30 % in 9.Tagen und es geht weiter !!!! - 500 Beiträge pro Seite

eröffnet am 09.02.09 17:02:20 von

neuester Beitrag 10.02.09 11:13:02 von

neuester Beitrag 10.02.09 11:13:02 von

Beiträge: 8

ID: 1.148.182

ID: 1.148.182

Aufrufe heute: 0

Gesamt: 1.203

Gesamt: 1.203

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 23:15 | 911 | |

| gestern 12:15 | 836 | |

| 20.04.24, 12:11 | 509 | |

| gestern 19:30 | 413 | |

| vor 1 Stunde | 404 | |

| heute 03:00 | 362 | |

| heute 05:38 | 343 | |

| vor 48 Minuten | 322 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.045,98 | -0,23 | 200 | |||

| 2. | 2. | 9,6950 | +0,52 | 184 | |||

| 3. | 3. | 150,02 | -1,02 | 132 | |||

| 4. | 4. | 0,1900 | -2,06 | 70 | |||

| 5. | 6. | 0,0211 | -32,59 | 29 | |||

| 6. | 5. | 6,7020 | -0,62 | 29 | |||

| 7. | 7. | 1,3500 | -0,74 | 29 | |||

| 8. | 15. | 2,2720 | -3,57 | 26 |

Es handelt sich hier um Bankers Petroleum Ltd

Hier ein paar Einzelheiten:

WKN: A0Q7E3

ISIN: CA0662863038

Symbol: D : OL2A

Ca: BNK

Bankers Petroleum Ltd Genuity Cuts

price target to C$1.40 from

(BNK.TO) C$1.50; rating buy

http://uk.reuters.com/article/oilRpt/idUKBNG22066720090126

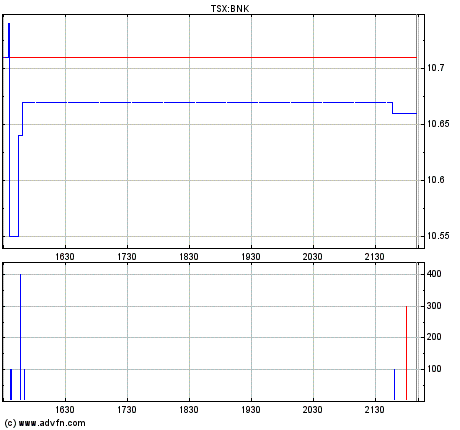

S&P/TSX Composite Index Intraday Chart

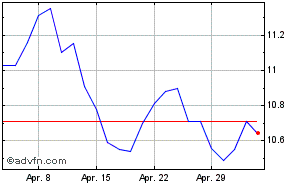

Bis 2.40 CAD ist noch viel Luft

siehe Chart

siehe Chart

und hier noch ein Chart

http://stockcharts.com/h-sc/ui?s=BNK.TO&p=D&yr=0&mn=10&dy=0&…

BANKERS PETROLEUM LTD·BNK·TORONTO STOCK EXCHANGE

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

1 700 1,04

1,05 500

BANKERS PETROLEUM LTD. REGISTERED SHARES·OL2A·STUTTGART

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

8 500 0,612

0,699 5 000

Hier ein paar Einzelheiten:

