News around the world - 500 Beiträge pro Seite (Seite 77)

eröffnet am 07.01.08 20:38:21 von

neuester Beitrag 27.09.20 09:44:04 von

neuester Beitrag 27.09.20 09:44:04 von

Beiträge: 38.484

ID: 1.137.033

ID: 1.137.033

Aufrufe heute: 98

Gesamt: 835.848

Gesamt: 835.848

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 7888 | |

| vor 53 Minuten | 5021 | |

| heute 14:19 | 2630 | |

| heute 14:32 | 2620 | |

| vor 1 Stunde | 2348 | |

| vor 58 Minuten | 2089 | |

| vor 1 Stunde | 2040 | |

| vor 1 Stunde | 1787 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.877,98 | -1,16 | 239 | |||

| 2. | 3. | 164,70 | +1,59 | 94 | |||

| 3. | 2. | 9,3300 | -3,27 | 90 | |||

| 4. | 4. | 0,1915 | -1,29 | 84 | |||

| 5. | 6. | 0,0160 | -24,17 | 52 | |||

| 6. | 14. | 6,9800 | +3,59 | 51 | |||

| 7. | 34. | 0,6600 | -52,86 | 49 | |||

| 8. | 13. | 440,01 | -10,84 | 47 |

Antwort auf Beitrag Nr.: 58.556.984 von Popeye82 am 29.08.18 08:23:24

Antwort auf Beitrag Nr.: 58.560.152 von Popeye82 am 29.08.18 13:43:01

Antwort auf Beitrag Nr.: 58.560.152 von Popeye82 am 29.08.18 13:43:01

Antwort auf Beitrag Nr.: 58.613.262 von Popeye82 am 04.09.18 18:03:02

Antwort auf Beitrag Nr.: 58.520.103 von Popeye82 am 23.08.18 18:59:35

Antwort auf Beitrag Nr.: 58.611.789 von Popeye82 am 04.09.18 15:55:30

Antwort auf Beitrag Nr.: 58.614.687 von Popeye82 am 04.09.18 20:02:12

Antwort auf Beitrag Nr.: 58.617.186 von Popeye82 am 05.09.18 03:42:17

I have the PERFECT body(and Soul)

Walking on Sunshine

NEVER do it!

Antwort auf Beitrag Nr.: 58.616.319 von Popeye82 am 04.09.18 22:25:58

www.faz.net/aktuell/gesellschaft/menschen/sesamstrasse-autor…

www.faz.net/aktuell/gesellschaft/menschen/sesamstrasse-autor…

Antwort auf Beitrag Nr.: 58.747.777 von Popeye82 am 20.09.18 11:41:42

See what She did when She knew He has $5 Million

Antwort auf Beitrag Nr.: 58.807.805 von Popeye82 am 26.09.18 21:10:22

Antwort auf Beitrag Nr.: 58.808.063 von Popeye82 am 26.09.18 21:34:14

Antwort auf Beitrag Nr.: 58.819.265 von Popeye82 am 28.09.18 04:45:03

Antwort auf Beitrag Nr.: 58.734.955 von Popeye82 am 19.09.18 09:42:18

Antwort auf Beitrag Nr.: 58.873.974 von Popeye82 am 05.10.18 00:21:53

Antwort auf Beitrag Nr.: 58.863.474 von Popeye82 am 03.10.18 20:15:18you think YOU have problems??????????????????????????????????????????????????????

NEVER drive them

Who is Goliath

Antwort auf Beitrag Nr.: 58.978.308 von Popeye82 am 17.10.18 08:38:23

Antwort auf Beitrag Nr.: 58.991.835 von Popeye82 am 18.10.18 13:15:03

Antwort auf Beitrag Nr.: 58.998.891 von Popeye82 am 18.10.18 23:31:34

Antwort auf Beitrag Nr.: 59.010.411 von Popeye82 am 20.10.18 12:56:27

Antwort auf Beitrag Nr.: 59.011.248 von Popeye82 am 20.10.18 16:37:47

Antwort auf Beitrag Nr.: 59.011.926 von Popeye82 am 20.10.18 20:27:07

Antwort auf Beitrag Nr.: 59.012.229 von Popeye82 am 20.10.18 22:20:07

GOOD Company

you HAVE to see, before you Die

WICHTIGE News(Erkenntnis)

