Geothermie- Der neue Megatrend !? - 500 Beiträge pro Seite

eröffnet am 14.12.07 17:14:30 von

neuester Beitrag 01.04.11 12:26:38 von

neuester Beitrag 01.04.11 12:26:38 von

Beiträge: 251

ID: 1.136.374

ID: 1.136.374

Aufrufe heute: 0

Gesamt: 55.650

Gesamt: 55.650

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 44 Minuten | 10970 | |

| vor 1 Stunde | 8118 | |

| vor 46 Minuten | 5015 | |

| gestern 21:42 | 4159 | |

| gestern 22:15 | 3769 | |

| vor 1 Stunde | 3617 | |

| vor 1 Stunde | 2846 | |

| vor 1 Stunde | 2727 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.075,00 | +0,33 | 240 | |||

| 2. | 2. | 1,3800 | -1,43 | 107 | |||

| 3. | 3. | 0,1890 | -2,58 | 82 | |||

| 4. | 4. | 172,31 | +6,28 | 78 | |||

| 5. | 5. | 9,3325 | -3,69 | 75 | |||

| 6. | 6. | 7,0010 | +4,17 | 53 | |||

| 7. | 7. | 22,240 | -3,22 | 41 | |||

| 8. | 8. | 0,0160 | -24,17 | 38 |

Hallo an Alle!

Seit mehreren Monaten beschäftige ich mich intensiv mit dem Thema Geothermie. Ich muss sagen diese Art der Energiegewinnung ist mehr als beeindruckend. Ich denke in Zukunft wird Geothermie eine so große Rolle spielen ,wie heute die Sonnenenergie.

Was heißt das alles jetzt für uns Anleger:

Wir können frühzeitig diesen Trend erkennen und damit Geld verdienen. Ich denke da vor Allem an Aktien , hab aber auch noch keinen Favoriten(es gibt ja auch noch nicht allzu viele Firmen, die börsennotiert sind).

, hab aber auch noch keinen Favoriten(es gibt ja auch noch nicht allzu viele Firmen, die börsennotiert sind).

In diesem Thread sind alle dazu eingeladen, über Gheotermie und ihre Geothermie-Aktien zu posten.

Gruß HuskyEnergy

Seit mehreren Monaten beschäftige ich mich intensiv mit dem Thema Geothermie. Ich muss sagen diese Art der Energiegewinnung ist mehr als beeindruckend. Ich denke in Zukunft wird Geothermie eine so große Rolle spielen ,wie heute die Sonnenenergie.

Was heißt das alles jetzt für uns Anleger:

Wir können frühzeitig diesen Trend erkennen und damit Geld verdienen. Ich denke da vor Allem an Aktien

, hab aber auch noch keinen Favoriten(es gibt ja auch noch nicht allzu viele Firmen, die börsennotiert sind).

, hab aber auch noch keinen Favoriten(es gibt ja auch noch nicht allzu viele Firmen, die börsennotiert sind).In diesem Thread sind alle dazu eingeladen, über Gheotermie und ihre Geothermie-Aktien zu posten.

Gruß HuskyEnergy

Welche notierten Unternehmen gibt es denn überhaupt, welche haben die besten Chancen?

Es gibt ,so weit ich sie gefunden habe:

Western Geopower,Geodynamics, Ormat Technologies, Enro, Nibe Industries,..

Aber allzu viele mehr kenn ich auch noch nicht, möchte sie aber kennen lernen

Gruß HuskyEnergy

Western Geopower,Geodynamics, Ormat Technologies, Enro, Nibe Industries,..

Aber allzu viele mehr kenn ich auch noch nicht, möchte sie aber kennen lernen

Gruß HuskyEnergy

Hey HuskyEnergy!,

Gefällt mir ja gut.

Vor lauter "Megatrends", aussichtsreichen Technologien,

Unternehmen... und dergleichen, fällts einem -mir zumindest-

ja schon schwer, einigermassen den Überblick zu behalten

-oder erstmal zu bekommen.

Genau deswegen hab ich mir auch vorgenommen, nach Rohstoffunternehmen

mich dann möglichst auch an Geothermie ranzutasten.

Weil Du Dich ja schon einige Zeit damit beschäftigt hast

-kannst Du da vielleicht einige gute Quellen nennen??,

Websites, wie vor alle auch Literatur.

Schon mit einem guten fachlichen Einblick, aber nicht

zu endlos, unnötig lang.

Die besagten Unternehmen sind ingesamt sicherlich nicht schlecht

(nur teils vom hörensagen), aber wenn man es schon etwas spekulativ, dafür noch chancenorientierter angehen will,

denke ich, muss man viel mehr international "überall und nirgendwo,

in allen Nischen und Ecken" versuchen zu stöbern.

Da findet man viele viele interessante, vor allem kleinere

(wenn das für einen auch in Frage kommt) Unternehmen.

Zwei, die mir sehr interessant erschienen, waren:

-Petratherm Ltd., AU000000PTR5 und

-Hot Rock Ltd., AU000000HRL9

Aber wie gesagt -unter der Berücksichtigung,

daß ich in der Richtung auch noch nicht allzugroße

Einblicke habe -interessant halt.

Popeye

Gefällt mir ja gut.

Vor lauter "Megatrends", aussichtsreichen Technologien,

Unternehmen... und dergleichen, fällts einem -mir zumindest-

ja schon schwer, einigermassen den Überblick zu behalten

-oder erstmal zu bekommen.

Genau deswegen hab ich mir auch vorgenommen, nach Rohstoffunternehmen

mich dann möglichst auch an Geothermie ranzutasten.

Weil Du Dich ja schon einige Zeit damit beschäftigt hast

-kannst Du da vielleicht einige gute Quellen nennen??,

Websites, wie vor alle auch Literatur.

Schon mit einem guten fachlichen Einblick, aber nicht

zu endlos, unnötig lang.

Die besagten Unternehmen sind ingesamt sicherlich nicht schlecht

(nur teils vom hörensagen), aber wenn man es schon etwas spekulativ, dafür noch chancenorientierter angehen will,

denke ich, muss man viel mehr international "überall und nirgendwo,

in allen Nischen und Ecken" versuchen zu stöbern.

Da findet man viele viele interessante, vor allem kleinere

(wenn das für einen auch in Frage kommt) Unternehmen.

Zwei, die mir sehr interessant erschienen, waren:

-Petratherm Ltd., AU000000PTR5 und

-Hot Rock Ltd., AU000000HRL9

Aber wie gesagt -unter der Berücksichtigung,

daß ich in der Richtung auch noch nicht allzugroße

Einblicke habe -interessant halt.

Popeye

Schaut mal in den Western Geopower Thread, dort sind auch sehr viele Quellen genannt....

Hallo Popeye!

Ja,auf http://de.wikipedia.org/wiki/Geothermie kannst du dich mal grundsätzlich informieren, was Geothermie im Genaueren ist, welche Länder Geothermie nutzen, usw..

Ja kleinere Firmen haben sicherlich mehr Potenzial,Hot Rock und vor Allem Petraterm sind interresant.

Schönes Wochende HuskyEnergy

Ja,auf http://de.wikipedia.org/wiki/Geothermie kannst du dich mal grundsätzlich informieren, was Geothermie im Genaueren ist, welche Länder Geothermie nutzen, usw..

Ja kleinere Firmen haben sicherlich mehr Potenzial,Hot Rock und vor Allem Petraterm sind interresant.

Schönes Wochende HuskyEnergy

Ganz vergessen: Natürlich gibt es da ja noch den deutsche Börsenneuling Daldrup&Söhne

Sierra Geothermal Power, CA82631N1042

www.sierrageopower.com

Wurden neulich in Frankfurt und Berlin gelistet,

mehr weiss ich nicht dazu

-nur im Sinne einer weiteren Option,

vielleicht ists ja was?!

www.sierrageopower.com

Wurden neulich in Frankfurt und Berlin gelistet,

mehr weiss ich nicht dazu

-nur im Sinne einer weiteren Option,

vielleicht ists ja was?!

Antwort auf Beitrag Nr.: 32.871.985 von Popeye82 am 26.12.07 16:10:07Kein schlechter Tipp von dir, danke

Seit IPO sehr gut gelaufen...

Ja richtig in Frankfurt und Berlin gelistet nur halt sehr wenig Volumen

Homepage hab ich mal schnell überflogen, schaut ja nicht schlecht aus, man müsste sich durch die jahresberichte durchlesen, um infos und kennzahlen zu bekommen

Seit IPO sehr gut gelaufen...

Ja richtig in Frankfurt und Berlin gelistet nur halt sehr wenig Volumen

Homepage hab ich mal schnell überflogen, schaut ja nicht schlecht aus, man müsste sich durch die jahresberichte durchlesen, um infos und kennzahlen zu bekommen

Wär schon wenn du Zeit hast und weitere Unternehmen "entdecken" könntest

Frage: Wie hast du Sierra Power gefunden? Gegoogelt?

Frage: Wie hast du Sierra Power gefunden? Gegoogelt?

Das war über eine eingegangene Mail,

in der recht viele zuletzt bei uns frisch gelistete

Unternehmen aufgeführt wurden.

also wenn ich bei dkb.de es mal einfach mit "Geothermal" versuche,

dann erscheinen da neben den schon genannten noch:

-Geothermal Resources Ltd., AU000000GHT5

www.geothermal-resources.com.au

-Nevada Geothermal Power Inc., CA64127M1059

www.nevadageothermal.com

(die dürften wohl einigen ein Begriff sein)

-Panax Geothermal Ltd., AU000000PAX3 www.panaxgeothermal.com.au

-Kentor Gold Ltd., AU000000KGL6,

www.kentorgold.com.au

(eigentlich ein Rohstoffexplorationsunternehmen,

meine aber mich dranerinnern zu können, daß die auch Absichten

in Richtung Geothermie hatten)

-Polaris Geothermal Inc., CA7310631030

www.polarisgeothermal.com

-U.S. Geothermal Inc., US90338S1024

www.usgeothermal.com

Ich glaube, ich hab da aber schon einige mehr gesehen,

versuch das nochmal zusammenzusuchen.

in der recht viele zuletzt bei uns frisch gelistete

Unternehmen aufgeführt wurden.

also wenn ich bei dkb.de es mal einfach mit "Geothermal" versuche,

dann erscheinen da neben den schon genannten noch:

-Geothermal Resources Ltd., AU000000GHT5

www.geothermal-resources.com.au

-Nevada Geothermal Power Inc., CA64127M1059

www.nevadageothermal.com

(die dürften wohl einigen ein Begriff sein)

-Panax Geothermal Ltd., AU000000PAX3 www.panaxgeothermal.com.au

-Kentor Gold Ltd., AU000000KGL6,

www.kentorgold.com.au

(eigentlich ein Rohstoffexplorationsunternehmen,

meine aber mich dranerinnern zu können, daß die auch Absichten

in Richtung Geothermie hatten)

-Polaris Geothermal Inc., CA7310631030

www.polarisgeothermal.com

-U.S. Geothermal Inc., US90338S1024

www.usgeothermal.com

Ich glaube, ich hab da aber schon einige mehr gesehen,

versuch das nochmal zusammenzusuchen.

Antwort auf Beitrag Nr.: 32.880.366 von Popeye82 am 27.12.07 16:28:03Ich finde auch nur die die zu aufgezählt hast, trotzdem danke für den Tipp. besonders gut gefallen mir Western Geopower und U:S: Geothermal

besonders gut gefallen mir Western Geopower und U:S: Geothermal

Was sind denn deine Favoriten?

besonders gut gefallen mir Western Geopower und U:S: Geothermal

besonders gut gefallen mir Western Geopower und U:S: Geothermal

Was sind denn deine Favoriten?

