Orvana Minerals -MK ~75Mio/ Cash 33Mio/ 22538 Unzen Gold produziert in Q2-2007 davon 7839 nur im Apr - Die letzten 30 Beiträge

eröffnet am 18.05.07 22:25:49 von

neuester Beitrag 02.12.23 11:36:02 von

neuester Beitrag 02.12.23 11:36:02 von

Beiträge: 326

ID: 1.127.571

ID: 1.127.571

Aufrufe heute: 0

Gesamt: 34.854

Gesamt: 34.854

Aktive User: 0

ISIN: CA68759M1014 · WKN: 889301 · Symbol: ORV

0,1850

CAD

-7,50 %

-0,0150 CAD

Letzter Kurs 25.04.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,59 | -98,01 |

Beitrag zu dieser Diskussion schreiben

1.12.

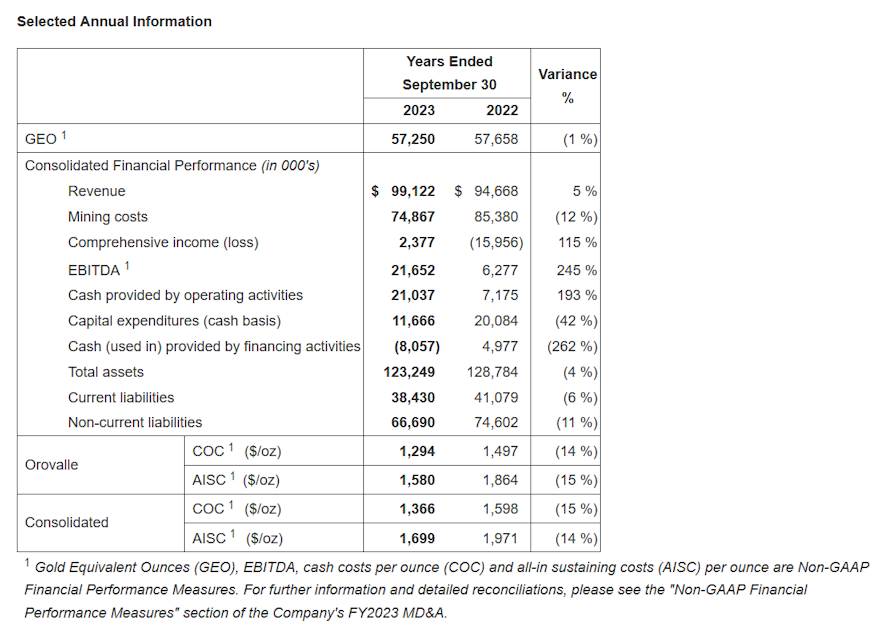

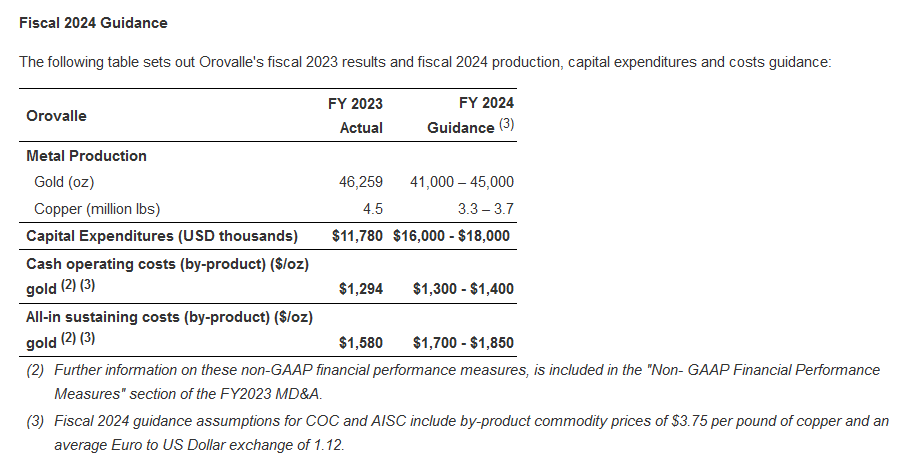

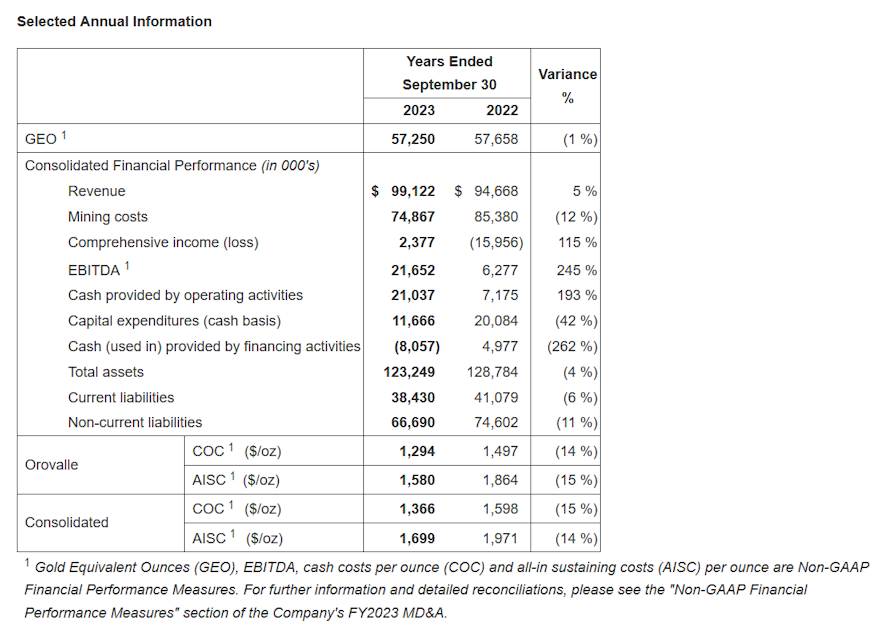

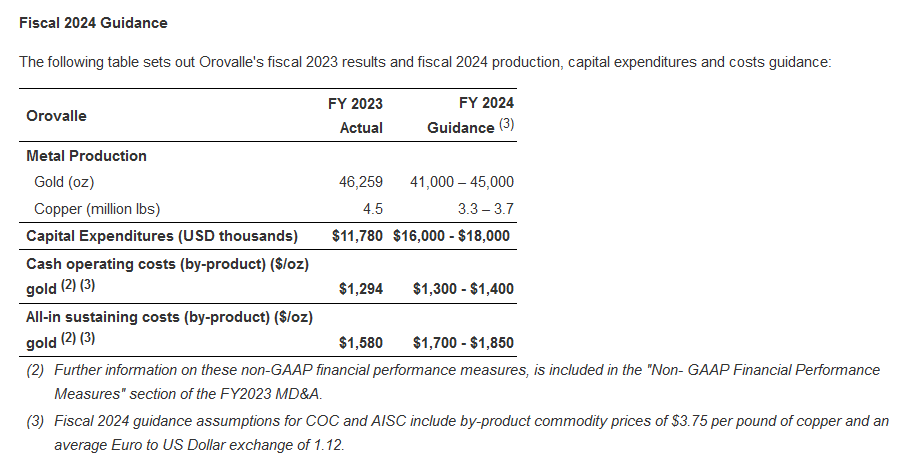

ORVANA REPORTS FY2023 RESULTS & FY2024 GUIDANCE

https://www.orvana.com/English/news/news-details/2023/ORVANA…

...

...

...

Juan Gavidia, CEO of Orvana Minerals Corp. stated: "FY2023 demonstrated Orvana's capacity to significantly address sudden costs increases driven by external factors that impacted us in FY2022. Sharp focus on efficiency improvements and cost management were key to deliver on our annual guidance. The Company has generated substantial operating cash flow in FY2023 to support our growth initiatives and debt reduction".

He added, "As we move forward, our primary focus remains delivering operating cash flow and executing our plan to restart production at Bolivia".

...

ORVANA REPORTS FY2023 RESULTS & FY2024 GUIDANCE

https://www.orvana.com/English/news/news-details/2023/ORVANA…

...

...

...

Juan Gavidia, CEO of Orvana Minerals Corp. stated: "FY2023 demonstrated Orvana's capacity to significantly address sudden costs increases driven by external factors that impacted us in FY2022. Sharp focus on efficiency improvements and cost management were key to deliver on our annual guidance. The Company has generated substantial operating cash flow in FY2023 to support our growth initiatives and debt reduction".

He added, "As we move forward, our primary focus remains delivering operating cash flow and executing our plan to restart production at Bolivia".

...

