RIESIG - kanad. AMC plant in 2010 ein Bohrprogramm von 80.000 m !!!! - 500 Beiträge pro Seite

eröffnet am 12.02.10 17:49:31 von

neuester Beitrag 25.01.12 11:28:14 von

neuester Beitrag 25.01.12 11:28:14 von

Beiträge: 42

ID: 1.155.935

ID: 1.155.935

Aufrufe heute: 0

Gesamt: 3.178

Gesamt: 3.178

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 26 Minuten | 3643 | |

| vor 14 Minuten | 3574 | |

| vor 8 Minuten | 2643 | |

| heute 10:01 | 2215 | |

| vor 13 Minuten | 1465 | |

| vor 4 Minuten | 1214 | |

| vor 1 Stunde | 1136 | |

| vor 5 Minuten | 901 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.044,87 | +0,61 | 189 | |||

| 2. | 2. | 133,68 | +0,32 | 126 | |||

| 3. | 3. | 2.302,38 | -1,07 | 86 | |||

| 4. | 19. | 0,2040 | +12,09 | 73 | |||

| 5. | 4. | 6,8940 | -0,06 | 57 | |||

| 6. | 9. | 44,80 | -0,88 | 48 | |||

| 7. | 5. | 685,20 | +1,72 | 40 | |||

| 8. | 8. | 2,3505 | +0,75 | 30 |

...hier die meldung dazu, die wohl noch gar nicht so recht

bei den investoren ´aufgeschlagen´ ist.........

Alexis' 2010 Objectives: Growth in Gold Production and Resources to Enhance Shareholder Value

- Alexis mined 34,872 ounces Gold in 2009, currently has 7400 oz. in stockpile - Garson Merger completed, more than doubles resources - Aurbel Gold Mill refurbishment completed: start-up in February - Snow Lake Mine NI 43-101 studies advancing on schedule - Lac Pelletier Mine - Bulk Sample Program Progressing - Surface Exploration Programs testing high potential targets

8:30 AM ET, February 9, 2010

TORONTO, ONTARIO, Feb 9, 2010 (Marketwire via COMTEX) -- ALEXIS MINERALS CORPORATION (AMC) ("Alexis" or the "Company") is pleased to provide an update and overview on progress and growth plans through 2010 and 2011 to enhance shareholder value with the objective of achieving the status of a 'mid-tier gold producer'. Alexis will focus on advancing its key new projects, the Lac Pelletier Mine and the Snow Lake Mine, while also advancing exploration for new mines across its highly prospective land packages in three Mining Camps, Val d'Or and Rouyn-Noranda, both in Quebec, and Snow Lake, Manitoba.

- Alexis mined 34,872 ounces Gold in 2009, currently has 7,400 oz. in stockpile

The Lac Herbin Mine in Val d'Or mined 32,998 ounces gold during 2009 of which 3,400 ounces were in stockpile at year end. Production in 2010 is expected to be a further 35,000 ounces as the mine settles into its five year life of mine plan. An additional 1,874 ounces were mined at the Lac Pelletier project as part of an underground exploration and bulk sampling program (see 'Lac Pelletier Mine' - below). Surface stockpiles at Lac Herbin and Lac Pelletier currently contain an estimated 7,400 ounces gold.

Year End Resources and Reserves at Lac Herbin are currently being reviewed, with exploration during 2009 projected to have achieved its annual objective of successfully replacing mined reserves. Additional details will be released with Annual and Q4- reporting in March 2010.

- Aurbel Gold Mill Refurbishment Completed: Start-Up in February

Refurbishment of the Aurbel Gold Mill advanced to completion in January, on budget and on schedule. All required personnel are hired and undergoing Health and Safety training and orientation. The mill is expected to commence processing ore in February upon receipt of the final operating permit from the Quebec Provincial Government. Due to the large current ore stockpile, custom milling of Herbin ore commenced on January 28th 2010 at a nearby custom mill. Alexis anticipates milling all remaining stockpiles with ongoing run-of-mine production before the end of the second quarter.

- Garson Merger Completed, more than doubling resources

Alexis Minerals has successfully acquired over 95% of the outstanding shares of Garson Gold Corporation and has terminated its recent share purchase offer. Alexis is proceeding with action to convert the remaining outstanding shares of Garson Gold Corporation.

The acquisition has more than doubled total resources in both the Measured and Indicated, as well as Inferred, categories (See Press Release: January 22, 2010). Alexis will rename the New Britannia Mine and will henceforth refer to the mine as the "Snow Lake Mine".

- Snow Lake Mine NI 43-101 studies advancing on schedule

A NI 43-101 Preliminary Economic Assessment (PEA) will be completed in Q1 on the principal resources of the Snow Lake Mine Property in Snow Lake, Manitoba. An Independent NI 43-101 Feasibility Study will continue thereafter and be complete by the end of June 2010. Resource updates and mine planning are currently well advanced and the project remains on schedule.

- Lac Pelletier Mine - Bulk Sample Program Progressing

The Lac Pelletier underground program was designed to confirm the resource model and obtain an initial 40,000 tonnes bulk sample from Zone 4 of the Lac Pelletier Mine in Rouyn-Noranda, Quebec. The program has advanced with the dewatering of 1,001 metres of ramp, 1,522 metres of drifting and raising generating 19,057 tonnes of mineralized material, and milling of an initial 9,627 tonnes in 2009. A total of 5,617 metres of definition diamond drilling have been completed. A second egress was also completed during the program to comply with stricter safety regulations.

The first 9,627 tonnes of the bulk sample were milled in December, 2009. A total of 1,175 ounces were recovered from this sample at an average recovery of 96.2%. Approximately 4,200 tonnes, over 43.5% of the sample, originated from access drifts developed outside of the mine reserve ore-blocks, an unexpected bonus during the program. Access drifts required for equipment to reach mineralized veins are wider than future stopes and dilution was therefore higher than the mine plan in this initial sample. An additional 9,800 tonnes grading 4.1g.Au/t are currently stockpiled at surface awaiting milling.

To date the program has revealed that vein geometry in Zone 4 is different than previously interpreted from surface drilling. Gold-bearing veins are represented by a fish-net pattern of shear related veins, individually up to 100 meters long and 80 metres down dip. Veins dip more steeply than anticipated. New gold bearing veins have been identified within this pattern and within the A shear. Zone 3, the focus of historical exploration in 1992, is located solely within the B shear along the northern limit of the mineralized area. Developments in the program are considered encouraging:

- Steeper veins should provide for cheaper long hole mining and a significant reduction in room and pillar mining proposed in the original pre-feasibility work (see Press Release: July 16, 2009).

- The increased dip and number of veins has potential to increase resources within the zone.

- "Non-resource block" mineralization encountered in access drifts provides the potential to place future mine access development within mineralization. This could significantly decrease the cost of capital for further development of the mine (formerly waste development).

Alexis will complete additional drifting, raising and diamond drilling to further define the geometry of Zone 4 shear veins, to model Resources and to design infrastructure and stoping sequence. The extended program should generate a further 7,000 tonnes from initial stoping. The program extension will take an additional 3 months with work to be completed in May 2010.

- Surface Exploration Programs test high potential targets

Alexis will undertake a budgeted program of exploration during 2010 of $5 million in the Val d'Or - Rouyn-Noranda area of Quebec and $5 million in the Snow Lake area of Manitoba. Surface exploration drilling is expected to exceed 80,000 metres during 2010.

Programs are focused on discovery and initial programs in 2010 will test for:

- Extensions of the Snow Lake Mine and 3 Zone, Manitoba

There is very limited historical exploration on strike of the known deposits. Drilling will test for near-surface extensions of these deposits to the East of the Snow Lake Mine (previously New Britannia Mine), and both East and West of the 3 Zone deposit. Additional drilling will target extensions to known Resource areas.

- Herbin West and NEF Gold Zones, Aurbel Property, Val d'Or

Exploration of the 100 sq.km Aurbel property, surrounding the Lac Herbin Mine and Aurbel Gold Mill was successful in 2009 in identifying two specific target areas that demonstrate strong similarities to initial exploration results at the Lac Herbin Deposit. The Herbin West and NEF showings will be tested through additional surface drilling. Additional showings and targets across the property will also be explored.

- Deep West and Manitou-Barvue VMS targets

Exploration drilling has resumed with one drill in the central area of the Val d'Or Camp, known for its polymetallic Volcanogenic Massive Sulphide (VMS) deposits. Alexis has advanced significant recompilation of this area after the discovery of the Deep West Zone in October 2008. Initially, two additional holes will be completed to test for down-plunge extensions to the Manitou-Barvue deposit and one hole will test the Deep West Zone, up-plunge of the original discovery. Compilation in 2009 has confirmed that this polymetallic massive sulphide zone lies within a major fold and its extension projects to the south-west and towards surface, into areas with extremely limited prior exploration.

