien und Deutschland, allgemein in Regionen wo die Legalisierung oder ein anderen Umgang mit Cana vor der Tür steht.

Wie gesagt, grundsätzlich bin ich von Aphria überzeugt und auch nur dort investiert aber um alle Märkte zu erobern muss wohl noch ein wenig getan werden. Was denkt ihr dazu?

Antwort auf Beitrag Nr.: 53.739.057 von TheDude335 am 21.11.16 13:36:51

Massroots ist eine App und Blog, die die Anwendungen und Verarbeitungen den Kunden näherbringt. Die könnten auch den Verkauf von Aphria-Cannabis für USA über ihre Plattform steuern.

https://massroots.com/blog

https://www.youtube.com/user/massrootsapp

Zitat von TheDude335: Ob es 'der' stärkste Cana-Wert ist sei mal dahingestellt, mir persönlich gefällt aber Aphria auch sehr. Ganz stark positioniert hat sich meiner Meinung nach aber auch Canopy, durch die globale Ausrichtung. Und da ist auch meine erste Frage zu Aphria. Es gibt ja die Zusammenarbeit mit Massroots, einem cana-social-network aber was machen die genau? Ist das ein Distributor? Und wie läuft eine Lieferung in die USA ab, ist das ohne Weiteres möglich?

Canopy positioniert sich zB. auch in Australien und Deutschland, allgemein in Regionen wo die Legalisierung oder ein anderen Umgang mit Cana vor der Tür steht.

Wie gesagt, grundsätzlich bin ich von Aphria überzeugt und auch nur dort investiert aber um alle Märkte zu erobern muss wohl noch ein wenig getan werden. Was denkt ihr dazu?

Massroots ist eine App und Blog, die die Anwendungen und Verarbeitungen den Kunden näherbringt. Die könnten auch den Verkauf von Aphria-Cannabis für USA über ihre Plattform steuern.

https://massroots.com/blog

https://www.youtube.com/user/massrootsapp

Antwort auf Beitrag Nr.: 53.739.057 von TheDude335 am 21.11.16 13:36:51

https://aphria.com/assets/reports/PR_Aug_22.pdf

Aphria verkauft sein KNOW-HOW an Copperstate Farm - Arizona (US) und sichert sich 5% + weiter 5% an Einnahmen!

https://aphria.com/assets/reports/Press_Release_-_October_27…

Arlene Dickinson von Dragons Den ist als Direktor benannt und Aphria hat schon jetzt eine Umsatz Ausbaustufe Phase 3 von 700 Mio $, das allein sollte einen Marktwert von 2,1 Mrd ergeben.

Aphria hat einen medizinischen Partner in Australien...

....Medlab und Exclusivrechte von Aphria entwickelt Medizin auf Basis Cannabis (THC) in Australien.https://aphria.com/assets/reports/PR_Aug_22.pdf

Aphria verkauft sein KNOW-HOW an Copperstate Farm - Arizona (US) und sichert sich 5% + weiter 5% an Einnahmen!

https://aphria.com/assets/reports/Press_Release_-_October_27…

Arlene Dickinson von Dragons Den ist als Direktor benannt und Aphria hat schon jetzt eine Umsatz Ausbaustufe Phase 3 von 700 Mio $, das allein sollte einen Marktwert von 2,1 Mrd ergeben.

Arlene Dickinson von Dragon Den ist wohl die stärkst Ergänzung im Team!

Chart startet aus dem Minus aber fängt sich wieder!

Kanada (CVE:APH): Dieses Bild ist nicht mehr verfügbar: [url][url]http://ca.advfn.com/p.php?pid=staticchart&s=TX%5EAPH&t=37&p=0&dm=0&vol=0&width=280&height=200&min_pre=0&min_after=0

[/url]"][/url] USA (OTCMKTS:APHQF):

Dieses Bild ist nicht mehr verfügbar: [url]http://ca.advfn.com/p.php?pid=staticchart&s=TX%5EAPH&t=37&p=0&dm=0&vol=0&width=280&height=200&min_pre=0&min_after=0

[/url] Korrektur war notwendig!

