Spider Res: 1500% bis Oktober? - 500 Beiträge pro Seite

eröffnet am 20.09.07 01:51:48 von

neuester Beitrag 08.07.10 21:41:50 von

neuester Beitrag 08.07.10 21:41:50 von

Beiträge: 257

ID: 1.133.050

ID: 1.133.050

Aufrufe heute: 0

Gesamt: 19.721

Gesamt: 19.721

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 21:20 | 6599 | |

| vor 1 Stunde | 4839 | |

| vor 1 Stunde | 4626 | |

| gestern 18:00 | 3197 | |

| gestern 22:23 | 2933 | |

| vor 1 Stunde | 2814 | |

| vor 1 Stunde | 2067 | |

| vor 1 Stunde | 1709 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.737,36 | -0,56 | 198 | |||

| 2. | 2. | 146,82 | -2,07 | 95 | |||

| 3. | 7. | 6,6460 | -1,23 | 70 | |||

| 4. | 5. | 0,1810 | -1,90 | 51 | |||

| 5. | Neu! | 711,55 | -23,36 | 46 | |||

| 6. | 8. | 3,7700 | +0,80 | 45 | |||

| 7. | 17. | 7,2825 | -0,24 | 43 | |||

| 8. | 4. | 2.390,60 | 0,00 | 41 |

http://www.spiderresources.com/

Wie der Aktien-Review bereits am Montag schrieb:

"Der Wahnsinn geht weiter":

Spider ist wie Noront (rund 500 Mio. C$ MK) am McFauld's Lake positioniert und hofft, die spektakulären Funde auf ihrem Gebiet im JV mit KWG nachvollziehen zu können.

Nachdem Spider von 0,03 $ kommend bis auf 0,16 in 3 Tagen laufen konnte, ging es nach der Veröffentlichung der Results heute bis zu 70% (!!!) in den Keller, um von ID 0,05 wider auf 0,11 zu laufen.

MK: 20 Mio. €.

Potenzial mathematisch bei einem Noront Kurs von z.Z 3.30 $:

10% von Noront (ca. 0,33).

Bei Funden und den zu erwartenden UNFASSBAREN Laborberichten zu Drillcore #5 von Noront: 0,40 bis Ende 2007.

Achtung: MAXIMAL riskant!

Wie der Aktien-Review bereits am Montag schrieb:

"Der Wahnsinn geht weiter":

Spider ist wie Noront (rund 500 Mio. C$ MK) am McFauld's Lake positioniert und hofft, die spektakulären Funde auf ihrem Gebiet im JV mit KWG nachvollziehen zu können.

Nachdem Spider von 0,03 $ kommend bis auf 0,16 in 3 Tagen laufen konnte, ging es nach der Veröffentlichung der Results heute bis zu 70% (!!!) in den Keller, um von ID 0,05 wider auf 0,11 zu laufen.

MK: 20 Mio. €.

Potenzial mathematisch bei einem Noront Kurs von z.Z 3.30 $:

10% von Noront (ca. 0,33).

Bei Funden und den zu erwartenden UNFASSBAREN Laborberichten zu Drillcore #5 von Noront: 0,40 bis Ende 2007.

Achtung: MAXIMAL riskant!

Wie gesagt: "Der Wahnsinn geht weiter".

Heute intraday bereits gerne mal -70%.

Willkommen im Casino ElNoront...

Heute intraday bereits gerne mal -70%.

Willkommen im Casino ElNoront...

September 5, 2007 Spider Resources Inc. and UC Resources Ltd.

intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag

over 19 metres at VMS project in Northern Ontario

intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag

over 19 metres at VMS project in Northern Ontario

Antwort auf Beitrag Nr.: 31.669.405 von Panem am 20.09.07 05:34:59, ging es nach der Veröffentlichung der Results heute bis zu 70% (!!!) in den Keller, um von ID 0,05 wider auf 0,11 zu laufen.

was brachten die Results`?

Heisse Luft ?

Zockern gehen hier mit Spielgeld rein

was brachten die Results`?

Heisse Luft ?

Zockern gehen hier mit Spielgeld rein

Antwort auf Beitrag Nr.: 31.669.332 von Panem am 20.09.07 01:51:48Hole NOT-07-01 partial assay results, 36 meters averaging 1.84% Nickel, 1.53% Copper, includes 1.04 g/t Platinum, 2.87 g/t Palladium and 0.127 g/t Gold, more results to follow

Antwort auf Beitrag Nr.: 31.669.332 von Panem am 20.09.07 01:51:48landschaftlich schöne gegend. muss sofort platt gemacht werden. gelle.

Antwort auf Beitrag Nr.: 31.669.332 von Panem am 20.09.07 01:51:48panem, Du alter Zocker, bist ja auch noch da.

Wo bist Du aktuell investiert?

Wo bist Du aktuell investiert?

Antwort auf Beitrag Nr.: 31.670.328 von timesystem1000 am 20.09.07 09:14:21Targetpreis für Noront laut IBK: 78$.

Zitat Stockhouse:

"I have seen this hole ( one core box full ) in person. After many years of looking at core, I will make the outrageous comment that hole 5 will be the best exploration hole hit in living memory.( Base Metal )

The market will dictate how good the results are, but I assure you, I've looked a lot of core over the years.

Just My Humble Opinion"

------------

Zielwert Spider dann:

8 Dollar.

Klar?

--------------

"To The MOON, Alice"

Zitat Stockhouse:

"I have seen this hole ( one core box full ) in person. After many years of looking at core, I will make the outrageous comment that hole 5 will be the best exploration hole hit in living memory.( Base Metal )

The market will dictate how good the results are, but I assure you, I've looked a lot of core over the years.

Just My Humble Opinion"

------------

Zielwert Spider dann:

8 Dollar.

Klar?

--------------

"To The MOON, Alice"

---WARNUNG----WARNUNG---

Und auch hier noch einmal meine PERSÖNLICHE EINSCHÄTZUNG:

Ich halte das hier alles für absoluten Wahnsinn und einen reinen Zock - zudem ist bei Spider die Aktienzahl immens hoch und die anstehende Verwässerung ist noch nicht eingerechnet.

Ein reiner spekulativer Kurs von 0,40 $ Ende 2007 wäre mehr als man erwarten dürfte und selbst dann noch Wahnsinn.

OK?

Da war damit mein letzter Kommentar zu einem Noront Play in absehbarer Zeit bei WO.

Und auch hier noch einmal meine PERSÖNLICHE EINSCHÄTZUNG:

Ich halte das hier alles für absoluten Wahnsinn und einen reinen Zock - zudem ist bei Spider die Aktienzahl immens hoch und die anstehende Verwässerung ist noch nicht eingerechnet.

Ein reiner spekulativer Kurs von 0,40 $ Ende 2007 wäre mehr als man erwarten dürfte und selbst dann noch Wahnsinn.

OK?

Da war damit mein letzter Kommentar zu einem Noront Play in absehbarer Zeit bei WO.

Re: SPQ in the news...Please notice...

Posted by: johndefur on November 02, 2007 07:05PM

In response to: SPQ in the news by vanrog

That SPQ now has $ 6,000.000.00 dollars in the kitty, and insiders who bought in that PP, bought the warrants @ 17.5 cents...now that ought to tell you something very important...

http://www.agoracom.com/ir/Spider/messages/618315#message

Posted by: johndefur on November 02, 2007 07:05PM

In response to: SPQ in the news by vanrog

That SPQ now has $ 6,000.000.00 dollars in the kitty, and insiders who bought in that PP, bought the warrants @ 17.5 cents...now that ought to tell you something very important...

http://www.agoracom.com/ir/Spider/messages/618315#message

Antwort auf Beitrag Nr.: 32.264.911 von mike32 am 03.11.07 12:47:50Oktober?

2007?

rot?

1500?

Gewinn?

2007?

rot?

1500?

Gewinn?

Warum wird hier ständig der Kurs aus Berlin angezeigt? Interessiert sich doch keine S.. für.

http://www.worldofinvestment.com/wkn/899289/FRA/

http://www.worldofinvestment.com/wkn/899289/FRA/

http://biz.yahoo.com/ccn/080204/200802040439969001.html?.v=1

KWG, Spider and Freewest Start Winter Exploration Program McFauld's Lake Area, Northern Ontario

Monday February 4, 9:23 am ET

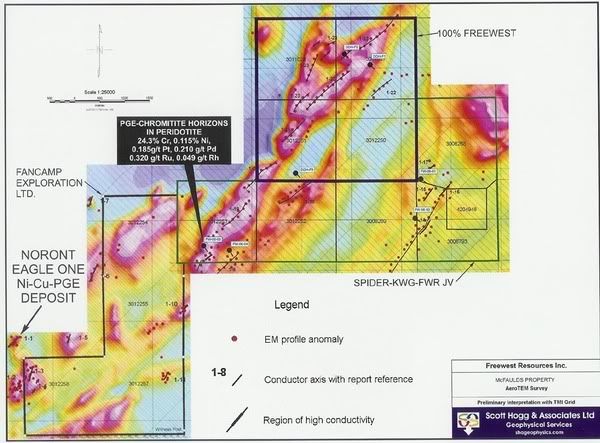

TORONTO, CANADA--(Marketwire - Feb. 4, 2008) - KWG Resources Inc. (TSX VENTURE:KWG - News) and Spider Resources Inc. (TSX VENTURE:SPQ - News) and Freewest Resources Canada Inc. (TSX VENTURE:FWR - News) are pleased to announce the start up of their 2008 winter exploration program on the Freewest option property (the "Property"), located approximately 15 kilometres southwest of the McFaulds Lake volcanogenic massive sulphide ("VMS") occurrences of KWG and Spider and approximately 3.6 kilometres northeast of Noront Resources Ltd.'s Eagle One Magmatic Massive Sulphide ("MMS") discovery in the James Bay Lowlands region of Northern Ontario.

