Neuer Tenbagger - Highbank Resources - 500 Beiträge pro Seite

eröffnet am 29.11.07 22:11:03 von

neuester Beitrag 09.05.08 16:27:53 von

neuester Beitrag 09.05.08 16:27:53 von

Beiträge: 29

ID: 1.135.824

ID: 1.135.824

Aufrufe heute: 0

Gesamt: 2.494

Gesamt: 2.494

Aktive User: 0

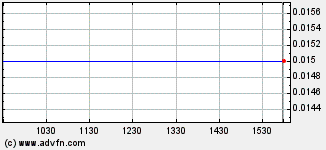

ISIN: CA42982U2065 · WKN: A3DMJA · Symbol: HBK

0,0100

CAD

0,00 %

0,0000 CAD

Letzter Kurs 17.04.24 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7000 | +11,11 | |

| 1,4000 | +10,24 | |

| 37,18 | +10,00 | |

| 17,930 | +10,00 | |

| 6,7700 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5900 | -8,09 | |

| 2,1800 | -9,17 | |

| 69,05 | -9,48 | |

| 154,95 | -9,76 | |

| 47,99 | -98,00 |

Nach der heutigen News unten haben wir hier einen echten Tenbagger vor uns:

HBK verfügt über 71 MioT hochwertiges Baumaterial bei einer Marketcap von zur Zeit 10 Mio C$:

http://www.stockhouse.ca/comp_info.asp?symbol=HBK&table=LIST

Dagegen verfügt Polaris TSX-V : PLS über 205 Mio T: siehe Folie 42 in der Präsenation:

http://www.polarmin.com/downloads/1195168413PLSNovember%20De…

Bei einer Marketcap von 470 Mio C$.

http://www.stockhouse.ca/comp_info.asp?symbol=PLS&table=list

Das bedeutet HBK müsste eigentlich bei einem Drittel der PLS Bewertung stehen wenn man die Verladeeinrichtung aufbaut (ca.10 Mio $ Kosten).

Das wären gut 150 Mio C$ Marketcap Ziel für HBK oder 1500% Kurspotential !!!

HBK verfügt über 71 MioT hochwertiges Baumaterial bei einer Marketcap von zur Zeit 10 Mio C$:

http://www.stockhouse.ca/comp_info.asp?symbol=HBK&table=LIST

Dagegen verfügt Polaris TSX-V : PLS über 205 Mio T: siehe Folie 42 in der Präsenation:

http://www.polarmin.com/downloads/1195168413PLSNovember%20De…

Bei einer Marketcap von 470 Mio C$.

http://www.stockhouse.ca/comp_info.asp?symbol=PLS&table=list

Das bedeutet HBK müsste eigentlich bei einem Drittel der PLS Bewertung stehen wenn man die Verladeeinrichtung aufbaut (ca.10 Mio $ Kosten).

Das wären gut 150 Mio C$ Marketcap Ziel für HBK oder 1500% Kurspotential !!!

HIGHBANK RECEIVES TECHNICAL REPORT AND RESOURCE ESTIMATE

Highbank Resources Ltd. (the “Company”), (“TSX.V – HBK”) is pleased to announce the receipt of a NI 43-101 Technical Report on the ‘Portland Canal Aggregates Corporation -Swamp Point North Property’ (the “Property”) located on the east shore of Portland Canal, approx. 50 km south of Stewart in northwestern British Columbia.

In February 2005, the Company entered into an Earn-In Agreement with Portland Canal Aggregates Corporation (“PCAC”) to acquire a 100% Working Ownership Interest (the “WOI”) in PCAC’s Property. To earn its WOI the Company has completed all aspects of the Agreement including the issuance of 2,000,000 common shares, completion of $1.3 million in work expenditures in stages and other advance royalty payments.

Associated Geosciences Ltd. (“AGL”) of Calgary, Alberta was commissioned by the Company and PCAC to prepare a NI 43-101 Technical Report on the property’s mineable sand , gravel, and aggregate resources and determine the optimal mine layout for preparation of a formal Mine Plan. Mr. Keith McCandlish, P.Geo., AGL’s Vice President and General Manager conducted the site visit and is the “Qualified Person” as defined in NI 43-101.

The AGL resource estimate was determined from aggregate volumes estimated from depth-to bedrock measurements obtained from ten (10) cored boreholes and on the results from 4,664 metres of seismic refraction surveys undertaken by the Company in 2005 and 2006. Geophysicists from Associated Mining Consultants Ltd. of Calgary, Alberta conducted the geophysical surveys and geologists from AGL have examined the core and core logs obtained subsequently.