Bei Closed Deal nächste Woche und News mit anstehender TSE Hochstufung spätestens im Frühjahr 17 sollte Aphria 2 stellig werden. Aphria Inc continues Its Ascent Following Supply Agreement

http://www.mmjobserver.com/aphria-inc-otcmktsaphqf-continues…Furthermore, Tetra Bio-Pharma also revealed that it plans to market PPP001 worldwide, with Aphria being the exclusive supplier, for the API, for both the development and commercialization phases. It should be noted here that much US regulations, Canada also calls for the implementation of GMP, as well as rigorous quality systems. Moreover, lot-to-lot consistency is also to be demonstrated, prior to manufacturing of the final product.

National Post says Aphria, others hear vet med pot bill soaring

Grund für den Absturz: 2016-11-22 08:49 ET - In the News

Also In the News (C-ACB) Aurora Cannabis Inc

Also In the News (C-CGC) Canopy Growth Corp

Also In the News (C-MT) Mettrum Health Corp

Also In the News (C-OGI) Organigram Holdings Inc

The National Post reports in its Tuesday, Nov. 22, edition that Veterans Affairs Canada is set to "reduce substantially" the amount of medical marijuana for which retired soldiers can seek reimbursement. The Post's John Ivison writes that the program under which veterans could access marijuana for medical purposes was introduced in 2008-2009 and by the end of the year there were just five recipients being reimbursed $19,000. An unnamed source says there are currently 3,300 users -- double the number from official statistics released in March -- and the department has projected the program will cost $90-million in the current fiscal year, if trends continue. To put that in context, the government spends about $247-million a year on all health treatments for veterans. Veterans Affairs Minister Kent Hehr said in March he would review the issue and he is expected to announce a dramatic reduction in the amount the department will reimburse from the current 10 grams a day. It is understood veterans will still be able to access whatever amount of marijuana is authorized by their doctors, but the government will not reimburse at current levels, unless there are exceptional circumstances.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:APH-2423614…

Aphria Inc: Making Heads or Tails of APH stock

Auszug vom Aphria coverage: Imagine the possibilities that recreational marijuana can do to the bottom line of a company that is already running in an efficient profitable manner. Under this premise, the profit potential for APH stock is stratospheric.

http://www.profitconfidential.com/stock/aphria-inc-making-he…

Heute wurde das mittlere Bollinger angelaufen. Schöne Korrektur. Der Wert war total überkauft. Abkühlung ist notwendig und meiner Meinung nach die Basis für einen künftigen weiteren Anstieg.

Positiver Beitrag zu Wirkung von Cannabis bei Veteranen mit PTSD!

MedReleaf continues to lead on scientific research: Landmark, peer-reviewed study shows medical cannabis dramatically improves lives of veterans with PTSDAuszug:

The study, being presented today in Vancouver at the 7th Annual Military and Veteran Health Research Forum, was conducted by Dr. Paul Smith, MD, using several of MedReleaf's proprietary strains of medical cannabis including AviDekel, Luminarium and Midnight.

From baseline to follow up, the study revealed a number of key insights on patient outcomes including:

Aggregate score of both PTSD symptoms and social impacts improved by 59%

Drug and alcohol overuse was reduced by 82%

Marital and relationship harmony improved 65% and

Severity of pain experienced by patients decreased 48%

Improvements in outcomes were also associated with a 50% reduction in the consumption of PTSD-related medications, including opioids. 36% of patients on PTSD related medications at baseline discontinued all such medications, for an estimated annual savings of $2,300 to $3,800 per patient.

http://www.newswire.ca/news-releases/medreleaf-continues-to-…

Auf allen Kanälen....

