Gewinnerbranchen der Jahre 2006 bis 2040 (Seite 8383)

eröffnet am 10.12.06 16:57:17 von

neuester Beitrag 16.02.24 09:33:08 von

neuester Beitrag 16.02.24 09:33:08 von

Beiträge: 94.068

ID: 1.099.361

ID: 1.099.361

Aufrufe heute: 3

Gesamt: 3.535.925

Gesamt: 3.535.925

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 21 Minuten | 7888 | |

| vor 13 Minuten | 5021 | |

| vor 1 Stunde | 2630 | |

| vor 1 Stunde | 2620 | |

| vor 58 Minuten | 2348 | |

| vor 18 Minuten | 2089 | |

| vor 34 Minuten | 2040 | |

| vor 32 Minuten | 1787 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.805,96 | -1,56 | 228 | |||

| 2. | 3. | 162,94 | +0,50 | 96 | |||

| 3. | 2. | 9,1850 | -4,77 | 90 | |||

| 4. | 4. | 0,1920 | -1,03 | 76 | |||

| 5. | 6. | 0,0211 | -32,59 | 53 | |||

| 6. | 34. | 0,6400 | -54,29 | 49 | |||

| 7. | 14. | 6,8040 | +0,98 | 48 | |||

| 8. | 13. | 421,70 | -14,55 | 44 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 33.717.450 von Pontiuspilatus am 25.03.08 11:03:42FactSet Beats Estimates, Boosts Dividend and Buyback

Hast du die? sieht schwer nach zu Unrecht hingerichtet aus!!!

Überlege etwas zu verkaufen und in fds zu tauschen, hat mir schon immer gefallen.

Hast du die? sieht schwer nach zu Unrecht hingerichtet aus!!!

Überlege etwas zu verkaufen und in fds zu tauschen, hat mir schon immer gefallen.

Antwort auf Beitrag Nr.: 33.717.946 von Pontiuspilatus am 25.03.08 11:53:37swcheint ne typische manie

ein freudscher verschreiber vom feinsten. ja, es schweint und es war in vielsten fongs. Jetzt wird zurückgefaltet, dürfte heute eine interessante Eröffnung geben. Mal sehen wie sich die anderen Ölwerte schlagen.

Pontius, ich wußte gar nicht, dass du auf englisch bloggst, oder ist der Artikel zur dollarrenaissance nicht von dir???

@simon: apollo group strongest klingeling

ein freudscher verschreiber vom feinsten. ja, es schweint und es war in vielsten fongs. Jetzt wird zurückgefaltet, dürfte heute eine interessante Eröffnung geben. Mal sehen wie sich die anderen Ölwerte schlagen.

Pontius, ich wußte gar nicht, dass du auf englisch bloggst, oder ist der Artikel zur dollarrenaissance nicht von dir???

@simon: apollo group strongest klingeling

chart sieht jedenfalls nicht gut aus.

25 jahre seitwärts und dann innerhalb von 3 jahren verachtfacht. swcheint ne typische manie im blasenbildungsstadium zu sein.

kenn das unternehmen aber nicht. würde zu den fondsmanagern passen sich sowas ins depot zu legen nachdem es beliebt geworden ist

25 jahre seitwärts und dann innerhalb von 3 jahren verachtfacht. swcheint ne typische manie im blasenbildungsstadium zu sein.

kenn das unternehmen aber nicht. würde zu den fondsmanagern passen sich sowas ins depot zu legen nachdem es beliebt geworden ist

Antwort auf Beitrag Nr.: 33.717.430 von clearasil am 25.03.08 11:01:06Valero... ich erinnere mich bruchstückhaft das Valero in einigen Namhaften Fonds eine gewichtige Position darstellt.

