U3O8 Corp. - Kanadischer Uranexplorer in Guyana - 500 Beiträge pro Seite

eröffnet am 23.08.07 13:08:33 von

neuester Beitrag 20.01.17 21:59:46 von

neuester Beitrag 20.01.17 21:59:46 von

Beiträge: 123

ID: 1.132.036

ID: 1.132.036

Aufrufe heute: 0

Gesamt: 6.159

Gesamt: 6.159

Aktive User: 0

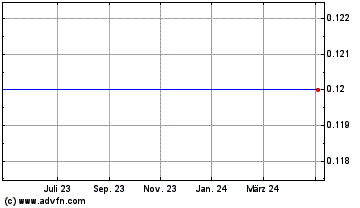

ISIN: CA3933801001 · WKN: A3DT77 · Symbol: GCOM

0,0500

CAD

-16,67 %

-0,0100 CAD

Letzter Kurs 22.04.24 TSX Venture

Neuigkeiten

09.04.24 · IRW Press |

09.04.24 · globenewswire |

25.02.24 · Jörg Schulte Anzeige |

21.01.24 · Jörg Schulte Anzeige |

14.01.24 · Jörg Schulte Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 1,7500 | +15,13 | |

| 11,180 | +14,08 | |

| 208,00 | +13,60 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7250 | -14,71 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 | |

| 46,80 | -98,06 |

U308 Corp. - Kanadischer Uranexplorer mit Projekten in Guyana

WKN: A0LG2H

ISIN: CA9034151071

Symbol TSX-V: UWE

Cash/Working Capital: $27,000,000 (Stand Mai 2007)

End of Day Data Last Updated: 22 Aug 2007

Rolling 52 Week High: $5.850

Rolling 52 Week Low: $0.860

Last Close: $1.40

Total Number of Shares: 23,051,700

Shares in Escrow: 6,075,000

Net Shares Outstanding: 16,976,700

Float Quoted Market Value: $23,767,380

Warrants/Optionen (Stand Mai 2007)

22,981,500 Common Shares issued and outstanding

644,500 broker warrants outstanding which would raise $1,611,250 if exercised in full

2,050,000 options outstanding which would raise $5,226,700 if exercised in full.

Kurs Frankfurt derzeit: 1,00 Euro

Projekte

U308 Corp hat zwei Permits in Guyana, deren erste Explorationsphase Anfang August mit positiven Resultaten abgeschlossen wurde.

Permit A 579,417 Hektar im Cuyuni/Mazaruni und Potaro Mining Distrikt

Permit B 746,309 Hektar im Potaro, Cuyuni/Mazaruni und Rupununi Mining Distrikt

Die Ergebnisse der ersten Explorationsphase wurden positiv kommentiert, Details sind auf der Website von U308 nachzulesen:

http://www.u308corp.com/

U308 Corp ist wie der gesamte Sektor arg unter die Räder gekommen, es zeichnet sich in den letzten Tagen aber eine Erholung ab.

Das weeitere Bohrprogramm ist durch den vorhandenen Cash mehr als finanziert, Kapitalmaßnahmen und eine Verwässerung des Aktienkurses sind nicht zu erwarten.

Meiner Meinung nach, eine extrem unterbewerterte Aktie, sieht man sich die finanzielle Situation und die positiven Explorationsergebnisse an.

Canaccord hat am 2.8.2007 ein Kursziel von $7.40 gesetzt:

Toni Wallis, PGeo toni.wallis@canaccordadams.com

UWE : TSX-V : C$1.80 | C$41.2M | Speculative Buy , Target C$7.40

Releases drill results from Aricheng South and West - final eight holes from Phase 1 drilling Event

U3O8 Corp. yesterday reported the results from the eight remaining holes in the Phase 1 drill program at Aricheng.

All holes intersected uranium mineralization. Five holes were completed at Aricheng South with the best holes (ARS-001 and ARS-002) having 17.5 metres grading 0.12% (2.42 lbs/t) U3O8, and 3.5 metres grading 0.301% (6.02lbs/t) U3O8.

Three holes were completed at Aricheng West with the best intersection being 8.0 metres grading 0.094% (1.88lbs/t) U3O8 in ARW-001.

Several holes from both zones intersected multiple zones of mineralization within 100 metres vertical depth from surface.

The originally proposed 16-hole program was reduced to 15 holes due to extensive rainfall. The Phase 2 drill program is in final planning stages and is expected to commence in mid- August to further test the Aricheng targets, as well as other targets on the Kurupung batholith.

Impact

The results from the Phase 1 program have confirmed that the Aricheng area contains uranium rich mineralization.

The grades reported are in line with estimates and validate previous work by Cogema in the 1980s.

Valuation

We have applied Canaccord Adams in situ average value for uranium of US$6.00 per pound for Inferred Resources to the estimated initial resource at Aricheng.

We had used an average grade of 0.15% U3O8 to derive a risk-adjusted value of US$153.00 million or C$7.42 per share (adjusted using the C$:US$ exchange rate at 1.00:0.90).

We maintain our recommendation for U3O8 Corp. as a SPECULATIVE BUY but reduce our target price from C$7.90 to C$7.40 per share.

WKN: A0LG2H

ISIN: CA9034151071

Symbol TSX-V: UWE

Cash/Working Capital: $27,000,000 (Stand Mai 2007)

End of Day Data Last Updated: 22 Aug 2007

Rolling 52 Week High: $5.850

Rolling 52 Week Low: $0.860

Last Close: $1.40

Total Number of Shares: 23,051,700

Shares in Escrow: 6,075,000

Net Shares Outstanding: 16,976,700

Float Quoted Market Value: $23,767,380

Warrants/Optionen (Stand Mai 2007)

22,981,500 Common Shares issued and outstanding

644,500 broker warrants outstanding which would raise $1,611,250 if exercised in full

2,050,000 options outstanding which would raise $5,226,700 if exercised in full.

Kurs Frankfurt derzeit: 1,00 Euro

Projekte

U308 Corp hat zwei Permits in Guyana, deren erste Explorationsphase Anfang August mit positiven Resultaten abgeschlossen wurde.

Permit A 579,417 Hektar im Cuyuni/Mazaruni und Potaro Mining Distrikt

Permit B 746,309 Hektar im Potaro, Cuyuni/Mazaruni und Rupununi Mining Distrikt

Die Ergebnisse der ersten Explorationsphase wurden positiv kommentiert, Details sind auf der Website von U308 nachzulesen:

http://www.u308corp.com/

U308 Corp ist wie der gesamte Sektor arg unter die Räder gekommen, es zeichnet sich in den letzten Tagen aber eine Erholung ab.

Das weeitere Bohrprogramm ist durch den vorhandenen Cash mehr als finanziert, Kapitalmaßnahmen und eine Verwässerung des Aktienkurses sind nicht zu erwarten.

Meiner Meinung nach, eine extrem unterbewerterte Aktie, sieht man sich die finanzielle Situation und die positiven Explorationsergebnisse an.

Canaccord hat am 2.8.2007 ein Kursziel von $7.40 gesetzt:

Toni Wallis, PGeo toni.wallis@canaccordadams.com

UWE : TSX-V : C$1.80 | C$41.2M | Speculative Buy , Target C$7.40

Releases drill results from Aricheng South and West - final eight holes from Phase 1 drilling Event

U3O8 Corp. yesterday reported the results from the eight remaining holes in the Phase 1 drill program at Aricheng.

All holes intersected uranium mineralization. Five holes were completed at Aricheng South with the best holes (ARS-001 and ARS-002) having 17.5 metres grading 0.12% (2.42 lbs/t) U3O8, and 3.5 metres grading 0.301% (6.02lbs/t) U3O8.

Three holes were completed at Aricheng West with the best intersection being 8.0 metres grading 0.094% (1.88lbs/t) U3O8 in ARW-001.

Several holes from both zones intersected multiple zones of mineralization within 100 metres vertical depth from surface.

The originally proposed 16-hole program was reduced to 15 holes due to extensive rainfall. The Phase 2 drill program is in final planning stages and is expected to commence in mid- August to further test the Aricheng targets, as well as other targets on the Kurupung batholith.

Impact

The results from the Phase 1 program have confirmed that the Aricheng area contains uranium rich mineralization.

The grades reported are in line with estimates and validate previous work by Cogema in the 1980s.

Valuation

We have applied Canaccord Adams in situ average value for uranium of US$6.00 per pound for Inferred Resources to the estimated initial resource at Aricheng.

We had used an average grade of 0.15% U3O8 to derive a risk-adjusted value of US$153.00 million or C$7.42 per share (adjusted using the C$:US$ exchange rate at 1.00:0.90).

We maintain our recommendation for U3O8 Corp. as a SPECULATIVE BUY but reduce our target price from C$7.90 to C$7.40 per share.

...