Vivien Azer, a cannabis analyst from Cowen Group Inc. indicated in a report that sales of recreational and medical marijuana will reach $50 billion by 2026.http://www.prnewswire.com/news-releases/legal-cannabis-marke…

http://www.9and10news.com/story/33779989/legal-cannabis-mark…

http://itbriefing.net/index.php?name=News&file=article&sid=9…

Aphria CEO Vic Neufeld sagte im July 2016 auf BNN ....

.....12-15% Marktanteil für Aphria voraus. Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]Für Kanada in 2020 mit einem Markt von 5,7 Mrd $ 0,684 - 0,855 Mrd $ Umsatz

Für USA mit 22,5 Mrd $ in 2020 wären das 2,7 -3,35 Mrd $ Umsatz.

Das heißt hier dürfte Cashmaschine entstehen mit dem besten Team, den günstigsten Herstellungskosten und dem meißten Cash von ca. 100 Mio $.

Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]Das BNN Interview dazu:

http://www.bnn.ca/csuite-interviews/video/aphria-will-speed-…

Deloitte hat seine Marktanalyse veröffentlicht mit einem 22,5 Mrd Markt!

Understanding the recreational marijuana market:- Public opinion,

- consumption

- trends and retail

- opportunity

Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/…

Aphria's Partner Partner un Marke "Tokio Smoke"

Auszug aus dem Bericht:Alan Gertner is a very interesting person.

The 32-year-old entrepreneur spent a number of years travelling the world while working for Google – living in New York, San Francisco, Bangkok and Singapore – and making mountains of money. But while heading to a voodoo ceremony in Ghana one day, he discussed his life with a Ghanaian tour guide and came to a realization: He wasn’t happy at all.

Tokyo Smoke currently has an agreement with one of the largest producers of medical marijuana in Canada, Aphria, and Gertner says that medical marijuana users will be able to order cannabis from his brand starting in January.

And once the federal government legalizes pot next year, Gertner and his father will be well positioned to shift into the retail marijuana industry.

Nuer Internetauftritt: http://www.tokyosmoke.com/

Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]Bericht: http://www.toronto24hours.ca/2016/11/10/the-coolest-marijuan…

Behandlungsalternativen für Brustkrebs....neue Aphria Werbung!

https://www.facebook.com/RethinkBreastCancer/videos/10154655… Insiderkäufe am freien Markt sind immer ein gutes Zeichen!

https://www.canadianinsider.com/company?menu_tickersearch=AP…

Antwort auf Beitrag Nr.: 53.761.887 von sunny3999 am 24.11.16 09:34:19

ich habe soeben erst deinen Thread mitbekommen und muss sagen, da ist auch für mich viel Neues dabei. Ich bin vom Erfolg von Aphria, Organigram, Canopy Growth und co überzeugt und bin selber auch seit über einem Jahr investiert.

Jetzt gerade habe ich allerdings angefangen zu verkaufen und üppige Gewinne mitzunehmen. Ich glaube wir stecken gerade Mitten in einer Rally die zu einer kleinen Blase geführt hat. Versteh mich nicht falsch, ich bin auf lange Sicht vom Erfolg 100% überzeugt aber moment ist doch alles ein wenig teuer.

Wie siehst du das?

Ist der Run auf MJ Aktien in Kanada evtl nur der Task-Force geschuldet, die spätestens nächste Woche einen Plan zur Legalisierung vorstellen soll?

Keep up the good work. I really appreciate it!!!

GROßES DANKESCHÖN

Hallo Sunny,ich habe soeben erst deinen Thread mitbekommen und muss sagen, da ist auch für mich viel Neues dabei. Ich bin vom Erfolg von Aphria, Organigram, Canopy Growth und co überzeugt und bin selber auch seit über einem Jahr investiert.

Jetzt gerade habe ich allerdings angefangen zu verkaufen und üppige Gewinne mitzunehmen. Ich glaube wir stecken gerade Mitten in einer Rally die zu einer kleinen Blase geführt hat. Versteh mich nicht falsch, ich bin auf lange Sicht vom Erfolg 100% überzeugt aber moment ist doch alles ein wenig teuer.

