5N PLUS: CdTe Lieferant von FirstSolar und Calyxo - 500 Beiträge pro Seite

eröffnet am 04.01.08 13:16:14 von

neuester Beitrag 30.03.19 15:33:50 von

neuester Beitrag 30.03.19 15:33:50 von

Beiträge: 239

ID: 1.136.928

ID: 1.136.928

Aufrufe heute: 0

Gesamt: 15.618

Gesamt: 15.618

Aktive User: 0

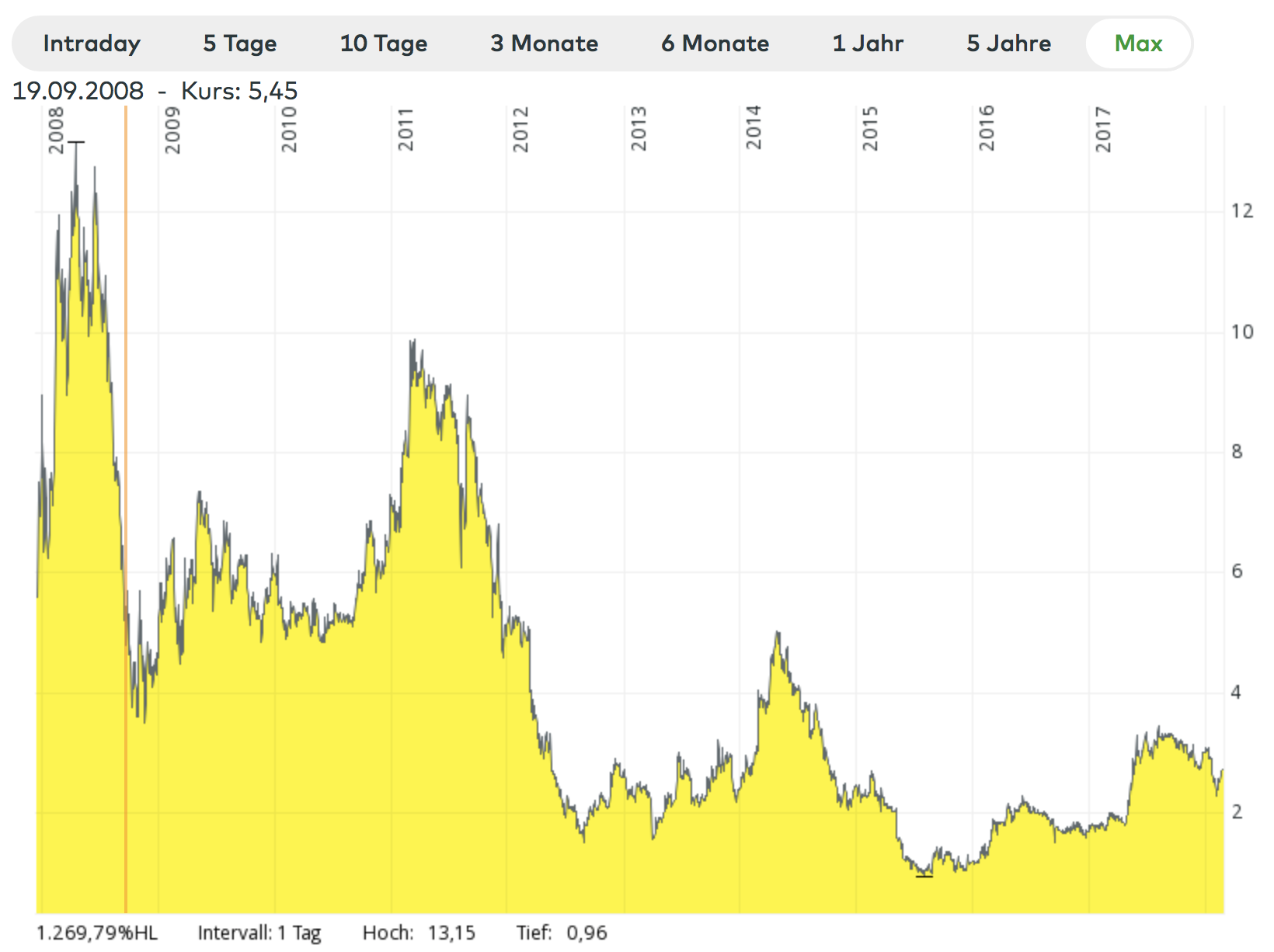

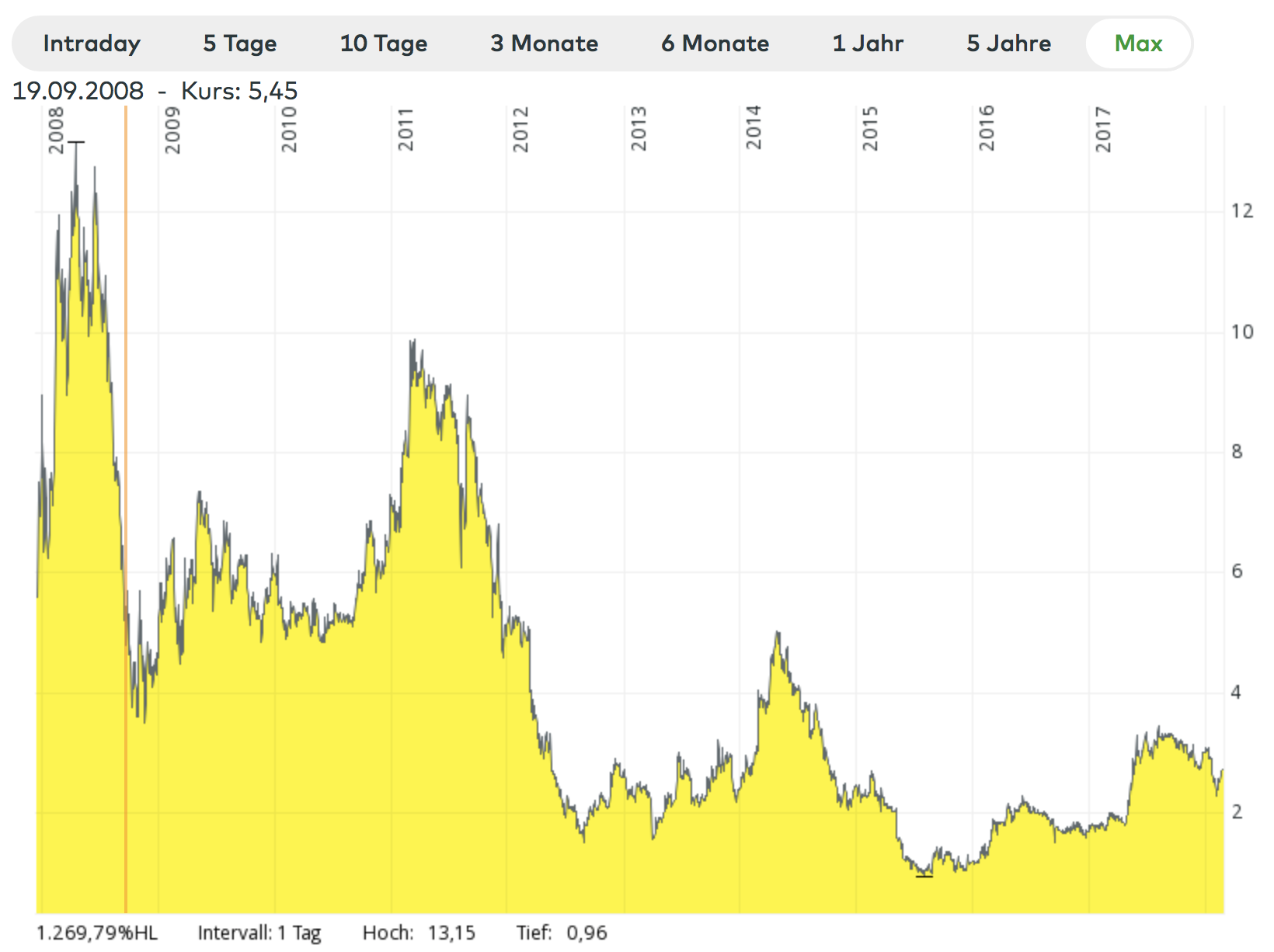

ISIN: CA33833X1015 · WKN: A0NAH2 · Symbol: VNP

4,6800

CAD

-1,68 %

-0,0800 CAD

Letzter Kurs 24.04.24 Toronto

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +49.900,00 | |

| 3,1000 | +43,52 | |

| 0,5446 | +21,05 | |

| 1,1700 | +17,00 | |

| 3,8700 | +13,49 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,6400 | -5,70 | |

| 1,0580 | -6,70 | |

| 3,6550 | -6,76 | |

| 3,3060 | -7,24 | |

| 9,4000 | -10,48 |

Sind am 20.12. in Toronto zu 3,00 CAD an die Börse gegangen

Kurs aktuell ca. 7,50 CAD

werde nachher wohl ein paar Guckstücke in Toronto kaufen.

später mehr.

Kurs aktuell ca. 7,50 CAD

werde nachher wohl ein paar Guckstücke in Toronto kaufen.

später mehr.

Antwort auf Beitrag Nr.: 32.938.328 von meinolf67 am 04.01.08 13:16:14Hi,

hast du mal ein paar fundamentals, danke

hast du mal ein paar fundamentals, danke

Thu Dec 20, 2:36 PM

0

* What's this

By The Canadian Press

ADVERTISEMENT

MONTREAL - High-purity metals processor 5N Plus Inc. (TSX:VNP) has completed its initial public offering of 10 million shares at $3.00 each.

