Anglo American - - Die letzten 30 Beiträge

eröffnet am 02.01.09 14:34:06 von

neuester Beitrag 02.04.24 18:39:42 von

neuester Beitrag 02.04.24 18:39:42 von

Beiträge: 635

ID: 1.147.225

ID: 1.147.225

Aufrufe heute: 4

Gesamt: 56.257

Gesamt: 56.257

Aktive User: 0

ISIN: GB00B1XZS820 · WKN: A0MUKL · Symbol: NGLB

25,48

EUR

+0,31 %

+0,08 EUR

Letzter Kurs 16:13:31 Tradegate

Neuigkeiten

08.04.24 · dpa-AFX |

08.04.24 · dpa-AFX |

20.03.24 · BNP Paribas Anzeige |

20.03.24 · Gold-Silber-Rohstofftrends |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,5501 | +14,63 | |

| 1,0100 | +10,99 | |

| 4,9300 | +10,04 | |

| 17.600,00 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 190,05 | -7,07 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Beitrag zu dieser Diskussion schreiben

In diesem Bericht werden einige Katalysatoren für Anglo genannt (Übernahme, Kupfer und Veräußerungen):

https://seekingalpha.com/news/4083103-anglo-american-gets-a-…

https://seekingalpha.com/news/4083103-anglo-american-gets-a-…

Antwort auf Beitrag Nr.: 74.934.070 von NickelChrome am 08.12.23 13:52:36

02.04.2024 16:37:14 23,8000 250 Schweren Fehler korrigiert - Zu früh gekauft heute asynchron ausgestoppt (mit kleinem Gewinn)

Durch das Zins Tohuwabohu beginnend gestern in den USA kriegen wir die Miners for an Apple and an Egg

Zu viele takktische Fehler (Takkt aus dem SDAX)

Zitat von NickelChrome: Neben Nickel Chrome braucht man auch Eisenerz

13:46:37 23,10 50

13:46:37 23,10 200

Mal ne kleine Erstposition bezogen ... Gerade ging es unter die 20 Pfund in London 1.994,80 GBp -10,33 % -229,70

02.04.2024 16:37:14 23,8000 250 Schweren Fehler korrigiert - Zu früh gekauft heute asynchron ausgestoppt (mit kleinem Gewinn)

Durch das Zins Tohuwabohu beginnend gestern in den USA kriegen wir die Miners for an Apple and an Egg

Zu viele takktische Fehler (Takkt aus dem SDAX)

Ein sehr informativer Bericht zur Lage und Ausrichtung von Anglo:

