kanad. BCG - ein neuer HIGH- flyer für 2010 !?!?!? - 500 Beiträge pro Seite

eröffnet am 17.04.10 13:48:25 von

neuester Beitrag 15.11.12 15:28:07 von

neuester Beitrag 15.11.12 15:28:07 von

Beiträge: 174

ID: 1.157.191

ID: 1.157.191

Aufrufe heute: 0

Gesamt: 5.880

Gesamt: 5.880

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 49 Minuten | 4032 | |

| heute 13:39 | 2992 | |

| vor 1 Stunde | 2167 | |

| heute 13:20 | 2073 | |

| vor 1 Stunde | 1584 | |

| vor 1 Stunde | 1470 | |

| heute 13:33 | 1148 | |

| heute 13:38 | 1056 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.726,21 | -0,15 | 202 | |||

| 2. | 2. | 149,46 | -0,31 | 98 | |||

| 3. | 7. | 6,6560 | -1,07 | 89 | |||

| 4. | 5. | 0,1795 | -2,71 | 71 | |||

| 5. | 8. | 3,7950 | +1,47 | 64 | |||

| 6. | 4. | 2.388,34 | +0,38 | 57 | |||

| 7. | 17. | 7,3700 | +0,89 | 38 | |||

| 8. | 9. | 12,380 | +0,41 | 37 |

...kann gut sein, daß wir in 2010 nen entscheidenen schritt

voran schaffen - man verfügt über aussichtsreiche proj. im

GOLD- und kupfer- sektor.......und jetzt kommts...mit KINROSS

GOLD hat man einen BIG PLAYER im boot, der bereits über einen

ansehnlichen 13%- block der shares verfügt und sein KNOW HOW

bei den weiteren expl.- aktiv. einbringt !!!!

dies sollte sich gerade für die anstehenden umfangreichen

massnahmen auszahlen.......weitere details hierzu gibts in der

folg. brandakt. pres. aus 03.2010........

http://www.bcgoldcorp.com/ckfinder/userfiles/files/BCG_Corpo…

...´kleines manko´....bislang läßt sich wert nur in CAN/ USA

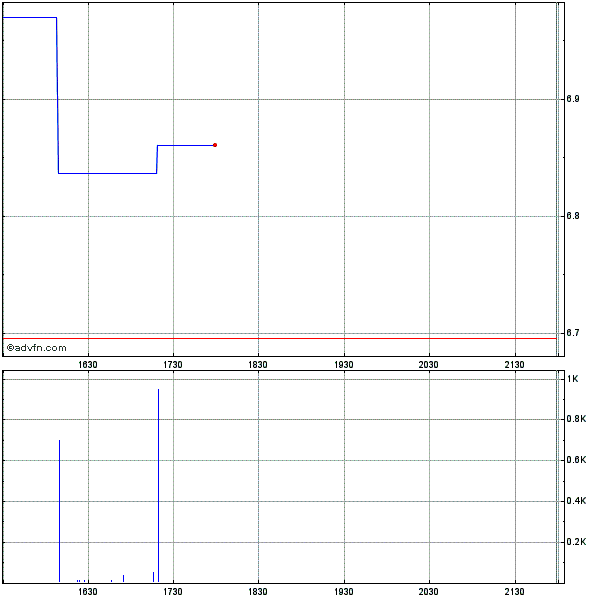

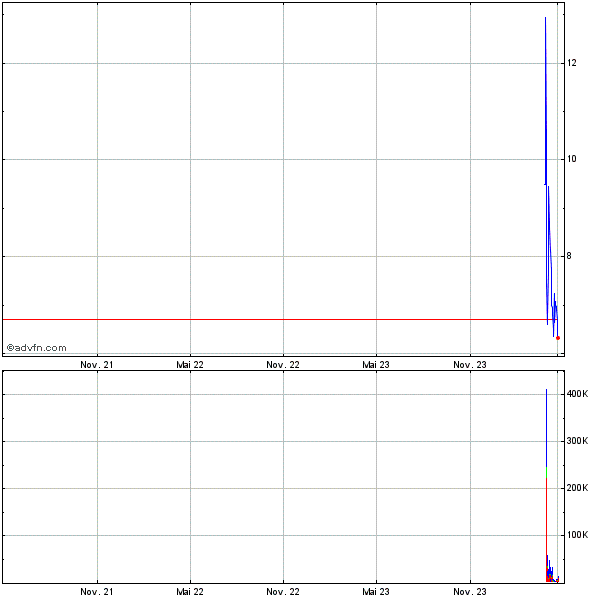

handeln - dafür aber bei schönem vol. wie nachfolg. chart zu

entnehmen ist!!!

SK gestern...cad 0,125

...schaumamal.......

Antwort auf Beitrag Nr.: 39.355.718 von hbg55 am 17.04.10 13:48:25

...ne reihe INSIDER- trades der jüngeren vergangenheit

signalisieren ebenfalls steigende zuversicht....IMO....

http://www.canadianinsider.com/coReport/allTransactions.php?…

...ne reihe INSIDER- trades der jüngeren vergangenheit

signalisieren ebenfalls steigende zuversicht....IMO....

http://www.canadianinsider.com/coReport/allTransactions.php?…

eine schöne zusammenfassung hat ein SH- user jüngst grad

unter nachfolg. link getitelt mit..........

BC Gold Corp. - Fantastic Undervalued Opportuntiy!

