FAKTENTHREAD: JAMES BAY LOWLANDS (firmenunabhängige Übersicht) - 500 Beiträge pro Seite

eröffnet am 20.10.07 13:58:40 von

neuester Beitrag 17.02.12 23:38:28 von

neuester Beitrag 17.02.12 23:38:28 von

Beiträge: 243

ID: 1.134.197

ID: 1.134.197

Aufrufe heute: 0

Gesamt: 31.610

Gesamt: 31.610

Aktive User: 0

ISIN: CA65626P1018 · WKN: A0CAKK

0,7840

EUR

-1,13 %

-0,0090 EUR

Letzter Kurs 08.04.22 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 45,20 | +14,14 | |

| 1,5500 | +13,97 | |

| 2,8600 | +10,85 | |

| 76,28 | +10,47 | |

| 4,9300 | +10,04 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1800 | -9,17 | |

| 0,5150 | -9,65 | |

| 0,5850 | -10,00 | |

| 0,7997 | -12,16 | |

| 4,2300 | -17,86 |

So, ich habe mal BWK´s Anregung aufgenommen und starte einen Faktenthread über das Gebiet JAMES BAY LOWLANDS, Ontario, Kanada.

Dies ist das Gebiet des Noront Double Eagle Fundes.

Der Thread soll es allen Interessierten ermöglichen, sich schnell und zusammenhängend über die Player in diesem Gebiet, mit aktuellen und historischen Drillergebnissen und entsprechenden Übersichtskarten zu erkundigen.

Daher meine Bitte: nur Fakten posten und bitte keine Kommentare etc. !

Aber fangen wir erst einmal mit Wikipedia an:

http://en.wikipedia.org/wiki/James_Bay

Gruß,

Dies ist das Gebiet des Noront Double Eagle Fundes.

Der Thread soll es allen Interessierten ermöglichen, sich schnell und zusammenhängend über die Player in diesem Gebiet, mit aktuellen und historischen Drillergebnissen und entsprechenden Übersichtskarten zu erkundigen.

Daher meine Bitte: nur Fakten posten und bitte keine Kommentare etc. !

Aber fangen wir erst einmal mit Wikipedia an:

http://en.wikipedia.org/wiki/James_Bay

Gruß,

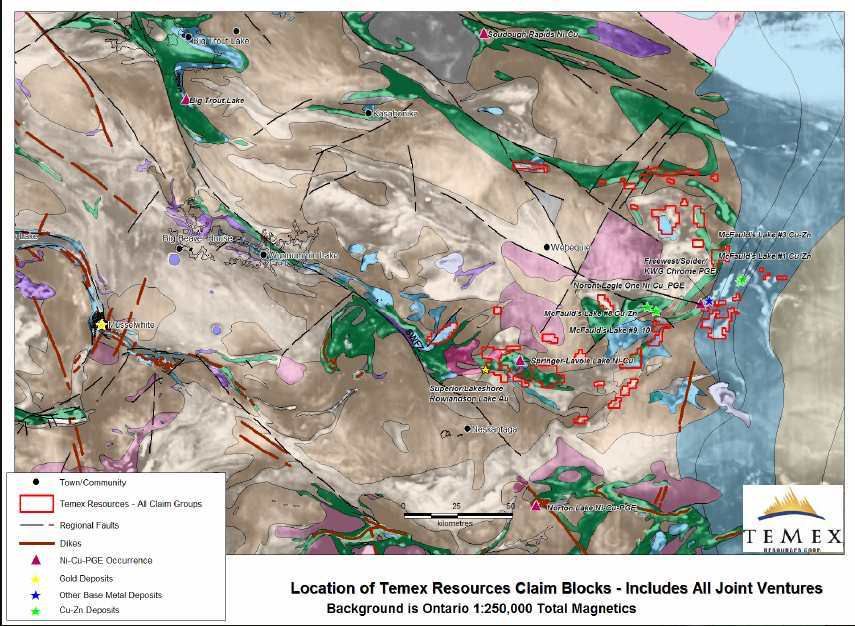

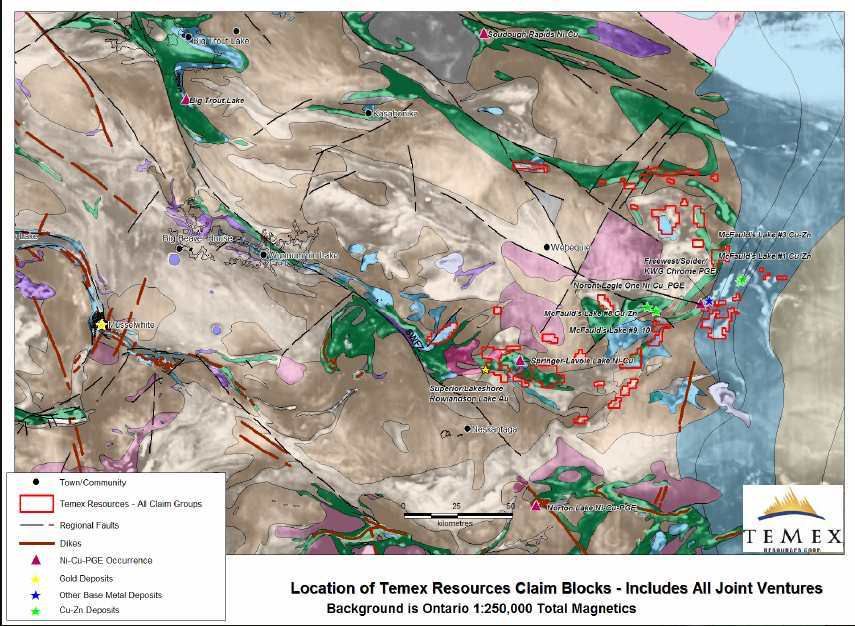

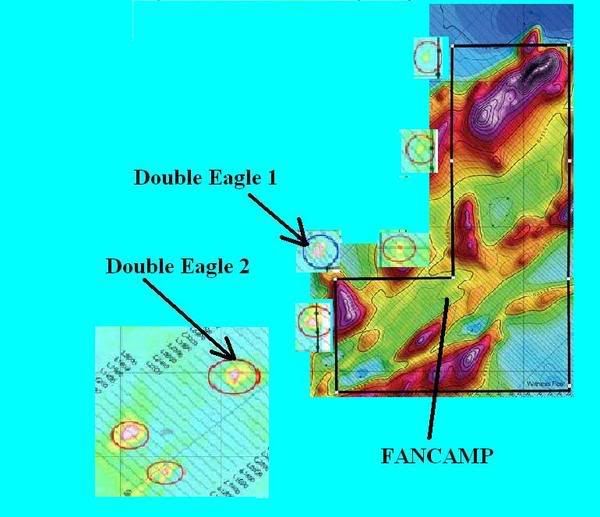

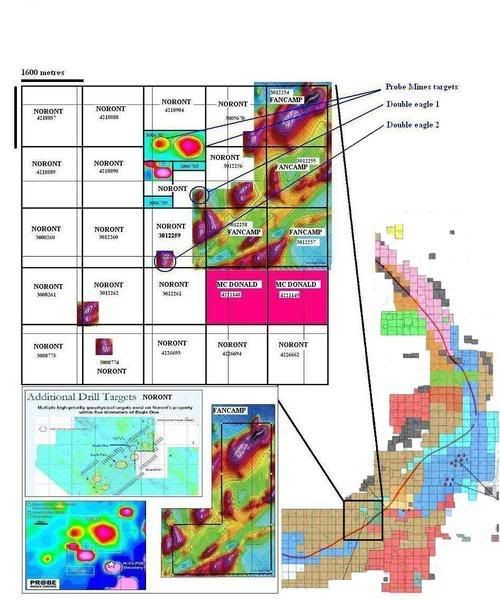

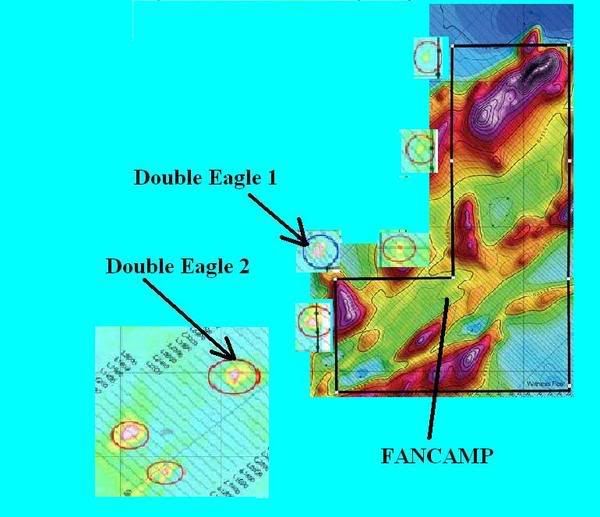

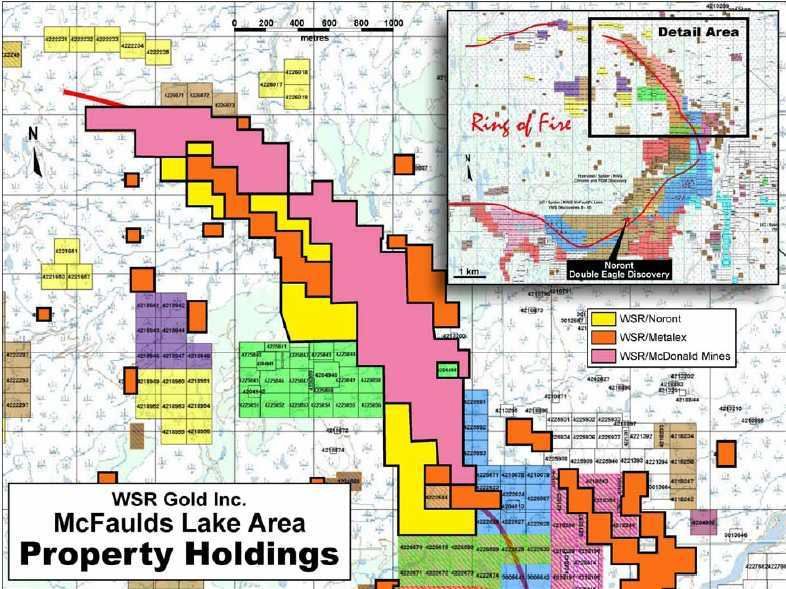

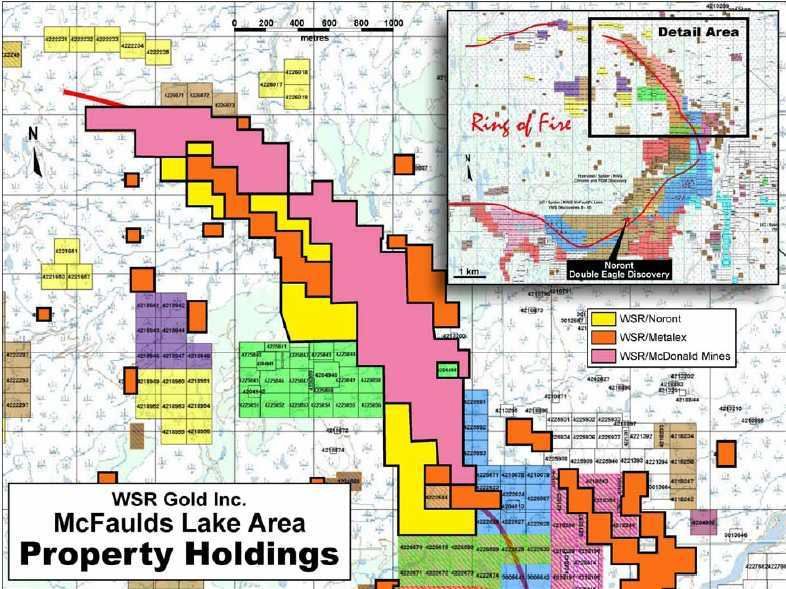

Als nächstes die neueste Übersichtskarte mit Claimzuordnung (Stand: Oktober 2007):

Starten wir mit dem "leader of the pack":

