PANCONTINENTAL OIL - Projekte in Australien, Kenya, Malta, Marocco und Namibia - Älteste Beiträge zuerst (Seite 313)

eröffnet am 23.01.10 01:07:33 von

neuester Beitrag 23.04.24 18:17:54 von

neuester Beitrag 23.04.24 18:17:54 von

Beiträge: 3.823

ID: 1.155.508

ID: 1.155.508

Aufrufe heute: 172

Gesamt: 419.543

Gesamt: 419.543

Aktive User: 0

ISIN: AU000000PCL4 · WKN: A0CAFF · Symbol: PUB

0,0150

EUR

+3,45 %

+0,0005 EUR

Letzter Kurs 22.04.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 0,8200 | +41,38 | |

| 0,5070 | +31,52 | |

| 17,200 | +27,31 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,1750 | -9,52 | |

| 6,7500 | -10,60 | |

| 1,2000 | -14,29 | |

| 11,430 | -19,17 | |

| 20,000 | -33,33 |

Hallo, ist das nicht auch PCL

Eco Atlantic's Farm-out successful closed

A strong sign for every explorer which holds licenses offshore Namibia. This underlines that Namibia is still on the map of the big players. After the 3D, Tullow immediately made the offer to Eco Atlantic so one has to conclude that the 3D data showed some strong indices. The Cooper Block (Block 2012 A) is by the way not that far away from block 1711. Hopefully this could give Energulf a little push in their search for a strong partner.

Eco Atlantic Announces Successful Closing of the Tullow Oil Farm-Out Transaction

Toronto – October 14, 2014 – Eco (Atlantic) Oil & Gas Ltd. (“Eco Atlantic” or the “Company”) (TSX-V:EOG, NSX:EOG) is pleased to announce that, through its wholly-owned subsidiary, it has closed the previously announced farm out transaction with Tullow Kudu Limited, a wholly owned subsidiary of Tullow Oil plc. (“Tullow”), including receiving all necessary Government of Namibia approvals, and the entering into an amended and restated joint operating agreement (“JOA”) with Tullow, the National Petroleum Corporation of Namibia (“NAMCOR”), and Azimuth Namibia Ltd (“Azinam”).

As described in the Company’s news release dated July 17, 2014, the Company and Tullow have entered into a Farm-Out Agreement (the “Farm-Out Agreement”), pursuant to which Tullow agreed to acquire up to a 40% working interest in the Company’s Cooper block (the “Block”). With the signing of the JOA, all of the conditions in the Farm-Out Agreement with respect to the initial transfer of a 25% working interest in the Block have been satisfied. Eco Atlantic expects to receive a contribution of its past costs in the amount of approximately CAD$1 million. Eco Atlantic now holds a 45% carried working interest in the Block, Azimuth holds a 20% working interest, NAMCOR holds a 10% carried working interest and Tullow holds a 25% working interest....

http://www.ecooilandgas.com/news/index.php?&content_id=85]Ec… Atlantic's farmout closed[/url

Read more at http://www.stockhouse.com/companies/bullboard/v.eng/energulf…

Eco Atlantic's Farm-out successful closed

A strong sign for every explorer which holds licenses offshore Namibia. This underlines that Namibia is still on the map of the big players. After the 3D, Tullow immediately made the offer to Eco Atlantic so one has to conclude that the 3D data showed some strong indices. The Cooper Block (Block 2012 A) is by the way not that far away from block 1711. Hopefully this could give Energulf a little push in their search for a strong partner.

Eco Atlantic Announces Successful Closing of the Tullow Oil Farm-Out Transaction

Toronto – October 14, 2014 – Eco (Atlantic) Oil & Gas Ltd. (“Eco Atlantic” or the “Company”) (TSX-V:EOG, NSX:EOG) is pleased to announce that, through its wholly-owned subsidiary, it has closed the previously announced farm out transaction with Tullow Kudu Limited, a wholly owned subsidiary of Tullow Oil plc. (“Tullow”), including receiving all necessary Government of Namibia approvals, and the entering into an amended and restated joint operating agreement (“JOA”) with Tullow, the National Petroleum Corporation of Namibia (“NAMCOR”), and Azimuth Namibia Ltd (“Azinam”).