The stock rose to over $5.00 in its Toronto Stock Exchange debut Thursday. The company, which draws its name from the 99.999 per cent purity of the specialty metals such as tellurium, cadmium and selenium which it refines for electronics makers, intends to use the proceeds of the $30-million issue to build a new cadmium telluride plant in Eisenhuttenstadt, Germany, as well as to fund capital projects at its Montreal facility, repay debt, and apply to general corporate purposes.

In a parallel secondary offering, II-VI Inc. of Saxonburg, Penn., an investor in 5N Plus, sold its entire holding of 10.7 million shares for $32 million.

5N Plus has 40 million shares outstanding.

The stock, sold through a syndicate led by National Bank Financial and including GMP Securities, Blackmont Capital, MGI Securities and Laurentian Bank Securities, traded at $5.20 with 7.7 million shares changing hands on the TSX by midafternoon.

0

* What's this

By The Canadian Press

ADVERTISEMENT

MONTREAL - High-purity metals processor 5N Plus Inc. (TSX:VNP) has completed its initial public offering of 10 million shares at $3.00 each.

The stock rose to over $5.00 in its Toronto Stock Exchange debut Thursday. The company, which draws its name from the 99.999 per cent purity of the specialty metals such as tellurium, cadmium and selenium which it refines for electronics makers, intends to use the proceeds of the $30-million issue to build a new cadmium telluride plant in Eisenhuttenstadt, Germany, as well as to fund capital projects at its Montreal facility, repay debt, and apply to general corporate purposes.

In a parallel secondary offering, II-VI Inc. of Saxonburg, Penn., an investor in 5N Plus, sold its entire holding of 10.7 million shares for $32 million.

5N Plus has 40 million shares outstanding.

The stock, sold through a syndicate led by National Bank Financial and including GMP Securities, Blackmont Capital, MGI Securities and Laurentian Bank Securities, traded at $5.20 with 7.7 million shares changing hands on the TSX by midafternoon.

Attention Business/Financial Editors

5N Plus Inc. Issues Additional Shares on Exercise of Over-Allotment Option

/This release is intended for distribution in Canada only and is not

intended for distribution to United States newswire services or for

dissemination in the United States/

<<

- 5N Plus Inc. Issues 1.5 Million Additional Shares for Proceeds of

$4.5 Million

- Increases Total Size of Initial Public Offering to $66.5 Million

MONTREAL, Dec. 21 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP) announced today

that it has issued 1,500,000 additional common shares following the exercise

in full of an over-allotment option by the underwriters of 5N Plus' initial

public offering. The 1,500,000 additional shares were issued at the offering

price of $3.00 per share, for gross proceeds to 5N Plus of $4.5 million.

At the closing of the initial public offering held yesterday, December 20,

2007, 5N Plus issued 10,000,000 common shares for gross proceeds to it of $30

million. As a result of the exercise in full of the over-allotment option, 5N

Plus raised a total of $34.5 million in its initial public offering, by

issuing a total of 11,500,000 common shares.

The 1,500,000 additional common shares were sold to a syndicate of

underwriters led by National Bank Financial Inc. and including GMP Securities

L.P., Blackmont Capital Inc., MGI Securities Inc. and Laurentian Bank

Securities Inc. The net proceeds from the exercise of the over-allotment

option will be used by 5N Plus for general corporate purposes and working

capital.

At the initial closing of the offering held on December 20, II-VI

Incorporated of Saxonburg, Pennsylvania, a minority shareholder, sold

10,671,801 common shares for gross proceeds to II-VI Incorporated of

$32 million. As a result, II-VI Incorporated (NASDAQ GS:IIVI) does not hold

any shares of 5N Plus. The exercise of the over-allotment option has brought

the total size of the initial public offering and secondary offering to

$66,515,403.

Following the exercise of the over-allotment option, there are

41,500,000 common shares of 5N Plus issued and outstanding.

The common shares of 5N Plus have not been registered under the United

States Securities Act of 1933, as amended, and subject to certain exceptions,

may not be offered or sold within the United States.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999% (five

nines or 5N) and more. 5N Plus, which has its head office in Montreal, Qu�bec,

develops and produces high-purity metals and compounds for electronic

applications and provides its customers with recycling solutions. The Company

is an integrated producer with both primary and secondary refining

capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium

and selenium and on related compounds such as cadmium telluride and cadmium

sulphide. The Company's products are critical precursors in a number of

electronic applications, including the rapidly-expanding solar (thin-film

photovoltaics) market, for which 5N Plus is a major supplier of cadmium

telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at

www.5nplus.com.

>>

5N Plus Inc. Issues Additional Shares on Exercise of Over-Allotment Option

/This release is intended for distribution in Canada only and is not

intended for distribution to United States newswire services or for

dissemination in the United States/

<<

- 5N Plus Inc. Issues 1.5 Million Additional Shares for Proceeds of

$4.5 Million

- Increases Total Size of Initial Public Offering to $66.5 Million

MONTREAL, Dec. 21 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP) announced today

that it has issued 1,500,000 additional common shares following the exercise

in full of an over-allotment option by the underwriters of 5N Plus' initial

public offering. The 1,500,000 additional shares were issued at the offering

price of $3.00 per share, for gross proceeds to 5N Plus of $4.5 million.

At the closing of the initial public offering held yesterday, December 20,

2007, 5N Plus issued 10,000,000 common shares for gross proceeds to it of $30

million. As a result of the exercise in full of the over-allotment option, 5N

Plus raised a total of $34.5 million in its initial public offering, by

issuing a total of 11,500,000 common shares.

The 1,500,000 additional common shares were sold to a syndicate of

underwriters led by National Bank Financial Inc. and including GMP Securities

L.P., Blackmont Capital Inc., MGI Securities Inc. and Laurentian Bank

Securities Inc. The net proceeds from the exercise of the over-allotment

option will be used by 5N Plus for general corporate purposes and working

capital.

At the initial closing of the offering held on December 20, II-VI

Incorporated of Saxonburg, Pennsylvania, a minority shareholder, sold

10,671,801 common shares for gross proceeds to II-VI Incorporated of

$32 million. As a result, II-VI Incorporated (NASDAQ GS:IIVI) does not hold

any shares of 5N Plus. The exercise of the over-allotment option has brought

the total size of the initial public offering and secondary offering to

$66,515,403.

Following the exercise of the over-allotment option, there are

41,500,000 common shares of 5N Plus issued and outstanding.

The common shares of 5N Plus have not been registered under the United

States Securities Act of 1933, as amended, and subject to certain exceptions,

may not be offered or sold within the United States.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999% (five

nines or 5N) and more. 5N Plus, which has its head office in Montreal, Qu�bec,

develops and produces high-purity metals and compounds for electronic

applications and provides its customers with recycling solutions. The Company

is an integrated producer with both primary and secondary refining

capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium

and selenium and on related compounds such as cadmium telluride and cadmium

sulphide. The Company's products are critical precursors in a number of

electronic applications, including the rapidly-expanding solar (thin-film

photovoltaics) market, for which 5N Plus is a major supplier of cadmium

telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at

www.5nplus.com.

>>

In October 2005, 5N Plus inaugurated a new plant near the existing installations, thus increasing the space available for our very-high-purity product line.

This new space is equipped with clean rooms and state-of-the-art production facilities, which enables us to process our products in a controlled environment and ensure their total purity until they are shipped.

This new space is equipped with clean rooms and state-of-the-art production facilities, which enables us to process our products in a controlled environment and ensure their total purity until they are shipped.

MONTREAL, Jan. 3 /CNW Telbec/ - 5N Plus announced that it will report financial results for the second quarter on Tuesday, January 8th, 2008. 5N Plus will host a conference call at 10:00 a.m., on Wednesday, January 9th. Interested parties may also access the conference call by webcast at www.5nplus.com

The telephone numbers to access the conference call are 800-733-7571, 416-644-3414 or 514-807-8791.

OPEN TO: Analysts, investors and all interested parties

DATE: January 9th, 2008

TIME: 10h00 Eastern Time

Interested parties will access the discussion by webcast at

www.5nplus.com

MEDIA WISHING TO QUOTE AN ANALYST SHOULD CONTACT THE ANALYST PERSONALLY FOR PERMISSION.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999% (five nines or 5N) and more. 5N Plus, which has its head office in Montreal, Québec, develops and produces high-purity metals and compounds for electronic applications and provides its customers with recycling solutions. The Company is an integrated producer with both primary and secondary refining capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium and selenium and on related compounds such as cadmium telluride and cadmium sulphide. The Company's products are critical precursors in a number of electronic applications, including the rapidly-expanding solar (thin-film photovoltaics) market, for which 5N Plus is a major supplier of cadmium telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at www.5nplus.com

The telephone numbers to access the conference call are 800-733-7571, 416-644-3414 or 514-807-8791.

OPEN TO: Analysts, investors and all interested parties

DATE: January 9th, 2008

TIME: 10h00 Eastern Time

Interested parties will access the discussion by webcast at

www.5nplus.com

MEDIA WISHING TO QUOTE AN ANALYST SHOULD CONTACT THE ANALYST PERSONALLY FOR PERMISSION.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999% (five nines or 5N) and more. 5N Plus, which has its head office in Montreal, Québec, develops and produces high-purity metals and compounds for electronic applications and provides its customers with recycling solutions. The Company is an integrated producer with both primary and secondary refining capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium and selenium and on related compounds such as cadmium telluride and cadmium sulphide. The Company's products are critical precursors in a number of electronic applications, including the rapidly-expanding solar (thin-film photovoltaics) market, for which 5N Plus is a major supplier of cadmium telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at www.5nplus.com

So, eben 100 Stk. zu 8 CAD gekauft.