Europäer sollten sich Sorgen über Hauspreisblasen in Spanien, Irland und Großbritannien machen. Sogar in Ländern wie Portugal, Italien oder Frankreich gab es einen bedeutenden Anstieg der Hauspreise. In manchen dieser Länder sind die Verbraucher finanziell überdehnt, weil die Kreditbedingungen straffer werden. Auch in Großbritannien gibt es flexibel verzinste Hypothekenkredite. Der spanische Boom hängt großteils am Bausektor. Bauinvestitionen machen dort inzwischen 19 Prozent des Bruttoinlandsprodukts aus, in den USA waren es in der Spitzenzeit nur 6 Prozent.

FactSet Beats Estimates, Boosts Dividend and Buyback

posted on: March 20, 2007 | about stocks: FDS Font Size: PrintEmail

FactSet Research Systems, a leading provider of financial information and analytical applications, reported Q2 (ended Feb. 28) net income of $26.5 million (+38% y-o-y), or $0.52/share, on revenue of $116.3m (+24%), beating analysts' average estimate of $0.48/share (Thomson). FactSet's board approved a 100% quarterly dividend increase to $0.12/share and increased its current share repurchase program by $100m. CEO Philip A. Hadley commented, "The dividend increase and additional share repurchase authorization reflect the consistency of our subscription business model, our historical free cash flow and our continued focus to enhance long-term shareholder value." FactSet forecasts Q3 revenue between $118m - $121m. Shares of FactSet lost 2.82% to $64.70 yesterday and have traded between $41.20 - $66.95 [all-time high] over the past year.

posted on: March 20, 2007 | about stocks: FDS Font Size: PrintEmail

FactSet Research Systems, a leading provider of financial information and analytical applications, reported Q2 (ended Feb. 28) net income of $26.5 million (+38% y-o-y), or $0.52/share, on revenue of $116.3m (+24%), beating analysts' average estimate of $0.48/share (Thomson). FactSet's board approved a 100% quarterly dividend increase to $0.12/share and increased its current share repurchase program by $100m. CEO Philip A. Hadley commented, "The dividend increase and additional share repurchase authorization reflect the consistency of our subscription business model, our historical free cash flow and our continued focus to enhance long-term shareholder value." FactSet forecasts Q3 revenue between $118m - $121m. Shares of FactSet lost 2.82% to $64.70 yesterday and have traded between $41.20 - $66.95 [all-time high] over the past year.

ist zwar nicht eine der hier besprochenen Firmen, aber der Einbruch ist schon frappierend.

San AntonioSan AntonioSan Antonio (aktiencheck.de AG) - Die Valero Energy Corp. (ISIN US91913Y1001 / WKN 908683) befürchtet, dass das Ergebnis im ersten Quartal 2008 um bis zu 95 Prozent unter das Vorjahresniveau fallen könnte.

Wie der der amerikanische Raffineriekonzern am Dienstag verkündete, rechnet er inzwischen nur noch mit einem Nettogewinn von 10 bis 35 Cents je Aktie. Im Vorjahr war noch ein Gewinn in Höhe von 1,86 Dollar pro Aktie ausgewiesen worden.

Hintergrund seien die geringen Gewinne bei der Benzinproduktion und ungeplante Raffinerieabschaltungen. Man habe die steigenden Preise für Rohöl nicht vollständig auf die Kunden abwälzen können.

Zuletzt schlossen die Valero-Aktien bei 50,08 Dollar (+1,15 Prozent).

(25.03.2008/ac/n/a)

San AntonioSan AntonioSan Antonio (aktiencheck.de AG) - Die Valero Energy Corp. (ISIN US91913Y1001 / WKN 908683) befürchtet, dass das Ergebnis im ersten Quartal 2008 um bis zu 95 Prozent unter das Vorjahresniveau fallen könnte.

Wie der der amerikanische Raffineriekonzern am Dienstag verkündete, rechnet er inzwischen nur noch mit einem Nettogewinn von 10 bis 35 Cents je Aktie. Im Vorjahr war noch ein Gewinn in Höhe von 1,86 Dollar pro Aktie ausgewiesen worden.

Hintergrund seien die geringen Gewinne bei der Benzinproduktion und ungeplante Raffinerieabschaltungen. Man habe die steigenden Preise für Rohöl nicht vollständig auf die Kunden abwälzen können.