https://www.miningmx.com/top-story/56175-anglo-review-raises…

https://www.miningmx.com/top-story/56175-anglo-review-raises…

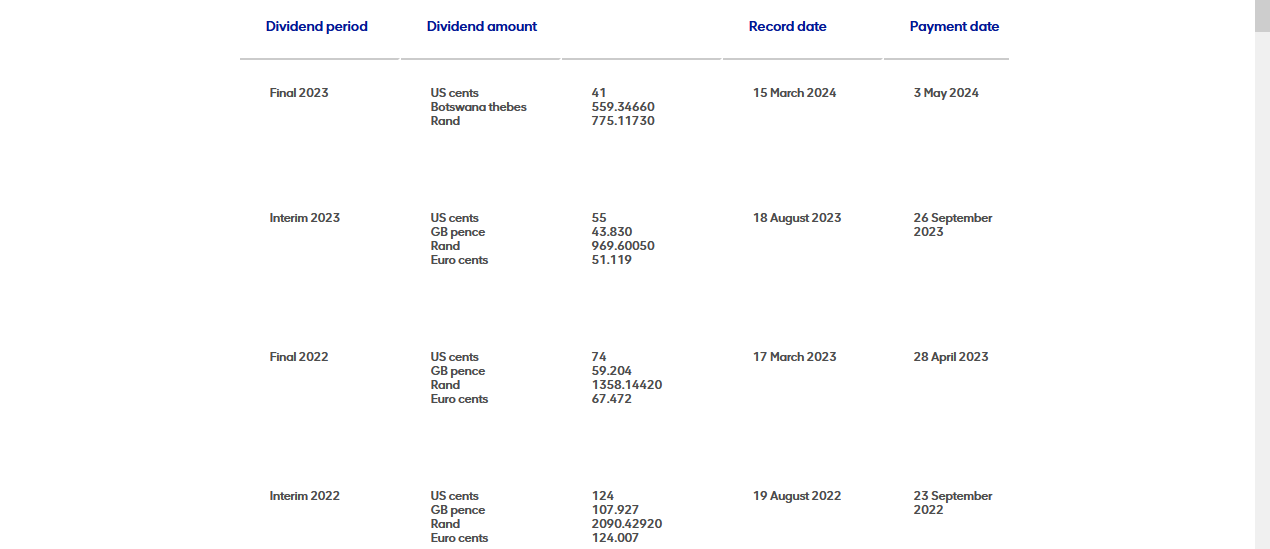

2023 DIV (55 + 41)USC, 2022 DIV (124 +74)USC => 96/198 ~ 0,485, Dividendenabschlag 2023 ggü. 2022 => 51,5%

Antwort auf Beitrag Nr.: 75.262.488 von Oginvest am 12.02.24 11:23:10Finnish Minerals Group and Anglo American to explore joint opportunities to further support Finland’s battery strategy

Finnish Minerals Group and Anglo American, one of the largest mining companies globally, have signed a memorandum of understanding (“MoU”) to work together to explore opportunities to further support Finland’s battery strategy.

Finnish Minerals Group and Anglo American jointly explore the potential of the Finnish mining industry and strengthen the companies' capabilities to build a battery value chain and the required responsible mining operations in Finland. The collaboration enables to combine international experience and resources with Finnish know-how and understanding of local conditions.

Domestic mining is an opportunity for Finland to provide a stable, secure, resource efficient source of the metals and minerals needed for the world to decarbonise. As one of the few countries in the world investing across the entire battery value chain, from mineral extraction to recycling, Finland is well positioned to respond to the increase in demand for responsibly sourced critical raw materials, as countries prioritise resilience and sustainable access to these minerals with increased urgency and focus.

Jani Kiuru, SVP Raw Materials at Finnish Minerals Group, says: ”Exploring joint opportunities with Anglo American is a natural choice for us as they already know the Finnish operational environment. In addition, the company has a long history in mining and is a forerunner in sustainability. We believe this collaboration reinforces both parties by combining local and global know-how in sustainability and technological development, thus maximising the value of Finnish minerals responsibly. We see there is a mutual understanding on the vast possibilities and importance of Finnish minerals for the green transition.”

Alison Atkinson, Projects & Development Director at Anglo American, says: “Finland is a highly attractive investment destination and has a strong heritage in both mining and innovation. We look forward to working with Finnish Minerals Group, whose mission is to responsibly maximise the value of Finnish minerals, to explore the wealth of opportunities that our agreement could offer. This agreement further strengthens our commitment to Finland as well as to our Sakatti project, a true polymetallic orebody very much aligned to Finland’s and the EU’s critical minerals priorities. Sakatti is designed as the next generation of FutureSmart Mining™, building on what we have learned in terms of minimal surface footprint and using technology and innovation to deliver ever better environmental and social outcomes, whilst producing essential raw materials needed to transition to a greener, low carbon energy future.”

..

https://www.mineralsgroup.fi/topical/news/finnish-minerals-g…

Finnish Minerals Group and Anglo American, one of the largest mining companies globally, have signed a memorandum of understanding (“MoU”) to work together to explore opportunities to further support Finland’s battery strategy.

Finnish Minerals Group and Anglo American jointly explore the potential of the Finnish mining industry and strengthen the companies' capabilities to build a battery value chain and the required responsible mining operations in Finland. The collaboration enables to combine international experience and resources with Finnish know-how and understanding of local conditions.

Domestic mining is an opportunity for Finland to provide a stable, secure, resource efficient source of the metals and minerals needed for the world to decarbonise. As one of the few countries in the world investing across the entire battery value chain, from mineral extraction to recycling, Finland is well positioned to respond to the increase in demand for responsibly sourced critical raw materials, as countries prioritise resilience and sustainable access to these minerals with increased urgency and focus.