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1021…

unter nachfolg. link getitelt mit..........

BC Gold Corp. - Fantastic Undervalued Opportuntiy!

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1021…

...noch siehts ´mancherorts´ noch soooo aus......nicht übel für tracking- fans.....aber

zukünftig noch weniger für GOLD- fans

Antwort auf Beitrag Nr.: 39.355.778 von hbg55 am 17.04.10 14:20:15....die samples sehen für meinen geschmack schon recht

schöööön aus.....und lassen bei MIR schon mal vorfreude auf die

zu erwartenden bohr- ergebnisse aufkommen....

schöööön aus.....und lassen bei MIR schon mal vorfreude auf die

zu erwartenden bohr- ergebnisse aufkommen....

Antwort auf Beitrag Nr.: 39.355.778 von hbg55 am 17.04.10 14:20:15

Ich hoffe das ist nicht Deren Büro -dann eventl. nochmal die Financials durchgehen.

Gruß

Popeye

Ich hoffe das ist nicht Deren Büro -dann eventl. nochmal die Financials durchgehen.

Gruß

Popeye

Antwort auf Beitrag Nr.: 39.355.718 von hbg55 am 17.04.10 13:48:25...und die drittgrößte Goldminen Company Nord Amerikas, Kingross, hat 0,35$ vor zwei Jahren für die 13% bezahlt...

vor zwei Jahren für die 13% bezahlt...

...ich nur 0,20$... TROTZDEM über 50% im Minus LANGE Zeit...

...Aber schon sehr bald werde ich massiv in die Gewinnzone gelangen!

Auch wieder so ein Beispiel dafür wie lange es u.U. dauern kann bis das Invest sich auszahlt...

Gruß Kelthe

vor zwei Jahren für die 13% bezahlt...

vor zwei Jahren für die 13% bezahlt......ich nur 0,20$... TROTZDEM über 50% im Minus LANGE Zeit...

...Aber schon sehr bald werde ich massiv in die Gewinnzone gelangen!

Auch wieder so ein Beispiel dafür wie lange es u.U. dauern kann bis das Invest sich auszahlt...

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.356.769 von Kelthe am 18.04.10 07:59:13...streiche das g bei Kinross...

Gruß Kelthe

Gruß Kelthe

@:hbg

Vielleicht sollte man da erst mal einen Rückgang abwarten, MACD schon ziemlich gut gelaufen...sieht nach einer Konsolidierung (zumindest notwendigen) aus...

Vielleicht sollte man da erst mal einen Rückgang abwarten, MACD schon ziemlich gut gelaufen...sieht nach einer Konsolidierung (zumindest notwendigen) aus...

Antwort auf Beitrag Nr.: 39.356.955 von Timesystem1002 am 18.04.10 10:38:37

moin TS1002,

....täusche dich nicht, innerhalb der letzten 3 tage fand

consol. innerhalb der täglichen sitzungen bereits statt....IMO

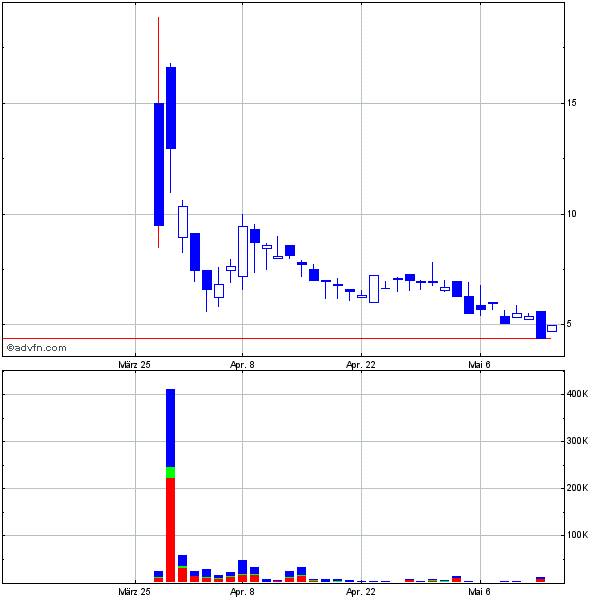

schau dir dazu mal den 5-tages- chart in # 1 an - insbesondere

den 14./4. !!!

moin TS1002,

....täusche dich nicht, innerhalb der letzten 3 tage fand

consol. innerhalb der täglichen sitzungen bereits statt....IMO

schau dir dazu mal den 5-tages- chart in # 1 an - insbesondere

den 14./4. !!!

Antwort auf Beitrag Nr.: 39.357.183 von hbg55 am 18.04.10 12:44:24

....auch auf nochfolg. bild läßt sich dies schön nachvollziehen....

....auch auf nochfolg. bild läßt sich dies schön nachvollziehen....

moin BCG-lers,

im SH- board rumorts gewaltig....um unser baby, KINROSS usw.....

hier lest mal die überlegungen von BEAMIN....

Anyone make this connection yet???

Or should I have kept it to myself???

I did a little more DD for BCG last night and it lead me to another company with huge potential very early on in their discovery phase. Please excuse me but I included a little bit of info on the other company, which I think many of you will like... Enjoy

I was doing in depth dd on Voigtberg property which is a part of the Golden Triangle in Northern BC. Did you know that our property is a 50/50 JV with a company called Kaminak Gold Corp? I have not found extensive terms of the condition but each party is subject to working capital payments on a yearly basis to maintain ownership.

