canad. AVION RES. (A0RPH1) startet JETZT durch !!! - 500 Beiträge pro Seite (Seite 2)

eröffnet am 06.05.09 20:15:38 von

neuester Beitrag 15.08.12 17:05:59 von

neuester Beitrag 15.08.12 17:05:59 von

Beiträge: 579

ID: 1.150.184

ID: 1.150.184

Aufrufe heute: 0

Gesamt: 32.677

Gesamt: 32.677

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 50 Minuten | 9089 | |

| vor 1 Stunde | 6700 | |

| vor 1 Stunde | 5034 | |

| heute 19:33 | 4744 | |

| vor 1 Stunde | 4665 | |

| heute 19:10 | 4136 | |

| heute 20:24 | 3574 | |

| vor 1 Stunde | 3217 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.773,00 | -0,65 | 229 | |||

| 2. | 2. | 147,85 | -2,29 | 113 | |||

| 3. | 5. | 6,7310 | -3,94 | 81 | |||

| 4. | 4. | 2.390,36 | +0,39 | 77 | |||

| 5. | 3. | 6,4420 | -3,11 | 57 | |||

| 6. | 20. | 15,513 | -4,98 | 50 | |||

| 7. | 8. | 7,4600 | -1,58 | 45 | |||

| 8. | 15. | 26,94 | +0,15 | 40 |

http://www.aviongoldcorp.com/News/News-Details/2011/Avion-Go…

Avion Gold Reports Updated Mineral Resource Estimate at Hounde Property, Burkina Faso Indicated Mineral Resources of 893,000 Ounces of Gold & Inferred Mineral Resources of 712,000 Ounces of Gold

Avion Gold Reports Updated Mineral Resource Estimate at Hounde Property, Burkina Faso Indicated Mineral Resources of 893,000 Ounces of Gold & Inferred Mineral Resources of 712,000 Ounces of Gold

http://www.aviongoldcorp.com/News/News-Details/2012/Avion-Go…

Avion Gold Appoints Alex Dann as New Chief Financial Officer Jan 09, 2012

----------------------------------------------------------------------------------------

http://www.aviongoldcorp.com/News/News-Details/2012/Avion-Go…

Avion Gold Corporation: 2011 Annual Gold Production of 91,200 Ounces Jan 09, 2012

Avion Gold Appoints Alex Dann as New Chief Financial Officer Jan 09, 2012

----------------------------------------------------------------------------------------

http://www.aviongoldcorp.com/News/News-Details/2012/Avion-Go…

Avion Gold Corporation: 2011 Annual Gold Production of 91,200 Ounces Jan 09, 2012

Avion Gold Corp. has added a new press release to its web site. For full details please visit the Avion web site at:

Avion Gold Corporation Reports Indicated Mineral Resources of 500,000 Ounces of Gold and Inferred Mineral Resources of 702,000 Ounces of Gold at Its Kofi Project, Mali

TORONTO, ONTARIO--(Marketwire - Jan. 17, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the 'Company') is pleased to announce the results of an updated mineral resource estimate for the Kofi Property.

Highlights of Avion's current mineral resources for the Kofi Property at a 0.5 g/t Au cut-off are as follows:

- Indicated Open Pit Mineral Resources

6.9 million tonnes grading 2.25 g/t Au totaling 500,000 ounces

- Inferred Open Pit Mineral Resources

12.4 million tonnes grading 1.77 g/t Au totaling 702,000 ounces

John Begeman, President and CEO, commented: "The strong jump in the mineral resource estimates at the Kofi Project, coupled with management's expectation, that we can further add to these resources, demonstrates Avion's ability to grow organically and showcases Avion as a short and medium term growth and value story."

The current mineral resource update is based on approximately 48,705 metres of drilling carried out by Avion and AXMIN Inc. ("Axmin") from December 5, 2007 to November 18, 2011. During this period, Avion completed 168 holes totaling approximately 25,889 metres in 2010 and 2011 and Axmin completed 484 holes totaling 22,816 metres from late 2007 to 2010. The current Kofi mineral resource estimates are derived from drill testing of eight mineralized zones of which the Kofi C and Betea zones (South, Central and North) comprise the bulk of the mineralization. The current mineral resource estimate represents a 70.6% increase in the Measured & Indicated mineral resources from 293,000 ozs of gold to 500,000 ozs of gold and a 90.8% increase in the Inferred mineral resources from 368,000 ozs of gold to 702,000 ozs of gold. Assays were capped at values ranging from 7.5 g/t Au to 50 g/t Au depending on the zone and individual mineralization wire frame. A technical report, written in compliance with National Instrument 43-101 standards, will be filed under Avion's profile on SEDAR within 45 days of this news release. A summary of the current mineral resource estimate is presented below.

Mineral Resource Estimate(1)(2)(3)(4)(5)(6)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

+ INDICATED INFERRED

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Grade Ounces Grade Ounces

ZONE Tonnes Au g/t Au Tonnes Au g/t Au

----------------------------------------------------------------------------

BETEA ZONES 3,029,000 1.74 169,200 7,266,000 1.65 385,700

KOFI C 3,441,000 2.72 300,900 1,947,000 2.06 129,000

A ZONE 10,000 1.46 500 462,000 1.77 26,300

B ZONE 339,000 2.17 23,700 1,536,000 1.58 77,800

BLANAID 82,000 2.06 5,400 499,000 2.32 37,200

A LINEAR 645,000 2.22 46,000

----------------------------------------------------------------------------

TOTAL 6,901,000 2.25 499,700 12,355,000 1.77 702,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1. Resource estimates based on a gold price of US$1,350 per ounce, a

90% process recovery, mining costs of US$1.50/tonne, process costs

of US$15/tonne and General & Administrative costs of US$4.00 per

tonne were used to determine the 0.5 g/t Open Pit cut-off grade.

2. Gold grades were estimated in a 5m x 5m x 5m and 5m x 5 m x 10m

block models from capped 1.5m composites utilizing inverse distance

cubed interpolation. Composites were capped up to 50 g/t depending

on the individual mineralized domain.

3. Eugene Puritch, P.Eng. and Antoine Yassa, P.Geo. from P&E Mining

Consultants Inc., Qualified Persons under NI 43-101 who are

independent of the Company, are responsible for the mineral

resource estimates presented herein.

4. Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by environmental, permitting, legal,

title, taxation, sociopolitical, marketing, or other relevant

issues.

5. The quantity and grade of reported inferred mineral resources in

this estimation are uncertain in nature and there has been

insufficient exploration to define these inferred mineral resources

as Indicated or Measured mineral resources and it is uncertain if

further exploration will result in upgrading them to indicated or

measured mineral resource categories.

6. The mineral resources in this press release were estimated using

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM),

CIM Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by CIM Council. The effective date of this

mineral resource estimate is December 21, 2011.

For reference, an open pittable sensitivity to the mineral resource at a 1.0 g/t Au cut-off grade was also calculated. A 1.0 g/t Au cut-off is consistent with the Axmin's historic resource estimate for Kofi (Roberts(1), 2008) and Avion previous practice at the Tabakoto Mine.

1.0 g/t Au Cut -Off Sensitivity to the Mineral Resource Estimate

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1.0 g/t Au

Cut-off INDICATED INFERRED

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Grade Ounces Grade Ounces

ZONE Tonnes Au g/t Au Tonnes Au g/t Au

----------------------------------------------------------------------------

BETEA ZONES 1,925,000 2.32 143,300 4,491,000 2.21 319,000

KOFI C 2,476,000 3.50 278,400 1,254,000 2.78 112,200

A ZONE 4,000 2.66 300 317,000 2.23 22,700

B ZONE 224,000 2.90 20,900 988,000 2.03 64,600

BLANAID 55,000 2.68 4,700 392,000 2.74 34,500

A LINEAR 482,000 2.69 41,700

----------------------------------------------------------------------------

TOTAL 4,684,000 2.98 447,600 7,924,000 2.33 594,700

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Don Dudek, Avion's Senior Vice President, Exploration stated: "The increase in overall ounces was great to see as we continue to move Kofi forward and hopefully toward production. In the short term, Avion will continue to focus on the Kofi C zone area and the northward extension of the Loulo structural corridor onto the Kofi Property, where management believes that there is a high likelihood of adding higher grade gold resources."