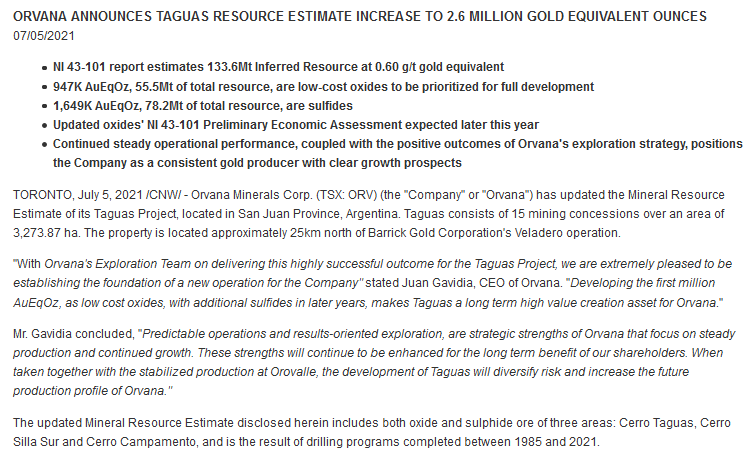

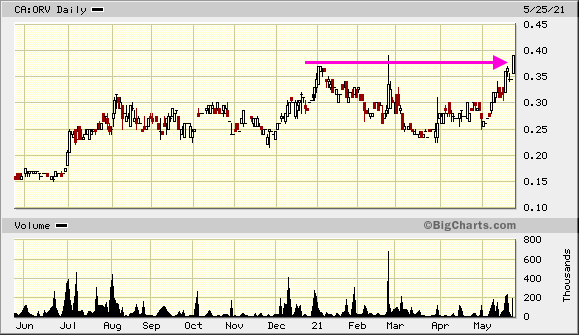

Antwort auf Beitrag Nr.: 68.297.657 von faultcode am 25.05.21 18:30:47Argentina:

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

Antwort auf Beitrag Nr.: 68.276.758 von faultcode am 22.05.21 16:11:23

Antwort auf Beitrag Nr.: 62.024.651 von faultcode am 27.11.19 13:34:04

https://www.orvana.com/English/news/news-details/2021/Orvana…

Orvana Announces the Completion of the Acquisition of the Taguas Property

05/21/2021

...

Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana") is pleased to announce that it has completed the requisite steps to transfer ownership of the Taguas property to Orvana Argentina S.A., a wholly-owned subsidiary of the Company. The Taguas acquisition is now complete.

The Taguas property consists of 15 mining concessions over an area of 3,273.87 ha (the "TaguasProperty", "Taguas" or the "Property"). The Property is located in the Province of San Juan, Argentina, on the eastern flank of the Andes, between 3,500 m to 4,300 m above sea level, and is approximately 25 km north of Barrick Gold Corporation's Veladero mining operations (see Figure 1 below).

Juan Gavidia, CEO of Orvana stated, "The Company is pleased to officially add the Taguas property as its potential third operation to target growth of our mineral reserves and resources. Subject to results of the latest drilling program and the availability of funds, the Company plans to further develop Taguas by completing an infill drilling program to upgrade resources from inferred to measured-indicated, and develop baseline studies for a pre-feasibility study....."

Zitat von faultcode: ...

Taguas:

• The Taguas Mine Development project is located in San Juan Province in Argentina. The Company expects to close the acquisition (including the rights transfer registration and the TSX final acceptance) during Q1 2020.

Subject to closing the transaction and securing the required financing, the Company is preparing a drilling program in order to expand the current resources (see news release dated May 14, 2019) and to support the potential upgrade in Mineral Resource estimates.

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

Orvana Announces the Completion of the Acquisition of the Taguas Property

05/21/2021

...

Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana") is pleased to announce that it has completed the requisite steps to transfer ownership of the Taguas property to Orvana Argentina S.A., a wholly-owned subsidiary of the Company. The Taguas acquisition is now complete.

The Taguas property consists of 15 mining concessions over an area of 3,273.87 ha (the "TaguasProperty", "Taguas" or the "Property"). The Property is located in the Province of San Juan, Argentina, on the eastern flank of the Andes, between 3,500 m to 4,300 m above sea level, and is approximately 25 km north of Barrick Gold Corporation's Veladero mining operations (see Figure 1 below).

Juan Gavidia, CEO of Orvana stated, "The Company is pleased to officially add the Taguas property as its potential third operation to target growth of our mineral reserves and resources. Subject to results of the latest drilling program and the availability of funds, the Company plans to further develop Taguas by completing an infill drilling program to upgrade resources from inferred to measured-indicated, and develop baseline studies for a pre-feasibility study....."

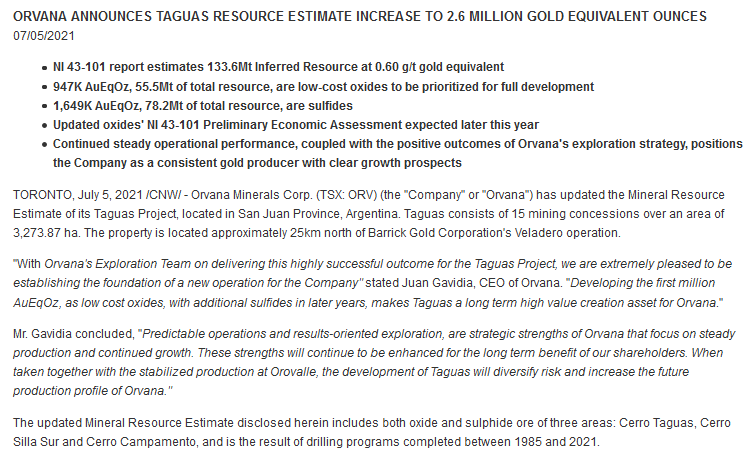

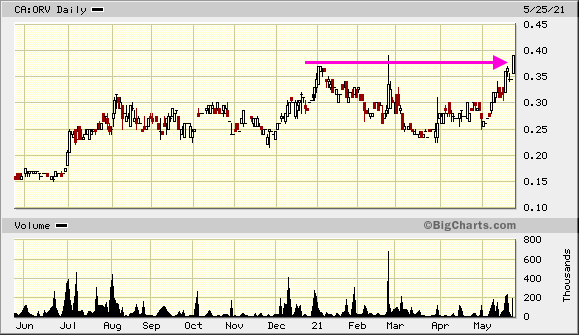

Allmählich schlägt auch der Kupferpreis sich in der Aktie nieder

Orvana Minerals Corp. meldete gestern die Produktionsergebnisse für das zweite Quartal des Finanzjahres 2021.

Den Angaben zufolge wurden bei der Mine OroValle im zweiten Quartal insgesamt 14.179 Unzen Goldäquivalent produziert, im Vergleich zum ersten Quartal 2021 stellt dies ein Minus von 23% dar. Die Produktion von Gold lag bei insgesamt 10.785 Unzen, während die Kupferproduktion 1,36 Mio. Pfund erreichte.

und der CEO klingt recht positiv für die Zukunft !

habe die Aktie schon einige Jahre und dümpeln jetzt so um meinen Einstandspreis - was meint Ihr - kommt da noch was oder besser abstoßen ? Danke um jede Meinung !

Den Angaben zufolge wurden bei der Mine OroValle im zweiten Quartal insgesamt 14.179 Unzen Goldäquivalent produziert, im Vergleich zum ersten Quartal 2021 stellt dies ein Minus von 23% dar. Die Produktion von Gold lag bei insgesamt 10.785 Unzen, während die Kupferproduktion 1,36 Mio. Pfund erreichte.

und der CEO klingt recht positiv für die Zukunft !

habe die Aktie schon einige Jahre und dümpeln jetzt so um meinen Einstandspreis - was meint Ihr - kommt da noch was oder besser abstoßen ? Danke um jede Meinung !

Orvana Provides Update on 2015 Judicial Process in Spain

03/03/2021

TORONTO, March 3, 2021 /CNW/ - Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana"). The Company is providing an update on its subsidiary's OroValle Minerals S.L. ("OroValle"), ongoing judicial process (the "Process") which started in 2015. This Process has been continuously disclosed and updated in the company's quarterly financial statements since June 30th 2015

The Process relates to selenium discharge levels in the Cauxa River. This river, flows past OroValle's operations as well as other properties owned by third parties. Selenium is a naturally occurring element that is found in rocks, land and water in the area, and is not used in OroValle's operations whatsoever. The results of scientific studies conducted by OroValle have confirmed that past and current levels of selenium in waterways in the vicinity do not cause environmental damage. The latest historical summary of this matter may be found in the quarter-ended December 31, 2020, financial statements.

OroValle's position in this Process is that the petitioned sanctions are unreasonable and without merit. OroValle has filed its preliminary statement of defence requesting for the dismissal of the Prosecutor's allegations on the basis that, among other things, there is an absence of a committed offence. Orovalle has submitted proven and conclusive evidence that demonstrate that its activities have not resulted in any environmental damage. Considering the strength of the legal defence and evidence in favor of OroValle's position, OroValle is confident that this Process will result in the dismissal of this matter.

Due to procedural matters, on March 1st, 2021, the trial has been rescheduled to an undetermined date in the future. The request of the Prosecutor and the State's Attorney acting in this Process includes a fine of up to €20m and the eventual withholding of OroValle's operations until it is demonstrated that the alleged polluting activity has ceased. The petition also includes a €5m indemnity for civil liability.

The company will provide further updates as the process advances.

