Biotech Depot 2010 - 500 Beiträge pro Seite

eröffnet am 03.01.10 16:49:57 von

neuester Beitrag 07.01.12 15:22:53 von

neuester Beitrag 07.01.12 15:22:53 von

Beiträge: 334

ID: 1.155.114

ID: 1.155.114

Aufrufe heute: 0

Gesamt: 12.716

Gesamt: 12.716

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 20.04.24, 12:11 | 677 | |

| vor 1 Stunde | 607 | |

| heute 01:03 | 597 | |

| vor 51 Minuten | 367 | |

| vor 45 Minuten | 291 | |

| gestern 22:37 | 289 | |

| heute 00:58 | 252 | |

| vor 1 Stunde | 226 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.963,73 | +0,15 | 210 | |||

| 2. | 2. | 132,56 | -0,53 | 129 | |||

| 3. | 3. | 2.304,33 | -0,98 | 81 | |||

| 4. | 4. | 6,9380 | +0,58 | 72 | |||

| 5. | 5. | 676,90 | +0,49 | 53 | |||

| 6. | 6. | 3,7250 | +0,13 | 40 | |||

| 7. | 8. | 2,3595 | +1,14 | 37 | |||

| 8. | 9. | 45,00 | -0,44 | 35 |

Auf ein neues!

Während im letzten Jahr Dax, Nasdaq usw große Gewinne einbrachten, hat sich mein Biotech-Depot Thread: Biotech Depot 2009 leider nur sehr durchwachsen entwickelt, was ein wenig entäuschend ist... am Ende blieb es bei einem kleinen Minus. Ein wesentlicher Grund lag in der sehr schlechten Entwicklung von Genmab, die im Laufe des Jahres fast 2/3 an Wert verloren und die ich recht hoch gewichtet hatte.

Dieses Jahr starte ich nun mit folgenden Werten:

11,9% Regeneron http://finance.yahoo.com/q?s=REGN

10,2% Incyte http://finance.yahoo.com/q?s=INCY

8,0% Genmab http://finance.yahoo.com/q?s=GEN.CO

7,3% Cubist http://finance.yahoo.com/q?s=CBST

6,3% Exelixis http://finance.yahoo.com/q?s=EXEL

6,1% Rigel http://finance.yahoo.com/q?s=RIGL

6,0% Onyx http://finance.yahoo.com/q?s=ONXX

5,9% Allos http://finance.yahoo.com/q?s=ALTH

5,4% Isis http://finance.yahoo.com/q?s=ISIS

5,1% Micromet http://finance.yahoo.com/q?s=MITI

3,9% Seattle Genetics http://finance.yahoo.com/q?s=SGEN

3,8% ArQule http://finance.yahoo.com/q?s=ARQL

3,7% Evotec http://finance.yahoo.com/q?s=EVT.DE

3,6% Medigene http://finance.yahoo.com/q?s=MDG.DE

3,3% Array http://finance.yahoo.com/q?s=ARRY

2,3% Arena http://finance.yahoo.com/q?s=ARNA

2,1% ViroPharma http://finance.yahoo.com/q?s=VPHM

1,8% NicOx http://finance.yahoo.com/q?s=COX.PA

1,2% Progenics http://finance.yahoo.com/q?s=PGNX

1,2% Addex http://finance.yahoo.com/q?s=ADXN.SW

1,0% Sucampo http://finance.yahoo.com/q?s=SCMP

Die letzten Änderungen in 2009 waren:

Aufstockung von ALTH, REGN und ISIS... Reduzierung von Evotec und Kauf von ARQL.

Ob es wohl diesmal eine gute Mischung ergibt?

Mal schauen, was dieses Jahr so bringt... wünsche jedenfalls allen ein gutes und erfolgreiches Jahr 2010 und viel Spaß mit ihren Investments!

mfg ipollit

Während im letzten Jahr Dax, Nasdaq usw große Gewinne einbrachten, hat sich mein Biotech-Depot Thread: Biotech Depot 2009 leider nur sehr durchwachsen entwickelt, was ein wenig entäuschend ist... am Ende blieb es bei einem kleinen Minus. Ein wesentlicher Grund lag in der sehr schlechten Entwicklung von Genmab, die im Laufe des Jahres fast 2/3 an Wert verloren und die ich recht hoch gewichtet hatte.

Dieses Jahr starte ich nun mit folgenden Werten:

11,9% Regeneron http://finance.yahoo.com/q?s=REGN

10,2% Incyte http://finance.yahoo.com/q?s=INCY

8,0% Genmab http://finance.yahoo.com/q?s=GEN.CO

7,3% Cubist http://finance.yahoo.com/q?s=CBST

6,3% Exelixis http://finance.yahoo.com/q?s=EXEL

6,1% Rigel http://finance.yahoo.com/q?s=RIGL

6,0% Onyx http://finance.yahoo.com/q?s=ONXX

5,9% Allos http://finance.yahoo.com/q?s=ALTH

5,4% Isis http://finance.yahoo.com/q?s=ISIS

5,1% Micromet http://finance.yahoo.com/q?s=MITI

3,9% Seattle Genetics http://finance.yahoo.com/q?s=SGEN

3,8% ArQule http://finance.yahoo.com/q?s=ARQL

3,7% Evotec http://finance.yahoo.com/q?s=EVT.DE

3,6% Medigene http://finance.yahoo.com/q?s=MDG.DE

3,3% Array http://finance.yahoo.com/q?s=ARRY

2,3% Arena http://finance.yahoo.com/q?s=ARNA

2,1% ViroPharma http://finance.yahoo.com/q?s=VPHM

1,8% NicOx http://finance.yahoo.com/q?s=COX.PA

1,2% Progenics http://finance.yahoo.com/q?s=PGNX

1,2% Addex http://finance.yahoo.com/q?s=ADXN.SW

1,0% Sucampo http://finance.yahoo.com/q?s=SCMP

Die letzten Änderungen in 2009 waren:

Aufstockung von ALTH, REGN und ISIS... Reduzierung von Evotec und Kauf von ARQL.

Ob es wohl diesmal eine gute Mischung ergibt?

Mal schauen, was dieses Jahr so bringt... wünsche jedenfalls allen ein gutes und erfolgreiches Jahr 2010 und viel Spaß mit ihren Investments!

mfg ipollit

Antwort auf Beitrag Nr.: 38.656.864 von ipollit am 03.01.10 16:49:57Zum Vergleich der Nasdaq Biotech Index...

Regeneron (REGN) - MK 1,95 Mrd USD (bei 24,18 USD)

http://finance.yahoo.com/q?s=regn

starke Pipeline und Partner, Avastin-ähnliches Aflibercept in PIII mit Sanofi (50% Gewinnanteil), Lucentis-ähnliches VEGF-Trap Eye in PIII mit Bayer (100% US-Rechte, 50% weltweit), Arcalyst zugelassen als Nischenprodukt gegen CAPS, in PIII gegen Gicht (100% weltweit), große AK-Allianz mit Sanofi... Regeneron erhält jährlich 160 Mio USD bis 2017 mit dem Ziel jährlich 4 bis 5 AKs in die PI zu bekommen

Incyte (INCY) - MK 1,08 Mrd USD (bei 9,11 USD)

http://finance.yahoo.com/q?s=incy

die Schuldenkrise scheint überwunden... zuletzt extrem gute Deals für die JAK1/2-Hemmer: Novartis hat die ex-US Rechte am sehr aussichtsreichen INCB018424 gegen Krebs in PIII gekauft (Incyte besitzt 100% der US-Rechte), EliLilly finanziert die teure Entwicklung von INCB28050 gegen Immunkrankheiten wie RA (Incyte bekommt bis zu 20% Royalties)... das brachte zusammen 300 Mio USD Upfront ein. In der Pipeline befinden sich aktuell noch 2 Kandidaten in PII gegen Brustkrebs und Diabetes, die theoretisch auslizensiert werden können

Genmab - MK 710 Mio USD (bei 82 DKK)

recht enttäuschend. zwar haben Genmab/GSK die Zulassung für Arzerra (Rituxan-ähnlich) gegen CLL erhalten, doch ist eine riskante PIII gegen die wichtige Indikation NHL fehlgeschlagen. Damit ist offen, ob Arzerra mit Rituxan konkurrieren kann... direkte, aber riskante Vergleichstudien mit Rituxan wurden begonnen. Zudem wird Arzerra subkutan gegen RA entwickelt. Wichtige PIII-Ergebnisse zum zweiten Kandidaten Zalutumumab (Erbitux-ähnlich) gegen HN-Krebs sollen in Kürze erfolgen... auch hier besteht ein großes Risiko, dass sich Zalutumumab nicht gegen Erbitux absetzen kann. Die Entwicklung von R1507 (Roche) wurde leider gestoppt... wohl aufgrund der Genentech-Übernahme. Zudem ist der (Zwangs-)Verkauf der AK-Produktionsstädten enttäuschend.

Cubist (CBST) - MK 1,1 Mrd USD (bei 18,97 USD)

http://finance.yahoo.com/q?s=cbst

KGV10e von 12,5... das Antibiotikum Cubicin bringt hohe Gewinne ein und entwickelt sich zum Blockbuster. Der relativ niedrige Kurs (und der Einbruch in 2009) ist nur dadurch zu erklären, dass Teva versucht, die Patente (bis 2017/19) auszuhebeln, um Cubicin generisch zu vertreiben. 2011 wird dieser Fall vor Gericht behandelt. In der Pipeline gab es ein paar Rückschläge... ALN-RSV01 in PII wurde vorerst an Alnylam zurückgegeben, Cubist will den präklinischen Nachfolger gegen eine größere Indikation entwickeln. Die PII von Ecallantide gegen Blutungen (lizensiert von Dyax, die zuletzt dafür die Zulassung als Kalbitor gegen akute Schwellungen HAE von der FDA erhalten haben) wurde wegen Unregelmäßigkeiten frühzeitig geschlossen... es besteht das Risiko, dass damit die PII scheitert. Dafür wurde zuletzt mit der Übernahme von Calixa mit CXA-201 ein weiteres ausichtsreiches Antibiotikum erworben, welches 2014 auf den Markt kommen könnte.

Exelixis (EXEL) - MK 791 Mio USD (bei 7,37 USD)

http://finance.yahoo.com/q?s=exel

große Pipline mit 11 Kandidaten in der klinischen Entwicklung, die im wesentlichen von namhaften Pharma-Partnern finanziert wird. In 2009 konnten mehrere gute Deals abgeschlossen werden.

Rigel (RIGL) - MK 493 Mio USD (bei 9,51 USD)

http://finance.yahoo.com/q?s=rigl

Unsicherheit bezügliche R788 als orales Mittel gegen RA. Die PII-Daten zeigten zwar eine gute Wirkung, doch könnten störende Nebenwirkungen wie leicht erhöhter Blutdruck Probleme bereiten. PIII ist in Vorbeitung... es konnte aber immer noch kein Pharma-Partner gefunden werden. R788 ist von der Indikation gegen Autoimmunskrankheiten und Krebs ähnlich wie INCY's JAK-Hemmer... nur handelt es sich mit SYK um ein anderes Target.