So, ich werd mal versuchen in den nächsten Tagen und Wochen den Thread

einiges zu erweitern.

Als erstes wollte ich eigentlich mal eine ganz grundsätzliche Definition von Geothermie

reinstellen, aber nachdem ich bei Wikipedia geguckt hab, lass ichs erstmal

-dann wär der Thread mit einem Mal 10 Seiten länger.

Ich wird mal versuchen selber was zusammenbasteln.

Nach ein paar Sachen, die ich mir die letzten Tage durchgelesen habe,

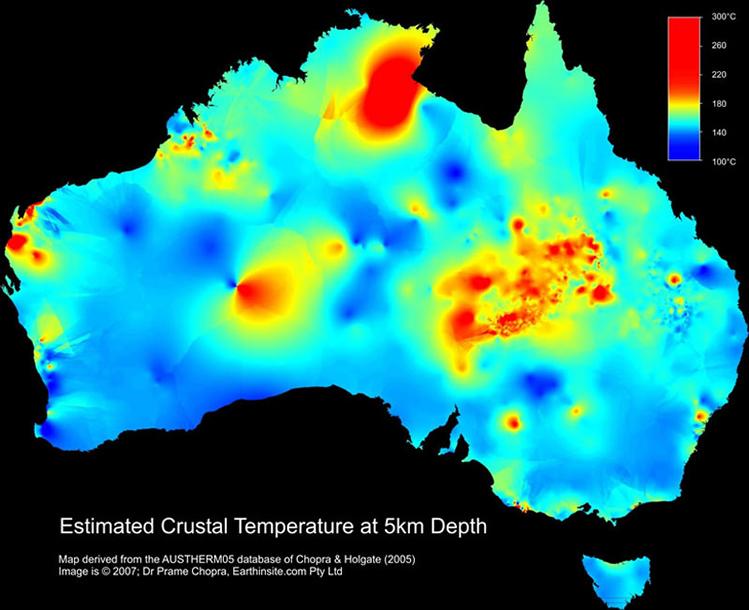

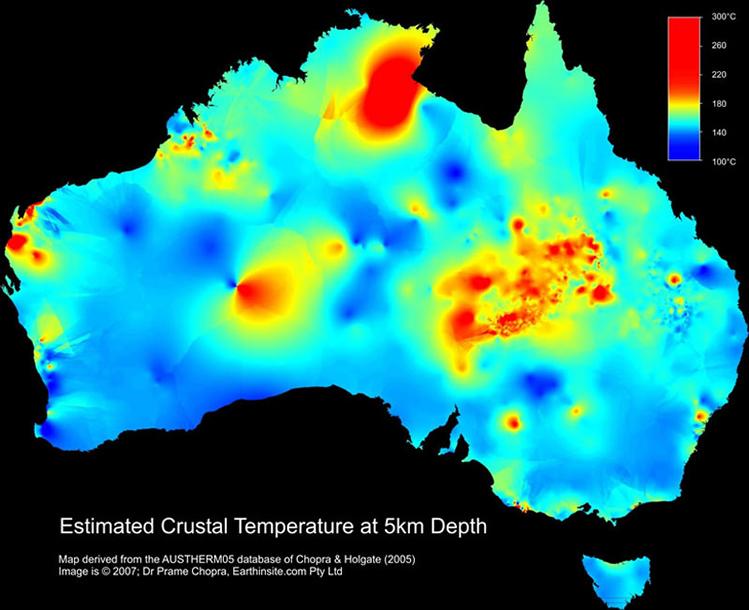

scheinen mir in Sachen Geothermie Australien (wenn nicht sogar das interssanteste Land diesbezüglich schlechthin?!?), Island und Indonesien sehr sehr interessant.

einiges zu erweitern.

Als erstes wollte ich eigentlich mal eine ganz grundsätzliche Definition von Geothermie

reinstellen, aber nachdem ich bei Wikipedia geguckt hab, lass ichs erstmal

-dann wär der Thread mit einem Mal 10 Seiten länger.

Ich wird mal versuchen selber was zusammenbasteln.

Nach ein paar Sachen, die ich mir die letzten Tage durchgelesen habe,

scheinen mir in Sachen Geothermie Australien (wenn nicht sogar das interssanteste Land diesbezüglich schlechthin?!?), Island und Indonesien sehr sehr interessant.

wenn die erste fa. aus bayern an die börse geht bin ich dabei

bisher haben aber die bayerischen kommunen schneller geschaltet

der gesamte süddeutsche raum hat sehr gute zapfmöglichkeiten!!!!

theak

bisher haben aber die bayerischen kommunen schneller geschaltet

der gesamte süddeutsche raum hat sehr gute zapfmöglichkeiten!!!!

theak

Hab doch noch ein paar mehr gefunden,

mach mal eine kleine „Bestandsaufnahme“ +die bisher genannten:

(wird nicht ganz kurz)

-Green Rock Energy

-Eden Energy

-KUTh Energy

-Torrens Energy

-PNOC Energy Development

Noch nicht gelistete, oder wo ich mir da nicht ganz sicher bin:

-Osiris Energy (noch privat??)

-Geogen (Victoria)

-Greenearth Energy (IPO müsste in ein paar Tagen ausstehen -10. Januar??- , wenn ich mir die Website anschaue, ist da von Geothermie nichts zu erkennen, meine aber die in dem Zusammenhang irgendwo aufgeführt gesehen zu haben, wenns nicht hinhaut nehm ich die wieder raus)

Die bisher schon genannten:-Western Geopower

-Ormat Technologies

-Enro AG (??)

-Petratherm

-Hot Rock

-Geothermal Resources

-Panax Geothermal

-Nibe Industrier (??)

-Sierra Geothermal Power

-Nevada Geothermal Power

-Kentor Gold (gehört wohl nur mit zu den Vorhaben)

-Polaris Geothermal Power

-US Geothermal

-Daldrup&Söhne

-Geodynamics

mach mal eine kleine „Bestandsaufnahme“ +die bisher genannten:

(wird nicht ganz kurz)

-Green Rock Energy

-Eden Energy

-KUTh Energy

-Torrens Energy

-PNOC Energy Development

Noch nicht gelistete, oder wo ich mir da nicht ganz sicher bin:

-Osiris Energy (noch privat??)

-Geogen (Victoria)

-Greenearth Energy (IPO müsste in ein paar Tagen ausstehen -10. Januar??- , wenn ich mir die Website anschaue, ist da von Geothermie nichts zu erkennen, meine aber die in dem Zusammenhang irgendwo aufgeführt gesehen zu haben, wenns nicht hinhaut nehm ich die wieder raus)

Die bisher schon genannten:-Western Geopower

-Ormat Technologies

-Enro AG (??)

-Petratherm

-Hot Rock

-Geothermal Resources

-Panax Geothermal

-Nibe Industrier (??)

-Sierra Geothermal Power

-Nevada Geothermal Power

-Kentor Gold (gehört wohl nur mit zu den Vorhaben)

-Polaris Geothermal Power

-US Geothermal

-Daldrup&Söhne

-Geodynamics

Werde mal versuchen die nächste Zeit vielleicht die Liste

weiter beizubehalten, allerdings noch ein paar ergänzende

Informationen hinzuzufügen.

Möglichst nicht zuviel, aber auch nicht zuwenig,

ein klein bisschen an den "Solarfavoriten-Thread 2008" vielleicht.

Wenn ich mir die Titel mal so einzeln anschaue muss ich sagen,

scheinen mir die doch die letzten 1, 2 Jahre

-und speziell zuletzt- gesamt doch absolut stark performt zu haben.

Ich würde meinen, der "Startschuss"dürfte langsam gefallen sein,

noch kann man frühzeitig dabeisein.

Ich würde mal einfach behaupten:

Wenn man die Titel alle als eine Art Fonds zusammentun würde,

dann dürften längerfristig -vielleicht 3-5 Jahre-

eine beeindruckende Performance zu Buche stehen

-und man viele andere Fonds damit schlagen.

Mal einfach als persönliche Hypothese.

Welche Titel mir am besten gefallen weiss ich

-noch- ich wirklich, hatte ja auch eingangs gesagt,

daß ich da keinerlei Erfahrung habe,

kann nur sagen, daß sich für mich Hot Rock +Petratherm wirklich interessant angehört haben -aber da dürften noch einige andere dabeisein.

Ich seh das erstmal als Anfang,

glaub das wird noch eine ganze Ecke umfangreicher werden.

weiter beizubehalten, allerdings noch ein paar ergänzende

Informationen hinzuzufügen.

Möglichst nicht zuviel, aber auch nicht zuwenig,

ein klein bisschen an den "Solarfavoriten-Thread 2008" vielleicht.

Wenn ich mir die Titel mal so einzeln anschaue muss ich sagen,

scheinen mir die doch die letzten 1, 2 Jahre

-und speziell zuletzt- gesamt doch absolut stark performt zu haben.

Ich würde meinen, der "Startschuss"dürfte langsam gefallen sein,

noch kann man frühzeitig dabeisein.

Ich würde mal einfach behaupten:

Wenn man die Titel alle als eine Art Fonds zusammentun würde,

dann dürften längerfristig -vielleicht 3-5 Jahre-

eine beeindruckende Performance zu Buche stehen

-und man viele andere Fonds damit schlagen.

Mal einfach als persönliche Hypothese.

Welche Titel mir am besten gefallen weiss ich

-noch- ich wirklich, hatte ja auch eingangs gesagt,

daß ich da keinerlei Erfahrung habe,

kann nur sagen, daß sich für mich Hot Rock +Petratherm wirklich interessant angehört haben -aber da dürften noch einige andere dabeisein.

Ich seh das erstmal als Anfang,

glaub das wird noch eine ganze Ecke umfangreicher werden.

an dem "Solarfavoriten-Thread 2008" orientiert, meinte ich.

Vielleicht müssen auch noch 1, 2 rausgenommen werden,

bin mir nicht ganz sicher, ob die alle wirklich in die Kategorie fallen.

-Wenn, vielleicht mal was sagen!

Zusätzlich vielleicht noch:

-derzeitige Bewertung

-eventuell kurze perönliche Einschätzung

-Anzahl der Projekte, größe der Gebiete

-vielleicht auch ab irgendeinem Zeitpunkt mal eine Art

Depot aufmachen +die somit von der Entwicklung,

perfomancetechnisch unter Beobachtung nehmen

Sowas in der Art vielleicht, wenn Ihr da Ideen habt

-einfach posten.

Das wars jetzt glaub ich erstmal.

Vielleicht müssen auch noch 1, 2 rausgenommen werden,

bin mir nicht ganz sicher, ob die alle wirklich in die Kategorie fallen.

-Wenn, vielleicht mal was sagen!

Zusätzlich vielleicht noch:

-derzeitige Bewertung

-eventuell kurze perönliche Einschätzung

-Anzahl der Projekte, größe der Gebiete

-vielleicht auch ab irgendeinem Zeitpunkt mal eine Art

Depot aufmachen +die somit von der Entwicklung,

perfomancetechnisch unter Beobachtung nehmen

Sowas in der Art vielleicht, wenn Ihr da Ideen habt

-einfach posten.

Das wars jetzt glaub ich erstmal.

