Lithium One - nach 50% Korrektur jetzt ein Kauf? - 500 Beiträge pro Seite

eröffnet am 16.10.09 09:19:54 von

neuester Beitrag 30.03.12 19:14:14 von

neuester Beitrag 30.03.12 19:14:14 von

Beiträge: 148

ID: 1.153.719

ID: 1.153.719

Aufrufe heute: 3

Gesamt: 10.028

Gesamt: 10.028

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 9332 | |

| vor 58 Minuten | 5975 | |

| vor 1 Stunde | 2969 | |

| heute 14:19 | 2899 | |

| vor 51 Minuten | 2896 | |

| vor 42 Minuten | 2610 | |

| vor 56 Minuten | 2271 | |

| vor 53 Minuten | 2184 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.891,68 | -1,09 | 240 | |||

| 2. | 3. | 164,16 | +1,25 | 90 | |||

| 3. | 4. | 0,1910 | -1,55 | 86 | |||

| 4. | 2. | 9,2250 | -4,35 | 86 | |||

| 5. | 6. | 0,0160 | -24,17 | 60 | |||

| 6. | 14. | 6,9600 | +3,29 | 55 | |||

| 7. | 34. | 0,6450 | -53,93 | 53 | |||

| 8. | 13. | 433,23 | -12,21 | 47 |

gestern 8% rauf nach ner Hammerkorrektur, die auch vom globalen Li-Hype nicht gestoppt werden konnte.

Trotzdem interessant und auf die Watchlist!

Und endlich mal eine Firma, die die wichtigsten Basisinfos nämlich die Zahl der ausgegebenen shares, options und warrants auf der ersten Seite präsentiert!

http://www.lithium1.com/

Trotzdem interessant und auf die Watchlist!

Und endlich mal eine Firma, die die wichtigsten Basisinfos nämlich die Zahl der ausgegebenen shares, options und warrants auf der ersten Seite präsentiert!

http://www.lithium1.com/

UNGLAUBLICH

Ich kann in meinem Commerzbank-Konto den Wert nicht handeln

Was ist das für ein Scheiss-Laden?

Ich kann in meinem Commerzbank-Konto den Wert nicht handeln

Was ist das für ein Scheiss-Laden?

bin hier nicht dabei, aber vllt. interessierts den ein oder anderen.

viel ist ja nicht los hier!

Lithium Investing Gets A Leg Up

Fri, Nov 13, 2009

By Kishori Krishnan, Exclusive To Lithium Investing News

One more player has joined the lithium club. Canaccord Adams, an international independent financial services firm that draws focus on potential global investment opportunities in metals, mining, energy among other fields, has now decided to initiate coverage on a group of small lithium exploration plays.

The spotlight has been turned on lithium after investments in the rare metal have shown a steady northward movement, even in these adverse times.

Even before the economic recession hit the world, the demand for lithium grew by 7.2 per cent every year between 2001-08.

Canaccord Adams, the international capital markets division of Canaccord Capital Inc, has decided to jump in. The report of the firm’s interest in lithium exploration appeared in the Financial Post.

Analyst Eric Zaunscherb had picked out Canada Lithium Corp, Lithium One Inc, and Western Lithium Corp, calling each one a “speculative buy.”

According to Canaccord, these three juniors met its criteria for potential investors getting exposure through one senior producer and a basket of junior explorers and developers.

All three fit well into Canaccord’s philosophy of the junior players either having good projects that allow them to force their way into the lithium “club,” or be advanced enough to get into production rapidly.

http://www.resourceinvestingnews.com

viel ist ja nicht los hier!

Lithium Investing Gets A Leg Up

Fri, Nov 13, 2009

By Kishori Krishnan, Exclusive To Lithium Investing News

One more player has joined the lithium club. Canaccord Adams, an international independent financial services firm that draws focus on potential global investment opportunities in metals, mining, energy among other fields, has now decided to initiate coverage on a group of small lithium exploration plays.

The spotlight has been turned on lithium after investments in the rare metal have shown a steady northward movement, even in these adverse times.

Even before the economic recession hit the world, the demand for lithium grew by 7.2 per cent every year between 2001-08.

Canaccord Adams, the international capital markets division of Canaccord Capital Inc, has decided to jump in. The report of the firm’s interest in lithium exploration appeared in the Financial Post.

Analyst Eric Zaunscherb had picked out Canada Lithium Corp, Lithium One Inc, and Western Lithium Corp, calling each one a “speculative buy.”

According to Canaccord, these three juniors met its criteria for potential investors getting exposure through one senior producer and a basket of junior explorers and developers.

All three fit well into Canaccord’s philosophy of the junior players either having good projects that allow them to force their way into the lithium “club,” or be advanced enough to get into production rapidly.

http://www.resourceinvestingnews.com

Morning Coffee, Canaccord Capital

(12/03/2009)

"With the demand for low emission cars expected to grow significantly, [Sanyo Electric] is accelerating development of lithium-ion batteries for plug-in hybrid cars. Most hybrid cars currently use nickel-metal hydride batteries; however, this market appears set to shift as automakers have begun to develop plug-in models and electric cars that use lithium-ion cells, which are lighter, more powerful, and more expensive.

Toyota, the maker of Prius, the world's most popular hybrid vehicle, plans to build a plug-in model for retail buyers in 2012. General Motors intends to build as many as 60,000 Chevrolet Volt plug-in electric cars annually, starting in November 2010.

Sanyo estimates that global sales of hybrid cars using lithium-ion cells, including plug-in models, will grow to 2.3 million units by 2015 and 10.2 million by 2020, while research by the Daiwa Institute of Research forecasts that lithium-ion cells will likely overtake nickel- hydride batteries in the car market around 2014.

To gain exposure to lithium, Canaccord Adams recommends a basket of quality explorers and developers such as: Canada Lithium (CLQ), Lithium One (LI), and Western Lithium (WLC)."

http://www.theenergyreport.com/cs/user/print/quote/3167?x-t=…

(12/03/2009)

"With the demand for low emission cars expected to grow significantly, [Sanyo Electric] is accelerating development of lithium-ion batteries for plug-in hybrid cars. Most hybrid cars currently use nickel-metal hydride batteries; however, this market appears set to shift as automakers have begun to develop plug-in models and electric cars that use lithium-ion cells, which are lighter, more powerful, and more expensive.

Toyota, the maker of Prius, the world's most popular hybrid vehicle, plans to build a plug-in model for retail buyers in 2012. General Motors intends to build as many as 60,000 Chevrolet Volt plug-in electric cars annually, starting in November 2010.

Sanyo estimates that global sales of hybrid cars using lithium-ion cells, including plug-in models, will grow to 2.3 million units by 2015 and 10.2 million by 2020, while research by the Daiwa Institute of Research forecasts that lithium-ion cells will likely overtake nickel- hydride batteries in the car market around 2014.

To gain exposure to lithium, Canaccord Adams recommends a basket of quality explorers and developers such as: Canada Lithium (CLQ), Lithium One (LI), and Western Lithium (WLC)."

http://www.theenergyreport.com/cs/user/print/quote/3167?x-t=…

Antwort auf Beitrag Nr.: 38.513.339 von Videomart am 04.12.09 20:49:01hat der Wert nicht bereits sein Kurziel laut Cannacord erreicht ( und ist somit jetzt eine Verkaufsposition ? )

Gruss

Gruss

Guter Artikel über Lithium

http://www.wallstreet-online.de/nachrichten/nachricht/289120…

Auch www.lithiumaktien.com hat viele gute Infos über Lithium bzw. Lithium-Firmen.

http://www.wallstreet-online.de/nachrichten/nachricht/289120…

Auch www.lithiumaktien.com hat viele gute Infos über Lithium bzw. Lithium-Firmen.

!

Dieser Beitrag wurde moderiert. Grund: Spammposting

Hallo User,

aufgrund aktueller Nachfrage, haben wir diesem Thread wieder eröffnet.

Mit freundlichen Grüßen,

JVogel

aufgrund aktueller Nachfrage, haben wir diesem Thread wieder eröffnet.

Mit freundlichen Grüßen,

JVogel

Lithiumaktien - kommt jetzt das Comeback?

Am heutigen Tag, dem 23.September, werden die Aktien von Salares Lithium in den Börsenhandel zurückkommen. Sie erinnern sich? Salares Lithium ist mit Talison Lithium fusioniert. Seit Bekanntgabe der Fusion vor einigen Wochen waren die Aktien von Salares vom Handel ausgesetzt. Doch mit dem heutigen Tag ist nichts mehr wie vorher. Das betrifft die Börsennotierung wie auch das Geschäft von Salares. Denn die Aktien von Salares werden nun unter dem Ticker TLH in Kanada gelistet sein. Und auch der Firmenname wird sich von Salares Lithium in Talison Lithium verwandelt haben. Kein Wunder, denn bei der Fusion war Talison eindeutig der Macher. Die größten Assets bringt nun einmal Talison mit in die "Ehe". Auch wenn Salares Lithium über tolle Projekte verfügt, keine Frage.

Talison gehört zu den größten Lithiumproduzenten weltweit. Im Westen Australiens, 250 Kilometer südlich von Perth, betreibt man die Mine Greenbushes. Eine Mine mit Tradition. Bereits seit den 1980-Jahren wird hier Lithium abgebaut. Im Laufe der Jahre wurde die Produktionskapazität systematisch ausgebaut. Heute liegt sie bei jährlichen 260.000 Tonnen. Gefördert wird natürlich kein reines Lithium, sondern das Lithiummineral Spodumen. 2008 waren es rund 7.000 Tonnen Lithiumcarbonat (Li2CO3), die man in Greenbushes so gewinnen konnte. Zum Vergleich, im selben Zeitraum wurden in der chilenischen Salar de Atacama 12.000 Tonnen Lithiumcarbonat gefördert. Dies zeigt, welch hohe Bedeutung die Greenbushes-Mine für den Lithiumweltmarkt hat.

