Starvest der Mineninvestor - 500 Beiträge pro Seite

eröffnet am 01.05.07 23:24:05 von

neuester Beitrag 15.01.11 14:15:24 von

neuester Beitrag 15.01.11 14:15:24 von

Beiträge: 128

ID: 1.126.736

ID: 1.126.736

Aufrufe heute: 0

Gesamt: 3.859

Gesamt: 3.859

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 30 Minuten | 8709 | |

| vor 23 Minuten | 6240 | |

| vor 1 Stunde | 4694 | |

| vor 1 Stunde | 4564 | |

| vor 1 Stunde | 4486 | |

| vor 1 Stunde | 3995 | |

| vor 37 Minuten | 3443 | |

| vor 1 Stunde | 3078 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.773,00 | -0,65 | 218 | |||

| 2. | 2. | 156,32 | -3,20 | 116 | |||

| 3. | 5. | 6,7440 | -3,93 | 82 | |||

| 4. | 4. | 2.390,36 | +0,39 | 79 | |||

| 5. | 3. | 6,4020 | -3,18 | 60 | |||

| 6. | 20. | 23,970 | -2,68 | 53 | |||

| 7. | 8. | 7,4500 | -1,72 | 43 | |||

| 8. | 15. | 26,74 | -0,48 | 38 |

http://www.starvest.co.uk/portfolio.html

Addworth plc - (AIM ticker: ADW)

African Platinum plc ("Afplats") - (AIM ticker: APP)

Agricola Resources plc - (PLUS ticker: AGRI)

Belmore Resources (Holdings) plc - (PLUS ticker: BEL)

Beowulf Mining plc - (AIM ticker: BEM)

Black Rock Oil & Gas plc - (AIM ticker: BLR)

Brazilian Diamonds Limited - (AIM ticker: BDY)

Carpathian Resources Limited - (AIM ticker: CPNR and Sydney ASX)

Concorde Oil and Gas plc - (PLUS ticker: CDEP)

The Core Business plc - (AIM ticker: CORE)

DTT plc - (AIM ticker: DTT)

Franchise Investment Strategies plc - (PLUS ticker: FIN)

Franconia Minerals Corporation - (PLUS ticker: FRA and Toronto TSV-V)

http://www.wallstreet-online.de/aktien/231809.html

Fundy Minerals Limited - (PLUS ticker: FUND)

Gippsland Limited - (AIM ticker: GIP and Sydney ASX)

Thread: Gippsland ...

Greatland Gold plc - (AIM ticker: GGP)

Hidefield Gold plc - (AIM ticker: HIF)

India Star Energy plc - (AIM ticker: INDY)

KEFI Minerals plc - (AIM ticker: KEFI)

Matisse Holdings plc - (AIM suspended)

Myhome International plc - (PLUS ticker: MYH)

Oracle Coalfields plc- (PLUS admission expected)

Red Rock Resources plc - (AIM ticker: RRR)

Thread: RED ROCK RES PLC

Regency Mines plc - (AIM ticker: RGM)

Thread: REGENCY MINES PLC - ja ist denn schon Weihnachten?

Sheba Exploration (UK) plc - (PLUS ticker: SHE)

St Helen's Capital plc - (PLUS ticker: SHCP)

Sunrise Diamonds plc - (AIM ticker: SDS)

AIM listing date 5 September 2000

Number of shares in issue 36,717,259

Number of shares held in treasury 500,000

Total shares in issue 37,217,259

Basic earnings per share

- 6 months to 31 March 2007

1.41 pence

- 14 months to 30 September 2006

2.5 pence

Diluted earnings per share

- 6 months to 31 March 2007

1.23 pence

- 14 months to 30 September 2006

2.2 pence

Options outstanding

- Exercisable at 5 pence

2,100,000

- Excercisable at 6 pence

500,000

- Excerisable at 15 pence

2,975,000

Total 5,575,000

Dividend - Special dividend proposed for payment on 20 June 2007 to Shareholders on the register on 25 May 2007. One penny per share

Industry Sector Financial

Addworth plc - (AIM ticker: ADW)

African Platinum plc ("Afplats") - (AIM ticker: APP)

Agricola Resources plc - (PLUS ticker: AGRI)

Belmore Resources (Holdings) plc - (PLUS ticker: BEL)

Beowulf Mining plc - (AIM ticker: BEM)

Black Rock Oil & Gas plc - (AIM ticker: BLR)

Brazilian Diamonds Limited - (AIM ticker: BDY)

Carpathian Resources Limited - (AIM ticker: CPNR and Sydney ASX)

Concorde Oil and Gas plc - (PLUS ticker: CDEP)

The Core Business plc - (AIM ticker: CORE)

DTT plc - (AIM ticker: DTT)

Franchise Investment Strategies plc - (PLUS ticker: FIN)

Franconia Minerals Corporation - (PLUS ticker: FRA and Toronto TSV-V)

http://www.wallstreet-online.de/aktien/231809.html

Fundy Minerals Limited - (PLUS ticker: FUND)

Gippsland Limited - (AIM ticker: GIP and Sydney ASX)

Thread: Gippsland ...

Greatland Gold plc - (AIM ticker: GGP)

Hidefield Gold plc - (AIM ticker: HIF)

India Star Energy plc - (AIM ticker: INDY)

KEFI Minerals plc - (AIM ticker: KEFI)

Matisse Holdings plc - (AIM suspended)

Myhome International plc - (PLUS ticker: MYH)

Oracle Coalfields plc- (PLUS admission expected)

Red Rock Resources plc - (AIM ticker: RRR)

Thread: RED ROCK RES PLC

Regency Mines plc - (AIM ticker: RGM)

Thread: REGENCY MINES PLC - ja ist denn schon Weihnachten?

Sheba Exploration (UK) plc - (PLUS ticker: SHE)

St Helen's Capital plc - (PLUS ticker: SHCP)

Sunrise Diamonds plc - (AIM ticker: SDS)

AIM listing date 5 September 2000

Number of shares in issue 36,717,259

Number of shares held in treasury 500,000

Total shares in issue 37,217,259

Basic earnings per share

- 6 months to 31 March 2007

1.41 pence

- 14 months to 30 September 2006

2.5 pence

Diluted earnings per share

- 6 months to 31 March 2007

1.23 pence

- 14 months to 30 September 2006

2.2 pence

Options outstanding

- Exercisable at 5 pence

2,100,000

- Excercisable at 6 pence

500,000

- Excerisable at 15 pence

2,975,000

Total 5,575,000

Dividend - Special dividend proposed for payment on 20 June 2007 to Shareholders on the register on 25 May 2007. One penny per share

Industry Sector Financial

Moin

Sunrise Diamonds ist für die WL interessant, da neben EPD mit der einzige finnische börsennotierte Diamantenexplorer.

EPD ist ja zur Zeit eher in Lesotho fokussiert, habe auf Minesite einen interessanten Bericht zu Sunrise gelesen.

EPD ist ja zur Zeit eher in Lesotho fokussiert, habe auf Minesite einen interessanten Bericht zu Sunrise gelesen.

Antwort auf Beitrag Nr.: 29.088.800 von XIO am 02.05.07 06:58:40PS:

http://www.minesite.com/companies/comp_single/company/sunris…

http://www.minesite.com/companies/comp_single/company/sunris…

Antwort auf Beitrag Nr.: 29.089.241 von XIO am 02.05.07 08:42:24Danke für diese schöne übersicht!

Antwort auf Beitrag Nr.: 29.090.058 von Albatossa am 02.05.07 09:43:48Ich glaube ich werde es so machen:

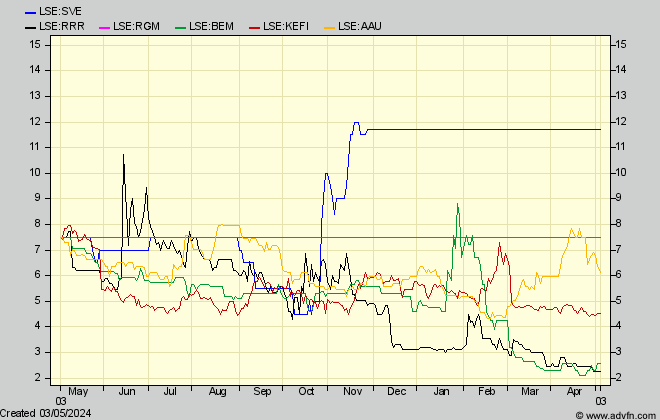

Wenn RRR und / oder RGM 100% abwerfen, werden diese in Starvest angelegt.

Wenn RRR und / oder RGM 100% abwerfen, werden diese in Starvest angelegt.

PS: ...riecht verdammt gut nach `ner "low Cost" Longview Variante

Antwort auf Beitrag Nr.: 29.090.132 von XIO am 02.05.07 09:48:09Danke für die Aufnahme eines eigenen Threads.Haben die auch verdient.Die Aufstellung von ADVFN ist super.

Habe mir eine Anfangsposition ins Depot gelegt.

Grüße

Habe mir eine Anfangsposition ins Depot gelegt.