Zuletzt schlossen die Valero-Aktien bei 50,08 Dollar (+1,15 Prozent).

(25.03.2008/ac/n/a)

sehr interessant

U.S. Dollar Paradigm Shift Underway

posted on: March 24, 2008 | about stocks: GLD / SPY / UDN / USO / UUP Font Size: PrintEmail Today is a day to talk about paradigm shifts.

One theme of our times is the US dollar 'collapse' all facilitated by political mismanagement of our system, unsustainable trade deficits, bloated budget deficits, horrible energy policy, and most recently, a credit crisis causing a loss of faith in US assets.

You don't need to go far to find areas of the blogosphere and youtube where goldbugs congregrate and call to an end of time, soliciting everyone to buy their duct tape and prepare to deal with our transition to becoming the next Zimbabwe.

So amidst all of this, plenty of emotion is gathered. Who can deny that any threat to the sanctity of the dollar is upsetting and definitely a threat to national pride? Its easy to understand how disappointing this situation can be for us Americans, who for the better part of our lives have lived under the notion of a nationalistic and even moral superiority. What a dilemma that puts us in this past few years, having to gather some humility having 'failed' on multiple levels?

So now everything is finally catching up with us. We are paying the price for fiscal mismanagement, years of bloating money supply without fear of repercussion, and as Ron Paul would say (I'll paraphrase his concept) a "flawed and unnecessary central bank driven system based on broken fractional reserve banking policy backed by no credibility (gold)."

That is at least what everyone you talk to would believe. The public notion is one of trend following. At the peak of any bubble, the public has resounding confidence in whatever the bubble is. During the tech bubble, Dow was going to 40k. During the housing bubble, you better buy now, or you'll be unable to afford anything ever again. The commodities bubble? The Long any currency but US dollar bubble? Well we're still dealing with that. But the gold and silver bubble of the early 80's has a familiar ending.

Ron Paul's folks are merely blind trend followers who do not realize innovation that defines America is by the large part fueled by a deflation-avoidance driven policy that serves to provide incentive to invest. The gold standard was a resounding failure as the US was trapped in a deflationary mire for decades on end, holding back economic and technological innovation unnecessarily.

The herd is never good at realizing the risk rises (at least in the long term) as we get further and further from the mean, because they assume every trend reflects a permanent paradigm shift. The reality is contrary - paradigm shifts are the exception; cycles are the commonality.

The resounding truth and best opportunity is always somewhere everyone is not looking. And that is this: The US Dollar is still a fundamentally sound currency, despite like any developed nations we face very real challenges in our entitlement systems(Medicare sustainability), energy policy, and war spending policy.

But all of those problems are fixable. One needn't look far to realize that speculative flows to the euro are not quite justifiable on news reel of German bank stability. It also doesn't take a rocket scientist to realize Japanese dependence on the American economy, nor its dependence on a weak Yen to buoy strength, thus justification for higher interest rates and more favorable currency fundamentals. Our debt to GDP ratios are still amongst best in the developed world, and a few mere changes of government policy with respect to entitlement sustainability, tax policy, energy and food subsidization, and redirection of war spending to local infrastructure improvement can easily usher an era of US broad economic leadership.

As far as money supply: we are in a deflationary time, not inflationary, as the goldbugs would have you believe. Money supply is coming down as the financial world is reassessing its risk models. Less money is moving around; credit is reigned in. In a market where fiscally sound municipal debt is chaotically unwound, you realize we are having a market dynamic driven detachment from risk related to the actual holdings determine new values of assets. The FOMC is merely swapping paper not able to be properly valued with treasuries to prevent a cascading liquidation effect. This is a stabilizer, not a monetary flood!

Aggregrate demand is falling. That is the short term trend until bottom is found. And yet, commodities have generally reigned (Did you know crude oil is the new 30 year bond?). While world equity markets have mostly become sharply negative bears, somewhat predicting global recession, the commodity bulls argue a contrary and nonsensical notion, of stagflation, where commodity demand is miraculously maintained. Baltic shipping indexes sharply disagree; rates on the movement of goods are coming down. While there are genuine issues in supply, especially concerning misguided food/energy policy, they are all repairable in a very real and attainable way.

