Rohstoff-Explorer: Research oder Neuvorstellung

eröffnet am 13.03.08 13:14:32 von

neuester Beitrag 18.04.24 09:34:48 von

neuester Beitrag 18.04.24 09:34:48 von

Beiträge: 29.529

ID: 1.139.490

ID: 1.139.490

Aufrufe heute: 2

Gesamt: 2.700.946

Gesamt: 2.700.946

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 01:29 | 411 | |

| gestern 13:40 | 339 | |

| heute 00:17 | 263 | |

| gestern 21:33 | 165 | |

| gestern 23:24 | 160 | |

| gestern 22:40 | 139 | |

| gestern 21:02 | 136 | |

| heute 01:34 | 128 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.179,00 | +1,33 | 218 | |||

| 2. | 2. | 160,89 | +13,26 | 155 | |||

| 3. | 3. | 0,1910 | +4,95 | 76 | |||

| 4. | 4. | 2.321,70 | -0,02 | 58 | |||

| 5. | 5. | 0,0313 | +95,63 | 49 | |||

| 6. | 6. | 43,75 | -3,42 | 45 | |||

| 7. | 7. | 4,7480 | +3,15 | 44 | |||

| 8. | 8. | 14,475 | +5,46 | 41 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.629.606 von rolleg am 16.04.24 17:55:01

Danke für den Link!

Hawsons Iron (HIO)

Es bestehen m.M.n. gute Aussichten, dass aus dem Hawsons Iron Projekt eine produzierende Eisenerz-Mine wird.

Die Erstellung der ursprünglichen BFS (Bankfähige Machbarkeitsstudie) wurde von HIO im Okt 2022 ausgesetzt, da die damals gewählte Größe eines Betriebs mit einer Jahreskapazität von 20 Mtpa die Investitionskosten (Capex) gesprengt hatte. Einzelne Komponenten sind auch inflationsbedingt derart teuer geworden, dass der angedachte Finanzierungsrahmen nicht mehr ausreichte.

Die Strategie für die geplante Eisenerz-Mine wird deshalb umgestellt auf Modulbauweise. Die BFS wird eine stufenweise Erhöhung der Jahresproduktion beinhalten. Vermutlich wird man in Stufen von 5 Mtpa arbeiten. Also mit 5 Mtpa als Anfang, dann eine Erhöhung auf 10 Mtpa, und zuletzt auf 20 Mtpa erhöht. Statt einer teuren, erst noch zu bauenden Pipeline von der Lagerstätte bis zum Seehafen soll die vorhandene Bahn für den Transport des Eisenerzes benutzt werden (spart enorme Capex, erhöht aber die Opex, was m.E. akzeptabel ist).

Durch die starke Nachfrage nach dem Fe-Konzentrat gab es im letzten Jahr 18 potentielle Abnahme-Partner und deren mögliche Beteiligung an den Capex (Vorauszahlungen für spätere Lieferungen).

Jetzt hat HIO eine „short list“ erstellt, und von den ursprünglich 18 Interessenten nun sieben (7) nationale und internationale potenzielle strategische Investoren, darunter Bergbauunternehmen, Handelshäuser und Stahlwerke, ausgewählt, um eine detaillierte Prüfung durchzuführen.

Hawsons führt derzeit ein Prozess zur Vereinbarung mit potenziellen strategischen Investoren durch, die bei der Finanzierung des Engineerings, weiterer Bohrungen zur Ressourcendefinition und anderer Aktivitäten zur Erstellung einer BFS helfen sollen.

Diese 7 möglichen Partner haben zur Erleichterung des Prozesses entsprechende Vertraulichkeitsvereinbarungen abgeschlossen und Bereitschaft signalisiert, die BFS zu finanzieren, um das Projekt voranzutreiben, vorbehaltlich weiterer Due Diligence (Prüfung).

Für die Prüfung wurde eine Marktstudie des Beratungsunternehmens AME Mineral Economics Pty Ltd (AME) und andere zugehörige Dokumente erstellt. HIO unterstützt die 7 potenziellen Partner nun bei ihrer Due-Diligence-Prüfung dieses Materials, bevor es in Gespräche über die Investitionsbedingungen eintritt, die voraussichtlich im Juni-Quartal 2024 abgeschlossen werden.

