DISNEY (DIS, 855686) - der größte Medien- und Unterhaltungskonzern - 500 Beiträge pro Seite

eröffnet am 28.11.07 11:09:46 von

neuester Beitrag 01.01.10 20:20:33 von

neuester Beitrag 01.01.10 20:20:33 von

Beiträge: 61

ID: 1.135.746

ID: 1.135.746

Aufrufe heute: 0

Gesamt: 21.107

Gesamt: 21.107

Aktive User: 0

ISIN: US2546871060 · WKN: 855686 · Symbol: DIS

112,94

USD

-0,83 %

-0,94 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

| Walt Disney Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

17.04.24 · BNP Paribas Anzeige |

12.04.24 · wO Newsflash |

11.04.24 · BNP Paribas Anzeige |

Werte aus der Branche Unterhaltung

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3198 | +21,08 | |

| 0,7400 | +11,28 | |

| 2,9800 | +9,56 | |

| 8,7200 | +7,65 | |

| 1,8000 | +6,51 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8460 | -8,44 | |

| 7,8500 | -8,72 | |

| 0,6980 | -10,28 | |

| 1,3000 | -12,75 | |

| 0,6800 | -15,00 |

Hallo,

ich beobachte DIS schon ne weile, aktuell gehts nur abwärts, da wohl die Investoren vermehrt von einer Rezession in den USA ausgehen, was auf die Spendierlaune der Amis negativen Einfluss haben könnte.

Wenn man von einer Konjunkturdelle ausgeht, dürfte DIS bei einer beruhigung der aktuellen lage auch Kursmässig am Boden angekommen sein...

eachstum immer so um 10-12%, allein die Divi von 1% stört mich ein bisserl...

Ist jemand von Euchj investiert?

Hier noch eine schöne aktuelle zusammenfassung der DIS-Situation aus der FTD.

Gruss space

Dossier Disney - Bezaubernd und verwünscht zugleich

von Jens Korte

In den USA ist gerade der neue Disney-Film \"Enchanted\" (\"Verwünscht\") angelaufen. Er handelt von einer Trickfilmprinzessin, die sich plötzlich im realen New York der Gegenwart wiederfindet. Klingt hübsch - im wirklichen Leben verzaubert die Disney-Aktie die Anleger derzeit jedoch kaum.

ANZEIGE

Ob Prinzessin Giselle auch den Weg an die Wall Street findet? Prinzessinnen stehen zumindest hoch im Kurs. Der Markt rund um den Mädchentraum ist auf rund 4 Mrd. $ angeschwollen. Das Cinderella-Schloss wird täglich von Horden Drei- bis Sechsjähriger in Ballkleidern bestürmt. Die Kleinen lassen sich die Nägel lackieren, ein Make-up verpassen oder die Haare möglichst majestätisch richten. Um das Marktpotenzial zu erweitern, zielt Disney mit Prinzessinnen-Krippen oder Windelunterlagen jetzt auch auf Neugeborene ab.

Die Investoren an der Wall Street waren von der Disney-Aktie im bisherigen Jahresverlauf jedoch weniger verzaubert. Nachdem der Kurs im April mit rund 36 $ den höchsten Stand seit Dezember 2000 erreicht hatte, ging es mit der Aktie in den vergangenen Monaten abwärts. Dabei fielen die jüngsten Geschäftszahlen durchaus vielversprechend aus. Trotz Anzeichen einer konjunkturellen Abschwächung in den USA meldeten die Vergnügungsparks ein Gewinnwachstum von neun Prozent im vierten Quartal. Die Mediensparte schaffte sogar ein Wachstum von 25 Prozent und die Sparte Consumer Products einen Anstieg um zehn Prozent. Lediglich die Filmstudios konnten an die Erfolge wie \"Fluch der Karibik\" aus dem Vorjahr nicht anknüpfen und meldeten einen Einbruch um 21 Prozent.

Der schwache Dollar, der gegenüber dem Euro erst in dieser Woche auf ein neues Rekordtief gefallen ist, kam Walt Disney nicht ungelegen. \"Zum einen ist die USA-Reise etwa für Europäer und Japaner günstiger geworden. Zum anderen ist die Europareise für Amerikaner teurer geworden\", sagt David Bank, Medienanalyst von RBC Capital Markets. Weshalb der Familienurlaub häufig auf Disneyland oder Disney World beschränkt wird. Allerdings kühlt die US-Konjunktur ab. \"Bisher zeigt sich das bei den Besucherzahlen noch nicht. Doch viele Investoren fürchten, dass sich das ändern könnte. Diese Sorge hat die Aktie zuletzt belastet\", sagt Bank.

Ähnlich wird die Situation für die Medien- und TV-Sparte eingeschätzt. Im abgelaufenen Quartal verbuchte vor allem der Sportsender ESPN Zuwächse. Ebenfalls zu Disney gehört der Kabelsender ABC. Bei geringerem Wirtschaftswachstum oder eventuell sogar einer Rezession in den USA dürften die Werbeeinnahmen deutlich sinken. \"Disney ist ein Makro-Call\", sagt David Joyce, Analyst von Miller Tabak. \"So wie die US-Konjunktur läuft auch die Disney-Aktie.\" Im abgelaufenen Geschäftsjahr wurde der Gewinn konzernweit von knapp 3,4 auf über 4,5 Mrd. $ gesteigert. Laut Citigroup-Analyst Jason Bazinet wird der Gewinn 2008 auf unter 4,3 Mrd. $ abkühlen.

Als wachstumsreichster Geschäftszweig gilt der Consumer- Products-Bereich mit dem Lizenzgeschäft. Walt Disney sei die Premiummarke schlechthin im Unterhaltungssektor, sagt Analyst Bank. Um die Marken besser zu nutzen, entwickelt Disney verstärkt eigene Videospiele rund um die Kinofilme. \"Das Risiko ist zwar etwas größer, als wenn man die Entwicklung Dritten überlässt. Aber dafür ist auch der potenzielle Gewinn deutlich höher\", sagte Bank. Laut einer jüngsten Bloomberg-Erhebung empfehlen 18 von 30 Analysten die Aktie zum Kauf. Zwölf Analysten bewerten die Aktie mit halten. Doch so wie Joyce und Bank schätzen für den Moment die meisten Experten die derzeitige Situation ein: Sollte die US-Konjunktur weiter abkühlen, gilt Disney nicht als das Investment der Stunde. Doch bei einer Wiederbelebung der US-Wirtschaft könnte es einer der Profiteure sein.

ich beobachte DIS schon ne weile, aktuell gehts nur abwärts, da wohl die Investoren vermehrt von einer Rezession in den USA ausgehen, was auf die Spendierlaune der Amis negativen Einfluss haben könnte.

Wenn man von einer Konjunkturdelle ausgeht, dürfte DIS bei einer beruhigung der aktuellen lage auch Kursmässig am Boden angekommen sein...

eachstum immer so um 10-12%, allein die Divi von 1% stört mich ein bisserl...

Ist jemand von Euchj investiert?

Hier noch eine schöne aktuelle zusammenfassung der DIS-Situation aus der FTD.

Gruss space

Dossier Disney - Bezaubernd und verwünscht zugleich

von Jens Korte

In den USA ist gerade der neue Disney-Film \"Enchanted\" (\"Verwünscht\") angelaufen. Er handelt von einer Trickfilmprinzessin, die sich plötzlich im realen New York der Gegenwart wiederfindet. Klingt hübsch - im wirklichen Leben verzaubert die Disney-Aktie die Anleger derzeit jedoch kaum.

ANZEIGE

Ob Prinzessin Giselle auch den Weg an die Wall Street findet? Prinzessinnen stehen zumindest hoch im Kurs. Der Markt rund um den Mädchentraum ist auf rund 4 Mrd. $ angeschwollen. Das Cinderella-Schloss wird täglich von Horden Drei- bis Sechsjähriger in Ballkleidern bestürmt. Die Kleinen lassen sich die Nägel lackieren, ein Make-up verpassen oder die Haare möglichst majestätisch richten. Um das Marktpotenzial zu erweitern, zielt Disney mit Prinzessinnen-Krippen oder Windelunterlagen jetzt auch auf Neugeborene ab.

Die Investoren an der Wall Street waren von der Disney-Aktie im bisherigen Jahresverlauf jedoch weniger verzaubert. Nachdem der Kurs im April mit rund 36 $ den höchsten Stand seit Dezember 2000 erreicht hatte, ging es mit der Aktie in den vergangenen Monaten abwärts. Dabei fielen die jüngsten Geschäftszahlen durchaus vielversprechend aus. Trotz Anzeichen einer konjunkturellen Abschwächung in den USA meldeten die Vergnügungsparks ein Gewinnwachstum von neun Prozent im vierten Quartal. Die Mediensparte schaffte sogar ein Wachstum von 25 Prozent und die Sparte Consumer Products einen Anstieg um zehn Prozent. Lediglich die Filmstudios konnten an die Erfolge wie \"Fluch der Karibik\" aus dem Vorjahr nicht anknüpfen und meldeten einen Einbruch um 21 Prozent.

Der schwache Dollar, der gegenüber dem Euro erst in dieser Woche auf ein neues Rekordtief gefallen ist, kam Walt Disney nicht ungelegen. \"Zum einen ist die USA-Reise etwa für Europäer und Japaner günstiger geworden. Zum anderen ist die Europareise für Amerikaner teurer geworden\", sagt David Bank, Medienanalyst von RBC Capital Markets. Weshalb der Familienurlaub häufig auf Disneyland oder Disney World beschränkt wird. Allerdings kühlt die US-Konjunktur ab. \"Bisher zeigt sich das bei den Besucherzahlen noch nicht. Doch viele Investoren fürchten, dass sich das ändern könnte. Diese Sorge hat die Aktie zuletzt belastet\", sagt Bank.