The Kofi C zone lies within a north-trending structural corridor that is at least 40 kilometres long by approximately 5 kilometres wide. This corridor contains at least 19 deposits and zones that have been discovered, fifteen of which are on the adjacent Randgold property (see Figure 1). A clear break, defined by the airborne geophysical conductivity data, suggests that this trend continues onto the Kofi property for at least 19 kilometres.

The Kofi property is a large, approximately 470 km2, property package situated, at its nearest point, within approximately five kilometres to the northwest of Avion's Tabakoto Project. The Kofi property wraps around the north side of Randgold's Loulo Mine concessions (Historic Measured and Indicated mineral resources of 62.69 million tonnes grading 4.55 g/t Au).

Don Dudek, P.Geo., the Senior Vice President, Exploration of the Company and Eugene Puritch, P.Eng. of P&E Mining Consultants Inc., both, a qualified persons under National Instrument 43-101 have reviewed and approved the scientific and technical information in this press release.

About Avion Gold Corporation

Avion is a Canadian-based gold mining company focused in West Africa that holds 80% of the Tabakoto and Segala gold projects in Mali. Gold production commenced at these projects in 2009 with approximately 51,290 ounces produced. 2010 production was 87,630 ounces of gold. 2011 production was 91,238 ounces of gold. The current mineral reserve estimate (as of January 1, 2011) of 7.24 million tonnes grading 3.92 g/t Au totaling 913,100 ounces of gold, for the Tabakoto project, demonstrates several sources of excellent grade open pit and good grade underground mineral resources thus providing significant flexibility for Avion's future mining plans. Production sustainability will continue to be supported by exploration programs over an approximately 600 km2 exploration package that both surrounds and is near to the Company's existing mine infrastructure. Additionally, mineral resources at Avion's 1,600 km2 Hounde exploration property in Burkina Faso have grown considerably in 2011 with an aggressive exploration program planned for 2012. Avion continues to progress towards its short term goal of 200,000 ounces of gold per year and a longer term goal of 400,000 to 500,000 ounces of gold per year through development of its exploration properties. The Company is developing an underground mine at the Tabakoto deposit, and is preparing to mine underground at the Segala deposit. Avion has a highly skilled management team, with a focus on growth and consolidation within West Africa.

Cautionary Notes

(1) Avion has reviewed Dr. Roberts 2008 report titled 'Mineral Resource Estimation for the Kofi Project, Mali'. This report, as stated, was prepared as per NI 43-101 and Canadian Institute of Mining, Metallurgy and Petroleum (CIM) guidelines. Accepted methodology includes construction of a section set near-perpendicular to the zone trend, the calculation of composites using a statistical Au top-cut, the construction of wire frames using a 0.5 g/t Au cut-off grade, modeling of the saprolite, transition and fresh rock contacts, the collection of a satisfactory amount of specific gravity data and then block modeling the zone using ordinary Kriging with a 1 g/t Au cut-off grade. The distinction between indicated and inferred mineral resources was determined statistically by the available data. Avion accepts this methodology and has completed drilling over both the Betea Central and Kofi C zones that generally confirms the location, the shape and grades of the mineralized zones at the Betea Central zone. However, at this point it is too early to comment on the accuracy of the resource study completed by Roberts so the reader must be cautioned that the stated indicated and inferred mineral resources are only for overall reference and still need to be validated and re-stated by Avion. Stated simply, a qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserve and Avion is not treating the historical estimate as current mineral resources or mineral reserves.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the impact of the mineral resource estimate on the Company statements regarding the impact of the drill results on the Company; statements with respect to the development potential and timetable of the Tabakoto, Kofi and Hounde projects; the future price of gold; the estimation of mineral resources; conclusions of economic evaluation (including scoping studies); the realization of mineral resource estimates; the timing and amount of estimated future production, development and exploration; costs of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; currency exchange rates; government regulation of mining operations; and environmental risks. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the annual information form of the Company which is available under the profile of the Company on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

For additional information, please visit our website at www.aviongoldcorp.com. Follow us on Facebook: AvionGoldCorp and Twitter: @AvionGoldAVR.

To view the map associated with this press release please visit the following link: http://media3.marketwire.com/docs/KofiFig1.pdf

Avion Gold Corporation Reports Indicated Mineral Resources of 500,000 Ounces of Gold and Inferred Mineral Resources of 702,000 Ounces of Gold at Its Kofi Project, Mali

TORONTO, ONTARIO--(Marketwire - Jan. 17, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the 'Company') is pleased to announce the results of an updated mineral resource estimate for the Kofi Property.

Highlights of Avion's current mineral resources for the Kofi Property at a 0.5 g/t Au cut-off are as follows:

- Indicated Open Pit Mineral Resources

6.9 million tonnes grading 2.25 g/t Au totaling 500,000 ounces

- Inferred Open Pit Mineral Resources

12.4 million tonnes grading 1.77 g/t Au totaling 702,000 ounces

John Begeman, President and CEO, commented: "The strong jump in the mineral resource estimates at the Kofi Project, coupled with management's expectation, that we can further add to these resources, demonstrates Avion's ability to grow organically and showcases Avion as a short and medium term growth and value story."

The current mineral resource update is based on approximately 48,705 metres of drilling carried out by Avion and AXMIN Inc. ("Axmin") from December 5, 2007 to November 18, 2011. During this period, Avion completed 168 holes totaling approximately 25,889 metres in 2010 and 2011 and Axmin completed 484 holes totaling 22,816 metres from late 2007 to 2010. The current Kofi mineral resource estimates are derived from drill testing of eight mineralized zones of which the Kofi C and Betea zones (South, Central and North) comprise the bulk of the mineralization. The current mineral resource estimate represents a 70.6% increase in the Measured & Indicated mineral resources from 293,000 ozs of gold to 500,000 ozs of gold and a 90.8% increase in the Inferred mineral resources from 368,000 ozs of gold to 702,000 ozs of gold. Assays were capped at values ranging from 7.5 g/t Au to 50 g/t Au depending on the zone and individual mineralization wire frame. A technical report, written in compliance with National Instrument 43-101 standards, will be filed under Avion's profile on SEDAR within 45 days of this news release. A summary of the current mineral resource estimate is presented below.

Mineral Resource Estimate(1)(2)(3)(4)(5)(6)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

+ INDICATED INFERRED

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Grade Ounces Grade Ounces

ZONE Tonnes Au g/t Au Tonnes Au g/t Au

----------------------------------------------------------------------------

BETEA ZONES 3,029,000 1.74 169,200 7,266,000 1.65 385,700

KOFI C 3,441,000 2.72 300,900 1,947,000 2.06 129,000

A ZONE 10,000 1.46 500 462,000 1.77 26,300

B ZONE 339,000 2.17 23,700 1,536,000 1.58 77,800

BLANAID 82,000 2.06 5,400 499,000 2.32 37,200

A LINEAR 645,000 2.22 46,000

----------------------------------------------------------------------------

TOTAL 6,901,000 2.25 499,700 12,355,000 1.77 702,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1. Resource estimates based on a gold price of US$1,350 per ounce, a

90% process recovery, mining costs of US$1.50/tonne, process costs

of US$15/tonne and General & Administrative costs of US$4.00 per

tonne were used to determine the 0.5 g/t Open Pit cut-off grade.

2. Gold grades were estimated in a 5m x 5m x 5m and 5m x 5 m x 10m

block models from capped 1.5m composites utilizing inverse distance

cubed interpolation. Composites were capped up to 50 g/t depending

on the individual mineralized domain.

3. Eugene Puritch, P.Eng. and Antoine Yassa, P.Geo. from P&E Mining

Consultants Inc., Qualified Persons under NI 43-101 who are

independent of the Company, are responsible for the mineral

resource estimates presented herein.

4. Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by environmental, permitting, legal,

title, taxation, sociopolitical, marketing, or other relevant

issues.

5. The quantity and grade of reported inferred mineral resources in

this estimation are uncertain in nature and there has been

insufficient exploration to define these inferred mineral resources

as Indicated or Measured mineral resources and it is uncertain if

further exploration will result in upgrading them to indicated or

measured mineral resource categories.