Salares Lithium betreibt sieben Lithiumprojekte in Chile. Diese sind allerdings noch nicht in Produktion. In Zukunft können diese Projekte aus den Gewinnen aus dem Verkauf des australischen Lithiums finanziert werden. Salares Lithium ist dann nicht mehr von der schwankenden Börse und ihren Finanzierungsmöglichkeiten abhängig. Aber auch für Talison bringt die Fusion mit Salares natürlich Vorteile. Vor allem kommen die Australier so an eine Börsennotierung zu recht günstigen Konditionen; Talison war nämlich bislang nicht börsennotiert.

Die Fusion von Salares und Talison hat in der Szene für große Aufmerksamkeit gesorgt. Von der heutigen Wiederaufnahme im Börsenhandel könnte die gesamte Lithiumbranche profitieren. Zumal es neben Salares noch einige andere potenzielle Übernahmekandidaten gibt. Pan American Lithium etwa ist so ein Kandidat. Die Aktien sind in den letzten Monaten völlig unter die Räder gekommen. Dabei sind es nicht die Projekte von Pan American Lithium, die die Korrektur ausgelöst haben - Experten bescheinigen diesen immer noch einen hohen Wert -, sondern viel mehr die finanziellen Transaktionen von einigen Großaktionären, die ohne Sinn und Verstand das Unternehmen in Bedrängnis gebracht haben. Gerüchten nach soll es nun Gespräche zwischen Pan American Lithium und Großkonzernen geben, die eine umfassende Kooperation/Beteiligung zum Ziel haben. Das würde uns auch nicht weiter wundern, denn Pan American Lithium ist derzeit im wahrsten Sinne des Wortes für "'n Appel und 'n Ei" zu haben. Mit rund 33 Millionen ausstehenden Aktien kommt die Gesellschaft an der Börse auf eine Marktkapitalisierung von nur etwas mehr als acht Millionen Kanadischen Dollar. Das ist wirklich nichts...

Auch Lithium One halten wir für hochinteressant. Doch dazu später mehr....

Quelle: www.lithiumaktien.com

Am heutigen Tag, dem 23.September, werden die Aktien von Salares Lithium in den Börsenhandel zurückkommen. Sie erinnern sich? Salares Lithium ist mit Talison Lithium fusioniert. Seit Bekanntgabe der Fusion vor einigen Wochen waren die Aktien von Salares vom Handel ausgesetzt. Doch mit dem heutigen Tag ist nichts mehr wie vorher. Das betrifft die Börsennotierung wie auch das Geschäft von Salares. Denn die Aktien von Salares werden nun unter dem Ticker TLH in Kanada gelistet sein. Und auch der Firmenname wird sich von Salares Lithium in Talison Lithium verwandelt haben. Kein Wunder, denn bei der Fusion war Talison eindeutig der Macher. Die größten Assets bringt nun einmal Talison mit in die "Ehe". Auch wenn Salares Lithium über tolle Projekte verfügt, keine Frage.

Talison gehört zu den größten Lithiumproduzenten weltweit. Im Westen Australiens, 250 Kilometer südlich von Perth, betreibt man die Mine Greenbushes. Eine Mine mit Tradition. Bereits seit den 1980-Jahren wird hier Lithium abgebaut. Im Laufe der Jahre wurde die Produktionskapazität systematisch ausgebaut. Heute liegt sie bei jährlichen 260.000 Tonnen. Gefördert wird natürlich kein reines Lithium, sondern das Lithiummineral Spodumen. 2008 waren es rund 7.000 Tonnen Lithiumcarbonat (Li2CO3), die man in Greenbushes so gewinnen konnte. Zum Vergleich, im selben Zeitraum wurden in der chilenischen Salar de Atacama 12.000 Tonnen Lithiumcarbonat gefördert. Dies zeigt, welch hohe Bedeutung die Greenbushes-Mine für den Lithiumweltmarkt hat.

Salares Lithium betreibt sieben Lithiumprojekte in Chile. Diese sind allerdings noch nicht in Produktion. In Zukunft können diese Projekte aus den Gewinnen aus dem Verkauf des australischen Lithiums finanziert werden. Salares Lithium ist dann nicht mehr von der schwankenden Börse und ihren Finanzierungsmöglichkeiten abhängig. Aber auch für Talison bringt die Fusion mit Salares natürlich Vorteile. Vor allem kommen die Australier so an eine Börsennotierung zu recht günstigen Konditionen; Talison war nämlich bislang nicht börsennotiert.

Die Fusion von Salares und Talison hat in der Szene für große Aufmerksamkeit gesorgt. Von der heutigen Wiederaufnahme im Börsenhandel könnte die gesamte Lithiumbranche profitieren. Zumal es neben Salares noch einige andere potenzielle Übernahmekandidaten gibt. Pan American Lithium etwa ist so ein Kandidat. Die Aktien sind in den letzten Monaten völlig unter die Räder gekommen. Dabei sind es nicht die Projekte von Pan American Lithium, die die Korrektur ausgelöst haben - Experten bescheinigen diesen immer noch einen hohen Wert -, sondern viel mehr die finanziellen Transaktionen von einigen Großaktionären, die ohne Sinn und Verstand das Unternehmen in Bedrängnis gebracht haben. Gerüchten nach soll es nun Gespräche zwischen Pan American Lithium und Großkonzernen geben, die eine umfassende Kooperation/Beteiligung zum Ziel haben. Das würde uns auch nicht weiter wundern, denn Pan American Lithium ist derzeit im wahrsten Sinne des Wortes für "'n Appel und 'n Ei" zu haben. Mit rund 33 Millionen ausstehenden Aktien kommt die Gesellschaft an der Börse auf eine Marktkapitalisierung von nur etwas mehr als acht Millionen Kanadischen Dollar. Das ist wirklich nichts...

Auch Lithium One halten wir für hochinteressant. Doch dazu später mehr....

Quelle: www.lithiumaktien.com

Letzte Chance zu kaufen!!! LI wird sehr bald nach oben ausbrechen!

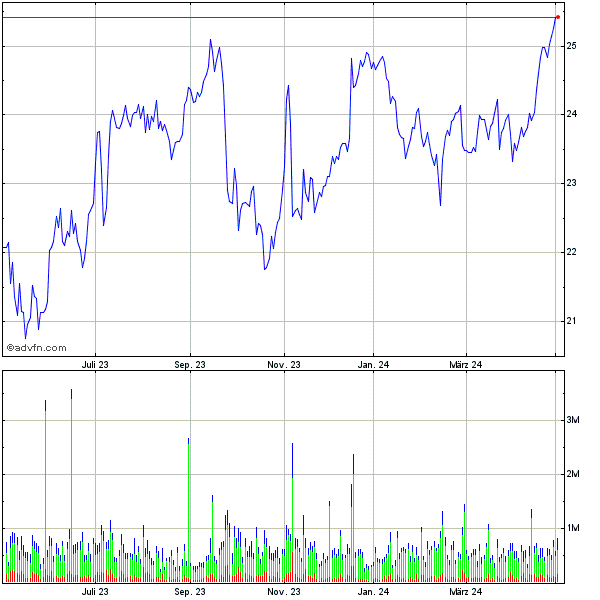

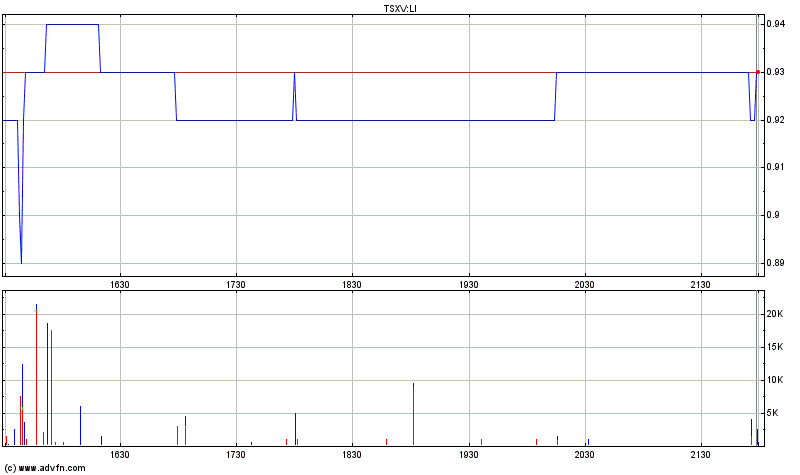

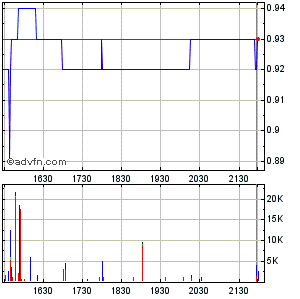

Einige Charts:

Und noch ein großer tagesaktueller:

toller Wert , habe bei Rodinia einige Gewinne rausgenommen und hier investiert

Fakten sehr interssant, sind schön einen Schritt weiter als Rodinia

Fakten sehr interssant, sind schön einen Schritt weiter als Rodinia

Antwort auf Beitrag Nr.: 40.311.034 von grasgruener am 13.10.10 10:51:19Cash-Rotation!

Antwort auf Beitrag Nr.: 40.311.109 von to_siam am 13.10.10 10:58:04 jo, bot sich an, selbes Segment, Lithium im Moment sehr gefragt und wirklich gute Werte mit Substanz sind rar!

jo, bot sich an, selbes Segment, Lithium im Moment sehr gefragt und wirklich gute Werte mit Substanz sind rar!