Sep 06, 2007 09:10 ET

U3O8 Corp. Provides Exploration Drilling Update

TORONTO, ONTARIO--(Marketwire - Sept. 6, 2007) - U3O8 Corp. (TSX VENTURE:UWE) ("Company") announces details of Phase II drilling in the Aricheng area, located in Permit A, Guyana South America. Initial drilling has started at Aricheng North and will proceed to Aricheng South and Aricheng West. These three areas have been prioritized for follow-up drilling based on results from the Phase I drilling program in combination with the interpretation of the limited historical data set. Significant downhole results from the completed Phase I drilling program in the Aricheng North area include:

- 7.5 meters at 0.13% U3O8 in hole ARN-002

- 11.0 meters at 0.233% U3O8 in hole ARN-003

- 9.0 meters at 0.221% U3O8 in hole ARN-006.

Complete results are available on SEDAR and have been detailed in previous press releases dated May 9, 2007 and June 19, 2007. Basement related uranium mineralization in the Aricheng area is hosted in a northwest trending shear zone in granodiorite.

Phase II drilling at Aricheng North will consist of 17 holes for a total of approximately 2,140 meters and will concentrate on extending mineralization along strike and at depth in two zones identified from Phase I drilling. Once drilling is complete at Aricheng North, the drill rig will be moved to Aricheng South and Aricheng West where a minimum combined total of 2,280 meters in 19 holes will be drilled to test for mineralization along strike.

Assay results from the first zone at Aricheng North are expected to be available in October barring delays at the analytical laboratory.

The exploration focus to date has been on basement hosted uranium mineralization in the Kurupung Batholith (please see Figure 1: Kurupung Batholith Map). Approximately 35 km2 have been explored in the Aricheng area. There are 25 targets identified by the airborne radiometric survey that are hosted by the 360 km2 Kurupung Batholith.

Reconnaissance exploration is evaluating targets in the Kurupung Batholith outside of the Aricheng area. Currently, four geologists are conducting reconnaissance in the Accori - Meamu area northwest of Aricheng. A satellite camp has been established and ground scintillometer surveying and detailed mapping is currently underway. Upon completion of the Aricheng area drilling, a 2,000 meter drilling program is planned to drill test anomalies identified during the ongoing regional reconnaissance program.

"We are pleased with the exploration progress to date. Field activities are on schedule and budget. The exploration plan continues to confirm and enhance the partial historical data set that was availed to the company" said Allan Ibbitson President and C.E.O. "We are still in the early exploration stage in the course of better understanding uranium mineralization associated with the Kurupung Batholith."

The Company is well funded with over $25 million held solely in cash and Canadian chartered bank backed Guaranteed Investment Certificates.

About U3O8 Corp.

U3O8 Corp. is a Canadian junior mineral exploration company based in Toronto, Canada. Currently focused on uranium exploration in the Roraima Basin area of Guyana, South America, U3O8 Corp.'s primary business objective is to acquire, explore and develop uranium projects in the Americas. Under its current exploration schedule, the Company expects to be fully funded for the next three years.

The Company has exclusive uranium exploration rights in two permitted areas in the Roraima Basin area of Guyana. The Permit Area A property covers approximately 579,500 hectares. The Permit Area B property covers approximately 750,900 hectares. This latter area is of particular interest as it is geologically similar to the unconformity related uranium deposits in the Athabasca region in Saskatchewan.

Richard Cleath, Vice President of U3O8 Corp, a qualified person within the definition of that term in National Instrument 43-101 of the Canadian Securities Administrators, has supervised the preparation of and verified the technical information contained in this news release. For further details on the property interests of the Company, please refer to the technical report entitled "Technical Report on the Prometheus Uranium Project" dated September 15, 2006 as amended and restated December 12, 2006 authored by Clinton Davis, available on SEDAR at www.sedar.com.

Forward Looking Statements

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of U3O8 Corp., including, but not limited to the impact of general economic conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, dependence upon regulatory approvals and exploration risk. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.

Shares Outstanding

Basic: 23,057,700

Fully diluted: 25,676,000

Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a mineral resource on any of the Company's properties and it is uncertain if further exploration will result in any such target being delineated as a mineral resource.

To view a copy of "Figure 1: Kurupung Batholith Map", please visit the link below:

http://www.ccnmatthews.com/docs/uwemap906.pdf.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

U3O8 Corp. Provides Exploration Drilling Update

TORONTO, ONTARIO--(Marketwire - Sept. 6, 2007) - U3O8 Corp. (TSX VENTURE:UWE) ("Company") announces details of Phase II drilling in the Aricheng area, located in Permit A, Guyana South America. Initial drilling has started at Aricheng North and will proceed to Aricheng South and Aricheng West. These three areas have been prioritized for follow-up drilling based on results from the Phase I drilling program in combination with the interpretation of the limited historical data set. Significant downhole results from the completed Phase I drilling program in the Aricheng North area include:

- 7.5 meters at 0.13% U3O8 in hole ARN-002

- 11.0 meters at 0.233% U3O8 in hole ARN-003

- 9.0 meters at 0.221% U3O8 in hole ARN-006.

Complete results are available on SEDAR and have been detailed in previous press releases dated May 9, 2007 and June 19, 2007. Basement related uranium mineralization in the Aricheng area is hosted in a northwest trending shear zone in granodiorite.

Phase II drilling at Aricheng North will consist of 17 holes for a total of approximately 2,140 meters and will concentrate on extending mineralization along strike and at depth in two zones identified from Phase I drilling. Once drilling is complete at Aricheng North, the drill rig will be moved to Aricheng South and Aricheng West where a minimum combined total of 2,280 meters in 19 holes will be drilled to test for mineralization along strike.

Assay results from the first zone at Aricheng North are expected to be available in October barring delays at the analytical laboratory.

The exploration focus to date has been on basement hosted uranium mineralization in the Kurupung Batholith (please see Figure 1: Kurupung Batholith Map). Approximately 35 km2 have been explored in the Aricheng area. There are 25 targets identified by the airborne radiometric survey that are hosted by the 360 km2 Kurupung Batholith.

Reconnaissance exploration is evaluating targets in the Kurupung Batholith outside of the Aricheng area. Currently, four geologists are conducting reconnaissance in the Accori - Meamu area northwest of Aricheng. A satellite camp has been established and ground scintillometer surveying and detailed mapping is currently underway. Upon completion of the Aricheng area drilling, a 2,000 meter drilling program is planned to drill test anomalies identified during the ongoing regional reconnaissance program.

"We are pleased with the exploration progress to date. Field activities are on schedule and budget. The exploration plan continues to confirm and enhance the partial historical data set that was availed to the company" said Allan Ibbitson President and C.E.O. "We are still in the early exploration stage in the course of better understanding uranium mineralization associated with the Kurupung Batholith."

The Company is well funded with over $25 million held solely in cash and Canadian chartered bank backed Guaranteed Investment Certificates.

About U3O8 Corp.

U3O8 Corp. is a Canadian junior mineral exploration company based in Toronto, Canada. Currently focused on uranium exploration in the Roraima Basin area of Guyana, South America, U3O8 Corp.'s primary business objective is to acquire, explore and develop uranium projects in the Americas. Under its current exploration schedule, the Company expects to be fully funded for the next three years.

The Company has exclusive uranium exploration rights in two permitted areas in the Roraima Basin area of Guyana. The Permit Area A property covers approximately 579,500 hectares. The Permit Area B property covers approximately 750,900 hectares. This latter area is of particular interest as it is geologically similar to the unconformity related uranium deposits in the Athabasca region in Saskatchewan.

Richard Cleath, Vice President of U3O8 Corp, a qualified person within the definition of that term in National Instrument 43-101 of the Canadian Securities Administrators, has supervised the preparation of and verified the technical information contained in this news release. For further details on the property interests of the Company, please refer to the technical report entitled "Technical Report on the Prometheus Uranium Project" dated September 15, 2006 as amended and restated December 12, 2006 authored by Clinton Davis, available on SEDAR at www.sedar.com.

Forward Looking Statements

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of U3O8 Corp., including, but not limited to the impact of general economic conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, dependence upon regulatory approvals and exploration risk. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.

Shares Outstanding

Basic: 23,057,700

Fully diluted: 25,676,000

Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a mineral resource on any of the Company's properties and it is uncertain if further exploration will result in any such target being delineated as a mineral resource.

To view a copy of "Figure 1: Kurupung Batholith Map", please visit the link below:

http://www.ccnmatthews.com/docs/uwemap906.pdf.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Die ersten Bohrergebnisse der Phase II lassen noch auf sich warten, das Labor hat zuviel zu tun.

Im Feld läuft soweit alles wie geplant, 24 der geplanten 36 Borhrungen sind seit August fertig gestellt worden.

Außerdem wurden vier neue Anomalien identifiziert, die nach Ende der derzeitigen Bohrarbeiten angegangen werden.