Ähnlich wird die Situation für die Medien- und TV-Sparte eingeschätzt. Im abgelaufenen Quartal verbuchte vor allem der Sportsender ESPN Zuwächse. Ebenfalls zu Disney gehört der Kabelsender ABC. Bei geringerem Wirtschaftswachstum oder eventuell sogar einer Rezession in den USA dürften die Werbeeinnahmen deutlich sinken. \"Disney ist ein Makro-Call\", sagt David Joyce, Analyst von Miller Tabak. \"So wie die US-Konjunktur läuft auch die Disney-Aktie.\" Im abgelaufenen Geschäftsjahr wurde der Gewinn konzernweit von knapp 3,4 auf über 4,5 Mrd. $ gesteigert. Laut Citigroup-Analyst Jason Bazinet wird der Gewinn 2008 auf unter 4,3 Mrd. $ abkühlen.

Als wachstumsreichster Geschäftszweig gilt der Consumer- Products-Bereich mit dem Lizenzgeschäft. Walt Disney sei die Premiummarke schlechthin im Unterhaltungssektor, sagt Analyst Bank. Um die Marken besser zu nutzen, entwickelt Disney verstärkt eigene Videospiele rund um die Kinofilme. \"Das Risiko ist zwar etwas größer, als wenn man die Entwicklung Dritten überlässt. Aber dafür ist auch der potenzielle Gewinn deutlich höher\", sagte Bank. Laut einer jüngsten Bloomberg-Erhebung empfehlen 18 von 30 Analysten die Aktie zum Kauf. Zwölf Analysten bewerten die Aktie mit halten. Doch so wie Joyce und Bank schätzen für den Moment die meisten Experten die derzeitige Situation ein: Sollte die US-Konjunktur weiter abkühlen, gilt Disney nicht als das Investment der Stunde. Doch bei einer Wiederbelebung der US-Wirtschaft könnte es einer der Profiteure sein.

Bin gestern zur Börseneröffnung in NYC eingestiegen. war vieleciht gar nicht schlecht der zeitpunkt...

Dividende wird gesteigert, zudem unten noch einen aktuelle Chartbericht.

Gruss space

Walt Disney Boosts Annual Dividend To 35c From 31c

By Monica M. Clark

Last Update: 4:16 PM ET Nov 28, 2007

DIS boosted its annual dividend 12.9% to 35 cents from 31 cents. The Burbank, Calif., family-entertainment and media enterprise said the dividend is payable on Jan. 11 to shareholders of record Dec. 7. Walt Disney shares closed up 3%, or 97 cents, at $32.69. End of Story

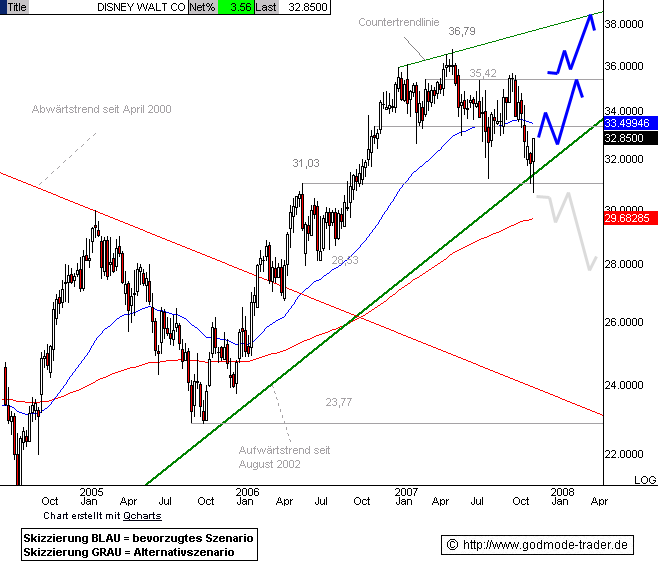

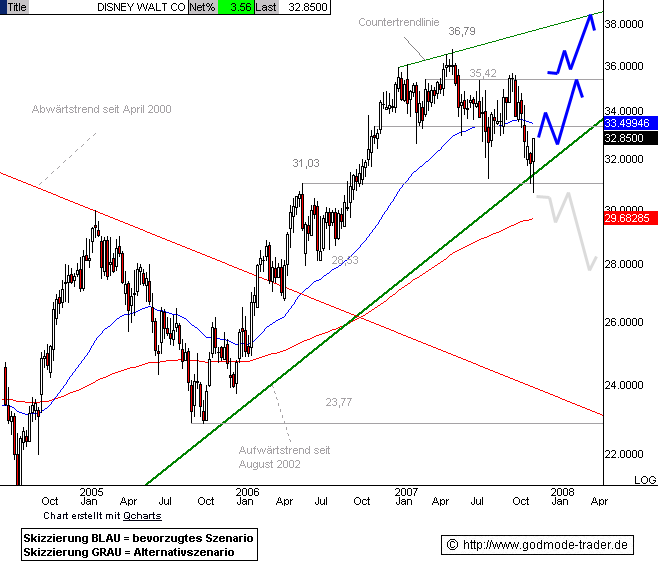

WALT DISNEY - Nachfrageseite meldet sich!

The Walt Disney Company (Nachrichten/Aktienkurs) - Kürzel: DIS - ISIN: US2546871060

Börse: NYSE in USD / Kursstand: 32,85 $

Kursverlauf vom 05.09.2004 bis 28.11.2007 (log. Kerzenchartdarstellung / 1 Kerze = 1 Woche)

Rückblick: Die WALT DISNEY Aktie befindet sich in einer mittelfristigen Kursrallye. Anfang Mai brach sie auf ein neues Mehrjahreshoch aus und etablierte eine Countertrendlinie als obere Begrenzung. In der ersten Jahreshälfte 2007 prallte sie nach einem neuen Hoch bei 36,79 $ an dieser Linie nach unten hin ab und vollzog eine dynamische Zwischenkorrektur. Diese Korrektur fiel noch in den 31,03er Bereich zurück. Diese Marke wurde gleich 2 Mal erfolgreich getestet. Ausgehend davon stieg die Nachfrageseite und die Aktie wieder an. In den letzten Handelstagen setzte die Aktie erneut in diesen Bereich zurück und bietet demzufolge eine Longchance mit verbesserten Chance/Risiko Verhältnis.

Charttechnischer Ausblick: Aufgrund der beschriebenen Stabilisierung besteht durchaus weiteres Erholungspotenzial bis an den Widerstand bei 36,79 $. Das negative Potenzial bis möglicherweise 31,03 $ steht weiterhin zur Debatte und muss als Restrisiko klassifiziert werden. Unter 31,03 $ sollte der Basiswert nicht mehr gehen, hier könnten dann auch antizyklische Longpositionen aufgelöst werden. Sobald die Aktie einen mittelfristigen Kursanstieg über 35,42 $ vollzieht, dürfte sofort unser langfristiges Kursziel bei 51,00 $ zum Tragen kommen. Kurzfristig wäre bereits ein Kursanstieg über 35,42 $ als zartes Kaufsignal zu interpretieren.

Dividende wird gesteigert, zudem unten noch einen aktuelle Chartbericht.

Gruss space

Walt Disney Boosts Annual Dividend To 35c From 31c

By Monica M. Clark

Last Update: 4:16 PM ET Nov 28, 2007

DIS boosted its annual dividend 12.9% to 35 cents from 31 cents. The Burbank, Calif., family-entertainment and media enterprise said the dividend is payable on Jan. 11 to shareholders of record Dec. 7. Walt Disney shares closed up 3%, or 97 cents, at $32.69. End of Story

WALT DISNEY - Nachfrageseite meldet sich!

The Walt Disney Company (Nachrichten/Aktienkurs) - Kürzel: DIS - ISIN: US2546871060

Börse: NYSE in USD / Kursstand: 32,85 $

Kursverlauf vom 05.09.2004 bis 28.11.2007 (log. Kerzenchartdarstellung / 1 Kerze = 1 Woche)

Rückblick: Die WALT DISNEY Aktie befindet sich in einer mittelfristigen Kursrallye. Anfang Mai brach sie auf ein neues Mehrjahreshoch aus und etablierte eine Countertrendlinie als obere Begrenzung. In der ersten Jahreshälfte 2007 prallte sie nach einem neuen Hoch bei 36,79 $ an dieser Linie nach unten hin ab und vollzog eine dynamische Zwischenkorrektur. Diese Korrektur fiel noch in den 31,03er Bereich zurück. Diese Marke wurde gleich 2 Mal erfolgreich getestet. Ausgehend davon stieg die Nachfrageseite und die Aktie wieder an. In den letzten Handelstagen setzte die Aktie erneut in diesen Bereich zurück und bietet demzufolge eine Longchance mit verbesserten Chance/Risiko Verhältnis.

Charttechnischer Ausblick: Aufgrund der beschriebenen Stabilisierung besteht durchaus weiteres Erholungspotenzial bis an den Widerstand bei 36,79 $. Das negative Potenzial bis möglicherweise 31,03 $ steht weiterhin zur Debatte und muss als Restrisiko klassifiziert werden. Unter 31,03 $ sollte der Basiswert nicht mehr gehen, hier könnten dann auch antizyklische Longpositionen aufgelöst werden. Sobald die Aktie einen mittelfristigen Kursanstieg über 35,42 $ vollzieht, dürfte sofort unser langfristiges Kursziel bei 51,00 $ zum Tragen kommen. Kurzfristig wäre bereits ein Kursanstieg über 35,42 $ als zartes Kaufsignal zu interpretieren.