If you haven’t already heard Kaminak Gold is a company that doesn’t even get talked about in the Golden Triangle even with their considerable holding there with BCG. This company’s main focus as of late is being one of the three darling companies in the Yukon white gold district where Kinross Gold just took out Underworld Resources for a mere couple hundred mil. Kaminak’s properties have been discovered by the same person who did the work on Underworlds’s discovery. This play has multi million ounce white gold discovery potential. They have in the first year found over 20 targets on a giant property that drilling will begin on this May...

There are lots of rumours around that Kinross will snap up another explorer in the area if encouraging results were released... The big difference between Kaminak and ATAC resources (the third of the 3 best plays in the area of UW) which sets them apart is that Kaminak employs a gentlemen by the name of Sean Ryan... Here is what the CEO of Kaminak Robert Carpenter said recently in a new interview about Sean Ryan and their project which adjoins the UW land package 20km to the south of their discovery..

“I think, it was mentioned that geologically the host rocks are very similar at Golden Saddle. One of the compelling parts is that the guy that did the initial soil sampling and trenching at Underworld is the same guy that did the soil sampling and trenching at Coffee, a guy name Sean Ryan, the guy that discovered both.”

The CEO of Kaminak Gold also went on to say this in the report:

“We’ve got probably 20 high quality gold targets right now that we’re going to be drilling that actually have mineralization on surface, so we don’t have to drill extremely deep holes, we’re not modeling any geophysical data, this is really simple, we had a soil sample, we trenched it, we got gold in the rock and now we’re going to drill right underneath it and try to put something in the 3rd dimension.”

Ok now back to why this is good for BC Gold... Kinross likes to take out companies that it holds stake in... It holds 0 shares of Kaminak Gold. However don’t let that scare you. Kinross’s purchase of neighbor Underworld as well as the fact BC Gold is a 50/50 partner with Kaminak in the Golden Triangle and Kinross holds stake in BC Gold. This has to raise connections and questions for everyone about Kaminak’s very bright future...

With significant results from spring drilling programs, this summer and fall could turn out to be very life changing for those of you who own either BCG or KAM... I think this is mainly because when K buy’s KAM they will get the 50% of Voigtberg too.... Since K already owns 13% or so of BCG then I think BCG would be Kinross’s next target once KAM is acquired? If you look at exploration timelines Kinross is probably just sitting back and waiting... Acquiring UW, KAM and BCG would be chump change for Kinross by time the information is available to make them highly perspective takeout targets.

But how much would K pay??? Well Kam at 43mil shares out would go up 5 times from here with a similar buyout from Kinross... That is if KAM’s discovery is the twin brother to UW... If the property is the big brother then you could be looking at 7 or 8 times your money from these prices... And if the Voigtberg property and the Coffee hills properties return greater results than UW you could see the market cap increase 10-12 times or even greater from its current levels.... KAM is a Great speculative buy and has sold off nicely from recent 52 week highs for those looking for another good Canadian story with a connection to BCG. Also BCG at a 5.8 mil market cap is laughable and the reason I am in here early and often!! Look at ASW and tell me why that company with their Kenville property in BC I think it’s called is trading at a market cap thats almost 7 times higher than ours???? We have so much more discovery and shorter term production potential then they have. Set in mining camps that are getting much much more provincial and federal spending attention...

This puppy is going to get rocking and rolling very soon! 20-30 mil market cap in our short future??? I am talking in the coming weeks to month? Look at page 41 in the investor presentation on BC Gold’s website... I like that road Nova gold and the BC Government is building to provide access to highway 37... a short 5 km away for BCGold to tap into power and transportation... Great accessibility!!! Lots of success in the area already!!! The potential at this point in the game is limitless and risk reward is seriously on the investors side in BCG right now!!

Discolsure I do not own any shares of KAM this was just interesting reading I did last night that I thought it best to share with y’all... Do not rush into KAM however they are getting ahead of themselves with only soil samples to this point as drilling begins in May this year... With that being said you could see this puppy sell a little bit into the drill program as little to no material news should be anticipated over the next month or so. Only fluff releases may come in my mind, so I and many others will look for my gains in BCG as well as another while I survey that situation a little more!!

Good luck all

Beamin

im SH- board rumorts gewaltig....um unser baby, KINROSS usw.....

hier lest mal die überlegungen von BEAMIN....

Anyone make this connection yet???

Or should I have kept it to myself???

I did a little more DD for BCG last night and it lead me to another company with huge potential very early on in their discovery phase. Please excuse me but I included a little bit of info on the other company, which I think many of you will like... Enjoy

I was doing in depth dd on Voigtberg property which is a part of the Golden Triangle in Northern BC. Did you know that our property is a 50/50 JV with a company called Kaminak Gold Corp? I have not found extensive terms of the condition but each party is subject to working capital payments on a yearly basis to maintain ownership.

If you haven’t already heard Kaminak Gold is a company that doesn’t even get talked about in the Golden Triangle even with their considerable holding there with BCG. This company’s main focus as of late is being one of the three darling companies in the Yukon white gold district where Kinross Gold just took out Underworld Resources for a mere couple hundred mil. Kaminak’s properties have been discovered by the same person who did the work on Underworlds’s discovery. This play has multi million ounce white gold discovery potential. They have in the first year found over 20 targets on a giant property that drilling will begin on this May...