WKN: A0Q7E3

ISIN: CA0662863038

Symbol: D : OL2A

Ca: BNK

Bankers Petroleum Ltd Genuity Cuts

price target to C$1.40 from

(BNK.TO) C$1.50; rating buy

http://uk.reuters.com/article/oilRpt/idUKBNG22066720090126

S&P/TSX Composite Index Intraday Chart

Bis 2.40 CAD ist noch viel Luft

siehe Chart

siehe Chartund hier noch ein Chart

http://stockcharts.com/h-sc/ui?s=BNK.TO&p=D&yr=0&mn=10&dy=0&…

BANKERS PETROLEUM LTD·BNK·TORONTO STOCK EXCHANGE

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

1 700 1,04

1,05 500

BANKERS PETROLEUM LTD. REGISTERED SHARES·OL2A·STUTTGART

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

8 500 0,612

0,699 5 000

in Deutschland wird keiner bedient  also in Canada kaufen

also in Canada kaufen

BANKERS PETROLEUM LTD. REGISTERED SHARES·OL2A·STUTTGART

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

13 000 0,60

0,687 12 500

BANKERS PETROLEUM LTD·BNK·TORONTO STOCK EXCHANGE

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

2 600 1,02

1,03 3 000

also in Canada kaufen

also in Canada kaufen

BANKERS PETROLEUM LTD. REGISTERED SHARES·OL2A·STUTTGART

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

13 000 0,60

0,687 12 500

BANKERS PETROLEUM LTD·BNK·TORONTO STOCK EXCHANGE

ORDERTIEFE

Anzahl Limit Kauf Verkauf Limit Anzahl

2 600 1,02

1,03 3 000

Die Fonds steigen jetzt ein

schaut einfaqch mal die Balken an

schaut einfaqch mal die Balken an

schaut einfaqch mal die Balken an

schaut einfaqch mal die Balken an

Wenn ich das mal hochrechne, wirst Du bis Jahresende etwa 75 Threads zu BNK eröffnet haben.

Lehne mich jetzt mal aus dem Fenster, aber ich meine die Allgemeinheit hat gemerkt, daß Dich das Unternehmen interessiert.

Popeye

Lehne mich jetzt mal aus dem Fenster, aber ich meine die Allgemeinheit hat gemerkt, daß Dich das Unternehmen interessiert.

Popeye

ne mach ich nicht  aber der Bekanntheitsgrad hier bei WO ist ja fast bei null

aber der Bekanntheitsgrad hier bei WO ist ja fast bei null  aber das wird schon noch. Heute sind die Fonds bei BNK eingestiegen und der Aufwärtstrend ich auch ok. Morgen könnte es dan so weit sein das 1.10 CAD fällt und wir Kurse um die 1.20 CAD sehen werden

aber das wird schon noch. Heute sind die Fonds bei BNK eingestiegen und der Aufwärtstrend ich auch ok. Morgen könnte es dan so weit sein das 1.10 CAD fällt und wir Kurse um die 1.20 CAD sehen werden  aber alles nur meine Meinung

aber alles nur meine Meinung

aber der Bekanntheitsgrad hier bei WO ist ja fast bei null

aber der Bekanntheitsgrad hier bei WO ist ja fast bei null  aber das wird schon noch. Heute sind die Fonds bei BNK eingestiegen und der Aufwärtstrend ich auch ok. Morgen könnte es dan so weit sein das 1.10 CAD fällt und wir Kurse um die 1.20 CAD sehen werden

aber das wird schon noch. Heute sind die Fonds bei BNK eingestiegen und der Aufwärtstrend ich auch ok. Morgen könnte es dan so weit sein das 1.10 CAD fällt und wir Kurse um die 1.20 CAD sehen werden  aber alles nur meine Meinung

aber alles nur meine Meinung

Bankers Petroleum Provides Operational And Corporate Update

Tuesday, January 13, 2009

Bankers Petroleum Ltd announces the following operational and corporate updates.

Production

Fourth quarter production averaged 6,563 bopd from the Patos Marinza oil field in Albania compared to third quarter production of 5,880 bopd. Net oil inventory at the end of December was approximately 90,000 barrels, an increase of 10,000 barrels from the previous quarter. The exit production rate was 6,960 bopd and represents a 31% increase from the 2007 exit production rate of 5,300 bopd. During the quarter, 11 re-activation operations of existing wells were completed with 10 wells placed on production. Six new oil wells were also drilled.

Production for 2008 averaged 5,874 bopd, generating revenue of approximately $110 million, representing an average price of $51.29 per barrel.