Disney Shares The Wealth

Walt Disney, coming off a better-than-expected quarter, will use some of its growing profits to boost its payments to shareholders. The company's stock, however, is still not the best-yielding play in the entertainment sector.

Walt Disney (nyse: DIS - news - people ) hiked its annual dividend by 12.9% to 35 cents per share. The dividend will be paid on January 11, 2008 to shareholders who held Disney stock on December 7th, 2007.

"I’m delighted to say that 2007 was another outstanding year for the company, marked by significant creative and financial achievements," said Disney Chief Executive Officer Robert A. Iger. "With our strong balance sheet, bolstered by record 2007 earnings, Disney is in a good position to continue returning capital to shareholders even as we invest for growth."

Despite the dividend increase, shares of Walt Disney fell 11 cents, or 0.3%, to $32.58, on Thursday, as investors may have anticipated the dividend bump.

"The 12.9 percent increase in its cash dividend is a positive for Disney shareholders and in keeping with the pattern of increasing the company's cash payout by $0.04 annually the last few years," said BMO Capital Markets analyst Jeffrey Logsdon.

Based on Thursday's share price, Disney's stock now yields 1.1%. According to Revere Data, that puts Disney in the middle of the pack for dividends among entertainment companies.

CBS (nyse: CBS - news - people )'s stock yields 3.7% annually. The EMI Group (other-otc: EMIPY - news - people )'s stock yields 3.2% annually. Viacom (nyse: VIA - news - people )'s stock yields 0.7% annually.

Disney, headquartered in Burbank, Calif., is a diversified entertainment company. It operates TV networks, theme parks, and movie studios.

The company is benefiting from strong performances at its television networks. During the fourth-quarter, sales at the networks jumped 14.3% to $4.0 billion. Its networks include ABC and ESPN. (See: "Disney Does Well, But Can The Magic Last?")

The division helped the company post better-than-expected profits. It announced earlier this month a fourth-quarter profit on the continuing operations basis used by analysts of 42 cents per share. Analysts had expected 41 cents per share. (See: "Disney Does Well, But Can The Magic Last?")

Walt Disney, coming off a better-than-expected quarter, will use some of its growing profits to boost its payments to shareholders. The company's stock, however, is still not the best-yielding play in the entertainment sector.

Walt Disney (nyse: DIS - news - people ) hiked its annual dividend by 12.9% to 35 cents per share. The dividend will be paid on January 11, 2008 to shareholders who held Disney stock on December 7th, 2007.

"I’m delighted to say that 2007 was another outstanding year for the company, marked by significant creative and financial achievements," said Disney Chief Executive Officer Robert A. Iger. "With our strong balance sheet, bolstered by record 2007 earnings, Disney is in a good position to continue returning capital to shareholders even as we invest for growth."

Despite the dividend increase, shares of Walt Disney fell 11 cents, or 0.3%, to $32.58, on Thursday, as investors may have anticipated the dividend bump.

"The 12.9 percent increase in its cash dividend is a positive for Disney shareholders and in keeping with the pattern of increasing the company's cash payout by $0.04 annually the last few years," said BMO Capital Markets analyst Jeffrey Logsdon.

Based on Thursday's share price, Disney's stock now yields 1.1%. According to Revere Data, that puts Disney in the middle of the pack for dividends among entertainment companies.

CBS (nyse: CBS - news - people )'s stock yields 3.7% annually. The EMI Group (other-otc: EMIPY - news - people )'s stock yields 3.2% annually. Viacom (nyse: VIA - news - people )'s stock yields 0.7% annually.

Disney, headquartered in Burbank, Calif., is a diversified entertainment company. It operates TV networks, theme parks, and movie studios.

The company is benefiting from strong performances at its television networks. During the fourth-quarter, sales at the networks jumped 14.3% to $4.0 billion. Its networks include ABC and ESPN. (See: "Disney Does Well, But Can The Magic Last?")

The division helped the company post better-than-expected profits. It announced earlier this month a fourth-quarter profit on the continuing operations basis used by analysts of 42 cents per share. Analysts had expected 41 cents per share. (See: "Disney Does Well, But Can The Magic Last?")

Disney reportedly to lift stake in India's UTV Software, take management control

By New Delhi

Last update: 5:57 a.m. EST Nov. 30, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

NEW DELHI (MarketWatch) -- U.S. based Walt Disney Co. plans to acquire an additional 11%-15% stake in India's UTV Software Communications Ltd. for INR1,250 a share and gain management control of the company, the Hindustan Times reported Friday, citing unnamed industry sources.

Walt Disney, which acquired a 14.85% stake in UTV at INR200 a share in August 2006, is likely to buy the fresh shares through a private placement, the report said.

UTV Chairman Ronnie Screwvala and his associates currently own 30.67% of the company, and this stake will likely fall to 26% after the sale of fresh shares to Walt Disney, the report said.

The deal is expected to close in December, the report added.

By New Delhi

Last update: 5:57 a.m. EST Nov. 30, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

NEW DELHI (MarketWatch) -- U.S. based Walt Disney Co. plans to acquire an additional 11%-15% stake in India's UTV Software Communications Ltd. for INR1,250 a share and gain management control of the company, the Hindustan Times reported Friday, citing unnamed industry sources.

Walt Disney, which acquired a 14.85% stake in UTV at INR200 a share in August 2006, is likely to buy the fresh shares through a private placement, the report said.

UTV Chairman Ronnie Screwvala and his associates currently own 30.67% of the company, and this stake will likely fall to 26% after the sale of fresh shares to Walt Disney, the report said.

The deal is expected to close in December, the report added.

D-BOX TECHNOLOGIES INC.

D-BOX TECHNOLOGIES INC.

Attention Business Editors

D-BOX Closes Deal With Walt Disney Studios Home Entertainment

Beginning with "The Game Plan," Walt Disney Studios Home Entertainment

will include D-BOX MOTION CODE(TM) on select High Definition Blu-ray

Disc(R) titles

LONGUEUIL, QC, Dec. 3 /CNW/ - D-BOX Technologies Inc. (TSX-V: DBO.A)

announced today that it has closed a licensing agreement with Walt Disney

Studios Home Entertainment (WDSHE) to feature D-BOX MOTION CODETM on select

Blu-ray Disc releases. D-BOX MOTION CODE(TM) will initially be featured on

WDSHE's "The Game Plan," which will be available in high-def only on Disney

Blu-ray Disc on January 22, 2008.

The addition of the D-BOX MOTION CODE(TM) to the high quality picture and

sound of the Blu-ray format will transport movie-viewers in the comfort of

their homes to a new dimension and let them be part of the movie. Of course,

only those homes equipped with D-BOX motion generation systems will enjoy the

full benefit of the Blu-ray Disc-embedded with D-BOX MOTION CODE(TM).

"This is a very special time for D-BOX, as our technology will be used by

another one of the largest movie studios worldwide," stated Claude Mc Master,

President and Chief Executive Officer of D-BOX Technologies. "As a Contributor

member of the Blu-ray Disc Association, we also want to show our strong

support for the high definition Blu-ray format. We are very proud of having

Walt Disney Studios Home Entertainment on board as it will undoubtedly

accelerate the penetration of our technology worldwide and will significantly

enhance our efforts to become a world standard in the entertainment industry."

"With the amazing picture and sound quality of our High Definition

Blu-ray titles, D-BOX MOTION CODETM Technology is the perfect addition to

further engage viewers in an immersive experience," added Gordon Ho, Executive

Vice President of Worldwide Marketing, Creative Content and Business

Development for Walt Disney Studios Home Entertainment.

About D-BOX

D-BOX Technologies designs and manufactures high-technology motion

systems destined mainly for the entertainment industry. Its unique, patented

technology uses motion codes specifically programmed for each film, TV program

or video game, resulting in motion that is perfectly synchronized with

on-screen action. By forming strong industry alliances, D-BOX's award-winning

motion technology is creating a global standard in the entertainment world.

For more information, please visit www.d-box.com.

D-BOX(TM) is a registered trademark and Motion Code is a trademark of

D-BOX Technologies Inc. Other names are for informational purposes only and

may be trademarks of their respective owners.

Forward-Looking Statements

Certain statements included herein, including those that express

management's expectations or estimates of our future performance, constitute

"forward-looking statements" within the meaning of applicable securities laws.

Forward-looking statements are necessarily based upon a number of estimates

and assumptions that, while considered reasonable by management at this time,

are inherently subject to significant business, economic and competitive

uncertainties and contingencies. We caution that such forward-looking

statements involve known and unknown risks, uncertainties and other risks that

may cause our actual financial results, performance, or achievements to be

materially different from our estimated future results, performance or

achievements expressed or implied by those forward-looking statements.

Numerous factors could cause actual results to differ materially from those in

the forward-looking statements, including without limitation, our ability to

achieve increased market acceptance for our product offerings and penetrate

new markets; the existence of undetected errors or similar problems in our

products; our ability to manage our growth; our ability to compete

successfully; potential liabilities; maintaining our intellectual property

rights and litigation involving intellectual property rights; our dependence

on the expertise of our key personnel; and our access to sufficient capital to

fund our future requirements. This list is not exhaustive of the factors that

may affect any of our forward-looking statements. Investors are cautioned not

to put undue reliance on forward-looking statements. All subsequent written

and oral forward-looking statements attributable to D-BOX or persons acting on

our behalf are expressly qualified in their entirety by this notice. We

disclaim any intent or obligation to update publicly these forward-looking

statements, whether as a result of new information, future events or

otherwise. Risks and uncertainties about our business are more fully discussed

in our Annual Report.

