[posting]61335256[/posting]... on 8 and 9 August, a week after winning a $55 million contract to redesign the aircraft’s boom telescope actuator.

12.8.

https://www.flightglobal.com/news/articles/boeing-juggles-kc…

=>

Boeing is redesigning the actuator to address hardware specification flaws coming from the service’s initial design requirements. Designing and retrofitting the aircraft will likely cost more than $300 million, according to a Government Accountability Office (GAO) report released in June 2019. Programme officials told GAO that developing a solution, and receiving Federal Aviation Administration certification, would likely take three to four years.

The boom's issues became apparent during developmental flight testing, when pilots of lighter receiver aircraft – such as Fairchild Republic A-10s and Lockheed Martin F-16s – reported they needed more force to connect and disconnect their aircraft from the boom, as compared to older tankers, like the KC-135 and KC-10, says GAO.

The additional force required can cause the receiving aircraft to suddenly lunge and collide with the boom, damaging the aircraft’s glass cockpit canopy or tail. It can also damage the boom.

...

Boeing’s KC-46 deliveries to the USAF have been slowed, and at times halted, by issues with Foreign Object Debris (FOD) found inside the airframes. Boeing says it has implemented new FOD-awareness days and clean-as-you-go practices to eliminate the problem, but declines to say if FOD has been discovered in the aircraft in recent months.

--> also auch im Militärbereich läuft's offenbar nicht besonders störungsfrei bei Boeing

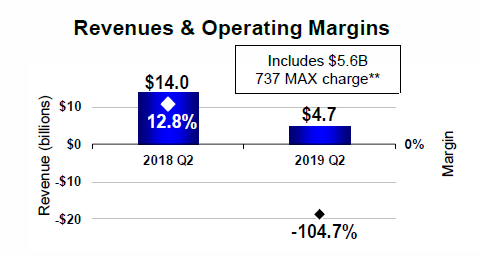

2018Q2, revenues -- also vor dem MAX-Desaster (*)

• Commercial Airplanes: USD14.0b = 58% (~)

• Defense, Space & Security: USD6.1b = 25%

• Global Services: USD4.1b (gemischt zivil + militärisch) = 17% => 8.5% + 8.5% (~) <meine willkürliche Annahme>

-------------------------------

= USD24.3b (Rundungseffekt)

(*) ..wie es sich hier darstellt im krassen Umsatzrückgang 2018Q2 --> 2019Q2:

<Commercial Airplanes>

=> demnach lag vor dem MAX-Desaster der zivile Umsatzanteil bei Boeing bei so rund (58+8.5)% = ~2/3

--> auch mal gut zu wissen

Der Backlog im Bereich Defense, Space & Security ist laut Boeing zum 30.6.2019 mit USD64b sehr hoch (das scheint offenbar gewohnheitsmäßig so zu sein bei Boeing)

--> Orders valued at $4B; Backlog of $64B

--> hier scheint also immer noch ein (gesund) hohes Book-to-bill Ratio zu bestehen

--> bei Commercial Airplanes sagt Boeing (immer noch): Healthy backlog of $390B

=> ich sehe es derzeit so, daß der Markt in Summe das MAX-Desaster nur als eine vorübergehende Delle sieht, gestützt von einem weiterhin starken Militärgeschäft (unter Pres.Trump)