As described in the Company’s news release dated July 17, 2014, the Company and Tullow have entered into a Farm-Out Agreement (the “Farm-Out Agreement”), pursuant to which Tullow agreed to acquire up to a 40% working interest in the Company’s Cooper block (the “Block”). With the signing of the JOA, all of the conditions in the Farm-Out Agreement with respect to the initial transfer of a 25% working interest in the Block have been satisfied. Eco Atlantic expects to receive a contribution of its past costs in the amount of approximately CAD$1 million. Eco Atlantic now holds a 45% carried working interest in the Block, Azimuth holds a 20% working interest, NAMCOR holds a 10% carried working interest and Tullow holds a 25% working interest....

http://www.ecooilandgas.com/news/index.php?&content_id=85]Ec… Atlantic's farmout closed[/url

Read more at http://www.stockhouse.com/companies/bullboard/v.eng/energulf…

"Golden Cross"

SMA(50) hat heute Nacht SMA(200) gekreuzt,

SMA(50): AUD 0.0336

SMA(200): AUD 0.0335

http://www.financeblog.ch/2010/10/25/indikator-golden-cross/

"Beim Golden Cross betrachtet man die beiden gleitenden Durchschnitte über 50 und 200 Tage. Wenn der “kürzere” 50-Tage-Durchschnitt den “längeren” 200-Tage-Durchschnitt von unten nach oben “schneidet” und beide gleitenden Durchschnitte noch oben tendieren, spricht man vom Golden Cross. Dies wird generell als positives Zeichen für den weiteren Verlauf der Preisentwicklung gesehen. Streng genommen wir ein neuer Aufwärtstrend oder Aufwärtszyklus erst durch das Schneiden der beiden Durchschnittslinien bestätigt."

GLA

SMA(50) hat heute Nacht SMA(200) gekreuzt,

SMA(50): AUD 0.0336

SMA(200): AUD 0.0335

http://www.financeblog.ch/2010/10/25/indikator-golden-cross/

"Beim Golden Cross betrachtet man die beiden gleitenden Durchschnitte über 50 und 200 Tage. Wenn der “kürzere” 50-Tage-Durchschnitt den “längeren” 200-Tage-Durchschnitt von unten nach oben “schneidet” und beide gleitenden Durchschnitte noch oben tendieren, spricht man vom Golden Cross. Dies wird generell als positives Zeichen für den weiteren Verlauf der Preisentwicklung gesehen. Streng genommen wir ein neuer Aufwärtstrend oder Aufwärtszyklus erst durch das Schneiden der beiden Durchschnittslinien bestätigt."

GLA

Antwort auf Beitrag Nr.: 48.100.843 von Drill-a-Hill am 22.10.14 10:17:30Bleibe deswegen weiter dabei

Das grosse Volumen spricht dafür, das in kommender Zeit gute News anstehen.

Da wollten einige unbedingt grosse Mengen Aktien bekommen, fast egal zu welchem Preis

Das stimmt mich recht positiv für die nächsten Monate...

Das grosse Volumen spricht dafür, das in kommender Zeit gute News anstehen.

Da wollten einige unbedingt grosse Mengen Aktien bekommen, fast egal zu welchem Preis

Das stimmt mich recht positiv für die nächsten Monate...

Kenya Offshore L10A&B - Pancontinental considers that two wells may be drilled commencing in 2015

http://clients2.weblink.com.au/clients/pancon/article.asp?as… (pdf, p.15)

The L10A consortium is now considering the location for one or more additional wells. A drilling decision will be

made after further technical and joint venture consideration. At the present time, Pancontinental considers that

two wells may be drilled commencing in 2015, one in each of L10A and L10B, and the company awaits the

drilling recommendations of operator BG Group before any firm joint venture drilling decisions will be made.