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

03/03/2021

TORONTO, March 3, 2021 /CNW/ - Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana"). The Company is providing an update on its subsidiary's OroValle Minerals S.L. ("OroValle"), ongoing judicial process (the "Process") which started in 2015. This Process has been continuously disclosed and updated in the company's quarterly financial statements since June 30th 2015

The Process relates to selenium discharge levels in the Cauxa River. This river, flows past OroValle's operations as well as other properties owned by third parties. Selenium is a naturally occurring element that is found in rocks, land and water in the area, and is not used in OroValle's operations whatsoever. The results of scientific studies conducted by OroValle have confirmed that past and current levels of selenium in waterways in the vicinity do not cause environmental damage. The latest historical summary of this matter may be found in the quarter-ended December 31, 2020, financial statements.

OroValle's position in this Process is that the petitioned sanctions are unreasonable and without merit. OroValle has filed its preliminary statement of defence requesting for the dismissal of the Prosecutor's allegations on the basis that, among other things, there is an absence of a committed offence. Orovalle has submitted proven and conclusive evidence that demonstrate that its activities have not resulted in any environmental damage. Considering the strength of the legal defence and evidence in favor of OroValle's position, OroValle is confident that this Process will result in the dismissal of this matter.

Due to procedural matters, on March 1st, 2021, the trial has been rescheduled to an undetermined date in the future. The request of the Prosecutor and the State's Attorney acting in this Process includes a fine of up to €20m and the eventual withholding of OroValle's operations until it is demonstrated that the alleged polluting activity has ceased. The petition also includes a €5m indemnity for civil liability.

The company will provide further updates as the process advances.

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

Antwort auf Beitrag Nr.: 66.973.979 von faultcode am 12.02.21 11:59:53Eigentlich saustark, wäre aufs Jahr ein KGV von ca 1. 2011 war der Kurs um über Faktor 10 höher...

Antwort auf Beitrag Nr.: 66.489.689 von faultcode am 18.01.21 15:38:12

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

...

https://www.orvana.com/English/news/news-details/2021/Orvana…

Antwort auf Beitrag Nr.: 66.225.072 von faultcode am 29.12.20 14:35:47https://www.orvana.com/English/news/news-details/2021/Orvana…

...

...

Antwort auf Beitrag Nr.: 65.920.707 von 02487 am 02.12.20 14:00:46

Nö passt schon. Gold- und Kupferpreis spielten Orvana in die Karten. Sollte die Mine in Argentinien in 2021 nicht wieder zur erhöhten Produktion beitragen?

Zitat von 02487: Fiscal Q4 2020 Net income (loss) per share (basic/diluted) $0.06

https://finance.yahoo.com/news/orvana-reports-2020-results-2…

Übersehe ich etwas?

Nö passt schon. Gold- und Kupferpreis spielten Orvana in die Karten. Sollte die Mine in Argentinien in 2021 nicht wieder zur erhöhten Produktion beitragen?

Q4 EPS $0.06?

Fiscal Q4 2020 Net income (loss) per share (basic/diluted) $0.06https://finance.yahoo.com/news/orvana-reports-2020-results-2…

Übersehe ich etwas?

Antwort auf Beitrag Nr.: 65.477.100 von faultcode am 23.10.20 14:10:11https://www.orvana.com/English/news/news-details/2020/Orvana…

...

...

Antwort auf Beitrag Nr.: 65.406.795 von faultcode am 16.10.20 12:20:50https://www.orvana.com/English/news/news-details/2020/Orvana…

...

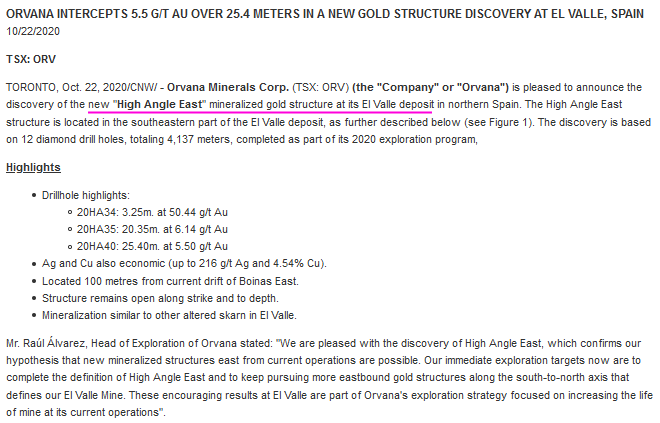

=> nicht unerwartet wieder Skarn-Erze (altered skarn) und daher ist der Markt hier (immer noch) nicht euphorisch

ansonsten:

OroValle is currently preparing an update to the mineral resources and mineral reserves estimates (the "MRMR Update") and the life-of-mine plan (the "LOMP Update") for El Valle and Carles gold-copper mines in northern Spain.

These updates are being prepared in accordance with CIM Definition Standards (2014) and in compliance with the Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") by RPA, now part of SLR Consulting Ltd., an independent mining consulting firm. The Company expects to complete the work in December 2020.

...

=> nicht unerwartet wieder Skarn-Erze (altered skarn) und daher ist der Markt hier (immer noch) nicht euphorisch

ansonsten:

OroValle is currently preparing an update to the mineral resources and mineral reserves estimates (the "MRMR Update") and the life-of-mine plan (the "LOMP Update") for El Valle and Carles gold-copper mines in northern Spain.

These updates are being prepared in accordance with CIM Definition Standards (2014) and in compliance with the Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") by RPA, now part of SLR Consulting Ltd., an independent mining consulting firm. The Company expects to complete the work in December 2020.

15.10.