Wie siehst du das?

Ist der Run auf MJ Aktien in Kanada evtl nur der Task-Force geschuldet, die spätestens nächste Woche einen Plan zur Legalisierung vorstellen soll?

Keep up the good work. I really appreciate it!!!

Antwort auf Beitrag Nr.: 53.763.843 von vonsen am 24.11.16 13:32:25

Die Welle wurde in Colorado angestossen und lief erfolgreich! 4 weitere US-Staaten haben für recreational gestimmt. Weitere werden folgen.

Die Büchse der Pandora ist geöffnet und wird schwer wieder zu schließen sein, zumal Arbeitsplätze und Steuereinnahmen für den Staat dahinter stehen.

Trump ist zwar der Staat, meint er zumindest, wird sich jedoch schwer gegen eine Mehrheitsentscheidung der Bevölkerung entgegenstellen können. IMO.

Wenn Trudeau in Kanada auf Green also recreational geht was sein Wahlversprechen war in 2016, dann dürfte Partystimmung aufkommen.

Also der medizinische Nutzen ist in vielen Fällen bewiesen und der Markt allein ist riesig.

Achterbahnfahrt wird jedoch weitergehen mit Über- und Unterbewertungen. Das ist nicht nur dem Markt also Börse geschuldet, sondern den großen Jungs im Casino, also den Hedgefunds und Investmenthäusern.

Oder wer von euch denkt hier, das ein paar kleine Anleger mit 100erten Millionen $ solche Kursbewegungen bei Allen MJ Aktien mit +/-20-30 anstellen können?

Die Fahrt wird sehr spannend mit Gewinnern und Verlierern, wie immer im Leben!

Es kommt auf die Kanadier und Trump an!

Die Task Force wird nächste Woche wohl ihren Ratschlag und Plan der Legalisierung und zur weiteren Vorgehensweise der freien Nutzung "recreational" in Kanada abgeben.Die Welle wurde in Colorado angestossen und lief erfolgreich! 4 weitere US-Staaten haben für recreational gestimmt. Weitere werden folgen.

Die Büchse der Pandora ist geöffnet und wird schwer wieder zu schließen sein, zumal Arbeitsplätze und Steuereinnahmen für den Staat dahinter stehen.

Trump ist zwar der Staat, meint er zumindest, wird sich jedoch schwer gegen eine Mehrheitsentscheidung der Bevölkerung entgegenstellen können. IMO.

Wenn Trudeau in Kanada auf Green also recreational geht was sein Wahlversprechen war in 2016, dann dürfte Partystimmung aufkommen.

Also der medizinische Nutzen ist in vielen Fällen bewiesen und der Markt allein ist riesig.

Achterbahnfahrt wird jedoch weitergehen mit Über- und Unterbewertungen. Das ist nicht nur dem Markt also Börse geschuldet, sondern den großen Jungs im Casino, also den Hedgefunds und Investmenthäusern.

Oder wer von euch denkt hier, das ein paar kleine Anleger mit 100erten Millionen $ solche Kursbewegungen bei Allen MJ Aktien mit +/-20-30 anstellen können?

Die Fahrt wird sehr spannend mit Gewinnern und Verlierern, wie immer im Leben!

Aphria Management - 2 Videos und Beitrag

Aphria Kanadas günstigster Hersteller! Link:

http://business.financialpost.com/news/agriculture/canadas-c…

Aphria agrees with changes to Veteran Affairs policy

Das ist profihaft: Link:

http://sports.yahoo.com/news/aphria-agrees-changes-veteran-a…

Thanksgiving USA

Das Handelsvolumen dürfte wegen dem Feiertag etwas niedriger sein als wie sonst weil "Grossen" wahrscheinlich langes Wochenende in US haben. Morgen auch nur verkürzter Handel in USA.Volatilität voraus!