Grüße

Antwort auf Beitrag Nr.: 29.090.472 von bobelle am 02.05.07 10:07:47kuckt mal bei RGM auf die Prozente heute in der WO-Anzeige

huhu

kenn mich dem thema beteiligungsgesellschaften nicht so aus

und wollte eigentlich direkt in regency aber dies hier schaut auch nett aus?

die erwirtschaften ihren gewinn dadurch das ihre anteile mehr wert werden oder?

aber wenn die sogar ne dividende zahlen müssen die ja auch cash flow haben?

die verkaufen ja nicht ständig anteile da dies ja alles firmen auf 5 jahres sicht sind?

also wie genau funktioniert das?

falls sie die werte einfach nur halten und gut

ist starvest ja praktisch ein zertifikat mit all diesen firmen im basket?

wo ist mein denkfehler??

grüße

und wollte eigentlich direkt in regency aber dies hier schaut auch nett aus?

die erwirtschaften ihren gewinn dadurch das ihre anteile mehr wert werden oder?

aber wenn die sogar ne dividende zahlen müssen die ja auch cash flow haben?

die verkaufen ja nicht ständig anteile da dies ja alles firmen auf 5 jahres sicht sind?

also wie genau funktioniert das?

falls sie die werte einfach nur halten und gut

ist starvest ja praktisch ein zertifikat mit all diesen firmen im basket?

wo ist mein denkfehler??

grüße

Antwort auf Beitrag Nr.: 29.094.028 von tjcc281086 am 02.05.07 13:53:09vergleichs mit Longview, da biste am nächsten dran.. muss mich auch noch einlesen

Antwort auf Beitrag Nr.: 29.094.028 von tjcc281086 am 02.05.07 13:53:09kannst es auch mit BB Biotech vergleichen. ist quasi ein Fonds für den man keinen Ausgabeaufschlag zahlen muss und ihn sogar günstiger als seinen inneren Wert kaufen kann. Allerdings gibt es keine regelmäßigen Ausschüttungen.

Die Dividende stammt hauptsächlich aus dem Verkauf ihrer Beteiligung an African Platinum plc. Die wurden kürzlich übernommem.

Starvest hatte im Mai 2002 vor dem AIM-Ipo von African Platinum plc (auch ein guter Investmentgrund für Starvest) eine Beteiligung an Ihnen erworben.

Grüße

www.starvest.co.uk/downloads/RNS070412.pdf

Die Dividende stammt hauptsächlich aus dem Verkauf ihrer Beteiligung an African Platinum plc. Die wurden kürzlich übernommem.

Starvest hatte im Mai 2002 vor dem AIM-Ipo von African Platinum plc (auch ein guter Investmentgrund für Starvest) eine Beteiligung an Ihnen erworben.

Grüße

www.starvest.co.uk/downloads/RNS070412.pdf

bin dabei

da ich der erste deutsche bank kunde war der starvest kaufen wollte musste starvest erst freigeschaltet werden

bin guter dinge

die haben n guten riecher

grüße

da ich der erste deutsche bank kunde war der starvest kaufen wollte musste starvest erst freigeschaltet werden

bin guter dinge

die haben n guten riecher

grüße

will mich keiner begleiten?

in 2 wochen gibt es dividende

und das update ist auch net mehr lang ...

grüße

in 2 wochen gibt es dividende

und das update ist auch net mehr lang ...

grüße

NAV Update. erneute Steigerung. Grüße

Announcement 15 May 2007

Net asset value update

As at the close of business on 11 May 2007, Starvest had a holding of 8.25m Ordinary shares in African Platinum plc (“Afplats”) valued at £4,537,500. The Scheme of Arrangement under which Afplats is being acquired by Impala Platinum Holdings Limited was sanctioned by a Court Order on 10 May 2007 to be effective on 14 May 2007.

Accordingly on 28 May 2007, Starvest expects to receive the consideration of £4,537,500.

Under normal circumstances the next net asset value update would be made immediately following 30 June 2007. However, following the conclusion of the Afplats takeover, the directors are pleased to provide an intermediate update.

Taking into account the consequential tax liability resulting from the Afplats takeover and other recent changes in the values of the investment portfolio, the Starvest net asset value as at 11 May 2007 was £16.7m which equates to 40.96 pence per share. This represents an increase of £1.3m since 30 March 2007.

The net asset value is calculated on a fully diluted basis, after a taxation provision on estimated trading profits for the current year to 30 September 2007 of £1.525m but without any provision for taxation on unrealised profits.

The closing share price on 11 May 2007 of 26.5 pence was at a discount to net asset value of 35.3%.

The directors expect to release the next update on 2 July 2007.

Announcement 15 May 2007

Net asset value update

As at the close of business on 11 May 2007, Starvest had a holding of 8.25m Ordinary shares in African Platinum plc (“Afplats”) valued at £4,537,500. The Scheme of Arrangement under which Afplats is being acquired by Impala Platinum Holdings Limited was sanctioned by a Court Order on 10 May 2007 to be effective on 14 May 2007.

Accordingly on 28 May 2007, Starvest expects to receive the consideration of £4,537,500.

Under normal circumstances the next net asset value update would be made immediately following 30 June 2007. However, following the conclusion of the Afplats takeover, the directors are pleased to provide an intermediate update.

Taking into account the consequential tax liability resulting from the Afplats takeover and other recent changes in the values of the investment portfolio, the Starvest net asset value as at 11 May 2007 was £16.7m which equates to 40.96 pence per share. This represents an increase of £1.3m since 30 March 2007.

The net asset value is calculated on a fully diluted basis, after a taxation provision on estimated trading profits for the current year to 30 September 2007 of £1.525m but without any provision for taxation on unrealised profits.

The closing share price on 11 May 2007 of 26.5 pence was at a discount to net asset value of 35.3%.

The directors expect to release the next update on 2 July 2007.

So, ihr lieben Leute, von mir aus kann es auch losgehen.

Bin mit on Board

Bin mit on Board

Mal bissl Schwung in die Bude:

Aktuelle Major Shareholder

Aktuelle Major Shareholder

Auch nicht ganz uninteressant, der Abschlag in der bewertungs des Unternehmens im Gegensatz zu dem Wert seinen Beteiligungen.

Dürfte momentan durch Franconia noch besser sein.

Dürfte momentan durch Franconia noch besser sein.

Antwort auf Beitrag Nr.: 29.348.570 von XIO am 16.05.07 19:05:02steht ja schon im Vorposting: Differenz (Unterbewertung) zur Summe der Beteiligungen satte 35%

" The closing share price on 11 May 2007 of 26.5 pence was at a discount to net asset value of 35.3%."

http://www.starvest.co.uk/announcments.html

" The closing share price on 11 May 2007 of 26.5 pence was at a discount to net asset value of 35.3%."

http://www.starvest.co.uk/announcments.html

Was ich weiterhin gut finde ist, daß die Beteiligungen fully diluted gerechnent sind, also keine Augenwischerei mit ausstehenden Warrants / Optionen usw.

http://www.starvest.co.uk/netasset.html

Note: All values are calculated on a fully diluted basis making allowance for outstanding share options but without any provision for future corporation tax other than on realised trading profits.

http://www.starvest.co.uk/netasset.html

Note: All values are calculated on a fully diluted basis making allowance for outstanding share options but without any provision for future corporation tax other than on realised trading profits.

die find ich auch interesant, sind ebenfalls im portfolio von starvest

http://www.sunrisediamonds.com/kaavi.html

diamanten in finnland, hatten auch einen artikel auf minesite:

http://www.minesite.com/nc/minews/singlenews/article/sunrise…

http://www.sunrisediamonds.com/kaavi.html

diamanten in finnland, hatten auch einen artikel auf minesite:

http://www.minesite.com/nc/minews/singlenews/article/sunrise…

ich stöbere immer noch im starverst portfolio rum... auch interessant:

http://www.hidefieldgold.com/s/Management.asp

Francis Johnstone

Mr. Johnstone is the Commercial Director of Ridge Mining

He has also been a director of Brazilian Diamonds

http://213.38.100.13:50803/hs_templates/majholders.php?epic=…

Starvest ist in guter Gesellschaft

http://www.hidefieldgold.com/s/Management.asp

Francis Johnstone

Mr. Johnstone is the Commercial Director of Ridge Mining

He has also been a director of Brazilian Diamonds

http://213.38.100.13:50803/hs_templates/majholders.php?epic=…

Starvest ist in guter Gesellschaft

Antwort auf Beitrag Nr.: 29.352.527 von XIO am 17.05.07 00:39:53nicht schlecht, Herr Specht:

34.3 g/t gold) across 26.0 metres in CYN-D06-06 at Coyote Sur

http://www.hidefield.co.uk/s/NewsReleases.asp?ReportID=18148…

34.3 g/t gold) across 26.0 metres in CYN-D06-06 at Coyote Sur

http://www.hidefield.co.uk/s/NewsReleases.asp?ReportID=18148…

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

SVE Beteiligung Gippsland auch ordentlich im Aufwärtstrend:

+9 in London

+9 in London

0.2675 British Pound = 0.39124 Euro

Antwort auf Beitrag Nr.: 29.373.719 von XIO am 18.05.07 15:55:50Leider gibt es in Deutschland keinen Handel!