The technical and scientific content of this press release has been reviewed by David Rigg, P.Geo., and Keith Boyle, P. Eng. Qualified Persons as defined under NI 43-101 guidelines. Individual programs are supervised by the following QP's: Lac Herbin: Jean Bastien Ing., Manager; Lac Pelletier: Pascal Hamelin Ing., P.Eng. Manager, and Martin Perron, Eng., Geology Superintendent; and in Snow Lake: J. Lavigne, P.Geol., VP Exploration. The Qualified People have reviewed and authorized the content of this news release.

About Alexis Minerals

Alexis Minerals Corporation is a Canadian mining company listed on the Toronto Stock Exchange (symbol "AMC"). The Company owns one producing gold mine in Val d'Or and the right to earn a 100% interest in the Lac Pelletier gold property in Rouyn-Noranda where an underground bulk sampling and exploration program is ongoing. Alexis undertakes exploration in the mineral rich Val d'Or (100% ownership of 212 sq. km. and Rouyn-Noranda Mining Camps (50% ownership of 785 sq. km and in joint venture with Xstrata Copper). A third project area is located in the very prospective Snow Lake Mining Camp in Manitoba where Alexis will complete a feasibility study of the Snow Lake (formerly the New Britannia Mine) in 2010 as well as exploration across the properties. Alexis currently has four surface drills active in exploration.

Further information about Alexis Minerals can be found at its website: www.alexisminerals.com.

Forward looking information.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the future financial or operating performance of Alexis and its projects, the identification of mineral reserves and resources, costs of and capital for exploration projects, exploration expenditures, timing of future exploration, requirements for additional capital, government regulation of mining operations, environmental risks, reclamation expenses, title disputes or claims, limitations of insurance coverage and the timing and possible outcome of pending litigation and regulatory matters. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the annual information form of the Company. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Alexis Minerals Corporation

Alexis Minerals Corporation

David Rigg

President and CEO

(416) 861-5889

(416) 861-8165 (FAX)

info@alexisminerals.com

Alexis Minerals Corporation

Bruce Barch

VP Investor & Corporate Affairs

(416) 861-5905

bruce.barch@alexisminerals.ca

Alexis Minerals Corporation

Louis Baribeau

Relationniste

(514) 667-2304

lb@decorporateconsultants.ca

www.alexisminerals.com

Copyright (C) 2010 Marketwire. All rights reserved.

http://cxa.marketwatch.com/TSX/en/Market/article.aspx?guid=h…

...denke mal, hier werden wir uns alsbald auf gaaaaanz andrem

level wiederfinden

...na, dann schaumermal..........

RT...cad 0,39

RT...cad 0,39

...wie reizvoll grad akt. ein zustieg ist, kann

man am ehrgeizigen vorhaben ermessen, schon bald GOLD-

produzent von jährlich 150.000 oz. werden zu wollen.....

Alexis Targets 150,000 oz. Annual Gold Production

as Resources More Than Double with Garson Gold Acquisition

TORONTO, ONTARIO – January 22, 2010 – ALEXIS MINERALS CORPORATION (AMC: TSX) ("Alexis" or the “Company") announces that its successful acquisition of Garson Gold Corp. (“Garson”) creates a significantly enhanced gold resource base for Alexis, more than doubling the amount prior to the acquisition. Measured and Indicated Resources now exceed 865,000 ounces of gold (108% increase) and Inferred Resources are 479,000 ounces of gold (195% increase). Alexis will focus on the potential to develop production into 2011 with the expectation of reaching mid-tier gold production levels exceeding 150,000 ounces of gold per year, which forecasts are subject to completion of positive feasibility studies.

http://www.alexisminerals.com/docs08/pdfs/2010%2001%2022%20D…

man am ehrgeizigen vorhaben ermessen, schon bald GOLD-

produzent von jährlich 150.000 oz. werden zu wollen.....

Alexis Targets 150,000 oz. Annual Gold Production

as Resources More Than Double with Garson Gold Acquisition

TORONTO, ONTARIO – January 22, 2010 – ALEXIS MINERALS CORPORATION (AMC: TSX) ("Alexis" or the “Company") announces that its successful acquisition of Garson Gold Corp. (“Garson”) creates a significantly enhanced gold resource base for Alexis, more than doubling the amount prior to the acquisition. Measured and Indicated Resources now exceed 865,000 ounces of gold (108% increase) and Inferred Resources are 479,000 ounces of gold (195% increase). Alexis will focus on the potential to develop production into 2011 with the expectation of reaching mid-tier gold production levels exceeding 150,000 ounces of gold per year, which forecasts are subject to completion of positive feasibility studies.

http://www.alexisminerals.com/docs08/pdfs/2010%2001%2022%20D…

Antwort auf Beitrag Nr.: 38.936.704 von hbg55 am 12.02.10 18:31:41

....auch die charttechnik sieht ´reizvoll´ aus....bzw. ist

im begriff zu drehen.....IMO

....auch die charttechnik sieht ´reizvoll´ aus....bzw. ist

im begriff zu drehen.....IMO

zum wochenauftakt, sehen wir anziehende GOLD- notierungen....gehts

wieder ueber widerstand bei usd 1100,-

akt.....usd 1095,80

wieder ueber widerstand bei usd 1100,-

akt.....usd 1095,80

...über nachfolg. link gehts zu einer übersichtl.

zusammenfang bzw. perspektiven von AMC.......

http://www.metalsnews.com/Metals+News/MetalsNews/Dr.+Allen+A…

zusammenfang bzw. perspektiven von AMC.......

http://www.metalsnews.com/Metals+News/MetalsNews/Dr.+Allen+A…

Antwort auf Beitrag Nr.: 38.944.320 von hbg55 am 15.02.10 11:25:02

....über ALLLEM steht einer der erfolgreichsten investoren

in kanad. EXPLORER der jüngeren vergangenheit......unter anderm

mit erfolgs- STORYS bei....AVION GOLD und CROCODILE GOLD

........und ALEXIS hat nach vollzogenem merger mit GARSON GOLD hervorragende

aussichten die nächste story zu werden...IMO

aber lest mal selbst..........

Stan Bharti: A Modern Founder and Leader of Successful Emerging Diversified Companies

http://www.metalsnews.com/Metals+News/MetalsNews/Dr.+Allen+M…

....über ALLLEM steht einer der erfolgreichsten investoren

in kanad. EXPLORER der jüngeren vergangenheit......unter anderm

mit erfolgs- STORYS bei....AVION GOLD und CROCODILE GOLD

........und ALEXIS hat nach vollzogenem merger mit GARSON GOLD hervorragende

aussichten die nächste story zu werden...IMO

aber lest mal selbst..........

Stan Bharti: A Modern Founder and Leader of Successful Emerging Diversified Companies

http://www.metalsnews.com/Metals+News/MetalsNews/Dr.+Allen+M…

....HEUTE allerdings, feiertagsbedingt, nur handel

in GER möglich

in GER möglich

Antwort auf Beitrag Nr.: 38.944.079 von hbg55 am 15.02.10 10:44:21

...mit dem heutigen sind wir beim GOLD- preis

zurück bzw. oberhalb von usd 1100,-

.....akt. sogar bei usd 1113,40

...mit dem heutigen sind wir beim GOLD- preis

zurück bzw. oberhalb von usd 1100,-

.....akt. sogar bei usd 1113,40

Antwort auf Beitrag Nr.: 38.948.876 von hbg55 am 16.02.10 09:57:46

mittlerweile stehen wir kurz vor usd 1120,- !!!

drum nicht weiter verwunderlich, daß wir HEUTE auch

ne schöne vol.- zunahme sehen, die den kurs auch

wieder über die 0,40 mitreißen sollte........

Time Ex Price Change Volume Buyer Seller Markers

11:11:11 T 0.39 - 100,000 85 Scotia 7 TD Sec K

11:10:03 T 0.385 -0.005 1,500 85 Scotia 85 Scotia K

11:04:52 T 0.39 - 500 85 Scotia 79 CIBC K

11:04:52 T 0.39 - 98,500 85 Scotia 7 TD Sec K

10:58:19 T 0.39 - 1,000 1 Anonymous 7 TD Sec K

10:57:52 T 0.39 - 4,000 19 Desjardins 7 TD Sec K

10:55:10 T 0.39 - 19,500 80 National Bank 7 TD Sec K

10:49:41 T 0.39 - 8,500 7 TD Sec 7 TD Sec K

10:48:14 T 0.39 - 7,000 7 TD Sec 7 TD Sec K

10:48:14 T 0.39 - 500 79 CIBC 7 TD Sec K

mittlerweile stehen wir kurz vor usd 1120,- !!!

drum nicht weiter verwunderlich, daß wir HEUTE auch

ne schöne vol.- zunahme sehen, die den kurs auch

wieder über die 0,40 mitreißen sollte........