ADVERTISEMENT

The joint venture partners (KWG and Spider) last completed field work on this property in 2006, that included a diamond drill program resulting in the discovery of a layered chromitite-bearing, nickel-enriched peridotite (See press release dated March 7, 2006). Assay results received later (see press release dated June 29, 2006) confirmed that the layering within this peridotite was enriched in chrome and nickel, as well as Platinum Group Elements ("PGE's"). The 2006 winter exploration program was highlighted by the discovery of two massive chromitite layers hosted within peridotite, encountered while drilling ground geophysical anomalies targeting volcanic-hosted massive sulphide deposits (drill hole FW-06-03). The drilling returned the following assays:

----------------------------------------------------------------------

Upper Chromitite Layer Lower Chromitite Layer

----------------------------------------------------------------------

22.70% chrome, 0.17 g/t 23.70% chrome, 0.21 g/t

platinum, 0.24 g/t palladium platinum, 0.46 g/t palladium

over 1.05 metres(1) over 0.60 metres(1)

----------------------------------------------------------------------

(1) Assays performed by ALS Chemex of Vancouver, B.C. utilizing multi-acid

ICP techniques for low and higher grades on samples selected, bagged

and tagged and sent by bonded courier to the lab, under the supervision

of Howard Lahti Ph.D. P.Geo. of Fredericton New Brunswick.

Subsequent re-analyses of selected samples and some additional assaying of the drill core from the 2 chromitite layers and intervening wall rock in the peridotite was later completed by Actlabs. The analyses yielded the following results:

----------------------------------------------------------------------

Upper Chromitite Layer Lower Chromitite Layer

----------------------------------------------------------------------

23.40% chrome, 0.19 g/t 18.60% chrome, 0.23 g/t

platinum, 0.21 g/t palladium, platinum, 0.48 g/t palladium,

0.32 g/t ruthenium, 0.05 g/t 0.30 g/t ruthenium, 0.05 g/t

rhodium, 0.12% nickel rhodium, 0.13% nickel

over 1.03 metres(2) over 0.85 metres(2)

----------------------------------------------------------------------

(2) Assays performed by Actlabs of Ancaster, Ontario, utilizing INAA for

chrome, sodium peroxide fusion and ICP analysis for nickel and nickel

sulphide fire assay technique for PGE's on samples selected, bagged and

tagged and sent by bonded courier to the lab, under the supervision of

Howard Lahti Ph.D. P.Geo of Fredericton New Brunswick overseeing the

lab to lab delivery of samples.

The additional assaying completed on the entire mineralized zone in the peridotite, including the upper and lower chromitite layers, yielded 4.05% chrome and 0.17% nickel over a core length of 16.85 metres. This chrome-PGE-nickel discovery was the first of its kind in the McFauld's Lake area of the Sachigo Greenstone Belt. The host peridotite contains variable amounts of magnetite as disseminations and seams and is strongly magnetic. This magnetic-high feature measures 400 metres by 400 metres at its surface expression. Due to these dimensions and the peridotite-hosted similarity to Eagle One, the target is compelling for further sampling for chrome-PGE-nickel mineralization.

Under the terms of an agreement with Freewest (see press release December 19, 2005), Spider and KWG must spend an aggregate of $3.0 million on exploration over a four-year period to earn an initial joint 50% interest in the Property. They may earn a cumulative joint 60% interest in the Property by delivering a bankable feasibility study on any mineralization identified and subsequently a cumulative joint 65% interest, by arranging financing on behalf of Freewest to put the Property into commercial production. An initial $200,000 needed to be expended on the property by February 28, 2006. The early 2006 work program covered this initial earn-in allowing the option to continue where an additional $2.8 million needs to be expended prior to the end of October 2009 to complete the initial option requirement to earn 50% in this project from Freewest. KWG and Spider are in agreement and are sharing the cost of the current program on a 50:50 basis, each contributing an additional $1.08 million to the project for a total exploration expenditure of $2.16 million to be incurred in the current program (estimated to be completed by May 2008). Both parties are well funded to complete this program.

The initial field crew arrived on site in late January and commenced re-identification of the claim boundaries prior to starting a detail line-cutting program. A property-wide grid with 200 metre line spacing is currently being established, initially focussing on the western portion of the property covering the peridotite in the vicinity of 2006 drill hole FW-06-03, where the grid will be detailed at 100 metre spaced lines. Upon completion of the detail grid area, horizontal loop electromagnetic (HLEM), along with Magnetic and VLF electromagnetic ground surveying will be completed. Drilling is scheduled to start during February, once the initial geophysical surveying is complete. Initial holes will test the layered peridotite and explore this exciting occurrence for its MMS potential. Preliminary maps produced from the recent Aerotem2 airborne survey have been reviewed and are being used to plan the exploration of the remainder of the property. Several other similar anomalies are evident in this early interpretation, however, these need to be confirmed by review of the data in the final airborne survey report. The parties have retained Billiken Management Services Inc for the provision and management of all field operations.

Mousseau Tremblay, Ph.D., P.Geo, Chairman of KWG Resources Inc. and a Qualified Person as such term is defined under National Instrument 43-101, has reviewed and verified the technical information contained in this press release and has approved the contents of this press release.

Shares issued and outstanding: 262,863,821

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this press release.

Contact:

Frank C. Smeenk

KWG Resources Inc.

President and CEO

416-642-3575

514-866-6193 (FAX)

Michel Cote

KWG Resources Inc.

Director

514-866-6001 - Ext. 266

514-866-6193 (FAX)

www.kwgresources.com

Source: KWG Resources Inc.

SPIDER PLAYBOOK...(review #4)

Posted by: kelsee on February 05, 2008 03:15PM

SPIDER PLAYBOOK

1st Edition – Feb. 4th, ’08 (and maybe last, lol)

Spider Plays in McFaulds:

1) SPQ/KWG/FWR – JV earn-in percentages:

a. SPQ – 32.5%

b. KWG – 32.5%

c. FWR – 35%

**the latest on this joint venture:

http://www.marketwire.com/mw/release.do?id=817086

2) SPQ/KWG/UC – JV earn-in percentages:

a. SPQ - 30%

b. KWG - 15%

c. UC - 55%

**UC is continuing to fund the exploration of this VMS camp by initially concentrating their efforts on the McFaulds #3 and #1 occurrences, then they advise that they will be looking at completing additional exploration on the other occurrences as the program progresses, through year two, three and four of the agreement.

*we await the official commencement/announcement of the winter/spring ’08 drilling program

3) SPQ/KWG/Renforth – JV earn-in percentages:

a. SPQ - 30%

b. KWG - 15%

c. Renforth – 55%

**drill program status:http://www.agoracom.com/ir/Spider/messages/715503" target="_blank" rel="nofollow ugc noopener">

http://www.agoracom.com/ir/Spider/messages/715503

4) SPQ/KWG – JV percentages:

Wawa Project: SPQ – 66.6%

KWG – 33.3%

**The joint venture is planning a follow up drilling program on this property to be completed in the next 6-8 months.,,(from Oct. 1, 2007 news release)

MacFayden Project:

KWG – 66.6%

SPQ - 33.3%

Diagnos Project:

SPQ and KWG both share this project 50-50

**The parties are considering a drilling program to test the 2 highest priority targets this winter…(from Oct. 1, 2007 news release)

**’08 drilling program yet to be announcement

ACCESS LINK BELOW TO VIEW McFAULD’S CLAIMS MAP:

*the preceding information was gathered from news releases/maps issued by some of the companies involved and is deemed to reflect the agreed to percentages per: jv agreements, however, please do your own due diligence.

http://www.agoracom.com/ir/Spider/messages/719446#message

Posted by: kelsee on February 05, 2008 03:15PM

SPIDER PLAYBOOK

1st Edition – Feb. 4th, ’08 (and maybe last, lol)

Spider Plays in McFaulds:

1) SPQ/KWG/FWR – JV earn-in percentages:

a. SPQ – 32.5%

b. KWG – 32.5%

c. FWR – 35%

**the latest on this joint venture:

http://www.marketwire.com/mw/release.do?id=817086

2) SPQ/KWG/UC – JV earn-in percentages:

a. SPQ - 30%

b. KWG - 15%

c. UC - 55%

**UC is continuing to fund the exploration of this VMS camp by initially concentrating their efforts on the McFaulds #3 and #1 occurrences, then they advise that they will be looking at completing additional exploration on the other occurrences as the program progresses, through year two, three and four of the agreement.

*we await the official commencement/announcement of the winter/spring ’08 drilling program

3) SPQ/KWG/Renforth – JV earn-in percentages:

a. SPQ - 30%

b. KWG - 15%

c. Renforth – 55%

**drill program status:http://www.agoracom.com/ir/Spider/messages/715503" target="_blank" rel="nofollow ugc noopener">

http://www.agoracom.com/ir/Spider/messages/715503

4) SPQ/KWG – JV percentages:

Wawa Project: SPQ – 66.6%

KWG – 33.3%

**The joint venture is planning a follow up drilling program on this property to be completed in the next 6-8 months.,,(from Oct. 1, 2007 news release)

MacFayden Project:

KWG – 66.6%

SPQ - 33.3%

Diagnos Project:

SPQ and KWG both share this project 50-50

**The parties are considering a drilling program to test the 2 highest priority targets this winter…(from Oct. 1, 2007 news release)

**’08 drilling program yet to be announcement

ACCESS LINK BELOW TO VIEW McFAULD’S CLAIMS MAP:

*the preceding information was gathered from news releases/maps issued by some of the companies involved and is deemed to reflect the agreed to percentages per: jv agreements, however, please do your own due diligence.

http://www.agoracom.com/ir/Spider/messages/719446#message

Video for the Forum

Posted by: Crowlee on February 08, 2008 12:20AM

I have created a video for the McFaulds Lake Forum. Parts of it may go by quick but that gives you more reason to watch it more than once.