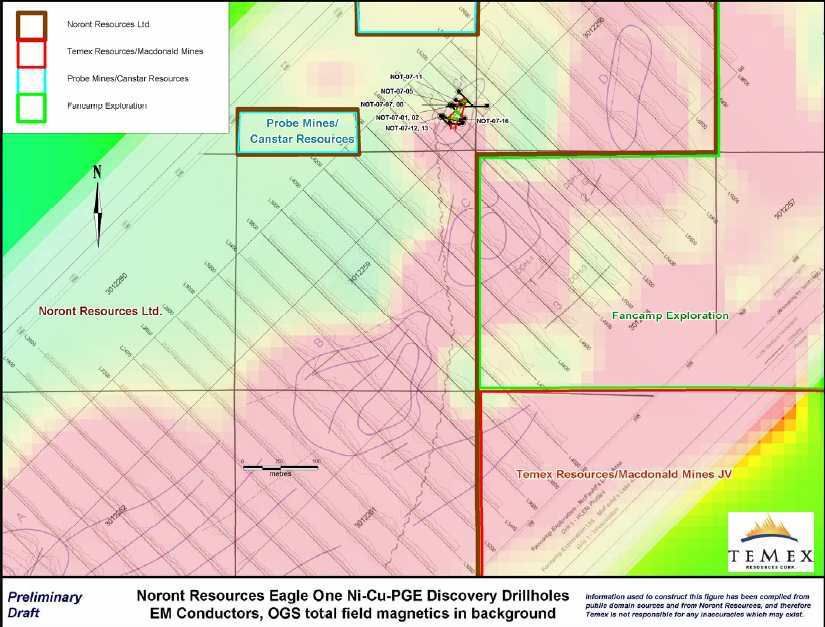

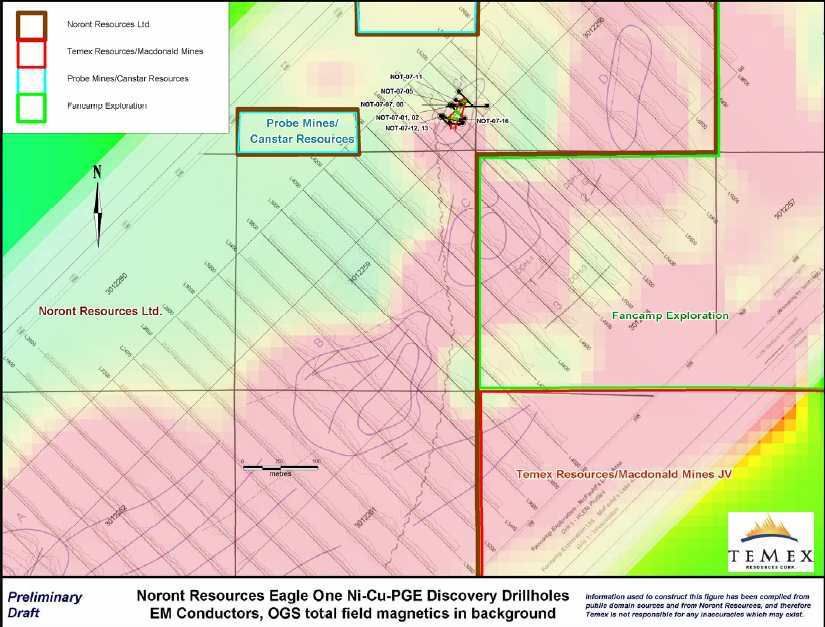

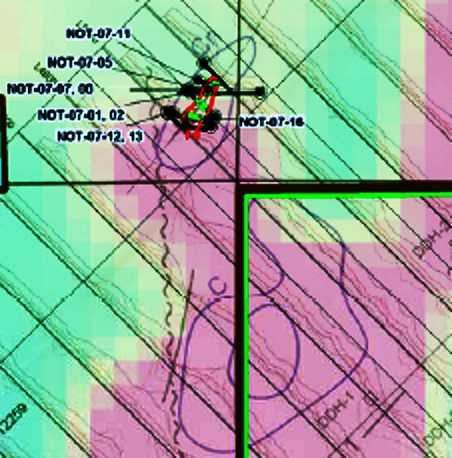

NORONT (NOT.V) Double Eagle Projekt :

Folgende Drillergebnisse sind bisher bestätigt:

NOT-07-01

71,5 m mit 0.86% Kupfer, 1.12% Nickel, 0.70 g/t Platin, 2.14 g/t Palladium, 0.09 g/t Gold, 2.90 g/t Silber

inklusive 36.0 m mit 1.53% Kupfer, 1.84% Nickel, 1.14 g/t Platin, 3.49 g/t Palladium, 0.13 g/t Gold, 4.80 g/t Silber

gefolgt von 34.5 m mit 0.19% Kupfer, 0.4% Nickel, 0.24 g/t Platin, 0.74 g/t Palladium, 0.06 g/t Gold, 1.0 g/t Silber

NOT-07-02

86.4 m mit 1.16% Kupfer, 1.88% Nickel, 0.99 g/t Platin, 3.16 g/t Palladium, 0.13 g/t Gold, 4.10 g/t Silber

inklusive 57.9 m mit 1.40% Kupfer, 2.02% Nickel, 1.00 g/t Platin, 3.27 g/t Palladium, 0.14 g/t Gold, 5.30 g/t Silber

gefolgt von 28.5 m mit 0.70% Kupfer, 1.65% Nickel, 0.96 g/t Platin, 2.97 g/t Palladium, 0.09 g/t Gold, 1.70 g/t Silber

NOT-07-03

Keine positiven Ergebnisse

NOT-07-04

Keine positiven Ergebnisse

NOT-07-05

117.4 m mit 2.20% Kupfer, 4.10% Nickel, 2.09 g/t Platin, 7.13 g/t Palladium, 0.42 g/t Gold, 6.30 g/t Silber

inklusive 68.2 m mit 3.10% Kupfer, 5.90% Nickel, 2.87 g/t Platin, 9.78 g/t Palladium, 0.61 g/t Gold, 8.50 g/t Silber

inklusive 3.0 m mit 10.90% Kupfer, 8.65% Nickel, 40.79 g/t Platin, 14.57 g/t Palladium, 9.39 g/t Gold, 8.70 g/t Silber

NOT-07-06

Keine positiven Ergebnisse

Bis jetzt sind mindestens 12 Löcher gebohrt worden, wobei gerade die Ergebnisse für NOT-07-07, NOT-07-09 und NOT-07-12 besonders erwartet werden, da diese den mineralisierten Erzkörper auf einer Länge von 51 m bzw. 42,75 m bzw. 128,7 m (bisher, da noch nicht beendet !) getroffen haben.

Die Ergebnisse werden in Kürze erwartet.

Gruß,

Fantomas

NORONT (NOT.V) Double Eagle Projekt :

Folgende Drillergebnisse sind bisher bestätigt:

NOT-07-01

71,5 m mit 0.86% Kupfer, 1.12% Nickel, 0.70 g/t Platin, 2.14 g/t Palladium, 0.09 g/t Gold, 2.90 g/t Silber

inklusive 36.0 m mit 1.53% Kupfer, 1.84% Nickel, 1.14 g/t Platin, 3.49 g/t Palladium, 0.13 g/t Gold, 4.80 g/t Silber

gefolgt von 34.5 m mit 0.19% Kupfer, 0.4% Nickel, 0.24 g/t Platin, 0.74 g/t Palladium, 0.06 g/t Gold, 1.0 g/t Silber

NOT-07-02

86.4 m mit 1.16% Kupfer, 1.88% Nickel, 0.99 g/t Platin, 3.16 g/t Palladium, 0.13 g/t Gold, 4.10 g/t Silber

inklusive 57.9 m mit 1.40% Kupfer, 2.02% Nickel, 1.00 g/t Platin, 3.27 g/t Palladium, 0.14 g/t Gold, 5.30 g/t Silber

gefolgt von 28.5 m mit 0.70% Kupfer, 1.65% Nickel, 0.96 g/t Platin, 2.97 g/t Palladium, 0.09 g/t Gold, 1.70 g/t Silber

NOT-07-03

Keine positiven Ergebnisse

NOT-07-04

Keine positiven Ergebnisse

NOT-07-05

117.4 m mit 2.20% Kupfer, 4.10% Nickel, 2.09 g/t Platin, 7.13 g/t Palladium, 0.42 g/t Gold, 6.30 g/t Silber

inklusive 68.2 m mit 3.10% Kupfer, 5.90% Nickel, 2.87 g/t Platin, 9.78 g/t Palladium, 0.61 g/t Gold, 8.50 g/t Silber

inklusive 3.0 m mit 10.90% Kupfer, 8.65% Nickel, 40.79 g/t Platin, 14.57 g/t Palladium, 9.39 g/t Gold, 8.70 g/t Silber

NOT-07-06

Keine positiven Ergebnisse

Bis jetzt sind mindestens 12 Löcher gebohrt worden, wobei gerade die Ergebnisse für NOT-07-07, NOT-07-09 und NOT-07-12 besonders erwartet werden, da diese den mineralisierten Erzkörper auf einer Länge von 51 m bzw. 42,75 m bzw. 128,7 m (bisher, da noch nicht beendet !) getroffen haben.

Die Ergebnisse werden in Kürze erwartet.

Gruß,

Fantomas

Diejenigen, die sich über den aktuellen Stand der Claims in dem Gebiet informieren wollen (wer hat wann "gestaked" ?, wem gehört der Claim ? etc.), seien auf folgende Seite des Kanadischen Minenministeriums (MNDM) verwiesen:

http://www.mndm.gov.on.ca/mndm/mines/lands/claimap3/disclaim…

Anleitung:

1. Unten auf der Seite den Disclaimer mit YES bestätigen.

2. Auf der sich neu öffnenden Seite (CLAIMaps III) oben rechts das Feld "search by" auf "Claim Number" ändern.

3. dann im Feld rechts daneben die Claim Nummer des Double Eagle Fundes eingeben : 3012264

4. Auf "GO" clicken -> ihr seht die Karte mit dem Noront Claim

5. Dann kann man am linken Bildschirmrand in der Taskleiste auf das Symbol "Grünes C" (unterhalb der weißen Hand) clicken ("Identify Claim") und dann auf einen beliebigen Claim clicken.

6. Unten links erscheint dann die Claim Nummer und darunter "Link to MCI System"

7. Hier dann auf "Link" clicken

8. Ein neues Fenster mit allen Informationen (Eigentümer, wann gestaked, Investitionen etc.) öffnet sich

9. FERTIG !

Gruß,

Fantomas

P.S.: Die Information bezieht sich natürlich nur auf den Eigentümer, dieser kann den Claim natürlich "veroptioniert" haben, ein Eigentümerwechsel ist aber eingetragen.

http://www.mndm.gov.on.ca/mndm/mines/lands/claimap3/disclaim…

Anleitung:

1. Unten auf der Seite den Disclaimer mit YES bestätigen.

2. Auf der sich neu öffnenden Seite (CLAIMaps III) oben rechts das Feld "search by" auf "Claim Number" ändern.

3. dann im Feld rechts daneben die Claim Nummer des Double Eagle Fundes eingeben : 3012264

4. Auf "GO" clicken -> ihr seht die Karte mit dem Noront Claim

5. Dann kann man am linken Bildschirmrand in der Taskleiste auf das Symbol "Grünes C" (unterhalb der weißen Hand) clicken ("Identify Claim") und dann auf einen beliebigen Claim clicken.

6. Unten links erscheint dann die Claim Nummer und darunter "Link to MCI System"

7. Hier dann auf "Link" clicken

8. Ein neues Fenster mit allen Informationen (Eigentümer, wann gestaked, Investitionen etc.) öffnet sich

9. FERTIG !

Gruß,

Fantomas

P.S.: Die Information bezieht sich natürlich nur auf den Eigentümer, dieser kann den Claim natürlich "veroptioniert" haben, ein Eigentümerwechsel ist aber eingetragen.

Antwort auf Beitrag Nr.: 32.093.184 von Fantomas96 am 20.10.07 13:58:40QUOTE FROM NATIONAL POST-----NORONT & BMK

Is this Voisey's Bay II?

Nickel, copper grades at Noront's James Bay Double Eagle project are 'unbelievable'

Peter Koven, Financial Post

Published: Saturday, October 13, 2007

The wildest staking rush Ontario has seen in many years began with an accidental discovery.

Richard Nemis, chief executive of Noront Resources Ltd., staked out some territory in the James Bay Lowlands about three years ago. He thought it had good potential after De Beers Canada Inc. and a pair of junior miners, Spider Resources Inc. and KWG Resources Inc., made some interesting zinc and copper finds nearby.

But the area he really wanted to drill was caught up in litigation, and he didn't get his hands on it until recently. He promised to drill one hole in exchange for getting the land.