LI - LithiumOne

2 Projekte:

Projects Overview

Lithium One takes a methodical approach to the acquisition and development of its lithium projects. We focus on stable jurisdictions and target projects with superior chemistry that are amenable to proven technologies. Our team then systematically de-risks the projects by applying best practice exploration science to define low-cost resources.

Sale de Vida Brine Project: Northwest Argentina

The flagship Sal de Vida Lithium Brine Project is located at Salar del Hombre Muerto, the only commercial lithium-producing salar in Argentina and the source of more than 16% of the world's production of lithium.

- gleich neben dem einzigsten Produzenten in Argentinien - FMC - !!!!

The brines in production at FMC Corporation's adjacent operation are peerless with respect to lithium grade and process chemistry. Lithium One's sampling continues to reveal similar grade and brine chemistry.

The Company controls more than 365 sq km of land, where an aggressive program is well underway, systematically de-risking the project and advancing towards the timely development of a low-cost source of lithium for a rapidly evolving market. The systematic evaluation of the Sal de Vida Brine Project continues according to the $15 million work program approved by the Company and the Korea Consortium (KC) led by the Korea Resources Corporation (KORES). The KC is earning into the project by funding this program, retroactive to May 7, 2010 and through delivery of a definitive feasibility study in approximately 15 months. The KC will also guarantee the project debt facility for Lithium One's share of mine construction will negotiate an off-take agreement that will see the KC purchase at least 30% and up to 50% of the lithium production.

James Bay Lithium Project: Northwest Quebec

The James Bay Lithium Pegmatite Project in mining-friendly Quebec is an extensive high-grade spodumene pegmatite deposit that occurs at the surface. A large drill program in 2009 demonstrated impressive grade and continuity. Pending resource calculations and metallurgical test results will reveal the project's value.

Situated adjacent to high-tension power, a paved highway, and water, the project is well located to provide a stable supply of lithium to the emerging lithium battery sector in the northeast United States and Eastern Canada.

http://www.lithium1.com/

http://www.lithium1.com/pdfs/Media%20Fact%20Sheet%20V2.pdf

http://www.lithium1.com/pdfs/Corpor....entation%20082410_web…

jo, bot sich an, selbes Segment, Lithium im Moment sehr gefragt und wirklich gute Werte mit Substanz sind rar!

jo, bot sich an, selbes Segment, Lithium im Moment sehr gefragt und wirklich gute Werte mit Substanz sind rar!LI - LithiumOne

2 Projekte:

Projects Overview

Lithium One takes a methodical approach to the acquisition and development of its lithium projects. We focus on stable jurisdictions and target projects with superior chemistry that are amenable to proven technologies. Our team then systematically de-risks the projects by applying best practice exploration science to define low-cost resources.

Sale de Vida Brine Project: Northwest Argentina

The flagship Sal de Vida Lithium Brine Project is located at Salar del Hombre Muerto, the only commercial lithium-producing salar in Argentina and the source of more than 16% of the world's production of lithium.

- gleich neben dem einzigsten Produzenten in Argentinien - FMC - !!!!

The brines in production at FMC Corporation's adjacent operation are peerless with respect to lithium grade and process chemistry. Lithium One's sampling continues to reveal similar grade and brine chemistry.

The Company controls more than 365 sq km of land, where an aggressive program is well underway, systematically de-risking the project and advancing towards the timely development of a low-cost source of lithium for a rapidly evolving market. The systematic evaluation of the Sal de Vida Brine Project continues according to the $15 million work program approved by the Company and the Korea Consortium (KC) led by the Korea Resources Corporation (KORES). The KC is earning into the project by funding this program, retroactive to May 7, 2010 and through delivery of a definitive feasibility study in approximately 15 months. The KC will also guarantee the project debt facility for Lithium One's share of mine construction will negotiate an off-take agreement that will see the KC purchase at least 30% and up to 50% of the lithium production.

James Bay Lithium Project: Northwest Quebec

The James Bay Lithium Pegmatite Project in mining-friendly Quebec is an extensive high-grade spodumene pegmatite deposit that occurs at the surface. A large drill program in 2009 demonstrated impressive grade and continuity. Pending resource calculations and metallurgical test results will reveal the project's value.

Situated adjacent to high-tension power, a paved highway, and water, the project is well located to provide a stable supply of lithium to the emerging lithium battery sector in the northeast United States and Eastern Canada.

http://www.lithium1.com/

http://www.lithium1.com/pdfs/Media%20Fact%20Sheet%20V2.pdf

http://www.lithium1.com/pdfs/Corpor....entation%20082410_web…

von letzter Woche - Rodinia und WLC sind dann gut gelaufen, LI ist Nachzügler

Electric cars put lithium miners on fast track

Thu Oct 7, 2010 1:14pm EDT

* Lithium demand seen doubling by 2020

* Push for fuel economy through hybrids, EVs boosts demand

* Battery makers, automakers buying stakes in miners

* Producers see benefits of diversifying production

By Julie Gordon

TORONTO, Oct 7 (Reuters) - Lithium miners are reaping the benefits of a political and industry push to get more electric vehicles on the road, with shares in some Canadian-listed miners up more than 50 percent in the past two months................

Looking ahead, companies with promising properties like Rodinia Lithium (RM.V), Lithium One (LI.V) and Western Lithium (WLC.V) could become takeover targets, said Hykawy

And with demand soaring, there is space for two or three of the junior miners to grow into major players, analysts say....

durch das JV mit den Koreaner ist LithiumOne eindeutig in einer besseren Ausgangslage, bzw. schon einen Schritt weiter

http://www.reuters.com/article/idUSN0517500720101007

Electric cars put lithium miners on fast track

Thu Oct 7, 2010 1:14pm EDT

* Lithium demand seen doubling by 2020

* Push for fuel economy through hybrids, EVs boosts demand

* Battery makers, automakers buying stakes in miners

* Producers see benefits of diversifying production

By Julie Gordon

TORONTO, Oct 7 (Reuters) - Lithium miners are reaping the benefits of a political and industry push to get more electric vehicles on the road, with shares in some Canadian-listed miners up more than 50 percent in the past two months................

Looking ahead, companies with promising properties like Rodinia Lithium (RM.V), Lithium One (LI.V) and Western Lithium (WLC.V) could become takeover targets, said Hykawy

And with demand soaring, there is space for two or three of the junior miners to grow into major players, analysts say....

durch das JV mit den Koreaner ist LithiumOne eindeutig in einer besseren Ausgangslage, bzw. schon einen Schritt weiter

http://www.reuters.com/article/idUSN0517500720101007

der ganze Artikel - LI hat Übernahmepotential; entweder durch FMC oder eine Autobude

http://www.reuters.com/article/idUSN0517500720101007

http://www.reuters.com/article/idUSN0517500720101007

und dann das Managment und die Directors - alles Granaten! viel viel Know und Erfahrung:

ManagementLithium One's Management Team consists of mining industry professionals experienced in creating value through disciplined management, applied science and resource development.

Patrick Highsmith; President and CEO

Mr. Highsmith is a Geochemist/Geologist with 20 years of multi-commodity minerals industry experience. He holds Bachelor's and Master's degrees in Geological Engineering and Economic Geology/Geochemistry from the Colorado School of Mines. Mr. Highsmith brings experience from more than 200 mines and projects in over 20 countries, and he has been directly involved with numerous deals, project start-ups, and financings.

Mr. Highsmith has held positions in mining, exploration, and business development with Rio Tinto, BHP Billiton, and Newmont Mining. He also served as Chief Geochemist and US Manager for ALS Chemex Labs. Most recently he was Global Manager - Exploration Business Development with Newmont before leaving in 2008 to found Intuitive Exploration, Inc. and the BitterRoot Group LLC. In addition to his role at Lithium One, Patrick is also Chairman of Copper One Inc.

Rebecca Hudson, C.A.; Chief Financial Officer

Ms. Hudson is a Chartered Accountant with 12 years of experience in the fields of financial audit, corporate finance, risk management, financial reporting, and corporate governance. She has worked primarily with publicly traded international and Canadian corporations, and has conducted transactions in reverse takeovers, mergers & acquisitions, divestitures and various advisory services.

Ms. Hudson also serves as CFO of Explorator Resources Inc. and was recently CFO of Sierra Minerals Inc., a junior mining company producing gold. Ms. Hudson's industry practice also includes development of internal controls, liaising with external parties, managing foreign subsidiaries, and performing due diligence. Ms. Hudson holds a Masters of Accounting and a Bachelor's Degree from the University of Waterloo. She is fluent in both English and Spanish.

Iain Scarr; Vice President Development

Mr. Scarr brings extensive experience in industrial minerals exploration and development garnered from a thirty year career with Rio Tinto and its subsidiaries. Until February 2009, Mr. Scarr was Rio Tinto Exploration's Commercial Director for Industrial Minerals Exploration. In that position he played key leadership roles in marketing, commercial, and strategic assessments of worldwide industrial minerals projects, including Rio Tinto's much-publicized Jadar Lithium Project in Serbia.

Previously, as Vice President of Exploration for Rio Tinto America Industrial Minerals Inc, Mr. Scarr led diverse exploration teams across the Americas, Australia, and Africa. During his tenure at Rio Tinto Minerals and forerunner subsidiary US Borax, he is credited with leading several industrial mineral discoveries and acquisitions. He has also worked extensively in Argentina, including at Rio Tinto's Tincalayu Borates Mine at Salar del Hombre Muerto, just northwest of the Company's Sal de Vida Project.