Üble Spesen, aber man will es ja im Auge behalten.

GJ-Ende war der 31.5.; bezogen darauf beträgt das KGV ca. 92.

KBV ist 8.

wieder mal teuer, aber die Fertigungsstätte in Deutschland soll allein zu einer Verdoppelung der bisherigen Kapazität führen.

Selbst unter Einbeziehung des neu eingesammelten Kapitals eine EK-Rendite von knapp 10%; vorher waren es eher 30%.

Schaun mer mal, für mich ist das Primärinteresse, zu erkennen ob FSLR mal ein Rohstoffproblem bekommt....

Üble Spesen, aber man will es ja im Auge behalten.

GJ-Ende war der 31.5.; bezogen darauf beträgt das KGV ca. 92.

KBV ist 8.

wieder mal teuer, aber die Fertigungsstätte in Deutschland soll allein zu einer Verdoppelung der bisherigen Kapazität führen.

Selbst unter Einbeziehung des neu eingesammelten Kapitals eine EK-Rendite von knapp 10%; vorher waren es eher 30%.

Schaun mer mal, für mich ist das Primärinteresse, zu erkennen ob FSLR mal ein Rohstoffproblem bekommt....

Antwort auf Beitrag Nr.: 32.940.610 von meinolf67 am 04.01.08 16:22:49GJ-Ende war der 31.5.; bezogen darauf beträgt das KGV ca. 92.

KBV ist 8.

Billig würd ich das nicht nennen!

KBV ist 8.

Billig würd ich das nicht nennen!

Antwort auf Beitrag Nr.: 32.940.634 von HuskyEnergy am 04.01.08 16:24:13Hab ich ja auch nicht gesagt.

hallo leute,

klingt ja interessant!

leider kann ich den wert bei cortal consors nicht finden?

weder mit dem namen noch mit der wkn

hilft mir bitte jemand?

danke!

klingt ja interessant!

leider kann ich den wert bei cortal consors nicht finden?

weder mit dem namen noch mit der wkn

hilft mir bitte jemand?

danke!

Antwort auf Beitrag Nr.: 32.944.619 von brady13 am 04.01.08 21:23:53Habe es eben bei Consors versucht. Finde ich auch nicht.

Bei comdirect geht es. Bei Finanznachrichten.de auch.

Beschwer Dich einfach bei Consors.

WKN ist: A0NAH2

Bei comdirect geht es. Bei Finanznachrichten.de auch.

Beschwer Dich einfach bei Consors.

WKN ist: A0NAH2

Antwort auf Beitrag Nr.: 32.945.379 von meinolf67 am 04.01.08 22:20:44unter der wkn finde ich bei comdirekt nichts aber dafür unter 5n plus!

danke!

hat hier jemand erfahrungen mit comdirect?

würde mich freuen? haben die noch immer das kostenlose depot?

sind die orders teuer?

na ich werde mich wohl selber schlau machen müssen.

falls jemans was weiß, gerne per pm an mich!

danke, nochmal meinolf!

danke!

hat hier jemand erfahrungen mit comdirect?

würde mich freuen? haben die noch immer das kostenlose depot?

sind die orders teuer?

na ich werde mich wohl selber schlau machen müssen.

falls jemans was weiß, gerne per pm an mich!

danke, nochmal meinolf!

5N Plus Inc. Reports Record Sales and Earnings for the Second Quarter of 2008

Tuesday January 8, 6:21 pm ET

MONTREAL, Jan. 8 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP - News) today announced financial results for the second quarter of fiscal 2008 ended November 30, 2007. Net earnings for the second quarter of 2008 reached a record level of $1,219,548 (4 cents per share), which represents a 40.6% increase over net earnings of $867,255 (3 cents per share) for the second quarter of the previous fiscal year. Sales for the quarter also reached a record level of $6,795,743, up by 39.0% compared with sales of $4,889,938 for the second quarter of the previous fiscal year. EBITDA(1) increased by 49.2% for the second quarter of fiscal 2008 to a record level of $2,318,111 up from $1,553,343 during the second quarter of the previous fiscal year.

ADVERTISEMENT

For the six month period ended November 30, 2007, net earnings increased by 49.3% to $2,318,804 (8 cents per share) and sales by 34.7% to $13,190,216. This compares with earnings of $1,553,581 (5 cents per share) and sales of $9,793,091 for the same period of the previous fiscal year. EBITDA(1) also increased by a similar amount, 49.7%, up from $2,946,905 during the six month period ended November 30, 2006, to $4,411,869 during the six month period ended November 30, 2007.

"We are very pleased to report our second quarter results to our shareholders, our employees and other stakeholders as we take on the challenges of a publicly traded company and the associated opportunities" commented Mr. Jacques L'Ecuyer, President and Chief Executive Officer. He added, "These results reflect our increasing penetration of the solar cell market where we expect growing demand for our products. We are making significant investments to address this forecasted growth in demand, which include our new Eisenhuttenstadt plant in Germany and additions to our Montreal facility aimed at increasing capacity and improving efficiency. Our recent successful initial public offering, which yielded net proceeds of approximately $31,500,000, will enable us to pursue our investment program as planned."

Mr. L'Ecuyer concluded, "We are also pleased to welcome to our board of directors two new independent members, namely Mr. Jean-Marie Bourassa, CA (Managing Partner of Bourassa Boyer Inc.), who will chair our audit committee, and Mr. Pierre Shoiry (Chief Executive Officer of Genivar (TSX:GNV-U - News)). Both will bring valuable experience and knowledge that will strengthen our largely independent board of directors chaired by Mr. Dennis Wood."

Webcast Information

Tuesday January 8, 6:21 pm ET

MONTREAL, Jan. 8 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP - News) today announced financial results for the second quarter of fiscal 2008 ended November 30, 2007. Net earnings for the second quarter of 2008 reached a record level of $1,219,548 (4 cents per share), which represents a 40.6% increase over net earnings of $867,255 (3 cents per share) for the second quarter of the previous fiscal year. Sales for the quarter also reached a record level of $6,795,743, up by 39.0% compared with sales of $4,889,938 for the second quarter of the previous fiscal year. EBITDA(1) increased by 49.2% for the second quarter of fiscal 2008 to a record level of $2,318,111 up from $1,553,343 during the second quarter of the previous fiscal year.

ADVERTISEMENT

For the six month period ended November 30, 2007, net earnings increased by 49.3% to $2,318,804 (8 cents per share) and sales by 34.7% to $13,190,216. This compares with earnings of $1,553,581 (5 cents per share) and sales of $9,793,091 for the same period of the previous fiscal year. EBITDA(1) also increased by a similar amount, 49.7%, up from $2,946,905 during the six month period ended November 30, 2006, to $4,411,869 during the six month period ended November 30, 2007.

"We are very pleased to report our second quarter results to our shareholders, our employees and other stakeholders as we take on the challenges of a publicly traded company and the associated opportunities" commented Mr. Jacques L'Ecuyer, President and Chief Executive Officer. He added, "These results reflect our increasing penetration of the solar cell market where we expect growing demand for our products. We are making significant investments to address this forecasted growth in demand, which include our new Eisenhuttenstadt plant in Germany and additions to our Montreal facility aimed at increasing capacity and improving efficiency. Our recent successful initial public offering, which yielded net proceeds of approximately $31,500,000, will enable us to pursue our investment program as planned."

Mr. L'Ecuyer concluded, "We are also pleased to welcome to our board of directors two new independent members, namely Mr. Jean-Marie Bourassa, CA (Managing Partner of Bourassa Boyer Inc.), who will chair our audit committee, and Mr. Pierre Shoiry (Chief Executive Officer of Genivar (TSX:GNV-U - News)). Both will bring valuable experience and knowledge that will strengthen our largely independent board of directors chaired by Mr. Dennis Wood."

Webcast Information

Next Webcast - January 9th, 2008 at 10h00 EST

log in ---> http://www.newswire.ca/en/webcast/viewEvent.cgi?eventID=2120…

log in ---> http://www.newswire.ca/en/webcast/viewEvent.cgi?eventID=2120…

Antwort auf Beitrag Nr.: 32.993.291 von Hoerschwelle am 09.01.08 14:51:47http://isht.comdirect.de/charts/big.chart?hist=3m&type=CONNE…

... und, jemand dabei gewesen?

http://webcast.newswire.ca/archive/5nplus/5nplus20080109.wma

Na dann will ich mal lauschen

http://webcast.newswire.ca/archive/5nplus/5nplus20080109.wma

Na dann will ich mal lauschen

Antwort auf Beitrag Nr.: 32.998.838 von Hoerschwelle am 09.01.08 21:02:29...und?

was denkste?

FSLR ist 60% Kunde

Eisenhüttenstadt soll am 31.7.08 in Betrieb gehen.

Kg-Preis von Te zwischen 300-500 USD

macht bei 0,13g/Wp für FSLR immerhin schon mindestens 4c, wahrscheinlicher aber 6c oder mehr.

Im Q3 wiesen Sie unter "Cost of goods sold" 24,537 Mio. bei 69,4 MW aus;

=> also 35c/Wp, bedeutet einen Te-Anteil an den Produktionskosten von MINDESTENS gut 11%, realistischerweise wahrscheinlich eher größer 20%

Wenn sich der Te-Preis z.B. verdoppelt, dann sollte man das wiederfinden.

Hinsichtlich der Versorgungslage habe ich zum ersten Mal Analystenfragen gehört. Die Antwort lautete:

"we expect Te-production will gradually increase... and no near-term or mid-term supply problems"

Interessanterweise scheint man die malayischen Werke bisher NICHT als Kunden gewonnen zu haben.