(See hardcopy for Photo Description)

Andrew Barr, National Post

Email to a friendPrinter friendly

Font:

He didn't find the zinc he was hoping for in that hole. Instead, he found the mother lode.

"We hit nickel-copper, which we never expected to see," Mr. Nemis, 69, says in an interview from Wawa, Ont., where he is hiring stakers as fast as he can and sending them up to James Bay. "This could be bigger than Voisey's Bay. It's a huge discovery."

The drilling results, which started to emerge six weeks ago and feature massive amounts of copper and nickel sulphides, have astounded the mining industry and made Toronto-based Noront (as in NORthern ONTario) an overnight sensation.

The stock catapulted from pennies to more than $4 a share, and the big boys, such as CVRD Inco and Xstrata PLC, are already inquiring about the deposit. Noront expects one of them to eventually buy the company.

"They all want to come in and kick the tires. We'll get a big major in there to develop it eventually. This thing is getting bigger and bigger," Mr. Nemis says.

Noront's drilling is still in its early stages: Only a dozen holes have been drilled at the Double Eagle project.

But Jean-Francois Tardif, a fund manager at Sprott Asset Management (a major shareholder), calculated the company has already identified about $2-billion in value under the ground. He also pointed out that some of the drill holes have values of far more than US$1,000 per ton.

"Some mines are profitable at US$15 or US$20 per ton," he says."This would be massively profitable if it was being mined. The grade is just unbelievable."

If the discovery does turn out to be the next big find, it will be bought by one of the big players and put into production. But, meantime, hundreds of thousands of hectares of land surrounding the find are up for grabs, and there is a mad rush by junior miners to get their hands on it.

More than 100,000 hectares have been staked in the James Bay Lowlands in just six weeks.

Kirk McKinnon, chief executive of MacDonald Mines Exploration Ltd., figures it could be as much as 200,000. Nothing in Ontario compares since the diamond exploration boom in the late 1980s and early 1990s, and the Hem-lo gold discovery in the early 1980s.

At least 10 junior companies are already there, and more land is being staked every day.

"When Noront stock was first halted, the rumours started flying around," Mr. McKinnon says. "We sent a helicopter out [to James Bay] that day and started staking the next day. We took a chance, but that's what staking is all about."

MacDonald and its joint-venture partners have already staked more than 60,000 hectares.

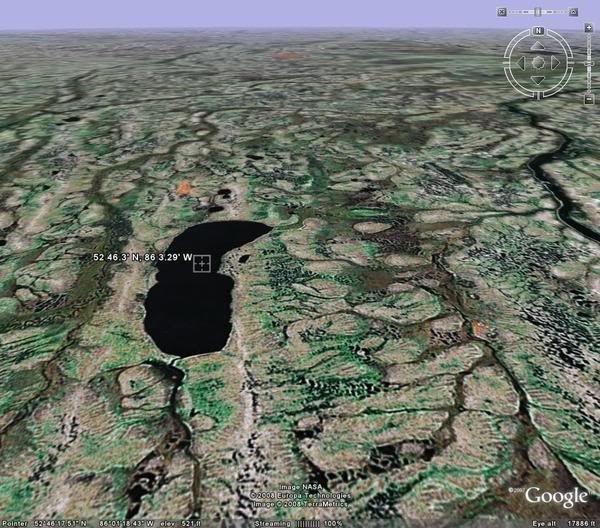

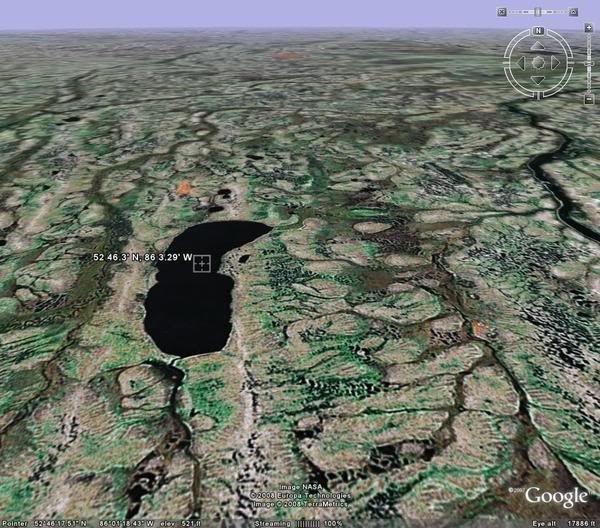

The remarkable thing about this staking rush is that it is happening in one of the most isolated areas in the province. The discovery is about halfway up the west side of James Bay and 150 kilometres inland to the west. The only way to reach it is by helicopter, and the only community anywhere close is Webequie, a tiny aboriginal reserve about 50 km away.

The formerly desolate region is now bustling with helicopters and prospectors flying in and out.

"I've heard it described as busy as Toronto airport, with all the airplanes flying around," says Brian Atkinson, resident geologist in Timmins with the Ontario Ministry of Northern Development and Mines. His phone is ringing off the hook with people looking for property in the Lowlands.

But it remains a very difficult place to drill. There is a lot of water and no exposed mineralization on the ground's surface. The mapping of the region is also very limited; the companies are mostly working off of old government maps, and a lot of the geophysical work has to be done in the helicopters.

Geologists, essentially, have nothing on the ground to work with.

As a result of that, and the fact that exploration is still in its very early stages, it is impossible to know exactly how big this discovery is.

"We don't know how long the thing is, and we don't know how deep it goes," says Bill Nielson, a geologist on MacDonald's board of directors. "We don't even know what direction it's going in at this point in time. It could just be a few million tons [of ore]. Or it could be 30 million."

Noront is hoping for the latter. The company believes its shares are grossly undervalued, and has hired financial advisor IBK Capital Corp. to figure out how to maximize value.

IBK is already comparing the stock's recent performance to Robert Friedland's Diamond Fields Inc. shortly after it found Voisey's Bay. That company eventually sold for US$4.3-billion.

"It is probably the biggest new discovery in Canada in the last 10 years," Mr. Nemis says. "That's how big it is. It's important." He pauses. "Very important."

pkoven@nationalpost.com

Is this Voisey's Bay II?

Nickel, copper grades at Noront's James Bay Double Eagle project are 'unbelievable'

Peter Koven, Financial Post

Published: Saturday, October 13, 2007

The wildest staking rush Ontario has seen in many years began with an accidental discovery.

Richard Nemis, chief executive of Noront Resources Ltd., staked out some territory in the James Bay Lowlands about three years ago. He thought it had good potential after De Beers Canada Inc. and a pair of junior miners, Spider Resources Inc. and KWG Resources Inc., made some interesting zinc and copper finds nearby.

But the area he really wanted to drill was caught up in litigation, and he didn't get his hands on it until recently. He promised to drill one hole in exchange for getting the land.

(See hardcopy for Photo Description)

Andrew Barr, National Post

Email to a friendPrinter friendly

Font:

He didn't find the zinc he was hoping for in that hole. Instead, he found the mother lode.

"We hit nickel-copper, which we never expected to see," Mr. Nemis, 69, says in an interview from Wawa, Ont., where he is hiring stakers as fast as he can and sending them up to James Bay. "This could be bigger than Voisey's Bay. It's a huge discovery."

The drilling results, which started to emerge six weeks ago and feature massive amounts of copper and nickel sulphides, have astounded the mining industry and made Toronto-based Noront (as in NORthern ONTario) an overnight sensation.

The stock catapulted from pennies to more than $4 a share, and the big boys, such as CVRD Inco and Xstrata PLC, are already inquiring about the deposit. Noront expects one of them to eventually buy the company.

"They all want to come in and kick the tires. We'll get a big major in there to develop it eventually. This thing is getting bigger and bigger," Mr. Nemis says.

Noront's drilling is still in its early stages: Only a dozen holes have been drilled at the Double Eagle project.

But Jean-Francois Tardif, a fund manager at Sprott Asset Management (a major shareholder), calculated the company has already identified about $2-billion in value under the ground. He also pointed out that some of the drill holes have values of far more than US$1,000 per ton.

"Some mines are profitable at US$15 or US$20 per ton," he says."This would be massively profitable if it was being mined. The grade is just unbelievable."

If the discovery does turn out to be the next big find, it will be bought by one of the big players and put into production. But, meantime, hundreds of thousands of hectares of land surrounding the find are up for grabs, and there is a mad rush by junior miners to get their hands on it.

More than 100,000 hectares have been staked in the James Bay Lowlands in just six weeks.

Kirk McKinnon, chief executive of MacDonald Mines Exploration Ltd., figures it could be as much as 200,000. Nothing in Ontario compares since the diamond exploration boom in the late 1980s and early 1990s, and the Hem-lo gold discovery in the early 1980s.

At least 10 junior companies are already there, and more land is being staked every day.

"When Noront stock was first halted, the rumours started flying around," Mr. McKinnon says. "We sent a helicopter out [to James Bay] that day and started staking the next day. We took a chance, but that's what staking is all about."

MacDonald and its joint-venture partners have already staked more than 60,000 hectares.

The remarkable thing about this staking rush is that it is happening in one of the most isolated areas in the province. The discovery is about halfway up the west side of James Bay and 150 kilometres inland to the west. The only way to reach it is by helicopter, and the only community anywhere close is Webequie, a tiny aboriginal reserve about 50 km away.

The formerly desolate region is now bustling with helicopters and prospectors flying in and out.

"I've heard it described as busy as Toronto airport, with all the airplanes flying around," says Brian Atkinson, resident geologist in Timmins with the Ontario Ministry of Northern Development and Mines. His phone is ringing off the hook with people looking for property in the Lowlands.

But it remains a very difficult place to drill. There is a lot of water and no exposed mineralization on the ground's surface. The mapping of the region is also very limited; the companies are mostly working off of old government maps, and a lot of the geophysical work has to be done in the helicopters.

Geologists, essentially, have nothing on the ground to work with.

As a result of that, and the fact that exploration is still in its very early stages, it is impossible to know exactly how big this discovery is.

"We don't know how long the thing is, and we don't know how deep it goes," says Bill Nielson, a geologist on MacDonald's board of directors. "We don't even know what direction it's going in at this point in time. It could just be a few million tons [of ore]. Or it could be 30 million."

Noront is hoping for the latter. The company believes its shares are grossly undervalued, and has hired financial advisor IBK Capital Corp. to figure out how to maximize value.

IBK is already comparing the stock's recent performance to Robert Friedland's Diamond Fields Inc. shortly after it found Voisey's Bay. That company eventually sold for US$4.3-billion.

"It is probably the biggest new discovery in Canada in the last 10 years," Mr. Nemis says. "That's how big it is. It's important." He pauses. "Very important."

pkoven@nationalpost.com

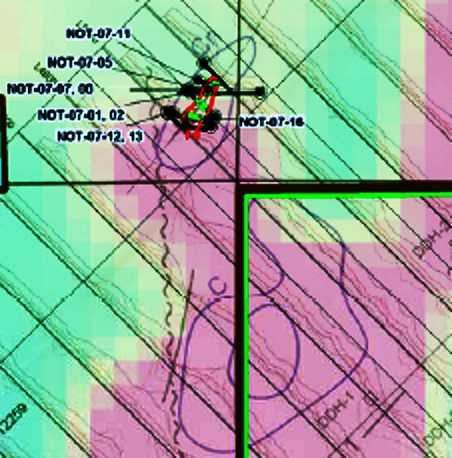

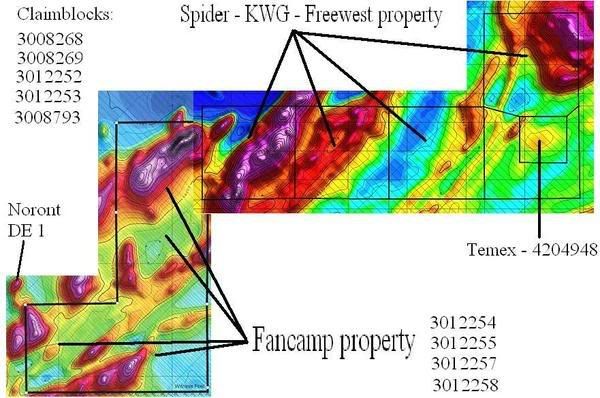

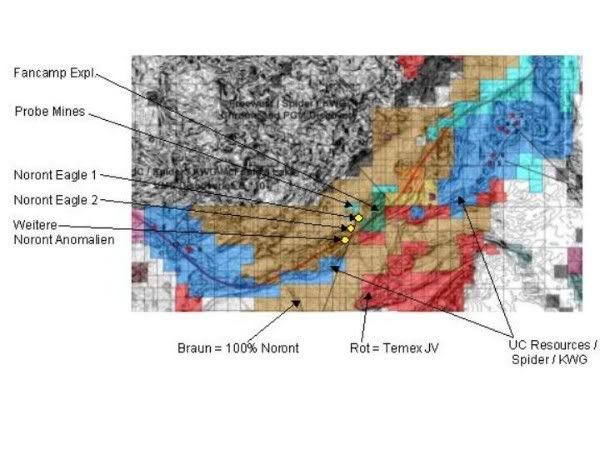

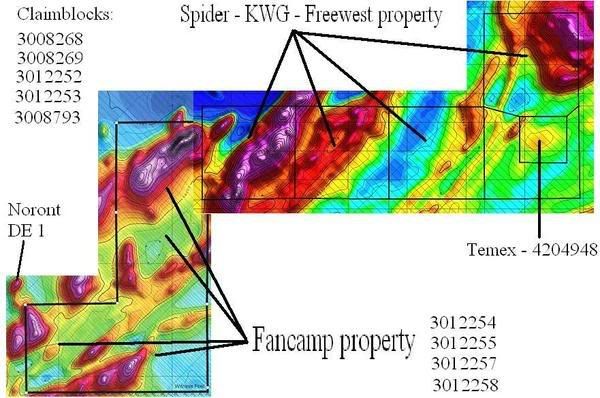

Nach dem GRÖßTEN Fund in James Bay durch Noront komme ich nun zu dem Joint Venture mit den MEIßTEN Funden in dem Gebiet:

SPIDER RESOURCES (SPQ.V) und KWG RESOURCES (KWG.V)

Anm.: Inzwischen ist ein großer Teil der JV-Properties in ein Joint Venture mit UC RESOURCES (UC.V) eingebunden worden.