Es findet dann ein Auswahl-Verfahren statt. Die Zahl der strategischen Investoren wird dann vor dem Eintritt in die letzte Phase reduziert, in der die bestätigende Due-Diligence-Prüfung abgeschlossen und die endgültigen Investitionsbedingungen vereinbart werden.

Es wird somit eine weitere „short list“ geben, und von den 7 potenziellen Partnern werden vermutlich nur 2-3 übrig bleiben, mit denen man dann verbindliche Verträge abschließt, die die Partner zu finanziellen Vorleistungen verpflichtet. Diese letzte Phase wird voraussichtlich im September-Quartal dieses Jahres abgeschlossen sein, und Hawsons beabsichtigt dann sofort mit der BFS fortzufahren.

Der Vorteil liegt auf der Hand: Man muss für die Erstellung der BFS keine verwässernden Kapitalerhöhungen (KE) durchführen, sondern erhält von den Partnern Vorauszahlungen für spätere Fe-Lieferungen.

Das hört sich für mich sehr gut an, und ich denke, dass die Chancen für die Realisierung der Fe-Mine durch diesen Auswahl-Prozess steigen.

Unabhängig davon erwarte ich noch dieses Jahr eine „kleine KE“, um die weiteren laufenden Kosten decken zu können. Noch ist HIO ein Explorer und noch kein Produzent mit eigenen Einnahmen.

Die Ankündigung reduziert m.M.n. das Risiko dieses Projekts: Die bekannten Ressourcen werden in einem großen Tagebau abgebaut, mit bewährten Techniken verarbeitet, haben Zugang zu vorhandenem Wasser und Strom und werden über die vorhandenen Bahn-Schienen und den Hafen auf den Markt gebracht. Hinzu kommen politische Stabilität, keine einheimischen Eigentumsrechte und ein Produkt, für das es eine steigende Nachfrage geben wird. Viele der üblichen Risiken, die mit der Inbetriebnahme einer Mine verbunden sind, sind somit nicht vorhanden. Die Auswahl strategisch wichtiger und finanziell potenter Partner, die bereit sind im Voraus Kapital einzubringen, unterstreicht die Qualität des HIO-Projektes.

Zitat von rolleg: Hawsons Iron - Comprehensive project and strategic investor process update

https://hawsons.com.au/wp-content/uploads/2024/04/20240416-H…

Danke für den Link!

Hawsons Iron (HIO)

Es bestehen m.M.n. gute Aussichten, dass aus dem Hawsons Iron Projekt eine produzierende Eisenerz-Mine wird.

Die Erstellung der ursprünglichen BFS (Bankfähige Machbarkeitsstudie) wurde von HIO im Okt 2022 ausgesetzt, da die damals gewählte Größe eines Betriebs mit einer Jahreskapazität von 20 Mtpa die Investitionskosten (Capex) gesprengt hatte. Einzelne Komponenten sind auch inflationsbedingt derart teuer geworden, dass der angedachte Finanzierungsrahmen nicht mehr ausreichte.

Die Strategie für die geplante Eisenerz-Mine wird deshalb umgestellt auf Modulbauweise. Die BFS wird eine stufenweise Erhöhung der Jahresproduktion beinhalten. Vermutlich wird man in Stufen von 5 Mtpa arbeiten. Also mit 5 Mtpa als Anfang, dann eine Erhöhung auf 10 Mtpa, und zuletzt auf 20 Mtpa erhöht. Statt einer teuren, erst noch zu bauenden Pipeline von der Lagerstätte bis zum Seehafen soll die vorhandene Bahn für den Transport des Eisenerzes benutzt werden (spart enorme Capex, erhöht aber die Opex, was m.E. akzeptabel ist).

Durch die starke Nachfrage nach dem Fe-Konzentrat gab es im letzten Jahr 18 potentielle Abnahme-Partner und deren mögliche Beteiligung an den Capex (Vorauszahlungen für spätere Lieferungen).