Antwort auf Beitrag Nr.: 29.374.448 von Albatossa am 18.05.07 16:27:44Jetzt sag bloss nicht, du hast den Thread aufgemacht und bist noch nicht drin

heute rockt`s

0.28 British Pound = 0.40952 Euro

0.28 British Pound = 0.40952 Euro

lt. einigen unbestätigten Berechnungen/Postings im ADVFN Thread beträgt die Differenz von SVE und der Summe der Beteiligungen aktuell mehr als 50%.

Market Cap. 10.70 Mio £ = 15 Mio €

Addworth plc - (AIM ticker: ADW)

website: www.addworth.co.uk

African Platinum plc ("Afplats") - (AIM ticker: APP)

formerly, Southern African Resources plc

website: www.afplats.com

Agricola Resources plc - (PLUS ticker: AGRI)

website: www.agricolaresources.com

Belmore Resources (Holdings) plc - (PLUS ticker: BEL)

website: www.belmoreresources.com

Beowulf Mining plc - (AIM ticker: BEM)

website: www.beowulfmining.com

Black Rock Oil & Gas plc - (AIM ticker: BLR)

website: www.blackrockoilandgasplc.co.uk

Brazilian Diamonds Limited - (AIM ticker: BDY)

website: www.braziliandiamonds.com

Carpathian Resources Limited - (AIM ticker: CPNR and Sydney ASX)

website: www.carpathian.com.au

Concorde Oil and Gas plc - (PLUS ticker: CDEP)

The Core Business plc - (AIM ticker: CORE)

website: www.thecorebusiness.co.uk

DTT plc - (PLUS ticker: DTT)

website: www.drivertransporttraining.co.uk

Franchise Investment Strategies plc - (PLUS ticker: FIN)

Franconia Minerals Corporation - (PLUS ticker: FRA and Toronto TSV-V)

website: www.franconiaminerals.com

Fundy Minerals Limited - (PLUS ticker: FUND)

website: www.fundyminerals.com

Gippsland Limited - (AIM ticker: GIP and Sydney ASX)

website: www.gippslandltd.com.au

Greatland Gold plc - (AIM ticker: GGP)

website: www.greatlandgold.com

Hidefield Gold plc - (AIM ticker: HIF)

website: www.hidefieldgold.com

India Star Energy plc - (AIM ticker: INDY)

KEFI Minerals plc - (AIM ticker: KEFI)

website: www.kefi-minerals.com

Matisse Holdings plc - (AIM suspended)

Myhome International plc - (PLUS ticker: MYH)

website: www.myhomeplc.com

Oracle Coalfields plc - (PLUS admission expected)

website: www.oraclecoalfields.com

Red Rock Resources plc - (AIM ticker: RRR)

website: www.rrrplc.com

.gif)

Regency Mines plc - (AIM ticker: RGM)

website: www.regency-mines.com

Sheba Exploration (UK) plc - (PLUS ticker: SHE)

website: www.shebagold.com

St Helen's Capital plc - (PLUS ticker: SHCP)

website: www.sthelenscapital.com

Sunrise Diamonds plc - (AIM ticker: SDS)

website: www.sunrisediamonds.com

website: www.addworth.co.uk

African Platinum plc ("Afplats") - (AIM ticker: APP)

formerly, Southern African Resources plc

website: www.afplats.com

Agricola Resources plc - (PLUS ticker: AGRI)

website: www.agricolaresources.com

Belmore Resources (Holdings) plc - (PLUS ticker: BEL)

website: www.belmoreresources.com

Beowulf Mining plc - (AIM ticker: BEM)

website: www.beowulfmining.com

Black Rock Oil & Gas plc - (AIM ticker: BLR)

website: www.blackrockoilandgasplc.co.uk

Brazilian Diamonds Limited - (AIM ticker: BDY)

website: www.braziliandiamonds.com

Carpathian Resources Limited - (AIM ticker: CPNR and Sydney ASX)

website: www.carpathian.com.au

Concorde Oil and Gas plc - (PLUS ticker: CDEP)

The Core Business plc - (AIM ticker: CORE)

website: www.thecorebusiness.co.uk

DTT plc - (PLUS ticker: DTT)

website: www.drivertransporttraining.co.uk

Franchise Investment Strategies plc - (PLUS ticker: FIN)

Franconia Minerals Corporation - (PLUS ticker: FRA and Toronto TSV-V)

website: www.franconiaminerals.com

Fundy Minerals Limited - (PLUS ticker: FUND)

website: www.fundyminerals.com

Gippsland Limited - (AIM ticker: GIP and Sydney ASX)

website: www.gippslandltd.com.au

Greatland Gold plc - (AIM ticker: GGP)

website: www.greatlandgold.com

Hidefield Gold plc - (AIM ticker: HIF)

website: www.hidefieldgold.com

India Star Energy plc - (AIM ticker: INDY)

KEFI Minerals plc - (AIM ticker: KEFI)

website: www.kefi-minerals.com

Matisse Holdings plc - (AIM suspended)

Myhome International plc - (PLUS ticker: MYH)

website: www.myhomeplc.com

Oracle Coalfields plc - (PLUS admission expected)

website: www.oraclecoalfields.com

Red Rock Resources plc - (AIM ticker: RRR)

website: www.rrrplc.com

.gif)

Regency Mines plc - (AIM ticker: RGM)

website: www.regency-mines.com

Sheba Exploration (UK) plc - (PLUS ticker: SHE)

website: www.shebagold.com

St Helen's Capital plc - (PLUS ticker: SHCP)

website: www.sthelenscapital.com

Sunrise Diamonds plc - (AIM ticker: SDS)

website: www.sunrisediamonds.com

Antwort auf Beitrag Nr.: 29.425.511 von XIO am 22.05.07 21:20:11Danke für die viele Arbeit XIO! Wird sich aber lohnen für uns

Grüße

Grüße

Antwort auf Beitrag Nr.: 29.425.511 von XIO am 22.05.07 21:20:11Ebenfalls ein Danke von mir , für die viele und tolle Arbeit !

Seit gestern ist auch bei NORDNET ein Handel in London möglich !

gruss, mike32

Seit gestern ist auch bei NORDNET ein Handel in London möglich !

gruss, mike32

Antwort auf Beitrag Nr.: 29.434.142 von mike32 am 23.05.07 13:48:42Für kleinere Beträge bis ca. 3.000€ scheint Nordnet sogar günstiger zu sein, als Consors

Franconia entwickelt sich momentan extrem gut im Portfolio von SVE:

http://www.franconiaminerals.com/i/pdf/presentation-mar07.pd…

http://www.franconiaminerals.com/i/pdf/presentation-mar07.pd…

Kucke mir gerade so einige SVE Beteiligungen an, welche gut laufen...

Carpathian Resources Limited ("Carpathian") is an oil and gas explorer and producer with a focus on Central Europe

Market Cap. 15.79 Mio BP

http://www.carpathian.com.au/

Carpathian Resources Limited ("Carpathian") is an oil and gas explorer and producer with a focus on Central Europe

Market Cap. 15.79 Mio BP

http://www.carpathian.com.au/

Am 20. Juni gibts die Sonderdividende, also wundert euch nicht über einen kleinen Kurssturz  Grüße

Grüße

Announcement 23 May 2007

Result of EGM and payment of Special Dividend

Starvest plc ("the Company") is pleased to announce that the resolutions put to shareholders at the Extraordinary General Meeting held today were passed.

1. Accordingly, the Company will pay a Special Dividend on 20 June 2007 at the rate of one penny per share to those Members on the register at the close of business on 25 May 2007.

Grüße

GrüßeAnnouncement 23 May 2007

Result of EGM and payment of Special Dividend

Starvest plc ("the Company") is pleased to announce that the resolutions put to shareholders at the Extraordinary General Meeting held today were passed.

1. Accordingly, the Company will pay a Special Dividend on 20 June 2007 at the rate of one penny per share to those Members on the register at the close of business on 25 May 2007.

Antwort auf Beitrag Nr.: 29.484.436 von bobelle am 27.05.07 13:23:54ha.. ich glaube eher an einen kräftigen kursnstieg, der Unterschied zum "NAV" dürfte mittlerweile ja über 50% betragen.

Da "stören" die 3% Dividende die Feiertagsstimmung sowas von garnicht.

Da "stören" die 3% Dividende die Feiertagsstimmung sowas von garnicht.

Carpathian heute nochmal satte 20% plus am, ASX

gerade mal ein altes Info aus 2005 angekuckt, sind schon lange dabei.. also volle Kanne Gewinn jetzt

http://www.advfn.com/news_Final-Results_12271444.html

http://www.advfn.com/news_Final-Results_12271444.html

auch ganz nett zu wissen:

Mr Maximiliaan Danishevski, has been appointed to the board of Carpathian as

Executive Chairman. Currently, Mr. Danishevski is CEO of BSGE Mediterranean, a

joint co operation with Gazprom, one of the world's largest energy companies,

for the supply and distribution of gas to Cyprus and Israel known as Blue Stream

II. Within this framework of activities, he is also a member of the Gazprom

Export / BSGE Mediterranean Steering Committee. Gazprom Export is the exclusive

gas export arm of Gazprom.

Mr Maximiliaan Danishevski, has been appointed to the board of Carpathian as

Executive Chairman. Currently, Mr. Danishevski is CEO of BSGE Mediterranean, a

joint co operation with Gazprom, one of the world's largest energy companies,

for the supply and distribution of gas to Cyprus and Israel known as Blue Stream

II. Within this framework of activities, he is also a member of the Gazprom

Export / BSGE Mediterranean Steering Committee. Gazprom Export is the exclusive

gas export arm of Gazprom.