"Spider and KWG have been exploring the James Bay Lowlands since 1992. In the process we have acquired hundreds of thousands of line kilometers of both fixed-wing and helicopter magnetic survey data and have drill-tested scores of anomalies. Our knowledge base of this area is vast and very well suited for the CARDS process."

Hier eine Karte mit den bisherigen 10 VMS-Funden (diese Tatsache an sich ist schon beachtenswert):

Und hier die Karte mit den McFaulds VMS-Funden:

McFaulds #1:

Ergebnisse:

http://www.spiderresources.com/news/September%204%202003.htm

Hole From(m) To(m) Int.(m) Cu % Zn % Au g/t Ag g/t

McF-03-11 309.0 312.5 3.5 2.00 0.025 0.137 3.5

Including 357.45 359.0 3.05 2.15 0.017 0.16 6.22

McF-03-14 90.00 116.65 26.55 0.90 2.440 0.135 5.52

Including 94.75 97.50 2.75 2.84 2.040 0.290 17.78

Including 99.00 103.60 4.60 0.84 4.410 0.060 4.27

McF-03-15 133.75 138.45 4.7 1.00 4.94 0.15 9.99

McF-03-16 354.9 360 5.1 0.06 1.55 0.01 1.59

As well as 382.5 390 7.5 1.30 0.025 0.03 3.43

McFaulds #2:

Hole From(m) To(m) Int.(m) Cu % Zn % Au g/t Ag g/t

McF-03-12 82.5 95.0 12.5 1.81 0.0132 0.22 6.06

McF-03-13 95.8 99.75 3.95 0.026 0.029 0.022 0.18

Mc Faulds #3 und #4:

The McFaulds 3 deposit has undergone extensive drill testing. To date, 13 holes have been drilled. The body has a surface length greater than 150m and a depth extent that exceeds 300m. Copper mineralization predominates and a summary table of assay highlights will be posted soon.

The McFaulds 4 body has been tested by only two drill holes. Although similar to McFaulds 1 and 3 geologically, the copper-zinc minearlization is sparse with the best intercept of 0.93% copper over 3.75m.

Mc Faulds #5 und #6:

Grid G hosts the McFaulds 5 and 6 bodies, approximately five kilometers southwest of McFaulds 1.

McFaulds 5 has been tested by two holes and the best copper intercept is 0.86% over 1.07m

McFaulds 6 has had four holes drilled into it and the best copper intercept is 1.82% over 3.3m

Mc Faulds #7:

Grid H was completed in a cooperative venture with an adjacent property holder. The total magnetic field image to the right shows only the portion of the grid on the Spider / KWG property. The location of McFaulds 7, approximately fifteen kilometers southwest of McFaulds 1, is shown. Mineralization of the McFaulds 7 body consists of an 8.6m core interval of 20-60% pyrite. Fifteen metres further down hole there is a 2.05m zone of 1.15% zinc.

__________________________________________________________________

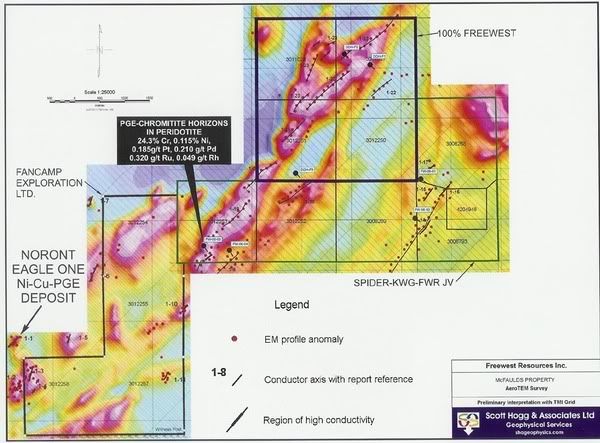

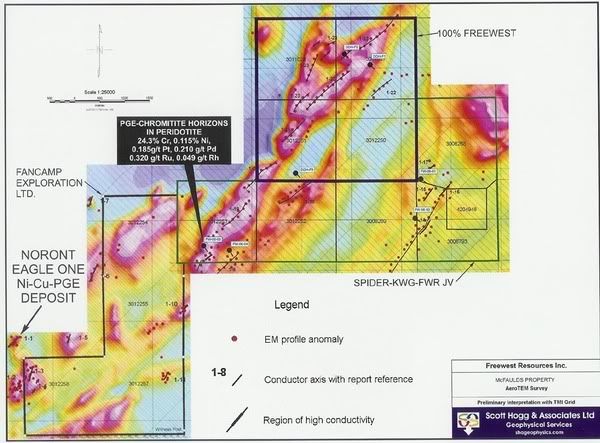

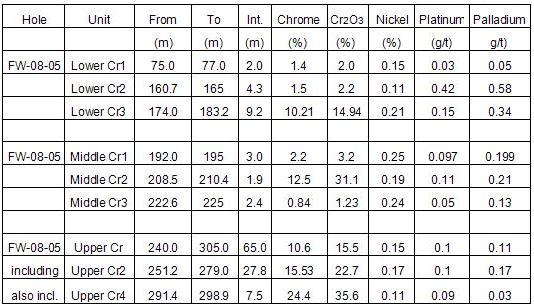

Und abschließend noch das Freewest Joint-Venture:

Freewest Property

The Freewest property is located approximately 15 kilometres southwest of the McFauld's volcanic-hosted massive sulphide deposits. An airborne magnetic and electromagnetic survey was completed in the summer of 2003. The image to the right shows a grid of apparent magnetic susceptibility, with late-time transient EM profiles.

As part of their winter 2006 drilling program, Spider and KWG included conductive anomalies in the Freewest property. In the drill hole indicated in the south-west corner of the property, two massive chromitite layers hosted with peridotite were discovered yielding assays of

23.4% chrome (34.5% Cr2O3) over 1.03 metres and

18.6% chrome (28.9% Cr2O3) over 0.85 metres

Under the terms of an agreement with Freewest, Spider and KWG must spend a total of $3.0 Million on exploration over a four-year period to earn an initial 50% interest in the Property. They may earn a cumulative 60% interest in the Property by delivering a bankable feasibility study on any mineralization identified and a cumulative 65% interest, by arranging financing on behalf of Freewest to put the Property into commercial production.

http://www.spiderresources.com/news/June%2029b%202006.htm

Gerade die Funde dieses JV sind m.E. sehr vielversprechend, wenn man sich eine elektromagnetische Karte von Fancamp ansieht, wo die Konduktoren des FWR/SPQ/KWG- Gebietes ähnlich starke Ausschläge wie die des Noront Fundes zeigen (siehe untere Karte rechts neben Fancamp Claim 3012254):

http://www.ccnmatthews.com/docs/FNC1017.pdf

Die Claims von SPQ/KWG sind sehr vielversprechend und damit auch die JV-Partner UC bzw. FWR.

Gruß,

Fantomas

SPIDER RESOURCES (SPQ.V) und KWG RESOURCES (KWG.V)

Anm.: Inzwischen ist ein großer Teil der JV-Properties in ein Joint Venture mit UC RESOURCES (UC.V) eingebunden worden.

"Spider and KWG have been exploring the James Bay Lowlands since 1992. In the process we have acquired hundreds of thousands of line kilometers of both fixed-wing and helicopter magnetic survey data and have drill-tested scores of anomalies. Our knowledge base of this area is vast and very well suited for the CARDS process."

Hier eine Karte mit den bisherigen 10 VMS-Funden (diese Tatsache an sich ist schon beachtenswert):

Und hier die Karte mit den McFaulds VMS-Funden:

McFaulds #1:

Ergebnisse:

http://www.spiderresources.com/news/September%204%202003.htm

Hole From(m) To(m) Int.(m) Cu % Zn % Au g/t Ag g/t

McF-03-11 309.0 312.5 3.5 2.00 0.025 0.137 3.5

Including 357.45 359.0 3.05 2.15 0.017 0.16 6.22

McF-03-14 90.00 116.65 26.55 0.90 2.440 0.135 5.52

Including 94.75 97.50 2.75 2.84 2.040 0.290 17.78

Including 99.00 103.60 4.60 0.84 4.410 0.060 4.27

McF-03-15 133.75 138.45 4.7 1.00 4.94 0.15 9.99

McF-03-16 354.9 360 5.1 0.06 1.55 0.01 1.59

As well as 382.5 390 7.5 1.30 0.025 0.03 3.43

McFaulds #2:

Hole From(m) To(m) Int.(m) Cu % Zn % Au g/t Ag g/t

McF-03-12 82.5 95.0 12.5 1.81 0.0132 0.22 6.06

McF-03-13 95.8 99.75 3.95 0.026 0.029 0.022 0.18

Mc Faulds #3 und #4:

The McFaulds 3 deposit has undergone extensive drill testing. To date, 13 holes have been drilled. The body has a surface length greater than 150m and a depth extent that exceeds 300m. Copper mineralization predominates and a summary table of assay highlights will be posted soon.

The McFaulds 4 body has been tested by only two drill holes. Although similar to McFaulds 1 and 3 geologically, the copper-zinc minearlization is sparse with the best intercept of 0.93% copper over 3.75m.

Mc Faulds #5 und #6:

Grid G hosts the McFaulds 5 and 6 bodies, approximately five kilometers southwest of McFaulds 1.

McFaulds 5 has been tested by two holes and the best copper intercept is 0.86% over 1.07m

McFaulds 6 has had four holes drilled into it and the best copper intercept is 1.82% over 3.3m

Mc Faulds #7:

Grid H was completed in a cooperative venture with an adjacent property holder. The total magnetic field image to the right shows only the portion of the grid on the Spider / KWG property. The location of McFaulds 7, approximately fifteen kilometers southwest of McFaulds 1, is shown. Mineralization of the McFaulds 7 body consists of an 8.6m core interval of 20-60% pyrite. Fifteen metres further down hole there is a 2.05m zone of 1.15% zinc.

__________________________________________________________________

Und abschließend noch das Freewest Joint-Venture:

Freewest Property

The Freewest property is located approximately 15 kilometres southwest of the McFauld's volcanic-hosted massive sulphide deposits. An airborne magnetic and electromagnetic survey was completed in the summer of 2003. The image to the right shows a grid of apparent magnetic susceptibility, with late-time transient EM profiles.