As I've previously detailed, our structural price problems could largely be remedied by investment instead of consumption spending. By investing, and merely going to all electric/battery vehicles, we could stop oil importation. Just imagine the cascading benefits on the broad economy of a lesser 'energy tax' (higher productivity), lesser dollar exportation to petro producers, and a disappearing need to use food for fuel. The whole equation changes. Suddenly oil is no longer worth its weight in gold, the dollar is, and hundreds of billions of dollars are no longer necessary to be 'invested' in stabilizing the mid-east.

So my point? The world will (likely already) obviously experience a global cyclical recession of some extent and decoupling will prove to be a fantastical myth, thus undermining commodity bulls' claim as their sole justification for continued high prices. Financial memories are short, and never let the equity markets get far ahead of themselves following the 2000 bubble pop. With that said, the beef of substantial risk (as an investor, not a short term trader) is entirely in holding long commodities and USD short positions. Deflation is the name of the game, and reversion to the mean based on fundamentals, not momentum, is where the value lies.

The years of 2008-2009 will likely mark a multi-decade bottom in dollar weakness, as a new political and financial landscape with a fundamentally sound direction will take hold. The fundamentals in so many trade partners have detached from their currency valuations, and this provides opportunity. New financial memory will prevent further debacles of excess, and hopefully crude will stay high long enough to stimulate a new era of energy efficiency, leading to the next great bull. Call me the optimist, even a contrarian, but selling the US short is a foolish thing to do after the proverbial toilet has already been flushed.

U.S. Dollar Paradigm Shift Underway

posted on: March 24, 2008 | about stocks: GLD / SPY / UDN / USO / UUP Font Size: PrintEmail Today is a day to talk about paradigm shifts.

One theme of our times is the US dollar 'collapse' all facilitated by political mismanagement of our system, unsustainable trade deficits, bloated budget deficits, horrible energy policy, and most recently, a credit crisis causing a loss of faith in US assets.

You don't need to go far to find areas of the blogosphere and youtube where goldbugs congregrate and call to an end of time, soliciting everyone to buy their duct tape and prepare to deal with our transition to becoming the next Zimbabwe.

So amidst all of this, plenty of emotion is gathered. Who can deny that any threat to the sanctity of the dollar is upsetting and definitely a threat to national pride? Its easy to understand how disappointing this situation can be for us Americans, who for the better part of our lives have lived under the notion of a nationalistic and even moral superiority. What a dilemma that puts us in this past few years, having to gather some humility having 'failed' on multiple levels?

So now everything is finally catching up with us. We are paying the price for fiscal mismanagement, years of bloating money supply without fear of repercussion, and as Ron Paul would say (I'll paraphrase his concept) a "flawed and unnecessary central bank driven system based on broken fractional reserve banking policy backed by no credibility (gold)."

That is at least what everyone you talk to would believe. The public notion is one of trend following. At the peak of any bubble, the public has resounding confidence in whatever the bubble is. During the tech bubble, Dow was going to 40k. During the housing bubble, you better buy now, or you'll be unable to afford anything ever again. The commodities bubble? The Long any currency but US dollar bubble? Well we're still dealing with that. But the gold and silver bubble of the early 80's has a familiar ending.

Ron Paul's folks are merely blind trend followers who do not realize innovation that defines America is by the large part fueled by a deflation-avoidance driven policy that serves to provide incentive to invest. The gold standard was a resounding failure as the US was trapped in a deflationary mire for decades on end, holding back economic and technological innovation unnecessarily.

The herd is never good at realizing the risk rises (at least in the long term) as we get further and further from the mean, because they assume every trend reflects a permanent paradigm shift. The reality is contrary - paradigm shifts are the exception; cycles are the commonality.

The resounding truth and best opportunity is always somewhere everyone is not looking. And that is this: The US Dollar is still a fundamentally sound currency, despite like any developed nations we face very real challenges in our entitlement systems(Medicare sustainability), energy policy, and war spending policy.