Time Ex Price Change Volume Buyer Seller Markers

11:11:11 T 0.39 - 100,000 85 Scotia 7 TD Sec K

11:10:03 T 0.385 -0.005 1,500 85 Scotia 85 Scotia K

11:04:52 T 0.39 - 500 85 Scotia 79 CIBC K

11:04:52 T 0.39 - 98,500 85 Scotia 7 TD Sec K

10:58:19 T 0.39 - 1,000 1 Anonymous 7 TD Sec K

10:57:52 T 0.39 - 4,000 19 Desjardins 7 TD Sec K

10:55:10 T 0.39 - 19,500 80 National Bank 7 TD Sec K

10:49:41 T 0.39 - 8,500 7 TD Sec 7 TD Sec K

10:48:14 T 0.39 - 7,000 7 TD Sec 7 TD Sec K

10:48:14 T 0.39 - 500 79 CIBC 7 TD Sec K

Alexis Minerals Enhances Investor Awareness and Access-Commences Trading on OTCQX

8:32 AM ET, February 16, 2010

TORONTO, ONTARIO, Feb 16, 2010 (MARKETWIRE via COMTEX) -- ALEXIS MINERALS CORPORATION (AMC)(OTCQX: AXSMF) ("Alexis" or the "Company") is pleased to advise that today it commences trading on the highest tier of the U.S. Over the Counter market ('OTC') - the OTCQX(R), where it will trade under the symbol "AXSMF". This listing enhances the opportunity to increase the awareness and liquidity for Alexis in the United States, the prime global investment market. Alexis gains broad exposure to U.S. institutional and retail investors as it continues to build a global brand in this low-cost, efficient manner.

http://cxa.marketwatch.com/TSX/en/Market/article.aspx?guid=h…

8:32 AM ET, February 16, 2010

TORONTO, ONTARIO, Feb 16, 2010 (MARKETWIRE via COMTEX) -- ALEXIS MINERALS CORPORATION (AMC)(OTCQX: AXSMF) ("Alexis" or the "Company") is pleased to advise that today it commences trading on the highest tier of the U.S. Over the Counter market ('OTC') - the OTCQX(R), where it will trade under the symbol "AXSMF". This listing enhances the opportunity to increase the awareness and liquidity for Alexis in the United States, the prime global investment market. Alexis gains broad exposure to U.S. institutional and retail investors as it continues to build a global brand in this low-cost, efficient manner.

http://cxa.marketwatch.com/TSX/en/Market/article.aspx?guid=h…

February 16, 2010 –

ALEXIS MINERALS CORPORATION (AMC: TSX) ("Alexis" or the “Company") is pleased to advise that today it commences trading on the highest tier of the U.S. Over the Counter market („OTC‟) - the OTCQX®, where it will trade under the symbol “AXSMF”. This listing enhances the opportunity to increase the awareness and liquidity for Alexis in the United States, the prime global investment market. Alexis gains broad exposure to U.S. institutional and retail investors as it continues to build a global brand in this low-cost, efficient manner.

ALEXIS MINERALS CORPORATION (AMC: TSX) ("Alexis" or the “Company") is pleased to advise that today it commences trading on the highest tier of the U.S. Over the Counter market („OTC‟) - the OTCQX®, where it will trade under the symbol “AXSMF”. This listing enhances the opportunity to increase the awareness and liquidity for Alexis in the United States, the prime global investment market. Alexis gains broad exposure to U.S. institutional and retail investors as it continues to build a global brand in this low-cost, efficient manner.

ALEXIS MINERALS CORPORATION (AMC:TSX) ("Alexis" or the “Company") is pleased to announce the discovery of significant gold mineralization in an on-strike extension to the Snow Lake Mine, Manitoba (formerly the New Britannia Mine). Mineralization remains open to the east and down plunge, and may represent the discovery of a major new ore zone, similar to one of two principal ore lenses which broadly characterize the Snow Lake deposit, and from which over 1.4 million ounces of gold have been historically mined.

Die komplette News gibts hier:

http://www.alexisminerals.com/docs08/pdfs/20100217Snow%20Lak…

Die komplette News gibts hier:

http://www.alexisminerals.com/docs08/pdfs/20100217Snow%20Lak…

News: Die Aurbel Gold Mill wird seit 25.02. hochgefahren. Damit will Alexis die Produktionskosten von Lac Herbin um 10% senken.

Die komplette News:

http://www.alexisminerals.com/docs08/pdfs/20100301Aurbel%20R…

Die komplette News:

http://www.alexisminerals.com/docs08/pdfs/20100301Aurbel%20R…

Zur Snow Lake Mine wurden gestern die Ergebnisse einer Vorstudie veröffentlicht. Demnach rechnet Alexis mit Produktionskosten von US$540/oz bei einer jährlichen Produktion von 90000oz.

News Release:

http://www.alexisminerals.com/docs08/pdfs/march8_2010.pdf

News Release:

http://www.alexisminerals.com/docs08/pdfs/march8_2010.pdf

Antwort auf Beitrag Nr.: 39.098.469 von JohnMole am 09.03.10 21:06:00Hallo,,

mmhhh, muss ich mir noch mal anschauen!

Wann soll die Produktion den beginnen?

Gruß

TimLuca

mmhhh, muss ich mir noch mal anschauen!

Wann soll die Produktion den beginnen?

Gruß

TimLuca

Antwort auf Beitrag Nr.: 39.098.506 von TimLuca am 09.03.10 21:10:20Hallo Tim,

jetzt auch an Alexis interessiert? Suchst wohl auch nach einer Alternative zu MMY? So zumindest bin ich auf Alexis aufmerksam geworden.

Zu Deiner Frage: Alexis produziert bereits, die Mine nennt sich "Lac Herbin", dort will man in 2010 etwa 40000oz prodzieren, bei Kosten von ca. 500 US$/oz.

Zudem gibt es ein Projekt "Lac Pelletier", dort ist man gerade mit einem "Probe-Abbau" beschäftigt (Bulk Sample Program), das man im Mai 2010 abschließen will.

Durch die Übernahme von Garson Gold hat man jetzt auch ein drittes aussichtsreiches Projekt, die "Snow Lake Mine". Erste Ergebnisse wurden dazu schon veröffentlicht, eine Feasibility Study soll Ende Juni 2010 fertig sein.

Eine gute und relativ aktuelle Zusammenstellung findest Du hier:

http://www.alexisminerals.com/docs08/pdf/2010_02_09_eng.pdf

Die Informationspolitik ist hier jedenfalls deutlich besser als die Nicht-Informationspolitik bei MMY. Übrigens eine weitere Alternative, die ich gefunden hab: Crocodile Gold

http://www.crocgold.com

jetzt auch an Alexis interessiert? Suchst wohl auch nach einer Alternative zu MMY? So zumindest bin ich auf Alexis aufmerksam geworden.

Zu Deiner Frage: Alexis produziert bereits, die Mine nennt sich "Lac Herbin", dort will man in 2010 etwa 40000oz prodzieren, bei Kosten von ca. 500 US$/oz.

Zudem gibt es ein Projekt "Lac Pelletier", dort ist man gerade mit einem "Probe-Abbau" beschäftigt (Bulk Sample Program), das man im Mai 2010 abschließen will.

Durch die Übernahme von Garson Gold hat man jetzt auch ein drittes aussichtsreiches Projekt, die "Snow Lake Mine". Erste Ergebnisse wurden dazu schon veröffentlicht, eine Feasibility Study soll Ende Juni 2010 fertig sein.

Eine gute und relativ aktuelle Zusammenstellung findest Du hier:

http://www.alexisminerals.com/docs08/pdf/2010_02_09_eng.pdf

Die Informationspolitik ist hier jedenfalls deutlich besser als die Nicht-Informationspolitik bei MMY. Übrigens eine weitere Alternative, die ich gefunden hab: Crocodile Gold

http://www.crocgold.com

Antwort auf Beitrag Nr.: 39.133.204 von JohnMole am 13.03.10 16:46:46Hallo,

danke dir für deinen Infos. Ich werde es mir mal näher anschauen denn es hört sich nicht schlecht an.....

Auch diese Präsentation ist echt aussagekräftig gestaltet: http://www.alexisminerals.com/docs08/pdfs/20100203_Triple_Go…

Jetzt gilt es Cash zu verdienen und aus dem Tief heraus zu kommen.....

Auch die Damen und Herren Insider haben zumindest mal die Optionen und ein paar Shares in der Tasche, soweit ich das sehen kann.....

http://www.canadianinsider.com/coReport/allTransactions.php?…

Robert Bryce hat seine Weihnachtsposi die er im Dezember 09 verkauft hat, im Febr. 2010 wieder etwas günstiger zurückgekauft.....

Sieht alles ganz gut aus......

Die Informationspolitik ist hier jedenfalls deutlich besser als die Nicht-Informationspolitik bei MMY.

Da muss ich dir Recht geben, aber ich halte an MMY weiter fest, aber das gehört ja hier in den Thread nicht rein.....

Deine Crocgold schau ich mir auch mal an, es gibt z.Z. so viel da muss man echt abwägen was man macht!!!