======

jetz noch was globales:

lt. Wiki (http://en.wikipedia.org/wiki/Tellurium) ist Te sehr selten

Occurrence

With an abundance in the Earth's crust even lower than platinum, tellurium is, apart from the precious metals, the rarest stable solid element in the earth's crust. Its abundance by mass is less than 0.001 ppm, compare with 0.037 ppm for platinum. By comparison, even the rarest of the lanthanides have crustal abundances of 0.5 ppm.

The extreme rarity of tellurium in the Earth's crust is not a reflection of its cosmic abundance, which is in fact greater than that of rubidium[1], even though rubidium is ten thousand times more abundant in the Earth's crust. Rather, the extraordinarily low abundance of tellurium on Earth results from the fact that, during the formation of the Earth, the stable form of elements in the absence of oxygen and water was controlled by the oxidation and reduction of hydrogen. Under this scenario elements such as tellurium which form volatile hydrides were severely depleted during the formation of the Earth's crust through evaporation. Tellurium and selenium are the heavy elements most depleted in the Earth's crust by this process.

Tellurium is sometimes found in its native (elemental) form, but is more often found as the tellurides of gold (calaverite, krennerite, petzite, sylvanite, and others). Tellurium compounds are the only chemical compounds of gold found in nature, but tellurium itself (unlike gold) is also found combined with other elements (in metallic salts). The principal source of tellurium is from anode sludges produced during the electrolytic refining of blister copper. It is a component of dusts from blast furnace refining of lead. Treatment of 500 tons of copper ore typically yields one pound of tellurium. Tellurium is produced mainly in the US, Canada, Peru, and Japan. See here.

Commercial-grade tellurium is usually marketed as minus 200-mesh powder but is also available as slabs, ingots, sticks, or lumps. The year-end price for tellurium in 2000 was US$14 per pound. In recent years, tellurium price was driven up by increased demand and limited supply, reaching as high as US$100 per pound in 2006

was denkste?

FSLR ist 60% Kunde

Eisenhüttenstadt soll am 31.7.08 in Betrieb gehen.

Kg-Preis von Te zwischen 300-500 USD

macht bei 0,13g/Wp für FSLR immerhin schon mindestens 4c, wahrscheinlicher aber 6c oder mehr.

Im Q3 wiesen Sie unter "Cost of goods sold" 24,537 Mio. bei 69,4 MW aus;

=> also 35c/Wp, bedeutet einen Te-Anteil an den Produktionskosten von MINDESTENS gut 11%, realistischerweise wahrscheinlich eher größer 20%

Wenn sich der Te-Preis z.B. verdoppelt, dann sollte man das wiederfinden.

Hinsichtlich der Versorgungslage habe ich zum ersten Mal Analystenfragen gehört. Die Antwort lautete:

"we expect Te-production will gradually increase... and no near-term or mid-term supply problems"

Interessanterweise scheint man die malayischen Werke bisher NICHT als Kunden gewonnen zu haben.

======

jetz noch was globales:

lt. Wiki (http://en.wikipedia.org/wiki/Tellurium) ist Te sehr selten

Occurrence

With an abundance in the Earth's crust even lower than platinum, tellurium is, apart from the precious metals, the rarest stable solid element in the earth's crust. Its abundance by mass is less than 0.001 ppm, compare with 0.037 ppm for platinum. By comparison, even the rarest of the lanthanides have crustal abundances of 0.5 ppm.

The extreme rarity of tellurium in the Earth's crust is not a reflection of its cosmic abundance, which is in fact greater than that of rubidium[1], even though rubidium is ten thousand times more abundant in the Earth's crust. Rather, the extraordinarily low abundance of tellurium on Earth results from the fact that, during the formation of the Earth, the stable form of elements in the absence of oxygen and water was controlled by the oxidation and reduction of hydrogen. Under this scenario elements such as tellurium which form volatile hydrides were severely depleted during the formation of the Earth's crust through evaporation. Tellurium and selenium are the heavy elements most depleted in the Earth's crust by this process.

Tellurium is sometimes found in its native (elemental) form, but is more often found as the tellurides of gold (calaverite, krennerite, petzite, sylvanite, and others). Tellurium compounds are the only chemical compounds of gold found in nature, but tellurium itself (unlike gold) is also found combined with other elements (in metallic salts). The principal source of tellurium is from anode sludges produced during the electrolytic refining of blister copper. It is a component of dusts from blast furnace refining of lead. Treatment of 500 tons of copper ore typically yields one pound of tellurium. Tellurium is produced mainly in the US, Canada, Peru, and Japan. See here.

Commercial-grade tellurium is usually marketed as minus 200-mesh powder but is also available as slabs, ingots, sticks, or lumps. The year-end price for tellurium in 2000 was US$14 per pound. In recent years, tellurium price was driven up by increased demand and limited supply, reaching as high as US$100 per pound in 2006

Hiernach sind es bis zu 700 to/a:

http://www.uniterra.de/rutherford/ele052.htm

Verwendung

Jährlich werden von Tellur zwischen 250 und 700 Tonnen gewonnen. Verwendung findet überwiegend seine metallische Form in Stahl-, Aluminium- und Kupferlegierungen. Es wird in Katalysatoren der chemischen Industrie und zur Herstellung von Elektronikbauteilen in der Halbleitertechnik eingesetzt. Darüber hinaus wird es auch in Photozellen zur Nutzung der Sonnenenergie verarbeitet

http://www.uniterra.de/rutherford/ele052.htm

Verwendung

Jährlich werden von Tellur zwischen 250 und 700 Tonnen gewonnen. Verwendung findet überwiegend seine metallische Form in Stahl-, Aluminium- und Kupferlegierungen. Es wird in Katalysatoren der chemischen Industrie und zur Herstellung von Elektronikbauteilen in der Halbleitertechnik eingesetzt. Darüber hinaus wird es auch in Photozellen zur Nutzung der Sonnenenergie verarbeitet

Antwort auf Beitrag Nr.: 33.007.681 von meinolf67 am 10.01.08 15:52:12Ich stehe im Augenblick in Gesprächen mit einer CdTe Firma über die möglichen Mengen der weltweiten Te Produktion. Über 5N dekt, wie Du sagst FSLR 60% ab, aber es gibt ja eben nicht nur 5N. Sobald ich näheres weiss, melde ich mich.

Nach meinem inoffiziellen Kenntnisstand liegt die Produktionsmenge weit höher als angenommen. Die ehemaligen Ostblockstaaten spielen dabei eine Zentrale Rolle ...

Ansonsten in 5N nicht übel, wobei mich der Cast nicht vom Hocker gehauen hat.

Das CdTe Thema wird, soweit ich das interpretieren kann, zur Zeit im wesentlichen zur Stimmungsmache eingesetzt. Fundamental gibt es da die unterschiedlichsten Statements ...

Nach meinem inoffiziellen Kenntnisstand liegt die Produktionsmenge weit höher als angenommen. Die ehemaligen Ostblockstaaten spielen dabei eine Zentrale Rolle ...

Ansonsten in 5N nicht übel, wobei mich der Cast nicht vom Hocker gehauen hat.

Das CdTe Thema wird, soweit ich das interpretieren kann, zur Zeit im wesentlichen zur Stimmungsmache eingesetzt. Fundamental gibt es da die unterschiedlichsten Statements ...

Antwort auf Beitrag Nr.: 33.009.272 von meinolf67 am 10.01.08 17:23:42Von 2006 ist die Feststellung, wer weiss wann die Daten tatsächlich gesammelt wurden

laut H&M, einem Metallhändler, beträgt die Weltjahresproduktion an Tellur ca. 25o Tonnen, geschätzt.

und es gilt als giftig.

und es gilt als giftig.

Antwort auf Beitrag Nr.: 33.021.673 von Robert_Reichschwein am 11.01.08 16:19:18Viel höher.

http://seekingalpha.com/article/60008-5n-plus-f2q08-qtr-end-…

5N Plus Inc (VNP)

F2Q08 Earnings Call

January 9, 2008 10:00 am ET

Executives

Jacques L’Ecuyer – President, Chief Executive Officer & Director

Christian Dupont – Chief Financial Officer

Analysts

Carolina Vargas – Clarus Securities, Inc.

Rupert Merer – National Bank Financial

Lisa Brown – GMP Securities, LP

[Patrick Chan] – TD Waterhouse

Ian Thorpe – Dundee Securities

Mac Whale – Cormark Securities

Presentation

Operator

Welcome to the 5N Plus Fiscal Year 2008 Second quarter results conference call. At this time all participants are in the listen only mode. (Operator Instructions) I would now like to turn the conference over to Mr. Jacque Philippe L’Ecuyer, President and Chief Executive Officer. (French Translation)

Jacques L’Ecuyer

Good morning everyone and thank you for joining us today for the 5N Plus FY08 second quarter results presentation. This is our first ever webcast conference as we’ve just very recently completed our IPO on December 20th and now take on the challenges of regular reporting to the public. A quick reminder concerning our second quarter results which were issued earlier this morning together with our MD&A and financial statements. If you’ve not been able to geta copy of these documents I invite you to doso by accessing the center website at www.sedar.com where these documents are posted.

Joining me this morning is Christian Dupont our Chief Financial Officer who will be providing you with more detailed information later during the call concerning our financial statements. For those of you who are not very familiar with our corporation we are a producer of high-purity metals and compounds for electronic applications and we draw our name from the nominal purity of the products that we sell. 99.999%, five nines or five N’s and above.