Jetzt hat HIO eine „short list“ erstellt, und von den ursprünglich 18 Interessenten nun sieben (7) nationale und internationale potenzielle strategische Investoren, darunter Bergbauunternehmen, Handelshäuser und Stahlwerke, ausgewählt, um eine detaillierte Prüfung durchzuführen.

Hawsons führt derzeit ein Prozess zur Vereinbarung mit potenziellen strategischen Investoren durch, die bei der Finanzierung des Engineerings, weiterer Bohrungen zur Ressourcendefinition und anderer Aktivitäten zur Erstellung einer BFS helfen sollen.

Diese 7 möglichen Partner haben zur Erleichterung des Prozesses entsprechende Vertraulichkeitsvereinbarungen abgeschlossen und Bereitschaft signalisiert, die BFS zu finanzieren, um das Projekt voranzutreiben, vorbehaltlich weiterer Due Diligence (Prüfung).

Für die Prüfung wurde eine Marktstudie des Beratungsunternehmens AME Mineral Economics Pty Ltd (AME) und andere zugehörige Dokumente erstellt. HIO unterstützt die 7 potenziellen Partner nun bei ihrer Due-Diligence-Prüfung dieses Materials, bevor es in Gespräche über die Investitionsbedingungen eintritt, die voraussichtlich im Juni-Quartal 2024 abgeschlossen werden.

Es findet dann ein Auswahl-Verfahren statt. Die Zahl der strategischen Investoren wird dann vor dem Eintritt in die letzte Phase reduziert, in der die bestätigende Due-Diligence-Prüfung abgeschlossen und die endgültigen Investitionsbedingungen vereinbart werden.

Es wird somit eine weitere „short list“ geben, und von den 7 potenziellen Partnern werden vermutlich nur 2-3 übrig bleiben, mit denen man dann verbindliche Verträge abschließt, die die Partner zu finanziellen Vorleistungen verpflichtet. Diese letzte Phase wird voraussichtlich im September-Quartal dieses Jahres abgeschlossen sein, und Hawsons beabsichtigt dann sofort mit der BFS fortzufahren.

Der Vorteil liegt auf der Hand: Man muss für die Erstellung der BFS keine verwässernden Kapitalerhöhungen (KE) durchführen, sondern erhält von den Partnern Vorauszahlungen für spätere Fe-Lieferungen.

Das hört sich für mich sehr gut an, und ich denke, dass die Chancen für die Realisierung der Fe-Mine durch diesen Auswahl-Prozess steigen.

Unabhängig davon erwarte ich noch dieses Jahr eine „kleine KE“, um die weiteren laufenden Kosten decken zu können. Noch ist HIO ein Explorer und noch kein Produzent mit eigenen Einnahmen.

Die Ankündigung reduziert m.M.n. das Risiko dieses Projekts: Die bekannten Ressourcen werden in einem großen Tagebau abgebaut, mit bewährten Techniken verarbeitet, haben Zugang zu vorhandenem Wasser und Strom und werden über die vorhandenen Bahn-Schienen und den Hafen auf den Markt gebracht. Hinzu kommen politische Stabilität, keine einheimischen Eigentumsrechte und ein Produkt, für das es eine steigende Nachfrage geben wird. Viele der üblichen Risiken, die mit der Inbetriebnahme einer Mine verbunden sind, sind somit nicht vorhanden. Die Auswahl strategisch wichtiger und finanziell potenter Partner, die bereit sind im Voraus Kapital einzubringen, unterstreicht die Qualität des HIO-Projektes.