Zudem ist derzeit ein Helikoptergestützte radiometrische Überprüfung im Gange, die genauere Ergebnisse als die schon vorliegenede Flugzeugbasierte liefern soll.

Uranpreise ziehen auch wieder an, sieht gut aus.

Nov 08, 2007 09:19 ET

U3O8 Corp. Commences Helicopter Radiometric Survey

TORONTO, ONTARIO--(Marketwire - Nov. 8, 2007) - U3O8 Corp. (TSX VENTURE:UWE) ("U3O8" or "Company") is pleased to announce that an aerial radiometric survey of the exposed Roraima basement unconformity is currently underway to provide detailed results related to the underlying unconformity. A Bell Long Ranger helicopter is being employed as it has the capability to follow the steep topographic undulations of the escarpment area.

The Company has exclusive uranium exploration rights in two permitted areas in the Roraima Basin area of Guyana. The Permit Area A property covers approximately 579,500 hectares. The Permit Area B property covers approximately 750,900 hectares. This latter area is of particular interest as it is geologically similar to the unconformity-related uranium deposits in the Athabasca Basin region in Saskatchewan.

"The Company is excited about the additional radiometric spectrometer detail that will be gathered with the aid of the helicopter program" stated Allan Ibbitson President and C.E.O. "The work is an extension of the data gathered in the 14,000 line kilometer airplane radiometric program performed in the fall of 2006. For safety reasons, the airplane was limited in its ability to fly close to the escarpment and this helicopter survey will greatly enhance our ability to detect new targets and provide details of anomalies previously identified."

The 12,000 line kilometer survey involves a spectrometer that utilizes a 1024 cubic inch Nal crystal to measure gamma radiation. During the course of the four-week program, radiometric data will be collected parallel to and in close proximity to the escarpment which defines the thinner leading edge of the Roraima basin. The survey will also include radiometric reconnaissance of the river drainages that perforate the escarpment edges.

Once the survey has been completed, the data will be compiled and analyzed. This data along with surface reconnaissance work already underway at the base of the escarpment will aid in identifying potential, unconformity-related uranium mineralization and potential drill targets. Follow-up of the newly identified airborne anomalies will begin in earnest in Q1 2008.

The Company also wishes to update the ongoing Phase II drill program in the Aricheng area of Permit "A". To date, 24 holes have been completed from the planned 36 hole Phase II program, which began in August of this year. As a result of a backlog at the assay lab, the Company still awaits a complete reporting of all assays in certain Aricheng areas.

Four additional radioactive anomalies have been identified in the Accori area, located six km west of the Aricheng camp as part of the ongoing regional reconnaissance program in Permit A. These anomalies will be drill tested following completion of Phase II drilling at Aricheng.

Im Feld läuft soweit alles wie geplant, 24 der geplanten 36 Borhrungen sind seit August fertig gestellt worden.

Außerdem wurden vier neue Anomalien identifiziert, die nach Ende der derzeitigen Bohrarbeiten angegangen werden.

Zudem ist derzeit ein Helikoptergestützte radiometrische Überprüfung im Gange, die genauere Ergebnisse als die schon vorliegenede Flugzeugbasierte liefern soll.

Uranpreise ziehen auch wieder an, sieht gut aus.

Nov 08, 2007 09:19 ET

U3O8 Corp. Commences Helicopter Radiometric Survey

TORONTO, ONTARIO--(Marketwire - Nov. 8, 2007) - U3O8 Corp. (TSX VENTURE:UWE) ("U3O8" or "Company") is pleased to announce that an aerial radiometric survey of the exposed Roraima basement unconformity is currently underway to provide detailed results related to the underlying unconformity. A Bell Long Ranger helicopter is being employed as it has the capability to follow the steep topographic undulations of the escarpment area.

The Company has exclusive uranium exploration rights in two permitted areas in the Roraima Basin area of Guyana. The Permit Area A property covers approximately 579,500 hectares. The Permit Area B property covers approximately 750,900 hectares. This latter area is of particular interest as it is geologically similar to the unconformity-related uranium deposits in the Athabasca Basin region in Saskatchewan.

"The Company is excited about the additional radiometric spectrometer detail that will be gathered with the aid of the helicopter program" stated Allan Ibbitson President and C.E.O. "The work is an extension of the data gathered in the 14,000 line kilometer airplane radiometric program performed in the fall of 2006. For safety reasons, the airplane was limited in its ability to fly close to the escarpment and this helicopter survey will greatly enhance our ability to detect new targets and provide details of anomalies previously identified."

The 12,000 line kilometer survey involves a spectrometer that utilizes a 1024 cubic inch Nal crystal to measure gamma radiation. During the course of the four-week program, radiometric data will be collected parallel to and in close proximity to the escarpment which defines the thinner leading edge of the Roraima basin. The survey will also include radiometric reconnaissance of the river drainages that perforate the escarpment edges.

Once the survey has been completed, the data will be compiled and analyzed. This data along with surface reconnaissance work already underway at the base of the escarpment will aid in identifying potential, unconformity-related uranium mineralization and potential drill targets. Follow-up of the newly identified airborne anomalies will begin in earnest in Q1 2008.

The Company also wishes to update the ongoing Phase II drill program in the Aricheng area of Permit "A". To date, 24 holes have been completed from the planned 36 hole Phase II program, which began in August of this year. As a result of a backlog at the assay lab, the Company still awaits a complete reporting of all assays in certain Aricheng areas.

Four additional radioactive anomalies have been identified in the Accori area, located six km west of the Aricheng camp as part of the ongoing regional reconnaissance program in Permit A. These anomalies will be drill tested following completion of Phase II drilling at Aricheng.

So, ab sofort kann hier wieder diskutiert werden.

Viele Spaß

Pascal Heinze

Viele Spaß

Pascal Heinze

U3O8 Corp. to Acquire Mega Uranium´s South American Assets to Createa Dominant South American-Focused Uranium Exploration Company; Resultsin a larger platform for growth to realize resource expansion potential&exploration upside - Feb 17, 2010

"U3O8 Corp. (TSX VENTURE:UWE) and Mega Uranium Ltd. (TSX:MGA) ("Mega")are pleased to announce that they have entered into a definitiveagreement under which U3O8 Corp. will acquire all of Mega's SouthAmerican uranium properties and $4 million in cash in exchange for30,564,858 common shares of U3O8 Corp. (the "U3O8 Shares"). Theacquisition will provide U3O8 Corp. with an expanded portfolio ofprojects at various stages, from National Instrument 43-101 ("NI43-101") compliant resources in Guyana, to significant historicalresources in Colombia and near-resource and discovery potential inArgentina. U3O8 Corp. will emerge as a well funded dominant explorerwith a strong platform for growth in South America – one of the world'spromising new frontiers for uranium exploration and development.

Following completion of the sale, Mega has agreed to take stepsnecessary to distribute the U3O8 Shares directly to its Canadianshareholders, on a pro-rata basis, by way of a dividend-in-kind paid onMega's common shares, providing Mega's shareholders with directownership in U3O8 Corp. Non-resident shareholders will receive cashproceeds in lieu of U3O8 Shares, as further described below.

Strategic Benefits

U3O8 Corp. and Mega believe this transaction will result in significantstrategic benefits and enhance shareholder value for both companies bycreating a South American-focused uranium discovery and developmentcompany that will have:

+ Strengthened balance sheet – $8 million in cash to advance resource expansion and drive exploration;

+ NI 43-101 resource – U3O8 Corp's initial IndicatedResource of 5.8 million pounds U3O8 (2.7 million tonnes at a grade of0.10% U3O8) and Inferred Resource of 1.3 million pounds U3O8 (0.65million tonnes at a grade of 0.09% U3O8) in the Kurupung Batholith inGuyana. Uranium in the Kurupung is geologically similar toalbitite-hosted uranium deposits worldwide that typically containresources in the 50 to 130 million pound range, although there is noguarantee that the Kurupung will host a resource of similar size;

+ Significant historic resource – Mega's Berlin Project inColombia with historical uranium resource1 potential of 12.9 milliontonnes at a grade of 0.13% U3O8 (38 million pounds U3O8) as well aspotential for vanadium, molybdenum and phosphate by-products;

+ Near-resource potential – Ongoing exploration drillingin the Kurupung project continues to define new mineralized areas thatare expected to lead to potentially strong resource growth in theshort-term. Mega's Laguna Salada project in Chubut Province, Argentina,is poised to advance to resource estimation in 2010;

+ Principal exploration opportunities – Drilling on Mega'smineral concessions near the Cerro Solo uranium deposit in Argentinahas intersected significant sandstone-hosted uranium mineralization.U3O8 Corp's exploration in the Roraima Basin in Guyana is identifyingkey features typically associated with unconformity-related uranium inCanada's Athabasca Basin, which is host to approximately one third ofthe world's uranium resources. U3O8 Corp. expects to commence drillingof its unconformity-related targets in the Roraima Basin in 2010;

+ Strong land positions in favourable South American jurisdictions– broader geographic presence in highly prospective regions inColombia, Guyana and Argentina. Mega has an extensive land positionnear Argentina's two largest known uranium deposits (10 million poundCerro Solo and 30 million pound Sierra Pintada deposits) presentlyowned and under development by Comision Nacional de Energia Atomica(CNEA), the Argentinean national nuclear authority;

+ Strong management and board – proven technical andexecutive teams with a track record of discoveries and experience inSouth America, uranium exploration, resource development, and financialmarkets; and

+ Broader investor reach – expanded and diverse shareholder base for enhanced market exposure and liquidity

www.marketwire.com/press-release/U3O8-Corp-Acquire-Mega-Uran…

"This acquisition enhances U3O8 Corp's position as a premier SouthAmerican uranium exploration company by significantly adding to ourresource pipeline and expanding our geographic presence in highlyprospective regions. Together, we are establishing a larger platformand a strengthened balance sheet from which to advance a strong uraniumportfolio to create value for our shareholders and stakeholders," saidDr. Richard Spencer, U3O8 Corp's President and CEO.

