[posting]63930260[/posting]June 18, 2020 / 5:15 PM / 11 days ago

Saudi Aramco cuts hundreds of jobs amid oil market downturn, sources say

DUBAI (Reuters) - State oil giant Saudi Aramco (2222.SE) started laying off hundreds of employees this month, two sources familiar with the matter said, as global energy companies reduce their workforces in response to the coronavirus crisis.

Like other top oil firms, ...

https://www.reuters.com/article/us-saudi-aramco-jobs/saudi-a…

..........................................................................................................................................................

Jun 27, 2020

Saudi Aramco's Dividend Math Doesn't Add Up

David Fickling, Bloomberg News

BC-Saudi-Aramco's-Dividend-Math-Doesn't-Add-Up , David Fickling

(Bloomberg Opinion) -- It’s the mother of all payouts.

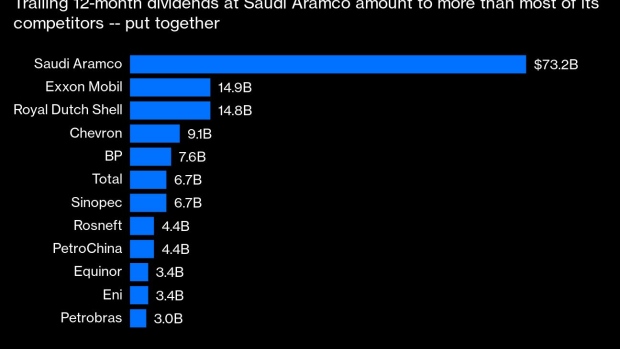

The $75 billion that Saudi Aramco doles out in dividends every year dwarfs what any other listed company gives to shareholders. It’s roughly equivalent to the payouts from Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., BP Plc, Total SA, PetroChina Co., Eni SpA, Petroleo Brasiliero SA and China Petroleum & Chemical Corp. or Sinopec — put together.

That makes Chief Executive Officer Amin Nasser’s promise to continue that level of returns for the next five years an extraordinary vote of confidence in an oil market awash with uncertainties. Saudi Aramco will be prepared to borrow money to ensure that it meets its commitment this year despite oil prices heading into negative territory, he said this month.

Running up debts to keep the dividend on track is standard practice for energy companies amid the carnage of 2020’s oil market —

https://www.bnnbloomberg.ca/saudi-aramco-s-dividend-math-doe…

..........................................................................................................................................................

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar

Nachrichtenagentur: dpa-AFX 29.06.2020, 11:08 | 249 | 0 | 0

LONDON (dpa-AFX) - Der Ölkonzern BP verkauft sein Petrochemiegeschäft für insgesamt 5 Milliarden US-Dollar. Käufer ist das britische Chemieunternehmen Ineos, wie BP am Montag in London mitteilte. Dabei erhält der Ölkonzern eine Vorabzahlung von 400 Millionen Dollar, weitere 3,6 Milliarden fließen bei Abschluss der Transaktion, der zum Jahresende erwartet wird. Eine weitere Milliarde Dollar wird in mehreren Tranchen 2021 gezahlt. Mit dem Verkauf schließe BP sein Programm zur Abgabe von Geschäften mit einem Wert von insgesamt 15 Milliarden Dollar ein Jahr früher ab als geplant, ...

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar | wallstreet-online.de - Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/12668677-bp-verka…

..........................................................................................................................................................

Amerikas Öl-Industrie steht vor Pleitewelle: Jetzt schauen alle verzweifelt auf Trump und die Fed

29.06.2020 09:00

Viele Fracking-Unternehmen schreiben hohe Verluste, der Branche droht ein Massensterben. Ein Trumpf aber bleibt: Die Regierung von Präsident Trump wird alles unternehmen, um die strategisch wichtige Branche zu retten.

https://deutsche-wirtschafts-nachrichten.de/504867/Amerikas-…

... \ud83d\udcb5 ... Schuldenabbau ... Bankversklavung ...

... \ud83d\udcb5 ... Schuldenabbau ... Korruptin etc. ...

... \ud83d\udcb5 ... Aufbau ...

..........................................................................................................................................................

Russland warnt die USA vor Regime-Wechsel in Venezuela

28.06.2020 12:00

Moskau hat Venezuela Solidarität im Kampf gegen einen möglichen von der USA betriebenen Regimewechsel in dem Land zugesichert. Doch auch die USA lassen derzeit die Muskeln spielen.

https://deutsche-wirtschafts-nachrichten.de/504923/Russland-…

..........................................................................................................................................................

On V-Day, Russia Vows To Prevent US-Led 'Regime Change' In Venezuela

by Tyler Durden

Wed, 06/24/2020 - 21:25

On Wednesday Russian Foreign Minister Sergey Lavrov used the occasion of Moscow's 75th anniversary V-Day parade commemorating the end of WWII to warn Washington against pushing regime change in Venezuela.