It's located in the upper right under "President's Video". It's also located here on YouTube:

http://www.youtube.com/watch?v=9BqWq8-0OBs

Feel free to share it with the other McFauld Lake forums.

Crow

http://www.agoracom.com/ir/McFaulds/messages/722143#message

gruss mike

Posted by: Crowlee on February 08, 2008 12:20AM

I have created a video for the McFaulds Lake Forum. Parts of it may go by quick but that gives you more reason to watch it more than once.

It's located in the upper right under "President's Video". It's also located here on YouTube:

http://www.youtube.com/watch?v=9BqWq8-0OBs

Feel free to share it with the other McFauld Lake forums.

Crow

http://www.agoracom.com/ir/McFaulds/messages/722143#message

gruss mike

area play and jv action today

Posted by: QQ_Girl on February 08, 2008 05:48PM

a couple of new ones at the bottom that I found on Helium's datebase claim maps - can anyone tell me Vale Inco's ticker symbol, not sure why I can't find it - ty QQ

SPQ

$.005 4.55% 2,675,200

.105 - .12

.115 .........

http://agoracom.com/ir/Noront/messages/723361#message

That patience thing

Posted by: SnugTheJoiner on February 12, 2008 06:03PM

It's snowing like crazy here in Toronto, and the polar bears are sleeping soundly.

SPQ had a relatively quiet day volume wise. As you noted Poly, it probably will be another 4-5 months of slumber for the Spider. I would put a lot of money on 3Q08 for significant upside movement for SPQ and the other McFaulds players. There will be a "convergence" of events. Here's my reasoning on what will converge:

1) Humungous amounts of data in many forms will be out from the Ring of Fire (EM aerial maps, drill results, assays, and 43-101s)

2) The dog days of the summer stock market will be replaced by a stronger than normal 3Q08 stock market (post September) which tends to be, along with 4Qs, the strongest time of the year for equities

3) The subprime mess which has affected global stock markets will finally fade into history.

4) A new US President will be enthroned in Washingston, and everything will be right with the world.

Until the 3Q08 there will be the occasional blip on the radar screen when the a McFaulds' play goes ballastic for a bit. But I don't think there will be any strong movement upward until then. In fact, in the absence of any news of a substantive nature, there will be a continual downward pressure on share prices. People quickly lose patience, and sell out. Too bad.

HOWEVER, I'm LONG. You won't see any of my shares on the SELL side of the ledger. My powder is dry, and I'll be on the BUY side of the market a chosen times.Snug

http://www.agoracom.com/ir/Spider/messages/726742#message

gruss mike

Talk with Neil Novak -

Feb. 13/08

Posted by: SnugTheJoiner on February 13, 2008 10:05AM

I had a brief discussion this a.m. with Neil Novak. He was answering the phones before 9:00 a.m. when I caught him. We discussed a number of things before he had to head off to a meeting at 9.

Here's some of the project info that SPQ is working on. It's not inclusive and there's still not a great deal of information about specific geological facts because the drilling is just about to begin. Note 1: SPQ has one drill for its 2008 projects.

On the topic of the SPQ/FWR/KWG chromite and PGM option, Neil was up at the site last week. He spotted the first drill hole location and the drill crew is ready to go. The start of drilling is pencilled in for February 15. Neil noted that there are "junior geos" at the site but that Dr. Lahti, the senior geologist, will be overseeing the drilling. 5000 meters is scheduled to be drilled by June with a July completion date. If something "big" if struck, more drilling can take place at this location.

Regarding the "Diagnos" project, the preliminary geophysics has been done. Neil mentioned that he has identfied a couple of anomalies which look good. He has to put a proposal together to put in front of the JV partners. He needs to go up in the summer to see whether there is a dry site to begin drilling. If the sites are wet, drilling would begin in the winter of 2009. Note 2: The drill platform from the chrome & PGM site would be used for this drilling unless of course something exciting was seen at the first site.

On the topic of McFaulds East & West, Jim Voisin of UC Resources is driving these projects. A meeting is scheduled to take place next week where Jim will pitch his ideas. Decisions will be made at that time with regards to moving forward on these projects.

Neil is constant contact with all of the players at McFaulds, particularly with the Noront people. I think he is very happy with his role as VP of Noront. He has know Richard Nemis for a long time; he trust him; and he understands that RN is the "deal maker" (his words). He's in weekly contact with John Harvey who is the "big picture" guy (Neil's words). Neil, talking about himself, is the "details guy". He believes in project protocols. (i.e., he's no Robert Friedland).

Some final thoughts:

Neil is terrific to talk with and shares what he knows and what is not company confidential. He clearly wants his McFaulds' plays to be successful, but honestly, all that he knows - more than us, the retail investor - is what he sees on the preliminary aerial surveys - and that isn't 100%. So guess what, he's speculating too! He is risking his money too! The bottom line for me: Trust in the Management. The triad of Nemis, Harvey, and Novak are smart, forthright, hardworking, and communicate very well.

I asked Neil about the PDAC luncheon on March 6. He seems to think that it will have a strong emphasis on students. The presentation will be geared to telling the students about McFaulds and its geology. In fact, the First Nations people will have representation. Neil has done a fabulous job working with the First Nations. (His last presentation in Thunderbay to the Chiefs was scheduled to run 30 minutes. It ended up going 5 hours!)

So there you have it. I wish I could tell you about drill cores, visuals, assays, 43-101s, and the fabulous wealth that's on the horizon - but I can't. But there are viable SPQ projects with project timelines. And it's all part of the McFaulds Great Canadian Area Play.

Be patient and keep the faith.

Snug

http://www.agoracom.com/ir/Spider/messages/727203#message

Talk with Neil Novak -

Feb. 13/08

Posted by: SnugTheJoiner on February 13, 2008 10:05AM

I had a brief discussion this a.m. with Neil Novak. He was answering the phones before 9:00 a.m. when I caught him. We discussed a number of things before he had to head off to a meeting at 9.

Here's some of the project info that SPQ is working on. It's not inclusive and there's still not a great deal of information about specific geological facts because the drilling is just about to begin. Note 1: SPQ has one drill for its 2008 projects.

On the topic of the SPQ/FWR/KWG chromite and PGM option, Neil was up at the site last week. He spotted the first drill hole location and the drill crew is ready to go. The start of drilling is pencilled in for February 15. Neil noted that there are "junior geos" at the site but that Dr. Lahti, the senior geologist, will be overseeing the drilling. 5000 meters is scheduled to be drilled by June with a July completion date. If something "big" if struck, more drilling can take place at this location.

Regarding the "Diagnos" project, the preliminary geophysics has been done. Neil mentioned that he has identfied a couple of anomalies which look good. He has to put a proposal together to put in front of the JV partners. He needs to go up in the summer to see whether there is a dry site to begin drilling. If the sites are wet, drilling would begin in the winter of 2009. Note 2: The drill platform from the chrome & PGM site would be used for this drilling unless of course something exciting was seen at the first site.

On the topic of McFaulds East & West, Jim Voisin of UC Resources is driving these projects. A meeting is scheduled to take place next week where Jim will pitch his ideas. Decisions will be made at that time with regards to moving forward on these projects.

Neil is constant contact with all of the players at McFaulds, particularly with the Noront people. I think he is very happy with his role as VP of Noront. He has know Richard Nemis for a long time; he trust him; and he understands that RN is the "deal maker" (his words). He's in weekly contact with John Harvey who is the "big picture" guy (Neil's words). Neil, talking about himself, is the "details guy". He believes in project protocols. (i.e., he's no Robert Friedland).

Some final thoughts:

Neil is terrific to talk with and shares what he knows and what is not company confidential. He clearly wants his McFaulds' plays to be successful, but honestly, all that he knows - more than us, the retail investor - is what he sees on the preliminary aerial surveys - and that isn't 100%. So guess what, he's speculating too! He is risking his money too! The bottom line for me: Trust in the Management. The triad of Nemis, Harvey, and Novak are smart, forthright, hardworking, and communicate very well.

I asked Neil about the PDAC luncheon on March 6. He seems to think that it will have a strong emphasis on students. The presentation will be geared to telling the students about McFaulds and its geology. In fact, the First Nations people will have representation. Neil has done a fabulous job working with the First Nations. (His last presentation in Thunderbay to the Chiefs was scheduled to run 30 minutes. It ended up going 5 hours!)

So there you have it. I wish I could tell you about drill cores, visuals, assays, 43-101s, and the fabulous wealth that's on the horizon - but I can't. But there are viable SPQ projects with project timelines. And it's all part of the McFaulds Great Canadian Area Play.

Be patient and keep the faith.

Snug

http://www.agoracom.com/ir/Spider/messages/727203#message

A fairy tale in response of the varous rumours.

Posted by: Helium on February 14, 2008 06:34AM

I do not have a glass bowl nor do I have a fairy wand.

But I do have a magical looking-glass.

It has never let me down. Every answer was spot on.

So I asked what the future for Mc Faulds has instored for me. Before I give you the answer, the mirror said, do not question history, for you will not be worthy of the future.