There are lots of rumours around that Kinross will snap up another explorer in the area if encouraging results were released... The big difference between Kaminak and ATAC resources (the third of the 3 best plays in the area of UW) which sets them apart is that Kaminak employs a gentlemen by the name of Sean Ryan... Here is what the CEO of Kaminak Robert Carpenter said recently in a new interview about Sean Ryan and their project which adjoins the UW land package 20km to the south of their discovery..

“I think, it was mentioned that geologically the host rocks are very similar at Golden Saddle. One of the compelling parts is that the guy that did the initial soil sampling and trenching at Underworld is the same guy that did the soil sampling and trenching at Coffee, a guy name Sean Ryan, the guy that discovered both.”

The CEO of Kaminak Gold also went on to say this in the report:

“We’ve got probably 20 high quality gold targets right now that we’re going to be drilling that actually have mineralization on surface, so we don’t have to drill extremely deep holes, we’re not modeling any geophysical data, this is really simple, we had a soil sample, we trenched it, we got gold in the rock and now we’re going to drill right underneath it and try to put something in the 3rd dimension.”

Ok now back to why this is good for BC Gold... Kinross likes to take out companies that it holds stake in... It holds 0 shares of Kaminak Gold. However don’t let that scare you. Kinross’s purchase of neighbor Underworld as well as the fact BC Gold is a 50/50 partner with Kaminak in the Golden Triangle and Kinross holds stake in BC Gold. This has to raise connections and questions for everyone about Kaminak’s very bright future...

With significant results from spring drilling programs, this summer and fall could turn out to be very life changing for those of you who own either BCG or KAM... I think this is mainly because when K buy’s KAM they will get the 50% of Voigtberg too.... Since K already owns 13% or so of BCG then I think BCG would be Kinross’s next target once KAM is acquired? If you look at exploration timelines Kinross is probably just sitting back and waiting... Acquiring UW, KAM and BCG would be chump change for Kinross by time the information is available to make them highly perspective takeout targets.

But how much would K pay??? Well Kam at 43mil shares out would go up 5 times from here with a similar buyout from Kinross... That is if KAM’s discovery is the twin brother to UW... If the property is the big brother then you could be looking at 7 or 8 times your money from these prices... And if the Voigtberg property and the Coffee hills properties return greater results than UW you could see the market cap increase 10-12 times or even greater from its current levels.... KAM is a Great speculative buy and has sold off nicely from recent 52 week highs for those looking for another good Canadian story with a connection to BCG. Also BCG at a 5.8 mil market cap is laughable and the reason I am in here early and often!! Look at ASW and tell me why that company with their Kenville property in BC I think it’s called is trading at a market cap thats almost 7 times higher than ours???? We have so much more discovery and shorter term production potential then they have. Set in mining camps that are getting much much more provincial and federal spending attention...

This puppy is going to get rocking and rolling very soon! 20-30 mil market cap in our short future??? I am talking in the coming weeks to month? Look at page 41 in the investor presentation on BC Gold’s website... I like that road Nova gold and the BC Government is building to provide access to highway 37... a short 5 km away for BCGold to tap into power and transportation... Great accessibility!!! Lots of success in the area already!!! The potential at this point in the game is limitless and risk reward is seriously on the investors side in BCG right now!!

Discolsure I do not own any shares of KAM this was just interesting reading I did last night that I thought it best to share with y’all... Do not rush into KAM however they are getting ahead of themselves with only soil samples to this point as drilling begins in May this year... With that being said you could see this puppy sell a little bit into the drill program as little to no material news should be anticipated over the next month or so. Only fluff releases may come in my mind, so I and many others will look for my gains in BCG as well as another while I survey that situation a little more!!

Good luck all

Beamin

hallo h5

danke für die eröffnung!!!!

denke man hat noch reichlich zeit sich günstig einzudecken

gruss

runn64

danke für die eröffnung!!!!

denke man hat noch reichlich zeit sich günstig einzudecken

gruss

runn64

Antwort auf Beitrag Nr.: 39.362.761 von runn64 am 19.04.10 18:31:56

moin r64,

...da bin ICH mir nicht so sicher - denk mal an GQ, da

haben auch ne menge leuze immmmmer schön auf günstigere kurse

gewartet........und dann gallopierte sie davon !!!

die story hier zwar anders gelagert, aber die jüngst

kräftig angezogenen vols. signalisieren, daß sich da

hinter den kulissen was zusammenbraut....IMO

moin r64,

...da bin ICH mir nicht so sicher - denk mal an GQ, da

haben auch ne menge leuze immmmmer schön auf günstigere kurse

gewartet........und dann gallopierte sie davon !!!