Bleibe aber hier am Ball!!

Gruß

TimLuca

danke dir für deinen Infos. Ich werde es mir mal näher anschauen denn es hört sich nicht schlecht an.....

Auch diese Präsentation ist echt aussagekräftig gestaltet: http://www.alexisminerals.com/docs08/pdfs/20100203_Triple_Go…

Jetzt gilt es Cash zu verdienen und aus dem Tief heraus zu kommen.....

Auch die Damen und Herren Insider haben zumindest mal die Optionen und ein paar Shares in der Tasche, soweit ich das sehen kann.....

http://www.canadianinsider.com/coReport/allTransactions.php?…

Robert Bryce hat seine Weihnachtsposi die er im Dezember 09 verkauft hat, im Febr. 2010 wieder etwas günstiger zurückgekauft.....

Sieht alles ganz gut aus......

Die Informationspolitik ist hier jedenfalls deutlich besser als die Nicht-Informationspolitik bei MMY.

Da muss ich dir Recht geben, aber ich halte an MMY weiter fest, aber das gehört ja hier in den Thread nicht rein.....

Deine Crocgold schau ich mir auch mal an, es gibt z.Z. so viel da muss man echt abwägen was man macht!!!

Bleibe aber hier am Ball!!

Gruß

TimLuca

Update zu Lac Pelletier:

http://www.alexisminerals.com/docs08/pdfs/march16_2010_eng.p…

Beim zweiten Teil des Bulk Sample Milling wurden 1924oz Gold produziert. Dritter (und letzter) Teil bis Anfang April, danach Update der Ressourcen und die Fertigstellung einer Machbarkeitsstudie bis Anfang Mai. Die im Rahmen des Bulk Sample Programs erwarteten 9000oz werden zwar nicht erreicht, aber das wird auch begründet. So wie ich das verstehe hat man auch Gestein für die Probe verwendet, das bei der Entwicklung der Zugänge sowieso angefallen ist. Das hatte zwar weniger Goldgehalt als das eigentlich geplante Probegestein, aber das ist immer noch besser als gar kein Gold. Schließlich hatte man nicht erwartet, dass man beim Errichten der Zugänge überhaupt in goldhaltigem Gestein gräbt. Oder versteht ihr das anders?

http://www.alexisminerals.com/docs08/pdfs/march16_2010_eng.p…

Beim zweiten Teil des Bulk Sample Milling wurden 1924oz Gold produziert. Dritter (und letzter) Teil bis Anfang April, danach Update der Ressourcen und die Fertigstellung einer Machbarkeitsstudie bis Anfang Mai. Die im Rahmen des Bulk Sample Programs erwarteten 9000oz werden zwar nicht erreicht, aber das wird auch begründet. So wie ich das verstehe hat man auch Gestein für die Probe verwendet, das bei der Entwicklung der Zugänge sowieso angefallen ist. Das hatte zwar weniger Goldgehalt als das eigentlich geplante Probegestein, aber das ist immer noch besser als gar kein Gold. Schließlich hatte man nicht erwartet, dass man beim Errichten der Zugänge überhaupt in goldhaltigem Gestein gräbt. Oder versteht ihr das anders?

Auch wenn sich der Kurs schrecklich entwickelt hat ( wie bei vielen anderen ebenfalls ) so sehen nach den Veröffentlichungen der letzten 3-4 Monate die Fundamentaldaten wesentlich verbessert aus.

Die Zeit bis Mitte/Ende 2011 wird höchst spannend :

.) Eigene Mühle fährt mit 450-480 to/Tag an

.) die zweite Mühle wird in Schwung gebracht (Kostendeckung über neue shares)

.) Ressourcenerweiterung

.) Kostensenkung durch Wegfall des Lohn-Millings

.) Produktionsausweitung

Für einen Produzenten mit zwar noch relativ wenige Gesamtunzen im Verhältnis zum hochgesteckten jährlichen Produktionsziel sind die derzeitigen Kurse kein Spiegel der tatsächlichen Stärke.

Gegenteilige Meinungen ????

Wäre schön, könnte sich hier wieder ein konstruktiver Diskussionskreis über die derzeitige Unternehmensrichtung entwickeln.

Gruß

Picker56

Die Zeit bis Mitte/Ende 2011 wird höchst spannend :

.) Eigene Mühle fährt mit 450-480 to/Tag an

.) die zweite Mühle wird in Schwung gebracht (Kostendeckung über neue shares)

.) Ressourcenerweiterung

.) Kostensenkung durch Wegfall des Lohn-Millings

.) Produktionsausweitung

Für einen Produzenten mit zwar noch relativ wenige Gesamtunzen im Verhältnis zum hochgesteckten jährlichen Produktionsziel sind die derzeitigen Kurse kein Spiegel der tatsächlichen Stärke.

Gegenteilige Meinungen ????

Wäre schön, könnte sich hier wieder ein konstruktiver Diskussionskreis über die derzeitige Unternehmensrichtung entwickeln.

Gruß

Picker56

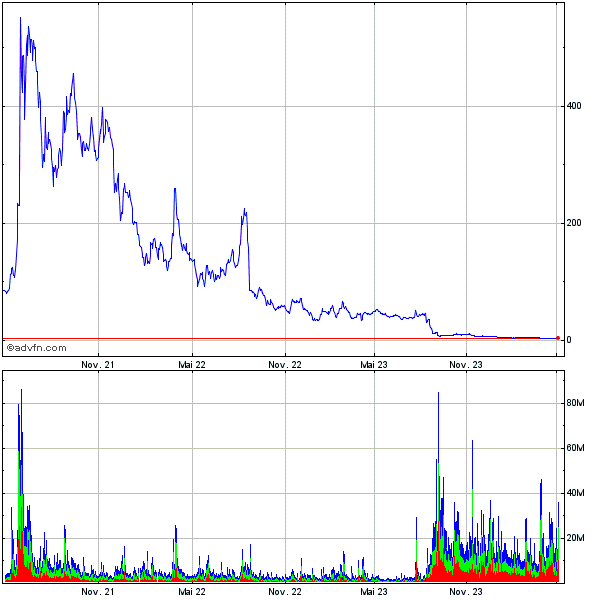

Antwort auf Beitrag Nr.: 39.933.195 von Picker56 am 05.08.10 11:27:53vom chart her siehts nach nem kleinen turnaround aus....

ich werde alexis mal beaobachten

ich werde alexis mal beaobachten

Antwort auf Beitrag Nr.: 39.933.408 von MoneyDee am 05.08.10 11:53:10Ich geh nicht mal vom chart aus, da der kleine Zucker nach oben nicht wirklich ein turnaround sein muss.

Auch wenn derzeit noch shares auf den Markt kommen ( für Fertigstellung der zweiten Mühle ), so müsste bei kontinuierlicher Weiterentwicklung des Unternehmens eine Neubewertung erfolgen.

Unter kontinuierlicher Weiterentwicklung verstehe ich die Einhaltung der Produktionsziele und der damit verbundenen Kosten. Und natürlich nicht zu vergessen dass die beiden Mühlen weitere Ressourcen benötigen.

Nur die heutige Kapitalisierung von unter 40 Mio erscheint mir persönlich als zu gering - auch in Anbetracht der gedrückten Gesamtmarktstimmung bei Minengesellschaften.

Picker56

Auch wenn derzeit noch shares auf den Markt kommen ( für Fertigstellung der zweiten Mühle ), so müsste bei kontinuierlicher Weiterentwicklung des Unternehmens eine Neubewertung erfolgen.

Unter kontinuierlicher Weiterentwicklung verstehe ich die Einhaltung der Produktionsziele und der damit verbundenen Kosten. Und natürlich nicht zu vergessen dass die beiden Mühlen weitere Ressourcen benötigen.

Nur die heutige Kapitalisierung von unter 40 Mio erscheint mir persönlich als zu gering - auch in Anbetracht der gedrückten Gesamtmarktstimmung bei Minengesellschaften.

Picker56

Alexis Closes Over-Allotment Option

TORONTO, ONTARIO, Sep. 20, 2010 (Marketwire) --

NOT FOR DISSEMINATION IN THE UNITED STATES OR TO U.S. NEWS WIRE SERVICES

ALEXIS MINERALS CORPORATION (TSX:AMC)(OTCQX:AXSMF) ("Alexis" or the "Company") announced today that it has completed the sale of an additional 12,500,000 units of the Company (the "Units") priced at $0.15 per Unit pursuant to the exercise in full of an over-allotment option (the "Over-Allotment Option") granted to Industrial Alliance Securities Inc. and including NCP Northland Capital Partners Inc. and Global Hunter Securities (the "Agents") in connection with the Company's previously announced offering for aggregate gross proceeds of $12,500,000. (the "Offering"). The exercise of the Over-Allotment Option brings the total gross proceeds from the Offering to $14,375,000.