Jani Kiuru, SVP Raw Materials at Finnish Minerals Group, says: ”Exploring joint opportunities with Anglo American is a natural choice for us as they already know the Finnish operational environment. In addition, the company has a long history in mining and is a forerunner in sustainability. We believe this collaboration reinforces both parties by combining local and global know-how in sustainability and technological development, thus maximising the value of Finnish minerals responsibly. We see there is a mutual understanding on the vast possibilities and importance of Finnish minerals for the green transition.”

Alison Atkinson, Projects & Development Director at Anglo American, says: “Finland is a highly attractive investment destination and has a strong heritage in both mining and innovation. We look forward to working with Finnish Minerals Group, whose mission is to responsibly maximise the value of Finnish minerals, to explore the wealth of opportunities that our agreement could offer. This agreement further strengthens our commitment to Finland as well as to our Sakatti project, a true polymetallic orebody very much aligned to Finland’s and the EU’s critical minerals priorities. Sakatti is designed as the next generation of FutureSmart Mining™, building on what we have learned in terms of minimal surface footprint and using technology and innovation to deliver ever better environmental and social outcomes, whilst producing essential raw materials needed to transition to a greener, low carbon energy future.”

..

https://www.mineralsgroup.fi/topical/news/finnish-minerals-g…

Anglo American stärkt seine Präsenz in Finnland

Anglo American stärkt seine Präsenz in Finnland durch eine Vereinbarung über die Wertschöpfungskette bei Batterien (Alliance News) - 12. Februar 2024 - Anglo American PLC hat am Montag eine Absichtserklärung mit der Finnish Minerals Group unterzeichnet, um Möglichkeiten zur Unterstützung der finnischen Batteriestrategie zu prüfen.

Das in London ansässige Bergbauunternehmen sagte: "Finnland ist ein äußerst attraktives Investitionsziel und verfügt über ein starkes Erbe sowohl im Bergbau als auch in der Innovation".

Alison Atkinson, Direktorin für Projekte und Entwicklung, sagte: "Diese Vereinbarung stärkt unser Engagement in Finnland und in unserem Sakatti-Projekt, einem echten polymetallischen Erzkörper, der den Prioritäten Finnlands und der EU im Bereich der kritischen Mineralien entspricht".

AA Sakatti Mining Oy ist die finnische Tochtergesellschaft von Anglo American, die in Sodankyla tätig ist.

Sakatti ist eine Multimetall-Lagerstätte mit "exzellentem" Explorationspotenzial. Neben den wichtigen Basismetallen wie Kupfer, Nickel und Kobalt enthält die Lagerstätte auch Platin, Palladium, Gold und Silber.

...

https://de.marketscreener.com/kurs/aktie/ANGLO-AMERICAN-PLC-…

Wer weiter kaufen möchte freut sich über die günstigen Einstiegskurse

Das könnte aufgrund einiger gewichtiger Rohstoffpreise ggf. den Kurs noch weiter nach unten ziehen, was sich die potenziellen Nachkäufer für die nächsten Monate wohl erhoffen dürfen. Rohstoffe zusammen mit den Diamanten, welch phantastisches Gemisch. Anglo American posts 24% rise in annual copper output

LONDON, Feb 8 (Reuters) - Global miner Anglo American on Thursday reported a 24% rise in copper production last year to 826,000 metric tons, lower than a previously forecast range of 830,000-870,000 tons.The company left its 2024 copper output guidance at 730,000-790,000 tons. The metal is used for electric vehicles and renewable infrastructure, key planks of the energy transition.

Analysts have forecast a copper deficit from this year after Panama ordered the closure of a First Quantum mine with capacity of 350,000 tons per year and as major producers including Anglo, Glencore , Codelco and Vale Base Metals expect lower supply from their operations.

London-listed Anglo in December announced $1.8 billion of spending cuts by 2026, which it is prepared to deepen in the event of worsening demand for the metals it mines.

"Various operational challenges remain, but 2024 guidance - which has been reiterated - is achievable," Jefferies analysts said in a note.

Production of rough diamonds at the company's De Beers unit fell 8% to 31.9 million carats in 2023. Diamond demand in major consumer China dropped last year as an economic slowdown curbed appetite for luxury items.