die story hier zwar anders gelagert, aber die jüngst

kräftig angezogenen vols. signalisieren, daß sich da

hinter den kulissen was zusammenbraut....IMO

Antwort auf Beitrag Nr.: 39.362.850 von hbg55 am 19.04.10 18:45:07so ist es,

habe mich falsch ausgedrückt;ich meinte

daß bis 0.20 noch einige zeit(paar tage !) bleibt

um sich zu positionieren ,dann wäre BCG wie GQ zu 0.09-0.11

heute wissen wir daß es nicht zu teuer war

habe mich falsch ausgedrückt;ich meinte

daß bis 0.20 noch einige zeit(paar tage !) bleibt

um sich zu positionieren ,dann wäre BCG wie GQ zu 0.09-0.11

heute wissen wir daß es nicht zu teuer war

Recent Trades - Last 10 of 72

Time ET Ex Price Change Volume Buyer Seller Markers

15:29:59 V 0.13 0.005 17,500 9 BMO Nesbitt 7 TD Sec K

15:29:04 V 0.13 0.005 5,000 85 Scotia 7 TD Sec K

15:28:47 V 0.13 0.005 10,000 2 RBC 7 TD Sec K

15:19:35 V 0.13 0.005 2,000 80 National Bank 7 TD Sec K

15:13:08 V 0.13 0.005 100 7 TD Sec 62 Haywood E

15:13:08 V 0.13 0.005 4,500 7 TD Sec 7 TD Sec K

15:01:35 V 0.13 0.005 3,000 6 Union 85 Scotia K

15:01:35 V 0.13 0.005 47,000 6 Union 7 TD Sec K

14:44:47 V 0.13 0.005 11,000 85 Scotia 7 TD Sec K

14:43:43 V 0.13 0.005 60,000 7 TD Sec 7 TD Sec K

...auch heute, zum wochenstart, setzt sich KAUF- laune der

vorwoche fort

Time ET Ex Price Change Volume Buyer Seller Markers

15:29:59 V 0.13 0.005 17,500 9 BMO Nesbitt 7 TD Sec K

15:29:04 V 0.13 0.005 5,000 85 Scotia 7 TD Sec K

15:28:47 V 0.13 0.005 10,000 2 RBC 7 TD Sec K

15:19:35 V 0.13 0.005 2,000 80 National Bank 7 TD Sec K

15:13:08 V 0.13 0.005 100 7 TD Sec 62 Haywood E

15:13:08 V 0.13 0.005 4,500 7 TD Sec 7 TD Sec K

15:01:35 V 0.13 0.005 3,000 6 Union 85 Scotia K

15:01:35 V 0.13 0.005 47,000 6 Union 7 TD Sec K

14:44:47 V 0.13 0.005 11,000 85 Scotia 7 TD Sec K

14:43:43 V 0.13 0.005 60,000 7 TD Sec 7 TD Sec K

...auch heute, zum wochenstart, setzt sich KAUF- laune der

vorwoche fort

Antwort auf Beitrag Nr.: 39.364.120 von hbg55 am 19.04.10 21:50:54Wann wird das Teil endlich mal in Deutschland gelistet??

Antwort auf Beitrag Nr.: 39.365.539 von ooy am 20.04.10 09:45:01moin OOY.........warum sollten SIE - kostet nur ne menge kohle,

die besser für explor. angelegt ist....IMO

MIR nixxxx bekannt, daß sie daran in nächster zeit was

ändern wollen !!!

die besser für explor. angelegt ist....IMO

MIR nixxxx bekannt, daß sie daran in nächster zeit was

ändern wollen !!!

Antwort auf Beitrag Nr.: 39.365.539 von ooy am 20.04.10 09:45:01Kauf doch in TOR, ist meist ohnehin günstiger als die Wucherpreise aus FRA.

Gruß Kelthe

Gruß Kelthe

....und heute gehts mit TOP- vol.......UPPPPP........

RT...cad 0,165

RT...cad 0,165

Antwort auf Beitrag Nr.: 39.378.369 von hbg55 am 21.04.10 19:59:32Yes, gefällt mir SEHR gut...

Wollen mal sehen wo uns die Reise hin führt...

Gruß Kelthe

Wollen mal sehen wo uns die Reise hin führt...

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.378.471 von Kelthe am 21.04.10 20:11:11

moin kelthe

.....abisl richtung norden noch würd MIR schon gefallen

moin kelthe

.....abisl richtung norden noch würd MIR schon gefallen

Antwort auf Beitrag Nr.: 39.378.547 von hbg55 am 21.04.10 20:19:57

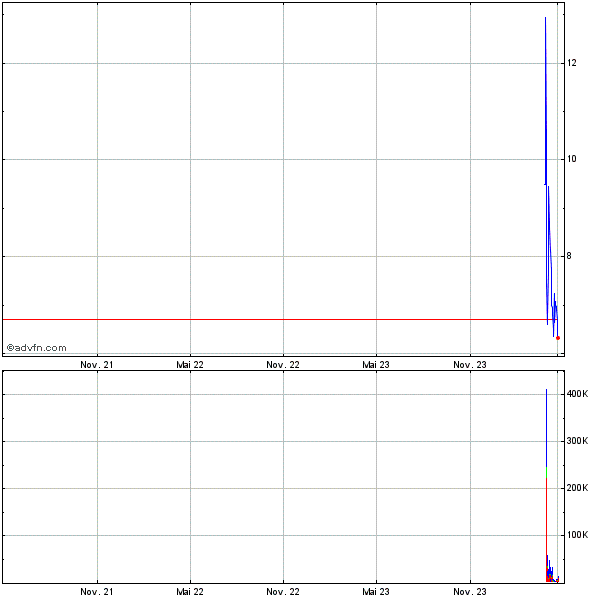

und das SIES kann, hat sie ja schon mal unter beweis gestellt....

vor knapp 3 jahren.......alllerdings bei nicht annäherndem vol.

von heute...

und das SIES kann, hat sie ja schon mal unter beweis gestellt....

vor knapp 3 jahren.......alllerdings bei nicht annäherndem vol.

von heute...

Antwort auf Beitrag Nr.: 39.378.547 von hbg55 am 21.04.10 20:19:57Denke wir werden hier relativ schnell die 0,4CAD sehen.