Die Franconia Präsentation unbedingt mal reinziehen:

http://www.franconiaminerals.com/i/pdf/presentation-mar07.pd…

Da wird auch weiterhin noch ordentlich was abgehen

http://www.franconiaminerals.com/i/pdf/presentation-mar07.pd…

Da wird auch weiterhin noch ordentlich was abgehen

RRR (+21) und RGM (+12,5) fein im Plus heut:

Starvest hält sich selbst auch für eine gue Investition

Announcement 30 May 2007

Purchase of own shares

Starvest plc (the “Company”) announces that on 29 May 2007, the Company purchased through its broker, Simple Investments, 250,000 Ordinary shares of 1p each in the issued share capital of the Company at a price of 30 pence per Ordinary share. These Ordinary shares are to be held as treasury stock.

Following the above purchase, the Company holds 750,000 Ordinary shares in treasury and the total issued share capital of the Company less treasury shares is 36,467,259 Ordinary shares.

This purchase was made pursuant to the authority granted by Shareholders at the Company’s annual general meeting held on 12 December 2006. To date, 750,000 Ordinary shares have been purchased under this authority.

Announcement 30 May 2007

Purchase of own shares

Starvest plc (the “Company”) announces that on 29 May 2007, the Company purchased through its broker, Simple Investments, 250,000 Ordinary shares of 1p each in the issued share capital of the Company at a price of 30 pence per Ordinary share. These Ordinary shares are to be held as treasury stock.

Following the above purchase, the Company holds 750,000 Ordinary shares in treasury and the total issued share capital of the Company less treasury shares is 36,467,259 Ordinary shares.

This purchase was made pursuant to the authority granted by Shareholders at the Company’s annual general meeting held on 12 December 2006. To date, 750,000 Ordinary shares have been purchased under this authority.

Antwort auf Beitrag Nr.: 29.548.451 von bobelle am 30.05.07 22:44:49http://www.iii.co.uk/investment/detail?code=cotn:SVE.L&it=le

Antwort auf Beitrag Nr.: 29.549.347 von mike32 am 31.05.07 00:56:58feine Sache das.. auf diesen Wert musste man erstmal kommen.

RAMBAZAMBA

und ich bin dabei

und ich bin dabei

Erde ruft Berlin:

0.3225 British Pound = 0.47480 Euro

0.3225 British Pound = 0.47480 Euro

0.34 British Pound = 0.50008 Euro

Starvest says to carry on with its share buyback

LONDON (Thomson Financial) - Starvest PLC confirmed it intends to continue

its share buyback programme as opportunities arise, and that it received 4.54

mln stg cash as proceeds from the takeover of African Platinum PLC on May 29.

The UK smallcap natural resources investment fund said its fully-diluted net

asset value as at May 31 was 46.21 pence a share.

TFN.newsdesk@thomson.com

Starvest says to carry on with its share buyback

LONDON (Thomson Financial) - Starvest PLC confirmed it intends to continue

its share buyback programme as opportunities arise, and that it received 4.54

mln stg cash as proceeds from the takeover of African Platinum PLC on May 29.

The UK smallcap natural resources investment fund said its fully-diluted net

asset value as at May 31 was 46.21 pence a share.

TFN.newsdesk@thomson.com

Zitat

"if correct these estimates would rank Mambare as a large scale producer, with a potential resource, according to Andrew Bell, of £25bn.

bell ist hier sehr zurueckhaltend - wie es sich fuer einen briten gehoert. 4Mt Ni sind heute US$ 200bn wert.

bei 170 Mshares outstanding sichert sich der investor 1170 US$ in-soil value (nur im mambare projekt) ... pro share wohlgemerkt.

kuenftige kapitalmassnahmen sind hier nicht zwingend: fuer cash flow wird, moeglicherweise schon in 12 monaten, das PNG projekt sorgen. das erz auf lkw-s zu verladen und nach china verfrachten ist wirklich ein 'no brainer'

langsam kommt hier ein wenig bewegung. frankfurt schlaeft noch, aber vermutlich nicht mehr lange. regency wird ihren aktionaeren noch viel, viel freude machen.!

#100 von gurine auf WO im RGM Thread"

sehr bemerkenswert!!!

"if correct these estimates would rank Mambare as a large scale producer, with a potential resource, according to Andrew Bell, of £25bn.

bell ist hier sehr zurueckhaltend - wie es sich fuer einen briten gehoert. 4Mt Ni sind heute US$ 200bn wert.

bei 170 Mshares outstanding sichert sich der investor 1170 US$ in-soil value (nur im mambare projekt) ... pro share wohlgemerkt.

kuenftige kapitalmassnahmen sind hier nicht zwingend: fuer cash flow wird, moeglicherweise schon in 12 monaten, das PNG projekt sorgen. das erz auf lkw-s zu verladen und nach china verfrachten ist wirklich ein 'no brainer'

langsam kommt hier ein wenig bewegung. frankfurt schlaeft noch, aber vermutlich nicht mehr lange. regency wird ihren aktionaeren noch viel, viel freude machen.!

#100 von gurine auf WO im RGM Thread"

sehr bemerkenswert!!!

http://www.sharecast.com/cgi-bin/sharecast/story.cgi?story_i…

Starvest receives AfPlats proceeds

Fri 01 Jun 2007

LONDON (SHARECAST) - Starvest extended its recent strong run after the investment company received £4.54m from the takeover of African Platinum and said it is trading at a 30% discount to net asset value.

In February, the miner recommended a £297m offer from South African counterpart Impala Platinum, valuing each African Platinum share at 55p.

Starvest, which specialises in new issues and trades in pre-IPO stocks, added today that its net asset value as at the close of business on 31 May was 46.21p per share fully diluted.

It bought back some of its own shares on 29 May and confirmed today that as opportunities arise, it intends to buy back more stock.

A dividend of one penny per share will be paid on 20 June as previously announced.

Starvest receives AfPlats proceeds

Fri 01 Jun 2007

LONDON (SHARECAST) - Starvest extended its recent strong run after the investment company received £4.54m from the takeover of African Platinum and said it is trading at a 30% discount to net asset value.

In February, the miner recommended a £297m offer from South African counterpart Impala Platinum, valuing each African Platinum share at 55p.

Starvest, which specialises in new issues and trades in pre-IPO stocks, added today that its net asset value as at the close of business on 31 May was 46.21p per share fully diluted.

It bought back some of its own shares on 29 May and confirmed today that as opportunities arise, it intends to buy back more stock.

A dividend of one penny per share will be paid on 20 June as previously announced.

Fundy Minerals Limited

http://www.fundyminerals.com/

Fundy Minerals Ltd

Fundy Minerals is a resource exploration and development company, actively involved in the exploration of gold, silver, diamond and base metals in New Brunswick, Canada and in Liberia, West Africa.

Fundy Minerals has a 100% mining interest in eight mineral exploration and development Properties in the Province of New Brunswick, Canada. In the 2004 field season, Fundy Minerals undertook advanced analysis of all eight Prospects. Each of these Prospects warranted bona fide exploration advancement, re-affirming the past historical exploration results. An independent assessment of six of the Properties in New Brunswick carried out in September 2006, found gold deposits in two of the Properties and a deposit model for one other area, whilst the three remaining Properties reflected base metal deposits. All Prospects generated encouraging confirmation of mineralised zones and strong assay results.

The Company is currently quoted on PLUS and has recently appointed Beaumont Cornish Limited as Nominated Adviser for its listing on AIM, expected to be within three months of this Offer.

Available for Investment Now

Offer Closes 31st May 2007

http://www.allipo.com/moreinfo/83/ipo-fundy-minerals-ltd

Fundy Minerals Limited

Involved in the acquisition & exploration of gold, diamond and base metals. Admission onto AIM expected to be within 3 months.

Offer for Subscription. Admission onto AIM expected to be within 3 months. Currently quoted on PLUS markets.

· An opportunity to purchase shares in Fundy Minerals at a 20% discount to the mid-trading price, as at March 14 2007

· Fundy Minerals has appointed Beaumont Cornish Ltd as nominated adviser for its AIM market listing, expected to be within three months of this offer closing date

· For each common share subscribed, investors will receive one warrant, convertible into one common share, up to 12 months from allotment

· 100% mining interest in eight mineral exploration and development properties in the Province of New Brunswick, Canada

· Gold, limestone and base metal interests in Canada, diamond and gold interests in Liberia

· Permission to explore 2000 square kilometres of land in Liberia, West Africa, where a significant quantity of gem quality alluvial diamonds have previously been extracted

· Institutional investors RAB Capital and Starvest plc, both experienced within the mining sector, have invested

· Another year of strong performance is expected from the AIM mining sector; owing to high commodity prices and rising production levels

· Fundy Minerals specialises in mid-stage exploration and seeks growth through geographical diversity, development stage acquisitions and joint ventures

http://www.fundyminerals.com/

Fundy Minerals Ltd

Fundy Minerals is a resource exploration and development company, actively involved in the exploration of gold, silver, diamond and base metals in New Brunswick, Canada and in Liberia, West Africa.