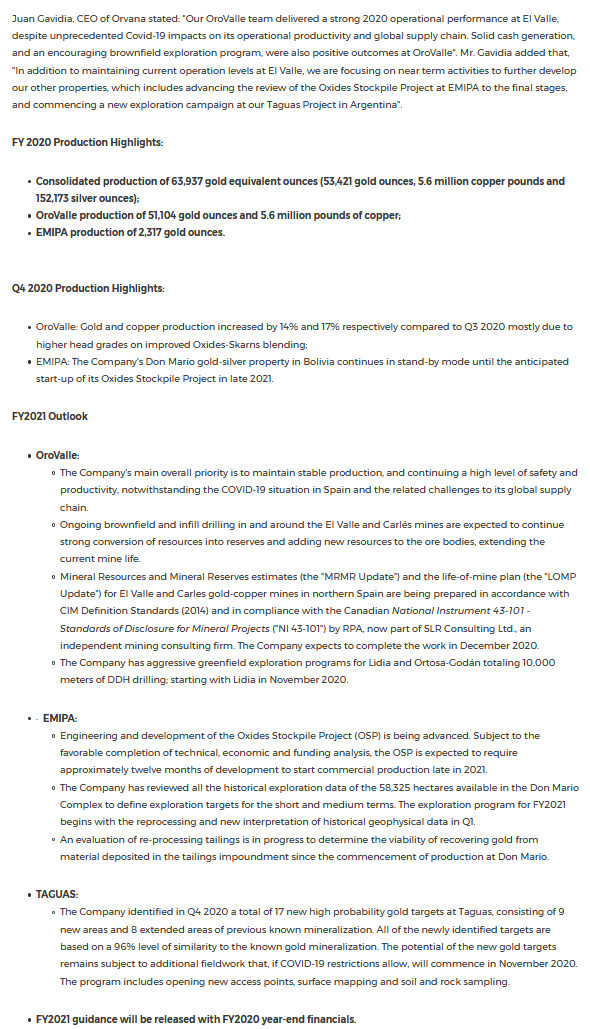

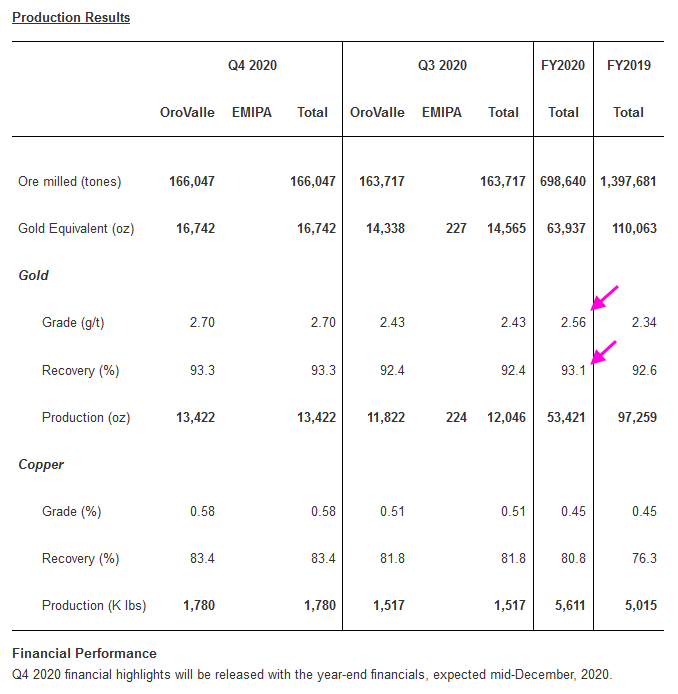

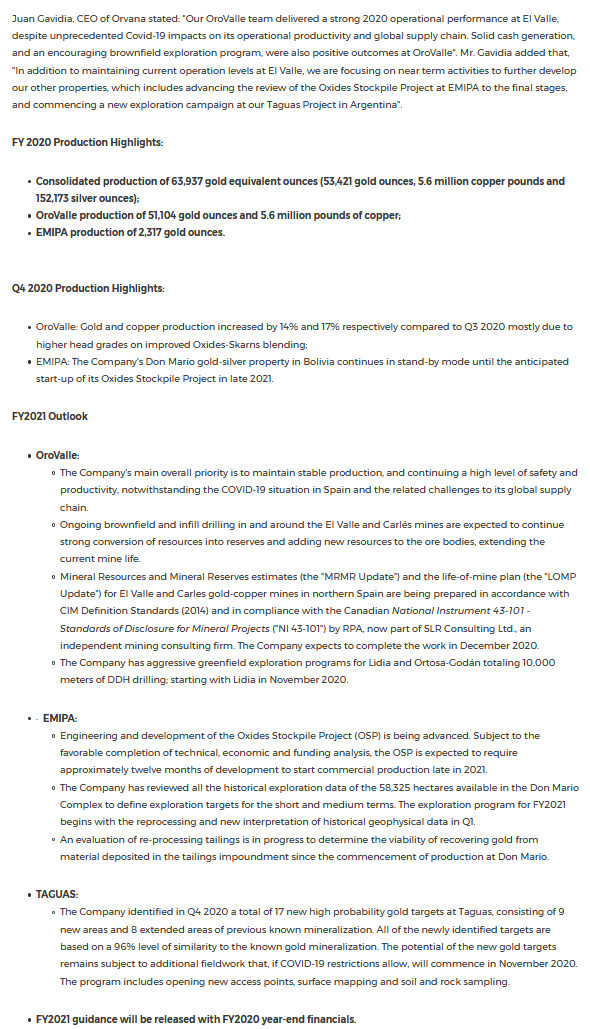

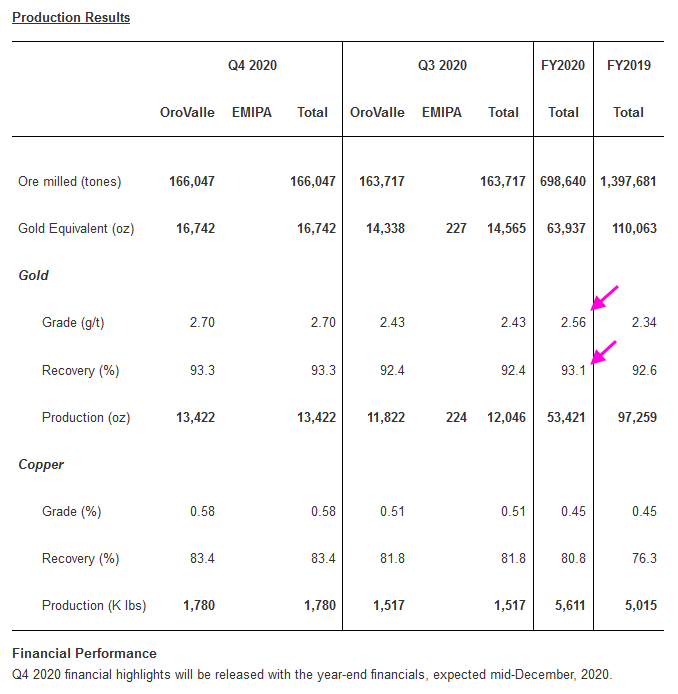

Orvana Reports Fiscal Year 2020 Consolidated Production of 63,937 Gold Equivalent Ounces

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

...

Orvana Reports Fiscal Year 2020 Consolidated Production of 63,937 Gold Equivalent Ounces

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

...

Antwort auf Beitrag Nr.: 64.777.369 von 02487 am 16.08.20 12:09:02

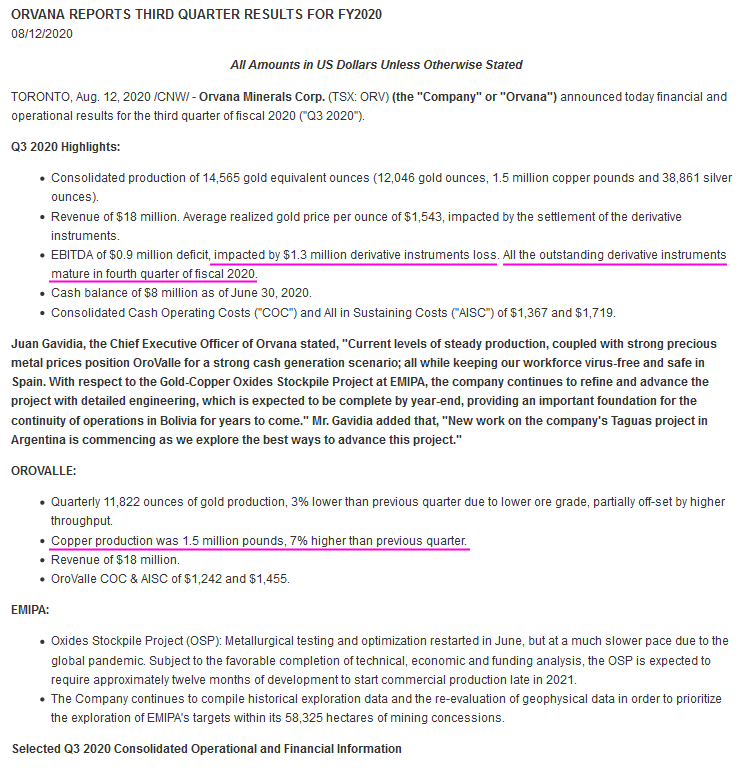

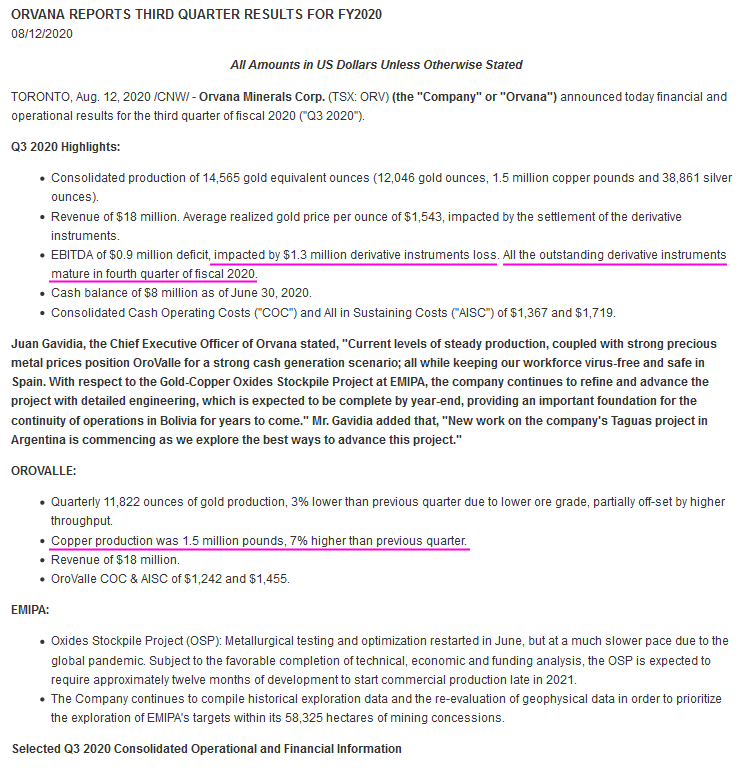

https://finance.yahoo.com/news/orvana-reports-third-quarter-…

>> All the outstanding derivative instruments mature in fourth quarter of fiscal 2020.

Ab Okt-Dez Quartal dieses Jahr sollten die Goldabsicherungen(Derivate) nicht mehr bremsen.

Bremsende Derivate laufen Ende September 2020 aus?

Sorry, hatte vorher im Titel den falschen Monat erwischt.https://finance.yahoo.com/news/orvana-reports-third-quarter-…

>> All the outstanding derivative instruments mature in fourth quarter of fiscal 2020.

Ab Okt-Dez Quartal dieses Jahr sollten die Goldabsicherungen(Derivate) nicht mehr bremsen.

Bremsende Derivate laufen Ende Oktober 2020 aus?

https://finance.yahoo.com/news/orvana-reports-third-quarter-…>> All the outstanding derivative instruments mature in fourth quarter of fiscal 2020.

Ab Okt-Dez Quartal dieses Jahr sollten die Goldabsicherungen(Derivate) nicht mehr bremsen.