This was the answer: (after reading I realised once again the mirror was right and I am more than ever confident in the future. This post will be history tomorrow btw.)

“Spider starts drill program at Kyle #3 kimberlite, James Bay Lowlands, Ontario. News releases Spider of May 3, 2000; June 27, 2000; July 10, 2000; October 31 2000.

“This preliminary diamond grade result ranks the Kyle #3 kimberlite dike as one of the highest grade diamond bearing kimberlite bodies in the Province of Ontario to date”

SPIDER RESOURCES INC. and joint venture partner KWG RESOURCES INC. report the discovery of 11 new diamond bearing outcrops on their jointly-owned, 45 square kilometer Wawa property in northern Ontario News release Spider of March 13, 2002

SPIDER RESOURCES INC. Reports 2.617 carat/tonne regional sample from Wawa project News release Spider of October 16, 2002

SPIDER RESOURCES INC. AND KWG RESOURCES INC. IDENTIFY NEW "VMS BELT" IN ONTARIO LOWLANDS REPORTING GRADES AS HIGH AS 7.09% COPPER News release Spider of October 23, 2002

Massive Sulphide Zone Located While Drill Testing New Geophysical Anomaly News release SPQ of October 14, 2003

McFauld’s VMS drilling intersects 13.8m of 5.5% Copper, including higher grade zone over 4.6m averaging 10.4% Copper News release Spider of February 19, 2004

McFauld’s Hole #45 intersects 5.2 meters Massive Sulphide, Greater than 30% Zinc over 0.75 metersNews release Spider of September 13, 2004 Massive Sulphide grading 8.02% Copper over 18.8 meters at McFaulds Lake, Northern Ontario News release Spider of November 8, 2004

UC Resources Limited and Spider Resources Inc. Intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag Over 19 Metres at VMS

Project in Northern Ontario Probe Mines Discovers Copper Zone on McFauld's Lake Property News release Probe October 12, 2005

High Grade Copper Mineralization Discovered on Probe Mines McFauld's Lake Property, including 7.8m of 3.1% Cu News release Probe November 1, 2005

Probe Mines: Identifies New Conductors Near Recent VMS Discovery News release Probe January 17, 2006

KWG Resources Inc., Spider Resources Inc. and Renforth Resources Inc. Begin Exploration of Kyle Kimberlies; Collect 550 Kg. in First Two Holes Testing Kyle 2 News release KWG November 15, 2006

MacDonald's Initiates January Exploration Program on its MacNugget Drill Ready Targets....Area Play in McFauld's Lake/James Bay Lowlands Heats Up With Multiple Companies Announcing Early 2006 Exploration Programs.... First Tranche Financing Completed News release MacDonald January 3, 2006

MacDonald Mines Completes Ground Geophysics on the McNugget Property - Identifies Multiple Strong Drill Target Anomalies. Drilling of these Targets to Commence in March. News release MacDonald March 1, 2006

MacDonald Mines: Five Drill Holes Along A Strongly Anomolous 4.6 Km Trend Hit Massive & Disseminated Sulphides All With Visible Copper & Zinc Mineralization News releases MacDonald May 1, 2006 , June 7, 2006 , September 18, 2006, October 5, 2006

“Highlights of the spring 2006 campaign included holes MN-06-17 with 9.00m at 0.43% Cu, 3.1% Zn and 18.73 g/t Ag, including 2.66m at 7.07% Zn; MN-06-19 with 6.49m at 0.64% Cu, 2.92% Zn and 18.84 g/t Ag, including 2.79m at 5.21% Zn; and MN-06-14 with 2.57m at 1.01% Cu, 2.49% Zn and 31.00 g/t Ag.”

MacDonald Mines: McNugget Expands VMS Zones and Intersects Higher Tenor Mineralization News release MacDonald December 18, 2006

MacDonald Intersects New Nickel Sulfide Zone on McNugget Property, James Bay Lowlands News releases MacDonald June 14, 2007

MacDonald Mines Acquires a Significant Geological Favorable Land Position Similar to the Ground Hosting the Spectacular Noront Nickel-Copper Discovery News release MacDonald September 19, 2007

Noront Resources Ltd.: Double Eagle Project, James Bay Lowlands News releases Noront of August 29, 2007; September 10, 2007; September 13, 2007; September 19, 2007; September 25, 2007; September 27, 2007; October 10, 2007; October 30, 2007; November 6, 2007; December 21, 2007; January 3, 2008; January 28, 2008.

“Hole NOT-07-01 final assay results include; 36 meters averaging 1.84% Nickel, 1.53% Copper, 1.14 g/t Platinum, 3.49 g/t Palladium, 0.13 g/t gold and 4.8 g/t silver.

Hole NOT-07-05 final assay results include; 68.3 meters averaging 5.9% nickel, 3.1% copper, 2.87 g/t platinum, 9.78 g/t palladium, 0.61 g/t gold and 8.5 g/t silver.3 meter section of hole averaged 8.7% nickel, 10.9% copper, 40.79 g/t platinum, 14.57 g/t palladium, 9.39 g/t gold and 8.7 g/t silver

Hole NOT-07-07 undercut hole NOT-07-05 intersected the main mineralized zone starting at 72 meters core length and remained in it until 123.5 meters, for a total of 51.5 meters which included massive sulphide mineralization between 75.2 and 89.5 meters (14.3 meters) core length that averaged 2.5% Cu, 6.3 % Ni, 5.92 g/t Pt, 16.21 g/t Pd, 0.24 g/t Au and 8.3 g/t Ag.

Hole NOT-07-09 intersected the mineralized zone at 43 meters core length and remained in it until 88.6 meters for a total intersection of 45.6 meters. This mineralized zone included two massive sulphide sections totaling 22 meters. Assays for the 17.4 meter upper massive sulphide section averaged 3.87 % Cu, 4.82 % Ni, 1.02 g/t Pt, 14.78 g/t Pd, 0.27 g/t Au and 11.3 g/t Ag (Pd values pending), while the lower 4.6 meter massive sulphide section averaged 2.01 % Cu, 8.3 % Ni, 0.14 g/t Pt, 0.23 g/t, 11.53 g/t Pd, Au and 5.1 g/t Ag; Hole NOT-07-11 encountered two massive sulphide zones separated by weakly mineralized peridotite; first massive sulphide zone between 58.5 and 60.1 meters (1.6 meters averaged 4.82% Cu., 7.11% Ni., 2.53 g/t Pt., 14.65 g/t Pd., 0.19 g/t Au., and 14 g/t Ag.) followed by a second massive sulphide section between 74.5 and 75.8 meters (1.3 meters averaging 4.43% Cu., 7.37% Ni., 1.08g/t Pt., 18.1g/t Pd., 0.22g/t Au and 13 g/t Ag).

NOT-07-11 was reviewed and found to contain mineralized sulphides over greater lengths than previously reported (November 6, 2007).

Hole NOT-07-12 intersected mineralized peridotite between 81.5 meters and 176 meters including a massive sulphide zone between 82.5 and 92 meters downhole. This 9.5 meter section averaged 1.54% Cu., 6.99% Ni., 2.61 g/t Pt., 10.07g/t Pd., 0.15g/t Au and 5.21g/t Ag. Then from 92 to 113 meters a semi-massive section of sulphides was encountered consisting of pyrrhotite, pentlandite and chalcopyrite, followed by net textured nickel and copper sulphide mineralization to 176 meters.

NOT-07-14 between 52.8 meters to 56.4 meters, 3.6 meters of massive sulphides were intersected that averaged 3.43% copper, 7.45% nickel, 5.0 g/t platinum, 9.1 g/t palladium and 0.12 g/t gold, within part of a much larger intersection between 45.9 to 80 meters (34.1 meters) that averaged 1.22% copper, 2.28% nickel, 1.6 g/t platinum, 4.13 g/t palladium and 0.14 g/t gold. In addition a lower grade zone exists from 80 to 110 meters averaging 0.28% Cu, 0.59% Ni, 0.37 g/t Pt, 1.18 g/t Pd and 0.1 g/t Au. NOT-07-16 encountered a net-textured peridotite section combined with the massive sulphide section over 12.7 meters between 121.1 and 133.8 averaging 1.55% Cu, 2.4% Ni, 2.63 g/t Pt, 5.1 g/t Pd, 0.12 g/t Au and 4.5 g/t Ag. A lower grade section between 92.9 and 121.1 meters (28.2 meters wide) averaged 0.50% Cu, 0.57% Ni, 0.47 g/t Pt, 1.5 g/t Pt, 0.17 g/t Au and 1.5 g/t Ag. NOT-07-17 encountered the main mineralized zone between 96.5 meters and 177.5 meters downhole that over 81 meters averaged 0.77% Cu, 1.55% Ni, 0.91 g/t Pt, 2.97 g/t Pd, 0.13 g/t Au and 3.1 g/t Ag including a 7.5 meter wide massive sulphide intersection that averaged 1.54% Cu, 6.81% Ni, 2.17 g/t Pt, 6.62 g/t Pd, 0.15 g/t Au and 6.12 g/t Ag. NOT-07-18 intersected mineralization between 105.2 meters and 229.8 meters that over 124.6 meters averaged 2.39% Ni, 1.09% Cu, 1.12 g/t Pt, 3.86 g/t Pd, 0.28 g/t Au and 3.89 g/t Ag. This well mineralized zone contained an 18.8 meter massive sulphide mineralized section between 211 meters and 229.8 meters that graded 7.38% Ni, 3.18% Cu, 1.05 g/t Pt, 10.16 g/t Pd, 0.23g/t Au and 8.92 g/t Ag.