6. The mineral resources in this press release were estimated using

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM),

CIM Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by CIM Council. The effective date of this

mineral resource estimate is December 21, 2011.

For reference, an open pittable sensitivity to the mineral resource at a 1.0 g/t Au cut-off grade was also calculated. A 1.0 g/t Au cut-off is consistent with the Axmin's historic resource estimate for Kofi (Roberts(1), 2008) and Avion previous practice at the Tabakoto Mine.

1.0 g/t Au Cut -Off Sensitivity to the Mineral Resource Estimate

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1.0 g/t Au

Cut-off INDICATED INFERRED

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Grade Ounces Grade Ounces

ZONE Tonnes Au g/t Au Tonnes Au g/t Au

----------------------------------------------------------------------------

BETEA ZONES 1,925,000 2.32 143,300 4,491,000 2.21 319,000

KOFI C 2,476,000 3.50 278,400 1,254,000 2.78 112,200

A ZONE 4,000 2.66 300 317,000 2.23 22,700

B ZONE 224,000 2.90 20,900 988,000 2.03 64,600

BLANAID 55,000 2.68 4,700 392,000 2.74 34,500

A LINEAR 482,000 2.69 41,700

----------------------------------------------------------------------------

TOTAL 4,684,000 2.98 447,600 7,924,000 2.33 594,700

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Don Dudek, Avion's Senior Vice President, Exploration stated: "The increase in overall ounces was great to see as we continue to move Kofi forward and hopefully toward production. In the short term, Avion will continue to focus on the Kofi C zone area and the northward extension of the Loulo structural corridor onto the Kofi Property, where management believes that there is a high likelihood of adding higher grade gold resources."

The Kofi C zone lies within a north-trending structural corridor that is at least 40 kilometres long by approximately 5 kilometres wide. This corridor contains at least 19 deposits and zones that have been discovered, fifteen of which are on the adjacent Randgold property (see Figure 1). A clear break, defined by the airborne geophysical conductivity data, suggests that this trend continues onto the Kofi property for at least 19 kilometres.

The Kofi property is a large, approximately 470 km2, property package situated, at its nearest point, within approximately five kilometres to the northwest of Avion's Tabakoto Project. The Kofi property wraps around the north side of Randgold's Loulo Mine concessions (Historic Measured and Indicated mineral resources of 62.69 million tonnes grading 4.55 g/t Au).

Don Dudek, P.Geo., the Senior Vice President, Exploration of the Company and Eugene Puritch, P.Eng. of P&E Mining Consultants Inc., both, a qualified persons under National Instrument 43-101 have reviewed and approved the scientific and technical information in this press release.

About Avion Gold Corporation

Avion is a Canadian-based gold mining company focused in West Africa that holds 80% of the Tabakoto and Segala gold projects in Mali. Gold production commenced at these projects in 2009 with approximately 51,290 ounces produced. 2010 production was 87,630 ounces of gold. 2011 production was 91,238 ounces of gold. The current mineral reserve estimate (as of January 1, 2011) of 7.24 million tonnes grading 3.92 g/t Au totaling 913,100 ounces of gold, for the Tabakoto project, demonstrates several sources of excellent grade open pit and good grade underground mineral resources thus providing significant flexibility for Avion's future mining plans. Production sustainability will continue to be supported by exploration programs over an approximately 600 km2 exploration package that both surrounds and is near to the Company's existing mine infrastructure. Additionally, mineral resources at Avion's 1,600 km2 Hounde exploration property in Burkina Faso have grown considerably in 2011 with an aggressive exploration program planned for 2012. Avion continues to progress towards its short term goal of 200,000 ounces of gold per year and a longer term goal of 400,000 to 500,000 ounces of gold per year through development of its exploration properties. The Company is developing an underground mine at the Tabakoto deposit, and is preparing to mine underground at the Segala deposit. Avion has a highly skilled management team, with a focus on growth and consolidation within West Africa.

Cautionary Notes

(1) Avion has reviewed Dr. Roberts 2008 report titled 'Mineral Resource Estimation for the Kofi Project, Mali'. This report, as stated, was prepared as per NI 43-101 and Canadian Institute of Mining, Metallurgy and Petroleum (CIM) guidelines. Accepted methodology includes construction of a section set near-perpendicular to the zone trend, the calculation of composites using a statistical Au top-cut, the construction of wire frames using a 0.5 g/t Au cut-off grade, modeling of the saprolite, transition and fresh rock contacts, the collection of a satisfactory amount of specific gravity data and then block modeling the zone using ordinary Kriging with a 1 g/t Au cut-off grade. The distinction between indicated and inferred mineral resources was determined statistically by the available data. Avion accepts this methodology and has completed drilling over both the Betea Central and Kofi C zones that generally confirms the location, the shape and grades of the mineralized zones at the Betea Central zone. However, at this point it is too early to comment on the accuracy of the resource study completed by Roberts so the reader must be cautioned that the stated indicated and inferred mineral resources are only for overall reference and still need to be validated and re-stated by Avion. Stated simply, a qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserve and Avion is not treating the historical estimate as current mineral resources or mineral reserves.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the impact of the mineral resource estimate on the Company statements regarding the impact of the drill results on the Company; statements with respect to the development potential and timetable of the Tabakoto, Kofi and Hounde projects; the future price of gold; the estimation of mineral resources; conclusions of economic evaluation (including scoping studies); the realization of mineral resource estimates; the timing and amount of estimated future production, development and exploration; costs of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; currency exchange rates; government regulation of mining operations; and environmental risks. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the annual information form of the Company which is available under the profile of the Company on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

For additional information, please visit our website at www.aviongoldcorp.com. Follow us on Facebook: AvionGoldCorp and Twitter: @AvionGoldAVR.

To view the map associated with this press release please visit the following link: http://media3.marketwire.com/docs/KofiFig1.pdf

Was ist den heute los ?

Was ist den heute los ?

Antwort auf Beitrag Nr.: 42.635.018 von ichweiss am 23.01.12 19:37:14news aus mali und dazu kommt noch das stan bharti und konsorten die aktionäre bei crocodile mal richtig verarscht haben

Avion Gold Corp. has added a new press release to its web site. For full details please visit the Avion web site at:

Avion Files a NI 43-101 Technical Report and Mineral Resource Estimate for Hounde Project in Burkina Faso

TORONTO, ONTARIO--(Marketwire - Feb. 3, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") is pleased to announce that a technical report in respect of its updated mineral resource estimate at the Hounde Project in Burkina Faso, as announced on December 21, 2011 has been filed on SEDAR in compliance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") requirements.

The report was prepared to provide a technical overview of the Hounde Property and an independent Mineral Resource estimate of the gold mineralization in the Vindaloo zone area of the Hounde Project in Burkina Faso, West Africa.

The current resource estimate for the Vindaloo zone at the Hounde Project represents a 1,400% increase in Open Pit Indicated Mineral Resources from 883,000 tonnes Indicated Mineral Resources at 2.23 g/t Au totalling 63,000 ounces of gold (Avion news release October 26, 2010) to 13.41 million tonnes at 2.07 g/t Au for a total of 893,000 ounces of gold. In addition, there is also a 30% increase in Open Pit Inferred Mineral Resource from 5,725,000 tonnes Inferred Mineral Resources at 2.97 g/t Au totalling 547,000 ounces of gold (Avion news release October 26, 2010) to 10.71 million tonnes grading 2.07 g/t Au for a total of 712,000 ounces of gold.

The NI 43-101 mineral reserve technical report was authored by Mr. Don Dudek, P.Geo.an officer of the Corporation, Klaus Kappenschneider, an employee of the Company and by Mr. Eugene J. Puritch, P. Eng. and Mr. Antoine Yassa, P. Geo. of P&E Mining Consultants, who are independent of Avion, and all of whom are "qualified persons" as defined in NI 43-101.

The Technical Report, entitled "Technical Report and Resource Estimate on the Hounde Property Burkina Faso, Africa" dated effective December 19, 2011, has been filed under Avion's profile on SEDAR (www.sedar.com).