The volume of aggregate was determined as the volume of material bounded by the topographic ground surface, (a digital terrain model obtained from an aerial photogrammetric survey), and the bedrock contours, determined from the exploration data using the Gemcom Surpac™ suite of modelling applications. Bedrock data were augmented with three additional sets of points:

• Field observations and a slope gradient map generated from the topographic data were used to infer the surface limit of the gravel deposit against bedrock topography. This limit was described as a line of points with eastings, northings, and, elevations (X, Y, Z co-ordinates) and a resource thickness of zero.

• Surface contours in areas determined to have zero aggregate thickness were included in the model as bedrock contours.

• The results of offshore dive transects which indicated the presence of aggregate to at least a depth of 5 m along the foreshore were included.

Limits consistent with mining and environmental regulations in British Columbia were applied prior to the resource calculation:

• Material occurring within 30 m of the high water mark (HWM) was eliminated; there is a regulated offset from the HWM for minerals extraction.

• Material occurring within 5 m of the licence boundaries was not included in the estimate as there is a prohibition against working closer than 5 m to the license boundary in the BC mining code.

• Material occurring within a band 15 m on either side of the crest of the banks of Donahue Creek was eliminated; working within these limits is forbidden under BC’s environmental code.

The geological modeling and aggregate resource estimation was completed by Susan O’Donnell, Geol.I.T., under the direction of Mr. Keith McCandlish, P.Geo., using the Gemcom-Surpac(TM) suite of geological modeling applications.

The mine planning was completed by Eric Beresford, P.Eng. under the direction of Mr. Peter Cain, Ph.D.,P.Eng., AGL’s Head of Mining Engineering. AGL has relied on aggregate testing results performed by Levelton Consultants of Richmond, B.C. in assessing the quality of the aggregates on the property. This testing was conducted on bulk samples collected by the Company and Portland Canal Aggregates Corporation (“PCAC”).

The Industrial Mineral Resource Estimate tables following provides resource volumes and tonnes for two separate areas, and a third summary table. The separate areas represent the License area held by PCAC and the area (the “extension area”) for which an Investigation Permit was issued by the BC government for PCAC:

License Area Resources

Classification Volume (m3) Mass (t) *

Measured 13,618,365 29,551,852

Indicated 1,848,388 4,011,002

Measured and Indicated 15,466,753 33,562,854

Inferred 203,772 442,185

Extension Area Resources

Classification Volume (m3) Mass(t)*

Measured 15,384,804 33,385,025

Indicated 2,195,467 4,764,164

Measured and Indicated 17,580,271 38,149,189

Inferred 831,465 1,804,279

Combined Area Resources

Classification Volume (m3) Mass(t)*

Measured 29,003,169 62,936,877

Indicated 4,043,855 8,775,166

Measured and Indicated 33,047,024 71,712,043

Inferred 1,035,237 2,246,464

*The specific gravity value of 2.17 used to convert volumes to tonnes is the value used by B.C. Government to assess extraction tonnages for royalty revenue purposes.

Material located within 250 m of a drill hole and complemented by geophysical data has been

classified as measured, while material located outside the 250 m radius of a drill hole but still

within 125 m of a geophysical data point has been classified as indicated. Inferred resources

encompass all additional material located outside the optimum range to which the data can

reasonably be projected, but within the limits of mining.

The Company and PCAC are proceeding with the preparation of an Environmental Assessment application (“EAA”) and a Mine Permit application (“MPA”) to the B.C. Government in anticipation of the start up of aggregate production operations.

Micon International Limited of Vancouver, B.C. has been retained to compile the EAA and assist with the Environment Assessment process.

Mr. Eric Beresford, P.Eng., an independent consultant, was retained by AGL to prepare the mine plans to support the EAA and MPA to the B.C. government.

The Technical Report summarizing the above information will be submitted within 30 days and will be available on the Highbank website (www.HighbankResources.com) and through SEDAR (www.sedar.com). This news release has been reviewed and approved by Mr. Keith McCandlish, P.Geo of Associated Geosciences Ltd. , the qualified person under NI 43-101, and by Mr. Peter Cain, Ph.D., P.Eng.

ON BEHALF OF THE BOARD OF DIRECTORS

“JAKE BOTTAY”

Jake Bottay,

President/Director

Kommt noch dazu, dass in Whistler demnächst Olympische Winterspiele stattfinden. Da wird gebaut ohne Ende...

Antwort auf Beitrag Nr.: 32.622.400 von schwochner am 29.11.07 23:57:59Ja und die Politiker Stimmen mehren sich der Bauindustrie nach dem Abschwung in der privaten Bautätigkeit mit mehr öffentlichen Aufträgen unter die Arme zu greifen.

Der Brückeneinsturz in den USA vor kurzem zeigt die marode Verfassung der meisten Brücken und öffentlichen Gebäude in den USA.