Central Petroleum, möchten sich da demnächst auch engagieren.

Die gefallen mir so gut, daß ich die demnächst vorstellen möchte.

-Glass Earth

-Medco Energi International

Die gefallen mir so gut, daß ich die demnächst vorstellen möchte.

-Glass Earth

-Medco Energi International

Danke Popeye, für deine Mühe!

Diie Idee find ich gut, mit den "Solarfavoriten 2008", hoffe da kommt was zu stande Interresant wären Marktk., KGV, usw obwohl ich natürlich weiß, dass bei so marktengen Aktien, es sehr schwer ist, diese Kennzahlen herauszufinden.

Interresant wären Marktk., KGV, usw obwohl ich natürlich weiß, dass bei so marktengen Aktien, es sehr schwer ist, diese Kennzahlen herauszufinden.

Australien gefällt mir als Land auch sehr gut, ich schau mir jetzt erstmal deine genannten Firmen etwas genauer an

Natürlich würde ich dich bei der Tabelle unterstützten

HuskyEnergy

Diie Idee find ich gut, mit den "Solarfavoriten 2008", hoffe da kommt was zu stande

Interresant wären Marktk., KGV, usw obwohl ich natürlich weiß, dass bei so marktengen Aktien, es sehr schwer ist, diese Kennzahlen herauszufinden.

Interresant wären Marktk., KGV, usw obwohl ich natürlich weiß, dass bei so marktengen Aktien, es sehr schwer ist, diese Kennzahlen herauszufinden.Australien gefällt mir als Land auch sehr gut, ich schau mir jetzt erstmal deine genannten Firmen etwas genauer an

Natürlich würde ich dich bei der Tabelle unterstützten

HuskyEnergy

Also ich werde jetzt in fünf Aktien investieren, sozusagen mein eigener "Fonds".

Ich werde mir mal alle Firmen anschauen, und dann eine Entscheídung treffen

Ich werde mir mal alle Firmen anschauen, und dann eine Entscheídung treffen

Antwort auf Beitrag Nr.: 33.029.998 von HuskyEnergy am 12.01.08 17:49:50

...das würd mich "brennend" interessieren! Herzl.Gruss Via.!

...das würd mich "brennend" interessieren! Herzl.Gruss Via.!

Antwort auf Beitrag Nr.: 33.033.672 von VIALUXX am 13.01.08 13:26:39Hi VIA,

Am besten gefallen mir nach intensiven Nachforschen der Marktführer Ormar Technologies, WGP,Petraterm, Sierra Ge. Power und Daldrup.

Das Problem, bei den kleineren Firmen, (also praktisch alle bis auf Daldrup und Ormat) ist, dass sie im Moment noch keine Gewinne machen, aber das kommt schon noch !

Gruß HuskyEnergy

Am besten gefallen mir nach intensiven Nachforschen der Marktführer Ormar Technologies, WGP,Petraterm, Sierra Ge. Power und Daldrup.

Das Problem, bei den kleineren Firmen, (also praktisch alle bis auf Daldrup und Ormat) ist, dass sie im Moment noch keine Gewinne machen, aber das kommt schon noch !

Gruß HuskyEnergy

Antwort auf Beitrag Nr.: 33.033.933 von HuskyEnergy am 13.01.08 14:40:15

...danke HuskyEnergy für die prompte Antwort.

...danke HuskyEnergy für die prompte Antwort.

Hallo,

Also ich hab jetzt mal eine Watchlist angelegt zu den genannten Werten. Nicht dabei sind Enro (is nur ein Energieversorger und Nibe, da hab ich mich auch geirrt. Geodynamics kann man nur in Amerika handeln, also auch nicht dabei)

Hier der Link:

http://www.wallstreet-online.de/watchlist/watchlist-detail.h…

Schaun wir mal ob, und wie dieses "Depot" den Markt schlagen kann.

Viele Grüße und ein schönes Wochenende

Husky

Also ich hab jetzt mal eine Watchlist angelegt zu den genannten Werten. Nicht dabei sind Enro (is nur ein Energieversorger und Nibe, da hab ich mich auch geirrt. Geodynamics kann man nur in Amerika handeln, also auch nicht dabei)

Hier der Link:

http://www.wallstreet-online.de/watchlist/watchlist-detail.h…

Schaun wir mal ob, und wie dieses "Depot" den Markt schlagen kann.

Viele Grüße und ein schönes Wochenende

Husky

Antwort auf Beitrag Nr.: 33.100.774 von HuskyEnergy am 18.01.08 19:46:01Der Link führt auf meine eigene Watchlist bei w:o.

Oder sind die beiden etwa identisch?!

Oder sind die beiden etwa identisch?!

Antwort auf Beitrag Nr.: 33.102.298 von lieberlong am 18.01.08 22:16:12Nein der zweite müsste stimmen, der erste ist von mir nicht absichtlich eingefügt worden..

Drück mal auf den zweiten, das solte gehen

Drück mal auf den zweiten, das solte gehen

Antwort auf Beitrag Nr.: 33.102.318 von HuskyEnergy am 18.01.08 22:17:56Wo ist denn der zweite

Antwort auf Beitrag Nr.: 33.102.565 von lieberlong am 18.01.08 22:57:18OK, ich probiers nochmal:

http://www.wallstreet-online.de/watchlist/watchlist-detail.h…

Und der Link führt zu deiner Watchlist?

Gruß

http://www.wallstreet-online.de/watchlist/watchlist-detail.h…

Und der Link führt zu deiner Watchlist?

Gruß

Antwort auf Beitrag Nr.: 33.103.444 von HuskyEnergy am 19.01.08 09:22:27Das wird nichts. Kann glaube ich auch gar nicht funktionieren

Erdwärme als Geldanlage

von Christoph Lützenkirchen

Nach Windenergie und Solarstrom ist eine dritte Form der erneuerbaren Energien an der Börse angekommen: Geothermie. Mit Erdwärme lassen sich Kraftwerke betreiben und Häuser heizen.

Bestes Beispiel ist der Kavaliersstart des Börsenneulings Daldrup & Söhne. Die Aktien des Bohrtechnikspezialisten aus dem westfälischen Ascheberg wurden am 30. November für 13,50 Euro ausgegeben, am 4. Januar erreichte die Aktie 33,20 Euro. Seither hat sich der Kurs zwar korrigiert, doch das Plus seit dem Börsengang beträgt immer noch fast 75 Prozent.

"So ein Potenzial hatten wir noch nie vor Augen", sagt Vorstand Josef Daldrup. Das mittelständische Unternehmen gibt es seit 60 Jahren, früher beschäftigte es sich vor allem mit Bohrungen für den Brunnenbau oder die Rohstoffsuche.

Laut Daldrup sind allein in Bayern aktuell 100 Bohrstandorte für Geothermie bewilligt, bis vor einem halben Jahr seien es rund 60 gewesen. Wesentliches Investitionshemmnis sei bisher das sogenannte Fündigkeitsrisiko gewesen. Jede Bohrung kostet meist weit über 1 Mio. Euro. Im Idealfall stößt der Bohrer auf große Mengen heißen Wassers, im schlechtesten Fall bleibt das Loch trocken. Die bundeseigene Förderbank KfW Bankengruppe nimmt den Betreibern dieses Risiko seit Anfang des Jahres fast vollständig ab. "Das geht aus den Richtlinien zur Förderung von Maßnahmen zur Nutzung erneuerbarer Energien im Wärmemarkt hervor", sagt Daldrup. Allerdings müssten diese Richtlinien noch von der Europäischen Kommission genehmigt werden. Daldrup ist überzeugt: "Es wird ein riesiger Schub kommen. Auch die Großen wie Eon, EnBW und RWE steigen jetzt in den Markt ein."

Green Energy aus Hamburg hat schon zwei geschlossene Geothermiefonds initiiert. Der im Juli 2005 aufgelegte Geotherm Power Fonds soll über eine Laufzeit von zwölf Jahren durchschnittlich 7,42 Prozent Rendite jährlich erwirtschaften. Seit Mitte 2007 vertreibt Green Energy den Geotherm Opportunity Fonds, der bei einer Laufzeit von sechs Jahren jährlich zwölf Prozent Rendite bringen soll. Trotz der verbesserten Situation für Initiatoren geothermischer Kraftwerke ist unklar, ob die Fonds die versprochenen Gewinne realisieren werden: Nach einem Rechtsstreit um den ursprünglich gewählten Standort für die Kraftwerke hofft das Unternehmen auf ein Genehmigungsverfahren im bayerischen Peiting. "In Peiting könnten möglicherweise zwei Anlagen errichtet werden. Parallel bearbeiten wir weitere mögliche Standorte außerhalb Bayerns", sagt Geschäftsführer Matthias Michael.

In 30 Staaten sind nach Angaben des Branchenverbands GtV-BV derzeit über 250 Erdwärmekraftwerke mit einer Gesamtleistung von mehr als neun Gigawatt in Betrieb. "Das entspricht einer Leistung von circa sieben Atomkraftwerken", sagt GtV-Geschäftsführer Werner Bußmann. In Deutschland bieten sich für die geothermische Energieerzeugung die norddeutsche Tiefebene, der Oberrheingraben und das süddeutsche Molassebecken an.

Wenig Auswahl auf dem Kurszettel

Wer von einem möglichen Erfolg der Branche über den Kauf von Aktien profitieren will, hat auf dem deutschen Kurszettel wenig Auswahl. Robert Hauser, Leiter Nachhaltigkeitsresearch der Zürcher Kantonalbank (ZKB), verweist auf börsennotierte US-Unternehmen: "Am besten gefällt uns Ormat Technologies. Das Unternehmen hat viel Geothermie-Know-how und verdient mit der Technologie auch Geld", so der ZKB-Experte. Er rät zur Vorsicht gegenüber kleineren US-Unternehmen wie Nevada Geothermal oder Polaris Geothermal. Zwar könnten sie "positive Überraschungen bieten", sie seien aber zu stark von einzelnen Projekten abhängig. Das wichtigste Argument für die Branche sieht Hauser in der Grundlastfähigkeit: Die Kraftwerke können rund um die Uhr Strom liefern, unabhängig davon, ob der Wind weht oder die Sonne scheint.

Sven Olsson vom Stuttgarter Informationsdienstleister Axino sieht Western Geopower aus dem kanadischen Vancouver als aussichtsreich an. Das Unternehmen plant, auf dem seit 1960 genutzten Geothermiefeld "The Geysers" bei San Franscisco ein Kraftwerk mit mehr als 30 Megawatt Leistung zu bauen. "Die Bohrungen sind genehmigt", sagt Olsson. "Die isländischen Investoren Reykjavik Energy Invest, Geysir Green Energy und Glitnir haben sich bei Western Geopower eingekauft. Sie bringen Expertise mit." Für Western-Geo-Aktionäre verbindet sich damit die Hoffnung, dass die Aktie alte Höhen erreicht: Derzeit ist sie nur ein "Penny-Stock". Mehr als 1 Euro kostete sie letztmals 2004. Nicht nur dieses Beispiel zeigt die Risiken für Privatanleger: Die Branche ist von politischen Entscheidungen abhängig. Biodieselinvestoren wissen ein Lied davon zu singen, was es heißt, wenn die Politik eine Branche erst fördert - und ihr dann den Hahn zudreht.

Quelle:

von Christoph Lützenkirchen

Nach Windenergie und Solarstrom ist eine dritte Form der erneuerbaren Energien an der Börse angekommen: Geothermie. Mit Erdwärme lassen sich Kraftwerke betreiben und Häuser heizen.