We develop and produce such metals and compounds and provide our customers with recycling solutions. We have our head offices in Montreal Quebec, Canada and are currently building a new facility in Eisenhüttenstadt, Germany which is approximately 150 kilometers east of Berlin. We are an integrated producer with both primary and secondary refining capabilities and we focus on specialty metals such as tellurium, cadmium and selenium and on related compounds such as cadmium telluride and cadmium sulphide. We sell our products in a number of electronic applications, including the rapidly expanding solar cell market of thin-film photovoltaics and the radiation detector market where our products are used for medical imaging, for example.

Now before discussing our results, I would like to mention that we may be making forward-looking statements during this call and that such statements involves significant risks, uncertainties, and assumptions and are therefore subject to the usual cautionary remarks. For a list of the factors that could cause our actual results to differ materially from those discussed or implied in our forward-looking statement we refer you to the risk factor section of the prospectus that we filled on December 12, 2007.

5N Plus Inc (VNP)

F2Q08 Earnings Call

January 9, 2008 10:00 am ET

Executives

Jacques L’Ecuyer – President, Chief Executive Officer & Director

Christian Dupont – Chief Financial Officer

Analysts

Carolina Vargas – Clarus Securities, Inc.

Rupert Merer – National Bank Financial

Lisa Brown – GMP Securities, LP

[Patrick Chan] – TD Waterhouse

Ian Thorpe – Dundee Securities

Mac Whale – Cormark Securities

Presentation

Operator

Welcome to the 5N Plus Fiscal Year 2008 Second quarter results conference call. At this time all participants are in the listen only mode. (Operator Instructions) I would now like to turn the conference over to Mr. Jacque Philippe L’Ecuyer, President and Chief Executive Officer. (French Translation)

Jacques L’Ecuyer

Good morning everyone and thank you for joining us today for the 5N Plus FY08 second quarter results presentation. This is our first ever webcast conference as we’ve just very recently completed our IPO on December 20th and now take on the challenges of regular reporting to the public. A quick reminder concerning our second quarter results which were issued earlier this morning together with our MD&A and financial statements. If you’ve not been able to geta copy of these documents I invite you to doso by accessing the center website at www.sedar.com where these documents are posted.

Joining me this morning is Christian Dupont our Chief Financial Officer who will be providing you with more detailed information later during the call concerning our financial statements. For those of you who are not very familiar with our corporation we are a producer of high-purity metals and compounds for electronic applications and we draw our name from the nominal purity of the products that we sell. 99.999%, five nines or five N’s and above.

We develop and produce such metals and compounds and provide our customers with recycling solutions. We have our head offices in Montreal Quebec, Canada and are currently building a new facility in Eisenhüttenstadt, Germany which is approximately 150 kilometers east of Berlin. We are an integrated producer with both primary and secondary refining capabilities and we focus on specialty metals such as tellurium, cadmium and selenium and on related compounds such as cadmium telluride and cadmium sulphide. We sell our products in a number of electronic applications, including the rapidly expanding solar cell market of thin-film photovoltaics and the radiation detector market where our products are used for medical imaging, for example.

Now before discussing our results, I would like to mention that we may be making forward-looking statements during this call and that such statements involves significant risks, uncertainties, and assumptions and are therefore subject to the usual cautionary remarks. For a list of the factors that could cause our actual results to differ materially from those discussed or implied in our forward-looking statement we refer you to the risk factor section of the prospectus that we filled on December 12, 2007.

2008-01-23

Next Webcast - April 2008

Third quarter financial results.

2008-01-23

Next Webcast - April 2008

Next Webcast - April 2008

Third quarter financial results.

2008-01-23

Next Webcast - April 2008

Schöner Kursanstieg

das ding steig und steigt und ich hab kein geld an der seitenlinie.

haben dir ihre fabrik in germany denn schon auf die beine gestellt?

irgendwer der die letzten cc's verfolg hat?

hab bald n bisschen war übrig und überlege hmmm

danke schonmal!

haben dir ihre fabrik in germany denn schon auf die beine gestellt?

irgendwer der die letzten cc's verfolg hat?

hab bald n bisschen war übrig und überlege hmmm

danke schonmal!

Antwort auf Beitrag Nr.: 33.755.729 von brady13 am 28.03.08 22:02:19Fabrik in D soll im Sommer in Betrieb gehen.

5N Plus Inc. Reports Record Sales and Earnings for the Third Quarter of 2008

MONTREAL, April 7 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP) today announced

financial results for the third quarter of fiscal 2008 ended February 29,

2008. Net earnings for the third quarter reached a record level of $2,268,712

(6 cents per share), which represents a 184.3% increase over net earnings of

$798,073 (3 cents per share) for the third quarter of the previous fiscal

year. Sales for the quarter also reached a record level of $8,358,817, up by

50.5% compared with sales of $5,554,737 for the third quarter of the previous

fiscal year. EBITDA(1) increased by 93.7% in the third quarter to a record

level of $3,423,415 up from $1,767,318 during the third quarter of the

previous fiscal year.

For the nine-month period ended February 29, 2008, net earnings increased

by 95.1% to $4,587,516 (14 cents per share), and sales by 40.4% to

$21,549,033. This compares with earnings of $2,351,654 (8 cents per share) and

sales of $15,347,828 for the same period of the previous fiscal year.

EBITDA(1) also increased by 66.2% up from $4,714,223 during the nine- month

period ended February 28, 2007, to $7,835,284 during the corresponding period

of the current fiscal year.

"We (TSX:VNP) are pleased to report our third quarter results which

exceeded our expectations both in terms of sales and profitability. Closing of

our initial public offering ("IPO") occurred early in the quarter and these

results therefore reflect our performance as a publicly traded company."

commented Mr. Jacques L'Ecuyer, President and Chief Executive Officer. He

added, "Net earnings, EBITDA(1) and sales all reached record levels during the

quarter and the nine- month period considered. This is largely the result of a

continuing and increasing demand for our products in the photovoltaic market,

and to a lesser extent in the radiation detector market, combined with

improvements in operating performance which have led to increased production

throughput. We are also making steady progress at our new Eisenhuttenstadt

plant in Germany, the construction of which is now almost completed. Although

we have experienced some minor delays in the delivery of the building, we

continue to expect the plant to be operational by the end of July 2008 in

accordance with our contractual obligations towards our customers."

Mr. L'Ecuyer concluded, "Aside from providing us with means for funding

the construction of our German facility, our recent IPO has significantly

raised our profile and exposure, creating a number of new potential growth

opportunities that we hope to take advantage of in the future. Our IPO has

also enabled us to increase and promote, through direct stock purchases and

our stock option plan, employee ownership, an important component of our

corporate strategy."

MONTREAL, April 7 /CNW Telbec/ - 5N Plus Inc. (TSX: VNP) today announced

financial results for the third quarter of fiscal 2008 ended February 29,

2008. Net earnings for the third quarter reached a record level of $2,268,712

(6 cents per share), which represents a 184.3% increase over net earnings of

$798,073 (3 cents per share) for the third quarter of the previous fiscal

year. Sales for the quarter also reached a record level of $8,358,817, up by

50.5% compared with sales of $5,554,737 for the third quarter of the previous

fiscal year. EBITDA(1) increased by 93.7% in the third quarter to a record

level of $3,423,415 up from $1,767,318 during the third quarter of the

previous fiscal year.

For the nine-month period ended February 29, 2008, net earnings increased

by 95.1% to $4,587,516 (14 cents per share), and sales by 40.4% to

$21,549,033. This compares with earnings of $2,351,654 (8 cents per share) and

sales of $15,347,828 for the same period of the previous fiscal year.

EBITDA(1) also increased by 66.2% up from $4,714,223 during the nine- month

period ended February 28, 2007, to $7,835,284 during the corresponding period

of the current fiscal year.

"We (TSX:VNP) are pleased to report our third quarter results which

exceeded our expectations both in terms of sales and profitability. Closing of

our initial public offering ("IPO") occurred early in the quarter and these

results therefore reflect our performance as a publicly traded company."

commented Mr. Jacques L'Ecuyer, President and Chief Executive Officer. He

added, "Net earnings, EBITDA(1) and sales all reached record levels during the

quarter and the nine- month period considered. This is largely the result of a

continuing and increasing demand for our products in the photovoltaic market,

and to a lesser extent in the radiation detector market, combined with

improvements in operating performance which have led to increased production

throughput. We are also making steady progress at our new Eisenhuttenstadt

plant in Germany, the construction of which is now almost completed. Although

we have experienced some minor delays in the delivery of the building, we

continue to expect the plant to be operational by the end of July 2008 in

accordance with our contractual obligations towards our customers."

Mr. L'Ecuyer concluded, "Aside from providing us with means for funding

the construction of our German facility, our recent IPO has significantly

raised our profile and exposure, creating a number of new potential growth

opportunities that we hope to take advantage of in the future. Our IPO has

also enabled us to increase and promote, through direct stock purchases and

our stock option plan, employee ownership, an important component of our

corporate strategy."

5N Plus Inc. Announces $46.2 Million Bought Deal Equity Financing

/THIS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT

INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES./

TSX: VNP

MONTREAL, April 9 /CNW Telbec/ - 5N Plus Inc. (TSX:VNP) today announced

that it has agreed to issue 4 million common shares from treasury of the

Company on a bought-deal basis to a syndicate of underwriters led by National

Bank Financial Inc. The shares will be issued at a price of $11.55 per share,

for gross proceeds to the Company of $46.2 million. The common shares will be

offered by way of short form prospectus in each of the provinces of Canada, as

well as in the United States under applicable private placement exemptions.

The financing is subject to all normal regulatory approvals and is expected to

close on or about April 29, 2008.