Sergio Lopez, Project Manager - Sal de Vida

Mr. Lopez is an accomplished field geologist with nearly 25 years of exploration experience in Argentina and Bolivia. While he has spent many years working in gold, copper and other metals, much of his career has been spent exploring for industrial minerals such as borates and potash in the Puna region, including at the Salar del Hombre Muerto and Potasio Rio Colorado in the Patagonia north. Mr. Lopez has worked with both junior explorers and major mining companies including the Rio Tinto Group, the Gencor group and Billiton. He advanced to be Senior Geologist with Rio Tinto Industrial Minerals, and became highly-skilled in all aspects of exploring and evaluating the salt deposits of South America.

Board of DirectorsLithium One's Board of Directors is comprised of mining industry professionals with an impressive history of success in discovery and value creation.

Martin R. Rowley; Chairman of the Board

Mr. Rowley has had a distinguished career for over 25 years in the mining industry, being involved in the financing and development of several successful mines. Most notably Mr. Rowley was a co-founder of First Quantum Minerals Ltd in 1996. First Quantum is a highly successful mining and metals company with operations in Zambia, the Democratic Republic of Congo and Mauritania in Africa, as well as in Finland. Mr. Rowley served as First Quantum's CFO and as a Director until January 2007, and is currently the company's Executive Director, Business Development. He is also non-executive Chairman of Forsys Metals Corp, a leading company in the uranium sector.

Maurice J. Colson; Vice Chairman of the Board

Mr. Colson holds a masters degree in business (M.B.A.) and has been involved in the investment business for more than thirty five years. He was managing director in the U.K. for a major Canadian investment dealer for many years, and in Canada, he has been actively involved in providing strategic counsel and assistance with financing to emerging private and public companies. His network in the resource industry has expanded significantly from Canada ,and he has been actively involved in financing Canadian companies operating in China, Africa, and South America. He sits on the board of several TSE and TSX listed companies and is the former President and CEO of Lithium One Resources.

Patrick Highsmith; President and CEO, Director

Mr. Highsmith is a Geochemist/Geologist with 20 years of multi-commodity minerals industry experience. He holds Bachelor's and Master's degrees in Geological Engineering and Economic Geology/Geochemistry from the Colorado School of Mines. Mr. Highsmith brings experience from more than 200 mines and projects in over 20 countries, and he has been directly involved with numerous deals, project start-ups, and financings.

Mr. Highsmith has held positions in mining, exploration, and business development with Rio Tinto, BHP Billiton, and Newmont Mining. He also served as Chief Geochemist and US Manager for ALS Chemex Labs. Most recently he was Global Manager - Exploration Business Development with Newmont before leaving in 2008 to found Intuitive Exploration, Inc. and the BitterRoot Group LLC. In addition to his role at Lithium One, Patrick is also Chairman of Copper One Inc.

Paul Matysek; Director

Mr. Matysek is President and CEO of Potash One, he is an experienced geochemist/geologist with a Bachelor of Science degree and a Masters of Science degree in Geology. Mr. Matysek has held management and director positions with several natural resource exploration and development companies.

Previously Mr. Matysek was the CEO and President of Energy Metals Corporation, a uranium company traded on New York Stock Exchange and Toronto Stock Exchange. During the mid 2000's, Energy Metals became one of the fastest growing companies in Canada, growing from a market capitalization of only $10 million in 2004 to $1.8 billion when it was sold to a larger uranium producer in 2007.

He has been involved in raising over $200 million for various exploration and development projects since 1999. Mr. Matysek is a founder of Lithium One.

Jeff Pontius; Director

Jeff has over 30 year's geological experience and possesses a distinguished track record of successful discovery that includes four precious metal deposits in North America. Significantly, he led the discovery and development team for Cripple Creek Deposit in Colorado, which is operated by AngloGold Ashanti and contains over 15 million ounces of gold. Additionally Jeff led the discovery work on two other Nevada gold deposits as well as the recent discovery of the new Livengood Gold Deposit in Alaska, which now has a total resource of more than 12 million ounces of gold and continues to rapidly expand.

Jeff spent the past three years as the President and CEO of International Tower Hill Mines Ltd. which has made a number of gold and copper-gold discoveries in Alaska and Nevada the most notable of which being the Livengood Gold Deposit. For the seven years prior to this Jeff served as the US and North American Exploration Manager for AngloGold Ashanti as well as participating as a Director of Anglo American (USA) Exploration Inc. and a member of AngloGold Ashanti's regional business development team providing support for the company's acquisition program.

Darren Pylot; Director

Mr. Pylot is the founder of Capstone Mining Corp and in 2006 created Silverstone Resources Corp. He serves as President and Chief Executive Officer for Silverstone, and has been responsible for bringing Capstone's Cozamin base metal mine into production as well as negotiating and securing Silverstone's silver by-product streams agreements. Silverstone's business model of pursuing silver by-product streams and exploration projects are unique in the industry; and in less than 2 years Capstone has increased production at the Cozamin mine by 200%.

Mr. Pylot has over 17 years experience in the management, administration and financing of public companies focusing on the junior resource sector. He has raised over C$200 million in equity financings in the past three years. Mr. Pylot is also a director of East Asia Minerals Corp. a well-financed, Asian-based Canadian mineral exploration company with uranium properties and advanced gold and gold-copper properties, and he serves as Chairman of the Board of Zena Capital Corp.

ManagementLithium One's Management Team consists of mining industry professionals experienced in creating value through disciplined management, applied science and resource development.

Patrick Highsmith; President and CEO

Mr. Highsmith is a Geochemist/Geologist with 20 years of multi-commodity minerals industry experience. He holds Bachelor's and Master's degrees in Geological Engineering and Economic Geology/Geochemistry from the Colorado School of Mines. Mr. Highsmith brings experience from more than 200 mines and projects in over 20 countries, and he has been directly involved with numerous deals, project start-ups, and financings.

Mr. Highsmith has held positions in mining, exploration, and business development with Rio Tinto, BHP Billiton, and Newmont Mining. He also served as Chief Geochemist and US Manager for ALS Chemex Labs. Most recently he was Global Manager - Exploration Business Development with Newmont before leaving in 2008 to found Intuitive Exploration, Inc. and the BitterRoot Group LLC. In addition to his role at Lithium One, Patrick is also Chairman of Copper One Inc.

Rebecca Hudson, C.A.; Chief Financial Officer

Ms. Hudson is a Chartered Accountant with 12 years of experience in the fields of financial audit, corporate finance, risk management, financial reporting, and corporate governance. She has worked primarily with publicly traded international and Canadian corporations, and has conducted transactions in reverse takeovers, mergers & acquisitions, divestitures and various advisory services.

Ms. Hudson also serves as CFO of Explorator Resources Inc. and was recently CFO of Sierra Minerals Inc., a junior mining company producing gold. Ms. Hudson's industry practice also includes development of internal controls, liaising with external parties, managing foreign subsidiaries, and performing due diligence. Ms. Hudson holds a Masters of Accounting and a Bachelor's Degree from the University of Waterloo. She is fluent in both English and Spanish.

Iain Scarr; Vice President Development

Mr. Scarr brings extensive experience in industrial minerals exploration and development garnered from a thirty year career with Rio Tinto and its subsidiaries. Until February 2009, Mr. Scarr was Rio Tinto Exploration's Commercial Director for Industrial Minerals Exploration. In that position he played key leadership roles in marketing, commercial, and strategic assessments of worldwide industrial minerals projects, including Rio Tinto's much-publicized Jadar Lithium Project in Serbia.

Previously, as Vice President of Exploration for Rio Tinto America Industrial Minerals Inc, Mr. Scarr led diverse exploration teams across the Americas, Australia, and Africa. During his tenure at Rio Tinto Minerals and forerunner subsidiary US Borax, he is credited with leading several industrial mineral discoveries and acquisitions. He has also worked extensively in Argentina, including at Rio Tinto's Tincalayu Borates Mine at Salar del Hombre Muerto, just northwest of the Company's Sal de Vida Project.

Sergio Lopez, Project Manager - Sal de Vida

Mr. Lopez is an accomplished field geologist with nearly 25 years of exploration experience in Argentina and Bolivia. While he has spent many years working in gold, copper and other metals, much of his career has been spent exploring for industrial minerals such as borates and potash in the Puna region, including at the Salar del Hombre Muerto and Potasio Rio Colorado in the Patagonia north. Mr. Lopez has worked with both junior explorers and major mining companies including the Rio Tinto Group, the Gencor group and Billiton. He advanced to be Senior Geologist with Rio Tinto Industrial Minerals, and became highly-skilled in all aspects of exploring and evaluating the salt deposits of South America.

Board of DirectorsLithium One's Board of Directors is comprised of mining industry professionals with an impressive history of success in discovery and value creation.

Martin R. Rowley; Chairman of the Board

Mr. Rowley has had a distinguished career for over 25 years in the mining industry, being involved in the financing and development of several successful mines. Most notably Mr. Rowley was a co-founder of First Quantum Minerals Ltd in 1996. First Quantum is a highly successful mining and metals company with operations in Zambia, the Democratic Republic of Congo and Mauritania in Africa, as well as in Finland. Mr. Rowley served as First Quantum's CFO and as a Director until January 2007, and is currently the company's Executive Director, Business Development. He is also non-executive Chairman of Forsys Metals Corp, a leading company in the uranium sector.