But all of those problems are fixable. One needn't look far to realize that speculative flows to the euro are not quite justifiable on news reel of German bank stability. It also doesn't take a rocket scientist to realize Japanese dependence on the American economy, nor its dependence on a weak Yen to buoy strength, thus justification for higher interest rates and more favorable currency fundamentals. Our debt to GDP ratios are still amongst best in the developed world, and a few mere changes of government policy with respect to entitlement sustainability, tax policy, energy and food subsidization, and redirection of war spending to local infrastructure improvement can easily usher an era of US broad economic leadership.

As far as money supply: we are in a deflationary time, not inflationary, as the goldbugs would have you believe. Money supply is coming down as the financial world is reassessing its risk models. Less money is moving around; credit is reigned in. In a market where fiscally sound municipal debt is chaotically unwound, you realize we are having a market dynamic driven detachment from risk related to the actual holdings determine new values of assets. The FOMC is merely swapping paper not able to be properly valued with treasuries to prevent a cascading liquidation effect. This is a stabilizer, not a monetary flood!

Aggregrate demand is falling. That is the short term trend until bottom is found. And yet, commodities have generally reigned (Did you know crude oil is the new 30 year bond?). While world equity markets have mostly become sharply negative bears, somewhat predicting global recession, the commodity bulls argue a contrary and nonsensical notion, of stagflation, where commodity demand is miraculously maintained. Baltic shipping indexes sharply disagree; rates on the movement of goods are coming down. While there are genuine issues in supply, especially concerning misguided food/energy policy, they are all repairable in a very real and attainable way.

As I've previously detailed, our structural price problems could largely be remedied by investment instead of consumption spending. By investing, and merely going to all electric/battery vehicles, we could stop oil importation. Just imagine the cascading benefits on the broad economy of a lesser 'energy tax' (higher productivity), lesser dollar exportation to petro producers, and a disappearing need to use food for fuel. The whole equation changes. Suddenly oil is no longer worth its weight in gold, the dollar is, and hundreds of billions of dollars are no longer necessary to be 'invested' in stabilizing the mid-east.

So my point? The world will (likely already) obviously experience a global cyclical recession of some extent and decoupling will prove to be a fantastical myth, thus undermining commodity bulls' claim as their sole justification for continued high prices. Financial memories are short, and never let the equity markets get far ahead of themselves following the 2000 bubble pop. With that said, the beef of substantial risk (as an investor, not a short term trader) is entirely in holding long commodities and USD short positions. Deflation is the name of the game, and reversion to the mean based on fundamentals, not momentum, is where the value lies.

The years of 2008-2009 will likely mark a multi-decade bottom in dollar weakness, as a new political and financial landscape with a fundamentally sound direction will take hold. The fundamentals in so many trade partners have detached from their currency valuations, and this provides opportunity. New financial memory will prevent further debacles of excess, and hopefully crude will stay high long enough to stimulate a new era of energy efficiency, leading to the next great bull. Call me the optimist, even a contrarian, but selling the US short is a foolish thing to do after the proverbial toilet has already been flushed.