Fundy Minerals has a 100% mining interest in eight mineral exploration and development Properties in the Province of New Brunswick, Canada. In the 2004 field season, Fundy Minerals undertook advanced analysis of all eight Prospects. Each of these Prospects warranted bona fide exploration advancement, re-affirming the past historical exploration results. An independent assessment of six of the Properties in New Brunswick carried out in September 2006, found gold deposits in two of the Properties and a deposit model for one other area, whilst the three remaining Properties reflected base metal deposits. All Prospects generated encouraging confirmation of mineralised zones and strong assay results.

The Company is currently quoted on PLUS and has recently appointed Beaumont Cornish Limited as Nominated Adviser for its listing on AIM, expected to be within three months of this Offer.

Available for Investment Now

Offer Closes 31st May 2007

http://www.allipo.com/moreinfo/83/ipo-fundy-minerals-ltd

Fundy Minerals Limited

Involved in the acquisition & exploration of gold, diamond and base metals. Admission onto AIM expected to be within 3 months.

Offer for Subscription. Admission onto AIM expected to be within 3 months. Currently quoted on PLUS markets.

· An opportunity to purchase shares in Fundy Minerals at a 20% discount to the mid-trading price, as at March 14 2007

· Fundy Minerals has appointed Beaumont Cornish Ltd as nominated adviser for its AIM market listing, expected to be within three months of this offer closing date

· For each common share subscribed, investors will receive one warrant, convertible into one common share, up to 12 months from allotment

· 100% mining interest in eight mineral exploration and development properties in the Province of New Brunswick, Canada

· Gold, limestone and base metal interests in Canada, diamond and gold interests in Liberia

· Permission to explore 2000 square kilometres of land in Liberia, West Africa, where a significant quantity of gem quality alluvial diamonds have previously been extracted

· Institutional investors RAB Capital and Starvest plc, both experienced within the mining sector, have invested

· Another year of strong performance is expected from the AIM mining sector; owing to high commodity prices and rising production levels

· Fundy Minerals specialises in mid-stage exploration and seeks growth through geographical diversity, development stage acquisitions and joint ventures

Starvest hält 17,47% an Fundy

Das sieht ja immer besser aus:

Shares issued: 69,822,208

Market cap: C$5.70 Million

Cusip # 360897102 ISIN# 3608971022

Shares issued: 69,822,208

Market cap: C$5.70 Million

Cusip # 360897102 ISIN# 3608971022

Zitat von einem User, der so freundlich war, Fundy kritisch tzu betrachten, ich bin ja meistens etwas zu euphorisch, daher ist das evtl ganz hilfreich  :

:

Hallo,

Ich habe mir kurz Fundy angesehen aber finde es ein ziemliche Zock mit viel risiko. (Als einzelinvestition, als teil von das starvestportfolio finde ich es OK).

Die properties sind nicht uninteressant aber sehr ´greenfield´. Das wichstigste projekt ist offenbar das Liberiaprojekt. Liberia hat sich noch nicht bewiesen als investorfreundliches und stabiles land wenn ich es nett sage...

Ausser das (und warscheinlich noch viel wichtiger) sucht die firma momentan geld via ein pp. Die pp ist schon 2x verschoben und ist bei die heutige shareprice nicht wirklich attraktiv. Die sp muss mindestens innerhalb 1 jahr 6,7 p sein, anders kann man besser direkt aktien kaufen gegen die heutige preis.

Nach die pp hat die firma 120 Mio ausstehende aktien und mindestens 50 Mio warrants aus die pp (ich sehe so schnell nicht wie viel optionen/warrants momentan ausstehen, bestimmt auch schon einige). Nicht wenig.... Auch denke ich das möglicherweise die preis von die pp niedriger wirt (mehr verwässerung), weil die pp momentan nicht sehr attraktiv ist (price von unit wesentlich über shareprice bei viel risiko und grienfieldprojekten sehe auch oben).

Alles zusammen nach meiner meinung sehr viel risiko auch wenn die belohnung groß sein kann... Würde eher RGM (oder andere firma´s) kaufen wenn man kein problem hat mit risiko und große gewinne sucht...

:

:Hallo,

Ich habe mir kurz Fundy angesehen aber finde es ein ziemliche Zock mit viel risiko. (Als einzelinvestition, als teil von das starvestportfolio finde ich es OK).

Die properties sind nicht uninteressant aber sehr ´greenfield´. Das wichstigste projekt ist offenbar das Liberiaprojekt. Liberia hat sich noch nicht bewiesen als investorfreundliches und stabiles land wenn ich es nett sage...

Ausser das (und warscheinlich noch viel wichtiger) sucht die firma momentan geld via ein pp. Die pp ist schon 2x verschoben und ist bei die heutige shareprice nicht wirklich attraktiv. Die sp muss mindestens innerhalb 1 jahr 6,7 p sein, anders kann man besser direkt aktien kaufen gegen die heutige preis.

Nach die pp hat die firma 120 Mio ausstehende aktien und mindestens 50 Mio warrants aus die pp (ich sehe so schnell nicht wie viel optionen/warrants momentan ausstehen, bestimmt auch schon einige). Nicht wenig.... Auch denke ich das möglicherweise die preis von die pp niedriger wirt (mehr verwässerung), weil die pp momentan nicht sehr attraktiv ist (price von unit wesentlich über shareprice bei viel risiko und grienfieldprojekten sehe auch oben).

Alles zusammen nach meiner meinung sehr viel risiko auch wenn die belohnung groß sein kann... Würde eher RGM (oder andere firma´s) kaufen wenn man kein problem hat mit risiko und große gewinne sucht...

habe mich auch nochmal mit Liberia und diamanten sueinandergesetzt, WENN das embargo passè ist, könnte Fundy eine ziemlich interessante geschichte werden.

Und die Anzeichen sehen derzeit gut aus... bzw. eigentlich ist das Export-Embargo durch die UN ab sofort aufgehoben!

Ein paar Links:

Regulatory framework begins to prove effectiveness

http://www.miningweekly.co.za/article.php?a_id=109721

Liberia relaunches diamond trade after embargo ends

TUBMANBURG, Liberia -- Liberia relaunched its diamond trade yesterday after the United Nations lifted an embargo, hoping the revival of the industry will fund reconstruction rather than lead to more bloodshed.

http://www.boston.com/news/world/africa/articles/2007/05/02/…

Liberia still reluctant to re-legalize diamond mining

http://www.resourceinvestor.com/pebble.asp?relid=32686

By Jon Nones

06 Jun 2007 at 12:32 PM

Two months after the United Nations lifted a six-year ban on Liberia exporting diamonds the government has still not legalised diamond mining, gaining support from NGOs.

The UN Security Council lifted the embargo on Liberian diamond exports on 27 April, applauding the government’s ongoing efforts to implement the international certification scheme known as the Kimberly Process. But government must first be able to apply the certification process to ensure that diamonds never again fuel conflict in the region.

Trafficking in diamonds and other natural resources in Liberia and neighbouring Sierra Leone was seen as fuelling those countries' civil wars in the 1990s. This is the basis for the story line in “Blood Diamond,” a very entertaining film, albeit a bit factually stretched.

Und die Anzeichen sehen derzeit gut aus... bzw. eigentlich ist das Export-Embargo durch die UN ab sofort aufgehoben!

Ein paar Links:

Regulatory framework begins to prove effectiveness

http://www.miningweekly.co.za/article.php?a_id=109721

Liberia relaunches diamond trade after embargo ends

TUBMANBURG, Liberia -- Liberia relaunched its diamond trade yesterday after the United Nations lifted an embargo, hoping the revival of the industry will fund reconstruction rather than lead to more bloodshed.

http://www.boston.com/news/world/africa/articles/2007/05/02/…

Liberia still reluctant to re-legalize diamond mining

http://www.resourceinvestor.com/pebble.asp?relid=32686

By Jon Nones

06 Jun 2007 at 12:32 PM

Two months after the United Nations lifted a six-year ban on Liberia exporting diamonds the government has still not legalised diamond mining, gaining support from NGOs.

The UN Security Council lifted the embargo on Liberian diamond exports on 27 April, applauding the government’s ongoing efforts to implement the international certification scheme known as the Kimberly Process. But government must first be able to apply the certification process to ensure that diamonds never again fuel conflict in the region.

Trafficking in diamonds and other natural resources in Liberia and neighbouring Sierra Leone was seen as fuelling those countries' civil wars in the 1990s. This is the basis for the story line in “Blood Diamond,” a very entertaining film, albeit a bit factually stretched.

Starvest Transaction in Own Shares

RNS Number:3401Y

Starvest PLC

14 June 2007

Starvest plc

Purchase of own shares

Starvest plc (the "Company") announces that on 13 June 2007, the Company

purchased through its broker, Simple Investments, 200,000 Ordinary shares of 1p

each in the issued share capital of the Company at a price of 30 pence per

Ordinary share. These Ordinary shares are to be held as treasury stock.

Following the above purchase, the Company holds 950,000 Ordinary shares in

treasury and the total issued share capital of the Company less treasury shares

is 36,267,259 Ordinary shares.

This purchase was made pursuant to the authority granted by Shareholders at the

Company's annual general meeting held on 12 December 2006. To date, 950,000

Ordinary shares have been purchased under this authority.