The net proceeds of the offering will be used by 5N Plus for general

corporate purposes and to pursue various growth opportunities.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999%

(five nines or 5N) and more. 5N Plus, which has its head office in Montreal,

Quebec, develops and produces high-purity metals and compounds for electronic

applications and provides its customers with recycling solutions. The Company

is an integrated producer with both primary and secondary refining

capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium

and selenium and on related compounds such as cadmium telluride and cadmium

sulphide. The Company's products are critical precursors in a number of

electronic applications, including the rapidly-expanding solar (thin-film

photovoltaics) market, for which 5N Plus is a major supplier of cadmium

telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at

www.5nplus.com.

/THIS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT

INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES./

TSX: VNP

MONTREAL, April 9 /CNW Telbec/ - 5N Plus Inc. (TSX:VNP) today announced

that it has agreed to issue 4 million common shares from treasury of the

Company on a bought-deal basis to a syndicate of underwriters led by National

Bank Financial Inc. The shares will be issued at a price of $11.55 per share,

for gross proceeds to the Company of $46.2 million. The common shares will be

offered by way of short form prospectus in each of the provinces of Canada, as

well as in the United States under applicable private placement exemptions.

The financing is subject to all normal regulatory approvals and is expected to

close on or about April 29, 2008.

The net proceeds of the offering will be used by 5N Plus for general

corporate purposes and to pursue various growth opportunities.

About 5N Plus Inc.

5N Plus draws its name from the purity of its products, 99.999%

(five nines or 5N) and more. 5N Plus, which has its head office in Montreal,

Quebec, develops and produces high-purity metals and compounds for electronic

applications and provides its customers with recycling solutions. The Company

is an integrated producer with both primary and secondary refining

capabilities. 5N Plus focuses on specialty metals such as tellurium, cadmium

and selenium and on related compounds such as cadmium telluride and cadmium

sulphide. The Company's products are critical precursors in a number of

electronic applications, including the rapidly-expanding solar (thin-film

photovoltaics) market, for which 5N Plus is a major supplier of cadmium

telluride, and the radiation detector market.

Additional information about 5N Plus is available on its Web site at

www.5nplus.com.

The Tellurium Supernova Has Erupted

by: Mark Anthony posted on: April 11, 2008 | about stocks: FSLR / VNP

*

Font Size:

*

Print

* Email

In my previous article, The Tellurium Supernova, I discussed the rapidly expanding new applications of the extremely rare metal tellurium, and that looming global shortage of telluriumcould threaten the very survival of the red hot solar company, strong>First Solar Inc. (FSLR), which produces solar PV panels based on the CdTe (cadmium telluride) semiconductor material.

The Tellurium Supernova article caused quite some disturbance on the internet. Not every one agrees with me. But I am happy that Mr. Free Market does seem to agree with me. The charts show that tellurium price staged an incredible rally since mid January, raising from 860 yuan to 2100 yuan per kilogram, or US$300 per kilogram, a raise of 2.44 fold in less than three months. Tellurium went from US$10 a kilogram in 2004 to now over US$300. If such a stellar price rally does not indicate a severe global shortage of tellurium, then I don't know what does.

The Tellurium Supernova has erupted!

Does First Solar feel the squeeze of a tellurium shortage? Maybe not. At a conference last November, the CFOclaimed (22:58) "We have identified terawattslevels of tellurium availability." So the ultimate limit to the growth is one terawatts? No! The CEO proudly declared"Are there issues there that limit the ultimate size of the company? We think the answer to that is NO." Wow! I never knew that FSLR can grow with o ultimate limit of size, even though they rely on a metal with extremely limited supply.

FSLR, as well as its dominant raw material supplier, 5N Plus Inc. (VNP), repeatedly reassured people that it is not worried about tellurium availability and they are actively "managing it." But I noticed that it would NEVER divulge anything specific or anything quantitative when it comes to its tellurium supply. In multiple occasions, analysts, including Michael Molnar from Goldman Sachs, explicitly demanded specific and quantitative answers, but got only the vague go-around answers. Why is the company not willing to reveal any data on tellurium?

Fortunately, VNP, the virtually exclusive high purity CdTe and dS supplier to FSLR, is now a publicly traded company and must file regular financial reports, allowing us to dig out some useful information. You can go to Sedar.com and search for "5N Plus" to find all VNP regulatory filings. I think the VNP's Dec. 12, 2007 prospectus document is worth reading through carefully. It discusses a lot of details of the industrial use of high purity tellurium, and its relationship with FSLR. You might also listen to latest conference call. A few important things to note from the prospectus:

1. VNP is the first to enter the market of high purity tellurium metal and compounds. It has years of expertise, large scale production capacity, and business relationship with tellurium sources. It is the world's dominant CdTe supplier and all dTe solar PV manufacturers purchase CdTe from them.

2. VNP is a virtual monopoly in this niche market. The barrier of entry is too high for a second major CdTe supplier, and the market is too narrow to provide enough economic incentive for competitors to enter this small niche market and compete with VNP. FSLR desperately wanted to diversify its CdTe sources but there is just no significant secondary supplier in existance in the world. It refuses to name the secondary supplier. Does it even exist at all? NP already named all of its few potential competitors.

3. It is safe to say SLR gets virtually all of its dTe supply from VNP. VNP has plenty of production capacity, 100 metric tons of CdTe annually, and under contracts with FSLR, it is building a new Germany facility, bringing the annual capacity to 200 metric tons and eventually reaching 350 metric tons a year. Why would VNP expand if FSLR does not continue to heavily depend on VNP for supply?

4. VNP noted rapidly expanding industry demand on tellurium. It mentioned 300 metric tons of start metals per year for thermoelectrics applications (page 21). That number really strikes me. According to USGS, global tellurium supply can not be much more than 200 metric tons per year. Thermoelectrics usage of tellurium wasn't even mentioned a few years ago. Now that market alone consumes 143.4 metric tons of tellurium (48% of the Bi2Te3 thermoelectrics material is tellurium).

So we can pretty accurately estimate FSLR's raw material supply by looking at how much CdTe VNP is selling to FSLR. VNP refused to provide numbers in kilograms, but it gave a price range of $300 to $500 per kilogram during the Q2 conference call, and suggested in Q3 conference call that the price may exceed the top of the range now. So using $500 per kilogram, one can get some reasonable numbers. VNP also revealed that 60% of sales was to FSLR, and 65% to 70%.

Let me list VNP's quarterly sales revenue, as well as cost of goolds sold (in bracket) below. Note their fiscal year 2008 starts on June 1st, 2007. Q3,08 is the quarter ending Feb. 29, 08.

Q3,08 $8.359M ($3.905M) OP. Margin $4.454M

Q2,08 $6.796M ($3.519M) OP. Margin $3.277M

Q1,08 $6.394M ($3.417M) OP. Margin $2.977M

Q4,07 $6.549M ($3.442M) OP. Margin $3.107M

Q3,07 $5.555M ($3.419M) OP. Margin $2.136M

Q2,07 $4.890M ($2.779M) OP. Margin $2.111M

Q1,07 $4.903M ($3.122M) OP. Margin $1.781M

I noticed one curious thing. During the past quarters, even though the sales revenue saw some growth, the growth is not impressive at all. The cost of goods sold saw virtually no growth at all, while the operating profit jumps up rapidly!

Put it in a chart you can see the data more clearly. In the chart, blackis FSLR's rapidly ramped up quarterly production in MWs, red is VNP's cost of goods sold, blue is sales revenue, and green is gross operating profit.

Notice the gigantic contrast between how quickly FSLR's production ramped up, and how there is virtually no increase in VNP's ost of goods sold? Logically, as FSLR ramps up production, it needs to purchase way much more CdTe semiconductor material from VNP. Hence, VNP needs to spend more money to purchase the raw tellurium feedstock, not to mention the unit price of the feedstock raw material must increase dramatically as tellurium price went up a lot.

Something is not right here!

The rapid growth of VNP's gross operating profit, without much increase in the production cost, further enhances the logical wisdom that VNP enjoys an absolute monopoly in this small niche market of high purity CdTe supply, and hence can demand higher unit price as they see fit, while FSLR has nowhere to go but purchase the bulk of their CdTe supply from VNP.

My suspicion is FSLR is not getting all the CdTe it needs for its production. At 3 microns CdTe layer thickness, there's about 15 gramsof CdTe per 2 feet x 4 feet panel of 70 watts. Allowing for some production waste, 0.25 grams/watt CdTeis reasonable. FSLR produced 77 MW in Q4,07, that's a consumption of roughly 19.25 metric tons of CdTe. At over US$500 per kilogram, that's worth $9.625M of purchase from VNP. Add dS, which also came from NP, total purchase should be almost US$11M for the quarter.

VNP's latest quarterly revenue is only $8.359M, and with 65% going to FSLR, that's $5.433M. Split it into $4.8M for CdTe and the rest for CdS, at over $500/kilogram, they sold about 9.6 metric tons of CdTe to FSLR. That's only about HALF of what FSLR would need!

From the VNP's cost point of view, about half of cost is salary, machinery and other fixed costs. Let's say $2M of the $3.905M cost in the quarter is on raw material purchase. SLR's portion takes 65%, or $1.3M, tellurium price during the quarter probably averaged $250/kilogram. So that gives 5.2 metric tons of tellurium, enough to make 9.8 metric tons of CdTe for FSLR, consistent with the above estimate, and inconsistent with FSLR's 19.25 metric tons requirement for quarterly production.

My conclusion, based on the best information available to me and the most logical and reasonable estimate, is that FSLR has already run into a raw material supply shortage due to the global shortage of tellurium. It is either now producing from the raw material inventory, or it probably booked quarterly sales but really could not produce and deliver the quantity of products it sold. Later this year and next, when its new Malaysia factories start production, I really have o idea how it is going to get the tellurium supply it needs.