Onyx (ONXX) - MK 1,82 Mrd USD (bei 29,34 USD)

http://finance.yahoo.com/q?s=onxx

KGV10e von 38. Nexavar gegen Krebs entwickelt weiter positiv... doch versucht der Partner Bayer an Onyx vorbei eine leicht modifizierte Version zu entwickeln, worauf Onyx Bayer verklagt hat. Nexavar könnte gegen Brustkrebs wirksam sein... dies würde das Potential deutlich erhöhen. Durch die Übernahme von Proteolix wurde zuletzt das Krebsmedikament Carfilzomib in PII erworben, dass ein nebenwirkungsfreieres Velcade sein könnte. Sind die Daten bei MM in 2010 positiv, könnte bereits 2011 ein weiterer potentieller Blockbuster von Onyx auf den Markt kommen.

Allos (ALTH) - MK 684 Mio USD (bei 6,58 USD)

http://finance.yahoo.com/q?s=alth

Ein-Produkt Unternehmen... im September hat Allos die Zulassung von Folotyn (neuartiges Chemotherapeutikum) gegen die seltene Krebsart PTCL erhalten. Es ist zwar eine kleine Indikation, aber es gibt keine Alternativen und der Preis für Folotyn ist entsprechend sehr hoch. Außerdem kann Allos es mit einer kleinen Vertriebsstruktur selber vermarkten. Folotyn wird nun bei größeren Indikationen wie NHL oder NSCLC getestet

Isis (ISIS) - MK 1,09 Mrd USD (bei 11,11 USD)

http://finance.yahoo.com/q?s=isis

Führend in der RNAi-Technologie... umfangreiche Pipeline und Kooperationen, die einiges an Bargeld einbringen (teilweise cashflow positiv), hoher Bargeldbestand mit 600 Mio USD. Wichtigstes Projekt ist Mipomersen in PIII, das zusammen mit Genzyme zur Senkung von Cholesterin, wenn z.B. Statine nicht ausreichend helfen, entwickelt wird. Bis Mitte 2010 sollen Daten von 3 weiteren PIIIs vorliegen... die Zulassung für Hochrisikopatienten soll im Sommer 2011 erfolgen, etwas später als ursprünglich geplant. Zwar konnte in der ersten PIII Mipomersen bei Hochrisiko-Patienten das Cholesterin senken, doch gab es auch bei einem Teil der Patienten erhöhte Leberwerte, ein Anzeichen von möglicher Leberschädigung. Die Frage ist nun, in wie weit Mipomersen dafür verantwortlich ist und ob dies auch bei Patienten, die keine lebensgefährlichen Cholesterinwerte aufweisen, auftritt, denn nur damit kann Mipomersen zu einem Blockbuster werden. Daher ist der Kurs zuletzt gefallen.

Micromet (MITI) - MK 459 Mio USD (bei 6,66 USD)

http://finance.yahoo.com/q?s=miti

hat spezielle BiTE-AKs in der Pipeline, mit denen T-Killerzellen des Immunsystems an bestimmte Targets gebunden werden sollen, damit der Körper diese zerstört. Der CD19-BiTE-AK Blinatumomab hat in PI/II Studien gute Ergebnisse geliefert... so war bei 80% von Patienten mit ALL der Krebs nicht mehr nachweisbar und die Ansprechrate bei NHL, bei denen andere Therapien nicht ansprechen, lag bei 100%. Dies sind zwar unsichere, aber ermutigende Ergebnisse. Der AK ist noch nicht verpartnert und es könnte bald eine Zulassungsstudie begonnen werden.

Seattle Genetics (SGEN) - MK 1,02 Mrd USD (bei 10,16 UDS)

http://finance.yahoo.com/q?s=sgen

Technologie, die AKs mit einer Chemo belädt, um die Wirkung der AKs zu erhöhen. Mit dem CD40-AK SGN-40 gab es einen Rückschlag... eine PII wurde gestoppt und Genentech ist aus der Entwickung ausgestiegen. Vielversprechender CD30 AK SGN-35 gegen HL in PIII konnte mit Takeda/Millennium verpartnert werden... SGEN besitzt noch die vollen US-Rechte. PIII Ergebnisse sollen in Laufe von 2010 vorliegen und die Zulassung in 2011 beantragt werden. Desweiteren sollen in 1H10 PII-Daten zum CD33-AK SGN-33 in AML kommen, die bereits für eine Zulassung ausreichend sein könnten. SGN-33 ist noch nicht verpartnert.

ArQule (ARQL) - MK 165 Mio USD (bei 3,69 USD)

http://finance.yahoo.com/q?s=arql

vielversprechender CMet-Hemmer ARQ-197 in PII gegen Krebs zusammen mit Daiichi... PII-Daten bei NSCLC in Kombination mit Tarceva in 1H10. Mit etwa 160 Mio USD Cash (netto 110) in etwa auf Cash-Niveau.

Evotec - MK 334 Mio USD (bei 1,13 EUR)

Mehrere Rückschläge in 2009 mit Scheitern von u.a. EVT201, EVT302. Umstrukturierung auf mehr Dienstleistung mit dem Ziel, ab 2012 profitabel zu werden. Die Pipeline befindet sich noch in einem sehr frühen Stadium... eine neue Kooperation mit Roche für EVT101/3 in PI gegen Depressionen. Daneben den oralen P2X7-Antagonisten gegen RA in PI.

Medigene - MK 183 Mio USD (bei 3,58 EUR)

Mit Eligard und Veregen 2 Produkte am Markt. Negative Kursentwicklung, da es laufend zu Verzögerungen kommt... Hoffungsträger ist EndoTag-1, liposomales Paclitaxel in PII, auf das sich nun ganz fokussiert wird. Es konnte trotz positiver PII-Daten bei BSDK immer noch kein Partner für eine PIII gefunden werden... in 2010 sollen Daten bei der größeren Indikation Brustkrebs folgen.

Array (ARRY) - MK 139 Mio USD (bei 2,81 USD)

http://finance.yahoo.com/q?s=arry

Ähnlich wie EXEL Konzentration auf Krebs und Autoimmunerkrankungen und unterschiedlichen Targets (7 Kandidaten in der Klinik). Mehrere negative Studienergebnisse in 2009. Finanzierungsprobleme, die mit der letzten Verpartnerung von ARRY-403 gegen Diabetes mit Amgen etwas gelindert werden konnten. In 2010 stehen weitere klinische Daten an.

Arena (ARNA) - MK 329 Mio USD (bei 3,55 USD)

http://finance.yahoo.com/q?s=arna

Arena hängt von Lorcaserin ab, ein Mittel gegen Fettsucht. Zwar gibt es einen großen Bedarf an Mitteln, die das Übergewicht reduzieren, doch dürfen diese keine Nebenwirkungen aufweisen. Lorcaserin scheint kaum Nebenwirkungen zu besitzen, doch ist die Wirkung nur gering, so dass es nicht klar ist, ob es für eine Zulassung ausreicht und ob das Mittel dann auch vom Markt angenommen wird. Es konnte kein Partner gefunden werden... die Zulassung wurde vor Kurzem alleine beantragt. Die Zulassungsentscheidung der FDA dürfte nächstes Jahr fallen... bei einer Zulassung wäre es das erste Mittel dieser Art am Markt.

ViroPharma (VPHM) - MK 650 Mio USD (bei 8,39 USD)

Anfang 2009 gab es mit dem überraschenden Scheitern von Maribavir in PIII einen größeren Rückschlag. Zudem wurde das wichtigste Produkt, das Antibiotikum Vancocin, wie seit langem erwartet generisch. Dafür entwickelt sich das in 2008 erworbene Cinryze als einziges Mittel zur Prophylaxe von HAE gut, so dass Vancocin vielleicht ersetzt werden kann.

NicOx - MK 590 Mio USD (bei 5,68 EUR)

Es konnte immer noch kein Partner für das Schmerzmittel Naproxcinod gefunden werden. Zuletzt wurde alleine die Zulassung beantragt.

Progenics (PGNX) - MK 141 Mio USD (bei 4,44 USD)

http://finance.yahoo.com/q?s=pgnx

Ein zugelassenes Produkt mit Relistor, das Verdauungsprobleme bei Gabe von Morphium verhindern soll. Relistor hat bisher sehr enttäuscht und wurde von Wyeth an PGNX zurückgegeben. PGNX sucht nun nach neuen Vermarktungsstrategien und entwickelt eine orale Version. Mit zuletzt 100 Mio USD Cash relativ hoher Cashbestand.

Addex - MK 120 Mio USD (bei 13,8 CHF)

Allosterische Modulatoren insbesondere für CNS, die u.a. bisherige etablierte Wirkansätze verbessern sollen. Zuletzt gab es mit dem unerwarteten Stopp der Entwicklung von ADX10059 für Langzeittherapien wegen möglicher Leberschäden einen schweren Rückschlag.

Sucampo - MK 169 Mio USD (bei 4,04 USD)

http://finance.yahoo.com/q?s=SCMP

Mit Amitiza ein Produkt am Markt... teilweise in der Gewinnzone

mfg ipollit

Regeneron (REGN) - MK 1,95 Mrd USD (bei 24,18 USD)

http://finance.yahoo.com/q?s=regn

starke Pipeline und Partner, Avastin-ähnliches Aflibercept in PIII mit Sanofi (50% Gewinnanteil), Lucentis-ähnliches VEGF-Trap Eye in PIII mit Bayer (100% US-Rechte, 50% weltweit), Arcalyst zugelassen als Nischenprodukt gegen CAPS, in PIII gegen Gicht (100% weltweit), große AK-Allianz mit Sanofi... Regeneron erhält jährlich 160 Mio USD bis 2017 mit dem Ziel jährlich 4 bis 5 AKs in die PI zu bekommen

Incyte (INCY) - MK 1,08 Mrd USD (bei 9,11 USD)

http://finance.yahoo.com/q?s=incy

die Schuldenkrise scheint überwunden... zuletzt extrem gute Deals für die JAK1/2-Hemmer: Novartis hat die ex-US Rechte am sehr aussichtsreichen INCB018424 gegen Krebs in PIII gekauft (Incyte besitzt 100% der US-Rechte), EliLilly finanziert die teure Entwicklung von INCB28050 gegen Immunkrankheiten wie RA (Incyte bekommt bis zu 20% Royalties)... das brachte zusammen 300 Mio USD Upfront ein. In der Pipeline befinden sich aktuell noch 2 Kandidaten in PII gegen Brustkrebs und Diabetes, die theoretisch auslizensiert werden können

Genmab - MK 710 Mio USD (bei 82 DKK)

recht enttäuschend. zwar haben Genmab/GSK die Zulassung für Arzerra (Rituxan-ähnlich) gegen CLL erhalten, doch ist eine riskante PIII gegen die wichtige Indikation NHL fehlgeschlagen. Damit ist offen, ob Arzerra mit Rituxan konkurrieren kann... direkte, aber riskante Vergleichstudien mit Rituxan wurden begonnen. Zudem wird Arzerra subkutan gegen RA entwickelt. Wichtige PIII-Ergebnisse zum zweiten Kandidaten Zalutumumab (Erbitux-ähnlich) gegen HN-Krebs sollen in Kürze erfolgen... auch hier besteht ein großes Risiko, dass sich Zalutumumab nicht gegen Erbitux absetzen kann. Die Entwicklung von R1507 (Roche) wurde leider gestoppt... wohl aufgrund der Genentech-Übernahme. Zudem ist der (Zwangs-)Verkauf der AK-Produktionsstädten enttäuschend.