Bestes Beispiel ist der Kavaliersstart des Börsenneulings Daldrup & Söhne. Die Aktien des Bohrtechnikspezialisten aus dem westfälischen Ascheberg wurden am 30. November für 13,50 Euro ausgegeben, am 4. Januar erreichte die Aktie 33,20 Euro. Seither hat sich der Kurs zwar korrigiert, doch das Plus seit dem Börsengang beträgt immer noch fast 75 Prozent.

"So ein Potenzial hatten wir noch nie vor Augen", sagt Vorstand Josef Daldrup. Das mittelständische Unternehmen gibt es seit 60 Jahren, früher beschäftigte es sich vor allem mit Bohrungen für den Brunnenbau oder die Rohstoffsuche.

Laut Daldrup sind allein in Bayern aktuell 100 Bohrstandorte für Geothermie bewilligt, bis vor einem halben Jahr seien es rund 60 gewesen. Wesentliches Investitionshemmnis sei bisher das sogenannte Fündigkeitsrisiko gewesen. Jede Bohrung kostet meist weit über 1 Mio. Euro. Im Idealfall stößt der Bohrer auf große Mengen heißen Wassers, im schlechtesten Fall bleibt das Loch trocken. Die bundeseigene Förderbank KfW Bankengruppe nimmt den Betreibern dieses Risiko seit Anfang des Jahres fast vollständig ab. "Das geht aus den Richtlinien zur Förderung von Maßnahmen zur Nutzung erneuerbarer Energien im Wärmemarkt hervor", sagt Daldrup. Allerdings müssten diese Richtlinien noch von der Europäischen Kommission genehmigt werden. Daldrup ist überzeugt: "Es wird ein riesiger Schub kommen. Auch die Großen wie Eon, EnBW und RWE steigen jetzt in den Markt ein."

Green Energy aus Hamburg hat schon zwei geschlossene Geothermiefonds initiiert. Der im Juli 2005 aufgelegte Geotherm Power Fonds soll über eine Laufzeit von zwölf Jahren durchschnittlich 7,42 Prozent Rendite jährlich erwirtschaften. Seit Mitte 2007 vertreibt Green Energy den Geotherm Opportunity Fonds, der bei einer Laufzeit von sechs Jahren jährlich zwölf Prozent Rendite bringen soll. Trotz der verbesserten Situation für Initiatoren geothermischer Kraftwerke ist unklar, ob die Fonds die versprochenen Gewinne realisieren werden: Nach einem Rechtsstreit um den ursprünglich gewählten Standort für die Kraftwerke hofft das Unternehmen auf ein Genehmigungsverfahren im bayerischen Peiting. "In Peiting könnten möglicherweise zwei Anlagen errichtet werden. Parallel bearbeiten wir weitere mögliche Standorte außerhalb Bayerns", sagt Geschäftsführer Matthias Michael.

In 30 Staaten sind nach Angaben des Branchenverbands GtV-BV derzeit über 250 Erdwärmekraftwerke mit einer Gesamtleistung von mehr als neun Gigawatt in Betrieb. "Das entspricht einer Leistung von circa sieben Atomkraftwerken", sagt GtV-Geschäftsführer Werner Bußmann. In Deutschland bieten sich für die geothermische Energieerzeugung die norddeutsche Tiefebene, der Oberrheingraben und das süddeutsche Molassebecken an.

Wenig Auswahl auf dem Kurszettel

Wer von einem möglichen Erfolg der Branche über den Kauf von Aktien profitieren will, hat auf dem deutschen Kurszettel wenig Auswahl. Robert Hauser, Leiter Nachhaltigkeitsresearch der Zürcher Kantonalbank (ZKB), verweist auf börsennotierte US-Unternehmen: "Am besten gefällt uns Ormat Technologies. Das Unternehmen hat viel Geothermie-Know-how und verdient mit der Technologie auch Geld", so der ZKB-Experte. Er rät zur Vorsicht gegenüber kleineren US-Unternehmen wie Nevada Geothermal oder Polaris Geothermal. Zwar könnten sie "positive Überraschungen bieten", sie seien aber zu stark von einzelnen Projekten abhängig. Das wichtigste Argument für die Branche sieht Hauser in der Grundlastfähigkeit: Die Kraftwerke können rund um die Uhr Strom liefern, unabhängig davon, ob der Wind weht oder die Sonne scheint.

Sven Olsson vom Stuttgarter Informationsdienstleister Axino sieht Western Geopower aus dem kanadischen Vancouver als aussichtsreich an. Das Unternehmen plant, auf dem seit 1960 genutzten Geothermiefeld "The Geysers" bei San Franscisco ein Kraftwerk mit mehr als 30 Megawatt Leistung zu bauen. "Die Bohrungen sind genehmigt", sagt Olsson. "Die isländischen Investoren Reykjavik Energy Invest, Geysir Green Energy und Glitnir haben sich bei Western Geopower eingekauft. Sie bringen Expertise mit." Für Western-Geo-Aktionäre verbindet sich damit die Hoffnung, dass die Aktie alte Höhen erreicht: Derzeit ist sie nur ein "Penny-Stock". Mehr als 1 Euro kostete sie letztmals 2004. Nicht nur dieses Beispiel zeigt die Risiken für Privatanleger: Die Branche ist von politischen Entscheidungen abhängig. Biodieselinvestoren wissen ein Lied davon zu singen, was es heißt, wenn die Politik eine Branche erst fördert - und ihr dann den Hahn zudreht.

Quelle:

Geldanlage & Börse Heißes Erdwasser fürs Depot

(PR-inside.com 20.01.2008 08:36:07)

München (AP) Wer sein Geld «grün» anlegen will, kann zunehmend in heißes Wasser aus den Tiefen der Erde investieren. Nach Solarstrom und Windenergie ist auch die Erdwärme, die Geothermie, als zusätzliche Form erneuerbarer Energien im Visier der Anleger. Mit dem heißen Wasser aus dem Erdinnern lassen sich Heizwärme und Strom erzeugen. Die junge Energieform gilt als Boombranche mit vielversprechender Zukunft.

Nach ersten erfolgreichen Börsengängen scheint es

verlockend, sich Aktien engagierter Geothermie-Spezialisten ins Depot zu legen. Ökologisches Alternativ-Investment: eine Beteiligung an geschlossenen Fonds zum Bau geothermischer Kraftwerke. «Wir raten von dem Nischenmarkt nicht grundsätzlich ab, warnen aber vor den enormen Risiken für Geldanleger», gibt Lothar Gries, Sprecher der Schutzgemeinschaft der Kapitalanleger (SdK) zu bedenken.

«Kluge Leute heizen mit der Erde», meint der Bundesverband Geothermie in einer Pressemitteilung. Kluge Investoren sollten nicht übereilt Geld in diesen jungen Markt stecken und es womöglich verheizen, mahnen Verbraucher- und Aktionärsschützer zur Besonnenheit. Die Ertragsmöglichkeiten seien selbst für Finanzprofis schwer einzuschätzen.

«Die Idee der Erdwärme klingt spannend, das mutet fast nach einer Lösung unseres Energieproblems an», sagt Roland Aulitzky von der Zeitschrift «Finanztest» der Stiftung Warentest. Für eine Geldanlage in Geothermie-Projekte oder -Aktientitel sei es aber noch zu früh. Ein finanzielles Engagement sei für den Durchschnittsinvestor hochspekulativ. «Das Risiko ist groß», findet auch Niels Nauhauser, Finanzexperte der Verbraucherzentrale Baden-Württemberg.

Grundsätzlich unbestritten ist, dass die Erde ein gigantisches Wärmereservoir darstellt. Anders als bei Solar- und Windkraft-Technologie ist ein Energiebezug völlig unabhängig von Tageszeit und Wetter. Um die Ressourcen zu nutzen, wird das heiße Wasser mit Hilfe von Pumpen nach oben gefördert, die Hitze wird auf Heizungssysteme und Warmwasser übertragen und das Wasser wieder nach unten in die Erde geleitet. Schon einen Kilometer unter der Erdoberfläche herrscht eine Temperatur von 40 bis 60 Grad Celsius.

Zur Stromerzeugung muss deutlich tiefer gebohrt werden, in Regionen, wo die Temperaturen höher als 100 Grad sind. Weltweit ist die umweltfreundliche Nutzung von Erdwärme nach Branchenangaben im Aufschwung. In Zeiten knapper Ressourcen sowie steigender Gas- und Ölpreise habe der Sektor glänzende Zukunftsaussichten, auch in Deutschland.

Zwtl: Bestes Investment: Geothermie-Heizung für daheim

Wer als Privatanleger von möglichen Wachstumssprüngen an den Wertpapiermärkten profitieren will, sollte sich intensiv mit der Materie und den beteiligten Unternehmen beschäftigen, rät Aulitzky. Die Vorstellung, mit Geothermie-Aktien oder -Fonds schnell reich werden zu können, sei in der Regel ein Trugschluss. Auch wenn an der Börse ökologische Themen schon seit längerem der Renner sind, Solaraktien spektakuläre Gewinne hatten und die Kurse in der Windkraftbranche ebenfalls in schwindelerregenden Höhen waren. «Wer kann schon beurteilen, ob der Kurs der Bohrtechnikfirma XY angemessen oder schon völlig überhitzt ist?», warnt Nauhauser. Börsennotierte US-Firmen seien noch schwieriger einzuschätzen als deutsche.

Auch eine Beteiligung an geschlossenen Geothermie-Fonds, die auf dem deutschen Markt zu haben sind, bergen Risiken. Investoren lassen sich auf Fonds-Laufzeiten von etwa 6 bis 12 Jahren ein. Ein vorzeitiger Ausstieg ist in der Regel nur unter großen Verlusten möglich. Außerdem sei das unternehmerische Risiko immens, warnt Aulitzky. Anleger haften bis zur Höhe ihrer Einlage für Verluste der Firma. Schlimmstenfalls ist das investierte Geld komplett weg.

Schwierig ist zudem, gute von schlecht geführte Fonds zu unterscheiden. Weil Geothermie-Produkte noch neu am Markt sind, kann kein Anbieter bisher aussagekräftige Leistungsbilanzen vorweisen. «Nicht locken lassen von Renditeversprechen von 12 Prozent jährlich», betont Gries. «Zweistellige Gewinnprognosen kann man kaum Glauben schenken.

Wer gern «grün» investieren will, solle sich eine neue Geothermie-Heizung fürs eigene Häuschen anschaffen, so Aulitzkys Tipp. «Das ist die ideale Investmentmöglichkeit.

Quelle:

(PR-inside.com 20.01.2008 08:36:07)

München (AP) Wer sein Geld «grün» anlegen will, kann zunehmend in heißes Wasser aus den Tiefen der Erde investieren. Nach Solarstrom und Windenergie ist auch die Erdwärme, die Geothermie, als zusätzliche Form erneuerbarer Energien im Visier der Anleger. Mit dem heißen Wasser aus dem Erdinnern lassen sich Heizwärme und Strom erzeugen. Die junge Energieform gilt als Boombranche mit vielversprechender Zukunft.

Nach ersten erfolgreichen Börsengängen scheint es

verlockend, sich Aktien engagierter Geothermie-Spezialisten ins Depot zu legen. Ökologisches Alternativ-Investment: eine Beteiligung an geschlossenen Fonds zum Bau geothermischer Kraftwerke. «Wir raten von dem Nischenmarkt nicht grundsätzlich ab, warnen aber vor den enormen Risiken für Geldanleger», gibt Lothar Gries, Sprecher der Schutzgemeinschaft der Kapitalanleger (SdK) zu bedenken.