"Whilst there has been some improvement coming into 2024, the prospects for economic growth in many major economies remain uncertain and it may take some time for rough diamond demand to fully recover, which has led to the Group currently assessing its carrying value of De Beers," Anglo said in a statement.

Iron ore production rose by 1%, while platinum group metals (PGMs) registered a 5% output drop, it said.

https://www.reuters.com/markets/commodities/anglo-american-p…

De Beers pursues new diamond prospects and best practice in Angola

CAPE TOWN, Feb 6 (Reuters) - Anglo America (AAL.L) unit De Beers has signed agreements with Angola on diamond processing and exploration prospects, CEO Al Cook said on Tuesday, as the diamond producer deepens its presence in the southern African country.The agreements, including one with Angola's state-owned diamond company Endiama, build on exploration contracts signed in 2022 when De Beers returned to the country it left in 2012.

"We believe this is a real step forward in our cooperation," Cook said during a signing ceremony on the margins of an African mining conference in Cape Town.

One agreement with Sodiam, Angola's national diamond trading company, sought to ensure partners used best practice on sorting and processing diamonds in Angola, leaning on expertise developed by De Beers in Botswana.

"Definitely, with De Beers there, we will increase our rough diamond production and with more rough diamonds available, we can have more factories and more processing capacity in Angola," Sendji Dias, head of the planning department at Sodiam, told Reuters.

According to a Sodiam presentation to delegates, seen by Reuters, Angola produces around 9 million carats of rough diamonds a year. Of these, 20% must be sold to local manufacturers under national law.

The presentation showed Endiama expected to significantly increase its rough diamond production this year to 14 million carats. An Endiama official was not immediately available to confirm this figure, which would be driven by output from Angola's $600 million Luele project, that opened in a weak global diamond market.

...

https://www.reuters.com/markets/commodities/de-beers-pursues…

Anglo American considers deeper cost cuts in face of worst downturn in years

CAPE TOWN, Feb 5 (Reuters) - Anglo American (AAL.L), may consider deeper cost-cutting measures unless market conditions improve after a fall in prices and a downturn in the platinum group metals (PGMs) sector that is the worst in 35 years, CEO Duncan Wanblad said on Monday.The diversified miner announced sweeping cuts last year to save about $1.8 billion.

Speaking on the sidelines of the African Mining Indaba in Cape Town, Wanblad told Reuters in an interview he did not see signs of any early PGM recovery, although diamond prices showed faint signs of strengthening.

"To the extent that market conditions continue, we will have to cut deeper and we will just knuckle down and get it done," Wanblad said. "I absolutely understand how difficult this is."

A drop in palladium and rhodium prices has squeezed profits for Anglo's South African units. At its iron ore unit in South Africa, a lack of sufficient rail capacity to ship material to port has also weighed.

South African platinum miners have depended on automakers' use of PGMs to curb exhaust emissions from conventional cars and trucks and face uncertain demand as the world pivots towards electric vehicles.

...

https://www.reuters.com/world/africa/anglo-american-ceo-says…

Anglo American explores for copper, cobalt in Zambia

CAPE TOWN, Feb 5 (Reuters) - Anglo American is in the early stages of exploring for copper and cobalt in Zambia's North-Western province, its Chief Executive Officer Duncan Wanblad said on Monday."Zambia's mining sector appears to be on track for renewed activity - and that is good for Zambia and African mining," Wanblad told delegates at the African Mining Indaba in Cape Town.

"I am pleased that we are progressing with early-stage exploration in Zambia's North-Western Province to identify potential copper and cobalt opportunities."

However, Wanblad also said much more needed to be done to make a compelling argument for Africa given intense global competition.

"We sometimes forget this simple truth: mining jurisdictions across the world are competing for every dollar of investment. Capital is highly mobile and, increasingly, as we are all seeing, the best capital will go to those countries that are set on making themselves competitive for the long term."

Anglo American aims to cut capital expenditure by $1.8 billion by 2026, as it grapples with a fall in demand for most of the metals it mines and a writedown for its British fertiliser project.