Patos Marinza Oil Price

Fourth quarter average oil price was approximately $29.62 per barrel (54% of the Brent oil price), 52% lower than the third quarter price of

$62.08 per barrel.

Drilling Update

Eleven new vertical infill wells were drilled in 2008 with 10 oil wells currently on production and one well awaiting completion. Total production from the new wells was 320 bopd with individual well averages ranging from 15 to 75 bopd. Several of the wells are demonstrating productive capabilities beyond their existing completion configurations and will be re-equipped with larger tubing and rods in order to maximize production rates. Others, with lower production rates, will have additional pay sections perforated and commingled with existing production.

The field extension well (5012) has also been drilled and log analysis indicates 42 meters of potential net oil pay from the four main producing formations. The well is currently being tested to evaluate productivity of the different pay zones.

The first horizontal well (5013) in Patos Marinza has been successfully drilled and completed with 375 meters of lateral pay section. The well is currently producing at a rate of 120 bopd. Fluid levels in the well are high and production rates are expected to increase as the well is optimized.

Overall, the production levels from all the new wells are in line with forecast.

Kuçova

Technical evaluations of the Kuçova pools are advancing. This analysis indicates that there is significant evidence that the implementation of waterflood technology will increase production rates and reserves recovery. Current plans call for a first phase waterflood demonstration project involving the re-activation of a 14 well unit in the second quarter of 2009.

Liquidity

Total cash on deposit as at December 2008 was approximately $18.5 million and total debt with Raiffeisen Bank was US$28.3 million. In January 2009, the Company received approval for an increase to its existing facility to $35 million, of which $11 million continues as a three-year term loan, a new $4 million five-year term loan and a $20 million revolving operating loan facility renewable after its maturity in February 2010. To supplement the Raiffeisen facility, the Company continues to examine other proposals for reserve-based debt facilities that will be more closely aligned with the year-end 2008 reserves, when finalized in February.

Abby Badwi President and CEO of Bankers said:

"We had a successful re-activation and drilling program in 2008 including the first horizontal well at the Patos Marinza oil field and, despite reduced capital expenditures in the fourth quarter to cope with low oil prices, the Company was able to achieve its exit rate production guidance of approximately 7,000 bopd. We will continue to monitor oil prices and adjust our capital expenditure programs accordingly to remain within our financial capabilities".

Tuesday, January 13, 2009

Bankers Petroleum Ltd announces the following operational and corporate updates.

Production

Fourth quarter production averaged 6,563 bopd from the Patos Marinza oil field in Albania compared to third quarter production of 5,880 bopd. Net oil inventory at the end of December was approximately 90,000 barrels, an increase of 10,000 barrels from the previous quarter. The exit production rate was 6,960 bopd and represents a 31% increase from the 2007 exit production rate of 5,300 bopd. During the quarter, 11 re-activation operations of existing wells were completed with 10 wells placed on production. Six new oil wells were also drilled.

Production for 2008 averaged 5,874 bopd, generating revenue of approximately $110 million, representing an average price of $51.29 per barrel.

Patos Marinza Oil Price

Fourth quarter average oil price was approximately $29.62 per barrel (54% of the Brent oil price), 52% lower than the third quarter price of

$62.08 per barrel.

Drilling Update

Eleven new vertical infill wells were drilled in 2008 with 10 oil wells currently on production and one well awaiting completion. Total production from the new wells was 320 bopd with individual well averages ranging from 15 to 75 bopd. Several of the wells are demonstrating productive capabilities beyond their existing completion configurations and will be re-equipped with larger tubing and rods in order to maximize production rates. Others, with lower production rates, will have additional pay sections perforated and commingled with existing production.

The field extension well (5012) has also been drilled and log analysis indicates 42 meters of potential net oil pay from the four main producing formations. The well is currently being tested to evaluate productivity of the different pay zones.