Fair bewertet zum akt. Zeitpunkt ca 0,49 Cad. Damit stimme ich mit den meisten SH usern überein!

Evtl. PP abgeschlossen, und daher der Anstieg heute...

Und Mai/Juni wird gebuddelt. Übrigens liegt Nova Gold nicht weit von uns entfernt...

Gruß Kelthe

PS: Genau so viel Potenzial wie unsere GQ meiner Meinung nach...

Fair bewertet zum akt. Zeitpunkt ca 0,49 Cad. Damit stimme ich mit den meisten SH usern überein!

Evtl. PP abgeschlossen, und daher der Anstieg heute...

Und Mai/Juni wird gebuddelt. Übrigens liegt Nova Gold nicht weit von uns entfernt...

Gruß Kelthe

PS: Genau so viel Potenzial wie unsere GQ meiner Meinung nach...

Antwort auf Beitrag Nr.: 39.378.581 von hbg55 am 21.04.10 20:23:54

mit NIE gesehenem vol. von über 5mios. gings heute ausm

handel....uuuuund denke mal, die folgetage dürften nicht

minder aufregend verlaufen......

Recent Trades - Last 10 of 429

Time ET Ex Price Change Volume Buyer Seller Markers

15:58:45 V 0.155 0.035 5,000 1 Anonymous 99 Jitney K

15:58:45 V 0.155 0.035 1,000 1 Anonymous 9 BMO Nesbitt K

15:55:15 V 0.155 0.035 10,000 81 HSBC 9 BMO Nesbitt K

15:55:02 V 0.155 0.035 8,000 81 HSBC 9 BMO Nesbitt K

15:55:02 V 0.155 0.035 5,000 79 CIBC 9 BMO Nesbitt K

15:53:30 V 0.155 0.035 14,000 7 TD Sec 9 BMO Nesbitt K

15:53:15 V 0.155 0.035 100 19 Desjardins 62 Haywood E

15:52:38 V 0.155 0.035 2,000 99 Jitney 9 BMO Nesbitt K

15:52:04 V 0.16 0.04 2,000 81 HSBC 7 TD Sec K

15:52:04 V 0.16 0.04 18,000 81 HSBC 7 TD Sec K

mit NIE gesehenem vol. von über 5mios. gings heute ausm

handel....uuuuund denke mal, die folgetage dürften nicht

minder aufregend verlaufen......

Recent Trades - Last 10 of 429

Time ET Ex Price Change Volume Buyer Seller Markers

15:58:45 V 0.155 0.035 5,000 1 Anonymous 99 Jitney K

15:58:45 V 0.155 0.035 1,000 1 Anonymous 9 BMO Nesbitt K

15:55:15 V 0.155 0.035 10,000 81 HSBC 9 BMO Nesbitt K

15:55:02 V 0.155 0.035 8,000 81 HSBC 9 BMO Nesbitt K

15:55:02 V 0.155 0.035 5,000 79 CIBC 9 BMO Nesbitt K

15:53:30 V 0.155 0.035 14,000 7 TD Sec 9 BMO Nesbitt K

15:53:15 V 0.155 0.035 100 19 Desjardins 62 Haywood E

15:52:38 V 0.155 0.035 2,000 99 Jitney 9 BMO Nesbitt K

15:52:04 V 0.16 0.04 2,000 81 HSBC 7 TD Sec K

15:52:04 V 0.16 0.04 18,000 81 HSBC 7 TD Sec K

Antwort auf Beitrag Nr.: 39.379.622 von hbg55 am 21.04.10 22:56:01 ,es geht ja sogar paaaar ticks schneller als erwartet

,es geht ja sogar paaaar ticks schneller als erwartet

habe eben erst gesehen- da bleibt nicht viel zeit um noch unter 0.2 zum zuge zu kommen

,es geht ja sogar paaaar ticks schneller als erwartet

,es geht ja sogar paaaar ticks schneller als erwartethabe eben erst gesehen- da bleibt nicht viel zeit um noch unter 0.2 zum zuge zu kommen

Antwort auf Beitrag Nr.: 39.379.820 von runn64 am 21.04.10 23:39:46moin r64,

...auch gestern int. zu beobachten, daß wiederum ´innerhalb´ der

tages- sitzung korrigiert wurde - da werden sich immmmmmer mehr

auf dem falschen bein wiederfinden und zu höheren kursen ein-

decken müssen.......IMO !!

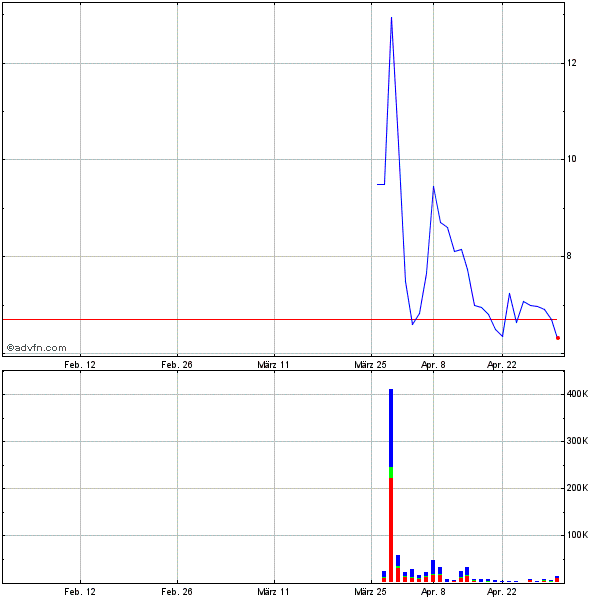

hier schau mal aufs chart- bild.....