U.S. Decouples From Global Markets - in Reverse

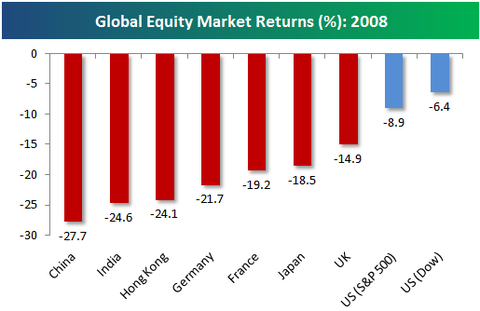

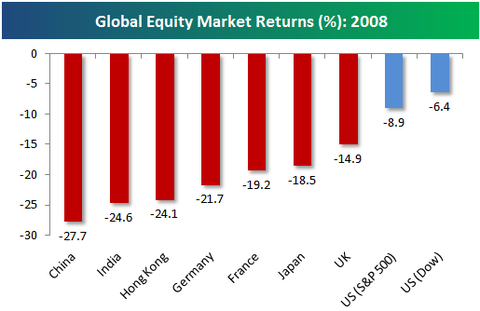

posted on: March 24, 2008 | about stocks: DIA / EWG / EWH / EWJ / EWQ / EWU / FXI / INP / IVV / SPY Font Size: PrintEmail Below we highlight the year to date returns of the major equity indices for a number of key countries. Using prices from this morning (before the U.S. market opened), the United States' S&P 500 and Dow 30 are down much less than the rest of the countries analyzed. China is down 27.7%, India is down 24.6%, Hong Kong is down 24% and Germany is down 21.7%.

Leading up to the peak in global equity markets last year, many people thought that countries were finally strong enough to decouple from the US and perform well even if the US went down the tubes. These days, however, the US is the one doing the decoupling to the upside.

posted on: March 24, 2008 | about stocks: DIA / EWG / EWH / EWJ / EWQ / EWU / FXI / INP / IVV / SPY Font Size: PrintEmail Below we highlight the year to date returns of the major equity indices for a number of key countries. Using prices from this morning (before the U.S. market opened), the United States' S&P 500 and Dow 30 are down much less than the rest of the countries analyzed. China is down 27.7%, India is down 24.6%, Hong Kong is down 24% and Germany is down 21.7%.

Leading up to the peak in global equity markets last year, many people thought that countries were finally strong enough to decouple from the US and perform well even if the US went down the tubes. These days, however, the US is the one doing the decoupling to the upside.

Thinking the unthinkable: what if it's not that bad

powered by Sphere

Market News

Stocks soar on revised Bear offer, home sales | Video

Asia shares rise, bonds fall on credit optimism

LONDON (Reuters) - Maybe, just maybe, the financial world is not about to implode.

Such is the level of disaster mongering surrounding the latest phase of the eight-month-old credit crisis that you could be forgiven for thinking we will all soon be hoarding food and reverting to a barter economy.

At the very least, some market pricing and financial commentary has invoked a systemic collapse akin to 1929's stock market crash and the Great Depression that followed.

Let's put that in context. U.S. historians estimate that in the first 10 months of 1930 some 744 U.S. banks failed -- rising to a total of 9,000 by the end of the 1930s. Savers lost the equivalent in today's money of $140 billion in deposits by 1933. U.S. unemployment rose to 25 percent from 4 percent in 1929 and prices and incomes fell by 20 to 50 percent over the same period.

The debate, as German government spokesman Thomas Steg noted this week, has become "hysterical."

This crisis is serious, for sure. But there is a pretty good chance it is not 1929 -- even if the U.S. Federal Reserve has adopted depression-era tactics to address it.

"To justify a repeat of last week, you really have to start believing this is going to be 1929 again," said Jim O'Neill, chief global economist at Goldman Sachs. "With the Fed moving so quickly, I think that is unlikely."

But with investors already positioning for a "worst case" scenario, there is a chance of a large pendulum swing

Last week, a survey by Merrill Lynch showed a majority of 193 fund managers were overweight cash in March, signaling extreme caution.

No coincidence then that three-month U.S. Treasury bill yields <US3MT=RR> are their lowest since the 1950s, at less than 1 percent. Or that safe-haven gold <XAU=> had topped $1,000 an ounce before a violent reversal late last week that may itself signal a turn.

"People are one-way; they've got the cash; they believe equities are cheap," said Merrill consultant David Bowers. "They just need a catalyst to know when it is safe to go back into the markets."

Whatever the catalyst for a turn, it will first need to offer evidence the problem is not getting any worse.

The credit crisis, rooted in the U.S. real estate bust, is now essentially one of bank liquidity and solvency. The problem is lack of confidence. Visibility is near zero as markets fail to provide adequate pricing for mortgage assets and securities.