Der Brückeneinsturz in den USA vor kurzem zeigt die marode Verfassung der meisten Brücken und öffentlichen Gebäude in den USA.

Eine andere Value Kalkulation von einem US Investor:

http://www.stockhouse.ca/bullboards/viewmessage.asp?stat_num…

Kurspotential danach 31 C$ = 21 Euro

Das sind fast 10 000% !!!

http://www.stockhouse.ca/bullboards/viewmessage.asp?stat_num…

Kurspotential danach 31 C$ = 21 Euro

Das sind fast 10 000% !!!

Antwort auf Beitrag Nr.: 32.623.275 von RiscTec am 30.11.07 08:55:14Aus:

http://www.stockhouse.ca/bullboards/viewmessage.asp?stat_num…

Asset 74,000,000 tons of prime grade C1 and C2 gravel

Value @ 15.00/ton is $1,110,000,000.

35,000,000 ( estimated) shares outstanding or capable of conversion to shares

$1,110,000,000 divided by 35,000,000 = $31.71 (e/oe)

current market price .39

So where do you think the SP will go?

bwt

Allerdings musst du die 31 CAN dann noch durch die Dauer des Projektes in Jahren teilen. Waren es nicht 15 Jahre?

Somit wären 31,71 CAN/15 Jahre gleich 2.11 CAN.

Die Aktie ist, egal wie, krass unterbewertet.

Gruss und schönes WE!

http://www.stockhouse.ca/bullboards/viewmessage.asp?stat_num…

Asset 74,000,000 tons of prime grade C1 and C2 gravel

Value @ 15.00/ton is $1,110,000,000.

35,000,000 ( estimated) shares outstanding or capable of conversion to shares

$1,110,000,000 divided by 35,000,000 = $31.71 (e/oe)

current market price .39

So where do you think the SP will go?

bwt

Allerdings musst du die 31 CAN dann noch durch die Dauer des Projektes in Jahren teilen. Waren es nicht 15 Jahre?

Somit wären 31,71 CAN/15 Jahre gleich 2.11 CAN.

Die Aktie ist, egal wie, krass unterbewertet.

Gruss und schönes WE!

Antwort auf Beitrag Nr.: 32.629.757 von Senfsocke am 30.11.07 16:57:01Könnte man auch ansetzen, allerdings ist die Liegenschaft von HBK noch sehr ausbaufähig.

Es wurde nur ein kleiner Teil der 43-101 Studie unterzogen.

Aber wie du schon richtig sagst - egal wie - die HBK Aktie ist mit zur Zeit knapp 10 Mio C$ Marketcap krass unterbewertet !

Es wurde nur ein kleiner Teil der 43-101 Studie unterzogen.

Aber wie du schon richtig sagst - egal wie - die HBK Aktie ist mit zur Zeit knapp 10 Mio C$ Marketcap krass unterbewertet !

Mit unter 0,4 C$ ist HBK immer noch auf guten Kaufniveau.

Noch eine 10 000% Kurspotential Kalkulation aus den USA:

http://www.investorvillage.com/beta/smbd.asp?mb=12342&mn=154…

http://www.investorvillage.com/beta/smbd.asp?mb=12342&mn=154…

Hört sich interessant an.

Wäre sicher lustig, wenn man so um die 1000% macht, weil man sein Geld in den Sand (und Kies) gesetzt hat

Wäre sicher lustig, wenn man so um die 1000% macht, weil man sein Geld in den Sand (und Kies) gesetzt hat

Der Handel hat stark nachgelassen, wie denkt ihr geht es weiter?

Antwort auf Beitrag Nr.: 32.671.662 von Senfsocke am 05.12.07 13:59:41Denke das liegt an der allgeminen Marktschwächse zur Zeit.

Der Kurs kann eigentlich nur nach oben gehen. Die Regierung hat jetzt glaube ich 6 Wochen um die zu genehmigen.

Bis dahin müssen wir uns gedulden.

Allgemein wird erwartet das HBK die benötigte Infrastruktur sehr schnell aufbauen kann (siehe z.B. Investor Village Diskussionen).

Das heisst vielleicht Mitte 2008 sind wir schon in Produktion...wenn alles gut geht.

Was dann mit dem Kurs passiert kann man bei TSX-V : PLS ablesen vor 2 Jahren.

Der Kurs kann eigentlich nur nach oben gehen. Die Regierung hat jetzt glaube ich 6 Wochen um die zu genehmigen.

Bis dahin müssen wir uns gedulden.

Allgemein wird erwartet das HBK die benötigte Infrastruktur sehr schnell aufbauen kann (siehe z.B. Investor Village Diskussionen).

Das heisst vielleicht Mitte 2008 sind wir schon in Produktion...wenn alles gut geht.

Was dann mit dem Kurs passiert kann man bei TSX-V : PLS ablesen vor 2 Jahren.