As part of their winter 2006 drilling program, Spider and KWG included conductive anomalies in the Freewest property. In the drill hole indicated in the south-west corner of the property, two massive chromitite layers hosted with peridotite were discovered yielding assays of

23.4% chrome (34.5% Cr2O3) over 1.03 metres and

18.6% chrome (28.9% Cr2O3) over 0.85 metres

Under the terms of an agreement with Freewest, Spider and KWG must spend a total of $3.0 Million on exploration over a four-year period to earn an initial 50% interest in the Property. They may earn a cumulative 60% interest in the Property by delivering a bankable feasibility study on any mineralization identified and a cumulative 65% interest, by arranging financing on behalf of Freewest to put the Property into commercial production.

http://www.spiderresources.com/news/June%2029b%202006.htm

Gerade die Funde dieses JV sind m.E. sehr vielversprechend, wenn man sich eine elektromagnetische Karte von Fancamp ansieht, wo die Konduktoren des FWR/SPQ/KWG- Gebietes ähnlich starke Ausschläge wie die des Noront Fundes zeigen (siehe untere Karte rechts neben Fancamp Claim 3012254):

http://www.ccnmatthews.com/docs/FNC1017.pdf

Die Claims von SPQ/KWG sind sehr vielversprechend und damit auch die JV-Partner UC bzw. FWR.

Gruß,

Fantomas

Hier noch ein Nachtrag (News vom 05.09.07) mit einem sehr guten Drill-Ergebnis des Spider/UC- Joint Ventures auf der McFaulds Property:

http://www.spiderresources.com/news/September%2005%202007.ht…

Spider Resources Inc. and UC Resources Ltd.

intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag

over 19 metres at VMS project in Northern Ontario

Gruß,

Fantomas

http://www.spiderresources.com/news/September%2005%202007.ht…

Spider Resources Inc. and UC Resources Ltd.

intersect 4.35% Zn, 2.69% Cu, 0.35 g/t Au and 6.63 g/t Ag

over 19 metres at VMS project in Northern Ontario

Gruß,

Fantomas

Und die Spider/KWG- News zum o.g. Freewest Joint-Venture, daß ein Winter-Drilling Programm über CAD 2 Mio. in Kürze startet:

http://www.spiderresources.com/news/October%2001%202007.htm

SPIDER & KWG JV UP-DATE AND PLANS TO DRILL TARGETS IN VICINITY OF THE NEW NORONT COPPER – NICKEL - PGE DISCOVERY

Gruß,

Fantomas

http://www.spiderresources.com/news/October%2001%202007.htm

SPIDER & KWG JV UP-DATE AND PLANS TO DRILL TARGETS IN VICINITY OF THE NEW NORONT COPPER – NICKEL - PGE DISCOVERY

Gruß,

Fantomas

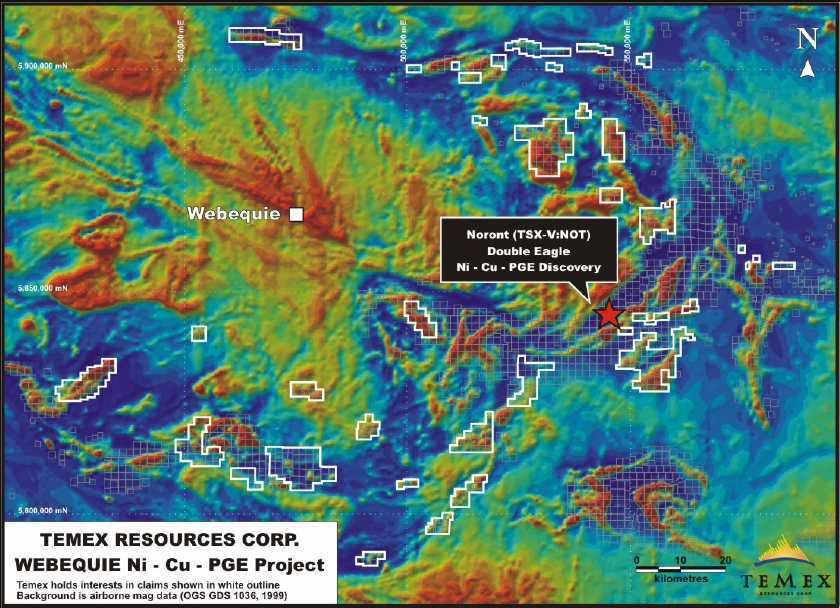

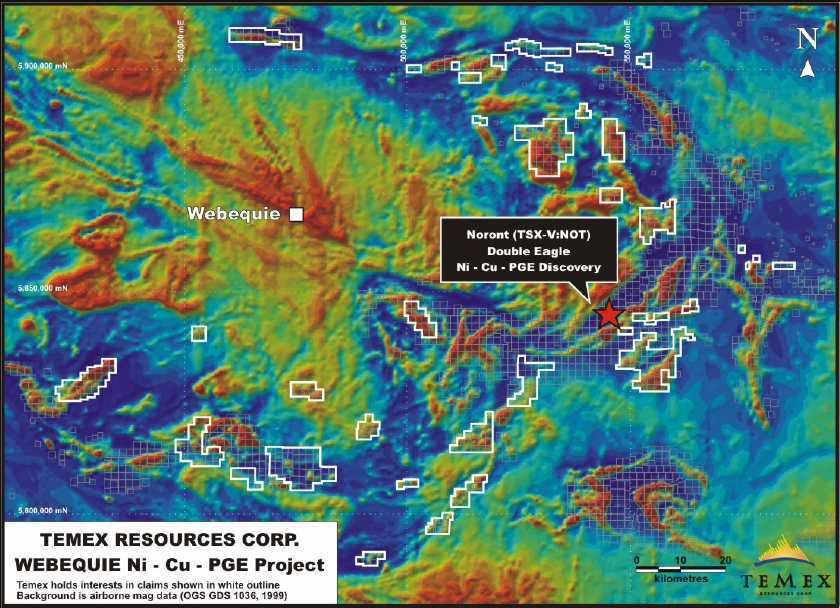

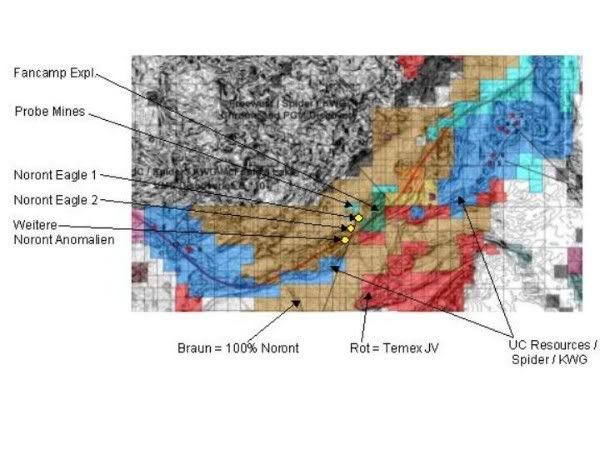

Nach dem größten Fund und den meißten Funden nun zum GRÖßTEN CLAIM-EIGENTÜMER im Gebiet:

MACDONALD MINES (BMK.V)

Eine sehr gute Übersicht über die Claims und die aktuellen Aktivitäten von BMK liefert die Präsentation:

http://www.macdonaldmines.com/Downloads/Macdonald_Presentati…

Macdonald Mines ist inzwischen auch mit verschiedenen Joint-Ventures im Gebiet vertreten, u.a. mit Temex (TME.V) und Baltic (BLR.V).

Aus dem Pressetext:

MacDonald - Exploration Activities in the Webequie Area of James Bay

MacDonald has set upon a strategic direction of exploration in Central Canadian Northlands.

The Company has the largest geologically favorable land position similar to the SPECTACULAR NORONT Nickel-Copper Discovery. Total land holdings which are wholly-owned or with partners is approximately 60,000 Hectares.

Previous MacDonald exploration on it's McNugget Property intersected nickel mineralization. This new nickel discovery reported in hole MN-07-39 intersected 4.5 m grading 0.36%NI and 22.5m down the hole a further intersection of 27.0 m averaging 0.26%NI.

MacDonald's 2004 Airborne Survey flown @ 75 metre line spacing has allowed the Company to re-analyse this excellent data with the new focus on nickel interpretation verses previous VMS interpretation.

Und:

MacDonald is the only company in the Attawapiskat Camp with defined gold targets.

__________________________________________________________________

Weiterhin wurde am 11.10.07 ein Drill-Programm für die James Bay -Area angekündigt:

http://www.macdonaldmines.com/PressReleases/Oct11,2007.htm

Es sollen 10-15 Löcher mit einer Gesamtlänge von 2000 m gebohrt werden.

Gruß,

Fantomas

MACDONALD MINES (BMK.V)

Eine sehr gute Übersicht über die Claims und die aktuellen Aktivitäten von BMK liefert die Präsentation:

http://www.macdonaldmines.com/Downloads/Macdonald_Presentati…

Macdonald Mines ist inzwischen auch mit verschiedenen Joint-Ventures im Gebiet vertreten, u.a. mit Temex (TME.V) und Baltic (BLR.V).

Aus dem Pressetext:

MacDonald - Exploration Activities in the Webequie Area of James Bay

MacDonald has set upon a strategic direction of exploration in Central Canadian Northlands.

The Company has the largest geologically favorable land position similar to the SPECTACULAR NORONT Nickel-Copper Discovery. Total land holdings which are wholly-owned or with partners is approximately 60,000 Hectares.

Previous MacDonald exploration on it's McNugget Property intersected nickel mineralization. This new nickel discovery reported in hole MN-07-39 intersected 4.5 m grading 0.36%NI and 22.5m down the hole a further intersection of 27.0 m averaging 0.26%NI.

MacDonald's 2004 Airborne Survey flown @ 75 metre line spacing has allowed the Company to re-analyse this excellent data with the new focus on nickel interpretation verses previous VMS interpretation.

Und:

MacDonald is the only company in the Attawapiskat Camp with defined gold targets.

__________________________________________________________________

Weiterhin wurde am 11.10.07 ein Drill-Programm für die James Bay -Area angekündigt:

http://www.macdonaldmines.com/PressReleases/Oct11,2007.htm

Es sollen 10-15 Löcher mit einer Gesamtlänge von 2000 m gebohrt werden.

Gruß,

Fantomas

new map posted on probe site

Posted by: Aussie1 on October 21, 2007 09:21AM

http://www.probemines.com/i/pdf/Fact_Sheet_October%202_%2020…

http://www.probemines.com/i/pdf/McFauld_Lake_Fact_Sheet.pdf

http://agoracom.com/ir/Noront/messages/602232#message

Posted by: Aussie1 on October 21, 2007 09:21AM

http://www.probemines.com/i/pdf/Fact_Sheet_October%202_%2020…

http://www.probemines.com/i/pdf/McFauld_Lake_Fact_Sheet.pdf

http://agoracom.com/ir/Noront/messages/602232#message

Zur schnellen Kursübersicht der wichtigsten Player im James Bay Lowlands-Gebiet empfehle ich Mike´s RT-Chart-Thread:

Thread: Realtime - Charts NORONT und angrenzende Explorer

Und hier die Homepage-Links zu den Firmen:

http://www.norontresources.com/home.htm

http://www.spiderresources.com/

http://www.macdonaldmines.com/

http://www.freewest.com/

http://www.ucresources.net/

http://www.kwgresources.com/

http://www.probemines.com/s/Home.asp

http://www.renforthresources.com/

TEMEX RESOURCES (TME.V)

http://www.temexcorp.com/s/Home.asp

NORTHERN SHIELD (NRN.V)

http://www.northern-shield.com/

FANCAMP EXPLORATION (FNC.V)

KEINE WEBSITE

Gruß,

Fantomas

Thread: Realtime - Charts NORONT und angrenzende Explorer

Und hier die Homepage-Links zu den Firmen:

http://www.norontresources.com/home.htm

http://www.spiderresources.com/

http://www.macdonaldmines.com/

http://www.freewest.com/

http://www.ucresources.net/

http://www.kwgresources.com/

http://www.probemines.com/s/Home.asp

http://www.renforthresources.com/

TEMEX RESOURCES (TME.V)

http://www.temexcorp.com/s/Home.asp

NORTHERN SHIELD (NRN.V)

http://www.northern-shield.com/

FANCAMP EXPLORATION (FNC.V)

KEINE WEBSITE

Gruß,

Fantomas

Die wichtigsten "Area Plays" am McFaulds Lake:

Noront Resources

Symbol: NOT

ISIN: CA65626P1018

Schlusskurs 19.10.07 Toronto: 5,60 CAD

MK: 505.684.519 CAD

Website: norontresources.com

Fancamp Exploration

Symbol: FNC

ISIN: CA30710P1027

Schlusskurs 19.10.07 Toronto: 2,20 CAD

MK: 55.305.758 CAD

Website: unbekannt

MacDonald Mines

Symbol: BMK

ISIN: CA5543243011

Schlusskurs 19.10.07 Toronto: 0,700 CAD

MK: 53.352.123 CAD

Website: macdonaldmines.com

Northern Shield Resources

Symbol: NRN

ISIN: CA6857201064

Schlusskurs 19.10.07 Toronto: 0,980 CAD

MK: 50.791.494 CAD

Website: www.northernshield.com

Temex Resources

Symbol: TME

ISIN: CA87971U1057

Schlusskurs 19.10.07 Toronto: 0,800 CAD

MK: 46.944.648 CAD

Website: www.temexcorp.com

Spider Resources

Symbol: SPQ

ISIN: CA84844C1077

Schlusskurs 19.10.07 Toronto: 0,170 CAD

MK: 41.172.901 CAD

Website: www.spiderresources.com

UC Resources

Symbol: UC

ISIN: unbekannt

Schlusskurs 19.10.07 Toronto: 0,470 CAD

MK: 40.922.818 CAD

Website: www.ucresources.net

Baltis Resources

Symbol: BLR

ISIN: CA0589111081

Schlusskurs 19.10.07 Toronto: 1,21 CAD

MK: 39.831.868 CAD

Website: www.balticresources.ca

Free West Resources

Symbol: FWR

ISIN: CA3569041021

Schlusskurs 19.10.07 Toronto: 0,275 CAD

MK: 39.644.737 CAD

Website: www.freewest.com

KWG Resources

Symbol: KWG

ISIN: CA48277D2059

Schlusskurs 19.10.07 Toronto: 0,150 CAD

MK: 27.679.887 CAD

Website: www.kwgresources.com

Probe Mines

Symbol: PRB

ISIN: CA7426671086

Schlusskurs 19.10.07 Toronto: 0,820 CAD

MK: 19.610.278 CAD

Website: www.probemines.com

Murgor Resources

Symbol: MUG

ISIN: CA62660P1053

Schlusskurs 19.10.07 Toronto: 0,165 CAD

MK: 18.632.698 CAD

Website: unbekannt

Canstar Resources

Symbol: ROX

ISIN: CA1380811044

Schlusskurs 19.10.07 Toronto: 0,160 CAD

MK: 8.528.408 CAD

Website: unbekannt

(alle ISIN ohne Gewähr)

Aktuell: 1 EUR = 1,38230 CAD

Neben den Websites meine wichtigsten Informationsquellen zurzeit:

www.tsx.com

www.agoracom.com

www.stockhouse.com

Auf allen drei Links genügt es, das o. a. Symbol einzugeben, dann kommt man zu der entsprechenden Company-Seite bzw. zu dem entsprechenden Thread.

Noront Resources

Symbol: NOT

ISIN: CA65626P1018

Schlusskurs 19.10.07 Toronto: 5,60 CAD

MK: 505.684.519 CAD

Website: norontresources.com

Fancamp Exploration

Symbol: FNC

ISIN: CA30710P1027

Schlusskurs 19.10.07 Toronto: 2,20 CAD

MK: 55.305.758 CAD

Website: unbekannt

MacDonald Mines

Symbol: BMK

ISIN: CA5543243011

Schlusskurs 19.10.07 Toronto: 0,700 CAD

MK: 53.352.123 CAD

Website: macdonaldmines.com

Northern Shield Resources

Symbol: NRN

ISIN: CA6857201064

Schlusskurs 19.10.07 Toronto: 0,980 CAD

MK: 50.791.494 CAD

Website: www.northernshield.com

Temex Resources

Symbol: TME

ISIN: CA87971U1057

Schlusskurs 19.10.07 Toronto: 0,800 CAD

MK: 46.944.648 CAD

Website: www.temexcorp.com

Spider Resources

Symbol: SPQ

ISIN: CA84844C1077

Schlusskurs 19.10.07 Toronto: 0,170 CAD

MK: 41.172.901 CAD

Website: www.spiderresources.com

UC Resources

Symbol: UC

ISIN: unbekannt

Schlusskurs 19.10.07 Toronto: 0,470 CAD

MK: 40.922.818 CAD

Website: www.ucresources.net

Baltis Resources

Symbol: BLR

ISIN: CA0589111081

Schlusskurs 19.10.07 Toronto: 1,21 CAD

MK: 39.831.868 CAD

Website: www.balticresources.ca

Free West Resources

Symbol: FWR

ISIN: CA3569041021

Schlusskurs 19.10.07 Toronto: 0,275 CAD

MK: 39.644.737 CAD

Website: www.freewest.com

KWG Resources

Symbol: KWG

ISIN: CA48277D2059

Schlusskurs 19.10.07 Toronto: 0,150 CAD

MK: 27.679.887 CAD

Website: www.kwgresources.com

Probe Mines

Symbol: PRB

ISIN: CA7426671086

Schlusskurs 19.10.07 Toronto: 0,820 CAD

MK: 19.610.278 CAD

Website: www.probemines.com

Murgor Resources

Symbol: MUG

ISIN: CA62660P1053

Schlusskurs 19.10.07 Toronto: 0,165 CAD

MK: 18.632.698 CAD

Website: unbekannt

Canstar Resources

Symbol: ROX

ISIN: CA1380811044

Schlusskurs 19.10.07 Toronto: 0,160 CAD

MK: 8.528.408 CAD

Website: unbekannt

(alle ISIN ohne Gewähr)

Aktuell: 1 EUR = 1,38230 CAD

Neben den Websites meine wichtigsten Informationsquellen zurzeit:

www.tsx.com

www.agoracom.com

www.stockhouse.com

Auf allen drei Links genügt es, das o. a. Symbol einzugeben, dann kommt man zu der entsprechenden Company-Seite bzw. zu dem entsprechenden Thread.

Antwort auf Beitrag Nr.: 32.099.581 von Fantomas96 am 21.10.07 18:20:20@Fantomas,

ich war etwas langsamer.

pintador

ich war etwas langsamer.

pintador

Antwort auf Beitrag Nr.: 32.099.903 von pintador am 21.10.07 18:43:13Berichtigungen und Ergänzungen:

Murgor Resources

Website: www.murgor.com

Northern Shield Resources

www.northern-shield.com

MacDonald Mines

MK: 62.870.020 CAD

Murgor Resources

Website: www.murgor.com

Northern Shield Resources

www.northern-shield.com

MacDonald Mines

MK: 62.870.020 CAD

Antwort auf Beitrag Nr.: 32.101.534 von pintador am 21.10.07 20:52:25www.murgor.com

www.northern-shield.com

www.northern-shield.com

Und hier eine interessante Grafik aus Kaisers Blog (Kopie siehe in meinem Thread: NORONT RES. (NOT.V): Spektakuläre Funde (Gold,Kupfer,Uran,Metalle)), die zeigt, wie die aktuellen Werte der Firmen und der Fortschritt ihres Deposits ist, auch im Vergleich zu vielen bisherigen (großen) Entdeckungen:

Gruß,

Fantomas

Gruß,

Fantomas

Antwort auf Beitrag Nr.: 32.101.534 von pintador am 21.10.07 20:52:25Hallo pintador,

danke für Deinen Input, aber Murgor ist nicht im James Bay Gebiet engagiert, sie sind "lediglich" ein Noront-Partner bei Windfall und halten Aktien von Noront.

Gruß,

Fantomas

danke für Deinen Input, aber Murgor ist nicht im James Bay Gebiet engagiert, sie sind "lediglich" ein Noront-Partner bei Windfall und halten Aktien von Noront.

Gruß,

Fantomas

Antwort auf Beitrag Nr.: 32.114.829 von Fantomas96 am 22.10.07 22:49:55Ich konnte mit Murgor nicht viel anfangen, habe Murgor nur deshalb erwähnt, weil mike32 sie in den Charts-Thread der Area Plays aufgenommen hat.

pintador

pintador

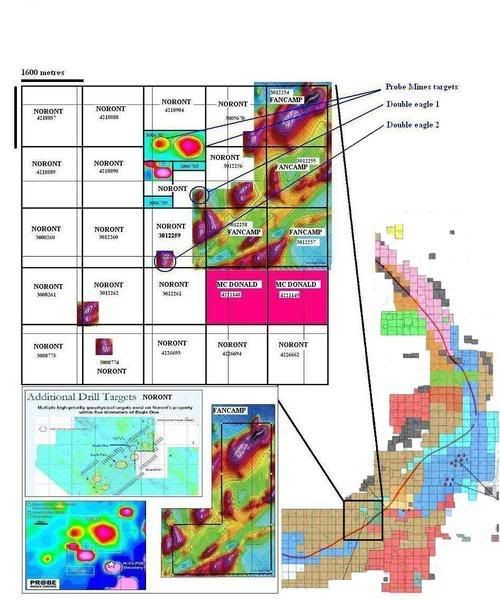

NEWS - Probe Mines Announces $3,000,000 Non-Brokered Private Placement to Explore McFauld's Lake Project

Posted by: AGORACOM on October 22, 2007 04:35PM

Toronto, October 22, 2007 – The Directors of PROBE MINES LIMITED (TSX-V: PRB) ("Probe") are pleased to announce a proposed non-brokered private placement financing of up to $3,000,000 comprising the sale of up to 4,000,000 Units, to be sold at $0.75 per Unit, subject to regulatory approval and closing. Each Unit consists of one common share and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one common share for $1.00 for a period of 24 months (the "Warrant Term") from the closing of the transaction (the "Closing Date"), provided, however, that should the closing price at which the common shares trade, equal or exceed $1.75 for 20 consecutive trading days following the date that is four months and one day after the Closing Date, Probe may accelerate the Warrant Term to the date which is 30 days following the date a press release is issued by Probe announcing the reduced Warrant Term. All securities issued in conjunction with the offering will be subject to a hold period, which expires four months after closing.

Proceeds of the financing will be used to fund exploration on the Company’s McFauld’s Lake properties, including the 100%-owned McFauld’s Lake West Project, located approximately 450m from Noront Resources recent high-grade nickel-copper-PGE discovery; and the 100%-owned Victory Project which hosts numerous untested drill targets in a volcanic belt attached to the McFauld’s Lake Belt. Exploration on the McFauld’s Lake properties will include a winter program of magnetic and electromagnetic geophysical surveys followed by diamond drilling. The programs are expected to commence shortly, and will be focused on bringing the properties to a drill-ready state as soon as possible. Drilling will focus on the McFauld’s West property, where regional government magnetic data shows the presence of two anomalies within the claims that are similar in size and shape to that associated with Noront's discovery.

The McFauld's area is once again receiving considerable attention with the recent discovery of high-grade nickel-copper-PGE mineralization by Noront Resources. Results from hole NOT07-05 returned a 63.8m intersection of massive and net-textured sulphides in olivine-bearing peridotite grading 5.9% nickel, 3.1% copper, 2.9 g/t Pt and 9.8 g/t Pd; including a 3m interval grading 8.7% nickel, 10.9% copper, 41 g/t Pt and 14 g/t Pd. Recent field observations indicate the boundary of Probe’s McFauld’s West property is only 450m from the discovery zone. The management of Probe is encouraged by the proximity to this significant discovery, and believes there is a strong potential for this property to also host mineralization.

About Probe Mines:

Probe Mines Limited is a Canadian base and precious metal exploration company with a portfolio of highly prospective mineral properties. The Company is currently focused on the McFauld’s Lake area where it owns 931 claims covering almost 15,000 hectares. This includes a 100% interest in 12 claims (192 hectares) situated less than 450 metres from the site of Noront’s significant new nickel-copper discovery and represents one of the closest properties to the discovery. Probe currently has joint venture agreements on its Bristol Township gold project (West Timmins Mining Inc.) and Tamarack base metal project (Mantis Minerals Corp.). The Bristol Project is adjacent to the million-plus ounce gold deposit owned by Lake Shore Gold Corp., which has recently announced a positive pre-feasibility study for the project. Probe also maintains a 5% net smelter royalty on a portion of Agnico Eagle’s Goldex Mine near Val d’Or, Quebec, slated for production in 2008. The company’s shares trade on the TSX Venture Exchange under the symbol PRB.

Investors are invited to visit the Probe Mines IR Hub at http://www.agoracom.com/IR/Probemines where they can post questions and receive answers or review questions and answers already posted by other investors. Alternatively, investors are able to e-mail all questions and correspondence to PRB@agoracom.com where they can also request to be added to the investor e-mail list to receive all future press releases and updates in real time.