Maurice J. Colson; Vice Chairman of the Board

Mr. Colson holds a masters degree in business (M.B.A.) and has been involved in the investment business for more than thirty five years. He was managing director in the U.K. for a major Canadian investment dealer for many years, and in Canada, he has been actively involved in providing strategic counsel and assistance with financing to emerging private and public companies. His network in the resource industry has expanded significantly from Canada ,and he has been actively involved in financing Canadian companies operating in China, Africa, and South America. He sits on the board of several TSE and TSX listed companies and is the former President and CEO of Lithium One Resources.

Patrick Highsmith; President and CEO, Director

Mr. Highsmith is a Geochemist/Geologist with 20 years of multi-commodity minerals industry experience. He holds Bachelor's and Master's degrees in Geological Engineering and Economic Geology/Geochemistry from the Colorado School of Mines. Mr. Highsmith brings experience from more than 200 mines and projects in over 20 countries, and he has been directly involved with numerous deals, project start-ups, and financings.

Mr. Highsmith has held positions in mining, exploration, and business development with Rio Tinto, BHP Billiton, and Newmont Mining. He also served as Chief Geochemist and US Manager for ALS Chemex Labs. Most recently he was Global Manager - Exploration Business Development with Newmont before leaving in 2008 to found Intuitive Exploration, Inc. and the BitterRoot Group LLC. In addition to his role at Lithium One, Patrick is also Chairman of Copper One Inc.

Paul Matysek; Director

Mr. Matysek is President and CEO of Potash One, he is an experienced geochemist/geologist with a Bachelor of Science degree and a Masters of Science degree in Geology. Mr. Matysek has held management and director positions with several natural resource exploration and development companies.

Previously Mr. Matysek was the CEO and President of Energy Metals Corporation, a uranium company traded on New York Stock Exchange and Toronto Stock Exchange. During the mid 2000's, Energy Metals became one of the fastest growing companies in Canada, growing from a market capitalization of only $10 million in 2004 to $1.8 billion when it was sold to a larger uranium producer in 2007.

He has been involved in raising over $200 million for various exploration and development projects since 1999. Mr. Matysek is a founder of Lithium One.

Jeff Pontius; Director

Jeff has over 30 year's geological experience and possesses a distinguished track record of successful discovery that includes four precious metal deposits in North America. Significantly, he led the discovery and development team for Cripple Creek Deposit in Colorado, which is operated by AngloGold Ashanti and contains over 15 million ounces of gold. Additionally Jeff led the discovery work on two other Nevada gold deposits as well as the recent discovery of the new Livengood Gold Deposit in Alaska, which now has a total resource of more than 12 million ounces of gold and continues to rapidly expand.

Jeff spent the past three years as the President and CEO of International Tower Hill Mines Ltd. which has made a number of gold and copper-gold discoveries in Alaska and Nevada the most notable of which being the Livengood Gold Deposit. For the seven years prior to this Jeff served as the US and North American Exploration Manager for AngloGold Ashanti as well as participating as a Director of Anglo American (USA) Exploration Inc. and a member of AngloGold Ashanti's regional business development team providing support for the company's acquisition program.

Darren Pylot; Director

Mr. Pylot is the founder of Capstone Mining Corp and in 2006 created Silverstone Resources Corp. He serves as President and Chief Executive Officer for Silverstone, and has been responsible for bringing Capstone's Cozamin base metal mine into production as well as negotiating and securing Silverstone's silver by-product streams agreements. Silverstone's business model of pursuing silver by-product streams and exploration projects are unique in the industry; and in less than 2 years Capstone has increased production at the Cozamin mine by 200%.

Mr. Pylot has over 17 years experience in the management, administration and financing of public companies focusing on the junior resource sector. He has raised over C$200 million in equity financings in the past three years. Mr. Pylot is also a director of East Asia Minerals Corp. a well-financed, Asian-based Canadian mineral exploration company with uranium properties and advanced gold and gold-copper properties, and he serves as Chairman of the Board of Zena Capital Corp.

Ich denke hier beginnt die Story erst so richtig.Man kann sozusagen von Anfang an dabei sein.Günstiger wird man wohl nun nicht mehr reinkommen.

Schade das hier gar nichts geschrieben wird Dabei ist das sicher eine sehr -sehr gute Aktie mit viel Zukunftspotential.

Dabei ist das sicher eine sehr -sehr gute Aktie mit viel Zukunftspotential.

Dabei ist das sicher eine sehr -sehr gute Aktie mit viel Zukunftspotential.

Dabei ist das sicher eine sehr -sehr gute Aktie mit viel Zukunftspotential.

aufgepasst: Empfehlung von Grandich

" Lithium One Quietly Revving Up Two Major Projects

by Peter Grandich

www.grandich.com

One of the key features of hybrid and electric vehicles is that even the most powerful are incredibly quiet and you can barely hear them until they are nearly on top of you. Not a bad metaphor for one of the key lithium players in the junior market today - Lithium One Inc. (TSX-V: LI).

The company has been diligently and quietly working throughout the summer, and even if you can’t hear their engines running, you’d better look out because their fall news cycle is nearly here and it could prove to be a big one.

Upcoming News: Core drilling results from Sal de Vida lithium-potash brine project.

Lithium One’s feature project is the Sal de Vida lithium and potash brine project in Argentina. The project covers the eastern sub-basin of the Salar del Hombre Muerto; the western sub-basin is operated by FMC Corporation and produced about 16% of the world’s lithium last year. The salar is massive, as needed for a viable lithium brine operation, and in the past year the company has completed significant work to sample near-surface brines over an area of more than 225km2. Results were remarkably consistent and extremely positive, containing high lithium and potash (averaging 765 mg/L (650 ppm) Li, 8,976 mg/L (0.76 %) K) and low adverse elements (averaging 1.77 for Mg:Li ratio and 10:57 SO4:Li ratio).

The company has been core drilling the project since July, so any day we should see the first results that should delineate the brines in detail down to approximately 100 m depth. Two initial rotary holes were released in June. Results from those holes averaged 706 mg/L lithium and 0.58% potash to a depth of 60 m, well in line with the surface results and providing a glimpse of what may be around the corner.

Upcoming News: First resource estimate at Sal de Vida, steps towards Feasibility.

The anticipated core drill results will be used to model the extent and grade of the lithium and potash rich brine, and Lithium One expects to be able to report the first NI 43-101 resource estimate before the end of the year.

At the same time, the company is moving towards tabling a definitive feasibility study by the end of 2011. The key steps in this stage include a year of on-site evaporation testing as well as hydrological studies to evaluate the project’s economics. These tests are expected to commence this fall so the company remains on schedule for completing the feasibility study.

Upcoming News: Partnership agreement to include major corporate end-users.

Last June, Lithium One’s combination of a great project and great team at Sal de Vida was recognized, and the company signed a coveted strategic partnership contract with the Korean state-run mining company, Korea Resources Corporation (KORES). The definitive agreement sees KORES fund the project through feasibility in order to acquire a 30% interest. Even more importantly however, it provides a guarantee that the partner will secure the debt share of project financing for mine development, including Lithium One’s portion, and purchase between 30% and 50% of the lithium products from the eventual operation.

When Lithium One announced the partnership, it also indicated that KORES had signed a memorandum of understanding (MOU) to share its portion of the development joint venture via a consortium with two Korean corporate powerhouses: GS Caltex Corporation and LG International Corp. GS Caltex is one of the largest energy companies in Korea and is jointly owned by GS Holdings and Chevron. LG International is a trading company and part of the massive LG group of companies that includes the global lithium battery maker LG Chem. LG Chem has been aggressively expanding its production centers and clients for lithium batteries, most recently announcing a deal with Renault estimated to be worth a minimum of $1.8 billion over five years. The battery maker already had deals with Ford, GM, Hyundai and Volvo.

Since June, GS Caltex and LG International have been involved in due diligence and legal proceedings in order to formalize the MOU into a definitive agreement. When that is completed and formally announced, Lithium One should be in a position to garner international recognition for having such prestigious partners.

Lithium One features a board and management team with a history of delivering results in exploration, development and financing, which has served the company well in acquiring top projects and firm support from lithium end-users. With several major milestone announcements from the Sal de Vida project just around the corner, Lithium One is clearly poised to emerge as a leader in the race to develop new supplies of lithium."

We are primed to take off soon!!!

http://www.theprospectornews.com/weekly_1019_02.php

" Lithium One Quietly Revving Up Two Major Projects

by Peter Grandich

www.grandich.com

One of the key features of hybrid and electric vehicles is that even the most powerful are incredibly quiet and you can barely hear them until they are nearly on top of you. Not a bad metaphor for one of the key lithium players in the junior market today - Lithium One Inc. (TSX-V: LI).

The company has been diligently and quietly working throughout the summer, and even if you can’t hear their engines running, you’d better look out because their fall news cycle is nearly here and it could prove to be a big one.

Upcoming News: Core drilling results from Sal de Vida lithium-potash brine project.

Lithium One’s feature project is the Sal de Vida lithium and potash brine project in Argentina. The project covers the eastern sub-basin of the Salar del Hombre Muerto; the western sub-basin is operated by FMC Corporation and produced about 16% of the world’s lithium last year. The salar is massive, as needed for a viable lithium brine operation, and in the past year the company has completed significant work to sample near-surface brines over an area of more than 225km2. Results were remarkably consistent and extremely positive, containing high lithium and potash (averaging 765 mg/L (650 ppm) Li, 8,976 mg/L (0.76 %) K) and low adverse elements (averaging 1.77 for Mg:Li ratio and 10:57 SO4:Li ratio).

The company has been core drilling the project since July, so any day we should see the first results that should delineate the brines in detail down to approximately 100 m depth. Two initial rotary holes were released in June. Results from those holes averaged 706 mg/L lithium and 0.58% potash to a depth of 60 m, well in line with the surface results and providing a glimpse of what may be around the corner.