Es ist ruhig geworden um HBK. Fast kein Kaufinteresse.

Antwort auf Beitrag Nr.: 32.792.649 von Senfsocke am 17.12.07 16:37:53ja grad wieder flaute aber ich bleib looong !!

!!

!!

!!

Frohes neues Jahr !

Noch jemand hier und investiert ?

Nachdem ASCOT wohl auf Swamp Point voran macht mit Produktionsstart auf Swamp Point noch in diese Jahr erwarte ich auch von HBK bald News Richtung Produktionsstart.

Noch jemand hier und investiert ?

Nachdem ASCOT wohl auf Swamp Point voran macht mit Produktionsstart auf Swamp Point noch in diese Jahr erwarte ich auch von HBK bald News Richtung Produktionsstart.

Antwort auf Beitrag Nr.: 32.964.343 von RiscTec am 07.01.08 10:35:32Bin hier und investiert - aber eher stiller Mitleser und schaue höchstens einmal täglich rein.

Überlege diese oder nächste Woche noch nachzukaufen.

Ich glaube das nicht so rege Interesse beruht vor allem darauf, dass sich die meisten nicht so richtig vorstellen können, dass man mit Sand und Kies Geld machen kann.

Überlege diese oder nächste Woche noch nachzukaufen.

Ich glaube das nicht so rege Interesse beruht vor allem darauf, dass sich die meisten nicht so richtig vorstellen können, dass man mit Sand und Kies Geld machen kann.

Antwort auf Beitrag Nr.: 32.971.854 von mihawk am 07.01.08 20:08:51Ja, könnte auch ein Grund sein.

Kies erscheint mir aber sicherer als irgend ein seltener Erde Wert bei dem niemand weiss ob der Markt bei dem ein oder anderen Metall nicht ploetzlich wegbricht.

Kies wird immer gebraucht wenn Bautätigkeit herrscht - speziell bei Grossprojekten eine sichere Einnahmequelle.

Kies erscheint mir aber sicherer als irgend ein seltener Erde Wert bei dem niemand weiss ob der Markt bei dem ein oder anderen Metall nicht ploetzlich wegbricht.

Kies wird immer gebraucht wenn Bautätigkeit herrscht - speziell bei Grossprojekten eine sichere Einnahmequelle.

.. bei mir macht unsere perle mittlerweile knapp 25% meines depots aus und ich werde bei gelegenheit weiter aufstocken.ich denke wir sitzen hier auf einer bombe die beim nächsten update endgültig platzt und sich auch kursrelevant niederschlägt.

long &strong

Roigelman

long &strong

Roigelman

Antwort auf Beitrag Nr.: 33.027.467 von Roigelman am 12.01.08 00:54:45Ich bin auch significant investiert und denke wir sehen hier bald eine Explosion. Spätestens wenn der Environmental Bericht da ist und die Abbaugehmigung vorliegt.

Mmmmhhh...heute ist Weltuntergang: DAX -7%

Und HBK steht auf 0,175 Euro - Das sind gerade einmal noch 6 Mio $ Marketcap.

Hoffentlich halten die wenigstens. Würde gerne bald einmal einen Boden sehen.

Und HBK steht auf 0,175 Euro - Das sind gerade einmal noch 6 Mio $ Marketcap.

Hoffentlich halten die wenigstens. Würde gerne bald einmal einen Boden sehen.

Bei Polaris sieht jedenfalls alles bestens aus - soweit sollte HBK in knapp 2 Jahren auch sein...

Polaris provides 2007 update and guidance for 2008

19:35 EST Wednesday, January 23, 2008

VANCOUVER, Jan. 23 /CNW/ - Polaris Minerals Corporation (TSX: PLS) announced today that it shipped 1.18 million tons from the Orca Quarry to customers in California,Vancouver and Hawaii in calendar 2007. The Company expects shipments of between 0.50 and 0.60 million tons during the first quarter of 2008 for a total of 1.68 to 1.78 million tons in the first 12 months of operations. Total shipments for calendar 2008 are expected to be between 2.9 and 3.2 million tons based on current customer expectations.

In 2007, the Company provided guidance that it expected to exceed the Orca Quarry feasibility study target sales of 1.54 million tons in the first 12 months of operations ending on March 31, 2008. The feasibility study also provided estimated sales of 2.53 million tons in the second 12 months of operations.

Commenting on the guidance, Marco Romero, Polaris President and CEO, said "Our performance was excellent in 2007 and, based on customers' expectations, we anticipate strong growth in 2008. As a result, we now expect to exceed both our first and second year feasibility study estimates of sales volumes. We are also very pleased that our quarry production costs (unaudited) have been in line with the feasibility study and management expectations during 2007. We expect our annual sales volumes to continue to increase in the short and medium term."