"This transaction represents the first step for us in unlockingshareholder value attributable to our exploration properties, but notfully recognized, as Mega has become more identified as anear-production company due to the progress of our Lake Maitlandproject," said Sheldon Inwentash, Mega Uranium's Chairman and CEO."Shareholders of U3O8 Corp. and Mega (through their equityparticipation in U3O8 Corp.) can benefit directly from the formation ofa unique South American-focused uranium company that brings together asuite of advanced projects, strategic land holdings and highlyexperienced exploration and executive teams aimed at creating adominant explorer in an environment of accelerating demand for uranium."

Management and Directors

Upon completion of the transaction, management of U3O8 Corp. willconsist of Richard Spencer (President and Chief Executive Officer),Carmelo Marrelli (Chief Financial Officer), Richard Cleath and Dr. HugoBastias (Vice Presidents responsible for exploration and resourcedevelopment), Philip Williams (Vice President, Business Development)and Nancy Chan-Palmateer (Vice President, Investor Relations). Inaddition, two of the existing five directors of U3O8 Corp. will resign,the size of the board of directors of U3O8 Corp. will be increased byone, and three nominees of Mega will be appointed. Accordingly, theU3O8 Corp. board of directors post-closing will be comprised of SheldonInwentash, Stewart Taylor, Richard Patricio (as nominees of Mega), andKeith Barron, Bryan Coates, David Constable (the remaining existingdirectors of U3O8 Corp.). The six directors of U3O8 Corp. post-closingwill then agree upon a seventh candidate to be nominated for electionat the next shareholders meeting of U3O8 Corp.

Transaction Details

As currently proposed, U3O8 Corp. will issue the U3O8 Shares to Mega,in exchange for all of the outstanding shares of a wholly-ownedsubsidiary of Mega, which will indirectly hold Mega's South Americanproperties and $4 million in cash. Following completion of the sale, itis expected that Mega will distribute the U3O8 Shares to itsshareholders as a dividend-in-kind paid on its common shares (the"Dividend").

No U3O8 Shares will be delivered to Mega shareholders who are, or aredeemed to be, non-residents of Canada. Instead, these shares will beaggregated and sold in the open market, in an orderly fashion, onbehalf of the non-resident shareholders who will receive a pro-ratashare of the cash proceeds from the sale, net of applicable withholdingtaxes and brokerage fees.

If the transaction is completed as contemplated, Mega will adviseshareholders of the record date and payment date of the Dividend.

Prior to the transaction, there are 23,057,700 issued and outstandingcommon shares of U3O8 Corp. After the completion of the transaction,there will be 53,622,558 common shares outstanding of U3O8 Corp.(approximately 57% of which will be held by Mega shareholders withoutconsideration of U3O8 Shares to be sold on behalf of non-residents andtreatment of fractional shares).

The acquisition is subject to the satisfaction of various conditions,including the approval by the Toronto Stock Exchange, TSX VentureExchange and, in order to effect the Dividend, the approval by Mega'sshareholders of a reduction in the stated capital of Mega's commonshares at its Annual and Special Meeting to be held on March 19, 2010(the "Meeting"). Subject to the satisfaction of all conditions, thetransaction is expected to close on or about March 31, 2010.

U3O8 Corp's financial advisor is Cormark Securities Inc.

Stewart Taylor, President of Mega and a qualified person for thepurposes of NI 43-101, has reviewed the technical information containedin this news release pertaining to Mega's mineral properties.

Richard Spencer, President and CEO of U3O8 Corp., a qualified personfor the purposes of NI 43-101, has reviewed the technical informationcontained in this news release pertaining to U3O8 Corp's mineralproperties.

The securities described in this press release have not been and willnot be registered under the United States Securities Act of 1933, asamended (the "U.S. Securities Act"), or any state securities laws andmay not be offered or sold within the United States unless registeredunder the U.S. Securities Act and applicable state securities laws oran exemption from such registration is available. This press release isfor information purposes only and shall not constitute an offer to sellor the solicitation of an offer to buy nor shall there be any sale ofthe securities in any jurisdiction in which such offer, solicitation orsale would be unlawful.

(1) The Berlin resource estimate is historical and is reported inCastano, R. (1981), Calcul provisoire des reserves geologiques deBerlin, sur la base des resultants des sondages, unpublished Minatomereport, 15p. Recent independent verification of the historical data hasnot been performed and sufficient exploration work has not beencompleted to verify the historic estimate. Mega is not treating thehistorical estimate as current mineral resources and it should not berelied upon. As the 38 million pound U3O8 estimated is based only on 11widely-spaced drill holes, it is regarded by Mega as merely anindication of the magnitude of the uranium resource potential of thesouthernmost five kilometre long portion of the syncline containing theBerlin uranium mineralization.

About U3O8 Corp.

U3O8 Corp. is a Toronto-based uranium exploration company in Canada.Currently focused on uranium exploration in the Roraima Basin inGuyana, South America, U3O8 Corp. has exclusive uranium explorationrights covering about one million hectares that straddles the edge ofthe Roraima Basin in Guyana. The company is advancing a two-prongedexploration strategy that focuses on: (1) exploration for multipleuranium-bearing structures within structural systems in the basementadjacent to the Roraima Basin with the concept that the individualbreccia zones could potentially aggregate to a significant totalresource; and (2) exploration for unconformity-related uranium depositsnear the base of the Roraima Basin, which are similar to those of theprolific Athabasca Basin in Saskatchewan.

Further information on U3O8 Corp's properties are available in thetechnical report prepared for the company by Dahrouge GeologicalConsulting Ltd. and dated September 15, 2006 as amended and restatedDecember 12, 2006; and on U3O8 Corp's NI 43-101 resource as detailed inthe NI 43-101 report titled "A Technical Review of the Aricheng Northand Aricheng South Uranium Deposits in Western Guyana for U3O8 Corp.and Prometheus Resources (Guyana) Inc." by Watts, Griffis and McOuatdated January 14, 2009.

About Mega Uranium Ltd.

Mega is a Toronto-based mineral resources company with a focus onuranium properties in Australia, Canada, Argentina, Colombia andCameroon. Mega is currently advancing its Lake Maitland uranium projectin Western Australia to production. Mega's Ben Lomond and Maureenuranium resources are subject to a Queensland State Government policythat presently prohibits the mining of uranium. "

"U3O8 Corp. (TSX VENTURE:UWE) and Mega Uranium Ltd. (TSX:MGA) ("Mega")are pleased to announce that they have entered into a definitiveagreement under which U3O8 Corp. will acquire all of Mega's SouthAmerican uranium properties and $4 million in cash in exchange for30,564,858 common shares of U3O8 Corp. (the "U3O8 Shares"). Theacquisition will provide U3O8 Corp. with an expanded portfolio ofprojects at various stages, from National Instrument 43-101 ("NI43-101") compliant resources in Guyana, to significant historicalresources in Colombia and near-resource and discovery potential inArgentina. U3O8 Corp. will emerge as a well funded dominant explorerwith a strong platform for growth in South America – one of the world'spromising new frontiers for uranium exploration and development.

Following completion of the sale, Mega has agreed to take stepsnecessary to distribute the U3O8 Shares directly to its Canadianshareholders, on a pro-rata basis, by way of a dividend-in-kind paid onMega's common shares, providing Mega's shareholders with directownership in U3O8 Corp. Non-resident shareholders will receive cashproceeds in lieu of U3O8 Shares, as further described below.