The TSX Venture Exchange does not accept responsibility for the adequacy

or accuracy of this release.

D-BOX TECHNOLOGIES INC.

Attention Business Editors

D-BOX Closes Deal With Walt Disney Studios Home Entertainment

Beginning with "The Game Plan," Walt Disney Studios Home Entertainment

will include D-BOX MOTION CODE(TM) on select High Definition Blu-ray

Disc(R) titles

LONGUEUIL, QC, Dec. 3 /CNW/ - D-BOX Technologies Inc. (TSX-V: DBO.A)

announced today that it has closed a licensing agreement with Walt Disney

Studios Home Entertainment (WDSHE) to feature D-BOX MOTION CODETM on select

Blu-ray Disc releases. D-BOX MOTION CODE(TM) will initially be featured on

WDSHE's "The Game Plan," which will be available in high-def only on Disney

Blu-ray Disc on January 22, 2008.

The addition of the D-BOX MOTION CODE(TM) to the high quality picture and

sound of the Blu-ray format will transport movie-viewers in the comfort of

their homes to a new dimension and let them be part of the movie. Of course,

only those homes equipped with D-BOX motion generation systems will enjoy the

full benefit of the Blu-ray Disc-embedded with D-BOX MOTION CODE(TM).

"This is a very special time for D-BOX, as our technology will be used by

another one of the largest movie studios worldwide," stated Claude Mc Master,

President and Chief Executive Officer of D-BOX Technologies. "As a Contributor

member of the Blu-ray Disc Association, we also want to show our strong

support for the high definition Blu-ray format. We are very proud of having

Walt Disney Studios Home Entertainment on board as it will undoubtedly

accelerate the penetration of our technology worldwide and will significantly

enhance our efforts to become a world standard in the entertainment industry."

"With the amazing picture and sound quality of our High Definition

Blu-ray titles, D-BOX MOTION CODETM Technology is the perfect addition to

further engage viewers in an immersive experience," added Gordon Ho, Executive

Vice President of Worldwide Marketing, Creative Content and Business

Development for Walt Disney Studios Home Entertainment.

About D-BOX

D-BOX Technologies designs and manufactures high-technology motion

systems destined mainly for the entertainment industry. Its unique, patented

technology uses motion codes specifically programmed for each film, TV program

or video game, resulting in motion that is perfectly synchronized with

on-screen action. By forming strong industry alliances, D-BOX's award-winning

motion technology is creating a global standard in the entertainment world.

For more information, please visit www.d-box.com.

D-BOX(TM) is a registered trademark and Motion Code is a trademark of

D-BOX Technologies Inc. Other names are for informational purposes only and

may be trademarks of their respective owners.

Forward-Looking Statements

Certain statements included herein, including those that express

management's expectations or estimates of our future performance, constitute

"forward-looking statements" within the meaning of applicable securities laws.

Forward-looking statements are necessarily based upon a number of estimates

and assumptions that, while considered reasonable by management at this time,

are inherently subject to significant business, economic and competitive

uncertainties and contingencies. We caution that such forward-looking

statements involve known and unknown risks, uncertainties and other risks that

may cause our actual financial results, performance, or achievements to be

materially different from our estimated future results, performance or

achievements expressed or implied by those forward-looking statements.

Numerous factors could cause actual results to differ materially from those in

the forward-looking statements, including without limitation, our ability to

achieve increased market acceptance for our product offerings and penetrate

new markets; the existence of undetected errors or similar problems in our

products; our ability to manage our growth; our ability to compete

successfully; potential liabilities; maintaining our intellectual property

rights and litigation involving intellectual property rights; our dependence

on the expertise of our key personnel; and our access to sufficient capital to

fund our future requirements. This list is not exhaustive of the factors that

may affect any of our forward-looking statements. Investors are cautioned not

to put undue reliance on forward-looking statements. All subsequent written

and oral forward-looking statements attributable to D-BOX or persons acting on

our behalf are expressly qualified in their entirety by this notice. We

disclaim any intent or obligation to update publicly these forward-looking

statements, whether as a result of new information, future events or

otherwise. Risks and uncertainties about our business are more fully discussed

in our Annual Report.

The TSX Venture Exchange does not accept responsibility for the adequacy

or accuracy of this release.

Shanghai determined to build own Disney

Kathy Wang and Benjamin Scent

Tuesday, December 04, 2007

A competitor to the already troubled Hong Kong Disneyland may emerge sooner than expected because Shanghai has expressed determination to build its own Disneyland theme park starting 2010, when it hosts the World Expo, according to mainland media reports.

The proposed location for the attraction has switched from suburban Chuansha town in Shanghai's Pudong district to Chongming Island, the China Business Journal reported, quoting an unidentified source.

Project investment has also increased to 40 billion yuan (HK$42.12 billion), from the previous plan of 30 billion yuan.

Negotiations for a Shanghai Chuansha Disneyland was stopped last year when the probe into the city's pension fund began, the China Business Journal said.

Walt Disney Corporation has resumed talks with the Shanghai government recently for a possible shift in location, according to the newspaper report.

Chuansha's main advantage is its location. Only 10 minutes away from Shanghai Pudong International Airport, the easy access would allow airport transit passengers to visit the park for up to 48 hours without needing a visa.

But as it is also within the Shanghai Pudong area, any future land expansion would be very difficult.

Chongming Island, situated at the mouth of Yangtze River, has a population of 650,000 and an area of nearly 1,200 square kilometers. Its main advantage over Chuansha is that it is "virgin territory," according to the report.

The undeveloped island is said to be more suitable for a theme park, allowing it to adopt the same model as Disney World Orlando in Florida and be a "back to nature" park.

The Chongming county government has had plans to develop the island since 2004 and already set aside land for a theme park as part of its plans to develop the economy in an environmentally friendly way.

Kathy Wang and Benjamin Scent

Tuesday, December 04, 2007

A competitor to the already troubled Hong Kong Disneyland may emerge sooner than expected because Shanghai has expressed determination to build its own Disneyland theme park starting 2010, when it hosts the World Expo, according to mainland media reports.

The proposed location for the attraction has switched from suburban Chuansha town in Shanghai's Pudong district to Chongming Island, the China Business Journal reported, quoting an unidentified source.

Project investment has also increased to 40 billion yuan (HK$42.12 billion), from the previous plan of 30 billion yuan.

Negotiations for a Shanghai Chuansha Disneyland was stopped last year when the probe into the city's pension fund began, the China Business Journal said.

Walt Disney Corporation has resumed talks with the Shanghai government recently for a possible shift in location, according to the newspaper report.

Chuansha's main advantage is its location. Only 10 minutes away from Shanghai Pudong International Airport, the easy access would allow airport transit passengers to visit the park for up to 48 hours without needing a visa.

But as it is also within the Shanghai Pudong area, any future land expansion would be very difficult.

Chongming Island, situated at the mouth of Yangtze River, has a population of 650,000 and an area of nearly 1,200 square kilometers. Its main advantage over Chuansha is that it is "virgin territory," according to the report.

The undeveloped island is said to be more suitable for a theme park, allowing it to adopt the same model as Disney World Orlando in Florida and be a "back to nature" park.

The Chongming county government has had plans to develop the island since 2004 and already set aside land for a theme park as part of its plans to develop the economy in an environmentally friendly way.

Walt Disney acquires iParenting Media

By Simon Kennedy

Last update: 6:11 a.m. EST Dec. 4, 2007

PrintPrint Email Subscribe to RSSRSS DisableDisable Live Quotes

LONDON (MarketWatch) -- Walt Disney Co. said Tuesday that its Internet division has acquired iParenting Media in a deal intended to add to its line-up of family-targeted Web sites. Terms of the deal were not disclosed. "IParenting has built a strong, trusted reputation among parents, and we feel the site is a perfect complement to our overall portfolio," said Paul Yanover, managing director of Disney Online

By Simon Kennedy

Last update: 6:11 a.m. EST Dec. 4, 2007

PrintPrint Email Subscribe to RSSRSS DisableDisable Live Quotes

LONDON (MarketWatch) -- Walt Disney Co. said Tuesday that its Internet division has acquired iParenting Media in a deal intended to add to its line-up of family-targeted Web sites. Terms of the deal were not disclosed. "IParenting has built a strong, trusted reputation among parents, and we feel the site is a perfect complement to our overall portfolio," said Paul Yanover, managing director of Disney Online

ist zwar nicht die riesen Position, aber immerhin:

Disney Director Buys Shares

Thursday December 6, 3:57 pm ET

Disney Director Orin Smith Buys 3,100 Shares

NEW YORK (AP) -- A director of entertainment company Walt Disney Co. bought 3,100 shares of common stock, according to a Securities and Exchange Commission filing Wednesday.

In a Form 4 filed with the SEC, Orin Smith reported he bought the shares for $32.86 to $32.87 apiece.

Insiders file Form 4s with the SEC to report transactions in their companies' shares. Open market purchases and sales must be reported within two business days of the transaction.

Disney is based in Burbank, Calif.

Disney Director Buys Shares

Thursday December 6, 3:57 pm ET

Disney Director Orin Smith Buys 3,100 Shares

NEW YORK (AP) -- A director of entertainment company Walt Disney Co. bought 3,100 shares of common stock, according to a Securities and Exchange Commission filing Wednesday.

In a Form 4 filed with the SEC, Orin Smith reported he bought the shares for $32.86 to $32.87 apiece.