Enquiries to

Bruce Rowan, Chairman 020 7486 3997 or

John Watkins, Finance Director 01483 771992; john@starvest.co.uk

Gerry Beaney or Colin Aaronson, Grant Thornton Corporate Finance 020 7383 5100

14 June 2007

RNS Number:3401Y

Starvest PLC

14 June 2007

Starvest plc

Purchase of own shares

Starvest plc (the "Company") announces that on 13 June 2007, the Company

purchased through its broker, Simple Investments, 200,000 Ordinary shares of 1p

each in the issued share capital of the Company at a price of 30 pence per

Ordinary share. These Ordinary shares are to be held as treasury stock.

Following the above purchase, the Company holds 950,000 Ordinary shares in

treasury and the total issued share capital of the Company less treasury shares

is 36,267,259 Ordinary shares.

This purchase was made pursuant to the authority granted by Shareholders at the

Company's annual general meeting held on 12 December 2006. To date, 950,000

Ordinary shares have been purchased under this authority.

Enquiries to

Bruce Rowan, Chairman 020 7486 3997 or

John Watkins, Finance Director 01483 771992; john@starvest.co.uk

Gerry Beaney or Colin Aaronson, Grant Thornton Corporate Finance 020 7383 5100

14 June 2007

nach dem Buyback gehts heute ja mal ordentlich zur Sache:

Erde an Börse Berlin

0.335 British Pound = 0.49557 Euro

0.335 British Pound = 0.49557 Euro

betrifft SVE Beteiligung:

June 18, 2007

Brazilian Diamonds Gets Ready to Start Testing One Of Its Kimberlites

By Rob Davies

Brazil is a little odd as a diamond producing country in that none of its diamonds come from kimberlite mines. The country has plenty of alluvial mines extracting diamonds that have clearly come from kimberlites but Paul Ensor from the company confirms that as yet no miner is digging them up from their primary source. Brazilian Diamonds hoped to be the one that broke the mould when it purchased the Canastra kimberlite from De Beers in 2001. Despite proving that it was diamondiferous it has so far been unable to secure an environmental licence so it remains undeveloped.

Stephen Fabian, the Chief Executive Officer, was able to give Minews some background context to explain the delay. In essence it relates to confusion over the original size of the park where Canastra sits on the boundary. First announced as being 200,000 hectares in 1972 it was only ever formalised at 71,000 hectares but a recent change of government created a new environmental ministry and it is keen to increase the size of the park back to the original proposal. Stephen says this would create numerous problems and he is confident that reason will prevail, the park size will be limited and permission to start processing will finally be given. Once that happens he is ready to begin trial mining and start extracting diamonds that a decade ago were valued at US$130 a carat. The grade was recorded as 0.25 carats a tonne and Stephen thinks that would be a viable operation for five years, especially as all the infrastructure is in place and no stripping is required.

In the immediate future the company’s hopes now rest with the Salvador 1 kimberlite, also purchased from De Beers, but more recently in 2006. It was discovered in the 1990s and diamonds, both micro and macro, were recovered from nine of ten large diameter drill holes. The total yield from the 133 tonnes processed was 1.67 carats giving a grade of 1.3 carats per hundred tonnes. In the programme about to start the company is aiming to take samples of 640 cubic metres from each of six test pits down to a maximum depth of 11 metres. Analysis of the samples will be made at the company’s own laboratory in Patos de Minas which is certified to ISO 17025 for indicator minerals and fine diamond analysis.

Early results from the first two test pits, where the kimberlite is already visible, should be available by the end of the third quarter. At its Regis prospect the company has completed its Phase 11 drilling programme to define the twenty hectare central zone. Six holes totalling 1,738 metres were drilled to narrow down the target area from the 120 hectares of surface expression. In the process 129 micro-diamonds were recovered from drill hole no 1 and 20 from hole no 2. Results from all six are expected by the middle of 2007 and Stephen hopes better understanding of the phases will enable them to concentrate the exploration programme.

While Brazilian Diamonds is hoping to be the first kimberlite diamond miner in Brazil it has not neglected the traditional alluvial extraction route. On the Santa Antonio river it is developing the Santa Antonio do Bonito (SAB) property in a joint venture with CODEMIG. This 7,600 hectare property stretches along 22 kilometres of the river and the first three test pits have already yielded 31 diamonds weighing 19.38 carats. The largest at 5.92 carats was valued at US$45,000 and the results of C$1million feasibility study are due later this year.

Stephen’s view is that the best option is go for a smaller, higher grade mining operation to concentrate on the higher value stones. In contrast its partner wants a more traditional dredging operation to recover all the smaller stones in the finer sands. Either way, it is clear that the area is highly prospective. Capitalised at C$34million Brazilian Diamonds does not have a lot of expectation built into the share price of 8p. Indeed, Paul says that much of the share price’s recent history reflects the variations in opinions over Canastra. Nevertheless, the other projects look promising and there is often scope for surprise when there is not much factored into a valuation.

June 18, 2007

Brazilian Diamonds Gets Ready to Start Testing One Of Its Kimberlites

By Rob Davies

Brazil is a little odd as a diamond producing country in that none of its diamonds come from kimberlite mines. The country has plenty of alluvial mines extracting diamonds that have clearly come from kimberlites but Paul Ensor from the company confirms that as yet no miner is digging them up from their primary source. Brazilian Diamonds hoped to be the one that broke the mould when it purchased the Canastra kimberlite from De Beers in 2001. Despite proving that it was diamondiferous it has so far been unable to secure an environmental licence so it remains undeveloped.

Stephen Fabian, the Chief Executive Officer, was able to give Minews some background context to explain the delay. In essence it relates to confusion over the original size of the park where Canastra sits on the boundary. First announced as being 200,000 hectares in 1972 it was only ever formalised at 71,000 hectares but a recent change of government created a new environmental ministry and it is keen to increase the size of the park back to the original proposal. Stephen says this would create numerous problems and he is confident that reason will prevail, the park size will be limited and permission to start processing will finally be given. Once that happens he is ready to begin trial mining and start extracting diamonds that a decade ago were valued at US$130 a carat. The grade was recorded as 0.25 carats a tonne and Stephen thinks that would be a viable operation for five years, especially as all the infrastructure is in place and no stripping is required.

In the immediate future the company’s hopes now rest with the Salvador 1 kimberlite, also purchased from De Beers, but more recently in 2006. It was discovered in the 1990s and diamonds, both micro and macro, were recovered from nine of ten large diameter drill holes. The total yield from the 133 tonnes processed was 1.67 carats giving a grade of 1.3 carats per hundred tonnes. In the programme about to start the company is aiming to take samples of 640 cubic metres from each of six test pits down to a maximum depth of 11 metres. Analysis of the samples will be made at the company’s own laboratory in Patos de Minas which is certified to ISO 17025 for indicator minerals and fine diamond analysis.

Early results from the first two test pits, where the kimberlite is already visible, should be available by the end of the third quarter. At its Regis prospect the company has completed its Phase 11 drilling programme to define the twenty hectare central zone. Six holes totalling 1,738 metres were drilled to narrow down the target area from the 120 hectares of surface expression. In the process 129 micro-diamonds were recovered from drill hole no 1 and 20 from hole no 2. Results from all six are expected by the middle of 2007 and Stephen hopes better understanding of the phases will enable them to concentrate the exploration programme.

While Brazilian Diamonds is hoping to be the first kimberlite diamond miner in Brazil it has not neglected the traditional alluvial extraction route. On the Santa Antonio river it is developing the Santa Antonio do Bonito (SAB) property in a joint venture with CODEMIG. This 7,600 hectare property stretches along 22 kilometres of the river and the first three test pits have already yielded 31 diamonds weighing 19.38 carats. The largest at 5.92 carats was valued at US$45,000 and the results of C$1million feasibility study are due later this year.

Stephen’s view is that the best option is go for a smaller, higher grade mining operation to concentrate on the higher value stones. In contrast its partner wants a more traditional dredging operation to recover all the smaller stones in the finer sands. Either way, it is clear that the area is highly prospective. Capitalised at C$34million Brazilian Diamonds does not have a lot of expectation built into the share price of 8p. Indeed, Paul says that much of the share price’s recent history reflects the variations in opinions over Canastra. Nevertheless, the other projects look promising and there is often scope for surprise when there is not much factored into a valuation.

betrifft SVE Beteiligung:

June 19, 2007

Beowulf Mining Seeking To Joint Venture Non-Core Projects

http://www.minesite.com/nc/minews/singlenews/article/beowulf…

June 19, 2007

Beowulf Mining Seeking To Joint Venture Non-Core Projects

http://www.minesite.com/nc/minews/singlenews/article/beowulf…

betrifft SVE Beteiligung:

betrifft SVE Beteiligung

News - Warrants and IR Firm Appointed

Franconia Receives Cdn$4.2 Million From Warrant Exercises

Investor Relations Firm Engaged in US

SPOKANE, WASHINGTON, Jun 21, 2007 (MARKET WIRE via COMTEX News Network) --

FRANCONIA MINERALS CORPORATION (TSX VENTURE: FRA) ("Franconia" or the "Company") is pleased to announce that, pursuant to the terms of a non-brokered private placement (see Franconia press release of November 21, 2006) and in response to the Company's notice that the weighted average price of the common shares on the TSX Venture Exchange has been equal to or greater than Cdn$3.00 for a period of 15 consecutive trading days, all warrant holders from the private placement have now exercised their right to convert their warrants into the Company's common shares. The Company has received total proceeds of Cdn$4,218,930 and issued 2,281,043 new common shares from Treasury in exchange for these warrants.

