ATS Automation Tooling Systems - PV-Zulieferer und PHOTOWATT-Eigner

eröffnet am 17.07.09 19:42:58 von

neuester Beitrag 30.10.23 20:44:08 von

neuester Beitrag 30.10.23 20:44:08 von

Beiträge: 38

ID: 1.151.826

ID: 1.151.826

Aufrufe heute: 0

Gesamt: 3.485

Gesamt: 3.485

Aktive User: 0

ISIN: CA00217Y1043 · WKN: A3D2TT · Symbol: ATS

45,66

CAD

+1,35 %

+0,61 CAD

Letzter Kurs 24.04.24 Toronto

Neuigkeiten

01.04.24 · wO Chartvergleich |

29.03.24 · wO Chartvergleich |

27.03.24 · globenewswire |

27.02.24 · Business Wire (engl.) |

12.02.24 · Business Wire (engl.) |

Werte aus der Branche Elektrogeräte

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3000 | +71.367,84 | |

| 1,02 | +103,00 | |

| 25,12 | +39,05 | |

| 0,9899 | +37,49 | |

| 0,7000 | +34,62 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.080,20 | -10,45 | |

| 111,59 | -12,62 | |

| 1,0400 | -14,89 | |

| 1,7400 | -19,44 | |

| 4,0000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

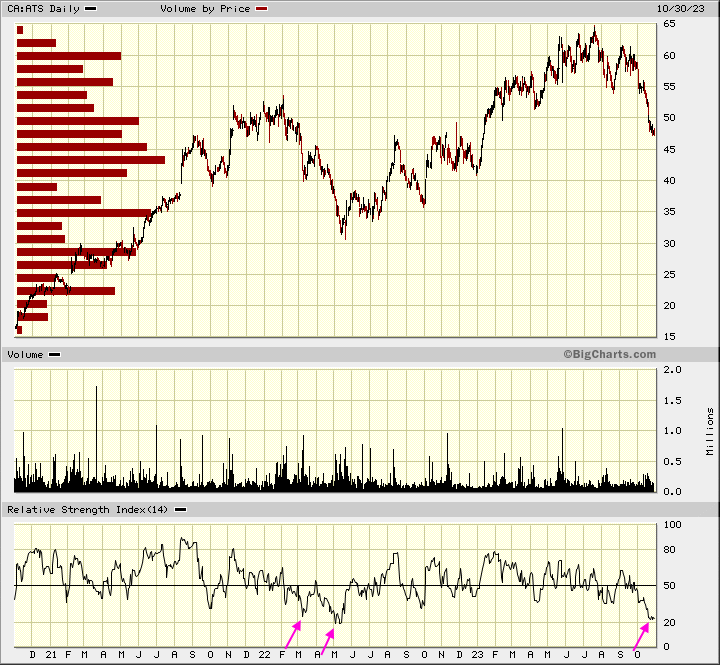

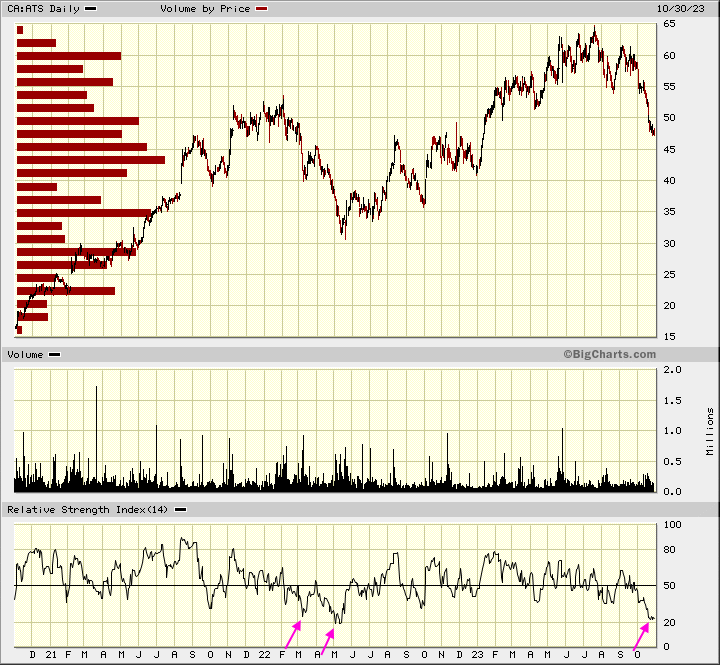

Antwort auf Beitrag Nr.: 72.461.187 von faultcode am 24.09.22 15:12:01

ATS Automation Tooling Systems

Hier geht es weiterATS Automation Tooling Systems meldet Aufträge für Elektrofahrzeuge im Wert von 140 Millionen US-Dollar