Among other foreign dignitaries, Caracas' top diplomat Jorge Arreaza was in Moscow for the events. Lavrov issued public statements of solidarity expressing support to the socialist country, calling it "a mainstay for countering the attempts to draw the region back into the 19th century and to impose the Monroe Doctrine."

"We strongly support your commitment to combating foreign diktat and any attempts at blatant interference in the domestic affairs of a sovereign state, opposing any attempts at a forced regime change," Lavrov said, as reported in Newsweek. ...

https://www.zerohedge.com/geopolitical/v-day-russia-vows-pre…

..........................................................................................................................................................

18 Million Barrels Of Sanctioned Venezuelan Oil Are Stuck At Sea

By Tsvetana Paraskova - Jun 24, 2020, 11:30 AM CDT

Oil tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

According to Reuters estimates based on shipping data, industry sources, and documents of Venezuela’s state oil firm PDVSA, at least 16 tankers are idling off the coasts of Africa and Southeast Asia because few potential buyers would risk U.S. sanctions for dealing with the regime of Nicolas Maduro.

The 18.1 million barrels of still unsold Venezuelan crude oil is equal to two months of the country’s production at its current rate, according to Reuters.

Over the past months, the U.S. Administration has increasingly stepped up its maximum pressure campaign on Venezuela and its oil industry and exports, seeking to cut off revenues for Maduro’s regime.

Earlier this year, the United States slapped sanctions on Rosneft’s Switzerland-based trading arm and signaled that it was ready to tighten even more the noose around the Venezuelan government.

Last week, the U.S. Department of the Treasury designated three individuals and eight foreign entities, and identified two ...

https://oilprice.com/Latest-Energy-News/World-News/18-Millio…

..........................................................................................................................................................

Schiffe mit Öl aus Venezuela irren auf den Weltmeeren umher

26.06.2020 16:10

Branchendaten zufolge fahren derzeit Tanker mit vielen Millionen Barrel Erdöl auf den Weltmeeren umher, weil sie nach einem Käufer suchen. Denn sie fürchten die USA.

Das "Schwarze Gold" wird zum "Schwarzen Peter": Aus Furcht vor einer Verfolgung durch die US-Behörden wegen möglicher Sanktionsverstöße scheuen Firmen davor zurück, Venezuela Rohöl abzunehmen. Branchendaten zufolge fahren derzeit mindestens 16 Öltanker auf der Suche nach einem Käufer auf den Weltmeeren umher - ...

https://deutsche-wirtschafts-nachrichten.de/504963/Schiffe-m…

... \ud83d\udca3 ... Pechmarie ... \ud83d\udcb5 ... de Ölsumpf wird trocken gelegt ,,, Ölsand ...

..........................................................................................................................................................

Owner Of Largest Refinery In India Stops Importing Venezuelan Oil

By Irina Slav - Jun 26, 2020, 9:30 AM CDT

Reliance Industries, the owner of the largest refinery in India and the world, has stopped buying Venezuelan crude, according to unnamed sources in the know who spoke to Bloomberg,

Last year, Reliance bought a quarter of the oil Venezuela exported, but the last time it bought Venezuelan crude this year was in March, Bloomberg reported, citing tanker data, and at a much lower rate than in 2019, at 117,650 bpd.

Reliance is not alone in shunning Venezuelan oil, fearing repercussions from Washington. India’s second-largest refiner, Nayara Energy, has also stopped buying Venezuelan crude, switching to Canadian, Kuwaiti, and Ecuadorian oil, again according to Bloomberg shipping data.

Meanwhile, tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

The latest round of sanction action by Washington against Caracas was to blacklist five Iranian tanker captains and all tankers that have called at Venezuelan ports over the 12 months to June, making many oil traders reconsider their plans. According to shopping brokerage data cited by Reuters earlier this month, there were as many as 77 tankers that have called at Venezuelan ports over the past 12 months, which puts them at risk of being blacklisted.

Despite the sanctions, Venezuela is still exporting some oil, mostly to ...

https://oilprice.com/Latest-Energy-News/World-News/Owner-Of-…

..........................................................................................................................................................

Reliance working to complete Saudi Aramco deal: Mukesh Ambani

1 min read . Updated: 24 Jun 2020, 06:44 AM IST

Written By Nikhil Agarwal

• Reliance and Aramco share a common outlook and vision on evolution of the business in the future, Mukesh Ambani said

• He said the partnership gives the refineries access to a wide portfolio of value accretive crude grades and enhanced feedstock security

NEW DELHI: Having already raised ₹1.15 lakh crore from global tech investors, including Facebook to make the company net debt-free, Reliance Industries chairman Mukesh Ambani said they are now working to complete contours of a $15-billion deal with Saudi Aramco. Announced in the oil-to-telecom conglomerate's last year annual general meeting (AGM), the deal was to be concluded by March 2020 but has been delayed.

Reliance has not yet given a fresh timeline for the completion of the deal.

"In the energy businesses, ...

https://www.livemint.com/companies/news/reliance-working-to-…