Investor Relations Firm Engaged in US

Franconia has engaged a specialist investor relations firm in the United States to provide consulting services including investor relations and shareholder communications.

EVC Group, Inc, through the firm's offices in New York City and San Francisco, will assist the company in gaining increased exposure to investors, primarily in the United States by providing strategic advisory services, financial community targeting and marketing and financial media relations. The services agreement with EVC is for an initial term of six months at a monthly fee of US$10,000 per month and will subsequently continue on a month-to-month basis.

Franconia Minerals Corporation is an exploration and development company focused on large-scale platinum group metals (PGM) and base metals projects in the continental United States. Franconia's most advanced property is the Birch Lake copper-nickel-PGM in the Duluth Complex, northern Minnesota.

Franconia Minerals Corporation trades on the TSX-V under the symbol FRA. (For additional information see www.franconiaminerals.com.) Following the issuance of share on the exercise of the warrants as above, the Company has 57,629,774 shares issued and outstanding.

Brian Gavin, President

FORWARD-LOOKING STATEMENT: Although Franconia Minerals Corporation believes many of its properties have promising potential, its properties are in the exploration stage and none have yet been shown to contain proven or probable mineral reserves. There can be no assurance that such reserves will be identified on any property, or that, if identified, any mineralization may be economically extracted.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FRA.TSX

betrifft SVE Beteiligung

News - Warrants and IR Firm Appointed

Franconia Receives Cdn$4.2 Million From Warrant Exercises

Investor Relations Firm Engaged in US

SPOKANE, WASHINGTON, Jun 21, 2007 (MARKET WIRE via COMTEX News Network) --

FRANCONIA MINERALS CORPORATION (TSX VENTURE: FRA) ("Franconia" or the "Company") is pleased to announce that, pursuant to the terms of a non-brokered private placement (see Franconia press release of November 21, 2006) and in response to the Company's notice that the weighted average price of the common shares on the TSX Venture Exchange has been equal to or greater than Cdn$3.00 for a period of 15 consecutive trading days, all warrant holders from the private placement have now exercised their right to convert their warrants into the Company's common shares. The Company has received total proceeds of Cdn$4,218,930 and issued 2,281,043 new common shares from Treasury in exchange for these warrants.

Investor Relations Firm Engaged in US

Franconia has engaged a specialist investor relations firm in the United States to provide consulting services including investor relations and shareholder communications.

EVC Group, Inc, through the firm's offices in New York City and San Francisco, will assist the company in gaining increased exposure to investors, primarily in the United States by providing strategic advisory services, financial community targeting and marketing and financial media relations. The services agreement with EVC is for an initial term of six months at a monthly fee of US$10,000 per month and will subsequently continue on a month-to-month basis.

Franconia Minerals Corporation is an exploration and development company focused on large-scale platinum group metals (PGM) and base metals projects in the continental United States. Franconia's most advanced property is the Birch Lake copper-nickel-PGM in the Duluth Complex, northern Minnesota.

Franconia Minerals Corporation trades on the TSX-V under the symbol FRA. (For additional information see www.franconiaminerals.com.) Following the issuance of share on the exercise of the warrants as above, the Company has 57,629,774 shares issued and outstanding.

Brian Gavin, President

FORWARD-LOOKING STATEMENT: Although Franconia Minerals Corporation believes many of its properties have promising potential, its properties are in the exploration stage and none have yet been shown to contain proven or probable mineral reserves. There can be no assurance that such reserves will be identified on any property, or that, if identified, any mineralization may be economically extracted.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FRA.TSX

Die Financials können sich sehen lassen...alles sehr gesund

http://www.advfn.com/p.php?pid=ukfinancials&symbol=L%5ESVE

News

02 July 2007

Total Voting Rights

In conformity with the Transparency Directive's transitional provision 6, the

Company notifies the market of the following:

As at the date of this announcement, the Company's issued share capital consists

of 37,217,259 Ordinary shares with a nominal value of 1p each ("Ordinary Shares

"), with voting rights. The Company holds 950,000 Ordinary Shares in Treasury.

Therefore, the total number of Ordinary Shares with voting rights is 36,267,259.

The above figure of 36,267,259 Ordinary Shares may be used by shareholders in

the Company as the denominator for the calculations by which they will determine

if they are required to notify their interest in, or change in their interest in

the share capital of the capital of the Company under the FSA's Disclosure and

Transparency Rules.

....................................................

Starvest Quarterly update

RNS Number:4458Z

Starvest PLC

02 July 2007

Starvest plc

Net asset value at 30 June 2007

The Directors report a 25% increase of #3.8m in the value of the Starvest

portfolio since 31 March 2007, the date of the last quarterly update.

The net asset value based on mid-market closing prices on Friday 29 June 2007

was #19.2m, which equates to 47.4 pence per share, an increase of 9.7 pence per

share since 31 March. All values are calculated on a fully diluted pre tax

basis, except that a full tax provision has been made on realised trading

profits.

During the quarter, the Starvest share price has risen from 26.5 pence to close

at 31.75 pence; the discount to net asset value at 30 June 2007 was 33%.

Interim statement

The Directors plan to issue a nine month interim statement on 12 July 2007.

http://www.advfn.com/p.php?pid=ukfinancials&symbol=L%5ESVE

News

02 July 2007

Total Voting Rights

In conformity with the Transparency Directive's transitional provision 6, the

Company notifies the market of the following:

As at the date of this announcement, the Company's issued share capital consists

of 37,217,259 Ordinary shares with a nominal value of 1p each ("Ordinary Shares

"), with voting rights. The Company holds 950,000 Ordinary Shares in Treasury.

Therefore, the total number of Ordinary Shares with voting rights is 36,267,259.

The above figure of 36,267,259 Ordinary Shares may be used by shareholders in

the Company as the denominator for the calculations by which they will determine

if they are required to notify their interest in, or change in their interest in

the share capital of the capital of the Company under the FSA's Disclosure and

Transparency Rules.

....................................................

Starvest Quarterly update

RNS Number:4458Z

Starvest PLC

02 July 2007

Starvest plc

Net asset value at 30 June 2007

The Directors report a 25% increase of #3.8m in the value of the Starvest

portfolio since 31 March 2007, the date of the last quarterly update.

The net asset value based on mid-market closing prices on Friday 29 June 2007

was #19.2m, which equates to 47.4 pence per share, an increase of 9.7 pence per

share since 31 March. All values are calculated on a fully diluted pre tax

basis, except that a full tax provision has been made on realised trading

profits.

During the quarter, the Starvest share price has risen from 26.5 pence to close

at 31.75 pence; the discount to net asset value at 30 June 2007 was 33%.

Interim statement

The Directors plan to issue a nine month interim statement on 12 July 2007.

Wohin soll denn die Reise gehn..wohin, sag wohin, ja wohin....

"

kleines Fazit aus dem ADVFN Board

Zitat:

Latest NAV figure is out - 47.4p/share as of Friday 29 June, which they say was a 33% discount to the latest share price of 31.75p.

Of course, for the share price to rise to 47.4p (from 31.75p) it would need to advance by almost 50%.

Note that this is still without taking into account tax on unrealised gains.

Having said that, with the Afplats transaction closed and plenty of post-tax cash in hand, tax on unrealised gains won't have quite as significant an impact as it has in the past. (And of course, we don't pay tax till we realise, so we enjoy the leverage of a 47.4p/share NAV even if in the end tax is payable.)"

"

kleines Fazit aus dem ADVFN Board

Zitat:

Latest NAV figure is out - 47.4p/share as of Friday 29 June, which they say was a 33% discount to the latest share price of 31.75p.

Of course, for the share price to rise to 47.4p (from 31.75p) it would need to advance by almost 50%.

Note that this is still without taking into account tax on unrealised gains.

Having said that, with the Afplats transaction closed and plenty of post-tax cash in hand, tax on unrealised gains won't have quite as significant an impact as it has in the past. (And of course, we don't pay tax till we realise, so we enjoy the leverage of a 47.4p/share NAV even if in the end tax is payable.)"

aktuelles NAV-Discount (aus dem ADVFN -Board):

betrifft SVE Beteiligung

Brazilian Diamonds Limited

13 July 2007

BRAZILIAN DIAMONDS LIMITED

APPOINTMENT OF COMPANY PRESIDENT, GRANTS OF OPTIONS AND DIRECTOR RETIREMENT

The Directors of Brazilian Diamonds Limited ('Brazilian Diamonds' or 'the

Company') BDY:TSX/AIM are pleased to announce that Mr. Homero Braz Silva has

been appointed to the position of President of the Company with effect from 16

July 2007.

Mr. Silva is a highly respected geologist with more than 30 years of domestic

and international experience in diamond exploration with De Beers in South

America, Canada, Africa and Russia was until recently the Operations Manager for

De Beers in South America.