Regulatory Notes

Don Dudek, P.Geo., the Senior Vice President, Exploration, of the Company is a "qualified persons" under National Instrument 43-101 and have reviewed and approved the scientific and technical information contained in this news release.

For a full description of the mineral resources discussed herein, the key parameters, assumptions and methods used to estimate these mineral resources and a discussion of the legal, political and environmental risks that may have an impact on the estimates, refer to the Technical Report.

Cautionary Notes

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking inform

Avion Files a NI 43-101 Technical Report and Mineral Resource Estimate for Hounde Project in Burkina Faso

TORONTO, ONTARIO--(Marketwire - Feb. 3, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") is pleased to announce that a technical report in respect of its updated mineral resource estimate at the Hounde Project in Burkina Faso, as announced on December 21, 2011 has been filed on SEDAR in compliance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") requirements.

The report was prepared to provide a technical overview of the Hounde Property and an independent Mineral Resource estimate of the gold mineralization in the Vindaloo zone area of the Hounde Project in Burkina Faso, West Africa.

The current resource estimate for the Vindaloo zone at the Hounde Project represents a 1,400% increase in Open Pit Indicated Mineral Resources from 883,000 tonnes Indicated Mineral Resources at 2.23 g/t Au totalling 63,000 ounces of gold (Avion news release October 26, 2010) to 13.41 million tonnes at 2.07 g/t Au for a total of 893,000 ounces of gold. In addition, there is also a 30% increase in Open Pit Inferred Mineral Resource from 5,725,000 tonnes Inferred Mineral Resources at 2.97 g/t Au totalling 547,000 ounces of gold (Avion news release October 26, 2010) to 10.71 million tonnes grading 2.07 g/t Au for a total of 712,000 ounces of gold.

The NI 43-101 mineral reserve technical report was authored by Mr. Don Dudek, P.Geo.an officer of the Corporation, Klaus Kappenschneider, an employee of the Company and by Mr. Eugene J. Puritch, P. Eng. and Mr. Antoine Yassa, P. Geo. of P&E Mining Consultants, who are independent of Avion, and all of whom are "qualified persons" as defined in NI 43-101.

The Technical Report, entitled "Technical Report and Resource Estimate on the Hounde Property Burkina Faso, Africa" dated effective December 19, 2011, has been filed under Avion's profile on SEDAR (www.sedar.com).

Regulatory Notes

Don Dudek, P.Geo., the Senior Vice President, Exploration, of the Company is a "qualified persons" under National Instrument 43-101 and have reviewed and approved the scientific and technical information contained in this news release.

For a full description of the mineral resources discussed herein, the key parameters, assumptions and methods used to estimate these mineral resources and a discussion of the legal, political and environmental risks that may have an impact on the estimates, refer to the Technical Report.

Cautionary Notes

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking inform

http://www.aviongoldcorp.com/News/News-Details/2012/Avions-H…

Avion's Hounde Property, Burkina Faso, Returns Intercepts of 51.63 g/t Au Over 8.0 Metres and 12.4 g/t Au Over 6.5 Metres

Avion's Hounde Property, Burkina Faso, Returns Intercepts of 51.63 g/t Au Over 8.0 Metres and 12.4 g/t Au Over 6.5 Metres

Sehr gute Bohrergebnisse wie ich meine und der Markt hat Sie gestern auch gut aufgenommen,nachdem der Montag entgegen meiner Annahme enttäuschend verlief.

Moin moin, ein weiterer aussichtsreicher Burkina Faso Play neben Riverstone, Roxgold, Goldrush umd Semafo.

http://www.aviongoldcorp.com/News/News-Details/2012/Avion-Go…

Avion Gold Corporation: Underground Ore Production Starts at Tabakoto Mine, Mali

Avion Gold Corporation: Underground Ore Production Starts at Tabakoto Mine, Mali

Avion Gold Corp. has added a new press release to its web site. For full details please visit the Avion web site at:

Avion Files A NI 43-101 Technical Report and Mineral Resource Estimate for Kofi Project in Mali

TORONTO, ONTARIO--(Marketwire - March 5, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") is pleased to announce that a technical report in respect of its updated mineral resource estimate at the Kofi Project in Mali, as announced on January 17, 2012 has been filed on SEDAR in compliance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") requirements.

The report was prepared to provide a technical overview of the Kofi Property and an independent Mineral Resource estimate of the gold mineralization of the Kofi Project in Mali, West Africa.

The current resource estimate for the Kofi Project represents a 71% increase in Open Pit Indicated Mineral Resources from 3.24 million Indicated Mineral Resource tonnes at 2.55 g/t Au totaling 293,000 ounces Au (Roberts, 2008, NI43-101 compliant report) to 6.9 million tonnes grading 2.25 g/t Au totaling 500,000 ounces. In addition, there is also a 91% increase in Open Pit Inferred Mineral Resource from 5.26 million tonnes Inferred Mineral Resource grading 2.18 g/t Au totaling 368,000 ounces gold (Dec. 11, 2007 AXMIN news release, Roberts, 2008 NI43-101 compliant report) to 12.4 million tonnes grading 1.77 g/t Au totaling 702,000 ounces.

The NI 43-101 mineral reserve technical report was authored by Mr. Don Dudek, P.Geo. an officer of the Corporation, Mr. John Gartner, P. Geo., an employee of the Company and by Mr. Eugene J. Puritch, P. Eng., Tracy Armstrong, P. Geo., David Burga, P.Geo. and Mr. Antoine Yassa, P. Geo. of P&E Mining Consultants, who are independent of Avion, and all of whom are "qualified persons" as defined in NI 43-101.

The Technical Report, entitled "Technical Report and Updated Resource Estimate on the Kofi Property Mali, Africa" dated effective December 21, 2011, has been filed under Avion's profile on SEDAR (www.sedar.com).

Regulatory Notes

Don Dudek, P.Geo., the Senior Vice President, Exploration, of the Company is a "qualified persons" under National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

For a full description of the mineral resources discussed herein, the key parameters, assumptions and methods used to estimate these mineral resources and a discussion of the legal, political and environmental risks that may have an impact on the estimates, refer to the Technical Report.

About Avion Gold Corporation

Avion is a Canadian-based gold mining company focused in West Africa that holds 80% of the Tabakoto and Segala gold projects in Mali. Gold production commenced at these projects in 2009 with approximately 51,290 ounces produced. 2010 production was 87,630 ounces of gold. 2011 production was 91,238 ounces of gold. The current mineral reserve estimate (as of January 1, 2011) of 7.24 million tonnes grading 3.92 g/t Au totaling 913,100 ounces of gold (proven and probable), for the Tabakoto project property, demonstrates several sources of excellent grade open pit and good grade underground mineral resources thus providing significant flexibility for Avion's future mining plans. The Company has developed an underground mine at the Tabakoto deposit, and is developing another underground mine at the Segala deposit. The Tabakoto project property also contains several producing open pit mines. Production sustainability will continue to be supported by exploration programs over an approximately 600 km2 exploration package that both surrounds and is near to the Company's existing mine infrastructure, and contains mineral resources on the Kofi property. Additionally, mineral resources have grown considerably at Avion's 1,600 km2 Hounde exploration property in Burkina Faso. Aggressive exploration programs are underway at the Tabakoto, Kofi and Hounde properties for 2012. Avion continues to progress towards its short term goal of 200,000 ounces of gold per year and a longer term goal of 400,000 to 500,000 ounces of gold per year through development of its exploration properties. Avion has a highly skilled management team, with a focus on growth and consolidation within West Africa.

Avion Files A NI 43-101 Technical Report and Mineral Resource Estimate for Kofi Project in Mali

TORONTO, ONTARIO--(Marketwire - March 5, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") is pleased to announce that a technical report in respect of its updated mineral resource estimate at the Kofi Project in Mali, as announced on January 17, 2012 has been filed on SEDAR in compliance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") requirements.

The report was prepared to provide a technical overview of the Kofi Property and an independent Mineral Resource estimate of the gold mineralization of the Kofi Project in Mali, West Africa.