Upcoming News: First resource estimate at Sal de Vida, steps towards Feasibility.

The anticipated core drill results will be used to model the extent and grade of the lithium and potash rich brine, and Lithium One expects to be able to report the first NI 43-101 resource estimate before the end of the year.

At the same time, the company is moving towards tabling a definitive feasibility study by the end of 2011. The key steps in this stage include a year of on-site evaporation testing as well as hydrological studies to evaluate the project’s economics. These tests are expected to commence this fall so the company remains on schedule for completing the feasibility study.

Upcoming News: Partnership agreement to include major corporate end-users.

Last June, Lithium One’s combination of a great project and great team at Sal de Vida was recognized, and the company signed a coveted strategic partnership contract with the Korean state-run mining company, Korea Resources Corporation (KORES). The definitive agreement sees KORES fund the project through feasibility in order to acquire a 30% interest. Even more importantly however, it provides a guarantee that the partner will secure the debt share of project financing for mine development, including Lithium One’s portion, and purchase between 30% and 50% of the lithium products from the eventual operation.

When Lithium One announced the partnership, it also indicated that KORES had signed a memorandum of understanding (MOU) to share its portion of the development joint venture via a consortium with two Korean corporate powerhouses: GS Caltex Corporation and LG International Corp. GS Caltex is one of the largest energy companies in Korea and is jointly owned by GS Holdings and Chevron. LG International is a trading company and part of the massive LG group of companies that includes the global lithium battery maker LG Chem. LG Chem has been aggressively expanding its production centers and clients for lithium batteries, most recently announcing a deal with Renault estimated to be worth a minimum of $1.8 billion over five years. The battery maker already had deals with Ford, GM, Hyundai and Volvo.

Since June, GS Caltex and LG International have been involved in due diligence and legal proceedings in order to formalize the MOU into a definitive agreement. When that is completed and formally announced, Lithium One should be in a position to garner international recognition for having such prestigious partners.

Lithium One features a board and management team with a history of delivering results in exploration, development and financing, which has served the company well in acquiring top projects and firm support from lithium end-users. With several major milestone announcements from the Sal de Vida project just around the corner, Lithium One is clearly poised to emerge as a leader in the race to develop new supplies of lithium."

We are primed to take off soon!!!

http://www.theprospectornews.com/weekly_1019_02.php

That will consume lots of Lithium!

" Mindful of the ecological toll that gasoline and diesel engines exact on the environment, the Chinese government is pressing forward with plans to build 1 million electric vehicles a year by 2020, according to the Xinhua news agency.

Citing comments Saturday from the country's minister of science and technology, Wan Gang, Xinhua reported that environmentally friendly vehicles are essential for the development of the auto industry in China, where vehicle emissions account for 70% of the air pollution in major cities.

The ministry's plan calls for it to soon issue a framework to help bolster electric-vehicle production during the next five years, Xinhua said. China's government plans to spend 100 billion yuan ($15 billion) in the next 10 years to subsidize the effort, which includes building plants and infrastructure to accommodate green vehicles.

Capital markets have already invested 8.5 billion yuan in electric vehicle production, Gang said, but more is needed.

Growth -- and Subsidies

"As the world's largest auto market, new energy vehicles are key to the development of China's auto industry," he said. Chinese demand for cars and trucks has continued to grow rapidly, with sales up nearly 48% during the first half of 2010.

China also has a pilot program operating in 25 cities to provide consumers a subsidy of 60,000 yuan -- about $9,000 -- to purchase a zero-emissions vehicle.

In August, 16 Chinese state-owned enterprises established a consortium of electric-vehicle manufacturers, AutomotiveWorld.com reported. The group's goal is to unify and consolidate existing technologies and coordinate efforts among the various companies.

The world's second largest economy is also looking for ways to "de-carbonize" its electricity production as demand for electric vehicles -- and thus electricity -- heats up, according to Nobuo Tanaka, executive director of the International Energy Agency. China relies heavily on coal to for electricity production.

Speaking earlier this month, Tanaka said that while the country's progress in promoting electrical vehicles was welcome, "China's problem is how to supply electricity carbon-free."

" Mindful of the ecological toll that gasoline and diesel engines exact on the environment, the Chinese government is pressing forward with plans to build 1 million electric vehicles a year by 2020, according to the Xinhua news agency.

Citing comments Saturday from the country's minister of science and technology, Wan Gang, Xinhua reported that environmentally friendly vehicles are essential for the development of the auto industry in China, where vehicle emissions account for 70% of the air pollution in major cities.

The ministry's plan calls for it to soon issue a framework to help bolster electric-vehicle production during the next five years, Xinhua said. China's government plans to spend 100 billion yuan ($15 billion) in the next 10 years to subsidize the effort, which includes building plants and infrastructure to accommodate green vehicles.

Capital markets have already invested 8.5 billion yuan in electric vehicle production, Gang said, but more is needed.

Growth -- and Subsidies

"As the world's largest auto market, new energy vehicles are key to the development of China's auto industry," he said. Chinese demand for cars and trucks has continued to grow rapidly, with sales up nearly 48% during the first half of 2010.

China also has a pilot program operating in 25 cities to provide consumers a subsidy of 60,000 yuan -- about $9,000 -- to purchase a zero-emissions vehicle.

In August, 16 Chinese state-owned enterprises established a consortium of electric-vehicle manufacturers, AutomotiveWorld.com reported. The group's goal is to unify and consolidate existing technologies and coordinate efforts among the various companies.

The world's second largest economy is also looking for ways to "de-carbonize" its electricity production as demand for electric vehicles -- and thus electricity -- heats up, according to Nobuo Tanaka, executive director of the International Energy Agency. China relies heavily on coal to for electricity production.

Speaking earlier this month, Tanaka said that while the country's progress in promoting electrical vehicles was welcome, "China's problem is how to supply electricity carbon-free."

Fascinating paragraph in an article by the incomparable John Mauldin on the rare earth crisis developing not just between Japan and China, but between China and the rest of the world. Mauldin talks about the ways that some businesses have been trying to respond to the threat of having their supplies of REE severely limited, as well as the threat of greatly increased prices.

"The shift in prices could well give amuch-needed boost to non-REEdependent technologies hampered by relatively inexpensive REEs. For example, the REE lanthanum is a leading component in the Prius’ nickelmetal-hydride battery system. (The Prius uses ten kilograms of lanthanum). Toyota has been edging toward replacing the nickel-hydride system with REE-free lithium-ion batteries, but has demurred due to the low price of lanthanum. Increase that cost by a factor of 20, or even the factor of three seen in recent months — and add in the threat of a full cutoff — and Toyota’s board is likely to come to a different conclusion."

http://pragcap.com/china-future-rare-earth-metals

Honda has already started making the switch to lithium-ion batteries.Personally, I think Toyota too will eventually make the switch, even if prices for neodymium (each Prius also uses 1 kg of Nd) and lanthanum don't go ridiculously high. It seems to me that the present superiority of lithium-ion batteries is increasing steadily with all the research going full force, where as there is limited room for improvement in nickel-metal hydride technology.

IF Toyota starts making its hybrids and future e-cars with li-ion batteries, that will add massively to demand for lithium

"The shift in prices could well give amuch-needed boost to non-REEdependent technologies hampered by relatively inexpensive REEs. For example, the REE lanthanum is a leading component in the Prius’ nickelmetal-hydride battery system. (The Prius uses ten kilograms of lanthanum). Toyota has been edging toward replacing the nickel-hydride system with REE-free lithium-ion batteries, but has demurred due to the low price of lanthanum. Increase that cost by a factor of 20, or even the factor of three seen in recent months — and add in the threat of a full cutoff — and Toyota’s board is likely to come to a different conclusion."

http://pragcap.com/china-future-rare-earth-metals

Honda has already started making the switch to lithium-ion batteries.Personally, I think Toyota too will eventually make the switch, even if prices for neodymium (each Prius also uses 1 kg of Nd) and lanthanum don't go ridiculously high. It seems to me that the present superiority of lithium-ion batteries is increasing steadily with all the research going full force, where as there is limited room for improvement in nickel-metal hydride technology.

IF Toyota starts making its hybrids and future e-cars with li-ion batteries, that will add massively to demand for lithium

koennte einer der freundlichen Thread-Experten auf eine Analyse der verschiedenen Lithiumproduzenten / Explorer verweisen ?

Antwort auf Beitrag Nr.: 40.369.305 von bmann025 am 21.10.10 20:37:33habe gestern in einem artikel gelesen, dass die seltenen erden aktien aktuell derart hochgepusht sind,

und eventuell gar keine so große industrie-abhängigkeit davon besteht. hm...

es steht weiter drin, dass aber lithium sehr wohl gebraucht wird, bzw. in zukunft sehr wichtig ist.

zumindest gestern zeigte lithium one stärke, das freut uns doch

und eventuell gar keine so große industrie-abhängigkeit davon besteht. hm...

es steht weiter drin, dass aber lithium sehr wohl gebraucht wird, bzw. in zukunft sehr wichtig ist.

zumindest gestern zeigte lithium one stärke, das freut uns doch

Antwort auf Beitrag Nr.: 40.355.779 von German2 am 20.10.10 11:15:07Hi German2 - schön sich auch hier zu treffen!

glaube die erste "Begegnung" liegt lange zurück bei Transmeridan oder Osisko

glaube die erste "Begegnung" liegt lange zurück bei Transmeridan oder Osisko

Antwort auf Beitrag Nr.: 40.355.779 von German2 am 20.10.10 11:15:07ich denke die Beteiligung der Koreaner (Kores) und indirekt LG International wird nochmal das Salz in der "Suppe" sein das den Pfiff bringen wird!