During his time with De Beers, Mr. Silva has been involved in all aspects of

diamond exploration and production, including the discovery of kimberlite

provinces in North, Centre West and Northeast Brazil and Bolivia, Venezuela and

Gabon.

As a consequence of his roles with De Beers, Mr. Silva has extensive experience

in corporate and project management, governmental relations and environmental

licensing which well qualify Mr. Silva to assume responsibility for the overall

management of the Company's operations and exploration activities in Brazil.

The Chairman of Brazilian Diamonds, Mr Kenneth Judge said today 'We are

delighted to have Homero Silva accept this important appointment and look

forward to his considerable practical experience and strong technical background

assisting our team of professionals to advance our exploration efforts in

Brazil. Homero has been known to us for many years and already has an intimate

knowledge of our portfolio as he was involved in the discovery of a number of

our most important projects. We expect Homero's skill and experience to be a

tremendous boost to the team of talented professionals we have already working

with us in Brazil.'

Homero Silva commented 'I am very pleased to have been asked to lead the team of

talented professionals working with Brazilian Diamonds, many of whom were

colleagues of mine at De Beers. I think Brazilian Diamonds has assembled a

quality portfolio of advanced projects including the Canastra 1 and Salvador 1

kimberlite projects, both of which I know well from my time at De Beers. I look

forward to helping the Company progress these and a number of other promising

projects within the portfolio.'

As a part of the terms of his engagement, Mr. Silva, who is not joining the

board of the Company at this time, has been awarded options over 2,000,000

shares in the Company at an exercise price of Can$0.25 which will vest over the

next two years. In addition, 2,325,000 options have been allotted to certain

members of the Board and management of the Company in accordance with the terms

of the Company's shareholder approved Option Plan. These options are

exercisable on or before 12 July 2012 at a price of Can$0.25 per share. The

options granted to Board members are set out below:

Director Number of new options granted

David Cowan 150,000

Francis Johnstone 150,000

Roger Morton 150,000

Mike Byron 300,000

The Company also announces that Glenn Brown has retired as a Director of

Brazilian Diamonds with effect from the AGM held on 7 June 2007 where he did not

stand for re-election.

Editors' Note:

Brazilian Diamonds is a leading Brazil-based exploration company focused on the

discovery of kimberlites on its extensive portfolio of properties in the States

of Minas Gerais and Bahia, with the goal of becoming a significant producer of

diamonds.

The Company is awaiting final approval before commencing the environmental

licensing process for development of the Canastra 1 kimberlite body for which

mine feasibility work has already been completed and the required Mines

Department approvals are already in place. It is intended to bring Canastra 1

into production once the environmental licensing process is completed.

The Company's Salvador diamond project in Bahia includes the diamondiferous

Salvador 1 kimberlite. This project was acquired from De Beers which retains a

right to reacquire up to 40% of any kimberlite found on the Salvador properties

which is confirmed to contain more that 200 carats of diamonds.

The Company has a fully operational diamond separation/analysis laboratory at

Patos de Minas, Minas Gerais which is strategically located near its properties

in the Santo Antonio and Coromandel areas. The Company has a highly experienced

team including four geologists located at the Company's facilities in Brazil.

The Company's strategy for non-core activities on its properties is to form

joint ventures. A Cdn$1,000,000 feasibility study is underway for a joint

venture for the mining of alluvial diamonds on its properties in the Santo

Antonio river drainage. The joint venture involves two important Brazilian

companies: CODEMIG, the state owned mining development organization and

Mineracao Rio Novo Ltda., a wholly owned subsidiary of Andrade Gutierrez SA, one

of Brazil's largest civil engineering firms and an existing large scale, dredge

based producer of alluvial diamonds.

For further information refer to the Company's website www.braziliandiamonds.com

or contact:

Brazilian Diamonds Limited

Ken Judge, Chairman + 44 7733 001 002

Stephen Fabian, CEO + 55 31 8814 5111

Investor Relations

Europe + 44 207 590 5503

North America 1-866-689-2599

Hanson Westhouse Limited (Nomad to the Company) + 44 113 246 2610

Tim Feather/Matthew Johnson

Teather & Greenwood Limited (Broker to the Company) + 44 207 426 9000

Tom Hulme

Brazilian Diamonds Limited

13 July 2007

BRAZILIAN DIAMONDS LIMITED

APPOINTMENT OF COMPANY PRESIDENT, GRANTS OF OPTIONS AND DIRECTOR RETIREMENT

The Directors of Brazilian Diamonds Limited ('Brazilian Diamonds' or 'the

Company') BDY:TSX/AIM are pleased to announce that Mr. Homero Braz Silva has

been appointed to the position of President of the Company with effect from 16

July 2007.

Mr. Silva is a highly respected geologist with more than 30 years of domestic

and international experience in diamond exploration with De Beers in South

America, Canada, Africa and Russia was until recently the Operations Manager for

De Beers in South America.

During his time with De Beers, Mr. Silva has been involved in all aspects of

diamond exploration and production, including the discovery of kimberlite

provinces in North, Centre West and Northeast Brazil and Bolivia, Venezuela and

Gabon.

As a consequence of his roles with De Beers, Mr. Silva has extensive experience

in corporate and project management, governmental relations and environmental

licensing which well qualify Mr. Silva to assume responsibility for the overall

management of the Company's operations and exploration activities in Brazil.

The Chairman of Brazilian Diamonds, Mr Kenneth Judge said today 'We are

delighted to have Homero Silva accept this important appointment and look

forward to his considerable practical experience and strong technical background

assisting our team of professionals to advance our exploration efforts in

Brazil. Homero has been known to us for many years and already has an intimate

knowledge of our portfolio as he was involved in the discovery of a number of

our most important projects. We expect Homero's skill and experience to be a

tremendous boost to the team of talented professionals we have already working

with us in Brazil.'

Homero Silva commented 'I am very pleased to have been asked to lead the team of

talented professionals working with Brazilian Diamonds, many of whom were

colleagues of mine at De Beers. I think Brazilian Diamonds has assembled a

quality portfolio of advanced projects including the Canastra 1 and Salvador 1

kimberlite projects, both of which I know well from my time at De Beers. I look

forward to helping the Company progress these and a number of other promising

projects within the portfolio.'

As a part of the terms of his engagement, Mr. Silva, who is not joining the

board of the Company at this time, has been awarded options over 2,000,000

shares in the Company at an exercise price of Can$0.25 which will vest over the

next two years. In addition, 2,325,000 options have been allotted to certain

members of the Board and management of the Company in accordance with the terms

of the Company's shareholder approved Option Plan. These options are

exercisable on or before 12 July 2012 at a price of Can$0.25 per share. The

options granted to Board members are set out below:

Director Number of new options granted

David Cowan 150,000

Francis Johnstone 150,000

Roger Morton 150,000

Mike Byron 300,000

The Company also announces that Glenn Brown has retired as a Director of

Brazilian Diamonds with effect from the AGM held on 7 June 2007 where he did not

stand for re-election.

Editors' Note:

Brazilian Diamonds is a leading Brazil-based exploration company focused on the

discovery of kimberlites on its extensive portfolio of properties in the States

of Minas Gerais and Bahia, with the goal of becoming a significant producer of

diamonds.

The Company is awaiting final approval before commencing the environmental

licensing process for development of the Canastra 1 kimberlite body for which

mine feasibility work has already been completed and the required Mines

Department approvals are already in place. It is intended to bring Canastra 1

into production once the environmental licensing process is completed.

The Company's Salvador diamond project in Bahia includes the diamondiferous

Salvador 1 kimberlite. This project was acquired from De Beers which retains a

right to reacquire up to 40% of any kimberlite found on the Salvador properties

which is confirmed to contain more that 200 carats of diamonds.

The Company has a fully operational diamond separation/analysis laboratory at

Patos de Minas, Minas Gerais which is strategically located near its properties

in the Santo Antonio and Coromandel areas. The Company has a highly experienced

team including four geologists located at the Company's facilities in Brazil.

The Company's strategy for non-core activities on its properties is to form

joint ventures. A Cdn$1,000,000 feasibility study is underway for a joint

venture for the mining of alluvial diamonds on its properties in the Santo

Antonio river drainage. The joint venture involves two important Brazilian

companies: CODEMIG, the state owned mining development organization and

Mineracao Rio Novo Ltda., a wholly owned subsidiary of Andrade Gutierrez SA, one

of Brazil's largest civil engineering firms and an existing large scale, dredge

based producer of alluvial diamonds.

For further information refer to the Company's website www.braziliandiamonds.com

or contact:

Brazilian Diamonds Limited

Ken Judge, Chairman + 44 7733 001 002

Stephen Fabian, CEO + 55 31 8814 5111

Investor Relations

Europe + 44 207 590 5503

North America 1-866-689-2599

Hanson Westhouse Limited (Nomad to the Company) + 44 113 246 2610

Tim Feather/Matthew Johnson

Teather & Greenwood Limited (Broker to the Company) + 44 207 426 9000

Tom Hulme

Date : 30/07/2007 @ 11:07

Source : TFN

Stock : Beowulf Mining (BEM)

Quote : 4.625 0.0 (0.00%) @ 08:53

<< Back Quote Chart Trades Level2

Beowulf Mining to raise 250,000 stg via convertible loan

LONDON (Thomson Financial) - Beowulf Mining PLC said it has signed a 250,000