NOT-07-19 encountered the main mineralized zone between 104.2 meters and 110.8 meters over a drill intersection of 6.6 meters that averaged 0.63% Cu, 2.32% Ni, 1.13 g/t Pt, 3.93 g/t Pd, 0.06 g/t Au and 3.01 g/t Ag. This 37.5 meter stepout to the south is quite encouraging as the grade remains consistent.

NOT-07-27 intersected mineralization between 112.8 meters and 159 meters that over 46.6 meters averaged 6.25% nickel, 2.75% copper, 1.85 g/t platinum, 10.23 g/t palladium, 3.0 g/t gold and 10.3 g/t silver. This well mineralized zone contained a 35.6 meter wide massive sulphide mineralized section between 116.8 meters and 152.4 meters that graded 7.91% Ni, 3.45% Cu, 1.66 g/t Pt, 12.79 g/t Pd, 3.87/t Au and 9.27 g/t Ag.

NOT-07-29 intersected mineralization between 18.3 meters and 84.2 meters that over 65.9 meters averaged 1.48% nickel, 1.1% copper, 1.18 g/t platinum, 2.94 g/t palladium, 0.12 g/t gold and 3.3 g/t silver.”

KWG and Spider To Drill Targets Beside Noront Discovery News release KWG October 1, 2007

Fancamp Exploration Ltd.: McFaulds Property-Preliminary Airborne Data Received “...shows, in particular, the definite linkage of the conductive magnetic high of the Noront Zone with the large, conductive magnetic anomaly on the Fancamp Property, some 300 metres to the SSE. This "Linkage" forms a less intensely magnetic corridor about 150m wide which trends southerly from the SW end of the Noront magnetic feature, for about 300 metres then swings east into the Fancamp ground.”

Freewest Prioritizes Exploration Targets on its Mcfaulds Property, Ontario Freewest Flying Detailed Airborne Geophysical Survey on its McFaulds Property, James Bay Lowlands, Ontario News release Freewest October 29, 2007

KWG, Spider and Freewest Start Winter Exploration Program McFauld's Lake Area, Northern Ontario News release Freewest February 4, 2008

Hawk Uranium Inc. Increases Interest in Claims in McFaulds Lake Area of the James Bay Lowlands News release Hawk October 1, 2007

Work to Commence on the Hawk Joint Venture McNugget Claims in the McFaulds Lake Area of the James Bay LowlandsNews release Hawk October 12, 2007

Hawk's JV Partner-MacDonald Mines Exploration Ltd., Announces the Completion of the First Phase of Drill Program on the McNugget Property, McFaulds Lake Area, James Bay LowlandsNews release Hawk January 22, 2008

http://agoracom.com/ir/Noront/messages/728426#message

Posted by: Helium on February 14, 2008 06:34AM

I do not have a glass bowl nor do I have a fairy wand.

But I do have a magical looking-glass.

It has never let me down. Every answer was spot on.

So I asked what the future for Mc Faulds has instored for me. Before I give you the answer, the mirror said, do not question history, for you will not be worthy of the future.

This was the answer: (after reading I realised once again the mirror was right and I am more than ever confident in the future. This post will be history tomorrow btw.)

“Spider starts drill program at Kyle #3 kimberlite, James Bay Lowlands, Ontario. News releases Spider of May 3, 2000; June 27, 2000; July 10, 2000; October 31 2000.

“This preliminary diamond grade result ranks the Kyle #3 kimberlite dike as one of the highest grade diamond bearing kimberlite bodies in the Province of Ontario to date”

SPIDER RESOURCES INC. and joint venture partner KWG RESOURCES INC. report the discovery of 11 new diamond bearing outcrops on their jointly-owned, 45 square kilometer Wawa property in northern Ontario News release Spider of March 13, 2002

SPIDER RESOURCES INC. Reports 2.617 carat/tonne regional sample from Wawa project News release Spider of October 16, 2002

SPIDER RESOURCES INC. AND KWG RESOURCES INC. IDENTIFY NEW "VMS BELT" IN ONTARIO LOWLANDS REPORTING GRADES AS HIGH AS 7.09% COPPER News release Spider of October 23, 2002

Massive Sulphide Zone Located While Drill Testing New Geophysical Anomaly News release SPQ of October 14, 2003

McFauld’s VMS drilling intersects 13.8m of 5.5% Copper, including higher grade zone over 4.6m averaging 10.4% Copper News release Spider of February 19, 2004

McFauld’s Hole #45 intersects 5.2 meters Massive Sulphide, Greater than 30% Zinc over 0.75 metersNews release Spider of September 13, 2004 Massive Sulphide grading 8.02% Copper over 18.8 meters at McFaulds Lake, Northern Ontario News release Spider of November 8, 2004

UC Resources Limited and Spider Resources Inc. Intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag Over 19 Metres at VMS

Project in Northern Ontario Probe Mines Discovers Copper Zone on McFauld's Lake Property News release Probe October 12, 2005

High Grade Copper Mineralization Discovered on Probe Mines McFauld's Lake Property, including 7.8m of 3.1% Cu News release Probe November 1, 2005

Probe Mines: Identifies New Conductors Near Recent VMS Discovery News release Probe January 17, 2006

KWG Resources Inc., Spider Resources Inc. and Renforth Resources Inc. Begin Exploration of Kyle Kimberlies; Collect 550 Kg. in First Two Holes Testing Kyle 2 News release KWG November 15, 2006

MacDonald's Initiates January Exploration Program on its MacNugget Drill Ready Targets....Area Play in McFauld's Lake/James Bay Lowlands Heats Up With Multiple Companies Announcing Early 2006 Exploration Programs.... First Tranche Financing Completed News release MacDonald January 3, 2006

MacDonald Mines Completes Ground Geophysics on the McNugget Property - Identifies Multiple Strong Drill Target Anomalies. Drilling of these Targets to Commence in March. News release MacDonald March 1, 2006

MacDonald Mines: Five Drill Holes Along A Strongly Anomolous 4.6 Km Trend Hit Massive & Disseminated Sulphides All With Visible Copper & Zinc Mineralization News releases MacDonald May 1, 2006 , June 7, 2006 , September 18, 2006, October 5, 2006

“Highlights of the spring 2006 campaign included holes MN-06-17 with 9.00m at 0.43% Cu, 3.1% Zn and 18.73 g/t Ag, including 2.66m at 7.07% Zn; MN-06-19 with 6.49m at 0.64% Cu, 2.92% Zn and 18.84 g/t Ag, including 2.79m at 5.21% Zn; and MN-06-14 with 2.57m at 1.01% Cu, 2.49% Zn and 31.00 g/t Ag.”

MacDonald Mines: McNugget Expands VMS Zones and Intersects Higher Tenor Mineralization News release MacDonald December 18, 2006

MacDonald Intersects New Nickel Sulfide Zone on McNugget Property, James Bay Lowlands News releases MacDonald June 14, 2007

MacDonald Mines Acquires a Significant Geological Favorable Land Position Similar to the Ground Hosting the Spectacular Noront Nickel-Copper Discovery News release MacDonald September 19, 2007

Noront Resources Ltd.: Double Eagle Project, James Bay Lowlands News releases Noront of August 29, 2007; September 10, 2007; September 13, 2007; September 19, 2007; September 25, 2007; September 27, 2007; October 10, 2007; October 30, 2007; November 6, 2007; December 21, 2007; January 3, 2008; January 28, 2008.

“Hole NOT-07-01 final assay results include; 36 meters averaging 1.84% Nickel, 1.53% Copper, 1.14 g/t Platinum, 3.49 g/t Palladium, 0.13 g/t gold and 4.8 g/t silver.

Hole NOT-07-05 final assay results include; 68.3 meters averaging 5.9% nickel, 3.1% copper, 2.87 g/t platinum, 9.78 g/t palladium, 0.61 g/t gold and 8.5 g/t silver.3 meter section of hole averaged 8.7% nickel, 10.9% copper, 40.79 g/t platinum, 14.57 g/t palladium, 9.39 g/t gold and 8.7 g/t silver

Hole NOT-07-07 undercut hole NOT-07-05 intersected the main mineralized zone starting at 72 meters core length and remained in it until 123.5 meters, for a total of 51.5 meters which included massive sulphide mineralization between 75.2 and 89.5 meters (14.3 meters) core length that averaged 2.5% Cu, 6.3 % Ni, 5.92 g/t Pt, 16.21 g/t Pd, 0.24 g/t Au and 8.3 g/t Ag.

Hole NOT-07-09 intersected the mineralized zone at 43 meters core length and remained in it until 88.6 meters for a total intersection of 45.6 meters. This mineralized zone included two massive sulphide sections totaling 22 meters. Assays for the 17.4 meter upper massive sulphide section averaged 3.87 % Cu, 4.82 % Ni, 1.02 g/t Pt, 14.78 g/t Pd, 0.27 g/t Au and 11.3 g/t Ag (Pd values pending), while the lower 4.6 meter massive sulphide section averaged 2.01 % Cu, 8.3 % Ni, 0.14 g/t Pt, 0.23 g/t, 11.53 g/t Pd, Au and 5.1 g/t Ag; Hole NOT-07-11 encountered two massive sulphide zones separated by weakly mineralized peridotite; first massive sulphide zone between 58.5 and 60.1 meters (1.6 meters averaged 4.82% Cu., 7.11% Ni., 2.53 g/t Pt., 14.65 g/t Pd., 0.19 g/t Au., and 14 g/t Ag.) followed by a second massive sulphide section between 74.5 and 75.8 meters (1.3 meters averaging 4.43% Cu., 7.37% Ni., 1.08g/t Pt., 18.1g/t Pd., 0.22g/t Au and 13 g/t Ag).