Insiders file Form 4s with the SEC to report transactions in their companies' shares. Open market purchases and sales must be reported within two business days of the transaction.

Disney is based in Burbank, Calif.

Hier ne Analyse eines US-Brokers, ganz interessant. Übrigens, DIS notiert heute in den USA exD.

THE STOCKPICKERS

Fund's managers swing wide for value

Sound Shore finding relative bargains in tech, health care and media

By Murray Coleman, MarketWatch

Last update: 4:47 p.m. EST Dec. 9, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

SAN FRANCISCO (MarketWatch) -- In a tough year for value-focused managers, the Sound Shore Fund's team is staying above water.

......

Walt Disney Co.

The managers are also bullish about Walt Disney Co.

Free cash flow is key to evaluating media firms, DeGulis says. Disney's free cash flow is expected to equal about $2.35 per share in fiscal 2008, which ends in September.

"That should be slightly above earnings of $2.15 a share," DeGulis said. "That's a very healthy situation. Generally for the S&P 500, free cash flow is about half of EPS."

The most misunderstood piece of the entertainment giant is its ESPN property, he adds. It's part of Disney's cable networks unit, which has grown from about $1 billion in operating profits in 2002 to a forecasted $3.7 billion in fiscal 2008. "We expect that to represent about half the entire company's operating profit," DeGulis said.

While ESPN is the engine, the Disney Channel and other cable networks also provide support. "Their original programming in sports and entertainment is proving to be very popular," DeGulis said. "They've got they've got the best pure-play content of anybody in the business."

He adds that sports-viewing demand is growing in double-digits each year. "ESPN just signed a long-term deal with the international cricket league, which is immensely popular in the U.K. and Asia," DeGulis said. "We think ESPN has 10-15% earnings growth easily for the next five years."

Shares of Disney rose 7 cents to $32.79 on Friday. End of Story.

Murray Coleman is a reporter for MarketWatch in San Francisco

THE STOCKPICKERS

Fund's managers swing wide for value

Sound Shore finding relative bargains in tech, health care and media

By Murray Coleman, MarketWatch

Last update: 4:47 p.m. EST Dec. 9, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

SAN FRANCISCO (MarketWatch) -- In a tough year for value-focused managers, the Sound Shore Fund's team is staying above water.

......

Walt Disney Co.

The managers are also bullish about Walt Disney Co.

Free cash flow is key to evaluating media firms, DeGulis says. Disney's free cash flow is expected to equal about $2.35 per share in fiscal 2008, which ends in September.

"That should be slightly above earnings of $2.15 a share," DeGulis said. "That's a very healthy situation. Generally for the S&P 500, free cash flow is about half of EPS."

The most misunderstood piece of the entertainment giant is its ESPN property, he adds. It's part of Disney's cable networks unit, which has grown from about $1 billion in operating profits in 2002 to a forecasted $3.7 billion in fiscal 2008. "We expect that to represent about half the entire company's operating profit," DeGulis said.

While ESPN is the engine, the Disney Channel and other cable networks also provide support. "Their original programming in sports and entertainment is proving to be very popular," DeGulis said. "They've got they've got the best pure-play content of anybody in the business."

He adds that sports-viewing demand is growing in double-digits each year. "ESPN just signed a long-term deal with the international cricket league, which is immensely popular in the U.K. and Asia," DeGulis said. "We think ESPN has 10-15% earnings growth easily for the next five years."

Shares of Disney rose 7 cents to $32.79 on Friday. End of Story.

Murray Coleman is a reporter for MarketWatch in San Francisco

China Said to Block U.S. Films

* Sign In to E-Mail or Save This

* Print

* Reprints

* Share

o Del.icio.us

o Digg

o Facebook

o Newsvine

o Permalink

Article Tools Sponsored By

By DAVID BARBOZA

Published: December 11, 2007

SHANGHAI, Dec. 11 — China has stopped granting permission for American films to be shown in its cinemas in an apparent trade dispute with the United States, according to several Hollywood executives and United States government officials.

The Chinese government has not announced any ban, but American movies are no longer being approved for release early next year, according to the officials, who spoke on the condition of anonymity.

The Chinese action, these officials said, may be in retaliation for the United States decision last April to file an intellectual property rights case with the World Trade Organization. The filing was meant to pressure China to more strictly enforce its intellectual property rights laws and to give American companies greater access to the Chinese market.

At high-level economic talks held in Beijing today, United States government officials said they had raised the issue of the ban or suspension of film approvals, but the officials did not say how China responded.

According to the officials, Chinese leaders expressed strong displeasure with the decision to file the intellectual property rights case earlier this year.

The State Administration of Radio, Film and Television, which regulates China’s film industry, declined to comment. A spokeswoman at the agency’s Beijing office said by telephone that if a ban was in place it would have been publicly announced.

“If you can find the regulation banning films, it means we have; if you cannot find any information on our Web site, it means we haven’t,” said the spokeswoman, who declined to give her name.

China already has restrictions on foreign films shown here, limiting them to about 20 a year, but Hollywood has been pressing for greater access to Chinese cinemas. Films shown here must also pass Chinese censors and are often edited heavily.

China may also be moving to protect its own film industry. Foreign films — mostly from the United States — typically account for nearly half of China’s box office revenues, which topped $350 million in 2006.

This year, the Hollywood film “Transformers” was the top film at the Chinese box office.

The month of December, though, is generally set aside for Chinese films, so there are few American films now being shown in Chinese cinemas.

Hollywood executives said they were very worried about talking about any ban, which they say has been rumored in China for more than a month.

In recent weeks, Hollywood officials say they have attempted to submit films for approval to be shown early next year and the films were either not accepted by regulators or the requests were ignored or delayed.

“It’s not that they aren’t approving, you’re just not hearing anything from them,” one Hollywood executive said.

Officials working for three of the biggest studios operating here, Sony Pictures Entertainment, Warner Brothers and Walt Disney, all declined to comment today.

The Motion Picture Association of America, which has been pressing for greater market access and more enforcement of intellectual property rights laws, was not available for comment today.

The trade dispute over movies is just one among many now playing out between China and the United States, involving everything from currency reform to food safety to China’s booming trade surplus.

Among the worries in China is that the United States and the European Union may be moving toward increasing protectionism as a way to ease trade deficits.

Intellectual property rights are also a leading area of dispute. Last April, the office of the United States trade representative filed a case against China with the World Trade Organization concerning intellectual copyrights and market access. It covers authors and producers of books, music, movies and other goods.

The largest and most prominent of those goods are American movies, which are popular in theaters in China but also widely available on counterfeit DVDs in most large cities, particularly those films that have never been released in China.

Earlier this year, after the United States filed its case, Chinese officials complained it would not help cooperation between the two countries.

“I don’t deny that I.P.R. infringement and piracy occurs in the Chinese market, but that doesn’t mean the United States is founded to file complaints against China in the W.T.O.,” said Wang Ziqiang, a spokesman for China’s National Copyright Administration.

Chinese officials say they have moved aggressively to crack down on copyright violations and piracy and destroyed more than 70 million counterfeit goods in 2006.

* Sign In to E-Mail or Save This

* Reprints

* Share

o Del.icio.us

o Digg

o Facebook

o Newsvine

o Permalink

Article Tools Sponsored By

By DAVID BARBOZA

Published: December 11, 2007

SHANGHAI, Dec. 11 — China has stopped granting permission for American films to be shown in its cinemas in an apparent trade dispute with the United States, according to several Hollywood executives and United States government officials.

The Chinese government has not announced any ban, but American movies are no longer being approved for release early next year, according to the officials, who spoke on the condition of anonymity.

The Chinese action, these officials said, may be in retaliation for the United States decision last April to file an intellectual property rights case with the World Trade Organization. The filing was meant to pressure China to more strictly enforce its intellectual property rights laws and to give American companies greater access to the Chinese market.

At high-level economic talks held in Beijing today, United States government officials said they had raised the issue of the ban or suspension of film approvals, but the officials did not say how China responded.

According to the officials, Chinese leaders expressed strong displeasure with the decision to file the intellectual property rights case earlier this year.

The State Administration of Radio, Film and Television, which regulates China’s film industry, declined to comment. A spokeswoman at the agency’s Beijing office said by telephone that if a ban was in place it would have been publicly announced.

“If you can find the regulation banning films, it means we have; if you cannot find any information on our Web site, it means we haven’t,” said the spokeswoman, who declined to give her name.

China already has restrictions on foreign films shown here, limiting them to about 20 a year, but Hollywood has been pressing for greater access to Chinese cinemas. Films shown here must also pass Chinese censors and are often edited heavily.

China may also be moving to protect its own film industry. Foreign films — mostly from the United States — typically account for nearly half of China’s box office revenues, which topped $350 million in 2006.

This year, the Hollywood film “Transformers” was the top film at the Chinese box office.

The month of December, though, is generally set aside for Chinese films, so there are few American films now being shown in Chinese cinemas.

Hollywood executives said they were very worried about talking about any ban, which they say has been rumored in China for more than a month.

In recent weeks, Hollywood officials say they have attempted to submit films for approval to be shown early next year and the films were either not accepted by regulators or the requests were ignored or delayed.

“It’s not that they aren’t approving, you’re just not hearing anything from them,” one Hollywood executive said.

Officials working for three of the biggest studios operating here, Sony Pictures Entertainment, Warner Brothers and Walt Disney, all declined to comment today.

The Motion Picture Association of America, which has been pressing for greater market access and more enforcement of intellectual property rights laws, was not available for comment today.

The trade dispute over movies is just one among many now playing out between China and the United States, involving everything from currency reform to food safety to China’s booming trade surplus.