Cubist (CBST) - MK 1,1 Mrd USD (bei 18,97 USD)

http://finance.yahoo.com/q?s=cbst

KGV10e von 12,5... das Antibiotikum Cubicin bringt hohe Gewinne ein und entwickelt sich zum Blockbuster. Der relativ niedrige Kurs (und der Einbruch in 2009) ist nur dadurch zu erklären, dass Teva versucht, die Patente (bis 2017/19) auszuhebeln, um Cubicin generisch zu vertreiben. 2011 wird dieser Fall vor Gericht behandelt. In der Pipeline gab es ein paar Rückschläge... ALN-RSV01 in PII wurde vorerst an Alnylam zurückgegeben, Cubist will den präklinischen Nachfolger gegen eine größere Indikation entwickeln. Die PII von Ecallantide gegen Blutungen (lizensiert von Dyax, die zuletzt dafür die Zulassung als Kalbitor gegen akute Schwellungen HAE von der FDA erhalten haben) wurde wegen Unregelmäßigkeiten frühzeitig geschlossen... es besteht das Risiko, dass damit die PII scheitert. Dafür wurde zuletzt mit der Übernahme von Calixa mit CXA-201 ein weiteres ausichtsreiches Antibiotikum erworben, welches 2014 auf den Markt kommen könnte.

Exelixis (EXEL) - MK 791 Mio USD (bei 7,37 USD)

http://finance.yahoo.com/q?s=exel

große Pipline mit 11 Kandidaten in der klinischen Entwicklung, die im wesentlichen von namhaften Pharma-Partnern finanziert wird. In 2009 konnten mehrere gute Deals abgeschlossen werden.

Rigel (RIGL) - MK 493 Mio USD (bei 9,51 USD)

http://finance.yahoo.com/q?s=rigl

Unsicherheit bezügliche R788 als orales Mittel gegen RA. Die PII-Daten zeigten zwar eine gute Wirkung, doch könnten störende Nebenwirkungen wie leicht erhöhter Blutdruck Probleme bereiten. PIII ist in Vorbeitung... es konnte aber immer noch kein Pharma-Partner gefunden werden. R788 ist von der Indikation gegen Autoimmunskrankheiten und Krebs ähnlich wie INCY's JAK-Hemmer... nur handelt es sich mit SYK um ein anderes Target.

Onyx (ONXX) - MK 1,82 Mrd USD (bei 29,34 USD)

http://finance.yahoo.com/q?s=onxx

KGV10e von 38. Nexavar gegen Krebs entwickelt weiter positiv... doch versucht der Partner Bayer an Onyx vorbei eine leicht modifizierte Version zu entwickeln, worauf Onyx Bayer verklagt hat. Nexavar könnte gegen Brustkrebs wirksam sein... dies würde das Potential deutlich erhöhen. Durch die Übernahme von Proteolix wurde zuletzt das Krebsmedikament Carfilzomib in PII erworben, dass ein nebenwirkungsfreieres Velcade sein könnte. Sind die Daten bei MM in 2010 positiv, könnte bereits 2011 ein weiterer potentieller Blockbuster von Onyx auf den Markt kommen.

Allos (ALTH) - MK 684 Mio USD (bei 6,58 USD)

http://finance.yahoo.com/q?s=alth

Ein-Produkt Unternehmen... im September hat Allos die Zulassung von Folotyn (neuartiges Chemotherapeutikum) gegen die seltene Krebsart PTCL erhalten. Es ist zwar eine kleine Indikation, aber es gibt keine Alternativen und der Preis für Folotyn ist entsprechend sehr hoch. Außerdem kann Allos es mit einer kleinen Vertriebsstruktur selber vermarkten. Folotyn wird nun bei größeren Indikationen wie NHL oder NSCLC getestet

Isis (ISIS) - MK 1,09 Mrd USD (bei 11,11 USD)

http://finance.yahoo.com/q?s=isis

Führend in der RNAi-Technologie... umfangreiche Pipeline und Kooperationen, die einiges an Bargeld einbringen (teilweise cashflow positiv), hoher Bargeldbestand mit 600 Mio USD. Wichtigstes Projekt ist Mipomersen in PIII, das zusammen mit Genzyme zur Senkung von Cholesterin, wenn z.B. Statine nicht ausreichend helfen, entwickelt wird. Bis Mitte 2010 sollen Daten von 3 weiteren PIIIs vorliegen... die Zulassung für Hochrisikopatienten soll im Sommer 2011 erfolgen, etwas später als ursprünglich geplant. Zwar konnte in der ersten PIII Mipomersen bei Hochrisiko-Patienten das Cholesterin senken, doch gab es auch bei einem Teil der Patienten erhöhte Leberwerte, ein Anzeichen von möglicher Leberschädigung. Die Frage ist nun, in wie weit Mipomersen dafür verantwortlich ist und ob dies auch bei Patienten, die keine lebensgefährlichen Cholesterinwerte aufweisen, auftritt, denn nur damit kann Mipomersen zu einem Blockbuster werden. Daher ist der Kurs zuletzt gefallen.

Micromet (MITI) - MK 459 Mio USD (bei 6,66 USD)

http://finance.yahoo.com/q?s=miti

hat spezielle BiTE-AKs in der Pipeline, mit denen T-Killerzellen des Immunsystems an bestimmte Targets gebunden werden sollen, damit der Körper diese zerstört. Der CD19-BiTE-AK Blinatumomab hat in PI/II Studien gute Ergebnisse geliefert... so war bei 80% von Patienten mit ALL der Krebs nicht mehr nachweisbar und die Ansprechrate bei NHL, bei denen andere Therapien nicht ansprechen, lag bei 100%. Dies sind zwar unsichere, aber ermutigende Ergebnisse. Der AK ist noch nicht verpartnert und es könnte bald eine Zulassungsstudie begonnen werden.

Seattle Genetics (SGEN) - MK 1,02 Mrd USD (bei 10,16 UDS)

http://finance.yahoo.com/q?s=sgen

Technologie, die AKs mit einer Chemo belädt, um die Wirkung der AKs zu erhöhen. Mit dem CD40-AK SGN-40 gab es einen Rückschlag... eine PII wurde gestoppt und Genentech ist aus der Entwickung ausgestiegen. Vielversprechender CD30 AK SGN-35 gegen HL in PIII konnte mit Takeda/Millennium verpartnert werden... SGEN besitzt noch die vollen US-Rechte. PIII Ergebnisse sollen in Laufe von 2010 vorliegen und die Zulassung in 2011 beantragt werden. Desweiteren sollen in 1H10 PII-Daten zum CD33-AK SGN-33 in AML kommen, die bereits für eine Zulassung ausreichend sein könnten. SGN-33 ist noch nicht verpartnert.

ArQule (ARQL) - MK 165 Mio USD (bei 3,69 USD)

http://finance.yahoo.com/q?s=arql

vielversprechender CMet-Hemmer ARQ-197 in PII gegen Krebs zusammen mit Daiichi... PII-Daten bei NSCLC in Kombination mit Tarceva in 1H10. Mit etwa 160 Mio USD Cash (netto 110) in etwa auf Cash-Niveau.

Evotec - MK 334 Mio USD (bei 1,13 EUR)

Mehrere Rückschläge in 2009 mit Scheitern von u.a. EVT201, EVT302. Umstrukturierung auf mehr Dienstleistung mit dem Ziel, ab 2012 profitabel zu werden. Die Pipeline befindet sich noch in einem sehr frühen Stadium... eine neue Kooperation mit Roche für EVT101/3 in PI gegen Depressionen. Daneben den oralen P2X7-Antagonisten gegen RA in PI.

Medigene - MK 183 Mio USD (bei 3,58 EUR)

Mit Eligard und Veregen 2 Produkte am Markt. Negative Kursentwicklung, da es laufend zu Verzögerungen kommt... Hoffungsträger ist EndoTag-1, liposomales Paclitaxel in PII, auf das sich nun ganz fokussiert wird. Es konnte trotz positiver PII-Daten bei BSDK immer noch kein Partner für eine PIII gefunden werden... in 2010 sollen Daten bei der größeren Indikation Brustkrebs folgen.

Array (ARRY) - MK 139 Mio USD (bei 2,81 USD)

http://finance.yahoo.com/q?s=arry

Ähnlich wie EXEL Konzentration auf Krebs und Autoimmunerkrankungen und unterschiedlichen Targets (7 Kandidaten in der Klinik). Mehrere negative Studienergebnisse in 2009. Finanzierungsprobleme, die mit der letzten Verpartnerung von ARRY-403 gegen Diabetes mit Amgen etwas gelindert werden konnten. In 2010 stehen weitere klinische Daten an.

Arena (ARNA) - MK 329 Mio USD (bei 3,55 USD)

http://finance.yahoo.com/q?s=arna

Arena hängt von Lorcaserin ab, ein Mittel gegen Fettsucht. Zwar gibt es einen großen Bedarf an Mitteln, die das Übergewicht reduzieren, doch dürfen diese keine Nebenwirkungen aufweisen. Lorcaserin scheint kaum Nebenwirkungen zu besitzen, doch ist die Wirkung nur gering, so dass es nicht klar ist, ob es für eine Zulassung ausreicht und ob das Mittel dann auch vom Markt angenommen wird. Es konnte kein Partner gefunden werden... die Zulassung wurde vor Kurzem alleine beantragt. Die Zulassungsentscheidung der FDA dürfte nächstes Jahr fallen... bei einer Zulassung wäre es das erste Mittel dieser Art am Markt.

ViroPharma (VPHM) - MK 650 Mio USD (bei 8,39 USD)

Anfang 2009 gab es mit dem überraschenden Scheitern von Maribavir in PIII einen größeren Rückschlag. Zudem wurde das wichtigste Produkt, das Antibiotikum Vancocin, wie seit langem erwartet generisch. Dafür entwickelt sich das in 2008 erworbene Cinryze als einziges Mittel zur Prophylaxe von HAE gut, so dass Vancocin vielleicht ersetzt werden kann.

NicOx - MK 590 Mio USD (bei 5,68 EUR)

Es konnte immer noch kein Partner für das Schmerzmittel Naproxcinod gefunden werden. Zuletzt wurde alleine die Zulassung beantragt.

Progenics (PGNX) - MK 141 Mio USD (bei 4,44 USD)

http://finance.yahoo.com/q?s=pgnx

Ein zugelassenes Produkt mit Relistor, das Verdauungsprobleme bei Gabe von Morphium verhindern soll. Relistor hat bisher sehr enttäuscht und wurde von Wyeth an PGNX zurückgegeben. PGNX sucht nun nach neuen Vermarktungsstrategien und entwickelt eine orale Version. Mit zuletzt 100 Mio USD Cash relativ hoher Cashbestand.

Addex - MK 120 Mio USD (bei 13,8 CHF)

Allosterische Modulatoren insbesondere für CNS, die u.a. bisherige etablierte Wirkansätze verbessern sollen. Zuletzt gab es mit dem unerwarteten Stopp der Entwicklung von ADX10059 für Langzeittherapien wegen möglicher Leberschäden einen schweren Rückschlag.

Sucampo - MK 169 Mio USD (bei 4,04 USD)

http://finance.yahoo.com/q?s=SCMP

Mit Amitiza ein Produkt am Markt... teilweise in der Gewinnzone

mfg ipollit

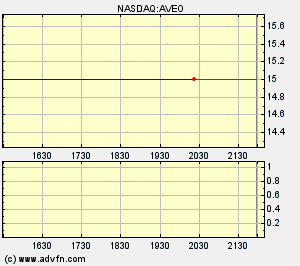

5-Tages-Charts...