Strategic Benefits

U3O8 Corp. and Mega believe this transaction will result in significantstrategic benefits and enhance shareholder value for both companies bycreating a South American-focused uranium discovery and developmentcompany that will have:

+ Strengthened balance sheet – $8 million in cash to advance resource expansion and drive exploration;

+ NI 43-101 resource – U3O8 Corp's initial IndicatedResource of 5.8 million pounds U3O8 (2.7 million tonnes at a grade of0.10% U3O8) and Inferred Resource of 1.3 million pounds U3O8 (0.65million tonnes at a grade of 0.09% U3O8) in the Kurupung Batholith inGuyana. Uranium in the Kurupung is geologically similar toalbitite-hosted uranium deposits worldwide that typically containresources in the 50 to 130 million pound range, although there is noguarantee that the Kurupung will host a resource of similar size;

+ Significant historic resource – Mega's Berlin Project inColombia with historical uranium resource1 potential of 12.9 milliontonnes at a grade of 0.13% U3O8 (38 million pounds U3O8) as well aspotential for vanadium, molybdenum and phosphate by-products;

+ Near-resource potential – Ongoing exploration drillingin the Kurupung project continues to define new mineralized areas thatare expected to lead to potentially strong resource growth in theshort-term. Mega's Laguna Salada project in Chubut Province, Argentina,is poised to advance to resource estimation in 2010;

+ Principal exploration opportunities – Drilling on Mega'smineral concessions near the Cerro Solo uranium deposit in Argentinahas intersected significant sandstone-hosted uranium mineralization.U3O8 Corp's exploration in the Roraima Basin in Guyana is identifyingkey features typically associated with unconformity-related uranium inCanada's Athabasca Basin, which is host to approximately one third ofthe world's uranium resources. U3O8 Corp. expects to commence drillingof its unconformity-related targets in the Roraima Basin in 2010;

+ Strong land positions in favourable South American jurisdictions– broader geographic presence in highly prospective regions inColombia, Guyana and Argentina. Mega has an extensive land positionnear Argentina's two largest known uranium deposits (10 million poundCerro Solo and 30 million pound Sierra Pintada deposits) presentlyowned and under development by Comision Nacional de Energia Atomica(CNEA), the Argentinean national nuclear authority;

+ Strong management and board – proven technical andexecutive teams with a track record of discoveries and experience inSouth America, uranium exploration, resource development, and financialmarkets; and

+ Broader investor reach – expanded and diverse shareholder base for enhanced market exposure and liquidity

www.marketwire.com/press-release/U3O8-Corp-Acquire-Mega-Uran…

"This acquisition enhances U3O8 Corp's position as a premier SouthAmerican uranium exploration company by significantly adding to ourresource pipeline and expanding our geographic presence in highlyprospective regions. Together, we are establishing a larger platformand a strengthened balance sheet from which to advance a strong uraniumportfolio to create value for our shareholders and stakeholders," saidDr. Richard Spencer, U3O8 Corp's President and CEO.

"This transaction represents the first step for us in unlockingshareholder value attributable to our exploration properties, but notfully recognized, as Mega has become more identified as anear-production company due to the progress of our Lake Maitlandproject," said Sheldon Inwentash, Mega Uranium's Chairman and CEO."Shareholders of U3O8 Corp. and Mega (through their equityparticipation in U3O8 Corp.) can benefit directly from the formation ofa unique South American-focused uranium company that brings together asuite of advanced projects, strategic land holdings and highlyexperienced exploration and executive teams aimed at creating adominant explorer in an environment of accelerating demand for uranium."

Management and Directors

Upon completion of the transaction, management of U3O8 Corp. willconsist of Richard Spencer (President and Chief Executive Officer),Carmelo Marrelli (Chief Financial Officer), Richard Cleath and Dr. HugoBastias (Vice Presidents responsible for exploration and resourcedevelopment), Philip Williams (Vice President, Business Development)and Nancy Chan-Palmateer (Vice President, Investor Relations). Inaddition, two of the existing five directors of U3O8 Corp. will resign,the size of the board of directors of U3O8 Corp. will be increased byone, and three nominees of Mega will be appointed. Accordingly, theU3O8 Corp. board of directors post-closing will be comprised of SheldonInwentash, Stewart Taylor, Richard Patricio (as nominees of Mega), andKeith Barron, Bryan Coates, David Constable (the remaining existingdirectors of U3O8 Corp.). The six directors of U3O8 Corp. post-closingwill then agree upon a seventh candidate to be nominated for electionat the next shareholders meeting of U3O8 Corp.

Transaction Details

As currently proposed, U3O8 Corp. will issue the U3O8 Shares to Mega,in exchange for all of the outstanding shares of a wholly-ownedsubsidiary of Mega, which will indirectly hold Mega's South Americanproperties and $4 million in cash. Following completion of the sale, itis expected that Mega will distribute the U3O8 Shares to itsshareholders as a dividend-in-kind paid on its common shares (the"Dividend").

No U3O8 Shares will be delivered to Mega shareholders who are, or aredeemed to be, non-residents of Canada. Instead, these shares will beaggregated and sold in the open market, in an orderly fashion, onbehalf of the non-resident shareholders who will receive a pro-ratashare of the cash proceeds from the sale, net of applicable withholdingtaxes and brokerage fees.

If the transaction is completed as contemplated, Mega will adviseshareholders of the record date and payment date of the Dividend.

Prior to the transaction, there are 23,057,700 issued and outstandingcommon shares of U3O8 Corp. After the completion of the transaction,there will be 53,622,558 common shares outstanding of U3O8 Corp.(approximately 57% of which will be held by Mega shareholders withoutconsideration of U3O8 Shares to be sold on behalf of non-residents andtreatment of fractional shares).

The acquisition is subject to the satisfaction of various conditions,including the approval by the Toronto Stock Exchange, TSX VentureExchange and, in order to effect the Dividend, the approval by Mega'sshareholders of a reduction in the stated capital of Mega's commonshares at its Annual and Special Meeting to be held on March 19, 2010(the "Meeting"). Subject to the satisfaction of all conditions, thetransaction is expected to close on or about March 31, 2010.

U3O8 Corp's financial advisor is Cormark Securities Inc.

Stewart Taylor, President of Mega and a qualified person for thepurposes of NI 43-101, has reviewed the technical information containedin this news release pertaining to Mega's mineral properties.

Richard Spencer, President and CEO of U3O8 Corp., a qualified personfor the purposes of NI 43-101, has reviewed the technical informationcontained in this news release pertaining to U3O8 Corp's mineralproperties.

The securities described in this press release have not been and willnot be registered under the United States Securities Act of 1933, asamended (the "U.S. Securities Act"), or any state securities laws andmay not be offered or sold within the United States unless registeredunder the U.S. Securities Act and applicable state securities laws oran exemption from such registration is available. This press release isfor information purposes only and shall not constitute an offer to sellor the solicitation of an offer to buy nor shall there be any sale ofthe securities in any jurisdiction in which such offer, solicitation orsale would be unlawful.

(1) The Berlin resource estimate is historical and is reported inCastano, R. (1981), Calcul provisoire des reserves geologiques deBerlin, sur la base des resultants des sondages, unpublished Minatomereport, 15p. Recent independent verification of the historical data hasnot been performed and sufficient exploration work has not beencompleted to verify the historic estimate. Mega is not treating thehistorical estimate as current mineral resources and it should not berelied upon. As the 38 million pound U3O8 estimated is based only on 11widely-spaced drill holes, it is regarded by Mega as merely anindication of the magnitude of the uranium resource potential of thesouthernmost five kilometre long portion of the syncline containing theBerlin uranium mineralization.

About U3O8 Corp.

U3O8 Corp. is a Toronto-based uranium exploration company in Canada.Currently focused on uranium exploration in the Roraima Basin inGuyana, South America, U3O8 Corp. has exclusive uranium explorationrights covering about one million hectares that straddles the edge ofthe Roraima Basin in Guyana. The company is advancing a two-prongedexploration strategy that focuses on: (1) exploration for multipleuranium-bearing structures within structural systems in the basementadjacent to the Roraima Basin with the concept that the individualbreccia zones could potentially aggregate to a significant totalresource; and (2) exploration for unconformity-related uranium depositsnear the base of the Roraima Basin, which are similar to those of theprolific Athabasca Basin in Saskatchewan.

Further information on U3O8 Corp's properties are available in thetechnical report prepared for the company by Dahrouge GeologicalConsulting Ltd. and dated September 15, 2006 as amended and restatedDecember 12, 2006; and on U3O8 Corp's NI 43-101 resource as detailed inthe NI 43-101 report titled "A Technical Review of the Aricheng Northand Aricheng South Uranium Deposits in Western Guyana for U3O8 Corp.and Prometheus Resources (Guyana) Inc." by Watts, Griffis and McOuatdated January 14, 2009.

About Mega Uranium Ltd.