Each Unit is comprised of one common share of the Company (each, a "Common Share") and one-half of one common share purchase warrant (each full common share purchase warrant, a "Warrant"). Each Warrant entitles its holder to purchase one additional Common Share of the Company at a price of $0.40, subject to acceleration in certain circumstances, until 5:00 p.m. (Eastern Time) on September 2, 2013.

Alexis intends to use the net proceeds from the Offering primarily to advance its key capital programs as it initiates the next phase of its strategic plan focused on the reopening of the Snow Lake Gold Mine in Manitoba. A portion of funds will be devoted towards preliminary work at Snow Lake including the feasibility study, care and maintenance, and the initial stages of refurbishing the ramp portal at the #3 Zone. The Company also intends to use a portion of the net proceeds for working capital and general corporate purposes.

The Company also announced the resignation of Julie Lassonde from the board of directors, effective September 17, 2010. Ms. Lassonde has tendered her resignation from the Alexis board as she intends to focus on her new position as Executive Chairman of Shear Minerals Ltd., a Canadian based mining company focused on diamond exploration.

The management and board of Alexis Minerals would like to thank Ms. Lassonde for her service and insight to the company and wish her well in the future.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Alexis Minerals

Alexis Minerals Corporation is a Canadian mining company listed on the Toronto Stock Exchange (symbol "AMC") and trades in the United States on the Over the Counter QX International platform (OTCQX:AXSMF). The Company owns one producing gold mine in Val-d'Or and the right to earn a 100% interest in the Lac Pelletier gold property in Rouyn-Noranda, both in Quebec. Alexis also owns the Snow Lake Mine in Manitoba. With these assets Alexis has the potential to develop gold production forwards. Alexis is targeting mid-tier gold production levels in 2011-2012. Alexis undertakes exploration in the mineral rich Val-d'Or (100% ownership of 212 sq. km.) and Rouyn-Noranda Mining Camps (50% ownership of 785 sq. km and in joint venture with Xstrata Copper) as well as in the Snow Lake Mining Camp (100% ownership of 50 sq. km). For more information about Alexis Minerals visit www.alexisminerals.com.

Forward looking information

This document may contain or refer to forward looking information within the meaning of applicable securities laws, based on current expectations, including, but not limited to, proposed use of proceeds, timing for closing of the financing, ability to attract financing, renunciation of flow-through expenses, regulatory approvals, ability to complete the Offer, and future exploration expenses and plans. Forward looking statements are subject to significant risks and uncertainties, including those risks identified in the annual information form of the Company, which is available under the profile of the Company on SEDAR, and other factors that could cause actual results to differ materially from expected results. Estimates and assumptions underlying the future-looking information are based upon negotiations between the Company and prospective investors, extensive technical and scientific analysis conducted by the management of the Company, and information obtained by the Company from third parties. Readers should not place undue reliance on forward-looking information. Forward looking information is provided as of the date hereof and we assume no responsibility to update or revise them to reflect new events or circumstances.

Alexis Minerals Corporation President and CEO (416) 861-5889 (416) 861-8165 (FAX) info@alexisminerals.com Alexis Minerals Corporation VP Investor & Corporate Affairs (416) 861-5905 or Toll Free: 877-717-3027 bruce.barch@alexisminerals.ca Alexis Minerals Corporation Relationniste (514) 667-2304 lb@decorporateconsultants.ca www.alexisminerals.com

SK heute...cad 0,18

Und wieder News: Für die Finanzierung des Snow Lake Projekts wurde ein Partner gefunden. Geplant ist eine Finanzierung von $60 Mio, ohne das Gold vorwärts verkauft wird oder neue Aktien/Optionen ausgegeben werden. Details:

http://alexisminerals.com/docs/wp-content/uploads/2010/09/20…

Und was macht der Kurs: Er hebt ab, von 0.19 auf 0.25 C$: +31,6%

http://alexisminerals.com/docs/wp-content/uploads/2010/09/20…

Und was macht der Kurs: Er hebt ab, von 0.19 auf 0.25 C$: +31,6%

http://www.marketwire.com/press-release/Alexis-Feasibility-S…

Alexis Feasibility Study Substantially Increases Snow Lake Gold Resources

TORONTO, ONTARIO--(Marketwire - Oct. 27, 2010) - ALEXIS MINERALS CORPORATION (TSX:AMC)(OTCQX:AXSMF) ("Alexis" or the "Company") is pleased to announce a substantial increase in gold Resources at the Company's Snow Lake Mine, located in Snow Lake, Manitoba. Increases in tonnage, contained ounces of gold and overall quality of the Resource occur in the two principal zones - the Main Mine and #3 Zone. Infill drilling programs in 2010 have focused on the conversion of Inferred Resources and have resulted in:

A 63% increase in contained gold (54,270 ounces) in Measured and Indicated Resources in #3 Zone resulting from a 73% increase in tonnage (287,150 tonnes); and,

A 30% increase in contained gold (138,839 ounces) in Measured and Indicated Resources in the Main Mine resulting from a 70% increase in tonnage (1,980,000 tonnes).

The Resource is presented in Table 1 and confirms that the Snow Lake Mine hosts:

Measured and Indicated Resources of 5,471,000 tonnes grading 4.14 g/t Au for 728,000 oz Au; and,

Inferred Resource of 2,367,000 tonnes grading 4.43 g/t Au for an additional 336,700 oz Au.

The Snow Lake property continues to show strong upside potential for increasing resources through exploration. Resources are considered open down-dip (plunge) at the Main Mine and also at #3 Zone. Mineralization at the Boundary, Bounter and Kim zones, all located in proximity to the Mine, will require additional drilling to evaluate areas of known mineralization. Two surface drills are currently engaged in surface exploration and a third drill will be mobilized shortly.

Resources were previously estimated and reported in a Preliminary Assessment of the Deposit (see news release: March 8, 2010). Recent infill drilling during 2010 has focused on upgrading the quality of information relating to the previously estimated inferred mineral resources in these areas. The new Mineral Resource estimate incorporates the drill results and uses a revised lower cut-off grade of 1.95 g Au/t to identify the limits of mineralization. The lowering of the cut off grade (Preliminary Assessment used 3.11 g Au/t) was in response to current metal price trends.

The Resource Estimate was made in conjunction with a Feasibility Study focused on the potential for reopening of the Snow Lake Mine. Results from the Feasibility Study will be available shortly, including the parameters and methodology used, described in a NI 43-101 technical report which will be filed on www.sedar.com.

Table 1.Snow Lake Resource Estimate

Zone Resource Category Tonnes Grade (g/t) Ounces Au

Main Mine Lower1 Measured 7,000 4.76 1,000

Main Mine Upper2 Indicated 3,748,000 3.57 427,600

Main Mine Lower1 Indicated 1,035,000 4.81 160,100

No. 3 Zone - Main2 Indicated 606,000 6.44 125,600

No. 3 Zone - Footwall2 Indicated 75,000 5.69 13,700

Total Property Measured and Indicated Resources 5,471,000 4.14 728,000

Main Mine Upper2 Inferred 446,000 3.57 51,200

Main Mine Lower1 Inferred 486,000 3.98 62,200

No. 3 Zone - Main2 Inferred 139,000 6.14 27,300

No. 3 Zone - Footwall2 Inferred 290,000 4.39 40,900

Birch1 Inferred 569,000 4.42 81,000

Squall Margaret Upper3 Inferred 100,000 4.87 15,600

Squall Margaret Lower3 Inferred 337,000 5.42 58,500

Total Snow Lake Mine Property Inferred Resources 2,367,000 4.43 336,700

(1) NI 43-101 Technical report on the New Britannia Mine Property and Review of the Mineral Resource Estimate, Snow Lake Manitoba by Wiliam J. Lewis, P. Geo and Richard Gowans, P. Eng., Micon International Ltd, October 2006.Cut-off grade 0,077 opt

(2) Numbers incorporate results of estimation completed for NI 43-101 Feasibility study, to be published on www.sedar.com.

(3) NI 43-101 Technical Report on the Squall Lake Property, The Pas Mining Division Snow Lake Manitoba. Completed for Garson Resources Ltd. by D Beilhartz, P. Geo., April 2006.

Lac Herbin Update

The Company advises an amended guidance for the 2010 gold production from its Lac Herbin gold mine, Val-d'Or, Quebec, now forecast to be approximately 24,000 ounces of gold. As previously reported, the Company has recently encountered grade variance as new stoping areas have been mined. Cost reduction measures are being implemented to coincide with the reduced production levels. Alexis continues to work on the challenges at the mine to produce profitable ounces of gold for the coming years.

Qualified Persons

Mineral Resource estimates for the Snow Lake Mine Property were prepared by Jamie Lavigne, P.Geo., Vice-President, Exploration with Alexis Minerals, and Qualified Person under NI 43-101 for the Resource estimate and who has reviewed the content of this press release. The technical and scientific content of this press release has been reviewed by Keith Boyle, P.Eng., Chief Operating Officer, Alexis Minerals and Qualified Person as defined under NI 43-101 guidelines.