...auch gestern int. zu beobachten, daß wiederum ´innerhalb´ der

tages- sitzung korrigiert wurde - da werden sich immmmmmer mehr

auf dem falschen bein wiederfinden und zu höheren kursen ein-

decken müssen.......IMO !!

hier schau mal aufs chart- bild.....

Thursday, April 22, 2010

Sprott Asset Management strategist John Embry sees gold up $500 in 6 months

by Geoff Candy (Mineweb)

http://www.proactiveinvestors.com.au/companies/news/6629/spr…

Antwort auf Beitrag Nr.: 39.380.146 von hbg55 am 22.04.10 07:46:29Du liebe Güte. Wer hat dich denn so früh aus dem Bett gescheucht?

Oder einfach nur so aufgeregt weil "unsere" Aktien sehr gut rennen?

Gruß Kelthe

Oder einfach nur so aufgeregt weil "unsere" Aktien sehr gut rennen?

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.380.509 von Kelthe am 22.04.10 09:01:43

moin......der MIXXXX wars wohl gepaart mit nem

knurren in der magengrube

moin......der MIXXXX wars wohl gepaart mit nem

knurren in der magengrube

Antwort auf Beitrag Nr.: 39.378.581 von hbg55 am 21.04.10 20:23:54

...sooooo, nach hist. vol.- HIGH gestern, gehts heute abisl

beschaulicher zu - der kurs hingegen krabbelt weiter gen norden....

Recent Trades - Last 10 of 54

Time ET Ex Price Change Volume Buyer Seller Markers

12:00:54 V 0.165 0.01 20,000 19 Desjardins 81 HSBC K

11:43:05 V 0.165 0.01 9,000 19 Desjardins 79 CIBC K

11:33:06 V 0.17 0.015 27,000 58 Qtrade 7 TD Sec K....akt. TH

11:33:06 V 0.165 0.01 5,000 58 Qtrade 99 Jitney K

11:33:06 V 0.165 0.01 10,000 58 Qtrade 9 BMO Nesbitt K

11:33:06 V 0.165 0.01 5,000 58 Qtrade 85 Scotia K

11:21:02 V 0.16 0.005 1,500 19 Desjardins 1 Anonymous K

11:21:02 V 0.16 0.005 6,000 2 RBC 1 Anonymous K

11:21:02 V 0.16 0.005 2,500 9 BMO Nesbitt 1 Anonymous K

11:20:11 V 0.165 0.01 14,000 7 TD Sec 7 TD Sec K

...sooooo, nach hist. vol.- HIGH gestern, gehts heute abisl

beschaulicher zu - der kurs hingegen krabbelt weiter gen norden....

Recent Trades - Last 10 of 54

Time ET Ex Price Change Volume Buyer Seller Markers

12:00:54 V 0.165 0.01 20,000 19 Desjardins 81 HSBC K

11:43:05 V 0.165 0.01 9,000 19 Desjardins 79 CIBC K

11:33:06 V 0.17 0.015 27,000 58 Qtrade 7 TD Sec K....akt. TH

11:33:06 V 0.165 0.01 5,000 58 Qtrade 99 Jitney K

11:33:06 V 0.165 0.01 10,000 58 Qtrade 9 BMO Nesbitt K

11:33:06 V 0.165 0.01 5,000 58 Qtrade 85 Scotia K

11:21:02 V 0.16 0.005 1,500 19 Desjardins 1 Anonymous K

11:21:02 V 0.16 0.005 6,000 2 RBC 1 Anonymous K

11:21:02 V 0.16 0.005 2,500 9 BMO Nesbitt 1 Anonymous K

11:20:11 V 0.165 0.01 14,000 7 TD Sec 7 TD Sec K

Antwort auf Beitrag Nr.: 39.385.777 von hbg55 am 22.04.10 18:37:54heute geht es etwas mehr beschaulicher,

daher bietet die lage nnnnoch unter 0.2(meine

magische zahl )dabeizusein,zumal das Gold

wieder anzieht

daher bietet die lage nnnnoch unter 0.2(meine

magische zahl )dabeizusein,zumal das Gold

wieder anzieht

!!!NEWS!!!

BCGold 14,166,200-share private placement

2010-04-29 20:16 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced March 30, 2010.

Number of shares: 10.16 million non-flow-through shares and 4,006,200 flow-through shares

Purchase price: Eight cents per non-flow-through share and 10 cents per flow-through share

Warrants: 5.08 million share purchase warrants to purchase 5.08 million shares at 15 cents per share for a one-year period (non-flow-through units) and 2,003,100 share purchase warrants to purchase 2,003,100 shares at 20 cents per share for a one-year period (flow-through units)

Hidden placees: 21 hidden placees (non-flow-through) and 18 hidden placees (flow-through)

Pro groups: Kostantinos Tsirigotis, 50,000 flow-through shares; Thomas W. Seltzer, 300,000 non-flow-through shares; David Elliott, 250,000 non-flow-through shares

Insiders: Kinross Gold Corp., 1.75 million non-flow-through shares; Dynamic Precious Metals Fund, 4.81 million non-flow-through shares

Finders' fees: Haywood Securities Inc., $8,610; Canaccord Financial Ltd., $5,320; Anthem Capital Group Inc., $12,000 and 200,000 warrants that are exercisable into common shares at 15 cents per share for an 18-month period; Barrington Capital Corp., $12,000 and 200,000 warrants that are exercisable into common shares at 15 cents per share for an 18-month period; Limited Market Dealer Inc., $12,000 and 160,000 warrants that are exercisable into common shares at 20 cents per share for an 18-month period

Das Erfreuliche daran ist, dass ca.47% der Shares des PP`s an INSIDER gegangen ist!!!