https://themarketherald.de/ats-automation-tooling-systems-wk…

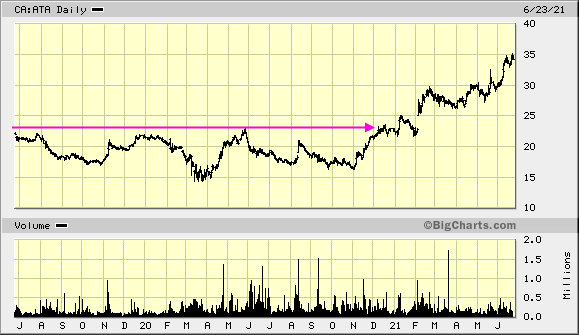

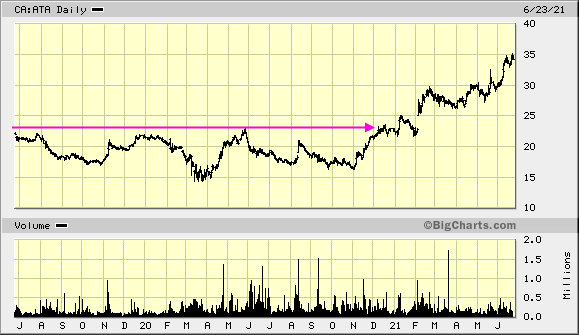

Antwort auf Beitrag Nr.: 68.603.545 von faultcode am 24.06.21 15:13:39

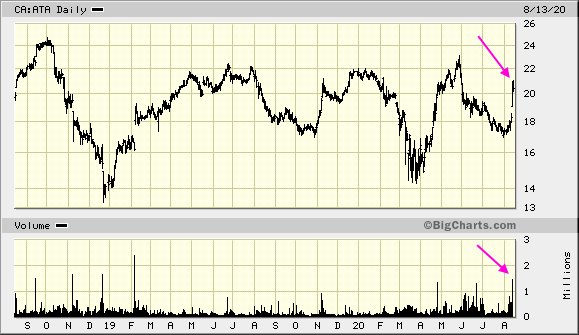

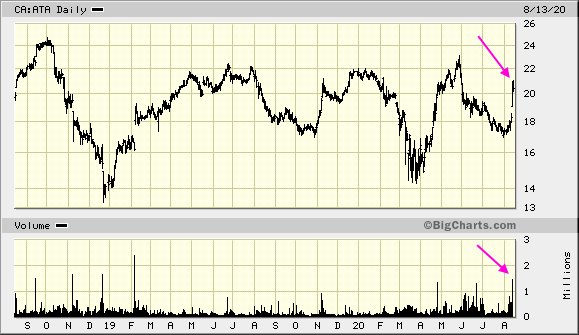

Antwort auf Beitrag Nr.: 64.763.440 von faultcode am 14.08.20 13:43:42

Antwort auf Beitrag Nr.: 57.734.620 von faultcode am 10.05.18 15:42:58

12.8.

Included in our Q1 orders was our previously announced $65 million program for the design, build and delivery of two automated systems that will enabled the production of up to 10 million units per month of critical components for point of care test kits that can be used to detect COVID-19. I'm pleased to report that our team is on track to meet this very aggressive delivery schedule.

CC Q2:

https://seekingalpha.com/article/4368066-ats-automation-tool…

12.8.

Included in our Q1 orders was our previously announced $65 million program for the design, build and delivery of two automated systems that will enabled the production of up to 10 million units per month of critical components for point of care test kits that can be used to detect COVID-19. I'm pleased to report that our team is on track to meet this very aggressive delivery schedule.