Mew Highs in APH are still possible!

Na denn, lets get high !Link:

http://www.profitconfidential.com/stock/aphria-inc-new-highs…

Chart Kanada sieht wild aber bis jetzt gut aus!

Wenn das ein reverse Schulter-Kopf-Schulter Formation wird...

...müßten wir im Plus bei 5,8-5,9 schließen (zumindest ins Plus sollte es gehen) und das wäre zu gleich ein sehr bullisches Zeichen.

Canadian Marijuana Stocks Could Mellow Out Until Spring: Bruce Campbell

Auszug:Despite the recent stomach-churning ups and downs, Bruce Campbell contends that legal marijuana will be a “huge” growth industry for the next 10 years, both on the medical and recreational sides of the market. Longer term, the estimates are this sector could be $9-$11 billion in Canada: $3 billion of that from medical and $6-$7 billion from recreational. That will, of course, take years to build and develop, he said. And, to put that into perspective, the illegal marijuana black market in Canada is estimated at $10 billion, bigger than either wine or spirits.

In fact, Mr. Campbell is so positive on the Canadian marijuana space that his firm is in the process of launching a Marijuana sector fund.

http://smallcappower.com/top-stories/canadian-marijuana-stoc…

Aphria Vorteile kurz nach Priorität zusammgefasst :

- 3 Quartale in Folge Gewinn erwirtschaftet (hat kein anderer MJ - Player),- somit grundsolides Management und sehr guter Trackrekord also Erfolgsquote,

- 2 Anteilseigentümer (mind. 20% Anteile) sind seit Generationen in der Grüngemüsebranche,

- 100 Millionen Cash + Gewinne versprechen kontinuierliches Wachstum,

- Vic Neufeld hat sehr enge Verhältnisse zu Health Canada,

- Vermarktungsstrategie auf vielen verschiedenen Feldern wie,

- Veteranen, Krebspatienten, Schmerzpatienten, Mentale Krankheiten,

- starkes Beratungsteam "Inhouse",

- exclusive Partnerschaften mit Pharmaindustrie auch schon in Australien

- Markenaufbau für den Lifestyle mit "Tokio Smoke" (ex. Google Manager)

- Partner und Rechte zur Ausweitung des Geschäftes in Arizona USA

- Bought Deal bei 4 $ kommt nächste Woche zum Abschluß

- durch das Aphria noch nicht an der TSE gelistet ist, fehlen noch solide Institutionelle

- die mit der höher Listung an der TSE erst Positionen aufbauen können,

- Canopy ist an der TSE und hat eine MK 1,6 Mrd und GWPH (Nasdaq) von 3 Mrd US$,

- für Zocker ein Spielfeld um kurzfristig Gewinne bei der Volatilität zu generieren,

- langfristig bei Freigabe durch die Regierung Kanadas/USA ein solides Investment.

Heute wird es nochmal spannend, jedoch schon ab nächster Woche rechne ich einer positiven Tendenz.

Tendenz:

kurzfristiges Ziel Richtung 8 Can $

mittelfristiges Ziel 2stellig (10+ Can $)

langfristiges Ziel anhand Fundamentaldaten die bekannt sind (700 Mio $ Umsatz realisierbar) 20-30 C$

Hier sind zukünftige Stärkung des Teams, Partnerschaften, Landerwerb und Celebrities die gewonnen werden nicht enthalten!

Noch viel Phantasie bis die ganz "Großen" Instis/Funds einsteigen & noch Zeit um eine gute Position aufzubauen.

Irgendwann kommen dann die große Pharma- oder Tabakmultis und bieten eine Übernahme an.....

...............................................dann ist Zahltag!

Aphria's exclusiv Partner Medlab in Australien...