«Kluge Leute heizen mit der Erde», meint der Bundesverband Geothermie in einer Pressemitteilung. Kluge Investoren sollten nicht übereilt Geld in diesen jungen Markt stecken und es womöglich verheizen, mahnen Verbraucher- und Aktionärsschützer zur Besonnenheit. Die Ertragsmöglichkeiten seien selbst für Finanzprofis schwer einzuschätzen.

«Die Idee der Erdwärme klingt spannend, das mutet fast nach einer Lösung unseres Energieproblems an», sagt Roland Aulitzky von der Zeitschrift «Finanztest» der Stiftung Warentest. Für eine Geldanlage in Geothermie-Projekte oder -Aktientitel sei es aber noch zu früh. Ein finanzielles Engagement sei für den Durchschnittsinvestor hochspekulativ. «Das Risiko ist groß», findet auch Niels Nauhauser, Finanzexperte der Verbraucherzentrale Baden-Württemberg.

Grundsätzlich unbestritten ist, dass die Erde ein gigantisches Wärmereservoir darstellt. Anders als bei Solar- und Windkraft-Technologie ist ein Energiebezug völlig unabhängig von Tageszeit und Wetter. Um die Ressourcen zu nutzen, wird das heiße Wasser mit Hilfe von Pumpen nach oben gefördert, die Hitze wird auf Heizungssysteme und Warmwasser übertragen und das Wasser wieder nach unten in die Erde geleitet. Schon einen Kilometer unter der Erdoberfläche herrscht eine Temperatur von 40 bis 60 Grad Celsius.

Zur Stromerzeugung muss deutlich tiefer gebohrt werden, in Regionen, wo die Temperaturen höher als 100 Grad sind. Weltweit ist die umweltfreundliche Nutzung von Erdwärme nach Branchenangaben im Aufschwung. In Zeiten knapper Ressourcen sowie steigender Gas- und Ölpreise habe der Sektor glänzende Zukunftsaussichten, auch in Deutschland.

Zwtl: Bestes Investment: Geothermie-Heizung für daheim

Wer als Privatanleger von möglichen Wachstumssprüngen an den Wertpapiermärkten profitieren will, sollte sich intensiv mit der Materie und den beteiligten Unternehmen beschäftigen, rät Aulitzky. Die Vorstellung, mit Geothermie-Aktien oder -Fonds schnell reich werden zu können, sei in der Regel ein Trugschluss. Auch wenn an der Börse ökologische Themen schon seit längerem der Renner sind, Solaraktien spektakuläre Gewinne hatten und die Kurse in der Windkraftbranche ebenfalls in schwindelerregenden Höhen waren. «Wer kann schon beurteilen, ob der Kurs der Bohrtechnikfirma XY angemessen oder schon völlig überhitzt ist?», warnt Nauhauser. Börsennotierte US-Firmen seien noch schwieriger einzuschätzen als deutsche.

Auch eine Beteiligung an geschlossenen Geothermie-Fonds, die auf dem deutschen Markt zu haben sind, bergen Risiken. Investoren lassen sich auf Fonds-Laufzeiten von etwa 6 bis 12 Jahren ein. Ein vorzeitiger Ausstieg ist in der Regel nur unter großen Verlusten möglich. Außerdem sei das unternehmerische Risiko immens, warnt Aulitzky. Anleger haften bis zur Höhe ihrer Einlage für Verluste der Firma. Schlimmstenfalls ist das investierte Geld komplett weg.

Schwierig ist zudem, gute von schlecht geführte Fonds zu unterscheiden. Weil Geothermie-Produkte noch neu am Markt sind, kann kein Anbieter bisher aussagekräftige Leistungsbilanzen vorweisen. «Nicht locken lassen von Renditeversprechen von 12 Prozent jährlich», betont Gries. «Zweistellige Gewinnprognosen kann man kaum Glauben schenken.

Wer gern «grün» investieren will, solle sich eine neue Geothermie-Heizung fürs eigene Häuschen anschaffen, so Aulitzkys Tipp. «Das ist die ideale Investmentmöglichkeit.

Quelle:

Danke für die News lieberlong

Mein "Geothermie-Portfolio" ist fast 10% im Minus...

Ganz gut steht zurzeit Torrens Energy mit +7% dar

Mein "Geothermie-Portfolio" ist fast 10% im Minus...

Ganz gut steht zurzeit Torrens Energy mit +7% dar

Den Börsengang von Evonik Industries abwarten  Marktführer in Sachen Geothermie in Deutschland über die Evonik New Energies...

Marktführer in Sachen Geothermie in Deutschland über die Evonik New Energies...

Marktführer in Sachen Geothermie in Deutschland über die Evonik New Energies...

Marktführer in Sachen Geothermie in Deutschland über die Evonik New Energies...

bei Greenearth müsste vor kurzem das IPO erfolgt sein,

weiss aber gerade nicht wo, bei uns scheinbar noch nicht.

Werde demnächst mal wieder versuchen ein bisschen was reinzustellen.

HuskyEnergy, mit im Schnitt -10% müsstest Du ja derzeit fast

zu den Topperformern zählen?! ,

so heftig das derzeit auch grad alles ist.

Auch wenn grad alles heftigst durchgeschüttelt wird,

an den Aussichten ändert sich nichts.

Popeye

weiss aber gerade nicht wo, bei uns scheinbar noch nicht.

Werde demnächst mal wieder versuchen ein bisschen was reinzustellen.

HuskyEnergy, mit im Schnitt -10% müsstest Du ja derzeit fast

zu den Topperformern zählen?! ,

so heftig das derzeit auch grad alles ist.

Auch wenn grad alles heftigst durchgeschüttelt wird,

an den Aussichten ändert sich nichts.

Popeye

So einmal die aktuelle Performance:

-Green Rock Energy: -13,79%

-Eden Energy: -10,78%

-Kuth Energy: +0,64%

-Torrens Energy: +12,13%

-Western Geopower: -6,91%

-Ormat Technologies: -1,27%

-Petratherm: -9,29%

-Hot Rock: -10,00%

-Geothermal Resources: -18,62%

-Panax Geothermal: +o,oo%

-Sierra Geothermal Power : -1,36%

-Nevada Geothermal Power: -19,51%

-Polaris Geothermal Power: -1,27%

-US Geothermal: -11,36%

-Daldrup&Söhne: -10,37%

-Geodynamics: -5,36%

Gesamt: -5,62%

Beste Aktie: Torrens Energy: +12,13%

Hält sich erstaunlich gut

Ich werde dann ab jetzt immer am Wochende die Stände posten

Gruß Husky

-Green Rock Energy: -13,79%

-Eden Energy: -10,78%

-Kuth Energy: +0,64%

-Torrens Energy: +12,13%

-Western Geopower: -6,91%

-Ormat Technologies: -1,27%

-Petratherm: -9,29%

-Hot Rock: -10,00%

-Geothermal Resources: -18,62%

-Panax Geothermal: +o,oo%

-Sierra Geothermal Power : -1,36%

-Nevada Geothermal Power: -19,51%

-Polaris Geothermal Power: -1,27%

-US Geothermal: -11,36%

-Daldrup&Söhne: -10,37%

-Geodynamics: -5,36%

Gesamt: -5,62%

Beste Aktie: Torrens Energy: +12,13%

Hält sich erstaunlich gut

Ich werde dann ab jetzt immer am Wochende die Stände posten

Gruß Husky

Antwort auf Beitrag Nr.: 33.145.622 von HuskyEnergy am 23.01.08 17:29:04Bei Dir ist wohl jetzt schon "Wochende"?

Antwort auf Beitrag Nr.: 33.145.722 von lieberlong am 23.01.08 17:34:22Nein, es steht ja auch "ab jetzt"

Aber jetzt ist Wochende

Hier die Übersicht:

DALDRUP+SOEHNE AG

-0,81 %

EDEN ENERGY LTD

-2,16 %

GEODYNAMICS LTD

2,42 %

GEOTHERMAL RES LTD

-7,89 %

GREEN ROCK EN. LTD

-13,79 %

HOT ROCK LTD.

-3,33 %

KUTH ENERGY LTD

-1,92 %

NEVADA GEOTHERMAL

-20,37 %

ORMAT TECHNOLOG.

1,75 %

PANAX GEOTHERMAL L

-0,00 %

PETRATHERM LTD

-7,91 %

POLARIS GEOTHERMAL INC

-3,10 %

TORRENS ENERGY LTD

5,44%

U.S. GEOTHERMAL I.

-2,84 %

WESTERN GEOPOWER CORP

-0,36 %

--------------------------------------

Unterm Strich( ) macht das ein lächerliches Minus von 0,04%

) macht das ein lächerliches Minus von 0,04%

******* Bester Wert******

Torrens Energy +5,44%

******* Schlechtester Wert ******

Nevda Geothermal - 20,37%

Hier die Übersicht:

DALDRUP+SOEHNE AG

-0,81 %

EDEN ENERGY LTD

-2,16 %

GEODYNAMICS LTD

2,42 %

GEOTHERMAL RES LTD

-7,89 %

GREEN ROCK EN. LTD

-13,79 %

HOT ROCK LTD.

-3,33 %

KUTH ENERGY LTD

-1,92 %

NEVADA GEOTHERMAL

-20,37 %

ORMAT TECHNOLOG.

1,75 %

PANAX GEOTHERMAL L

-0,00 %

PETRATHERM LTD

-7,91 %

POLARIS GEOTHERMAL INC

-3,10 %

TORRENS ENERGY LTD

5,44%

U.S. GEOTHERMAL I.

-2,84 %

WESTERN GEOPOWER CORP

-0,36 %

--------------------------------------

Unterm Strich(

) macht das ein lächerliches Minus von 0,04%

) macht das ein lächerliches Minus von 0,04%******* Bester Wert******

Torrens Energy +5,44%

******* Schlechtester Wert ******

Nevda Geothermal - 20,37%

So ist wieder mal Zeit:

Hier die aktuellen Stände:

DALDRUP+SOEHNE AG

+7,41%

EDEN ENERGY LTD

+0,86%

GEODYNAMICS LTD

+4,1%

GEOTHERMAL RES LTD

-13,56%

GREEN ROCK EN. LTD

-6,9%

HOT ROCK LTD.

-5,56%

KUTH ENERGY LTD

-10,90%

NEVADA GEOTHERMAL

-23,90%

ORMAT TECHNOLOG.

+1,51%

PANAX GEOTHERMAL L

-0,00 %

PETRATHERM LTD

-5,14%

POLARIS GEOTHERMAL INC

-6,33%

TORRENS ENERGY LTD

+25,10%

U.S. GEOTHERMAL I.

-6,25 %

WESTERN GEOPOWER CORP

-7,30 %

Ergbit ein Plus von 2,86%

*******Bester Wert*******

Torrens Energy + 25,10%

*******Schlechtester Wert*******

Nevada Geothermal -23,90%

Hier die aktuellen Stände:

DALDRUP+SOEHNE AG

+7,41%

EDEN ENERGY LTD

+0,86%

GEODYNAMICS LTD

+4,1%

GEOTHERMAL RES LTD

-13,56%

GREEN ROCK EN. LTD

-6,9%

HOT ROCK LTD.