Antwort auf Beitrag Nr.: 75.505.434 von IllePille am 23.03.24 10:47:27gestern erfolgte die Ankündigung der absehbaren Kapitalerhöhung bei Lithium Americas (LAC):

https://finance.yahoo.com/news/lithium-americas-announces-pr…

https://finance.yahoo.com/news/lithium-americas-prices-us-27…

mindestens 55 Mio Aktien @ U$5,00 je Aktie; der Kurs reagiert nachbörslich entsprechend mit einem Abschlag von 19%. Das sind die Art Kursverluste, die man als Anleger vermeiden kann

https://finance.yahoo.com/news/lithium-americas-announces-pr…

https://finance.yahoo.com/news/lithium-americas-prices-us-27…

mindestens 55 Mio Aktien @ U$5,00 je Aktie; der Kurs reagiert nachbörslich entsprechend mit einem Abschlag von 19%. Das sind die Art Kursverluste, die man als Anleger vermeiden kann

Antwort auf Beitrag Nr.: 75.613.847 von IllePille am 13.04.24 13:48:56der aktuelle Q-Bericht von Mount Gibson

https://stocknessmonster.com/announcements/mgx.asx-6A1203128…

https://stocknessmonster.com/announcements/mgx.asx-6A1203128…

Antwort auf Beitrag Nr.: 74.003.664 von tommy-hl am 14.06.23 15:03:12Hawsons Iron - Comprehensive project and strategic investor process update

https://hawsons.com.au/wp-content/uploads/2024/04/20240416-H…

https://hawsons.com.au/wp-content/uploads/2024/04/20240416-H…

Antwort auf Beitrag Nr.: 75.620.135 von ooy am 15.04.24 13:34:07das war zu erwarten. Selbst im "best case" hätte es eine massive Verwässerung der Altaktionäre gegeben, die einem Totalverlust nicht unähnlich wäre.

Antwort auf Beitrag Nr.: 75.619.256 von IllePille am 15.04.24 11:21:54The Company does not believe that any of these options are likely to recover any value for the Company's shareholders.

Antwort auf Beitrag Nr.: 75.537.969 von IllePille am 29.03.24 10:34:31sollte niemand mehr überraschen

Horizonte Minerals - Corporate Update

https://money.tmx.com/quote/HZM/news/5526045510694127/Horizo…

"...the Company has been unable to secure interest in the full financing needed to complete the Project or in a group acquiring the Project. "

Kostenexplosion und ein schwacher Nickelpreis waren zu viel. Interessant wird sein, wie es mit dem Projekt weiter geht, d.h. wer es am Ende übernehmen und fertig stellen wird

Horizonte Minerals - Corporate Update

https://money.tmx.com/quote/HZM/news/5526045510694127/Horizo…

"...the Company has been unable to secure interest in the full financing needed to complete the Project or in a group acquiring the Project. "

Kostenexplosion und ein schwacher Nickelpreis waren zu viel. Interessant wird sein, wie es mit dem Projekt weiter geht, d.h. wer es am Ende übernehmen und fertig stellen wird

Antwort auf Beitrag Nr.: 75.613.847 von IllePille am 13.04.24 13:48:56zu früh abgeschickt. Hier noch ein paar interessante Link zu MGXs:

Präsentation

https://stocknessmonster.com/announcements/mgx.asx-6A1199128/

Quarterly Activities Report

https://stocknessmonster.com/announcements/mgx.asx-6A1189963/

Hj-Bericht

https://stocknessmonster.com/announcements/mgx.asx-6A1194649/

Präsentation

https://stocknessmonster.com/announcements/mgx.asx-6A1199128/

Quarterly Activities Report

https://stocknessmonster.com/announcements/mgx.asx-6A1189963/

Hj-Bericht

https://stocknessmonster.com/announcements/mgx.asx-6A1194649/

wer auf substanzstarke Rohstoffwerte setzen will, kann sich Mount Gibson (MGX.AX, https://stocknessmonster.com/quotes/mgx.asx/) ansehen.