Antwort auf Beitrag Nr.: 64.683.736 von faultcode am 07.08.20 14:25:10hier auch noch Spezialisten im Handel mit Gold-Derivaten

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

2 Bemerkungen:

1/ die Gänge werden bei Orvana traditionell nur sehr langsam umgelegt. D.h., erst müssen die doofen Derivate-Kontrakte abgewickelt werden, dann muss Geld verdient werden und dann kann man hoffentlich - nach gefühlt 4 Jahren Vorplanung - mit der Fertig-Planung des Oxide Stockpile Project's in Bolivien beginnen

2/ Orvana ist vermutlich einer der wenigen Goldminer dieser Welt, der aus irgendeinem Grund immer wieder positiv bei der Kupferproduktion überrascht

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

2 Bemerkungen:

1/ die Gänge werden bei Orvana traditionell nur sehr langsam umgelegt. D.h., erst müssen die doofen Derivate-Kontrakte abgewickelt werden, dann muss Geld verdient werden und dann kann man hoffentlich - nach gefühlt 4 Jahren Vorplanung - mit der Fertig-Planung des Oxide Stockpile Project's in Bolivien beginnen

2/ Orvana ist vermutlich einer der wenigen Goldminer dieser Welt, der aus irgendeinem Grund immer wieder positiv bei der Kupferproduktion überrascht

Antwort auf Beitrag Nr.: 62.024.651 von faultcode am 27.11.19 13:34:0411.2.

Orvana Reports First Quarter Results; Provides El Valle and Carlés Exploration Update

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

Juan Gavidia, CEO of Orvana Minerals stated: "Our exploration program at El Valle is providing exciting results, showing potential to continue extending the mine life; at Carlés the drilling campaign is starting, and we expect to provide positive results in the near future". Mr. Gavidia continued, "At Don Mario, the Company is focused on developing final engineering and financing for the Oxides Stockpile Project, and anticipates processing to resume in FY2021."

...

On track to meet FY2020 production guidance.

...

Orvana Reports First Quarter Results; Provides El Valle and Carlés Exploration Update

https://www.orvana.com/English/news/news-details/2020/Orvana…

...

Juan Gavidia, CEO of Orvana Minerals stated: "Our exploration program at El Valle is providing exciting results, showing potential to continue extending the mine life; at Carlés the drilling campaign is starting, and we expect to provide positive results in the near future". Mr. Gavidia continued, "At Don Mario, the Company is focused on developing final engineering and financing for the Oxides Stockpile Project, and anticipates processing to resume in FY2021."

...

On track to meet FY2020 production guidance.

...

Orvana Reports Fourth Quarter and Year-End Financial Results, Provides 2020 Guidance

26.11.https://www.orvana.com/English/news/news-details/2019/Orvana…

=>

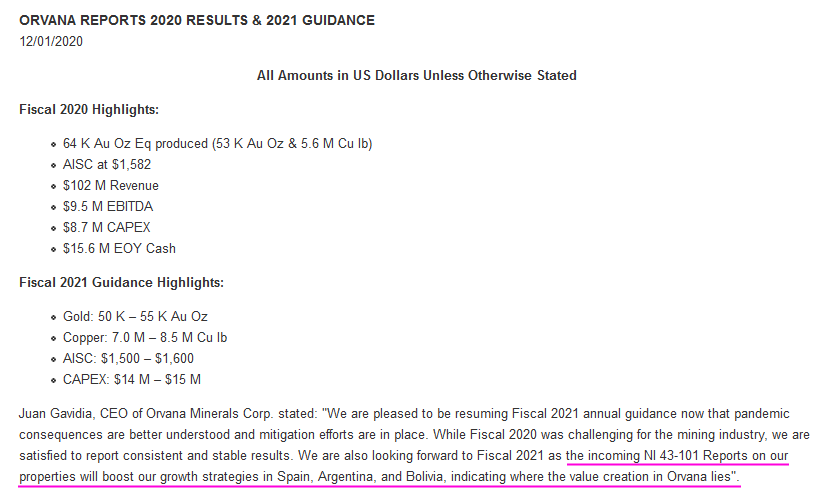

All Amounts in US Dollars Unless Otherwise Stated

Fiscal 2019 Consolidated Highlights:

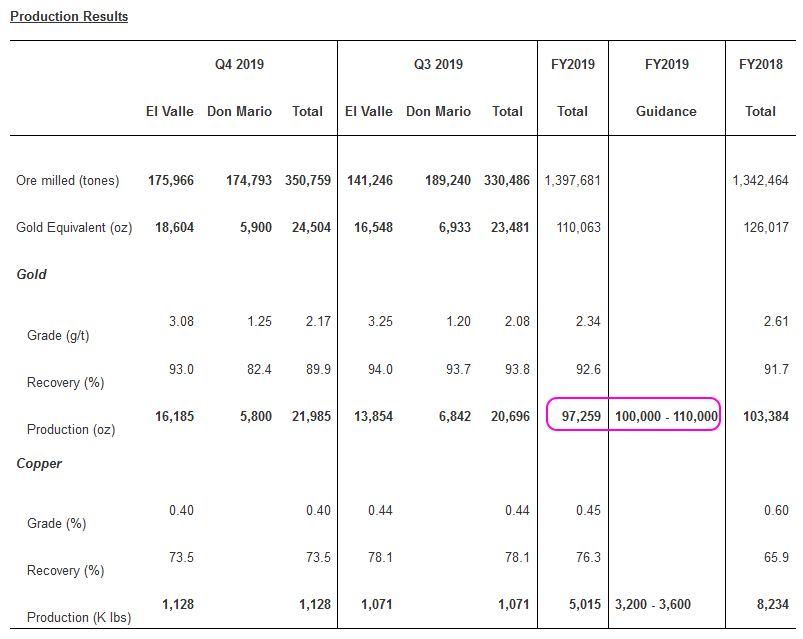

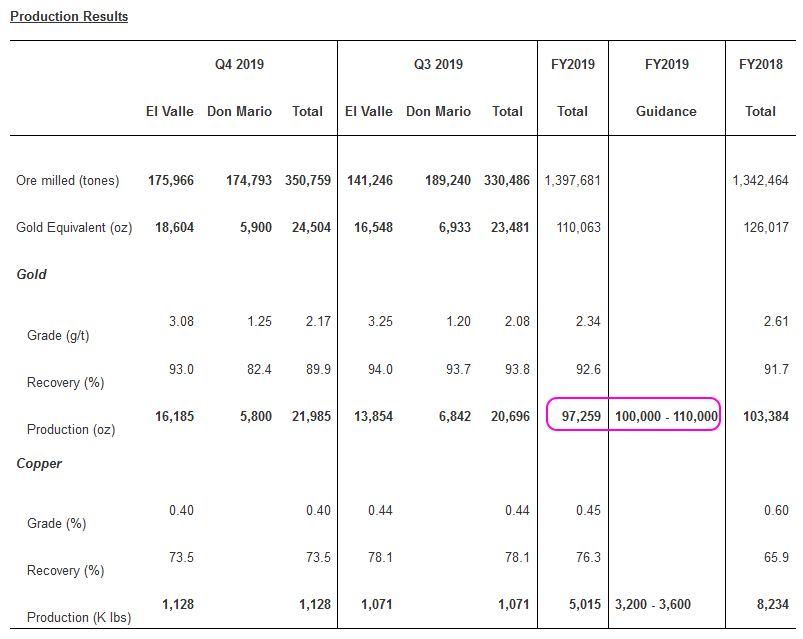

• Production of 110,063 gold equivalent ounces (97,259 gold ounces, 5.0 million copper pounds and 194,693 silver ounces);

• Cash Operating Costs ("COC") and All in Sustaining Costs ("AISC") of $1,094 and $1,253;

• Revenue of $136 million;

• EBITDA of $18.1 million;

• Capital expenditures of $10.9 million;

• Cash balance of $12.4 million as of September 30, 2019.

...

Fiscal 2020 Primary Objectives:

Orovalle:

• Increase the reliability of the underground mining fleet by enhancing current preventive maintenance programs.

• Continue reducing unitary costs, based on current cost reduction programs.

• Conversion of current mineral resources into mineral reserves as well as the definition and addition of new resources to the existing ore bodies to extend the current mine life.

• Continue with the execution of greenfield exploration programs mainly focused on Ortosa-Godán and Lidia permits which will target additional mineral resources to the current mine life.

EMIPA:

• New sulphidization plant circuit development to allow for the processing of the Oxide Stockpile Project (2.18 million tonnes); the Company anticipates that, subject to the favourable completion of technical, economic and funding analysis, the sulphidization circuit and ancillary facilities may be in full production by FY2021.

• Continue development of studies for the reprocessing of tailings for a potential treatment of 8 million tonnes.

• Regional exploration program mainly focused on the Company's land package of 58,000 hectares in the Don Mario Complex.

• Orderly suspension of mining and milling operations, labour restructuring, and expedient implementation of temporary care and maintenance program.

Taguas:

• The Taguas Mine Development project is located in San Juan Province in Argentina. The Company expects to close the acquisition (including the rights transfer registration and the TSX final acceptance) during Q1 2020.