...

https://finance.yahoo.com/news/1-anglo-american-explores-cop…

South Africa says platinum restructuring could cut 4,000-7,000 jobs

CAPE TOWN, Feb 5 (Reuters) - South Africa's Minerals Council said on Monday that the restructuring of the country's platinum group metals (PGM) industry could result in between 4,000 and 7,000 job cuts.South African PGM miners are increasingly discussing the need to restructure unprofitable production following a decline in prices and high input costs, the council said at the start of the Investing in African Mining Indaba conference in Cape Town.

The Minerals Council said the sector, largely dependent on automakers who use the metals to curb emissions in petroleum-powered engines, faces "a great deal of uncertainty" as the world pivots towards clean energy in transportation.

Top global PGM producer South Africa has some of the world's oldest and deepest platinum mines, which are expensive to operate, especially when metal prices are low.

The prices of palladium and platinum fell by 40% and 15% last year, respectively, mainly due to weak demand in China.

Electricity and labour costs account for most of PGM miners' total costs, the Minerals Council said in a statement.

"In light of this, various prominent PGM miners are restructuring their operations potentially impacting between 4,000 to 7,000 jobs," it added.

...

Anglo American Platinum (AMSJ.J), the world's biggest PGM producer by value, has said it is reviewing its cost structure to remain profitable.

https://www.reuters.com/world/africa/south-africa-says-plati…

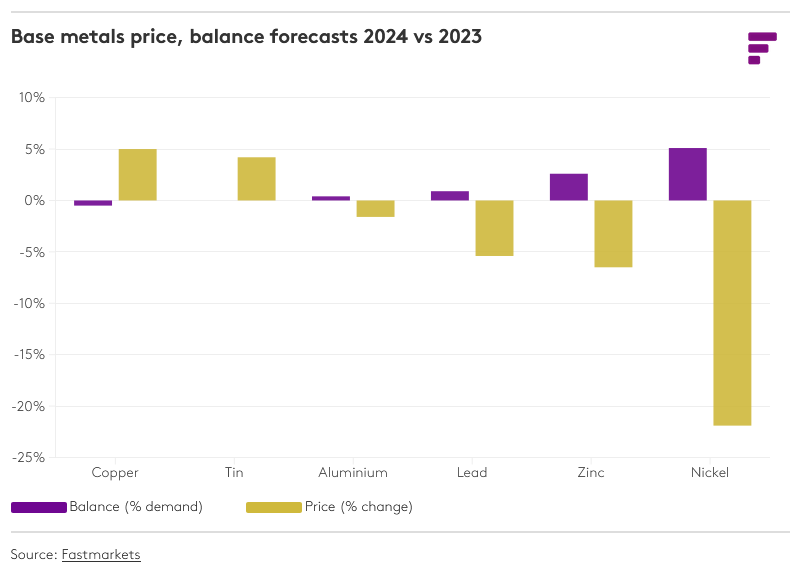

What’s ahead for the base metals market? | 2024 preview

The Fastmarkets base metals research team forecasts the dynamic trends and opportunities in the base metals market in 2024 and beyond The new year has got off to a relatively weak start for the base metals with London Metal Exchange prices generally lower in January. This reflects seasonal volatility, a rebound in the US dollar and other macroeconomic and geopolitical uncertainties that have dented risk appetite. But short-term price weakness should be viewed as a buying opportunity because there are positive macroeconomic factors ahead that should shape 2024. These factors include potential US Federal Reserve rate cuts and monetary policy injections in China, both of which could boost market liquidity and support base metal prices in the process.

The best performers of the group this year are likely to be those that have the strongest fundamental dynamics to enhance the effect of the broader macroeconomic backdrop. Here we review the outlooks for each base metal in order of their fundamentals – tightest to loosest.

https://www.fastmarkets.com/insights/whats-ahead-for-the-bas…

Analysts see weak demand dragging on base metals in 2024

LONDON, Feb 2 (Reuters) - Base metals are in for a subdued 2024 with weak demand damping any bullish supply pressures, judging by the latest Reuters poll of analysts.Only copper and aluminium are expected to see average higher prices this year and expected gains relative to 2023 are highly modest at 2.8% and 2.1% respectively.

Zinc, lead and tin are all expected to decline in price, albeit to an equally modest degree.

Nickel is the stand-out. It probably boasts the strongest demand profile thanks to its use in electric vehicle batteries, but is being swamped by a wave of new production from Indonesia.