The current resource estimate for the Kofi Project represents a 71% increase in Open Pit Indicated Mineral Resources from 3.24 million Indicated Mineral Resource tonnes at 2.55 g/t Au totaling 293,000 ounces Au (Roberts, 2008, NI43-101 compliant report) to 6.9 million tonnes grading 2.25 g/t Au totaling 500,000 ounces. In addition, there is also a 91% increase in Open Pit Inferred Mineral Resource from 5.26 million tonnes Inferred Mineral Resource grading 2.18 g/t Au totaling 368,000 ounces gold (Dec. 11, 2007 AXMIN news release, Roberts, 2008 NI43-101 compliant report) to 12.4 million tonnes grading 1.77 g/t Au totaling 702,000 ounces.

The NI 43-101 mineral reserve technical report was authored by Mr. Don Dudek, P.Geo. an officer of the Corporation, Mr. John Gartner, P. Geo., an employee of the Company and by Mr. Eugene J. Puritch, P. Eng., Tracy Armstrong, P. Geo., David Burga, P.Geo. and Mr. Antoine Yassa, P. Geo. of P&E Mining Consultants, who are independent of Avion, and all of whom are "qualified persons" as defined in NI 43-101.

The Technical Report, entitled "Technical Report and Updated Resource Estimate on the Kofi Property Mali, Africa" dated effective December 21, 2011, has been filed under Avion's profile on SEDAR (www.sedar.com).

Regulatory Notes

Don Dudek, P.Geo., the Senior Vice President, Exploration, of the Company is a "qualified persons" under National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

For a full description of the mineral resources discussed herein, the key parameters, assumptions and methods used to estimate these mineral resources and a discussion of the legal, political and environmental risks that may have an impact on the estimates, refer to the Technical Report.

About Avion Gold Corporation

Avion is a Canadian-based gold mining company focused in West Africa that holds 80% of the Tabakoto and Segala gold projects in Mali. Gold production commenced at these projects in 2009 with approximately 51,290 ounces produced. 2010 production was 87,630 ounces of gold. 2011 production was 91,238 ounces of gold. The current mineral reserve estimate (as of January 1, 2011) of 7.24 million tonnes grading 3.92 g/t Au totaling 913,100 ounces of gold (proven and probable), for the Tabakoto project property, demonstrates several sources of excellent grade open pit and good grade underground mineral resources thus providing significant flexibility for Avion's future mining plans. The Company has developed an underground mine at the Tabakoto deposit, and is developing another underground mine at the Segala deposit. The Tabakoto project property also contains several producing open pit mines. Production sustainability will continue to be supported by exploration programs over an approximately 600 km2 exploration package that both surrounds and is near to the Company's existing mine infrastructure, and contains mineral resources on the Kofi property. Additionally, mineral resources have grown considerably at Avion's 1,600 km2 Hounde exploration property in Burkina Faso. Aggressive exploration programs are underway at the Tabakoto, Kofi and Hounde properties for 2012. Avion continues to progress towards its short term goal of 200,000 ounces of gold per year and a longer term goal of 400,000 to 500,000 ounces of gold per year through development of its exploration properties. Avion has a highly skilled management team, with a focus on growth and consolidation within West Africa.

http://www.aviongoldcorp.com/News/News-Details/2012/Avions-T…

TORONTO, ONTARIO--(Marketwire - March 12, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion") is pleased to announce new drill results for the area just north of the Tabakoto Pit and for the Tabakoto South zone. The holes drilled to the north of the pit were designed to better define gold mineralization in known and new cross-structures and the holes drilled into the Tabakoto South zone were drilled to extend the zone down dip and along strike and to convert Inferred mineral resources to Measured and Indicated mineral resources. Intercept highlights include the following:

-- 13.38 g/t Au over 4.4 metres

-- 6.57 g/t Au over 6.9 metres

-- 6.44 g/t Au over 8.8 metres

-- 23.77 g/t Au over 5.0 metres

-- 7.39 g/t Au over 5.0 metres

-- 6.75 g/t Au over 9.5 metres

-- 38.55 g/t Au over 4.5 metres

usw.usw.usw.

TORONTO, ONTARIO--(Marketwire - March 12, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion") is pleased to announce new drill results for the area just north of the Tabakoto Pit and for the Tabakoto South zone. The holes drilled to the north of the pit were designed to better define gold mineralization in known and new cross-structures and the holes drilled into the Tabakoto South zone were drilled to extend the zone down dip and along strike and to convert Inferred mineral resources to Measured and Indicated mineral resources. Intercept highlights include the following:

-- 13.38 g/t Au over 4.4 metres

-- 6.57 g/t Au over 6.9 metres

-- 6.44 g/t Au over 8.8 metres

-- 23.77 g/t Au over 5.0 metres

-- 7.39 g/t Au over 5.0 metres

-- 6.75 g/t Au over 9.5 metres

-- 38.55 g/t Au over 4.5 metres

usw.usw.usw.

PRESS RELEASES 3/16/2012 7:00:00 AM | Marketwire News

Avion to Release 2011 Fourth Quarter Financial Results and MD&A on March 28, 2012

March 16, 2012 - 07:00:00 AM TORONTO, ONTARIO--(Marketwire - March 16, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces its plan to file its interim financials and MD&A, for the period ending December 31, 2011 with SEDAR after the markets close on March 27, 2012, they will be available on SEDAR by 7:00 AM (ET) Wednesday March 28, 2012.

Following the release, Avion plans to host a conference call at 10:30 AM (ET) on March 28, 2012. To participate in the call please dial:

International: +1 416 340 2216

Toll Free North America: 866-226-1792

Toronto Area: 416 340 2216

To register and listen to the webcast of the call, please go to Avion's website at www.aviongoldcorp.com. A webcast play back recording will remain on the company's website after the completion of the call.

Avion to Release 2011 Fourth Quarter Financial Results and MD&A on March 28, 2012

March 16, 2012 - 07:00:00 AM TORONTO, ONTARIO--(Marketwire - March 16, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces its plan to file its interim financials and MD&A, for the period ending December 31, 2011 with SEDAR after the markets close on March 27, 2012, they will be available on SEDAR by 7:00 AM (ET) Wednesday March 28, 2012.

Following the release, Avion plans to host a conference call at 10:30 AM (ET) on March 28, 2012. To participate in the call please dial:

International: +1 416 340 2216

Toll Free North America: 866-226-1792

Toronto Area: 416 340 2216

To register and listen to the webcast of the call, please go to Avion's website at www.aviongoldcorp.com. A webcast play back recording will remain on the company's website after the completion of the call.

Antwort auf Beitrag Nr.: 42.914.416 von allida am 16.03.12 15:37:36Wenn ich mir den Kursverlauf anschaue, scheinen die Zahlen auf ein Desaster hinzuweisen - nur glauben kann ich es nicht.

Schönes WE & Gruß,

grawshak

Schönes WE & Gruß,

grawshak

Die Zahlen stehen ja soweit fest. Interessant wird sein, ob Avion die Kostenseite in den Griff bekommt. Das sah im letzten Quartal ja nicht danach aus. Und der Goldkurs, der, wenn er unter die 1.600 USD fällt, zügig nach unten rauschen dürfte, tut dann noch sein Übriges. Ich bin mal gespannt. Vielleicht wird ja auch noch etwas von den Fortschritten bei der Erhöhung der Förderung pp. gesagt.

in Mali gibt es einen Putsch... Hintergrund ist der Aufstand der Touareg im Norden des Landes... könnte gefährlich werden....

http://www.sueddeutsche.de/politik/putschversuch-in-mali-meu…

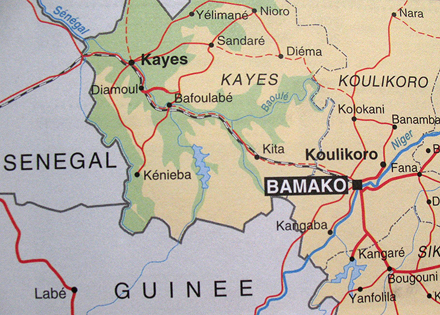

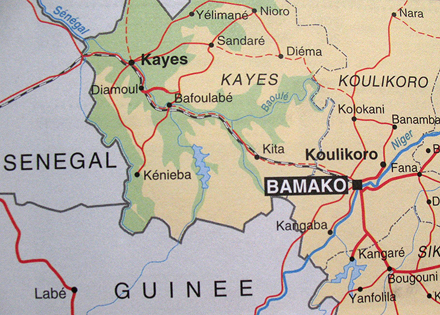

Der Putsch fand in der Hauptstadt Bamako statt, weit weg von den Kampfgebieten, aber nicht so weit von den Minen im Westen des Landes...

http://www.sueddeutsche.de/politik/putschversuch-in-mali-meu…

Der Putsch fand in der Hauptstadt Bamako statt, weit weg von den Kampfgebieten, aber nicht so weit von den Minen im Westen des Landes...