DAILY Arbeitsweg Gefahren

Antwort auf Beitrag Nr.: 59.074.708 von Popeye82 am 27.10.18 21:20:08

Antwort auf Beitrag Nr.: 59.074.726 von Popeye82 am 27.10.18 21:33:17

strangeALERT

Antwort auf Beitrag Nr.: 59.095.073 von Popeye82 am 30.10.18 15:28:52

THIRTY Seconds to Mars

Antwort auf Beitrag Nr.: 59.103.218 von Popeye82 am 31.10.18 12:26:14

Antwort auf Beitrag Nr.: 59.103.824 von Popeye82 am 31.10.18 13:28:11

Antwort auf Beitrag Nr.: 59.109.347 von Popeye82 am 31.10.18 22:29:06

Antwort auf Beitrag Nr.: 59.119.538 von Popeye82 am 02.11.18 01:25:14

Antwort auf Beitrag Nr.: 59.099.879 von Popeye82 am 31.10.18 05:50:23

Antwort auf Beitrag Nr.: 59.136.528 von Popeye82 am 05.11.18 02:32:14

you think YOU have Problems???????

NICHT für Ehrliche Menschen

Antwort auf Beitrag Nr.: 59.207.477 von Popeye82 am 13.11.18 22:18:50you THINK YOU have Problems????????? (2.0)

What IF

?

?

?

?

?

What IF

?

?

?

?

?

Antwort auf Beitrag Nr.: 59.207.770 von Popeye82 am 14.11.18 02:54:13

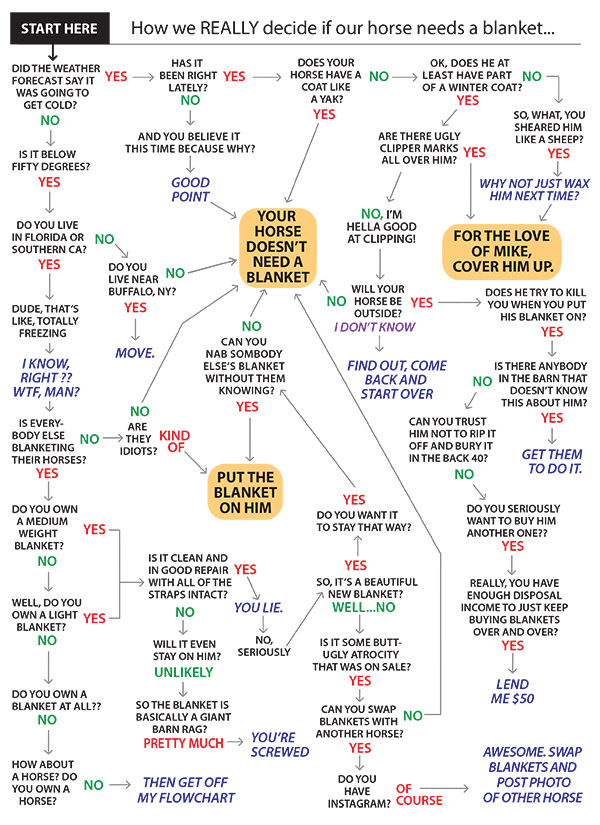

- Yeaaaaah, Maaaaaaama is back from parents teachers meeting at school and it returns out they have all been naughty as school so mama is trying to figure out the punishment they are going to get. -

you find Me OVER the Rainbow

TRAUMATIC Experiences

Antwort auf Beitrag Nr.: 59.314.592 von Popeye82 am 28.11.18 10:02:58

RESCUE me

moneyLAUNDERING

Antwort auf Beitrag Nr.: 59.426.595 von Popeye82 am 12.12.18 19:38:41

Antwort auf Beitrag Nr.: 59.426.856 von Popeye82 am 12.12.18 20:10:05

Antwort auf Beitrag Nr.: 59.447.061 von Popeye82 am 15.12.18 22:32:07

- Captain Joe

Am 19.10.2017 veröffentlicht

INSTAGRAM FLYWITHCAPTAINJOE: https://goo.gl/TToDlg

Meine WEBSEITE: https://goo.gl/KGTSWK

TFC-Flight Training Centre: https://goo.gl/xAZEBp

Dear friends and followers, welcome back to my channel. Today´s topic is one of the most ask passenger question, "Can a passenger land a plane?". There are so many rumours about this question, it´s just not true.

So a few facts. My friend Carolin, has no connection to the aviation world besides from flying to holiday once in a while, obviously as a passenger.