GLA

http://clients2.weblink.com.au/clients/pancon/article.asp?as… (pdf, p.15)

The L10A consortium is now considering the location for one or more additional wells. A drilling decision will be

made after further technical and joint venture consideration. At the present time, Pancontinental considers that

two wells may be drilled commencing in 2015, one in each of L10A and L10B, and the company awaits the

drilling recommendations of operator BG Group before any firm joint venture drilling decisions will be made.

GLA

Liebe PCL Gemeinde,

ein Auszug aus dem Annual Report 2014 vom 28.10.2014 an die Shareholders: (http://www.asx.com.au/asxpdf/20141028/pdf/42t89t540380m0.pdf…

Highlights

Kenya L10A – Sunbird-1 Oil Discovery

The historic Sunbird-1 first-ever oil discovery well was drilled offshore Kenya in area L10A in the first

months of 2014;

The top of the Sunbird Reef was drilled in an oil and gas bearing limestone reservoir and intersected a

gross 29.6m gas column overlying a gross 14m oil column;

The age and type of the oil source rocks, as well as other crucial data was uncovered by detailed oil

and gas geochemical analysis;

Results received from the Sunbird-1 well are highly significant as they are the first proof of the

presence of a prospective oil system in the Lamu Basin offshore Kenya;

The Sunbird-1 play-opening oil discovery brings a major opportunity for exploration of larger volumes of

oil, as well as gas, over Pancontinental’s extensive portfolio of prospects and leads offshore Kenya.

Namibia EL 0037 – Farmout to Tullow

Farmout to Tullow 65%, Pancontinental retains 30%;

Tullow to lead the forward programme as operator with a work programme of-

3D seismic survey of not less than 3,000 km2

prior to December 2014 – Pancontinental carried 100%;

2D seismic survey of not less than 1,000 km coincident or later than 3D – Pancontinental carried 100%;

Exploration well subject to identification of a suitable drilling prospect – Pancontinental carried 100%;

Additional costs such as purchasing, interpreting and mapping seismic – Pancontinental carried 100%;

Note – there are no caps in place for any of the above expenditure which means that Pancontinental

will have no financial exposure for the exploration work under farmout.

Past costs incurred by Pancontinental in licence EL 0037 – Tullow to reimburse Pancontinental 65%;

Pancontinental values the future work programme in the vicinity of US $130 million;

3D and 2D seismic survey data acquired early 2014 are currently yielding encouraging results.

Kenya L6 – Farmout to Milio

Farmout to Milio 24% onshore, Pancontinental retains 16% onshore, 40% offshore;

Milio to lead the forward programme as operator of the onshore portion of the block and FAR to remain

operator of the offshore portion of L6;

The farmin work programme consists of –

2D seismic survey of not less than 1,000 km, possibly late 2014 – Pancontinental carried 100%;

Drilling and testing of an onshore exploration well post the 2D seismic – Pancontinental carried 100%;

Additional costs such as processing and interpreting of the 2D seismic – Pancontinental carried 100%.

Note – there are no “caps” in place for any of the above expenditure which means that Pancontinental

will have no financial exposure for the exploration work under farmout in Kenya permit L6.

Current activity includes preparations for the onshore 2D seismic campaign;

Farmout efforts are under way for the offshore portion of the block

ein Auszug aus dem Annual Report 2014 vom 28.10.2014 an die Shareholders: (http://www.asx.com.au/asxpdf/20141028/pdf/42t89t540380m0.pdf…

Highlights

Kenya L10A – Sunbird-1 Oil Discovery

The historic Sunbird-1 first-ever oil discovery well was drilled offshore Kenya in area L10A in the first

months of 2014;

The top of the Sunbird Reef was drilled in an oil and gas bearing limestone reservoir and intersected a

gross 29.6m gas column overlying a gross 14m oil column;

The age and type of the oil source rocks, as well as other crucial data was uncovered by detailed oil

and gas geochemical analysis;

Results received from the Sunbird-1 well are highly significant as they are the first proof of the

presence of a prospective oil system in the Lamu Basin offshore Kenya;

The Sunbird-1 play-opening oil discovery brings a major opportunity for exploration of larger volumes of

oil, as well as gas, over Pancontinental’s extensive portfolio of prospects and leads offshore Kenya.