I contacted SLR investor relations and raised the CdTe supply issues more than a month ago and asked for a clarification, and never got any response. I am hoping that FSLR can come out and clarify how and where it is getting its critical material supply, how much it has secured, and how much they need. Of course, if there really is a shortage, the investor community has every right to demand that the FSLR management disclose the information fully and publicly, as soon as it knows it, as required by the SEC regulations.

by: Mark Anthony posted on: April 11, 2008 | about stocks: FSLR / VNP

*

Font Size:

*

In my previous article, The Tellurium Supernova, I discussed the rapidly expanding new applications of the extremely rare metal tellurium, and that looming global shortage of telluriumcould threaten the very survival of the red hot solar company, strong>First Solar Inc. (FSLR), which produces solar PV panels based on the CdTe (cadmium telluride) semiconductor material.

The Tellurium Supernova article caused quite some disturbance on the internet. Not every one agrees with me. But I am happy that Mr. Free Market does seem to agree with me. The charts show that tellurium price staged an incredible rally since mid January, raising from 860 yuan to 2100 yuan per kilogram, or US$300 per kilogram, a raise of 2.44 fold in less than three months. Tellurium went from US$10 a kilogram in 2004 to now over US$300. If such a stellar price rally does not indicate a severe global shortage of tellurium, then I don't know what does.

The Tellurium Supernova has erupted!

Does First Solar feel the squeeze of a tellurium shortage? Maybe not. At a conference last November, the CFOclaimed (22:58) "We have identified terawattslevels of tellurium availability." So the ultimate limit to the growth is one terawatts? No! The CEO proudly declared"Are there issues there that limit the ultimate size of the company? We think the answer to that is NO." Wow! I never knew that FSLR can grow with o ultimate limit of size, even though they rely on a metal with extremely limited supply.

FSLR, as well as its dominant raw material supplier, 5N Plus Inc. (VNP), repeatedly reassured people that it is not worried about tellurium availability and they are actively "managing it." But I noticed that it would NEVER divulge anything specific or anything quantitative when it comes to its tellurium supply. In multiple occasions, analysts, including Michael Molnar from Goldman Sachs, explicitly demanded specific and quantitative answers, but got only the vague go-around answers. Why is the company not willing to reveal any data on tellurium?

Fortunately, VNP, the virtually exclusive high purity CdTe and dS supplier to FSLR, is now a publicly traded company and must file regular financial reports, allowing us to dig out some useful information. You can go to Sedar.com and search for "5N Plus" to find all VNP regulatory filings. I think the VNP's Dec. 12, 2007 prospectus document is worth reading through carefully. It discusses a lot of details of the industrial use of high purity tellurium, and its relationship with FSLR. You might also listen to latest conference call. A few important things to note from the prospectus:

1. VNP is the first to enter the market of high purity tellurium metal and compounds. It has years of expertise, large scale production capacity, and business relationship with tellurium sources. It is the world's dominant CdTe supplier and all dTe solar PV manufacturers purchase CdTe from them.

2. VNP is a virtual monopoly in this niche market. The barrier of entry is too high for a second major CdTe supplier, and the market is too narrow to provide enough economic incentive for competitors to enter this small niche market and compete with VNP. FSLR desperately wanted to diversify its CdTe sources but there is just no significant secondary supplier in existance in the world. It refuses to name the secondary supplier. Does it even exist at all? NP already named all of its few potential competitors.

3. It is safe to say SLR gets virtually all of its dTe supply from VNP. VNP has plenty of production capacity, 100 metric tons of CdTe annually, and under contracts with FSLR, it is building a new Germany facility, bringing the annual capacity to 200 metric tons and eventually reaching 350 metric tons a year. Why would VNP expand if FSLR does not continue to heavily depend on VNP for supply?

4. VNP noted rapidly expanding industry demand on tellurium. It mentioned 300 metric tons of start metals per year for thermoelectrics applications (page 21). That number really strikes me. According to USGS, global tellurium supply can not be much more than 200 metric tons per year. Thermoelectrics usage of tellurium wasn't even mentioned a few years ago. Now that market alone consumes 143.4 metric tons of tellurium (48% of the Bi2Te3 thermoelectrics material is tellurium).

So we can pretty accurately estimate FSLR's raw material supply by looking at how much CdTe VNP is selling to FSLR. VNP refused to provide numbers in kilograms, but it gave a price range of $300 to $500 per kilogram during the Q2 conference call, and suggested in Q3 conference call that the price may exceed the top of the range now. So using $500 per kilogram, one can get some reasonable numbers. VNP also revealed that 60% of sales was to FSLR, and 65% to 70%.

Let me list VNP's quarterly sales revenue, as well as cost of goolds sold (in bracket) below. Note their fiscal year 2008 starts on June 1st, 2007. Q3,08 is the quarter ending Feb. 29, 08.

Q3,08 $8.359M ($3.905M) OP. Margin $4.454M

Q2,08 $6.796M ($3.519M) OP. Margin $3.277M

Q1,08 $6.394M ($3.417M) OP. Margin $2.977M

Q4,07 $6.549M ($3.442M) OP. Margin $3.107M

Q3,07 $5.555M ($3.419M) OP. Margin $2.136M

Q2,07 $4.890M ($2.779M) OP. Margin $2.111M

Q1,07 $4.903M ($3.122M) OP. Margin $1.781M

I noticed one curious thing. During the past quarters, even though the sales revenue saw some growth, the growth is not impressive at all. The cost of goods sold saw virtually no growth at all, while the operating profit jumps up rapidly!

Put it in a chart you can see the data more clearly. In the chart, blackis FSLR's rapidly ramped up quarterly production in MWs, red is VNP's cost of goods sold, blue is sales revenue, and green is gross operating profit.

Notice the gigantic contrast between how quickly FSLR's production ramped up, and how there is virtually no increase in VNP's ost of goods sold? Logically, as FSLR ramps up production, it needs to purchase way much more CdTe semiconductor material from VNP. Hence, VNP needs to spend more money to purchase the raw tellurium feedstock, not to mention the unit price of the feedstock raw material must increase dramatically as tellurium price went up a lot.

Something is not right here!

The rapid growth of VNP's gross operating profit, without much increase in the production cost, further enhances the logical wisdom that VNP enjoys an absolute monopoly in this small niche market of high purity CdTe supply, and hence can demand higher unit price as they see fit, while FSLR has nowhere to go but purchase the bulk of their CdTe supply from VNP.

My suspicion is FSLR is not getting all the CdTe it needs for its production. At 3 microns CdTe layer thickness, there's about 15 gramsof CdTe per 2 feet x 4 feet panel of 70 watts. Allowing for some production waste, 0.25 grams/watt CdTeis reasonable. FSLR produced 77 MW in Q4,07, that's a consumption of roughly 19.25 metric tons of CdTe. At over US$500 per kilogram, that's worth $9.625M of purchase from VNP. Add dS, which also came from NP, total purchase should be almost US$11M for the quarter.

VNP's latest quarterly revenue is only $8.359M, and with 65% going to FSLR, that's $5.433M. Split it into $4.8M for CdTe and the rest for CdS, at over $500/kilogram, they sold about 9.6 metric tons of CdTe to FSLR. That's only about HALF of what FSLR would need!

From the VNP's cost point of view, about half of cost is salary, machinery and other fixed costs. Let's say $2M of the $3.905M cost in the quarter is on raw material purchase. SLR's portion takes 65%, or $1.3M, tellurium price during the quarter probably averaged $250/kilogram. So that gives 5.2 metric tons of tellurium, enough to make 9.8 metric tons of CdTe for FSLR, consistent with the above estimate, and inconsistent with FSLR's 19.25 metric tons requirement for quarterly production.

My conclusion, based on the best information available to me and the most logical and reasonable estimate, is that FSLR has already run into a raw material supply shortage due to the global shortage of tellurium. It is either now producing from the raw material inventory, or it probably booked quarterly sales but really could not produce and deliver the quantity of products it sold. Later this year and next, when its new Malaysia factories start production, I really have o idea how it is going to get the tellurium supply it needs.

I contacted SLR investor relations and raised the CdTe supply issues more than a month ago and asked for a clarification, and never got any response. I am hoping that FSLR can come out and clarify how and where it is getting its critical material supply, how much it has secured, and how much they need. Of course, if there really is a shortage, the investor community has every right to demand that the FSLR management disclose the information fully and publicly, as soon as it knows it, as required by the SEC regulations.

5N Plus raises $46.2M from share sale

The Gazette; Canwest News Service

Published: 5 hours ago

High-purity metals producer 5N Plus Inc. said it raised $46.2 million by issuing 4 million shares at $11.55 each to an underwriting group led by National Bank Financial in a "bought deal." The proceeds will be used for general corporate purposes, including future acquisitions. The Montreal-based company's products are used by the electronics industry, makers of solar energy panels and radiation detection equipment.

© The Gazette (Montreal) 2008

The Gazette; Canwest News Service

Published: 5 hours ago

High-purity metals producer 5N Plus Inc. said it raised $46.2 million by issuing 4 million shares at $11.55 each to an underwriting group led by National Bank Financial in a "bought deal." The proceeds will be used for general corporate purposes, including future acquisitions. The Montreal-based company's products are used by the electronics industry, makers of solar energy panels and radiation detection equipment.

© The Gazette (Montreal) 2008

Tellurium prices stabilise

Exchange rates used in this story

Date: 2008-04-22

USD RMB EUR GBP

USD 1 7.0075 0.6307 0.5023

RMB 0.1431 1 0.09026 0.07188

LONDON (Metal-Pages) 29-Apr-08. The tellurium market has fallen back from recent highs but continues to hold up at relatively firm price levels due to tight supply, market sources said on Tuesday.