Randgold Loulo

IamGold Sadiola

Avion Tabakoto

IamGold Sadiola

Avion Tabakoto

oh weh... da knallts aber gewaltig.. die schöne story bricht weg:

Mali coup could put gold miners at risk

Peter Koven

Mar 22, 2012

For many gold miners, West Africa is proving to be a lot riskier than expected.

West Africa has been the single hottest gold mining region in the world over the past few years, receiving billions of dollars in investment. Miners like the area because it is under-explored compared to other gold-rich regions, and because governments have recently enacted investment-friendly policies.

However, political instability continues to create fresh problems. The latest example came this week, when the government of Mali was overthrown in a military coup. Last year, there was an outbreak of violence in Ivory Coast over a disputed election, and Burkina Faso experienced a partial army mutiny and related protests.

REUTERS/Malin Palm

The gold miners with direct exposure to Mali include Iamgold Corp., Avion Gold Corp., Randgold Resources Ltd. and Cluff Gold PLC.

According to reports, the Malian coup began because the military is frustrated at the government’s inability to end a rebellion in the Northern part of the country. A group of soldiers looted the presidential palace, and the constitution and all state institutions were dissolved. The whereabouts of former President Amadou Toumani Touré, who has held power since 2002 and brought democracy to the country, are not known.

“We promise to hand power back to a democratically elected president as soon as the country is re-unified and its integrity is no longer threatened,” Lieutenant Amadou Konare said on Malian state television. An immediate curfew was then imposed.

The gold miners with direct exposure to Mali include Iamgold Corp., Avion Gold Corp., Randgold Resources Ltd. and Cluff Gold PLC. Avion is the most exposed of that group, as the company’s two flagship projects are both in Mali. The Toronto-based miner’s shares tumbled as much as 25% Thursday, before closing at $11.20, down 12% on the day.

Related

Gold miners' results a mixed bag

Gold miners eye explorers on Canada’s Yukon trail

For now, none of the companies said they were facing any interruptions.

“Obviously, we’re on standby watching what goes on and making sure we’re on top of the situation,” said Bob Tait, vice-president of investor relations at Iamgold, whose shares fell 1.2% to $13.17.

The gold miners could easily emerge from the Malian crisis with few or no setbacks, as they did after trouble broke out in Ivory Coast and Burkina Faso. But the incident highlights the fact that West African democracies can be extremely fragile. Gold miners have spent a great deal of time in recent years promoting the untapped potential of West Africa, but far less discussing the political risks.

Tom Whelan, Canadian mining leader at Ernst & Young, said that miners need to have well-developed contingency plans to protect their employees and their investment in case of a political crisis like this one.

“You hope you never have to use them, but you make contingency plans for those disaster scenarios,” he said.

Mali coup could put gold miners at risk

Peter Koven

Mar 22, 2012

For many gold miners, West Africa is proving to be a lot riskier than expected.

West Africa has been the single hottest gold mining region in the world over the past few years, receiving billions of dollars in investment. Miners like the area because it is under-explored compared to other gold-rich regions, and because governments have recently enacted investment-friendly policies.

However, political instability continues to create fresh problems. The latest example came this week, when the government of Mali was overthrown in a military coup. Last year, there was an outbreak of violence in Ivory Coast over a disputed election, and Burkina Faso experienced a partial army mutiny and related protests.

REUTERS/Malin Palm

The gold miners with direct exposure to Mali include Iamgold Corp., Avion Gold Corp., Randgold Resources Ltd. and Cluff Gold PLC.

According to reports, the Malian coup began because the military is frustrated at the government’s inability to end a rebellion in the Northern part of the country. A group of soldiers looted the presidential palace, and the constitution and all state institutions were dissolved. The whereabouts of former President Amadou Toumani Touré, who has held power since 2002 and brought democracy to the country, are not known.

“We promise to hand power back to a democratically elected president as soon as the country is re-unified and its integrity is no longer threatened,” Lieutenant Amadou Konare said on Malian state television. An immediate curfew was then imposed.

The gold miners with direct exposure to Mali include Iamgold Corp., Avion Gold Corp., Randgold Resources Ltd. and Cluff Gold PLC. Avion is the most exposed of that group, as the company’s two flagship projects are both in Mali. The Toronto-based miner’s shares tumbled as much as 25% Thursday, before closing at $11.20, down 12% on the day.

Related

Gold miners' results a mixed bag

Gold miners eye explorers on Canada’s Yukon trail

For now, none of the companies said they were facing any interruptions.

“Obviously, we’re on standby watching what goes on and making sure we’re on top of the situation,” said Bob Tait, vice-president of investor relations at Iamgold, whose shares fell 1.2% to $13.17.

The gold miners could easily emerge from the Malian crisis with few or no setbacks, as they did after trouble broke out in Ivory Coast and Burkina Faso. But the incident highlights the fact that West African democracies can be extremely fragile. Gold miners have spent a great deal of time in recent years promoting the untapped potential of West Africa, but far less discussing the political risks.

Tom Whelan, Canadian mining leader at Ernst & Young, said that miners need to have well-developed contingency plans to protect their employees and their investment in case of a political crisis like this one.

“You hope you never have to use them, but you make contingency plans for those disaster scenarios,” he said.

Ja nicht gerade erfreulich - im Fall vom Avion trifft mich das zwar nicht, weil ich noch nicht investiert bin, und schon länger auf einen Wiedereinstieg zu günstigen Kursen warte. Dafür hat es mich auch mit RSG erwischt. Die haben aber heute gemeldet, dass momentan alles normal weiter geht. Der Frage ist, ob es so bleibt ...

Ich überlege hier einzusteigen - schließlich wäre es ja nicht mein erstes Putsch-Land. Bei letzten Mal ist es gut ausgegangen. Das Risiko derzeit ist sicherlich nicht zu unterschätzen, vielleicht risikiere ich aber mal eine kleine Anfangsposition. Ein paar Tage werde ich aber noch weiter beobachten

Ich überlege hier einzusteigen - schließlich wäre es ja nicht mein erstes Putsch-Land. Bei letzten Mal ist es gut ausgegangen. Das Risiko derzeit ist sicherlich nicht zu unterschätzen, vielleicht risikiere ich aber mal eine kleine Anfangsposition. Ein paar Tage werde ich aber noch weiter beobachten

PRESS RELEASES 3/23/2012 1:16:46 PM | Marketwire News

Avion Continues to Monitor Events of Military Coup in Mali While Operations Continue at Site Without Interference or Interruption

March 23, 2012 - 01:16:46 PM TORONTO, ONTARIO--(Marketwire - March 23, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces that it continues to monitor the situation and is keeping watch on events in Mali where members of the national army have mounted a coup.

Avion's management team, Board of Directors and the Forbes & Manhattan advisory team have spoken to and continue to have communications with Avion's management team at site in Mali. The company is also happy to report that Avion board members, the Hon. Pierre Pettigrew, ex Foreign Affairs Minister of Canada and Major-General (Ret.) Lewis MacKenzie as well as Forbes & Manhattan advisory board member General John Abizaid US Army (Ret.) are all working closely with management team and their respective contacts in the government and the military. Avion is taking every step to ensure that it has the best possible advice and information available in such a challenging time.

Currently, the operations at site are continuing without interference and all of the Company's personnel are safe and accounted for both at the mine site and in Bamako. Avion looks forward to the borders and airports re-opening on Tuesday.