Now as soon as she sat down, the hardest part was establishing a communication between her and me, the ATC controller. Carolin was totally overwhelmed with all the switches and buttons, that it took nearly 20 minutes to find the push to talk button. In a real-life situation, if a plane does not respond within 20 minutes, fighter jets will be on their way intercepting the aeroplane as it causes a potential threat to national security, depending which land you´re flying across.

Once communication was established, I had to give her instructions on how to set up the approach phase for an automatic landing, better known as AUTOLAND procedure. The AUTOLAND allows pilots to perform a fully automated landing in bad visual conditions, known as CAT3 approaches. More about that in future videos.

Once the approach set up was completed, I had to give her instructions to familiarize with important levers and switches, such as the landing gear lever, the flaps, flight control computer and much more.

Later I guided her via radar vectors towards the airport, constantly descending and reducing the speed accordingly.

But see for yourself.

My opinion if a passenger can land a plane. I´ll be honest with you! It´s impossible! We needed three attempts to just establish basic communication and Carolin accidentally brought the aircraft into a stall. Don´t ask how!

And she was pretty nervous, although she knew it was a simulator. Imagine the anxiety in a real plane!?

I know that there are many videos out there where apparently the passenger landed the plane, but all of the passengers had some kind of flying background. And the likelihood of both pilots being incapacitated is very unlikely.

BIG THANK YOU TO TFC KÄUFER for making this video possible

such as Lockheed Martin Prepar3D flight simulator, here a few more facts about the used simulation:

Scenery ORBX

A320 Flightsimlabs

Simulator Prepar3D v4.1

I hope you enjoyed this video and where able to learn something from it as well.

Thanks for watching, all the best your "Captain" Joe

Background track:

Stellardone - Airglow https://goo.gl/X3SffS

Outro Song:

Joakim Karud & Dyalla - Wish you were here https://goo.gl/kJ9pef

Equipment I use:

Camera: http://amzn.to/2nEHPDM

Microphone: http://amzn.to/2nff2oF

Lights: http://amzn.to/2nEPGkU

ALL COPYRIGHTS TO THIS VIDEO ARE OWNED BY FLYWITHCAPTAINJOE.COM ANY COPYING OR ILLEGALLY DOWNLOADING AND PUBLISHING ON OTHER PLATFORMS WILL FOLLOW LEGAL CONSEQUENCES

Untertitelautor (Niederländisch)

Bryan Simelyn

Untertitelautor (Indonesisch)

Naufal Rizqyansyah

Untertitelautoren (Dänisch)

Castilloz

Lucky

Untertitelautoren (Chinesisch (Taiwan))

RuiCat

Kevin T

Untertitelautor (Französisch)

Alexandre Mongin

Untertitelautor (Rumänisch)

GamI7

Untertitelautor (Englisch)

K StDrew

Untertitelautor (Griechisch)

John Maik

Untertitelautor (Polnisch)

Filip Pawelec

Untertitelautor (Ungarisch)

judit kertesz

Untertitelautor (Koreanisch)

꿱꿱오리

Kategorie

Wissenschaft & Technik -

Antwort auf Beitrag Nr.: 59.446.959 von Popeye82 am 15.12.18 21:49:06

Antwort auf Beitrag Nr.: 59.480.517 von Popeye82 am 20.12.18 15:43:16

Antwort auf Beitrag Nr.: 59.480.655 von Popeye82 am 20.12.18 15:55:51

JUST give Me a Call(I'm out of control((burning through the Sky(I LIKE it)))

Antwort auf Beitrag Nr.: 59.481.465 von Popeye82 am 20.12.18 16:49:54

Antwort auf Beitrag Nr.: 59.507.782 von Popeye82 am 26.12.18 06:13:18

Antwort auf Beitrag Nr.: 59.511.205 von Popeye82 am 27.12.18 03:26:00

Antwort auf Beitrag Nr.: 59.523.154 von Popeye82 am 28.12.18 20:12:31

Antwort auf Beitrag Nr.: 59.523.331 von Popeye82 am 28.12.18 20:45:45

Antwort auf Beitrag Nr.: 59.523.637 von Popeye82 am 28.12.18 21:53:53

Antwort auf Beitrag Nr.: 59.527.990 von Popeye82 am 30.12.18 04:46:26

necessary Paperwork

One time on Twitter I heard Arianna was pregnant.

So I got pregnant at the same Time, too.

Turns OUT it was a rumor.

So I got pregnant at the same Time, too.

Turns OUT it was a rumor.