-5,56%

KUTH ENERGY LTD

-10,90%

NEVADA GEOTHERMAL

-23,90%

ORMAT TECHNOLOG.

+1,51%

PANAX GEOTHERMAL L

-0,00 %

PETRATHERM LTD

-5,14%

POLARIS GEOTHERMAL INC

-6,33%

TORRENS ENERGY LTD

+25,10%

U.S. GEOTHERMAL I.

-6,25 %

WESTERN GEOPOWER CORP

-7,30 %

Ergbit ein Plus von 2,86%

*******Bester Wert*******

Torrens Energy + 25,10%

*******Schlechtester Wert*******

Nevada Geothermal -23,90%

Antwort auf Beitrag Nr.: 33.247.650 von HuskyEnergy am 02.02.08 13:41:03Insgesamt +4,54%

*****Bester Wert*****

Torrens Energy +14,23%

*****Schlechtester Wert*****

Nevada Geothermal -18,41%

*****Bester Wert*****

Torrens Energy +14,23%

*****Schlechtester Wert*****

Nevada Geothermal -18,41%

Versteh ich da irgendwas falsch

-oder bist Du wirklich in allen 13 Werten investiert??

-oder bist Du wirklich in allen 13 Werten investiert??

Antwort auf Beitrag Nr.: 33.371.937 von Popeye82 am 14.02.08 19:37:22Nein, hat alles zum besseren Vergleich in der Watchlist. Investiert ist er, glaube ich, derzeit in gar keinem Wert.

Antwort auf Beitrag Nr.: 33.372.769 von HuskyEnergy am 14.02.08 20:26:56Ach hast wohl mal zugeschlagen?!

Antwort auf Beitrag Nr.: 33.372.898 von lieberlong am 14.02.08 20:34:49Jep, ist aber sehr laaaaaaangfristig

Antwort auf Beitrag Nr.: 33.372.983 von HuskyEnergy am 14.02.08 20:40:18Bei allen fünf aus Posting #23,

oder eben nur Ormat und Daldrup?

oder eben nur Ormat und Daldrup?

Antwort auf Beitrag Nr.: 33.373.067 von lieberlong am 14.02.08 20:44:57Nein, nein alle fünf. Aber nur mit sehr kleinen Posis.

Antwort auf Beitrag Nr.: 33.373.102 von HuskyEnergy am 14.02.08 20:47:14Naja, wenn Du so zuschlägst, hätte ich auch noch Western Geopower mit reingepackt.

Antwort auf Beitrag Nr.: 33.373.137 von lieberlong am 14.02.08 20:48:55Hab ich eh drin:

WGP steht für Western Geo Power

WGP steht für Western Geo Power

Antwort auf Beitrag Nr.: 33.373.192 von HuskyEnergy am 14.02.08 20:51:53Achso. Da hätte ich auch selbst drauf kommen können!

Wünsche viel Erfolg!

Bleibe aber auch am Ball.

Wünsche viel Erfolg!

Bleibe aber auch am Ball.

"CCM Research Issues Initial Report on Nevada Geothermal Power, Inc.

Monday February 11, 1:28 pm ET

TORONTO, ONTARIO--(Marketwire - Feb. 11, 2008) - Nevada Geothermal Power Inc. (TSX VENTURE:NGP - News; OTCBB:NGLPF - News)

ADVERTISEMENT

CCM Research analyst, Mohammad Sharifzadeh, PhD., CFA, has written an initiating report on Nevada Geothermal Power, Inc.

Nevada Geothermal Power Inc. (TSX VENTURE:NGP - News; OTCBB:NGLPF - News) is an alternative renewable geothermal energy company actively exploring and developing several geothermal power plant projects and owns a 100% leasehold interest in four properties: Blue Mountain, Pumpernickel, Black Warrior in Nevada and Crump Geyser, Oregon.

In the report the analyst states, "With the Faulkner 1 power plant in the Blue Mountain Project scheduled to come online in 2009, NGP will move into the stage of commercialization with high growth potentials."

The analyst continues, "geothermal electricity producers like NGP will be the major beneficiaries of the strong U.S. electricity prices; simply because they do not bear the high cost of fossil fuels while they enjoy the buoyant electricity prices determined by market forces. For this reason we think, once getting into the production stage, NGP's income statement will be showing a growing gross and net margin and thus growing profitability in the future."

A free copy of the report can be found at www.ccmopportunitybase.com.

CCM Research, a division of Cronus Capital Markets, Inc., subscribes to the "Standards for Independent Research Providers" and the principles contained in the Analyst/Corporate Issuer Guidelines jointly promulgated by the CFA Institute and the National Investor Relations Institute, described at: http://www.cfainstitute.org and http://www.niri.org.

Cronus Capital Markets, Inc., through its CCM Consulting division, entered into a one year $42,500.00 contract with the company to assist it with the creation and execution of information-based strategies to overcome market inefficiencies that are commonplace for the vast majority of public companies, such as share illiquidity and stagnant market capitalization.

Cronus Capital Markets (CCM) is a global investment information firm who strategically produces and introduces, through various forms of analytics and worldwide distribution, information on equity market opportunities. CCM's equity indexes receive international attention and represent important new benchmarks of growth.

The TSX Venture Exchange has neither approved nor disapproved the contents of the press release.

Contact:

Peter Soni

Cronus Capital Markets

Chief Information Officer

(416) 368-3700 ext 225

Email: Peter@cronuscapitalmarkets.com

Source: Nevada Geothermal Power Inc."

Monday February 11, 1:28 pm ET

TORONTO, ONTARIO--(Marketwire - Feb. 11, 2008) - Nevada Geothermal Power Inc. (TSX VENTURE:NGP - News; OTCBB:NGLPF - News)

ADVERTISEMENT

CCM Research analyst, Mohammad Sharifzadeh, PhD., CFA, has written an initiating report on Nevada Geothermal Power, Inc.

Nevada Geothermal Power Inc. (TSX VENTURE:NGP - News; OTCBB:NGLPF - News) is an alternative renewable geothermal energy company actively exploring and developing several geothermal power plant projects and owns a 100% leasehold interest in four properties: Blue Mountain, Pumpernickel, Black Warrior in Nevada and Crump Geyser, Oregon.

In the report the analyst states, "With the Faulkner 1 power plant in the Blue Mountain Project scheduled to come online in 2009, NGP will move into the stage of commercialization with high growth potentials."

The analyst continues, "geothermal electricity producers like NGP will be the major beneficiaries of the strong U.S. electricity prices; simply because they do not bear the high cost of fossil fuels while they enjoy the buoyant electricity prices determined by market forces. For this reason we think, once getting into the production stage, NGP's income statement will be showing a growing gross and net margin and thus growing profitability in the future."

A free copy of the report can be found at www.ccmopportunitybase.com.

CCM Research, a division of Cronus Capital Markets, Inc., subscribes to the "Standards for Independent Research Providers" and the principles contained in the Analyst/Corporate Issuer Guidelines jointly promulgated by the CFA Institute and the National Investor Relations Institute, described at: http://www.cfainstitute.org and http://www.niri.org.

Cronus Capital Markets, Inc., through its CCM Consulting division, entered into a one year $42,500.00 contract with the company to assist it with the creation and execution of information-based strategies to overcome market inefficiencies that are commonplace for the vast majority of public companies, such as share illiquidity and stagnant market capitalization.

Cronus Capital Markets (CCM) is a global investment information firm who strategically produces and introduces, through various forms of analytics and worldwide distribution, information on equity market opportunities. CCM's equity indexes receive international attention and represent important new benchmarks of growth.

The TSX Venture Exchange has neither approved nor disapproved the contents of the press release.

Contact:

Peter Soni

Cronus Capital Markets

Chief Information Officer

(416) 368-3700 ext 225

Email: Peter@cronuscapitalmarkets.com

Source: Nevada Geothermal Power Inc."

Mir alles suspekt. Ist da nicht auch viel Frick-Niveau dabei?

Mir fällt aus Deutschland nur zusätzlich noch eine Bauer ein.

Mir fällt aus Deutschland nur zusätzlich noch eine Bauer ein.

Hi,

generell mal die Überlegung, ob die "Kleinen" wirklich überleben werden.

Welches Interesse hätten denn die "Großen", die den Markt beherrschen?

Ich stecke nicht so tief drin, weiß aber, daß die gerade erst dem CHPT11 entkommene Calpine u.a. auch auf Erdwärme setzt und damit auch wirbt.

Durch die anderen Kraftwerke sind die

a) im Energiemarkt drin

b) diversiviziert

Die Fragen wären:

a) Wie groß ist das Gesamtengagement der "Kleinen" im Vergleich zu Calpines-Erdwärme-Anteil

b) Haben die "Kleinen" wirklich schon Kraftwerke und können damit Cash generieren? Oder besitzen Sie "nur"

a) know how zur Erschließung von Quellen

b) Land mit existierenden/vermuteten Quellen

Kurz:

Wer ist mit Erdwärme schon produktiv bzw. am produktivsten und kann von dieser Basis aus agieren?

Mag konservativ sein, aber aus meiner Sicht ist alles Weitere ähnlich den "Öl-Explorern".

Da wird dann das Wissen und potentielle Quellen (mit Probebohrungen) hochgerechnet und nachher ist die Firma pleite und ein "Großer" übernimmt die Konkursmasse

Ihr müßt ja auch bedenken, wie die auf einen grünen Ast kommen:

a) verkaufen der Quellen

b) selbst bauen & investieren (wieviele Kraftwerke werden die bauen können)

c) Übernahme

Insofern wäre eine Analyse der oben genannten Player interessant

a) im wirklichen Besitz der Quellen

b) Anteil der Quellen, die bereits Energie erzeugen

c) Cashreserven, um noch einige Jahre "Unschlüssigkeit" auszuhalten

Es gibt also die Taktik

a) auf alle setzen und hoffen, daß einige überleben und zwar müssen die dann einen höheren Wert haben, als die derzeitige Bewertung mit sehr viel Phantasie

b) auf die Großen setzen, die einige Leute beschäftigen, die sich den ganzen Tag darüber Gedanken machen, wie sie hier den Einfluß vergrößern können

c) ein Fond, der ähnlich den Öl-Explorern, die aussichtsreichen a)-Kandidaten prüft und entsprechend umschichtet

Grüße

mac

generell mal die Überlegung, ob die "Kleinen" wirklich überleben werden.

Welches Interesse hätten denn die "Großen", die den Markt beherrschen?

Ich stecke nicht so tief drin, weiß aber, daß die gerade erst dem CHPT11 entkommene Calpine u.a. auch auf Erdwärme setzt und damit auch wirbt.

Durch die anderen Kraftwerke sind die

a) im Energiemarkt drin

b) diversiviziert

Die Fragen wären:

a) Wie groß ist das Gesamtengagement der "Kleinen" im Vergleich zu Calpines-Erdwärme-Anteil

b) Haben die "Kleinen" wirklich schon Kraftwerke und können damit Cash generieren? Oder besitzen Sie "nur"

a) know how zur Erschließung von Quellen

b) Land mit existierenden/vermuteten Quellen

Kurz:

Wer ist mit Erdwärme schon produktiv bzw. am produktivsten und kann von dieser Basis aus agieren?

Mag konservativ sein, aber aus meiner Sicht ist alles Weitere ähnlich den "Öl-Explorern".