DAIMLER<DAIGn.DE> hält trotz der Schwierigkeiten seines

Partners BYD<1211.HK> daran fest, in drei Jahren ein Elektroauto

in China herauszubringen, wie der Vorstandsvorsitzende Zetsche

laut FAZ (Samstagausgabe) sagte.

* BMW<BMWG.DE> ist laut "Wirtschaftswoche" mit den Tests

seiner Elektro-Minis zufrieden: "Das Elektroauto wird schneller

Normalität werden, als wir dachten", wird eine

Unternehmensvertreterin zitiert

Partners BYD<1211.HK> daran fest, in drei Jahren ein Elektroauto

in China herauszubringen, wie der Vorstandsvorsitzende Zetsche

laut FAZ (Samstagausgabe) sagte.

* BMW<BMWG.DE> ist laut "Wirtschaftswoche" mit den Tests

seiner Elektro-Minis zufrieden: "Das Elektroauto wird schneller

Normalität werden, als wir dachten", wird eine

Unternehmensvertreterin zitiert

Antwort auf Beitrag Nr.: 40.378.333 von grasgruener am 23.10.10 12:08:59ja, gut möglich.. nun, man schreibt nicht mehr so viel aber bin immernoch gut dabei im Rohstoffbereich..hab die Erfahrung gemacht das eher die Werte am besten laufen wo die Boards am ausgedünntesten sind..zu Neonos Zeiten war das wohl genau andersrum  nun,diese Aktie hier find ich äussest interessant, habsie schon paar mal getradet und hab mir jetzt einige Stücke für ein Longinvestment zugelegt .. die Partnerschaften und die echt hochgradigen Brinesmachen LI zu einer recht sicheren Nummer..man sollte nicht vergessen das der koreanische Partner einen Grossteil bis zurProduktion finanziert. Somit erwartet uns recht wenigVerwässerung.jedenfalsl hoffe ich das..

nun,diese Aktie hier find ich äussest interessant, habsie schon paar mal getradet und hab mir jetzt einige Stücke für ein Longinvestment zugelegt .. die Partnerschaften und die echt hochgradigen Brinesmachen LI zu einer recht sicheren Nummer..man sollte nicht vergessen das der koreanische Partner einen Grossteil bis zurProduktion finanziert. Somit erwartet uns recht wenigVerwässerung.jedenfalsl hoffe ich das.. ... die Aktie steht kurz vorm Ausbruch..hoffen wir das Beste

... die Aktie steht kurz vorm Ausbruch..hoffen wir das Beste

nun,diese Aktie hier find ich äussest interessant, habsie schon paar mal getradet und hab mir jetzt einige Stücke für ein Longinvestment zugelegt .. die Partnerschaften und die echt hochgradigen Brinesmachen LI zu einer recht sicheren Nummer..man sollte nicht vergessen das der koreanische Partner einen Grossteil bis zurProduktion finanziert. Somit erwartet uns recht wenigVerwässerung.jedenfalsl hoffe ich das..

nun,diese Aktie hier find ich äussest interessant, habsie schon paar mal getradet und hab mir jetzt einige Stücke für ein Longinvestment zugelegt .. die Partnerschaften und die echt hochgradigen Brinesmachen LI zu einer recht sicheren Nummer..man sollte nicht vergessen das der koreanische Partner einen Grossteil bis zurProduktion finanziert. Somit erwartet uns recht wenigVerwässerung.jedenfalsl hoffe ich das.. ... die Aktie steht kurz vorm Ausbruch..hoffen wir das Beste

... die Aktie steht kurz vorm Ausbruch..hoffen wir das Beste

Antwort auf Beitrag Nr.: 40.384.030 von German2 am 25.10.10 14:10:17bei mir ähnlich - treibe mich mehr auf einem anderen Board rum....... ;-)

die Konstellation bei LI mancht mich auch sehr zuversichtlich

die Konstellation bei LI mancht mich auch sehr zuversichtlich

Meiner Meinung nach, hat der Hund aber noch ein paar Flöhe. Das, das Projekt realisiert werden wird, steht für mich fest. Starker Partner, gute Daten usw. Jedoch hapert es genau an diesem starken Partner, denn dieser will sicher möglichst günstig das Lithium einkaufen und durch den hohen Anteil wird dieser höchstwahrscheinlich seine Macht ausüben um sich gute Konditionen zu verschaffen, was wiederum den Gewinn drückt.

Antwort auf Beitrag Nr.: 40.405.821 von Raminus am 28.10.10 10:53:54der Vertrag iss klar:

-30% des Projektes wenn KC 15 Millionen $ investiert bis die BFS fertig iss

-KC kann weiter aufstocken bei Minenaufbau durch Überlassung von Darlehen oder Shares bei Credit

-KC bekommt zwischen 30 - 50% der Lithium Produktion

die andere Option wäre eine Komplettübernahme, ansonsten wird es nich viel billiger, egal wo die Aktie steht - denn die Produktionskosten lassen sich über den Aktienpreis nicht beeinflussen!

KC wird m.M.n. Druck ausüben dahingehend, das es schnell und zielstrebig vorangeht - der Bedarf wächst und um zu profitieren muss man Zugang zum Rohstoff haben

die jüngste Äusserung von BWM und Mercedes das Elektorautos doch schneller als gedacht den markt in naher Zukunft bestimmen werden weist den Weg

abgesehen von der Unterhaltungselektronik

-30% des Projektes wenn KC 15 Millionen $ investiert bis die BFS fertig iss

-KC kann weiter aufstocken bei Minenaufbau durch Überlassung von Darlehen oder Shares bei Credit

-KC bekommt zwischen 30 - 50% der Lithium Produktion

die andere Option wäre eine Komplettübernahme, ansonsten wird es nich viel billiger, egal wo die Aktie steht - denn die Produktionskosten lassen sich über den Aktienpreis nicht beeinflussen!

KC wird m.M.n. Druck ausüben dahingehend, das es schnell und zielstrebig vorangeht - der Bedarf wächst und um zu profitieren muss man Zugang zum Rohstoff haben

die jüngste Äusserung von BWM und Mercedes das Elektorautos doch schneller als gedacht den markt in naher Zukunft bestimmen werden weist den Weg

abgesehen von der Unterhaltungselektronik

GE Plans Biggest Electric-Vehicle Order in ‘Huge’ Industry Step

By Rachel Layne and Alan Ohnsman

Oct. 29 (Bloomberg) -- GeneralElectric Co. may jump-startthe electric-vehicle industry with an order that Chief ExecutiveOfficer Jeffrey Immeltsaid will be the largest in history.

GE, whose power-generation equipment provides a third ofthe world’s electricity, will order “tens of thousands” of thevehicles in about a week, Immelt said yesterday in a speech inLondon, without giving a total or identifying a manufacturer.

“This is a huge step up,” said Brett Smith, avehicletechnology analyst at the Center for Automotive Research in AnnArbor, Michigan. “It’s the biggest order to date I’m aware of,by a lot.”

Expanding the world’s fleet of electric vehicles wouldbolster GE as it expands so-called clean-energy technology suchas car chargers, solar panels and wind turbines. For everydollar of electric-vehicle sales, GE estimates it may get 10cents in revenue, said Gary Sheffer, aspokesman.

Immelt said half of GE’s sales force of about 45,000 willdrive electric vehicles. The Fairfield, Connecticut-basedcompany also has a vehicle-leasing division through its GECapital finance unit. Financial terms and other details aboutthe order aren’t yet being disclosed, GE said.

GE is investing $10 billion over the next five years incleanenergy across its business lines, including power-transmission software and so-called smart-grid technologies. Itsproducts include lithium-ion batteries for cars and trucks via aventure with A123Systems Inc. and sodium-based batteries foruse in large vehicles such as locomotives.

Creating Jobs

That spending creates jobs, Immelt told executives at anevent sponsored by the University of Cambridge’s Programme forSustainability Leadership.

“GE has been one of the biggest players in this game andcertainly has a lot to gain from the electric vehicle,” Smithsaid. “They’ve really truly tried to push this hard to getthings going, and it seems to be a core corporate value.”

An order the size of GE’s probably would come from severalvehicle makers, Smith said.

Automakers preparing to sell vehicles powered solely bybatteries over the next 18 months include NissanMotor Co.,which starts delivering Leaf hatchbacks late this year; FordMotor Co., readying electric versions of its Transit Connectdelivery van and Focus compact car; and ToyotaMotor Corp.,which will sell a rechargeable RAV4 sport-utility vehicle.

GeneralMotors Co. begins delivering plug-in Volt hybridsthis year, and HondaMotor Co., Chrysler LLC, Bayerische MotorenWerke AG and other large brands are preparing battery vehiclesdue by 2012.

Global Outlook

Combined deliveries of hybrids, such as Toyota’s Prius, andbattery-powered cars may reach 5.2 million by 2020, according toan Oct. 27 forecast by J.D. Power & Associates. That would beabout 7.3 percent of the projected global vehicle market.

Immelt used his remarks in London to renew his call forincreased private spending on renewable-energy investments.

“Now is exactly the time, because it’s less popular, wherewe have to invest more,” Immelt said. “We have to do it morecourageously. And we’re going to have to go forward for a whilewithout government at our backs.”

GE Energy Infrastructure is the company’s biggestindustrialunit, accounting for $37 billion of the parentcompany’s $157 billion in revenue last year.

GE is the largest shareholder for Watertown, Massachusetts-based A123, which has signed agreements with NavistarInternational Corp. and Fisker Automotive Inc. to supplyadvanced batteries for their vehicles.