The weakest performer last year is forecast to see another 23% average price slump this year, according to the median forecast of analysts participating in the poll.

Things start to look a little rosier next year with some bullish calls breaking with the still cautious consensus.

Base metals poll forecasts vs 2023 actuals

https://www.reuters.com/markets/commodities/analysts-see-wea…

Western miners lag as oil powers enter race for Africa's critical metals

JOHANNESBURG/LONDON, Feb 2 (Reuters) - Risk aversion is likely to leave major Western miners lagging in a race to tap Africa's reserves of critical raw materials that has gathered pace now Middle Eastern oil powers have begun to emulate China's years of investment on the continent.Attracting the capital needed to advance copper, cobalt, nickel and lithium projects in Africa will be high on the agenda when executives, bankers and government officials gather in Cape Town, South Africa, for the annual African Mining Indaba beginning on Monday.

For the big listed miners, the problem is convincing board members anxious to keep shareholders onside, an issue China and the state-backed funds from the Middle East with a mandate to diversify from oil and gas do not face.

Major mining companies' mergers and acquisitions teams have been busy negotiating in countries including Democratic Republic of Congo, the world's top cobalt supplier, and third biggest source of copper. Potential deals in the country, however, are being held up in the boardrooms of Rio Tinto , and BHP Group , two sources with direct knowledge of the matter told Reuters.

The sources said boards were mindful of the shareholder focus on ESG (environmental, social and governance) concerns and past scandals in countries viewed as high risk.

....

> https://www.reuters.com/markets/commodities/western-miners-l…

De Beers makes sharp cuts to diamond prices after sales grind to near halt

Industry whipsawed since the start of the pandemic

De Beers made one of the steepest cuts to its diamond prices in years, as the world’s top producer tries to revive gem sales after the market ground to a halt.

The industry almost came to a complete standstill in the second half of 2023 as the two biggest miners all but stopped supplies in a desperate attempt to stem a collapse in prices. While those efforts helped the market to pick up a bit, it’s unclear how much appetite trade buyers currently have.

To improve demand, De Beers cut prices by about 10 per cent across the board at its first sale of this year — traditionally one of the largest — according to people familiar with the matter. The one-time monopoly made bigger cuts for some larger stones, with one category being lowered about 25 per cent, said the people, who asked not to be identified because the details are private.

The industry has been whipsawed since the start of the pandemic. It was one of the great winners as stuck-at-home shoppers turned to diamond jewellery and other luxury purchases. But demand quickly faded as economies reopened, leaving many in the trade holding excess stock that they’d paid too much for.

...

>> https://financialpost.com/commodities/mining/de-beers-cuts-d…

?Vielleicht nun anstelle von Aktien ein paar günstige Diamonds kaufen? 🤔 😆

Industry whipsawed since the start of the pandemic

De Beers made one of the steepest cuts to its diamond prices in years, as the world’s top producer tries to revive gem sales after the market ground to a halt.

The industry almost came to a complete standstill in the second half of 2023 as the two biggest miners all but stopped supplies in a desperate attempt to stem a collapse in prices. While those efforts helped the market to pick up a bit, it’s unclear how much appetite trade buyers currently have.

To improve demand, De Beers cut prices by about 10 per cent across the board at its first sale of this year — traditionally one of the largest — according to people familiar with the matter. The one-time monopoly made bigger cuts for some larger stones, with one category being lowered about 25 per cent, said the people, who asked not to be identified because the details are private.

The industry has been whipsawed since the start of the pandemic. It was one of the great winners as stuck-at-home shoppers turned to diamond jewellery and other luxury purchases. But demand quickly faded as economies reopened, leaving many in the trade holding excess stock that they’d paid too much for.

...

>> https://financialpost.com/commodities/mining/de-beers-cuts-d…

?Vielleicht nun anstelle von Aktien ein paar günstige Diamonds kaufen? 🤔 😆

Future of world copper production depends on projects developed in Peru, says analyst

12/16/2023 - Copper is in the eyes of the world due to energy transition. Given this, GCC Advisors Managing Partner Jose Gonzales stated that demand is going to double in the next 20 years."There will be a deficit of 8%, and its cost will stand between US$6 and US$8 per pound. In the case of Peru, we could double production, and the (positive) impact on the economy would be great," the expert explained before the Institute of Mining Engineers of Peru (IIMP).