...bekommt Lizenz von der australischen Gesundheitsbehörde TGA. [urlhttp://www.news.com.au/finance/business/breaking-news/medlab-gets-nod-to-import-marijuana/news-story/5693ecf58018ac5cd79f42ea87711a42][/url]

Depression and the Gut Microbiome

Presented by Professor Luis Vitetta

Topics covered in this clinically relevant webinar include:

Mental Health in the population Depression in Clinical Practice Current treatment options - Nutraceuticals Gut Microbiota in Depression Probiotics as an adjunct treatment option Online exclusive:

Post-script: Medicinal Cannabis

Webinar Only Exclusive Offer!

https://www.medlab.co/education/webinars

"bought deal"

Nächste woche soll ja laut der homepage von aphria der Deal mit clarus securities abgeschlossen sein. Interpretier ich das richtig, dass wir ggf. Nächste Woche abwärtsdruck bekommen da ja mehr Aktien vorhanden sind?

Antwort auf Beitrag Nr.: 53.771.304 von Snaxico am 25.11.16 13:41:51

Am 18ten August hat Aphria einen bought deal von 2$ gemeldet und war weder davor noch danach nochmal an den 2 $ sondern zwischen 10-20% höher! Nach der Meldung ging geradewegs auf die 4 $ zu!

http://www.marketwired.com/press-release/aphria-announces-cl…

Was werden die wohl nach closed deal mit 100 Mio $ cash an News melden ?

Zitat von Snaxico: Nächste woche soll ja laut der homepage von aphria der Deal mit clarus securities abgeschlossen sein. Interpretier ich das richtig, dass wir ggf. Nächste Woche abwärtsdruck bekommen da ja mehr Aktien vorhanden sind?

Am 18ten August hat Aphria einen bought deal von 2$ gemeldet und war weder davor noch danach nochmal an den 2 $ sondern zwischen 10-20% höher! Nach der Meldung ging geradewegs auf die 4 $ zu!

http://www.marketwired.com/press-release/aphria-announces-cl…

Was werden die wohl nach closed deal mit 100 Mio $ cash an News melden ?

Wollte eigentlich auf folgenden Artikel hinaus

http://www.wallstreet-online.de/nachricht/9083781-aphria-inc…

So wie ich das nämlich verstanden hab soll dieser deal ja am 29.11 abgeschlossen sein. Korrigier mich wenn ich falsch liege aber dann sind doch mehr Aktien im Umlauf. Wollte nämlich selbst nochmal meine Position aufstocken aber finde den Preis von über 5 cad aktuell zu hoch

http://www.wallstreet-online.de/nachricht/9083781-aphria-inc…

So wie ich das nämlich verstanden hab soll dieser deal ja am 29.11 abgeschlossen sein. Korrigier mich wenn ich falsch liege aber dann sind doch mehr Aktien im Umlauf. Wollte nämlich selbst nochmal meine Position aufstocken aber finde den Preis von über 5 cad aktuell zu hoch

Antwort auf Beitrag Nr.: 53.773.662 von Snaxico am 25.11.16 18:38:39

davon werden knapp 25 Mio Aktien vom Management gehalten siehe Management circular.

https://aphria.com/assets/reports/Management_Information_Cir…

Also sind nur noch 86 Mio für den offenen Markt, das ist der prozentuell geringste Anteil an handelbaren Aktien an lizensierten MJ.

Aphria hat nach bought deal...

....fully diluted 111 Mio Aktien im Umlauf. davon werden knapp 25 Mio Aktien vom Management gehalten siehe Management circular.

https://aphria.com/assets/reports/Management_Information_Cir…

Also sind nur noch 86 Mio für den offenen Markt, das ist der prozentuell geringste Anteil an handelbaren Aktien an lizensierten MJ.

Are Texans Finally Warming Up To Weed? Some Legislators Think So

Das wären weitere 27 Mio Bürger in den USA wenn die für "JA" stimmen sollten.http://www.houstonpress.com/news/are-texans-finally-warming-…

THIRD NATIVE AMERICAN CANNABIS CONFERENCE

December 5 – 6, 2016Viejas Casino & Resort, Alpine, CA

https://www.nativenationevents.org/events-conferences/third-…

Kanada dürfte wohl im Frühjahr 2017 legalisieren ....