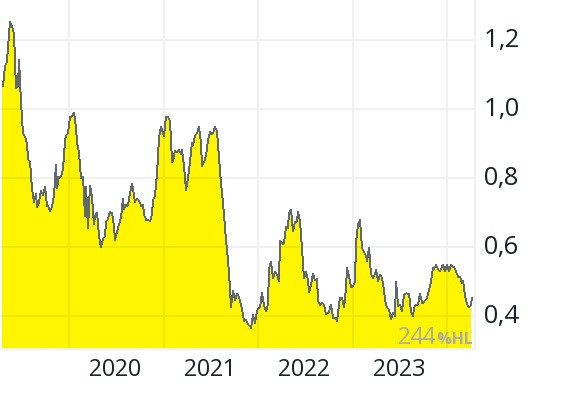

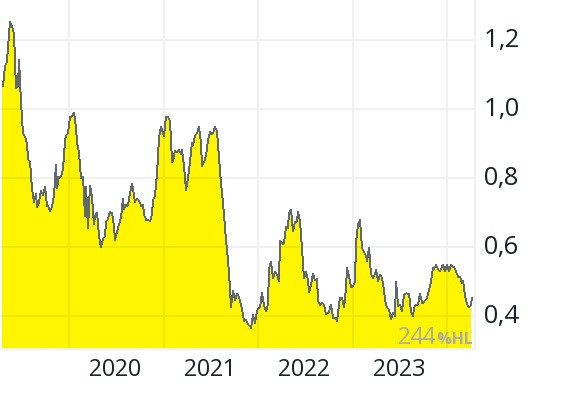

Zum 31.12.23 verfügte MGX über $353 Mio Cash und $406 Mio "working capital". Am 05.04. veröffentlichte MGX ein Upate "On Track for FY24 Shipping Guidance" (https://stocknessmonster.com/announcements/mgx.asx-6A1201445… demzufolge die Cash-Position auf $430 Mio gestiegen* ist. Demgegenüber beträgt die Marktkapitalisierung $547 Mio. Es ist also wahrscheinlich, dass die Marktkapitalisierung nach weiteren 2-3 erfolgreichen Quartalen (vorbehaltlich etwaiger Dividendenzahlungen) vollständig durch Netto-Cash abgedeckt sein wird (die zinstragenden Schulden beliefen sich zum 31.12. auf rund $17 Mio). Zu beachten ist, dass die ausgewiesenen Eisenerzreserven nur noch für 3-4 Jahre Produktion ausreichen. Phantasie besteht mit Blick auf die mögliche Ausschüttung einer attraktiven Dividende sowie die Möglichkeiten, die sich MGX dank der beachtlichen Cash-Position eröffnen. Interessant ist auch ein Blick auf den langjährigen Kursverlauf:

*dabei ist allerdings offen, ob bzw. in welcher Höhe Veränderungen beim "working capital" dazu beigetragen haben

Zum 31.12.23 verfügte MGX über $353 Mio Cash und $406 Mio "working capital". Am 05.04. veröffentlichte MGX ein Upate "On Track for FY24 Shipping Guidance" (https://stocknessmonster.com/announcements/mgx.asx-6A1201445… demzufolge die Cash-Position auf $430 Mio gestiegen* ist. Demgegenüber beträgt die Marktkapitalisierung $547 Mio. Es ist also wahrscheinlich, dass die Marktkapitalisierung nach weiteren 2-3 erfolgreichen Quartalen (vorbehaltlich etwaiger Dividendenzahlungen) vollständig durch Netto-Cash abgedeckt sein wird (die zinstragenden Schulden beliefen sich zum 31.12. auf rund $17 Mio). Zu beachten ist, dass die ausgewiesenen Eisenerzreserven nur noch für 3-4 Jahre Produktion ausreichen. Phantasie besteht mit Blick auf die mögliche Ausschüttung einer attraktiven Dividende sowie die Möglichkeiten, die sich MGX dank der beachtlichen Cash-Position eröffnen. Interessant ist auch ein Blick auf den langjährigen Kursverlauf:

*dabei ist allerdings offen, ob bzw. in welcher Höhe Veränderungen beim "working capital" dazu beigetragen haben

Antwort auf Beitrag Nr.: 75.589.685 von IllePille am 09.04.24 15:12:43Heute noch die Meldung dass günstige Stock Options verteilt wurden bei Cordoba Minerals und schon darf sie im Anschluss steigen, und wie immer ist zu erkennen dass aufgrund der Aktionärsstruktur schon geringe Umsätze von 50.000 Stück für ein Kursplus von 25 % reichen.