Nasdaq Biotech Index

Einzelwerte

mfg ipollit

Nasdaq Biotech Index

Einzelwerte

mfg ipollit

Regeneron - aktuelle Pipeline

mfg ipollit

mfg ipollit

Incyte - aktuelle Pipeline

mfg ipollit

mfg ipollit

Genmab - aktuelle Pipeline

mfg ipollit

mfg ipollit

Vl. kann man heute ja "Decode Genetics"(Island) aufnehmen?

Zwar in Ch11 - Mcap aktuell 4Mio USD. Sehr bekanntes Unternehmen, 300Mio USD Schulden.

Davon mal abgesehen, kennt jemand die Pipeline und den Hintergrund?

Wird morgen von der Nasdaq delistet wegen Kursunterschreitung.

Soll keine Kaufempfehlung sein, nur, um die Hintergründe zu diskutieren, falls bekannt.

Zwar in Ch11 - Mcap aktuell 4Mio USD. Sehr bekanntes Unternehmen, 300Mio USD Schulden.

Davon mal abgesehen, kennt jemand die Pipeline und den Hintergrund?

Wird morgen von der Nasdaq delistet wegen Kursunterschreitung.

Soll keine Kaufempfehlung sein, nur, um die Hintergründe zu diskutieren, falls bekannt.

Cubist - aktuelle Pipeline

noch nicht enthalten ist das durch die Übernahme von Calixa erworbene Antibiotikum CXA-201 in PI (bzw. CXA-101 in PII)...

mfg ipollit

noch nicht enthalten ist das durch die Übernahme von Calixa erworbene Antibiotikum CXA-201 in PI (bzw. CXA-101 in PII)...

mfg ipollit

Antwort auf Beitrag Nr.: 38.670.572 von MrRipley am 05.01.10 19:24:09DCGN... naja, ist ein wenig heiß, sich ein bereits bankrottes Unternehmen ins Depot zu legen mit der Hoffnung, dass es doch noch irgendwie überlebt. Davon lasse ich lieber die Finger. Trotzdem danke für den Hinweis!

mfg ipollit

mfg ipollit

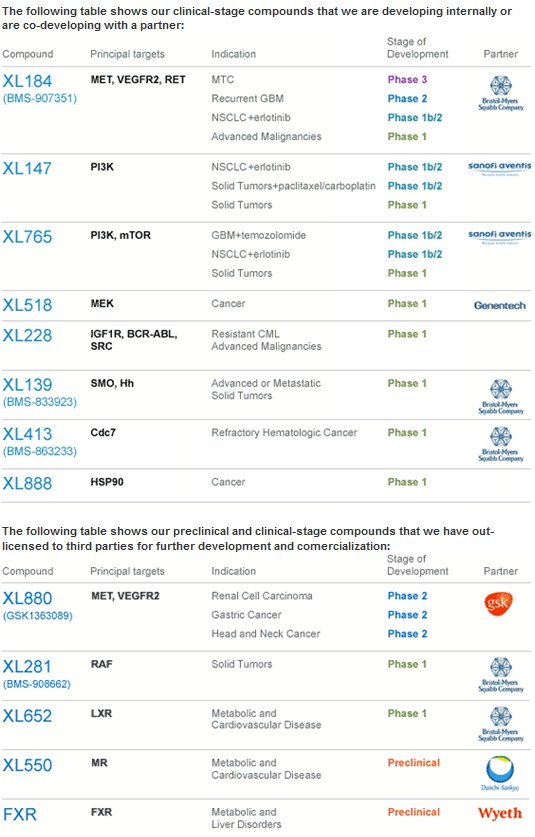

Exelixis - aktuelle Pipeline

mfg ipollit

mfg ipollit

Rigel - aktuelle Pipeline

mfg ipollit

mfg ipollit

Onyx - aktuelle Pipeline

mfg ipollit

mfg ipollit

Ich erlaube mir mal den Hinweis auf ein noch sehr kleines und ziemlich spezielles Unternehmen, nämlich:

NeurogesX

http://www.neurogesx.com/

Sie konzentrieren sich auf die Behandlung von Schmerzen, die durch Nervenschädigungen hervorgerufen werden.

Die Marktkapitalisierung beträgt 130 Millionen Dollar, wobei zum Ende des Q3/2009 ca. 57 Mio. Dollar Cash vorhanden waren.

Hier der Chart:

Der Kursaufschwung hat einen realen Grund, nämlich die Zulassung des Wirkstoffes Qutenza.

Was ist Qutenza?

Qutenza ist ein kutanes Pflaster (ein Pflaster, das ein Arzneimittel durch die Haut abgibt). Es enthält den Wirkstoff Capsaicin (8 %).

Wofür wird Qutenza angewendet?

Qutenza ist für die Behandlung von peripheren neuropathischen Schmerzen (d. h. Schmerzen, die durch Nervenschädigungen hervorgerufen werden) bei erwachsenen Nichtdiabetikern angezeigt. Es kann als Monotherapie oder in Kombination mit anderen Schmerzmitteln angewendet werden.

Das Arzneimittel ist nur auf ärztliche Verschreibung erhältlich.

Hier das File der EMEA:

http://www.emea.europa.eu/humandocs/PDFs/EPAR/Qutenza/H-909-…

Qutenza wird in Europa durch Astellas vertrieben (gegen double-digit royalties), die US-Rechte hält NeurogesX weiterhin selbst und will im 1. HJ 2010 einen eigenen Vertrieb in den USA aufbauen und zu einem Produktunternehmen werden.

Aufgrund der erfolgten Zulassungen werden im Jahre 2010 erstmals relevante Umsätze erzielt werden.

Das ist die Pipeline:

Das Unternehmen hängt also derzeit sehr stark am Wirkstoff capsaicin (Qutenza), was sicher nicht so wirklich schön ist.

Aber: Der Markt für Schmerzmittel in diesem Bereich ist Milliarden-Dollar schwer und Analysten trauen Qutenza langfristig (in einigen Jahren) Umsätze im Bereich mehrerer hundert Millionen Dollar zu.

Außerdem ist es überhaupt eine Leistung, einen Wirkstoff zugelassen und verpartnert zu bekommen. Da müssen andere erst mal "hinriechen", wo NeurogesX schon ist.

Letztlich kostet der ganze Laden nach Abzug des Cash derzeit vielleicht 80 Mio. Dollar oder so. Sollte Qutenza am Markt seine Nische erobern, ist das sicher nicht zu teuer bezahlt.

Kritik willkommen!

Gruß

NeurogesX

http://www.neurogesx.com/

Sie konzentrieren sich auf die Behandlung von Schmerzen, die durch Nervenschädigungen hervorgerufen werden.

Die Marktkapitalisierung beträgt 130 Millionen Dollar, wobei zum Ende des Q3/2009 ca. 57 Mio. Dollar Cash vorhanden waren.

Hier der Chart:

Der Kursaufschwung hat einen realen Grund, nämlich die Zulassung des Wirkstoffes Qutenza.

Was ist Qutenza?

Qutenza ist ein kutanes Pflaster (ein Pflaster, das ein Arzneimittel durch die Haut abgibt). Es enthält den Wirkstoff Capsaicin (8 %).

Wofür wird Qutenza angewendet?

Qutenza ist für die Behandlung von peripheren neuropathischen Schmerzen (d. h. Schmerzen, die durch Nervenschädigungen hervorgerufen werden) bei erwachsenen Nichtdiabetikern angezeigt. Es kann als Monotherapie oder in Kombination mit anderen Schmerzmitteln angewendet werden.

Das Arzneimittel ist nur auf ärztliche Verschreibung erhältlich.

Hier das File der EMEA:

http://www.emea.europa.eu/humandocs/PDFs/EPAR/Qutenza/H-909-…

Qutenza wird in Europa durch Astellas vertrieben (gegen double-digit royalties), die US-Rechte hält NeurogesX weiterhin selbst und will im 1. HJ 2010 einen eigenen Vertrieb in den USA aufbauen und zu einem Produktunternehmen werden.

Aufgrund der erfolgten Zulassungen werden im Jahre 2010 erstmals relevante Umsätze erzielt werden.

Das ist die Pipeline:

Das Unternehmen hängt also derzeit sehr stark am Wirkstoff capsaicin (Qutenza), was sicher nicht so wirklich schön ist.

Aber: Der Markt für Schmerzmittel in diesem Bereich ist Milliarden-Dollar schwer und Analysten trauen Qutenza langfristig (in einigen Jahren) Umsätze im Bereich mehrerer hundert Millionen Dollar zu.

Außerdem ist es überhaupt eine Leistung, einen Wirkstoff zugelassen und verpartnert zu bekommen. Da müssen andere erst mal "hinriechen", wo NeurogesX schon ist.

Letztlich kostet der ganze Laden nach Abzug des Cash derzeit vielleicht 80 Mio. Dollar oder so. Sollte Qutenza am Markt seine Nische erobern, ist das sicher nicht zu teuer bezahlt.

Kritik willkommen!

Gruß

Antwort auf Beitrag Nr.: 38.656.864 von ipollit am 03.01.10 16:49:57warum hast du keine mologen in deinem depot?

Antwort auf Beitrag Nr.: 38.672.882 von SLGramann am 06.01.10 09:37:06Hallo SLGramann!

Danke für die Infos!... NGSX - hast du die auch aus dem Ohad Hammer Blog. Kritik kann ich da nicht äußern... hört sich schon sehr interessant an. Falls es einen Haken gibt, habe ich ihn bisher nicht entdeckt. Das Marktpotential ist relativ zur MK schon recht hoch... es ist nur ein wenig unsicher, ob NGSX das auf dem US-Markt auch eigenständig gut vermarktet bekommt. Der US-Markt könnte einige 100 Mio Umsatz bringen... und hier in der EU ebenfalls. Könnte mir vorstellen, mir eine paar Stücke ins Depot zu legen. Im Kurs steckt das Potential bisher jedenfalls nicht drin, finde ich.

Ich suche auch immer nach interessanten Werten... was käme sonst noch in Frage? Im Moment habe ich da z.B. Xoma, Theravance, Basilea, Neurosearch und Wilex auf meiner Liste.

mfg ipollit

Danke für die Infos!... NGSX - hast du die auch aus dem Ohad Hammer Blog. Kritik kann ich da nicht äußern... hört sich schon sehr interessant an. Falls es einen Haken gibt, habe ich ihn bisher nicht entdeckt. Das Marktpotential ist relativ zur MK schon recht hoch... es ist nur ein wenig unsicher, ob NGSX das auf dem US-Markt auch eigenständig gut vermarktet bekommt. Der US-Markt könnte einige 100 Mio Umsatz bringen... und hier in der EU ebenfalls. Könnte mir vorstellen, mir eine paar Stücke ins Depot zu legen. Im Kurs steckt das Potential bisher jedenfalls nicht drin, finde ich.

Ich suche auch immer nach interessanten Werten... was käme sonst noch in Frage? Im Moment habe ich da z.B. Xoma, Theravance, Basilea, Neurosearch und Wilex auf meiner Liste.

mfg ipollit

Antwort auf Beitrag Nr.: 38.677.562 von ipollit am 06.01.10 18:37:35

Hi ipollit,

richtig, die Idee kam von Hammer. Er hat die Aktie nach der Zulassung in Europa ins Depot genommen, aber leider nie einen Artikel dazu geschrieben.