Polaris Minerals Corporation is exclusively focused on the development of quarries and the production of construction aggregates onVancouver Island, British Columbia, for marine transport to urban markets on the west coast of North America to meet growing local supply deficits. In 2007, Polaris began shipping sand and gravel from the Orca Quarry to San Francisco Bay, Vancouver, and Hawaii.

Polaris provides 2007 update and guidance for 2008

19:35 EST Wednesday, January 23, 2008

VANCOUVER, Jan. 23 /CNW/ - Polaris Minerals Corporation (TSX: PLS) announced today that it shipped 1.18 million tons from the Orca Quarry to customers in California,Vancouver and Hawaii in calendar 2007. The Company expects shipments of between 0.50 and 0.60 million tons during the first quarter of 2008 for a total of 1.68 to 1.78 million tons in the first 12 months of operations. Total shipments for calendar 2008 are expected to be between 2.9 and 3.2 million tons based on current customer expectations.

In 2007, the Company provided guidance that it expected to exceed the Orca Quarry feasibility study target sales of 1.54 million tons in the first 12 months of operations ending on March 31, 2008. The feasibility study also provided estimated sales of 2.53 million tons in the second 12 months of operations.

Commenting on the guidance, Marco Romero, Polaris President and CEO, said "Our performance was excellent in 2007 and, based on customers' expectations, we anticipate strong growth in 2008. As a result, we now expect to exceed both our first and second year feasibility study estimates of sales volumes. We are also very pleased that our quarry production costs (unaudited) have been in line with the feasibility study and management expectations during 2007. We expect our annual sales volumes to continue to increase in the short and medium term."

Polaris Minerals Corporation is exclusively focused on the development of quarries and the production of construction aggregates onVancouver Island, British Columbia, for marine transport to urban markets on the west coast of North America to meet growing local supply deficits. In 2007, Polaris began shipping sand and gravel from the Orca Quarry to San Francisco Bay, Vancouver, and Hawaii.

Interview von Canaccord über Ascot, die das Swamp Point Nachbarprojekt betreiben.

Interessante Zusammenfassung der Pre-Feasibility Studie von Ascot. So ähnlich (oder noch etwas besser da grösseres Deposit, einfacherer Tiefwasser Zugang) sollte es bei Highbank auch aussehen.

Interview with John Toffan

We are with John Toffan who has had an amazing investment history, starting out in his relative youth with the major success story, Calpine and Stikine discoveries of two of Canada's richest gold mines – the Snip Mine and the Eskay Creek Mine.

The discovery of Eskay saw Stikine go from dimes to a take out at $72.00. He's been in everything from horse racing - having recently sold a half interest in one of his horses for $5 million and now he seems to be back in the game with Ascot Resources in of all things - the gravel business!?

David Pescod: We realize that most commodities are running. Is gravel really in short supply in California?

John Toffan: Aggregate is the largest non-fuel mineral commodity produced in North America. It is not so much that there is a shortage of gravel in California, but that the existing local sources of supply in the San Francisco, Los Angeles and San Diego metropolitan regions are becoming exhausted and it is extremely difficult,

if not impossible, to permit new aggregate operations in these areas.

Consequently, aggregates are now being sourced from quite distant areas, including by water from B.C., by truck from the Central Valley area of California, and by rail from Nevada and Arizona. The net effect of these developments has been a significant increase in the delivered price of aggregate. The west coast U.S. market has emerged as a major new opportunity for BC based aggregate producers.

The total California market for aggregates in 2004 was 213 million

tonnes. Of this amount, demand in coastal California markets is estimated at 150 million tonnes.

David: You've been working for a while on the Swamp Point Aggregate

project in British Columbia. What were the conclusions of the feasibility report that were important to you?

John: The most important aspect of the Pre-Feasability study was the limited downside and tremendous upside potential of the project, with operating costs of $US 11.21 per tonne on a contractor operated basis including shipping, and a product price of $US 15.43 per tonne, this project is very viable.

Swamp Point Pre-Feasibility Study – Economic Parameters

Contractor operated

$US

Initial Capital $24.8 M

Sustaining Capital $0.1 M

Product Price (per tonne) $15.43

Operating Cost (per tonne product) $11.21

Payback (years from start of construction) 3.4

NPV (0%) – pre tax $140.5 M

NPV (5%) - pre tax $83.7 M

NPV (10%) – pre tax $51.5 M

IRR - pre tax 48%

David: One factor in this gravel shipping business seems to be the use of big barges which operate cheaply. But port facilities in California are going to be important. How is that working out?