Likewise, Gonzales called for considering that Peru is among the largest copper producers in the world, along with Chile, China, and the United States.

"Besides, Peru has the most important mineable copper reserves in the world," he detailed.

...

https://andina.pe/ingles/noticia-future-of-world-copper-prod…

Peru copper production in November up 10.9% from year ago

LIMA, Jan 12 (Reuters) - Copper production in Peru rose 10.9% in November from the year-ago month to 253,582 metric tons, the Andean nation's mining ministry said on Friday.Peru is the world's second-largest producer of copper, behind neighbor Chile.

Peru's production boost in the month largely came from strong performance at Anglo American's Quellaveco mine, as well as Glencore's Antapaccay and the jointly controlled Antamina mine.

Copper production through the first 11 months of the year was up 14% from the same period in 2022 to around 2,499,635 tons, the ministry added.

...

https://finance.yahoo.com/news/1-peru-copper-production-nove…

De Beers Approves $1 Billion Botswana Mine Investment

JOHANNESBURG, 10. Jan. - Global diamond giant De Beers said it will go ahead with a planned $1 billion investment to extend the life of its flagship Jwaneng mine in Botswana, even as last year's downturn in gem demand persists.The Anglo-American unit and the Botswana government, which jointly own Debswana Diamond Company, have approved the spending that will convert the Jwaneng pit into an underground operation.

In 2018, Debswana said it planned an investment to extend the lifespan of the mine by 11 years from 2024. De Beers said the spending is necessary as long-term supply of rough gems is expected to tighten.

...

https://www.voaafrica.com/a/de-beers-approves-1-billion-bots…

China smelters cut Q1 copper guidance price as supply outlook tightens

BEIJING, Dec 28 (Reuters) - China's top copper smelters lowered their first-quarter guidance for copper concentrate processing treatment and refining charges (TC/RCs) as mine closures and disruptions tightened the supply outlook.The rates, decided at a meeting of the China Smelters Purchase Team (CSPT) held on Thursday, were $80 per metric ton and 8 cents per pound, three sources with knowledge of the matter said.

The first-quarter guidance was down 16% from fourth-quarter guidance of $95 per ton and 9.5 cents per pound, a six-year high.

The rate is the lowest since the third quarter 2022 and the same as the 2024 annual benchmark of $80 per ton/8 cents per pound settled by leading Chinese smelters and global miners earlier this month.

Miners pay TC/RCs to smelters to process copper concentrate into refined metal, offsetting the cost of the ore. The charges tend to fall when supply tightens and rise when more concentrate is available.

The supply outlook for copper concentrate next year turned tight after Panama ordered the closure of First Quantum's FM.TO> Cobre mine and Anglo American lowered its copper production guidance for 2024.

...

https://finance.yahoo.com/news/1-china-smelters-cut-q1-03004…

Diamond sector in Antwerp prepares for fresh sanctions against Russia

The diamond sector in Antwerp is preparing to apply the newly agreed sanctions against Russian diamonds.After months of deliberation, the new measures agreed between the G7 and EU countries will start working progressively from January 1.

The first to be hit will be rough diamonds, of which Russia is the largest exporter globally, with 30% of the total production by volume.

...

https://www.euronews.com/my-europe/2023/12/21/diamond-sector…

Anglo American rough diamond sales value for De Beers’ tenth sales cycle of 2023

Anglo American plc announces the value of rough diamond sales (Global Sightholder Sales and Auctions) for De Beers’ tenth sales cycle of 2023, amounting to $130 million....

Al Cook, CEO of De Beers, said: “In the final sales cycle of 2023, De Beers continued to offer lower levels of rough diamond supply, in line with current demand. As the end-of-year holiday season progresses, we are seeing signs that the diamond industry is regaining its balance between wholesale supply and demand. Polished diamond prices look to have stabilised as inventory levels have decreased, though we expect improvements in rough diamond trading conditions to be gradual.”