About Alexis Minerals

Alexis Minerals Corporation is a Canadian mining company listed on the Toronto Stock Exchange (symbol "AMC") and trades in the United States on the Over the Counter QX International platform (OTCQX:AXSMF). The Company owns one producing gold mine in Val-d'Or and the right to earn a 100% interest in the Lac Pelletier gold property in Rouyn-Noranda, both in Quebec. Alexis also owns the Snow Lake Mine in Manitoba. With these assets Alexis has the potential to develop gold production forwards. Alexis is targeting mid-tier gold production levels in 2011. Alexis undertakes exploration in the mineral rich Val-d'Or (100% ownership of 212 sq. km.) and Rouyn-Noranda Mining Camps (50% ownership of 785 sq.km and in joint venture with Xstrata Copper) as well as in the Snow Lake Mining Camp (100% ownership of 50 sq. km). For more information about Alexis Minerals visit www.alexisminerals.com.

Forward-looking information.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the future financial or operating performance of Alexis and its projects, the identification of mineral reserves and resources, costs of and capital for development and mining projects, development and exploration expenditures, timing of future development, exploration and production, requirements for additional capital, government regulation of mining operations, environmental risks, reclamation expenses, title disputes or claims, limitations of insurance coverage and the timing and possible outcome of pending litigation and regulatory matters. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the annual information form of the Company. For a description of the factors affecting forward-looking information and the basis of management estimates, please see a copy of the annual information form of the Company and the technical report relating to the feasibility study, both of which are available under the profile of the Company on SEDAR. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

For more information, please contact

Alexis Minerals Corporation

David Rigg

President and CEO

(416) 861-5889

(416) 861-8165 (FAX)

info@alexisminerals.com

or

Alexis Minerals Corporation

Bruce Barch

VP Investor & Corporate Affairs

(416) 861-5905

bruce.barch@alexisminerals.ca

or

Alexis Minerals Corporation

Louis Baribeau

Relationniste

(514) 667-2304

lb@decorporateconsultants.ca

www.alexisminerals.com

Click here to see all recent news from this company

Alexis Feasibility Study Substantially Increases Snow Lake Gold Resources

TORONTO, ONTARIO--(Marketwire - Oct. 27, 2010) - ALEXIS MINERALS CORPORATION (TSX:AMC)(OTCQX:AXSMF) ("Alexis" or the "Company") is pleased to announce a substantial increase in gold Resources at the Company's Snow Lake Mine, located in Snow Lake, Manitoba. Increases in tonnage, contained ounces of gold and overall quality of the Resource occur in the two principal zones - the Main Mine and #3 Zone. Infill drilling programs in 2010 have focused on the conversion of Inferred Resources and have resulted in:

A 63% increase in contained gold (54,270 ounces) in Measured and Indicated Resources in #3 Zone resulting from a 73% increase in tonnage (287,150 tonnes); and,

A 30% increase in contained gold (138,839 ounces) in Measured and Indicated Resources in the Main Mine resulting from a 70% increase in tonnage (1,980,000 tonnes).

The Resource is presented in Table 1 and confirms that the Snow Lake Mine hosts:

Measured and Indicated Resources of 5,471,000 tonnes grading 4.14 g/t Au for 728,000 oz Au; and,

Inferred Resource of 2,367,000 tonnes grading 4.43 g/t Au for an additional 336,700 oz Au.

The Snow Lake property continues to show strong upside potential for increasing resources through exploration. Resources are considered open down-dip (plunge) at the Main Mine and also at #3 Zone. Mineralization at the Boundary, Bounter and Kim zones, all located in proximity to the Mine, will require additional drilling to evaluate areas of known mineralization. Two surface drills are currently engaged in surface exploration and a third drill will be mobilized shortly.

Resources were previously estimated and reported in a Preliminary Assessment of the Deposit (see news release: March 8, 2010). Recent infill drilling during 2010 has focused on upgrading the quality of information relating to the previously estimated inferred mineral resources in these areas. The new Mineral Resource estimate incorporates the drill results and uses a revised lower cut-off grade of 1.95 g Au/t to identify the limits of mineralization. The lowering of the cut off grade (Preliminary Assessment used 3.11 g Au/t) was in response to current metal price trends.

The Resource Estimate was made in conjunction with a Feasibility Study focused on the potential for reopening of the Snow Lake Mine. Results from the Feasibility Study will be available shortly, including the parameters and methodology used, described in a NI 43-101 technical report which will be filed on www.sedar.com.

Table 1.Snow Lake Resource Estimate

Zone Resource Category Tonnes Grade (g/t) Ounces Au

Main Mine Lower1 Measured 7,000 4.76 1,000

Main Mine Upper2 Indicated 3,748,000 3.57 427,600

Main Mine Lower1 Indicated 1,035,000 4.81 160,100

No. 3 Zone - Main2 Indicated 606,000 6.44 125,600

No. 3 Zone - Footwall2 Indicated 75,000 5.69 13,700

Total Property Measured and Indicated Resources 5,471,000 4.14 728,000

Main Mine Upper2 Inferred 446,000 3.57 51,200

Main Mine Lower1 Inferred 486,000 3.98 62,200

No. 3 Zone - Main2 Inferred 139,000 6.14 27,300

No. 3 Zone - Footwall2 Inferred 290,000 4.39 40,900

Birch1 Inferred 569,000 4.42 81,000

Squall Margaret Upper3 Inferred 100,000 4.87 15,600

Squall Margaret Lower3 Inferred 337,000 5.42 58,500

Total Snow Lake Mine Property Inferred Resources 2,367,000 4.43 336,700

(1) NI 43-101 Technical report on the New Britannia Mine Property and Review of the Mineral Resource Estimate, Snow Lake Manitoba by Wiliam J. Lewis, P. Geo and Richard Gowans, P. Eng., Micon International Ltd, October 2006.Cut-off grade 0,077 opt

(2) Numbers incorporate results of estimation completed for NI 43-101 Feasibility study, to be published on www.sedar.com.

(3) NI 43-101 Technical Report on the Squall Lake Property, The Pas Mining Division Snow Lake Manitoba. Completed for Garson Resources Ltd. by D Beilhartz, P. Geo., April 2006.

Lac Herbin Update

The Company advises an amended guidance for the 2010 gold production from its Lac Herbin gold mine, Val-d'Or, Quebec, now forecast to be approximately 24,000 ounces of gold. As previously reported, the Company has recently encountered grade variance as new stoping areas have been mined. Cost reduction measures are being implemented to coincide with the reduced production levels. Alexis continues to work on the challenges at the mine to produce profitable ounces of gold for the coming years.

Qualified Persons

Mineral Resource estimates for the Snow Lake Mine Property were prepared by Jamie Lavigne, P.Geo., Vice-President, Exploration with Alexis Minerals, and Qualified Person under NI 43-101 for the Resource estimate and who has reviewed the content of this press release. The technical and scientific content of this press release has been reviewed by Keith Boyle, P.Eng., Chief Operating Officer, Alexis Minerals and Qualified Person as defined under NI 43-101 guidelines.

About Alexis Minerals

Alexis Minerals Corporation is a Canadian mining company listed on the Toronto Stock Exchange (symbol "AMC") and trades in the United States on the Over the Counter QX International platform (OTCQX:AXSMF). The Company owns one producing gold mine in Val-d'Or and the right to earn a 100% interest in the Lac Pelletier gold property in Rouyn-Noranda, both in Quebec. Alexis also owns the Snow Lake Mine in Manitoba. With these assets Alexis has the potential to develop gold production forwards. Alexis is targeting mid-tier gold production levels in 2011. Alexis undertakes exploration in the mineral rich Val-d'Or (100% ownership of 212 sq. km.) and Rouyn-Noranda Mining Camps (50% ownership of 785 sq.km and in joint venture with Xstrata Copper) as well as in the Snow Lake Mining Camp (100% ownership of 50 sq. km). For more information about Alexis Minerals visit www.alexisminerals.com.

Forward-looking information.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the future financial or operating performance of Alexis and its projects, the identification of mineral reserves and resources, costs of and capital for development and mining projects, development and exploration expenditures, timing of future development, exploration and production, requirements for additional capital, government regulation of mining operations, environmental risks, reclamation expenses, title disputes or claims, limitations of insurance coverage and the timing and possible outcome of pending litigation and regulatory matters. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the annual information form of the Company. For a description of the factors affecting forward-looking information and the basis of management estimates, please see a copy of the annual information form of the Company and the technical report relating to the feasibility study, both of which are available under the profile of the Company on SEDAR. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

For more information, please contact

Alexis Minerals Corporation

David Rigg

President and CEO

(416) 861-5889

(416) 861-8165 (FAX)

info@alexisminerals.com

or

Alexis Minerals Corporation

Bruce Barch

VP Investor & Corporate Affairs

(416) 861-5905

bruce.barch@alexisminerals.ca

or

Alexis Minerals Corporation

Louis Baribeau

Relationniste

(514) 667-2304

lb@decorporateconsultants.ca

www.alexisminerals.com

Click here to see all recent news from this company

Warum kommen wir hier nicht vom Fleck? Wo liegt der Schönheitsfehler?