Wie die Vermarktung laufen wird, ist wirklich die entscheidende Frage. Ich bin sehr gespannt, wann genau und mit welchem Erfolg das in den USA anläuft.

Es mag auch Leute geben, die den Wirkstoff nicht "sexy" finden. Ist ja nur ne "geraspelte Chilischote", könnte man boshaft (und ziemlich falsch) sagen und kein schicker Antikörper. Aber ganz so simpel ist es dann wohl doch nicht, denn sonst hätte Astellas nicht 42 Millionen upfront überwiesen.

Ansonsten habe ich derzeit nur noch ArQule im Visier, aber die hast Du ja eh schon im Depot.

Von Actelion habe ich mich getrennt und habe jetzt folgendes im Depot:

MorphoSys

Biotest

Seattle Genetics

Immunogen

Micromet

Incyte

Exelixis

NeurogesX

Wir haben also ne Menge Überschneidungen.

Außerdem finde auch ich Regeneron sehr interessant. Aber ich trau mich da nicht ran, weil ich über die P III - Programme nicht genug weiß, an denen aber meiner Meinung nach 30 bis 50% der Marktkapitalisierung hängt.

Gruß

Hi ipollit,

richtig, die Idee kam von Hammer. Er hat die Aktie nach der Zulassung in Europa ins Depot genommen, aber leider nie einen Artikel dazu geschrieben.

Wie die Vermarktung laufen wird, ist wirklich die entscheidende Frage. Ich bin sehr gespannt, wann genau und mit welchem Erfolg das in den USA anläuft.

Es mag auch Leute geben, die den Wirkstoff nicht "sexy" finden. Ist ja nur ne "geraspelte Chilischote", könnte man boshaft (und ziemlich falsch) sagen und kein schicker Antikörper. Aber ganz so simpel ist es dann wohl doch nicht, denn sonst hätte Astellas nicht 42 Millionen upfront überwiesen.

Ansonsten habe ich derzeit nur noch ArQule im Visier, aber die hast Du ja eh schon im Depot.

Von Actelion habe ich mich getrennt und habe jetzt folgendes im Depot:

MorphoSys

Biotest

Seattle Genetics

Immunogen

Micromet

Incyte

Exelixis

NeurogesX

Wir haben also ne Menge Überschneidungen.

Außerdem finde auch ich Regeneron sehr interessant. Aber ich trau mich da nicht ran, weil ich über die P III - Programme nicht genug weiß, an denen aber meiner Meinung nach 30 bis 50% der Marktkapitalisierung hängt.

Gruß

Antwort auf Beitrag Nr.: 38.672.907 von pokemon am 06.01.10 09:42:41warum sollte ich Mologen haben?... nichts über PI hinaus. da gibt es meiner Meinung nach aussichtsreichere Sachen.

mfg ipollit

mfg ipollit

Antwort auf Beitrag Nr.: 38.678.515 von SLGramann am 06.01.10 20:21:12"nur ne geraspelte Chilischote"... naja, in Chili befindet sich nur zufällig derselbe Wirkstoff, der, wie man wahrscheinlich selber schon die Erfahrung gemacht hat, wunderbar auf die Schmerzrezeptoren wirkt, denn nichts anderes ist ja die Schärfe. Die Eigenschaften von Qutenza hören sich gut an... anderes als bei den bisherigen Schmerzmitteln sollen die Nebenwirkungen gering sein... außerdem ist die Schmerzfreiheit sehr lange anhaltend: eine Stunde Anwendung sollen zu 3 Monaten schmerzfreiheit führen. Wie gesagt... hört sich interessant an!

Regeneron... eine MK von aktuell 2 Mrd USD ist zwar nicht wenig, doch ist REGN eben nicht nur von einem Produkt abhängig. Quasi zwei Produkte sind bereits auf dem Markt... Arcalyst und Novartis Ilaris (wofür REGN Royalties erhält)... beide wirken auf IL1, was vielversprechend ist (was man z.B. auch an XOMAs 052 sieht). Ist REGN mit Arcalyst gegen Gicht erfolgreich, so könnte wohl alleine das schon ein Blockbuster werden. Arcalyst, Aflibercept und VEGF Trap-Eye sind keine AKs sondern Traps. Traps sind freie Rezeptoren, die wie AKs an den Targets binden, um sie zu neutralisieren. Ob Aflibercept erfolgreich wird, muss man sehen... aber immerhin stellt es eine Alternative zu Avastin dar und die Entwicklung wird zu 100% von Sanofi finanziert. VEGF-Trap Eye scheint vielversprechend zu sein. Nach den bisherigen Ergebnissen scheint es dauerhafter als Lucentis die Sehschärfe zu erhalten und/oder seltener verabreicht werden zu mussen (Spritze durch das Auge hindurch, was ja das Risiko einer Infektion beinhaltet). Zuletzt habe ich zugekauft, weil Sanofi sehr viel in REGN investiert, was Sanofi wohl nur macht, wenn sie in REGN einen wichtigen Partner sehen (vielleicht soetwas wie Roche und Genentech): in den nächsten Jahren erhält REGN weit über 1 Mrd USD von Sanofi für die Entwicklung von AKs... Ziel ist es, 5 neue AKs pro Jahr in die PI zu bringen. Sanofi fianziert dann die komplette klinische Entwicklung und Vermarktung. Dafür erhält REGN am Ende nicht 5% Royalties oder soetwas, sondern die Gewinne werden geteilt (wobei REGN aus dem Anteil dann zunächst die Hälte der Entwicklungskosten an Sanofi zurückzahlt). Das hört sich für mich nach einem sehr guten Deal an. Dadurch konnte REGN zuletzt 400 zusätzliche Mitarbeiter einstellen. 5 Aks pro Jahr... das könnten am Ende insgesamt bis zu 40 neue klinische AKs sein, an denen REGN zur Hälfte beteiligt ist. Naja... wie das zu bewerten ist, ist eine andere Frage... daher ist REGN auch nicht ganz billig.

mfg ipollit

Regeneron... eine MK von aktuell 2 Mrd USD ist zwar nicht wenig, doch ist REGN eben nicht nur von einem Produkt abhängig. Quasi zwei Produkte sind bereits auf dem Markt... Arcalyst und Novartis Ilaris (wofür REGN Royalties erhält)... beide wirken auf IL1, was vielversprechend ist (was man z.B. auch an XOMAs 052 sieht). Ist REGN mit Arcalyst gegen Gicht erfolgreich, so könnte wohl alleine das schon ein Blockbuster werden. Arcalyst, Aflibercept und VEGF Trap-Eye sind keine AKs sondern Traps. Traps sind freie Rezeptoren, die wie AKs an den Targets binden, um sie zu neutralisieren. Ob Aflibercept erfolgreich wird, muss man sehen... aber immerhin stellt es eine Alternative zu Avastin dar und die Entwicklung wird zu 100% von Sanofi finanziert. VEGF-Trap Eye scheint vielversprechend zu sein. Nach den bisherigen Ergebnissen scheint es dauerhafter als Lucentis die Sehschärfe zu erhalten und/oder seltener verabreicht werden zu mussen (Spritze durch das Auge hindurch, was ja das Risiko einer Infektion beinhaltet). Zuletzt habe ich zugekauft, weil Sanofi sehr viel in REGN investiert, was Sanofi wohl nur macht, wenn sie in REGN einen wichtigen Partner sehen (vielleicht soetwas wie Roche und Genentech): in den nächsten Jahren erhält REGN weit über 1 Mrd USD von Sanofi für die Entwicklung von AKs... Ziel ist es, 5 neue AKs pro Jahr in die PI zu bringen. Sanofi fianziert dann die komplette klinische Entwicklung und Vermarktung. Dafür erhält REGN am Ende nicht 5% Royalties oder soetwas, sondern die Gewinne werden geteilt (wobei REGN aus dem Anteil dann zunächst die Hälte der Entwicklungskosten an Sanofi zurückzahlt). Das hört sich für mich nach einem sehr guten Deal an. Dadurch konnte REGN zuletzt 400 zusätzliche Mitarbeiter einstellen. 5 Aks pro Jahr... das könnten am Ende insgesamt bis zu 40 neue klinische AKs sein, an denen REGN zur Hälfte beteiligt ist. Naja... wie das zu bewerten ist, ist eine andere Frage... daher ist REGN auch nicht ganz billig.

mfg ipollit

zu ALTH...

JMP SECURITIES

Allos ($6.65, ALTH, Market Outperform, PT: $20)

Scarcity value makes this hematology company with an approved product an obvious Target. We continue to view Allos as a prime take-out candidate and believe that interim data from a Phase II trial in lung cancer could act as a driving catalyst for acquirers. FOLOTYN is now approved and available in the US for the treatment of PTCL, and we expect a full commercial launch to gain traction early this year. Although early in the launch ramp, we believe that initial sales indications from November and December 2009 may provide upside to Street expectations. We also look forward to learning how quickly and readily reimbursement authorities are adopting the drug’s use.

mfg ipollit

JMP SECURITIES

Allos ($6.65, ALTH, Market Outperform, PT: $20)

Scarcity value makes this hematology company with an approved product an obvious Target. We continue to view Allos as a prime take-out candidate and believe that interim data from a Phase II trial in lung cancer could act as a driving catalyst for acquirers. FOLOTYN is now approved and available in the US for the treatment of PTCL, and we expect a full commercial launch to gain traction early this year. Although early in the launch ramp, we believe that initial sales indications from November and December 2009 may provide upside to Street expectations. We also look forward to learning how quickly and readily reimbursement authorities are adopting the drug’s use.

mfg ipollit

Allos - aktuelle Pipeline

mfg ipollit

mfg ipollit

Isis - aktuelle Pipeline

mfg ipollit

mfg ipollit

Micromet - aktuelle Pipeline

mfg ipollit

mfg ipollit

Seattle Genetics - aktuelle Pipeline

mfg ipollit

mfg ipollit

ArQule - aktuelle Pipeline

mfg ipollit

mfg ipollit

Evotec - aktuelle Pipeline

mfg ipollit

mfg ipollit

Medigene - aktuelle Pipeline

mfg ipollit

mfg ipollit

Array - aktuelle Pipeline

(ARRY-403 ist inzwischen an Amgen verpartnert)

mfg ipollit

(ARRY-403 ist inzwischen an Amgen verpartnert)

mfg ipollit

Arena - aktuelle Pipeline

(die Entwicklung von Mercks Niacin Receptor Agonist ist vor Kurzem gestoppt worden)

mfg ipollit

(die Entwicklung von Mercks Niacin Receptor Agonist ist vor Kurzem gestoppt worden)

mfg ipollit

ViroPharma - aktuelle Pipeline

(Maribavir ist in 2009 in der PIII gescheitert)

mfg ipollit

(Maribavir ist in 2009 in der PIII gescheitert)

mfg ipollit

NicOx - aktuelle Pipeline

mfg ipollit

mfg ipollit

Progenics - aktuelle Pipeline

mfg ipollit

mfg ipollit

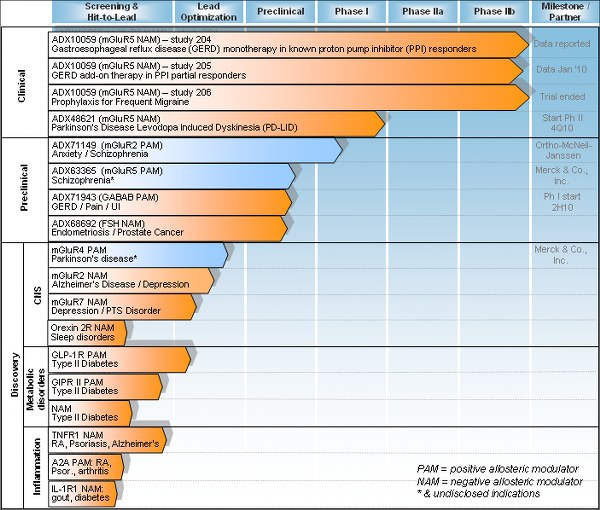

Addex - aktuelle Pipeline

ADX10059 scheint leider wegen Nebenwirkungen gescheitert zu sein!