Mega is a Toronto-based mineral resources company with a focus onuranium properties in Australia, Canada, Argentina, Colombia andCameroon. Mega is currently advancing its Lake Maitland uranium projectin Western Australia to production. Mega's Ben Lomond and Maureenuranium resources are subject to a Queensland State Government policythat presently prohibits the mining of uranium. "

U3O8 Corp. Intersects Eighth Uranium-Bearing Structure, UnderscoringSignificant Size Potential of the Kurupung System; Aricheng A adds topipeline of targets with potential to grow current uranium resource - Mar 16, 2010

www.marketwire.com/press-release/U3O8-Corp-Intersects-Eighth…

http://media3.marketwire.com/docs/uwe0315figure01.pdf

http://media3.marketwire.com/docs/uwe0315figure02.pdf

http://media3.marketwire.com/docs/uwe0315figure03.pdf

"TORONTO, ONTARIO--(Marketwire - March 16, 2010) - U3O8 Corp. (TSXVENTURE:UWE), a Canadian uranium exploration company, reportssignificant uranium mineralization from Phase I scout drilling in theAricheng A target in the Kurupung Batholith, in basement rocks near theRoraima Basin in Guyana (Figure 1). Aricheng A is the eighthuranium-bearing structure identified so far and underscores the growingsize potential of the Kurupung system, a promising uranium district inSouth America. Geologically similar albitite-hosted uranium depositsworldwide including the Valhalla deposit in Australia and Michelindeposit in Canada, typically host resources in the 50 to 130 millionpound range with typical grades of 0.06% to 0.10% U3O8, contained withinmultiple mineralized structures.

"The Kurupung Batholith is emerging into a potentially significanturanium system," said Dr. Richard Spencer, U3O8 Corp's President andCEO. "U3O8 Corp's goal is to demonstrate, through scout drilling, thatthe Kurupung could host a large uranium resource of comparable size toalbitite-hosted deposits worldwide. The discovery of a uranium-bearingstructure at Aricheng A is one more step towards achieving this goal.Given our exploration success in identifying new mineralized zones, weplan to continue scout drilling geophysical targets until mid-year. Atthat time, we will decide whether to further expand on the Kurupung'ssize prospects or focus on infill drilling to potentially add to ourexisting compliant resource."

To date, U3O8 Corp's drilling has delineated uranium mineralization ineight structures of which an initial National Instrument 43-101 (NI43-101) Indicated resource of 5.8 million pounds at an average grade of0.10% U3O8 and Inferred resource of 1.3 million pounds at an averagegrade of 0.09% U3O8 have been defined on two of these structures.Through further scout drilling, U3O8 Corp. aims to show that theKurupung has an estimated potential to host a conceptual target of 20-30million tonnes grading 0.08% to 0.10% U3O8 (for an estimated 30-50million pounds U3O8) aggregated from multiple structures.

Table 1 – Assay Results for Aricheng A

Summary of significantly mineralized intercepts cut in the seven boreholes (1,243 metres) completed in scout drilling of the Aricheng Astructure.

Bore Hole Number Intercept Grade

From (m) To (m) Interval (m) Estimated True Thickness (m) U3O8 (%) U3O8(lb/st)

ANOMA-001 56.0 58.0 2.0 1.6 0.031 0.6

ANOMA-002 62.0 63.0 1.0 0.8 0.109 2.2

ANOMA-003 78.5 81.5 3.0 2.5 0.046 0.9

145.0 153.0 8.0 6.6 0.056 1.1

ANOMA-004 38.0 40.0 2.0 1.6 0.190 3.8

100.0 102.0 2.0 1.6 0.047 0.9

ANOMA-005 100.0 107.0 7.0 5.7 0.038 0.8

144.0 161.0 17.0 13.9 0.048 1.0

Including 144.0 147.0 3.0 2.5 0.078 1.6

ANOMA-006 55.0 58.0 3.0 2.5 0.040 0.8

93.0 94.0 1.0 0.8 0.149 3.0

132.0 133.0 1.0 0.8 0.123 2.5

137.0 140.0 3.0 2.5 0.072 1.4

ANOMA-007 No Significant Results

Note: lb/st is an abbreviation for pounds per short ton. 1 short ton =2,000lbs or 0.907 metric tonnes.

Uranium mineralization at Aricheng A is associated with a set ofnortheast-trending structures, marked by a conspicuous radiometricanomaly (Figure 2). Aricheng A is located about 500 metres southeast ofthe Aricheng North uranium zone that coincides with another strongradiometric feature. The Aricheng A mineralization zone occurs inveinlets and micro-breccias within an envelope ofalbite-chlorite-hematite-calcite-magnetite alteration that is weakly tomoderately magnetic. The structures have a northeast strike and dipapproximately 80º to the northwest. Mineralization has been encounteredover a strike length of 300 metres, to a depth of 120 metres, andremains open at depth (Figure 3).

Potential quantity and grade are based on drill results that define theapproximate length, thickness, depth and grade of the Aricheng A target,but are considered conceptual in nature. Furthermore, the sizepotential stated above for the Kurupung Batholith is conceptual innature. It is uncertain if further exploration drilling will result in amineral resource of significant size being defined in the Kurupung orwill result in a mineral resource being defined in Aricheng A structure.

Quality Assurance &Quality Control

Diamond drilling at Aricheng A was undertaken with U3O8 Corp's own drillrig that produced NQ (nominal 47.6 millimetre diameter) core. Adown-hole spectral gamma probe was used on the seven bore holes reportedhere to determine the extent of the mineralized intervals by providingan estimate of the uranium grade based on the radioactivity measured.Core from each mineralized interval was halved with a diamond sawon-site and half core samples were delivered to ACME Laboratory'spreparation facility in Georgetown, Guyana. Sample blanks and certifiedstandards were inserted at an average frequency of 1 per 25 samples.Sample pulps were then shipped by ACME to their analytical facility inVancouver, BC, Canada, for analysis for uranium by ICP-MS after hot,four-acid digestion. The other half of the core was logged and is storedon-site, providing a complete record of the geology and mineralizedzones drilled.

Mr. Richard Cleath (M.Sc.), Vice President of U3O8 Corp., a QualifiedPerson within the definition of that term in National Instrument 43-101of the Canadian Securities Administrators, had overall responsibilityfor all aspects of target selection and drilling of the Aricheng Atarget. Mr. Cleath has supervised the preparation of, and verified, thetechnical information in this release.

To view Figure 1 - Multiple Uranium-Bearing Structures in the KurupungBatholith, please visit the following link:http://media3.marketwire.com/docs/uwe0315figure01.pdf

To view Figure 2 - Drill Hole Locations at Aricheng A, please visit thefollowing link: http://media3.marketwire.com/docs/uwe0315figure02.pdf

To view Figure 3 - Long Section of the Aricheng A, please visit thefollowing link: http://media3.marketwire.com/docs/uwe0315figure03.pdf

About U3O8 Corp.

U3O8 Corp. is a Canadian uranium exploration company based in Toronto,Canada. Currently focused on uranium exploration in the Roraima Basin inGuyana, South America, U3O8 Corp. has exclusive uranium explorationrights in an area covering approximately one million hectares thatstraddles the edge of the Roraima Basin in Guyana. The company isadvancing a two-pronged exploration strategy that focuses on: (1)exploration for multiple uranium-bearing structures within structuralsystems in the basement adjacent to the Roraima Basin with the conceptthat the individual breccia zones could potentially aggregate to asignificant total resource; and (2) exploration for unconformity-relateduranium deposits near the base of the Roraima Basin, which are similarto those of the prolific Athabasca Basin in Saskatchewan.

For further information on the company's properties, please refer to thetechnical reports prepared for the company by Dahrouge GeologicalConsulting Ltd. and dated September 15, 2006 as amended and restatedDecember 12, 2006; and U3O8 Corp's NI 43-101 resource as detailed in theNI 43-101 report titled "A Technical Review of the Aricheng North andAricheng South Uranium Deposits in Western Guyana for U3O8 Corp. andPrometheus Resources (Guyana) Inc." by Watts, Griffis and McOuat datedJanuary 14, 2009, available on SEDAR at www.sedar.com and on thecompany's website www.u3o8corp.com.

On February 17, 2010, U3O8 Corp. announced the acquisition of MegaUranium Ltd's South American uranium properties, which is expected toclose on or about March 31, 2010. "

www.marketwire.com/press-release/U3O8-Corp-Intersects-Eighth…

http://media3.marketwire.com/docs/uwe0315figure01.pdf

http://media3.marketwire.com/docs/uwe0315figure02.pdf

http://media3.marketwire.com/docs/uwe0315figure03.pdf

"TORONTO, ONTARIO--(Marketwire - March 16, 2010) - U3O8 Corp. (TSXVENTURE:UWE), a Canadian uranium exploration company, reportssignificant uranium mineralization from Phase I scout drilling in theAricheng A target in the Kurupung Batholith, in basement rocks near theRoraima Basin in Guyana (Figure 1). Aricheng A is the eighthuranium-bearing structure identified so far and underscores the growingsize potential of the Kurupung system, a promising uranium district inSouth America. Geologically similar albitite-hosted uranium depositsworldwide including the Valhalla deposit in Australia and Michelindeposit in Canada, typically host resources in the 50 to 130 millionpound range with typical grades of 0.06% to 0.10% U3O8, contained withinmultiple mineralized structures.