To contact the reporters on this story:Rachel Laynein Boston atrlayne@bloomberg.net;Alan Ohnsman in Los Angeles ataohnsman@bloomberg.net

To contact the editor responsible for this story:Ed Dufner atedufner@bloomberg.net

Last Updated: October 28, 2010 19:16 EDT

die Zukunft wird schneller Realität als wir denken

die Zukunft wird schneller Realität als wir denken01.11.2010

Nissan Leaf

Das Fünf-Milliarden-Dollar-Baby

Elektroautos gibt es mittlerweile zuhauf - doch der Nissan Leaf ist bisher das einzige Modell eines namhaften Herstellers, das tatsächlich in Großserie geht. SPIEGEL ONLINE fuhr den Wagen, der 2011 auch in Deutschland angeboten wird.

Nissan setzt alles auf eine Karte: die Elektromobilität. "Wir haben fünf Milliarden Dollar auf den Tisch gelegt", sagt Francois Bancon, der Chefstratege des japanischen Autobauers. "Wenn diese Nummer schief geht, sind wir tot, mausetot." Kein Wunder also, dass Bacon, der sich selbst als "gefährlichen Träumer" beschreibt, derzeit nervös ist. Denn nach drei Jahren Vorgeplänkel kommt sein erstes Elektroauto der Marke, der Nissan Leaf, auf den Markt. Es ist weltweit das erste in Großserie produzierte Modell, das um den Elektroantrieb herum komplett neue entwickelt wurde.

Dafür, dass er über die Zukunft des Konzerns entscheidet, sieht der Leaf ziemlich unscheinbar aus. Mit 4,45 Metern Länge und 1,55 Metern Höhe etwa so groß wie ein Opel Astra, wirkt er wie ein Kompaktwagen, der etwas zu lange im Windkanal gestanden hat. "Die Zurückhaltung ist Absicht", sagt Bancon, "man darf die Leute nicht zweimal schocken." Weil sich das Publikum schon auf einen völlig neuen Antrieb einstellen muss, sollten zumindest Design und Bedienung vertraut bleiben. Bei den vier E-Autos, die Nissan bis 2014 auf den Markt bringen will, soll sich das ändern. Geplant sind ein leichtes Nutzfahrzeug, ein eleganter Wagen der noblen Schwestermarke Infiniti und schließlich ein Auto, das Bancon nur "den Durchbruch" nennt. "Wer das sieht, wird uns nie mehr Langeweile vorwerfen."

Im Leaf kann man sich auf Anhieb wohlfühlen. Die Instrumente sind zwar ein wenig verspielt, der Wählhebel für das Ein-Gang-Getriebe ist ein gewöhnungsbedürftiges Plastik-Bällchen. Aber man sitzt ordentlich, und der Kofferraum fasst 330 Liter - bei 48 Akku-Zellen, jeweils von der Größe eines Laptops, die im Wagenboden verstaut wurden, ist das nicht selbstverständlich.

Spitze 145 km/h - bis auf Deutschland ist das überall mehr als erlaubt

Der Elektromotor leistet 109 PS und hat bei 280 Nm ab der ersten Umdrehung mit dem 1,6 Tonnen schweren Leaf keine Mühe. Wie jeder Stromer sprintet auch der Leaf wie ein Sportwagen los. Er fährt rundum flott, laut Tacho schaffte der Testwagen beinahe 160 Sachen. Dabei ist der Leaf mit Rücksicht auf die Reichweite offiziell auf 145 km/h limitiert. "Das reicht überall in Europa für den Verlust des Führerscheins", sagt Produktmanager Malo le Masson, "außer in Deutschland, natürlich."

Während der Leaf innen so leise ist, dass sogar der Antennenantrieb und die Scheibenwischer-Motoren ruhig gestellt werden mussten, um weiter unhörbar zu sein, macht er nach außen hin extra Krach. Ein Lautsprecher in der vorderen Stoßstange lässt bis Tempo 30 ein anschwellendes Surren und beim Rückwärtsfahren ein Piepen ertönen, damit Fußgänger gewarnt sind.

Die Reichweite beziffert Nissan auf etwas mehr als 160 Kilometer. Für den großen Autourlaub taugt das nicht. "Für die Urlaubsfahrt bekommen Leaf-Kunden kostenlos einen Leihwagen von uns", sagt Masson.

Die Reichweite schmilzt mit jedem herzhaften Beschleunigen

Zum Start unserer Testfahrt zeigt der Bordcomputer trotz voller Akkus nur 134 Kilometer Reichweite an. Und kaum ist die Klimaanlage aktiviert, sind gleich fünf Kilometer weg. Die nächsten fünf Kilometer schluckt der Sprint an der ersten Ampel. Und auf der Rampe über die Schnellstraße sind wieder fünf Kilometer fällig. Nach kaum zehn Minuten Fahrt ist der Aktionsradius plötzlich nur noch halb so groß. Dafür zeigt das Display schon jetzt eine erwartete Ladezeit von mehr als einer Stunde. Das kann ja heiter werden.

Nach weiteren zehn Minuten hat der Rechner die Energievorräte offenbar neu sortiert und zeigt eine Reichweite von gut 100 Kilometern an. Wir fahren locker im Stadtverkehr mit. Was der Leaf beim Beschleunigen an Strom verliert, gewinnt er beim Verzögern wieder hinzu. Das geht auch auf der Landstraße so weiter. Solange keine Steigungen anstehen, schmilzt die Ladung der Akkus so langsam, dass man die Reichweitensorge fast vergisst. Wird die Strecke steiler oder die Fahrt schneller, bekommt die Batterieanzeige Schwindsucht: Für jeden Kilometer Steigung büsst man zehn Kilometer Reichweite ein, und bei Vollgas auf der Autobahn kann man dem Countdown kaum mehr folgen.

Im Eco-Modus fährt der Leaf gemütlich - und sehr sparsam

Höchste Zeit, den Eco-Knopf zu drücken. Dann fährt der Leaf zwar wie mit angezogener Handbremse und der Klimaanlage geht beinahe die Puste aus, aber man gewinnt deutlich an Reichweite. Auf dem Navigationsbildschirm wird der jeweils der aktuelle Aktionsradius angezeigt. Außerdem kennt der Pfadfinder natürlich alle Ladestationen entlang der Strecke.

Die Akkus des Leaf haben jetzt zwei Stunden durchgehalten, doch nun geht der Stromvorrat zur Neige. Ein gelber Stecker blinkt im Cockpit - das Zeichen für Ebbe im Akku. Das Navigationssystem schlägt eine Route zur nächstgelegenen Ladesäule vor. Wir rollen dort, nach zweieinhalb Stunden und mehr als 100 Kilometern vor. Bislang hat das Auto Energie für kaum mehr als zwei Euro verbraucht, das ist erstaunlich.

Der Haken an der Sache: Das Laden dauert an der Haushaltssteckdose gut acht Stunden. Eine Fortsetzung der Testfahrt könnte man also vergessen. Doch Nissan hat glücklicherweise sogenannte Quickcharger aufgebaut. Die sind so groß wie Telefonzellen und verfügen über Starkstrom. 80 Prozent der Akkukapazität ist nach einer knappen halben Stunde wieder geladen - das passt prima zu einer kurzen Kaffeepause.

Im Innenraum wirkt das Auto ein bisschen schluderig

Wir nutzen die Zeit für eine gründliche Inspektion des Innenraumes und sind zum ersten Mal seit der Begegnung mit dem Leaf enttäuscht. Wer genauer hinsieht, erkennt die lieblose Materialauswahl, die lustlose Verarbeitung und Mankos wie den mangelnden Verstellweg des Lenkrads. Es wirkt, als seien über die Konzentration auf den Elektroantrieb ein paar Essentials des modernen Autobaus vergessen worden.

Dem Nachfrageansturm tut das keinen Abbruch. Im ersten vollen Jahr will Nissan 50.000 Leafs bauen. "Aber das reicht längst nicht, um die Nachfrage zu decken", sagt Bancon. Zunächst wird der Wagen daher nur dort angeboten, wo E-Autos speziell gefördert werden. In Japan und den USA zum Beispiel, sowie in England, Irland, Holland und Portugal. Die Deutschen Händler müssen wohl bis Ende 2011 warten auf den Leaf-Verkaufsstart warten. Hierzulande wird das Auto dann rund 35.000 Euro kosten.

Antwort auf Beitrag Nr.: 40.405.821 von Raminus am 28.10.10 10:53:541. der Partner bekommt das Lithium nicht geschenkt

2. er muss die Mine finanzieren bzw für LI's Anteil gradestehen

3. News von gestern ... man sichert sich nun das 2. Project endgültig und legt noch im Nov die Ressourcenschätzung nach ... dieses Projekt ist fast noch interessanter, denn die Gradesind für Lithium sehr hoch

..habe heute billig aufgestockt

2. er muss die Mine finanzieren bzw für LI's Anteil gradestehen

3. News von gestern ... man sichert sich nun das 2. Project endgültig und legt noch im Nov die Ressourcenschätzung nach ... dieses Projekt ist fast noch interessanter, denn die Gradesind für Lithium sehr hoch

..habe heute billig aufgestockt

ich stocke hier gerade weiter auf..es stehen einige News ins Haus .. 2 Ressourcenschätzungen , eine Scoping-Studie ...derNewsflow sollte die Aktie endlihausbrechen lassen

Rodinia Lithium Inc. Hits Lithium Fountain Grading 540 mg/l at Salar de Diablillos

- Artesian Brine Intersected in Last Three Drill Holes with Values up to 540 mg/l Lithium, 5500 mg/l Potassium, 660 mg/l Boron and a Mg:Li Ratio of 3.33