mfg ipollit

ADX10059 scheint leider wegen Nebenwirkungen gescheitert zu sein!

mfg ipollit

und zu guter letzt noch die aktuelle Pipeline von Sucampo

soviel zu den Pipelines Anfang 2010... mal schauen, wie sie sich im Laufe des Jahres entwickeln werden

mfg ipollit

soviel zu den Pipelines Anfang 2010... mal schauen, wie sie sich im Laufe des Jahres entwickeln werden

mfg ipollit

Antwort auf Beitrag Nr.: 38.680.068 von ipollit am 07.01.10 00:42:33Guten Morgen ipollit,

Human Genome ist zwar letztes Jahr schon stark gestiegen, aber da geht noch mehr!

Wenn die endgültige Zulassung für Benlysta kommt geht der Kurs über 40 $.

Danach hat Human Genome so viel Kohle, um auch seine anderen Entwicklungen erfolgreich voranzutreiben, oder es kommt ein Übernahmeangebot von Glaxo o.ä.

Ich habe letztes Jahr bei Human fast den absoluten Tiefpunkt erwischt und konnte meine gesamten Aktienverluste aus den letzten Jahren damit ausgleichen

Viele Grüße

af

Human Genome ist zwar letztes Jahr schon stark gestiegen, aber da geht noch mehr!

Wenn die endgültige Zulassung für Benlysta kommt geht der Kurs über 40 $.

Danach hat Human Genome so viel Kohle, um auch seine anderen Entwicklungen erfolgreich voranzutreiben, oder es kommt ein Übernahmeangebot von Glaxo o.ä.

Ich habe letztes Jahr bei Human fast den absoluten Tiefpunkt erwischt und konnte meine gesamten Aktienverluste aus den letzten Jahren damit ausgleichen

Viele Grüße

af

Antwort auf Beitrag Nr.: 38.680.263 von againstfotsch am 07.01.10 07:41:02Glückwunsch! Soetwas wie bei HGSI findet man nicht oft... ohne Benlysta hätte die Zukunft wohl düster ausgesehen... jetzt stehen die wieder blendend da. Allerdings beträgt die MK nun auch schon mehr als 5 Mrd USD. 40 USD wäre "nur" noch ein bisschen mehr als +20%... wenn dagegen doch noch etwas schief geht, dann gehts wohl wieder steil nach unten. Anfangs war ich nicht dabei gewesen und schaue nun lieber zu, wie es weiter geht.

mfg ipollit

mfg ipollit

Antwort auf Beitrag Nr.: 38.686.985 von ipollit am 07.01.10 19:36:50Hi ipollit, schön wieder von dir zu lesen. Drück dir die Daumen bei den US-Biotechs. Werd mich dieses Jahr aber hauptsächlich auf die deutschen konzentrieren. Hab noch paar Vertex im Depot liegen, da geht es ja dieses Jahr um die Wurst.

Grüße

blb

Grüße

blb

Antwort auf Beitrag Nr.: 38.687.140 von blb am 07.01.10 19:50:49Hallo blb!

Danke! - zu den deutschen Bios... wenn ich sie im Vergleich mit beispielsweise den US-Biotechs sehe, dann scheinen sie doch noch ziemlich hinterher zu hängen, so dass ich sie einfach im Vergleich zu wenig interessant finde. Welches deutsche Biotechunternehmen würde denn international Beachtung finden? Da sehe ich eigentlich nur eine Morphosys (Qiagen lasse ich mal außen vor, naja und eine Micromet ist ja eigentlich auch deutsch). Ich habe zwar auch Evotec und Medigene im Depot... aber das sind eigentlich im wesentlichen Spekulationen auf gute Deals für EndoTag-1 und EVT201 gewesen. Letzteres hat nichts ergeben und auch EndoTag-1 zieht sich ewig hin. Interessant finde ich vielleicht noch eine Wilex... vielleicht gelingt denen mal der Durchbruch, zumal die auch eine etwas breitere Pipeline besitzen, wofür sie allerdings recht wenig Geld zur Verfügung haben... immerhin etwas Potential.

Naja, wünsche dir trotzdem viel Glück dabei... z.B. Evotec war letztes Jahr vom Kurs her auch sehr erfolgreich, also warum nicht.

mfg ipollit

Danke! - zu den deutschen Bios... wenn ich sie im Vergleich mit beispielsweise den US-Biotechs sehe, dann scheinen sie doch noch ziemlich hinterher zu hängen, so dass ich sie einfach im Vergleich zu wenig interessant finde. Welches deutsche Biotechunternehmen würde denn international Beachtung finden? Da sehe ich eigentlich nur eine Morphosys (Qiagen lasse ich mal außen vor, naja und eine Micromet ist ja eigentlich auch deutsch). Ich habe zwar auch Evotec und Medigene im Depot... aber das sind eigentlich im wesentlichen Spekulationen auf gute Deals für EndoTag-1 und EVT201 gewesen. Letzteres hat nichts ergeben und auch EndoTag-1 zieht sich ewig hin. Interessant finde ich vielleicht noch eine Wilex... vielleicht gelingt denen mal der Durchbruch, zumal die auch eine etwas breitere Pipeline besitzen, wofür sie allerdings recht wenig Geld zur Verfügung haben... immerhin etwas Potential.

Naja, wünsche dir trotzdem viel Glück dabei... z.B. Evotec war letztes Jahr vom Kurs her auch sehr erfolgreich, also warum nicht.

mfg ipollit

Antwort auf Beitrag Nr.: 38.689.434 von ipollit am 08.01.10 00:00:58du solltest dir ein paar mologene dazulegen.

unbeachtet von den meisten machen die ihren weg! mgn1703 könnte binnen jahresfrist auslizenziert sein, so independent research in deren letzten studie.

unbeachtet von den meisten machen die ihren weg! mgn1703 könnte binnen jahresfrist auslizenziert sein, so independent research in deren letzten studie.

Antwort auf Beitrag Nr.: 38.679.857 von ipollit am 06.01.10 23:21:36

So, habe jetzt auch ArQule und Regeneron ins Depot genommen. Hoffe, dass ich an den Biotech-Werten dieses Jahr nicht mehr rumschrauben muss und gut aufgestellt bin. Entscheidende Daten kommen in 2010 jedenfalls massenweise...

So, habe jetzt auch ArQule und Regeneron ins Depot genommen. Hoffe, dass ich an den Biotech-Werten dieses Jahr nicht mehr rumschrauben muss und gut aufgestellt bin. Entscheidende Daten kommen in 2010 jedenfalls massenweise...

Antwort auf Beitrag Nr.: 38.694.977 von SLGramann am 08.01.10 16:13:42ja, hoffentlich wird dieses Jahr ein gutes für Biotechs. Ich habe jetzt auch meine Evotec in NGSX getauscht. So ein kleines Unternehmen, welches am Markt bisher nur wenig Beachtung findet, macht mich zwar etwas nervös, aber in dem immerhin zugelassenen Produkt steckt auch einiges an Potential, wenn es erfolgreich wird. Im Erfolgsfall könnten hier in Europa alleine Royalties von über 100 Mio USD drin sein. Bei einem Unternehmen, welches sich im Bereich einer 100 Mio MK bewegt, ist das ja schon ein ganze Menge. Naja... das Risiko besteht wohl aber auch, dass sich Qutenza ähnlich schwach wie z.B. Relistor entwickelt. Dann helfen alle tollen Prognosen nicht.

mfg ipollit

mfg ipollit

Antwort auf Beitrag Nr.: 38.697.089 von ipollit am 08.01.10 19:28:28Hallo ipollit, kennst du:

IMMUNOMEDICS INC. REGISTERED SHARES DL -,01 (872983)

Was hälst du von der Firma bzw. dem Kursverlauf?

Gruß

af

IMMUNOMEDICS INC. REGISTERED SHARES DL -,01 (872983)

Was hälst du von der Firma bzw. dem Kursverlauf?

Gruß

af

Antwort auf Beitrag Nr.: 38.679.580 von ipollit am 06.01.10 22:31:19heute war MOLOGEN + 11,5 %!

Antwort auf Beitrag Nr.: 38.679.580 von ipollit am 06.01.10 22:31:19sofern TLR 9 behandlungsansatz weiter gute ergebnisse zeigt, dann wird es noch ganz andere unternehmensbewertungen geben.

bei TLR 9 ist mologen international erste liga.

zulassungsrelevate phase II beim metas. darmkrebs nach der erstmaligen chemotheraoie soll in 1/2010 beginnen und bereits in 4/2010 soll erste zwischenauswertung erfolgen.

bei TLR 9 ist mologen international erste liga.

zulassungsrelevate phase II beim metas. darmkrebs nach der erstmaligen chemotheraoie soll in 1/2010 beginnen und bereits in 4/2010 soll erste zwischenauswertung erfolgen.

Antwort auf Beitrag Nr.: 38.712.750 von pokemon am 11.01.10 21:45:28dann Glückwunsch! Trotzdem ist es mir so zu unsicher... vielleicht schaue ich sie mir in ein paar Jahren an.

mfg ipollit

mfg ipollit

Antwort auf Beitrag Nr.: 38.712.207 von againstfotsch am 11.01.10 20:52:29mit IMMU kenne ich mich nicht aus, sorry... waren mir nur die Tage aufgefallen, weil es einen größeren Kurssprung gab. Ich weiß nicht recht, ob er gerechtfertigt ist... scheinen etwas vom HGSI-Hype zu profitieren, weil sie auch ein Medikament gegen Lupus in der Pipeline haben. Was mir zum Beispiel nicht gefiel, war der geringe Cash, falls das auf yahoo korrekt ist: 20 Mio USD sind nicht allzu viel. Eine MK von 300 Mio USD ist da auch nicht gerade wenig. Aber wie gesagt, kenne ich mich mit denen nicht aus und kann es somit nicht wirklich einschätzen.

mfg ipollit

mfg ipollit

zu ALTH...

JPM - Allos Therapeutics: Optionality Lies to the Upside Ahead of Folotyn Lung Data; Initiating at Overweight

We are initiating coverage of Allos Therapeutics (NASDAQ: ALTH) with an Overweight rating and a $10 Price Target. We see favorable risk-reward in ALTH shares given mitigated downside risk from one FDA approved indication (PTCL) for key value driver Folotyn, and clear upside potential from Folotyn label-expansion opportunities. The key near-term clinical catalyst is phase 2b data expected in 2nd/3rd-line non-small cell lung cancer (NSCLC) 1H10, which could reveal a sizable NSCLC opportunity but also demonstrate activity in solid tumors. With a valuation that seems anchored on PTCL only, we are Overweight given several free call options in the pipeline.