The price for 99.99% grade tellurium was quoted at $ 300-320/kg compared with a range of $ 330-340/kg quoted at the beginning of the month.

A European trader said: "The tellurium market is trading at around $ 300-320/kg, the lowest we have heard is $ 290/kg. The market has come down a little but it will be relatively stable in the next few months or see another increase because supply is extremely tight. Large quantities are not available, we can only obtain about 300-500 kg a month."

"Our partner is not willing to give us new offers until mid May because he is hoping for higher prices," the trader added.

However, a UK trader dealing with a lower purity material said tellurium had gone down. She quoted a price of $ 260/kg for 3N material saying that the price for that grade went up so quickly that it is seeing a natural correction.

Exchange rates used in this story

Date: 2008-04-22

USD RMB EUR GBP

USD 1 7.0075 0.6307 0.5023

RMB 0.1431 1 0.09026 0.07188

LONDON (Metal-Pages) 29-Apr-08. The tellurium market has fallen back from recent highs but continues to hold up at relatively firm price levels due to tight supply, market sources said on Tuesday.

The price for 99.99% grade tellurium was quoted at $ 300-320/kg compared with a range of $ 330-340/kg quoted at the beginning of the month.

A European trader said: "The tellurium market is trading at around $ 300-320/kg, the lowest we have heard is $ 290/kg. The market has come down a little but it will be relatively stable in the next few months or see another increase because supply is extremely tight. Large quantities are not available, we can only obtain about 300-500 kg a month."

"Our partner is not willing to give us new offers until mid May because he is hoping for higher prices," the trader added.

However, a UK trader dealing with a lower purity material said tellurium had gone down. She quoted a price of $ 260/kg for 3N material saying that the price for that grade went up so quickly that it is seeing a natural correction.

June 12, 2008 | about stocks: FPLSF.PK / FSLR

*

Font Size:

*

Print

* Email

Blackmont Capital analyst Trevor Johnson initiated coverage on 5N Plus Inc. (FPLSF.PK), a Montreal-based producer of metal compounds used in the production of photovoltaic cells for the solar energy industry, with a "buy" rating and a target price of C$14.50.

5N produces high purity metals, typically above the 99.999% mark, used in specific segments of the electronic materials market, in particular tellurium, cadmium, selenium and their compounds.

In a note to clients, Mr. Johnson pointed out that 5N differs in many ways from traditional, speculative stocks in the solar energy industry. He drew attention on the strong fundamentals of 5N which posted 31 consecutive quarters of profitability, and boasts a varied portfolio of products, services and applications, shielding it from potential industry upheavals.

5N currently derives over 60% of its revenue from First Solar Inc. (FSLR), the solar industry bellwether. 5N supplies an estimated 70% of First Solar's cadmium telluride [CdTe], the new metal compound poised to replace the traditional, thicker, silicon.

Mr. Johnson considers 5N a safer, inexpensive investment option to latch on to the fortunes of First Solar. "With First Solar trading at a forward P/E, EV/EBITDA and EV/Sales multiples that are on average 12, 10 and 4 multiple points higher than 5N respectively, we are inclined to believe this valuation spread is too wide," he wrote in a note.

The analyst concluded by outlining a series of potential positive catalysts for 5N in the next 12 months, including the completion of their new German facility, a production increase from 435 megawatts to 910 megawatts which should result in higher sales volumes, and an expansion of its recycling capabilities, to handle other types of thin film modules.

*

Font Size:

*

Blackmont Capital analyst Trevor Johnson initiated coverage on 5N Plus Inc. (FPLSF.PK), a Montreal-based producer of metal compounds used in the production of photovoltaic cells for the solar energy industry, with a "buy" rating and a target price of C$14.50.

5N produces high purity metals, typically above the 99.999% mark, used in specific segments of the electronic materials market, in particular tellurium, cadmium, selenium and their compounds.

In a note to clients, Mr. Johnson pointed out that 5N differs in many ways from traditional, speculative stocks in the solar energy industry. He drew attention on the strong fundamentals of 5N which posted 31 consecutive quarters of profitability, and boasts a varied portfolio of products, services and applications, shielding it from potential industry upheavals.

5N currently derives over 60% of its revenue from First Solar Inc. (FSLR), the solar industry bellwether. 5N supplies an estimated 70% of First Solar's cadmium telluride [CdTe], the new metal compound poised to replace the traditional, thicker, silicon.

Mr. Johnson considers 5N a safer, inexpensive investment option to latch on to the fortunes of First Solar. "With First Solar trading at a forward P/E, EV/EBITDA and EV/Sales multiples that are on average 12, 10 and 4 multiple points higher than 5N respectively, we are inclined to believe this valuation spread is too wide," he wrote in a note.

The analyst concluded by outlining a series of potential positive catalysts for 5N in the next 12 months, including the completion of their new German facility, a production increase from 435 megawatts to 910 megawatts which should result in higher sales volumes, and an expansion of its recycling capabilities, to handle other types of thin film modules.

5N Plus Inc. New German Facility Now Operational

Montreal, Quebec, July 29, 2008 – 5N Plus Inc. (TSX:VNP) is pleased to announce that its new German

facility is now operational. The facility will begin shipments of cadmium telluride and other products as

well as recycling activities in accordance with 5N Plus’ contractual obligations, which called for

commercial operations to be achieved by July 31st, 2008. The facility is owned and operated by 5N PV

GmbH, a wholly-owned German subsidiary of 5N Plus, and is located in Eisenhüttenstadt, in the state of

Brandenburg.

“We are extremely pleased that our new German facility is now operational and that we have met both

our cost objectives and the very tight schedule that we initially laid out” commented Mr. Jacques

L’Écuyer, President and Chief Executive Officer of 5N Plus. Mr. L’Écuyer added, “This international

expansion has been a huge undertaking for 5N Plus and we are delighted by the outcome. We take this

opportunity to thank the 42 employees of our new German subsidiary for their hard work and welcome

them to the 5N Plus team. We would also like to thank the many employees of 5N Plus who have been

involved in the construction and commissioning of our new facility”.

Montreal, Quebec, July 29, 2008 – 5N Plus Inc. (TSX:VNP) is pleased to announce that its new German

facility is now operational. The facility will begin shipments of cadmium telluride and other products as

well as recycling activities in accordance with 5N Plus’ contractual obligations, which called for

commercial operations to be achieved by July 31st, 2008. The facility is owned and operated by 5N PV

GmbH, a wholly-owned German subsidiary of 5N Plus, and is located in Eisenhüttenstadt, in the state of

Brandenburg.

“We are extremely pleased that our new German facility is now operational and that we have met both

our cost objectives and the very tight schedule that we initially laid out” commented Mr. Jacques

L’Écuyer, President and Chief Executive Officer of 5N Plus. Mr. L’Écuyer added, “This international

expansion has been a huge undertaking for 5N Plus and we are delighted by the outcome. We take this

opportunity to thank the 42 employees of our new German subsidiary for their hard work and welcome

them to the 5N Plus team. We would also like to thank the many employees of 5N Plus who have been

involved in the construction and commissioning of our new facility”.

Antwort auf Beitrag Nr.: 34.611.131 von meinolf67 am 30.07.08 06:10:31Sag mal Meinolf wie sieht das eigentich aus mit dem cadmium telluride...Habe ein paar artikel drueber gelesen die behauptet haben das fslr damit probleme bekommen koennte ihren demand zu "covern" langfrisitg...da es sich nicht lohnt cadmium telluride abzubauen...und ausserdem soll es nicht gerade umweltfreundlich sein...wie stehst du dazu?mfg CW

5N PLUS INC.

5N PLUS INC.

Attention Business/Financial/Assignment Editors

5N Plus Inc. will host a conference call to discuss its fourth quarter results

(TSX: VNP)

MONTREAL, Aug. 5 /CNW Telbec/ - 5N Plus announced that it will report

financial results for the fourth quarter on Monday, August 11th, 2008.

5N Plus will host a conference call at 10:00 a.m., on Tuesday,

August 12nd. Interested parties may also access the conference call by webcast

at www.5nplus.com

The telephone numbers to access the conference call are 1-800-732-9307,

1-416-644-3416 or 514-807-8791.

<<

OPEN TO: Analysts, investors and all interested parties

DATE: August 12, 2008

TIME: 10h00 Eastern Time

>>

5N PLUS INC.

Attention Business/Financial/Assignment Editors

5N Plus Inc. will host a conference call to discuss its fourth quarter results

(TSX: VNP)

MONTREAL, Aug. 5 /CNW Telbec/ - 5N Plus announced that it will report

financial results for the fourth quarter on Monday, August 11th, 2008.

5N Plus will host a conference call at 10:00 a.m., on Tuesday,

August 12nd. Interested parties may also access the conference call by webcast

at www.5nplus.com

The telephone numbers to access the conference call are 1-800-732-9307,

1-416-644-3416 or 514-807-8791.

<<

OPEN TO: Analysts, investors and all interested parties

DATE: August 12, 2008

TIME: 10h00 Eastern Time

>>

Antwort auf Beitrag Nr.: 34.612.216 von dicki31785 am 30.07.08 10:01:10es geht NUR um Tellur; dazu gibt es eine ausführliche Diskussion im FSLR-Thread, so um die Postings #1032-#1146

Meine ganz grobe Zusammenfassung:

Weltproduktion Te liegt wahscheinlich zwischen 200-1000 Tonnen/Jahr

1GW Module benötigt etwa 100 Tonnen

=> Wenn die Produktionszahlen stimmen UND es keinen großen Ausbau gibt, dann wird FSLR irgendwann so bei 5-10GW vor die Wand laufen.