The only burst of clarity tends to happen at the end of each quarter when accounting rules force banks to report asset values on their books. And as they write down assets where market prices are impossible to find, the banks struggle to raise cash to meet capital adequacy rules. This is despite the fact that many of these assets are in suspended animation rather than worthless -- many will still pay out over the life of the loans.

The coincident hoarding and searching for cash in the final weeks of each quarter leaves the weakest exposed and it's no surprise stricken UK lender Northern Rock NRK.L and U.S. investment house Bear Stearns (BSC.N: Quote, Profile, Research) were forced to go cap in hand to their central banks in mid-September and mid-March.

CIRCUIT BREAKER

With only volatile derivative prices or bespoke pricing models to go by, conservative accounting has led to huge writedowns, dents to bank capital ratios and a rationing of lending that we now know as the credit crunch.

So what could be the circuit breaker?

First, bankers and investors need to be able to see some timescale for the crisis. Otherwise they will continue to hunker down in safe havens of cash and gold and perpetuate the cycle.

One important development this month -- drowned out by panic surrounding the Bear Stearns rescue -- was that credit rating firm Standard & Poors said the end was in sight for writedowns of the subprime mortgage assets that sparked the crisis.

Putting total writedowns at some $285 billion, it said the banking sector had already written off the majority of its distressed assets and more than $150 billion was already declared. First quarter writedowns at three Wall St firms that reported last week -- Goldman Sachs (GS.N: Quote, Profile, Research), Lehman Brothers (LEH.N: Quote, Profile, Research) and Morgan Stanley (MS.N: Quote, Profile, Research) -- were indeed much less than analysts had feared.

S&P also emphasized that some subprime mortgage writedowns are larger than any reasonable estimate of actual losses. This raises the prospect that when the mortgage market normalizes, banks may be able to add "writebacks" onto quarterly results.

In the meantime, central banks need to stand ready to prevent seizures of the banking system and governments need to do all they can to stabilize the housing and mortgage market.

The Fed has gone some distance by slashing lending rates by three percentage points in six months and recently pumping $400 billion of liquidity into the banks.

The U.S. government's release last week of an additional $200 billion of cash from housing finance agencies to plough into the distressed mortgage market is another major boon.

No magic bullets. But when a turn comes, it may happen fast.

"We have all learnt, many times, that every moment of crisis is always also one of opportunity,"

genau so isses und wenn der markt nun beginnt nach oben zu rennen kommen alls hosenscheisser langsam aus ihren löchern gekrochen und beginnen hinterherzulaufen

wie bereits montag letzter woche geschrieben: der markt beginnt zu drehen. das risiko ist nach solchen abstürzen für gewöhlich sehr klein aber wird als sehr groß wahrgenommen. wenn die aktien dann gestiegen sind nimmt man das risiko als gering wahr obwohl es doch beträchtlich sein kann.

rbs bei 10 kaufen. ja aber sicher. aber als sie bei 3,90 stand. nö viel zu gefährlich

powered by Sphere

Market News

Stocks soar on revised Bear offer, home sales | Video

Asia shares rise, bonds fall on credit optimism

LONDON (Reuters) - Maybe, just maybe, the financial world is not about to implode.

Such is the level of disaster mongering surrounding the latest phase of the eight-month-old credit crisis that you could be forgiven for thinking we will all soon be hoarding food and reverting to a barter economy.

At the very least, some market pricing and financial commentary has invoked a systemic collapse akin to 1929's stock market crash and the Great Depression that followed.

Let's put that in context. U.S. historians estimate that in the first 10 months of 1930 some 744 U.S. banks failed -- rising to a total of 9,000 by the end of the 1930s. Savers lost the equivalent in today's money of $140 billion in deposits by 1933. U.S. unemployment rose to 25 percent from 4 percent in 1929 and prices and incomes fell by 20 to 50 percent over the same period.

The debate, as German government spokesman Thomas Steg noted this week, has become "hysterical."

This crisis is serious, for sure. But there is a pretty good chance it is not 1929 -- even if the U.S. Federal Reserve has adopted depression-era tactics to address it.