Subject to closing the transaction and securing the required financing, the Company is preparing a drilling program in order to expand the current resources (see news release dated May 14, 2019) and to support the potential upgrade in Mineral Resource estimates.

...

Heute wird es richtig bitter, massiv Probleme...

Orvana provides updates on its Bolivian and Spanish operations

TSX:ORV

TORONTO, Ontario, Nov. 8, 2019 /CNW/ - Orvana Minerals Corp. (TSX:ORV) (the "Company" or "Orvana") is providing an update on operations for its EMIPA operations located in Bolivia and its Orovalle operations, located in Northern Spain.

EMIPA:

The Company has determined to suspend mining operations at Las Tojas effective on or before December 31, 2019 because of a higher than expected ore-grade operational mining dilution with more narrow, erratic and discontinued mineralized structures, which is resulting in uneconomic unitary cost per ounce.

Notwithstanding the suspension of mining operations at Las Tojas, the previously announced development and engineering of the oxides stockpile that has accumulated from past mining activities at Don Mario (the "Oxides Stockpile Project") continues to advance. The Company anticipates that, subject to the favourable completion of technical, economic and funding analysis, the sulphidization circuit and ancillary facilities will be in full production by FY2021 to process the oxides stockpile. During this one-year interim period, contractors will be developing the Oxides Stockpile Project at site, while undertaking care and maintenance of existing facilities.

The oxides stockpile has a mineral resource (Measured) of 2.18 million tonnes with an average gold grade of 1.85 g/t; and contains 386,950 oz of gold equivalent1. The stockpile resource was estimated in the 2016 Report (as that term is defined in endnote no. 1 below) on the assumption that the stockpile would be processed by floatation and would not be included in the carbon-in-leach circuit. However, during FY2018 and FY2019, the Company has been evaluating metallurgical alternatives to process the oxides stockpile, concluding that a sulphidization circuit would maximize the value of the stockpile.

1 Cautionary Statement – Mineral resources that are not mineral reserves do not have demonstrated economic viability. The mineral resource for the oxides stockpile was prepared in compliance with National Instrument 43-101 and CIM guidelines, as set out in the Don Mario Mine Operation 2016 Technical Report dated January 27, 2017 and effective as of September 30, 2016 (the "2016 Report"). A copy of the 2016 Report is posted under the Company's profile on www.sedar.com. These mineral resources were estimated using a gold price of US$1,300 per ounce, copper price of US$3.00 per pound and silver price of US$18 per ounce, prices of which were used in the 2016 Report.

Subject to the ability to convert the estimated resources of the oxides stockpile into reserves, the Oxides Stockpile Project is expected to provide three full production years for Don Mario starting in FY2021.The Company will provide additional details regarding EMIPA and the development of the Oxides Stockpile Project as they become available.

Juan Gavidia, CEO of Orvana stated, "Given the anticipated near-term transition into our Oxides Stockpile Project, it is the right decision to suspend operations at Don Mario to mitigate a higher unitary cost burden onto the Company. Subject to a favourable outcome of the analysis of the feasibility of the oxides stockpile, we are committed to funding and building the Oxides Stockpile Project, which is expected to commence in early FY2021, with 33 months of expected low-cost gold and copper production," Mr. Gavidia continued, "as for our El Valle production, we have worked very hard over the past four years to ensure that the operations are stable, and delivery of gold production remains sustainable."

Technical Disclosure/Qualified Person

Mr. Gino Zandonai, M.Sc. Mining, CP, Mining Engineer is a Qualified Person as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects and he has reviewed and approved the technical information contained in the EMIPA section above.

Orovalle:

The Orovalle mining operations, located in Asturias Spain, consist of the El Valle and the Carlés mines, and include a mill operation. OroValle is a stable producer of gold and copper with fiscal 2019 production of 64,327 ounces of gold and 5.0 million pounds of copper or 76,752 gold equivalent ounces. In the fourth quarter of 2019, gold and copper production increased by 17% and 5% respectively compared to the previous quarter due to higher throughput, including a Carlés Mine short-term open pit project.

Unitary costs at OroValle, reported in the third quarter, were US$987 COC and US$1,154 AISC and are expected to continue to trend downward year-over-year. Based on current gold prices and stable 2019 production numbers, Orovalle is expected to continue generating free cash flow in fiscal 2020. Fourth quarter 2019 financial highlights and full guidance including COC and AISC will be released with the year-end financials, expected mid-December 2019.

Ongoing brownfield and infill drilling in and around the El Valle and Carlés mines is expected to continue strong conversion of resources into reserves and adding new resources to the ore bodies extending the current mine life.

Orovalle has a robust regional exploration package consisting of 45,164 hectares which includes concessions and investigation permits, some of which are still in progress. Strategic near-term regional targets within our permits include:

The Ortosa-Gordan Target, located near the Carlés mine deposit: between 1981 and 2011, 37 diamond drill holes ("DDH") (9,833m) where completed; a 9-hole DDH (5,900m) program is planned for 2020 targeting high-grade skarns and oxide mineralization.

The Lidia target, located in the Navelgas Gold Belt, which is located approximately 20km west of El Valle: between 1998 and 2005, 5 DDH (1,472m) were completed; a 4-hole DDH program (2,000m) is scheduled for 2020, targeting skarn mineralization and disseminated gold in the intrusive.

The Company anticipates spending approximately $1.7M in regional greenfields targets in 2020 to add new mineral resources to the current portfolio.

Technical Disclosure/Qualified Person

Ms. Guadalupe Collar, European Geologist, is a Qualified Person as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects and she has reviewed and approved the technical information contained in the OroValle section above.

About Orvana

Orvana's mining assets consist of the El Valle and Carlés gold-copper-silver mines in northern Spain and the mining rights on the Don Mario gold property in Bolivia. Additional information is available at Orvana's website (www.orvana.com).

Cautionary Statements - Forward-Looking Information

Certain statements made herein constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws ("forward-looking statements"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, potentials, future events or performance (often, but not always, using words or phrases such as "believes", "expects", "plans", "estimates" or "intends" or stating that certain actions, events or results "may", "could", "would", "might", "will" or "are projected to" be taken or achieved) are not statements of historical fact, but are forward-looking statements.

The forward-looking statements herein relate to, among other things, Orvana's ability to achieve improvement in free cash flow; the potential to extend the mine life of El Valle and Don Mario beyond their current life-of-mine estimates including specifically, but not limited to in the case of Don Mario, the processing of the mineral stockpiles and the reprocessing of the tailings material; Orvana's ability to optimize its assets to deliver shareholder value; the Company's ability to optimize productivity at Don Mario and El Valle; estimates of future production, operating costs and capital expenditures; mineral resource and reserve estimates; statements and information regarding future feasibility studies and their results; future transactions; future metal prices; the ability to achieve additional growth and geographic diversification; future financial performance, including the ability to increase cash flow and profits; future financing requirements; and mine development plans.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates and assumptions of the Company contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in Orvana's most recently filed Management's Discussion & Analysis and Annual Information Form in respect of the Company's most recently completed fiscal year (the "Company Disclosures") or as otherwise expressly incorporated herein by reference as well as: there being no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at El Valle and Don Mario being consistent with the Company's current expectations; political developments in any jurisdiction in which the Company operates being consistent with its current expectations; certain price assumptions for gold, copper and silver; prices for key supplies being approximately consistent with current levels; production and cost of sales forecasts meeting expectations; the accuracy of the Company's current mineral reserve and mineral resource estimates; and labour and materials costs increasing on a basis consistent with Orvana's current expectations.

A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include fluctuations in the price of gold, silver and copper; the need to recalculate estimates of resources based on actual production experience; the failure to achieve production estimates; variations in the grade of ore mined; variations in the cost of operations; the availability of qualified personnel; the Company's ability to obtain and maintain all necessary regulatory approvals and licenses; the Company's ability to use cyanide in its mining operations; risks generally associated with mineral exploration and development, including the Company's ability to continue to operate the El Valle and/or Don Mario and/or ability to resume long-term operations at the Carlés Mine; the Company's ability to successfully implement a sulphidization circuit and ancillary facilities to process the current oxides stockpiles at Don Mario; the Company's ability to acquire and develop mineral properties and to successfully integrate such acquisitions; the Company's ability to execute on its strategy; the Company's ability to obtain financing when required on terms that are acceptable to the Company; challenges to the Company's interests in its property and mineral rights; current, pending and proposed legislative or regulatory developments or changes in political, social or economic conditions in the countries in which the Company operates; general economic conditions worldwide; and the risks identified in the Company's disclosures. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's Disclosures for a description of additional risk factors.

Any forward-looking statements made herein with respect to the anticipated development and exploration of the Company's mineral projects are intended to provide an overview of management's expectations with respect to certain future activities of the Company and may not be appropriate for other purposes.

Forward-looking statements are based on management's current plans, estimates, projections, beliefs and opinions and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Readers are cautioned not to put undue reliance on forward-looking statements.

The forward-looking statements made herein are intended to provide an overview of management's expectations with respect to certain future operating activities of the Company and may not be appropriate for other purposes.