....damit ist der Markt für 5-7 Mrd $ nur für Kanada offen und die großen mit Cash positioniert!CANADA CAN LEARN HOW TO LEGALIZE POT FROM AMERICA’S EXAMPLE

http://ocannabiz.com/news/canada-can-learn-legalize-pot-amer…

Über Jahre viele Analysen zur Legalisierung in USA/Kanada

mit recht annehmbaren Resultaten für den Staat und die Bevölkerung.Dose of Reality

The Effect of State Marijuana Legalizations

https://object.cato.org/sites/cato.org/files/pubs/pdf/pa799.…

Legalized Cannabis

Fiscal Consideration in Canada

http://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports…

Jede Finanzierung in diesem Sektor führte zu höheren Kursen, weil der große Markt der dahinter steht den erzielbaren Marktwert in 1-2 Jahren wiederspiegelt!

Ich denke Aphria ist dabei sehr gut aufgestellt mit seinen Partnern in Arizona-US/Kanada/Australien für den medizinischen Markt.

Für den freien Markt wird eine eigene exclusive Partnermarke "Tokio Smoke" generiert, die im Januar ihre Tore im ersten Store in Toronto eröffnet!

Die Hedgefunds haben die Finanzierung in 2015-16 voran getrieben und die großen Investmenthäuser und Fonds werden wohl demnächst auch erste Positionen in dem Multi Mrd. Markt aufbauen.

Ich rechne mit vielen News nach Bekanntgabe der "Task Force" Info am 30 Nov. interessant, das Aphria am 29 Nov. den Closed Deal vermelden will.

Weitere News von Aphria zu Partner, Landakquise, Direktor uvm mit News von Anderen WB, dürften die Kurse wieder nach nach Norden treiben, für ein potentiellen Markt von 22 Mrd. $ in 2020!

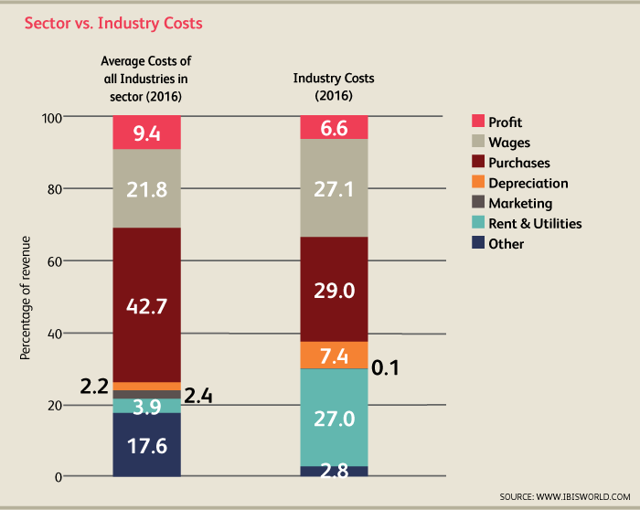

Unabhängige Marktanalyse zu Kosten per Pfund

Wettbewerbsfähigkeit Cannabis Benchmarks: Greenhouse - Outdoor - Indoor

Aphria ist mit seiner Gewächshausstrategie für den Wettbewerb auf dem richtigen Weg!

https://www.cannabisbenchmarks.com/special-reports.html

Wer sich noch tiefer einlesen will...

.....hier die Links zu Investoren und allerlei Plattformen die diesen Markt vorbereiten:Investoren: https://www.newcannabisventures.com/cannabis-investors/

Benchmarks: https://www.cannabisbenchmarks.com/

Service und Produkte: https://www.newcannabisventures.com/cannabis-products-and-se…

Ein Riesenmarkt!

Info der Legalisierung ist durchgesickert...

Jodie Emery @JodieEmery 25. Nov.Looks like "legal" will mean people will be arrested unless they buy Health Canada's stock-market pot.