"The Kurupung Batholith is emerging into a potentially significanturanium system," said Dr. Richard Spencer, U3O8 Corp's President andCEO. "U3O8 Corp's goal is to demonstrate, through scout drilling, thatthe Kurupung could host a large uranium resource of comparable size toalbitite-hosted deposits worldwide. The discovery of a uranium-bearingstructure at Aricheng A is one more step towards achieving this goal.Given our exploration success in identifying new mineralized zones, weplan to continue scout drilling geophysical targets until mid-year. Atthat time, we will decide whether to further expand on the Kurupung'ssize prospects or focus on infill drilling to potentially add to ourexisting compliant resource."

To date, U3O8 Corp's drilling has delineated uranium mineralization ineight structures of which an initial National Instrument 43-101 (NI43-101) Indicated resource of 5.8 million pounds at an average grade of0.10% U3O8 and Inferred resource of 1.3 million pounds at an averagegrade of 0.09% U3O8 have been defined on two of these structures.Through further scout drilling, U3O8 Corp. aims to show that theKurupung has an estimated potential to host a conceptual target of 20-30million tonnes grading 0.08% to 0.10% U3O8 (for an estimated 30-50million pounds U3O8) aggregated from multiple structures.

Table 1 – Assay Results for Aricheng A

Summary of significantly mineralized intercepts cut in the seven boreholes (1,243 metres) completed in scout drilling of the Aricheng Astructure.

Bore Hole Number Intercept Grade

From (m) To (m) Interval (m) Estimated True Thickness (m) U3O8 (%) U3O8(lb/st)

ANOMA-001 56.0 58.0 2.0 1.6 0.031 0.6

ANOMA-002 62.0 63.0 1.0 0.8 0.109 2.2

ANOMA-003 78.5 81.5 3.0 2.5 0.046 0.9

145.0 153.0 8.0 6.6 0.056 1.1

ANOMA-004 38.0 40.0 2.0 1.6 0.190 3.8

100.0 102.0 2.0 1.6 0.047 0.9

ANOMA-005 100.0 107.0 7.0 5.7 0.038 0.8

144.0 161.0 17.0 13.9 0.048 1.0

Including 144.0 147.0 3.0 2.5 0.078 1.6

ANOMA-006 55.0 58.0 3.0 2.5 0.040 0.8

93.0 94.0 1.0 0.8 0.149 3.0

132.0 133.0 1.0 0.8 0.123 2.5

137.0 140.0 3.0 2.5 0.072 1.4

ANOMA-007 No Significant Results

Note: lb/st is an abbreviation for pounds per short ton. 1 short ton =2,000lbs or 0.907 metric tonnes.

Uranium mineralization at Aricheng A is associated with a set ofnortheast-trending structures, marked by a conspicuous radiometricanomaly (Figure 2). Aricheng A is located about 500 metres southeast ofthe Aricheng North uranium zone that coincides with another strongradiometric feature. The Aricheng A mineralization zone occurs inveinlets and micro-breccias within an envelope ofalbite-chlorite-hematite-calcite-magnetite alteration that is weakly tomoderately magnetic. The structures have a northeast strike and dipapproximately 80º to the northwest. Mineralization has been encounteredover a strike length of 300 metres, to a depth of 120 metres, andremains open at depth (Figure 3).

Potential quantity and grade are based on drill results that define theapproximate length, thickness, depth and grade of the Aricheng A target,but are considered conceptual in nature. Furthermore, the sizepotential stated above for the Kurupung Batholith is conceptual innature. It is uncertain if further exploration drilling will result in amineral resource of significant size being defined in the Kurupung orwill result in a mineral resource being defined in Aricheng A structure.

Quality Assurance &Quality Control

Diamond drilling at Aricheng A was undertaken with U3O8 Corp's own drillrig that produced NQ (nominal 47.6 millimetre diameter) core. Adown-hole spectral gamma probe was used on the seven bore holes reportedhere to determine the extent of the mineralized intervals by providingan estimate of the uranium grade based on the radioactivity measured.Core from each mineralized interval was halved with a diamond sawon-site and half core samples were delivered to ACME Laboratory'spreparation facility in Georgetown, Guyana. Sample blanks and certifiedstandards were inserted at an average frequency of 1 per 25 samples.Sample pulps were then shipped by ACME to their analytical facility inVancouver, BC, Canada, for analysis for uranium by ICP-MS after hot,four-acid digestion. The other half of the core was logged and is storedon-site, providing a complete record of the geology and mineralizedzones drilled.

Mr. Richard Cleath (M.Sc.), Vice President of U3O8 Corp., a QualifiedPerson within the definition of that term in National Instrument 43-101of the Canadian Securities Administrators, had overall responsibilityfor all aspects of target selection and drilling of the Aricheng Atarget. Mr. Cleath has supervised the preparation of, and verified, thetechnical information in this release.

To view Figure 1 - Multiple Uranium-Bearing Structures in the KurupungBatholith, please visit the following link:http://media3.marketwire.com/docs/uwe0315figure01.pdf

To view Figure 2 - Drill Hole Locations at Aricheng A, please visit thefollowing link: http://media3.marketwire.com/docs/uwe0315figure02.pdf

To view Figure 3 - Long Section of the Aricheng A, please visit thefollowing link: http://media3.marketwire.com/docs/uwe0315figure03.pdf

About U3O8 Corp.

U3O8 Corp. is a Canadian uranium exploration company based in Toronto,Canada. Currently focused on uranium exploration in the Roraima Basin inGuyana, South America, U3O8 Corp. has exclusive uranium explorationrights in an area covering approximately one million hectares thatstraddles the edge of the Roraima Basin in Guyana. The company isadvancing a two-pronged exploration strategy that focuses on: (1)exploration for multiple uranium-bearing structures within structuralsystems in the basement adjacent to the Roraima Basin with the conceptthat the individual breccia zones could potentially aggregate to asignificant total resource; and (2) exploration for unconformity-relateduranium deposits near the base of the Roraima Basin, which are similarto those of the prolific Athabasca Basin in Saskatchewan.

For further information on the company's properties, please refer to thetechnical reports prepared for the company by Dahrouge GeologicalConsulting Ltd. and dated September 15, 2006 as amended and restatedDecember 12, 2006; and U3O8 Corp's NI 43-101 resource as detailed in theNI 43-101 report titled "A Technical Review of the Aricheng North andAricheng South Uranium Deposits in Western Guyana for U3O8 Corp. andPrometheus Resources (Guyana) Inc." by Watts, Griffis and McOuat datedJanuary 14, 2009, available on SEDAR at www.sedar.com and on thecompany's website www.u3o8corp.com.

On February 17, 2010, U3O8 Corp. announced the acquisition of MegaUranium Ltd's South American uranium properties, which is expected toclose on or about March 31, 2010. "

Antwort auf Beitrag Nr.: 39.181.336 von Popeye82 am 19.03.10 20:53:13

"Proposed Acquisition Presentation":

www.u3o8corp.com/docs/Presentations/2010 Presentations/UWE_M…

"Proposed Acquisition Presentation":

www.u3o8corp.com/docs/Presentations/2010 Presentations/UWE_M…

U3O8 Corp. Completes Acquisition of Mega Uranium's South American Assets - Apr 8, 2010

www.marketwire.com/press-release/U3O8-Corp-Completes-Acquisi…

www.marketwire.com/press-release/U3O8-Corp-Completes-Acquisi…

U3O8 Corp. Reports Significant Grades of Uranium, Vanadium, Molybdenum & Phosphate From Trenching in the Berlin Project, Colombia; Assay results provide first verification of historic resource potential of newly acquired project - Apr 29, 2010

www.marketwire.com/press-release/U3O8-Corp-Reports-Significa…

"TORONTO, ONTARIO--(Marketwire - April 29, 2010) - U3O8 Corp. (TSX VENTURE:UWE) a Canadian-based company focused on uranium exploration and resource expansion in South America, reports significant values of uranium, vanadium, molybdenum and phosphate from continuous rock-chip samples collected in the first six trenches of a 26-trench program currently underway in its Berlin Project in Caldas Province, Colombia, South America. The Berlin Project, recently acquired from Mega Uranium Ltd., is a phosphatic shale uranium prospect with a historic resource1 of 12.9 million tonnes at a grade of 0.13% U3O8 (38 million pounds U3O8) with associated vanadium, molybdenum and phosphate.