Nuria Menéndez, Chief Financial Officer, E: nmenendez@orvana.com; Joanne Jobin, Investor Relations Officer, E: jjobin@orvana.com, T: 647 964 0292

https://ceo.ca/@newswire/orvana-provides-updates-on-its-boli…

Orvana provides updates on its Bolivian and Spanish operations

TSX:ORV

TORONTO, Ontario, Nov. 8, 2019 /CNW/ - Orvana Minerals Corp. (TSX:ORV) (the "Company" or "Orvana") is providing an update on operations for its EMIPA operations located in Bolivia and its Orovalle operations, located in Northern Spain.

EMIPA:

The Company has determined to suspend mining operations at Las Tojas effective on or before December 31, 2019 because of a higher than expected ore-grade operational mining dilution with more narrow, erratic and discontinued mineralized structures, which is resulting in uneconomic unitary cost per ounce.

Notwithstanding the suspension of mining operations at Las Tojas, the previously announced development and engineering of the oxides stockpile that has accumulated from past mining activities at Don Mario (the "Oxides Stockpile Project") continues to advance. The Company anticipates that, subject to the favourable completion of technical, economic and funding analysis, the sulphidization circuit and ancillary facilities will be in full production by FY2021 to process the oxides stockpile. During this one-year interim period, contractors will be developing the Oxides Stockpile Project at site, while undertaking care and maintenance of existing facilities.

The oxides stockpile has a mineral resource (Measured) of 2.18 million tonnes with an average gold grade of 1.85 g/t; and contains 386,950 oz of gold equivalent1. The stockpile resource was estimated in the 2016 Report (as that term is defined in endnote no. 1 below) on the assumption that the stockpile would be processed by floatation and would not be included in the carbon-in-leach circuit. However, during FY2018 and FY2019, the Company has been evaluating metallurgical alternatives to process the oxides stockpile, concluding that a sulphidization circuit would maximize the value of the stockpile.

1 Cautionary Statement – Mineral resources that are not mineral reserves do not have demonstrated economic viability. The mineral resource for the oxides stockpile was prepared in compliance with National Instrument 43-101 and CIM guidelines, as set out in the Don Mario Mine Operation 2016 Technical Report dated January 27, 2017 and effective as of September 30, 2016 (the "2016 Report"). A copy of the 2016 Report is posted under the Company's profile on www.sedar.com. These mineral resources were estimated using a gold price of US$1,300 per ounce, copper price of US$3.00 per pound and silver price of US$18 per ounce, prices of which were used in the 2016 Report.

Subject to the ability to convert the estimated resources of the oxides stockpile into reserves, the Oxides Stockpile Project is expected to provide three full production years for Don Mario starting in FY2021.The Company will provide additional details regarding EMIPA and the development of the Oxides Stockpile Project as they become available.

Juan Gavidia, CEO of Orvana stated, "Given the anticipated near-term transition into our Oxides Stockpile Project, it is the right decision to suspend operations at Don Mario to mitigate a higher unitary cost burden onto the Company. Subject to a favourable outcome of the analysis of the feasibility of the oxides stockpile, we are committed to funding and building the Oxides Stockpile Project, which is expected to commence in early FY2021, with 33 months of expected low-cost gold and copper production," Mr. Gavidia continued, "as for our El Valle production, we have worked very hard over the past four years to ensure that the operations are stable, and delivery of gold production remains sustainable."

Technical Disclosure/Qualified Person

Mr. Gino Zandonai, M.Sc. Mining, CP, Mining Engineer is a Qualified Person as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects and he has reviewed and approved the technical information contained in the EMIPA section above.

Orovalle:

The Orovalle mining operations, located in Asturias Spain, consist of the El Valle and the Carlés mines, and include a mill operation. OroValle is a stable producer of gold and copper with fiscal 2019 production of 64,327 ounces of gold and 5.0 million pounds of copper or 76,752 gold equivalent ounces. In the fourth quarter of 2019, gold and copper production increased by 17% and 5% respectively compared to the previous quarter due to higher throughput, including a Carlés Mine short-term open pit project.

Unitary costs at OroValle, reported in the third quarter, were US$987 COC and US$1,154 AISC and are expected to continue to trend downward year-over-year. Based on current gold prices and stable 2019 production numbers, Orovalle is expected to continue generating free cash flow in fiscal 2020. Fourth quarter 2019 financial highlights and full guidance including COC and AISC will be released with the year-end financials, expected mid-December 2019.

Ongoing brownfield and infill drilling in and around the El Valle and Carlés mines is expected to continue strong conversion of resources into reserves and adding new resources to the ore bodies extending the current mine life.

Orovalle has a robust regional exploration package consisting of 45,164 hectares which includes concessions and investigation permits, some of which are still in progress. Strategic near-term regional targets within our permits include:

The Ortosa-Gordan Target, located near the Carlés mine deposit: between 1981 and 2011, 37 diamond drill holes ("DDH") (9,833m) where completed; a 9-hole DDH (5,900m) program is planned for 2020 targeting high-grade skarns and oxide mineralization.

The Lidia target, located in the Navelgas Gold Belt, which is located approximately 20km west of El Valle: between 1998 and 2005, 5 DDH (1,472m) were completed; a 4-hole DDH program (2,000m) is scheduled for 2020, targeting skarn mineralization and disseminated gold in the intrusive.

The Company anticipates spending approximately $1.7M in regional greenfields targets in 2020 to add new mineral resources to the current portfolio.

Technical Disclosure/Qualified Person

Ms. Guadalupe Collar, European Geologist, is a Qualified Person as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects and she has reviewed and approved the technical information contained in the OroValle section above.

About Orvana

Orvana's mining assets consist of the El Valle and Carlés gold-copper-silver mines in northern Spain and the mining rights on the Don Mario gold property in Bolivia. Additional information is available at Orvana's website (www.orvana.com).

Cautionary Statements - Forward-Looking Information

Certain statements made herein constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws ("forward-looking statements"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, potentials, future events or performance (often, but not always, using words or phrases such as "believes", "expects", "plans", "estimates" or "intends" or stating that certain actions, events or results "may", "could", "would", "might", "will" or "are projected to" be taken or achieved) are not statements of historical fact, but are forward-looking statements.

The forward-looking statements herein relate to, among other things, Orvana's ability to achieve improvement in free cash flow; the potential to extend the mine life of El Valle and Don Mario beyond their current life-of-mine estimates including specifically, but not limited to in the case of Don Mario, the processing of the mineral stockpiles and the reprocessing of the tailings material; Orvana's ability to optimize its assets to deliver shareholder value; the Company's ability to optimize productivity at Don Mario and El Valle; estimates of future production, operating costs and capital expenditures; mineral resource and reserve estimates; statements and information regarding future feasibility studies and their results; future transactions; future metal prices; the ability to achieve additional growth and geographic diversification; future financial performance, including the ability to increase cash flow and profits; future financing requirements; and mine development plans.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates and assumptions of the Company contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in Orvana's most recently filed Management's Discussion & Analysis and Annual Information Form in respect of the Company's most recently completed fiscal year (the "Company Disclosures") or as otherwise expressly incorporated herein by reference as well as: there being no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at El Valle and Don Mario being consistent with the Company's current expectations; political developments in any jurisdiction in which the Company operates being consistent with its current expectations; certain price assumptions for gold, copper and silver; prices for key supplies being approximately consistent with current levels; production and cost of sales forecasts meeting expectations; the accuracy of the Company's current mineral reserve and mineral resource estimates; and labour and materials costs increasing on a basis consistent with Orvana's current expectations.

A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include fluctuations in the price of gold, silver and copper; the need to recalculate estimates of resources based on actual production experience; the failure to achieve production estimates; variations in the grade of ore mined; variations in the cost of operations; the availability of qualified personnel; the Company's ability to obtain and maintain all necessary regulatory approvals and licenses; the Company's ability to use cyanide in its mining operations; risks generally associated with mineral exploration and development, including the Company's ability to continue to operate the El Valle and/or Don Mario and/or ability to resume long-term operations at the Carlés Mine; the Company's ability to successfully implement a sulphidization circuit and ancillary facilities to process the current oxides stockpiles at Don Mario; the Company's ability to acquire and develop mineral properties and to successfully integrate such acquisitions; the Company's ability to execute on its strategy; the Company's ability to obtain financing when required on terms that are acceptable to the Company; challenges to the Company's interests in its property and mineral rights; current, pending and proposed legislative or regulatory developments or changes in political, social or economic conditions in the countries in which the Company operates; general economic conditions worldwide; and the risks identified in the Company's disclosures. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's Disclosures for a description of additional risk factors.

Any forward-looking statements made herein with respect to the anticipated development and exploration of the Company's mineral projects are intended to provide an overview of management's expectations with respect to certain future activities of the Company and may not be appropriate for other purposes.

Forward-looking statements are based on management's current plans, estimates, projections, beliefs and opinions and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Readers are cautioned not to put undue reliance on forward-looking statements.

The forward-looking statements made herein are intended to provide an overview of management's expectations with respect to certain future operating activities of the Company and may not be appropriate for other purposes.