John: For customers closer to the Swamp Point project site, such as Prince Rupert or even Vancouver, ocean-going barges may be cost-effective. For shipping to more distant markets, specifically California, ocean going barges would not be cost effective. The Swamp Point aggregate products will instead be loaded directly into ocean going bulk carriers of 30,000 to 70,000 dead weight tonne misplacement. Port facilities for unloading these vessels in San Francisco and elsewhere in California is an important issue and we are currently focusing considerable effort to secure appropriate dock facilities in the target markets.

David: There are other public companies in this field, what can you say about them and their stock performance?

John: Polaris Minerals Corp., which has recently done an underwriting,

is probably the most similar to Ascot. They raised over a $100 million and are currently trading around $5.00. We think our project is simpler and less capital intensive.

David: There is going to be a need for Ascot Resources sooner or later to raise some money. How much is it going to take to get you to the level you hope to be and how much material do you hope to ship a year?

John: Ascot is going to require $US 25 million to put this project into production on a contractor operated basis. Payback is expected to be 3.4 years. We anticipate shipping 1.5 million tonnes in the first full year and increasing to 3.3 million tonnes by the 3rd year.

David: On this kind of volume of business, what kind of revenue and profits can you envision for down the road?

John: Based on product price of $15.43/tonne and a 3.3 million tonne/year production rate, pre-tax cash flow would be approximately $US 13 million. However this project is very sensitive to operating costs and sales prices. With a likely continued upward pressure on sales price because of the shortage of gravel in the costal areas of California, this project has excellent upside potential as illustrated by the price sensitivity table from our Pre-Feasibility report.

David: Of course, the question we always have to ask is what can go

wrong? Do you worry about recession, or manpower shortage, or lack of

barge?

John: The biggest hurdle to overcome is to secure contracts for product sales, and required port facilities. Ascot is currently working on this, but as of yet does not have any letters of intent or supply contracts signed. Aggregate is a commodity, and thus will be affected by price changes due to supply and demand.

Aggregates Manager magazine reports year-to-date price increases for 13.1% for sand and 12.8% for gravel for the period July 2004 through July 2005. Since new supply close to coastal markets is not likely to come on stream, and costs of transporting aggregate from inland sources are likely to rise due to increased fuel costs and ever increasing road congestion, shipping product to coastal markets should remain competitive. The northwest corner of British Columbia is still economically depressed, and currently there is a good supply of able workers. Shipping prices have decreased from their recent highs, and supply and demand should keep shipping prices competitive over the long term.

David: With the current resources available at Swamp Point, how many

years’ reserves do you think you currently have?

John: The Pre-Feasibility study was based on a 45.8 million

tonne Measured Resource of sand and gravel, which would result in a 15 year mine life based on 3.3 million tonnes per year. Opportunities exist for increasing the resource. There is additional material on the north and east sides of the pit designed for the Pre-Feasibility

Study.

David: Let's pretend you were a stock analyst, what would be the important factors and what kind of a price target can you see down the road?

John: The important factors are completing the Environmental

Assessment, securing permits and securing a sales contract or letter of intent.

Our efforts to complete the Environmental Assessment are going well and we expect to have permits in hand by the middle of this year. We are actively working on the product sales front. As for a price target down the road, I think it’s too early to speculate. A lot would depend on the outlook for the price of gravel.

David: John, you've been in everything from Stikine decades

ago to horse racing lately, can you fill us in as to what you've been doing over the few years in between?

John: I guess Stikine was a decade ago. I have stayed in the mineral exploration business through Ascot and two other companies and this is the most encouraging project we’ve seen since Stikine.

If you would like to receive a copy of David Pescod's Late Edition please contact either of the following:

Debbie Lewis at (780) 408-1748, email debbie_lewis@canaccord.com

Sandra Wicks at (780) 408-1749, email sandra_wicks@canaccord.com

Interessante Zusammenfassung der Pre-Feasibility Studie von Ascot. So ähnlich (oder noch etwas besser da grösseres Deposit, einfacherer Tiefwasser Zugang) sollte es bei Highbank auch aussehen.

Interview with John Toffan

We are with John Toffan who has had an amazing investment history, starting out in his relative youth with the major success story, Calpine and Stikine discoveries of two of Canada's richest gold mines – the Snip Mine and the Eskay Creek Mine.

The discovery of Eskay saw Stikine go from dimes to a take out at $72.00. He's been in everything from horse racing - having recently sold a half interest in one of his horses for $5 million and now he seems to be back in the game with Ascot Resources in of all things - the gravel business!?

David Pescod: We realize that most commodities are running. Is gravel really in short supply in California?

John Toffan: Aggregate is the largest non-fuel mineral commodity produced in North America. It is not so much that there is a shortage of gravel in California, but that the existing local sources of supply in the San Francisco, Los Angeles and San Diego metropolitan regions are becoming exhausted and it is extremely difficult,

if not impossible, to permit new aggregate operations in these areas.