Folotyn a lower risk asset that could cross the liquid/solid tumor divide. Folotyn is approved in PTCL, a niche market within hematological cancers and could gain compendia listing near term in cutaneous T cell lymphoma (CTCL). However, its mechanism of action is validated in solid tumors as well, and we are focused on the NSCLC data 1H10e given early signs of activity and strong comps vs. Alimta.

PTCL supports valuation. The initial FDA approval is in PTCL, a niche indication of ~5-10k addressable patients. We believe the peak sales opportunity is $500M in PTCL, which in our view, easily supports the current valuation. Concern over potential competition is not a deal breaker, and could assist in expanding the PTCL market.

CTCL up next, but lung cancer the key driver. Folotyn could become compendia-listed by 1H10e in CTCL, a niche indication. However, the real upside near-term driver in our view is the phase 2b data vs. Tarceva in 2nd-/3rd-line NSCLC, which, as we see it, could add $4-5 per share in NPV, assuming activity implies sales in NSCLC and other solid tumors.

Several catalysts in 2010. While we view 1H10e NSCLC data as the key catalyst in 2010, there are other catalysts expected throughout the year. Compendia listing for Folotyn in CTCL could come in 1H10e, while 2H10e data readouts for Folotyn in NHL and CTCL could drive additional upside.

Valuation attractive. Our Dec 2010 PT is $10 (implying 49% upside potential), which is based on a probability-adjusted NPV analysis of the three commercial scenarios for Folotyn. With a risk/reward profile that we view as attractive and not reflected in current levels, we rate ALTH shares Overweight, especially when considering the scarcity value of approved products that are owned exclusively in all indications

mfg ipollit

JPM - Allos Therapeutics: Optionality Lies to the Upside Ahead of Folotyn Lung Data; Initiating at Overweight

We are initiating coverage of Allos Therapeutics (NASDAQ: ALTH) with an Overweight rating and a $10 Price Target. We see favorable risk-reward in ALTH shares given mitigated downside risk from one FDA approved indication (PTCL) for key value driver Folotyn, and clear upside potential from Folotyn label-expansion opportunities. The key near-term clinical catalyst is phase 2b data expected in 2nd/3rd-line non-small cell lung cancer (NSCLC) 1H10, which could reveal a sizable NSCLC opportunity but also demonstrate activity in solid tumors. With a valuation that seems anchored on PTCL only, we are Overweight given several free call options in the pipeline.

Folotyn a lower risk asset that could cross the liquid/solid tumor divide. Folotyn is approved in PTCL, a niche market within hematological cancers and could gain compendia listing near term in cutaneous T cell lymphoma (CTCL). However, its mechanism of action is validated in solid tumors as well, and we are focused on the NSCLC data 1H10e given early signs of activity and strong comps vs. Alimta.

PTCL supports valuation. The initial FDA approval is in PTCL, a niche indication of ~5-10k addressable patients. We believe the peak sales opportunity is $500M in PTCL, which in our view, easily supports the current valuation. Concern over potential competition is not a deal breaker, and could assist in expanding the PTCL market.

CTCL up next, but lung cancer the key driver. Folotyn could become compendia-listed by 1H10e in CTCL, a niche indication. However, the real upside near-term driver in our view is the phase 2b data vs. Tarceva in 2nd-/3rd-line NSCLC, which, as we see it, could add $4-5 per share in NPV, assuming activity implies sales in NSCLC and other solid tumors.

Several catalysts in 2010. While we view 1H10e NSCLC data as the key catalyst in 2010, there are other catalysts expected throughout the year. Compendia listing for Folotyn in CTCL could come in 1H10e, while 2H10e data readouts for Folotyn in NHL and CTCL could drive additional upside.

Valuation attractive. Our Dec 2010 PT is $10 (implying 49% upside potential), which is based on a probability-adjusted NPV analysis of the three commercial scenarios for Folotyn. With a risk/reward profile that we view as attractive and not reflected in current levels, we rate ALTH shares Overweight, especially when considering the scarcity value of approved products that are owned exclusively in all indications

mfg ipollit

zu VPHM... Cinryze entwickelt sich ganz gut

ViroPharma Provides 2010 Cinryze(TM) (C1 Esterase Inhibitor [Human]) Outlook

http://finance.yahoo.com/news/ViroPharma-Provides-2010-prnew…

- Company Also Provides Update to U.S. Hereditary Angioedema (HAE) Peak Year Sales Estimates -

EXTON, Pa., Jan. 11 /PRNewswire/ -- ViroPharma Incorporated (Nasdaq: VPHM) today announced that Vincent Milano, president and chief executive officer of ViroPharma, will provide an overview of the company's business and present a financial update during the 28th Annual J.P. Morgan Healthcare Conference. As previously announced, this presentation will be webcast live at 11:00 A.M. ET (8:00 A.M. PT) on Wednesday, January 13, 2010 and may be accessed via the company's website at www.viropharma.com . The company expects to release full-year 2009 financial results and further discuss 2010 guidance later in the first quarter of 2010.

"The ultimate reward for us in any given year is to achieve our goal of providing solutions for patients with serious diseases and unmet medical needs; 2009 was a remarkable year in that respect," stated Vincent Milano, ViroPharma's chief executive officer. "In 2009 we successfully launched Cinryze™ (C1 esterase inhibitor [human]), the first and only drug approved to prevent HAE attacks. Thanks to meticulous execution by our team, we were able to provide Cinryze during 2009 to over 400 patients who are now actively preventing their attacks. We are pleased to announce that for 2009, we expect our net Cinryze sales will be toward the high end of our previous guidance range of $90 to $95 million, placing Cinryze among the best ever launches of an ultra orphan drug product."

Milano continued, "Our momentum into 2010 is also strong, as we announced this morning an agreement with our partner, Sanquin for the global rights to market and develop Cinryze, and as we continue our execution on our manufacturing scale up efforts to serve HAE patients including the hundreds who are now enrolled in CinryzeSolutions™. We are now producing Cinryze through our scaled-up parallel chromatography process, or PCP, which will begin to enter the trade in the second quarter of this year. Further, we recently conducted a successful meeting with the FDA on our industrial scale initiative where we were able to confirm our previous expectations of the path forward for this significantly expanded manufacturing process. As a result, we are announcing 2010 Cinryze net sales guidance of between $145 and $165 million, which represents tremendous revenue growth over 2009. Although we anticipate that we will be profitable in 2010, we will provide our full guidance later in the first quarter of this year. Finally, I am pleased to announce we have increased our projection of U.S. HAE peak year Cinryze sales to between $350 and $450 million. Our objective continues to be to ensure that every patient who can benefit from Cinryze will have access to this important drug."

***********

ViroPharma expands licensing deal for angioedema drug Cinryze

http://philadelphia.bizjournals.com/philadelphia/stories/201…

ViroPharma Inc. said Monday it has expanded it global licensing deal for Cinryze with Sanquin Blood Supply Foundation in the Netherlands.

The Exton, Pa., specialty pharmaceutical company said the revised agreement “significantly expands ViroPharma's rights to commercialize Cinryze in regions beyond the originally licensed territories of North America, most of the countries in South America, and Israel, and allows for development of potential new indications.”

In October 2008, the Food and Drug Administration approved the use of Cinryze to prevent against angioedema attacks in adolescent and adult patients with hereditary angioedema or HAE. HAE is a rare, severely debilitating, and life-threatening genetic disorder caused by a deficiency of C1 inhibitor, a human plasma protein. The drug is only approved in the United States.

“We have developed an outstanding relationship with Sanquin during the first year of the launch of Cinryze in the United States, and the expansion of our collaboration represents a significant step in our combined efforts to expand the potential markets in which we may commercialize Cinryze,” said Vincent Milano, ViroPharma's president and CEO.

Milano said ViroPharma (NASDAQ:VPHM) will look to getting Cinryze approved in new territories and for other C1-mediated diseases. The company also plans to develop new forms of administration for the drug, which is now delivered intravenously.

Under the terms of the expanded deal, which involved no upfront payments, ViroPharma agreed to modify the existing manufacturing fee, establish minimum purchase requirements, fund research efforts at Sanquin at the rate of 1 million Euros ($1.45 million) a year for five years, and provide an additional loan to Sanquin to fund capacity expansions.

ViroPharma has been granted the exclusive right and license to research, develop, obtain regulatory approvals for and commercialize Cinryze in all countries in Europe and the rest of world, other than certain European and other territories in which Sanquin has existing relationships. ViroPharma also has been granted the right to develop Cinryze for all potential new indications.

mfg ipollit

ViroPharma Provides 2010 Cinryze(TM) (C1 Esterase Inhibitor [Human]) Outlook

http://finance.yahoo.com/news/ViroPharma-Provides-2010-prnew…

- Company Also Provides Update to U.S. Hereditary Angioedema (HAE) Peak Year Sales Estimates -

EXTON, Pa., Jan. 11 /PRNewswire/ -- ViroPharma Incorporated (Nasdaq: VPHM) today announced that Vincent Milano, president and chief executive officer of ViroPharma, will provide an overview of the company's business and present a financial update during the 28th Annual J.P. Morgan Healthcare Conference. As previously announced, this presentation will be webcast live at 11:00 A.M. ET (8:00 A.M. PT) on Wednesday, January 13, 2010 and may be accessed via the company's website at www.viropharma.com . The company expects to release full-year 2009 financial results and further discuss 2010 guidance later in the first quarter of 2010.

"The ultimate reward for us in any given year is to achieve our goal of providing solutions for patients with serious diseases and unmet medical needs; 2009 was a remarkable year in that respect," stated Vincent Milano, ViroPharma's chief executive officer. "In 2009 we successfully launched Cinryze™ (C1 esterase inhibitor [human]), the first and only drug approved to prevent HAE attacks. Thanks to meticulous execution by our team, we were able to provide Cinryze during 2009 to over 400 patients who are now actively preventing their attacks. We are pleased to announce that for 2009, we expect our net Cinryze sales will be toward the high end of our previous guidance range of $90 to $95 million, placing Cinryze among the best ever launches of an ultra orphan drug product."

Milano continued, "Our momentum into 2010 is also strong, as we announced this morning an agreement with our partner, Sanquin for the global rights to market and develop Cinryze, and as we continue our execution on our manufacturing scale up efforts to serve HAE patients including the hundreds who are now enrolled in CinryzeSolutions™. We are now producing Cinryze through our scaled-up parallel chromatography process, or PCP, which will begin to enter the trade in the second quarter of this year. Further, we recently conducted a successful meeting with the FDA on our industrial scale initiative where we were able to confirm our previous expectations of the path forward for this significantly expanded manufacturing process. As a result, we are announcing 2010 Cinryze net sales guidance of between $145 and $165 million, which represents tremendous revenue growth over 2009. Although we anticipate that we will be profitable in 2010, we will provide our full guidance later in the first quarter of this year. Finally, I am pleased to announce we have increased our projection of U.S. HAE peak year Cinryze sales to between $350 and $450 million. Our objective continues to be to ensure that every patient who can benefit from Cinryze will have access to this important drug."