Da wird dann das Wissen und potentielle Quellen (mit Probebohrungen) hochgerechnet und nachher ist die Firma pleite und ein "Großer" übernimmt die Konkursmasse

Ihr müßt ja auch bedenken, wie die auf einen grünen Ast kommen:

a) verkaufen der Quellen

b) selbst bauen & investieren (wieviele Kraftwerke werden die bauen können)

c) Übernahme

Insofern wäre eine Analyse der oben genannten Player interessant

a) im wirklichen Besitz der Quellen

b) Anteil der Quellen, die bereits Energie erzeugen

c) Cashreserven, um noch einige Jahre "Unschlüssigkeit" auszuhalten

Es gibt also die Taktik

a) auf alle setzen und hoffen, daß einige überleben und zwar müssen die dann einen höheren Wert haben, als die derzeitige Bewertung mit sehr viel Phantasie

b) auf die Großen setzen, die einige Leute beschäftigen, die sich den ganzen Tag darüber Gedanken machen, wie sie hier den Einfluß vergrößern können

c) ein Fond, der ähnlich den Öl-Explorern, die aussichtsreichen a)-Kandidaten prüft und entsprechend umschichtet

Grüße

mac

Antwort auf Beitrag Nr.: 33.380.177 von macsoja am 15.02.08 13:12:45Hallo macsoja

Ich habe deine c-Taktik genommen, allerdings habe ich nicht in einen Fonds investiert, sondern in meinen "eigenen". Ich habe alle Firmen untersucht, die hier genannt wurden (hat ganz schön lang gedauert:rolleyes und die 5 Aussichtsreichtsten genommen.

und die 5 Aussichtsreichtsten genommen.

Müssen natürlich nicht die Besten sein, aber sie scheinen mir gut aufgestellt zu sein.

Nochmals meine 5: WGP (Western Geopower), Sierra Ge. Power, Daldrup, Ormat (mArktführer), sowie Petratherm

Ich habe deine c-Taktik genommen, allerdings habe ich nicht in einen Fonds investiert, sondern in meinen "eigenen". Ich habe alle Firmen untersucht, die hier genannt wurden (hat ganz schön lang gedauert:rolleyes

und die 5 Aussichtsreichtsten genommen.

und die 5 Aussichtsreichtsten genommen.Müssen natürlich nicht die Besten sein, aber sie scheinen mir gut aufgestellt zu sein.

Nochmals meine 5: WGP (Western Geopower), Sierra Ge. Power, Daldrup, Ormat (mArktführer), sowie Petratherm

Antwort auf Beitrag Nr.: 33.380.417 von HuskyEnergy am 15.02.08 13:28:56Hi Husky,

jaja so hatte ich das verstanden.

Wenn Du magst, können wir jetzt die Kriterien diskutieren, die Du für Deine Entscheidung herangezogen hast.

D.h.

- was ist ein Marktführer (jeder ist natürlich auf seinem Gebiet Marktführer)

- wie wichtig ist die Marktkap.

Naja und dann muß man beachten, daß man als Kleinanleger nur an die Daten kommt, von denen die Unternehmen wollen, daß Du sie siehst.

Während Fonds teilweise (hoffe ich zumindest) hinfahren und das Management auseinandernehmen bzw. sich mit weiteren Fakten auseinander setzen.

Daldrup -> bohrt also

-> wie lange kann man damit Geld verdienen

-> kann aber im Notfall auch nach Öl, Gold etc. bohren

ORMAT -> fast 1,7 Mrd $ wert

-> verkauft schon ca. 300Mio Umsatz

Western Geo -> 1 Feld und viel Hoffnung

-> 67 Mio Marktkap

Petratherm -> mmh?

SIERRA GEOTHERMAL POWER CORP

-> sucht / bohrt / hofft?

Fazit:

Kann verstehen, daß Fonds nur Daldrup & Ormat bevorzugen, wenn auch aus verschiedenen Gründen.

Daldrup ist in einem Fond für kleine/mittelgroße Unternehmen mit guten Chancen

Ormat in einigen Ökofonds.

jaja so hatte ich das verstanden.

Wenn Du magst, können wir jetzt die Kriterien diskutieren, die Du für Deine Entscheidung herangezogen hast.

D.h.

- was ist ein Marktführer (jeder ist natürlich auf seinem Gebiet Marktführer)

- wie wichtig ist die Marktkap.

Naja und dann muß man beachten, daß man als Kleinanleger nur an die Daten kommt, von denen die Unternehmen wollen, daß Du sie siehst.

Während Fonds teilweise (hoffe ich zumindest) hinfahren und das Management auseinandernehmen bzw. sich mit weiteren Fakten auseinander setzen.

Daldrup -> bohrt also

-> wie lange kann man damit Geld verdienen

-> kann aber im Notfall auch nach Öl, Gold etc. bohren

ORMAT -> fast 1,7 Mrd $ wert

-> verkauft schon ca. 300Mio Umsatz

Western Geo -> 1 Feld und viel Hoffnung

-> 67 Mio Marktkap

Petratherm -> mmh?

SIERRA GEOTHERMAL POWER CORP

-> sucht / bohrt / hofft?

Fazit:

Kann verstehen, daß Fonds nur Daldrup & Ormat bevorzugen, wenn auch aus verschiedenen Gründen.

Daldrup ist in einem Fond für kleine/mittelgroße Unternehmen mit guten Chancen

Ormat in einigen Ökofonds.

Antwort auf Beitrag Nr.: 33.380.417 von HuskyEnergy am 15.02.08 13:28:56hallo huskyenergy,

wie würdest du die Bauer AG bei diesem thema sehen...mit ihren bohrgeräten sicher ein potentieller ausstatter, wenn nicht sogar dienstleister?...oder mehr?

gruß

wolzik

wie würdest du die Bauer AG bei diesem thema sehen...mit ihren bohrgeräten sicher ein potentieller ausstatter, wenn nicht sogar dienstleister?...oder mehr?

gruß

wolzik

Antwort auf Beitrag Nr.: 33.382.395 von wolzik am 15.02.08 15:49:15Hallo wolzik,

Hier mal ein Kurzportrait von OnVista:

Die Bauer AG bildet mit ihren Tochtergesellschaften einen Konzern, der international Bauleistungen im Spezialtiefbau anbietet. Im Inland ist Bauer dabei auch in angrenzenden Bereichen wie der Umwelttechnik, Sanierung von Bauwerken, im Brücken-, Untertagebau und der Projektentwicklung tätig. Im stark fragmentierten Markt Spezialtiefbau sieht sich Bauer in Deutschland als führend und weltweit als eines der größten Unternehmen. Zum Angebotsspektrum gehören zudem Maschinen, Geräte und Werkzeuge sowie Servicedienstleistungen rund um den Spezialtiefbau. Ein Großteil dieser Maschinen, Geräte und Werkzeuge wird ins Ausland geliefert. Das operative Geschäft untergliedert sich in die Bereiche Bau, Maschinenbau und Sonstiges. Weltweit gehören mehr als 70 Gesellschaften zum Konzern

Sicherlich keine wirklicher Geothemie Aktie, aber es besteht ein Zusammenhang.

Ich finde die Firma sehr gut, einziges kleines Manko, ist die realtiv hohe Verschuldung

Grüße Husky

Hier mal ein Kurzportrait von OnVista:

Die Bauer AG bildet mit ihren Tochtergesellschaften einen Konzern, der international Bauleistungen im Spezialtiefbau anbietet. Im Inland ist Bauer dabei auch in angrenzenden Bereichen wie der Umwelttechnik, Sanierung von Bauwerken, im Brücken-, Untertagebau und der Projektentwicklung tätig. Im stark fragmentierten Markt Spezialtiefbau sieht sich Bauer in Deutschland als führend und weltweit als eines der größten Unternehmen. Zum Angebotsspektrum gehören zudem Maschinen, Geräte und Werkzeuge sowie Servicedienstleistungen rund um den Spezialtiefbau. Ein Großteil dieser Maschinen, Geräte und Werkzeuge wird ins Ausland geliefert. Das operative Geschäft untergliedert sich in die Bereiche Bau, Maschinenbau und Sonstiges. Weltweit gehören mehr als 70 Gesellschaften zum Konzern

Sicherlich keine wirklicher Geothemie Aktie, aber es besteht ein Zusammenhang.

Ich finde die Firma sehr gut, einziges kleines Manko, ist die realtiv hohe Verschuldung

Grüße Husky

Antwort auf Beitrag Nr.: 33.380.891 von macsoja am 15.02.08 14:01:46Es ist schon klar, dass die beiden(Daldrup, Ormat) zu bevorzugen sind. Sie machen ja auch schon Gewinn.

Petraterm kommt aus Australien.

Wenn ihr wollt kann ich eine Liste mit den Homepageslinks erstellen?!

Grüße Husky

Petraterm kommt aus Australien.

Wenn ihr wollt kann ich eine Liste mit den Homepageslinks erstellen?!

Grüße Husky

Antwort auf Beitrag Nr.: 33.382.784 von HuskyEnergy am 15.02.08 16:10:51ja bitte, das wäre toll....

Antwort auf Beitrag Nr.: 33.390.461 von wolzik am 16.02.08 11:03:15Ok:

Daldrup & Söhne --> http://www.daldrup.com/

EDEN ENERGY LTD -->http://www.edenenergy.com.au/

GEODYNAMICS LTD -->http://www.geodynamics.com.au/IRM/content/home.html

GREEN ROCK EN. LTD -->http://www.greenrock.com.au/

HOT ROCK LTD. --> http://www.hotrockltd.com/

KUTH ENERGY LTD -->KUTH ENERGY LTD

NEVADA GEOTHERMAL -->http://www.nevadageothermal.com/s/Home.asp

ORMAT TECHNOLOG. -->http://www.ormat.com/

PANAX GEOTHERMAL --> Da hab ich nur eine Presentation gefunden?!? http://www.panaxgeothermal.com.au/Resources/20071126_uranoz_…

PETRATHERM LTD -->http://www.petratherm.com.au/

POLARIS GEOTHERMAL INC-->http://www.polarisgeothermal.com/eng/main.html

TORRENS ENERGY LTD-->http://www.torrensenergy.com/

U.S. GEOTHERMAL -->http://www.usgeothermal.com/index.aspx

WESTERN GEOPOWER CORP-->http://www.geopower.ca/

Also macht euch ein eigenes Bild, wird euch eine Weile beschäftigen...

Gruß Husky

Daldrup & Söhne --> http://www.daldrup.com/

EDEN ENERGY LTD -->http://www.edenenergy.com.au/

GEODYNAMICS LTD -->http://www.geodynamics.com.au/IRM/content/home.html

GREEN ROCK EN. LTD -->http://www.greenrock.com.au/

HOT ROCK LTD. --> http://www.hotrockltd.com/

KUTH ENERGY LTD -->KUTH ENERGY LTD

NEVADA GEOTHERMAL -->http://www.nevadageothermal.com/s/Home.asp

ORMAT TECHNOLOG. -->http://www.ormat.com/

PANAX GEOTHERMAL --> Da hab ich nur eine Presentation gefunden?!? http://www.panaxgeothermal.com.au/Resources/20071126_uranoz_…

PETRATHERM LTD -->http://www.petratherm.com.au/

POLARIS GEOTHERMAL INC-->http://www.polarisgeothermal.com/eng/main.html

TORRENS ENERGY LTD-->http://www.torrensenergy.com/

U.S. GEOTHERMAL -->http://www.usgeothermal.com/index.aspx

WESTERN GEOPOWER CORP-->http://www.geopower.ca/

Also macht euch ein eigenes Bild, wird euch eine Weile beschäftigen...