Antwort auf Beitrag Nr.: 59.546.443 von Popeye82 am 03.01.19 03:06:45

erWISCHD

Antwort auf Beitrag Nr.: 59.594.930 von Popeye82 am 09.01.19 17:59:11erWISCHD, II(creepy, caN'T be explained)

Antwort auf Beitrag Nr.: 59.597.996 von Popeye82 am 10.01.19 04:38:41

Antwort auf Beitrag Nr.: 59.597.390 von Popeye82 am 09.01.19 22:41:30

Antwort auf Beitrag Nr.: 59.602.088 von Popeye82 am 10.01.19 15:06:54

Antwort auf Beitrag Nr.: 59.620.709 von Popeye82 am 13.01.19 15:50:07

Antwort auf Beitrag Nr.: 59.620.748 von Popeye82 am 13.01.19 16:01:57

Antwort auf Beitrag Nr.: 59.620.811 von Popeye82 am 13.01.19 16:20:37

Antwort auf Beitrag Nr.: 59.620.919 von Popeye82 am 13.01.19 16:48:50

Antwort auf Beitrag Nr.: 59.620.991 von Popeye82 am 13.01.19 17:05:20

Antwort auf Beitrag Nr.: 59.621.051 von Popeye82 am 13.01.19 17:17:02

Antwort auf Beitrag Nr.: 59.621.117 von Popeye82 am 13.01.19 17:29:51

Antwort auf Beitrag Nr.: 59.621.234 von Popeye82 am 13.01.19 17:54:15

Antwort auf Beitrag Nr.: 59.621.369 von Popeye82 am 13.01.19 18:19:01

Antwort auf Beitrag Nr.: 59.621.519 von Popeye82 am 13.01.19 18:56:47

Antwort auf Beitrag Nr.: 59.621.660 von Popeye82 am 13.01.19 19:42:51

SexualBELÄSTIGUNG

Antwort auf Beitrag Nr.: 59.622.644 von Popeye82 am 13.01.19 23:44:31

Antwort auf Beitrag Nr.: 59.622.674 von Popeye82 am 13.01.19 23:58:56

Antwort auf Beitrag Nr.: 59.622.707 von Popeye82 am 14.01.19 00:12:41

Antwort auf Beitrag Nr.: 59.643.926 von Popeye82 am 16.01.19 14:09:50

One of the Biggest Hoaxes, EVER created

WARTEzeiten

SWEDEN

?

?

?

?

?

?

?

?

?

?

Antwort auf Beitrag Nr.: 59.706.999 von Popeye82 am 25.01.19 04:03:41

!

Dieser Beitrag wurde von CommunitySupport moderiert. Grund: Anzüglicher Inhalt

Antwort auf Beitrag Nr.: 59.707.020 von Popeye82 am 25.01.19 04:31:55

Antwort auf Beitrag Nr.: 59.706.825 von Popeye82 am 25.01.19 00:08:38

Antwort auf Beitrag Nr.: 59.714.850 von Popeye82 am 25.01.19 21:34:12do You have ANY regrets, Sir

?

?

?

?

?

(

(  )

)

?

?

?

?

?

(

(  )

)

Antwort auf Beitrag Nr.: 59.740.749 von Popeye82 am 30.01.19 00:46:20

www.spiegel.de/karriere/hawaii-ein-deutscher-auswanderer-ber…

www.spiegel.de/karriere/hawaii-ein-deutscher-auswanderer-ber…

Antwort auf Beitrag Nr.: 59.741.163 von Popeye82 am 30.01.19 07:14:55WHAAAAAAAT is "IT"??????????????????????????????

Antwort auf Beitrag Nr.: 59.777.721 von Popeye82 am 02.02.19 21:26:37

Antwort auf Beitrag Nr.: 59.778.273 von Popeye82 am 03.02.19 00:15:15

Antwort auf Beitrag Nr.: 59.777.721 von Popeye82 am 02.02.19 21:26:37IT

WHAAAAAAAT is "IT"??????????????????????????????

WHAAAAAAAT is "IT"??????????????????????????????

