[posting]61521944[/posting]https://seekingalpha.com/article/4291754-envista-ipo-stable-…

IPO Analysis | Healthcare

Envista IPO: With Stable EBITDA, A Buy At 4x-6x EBITDA

Sep. 16, 2019 10:09 AM ET|

4 comments

|

About: Envista Holdings Corporation (NVST), Includes: PDCO

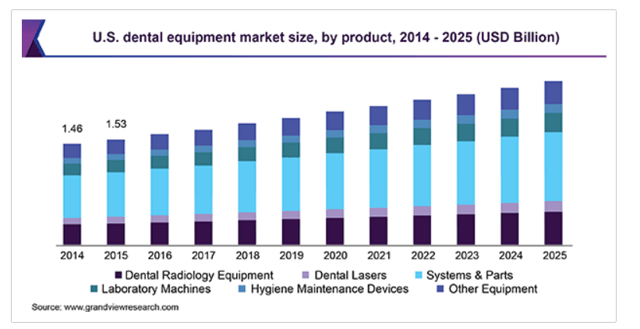

Envista is said to be one of the largest dental products companies in the world. Among the different products sold, the company is selling orthodontics, digital imaging technologies, and implants.

Note that Patterson trades at 8.6x EBITDA with Debt/EBITDA of 2.9x. In our view, Envista will be a buy at around that mark. A market opportunity will exist at 4x-6x.

Goodwill and intangibles represent 77% of the total amount of assets. The company has acquired over 25 dental businesses in the last 15 years.

The company expects to sign several debt agreements, which may increase the company's financial risk. Only the investors reading the company documentation carefully will get to know about it.

Envista expects to use $1.3 billion of proceeds from debt financing to pay Danaher, which most investors will not appreciate.

With stable and positive FCF and EBITDA, Envista (NVST) is a name that private equity analysts and value investors will look into. The company's financial debt appears to be less appealing feature of Envista. The investors who don't mind buying companies with debt/EBITDA of more than 5x may be able to acquire Envista at 4x-6x EBITDA or more. In our opinion, once the IPO goes live, the company will trade at 6x-9x EBITDA.

!!!

Declining Sales, But Growing FCF

In the last two years, sales increased by only 2%, and the costs of sales increased by 4.89%. As a result, the gross profit margin declined from 58% to 56%. The decline in the gross profit margin will not alarm investors. However, it will not be appreciated by growth investors, who may pass on this name. Also, notice that in the six months ended June 28, 2019, sales declined by 2.5%, and the gross profit margin declined to 55%.

!!!

Use Of Proceeds

Envista expects to use $1.3 billion of proceeds from debt financing to pay Danaher, which most investors will not appreciate. Investors should get to know that Envista reports positive FCF and Adjusted EBITDA. With this in mind, the company will most likely be able to continue its operations without selling additional equity. In our view, stock dilution risk does not appear to be significant on this name. The lines below offer further information on the matter:

We intend to pay to Danaher, as partial consideration for the Dental business Danaher is contributing to us in connection with the separation, all of the net proceeds we will receive from the sale of our common stock in this offering, including any net proceeds we receive as a result of any exercise of the underwriters' option to purchase additional shares, and approximately $1.3 billion of proceeds from term debt financing that we will enter into prior to the closing of this offering. Source: Prospectus