"U3O8 Corp. is aggressively moving forward on the Berlin Project – an exciting multi-commodity opportunity that could add significantly to our resource base in the short-term. We are pleased that the first assay results from our trenching program show similar grades to historic assays, and constitute a first step in verifying the historic resource," said Dr. Richard Spencer, U3O8 Corp's President and CEO. "The historic resource at Berlin was defined in the southern 4.4 kilometres of a 10.5 kilometre long mineralized trend. Our trenching has commenced in this southern area and will extend to the north to confirm grade continuity over the whole strike length of the uranium-bearing unit. Drilling is planned for the third quarter this year, with the objective of verifying results recorded in historic drilling. Fresh core will then be used for metallurgical test work to determine the approximate recovery rates of the different commodities from the mineralized rock. We aim to be in a position to undertake a National Instrument 43-101 compliant resource estimate in 2011."

Table 1 – Assay Results for the Berlin Project

Summary assay results for six trenches excavated in the southern part of the Berlin Project (Figure 1).

Trench Estimated true Assay Values

Number width of U3O8 V2O5 P2O5 Mo mineralization (m) (%) (%) (%) (ppm)

Tb0 1.03 0.090 0.82 18.46 278

Tb1 1.28 0.117 0.88 3.79 839

Tb2 1.73 0.213 0.98 4.31 162

Tb3 1.36 0.083 0.94 5.52 165

Tb4 1.22 0.091 1.38 19.92 181

Tb4du 1.48 0.127 1.03 11.47 49

The uranium, vanadium, phosphate and molybdenum mineralization at Berlin occurs in a continuous shale layer that has been folded into a keel-like syncline. The syncline measures 10.5 kilometres long in a north-south orientation to a maximum width of two kilometres in an east-west direction (Figure 2). The axis of the keel reaches a maximum depth of about 250 metres below surface. The mineralized layer is one to three metres thick, which would suggest an underground mining scenario.

Vanadium and molybdenum are used as alloys to strengthen steel, while vanadium has potential to be used in high-energy batteries for electric cars and for storage of energy generated by solar panels and wind turbines. Phosphate, together with nitrogen and potash, constitute the three principal components of chemical fertilizers.

Two trenches, Tb0 and Tb1, are spaced about 50 metres apart near the southern tip of the keel-shaped shale layer, while trench Tb2 and Tb3 are spaced at 200 to 300 metre intervals on the western flank of the syncline (Figure 1). Trenches Tb4 and Tb4du are located approximately 30 metres apart on the east flank of the syncline, some 800 metres from its southern tip. The wide-spaced trenches were designed to test lateral continuity of the mineralization, while the two sets of close-spaced trenches tested detailed variability of mineralization. Uranium and vanadium assay results were consistent over the distance sampled with molybdenum and phosphate values being more variable (Table 1).

Exploration Program

The planned trench program in the Berlin Project includes the excavation of 26 trenches at about 200-metre spacing on both sides of the southern 4.4 kilometre part of the 10.5 kilometre long syncline with the aim of confirming lateral continuity of mineralization over the area in which the histroric resource was estimated (Figure 2). Trenching of the southern area is scheduled for completion in May 2010, at which time, trenching will extend into the northern area with estimated completion in September 2010. The application for permission to drill is being processed by the authorities and drilling is expected to commence in July 2010. The drill program of approximately 1,500 metres in seven bore holes will aim to confirm the historic intercepts in the southern area. Contingent on successful drilling of potentially economic uranium grades, metallurgical test work is also planned for 2010. Subject to the results of the 2010 work program, the objective is to position the Berlin Project for an extensive drill program in order to define a potential National Instrument 43-101 ("NI 43-101") resource in 2011.

Quality Assurance & Quality Control

Trenches were sited in areas of outcrop of the shale layer and excavated by hand, perpendicular to the strike of mineralization. Continuous rock-chip samples were taken from the side walls of each trench, bagged and numbered on site and delivered to ALS Laboratory Group's preparation facility in Bogota, Colombia and analysis in Lima, Peru. Analysis was by Inductively Coupled Plasma Emission Spectroscopy (ICP-AES) after aqua regia digestion.

Mr. Richard Cleath (M.Sc.), Vice President of U3O8 Corp., a Qualified Person within the definition of that term in National Instrument 43-101 of the Canadian Securities Administrators, has verified the technical information in this release.

Historic Resource1

The majority of the prior exploration on the Berlin Project was conducted by the French company, Minatome, between 1978-1981 and culminated in the drilling of 11 bore holes and the excavation of 20 trenches and three adits. The historic estimate was generated on the southern 4.4 kilometres of a 10.5 kilometre long syncline (Figure 2). Historic data from trenching shows that anomalous grades of uranium continue along strike to the north. The Berlin Project appears geologically similar to the uranium-vanadium-nickel bearing Alum Shale in Sweden, although the assays reported above and the historic results are significantly higher than uranium and vanadium grades from the Alum Shale.

(1) The Berlin resource estimate is historical and is reported in Castano, R. (1981), Calcul provisoire des reserves geologiques de Berlin, sur la base des resultants des sondages, unpublished Minatome report, 15p. There has been insufficient exploration work completed to verify the historic estimate. U3O8 Corp. is not treating the historical estimate as current mineral resources and it should not be relied upon or considered a NI 43-101 compliant resource. As the 38 million pound U3O8 historic estimate is based only on 11 widely-spaced drill holes, it is regarded by U3O8 Corp. as merely an indication of the magnitude of the uranium resource potential of the southernmost 4.4 kilometre long portion of the syncline containing the Berlin uranium mineralization.

About U3O8 Corp.

U3O8 Corp. is a Toronto-based exploration company, focused on uranium exploration and resource expansion in South America – a promising new frontier for uranium exploration and development. U3O8 Corp. has one of the most advanced portfolios of uranium projects in the region comprising NI 43-101 compliant resources in Guyana to significant historic resources in Colombia and near-resource and discovery potential in Argentina.

For further information on U3O8 Corp's Berlin Project, refer to the technical report entitled "Review of Historic Exploration Data from the Unaniferous Black Shales of the Berlin Project and Chaparral Concession, Colombia: A guide to future exploration" prepared by Richard Spencer and Richard Cleath dated March 23, 2010 and available at www.sedar.com. Additional information on U3O8 Corp. is available on the company's web site at www.u3o8corp.com. "

www.marketwire.com/press-release/U3O8-Corp-Reports-Significa…

"TORONTO, ONTARIO--(Marketwire - April 29, 2010) - U3O8 Corp. (TSX VENTURE:UWE) a Canadian-based company focused on uranium exploration and resource expansion in South America, reports significant values of uranium, vanadium, molybdenum and phosphate from continuous rock-chip samples collected in the first six trenches of a 26-trench program currently underway in its Berlin Project in Caldas Province, Colombia, South America. The Berlin Project, recently acquired from Mega Uranium Ltd., is a phosphatic shale uranium prospect with a historic resource1 of 12.9 million tonnes at a grade of 0.13% U3O8 (38 million pounds U3O8) with associated vanadium, molybdenum and phosphate.

"U3O8 Corp. is aggressively moving forward on the Berlin Project – an exciting multi-commodity opportunity that could add significantly to our resource base in the short-term. We are pleased that the first assay results from our trenching program show similar grades to historic assays, and constitute a first step in verifying the historic resource," said Dr. Richard Spencer, U3O8 Corp's President and CEO. "The historic resource at Berlin was defined in the southern 4.4 kilometres of a 10.5 kilometre long mineralized trend. Our trenching has commenced in this southern area and will extend to the north to confirm grade continuity over the whole strike length of the uranium-bearing unit. Drilling is planned for the third quarter this year, with the objective of verifying results recorded in historic drilling. Fresh core will then be used for metallurgical test work to determine the approximate recovery rates of the different commodities from the mineralized rock. We aim to be in a position to undertake a National Instrument 43-101 compliant resource estimate in 2011."

Table 1 – Assay Results for the Berlin Project

Summary assay results for six trenches excavated in the southern part of the Berlin Project (Figure 1).

Trench Estimated true Assay Values

Number width of U3O8 V2O5 P2O5 Mo mineralization (m) (%) (%) (%) (ppm)

Tb0 1.03 0.090 0.82 18.46 278

Tb1 1.28 0.117 0.88 3.79 839

Tb2 1.73 0.213 0.98 4.31 162

Tb3 1.36 0.083 0.94 5.52 165

Tb4 1.22 0.091 1.38 19.92 181

Tb4du 1.48 0.127 1.03 11.47 49

The uranium, vanadium, phosphate and molybdenum mineralization at Berlin occurs in a continuous shale layer that has been folded into a keel-like syncline. The syncline measures 10.5 kilometres long in a north-south orientation to a maximum width of two kilometres in an east-west direction (Figure 2). The axis of the keel reaches a maximum depth of about 250 metres below surface. The mineralized layer is one to three metres thick, which would suggest an underground mining scenario.

Vanadium and molybdenum are used as alloys to strengthen steel, while vanadium has potential to be used in high-energy batteries for electric cars and for storage of energy generated by solar panels and wind turbines. Phosphate, together with nitrogen and potash, constitute the three principal components of chemical fertilizers.