Nuria Menéndez, Chief Financial Officer, E: nmenendez@orvana.com; Joanne Jobin, Investor Relations Officer, E: jjobin@orvana.com, T: 647 964 0292

https://ceo.ca/@newswire/orvana-provides-updates-on-its-boli…

Antwort auf Beitrag Nr.: 61.724.540 von faultcode am 19.10.19 11:20:40

Zum Chart her 👉 zurück auf los! Ich habe mal nachgekauft. Chartniveau an guter Unterstützung und die financials dürften gar nicht mal so schlecht sein. Aus meiner Sicht kann man Orvana aktuell beruhigter kaufen als 2018, wo ich es das erste Mal getan hab. Seitdem Gold rund 200 Dollar up...

Zitat von faultcode: Bloomberg gibt das P/B mit zuletzt 0.2597 an: https://www.bloomberg.com/quote/ORV:CN

--> bei Yahoo finance sind es 0.34

--> so gesehen, immer noch sehr günstiger Wert (was ja auch seine Gründe hat; siehe oben)

Zum Chart her 👉 zurück auf los! Ich habe mal nachgekauft. Chartniveau an guter Unterstützung und die financials dürften gar nicht mal so schlecht sein. Aus meiner Sicht kann man Orvana aktuell beruhigter kaufen als 2018, wo ich es das erste Mal getan hab. Seitdem Gold rund 200 Dollar up...

Antwort auf Beitrag Nr.: 61.724.477 von faultcode am 19.10.19 11:13:45Bloomberg gibt das P/B mit zuletzt 0.2597 an: https://www.bloomberg.com/quote/ORV:CN

--> bei Yahoo finance sind es 0.34

--> so gesehen, immer noch sehr günstiger Wert (was ja auch seine Gründe hat; siehe oben)

--> bei Yahoo finance sind es 0.34

--> so gesehen, immer noch sehr günstiger Wert (was ja auch seine Gründe hat; siehe oben)

Antwort auf Beitrag Nr.: 61.035.268 von faultcode am 16.07.19 12:27:24

https://www.orvana.com/English/news/news-details/2019/Orvana…

--> Produktionsziel bei Gold für FY2019 mit mind. 100k oz. nicht ganz erreicht:

...

ansonsten:

FY2020 Outlook

• El Valle to continue aggressive underground infill drilling to keep replenishing depletion.

• Don Mario to complete development of the Oxides Stockpile Project to add three years to its mine life.

• FY2020 guidance will be released with FY2019 year-end financials.

...

Orvana Reports Fiscal Year 2019 Consolidated Production of 110,063 Gold Equivalent Ounces

17.10.https://www.orvana.com/English/news/news-details/2019/Orvana…

--> Produktionsziel bei Gold für FY2019 mit mind. 100k oz. nicht ganz erreicht:

...

ansonsten:

FY2020 Outlook

• El Valle to continue aggressive underground infill drilling to keep replenishing depletion.

• Don Mario to complete development of the Oxides Stockpile Project to add three years to its mine life.

• FY2020 guidance will be released with FY2019 year-end financials.

...

Antwort auf Beitrag Nr.: 61.413.779 von Schlaubayer am 04.09.19 23:35:41Auszug Orvana.com, Mitteilung vom 9.9.19

TSX:ORV

TORONTO, Sept. 9, 2019 /CNW/ - Orvana Minerals Corp. (TSX:ORV) (the "Company" or "Orvana") is pleased to announce that it will be attending the Precious Metals Summit in Beaver Creek, and the Denver Gold Forum in Denver, both in Colorado. In this regard a summary operational update is provided.

Precious Metals Summit & Denver Gold Forum

Mr. Juan Gavidia, Chief Executive Officer, Ms. Nuria Menendez, Chief Financial Officer and Mr. Raúl Álvarez, Exploration Manager, will be attending the Precious Metals Summit held at Beaver Creek, Colorado from September 9-13, 2019. The Company will also be attending and presenting at the Denver Gold Forum, Exploration & Development, held in Denver, Colorado from September 15-18, 2019. Mr. Gavidia will be presenting on Wednesday, September 18, 2019 at 11:30 a.m. (MT). The Company Presentation and webcast will be available on Orvana's website.

El Valle (Spain) Update

During the fourth quarter of fiscal 2019, the Company restarted production at its Carlés Mine with a short-term open pit project, as scheduled. Further Carlés exploration activities are scheduled in the near term. El Valle continues to fine-tune the oxides fleet with higher capacity equipment to improve efficiencies and availability; evaluate backfill processes to improve logistic efficiencies with a focus on cost control; and is progressing on the ventilation system upgrade at El Valle, with emphasis on power cost control.

Don Mario (Bolivia) Update

The Company completed its exploration activities at Las Tojas in the third quarter of fiscal 2019, followed by the transition of open pit operations from Cerro Felix to Las Tojas during mid-August 2019. The Company is currently evaluating near-term production levels at the Las Tojas open pit as its parameters differ from its predecessor Cerro Felix. Continuous design and execution of fine-tuning is ongoing. The evaluation of processing stockpiled oxides continues as a priority and the re-processing of tailings is another revenue opportunity for the medium term.

Taguas (Argentina)

The Company entered into a purchase agreement with Compañía Minera Taguas S.A. on May 14, 2019 to acquire the Taguas gold property located in the Province of San Juan, Argentina. Taguas consists of 15 mining concessions over an area of 3,273.87 ha. It is located in the Province of San Juan, Argentina, on the eastern flank of the Andes, between 3,500 m to 4,300 m above sea level. The Company is in the process of making the applicable company and business registrations pursuant to local legislation and regulations in Argentina, to facilitate the closing of the acquisition of Taguas. Subject to the final acceptance of the TSX upon filing of certain closing documents and the completion of applicable registrations with local authorities in Argentina, the Company expects to complete the acquisition of Taguas during fiscal 2020. A Preliminary Economic Assessment Report effective May 14, 2019 for Taguas is available under the Company's profile on SEDAR.

TSX:ORV

TORONTO, Sept. 9, 2019 /CNW/ - Orvana Minerals Corp. (TSX:ORV) (the "Company" or "Orvana") is pleased to announce that it will be attending the Precious Metals Summit in Beaver Creek, and the Denver Gold Forum in Denver, both in Colorado. In this regard a summary operational update is provided.

Precious Metals Summit & Denver Gold Forum

Mr. Juan Gavidia, Chief Executive Officer, Ms. Nuria Menendez, Chief Financial Officer and Mr. Raúl Álvarez, Exploration Manager, will be attending the Precious Metals Summit held at Beaver Creek, Colorado from September 9-13, 2019. The Company will also be attending and presenting at the Denver Gold Forum, Exploration & Development, held in Denver, Colorado from September 15-18, 2019. Mr. Gavidia will be presenting on Wednesday, September 18, 2019 at 11:30 a.m. (MT). The Company Presentation and webcast will be available on Orvana's website.

El Valle (Spain) Update

During the fourth quarter of fiscal 2019, the Company restarted production at its Carlés Mine with a short-term open pit project, as scheduled. Further Carlés exploration activities are scheduled in the near term. El Valle continues to fine-tune the oxides fleet with higher capacity equipment to improve efficiencies and availability; evaluate backfill processes to improve logistic efficiencies with a focus on cost control; and is progressing on the ventilation system upgrade at El Valle, with emphasis on power cost control.

Don Mario (Bolivia) Update

The Company completed its exploration activities at Las Tojas in the third quarter of fiscal 2019, followed by the transition of open pit operations from Cerro Felix to Las Tojas during mid-August 2019. The Company is currently evaluating near-term production levels at the Las Tojas open pit as its parameters differ from its predecessor Cerro Felix. Continuous design and execution of fine-tuning is ongoing. The evaluation of processing stockpiled oxides continues as a priority and the re-processing of tailings is another revenue opportunity for the medium term.

Taguas (Argentina)

The Company entered into a purchase agreement with Compañía Minera Taguas S.A. on May 14, 2019 to acquire the Taguas gold property located in the Province of San Juan, Argentina. Taguas consists of 15 mining concessions over an area of 3,273.87 ha. It is located in the Province of San Juan, Argentina, on the eastern flank of the Andes, between 3,500 m to 4,300 m above sea level. The Company is in the process of making the applicable company and business registrations pursuant to local legislation and regulations in Argentina, to facilitate the closing of the acquisition of Taguas. Subject to the final acceptance of the TSX upon filing of certain closing documents and the completion of applicable registrations with local authorities in Argentina, the Company expects to complete the acquisition of Taguas during fiscal 2020. A Preliminary Economic Assessment Report effective May 14, 2019 for Taguas is available under the Company's profile on SEDAR.

Der Kurs wird durch kleinste Volumen klein gehalten.

Das Ding ist wie eine gespannte Feder - 100 Prozent intraday würden mich zumindest nicht wundern.

Das Ding ist wie eine gespannte Feder - 100 Prozent intraday würden mich zumindest nicht wundern.