Among the worries in China is that the United States and the European Union may be moving toward increasing protectionism as a way to ease trade deficits.

Intellectual property rights are also a leading area of dispute. Last April, the office of the United States trade representative filed a case against China with the World Trade Organization concerning intellectual copyrights and market access. It covers authors and producers of books, music, movies and other goods.

The largest and most prominent of those goods are American movies, which are popular in theaters in China but also widely available on counterfeit DVDs in most large cities, particularly those films that have never been released in China.

Earlier this year, after the United States filed its case, Chinese officials complained it would not help cooperation between the two countries.

“I don’t deny that I.P.R. infringement and piracy occurs in the Chinese market, but that doesn’t mean the United States is founded to file complaints against China in the W.T.O.,” said Wang Ziqiang, a spokesman for China’s National Copyright Administration.

Chinese officials say they have moved aggressively to crack down on copyright violations and piracy and destroyed more than 70 million counterfeit goods in 2006.

14.12.2007 19:11

Walt Disney: Verzweifelte Haufrauen verkaufen sich gut

Burbank, California (BoerseGo.de) - Bei Walt Disney (Nachrichten/Aktienkurs) laufen die Geschäft derzeit blendend, glaubt jedenfalls die UBS. Die Schweizer hoben den Medienkonzern jetzt auf „Kaufen“ an (vorher: „Neutral“) mit einem Kursziel von 39 Dollar. Der Sportkanal ESPN laufe gut und der TV-Kanal Disney Channel entwickle neue Programme. Außerdem expandierten die Themenparks (Disneyland) dank der Verwendung von Figuren aus den den Trickfilmen der Tochter Pixar. Daneben verkaufe sich die TV-Serie „Verzweifelte Hausfrauen“ („Desperate Housewives“) auf den Weltmärkten blendend.

Der Dow-Titel klettert 0,76% auf 33,01 Dollar.

(© BörseGo AG 2007 - http://www.boerse-go.de, Autor: Maier Gerhard, Redakteur)

Walt Disney: Verzweifelte Haufrauen verkaufen sich gut

Burbank, California (BoerseGo.de) - Bei Walt Disney (Nachrichten/Aktienkurs) laufen die Geschäft derzeit blendend, glaubt jedenfalls die UBS. Die Schweizer hoben den Medienkonzern jetzt auf „Kaufen“ an (vorher: „Neutral“) mit einem Kursziel von 39 Dollar. Der Sportkanal ESPN laufe gut und der TV-Kanal Disney Channel entwickle neue Programme. Außerdem expandierten die Themenparks (Disneyland) dank der Verwendung von Figuren aus den den Trickfilmen der Tochter Pixar. Daneben verkaufe sich die TV-Serie „Verzweifelte Hausfrauen“ („Desperate Housewives“) auf den Weltmärkten blendend.

Der Dow-Titel klettert 0,76% auf 33,01 Dollar.

(© BörseGo AG 2007 - http://www.boerse-go.de, Autor: Maier Gerhard, Redakteur)

The Walt Disney Company Executives to Discuss Fiscal First Quarter 2008 Financial Results via Webcast

Last update: 3:19 p.m. EST Dec. 18, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

BURBANK, Calif., Dec 18, 2007 (BUSINESS WIRE) -- The Walt Disney Company will announce fiscal first quarter 2008 financial results via a live audio Webcast beginning at 4:30 p.m. EST / 1:30 p.m. PST on Tuesday, February 5, 2008 (results will be released at approximately 4:01 p.m. EST / 1:01 p.m. PST). To listen to the Webcast, point your browser to www.disney.com/investors. The discussion will be available via re-play through February 19, 2008 at 7:00 p.m. EST / 4:00 p.m. PST.

SOURCE: The Walt Disney Company

The Walt Disney Company

Last update: 3:19 p.m. EST Dec. 18, 2007

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

BURBANK, Calif., Dec 18, 2007 (BUSINESS WIRE) -- The Walt Disney Company will announce fiscal first quarter 2008 financial results via a live audio Webcast beginning at 4:30 p.m. EST / 1:30 p.m. PST on Tuesday, February 5, 2008 (results will be released at approximately 4:01 p.m. EST / 1:01 p.m. PST). To listen to the Webcast, point your browser to www.disney.com/investors. The discussion will be available via re-play through February 19, 2008 at 7:00 p.m. EST / 4:00 p.m. PST.

SOURCE: The Walt Disney Company

The Walt Disney Company

Report: Disney to launch Japanese cellphone service

Los Angeles Business from bizjournals

Walt Disney Co. is planning on launching a new cellphone service in Japan on March 1, according to Tuesday reports.

Disney's Japan unit said it will become a mobile virtual network operator using Softbank Corp.'s pricing plans and sales channels, according to Dow Jones reports. The partnership was initially reported on in November.

Burbank-based Disney (NYSE: DIS) discontinued two similar services in the U.S. in recent years, with Disney Mobile announcing in September that it was stopping service at the end of 2007 and Mobile ESPN shutting down in September 2006.

Los Angeles Business from bizjournals

Walt Disney Co. is planning on launching a new cellphone service in Japan on March 1, according to Tuesday reports.

Disney's Japan unit said it will become a mobile virtual network operator using Softbank Corp.'s pricing plans and sales channels, according to Dow Jones reports. The partnership was initially reported on in November.

Burbank-based Disney (NYSE: DIS) discontinued two similar services in the U.S. in recent years, with Disney Mobile announcing in September that it was stopping service at the end of 2007 and Mobile ESPN shutting down in September 2006.

die Disney-Aktien reißen zur Zeit gar nix, gestern jetzt auch noch ein Verkaufsbefehl. Ich denke aber, langfristig ein gutes Invest.

Gruss space

UPDATE: Analyst Sees Disney Park Pitfalls; Shares Drop1-29-08 3:03 PM EST | E-mail Article | Print Article

LOS ANGELES (Dow Jones) -- Shares of Walt Disney Co. dropped Tuesday after the entertainment giant was downgraded by a Wall Street analyst over concerns about theme park business.

SPONSORED LINKS

Hot Stock News - OXFD

Mortgage Portfolio Recovery. Profit From Mortgage Meltdown.

Free Estate Planning Packet

A solid estate plan requires more than just a will. A.G. Edwards’ free estate planning packet discusses five topics you should consider when planning your estate. Request...

Trade with optionsXpress

Get $100 cash & free transfer when you fund your account by 12/31/2007

Gryphon Financial Has the 2008 Lock of the Year!

Gryphon has hit this trade 14 years in a row for over 500% profits. Absolutely free offer! Act Now!

Citigroup's Jason Bazinet cut Disney (DIS) to sell from hold and reduced his target price to $26 a share from $36, saying that weakness in the company's parks business could be on the horizon.

Bazinet said in a note to clients that the probability of selling out rooms at Disney's East Coast properties slipped during the last three months of 2007 vs. the year before. He added spot pricing for hotel rooms was down, and that weakness was spilling over to forward pricing.

Disney hotel rooms also were cheaper to book one week prior to travel than three months ahead from October to January, Bazinet noted.

"This suggests the calendar [fourth quarter] demand Disney anticipated did not materialize, prompting last-minute rate reductions to fill vacant rooms," Bazinet said.

Disney shares were down 3.8% in recent action to $28.27.

Bazinet noted there has been no issue with strategy or execution by Disney management. Instead, his concerns stem from whether the company will be able to sustain robust results at the parks.

He offered one caveat: that he had similar concerns in 2007 that never materialized.

"But now, as we enter 2008, we are getting increasingly concerned that Disney's strategy and strong execution may simply get overshadowed by macroeconomic forces. That is, as energy costs remain stubbornly high, the housing market falters, and equity values pull back, we think it's only natural for consumer spending to slow," Bazinet wrote.

(END) Dow Jones Newswires

01-29-081503ET

Copyright (c) 2008 Dow Jones & Company, Inc.

Gruss space

UPDATE: Analyst Sees Disney Park Pitfalls; Shares Drop1-29-08 3:03 PM EST | E-mail Article | Print Article

LOS ANGELES (Dow Jones) -- Shares of Walt Disney Co. dropped Tuesday after the entertainment giant was downgraded by a Wall Street analyst over concerns about theme park business.

SPONSORED LINKS

Hot Stock News - OXFD

Mortgage Portfolio Recovery. Profit From Mortgage Meltdown.

Free Estate Planning Packet

A solid estate plan requires more than just a will. A.G. Edwards’ free estate planning packet discusses five topics you should consider when planning your estate. Request...

Trade with optionsXpress

Get $100 cash & free transfer when you fund your account by 12/31/2007

Gryphon Financial Has the 2008 Lock of the Year!

Gryphon has hit this trade 14 years in a row for over 500% profits. Absolutely free offer! Act Now!

Citigroup's Jason Bazinet cut Disney (DIS) to sell from hold and reduced his target price to $26 a share from $36, saying that weakness in the company's parks business could be on the horizon.

Bazinet said in a note to clients that the probability of selling out rooms at Disney's East Coast properties slipped during the last three months of 2007 vs. the year before. He added spot pricing for hotel rooms was down, and that weakness was spilling over to forward pricing.

Disney hotel rooms also were cheaper to book one week prior to travel than three months ahead from October to January, Bazinet noted.

"This suggests the calendar [fourth quarter] demand Disney anticipated did not materialize, prompting last-minute rate reductions to fill vacant rooms," Bazinet said.

Disney shares were down 3.8% in recent action to $28.27.

Bazinet noted there has been no issue with strategy or execution by Disney management. Instead, his concerns stem from whether the company will be able to sustain robust results at the parks.