Antwort auf Beitrag Nr.: 59.706.825 von Popeye82 am 25.01.19 00:08:38

Antwort auf Beitrag Nr.: 59.809.911 von Popeye82 am 06.02.19 22:44:35

Antwort auf Beitrag Nr.: 59.858.674 von Popeye82 am 13.02.19 04:34:23

Antwort auf Beitrag Nr.: 59.716.779 von Popeye82 am 26.01.19 11:47:56

Antwort auf Beitrag Nr.: 59.909.648 von Popeye82 am 19.02.19 14:20:55

Antwort auf Beitrag Nr.: 59.918.735 von Popeye82 am 20.02.19 11:44:28

Antwort auf Beitrag Nr.: 59.915.828 von Popeye82 am 20.02.19 07:23:40

Antwort auf Beitrag Nr.: 59.914.658 von Popeye82 am 19.02.19 22:06:33

Antwort auf Beitrag Nr.: 59.931.293 von Popeye82 am 21.02.19 13:08:06

Antwort auf Beitrag Nr.: 59.931.185 von Popeye82 am 21.02.19 12:54:51

Antwort auf Beitrag Nr.: 59.946.761 von Popeye82 am 23.02.19 13:27:14

Antwort auf Beitrag Nr.: 59.948.089 von Popeye82 am 24.02.19 00:03:22

Antwort auf Beitrag Nr.: 59.948.093 von Popeye82 am 24.02.19 00:15:59

Antwort auf Beitrag Nr.: 59.948.107 von Popeye82 am 24.02.19 00:27:30

Antwort auf Beitrag Nr.: 59.952.508 von Popeye82 am 25.02.19 03:11:19

Antwort auf Beitrag Nr.: 60.001.963 von Popeye82 am 01.03.19 22:59:42

Antwort auf Beitrag Nr.: 60.009.008 von Popeye82 am 03.03.19 15:52:36

Antwort auf Beitrag Nr.: 60.009.122 von Popeye82 am 03.03.19 16:19:39

Antwort auf Beitrag Nr.: 60.010.766 von Popeye82 am 03.03.19 21:42:35

Antwort auf Beitrag Nr.: 60.011.267 von Popeye82 am 04.03.19 03:01:40

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam, Werbung

Antwort auf Beitrag Nr.: 60.019.925 von Popeye82 am 05.03.19 05:07:52

Antwort auf Beitrag Nr.: 60.060.446 von Popeye82 am 09.03.19 20:23:52

Antwort auf Beitrag Nr.: 60.081.093 von Popeye82 am 12.03.19 18:06:32

Antwort auf Beitrag Nr.: 60.081.339 von Popeye82 am 12.03.19 18:33:00

Antwort auf Beitrag Nr.: 60.081.714 von Popeye82 am 12.03.19 19:15:14

Antwort auf Beitrag Nr.: 60.082.605 von Popeye82 am 12.03.19 20:34:04

Antwort auf Beitrag Nr.: 60.083.466 von Popeye82 am 12.03.19 21:43:16

Antwort auf Beitrag Nr.: 60.084.246 von Popeye82 am 12.03.19 23:10:45

Antwort auf Beitrag Nr.: 60.084.366 von Popeye82 am 12.03.19 23:29:16

Antwort auf Beitrag Nr.: 60.092.097 von Popeye82 am 13.03.19 18:32:10

Antwort auf Beitrag Nr.: 60.095.199 von Popeye82 am 14.03.19 03:47:23

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam, Werbung

Antwort auf Beitrag Nr.: 60.095.292 von Popeye82 am 14.03.19 06:29:44

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam

Antwort auf Beitrag Nr.: 60.392.173 von Popeye82 am 20.04.19 01:09:27

Antwort auf Beitrag Nr.: 60.872.487 von Popeye82 am 23.06.19 19:06:00

Antwort auf Beitrag Nr.: 60.818.324 von Popeye82 am 16.06.19 17:12:09

Antwort auf Beitrag Nr.: 60.941.680 von Popeye82 am 03.07.19 02:00:35

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam

Antwort auf Beitrag Nr.: 60.932.638 von Popeye82 am 01.07.19 22:53:43

Antwort auf Beitrag Nr.: 61.382.849 von Popeye82 am 31.08.19 03:37:53https://stockhead.com.au/resources/battery-metals-lithium-pr…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 228 | ||

| 96 | ||

| 90 | ||

| 76 | ||

| 53 | ||

| 49 | ||

| 48 | ||

| 44 | ||

| 42 | ||

| 33 |

| Wertpapier | Beiträge | |

|---|---|---|

| 28 | ||

| 27 | ||

| 27 | ||

| 26 | ||

| 26 | ||

| 24 | ||

| 23 | ||

| 22 | ||

| 21 | ||

| 21 |