Consequently, aggregates are now being sourced from quite distant areas, including by water from B.C., by truck from the Central Valley area of California, and by rail from Nevada and Arizona. The net effect of these developments has been a significant increase in the delivered price of aggregate. The west coast U.S. market has emerged as a major new opportunity for BC based aggregate producers.

The total California market for aggregates in 2004 was 213 million

tonnes. Of this amount, demand in coastal California markets is estimated at 150 million tonnes.

David: You've been working for a while on the Swamp Point Aggregate

project in British Columbia. What were the conclusions of the feasibility report that were important to you?

John: The most important aspect of the Pre-Feasability study was the limited downside and tremendous upside potential of the project, with operating costs of $US 11.21 per tonne on a contractor operated basis including shipping, and a product price of $US 15.43 per tonne, this project is very viable.

Swamp Point Pre-Feasibility Study – Economic Parameters

Contractor operated

$US

Initial Capital $24.8 M

Sustaining Capital $0.1 M

Product Price (per tonne) $15.43

Operating Cost (per tonne product) $11.21

Payback (years from start of construction) 3.4

NPV (0%) – pre tax $140.5 M

NPV (5%) - pre tax $83.7 M

NPV (10%) – pre tax $51.5 M

IRR - pre tax 48%

David: One factor in this gravel shipping business seems to be the use of big barges which operate cheaply. But port facilities in California are going to be important. How is that working out?

John: For customers closer to the Swamp Point project site, such as Prince Rupert or even Vancouver, ocean-going barges may be cost-effective. For shipping to more distant markets, specifically California, ocean going barges would not be cost effective. The Swamp Point aggregate products will instead be loaded directly into ocean going bulk carriers of 30,000 to 70,000 dead weight tonne misplacement. Port facilities for unloading these vessels in San Francisco and elsewhere in California is an important issue and we are currently focusing considerable effort to secure appropriate dock facilities in the target markets.

David: There are other public companies in this field, what can you say about them and their stock performance?

John: Polaris Minerals Corp., which has recently done an underwriting,

is probably the most similar to Ascot. They raised over a $100 million and are currently trading around $5.00. We think our project is simpler and less capital intensive.

David: There is going to be a need for Ascot Resources sooner or later to raise some money. How much is it going to take to get you to the level you hope to be and how much material do you hope to ship a year?

John: Ascot is going to require $US 25 million to put this project into production on a contractor operated basis. Payback is expected to be 3.4 years. We anticipate shipping 1.5 million tonnes in the first full year and increasing to 3.3 million tonnes by the 3rd year.

David: On this kind of volume of business, what kind of revenue and profits can you envision for down the road?

John: Based on product price of $15.43/tonne and a 3.3 million tonne/year production rate, pre-tax cash flow would be approximately $US 13 million. However this project is very sensitive to operating costs and sales prices. With a likely continued upward pressure on sales price because of the shortage of gravel in the costal areas of California, this project has excellent upside potential as illustrated by the price sensitivity table from our Pre-Feasibility report.

David: Of course, the question we always have to ask is what can go

wrong? Do you worry about recession, or manpower shortage, or lack of

barge?

John: The biggest hurdle to overcome is to secure contracts for product sales, and required port facilities. Ascot is currently working on this, but as of yet does not have any letters of intent or supply contracts signed. Aggregate is a commodity, and thus will be affected by price changes due to supply and demand.

Aggregates Manager magazine reports year-to-date price increases for 13.1% for sand and 12.8% for gravel for the period July 2004 through July 2005. Since new supply close to coastal markets is not likely to come on stream, and costs of transporting aggregate from inland sources are likely to rise due to increased fuel costs and ever increasing road congestion, shipping product to coastal markets should remain competitive. The northwest corner of British Columbia is still economically depressed, and currently there is a good supply of able workers. Shipping prices have decreased from their recent highs, and supply and demand should keep shipping prices competitive over the long term.

David: With the current resources available at Swamp Point, how many

years’ reserves do you think you currently have?

John: The Pre-Feasibility study was based on a 45.8 million

tonne Measured Resource of sand and gravel, which would result in a 15 year mine life based on 3.3 million tonnes per year. Opportunities exist for increasing the resource. There is additional material on the north and east sides of the pit designed for the Pre-Feasibility

Study.

David: Let's pretend you were a stock analyst, what would be the important factors and what kind of a price target can you see down the road?

John: The important factors are completing the Environmental

Assessment, securing permits and securing a sales contract or letter of intent.

Our efforts to complete the Environmental Assessment are going well and we expect to have permits in hand by the middle of this year. We are actively working on the product sales front. As for a price target down the road, I think it’s too early to speculate. A lot would depend on the outlook for the price of gravel.