Namibia EL 0037 – Farmout to Tullow

Farmout to Tullow 65%, Pancontinental retains 30%;

Tullow to lead the forward programme as operator with a work programme of-

3D seismic survey of not less than 3,000 km2

prior to December 2014 – Pancontinental carried 100%;

2D seismic survey of not less than 1,000 km coincident or later than 3D – Pancontinental carried 100%;

Exploration well subject to identification of a suitable drilling prospect – Pancontinental carried 100%;

Additional costs such as purchasing, interpreting and mapping seismic – Pancontinental carried 100%;

Note – there are no caps in place for any of the above expenditure which means that Pancontinental

will have no financial exposure for the exploration work under farmout.

Past costs incurred by Pancontinental in licence EL 0037 – Tullow to reimburse Pancontinental 65%;

Pancontinental values the future work programme in the vicinity of US $130 million;

3D and 2D seismic survey data acquired early 2014 are currently yielding encouraging results.

Kenya L6 – Farmout to Milio

Farmout to Milio 24% onshore, Pancontinental retains 16% onshore, 40% offshore;

Milio to lead the forward programme as operator of the onshore portion of the block and FAR to remain

operator of the offshore portion of L6;

The farmin work programme consists of –

2D seismic survey of not less than 1,000 km, possibly late 2014 – Pancontinental carried 100%;

Drilling and testing of an onshore exploration well post the 2D seismic – Pancontinental carried 100%;

Additional costs such as processing and interpreting of the 2D seismic – Pancontinental carried 100%.

Note – there are no “caps” in place for any of the above expenditure which means that Pancontinental

will have no financial exposure for the exploration work under farmout in Kenya permit L6.

Current activity includes preparations for the onshore 2D seismic campaign;

Farmout efforts are under way for the offshore portion of the block

Das sind die neuen Veröffentlichungen von PCL:

Investor Presentation

[/b]http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Quarterly Cashflow October 2014

http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Quarterly Activities October 2014

http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Inventory of Major Prospects Offshore Namibia

identified during initial 3D interpretation work

Highlights

Namibia EL 0037 – Initial interpretation confirms Major Offshore Prospects

» 3D seismic survey programme – complete – Nil cost to Pancontinental

» 2D seismic survey programme – complete – Nil cost to Pancontinental

» Initial interpretation of surveys – complete – Nil cost to Pancontinental

» Tullow’s aggressive exploration campaign verifies Major Offshore Prospects

» Operator Tullow will now consider a drilling location, with a full carry of drilling

costs for Pancontinental under farmout

» With the exploration programme fully funded, Pancontinental is in a favourable

position to explore further opportunities in the Region

Kenya L10A – Analysis of Sunbird-1 discovery results

» The Sunbird-1 well uncovered Kenya’s historic first ever offshore oil discovery

» Ongoing analysis of the results will determine the future oil exploration activities

in the region

» Previously identified prospects and leads will now be reviewed using Sunbird-1

well data prior to the joint venture determining the location of one or more

additional wells

Kenya L10B – Analysis of extensive seismic data continues

» Analysis and assessment of the large volumes of 3D data previously acquired

continues with a focus on how the Sunbird-1 well results impact exploration in this

adjacent block

Kenya L6 – Fully funded onshore, farmout efforts offshore

» As exploration onshore is now fully funded, Pancontinental has focussed its

attention to farming out the offshore portion of the block

Kenya L8 – New licence

» Pancontinental is committed to continued efforts in the award of a new L8 licence