Retired General Lewis MacKenzie, Avion Board Member, has also noted "the modest amount of violence to date on both sides is encouraging and suggests an opportunity for an early resolution of the conflict centered in and around the capital, Bamako."

John Begeman, President & CEO of the Company has stated "we have an excellent advisory team helping us monitor the situation and we will continue to monitor the situation in Mali at our sites and in Bamako and will provide further updates as information becomes available to us."

Avion Continues to Monitor Events of Military Coup in Mali While Operations Continue at Site Without Interference or Interruption

March 23, 2012 - 01:16:46 PM TORONTO, ONTARIO--(Marketwire - March 23, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces that it continues to monitor the situation and is keeping watch on events in Mali where members of the national army have mounted a coup.

Avion's management team, Board of Directors and the Forbes & Manhattan advisory team have spoken to and continue to have communications with Avion's management team at site in Mali. The company is also happy to report that Avion board members, the Hon. Pierre Pettigrew, ex Foreign Affairs Minister of Canada and Major-General (Ret.) Lewis MacKenzie as well as Forbes & Manhattan advisory board member General John Abizaid US Army (Ret.) are all working closely with management team and their respective contacts in the government and the military. Avion is taking every step to ensure that it has the best possible advice and information available in such a challenging time.

Currently, the operations at site are continuing without interference and all of the Company's personnel are safe and accounted for both at the mine site and in Bamako. Avion looks forward to the borders and airports re-opening on Tuesday.

Retired General Lewis MacKenzie, Avion Board Member, has also noted "the modest amount of violence to date on both sides is encouraging and suggests an opportunity for an early resolution of the conflict centered in and around the capital, Bamako."

John Begeman, President & CEO of the Company has stated "we have an excellent advisory team helping us monitor the situation and we will continue to monitor the situation in Mali at our sites and in Bamako and will provide further updates as information becomes available to us."

Antwort auf Beitrag Nr.: 42.948.829 von allida am 23.03.12 19:16:03Na dann woll wir hoffen, dass das nur ein kurzes Zwischenspiel war ... jedenfalls gab's nochmals eine gute Gelegenheit hier wieder einzusteigen ...

Der Goldpreis schaut auch wieder besser aus ...

Der Goldpreis schaut auch wieder besser aus ...

Die Putschisten in Mali haben angekündigt, die Macht in dem westafrikanischen Land wieder abgeben zu wollen. Sobald die Armee in der Lage sei, die Sicherheit des Landes zu gewährleisten, werde man abtreten, sagte der Anführer der Gruppe, Amabou Sanogo, am Freitag der britischen BBC. Zugleich kündigte er an, die alte Staatsführung der Justiz zu übergeben. Allerdings soll sich der gestürzte Staatspräsident Amadou Toumani Touré gar nicht in den Händen der Putschisten befinden.

http://www.focus.de/politik/weitere-meldungen/putschisten-in…

http://www.focus.de/politik/weitere-meldungen/putschisten-in…

Ich werde nächste Woche auch eine kleine Posi aufbauen und dann schauen, wie sich die weitere politische Stabilisierung gestaltet.

Antwort auf Beitrag Nr.: 42.950.798 von Homer__Simpson am 24.03.12 15:09:11yo, kleine Position ist richtig,,,, wenn man es mit dem Invest nich übertreibt, kan man das politische Risiko durchaus eingehen...alle anderen Faktoren sind ziemlich gut

Antwort auf Beitrag Nr.: 42.951.063 von XIO am 24.03.12 18:55:16Genau, amsonsten würde ich ein Investment in einem Krisengebiet gar nicht in Erwägung ziehen. Aber hier überwiegen die Chancen deutlichst....imo

Insofern die Turbulente Zeit nutzen, um noch mal günstig was abzugreifen.

Insofern die Turbulente Zeit nutzen, um noch mal günstig was abzugreifen.

Habe mir auch noch ein paar gegönnt... bei diesen Preisen??

Avion Gold Corp. has added a new press release to its web site. For full details please visit the Avion web site at:

Avion Revises Date for Release of 2011 Fourth Quarter Financial Results and MD&A to March 30, 2012

TORONTO, ONTARIO--(Marketwire - March 26, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces plans to file its annual financials and MD&A for the period ending December 31, 2011 on the Company's SEDAR profile after the markets close on March 30, 2012, and they will be available on SEDAR by 7:00 AM (ET) March 31, 2012. By rescheduling the release date of the financial statements, MD&A and associated conference call, Avion will avoid conflicts with other mining companies who plan to release at a similar time. This will enable more analysts and participants to join the Company's conference call.

Following the revised release date, Avion now plans to host a conference call at 10:30 AM (ET) on Monday April 2, 2012. To participate in the call please dial:

International: +1 416 340 2216

Toll Free North America: 866-226-1792

Toronto Area: 416 340 2216

To register and listen to the webcast of the call, please go to Avion's website at www.aviongoldcorp.com. A webcast play back recording will remain on the Company's website after the completion of the call.

Avion Revises Date for Release of 2011 Fourth Quarter Financial Results and MD&A to March 30, 2012

TORONTO, ONTARIO--(Marketwire - March 26, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company") announces plans to file its annual financials and MD&A for the period ending December 31, 2011 on the Company's SEDAR profile after the markets close on March 30, 2012, and they will be available on SEDAR by 7:00 AM (ET) March 31, 2012. By rescheduling the release date of the financial statements, MD&A and associated conference call, Avion will avoid conflicts with other mining companies who plan to release at a similar time. This will enable more analysts and participants to join the Company's conference call.

Following the revised release date, Avion now plans to host a conference call at 10:30 AM (ET) on Monday April 2, 2012. To participate in the call please dial:

International: +1 416 340 2216

Toll Free North America: 866-226-1792

Toronto Area: 416 340 2216

To register and listen to the webcast of the call, please go to Avion's website at www.aviongoldcorp.com. A webcast play back recording will remain on the Company's website after the completion of the call.

PRESS RELEASES 3/31/2012 7:08:53 AM | Marketwire News

Avion Gold Announces Fourth Quarter 2011 Earnings of $8.1 Million With Earnings Per Share of $0.02

March 31, 2012 - 07:08:53 AM TORONTO, ONTARIO--(Marketwire - March 31, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company" ) today announces its financial results for the fourth quarter and year ended December 31, 2011. All amounts are in United States dollars unless otherwise indicated.

Avion will host a conference call at 10:30 AM (EST) on Monday, April 2, 2011 to discuss the results. To participate in the call please dial:

International: +1 416 340 2216

Toll Free: 866 226 1792

Toronto Area: 416 340 2216

Complete audited financial statements and related Management's Discussion and Analysis will be available under the Company's profile on www.sedar.com by 7:00AM (ET) on March 31, 2011.

Fourth Quarter Highlights:

-- The Company had earnings of $8.1 million, or $0.02 per share, and cash

flow from operations before working capital adjustments of $16.1

million.

-- During the quarter the Company sold 23,418 ounces of gold at an average

realized price of $1,647 per ounce compared to $1,370 in Q4 of the

previous year

-- Gold revenue was $37.2 million compared to $38.2 million for the

comparable quarter of 2010.

-- The Company produced 23,418 ounces of gold at a cash cost per ounce of

$734 and total cash costs produced of $823. Cash costs per ounce

declined from the previous quarter as the Company achieved additional

operating efficiencies.

-- The Company announced that it had increased the mineral resources at the

Vindaloo, Hounde property in Burkina Faso by more than 100% .

Full Year 2011 Highlights

-- During 2011, the Company achieved record earnings of $43.1 million, or

$0.10 per share compared to $35.9 million or $0.10 per share for the

prior year.

-- Gold revenue for the year 2011 was $143.9 million compared to $115.3

million for the prior year. The Company fully benefited from the higher

gold prices as it was un-hedged.

-- During 2011, the Company produced 91,200 ounces of gold at a cash cost

per ounce of $652 and total cash cost of $746.

-- In 2011, the Company generated operating cash flow before working

capital adjustments of $67.5 million compared to $54.7 million in 2010.

-- The Company completed 2011 with cash and cash equivalents of $21.2

million.