He offered one caveat: that he had similar concerns in 2007 that never materialized.

"But now, as we enter 2008, we are getting increasingly concerned that Disney's strategy and strong execution may simply get overshadowed by macroeconomic forces. That is, as energy costs remain stubbornly high, the housing market falters, and equity values pull back, we think it's only natural for consumer spending to slow," Bazinet wrote.

(END) Dow Jones Newswires

01-29-081503ET

Copyright (c) 2008 Dow Jones & Company, Inc.

Antwort auf Beitrag Nr.: 33.209.129 von spaceistheplace am 30.01.08 07:44:08hier was von CRAMER...recht hat er...

Gruss space

Jim Cramer's Mad Money In-Depth, 1/31/08: Disney's Mickey Mouse Downgrade

posted on: February 01, 2008 | about stocks: DIS / HOLX / JCP / RL

Print Email

Stocks discussed in the in-depth session of Jim Cramer’s Mad Money TV program, Thursday,January 31. Click on a stock ticker for more analysis:

Ralph Lauren (RL) and J.C Penney (JCP)

Cramer said he was including homebuilders, financials and retailers in his little black book of loved stocks. One may wonder why there was a selloff after the rate cut and before the eventual rally, and Cramer attributes the decline to thoughtless negativity which does not reflect the fact that the "cycle has turned." He would buy JCP, down 41% year-over-year and RL, down 26% on two "undeserved" downgrades, before the February 19th launch of American Living, JCP's and RL's joint venture. "I call it a kind of aspiration, apparel and home products game... and it's going to be huge. It's a way of feeling rich when you don't have any money." Cramer likes the balance between high-end RL and lower-end JCP and believes JCP CEO Mike Ullman that American Living will be a billion dollar concept.

Disney (DIS)

Cramer called Citi's downgrade of Disney a "miscarriage of justice." The analyst was concerned about the sustainability of Disney's theme parks, which comprise only 22% of the company's revenue; "Citi only talks about DIS's theme park business. Nothing about their cable properties, broadcasting, DVD sales or film... How could he not mention ESPN?" DIS' CFO brought data proving the theme parks are doing better than they were last year. Cramer notes Disney has a 15% long-term growth rate and trades at a mere 13.8x earnings; 'I happen to believe it is the right time to buy DIS for the next 12 days, let alone the 12 months... let alone the 12 years.'

Gruss space

Jim Cramer's Mad Money In-Depth, 1/31/08: Disney's Mickey Mouse Downgrade

posted on: February 01, 2008 | about stocks: DIS / HOLX / JCP / RL

Print Email

Stocks discussed in the in-depth session of Jim Cramer’s Mad Money TV program, Thursday,January 31. Click on a stock ticker for more analysis:

Ralph Lauren (RL) and J.C Penney (JCP)

Cramer said he was including homebuilders, financials and retailers in his little black book of loved stocks. One may wonder why there was a selloff after the rate cut and before the eventual rally, and Cramer attributes the decline to thoughtless negativity which does not reflect the fact that the "cycle has turned." He would buy JCP, down 41% year-over-year and RL, down 26% on two "undeserved" downgrades, before the February 19th launch of American Living, JCP's and RL's joint venture. "I call it a kind of aspiration, apparel and home products game... and it's going to be huge. It's a way of feeling rich when you don't have any money." Cramer likes the balance between high-end RL and lower-end JCP and believes JCP CEO Mike Ullman that American Living will be a billion dollar concept.

Disney (DIS)

Cramer called Citi's downgrade of Disney a "miscarriage of justice." The analyst was concerned about the sustainability of Disney's theme parks, which comprise only 22% of the company's revenue; "Citi only talks about DIS's theme park business. Nothing about their cable properties, broadcasting, DVD sales or film... How could he not mention ESPN?" DIS' CFO brought data proving the theme parks are doing better than they were last year. Cramer notes Disney has a 15% long-term growth rate and trades at a mere 13.8x earnings; 'I happen to believe it is the right time to buy DIS for the next 12 days, let alone the 12 months... let alone the 12 years.'

01.02.2008 18:47

Walt Disney: Broker streiten vor Quartalszahlen

Burbank, California (BoerseGo.de) - Der Medienkonzern Walt Disney Co. (News/Aktienkurs) meldet kommenden Dienstag seine aktuellen Quartalszahlen. Der Broker Oppenheimer&Co. zeigt sich im Vorfeld optimistisch. Oppenheimer-Analyst Jason Helfstein hob heute den Dow-Titel auf "Outperform" an (vorher: „Perform" , das entspricht „Neutral"). Helfstein rechnet damit, dass die Kalifronier am Dienstag die Erwartungen schlagen. Begründung: Er rechne mit guten Ergebnissen von den Themenparks und Freizeitanlagen des Mischkonzerns. Außerdem zeige die Aktie im Vergleich zum S&P 500 Index die niedrigste Bewertung seit 5 Jahren. Oppenheimer steht damit in Opposition zu Citi Investment Research. Der Analyst Jason Bazinet hatte Disney bereits am Dienstag auf „Verkaufen“ heruntergestuft. Bazinet befürchtet, dass die schwache US-Konjunktur auch den Besucherstrom in den Disney-Parks einschränkt. Analyst Doug Creutz vom Broker Cowen&Co. vergibt die Note „Neutral“ und verweist ebenfalls auf die schwache Konjunktur.

Walt Disney: Broker streiten vor Quartalszahlen

Burbank, California (BoerseGo.de) - Der Medienkonzern Walt Disney Co. (News/Aktienkurs) meldet kommenden Dienstag seine aktuellen Quartalszahlen. Der Broker Oppenheimer&Co. zeigt sich im Vorfeld optimistisch. Oppenheimer-Analyst Jason Helfstein hob heute den Dow-Titel auf "Outperform" an (vorher: „Perform" , das entspricht „Neutral"). Helfstein rechnet damit, dass die Kalifronier am Dienstag die Erwartungen schlagen. Begründung: Er rechne mit guten Ergebnissen von den Themenparks und Freizeitanlagen des Mischkonzerns. Außerdem zeige die Aktie im Vergleich zum S&P 500 Index die niedrigste Bewertung seit 5 Jahren. Oppenheimer steht damit in Opposition zu Citi Investment Research. Der Analyst Jason Bazinet hatte Disney bereits am Dienstag auf „Verkaufen“ heruntergestuft. Bazinet befürchtet, dass die schwache US-Konjunktur auch den Besucherstrom in den Disney-Parks einschränkt. Analyst Doug Creutz vom Broker Cowen&Co. vergibt die Note „Neutral“ und verweist ebenfalls auf die schwache Konjunktur.

Disney CEO Iger Inks 5-Year Deal

02/01/08 - 04:31 PM EST

DIS

TSC Staff

* loading...

*

*

*

* Article Tools

* Email this Article

* Print this Article

* RSS FeedRss Feed

* Digg this Article

* Save to Del.icio.us

*

Be the

First

Member to

Recommend

this article

Recommend it

SAN FRANCISCO -- Disney(DIS - Cramer's Take - Stockpickr) signed Chief Executive Robert A. Iger to a new five-year contract.

The media and theme park conglomerate said Friday that Iger's contract will end Jan. 31, 2013. His old deal would've expired in September 2010.

Iger became CEO of Disney in September 2005, following the increasingly tempestuous tenure of longtime chief Michael Eisner.

Shares of Disney, which closed Friday off 2.7% to $30.64, steadily climbed after Iger took the helm, but began slumping during the past seven months. In total, Disney's stock has now risen 21% in Iger's two-and-a-half year term.

Disney also signed a new five-year deal with CFO Thomas O. Staggs, to expire April 1, 2013.

02/01/08 - 04:31 PM EST

DIS

TSC Staff

* loading...

*

*

*

* Article Tools

* Email this Article

* Print this Article

* RSS FeedRss Feed

* Digg this Article

* Save to Del.icio.us

*

Be the

First

Member to

Recommend

this article

Recommend it

SAN FRANCISCO -- Disney(DIS - Cramer's Take - Stockpickr) signed Chief Executive Robert A. Iger to a new five-year contract.

The media and theme park conglomerate said Friday that Iger's contract will end Jan. 31, 2013. His old deal would've expired in September 2010.

Iger became CEO of Disney in September 2005, following the increasingly tempestuous tenure of longtime chief Michael Eisner.

Shares of Disney, which closed Friday off 2.7% to $30.64, steadily climbed after Iger took the helm, but began slumping during the past seven months. In total, Disney's stock has now risen 21% in Iger's two-and-a-half year term.

Disney also signed a new five-year deal with CFO Thomas O. Staggs, to expire April 1, 2013.

netter FOOL-Artikel zu DIS. Ist immer wieder nett zu lesen...

Gruss space

http://www.fool.com/investing/general/2008/02/04/foolish-for…

Gruss space

http://www.fool.com/investing/general/2008/02/04/foolish-for…

heute kommen nachbörslich die Quartalszahlen, hier ein "Vorbericht".

Gruss space

Disney profit expected higher on TV improvement

By David B. Wilkerson, MarketWatch

Last update: 10:02 p.m. EST Feb. 4, 2008

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

CHICAGO (MarketWatch) -- Walt Disney Co. is expected to report higher fiscal first-quarter earnings Tuesday afternoon, excluding a year-earlier gain, on higher revenue at its broadcast and cable networks.

Disney (DIS:

Walt Disney Company

News, chart, profile, more

Last: 30.90+0.24+0.78%

4:01pm 02/04/2008

Delayed quote data

Add to portfolio

Analyst

Create alert

Insider

Discuss

Financials

Sponsored by:

DIS 30.90, +0.24, +0.8%) is expected to earn 52 cents a share on $10 billion in revenue, according to a survey of analysts by Thomson Financial.