***********

ViroPharma expands licensing deal for angioedema drug Cinryze

http://philadelphia.bizjournals.com/philadelphia/stories/201…

ViroPharma Inc. said Monday it has expanded it global licensing deal for Cinryze with Sanquin Blood Supply Foundation in the Netherlands.

The Exton, Pa., specialty pharmaceutical company said the revised agreement “significantly expands ViroPharma's rights to commercialize Cinryze in regions beyond the originally licensed territories of North America, most of the countries in South America, and Israel, and allows for development of potential new indications.”

In October 2008, the Food and Drug Administration approved the use of Cinryze to prevent against angioedema attacks in adolescent and adult patients with hereditary angioedema or HAE. HAE is a rare, severely debilitating, and life-threatening genetic disorder caused by a deficiency of C1 inhibitor, a human plasma protein. The drug is only approved in the United States.

“We have developed an outstanding relationship with Sanquin during the first year of the launch of Cinryze in the United States, and the expansion of our collaboration represents a significant step in our combined efforts to expand the potential markets in which we may commercialize Cinryze,” said Vincent Milano, ViroPharma's president and CEO.

Milano said ViroPharma (NASDAQ:VPHM) will look to getting Cinryze approved in new territories and for other C1-mediated diseases. The company also plans to develop new forms of administration for the drug, which is now delivered intravenously.

Under the terms of the expanded deal, which involved no upfront payments, ViroPharma agreed to modify the existing manufacturing fee, establish minimum purchase requirements, fund research efforts at Sanquin at the rate of 1 million Euros ($1.45 million) a year for five years, and provide an additional loan to Sanquin to fund capacity expansions.

ViroPharma has been granted the exclusive right and license to research, develop, obtain regulatory approvals for and commercialize Cinryze in all countries in Europe and the rest of world, other than certain European and other territories in which Sanquin has existing relationships. ViroPharma also has been granted the right to develop Cinryze for all potential new indications.

mfg ipollit

zu ONXX...

http://www.thestreet.com/_yahoo/story/10658357/1/more-biotec…

More Biotech Nuggets From the J.P. Morgan Confab

China was a big topic at the Onyx Pharmaceuticals(ONXX Quote) breakout session. Specifically, investors are anxious for some visibility into the Chinese government's plan to reimburse for targeted cancer drugs, which would include Onyx's liver cancer drug Nexavar.

China represents an enormous commercial market opportunity for Nexavar, since about half of the 600,000 liver cancer deaths worldwide occur there. Nexavar is approved in China today but patients have to pay out of pocket for the drug. Sales in China could rocket, however, if the Chinese government decides to pay for the drug.

Onyx executives said the company expects the Chinese government to hold meetings with cancer drug companies over the next year as part of the decision-making process for reimbursement.

Meantime, Onyx expects to report results from the phase III "Nexus" study of Nexavar in non-small cell lung cancer sometime in 2010. A previous phase III study in lung cancer failed, but Onyx has increased the number of patients in the current trial and is using a different chemotherapy backbone, which may help yield more positive results.

mfg ipollit

http://www.thestreet.com/_yahoo/story/10658357/1/more-biotec…

More Biotech Nuggets From the J.P. Morgan Confab

China was a big topic at the Onyx Pharmaceuticals(ONXX Quote) breakout session. Specifically, investors are anxious for some visibility into the Chinese government's plan to reimburse for targeted cancer drugs, which would include Onyx's liver cancer drug Nexavar.

China represents an enormous commercial market opportunity for Nexavar, since about half of the 600,000 liver cancer deaths worldwide occur there. Nexavar is approved in China today but patients have to pay out of pocket for the drug. Sales in China could rocket, however, if the Chinese government decides to pay for the drug.

Onyx executives said the company expects the Chinese government to hold meetings with cancer drug companies over the next year as part of the decision-making process for reimbursement.

Meantime, Onyx expects to report results from the phase III "Nexus" study of Nexavar in non-small cell lung cancer sometime in 2010. A previous phase III study in lung cancer failed, but Onyx has increased the number of patients in the current trial and is using a different chemotherapy backbone, which may help yield more positive results.

mfg ipollit

Antwort auf Beitrag Nr.: 38.713.802 von ipollit am 12.01.10 00:24:15Hallo ipollit,

habe noch eine Frage an dich:

Was hälst du von Affymetrix?

Affymetrix underweight

13.01.2010 - 16:55

Rating-Update:

London (aktiencheck.de AG) - Die Analysten von Barclays Capital stufen die Aktie von Affymetrix (ISIN US00826T1088/ WKN 901198) von "equal weight" auf "underweight" herab. Das Kursziel werde von 6 USD auf 3 USD reduziert. (13.01.2010/ac/a/u)Analyse-Datum: 13.01.2010

Quelle: Finanzen.net

3$ halte ich für untertrieben, was meinst du?

Gruß

af

habe noch eine Frage an dich:

Was hälst du von Affymetrix?

Affymetrix underweight

13.01.2010 - 16:55

Rating-Update:

London (aktiencheck.de AG) - Die Analysten von Barclays Capital stufen die Aktie von Affymetrix (ISIN US00826T1088/ WKN 901198) von "equal weight" auf "underweight" herab. Das Kursziel werde von 6 USD auf 3 USD reduziert. (13.01.2010/ac/a/u)Analyse-Datum: 13.01.2010

Quelle: Finanzen.net

3$ halte ich für untertrieben, was meinst du?

Gruß

af

Antwort auf Beitrag Nr.: 38.689.434 von ipollit am 08.01.10 00:00:58hi ipollit,

ich verstehe nicht ganz, eine morphosys findest du ok, hast sie aber wie's scheint nicht im depot? bitte kurz um aufklärung.

ansonsten halte ich von SGEN und EXEL sehr viel und habe dementsprechend einiges davon.

diese NGSX muss ich mir mal anschaun - klingt interessant.

lg

pf2

ich verstehe nicht ganz, eine morphosys findest du ok, hast sie aber wie's scheint nicht im depot? bitte kurz um aufklärung.

ansonsten halte ich von SGEN und EXEL sehr viel und habe dementsprechend einiges davon.

diese NGSX muss ich mir mal anschaun - klingt interessant.

lg

pf2

@SL

nochmal zu dieser NGSX: in der aktuell in EU und USA zugelassenen indikation dürfte das marktpotenzial doch recht beschränkt sein, oder?!

wann folgen hier weitere indikationsgebiete?

nochmal zu dieser NGSX: in der aktuell in EU und USA zugelassenen indikation dürfte das marktpotenzial doch recht beschränkt sein, oder?!

wann folgen hier weitere indikationsgebiete?

Antwort auf Beitrag Nr.: 38.729.096 von againstfotsch am 13.01.10 17:44:01sorry, ich kenne Affymetrix nicht näher... da sie eher Systeme verkaufen, also weniger klassischer Biotech als mehr Gerätehersteller, sind sie nicht ganz so interessant für mich.

Nur weil irgendwelche Analysten ein Kursziel ausgeben, muss das noch lange nichts bedeuten. Der Kurs ist nachwievor über 6 USD... also keine Auswirkung. Interessant wäre höchstens deren Grund für die Abstufung.

mfg ipollit

Nur weil irgendwelche Analysten ein Kursziel ausgeben, muss das noch lange nichts bedeuten. Der Kurs ist nachwievor über 6 USD... also keine Auswirkung. Interessant wäre höchstens deren Grund für die Abstufung.

mfg ipollit

Antwort auf Beitrag Nr.: 38.731.676 von PathFinder2 am 13.01.10 22:21:12Ich finde, dass Morphoys auch international Beachtung finden kann, da sie recht breit aufgestellt sind und diese klassische AK-Technolgie besitzen, während mehrere Konkurrenten ja schon aufgekauft worden sind. Ich finde die Kooperation mit Novartis interessant und vielversprechend. Die Partner-Pipeline macht langsam Fortschritte und auch aus der eigenen Pipeline könnte etwas werden. Im Depot habe ich sie allerdings nicht... da warte ich noch etwas, bis es mit der Pipeline deutlich Richtung PIII geht. Die MK liegt ja, wenn ich das richtig sehe bereits über 500 Mio USD. Wäre z.B. eine Kursverdopplung d.h. eine MK von mehr als 1 Mrd USD angemessen für ein Unternehmen, dass zwar eine breite Pipeline hat, aber noch weit von möglichen Marktzulassungen entfernt ist? Ich denke, dass MOR im Moment gut bewertet ist... also warte ich erst einmal ab. Stattdessen habe ich bezügl. AK-Technologie z.B. REGN... die haben mehrere eigene PIIIs und eine deutlich bessere AK-Allianz mit Sanofi.

mfg ipollit

mfg ipollit

Antwort auf Beitrag Nr.: 38.747.915 von PathFinder2 am 15.01.10 19:05:13zu NGSX...

so schlecht ist die zugelassene Indikation PHN nicht, zumal HIV und PDN offlabel Umsätze einbringen können, auch wenn noch keine Zulassung dafür vorliegt.

Die aktuelle Zulassung+Offlabel soll so ca. 350+ Mio USD peak sales weltweit einbringen, was ja für ein Unternehmen mit einer MK von etwas über 100 Mio USD nicht wenig ist, auch wenn es teilweise nur Royalties usw sind.

http://www.europharmatoday.com/2009/06/neurogesx-brings-aste…

June 25, 2009

NeurogesX Brings Astellas On Board To Launch Pain Patch in Europe

A deal with Astellas to market and distribute the neuropathic pain patch Qutenza in Europe will bolster NeurogesX's cash position, giving the company some breathing room to prepare for regulatory approval and a 2010 launch in the U.S. market.

Qutenza was approved for neuropathic pain in non-diabetic patients by the European Medicines Agency in May and it is pending review at the FDA, with an Aug. 16 user fee date.

NeurogesX is set to get €30 million ($42 million) upfront for Qutenza commercialization rights from the European subsidiary of Japanese drug maker Astellas, according to a deal announced on June 22. In addition to 27 countries in the European Union, the deal covers Iceland, Switzerland, and some countries in the Middle East and Africa. The product will be launched in Europe by the first half of 2010.

Qutenza is a dermal patch packing a high concentration form of synthetic capsaicin (also called trans-capsaicin), which is the substance found in chili peppers. Capsaicin stimulates transient vanilloid 1 receptors in the skin, which in turn subdue overactive pain receptors. The effects are long-lasting, but also reversible, the company says.

As part of the agreement, Astellas also will pay €5 million upfront ($7 million) for a co-development and commercialization option on NGX-1998, a Phase I liquid formulation of the NeurogesX product.

NeurogesX now is eligible for €70 million ($97 million) in sales-based milestone payments and additional option payments for the liquid formulation. Royalty rates start in the high teens and escalate into the mid-20s, the company said during a June 22 investors' call.

Deal gives financial peace of mind

NeurogesX had about $19 million in cash and marketable securities at the close of the first quarter, enough to carry it through 2009, but insufficient to give the company much comfort in making plans for breaking into the U.S. market.

During the call, Chief Financial Officer Stephen Giglieri declined to provide runway guidance, which he says is likely to come in the company's second-quarter earnings report.

"The reason I am hesitant to do that [now] is we will be looking at our development plans and of course that has an impact on our cash runway," he said. "But obviously, putting $49 million into the bank is going to extend our runway fairly significantly."