NOT-07-11 was reviewed and found to contain mineralized sulphides over greater lengths than previously reported (November 6, 2007).

Hole NOT-07-12 intersected mineralized peridotite between 81.5 meters and 176 meters including a massive sulphide zone between 82.5 and 92 meters downhole. This 9.5 meter section averaged 1.54% Cu., 6.99% Ni., 2.61 g/t Pt., 10.07g/t Pd., 0.15g/t Au and 5.21g/t Ag. Then from 92 to 113 meters a semi-massive section of sulphides was encountered consisting of pyrrhotite, pentlandite and chalcopyrite, followed by net textured nickel and copper sulphide mineralization to 176 meters.

NOT-07-14 between 52.8 meters to 56.4 meters, 3.6 meters of massive sulphides were intersected that averaged 3.43% copper, 7.45% nickel, 5.0 g/t platinum, 9.1 g/t palladium and 0.12 g/t gold, within part of a much larger intersection between 45.9 to 80 meters (34.1 meters) that averaged 1.22% copper, 2.28% nickel, 1.6 g/t platinum, 4.13 g/t palladium and 0.14 g/t gold. In addition a lower grade zone exists from 80 to 110 meters averaging 0.28% Cu, 0.59% Ni, 0.37 g/t Pt, 1.18 g/t Pd and 0.1 g/t Au. NOT-07-16 encountered a net-textured peridotite section combined with the massive sulphide section over 12.7 meters between 121.1 and 133.8 averaging 1.55% Cu, 2.4% Ni, 2.63 g/t Pt, 5.1 g/t Pd, 0.12 g/t Au and 4.5 g/t Ag. A lower grade section between 92.9 and 121.1 meters (28.2 meters wide) averaged 0.50% Cu, 0.57% Ni, 0.47 g/t Pt, 1.5 g/t Pt, 0.17 g/t Au and 1.5 g/t Ag. NOT-07-17 encountered the main mineralized zone between 96.5 meters and 177.5 meters downhole that over 81 meters averaged 0.77% Cu, 1.55% Ni, 0.91 g/t Pt, 2.97 g/t Pd, 0.13 g/t Au and 3.1 g/t Ag including a 7.5 meter wide massive sulphide intersection that averaged 1.54% Cu, 6.81% Ni, 2.17 g/t Pt, 6.62 g/t Pd, 0.15 g/t Au and 6.12 g/t Ag. NOT-07-18 intersected mineralization between 105.2 meters and 229.8 meters that over 124.6 meters averaged 2.39% Ni, 1.09% Cu, 1.12 g/t Pt, 3.86 g/t Pd, 0.28 g/t Au and 3.89 g/t Ag. This well mineralized zone contained an 18.8 meter massive sulphide mineralized section between 211 meters and 229.8 meters that graded 7.38% Ni, 3.18% Cu, 1.05 g/t Pt, 10.16 g/t Pd, 0.23g/t Au and 8.92 g/t Ag.

NOT-07-19 encountered the main mineralized zone between 104.2 meters and 110.8 meters over a drill intersection of 6.6 meters that averaged 0.63% Cu, 2.32% Ni, 1.13 g/t Pt, 3.93 g/t Pd, 0.06 g/t Au and 3.01 g/t Ag. This 37.5 meter stepout to the south is quite encouraging as the grade remains consistent.

NOT-07-27 intersected mineralization between 112.8 meters and 159 meters that over 46.6 meters averaged 6.25% nickel, 2.75% copper, 1.85 g/t platinum, 10.23 g/t palladium, 3.0 g/t gold and 10.3 g/t silver. This well mineralized zone contained a 35.6 meter wide massive sulphide mineralized section between 116.8 meters and 152.4 meters that graded 7.91% Ni, 3.45% Cu, 1.66 g/t Pt, 12.79 g/t Pd, 3.87/t Au and 9.27 g/t Ag.

NOT-07-29 intersected mineralization between 18.3 meters and 84.2 meters that over 65.9 meters averaged 1.48% nickel, 1.1% copper, 1.18 g/t platinum, 2.94 g/t palladium, 0.12 g/t gold and 3.3 g/t silver.”

KWG and Spider To Drill Targets Beside Noront Discovery News release KWG October 1, 2007

Fancamp Exploration Ltd.: McFaulds Property-Preliminary Airborne Data Received “...shows, in particular, the definite linkage of the conductive magnetic high of the Noront Zone with the large, conductive magnetic anomaly on the Fancamp Property, some 300 metres to the SSE. This "Linkage" forms a less intensely magnetic corridor about 150m wide which trends southerly from the SW end of the Noront magnetic feature, for about 300 metres then swings east into the Fancamp ground.”

Freewest Prioritizes Exploration Targets on its Mcfaulds Property, Ontario Freewest Flying Detailed Airborne Geophysical Survey on its McFaulds Property, James Bay Lowlands, Ontario News release Freewest October 29, 2007

KWG, Spider and Freewest Start Winter Exploration Program McFauld's Lake Area, Northern Ontario News release Freewest February 4, 2008

Hawk Uranium Inc. Increases Interest in Claims in McFaulds Lake Area of the James Bay Lowlands News release Hawk October 1, 2007

Work to Commence on the Hawk Joint Venture McNugget Claims in the McFaulds Lake Area of the James Bay LowlandsNews release Hawk October 12, 2007

Hawk's JV Partner-MacDonald Mines Exploration Ltd., Announces the Completion of the First Phase of Drill Program on the McNugget Property, McFaulds Lake Area, James Bay LowlandsNews release Hawk January 22, 2008

http://agoracom.com/ir/Noront/messages/728426#message

Drilling set to GO!!...jeremy

Posted by: kelsee on February 14, 2008 03:58PM

…maybe you missed this Jeremy, it’s a segment taken from Snug’s post of his recent conversation with Neil earlier this week, hope this helps… kelsee

On the topic of the SPQ/FWR/KWG chromite and PGM option, Neil was up at the site last week. He spotted the first drill hole location and the drill crew is ready to go. The start of drilling is pencilled in for February 15. Neil noted that there are "junior geos" at the site but that Dr. Lahti, the senior geologist, will be overseeing the drilling. 5000 meters is scheduled to be drilled by June with a July completion date. If something "big" if struck, more drilling can take place at this location.

http://www.agoracom.com/ir/Spider/messages/729333#message

--------------------------------------------------------------

Diamonds?..FYI..

Posted by: kelsee on February 14, 2008 08:11PM

In response to: Re: Diamonds? by SnugTheJoiner

…here’s the story on SPQ’s diamond projects with both KWG and Renforth, taken from the Oct.1st 2007 news release, for jv percentages refer to Links Library re: Spider Playbook

http://www.agoracom.com/ir/Spider/messages/719446#message" target="_blank" rel="nofollow ugc noopener">

http://www.agoracom.com/ir/Spider/messages/719446#message - news release

http://www.agoracom.com/ir/Spider/messages/719446#message - Spider Playbook

Spider & KWG share three diamond discoveries

The Spider/KWG Joint Ventures also include three diamond projects each of them being original JV discoveries including; the Wawa Project, the MacFadyen Project and the Kyle Project. The MacFadyen and the Kyle kimberlite swarms are in the Attawapiskat River basin of the James Bay Lowlands, proximal to the De Beers Victor Diamond Mine that is in its last stages of construction and development, scheduled for start up in late 2008. The MacFadyen project is contiguous to the Victor project, while the Kyle kimberlites are located about 100 kilometres to the west, in the vicinity of where the McFaulds Lake VMS occurrences and the Noront discovery are located.

The Kyle Project has been optioned to Renforth Resources Inc, which may earn up to a 55% interest by completing total expenditures of $6 million over a newly agreed four year period. Renforth is nearing completion of their initial program, where it is anticipated that they will have spent $2 million in exploration and other expenditures related to their initial earn-in requirements for a vested 20% interest in this exciting diamond project. KWG and Spider currently jointly hold the remaining 80% interest.

The Wawa project is located northeast of Lake Superior near the town of Wawa, this project has been active since 1996, when diamonds were first discovered in bedrock in the area. Since then, other junior explorers have taken up land positions surrounding the Spider – KWG land position. The Joint venture is planning a follow up drilling program on this property to be completed in the next 6-8 months.

KWG operates MacFadyen; Spider operates Wawa

KWG has elected not to participate in funding the Wawa, Kyle and McFaulds Lake projects’ exploration programs until its 50% JV interest has been reduced to 33%, Spider is the operator for these three projects. Spider has elected not to participate in funding the MacFadyen project exploration programs until its 50% JV interest has been reduced to 33%, KWG is the operator of the MacFadyen project. The Diagnos Initiative project and the Freewest Option project are equally held, with operatorship switching from year to year.

http://www.agoracom.com/ir/Spider/messages/729619#message

Posted by: kelsee on February 14, 2008 03:58PM

…maybe you missed this Jeremy, it’s a segment taken from Snug’s post of his recent conversation with Neil earlier this week, hope this helps… kelsee

On the topic of the SPQ/FWR/KWG chromite and PGM option, Neil was up at the site last week. He spotted the first drill hole location and the drill crew is ready to go. The start of drilling is pencilled in for February 15. Neil noted that there are "junior geos" at the site but that Dr. Lahti, the senior geologist, will be overseeing the drilling. 5000 meters is scheduled to be drilled by June with a July completion date. If something "big" if struck, more drilling can take place at this location.

http://www.agoracom.com/ir/Spider/messages/729333#message

--------------------------------------------------------------

Diamonds?..FYI..