David Palmer, Ph.D., P.Geo., is the qualified person for all technical information in this release. To find out more about Probe Mines Limited, visit our website at www.probemines.com, or contact:

David Palmer, Ph.D.

President

Tel: (416) 777-6703

Harry J. Hodge, P.Eng.,

Director

Tel: (416) 363-4376

Karen Willoughby

Investor Relations

Tel: (866) 365-4724

http://agoracom.com/ir/probemines/messages/603259#message

Antwort auf Beitrag Nr.: 32.093.184 von Fantomas96 am 20.10.07 13:58:40

http://biz.yahoo.com/ccn/071023/200710230420661001.html?.v=1

Press Release Source: UC Resources Ltd.

UC Resources Limited and Spider Resources Inc. Diamond Drilling Program at McFaulds VMS project in Northern Ontario

Tuesday October 23, 1:11 pm ET

Gruß,

Fantomas

Freewest Resources Announces Closing of $500,000 "Flow-Through" Private Placement With Mineralfields

MONTREAL, QUEBEC--(Marketwire - Oct. 23, 2007) - Freewest Resources Canada Inc. (TSX VENTURE:FWR) announces that it has completed a private placement by issuing 1,923,074 "flow-through" common shares to six limited partnerships associated with MineralFields Group of Toronto, Ontario at a price of $0.26 per share, for gross proceeds to Freewest of $500,000.

Each share is accompanied by one-half of a common share purchase warrant. Each whole warrant entitles the holder to acquire one additional common share of Freewest at a price of $0.40 until October 23, 2008.

In connection with the private placement, Freewest paid a finder's fee to Limited Market Dealer Inc., consisting of 76,923 common shares and a compensation option entitling Limited Market Dealer Inc. to purchase up to 192,307 units of Freewest, representing 10 % of the number of "flow-through" common shares sold in the private placement. The compensation option is exercisable at a price of $0.26 per unit until October 23, 2008. Each unit will be comprised of one common share of Freewest and one-half of a common share purchase warrant. Each whole warrants will entitle the holder to purchase one additional common share of Freewest at a price of $0.40 until October 23, 2008.

Freewest also paid Limited Market Dealer Inc. a due diligence fee of $20,000, representing 4% of the gross proceeds raised in the private placement.

Under applicable securities legislation and policies of the TSX Venture Exchange, the common shares and warrants issued in the private placement are subject to a hold period expiring on February 24, 2008.

Freewest will use the proceeds from the private placement for exploration work on its properties.

As a result of the private placement, there are 148,943,254 common shares of Freewest issued and outstanding.

Freewest is a well-funded mineral exploration company exploring for gold, uranium and base metals in Eastern Canada. Corporate information can be accessed on the Internet at www.freewest.com. Freewest's shares are listed on the TSX Venture Exchange under the symbol FWR.

About MineralFields, Pathway and First Canadian Securities ®

MineralFields Group (a division of Pathway Asset Management) is a Toronto-based mining fund with significant assets under administration that offers its tax-advantaged super flow-through limited partnerships to investors throughout Canada during most of the calendar year, as well as hard-dollar resource limited partnerships to investors throughout the world. Pathway Asset Management also specializes in the manufacturing and distribution of structured products and mutual funds. Information about MineralFields Group is available at www.mineralfields.com. First Canadian Securities®, a division of Limited Market Dealer Inc., is active in leading resource financings (both flow-through and hard dollar) on competitive, effective and service-friendly terms, with investors both within, and outside of MineralFields Group.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this press release.

MONTREAL, QUEBEC--(Marketwire - Oct. 23, 2007) - Freewest Resources Canada Inc. (TSX VENTURE:FWR) announces that it has completed a private placement by issuing 1,923,074 "flow-through" common shares to six limited partnerships associated with MineralFields Group of Toronto, Ontario at a price of $0.26 per share, for gross proceeds to Freewest of $500,000.

Each share is accompanied by one-half of a common share purchase warrant. Each whole warrant entitles the holder to acquire one additional common share of Freewest at a price of $0.40 until October 23, 2008.

In connection with the private placement, Freewest paid a finder's fee to Limited Market Dealer Inc., consisting of 76,923 common shares and a compensation option entitling Limited Market Dealer Inc. to purchase up to 192,307 units of Freewest, representing 10 % of the number of "flow-through" common shares sold in the private placement. The compensation option is exercisable at a price of $0.26 per unit until October 23, 2008. Each unit will be comprised of one common share of Freewest and one-half of a common share purchase warrant. Each whole warrants will entitle the holder to purchase one additional common share of Freewest at a price of $0.40 until October 23, 2008.

Freewest also paid Limited Market Dealer Inc. a due diligence fee of $20,000, representing 4% of the gross proceeds raised in the private placement.

Under applicable securities legislation and policies of the TSX Venture Exchange, the common shares and warrants issued in the private placement are subject to a hold period expiring on February 24, 2008.

Freewest will use the proceeds from the private placement for exploration work on its properties.

As a result of the private placement, there are 148,943,254 common shares of Freewest issued and outstanding.

Freewest is a well-funded mineral exploration company exploring for gold, uranium and base metals in Eastern Canada. Corporate information can be accessed on the Internet at www.freewest.com. Freewest's shares are listed on the TSX Venture Exchange under the symbol FWR.

About MineralFields, Pathway and First Canadian Securities ®

MineralFields Group (a division of Pathway Asset Management) is a Toronto-based mining fund with significant assets under administration that offers its tax-advantaged super flow-through limited partnerships to investors throughout Canada during most of the calendar year, as well as hard-dollar resource limited partnerships to investors throughout the world. Pathway Asset Management also specializes in the manufacturing and distribution of structured products and mutual funds. Information about MineralFields Group is available at www.mineralfields.com. First Canadian Securities®, a division of Limited Market Dealer Inc., is active in leading resource financings (both flow-through and hard dollar) on competitive, effective and service-friendly terms, with investors both within, and outside of MineralFields Group.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this press release.

TSX Venture Exchange:TME, Frankfurt Exchange:TQ1

TORONTO, Oct. 24 /CNW/ - Temex Resources Corp. (TSX Venture Exchange:TME, Frankfurt:TQ1) ("Temex" or "the Company") is pleased to announce drill results from a recently completed 2,345 metre, 15 hole diamond drill program on the Whitney Township and Pam Properties. The program followed up on three areas drilled by Temex in 2005-2006 (Hugh Pam Conglomerate Zone, the Reef Offset Zone, and the Reef Pit Zone) as well as tested three new target areas (Pam Property, the West Banner Zone and the South Banner Zone). Temex has the option to earn a 60% interest in the Whitney Township Property from the Porcupine Joint Venture ("PJV", a joint venture between Goldcorp Inc. and Kinross Gold Corporation).

ADVERTISEMENT

Six holes tested the Hugh Pam Conglomerate Zone where previous drilling outlined two gold mineralized horizons, including results of 17.17 g/t gold over 12.00 metres. All six holes intersected gold mineralization with the best intersection being from hole TW-07-45, which included an assay interval of 2.47 g/t gold over a core length of 14.10 m, including 5.18 g/t gold over 4.70 metres. The main gold bearing zone called the Hugh Pam Conglomerate Zone occurs above the Timiskaming unconformity. The second mineralized horizon, the Mulholland Shear Zone, occurs in the footwall Tisdale group volcanic rocks below the unconformity; this horizon has loosely been termed the Mulholland Shear horizon.

Three holes were designed to test for the down dip and western extension of gold mineralization previously intersected by the Company at the Reef Pit zone. One drill hole was drilled to intersect the down-dip extension and this hole intersected 4.09 g/t gold over 4.15 metres, including 10.29 g/t gold over 1.35 metres. Two holes drilled to intersect the western strike extension of the Reef Pit Zone returned no significant gold however the holes did intersect alteration typically associated with gold mineralization along the Broulan Reef Mine Trend.

Two drill holes were completed to further test a gold zone, called the Reef Offset Zone, discovered by Temex in 2006 (TW06-30) and interpreted to be an extension of the Broulan Reef Shear Zone. Drill hole TW07-47 was drilled above TW06-30 to intersect the up-dip extension of the Reef Offset Zone. No significant assays were reported in either drill hole. Two drill holes completed on the newly acquired Pam Property targeted a gold zone in the north-central part of the property along strike from a previously reported zone of gold mineralization in quartz-carbonate stringers within carbonate altered volcanics intercepted in 1964 by Hollander Mines. No significant assays were returned from these holes.

Field Program Underway

A field program consisting of geological mapping, geochemical sampling, linecutting and surface geophysical induced polarization ("IP") and magnetometer surveys is underway. The linecutting and geophysical surveys will target the northwestern part of the property where very little previous exploration has occurred. Historic exploration indicates the presence of anomalous gold in till in the area as well as in bedrock from previous overburden drilling campaigns. Two of the reverse circulation drill holes had till concentrate samples which returned values of 11.27 g/t gold and 5.79 g/t gold, both of which are considered by Temex to have high potential to represent a proximal undiscovered bedrock source. The latter sample occurs approximately 100 metres along strike to the east of an historic drill hole which intersected 2.74 metres grading 9.69 g/t gold. Seven of the overburden holes also encountered auriferous bedrock gold mineralization with results up to 1.93 g/t gold.

The Property is strategically located along strike 2.5 km to the west of the Pamour mine (total historic production from underground and open pit of 52.2 million tons at 0.09 ounces gold per ton for 4.7 million ounces of gold) where the PJV are currently conducting an open pit gold mining operation. The Whitney Property includes the former Broulan Reef and Hallnor gold mines, the latter of which produced 4.23 million tons at a grade of 0.40 ounces gold per ton (1.69 million ounces gold) and was one of the two highest grade producers in the Timmins camp. Temex has the right to explore the former Hallnor Mine below the 1000 feet elevation (news release March 31, 2005). The Timmins camp is one of the largest gold camps in the world with total historical production in excess of 60 million ounces of gold.

Temex is a well-funded Canadian exploration company focused on advancing its precious metal, diamond, nickel and uranium projects in Manitoba and Ontario.

On behalf of the Board of Directors,

"Ian Campbell"

Ian Campbell

President and CEO

(x)The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of

TORONTO, Oct. 24 /CNW/ - Temex Resources Corp. (TSX Venture Exchange:TME, Frankfurt:TQ1) ("Temex" or "the Company") is pleased to announce drill results from a recently completed 2,345 metre, 15 hole diamond drill program on the Whitney Township and Pam Properties. The program followed up on three areas drilled by Temex in 2005-2006 (Hugh Pam Conglomerate Zone, the Reef Offset Zone, and the Reef Pit Zone) as well as tested three new target areas (Pam Property, the West Banner Zone and the South Banner Zone). Temex has the option to earn a 60% interest in the Whitney Township Property from the Porcupine Joint Venture ("PJV", a joint venture between Goldcorp Inc. and Kinross Gold Corporation).

ADVERTISEMENT

Six holes tested the Hugh Pam Conglomerate Zone where previous drilling outlined two gold mineralized horizons, including results of 17.17 g/t gold over 12.00 metres. All six holes intersected gold mineralization with the best intersection being from hole TW-07-45, which included an assay interval of 2.47 g/t gold over a core length of 14.10 m, including 5.18 g/t gold over 4.70 metres. The main gold bearing zone called the Hugh Pam Conglomerate Zone occurs above the Timiskaming unconformity. The second mineralized horizon, the Mulholland Shear Zone, occurs in the footwall Tisdale group volcanic rocks below the unconformity; this horizon has loosely been termed the Mulholland Shear horizon.

Three holes were designed to test for the down dip and western extension of gold mineralization previously intersected by the Company at the Reef Pit zone. One drill hole was drilled to intersect the down-dip extension and this hole intersected 4.09 g/t gold over 4.15 metres, including 10.29 g/t gold over 1.35 metres. Two holes drilled to intersect the western strike extension of the Reef Pit Zone returned no significant gold however the holes did intersect alteration typically associated with gold mineralization along the Broulan Reef Mine Trend.

Two drill holes were completed to further test a gold zone, called the Reef Offset Zone, discovered by Temex in 2006 (TW06-30) and interpreted to be an extension of the Broulan Reef Shear Zone. Drill hole TW07-47 was drilled above TW06-30 to intersect the up-dip extension of the Reef Offset Zone. No significant assays were reported in either drill hole. Two drill holes completed on the newly acquired Pam Property targeted a gold zone in the north-central part of the property along strike from a previously reported zone of gold mineralization in quartz-carbonate stringers within carbonate altered volcanics intercepted in 1964 by Hollander Mines. No significant assays were returned from these holes.