Instagramm: https://www.instagram.com/p/BNPVAQUDylM/

Twitter: https://twitter.com/JodieEmery

Legalized Marijuana Could Drive a New Tech Boom

FORBES: http://www.forbes.com/sites/tonybradley/2016/11/23/legalized…

Auf einige US-Staaten folgt Kanada.....

....in 2017 oder 2018!Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]

Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]

Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url] Video mit Vic Neufeld zur Markenstrategy und Branding!

Medical marijuana company CEO says branding for recreational market will be 'edgy' Dieses Bild ist nicht mehr verfügbar: [url]http://storage.proboards.com/5730511/images/pmPo7HD5_oeZSNXBED2X.gif

[/url]http://www.cbc.ca/news/canada/windsor/marijuana-company-prep…

Antwort auf Beitrag Nr.: 53.777.676 von sunny3999 am 26.11.16 18:42:13Tolle arbeit von dir, postest echt gute infos

Antwort auf Beitrag Nr.: 53.778.471 von Snaxico am 26.11.16 23:54:21

Danke

Hier die Nov./Dez. Ausgabe der CannaInvestor:

https://www.joomag.com/magazine/cannainvestor-magazine/M0367…

Wer den Markt durchleuchten will. Achtung auch viel heiße Luft.

Zitat von Snaxico: Tolle arbeit von dir, postest echt gute infos

Danke

Hier die Nov./Dez. Ausgabe der CannaInvestor:

https://www.joomag.com/magazine/cannainvestor-magazine/M0367…

Wer den Markt durchleuchten will. Achtung auch viel heiße Luft.

Task Force Report ? und Präsident Obama Herunterstufung von Cannabis als Risikodroge Stufe II

Doctors Nova Scotia Homepage zur Legalisierung in Kanada - Task Force Report ?:http://www.doctorsns.com/en/home/advocacy/position-statement…

Präsident Obama Risikoabstufung auf II für Cannabis:

http://www.smobserved.com/story/2016/11/26/news/obama-will-s…

Auszug:

November 26, 2016

Obama will sign executive order rescheduling Marijuana as a Class II drug.

The outgoing president will sign an executive order reversing President Richard Nixon's 1970 order, listing Marijuana as a Schedule One Drug, forbidden at all times. This is said to have been a jab at 1960's "Hippy Culture."

President Barack Obama, who wrote of experimenting with marijuana as a young man, will legalize marijuana on his way out of office. He will make pot a Class II drug, legal under Federal law with a doctors prescription. States will be able to continue to outlaw marijuana, if they choose. About half of US States now permit medicinal cannabis or recreational marijuana, within certain limits.

Aphria's Partner Tokyo Smoke Found - Hybrid Cannabis Cafes

Neue Farben für Aphria's recreational Produkte ?

Tokio Smoke: http://www.tokyosmoke.com/

AVAILABLE In legal recreation markets across the USA in 2017

TOKIO SMOKE: Available soon in legal recreation markets across the USA in 2017

Tokyo Smoke brings emotion, design and function to cannabis

LUXURIOUS, CONSISTENT, RELIABLE

Tokyo Smoke’s commitment to refined design drives the approach in the Cannabis space. Cannabis is an emotive experience and the product should match the needs and desires of the consumer. Tokyo Smoke has 4 proprietary strains of Cannabis; Go, Relax, Relief, Balance, which have been crafted and perfected over the past 20 years. These strains will be available through legal channels in 2016/17.

Go - an energizing, awakening sativa

Relax - an easing indica

Relief - a soothing CBD

Balance - a consistently crossed sativa-indica hybrid

Aphria's Partner Tokyo Smoke Found - Hybrid Cannabis Cafes

Alan Gertner früher Google Manager....https://www.youtube.com/watch?v=vKjU3RQvMzE

Wir sind die Guten - Warte auf erste Ergebnisse von Studien!