>> https://www.angloamerican.com/media/press-releases/2023/20-1…

Antwort auf Beitrag Nr.: 74.978.828 von Oliver1980 am 17.12.23 15:23:23

Sie wird sinken, nicht soll. Siehe letzten 3 Seiten im Thread u. INvestor relations.

Zitat von Oliver1980: Hallo Zusammen,

ich bin jetzt durch Zufall auf Anglo American gestoßen, weil ich im Rohstoffsektor nur bei BHP investiert bin. Kann mir jemand sagen, warum die Produktion von Anglo American in den nächsten beiden Jahrn sinken soll? Welche Annahmen liegen da zu Grunde?

Danke im Voraus!

Sie wird sinken, nicht soll. Siehe letzten 3 Seiten im Thread u. INvestor relations.

Hallo Zusammen,

ich bin jetzt durch Zufall auf Anglo American gestoßen, weil ich im Rohstoffsektor nur bei BHP investiert bin. Kann mir jemand sagen, warum die Produktion von Anglo American in den nächsten beiden Jahrn sinken soll? Welche Annahmen liegen da zu Grunde?

Danke im Voraus!

ich bin jetzt durch Zufall auf Anglo American gestoßen, weil ich im Rohstoffsektor nur bei BHP investiert bin. Kann mir jemand sagen, warum die Produktion von Anglo American in den nächsten beiden Jahrn sinken soll? Welche Annahmen liegen da zu Grunde?

Danke im Voraus!

South African court denies class action against Anglo American

JOHANNESBURG, Dec 16 (Reuters) - South Africa's High Court has ruled that a class action lawsuit against miner Anglo American (AAL.L) brought by victims of alleged historic lead poisoning in Zambia should not go ahead, lawyers for the claimants said on Saturday...

https://www.reuters.com/world/africa/south-african-court-den…

Wie will der CEO seine BONI kassieren bei einem solchen Kurssturz ? Wenn auch die anderen Bergbaufirmen so in die Knie gingen könnte man es verstehen. Die Gehälter der Führungskräfte sollten dem Sparkurs als erstes eingebunden werden. Eigentlich habe damit gerechnet , dass man K+S übernimmt und so den Bereich Polyhalit stärkt durch die Synergien. BHP wäre in Ohnmacht gefallen ,wie schnell und günstig man diesen Zweig erwerben kann.

genau, der Markt funktioniert und ein Unternehmen dieser Größenordnung reagiert infolgedessen, mithin auch der Aktienkurs;

wie immer übertreibt die Börse, sowohl nach oben als auch nach unten 😀

wie immer übertreibt die Börse, sowohl nach oben als auch nach unten 😀

Antwort auf Beitrag Nr.: 74.954.161 von stockfreek am 12.12.23 22:32:06Bei einer möglichen Übernahmephantasie würde ich steigende Kurse erwarten.

Hier ist die Aktie aufgrund Produktionskürzungen und tiefer Verkaufspreise der Produkte im freien Fall....

Hier ist die Aktie aufgrund Produktionskürzungen und tiefer Verkaufspreise der Produkte im freien Fall....

ist doch recht kühn, oder ?

die erzielbaren Preise sind eher im Moment das Problem, aber wenn das Zinsgespenst verschwindet, wird auch der Markt wieder aufnahmefähiger, denke ich !

die erzielbaren Preise sind eher im Moment das Problem, aber wenn das Zinsgespenst verschwindet, wird auch der Markt wieder aufnahmefähiger, denke ich !

Erste Stimmen reden sogar von einer möglichen Übernahme:

https://www.mining.com/anglo-americans-falling-shares-fuel-t…

https://www.mining.com/anglo-americans-falling-shares-fuel-t…

08.04.24 · dpa-AFX · Atos |

08.04.24 · dpa-AFX · Rio Tinto |

20.03.24 · Gold-Silber-Rohstofftrends · Anglo American |

11.03.24 · dpa-AFX · Infineon Technologies |

26.02.24 · Gold-Silber-Rohstofftrends · Anglo American |

22.02.24 · wallstreetONLINE Redaktion · Accor |

21.02.24 · BörsenNEWS.de · Accor |

08.02.24 · wallstreetONLINE Redaktion · British American Tobacco |

03.02.24 · Gold-Silber-Rohstofftrends · Anglo American |