Corporate

» Cash balance of $9.1 million as at 30 September 2014

» With a number of Pancontinental’s permits fully funded for the next phase of

exploration, the Company has been actively seeking farminees for the remaining

permits, as well as examining high-impact new projects

Investor Presentation

[/b]http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Quarterly Cashflow October 2014

http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Quarterly Activities October 2014

http://clients2.weblink.com.au/clients/pancon/article.asp?as…

Inventory of Major Prospects Offshore Namibia

identified during initial 3D interpretation work

Highlights

Namibia EL 0037 – Initial interpretation confirms Major Offshore Prospects

» 3D seismic survey programme – complete – Nil cost to Pancontinental

» 2D seismic survey programme – complete – Nil cost to Pancontinental

» Initial interpretation of surveys – complete – Nil cost to Pancontinental

» Tullow’s aggressive exploration campaign verifies Major Offshore Prospects

» Operator Tullow will now consider a drilling location, with a full carry of drilling

costs for Pancontinental under farmout

» With the exploration programme fully funded, Pancontinental is in a favourable

position to explore further opportunities in the Region

Kenya L10A – Analysis of Sunbird-1 discovery results

» The Sunbird-1 well uncovered Kenya’s historic first ever offshore oil discovery

» Ongoing analysis of the results will determine the future oil exploration activities

in the region

» Previously identified prospects and leads will now be reviewed using Sunbird-1

well data prior to the joint venture determining the location of one or more

additional wells

Kenya L10B – Analysis of extensive seismic data continues

» Analysis and assessment of the large volumes of 3D data previously acquired

continues with a focus on how the Sunbird-1 well results impact exploration in this

adjacent block

Kenya L6 – Fully funded onshore, farmout efforts offshore

» As exploration onshore is now fully funded, Pancontinental has focussed its

attention to farming out the offshore portion of the block

Kenya L8 – New licence

» Pancontinental is committed to continued efforts in the award of a new L8 licence