2012 Outlook

The current Outlook is Management's best estimate of the short and long term plans with respect to the Company. Recently, members of the National Army have mounted a coup in Mali, and while the Company has reported that operations at site are continuing without interference and that mine activities are progressing uninterrupted, there continues to be a risk that the political uncertainty in Mali will cause interruptions in receiving supplies and equipment. As a result, the assumptions and estimates upon which the Company has based its short and long term plans, could be curtailed due to lack of supplies and personnel availability as well as other known and unknown risks.

The Company is forecasting 2012 production of between 140,000 and 150,000 ounces of gold and its plans to increase to a run rate of 4,000 tonnes per day in the fourth quarter of 2012 are advanced. Avion's results in 2011 have allowed this plan to be put into action. Since production re-started in February 2009, the Company has achieved production increases year over year despite some operational challenges due to a strong management team at the mine site. Avion is currently focussed on underground production at Tabakoto, underground development at Segala (currently preparing to rehabilitate a 2 metre wide fault zone that has temporarily halted advance), and has contracted Genivar to lead the mill plant expansion to 4,000 tonnes per day which is expected to start commissioning at the end of Q2-2012. The Company has also initiated a Preliminary Economic Assessment at the Hounde Project in Burkina Faso which will be completed in late Q3 or early Q4-2012. This has required a significant amount of capital and necessitated the Company to access the equity markets and enter into debt facilities. In 2012, the mill expansion is expected to be completed providing greater production, the underground development at Segala will be further advanced and the Hounde Project will move towards a Feasibility study. Underground ore is being mined at Tabakoto, and ore is being mined from several open pit deposits. Activities during 2012 will set the stage for 2013 and achieving the capacity to produce 200,000 ounces per year from the 4,000 tonne per day mill which should be fully operational under our current plan...subject to no interruption by the military action.

Financial Discussion: three months ended December 31, 2011

The Company reported net income of $8,072,364 ($0.02 per share, basic and diluted) for the three months ended December 31, 2011 compared to $20,387,058 ($0.05 per share, basic and diluted) for the three months ended December 31, 2010.

During Q4-2011, the Company sold 23,418 ounces of gold and generated $37,199,811 in gold sales revenue. In Q4-2010, 27,908 ounces of gold was sold generating $38,249,405 in gold sales revenue. Mining and processing costs were $14,696,994 (Q4-2010: $14,913,311) and the Company recorded amortization and depletion of $8,120,033 (Q4-2010: $1,158,333). The Company is amortizing deferred property, plant and equipment related to the Mali projects on a unit of production basis from the current mine plan. The Company was subject to a 6% royalty on metal sales during the quarter. Royalty expense totaled $2,077,985 (Q4-2010: $2,019,134) for the ounces of gold sold during Q4-2011.

Corporate and administrative expenses decreased marginally for the quarter ended December 31, 2011 totalling $1,241,721 compared to $1,303,697 for Q4-2010.

Non-cash share-based compensation expense for Q4-2011 was $562,856 (Q4-2010: $497,824) related to the estimated fair value of stock options that were granted and vested during Q4-2011. A total of 700,000 stock options were granted during Q4-2011 compared to 565,000 during Q4-2010. Share-based compensation was estimated using the Black-Scholes option pricing model as at the date of grant.

The Company recorded an impairment charge of $2,129,554 related to the recoverability of fuel duties during Q4-2011 (Q4-2010: $nil).

The Company also incurred a foreign exchange translation loss of $235,963 during Q4-2011 compared to a loss of $1,595,416 during Q4-2010.

Financial Discussion: twelve months ended December 31, 2010

The Company reported net income of $43,072,532 ($0.10 and $0.10 per share, basic and diluted respectively) for the twelve months ended December 31, 2011 compared to $35,888,421 ($0.11 and $0.10 per share, basic and diluted respectively) for the twelve months ended December 31, 2010. The increase in income is primarily the result of increased sales volumes and gold prices offset by higher operating costs and increased depletion and depreciation expenditures.

During 2011, the Company sold 92,224 ounces of gold and generated $143,295,976 in gold sales revenue (2010: 92,630 ounces generating revenue of $115,306,132). Mining and processing costs were $62,114,494 (2010: $53,486,908), which includes $385,304 (2010: $2,866,703) in amortized deferred stripping costs. Mining and processing costs also includes a provision for taxes from prior years in the amount of $4,538,671. The Company recorded amortization and depletion of $17,215,360 (2010: $7,396,209) for the year ended December 31, 2011. The Company is amortizing deferred property, plant and equipment related to the Mali projects on a unit of production basis from the current mine plan. The Company was subject to a 6% royalty on metal sales during 2011. Royalty expenses totaled $8,597,019 (2010: $7,273,258) for the ounces of gold sold during 2011.

Corporate and administrative expenses for the twelve months ended December 31, 2011 totalled $4,722,932 compared to $4,092,667 for 2010. The increase in corporate costs is a result of the increased activity of the Company, including the hiring of additional personnel, higher compensation for employees and directors and an increase in professional fees.

Non-cash share-based compensation expense for the twelve months ended December 31, 2011 was $4,446,627 (2010: $6,865,189) related to the estimated fair value of stock options that were granted and vested during the nine months ended December 31, 2011. A total of 5,555,000 stock options were granted during the twelve months ended December 31, 2011 compared to 14,510,000 during the twelve months ended December 31, 2010.

The Company recorded tax penalties of $1,196,039 during 2011 compared to $nil during 2010 as a result of recent tax assessments made by the Malian government. As well, the Company recorded an impairment charge of $2,129,554 related to the recoverability of fuel duties during 2011 (2010: $nil).

The Company recognized an unrealized loss of $2,154,137 during the twelve months ended December 31, 2011 (2010: an unrealized loss of $910,319) related to their held-for-trading investments based on the fair market value of these investments as at December 31, 2011. During the comparative year, the Company recognized a gain of $750,359 on the revaluation of the warrant provision from warrants held in a currency other than the Company's functional currency.

The Company also incurred a foreign exchange translation gain of $2,136,035 during 2011 compared to a loss of $160,525 during 2010.

Avion Gold Announces Fourth Quarter 2011 Earnings of $8.1 Million With Earnings Per Share of $0.02

March 31, 2012 - 07:08:53 AM TORONTO, ONTARIO--(Marketwire - March 31, 2012) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the "Company" ) today announces its financial results for the fourth quarter and year ended December 31, 2011. All amounts are in United States dollars unless otherwise indicated.

Avion will host a conference call at 10:30 AM (EST) on Monday, April 2, 2011 to discuss the results. To participate in the call please dial:

International: +1 416 340 2216

Toll Free: 866 226 1792

Toronto Area: 416 340 2216

Complete audited financial statements and related Management's Discussion and Analysis will be available under the Company's profile on www.sedar.com by 7:00AM (ET) on March 31, 2011.

Fourth Quarter Highlights:

-- The Company had earnings of $8.1 million, or $0.02 per share, and cash

flow from operations before working capital adjustments of $16.1

million.

-- During the quarter the Company sold 23,418 ounces of gold at an average

realized price of $1,647 per ounce compared to $1,370 in Q4 of the

previous year

-- Gold revenue was $37.2 million compared to $38.2 million for the

comparable quarter of 2010.

-- The Company produced 23,418 ounces of gold at a cash cost per ounce of

$734 and total cash costs produced of $823. Cash costs per ounce

declined from the previous quarter as the Company achieved additional

operating efficiencies.

-- The Company announced that it had increased the mineral resources at the

Vindaloo, Hounde property in Burkina Faso by more than 100% .

Full Year 2011 Highlights

-- During 2011, the Company achieved record earnings of $43.1 million, or

$0.10 per share compared to $35.9 million or $0.10 per share for the

prior year.

-- Gold revenue for the year 2011 was $143.9 million compared to $115.3

million for the prior year. The Company fully benefited from the higher

gold prices as it was un-hedged.

-- During 2011, the Company produced 91,200 ounces of gold at a cash cost

per ounce of $652 and total cash cost of $746.

-- In 2011, the Company generated operating cash flow before working

capital adjustments of $67.5 million compared to $54.7 million in 2010.

-- The Company completed 2011 with cash and cash equivalents of $21.2

million.

2012 Outlook