Schnäppchenjagd

Unter 0,18.- stark abgesichert.Wenn Ausbruch, dann gewaltig

Lesezeichen

War ja nochmals richtig was los vor den Feiertagen. Wird Zeit, das wir wieder in einen kontinuierlichen Aufwärtstrend übergehen.

Hat wer ne Ahnung viele Meter vom 80.000m Bohrprogramm bereits gemacht wurden ?

Die letzte Ressourcenerhöhung aus dem Oktober kann ja noch nicht alles gewesen sein.

Da muss ja noch viel mehr kommen, um die geplanten Produktionsmengen für 2011 und 2012 ( bis zu 150.000 oz/Jahr ) auch tatsächlich mit genügend Erz erreichen zu können.

Picker56

Die letzte Ressourcenerhöhung aus dem Oktober kann ja noch nicht alles gewesen sein.

Da muss ja noch viel mehr kommen, um die geplanten Produktionsmengen für 2011 und 2012 ( bis zu 150.000 oz/Jahr ) auch tatsächlich mit genügend Erz erreichen zu können.

Picker56

Gestern wurden Produktionszahlen für 2010 veröffentlicht. Für mich ziemlich enttäuschend: Nicht ganz 25000oz, weiterhin Probleme mit niedrigem Goldgehalt. Und der verantwortliche COO verlässt jetzt auch noch das Unternehmen. Das dürfte wohl das Abrutschen von 0,2 auf 0,15C$ erklären.

Bin mal gespannt, ob das neue Management es besser macht. Die Ziele für 2011 sind ja recht sportlich. Wenn es tatsächlich 100.000oz in 2011 werden, dann könnte sich ein Einstieg auf dem aktuellen Level lohnen. Mir ist das aber zu unsicher.

Bin mal gespannt, ob das neue Management es besser macht. Die Ziele für 2011 sind ja recht sportlich. Wenn es tatsächlich 100.000oz in 2011 werden, dann könnte sich ein Einstieg auf dem aktuellen Level lohnen. Mir ist das aber zu unsicher.

Koennte hier bald ein einstieg lohnen? Der Wert ist ja total ausgebombt. Mich wuerde die Meinung eines AMC-Experten interessieren...

Antwort auf Beitrag Nr.: 41.248.522 von ooy am 22.03.11 16:44:04

...hier nur ein kleiner auszug. noch ganz viele fakten und tabellen und...

news gibts da....

http://www.stockhouse.com/tools/?page=%2FfinancialTools%2Fsn…

Alexis Minerals Reports Fourth Quarter and Full Year 2010 Results

3/31/2011 5:01:27 PM - Market Wire

TORONTO, ONTARIO, Mar 31, 2011 (MARKETWIRE via COMTEX News Network) --

(Note: All figures are reported in Canadian dollars, unless otherwise noted).

ALEXIS MINERALS CORPORATION (TSX: AMC)(OTCQX: AXSMF) ("Alexis" or the "Company") today released fourth quarter results, annual financial statements and management's discussion and analysis for the year ended December 31, 2010. These documents can be reviewed in full on SEDAR (www.sedar.com) or on the Company's website at www.alexisminerals.com.

2010 Year End and Fourth Quarter Financial Summary:

During the three and twelve months ended December 31, 2010 the following occurred at Alexis:

-- The Company reported revenue of $3.86 million for the fourth quarter and

$25.73 million for the year ended December 31, 2010.

-- The Company sold 2,912 ounces of gold at an average realized price of $

1,387/oz (USD $1,368/oz.) during the fourth quarter and 22,026 ounces at

an average realized price of $1,215(USD $1,184) during the year.

-- Cash cost (see non-GAAP measures) of sales per ounce of the Lac Herbin

gold sold increased to $2,020/oz for the fourth quarter.

-- The Company wrote down assets of $41.65 million at the Lac Herbin mine

and the Lac Pelletier project.

-- Alexis recorded a net loss for the fourth quarter of $44.46 million and

for the year ended December 31, 2010 of $48.45 million.

Annual Operations Summary:

-- The Company completed the acquisition with Garson Gold Corp. by plan of

arrangement, thereby acquiring the Snow Lake property and has positioned

itself towards its target of becoming a mid- tier status mining company.

-- The feasibility study conducted on the Snow Lake property projects over

80,000 ounces of annual gold production and a total of 415,000 ounces of

gold production over a five year operating life. In the fourth quarter

of 2010, additional mineral claims in the vicinity of Snow Lake were

acquired, almost doubling the size of the Company's property holding.

-- Revision of the mineral resource estimate at Lac Herbin Resource was

carried out as a result of operating experience encountered in the year.

See press release dated March 22, 2011.

Corporate Summary:

-- The Company announced the appointment of Mr. Francois Perron as the new President and Chief Executive Officer and a director of the Company; and -- The Company appointed Mr. David Rigg as Co-Chairman of the Company.

Francois Perron, President & Chief Executive Officer, commented: "This fiscal year has been disappointing for management and shareholders primarily due to under performance at our Lac Herbin gold mine and Lac Pelletier project. Lac Herbin had met production targets in 2009; however gold production declined throughout 2010 straining the cost ratio, as inconsistent gold grades and challenging ground conditions continued into the fourth quarter. While operating costs were reduced by 29% in the fourth quarter, compared to the third quarter; the continued lower than expected grade of gold, the lower than expected production tonnage and the lower than targeted mill recoveries, caused the cost per ounce to increase significantly. Accordingly, we are currently reviewing the operations for Lac Herbin. Unfortunately, Lac Herbin performance has overshadowed other developments in Alexis."

"The potential at the Snow Lake Mine is clear with the completion of the feasibility study in Q4 (see Feasibility Study NI43-101 Report dated December 10, 2010). The study projects over 80,000 ounces of annual gold production over a five year operating period, for total anticipated gold production of over 415,000 ounces of gold at a cash cost of $640 per oz gold. Mineral Resources for Snow Lake increased significantly during 2010. Total Measured and Indicated Resources now total 5.47 million tonnes (MT) grading 4.14 gram gold per tonne (g Au/t) for 728,000 ounces of gold, an increase of 279,000 ounces in 2010. Inferred Resources now total 2.37 MT grading 4.34 g Au/t for 336,700 ounces, an increase of 19,700 ounces gold. The feasibility study identifies new Proven and Probable gold reserves within these Mineral Resources of 3.47 MT grading 4.04 g Au/t for 451,900 ounces of gold. The snow lake results are significant and total Proven and Probable Reserves in Alexis quadrupled during 2010.

"I have high expectations for Alexis' potential and will be working aggressively in my new role to create a positive impact on shareholder value. Currently we have four drills on surface in the Abitibi exploring a variety of gold targets near the Lac Herbin Mine; newly recognized kilometer-long gold trends on Noralex; and, a variety of gold and base metal targets across our extensive properties. In Manitoba, at our Snow Lake project, we have two active drills which are delineating the new East Zone, a potential near- surface extension of the principal mine; and testing several gold occurrences. Drilling will continue here throughout 2011 and examine depth extensions and new discovery in the Snow lake basin." concluded Mr. Perron.

Operating and Financial Results For the year ended December 31, 2010

The Company sold 22,026 ounces of gold and generated $25.73 million in revenue from mining operations during the year ended December 31, 2010. Alexis' average gold sales price was $1,215 (USD $1,184) per ounce during the twelve month period. During the year ended December 31, 2009, 30,400 ounces of gold were sold generating $32.03 million in revenue. The average sales price realized during the year ended December 31, 2009 was $1,106 (USD $982). Mine operating expenses were $27.78 million (2009: $23.54 million) and amortization and depletion amounted to $7.14 million (2009: $6.87 million). The gross loss during the year ended December 31, 2010 was $9.20 million, compared to gross profit of $1.62 million during the year ended December 31, 2009.

...

http://www.stockhouse.com/tools/?page=%2FfinancialTools%2Fsn…

...hier nur ein kleiner auszug. noch ganz viele fakten und tabellen und...

news gibts da....

http://www.stockhouse.com/tools/?page=%2FfinancialTools%2Fsn…

Alexis Minerals Reports Fourth Quarter and Full Year 2010 Results

3/31/2011 5:01:27 PM - Market Wire

TORONTO, ONTARIO, Mar 31, 2011 (MARKETWIRE via COMTEX News Network) --

(Note: All figures are reported in Canadian dollars, unless otherwise noted).

ALEXIS MINERALS CORPORATION (TSX: AMC)(OTCQX: AXSMF) ("Alexis" or the "Company") today released fourth quarter results, annual financial statements and management's discussion and analysis for the year ended December 31, 2010. These documents can be reviewed in full on SEDAR (www.sedar.com) or on the Company's website at www.alexisminerals.com.