Posted by: kelsee on February 14, 2008 08:11PM

In response to: Re: Diamonds? by SnugTheJoiner

…here’s the story on SPQ’s diamond projects with both KWG and Renforth, taken from the Oct.1st 2007 news release, for jv percentages refer to Links Library re: Spider Playbook

http://www.agoracom.com/ir/Spider/messages/719446#message" target="_blank" rel="nofollow ugc noopener">

http://www.agoracom.com/ir/Spider/messages/719446#message - news release

http://www.agoracom.com/ir/Spider/messages/719446#message - Spider Playbook

Spider & KWG share three diamond discoveries

The Spider/KWG Joint Ventures also include three diamond projects each of them being original JV discoveries including; the Wawa Project, the MacFadyen Project and the Kyle Project. The MacFadyen and the Kyle kimberlite swarms are in the Attawapiskat River basin of the James Bay Lowlands, proximal to the De Beers Victor Diamond Mine that is in its last stages of construction and development, scheduled for start up in late 2008. The MacFadyen project is contiguous to the Victor project, while the Kyle kimberlites are located about 100 kilometres to the west, in the vicinity of where the McFaulds Lake VMS occurrences and the Noront discovery are located.

The Kyle Project has been optioned to Renforth Resources Inc, which may earn up to a 55% interest by completing total expenditures of $6 million over a newly agreed four year period. Renforth is nearing completion of their initial program, where it is anticipated that they will have spent $2 million in exploration and other expenditures related to their initial earn-in requirements for a vested 20% interest in this exciting diamond project. KWG and Spider currently jointly hold the remaining 80% interest.

The Wawa project is located northeast of Lake Superior near the town of Wawa, this project has been active since 1996, when diamonds were first discovered in bedrock in the area. Since then, other junior explorers have taken up land positions surrounding the Spider – KWG land position. The Joint venture is planning a follow up drilling program on this property to be completed in the next 6-8 months.

KWG operates MacFadyen; Spider operates Wawa

KWG has elected not to participate in funding the Wawa, Kyle and McFaulds Lake projects’ exploration programs until its 50% JV interest has been reduced to 33%, Spider is the operator for these three projects. Spider has elected not to participate in funding the MacFadyen project exploration programs until its 50% JV interest has been reduced to 33%, KWG is the operator of the MacFadyen project. The Diagnos Initiative project and the Freewest Option project are equally held, with operatorship switching from year to year.

http://www.agoracom.com/ir/Spider/messages/729619#message

updated claims map

Posted by: kelsee on February 15, 2008 02:46PM

…here’s the link below, and when you look at the map and the lines pointing out mineralized areas, it’s nice to see SPQ attached to all but one, that being the Noront DE-1 of course…it kinda falls in line with my post the other day with regard to Neil Novak being one of the first to kick stones in the JBL’s, that’s why you see Neil’s name, SPQ, attached to four of the five mineral finds, and he actually had everything to do with finding the DE-1 deposit, so… I guess there’s a moral to this story, the next time you get a chance to attend a ground-breaking ceremony, make sure you go cause you never know what you’ll find, right Neil?!….lol…okay…okay…so forget the moral already…. kelsee out..

http://www.agoracom.com/ir/Spider/messages/730536#message

Posted by: kelsee on February 15, 2008 02:46PM

…here’s the link below, and when you look at the map and the lines pointing out mineralized areas, it’s nice to see SPQ attached to all but one, that being the Noront DE-1 of course…it kinda falls in line with my post the other day with regard to Neil Novak being one of the first to kick stones in the JBL’s, that’s why you see Neil’s name, SPQ, attached to four of the five mineral finds, and he actually had everything to do with finding the DE-1 deposit, so… I guess there’s a moral to this story, the next time you get a chance to attend a ground-breaking ceremony, make sure you go cause you never know what you’ll find, right Neil?!….lol…okay…okay…so forget the moral already…. kelsee out..

http://www.agoracom.com/ir/Spider/messages/730536#message

@all ,

anbei noch eine schöne Zusammenfassung von kelsee .

Ich werde nicht viel Kommentare dazu schreiben ,

jedoch versuchen ,

hier die wichtigsten Kommentare zu posten .

Mein Kursziel bis Ende des Jahres liegt bei 1,00 CAD ,

etwas darunter o. darüber ,

sollte bei einem KK von ca. 0,11 CAD keine Rolle spielen .

SPIDER...

Posted by: kelsee on December 11, 2007 08:23PM

...this is the first "kick at the cat" in an attempt to put pertinent information forward on one plate for an overall "birds-eye" view of the company for the investor who wants a quick heads-up on the SPQ. More work to be done and info collected, but we'll eventually get it done.... kelsee

NEIL NOVAK

Education

Graduated from University of Waterloo in 1977 and immediately became involved as a project geologist for the Canadian operations of Australian based uranium explorer Pancontinental Mining Ltd.

History

Twenty-eight years experience in the mining industry, the last 10 of which have been directly related to the diamond exploration industry.

In 1983, Neil left Pancontinental and formed a private consulting company, Nominex Ltd. As managing director of Noninex, Neil became involved in various North American and International exploration assignments.

In late 1992, Neil prepared the geological report that supported the initial prospectus for Spider Resources Inc. in his capacity as consultant to the founders of Spider. Spider Resources Inc. became a public company in early 1993. Neil became an active board member and senior officer of Spider in 1995 and remained as such through to early 1999. Neil was re-elected to the Board of Spider in September 1999, and was re-appointed as Vice President in November 1999 and as Secretary for the corporation in January 2000. In June of 2003, Neil was appointed as the Chief Operating Officer of Spider.

In 1995, Neil joined KWG Resources Inc. and Ste Genevieve Resources Inc. as the International Exploration Manager for the group of companies; he remained with Ste Genevieve/KWG until November 1997, then helped both companies in their corporate restructuring through 1998.

In 1997, Neil in his capacity as International Exploration Manager for the Ste. Genevieve Group of Companies was appointed President of Ambrex Mining Corporation, (later changed name to Karmin Exploration).

In January, 2000 Neil through his ownership of Nominex Ltd., teamed up with Norman Brewster to form the consulting company Billiken Management Services Inc. Neil is president of Billiken Management. Billiken entered into a contract with Spider Resources Inc. and joint venture partner KWG Resources Inc. to manage all exploration activities of the KWG/Spider joint venture in the capacity of "appointed manager".

Neil through his involvement in Billiken provides geological consultation and assists in financing various other resource companies, and as a partial result, in November of 2002, Neil was appointed to the Board of Noront Resources Inc.

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

http://www.freewest.com/_resources/properties/mcfaulds/mcfau…

The Richmond Club

Posted by: SnugTheJoiner on November 28, 2007 07:45PM

I apologize folks for taking so much time. I had three glasses of red wine at lunch. It was held by The Richmond Club at the National Club on Bay Street. Rather hoitee-toitee. Reeked of money, actually. But once we all make some excellent $$$$ with SPQ, we must invite Jeannie to join us all for a lunch and numerous bottles of wine at the National!!!!

When I got home, and after I heard that Kelsee was shoveling snow, I felt really sorry, but only for a second or two. When I read about all the women waiting for me - my communication - my heart raced. Ah... it's a difficult job but someone's got to do it!!!

So here's the scoop. BUY, HOLD, and GO LONG.

Richard Nemis and Neil Novak were at the meeting. Michael White of IBK made the "dog and pony" presentation. I have numerous points so be patient. Remember these are MY notes, they are subjective, and should be understood as such. If you have any questions, post them on this hub. I will try to answer them.

a) Michael White of IBK made presentations over the last week or so in Europe: London, Brussels, Frankfurt, and Monaco. I think there was another European city, but I have forgotten. The NOT and Ring of Fire story was received with great interest.

b) Michael will be in New York City and Boston on Monday of next week. There may be other USA visits. He probably will be visiting citiies in Asia the week after.

c) From another guest who flew in from Montreal, it was mentioned that JP Morgan was hired by a very large mining company to assess NOT and the Ring of Fire. I can not confirm this, but it was suggested that the large mining company was XSTRATA. Remember that I can't confirm this, but where there's smoke, there's fire.

I have mentioned the above information from IBK and JP Morgan (investment companies) because Michael White mentioned twice a time-frame of 12-18 months for a larger investor to bid for the "Great Canadian Area Play". This speaks to the strategy being employed by Nemis, NOT, and Novak. (My personal comments directly on SPQ I will put a little further down.)

d) I asked this question of Mr. Nemis: Can you enlighten me on the tangled web of joint ventures with regarding to NOT and the Ring of Fire? He replied: It is my strategy to have as many as 15 JV's sign with Noront. Noront has staked many new claims (a new claims map should be out tomorrow - Kelsee). They want to option off many of these claims. The Ring of Fire is much, much too large for Noront to explore by itself. He has two (recent JVs (WSR, Hawk?) and six more on his desk. Each JV will pitch in $5 million; however, Noront will hold 50%+ ownership and hold operating responsibility.

Why is the above info important? It is clear from today's meeting and the NOT AGM that Noronto, that NOT will drive much of the exploration at the Ring of Fire. Nemis wants to be able to present in 12-18 months a 50%+ package to the likes of XSTRATA, CVRD, or some other Major.

Not only will the 50% NOT package look really good to the Major, it will benefit the JV. Their shares will also see a strong upside. Everyone wins.