CC Q2:

https://seekingalpha.com/article/4368066-ats-automation-tool…

ATS to Acquire a Leading Systems Provider to the Radiopharmaceutical and Pharmaceutical Markets

CAMBRIDGE, ON, Dec. 19, 2018 /CNW/ -

ATS Automation Tooling Systems Inc. (TSX: ATA) ("ATS" or the "Company"), an industry-leading automation solutions provider, today announced it has entered into a definitive agreement to acquire Comecer S.p.A. ("Comecer"), a leader in the design, engineering, manufacture and servicing of advanced aseptic containment and processing systems for the nuclear medicine and pharmaceutical industries.

"Comecer is a proven, high-quality business that brings new and complementary capabilities, customer relationships and specialized talent to ATS," said Andrew Hider, CEO of ATS. "Its addition will strengthen our customer offering in both pharma and biopharma, while adding an innovative new platform in radiopharmaceuticals. These are growing markets with desirable characteristics including stringent quality standards and regulations and where there is a high consequence of failure. We look forward to welcoming Comecer to the ATS family."

Comecer generates approximately 55% of its annual sales to customers in the radiopharmaceutical market, where it supplies specialized radiation shielding systems used by customers in the production, handling, and dispensing of radiopharmaceutical drugs. Applications for this type of equipment include the diagnosis and therapeutic treatment of a number of conditions including various forms of cancer and cardiovascular disorders. The balance of Comecer's sales are derived from equipment to support the aseptic processing, filling and handling of specialized pharmaceuticals as well as isolator and incubator equipment used in advanced therapy medicinal production (ATMP), a regenerative cell therapy that uses patient cells to grow new tissues.

Comecer was established in 1974, and today has approximately 320 skilled employees, the majority of whom work at its main production site in Castel-Bolognese, Italy. The main production site is the home of Comecer's research and development centre. Comecer also has a technical and assembly centre in Joure, Netherlands, and sales and service offices in North America, Europe and Asia.

The total cash purchase price for the acquisition will be 113 million Euro, subject to working capital and other adjustments. The Company will fund the acquisition primarily from cash on hand and its credit facilities. The transaction is expected to close in the first calendar quarter of 2019, subject to customary closing conditions.

For the 2018 calendar year, Comecer is expected to generate revenues of approximately 67 million Euro, with a low double-digit EBITDA margin. In fiscal 2020 (period beginning April 1, 2019), ATS expects adjusted earnings per share accretion in the mid-single digit percentage range as a result of the transaction. Earnings per share are expected to be diluted in the short-term due to the incremental amortization of Order Backlog and other intangible assets as a result of business combination accounting adjustments. Excluding the impact of business combination accounting, the Company expects the return on invested capital associated with this acquisition to achieve double digits by year five post-acquisition.

Integration of Comecer will target revenue synergies and will include the deployment of the ATS Business Model (ABM) which is expected to enable improvements in project management, operations, supply chain management and product life cycle management.

Comecer will continue to be led by its CEO, Alessia Zanelli. "We are very pleased to be joining ATS to continue the next phase of Comecer's growth," said Ms. Zanelli. "By combining ATS and Comecer, we will create a premier player in the radiopharma, pharma and ATMP markets. This will be a tremendous benefit to our customers and a great opportunity for our talented employees. This agreement confirms the potential of our capabilities and will enhance our globally recognized 'made-in-Italy' expertise."

CAMBRIDGE, ON, Dec. 19, 2018 /CNW/ -

ATS Automation Tooling Systems Inc. (TSX: ATA) ("ATS" or the "Company"), an industry-leading automation solutions provider, today announced it has entered into a definitive agreement to acquire Comecer S.p.A. ("Comecer"), a leader in the design, engineering, manufacture and servicing of advanced aseptic containment and processing systems for the nuclear medicine and pharmaceutical industries.

"Comecer is a proven, high-quality business that brings new and complementary capabilities, customer relationships and specialized talent to ATS," said Andrew Hider, CEO of ATS. "Its addition will strengthen our customer offering in both pharma and biopharma, while adding an innovative new platform in radiopharmaceuticals. These are growing markets with desirable characteristics including stringent quality standards and regulations and where there is a high consequence of failure. We look forward to welcoming Comecer to the ATS family."

Comecer generates approximately 55% of its annual sales to customers in the radiopharmaceutical market, where it supplies specialized radiation shielding systems used by customers in the production, handling, and dispensing of radiopharmaceutical drugs. Applications for this type of equipment include the diagnosis and therapeutic treatment of a number of conditions including various forms of cancer and cardiovascular disorders. The balance of Comecer's sales are derived from equipment to support the aseptic processing, filling and handling of specialized pharmaceuticals as well as isolator and incubator equipment used in advanced therapy medicinal production (ATMP), a regenerative cell therapy that uses patient cells to grow new tissues.