In its fiscal first quarter a year earlier, Disney's profit was 79 cents a share, including a gain from sales of interests in E! Entertainment and Us Weekly. Excluding the gain, the company would have earned 50 cents a share on revenue of $9.73 billion.

Oppenheimer & Co. analyst Jason Helfstein expects broadcast TV revenue at Disney to rise 7% to $1.75 billion due to higher advertising rates at the ABC network, despite an 11% drop in primetime ratings in the key adult 18-49 category. The segment should also be helped by DVD sales for "Lost: Season 3."

Helfstein sees cable network revenue climbing 10% to $2.4 billion on strong advertising rates. Laura Martin of Soleil-Media Metrics says the unit will benefit from strong results at ESPN.

Following News Corp.'s assessment on Monday that there are no signs of an advertising slowdown despite the shaky U.S. economy, Disney will be expected to offer its analysis of the situation. See related story

One standout in the prior year was studio operations, where the DVD releases of "Pirates of the Caribbean: Dead Man's Chest," "Cars" and a re-release of "Little Mermaid" pushed sales for the unit 29% higher to $2.6 billion. Against this difficult comparison, Helfstein says revenue will slip to $2.56 billion.

Helfstein is upbeat about Disney's theme parks, expecting a revenue increase of 10% to $2.7 billion on strong holiday season attendance.

However, analysts will be listening carefully to Disney's outlook at the theme parks. Citigroup analyst Jason Bazinet said in a note last month that it may be difficult for the parks to continue to execute as well as they have in the past year.

"(A)s we enter 2008, we are getting increasingly concerned that Disney's strategy and strong execution may simply get overshadowed by macroeconomic forces. That is, as energy costs remain stubbornly high, the housing market falters, and equity values pull back, we think it's only natural for consumer spending to slow," Bazinet wrote. End of Story

David B. Wilkerson is a reporter for MarketWatch in Chicago.

Gruss space

Disney profit expected higher on TV improvement

By David B. Wilkerson, MarketWatch

Last update: 10:02 p.m. EST Feb. 4, 2008

PrintPrint EmailE-mail Subscribe to RSSRSS DisableDisable Live Quotes

CHICAGO (MarketWatch) -- Walt Disney Co. is expected to report higher fiscal first-quarter earnings Tuesday afternoon, excluding a year-earlier gain, on higher revenue at its broadcast and cable networks.

Disney (DIS:

Walt Disney Company

News, chart, profile, more

Last: 30.90+0.24+0.78%

4:01pm 02/04/2008

Delayed quote data

Add to portfolio

Analyst

Create alert

Insider

Discuss

Financials

Sponsored by:

DIS 30.90, +0.24, +0.8%) is expected to earn 52 cents a share on $10 billion in revenue, according to a survey of analysts by Thomson Financial.

In its fiscal first quarter a year earlier, Disney's profit was 79 cents a share, including a gain from sales of interests in E! Entertainment and Us Weekly. Excluding the gain, the company would have earned 50 cents a share on revenue of $9.73 billion.

Oppenheimer & Co. analyst Jason Helfstein expects broadcast TV revenue at Disney to rise 7% to $1.75 billion due to higher advertising rates at the ABC network, despite an 11% drop in primetime ratings in the key adult 18-49 category. The segment should also be helped by DVD sales for "Lost: Season 3."

Helfstein sees cable network revenue climbing 10% to $2.4 billion on strong advertising rates. Laura Martin of Soleil-Media Metrics says the unit will benefit from strong results at ESPN.

Following News Corp.'s assessment on Monday that there are no signs of an advertising slowdown despite the shaky U.S. economy, Disney will be expected to offer its analysis of the situation. See related story

One standout in the prior year was studio operations, where the DVD releases of "Pirates of the Caribbean: Dead Man's Chest," "Cars" and a re-release of "Little Mermaid" pushed sales for the unit 29% higher to $2.6 billion. Against this difficult comparison, Helfstein says revenue will slip to $2.56 billion.

Helfstein is upbeat about Disney's theme parks, expecting a revenue increase of 10% to $2.7 billion on strong holiday season attendance.

However, analysts will be listening carefully to Disney's outlook at the theme parks. Citigroup analyst Jason Bazinet said in a note last month that it may be difficult for the parks to continue to execute as well as they have in the past year.

"(A)s we enter 2008, we are getting increasingly concerned that Disney's strategy and strong execution may simply get overshadowed by macroeconomic forces. That is, as energy costs remain stubbornly high, the housing market falters, and equity values pull back, we think it's only natural for consumer spending to slow," Bazinet wrote. End of Story

David B. Wilkerson is a reporter for MarketWatch in Chicago.

schöne zahlen von Disney, nacxhbörslich gehts gerade 4,5% hoch. Zuerst auf Deutsch, danach alles ausführlich.

Gruss space

Walt Disney kann Umsatz und Gewinn unerwartet deutlich steigern

Burbank, CA (aktiencheck.de AG) - Der Medien- und Entertainment-Konzern Walt Disney Co. (ISIN US2546871060/ WKN 855686) gab am Dienstag nach US-Börsenschluss die Zahlen für das erste Fiskalquartal 2007/08 bekannt. Dabei konnte der US-Konzern aufgrund einer positiven Entwicklung in allen Bereichen die Umsatz- und Gewinnerwartungen übertreffen.

Der Nettogewinn belief sich auf 1,25 Mrd. Dollar bzw. 63 Cents je Aktie, nach 1,70 Mrd. Dollar bzw. 79 Cents je Aktie im Vorjahreszeitraum. Der bereinigte Gewinn verbesserte sich dagegen um 29 Prozent auf nun 63 Cents je Aktie. Analysten waren im Vorfeld von einem EPS von 52 Cents ausgegangen.

Der Umsatz verbesserte sich im Berichtszeitraum von 9,58 Mrd. Dollar auf nun 10,45 Mrd. Dollar. Analysten hatten zuvor Erlöse von 10,04 Mrd. Dollar erwartet.

Für das laufende zweite Fiskalquartal 2007/08 prognostizieren die Analysten ein EPS von 48 Cents bei Umsatzerlösen von 8,39 Mrd. Dollar.

Die Aktie von Walt Disney schloss heute an der NYSE bei 30,24 Dollar (-2,14 Prozent). (05.02.2008/ac/n/a)

Quelle: Finanzen.net 05.02.2008 22:21:00

hier der offizielle Quartalsbericht:

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bDB0…

Gruss space

Walt Disney kann Umsatz und Gewinn unerwartet deutlich steigern

Burbank, CA (aktiencheck.de AG) - Der Medien- und Entertainment-Konzern Walt Disney Co. (ISIN US2546871060/ WKN 855686) gab am Dienstag nach US-Börsenschluss die Zahlen für das erste Fiskalquartal 2007/08 bekannt. Dabei konnte der US-Konzern aufgrund einer positiven Entwicklung in allen Bereichen die Umsatz- und Gewinnerwartungen übertreffen.

Der Nettogewinn belief sich auf 1,25 Mrd. Dollar bzw. 63 Cents je Aktie, nach 1,70 Mrd. Dollar bzw. 79 Cents je Aktie im Vorjahreszeitraum. Der bereinigte Gewinn verbesserte sich dagegen um 29 Prozent auf nun 63 Cents je Aktie. Analysten waren im Vorfeld von einem EPS von 52 Cents ausgegangen.

Der Umsatz verbesserte sich im Berichtszeitraum von 9,58 Mrd. Dollar auf nun 10,45 Mrd. Dollar. Analysten hatten zuvor Erlöse von 10,04 Mrd. Dollar erwartet.

Für das laufende zweite Fiskalquartal 2007/08 prognostizieren die Analysten ein EPS von 48 Cents bei Umsatzerlösen von 8,39 Mrd. Dollar.

Die Aktie von Walt Disney schloss heute an der NYSE bei 30,24 Dollar (-2,14 Prozent). (05.02.2008/ac/n/a)

Quelle: Finanzen.net 05.02.2008 22:21:00

hier der offizielle Quartalsbericht:

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bDB0…

und noch ein schöner Bericht zu den zahlen:

http://www.handelsblatt.com/news/_pv/_p/200040/_t/ft/_b/1386…

http://www.handelsblatt.com/news/_pv/_p/200040/_t/ft/_b/1386…

ist eigentlich noch jemand ausser mir in diesen klasischen Wachstumswert investiert?

Gruss mit der Bitte um outing...

space

Gruss mit der Bitte um outing...

space

Disney reported a net profit of $1.25 billion, or 63 cents per share, down 27% from the same period last year but beating consensus estimates of 52 cents per share.

also bei 62 cent gegenüber 52 cent erwartet, da nehmen sich die 5& Aufschlag nachbörslich noch gediegen...

Gruss space

also bei 62 cent gegenüber 52 cent erwartet, da nehmen sich die 5& Aufschlag nachbörslich noch gediegen...

Gruss space

Wieder mal ein schöner Fool-Artikel zu DIS.

Disney Makes Bears Look Goofy

By Rick Aristotle Munarriz February 6, 2008

6 Recommendations

Just last week, Citi analyst Jason Bazinet downgraded Disney (NYSE: DIS), fearing that weakening consumer spending trends and anecdotal evidence of last-minute resort discounting would eat into the family-entertainment giant's performance.

Sucker!

Disney is trouncing Wall Street's expectations, as it has during every single quarter under CEO Bob Iger's tenure. (Check out the previous quarter's topper).