It was also mentioned once again two other points that will look really good to the Major. 1) They will not have to build a smelter. There are smelters in Sudbury, Ontario and Thompson, Manitoba. 2) A road to the Double Eagle location will cost just $2 million. Peanuts to a Major.

e) NOT will focus its drilling at Double Eagle, and SPQ/FWR/FNC will focus their drilling at the PGM and chromium site close by. I inferred that they feel there's a stronger possibility of significant finds in those locations.

f) Nemis wants Noronto to have as many as fifteen (15) drill rigs on site. Drilling is costly but a necessary evil. The Major will require this information. (This does not include SPQ/FWR/FNC drill rigs.) If this number of rigs find their way to the Double Eagle, there probably will be one more NOT financing.

g) NOT assays for holes #13-#16 are imminent. They have "visuals" for holes #18-#26. Novak said #18 "looked" like #5 (the "glory hole").

h) Phase #1 or the aerial survey has just been completed. Phase #2 will be completed by year end. There are four (4) more phases to be completed. Sorry, I have no more information than that. However, if each phase takes 4-6 weeks, the survey should be completed sometime in 2Q08. I believe this information will be critical to selling the Major. (I heard from Novak that the TDEM survey looks down 150 meters into the earth.)

Final Impressions & SPQ

When I saw Nemis and Novak walk in together, I said to myself, "These guys are working closely together: one's the salesman, the other, the geologist (technical credibility). NOT and SPQ, to my mind, are just about one and the same. As the fortunes of NOT go, so will SPQ. How much SPQ's share price will appreciate with this scenario can only be guessed at. However, my guess is significant. (I'm still planning on a 2008 Holiday Season party. If the share price gets to $3.00, I'm changing the location to somewhere in Austria.)

The bottom line: it's imperative to be PATIENT. The story is not even half-way out. There's going to be lots of froth... I mean lots of froth. But if you buy at these bargain basement prices, you can expect a multi-bagger. One more big find by NOT or SPQ or FWR or FNC and share prices will move sharply up. And this will only happen with the drilling going on, and the rest of the 2008 winter drilling program.

SPQ is an important part of a much larger play. It's VMS locations are already documented and will be better defined by the TDEM surveys. It will be a juicy morsel for any Major, and is part of the larger NOT JV strategy.

Regards, Snug

Neil Novak, Noront AGM, and SPQPosted by: SnugTheJoiner on October 30, 2007 07:44PM

If you haven't had a listen to the Noront AGM, I suggest that it might be a good idea: a strategy is being hatched which will likely impact SPQ's share price in a very positive manner.

http://www.vcall.com/IC/CEPage.asp?ID=122308

Neil Novak impressed me at the AGM. He speaks intelligently, he knows his geology, and (when you listen to the AGM) he knows his $$$$. Clearly he is a very important Noront Director and well respected by Richard Nemis. This personal association is the first key point.

The second key point was outlined by Mr. Nemis: working with other juniors (SPQ, FNC, FWR, and PRB were mentioned), Noront will work as the "lead operator" to create a McFauld's area play. Options will be taken on each other's properties will mean that all of the players will be working together to maximize shareholder value.

The third key point is that mining majors (XSTRATA, CVRD, Diamond Fields were all mentioned by Novak) and major individuals have been calling and visiting "the ring of fire." Therefore, upcoming drill results by any of NOT, SPQ, FNC, FWR, or PRB. will further whet (sharpen) their appetite.

Finally, I sense that Neil Novak has been spending a great deal of his time busting his butt working with Nemis and Noront in order to present "a package" to the majors. SPQ is an integral and important part of this package. It has a large land area as part of "the ring of fire", which is very valuable.

SPQ's share price is a STEAL. Take advantage.

Snug

SPQ is preparing a 43-101 compliant document for their deposit reserves...

Posted by: johndefur on November 13, 2007 11:29AM

Below I have copied just SOME of the Cu only finds that SPQ has made..

SPQ has made double those findings in VMS style Cu Zn findings...

In total SPQ has found more than 10 of these types of deposits....the reason I only selected these (I will post the others another time), is because I believe, as my Geology post suggested, that these Cu only deposits are related to the MMS Ni Cu etc, deposit...Although SPQ had not been looking for them,my theory suggest that these MMS Ni Cu deposits may in fact exist in SPQ claims, and with the new HIGH MAG maps, SPQ will be able to outline them much easier...

IMCO

JD

On Sept/05, a drilling program was conducted on the seven occurrences

identified to date located on the Joint Venture’s 135 square kilometre

property. A VTEM airborne survey (January, 2005) and ground geophysical

follow-up survey over the project claims were also conducted. Preliminary

results from the VTEM and previous Geotem airborne survey revealed

additional targets in the vicinity of the McFaulds Lake VMS occurrences.

The most significant result during the year was obtained on the McFaulds

#3 occurrence where hole McF-04-57 intersected 8.02% copper over

a drill length of 18.8 metres. Further drilling will eventually be

required to fully test

the size of the three known targets, with the ultimate goal of confirming

the existence of a mineable reserve.

On Apr 07/05, received the assay results for the McFaulds Lake project.

The assay results for drill hole McF-05-64 intersected 5.0 m grading

4.02% Cu, 0.4 g/t Au and 10 g/t Ag. Within this interval there is

an upper 1.55 meter section grading 9.1% Cu and a lower 0.7m interval

grading 6.5% Cu. The Gold and Silver values are consistent with the

surrounding holes as is the relative lack of zinc. The drill results

indicate that the Alteration and Mineralization Zone has narrowed

to about 10m and the massive to semi-massive consisting of chalcopyrite

and pyrite has narrowed to 2.25m within the main sulphide zone of

5m (248.6-253.6m). Further results are pending.

For the period ending Mar31/05, resumed drilling, four new holes

intersected massive to semi-massive sulphide mineralization. A fifth

hole designed to test a deeper section of the volcanic stratigraphy

down plunge from the copper bearing drill-holes intercepted massive

magnetite with minor bands of chalcopyrite. On the MacFadyen Diamond

Project, drilling commenced in March with the objective to test the

deep magnetic dike-like structure located peripheral to the five

kimberlite pipes discovered on the property. KWG-Spider was still

awaiting results from the two five tonnes mini-bulk samples collected

from the Wawa diamond Property last fall.

On Mar 07/05, received assay results from the third and fourth holes

of the winter drill program. Drill hole McF-05-60 intersected a total

of 7.16 m grading 1.9 % Cu and within drill hole McF-05-61 intersected

3.5 m grading 2.2 % Cu, and within these intervals narrower intervals

of higher-grade copper were reported.the preliminary results of the

VTEM airborne survey have been received. Five significant magnetic-

electromagnetic anomalies with a total strike length in excess of

six kilometres have been identified by the joint venture from the

preliminary data. Two of these anomalies are located in the western

end of the claim block with one covering 10 flight lines (1.5 kilometres

long) and the second being significantly longer and formational in

nature.Grids are being cut on the best portion of the targets in

preparation for drilling this summer.

On Feb17/05, received assay results for the first two holes of the

winter drilling program at McFaulds Lake. Drill hole McF-05-58 intersected

a total of 10.2 m (265 m to 276.4 m) grading 4.84 % Cu, and within

this interval, there is a 9.2-m section grading 5.72 % Cu. Drill

hole McF-05-59 intersected 10.65 m (283.8 m to 294.5 m) grading 6.4

% Cu, and within this interval, there is an 8.5-m section grading

7.9 % Cu. Currently hole McF-05-62 is under way and is designed to

test the down-dip and downplunge extension of the mineralization

described above and this hole will be the deepest (minus-350-m vertical)

drilled on the McFaulds No. 3 body (occurrence) of massive sulphide

mineralized to date.

In Jan/05, a VTEM airborne survey was completed. To date, seven (7)

new base metal sulphide occurrences have been located on the property.

On Jan31/05, intersected significant massive sulphide thicknesses

in the first two drill holes of the winter drill program on the McFaulds

Lake # 3. Drill hole McF-05-58 intersected 12.4 m (264 m to 276.4

m) and drill hole McF-05-59 intersected 15.15 m (280.85 m to 296.0

m) of massive to semimassive sulphide mineralization similar in tenor

to that observed in drill hole McF-04-57 that had 18.8 m of 8.02

% Cu last fall. Drilling continues on the property.

Geological Theory/Facts of Genesis at McFaulds P.2

Posted by: johndefur on November 11, 2007 05:27PM

Geological Theory/Facts of Genesis of McFaulds P.2

I seldom say this, In my view this post, with the up to date Geological information contained herein , is a must “keeper” to cut and paste, for future reference, to those interested/invested in the McFaulds Area….this post has taken weeks to research and put together….

Information credit will be given to their Sources, accordingly, and in all cases referred to herein, these are their professional opinions, based on their interpretations of fact findings studies , to which , I have then added/applied my kowledge/information/opinions of the McFaulds Area…I have decided to post this information, knowing that I have met their requirements, which are proper “credit” and non commercial use…proper credits are listed below, and as you all know/may know, I have not /and am not being paid by anyone to post on these forums.. .I do so simply to provide information and my considered opinions…..just your usual cautionary statements…

The Purchase of

MNDM Publications

MNDM Publication Sales

Local: (705) 670-5691

Toll Free: 1-888-415-9845, ext. 5691

(inside Canada, United States

I will begin with Prof. A.J. Naldrett, world renowned Geology professor and probably “THE” or one of , the world experts on MMS , Ni Cu PGEs …

I met Prof. Naldrett of a few occasions and attended a good number of his lectures on MMS Ni Cu PGEs, in Toronto, and have read much of his written papers on said subject, long before McFaulds came along….I will not go into very complex and extremely difficult geological terms and theories..I will try to describe some theories here, as simple as possible, under the circumstances of the very complex subject of geology in general and super complex McFaulds geology in particular….

Below are 3 general “findings” by Prof. Naldrett of his studies of worldwide MMS Ni Cu PGEs deposits :