2010 Year End and Fourth Quarter Financial Summary:

During the three and twelve months ended December 31, 2010 the following occurred at Alexis:

-- The Company reported revenue of $3.86 million for the fourth quarter and

$25.73 million for the year ended December 31, 2010.

-- The Company sold 2,912 ounces of gold at an average realized price of $

1,387/oz (USD $1,368/oz.) during the fourth quarter and 22,026 ounces at

an average realized price of $1,215(USD $1,184) during the year.

-- Cash cost (see non-GAAP measures) of sales per ounce of the Lac Herbin

gold sold increased to $2,020/oz for the fourth quarter.

-- The Company wrote down assets of $41.65 million at the Lac Herbin mine

and the Lac Pelletier project.

-- Alexis recorded a net loss for the fourth quarter of $44.46 million and

for the year ended December 31, 2010 of $48.45 million.

Annual Operations Summary:

-- The Company completed the acquisition with Garson Gold Corp. by plan of

arrangement, thereby acquiring the Snow Lake property and has positioned

itself towards its target of becoming a mid- tier status mining company.

-- The feasibility study conducted on the Snow Lake property projects over

80,000 ounces of annual gold production and a total of 415,000 ounces of

gold production over a five year operating life. In the fourth quarter

of 2010, additional mineral claims in the vicinity of Snow Lake were

acquired, almost doubling the size of the Company's property holding.

-- Revision of the mineral resource estimate at Lac Herbin Resource was

carried out as a result of operating experience encountered in the year.

See press release dated March 22, 2011.

Corporate Summary:

-- The Company announced the appointment of Mr. Francois Perron as the new President and Chief Executive Officer and a director of the Company; and -- The Company appointed Mr. David Rigg as Co-Chairman of the Company.

Francois Perron, President & Chief Executive Officer, commented: "This fiscal year has been disappointing for management and shareholders primarily due to under performance at our Lac Herbin gold mine and Lac Pelletier project. Lac Herbin had met production targets in 2009; however gold production declined throughout 2010 straining the cost ratio, as inconsistent gold grades and challenging ground conditions continued into the fourth quarter. While operating costs were reduced by 29% in the fourth quarter, compared to the third quarter; the continued lower than expected grade of gold, the lower than expected production tonnage and the lower than targeted mill recoveries, caused the cost per ounce to increase significantly. Accordingly, we are currently reviewing the operations for Lac Herbin. Unfortunately, Lac Herbin performance has overshadowed other developments in Alexis."

"The potential at the Snow Lake Mine is clear with the completion of the feasibility study in Q4 (see Feasibility Study NI43-101 Report dated December 10, 2010). The study projects over 80,000 ounces of annual gold production over a five year operating period, for total anticipated gold production of over 415,000 ounces of gold at a cash cost of $640 per oz gold. Mineral Resources for Snow Lake increased significantly during 2010. Total Measured and Indicated Resources now total 5.47 million tonnes (MT) grading 4.14 gram gold per tonne (g Au/t) for 728,000 ounces of gold, an increase of 279,000 ounces in 2010. Inferred Resources now total 2.37 MT grading 4.34 g Au/t for 336,700 ounces, an increase of 19,700 ounces gold. The feasibility study identifies new Proven and Probable gold reserves within these Mineral Resources of 3.47 MT grading 4.04 g Au/t for 451,900 ounces of gold. The snow lake results are significant and total Proven and Probable Reserves in Alexis quadrupled during 2010.

"I have high expectations for Alexis' potential and will be working aggressively in my new role to create a positive impact on shareholder value. Currently we have four drills on surface in the Abitibi exploring a variety of gold targets near the Lac Herbin Mine; newly recognized kilometer-long gold trends on Noralex; and, a variety of gold and base metal targets across our extensive properties. In Manitoba, at our Snow Lake project, we have two active drills which are delineating the new East Zone, a potential near- surface extension of the principal mine; and testing several gold occurrences. Drilling will continue here throughout 2011 and examine depth extensions and new discovery in the Snow lake basin." concluded Mr. Perron.

Operating and Financial Results For the year ended December 31, 2010

The Company sold 22,026 ounces of gold and generated $25.73 million in revenue from mining operations during the year ended December 31, 2010. Alexis' average gold sales price was $1,215 (USD $1,184) per ounce during the twelve month period. During the year ended December 31, 2009, 30,400 ounces of gold were sold generating $32.03 million in revenue. The average sales price realized during the year ended December 31, 2009 was $1,106 (USD $982). Mine operating expenses were $27.78 million (2009: $23.54 million) and amortization and depletion amounted to $7.14 million (2009: $6.87 million). The gross loss during the year ended December 31, 2010 was $9.20 million, compared to gross profit of $1.62 million during the year ended December 31, 2009.

...

http://www.stockhouse.com/tools/?page=%2FfinancialTools%2Fsn…

ge-X-t

Antwort auf Beitrag Nr.: 41.305.543 von derPatriot1 am 01.04.11 17:43:57Im Augenblick gibt es reichlich insider-Käufe!!!

http://www.canadianinsider.com/coReport/allTransactions.php?…

Wird auch Zeit, dass sich der Kurs mal wieder Richtung Norden bewegt.

gruß wd.

http://www.canadianinsider.com/coReport/allTransactions.php?…

Wird auch Zeit, dass sich der Kurs mal wieder Richtung Norden bewegt.

gruß wd.

Antwort auf Beitrag Nr.: 41.573.084 von wieedeenn am 29.05.11 17:45:17Das Problem ist, dass die jetzt fast 600 Mio. Aktien ausstehend haben, noch ein placement und die koennen einen Reversesplit machen wie Crowflight, ich habe zum Glueck von einem Engagement abgesehen...

01.Sep.2011

ALEXIS EXPANDS NEAR MINE POTENTIAL ON TOOTS WEST ZONE

http://alexisminerals.com/docs/wp-content/uploads/2011/09/We…

22.Aug.2011

Alexis Minerals Reports Financial Results for Quarter Ended June 30

http://alexisminerals.com/docs/wp-content/uploads/2011/08/PR…

Management Discussion and Analysis Second Quarter 2011

http://alexisminerals.com/docs/wp-content/uploads/2011/08/Q2…

03.Aug.2011

ALEXIS COMPLETES TAKEOVER AGREEMENT ON ROUYN-NORANDA JOINT VENTURE PROPERTIES

http://alexisminerals.com/docs/wp-content/uploads/2011/08/PR…

26.Jul.2011

ALEXIS PROVIDES UPDATE ON SURFACE EXPLORATION EFFORTS AT ITS AURBEL PROPERTY FINDING 62.3 g/t (UNCUT) OVER 1.2 METRES AT THE BEAUFOR WEST EXTENSION

http://alexisminerals.com/docs/wp-content/uploads/2011/07/PR…

13.Jul.2011

Alexis Continues To Define the Bonanza Zone At Lac Herbin Intersecting up to 18.39g/t Au over 1.5 metres

http://alexisminerals.com/docs/wp-content/uploads/2011/07/PR…

Sollte mal genug Info sein.

ALEXIS EXPANDS NEAR MINE POTENTIAL ON TOOTS WEST ZONE

http://alexisminerals.com/docs/wp-content/uploads/2011/09/We…

22.Aug.2011

Alexis Minerals Reports Financial Results for Quarter Ended June 30

http://alexisminerals.com/docs/wp-content/uploads/2011/08/PR…

Management Discussion and Analysis Second Quarter 2011

http://alexisminerals.com/docs/wp-content/uploads/2011/08/Q2…

03.Aug.2011

ALEXIS COMPLETES TAKEOVER AGREEMENT ON ROUYN-NORANDA JOINT VENTURE PROPERTIES

http://alexisminerals.com/docs/wp-content/uploads/2011/08/PR…

26.Jul.2011

ALEXIS PROVIDES UPDATE ON SURFACE EXPLORATION EFFORTS AT ITS AURBEL PROPERTY FINDING 62.3 g/t (UNCUT) OVER 1.2 METRES AT THE BEAUFOR WEST EXTENSION

http://alexisminerals.com/docs/wp-content/uploads/2011/07/PR…

13.Jul.2011

Alexis Continues To Define the Bonanza Zone At Lac Herbin Intersecting up to 18.39g/t Au over 1.5 metres

http://alexisminerals.com/docs/wp-content/uploads/2011/07/PR…

Sollte mal genug Info sein.

Die großen Player sammeln ein.

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Es wird an der Börse nicht geklingelt.

gruß wd.

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Es wird an der Börse nicht geklingelt.

gruß wd.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 189 | ||

| 126 | ||

| 86 | ||

| 73 | ||

| 57 | ||

| 48 | ||

| 40 | ||

| 30 | ||

| 30 | ||

| 27 |

| Wertpapier | Beiträge | |

|---|---|---|

| 26 | ||

| 26 | ||

| 24 | ||

| 23 | ||

| 20 | ||

| 19 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 17 |