Comecer was established in 1974, and today has approximately 320 skilled employees, the majority of whom work at its main production site in Castel-Bolognese, Italy. The main production site is the home of Comecer's research and development centre. Comecer also has a technical and assembly centre in Joure, Netherlands, and sales and service offices in North America, Europe and Asia.

The total cash purchase price for the acquisition will be 113 million Euro, subject to working capital and other adjustments. The Company will fund the acquisition primarily from cash on hand and its credit facilities. The transaction is expected to close in the first calendar quarter of 2019, subject to customary closing conditions.

For the 2018 calendar year, Comecer is expected to generate revenues of approximately 67 million Euro, with a low double-digit EBITDA margin. In fiscal 2020 (period beginning April 1, 2019), ATS expects adjusted earnings per share accretion in the mid-single digit percentage range as a result of the transaction. Earnings per share are expected to be diluted in the short-term due to the incremental amortization of Order Backlog and other intangible assets as a result of business combination accounting adjustments. Excluding the impact of business combination accounting, the Company expects the return on invested capital associated with this acquisition to achieve double digits by year five post-acquisition.

Integration of Comecer will target revenue synergies and will include the deployment of the ATS Business Model (ABM) which is expected to enable improvements in project management, operations, supply chain management and product life cycle management.

Comecer will continue to be led by its CEO, Alessia Zanelli. "We are very pleased to be joining ATS to continue the next phase of Comecer's growth," said Ms. Zanelli. "By combining ATS and Comecer, we will create a premier player in the radiopharma, pharma and ATMP markets. This will be a tremendous benefit to our customers and a great opportunity for our talented employees. This agreement confirms the potential of our capabilities and will enhance our globally recognized 'made-in-Italy' expertise."

- ist ein bischen teuer momentan als zyklischer Industrieausstatter.

- ein bischen viel Schulden seit den Übernahmen der letzten Jahre für meinen Geschmack.

--> scheint eine M&A-Maschine zu sein.

--> Zukunft hat das -- keine Frage.

https://www.atsautomation.com/en/Investor%20Relations.aspx

--> AR2017

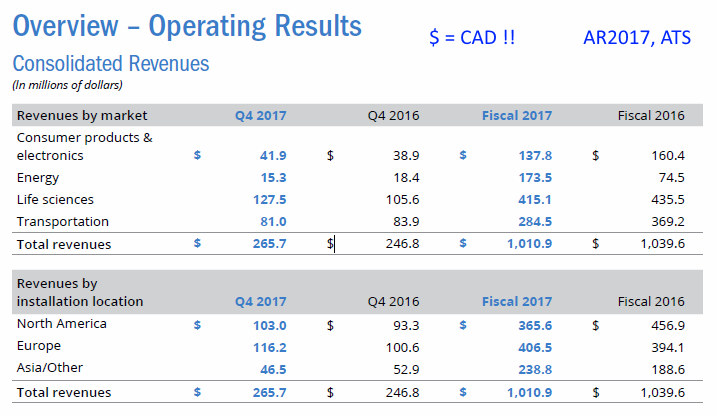

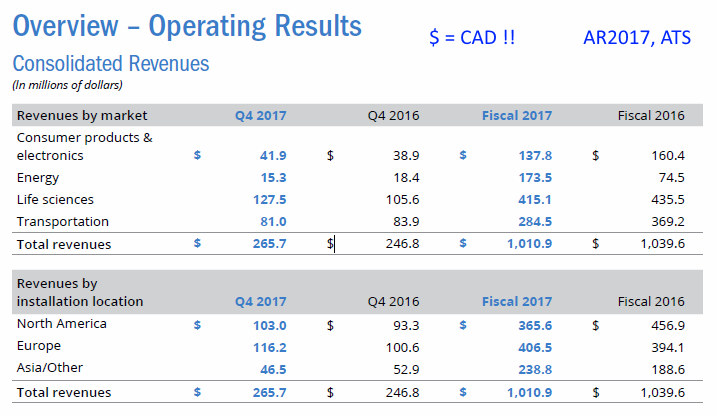

=> man sieht life sciences ist ein Schwerpunkt -- aber auch, dass es da Schwankungen, teilweise beträchtlicher Art, gibt:

business year ist 1.4. -- 31.3. --> AR2018 müsste also bald erscheinen

- ein bischen viel Schulden seit den Übernahmen der letzten Jahre für meinen Geschmack.