The first horizontal well (5013) in Patos Marinza has been successfully drilled and completed with 375 meters of lateral pay section. The well is currently producing at a rate of 120 bopd. Fluid levels in the well are high and production rates are expected to increase as the well is optimized.

Overall, the production levels from all the new wells are in line with forecast.

Kuçova

Technical evaluations of the Kuçova pools are advancing. This analysis indicates that there is significant evidence that the implementation of waterflood technology will increase production rates and reserves recovery. Current plans call for a first phase waterflood demonstration project involving the re-activation of a 14 well unit in the second quarter of 2009.

Liquidity

Total cash on deposit as at December 2008 was approximately $18.5 million and total debt with Raiffeisen Bank was US$28.3 million. In January 2009, the Company received approval for an increase to its existing facility to $35 million, of which $11 million continues as a three-year term loan, a new $4 million five-year term loan and a $20 million revolving operating loan facility renewable after its maturity in February 2010. To supplement the Raiffeisen facility, the Company continues to examine other proposals for reserve-based debt facilities that will be more closely aligned with the year-end 2008 reserves, when finalized in February.

Abby Badwi President and CEO of Bankers said:

"We had a successful re-activation and drilling program in 2008 including the first horizontal well at the Patos Marinza oil field and, despite reduced capital expenditures in the fourth quarter to cope with low oil prices, the Company was able to achieve its exit rate production guidance of approximately 7,000 bopd. We will continue to monitor oil prices and adjust our capital expenditure programs accordingly to remain within our financial capabilities".

Bankers Petroleum

Capital Expenditure and Future Plans

Capex Data

With recent sharp declines in oil prices, Bankers has decided to slow down its capital expenditure program in 2009 with an objective to remain self funding from cash flow, cash on hand and available credit facilities. Strategic allocation of the work program and budget is designed to prove additional recoverable reserves at the Patos Marinza and Kuçova oil fields and still achieve an appropriate growth in production.

Capital investment is estimated to be $60 million and is intended to achieve a forecast exit production rate for 2009 of 9,000 bopd. The budget for 2010 remains unchanged however the exit production target has been adjusted to 14,000 bopd to reflect the reduced investment in 2009. Bankers corporate presentation will be updated and posted on its website next week.

Future Plans

The revised capital program for 2009 includes the following:

- Reactivation and recompletion of existing wells:

- Drilling of vertical and horizontal wells including three field delineation wells and one exploration well; A waterflood program;

- A cyclic thermal steam pilot project; and,

- Field evaluation program at Kuçova.

Quelle: http://www.oilvoice.com/Capex-Data/Bankers_Petroleum/4b1116c…

Capital Expenditure and Future Plans

Capex Data

With recent sharp declines in oil prices, Bankers has decided to slow down its capital expenditure program in 2009 with an objective to remain self funding from cash flow, cash on hand and available credit facilities. Strategic allocation of the work program and budget is designed to prove additional recoverable reserves at the Patos Marinza and Kuçova oil fields and still achieve an appropriate growth in production.

Capital investment is estimated to be $60 million and is intended to achieve a forecast exit production rate for 2009 of 9,000 bopd. The budget for 2010 remains unchanged however the exit production target has been adjusted to 14,000 bopd to reflect the reduced investment in 2009. Bankers corporate presentation will be updated and posted on its website next week.

Future Plans

The revised capital program for 2009 includes the following:

- Reactivation and recompletion of existing wells:

- Drilling of vertical and horizontal wells including three field delineation wells and one exploration well; A waterflood program;

- A cyclic thermal steam pilot project; and,

- Field evaluation program at Kuçova.

Quelle: http://www.oilvoice.com/Capex-Data/Bankers_Petroleum/4b1116c…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 194 | ||

| 188 | ||

| 143 | ||

| 72 | ||

| 31 | ||

| 29 | ||

| 29 | ||

| 26 | ||

| 25 | ||

| 25 |

| Wertpapier | Beiträge | |

|---|---|---|

| 25 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 21 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 |