Field Program Underway

A field program consisting of geological mapping, geochemical sampling, linecutting and surface geophysical induced polarization ("IP") and magnetometer surveys is underway. The linecutting and geophysical surveys will target the northwestern part of the property where very little previous exploration has occurred. Historic exploration indicates the presence of anomalous gold in till in the area as well as in bedrock from previous overburden drilling campaigns. Two of the reverse circulation drill holes had till concentrate samples which returned values of 11.27 g/t gold and 5.79 g/t gold, both of which are considered by Temex to have high potential to represent a proximal undiscovered bedrock source. The latter sample occurs approximately 100 metres along strike to the east of an historic drill hole which intersected 2.74 metres grading 9.69 g/t gold. Seven of the overburden holes also encountered auriferous bedrock gold mineralization with results up to 1.93 g/t gold.

The Property is strategically located along strike 2.5 km to the west of the Pamour mine (total historic production from underground and open pit of 52.2 million tons at 0.09 ounces gold per ton for 4.7 million ounces of gold) where the PJV are currently conducting an open pit gold mining operation. The Whitney Property includes the former Broulan Reef and Hallnor gold mines, the latter of which produced 4.23 million tons at a grade of 0.40 ounces gold per ton (1.69 million ounces gold) and was one of the two highest grade producers in the Timmins camp. Temex has the right to explore the former Hallnor Mine below the 1000 feet elevation (news release March 31, 2005). The Timmins camp is one of the largest gold camps in the world with total historical production in excess of 60 million ounces of gold.

Temex is a well-funded Canadian exploration company focused on advancing its precious metal, diamond, nickel and uranium projects in Manitoba and Ontario.

On behalf of the Board of Directors,

"Ian Campbell"

Ian Campbell

President and CEO

(x)The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of

Exclusive AGORACOM Interview with John Kaiser – Renowned Junior Resource Analyst

Posted by: AGORACOM on October 23, 2007 02:53PM

http://agoracom.com/ir/Noront/messages/604387#message

Um das Interview zu hören , auf den Link klicken und dann ...!

Oct 25, 2007 09:20 ET

UC Resources Grants Stock Options

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 25, 2007) - UC Resources "the company" (TSX VENTURE:UC) announces today that the board of directors has granted 450,000 stock options at .45 per share with a five year term.

These options are available to directors, officers, consultants, and employees of the company.

On behalf of the board of directors,

Brian Gusko, CFO

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, Investors should review the Company's registered filings which are available at www.sedar.com.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

UC Resources Grants Stock Options

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 25, 2007) - UC Resources "the company" (TSX VENTURE:UC) announces today that the board of directors has granted 450,000 stock options at .45 per share with a five year term.

These options are available to directors, officers, consultants, and employees of the company.

On behalf of the board of directors,

Brian Gusko, CFO

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, Investors should review the Company's registered filings which are available at www.sedar.com.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Temex Announces Non-Brokered Private Placement Financing

Thursday October 25, 5:28 pm ET

TSX Venture Exchange: TME, Frankfurt Exchange: TQ1 NR-07-19

TORONTO, Oct. 25 /CNW/ - Temex Resources Corp. (TSX Venture Exchange: TME, Frankfurt:TQ1) ("Temex" or "the Company") announces a non-brokered private placement of units (the "Offering"), pursuant to which the company may sell up to 7,142,857 units at a price of $0.70 per unit, raising aggregate gross proceeds of approximately $5,000,000. Each Unit will be comprised of one common share in the capital of the Corporation (a "Common Share") and one-half of one Common Share purchase warrant, each whole warrant entitling the holder thereof to purchase a Common Share at a price of $1.00 for a period of 24 months.

ADVERTISEMENT

Thursday October 25, 5:28 pm ET

TSX Venture Exchange: TME, Frankfurt Exchange: TQ1 NR-07-19

TORONTO, Oct. 25 /CNW/ - Temex Resources Corp. (TSX Venture Exchange: TME, Frankfurt:TQ1) ("Temex" or "the Company") announces a non-brokered private placement of units (the "Offering"), pursuant to which the company may sell up to 7,142,857 units at a price of $0.70 per unit, raising aggregate gross proceeds of approximately $5,000,000. Each Unit will be comprised of one common share in the capital of the Corporation (a "Common Share") and one-half of one Common Share purchase warrant, each whole warrant entitling the holder thereof to purchase a Common Share at a price of $1.00 for a period of 24 months.

ADVERTISEMENT

Oct 25, 2007 19:51 ET

Probe Mines Announces Increase in Size of Non-Brokered Private Placement to Explore McFauld's Lake Project

TORONTO, ONTARIO--(Marketwire - Oct. 25, 2007) - The Directors of PROBE MINES LIMITED (TSX VENTURE:PRB) ("Probe") are pleased to announce an increase in the size of a proposed non-brokered private placement financing announced on October 22, 2007 (Press Release - 6/2007) from $3,000,000 to up to $3,500,000. All other terms of the proposed financing remain the same as earlier announced. The financing of up to $3,500,000 would comprise the sale of up to 4,666,667 Units, to be sold at $0.75 per Unit, subject to regulatory approval and closing. Each Unit consists of one common share and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one common share for $1.00 for a period of 24 months (the "Warrant Term") from the closing of the transaction (the "Closing Date"), provided, however, that should the closing price at which the common shares trade, equal or exceed $1.75 for 20 consecutive trading days following the date that is four months and one day after the Closing Date, Probe may accelerate the Warrant Term to the date which is 30 days following the date a press release is issued by Probe announcing the reduced Warrant Term. All securities issued in conjunction with the offering will be subject to a hold period, which expires four months after closing.

Proceeds of the financing will be used to fund exploration on the Company's McFauld's Lake properties, including the 100%-owned McFauld's Lake West Project, located approximately 450m from Noront Resources recent high-grade nickel-copper-PGE discovery; and the 100%-owned Victory Project which hosts numerous untested drill targets in a volcanic belt attached to the McFauld's Lake Belt. Exploration on the McFauld's Lake properties will include a winter program of magnetic and electromagnetic geophysical surveys followed by diamond drilling. The programs are expected to commence shortly, and will be focused on bringing the properties to a drill-ready state as soon as possible. Drilling will focus on the McFauld's West property, where regional government magnetic data shows the presence of two anomalies within the claims that are similar in size and shape to that associated with Noront's discovery.

The McFauld's area is once again receiving considerable attention with the recent discovery of high-grade nickel-copper-PGE mineralization by Noront Resources. Results from hole NOT07-05 returned a 63.8m intersection of massive and net-textured sulphides in olivine-bearing peridotite grading 5.9% nickel, 3.1% copper, 2.9 g/t Pt and 9.8 g/t Pd; including a 3m interval grading 8.7% nickel, 10.9% copper, 41 g/t Pt and 14 g/t Pd. Recent field observations indicate the boundary of Probe's McFauld's West property is only 450m from the discovery zone. The management of Probe is encouraged by the proximity to this significant discovery, and believes there is a strong potential for this property to also host mineralization.

About Probe Mines:

Probe Mines Limited is a Canadian base and precious metal exploration company with a portfolio of highly prospective mineral properties. The Company is currently focused on the McFauld's Lake area where it owns 931 claims covering almost 15,000 hectares. This includes a 100% interest in 12 claims (192 hectares) situated less than 450 metres from the site of Noront's significant new nickel-copper discovery and represents one of the closest properties to the discovery. Probe currently has joint venture agreements on its Bristol Township gold project (West Timmins Mining Inc.) and Tamarack base metal project (Mantis Minerals Corp.). The Bristol Project is adjacent to the million-plus ounce gold deposit owned by Lake Shore Gold Corp., which has recently announced a positive pre-feasibility study for the project. Probe also maintains a 5% net smelter royalty on a portion of Agnico Eagle's Goldex Mine near Val d'Or, Quebec, slated for production in 2008. The company's shares trade on the TSX Venture Exchange under the symbol PRB.

Investors are invited to visit the Probe Mines IR Hub at http://www.agoracom.com/IR/Probemines where they can post questions and receive answers or review questions and answers already posted by other investors. Alternatively, investors are able to e-mail all questions and correspondence to PRB@agoracom.com where they can also request to be added to the investor e-mail list to receive all future press releases and updates in real time.

David Palmer, Ph.D., P.Geo., is the qualified person for all technical information in this release.

Forward-Looking Statements

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This News Release includes certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding potential mineralization and reserves, exploration results, and future plans and objectives of Probe, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially form those anticipated in such statements. Important factors that could cause actual results to differ materially from Probe's expectations are exploration risks detailed herein and from time to time in the filings made by Probe with securities regulators.

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Probe Mines Announces Increase in Size of Non-Brokered Private Placement to Explore McFauld's Lake Project

TORONTO, ONTARIO--(Marketwire - Oct. 25, 2007) - The Directors of PROBE MINES LIMITED (TSX VENTURE:PRB) ("Probe") are pleased to announce an increase in the size of a proposed non-brokered private placement financing announced on October 22, 2007 (Press Release - 6/2007) from $3,000,000 to up to $3,500,000. All other terms of the proposed financing remain the same as earlier announced. The financing of up to $3,500,000 would comprise the sale of up to 4,666,667 Units, to be sold at $0.75 per Unit, subject to regulatory approval and closing. Each Unit consists of one common share and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one common share for $1.00 for a period of 24 months (the "Warrant Term") from the closing of the transaction (the "Closing Date"), provided, however, that should the closing price at which the common shares trade, equal or exceed $1.75 for 20 consecutive trading days following the date that is four months and one day after the Closing Date, Probe may accelerate the Warrant Term to the date which is 30 days following the date a press release is issued by Probe announcing the reduced Warrant Term. All securities issued in conjunction with the offering will be subject to a hold period, which expires four months after closing.

Proceeds of the financing will be used to fund exploration on the Company's McFauld's Lake properties, including the 100%-owned McFauld's Lake West Project, located approximately 450m from Noront Resources recent high-grade nickel-copper-PGE discovery; and the 100%-owned Victory Project which hosts numerous untested drill targets in a volcanic belt attached to the McFauld's Lake Belt. Exploration on the McFauld's Lake properties will include a winter program of magnetic and electromagnetic geophysical surveys followed by diamond drilling. The programs are expected to commence shortly, and will be focused on bringing the properties to a drill-ready state as soon as possible. Drilling will focus on the McFauld's West property, where regional government magnetic data shows the presence of two anomalies within the claims that are similar in size and shape to that associated with Noront's discovery.

The McFauld's area is once again receiving considerable attention with the recent discovery of high-grade nickel-copper-PGE mineralization by Noront Resources. Results from hole NOT07-05 returned a 63.8m intersection of massive and net-textured sulphides in olivine-bearing peridotite grading 5.9% nickel, 3.1% copper, 2.9 g/t Pt and 9.8 g/t Pd; including a 3m interval grading 8.7% nickel, 10.9% copper, 41 g/t Pt and 14 g/t Pd. Recent field observations indicate the boundary of Probe's McFauld's West property is only 450m from the discovery zone. The management of Probe is encouraged by the proximity to this significant discovery, and believes there is a strong potential for this property to also host mineralization.

About Probe Mines:

Probe Mines Limited is a Canadian base and precious metal exploration company with a portfolio of highly prospective mineral properties. The Company is currently focused on the McFauld's Lake area where it owns 931 claims covering almost 15,000 hectares. This includes a 100% interest in 12 claims (192 hectares) situated less than 450 metres from the site of Noront's significant new nickel-copper discovery and represents one of the closest properties to the discovery. Probe currently has joint venture agreements on its Bristol Township gold project (West Timmins Mining Inc.) and Tamarack base metal project (Mantis Minerals Corp.). The Bristol Project is adjacent to the million-plus ounce gold deposit owned by Lake Shore Gold Corp., which has recently announced a positive pre-feasibility study for the project. Probe also maintains a 5% net smelter royalty on a portion of Agnico Eagle's Goldex Mine near Val d'Or, Quebec, slated for production in 2008. The company's shares trade on the TSX Venture Exchange under the symbol PRB.

Investors are invited to visit the Probe Mines IR Hub at http://www.agoracom.com/IR/Probemines where they can post questions and receive answers or review questions and answers already posted by other investors. Alternatively, investors are able to e-mail all questions and correspondence to PRB@agoracom.com where they can also request to be added to the investor e-mail list to receive all future press releases and updates in real time.