Gruß Husky

Antwort auf Beitrag Nr.: 33.390.548 von HuskyEnergy am 16.02.08 11:26:18DANKE !! ....

Antwort auf Beitrag Nr.: 33.397.190 von wolzik am 17.02.08 21:55:19Gerne.

Ich merke gerade, dass der Kuth Energy Link nicht funktioniert, vielleicht klappts hier:

http://www.kuthenergy.com/

Ich merke gerade, dass der Kuth Energy Link nicht funktioniert, vielleicht klappts hier:

http://www.kuthenergy.com/

2 Links aus einem Thread rauskopiert:

http://ecotality.com/life/2007/10/25/6-geothermal-developers…

http://www.stansberryresearch.com/PRO/0711GLDJARSP/EGLDJ202/…

http://ecotality.com/life/2007/10/25/6-geothermal-developers…

http://www.stansberryresearch.com/PRO/0711GLDJARSP/EGLDJ202/…

Antwort auf Beitrag Nr.: 33.426.096 von HuskyEnergy am 20.02.08 17:40:24Zwei Aktien in dem Stansberry Pusher Artikel dürften Nevada Geothermal (stock#2) und Western Geopower (stock#1) sein.

Antwort auf Beitrag Nr.: 33.481.878 von oko am 26.02.08 19:01:56Danke, danke

Wenn immer euch Geothermie Webpages und Artikel auffallen, einfach hier reinstellen; wir lesens gerne

Ich geb mal wieder einen Überblick:

Insgesamt +6,90%

******Bester Wert******

U.S. Geothermal +18,18%

******Schlechtester Wert******

Nevada Geothermal -17,68%

Wenn immer euch Geothermie Webpages und Artikel auffallen, einfach hier reinstellen; wir lesens gerne

Ich geb mal wieder einen Überblick:

Insgesamt +6,90%

******Bester Wert******

U.S. Geothermal +18,18%

******Schlechtester Wert******

Nevada Geothermal -17,68%

Hier gibts paar schöne Filmchen zum Thema (auch zu allen EE´s):

http://213.133.109.5/wb/pages/portal/erneuerbare-energien/ge…

http://213.133.109.5/wb/pages/portal/erneuerbare-energien/ge…

Führe auch eine 'Geothermal-Watchlist',

die meisten haben zuletzt nach ziemlichen Rückgängen wieder

deutlich angezogen.

Zu Posting55+56, das sehe ich ziemlich anders

'Frickniveau' -auf keinen Fall.

Das sind reale Unternehmen mit realen Vorhaben

(auch wenns sicher die ein oder andere Ausnahme geben mag).

Anlagetechnisch muss man sich natürlich überlegen was man

will, die schon gut verdienenden +höher kapitalisierten

sind natürlich weitaus sicherer

-aber den größeren Hebel findet man da mit Sicherheit nicht.

Für mich ist das wirklich eine Art "Bewegung",

die erst am Anfang steht und noch sehr viel Potenzial hat.

(das wird ein ernstzunehmender Sektor, m.M.n.)

Aber genau weils halt noch so sehr am Beginn steht

sind die Risiken natürlich deutlich größer,

allein nur mal auf die bisherigen Erfahrungswerte bezogen.

Grundsätzlich sind die Unternehmen denke ich nicht sehr viel

anders als (Rohstoff)Explorer zu sehen,

die meisten haben sich gerade mal einige Lizenzen zusammengesammelt, mögliche Produktionsstarts liegen zumeist

noch in ziemlicher Ferne(2-3 Jahre aufwärts meist),

allerdings zumeist mit ernsthaften Absichten später auch

selber in Produktion zu gehen, m.M.n. .

Unter dem Strich vielleicht:

Die Risiken sind nicht klein,

aber der Sektor hat absolut reales Potenzial,

im Endeffekt kommt es aufs Stockpicking an -wie fast immer.

alles persönliche Ansichten.

die meisten haben zuletzt nach ziemlichen Rückgängen wieder

deutlich angezogen.

Zu Posting55+56, das sehe ich ziemlich anders

'Frickniveau' -auf keinen Fall.

Das sind reale Unternehmen mit realen Vorhaben

(auch wenns sicher die ein oder andere Ausnahme geben mag).

Anlagetechnisch muss man sich natürlich überlegen was man

will, die schon gut verdienenden +höher kapitalisierten

sind natürlich weitaus sicherer

-aber den größeren Hebel findet man da mit Sicherheit nicht.

Für mich ist das wirklich eine Art "Bewegung",

die erst am Anfang steht und noch sehr viel Potenzial hat.

(das wird ein ernstzunehmender Sektor, m.M.n.)

Aber genau weils halt noch so sehr am Beginn steht

sind die Risiken natürlich deutlich größer,

allein nur mal auf die bisherigen Erfahrungswerte bezogen.

Grundsätzlich sind die Unternehmen denke ich nicht sehr viel

anders als (Rohstoff)Explorer zu sehen,

die meisten haben sich gerade mal einige Lizenzen zusammengesammelt, mögliche Produktionsstarts liegen zumeist

noch in ziemlicher Ferne(2-3 Jahre aufwärts meist),

allerdings zumeist mit ernsthaften Absichten später auch

selber in Produktion zu gehen, m.M.n. .

Unter dem Strich vielleicht:

Die Risiken sind nicht klein,

aber der Sektor hat absolut reales Potenzial,

im Endeffekt kommt es aufs Stockpicking an -wie fast immer.

alles persönliche Ansichten.

Antwort auf Beitrag Nr.: 33.493.724 von Popeye82 am 27.02.08 17:07:38Update---> Gesamt: -1,03%

*****Bester Wert*****

Daldrup +7,23%

*****Schlechtester Wert*****

Petratherm -20,95%

Stay long

*****Bester Wert*****

Daldrup +7,23%

*****Schlechtester Wert*****

Petratherm -20,95%

Stay long

www.aegis.com.au/Data/assirt/Reports/BB/71202/XBB_71202.pdf

hier werden mindestens 2 der Titel besprochen,

ich hab keine Ahnung, ob der Link hinhaut, wenn man nicht angemeldet ist, könnt Ihr ja mal sagen...

hier werden mindestens 2 der Titel besprochen,

ich hab keine Ahnung, ob der Link hinhaut, wenn man nicht angemeldet ist, könnt Ihr ja mal sagen...

Antwort auf Beitrag Nr.: 33.762.077 von Popeye82 am 30.03.08 21:51:08Link funktioniert, danke!

Danke ,Popeye, für den Link

Bei der Gelegenheit mal ein Update:

Gesamt: +3,53%

*****Bester Wert****

Daldrup + 28,37%

****Schlechtester Wert*****

WGP - 34,31%

Bei der Gelegenheit mal ein Update:

Gesamt: +3,53%

*****Bester Wert****

Daldrup + 28,37%

****Schlechtester Wert*****

WGP - 34,31%

Nur mal so am Rande....

Is ne Nibe nedd auch was ???

912970

Man muss die Erdsondenbohrungen ja auch irgendwo anschließen...

bzw...die machen ja auch andere Wärmepumpen !!!

Gruß Mutzi

Is ne Nibe nedd auch was ???

912970

Man muss die Erdsondenbohrungen ja auch irgendwo anschließen...

bzw...die machen ja auch andere Wärmepumpen !!!

Gruß Mutzi

Antwort auf Beitrag Nr.: 33.780.316 von Mutzinger am 01.04.08 17:57:01Ich habe Nibe schon im 3. Posting erwähnt.Ich meinte, dass ich die Firma da in irgendeinem Zusammenhang gehört zu haben. Aber nicht weitergefoscht.

Was machen die denn genau?

Was machen die denn genau?

Antwort auf Beitrag Nr.: 33.781.147 von HuskyEnergy am 01.04.08 19:03:19http://www.nibe.de/Villaprodukter/

Torrens Energy heute 30% im plus. Habe das hier gefunden:

Torrens Energy is pleased to report exploration work is progressing well, with field measurements from the Parachilna Prospect continuing and modelling of recent heat-flow results underway.

Modelling thus far has shown that the target heat exchanger reservoir is likely to be in similar rocks to those being exploited in the Cooper Basin, and a favourable stress regime for heat exchanger development has been shown to occur nearby at Olympic Dam.

Planning for the 2008/2009 exploration programme is underway and Torrens Energy has secured the services of an experienced Exploration Manager to oversee drilling and exploration activities.

Torrens Energy has commenced the development of its 3D Temperature Field Model (3D-TFM) at its wholly owned Parachilna Prospect in the Company’s recently drilled Torrens Project Area north of Port Augusta, South Australia (ASX Announcement 25 February 2008).

The development of the 3D-TFM Project is supported by a $3m Grant under the Australian Government’s Renewable Energy Development Initiative

(REDI).

Torrens Energy has signed an agreement with the University of Adelaide to complete the 3D geological model required, and with Hot Dry Rocks Pty Ltd to complete the final 3D temperature modelling. The construction of the 3D-TFM for the Parachilna Prospect is expected to be completed by Q3 2008.

The results of temperature modelling completed in February 2008, at the newly drilled Parachilna Prospect, show that temperatures of over 200°C are achievable at approximately 4000m depth.

These resultsare higher than temperatures currently being exploited for “hot rock” geothermal power in Europe, and among the highest being evaluated in Australia.

Temperature results from this drilling campaign are still being returned. Parachilna Prospect - Geologically Favourable Heat Exchanger

Preliminary geological modelling has shown that the target heat exchanger reservoir at Parachilna, expected at approximately 4000m depth, corresponds to predicted “basement” geology.

This geological setting is analogous to the Cooper Basin, which is in the process of being successfully engineered to support a large heat exchanger.

Furthermore, recent technical work completed by Green Rock Energy at their nearby Olympic Dam Project shows that a highly favourable stress regime exists, enabling probable effective fracturing of the target geothermal reservoir.

It is considered highly likely that these favourable geological conditions, successfully being tested in the Cooper Basin, will extend to the Parachilna Prospect.

- 21 Apr 2008

-------------------------------------------------

Grüße und @Mutzinger Nibe ist jetzt auch auf der WS

Torrens Energy is pleased to report exploration work is progressing well, with field measurements from the Parachilna Prospect continuing and modelling of recent heat-flow results underway.

Modelling thus far has shown that the target heat exchanger reservoir is likely to be in similar rocks to those being exploited in the Cooper Basin, and a favourable stress regime for heat exchanger development has been shown to occur nearby at Olympic Dam.

Planning for the 2008/2009 exploration programme is underway and Torrens Energy has secured the services of an experienced Exploration Manager to oversee drilling and exploration activities.

Torrens Energy has commenced the development of its 3D Temperature Field Model (3D-TFM) at its wholly owned Parachilna Prospect in the Company’s recently drilled Torrens Project Area north of Port Augusta, South Australia (ASX Announcement 25 February 2008).

The development of the 3D-TFM Project is supported by a $3m Grant under the Australian Government’s Renewable Energy Development Initiative

(REDI).

Torrens Energy has signed an agreement with the University of Adelaide to complete the 3D geological model required, and with Hot Dry Rocks Pty Ltd to complete the final 3D temperature modelling. The construction of the 3D-TFM for the Parachilna Prospect is expected to be completed by Q3 2008.

The results of temperature modelling completed in February 2008, at the newly drilled Parachilna Prospect, show that temperatures of over 200°C are achievable at approximately 4000m depth.