Corporate

» Cash balance of $9.1 million as at 30 September 2014

» With a number of Pancontinental’s permits fully funded for the next phase of

exploration, the Company has been actively seeking farminees for the remaining

permits, as well as examining high-impact new projects

RollerCoaster - back to AUD 0.031 - strong stomach needed

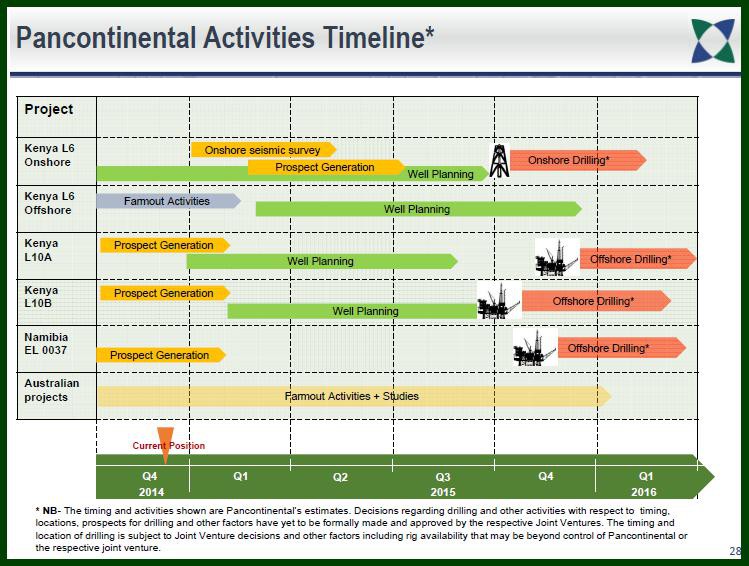

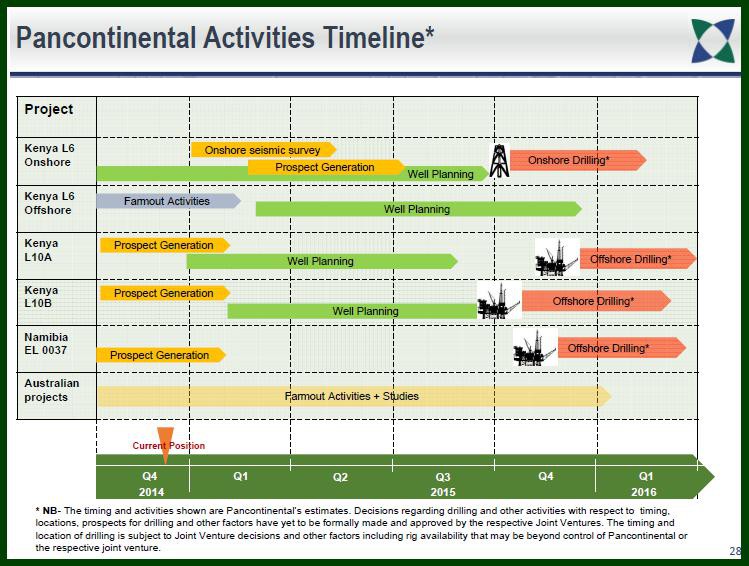

Schätze mal die TIMELINE

hat einige vertrieben,

viele (incl. mir) dachten Bohrungen wären schon in 1Q15 möglich..

Die Zeit bis hin zur nächsten offshore Kenya Bohrung

wird genutzt um aus einem Pool aus Angeboten das beste rauszufischen,

einen Partner zu küren,

um dann full carried

und mit Cash für diverse bereits geleistete Kosten,

die Früchte des Sunbird Datenbaums zu ernten.

In Namibia,

denke ich, wird Tullow erst einmal die 3D Daten vom Eco Block analysieren wollen (1Q15), bevor es dann zu einem möglichen multi well Program, frühestens in 2H15 kommen könnte.

Farmouts & die Antizipation

haben das Potential den Kurs von PCL durch 2015 zu vervielfachen.

daher für mich long term long

GLA

Schätze mal die TIMELINE

hat einige vertrieben,

viele (incl. mir) dachten Bohrungen wären schon in 1Q15 möglich..

Die Zeit bis hin zur nächsten offshore Kenya Bohrung

wird genutzt um aus einem Pool aus Angeboten das beste rauszufischen,

einen Partner zu küren,

um dann full carried

und mit Cash für diverse bereits geleistete Kosten,

die Früchte des Sunbird Datenbaums zu ernten.

In Namibia,

denke ich, wird Tullow erst einmal die 3D Daten vom Eco Block analysieren wollen (1Q15), bevor es dann zu einem möglichen multi well Program, frühestens in 2H15 kommen könnte.

Farmouts & die Antizipation

haben das Potential den Kurs von PCL durch 2015 zu vervielfachen.

daher für mich long term long

GLA

Eine Vervierfachung des Kurses sollte es schon werden. Dann bin ich wieder zurück auf Feld eins.

schöne Timeline

muss man sich keine Gedanken an kurzfristig steigende Kurse machen. Kann aber sein Körbchen aufstellen... Zeit genug bis Mitte/Ende 2015 ist ja. Und dann... ja dann fliegt die Münze wieder in die Luft und es kommt nur noch darauf an, wie sie landet....

muss man sich keine Gedanken an kurzfristig steigende Kurse machen. Kann aber sein Körbchen aufstellen... Zeit genug bis Mitte/Ende 2015 ist ja. Und dann... ja dann fliegt die Münze wieder in die Luft und es kommt nur noch darauf an, wie sie landet....

Etwas OT

Verfolgt gerade jemand die Geschehnisse um unseren langjährigen JV-Partner FAR? Die haben offshore Senegal ziemlich gut gearbeitet und meldeten den zweiten Treffer bei der zweiten Bohrung, wobei sie da noch nicht mal das main target erreicht haben...

Sieht insgesamt sehr interessant aus, bin gespannt was an der ASX passiert

Verfolgt gerade jemand die Geschehnisse um unseren langjährigen JV-Partner FAR? Die haben offshore Senegal ziemlich gut gearbeitet und meldeten den zweiten Treffer bei der zweiten Bohrung, wobei sie da noch nicht mal das main target erreicht haben...

Sieht insgesamt sehr interessant aus, bin gespannt was an der ASX passiert

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +6,64 | |

| -2,22 | |

| +1,69 | |

| -5,66 | |

| +33,33 | |

| -0,36 | |

| -2,11 | |

| +2,88 | |

| 0,00 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 210 | ||

| 94 | ||

| 82 | ||

| 62 | ||

| 53 | ||

| 49 | ||

| 41 | ||

| 34 | ||

| 29 | ||

| 28 |