"To justify a repeat of last week, you really have to start believing this is going to be 1929 again," said Jim O'Neill, chief global economist at Goldman Sachs. "With the Fed moving so quickly, I think that is unlikely."

But with investors already positioning for a "worst case" scenario, there is a chance of a large pendulum swing

Last week, a survey by Merrill Lynch showed a majority of 193 fund managers were overweight cash in March, signaling extreme caution.

No coincidence then that three-month U.S. Treasury bill yields <US3MT=RR> are their lowest since the 1950s, at less than 1 percent. Or that safe-haven gold <XAU=> had topped $1,000 an ounce before a violent reversal late last week that may itself signal a turn.

"People are one-way; they've got the cash; they believe equities are cheap," said Merrill consultant David Bowers. "They just need a catalyst to know when it is safe to go back into the markets."

Whatever the catalyst for a turn, it will first need to offer evidence the problem is not getting any worse.

The credit crisis, rooted in the U.S. real estate bust, is now essentially one of bank liquidity and solvency. The problem is lack of confidence. Visibility is near zero as markets fail to provide adequate pricing for mortgage assets and securities.

The only burst of clarity tends to happen at the end of each quarter when accounting rules force banks to report asset values on their books. And as they write down assets where market prices are impossible to find, the banks struggle to raise cash to meet capital adequacy rules. This is despite the fact that many of these assets are in suspended animation rather than worthless -- many will still pay out over the life of the loans.

The coincident hoarding and searching for cash in the final weeks of each quarter leaves the weakest exposed and it's no surprise stricken UK lender Northern Rock NRK.L and U.S. investment house Bear Stearns (BSC.N: Quote, Profile, Research) were forced to go cap in hand to their central banks in mid-September and mid-March.

CIRCUIT BREAKER

With only volatile derivative prices or bespoke pricing models to go by, conservative accounting has led to huge writedowns, dents to bank capital ratios and a rationing of lending that we now know as the credit crunch.

So what could be the circuit breaker?

First, bankers and investors need to be able to see some timescale for the crisis. Otherwise they will continue to hunker down in safe havens of cash and gold and perpetuate the cycle.

One important development this month -- drowned out by panic surrounding the Bear Stearns rescue -- was that credit rating firm Standard & Poors said the end was in sight for writedowns of the subprime mortgage assets that sparked the crisis.

Putting total writedowns at some $285 billion, it said the banking sector had already written off the majority of its distressed assets and more than $150 billion was already declared. First quarter writedowns at three Wall St firms that reported last week -- Goldman Sachs (GS.N: Quote, Profile, Research), Lehman Brothers (LEH.N: Quote, Profile, Research) and Morgan Stanley (MS.N: Quote, Profile, Research) -- were indeed much less than analysts had feared.

S&P also emphasized that some subprime mortgage writedowns are larger than any reasonable estimate of actual losses. This raises the prospect that when the mortgage market normalizes, banks may be able to add "writebacks" onto quarterly results.

In the meantime, central banks need to stand ready to prevent seizures of the banking system and governments need to do all they can to stabilize the housing and mortgage market.

The Fed has gone some distance by slashing lending rates by three percentage points in six months and recently pumping $400 billion of liquidity into the banks.

The U.S. government's release last week of an additional $200 billion of cash from housing finance agencies to plough into the distressed mortgage market is another major boon.

No magic bullets. But when a turn comes, it may happen fast.

"We have all learnt, many times, that every moment of crisis is always also one of opportunity,"

genau so isses und wenn der markt nun beginnt nach oben zu rennen kommen alls hosenscheisser langsam aus ihren löchern gekrochen und beginnen hinterherzulaufen

wie bereits montag letzter woche geschrieben: der markt beginnt zu drehen. das risiko ist nach solchen abstürzen für gewöhlich sehr klein aber wird als sehr groß wahrgenommen. wenn die aktien dann gestiegen sind nimmt man das risiko als gering wahr obwohl es doch beträchtlich sein kann.

rbs bei 10 kaufen. ja aber sicher. aber als sie bei 3,90 stand. nö viel zu gefährlich