David: John, you've been in everything from Stikine decades

ago to horse racing lately, can you fill us in as to what you've been doing over the few years in between?

John: I guess Stikine was a decade ago. I have stayed in the mineral exploration business through Ascot and two other companies and this is the most encouraging project we’ve seen since Stikine.

If you would like to receive a copy of David Pescod's Late Edition please contact either of the following:

Debbie Lewis at (780) 408-1748, email debbie_lewis@canaccord.com

Sandra Wicks at (780) 408-1749, email sandra_wicks@canaccord.com

Es könnte heute etwas gehen. Nur 13.000 Stück gehandelt, das ask scheint ziemlich dünn zu sein, jetzt schon bei .32 CAN.

Vielleicht News?

Vielleicht News?

Antwort auf Beitrag Nr.: 33.355.919 von Senfsocke am 13.02.08 16:06:25Ja, so langsam kommt in Kanada wieder Kaufinteresse auf...hoffen wir einmal das es so weitergeht.

Aus dem InvestorVillage board:

Atrox here:

I posted this on SH in response to Cindylou's post.

"Your sources are indeed accurate.

Representaives from Athabasca Minerals Inc. (ABM:V) based out of Edmonton held meetings at HBK's head office.

I spoke personally with Dom Kriangkum, President and CEO of ABM and he confirmed that they have begun initial discussions to become the pit operator.

A little bit of haggling and Jake might fit another piece into the puzzle."

Atrox

Es sieht also so aus als ob Highbank den Betrieb der Mine outsourcen will. Ein Vertragsabschluss hier würde dem Kurs sicher Beine machen. Allein die lump sum Einmalzahlung dürfte in der Höhe der jetzigen Marktkapitalisierung liegen (6,5 Mio C$)

Atrox here:

I posted this on SH in response to Cindylou's post.

"Your sources are indeed accurate.

Representaives from Athabasca Minerals Inc. (ABM:V) based out of Edmonton held meetings at HBK's head office.

I spoke personally with Dom Kriangkum, President and CEO of ABM and he confirmed that they have begun initial discussions to become the pit operator.

A little bit of haggling and Jake might fit another piece into the puzzle."

Atrox

Es sieht also so aus als ob Highbank den Betrieb der Mine outsourcen will. Ein Vertragsabschluss hier würde dem Kurs sicher Beine machen. Allein die lump sum Einmalzahlung dürfte in der Höhe der jetzigen Marktkapitalisierung liegen (6,5 Mio C$)

noch jemand investiert?

Bin am Freitag komplett raus. Habe umgeschichtet.

Hier kommen keine News!

Viel Glück!

Hier kommen keine News!

Viel Glück!

bin schon länger raus hier,denk auch das die news nicht kommen.allen investierten noch viel glück!!

Ich warte noch - jezt zu verkaufen wäre voreilig denke ich.

Der Business Case ist nach wie vor attraktiv.

Der Business Case ist nach wie vor attraktiv.

Antwort auf Beitrag Nr.: 33.705.303 von RiscTec am 21.03.08 16:17:35News from Canada NewsWire

Market Regulation Services - Trading Halt - Highbank Resources Ltd. - HBK

12:53 EDT Thursday, May 08, 2008

VANCOUVER, May 8 /CNW/ - The following issues have been halted by Market Regulation Services (RS):

Issuer Name: Highbank Resources Ltd.

TSX-V Ticker Symbol: HBK

Time of Halt: 12:43 ET

Reason for Halt: Pending News

For further information: contact - RS Inquiries (416) 646-7299 - * Please note that RS is not able to provide any additional information regarding a specific trading halt. Information is limited to general enquiries only.

Trading halt war schon gestern, was soll da kommen. Bin wieder eingestiegen vor dem Halt.

Market Regulation Services - Trading Halt - Highbank Resources Ltd. - HBK

12:53 EDT Thursday, May 08, 2008

VANCOUVER, May 8 /CNW/ - The following issues have been halted by Market Regulation Services (RS):

Issuer Name: Highbank Resources Ltd.

TSX-V Ticker Symbol: HBK

Time of Halt: 12:43 ET

Reason for Halt: Pending News

For further information: contact - RS Inquiries (416) 646-7299 - * Please note that RS is not able to provide any additional information regarding a specific trading halt. Information is limited to general enquiries only.

Trading halt war schon gestern, was soll da kommen. Bin wieder eingestiegen vor dem Halt.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,05 | |

| -1,25 | |

| -1,08 | |

| -8,89 | |

| -12,00 | |

| -6,44 | |

| 0,00 | |

| +13,33 | |

| 0,00 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 212 | ||

| 116 | ||

| 101 | ||

| 85 | ||

| 77 | ||

| 46 | ||

| 44 | ||

| 41 | ||

| 32 | ||

| 30 |