--> scheint eine M&A-Maschine zu sein.

--> Zukunft hat das -- keine Frage.

https://www.atsautomation.com/en/Investor%20Relations.aspx

--> AR2017

=> man sieht life sciences ist ein Schwerpunkt -- aber auch, dass es da Schwankungen, teilweise beträchtlicher Art, gibt:

business year ist 1.4. -- 31.3. --> AR2018 müsste also bald erscheinen

what's another year...

Antwort auf Beitrag Nr.: 52.016.735 von R-BgO am 19.03.16 10:32:08

CAMBRIDGE, ON, Dec. 12, 2016 /CNW/ - ATS Automation Tooling Systems Inc. (TSX: ATA) ("ATS" or the "Company") today provided an update in relation to a program that was put on hold by a customer, which impacted approximately $70 million of Order Backlog.

As reported in the Company's Management's Discussion & Analysis for the three months ended October 2, 2016 ("MD&A"), the customer had placed the program on hold subsequent to the end of the Company's second fiscal quarter, following rapid changes in their market which caused them to re-evaluate their product road map. The customer has now formally cancelled the program. The expected impact of the hold/cancellation on the Company for the third fiscal quarter was previously disclosed in the MD&A.

Going forward, ATS has been engaged by the customer to repurpose those parts of the equipment already completed that can be used by the customer in the manufacture of its next-generation product. Based on consultations with the customer, ATS expects to be invited to bid on and potentially participate in the provision of additional equipment to manufacture this next generation of product. The customer has advised that it expects to begin placing orders in early-to-mid calendar 2017.

schätze dass es hier um First Solar geht:

ATS provides update in relation to customer program on holdCAMBRIDGE, ON, Dec. 12, 2016 /CNW/ - ATS Automation Tooling Systems Inc. (TSX: ATA) ("ATS" or the "Company") today provided an update in relation to a program that was put on hold by a customer, which impacted approximately $70 million of Order Backlog.

As reported in the Company's Management's Discussion & Analysis for the three months ended October 2, 2016 ("MD&A"), the customer had placed the program on hold subsequent to the end of the Company's second fiscal quarter, following rapid changes in their market which caused them to re-evaluate their product road map. The customer has now formally cancelled the program. The expected impact of the hold/cancellation on the Company for the third fiscal quarter was previously disclosed in the MD&A.

Going forward, ATS has been engaged by the customer to repurpose those parts of the equipment already completed that can be used by the customer in the manufacture of its next-generation product. Based on consultations with the customer, ATS expects to be invited to bid on and potentially participate in the provision of additional equipment to manufacture this next generation of product. The customer has advised that it expects to begin placing orders in early-to-mid calendar 2017.

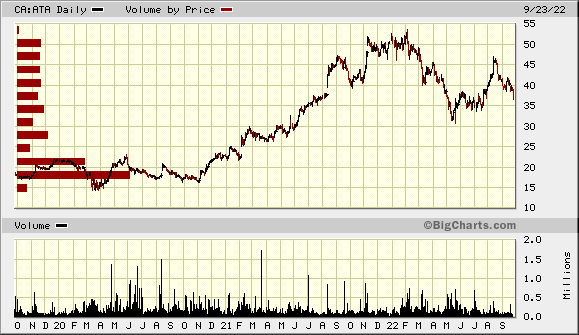

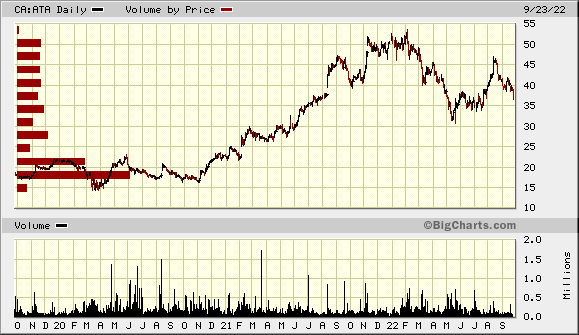

wieder günstig geworden

ATS Automation Tooling Systems - PV-Zulieferer und PHOTOWATT-Eigner