Dann kann es ja jetzt los gehen!!

Gruß Kelthe

BCGold 14,166,200-share private placement

2010-04-29 20:16 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced March 30, 2010.

Number of shares: 10.16 million non-flow-through shares and 4,006,200 flow-through shares

Purchase price: Eight cents per non-flow-through share and 10 cents per flow-through share

Warrants: 5.08 million share purchase warrants to purchase 5.08 million shares at 15 cents per share for a one-year period (non-flow-through units) and 2,003,100 share purchase warrants to purchase 2,003,100 shares at 20 cents per share for a one-year period (flow-through units)

Hidden placees: 21 hidden placees (non-flow-through) and 18 hidden placees (flow-through)

Pro groups: Kostantinos Tsirigotis, 50,000 flow-through shares; Thomas W. Seltzer, 300,000 non-flow-through shares; David Elliott, 250,000 non-flow-through shares

Insiders: Kinross Gold Corp., 1.75 million non-flow-through shares; Dynamic Precious Metals Fund, 4.81 million non-flow-through shares

Finders' fees: Haywood Securities Inc., $8,610; Canaccord Financial Ltd., $5,320; Anthem Capital Group Inc., $12,000 and 200,000 warrants that are exercisable into common shares at 15 cents per share for an 18-month period; Barrington Capital Corp., $12,000 and 200,000 warrants that are exercisable into common shares at 15 cents per share for an 18-month period; Limited Market Dealer Inc., $12,000 and 160,000 warrants that are exercisable into common shares at 20 cents per share for an 18-month period

Das Erfreuliche daran ist, dass ca.47% der Shares des PP`s an INSIDER gegangen ist!!!

Dann kann es ja jetzt los gehen!!

Gruß Kelthe

Na, Superpreise... für das PP

Und warum soll ich -an der Börse- 0,14 CAD bezahlen?

Die haben doch ein Rad ab, 0,08 CAD bzw. 0,10 CAD, solche Abschläge..

Spricht überhaupt nicht für diese Aktie...

Und warum soll ich -an der Börse- 0,14 CAD bezahlen?

Die haben doch ein Rad ab, 0,08 CAD bzw. 0,10 CAD, solche Abschläge..

Spricht überhaupt nicht für diese Aktie...

Antwort auf Beitrag Nr.: 39.430.228 von Timesystem1002 am 30.04.10 08:45:49Ja, hatte auch ueberlegt zu kaufen, hat sich jetzt aber erledigt...

Antwort auf Beitrag Nr.: 39.430.022 von Kelthe am 30.04.10 08:04:04

thx kelthe....jooo, niedriger PP-preis eindeutig dem umstand

geschuldet den GROSS- aktionären attraktive kond. bieten zu

müssen........und DIE schnappen, wie uns die INSIDER- quote

zeigt, geeeerne zu

.....dies hat kurs- niv. im übrigen gestern nicht gedrückt,

sondern zum sitzungsende sogar noch auf TH geführt - WARUM

wohl !?!?

thx kelthe....jooo, niedriger PP-preis eindeutig dem umstand

geschuldet den GROSS- aktionären attraktive kond. bieten zu

müssen........und DIE schnappen, wie uns die INSIDER- quote

zeigt, geeeerne zu

.....dies hat kurs- niv. im übrigen gestern nicht gedrückt,

sondern zum sitzungsende sogar noch auf TH geführt - WARUM

wohl !?!?

Antwort auf Beitrag Nr.: 39.430.228 von Timesystem1002 am 30.04.10 08:45:49Sorry Leute, aber was das für eine Logik ist verstehe wer will.

Zu welchem Preis habt ihr denn geglaubt wird das PP durchgeführt??

Wisst ihr überhaupt wie der Kursdurchschnitt der letzten zwei Jahre war??

PP`s werden nicht an einem Tag durchgeführt! Vor kurzem stand der Kurs noch bei 0,06Cad.

Außerdem muss man Großinvestoren mit Vorzügen bedienen. Oder wollt ihr paar Mio`s hier zur Verfügung stellen?

Aus meiner Sicht ist das PP aus folgenden Gründen gelungen.

-Großinvestoren + Insider haben ordentlich zugelangt! Das würden sie wohl kaum machen wenn sie nicht an den Laden glauben würden.

Der Bezugskurs ist absolut nicht ZU niedrig wenn man den Kurs der letzten Monate betrachtet!

-Die Verwässerung ist bereits im akt. Kurs enthalten. Wenn man bedenkt wo sich der Kurs aktuell befindet + die neuen Shares hat die MK bedeutend zugelegt!!

Meiner Meinung nach absolute Einstiegskurse. Gehe davon aus, dass wir nun, da das PP abgeschlossen ist WEITER steigende Kurse sehen werden!

Gruß Kelthe

Zu welchem Preis habt ihr denn geglaubt wird das PP durchgeführt??

Wisst ihr überhaupt wie der Kursdurchschnitt der letzten zwei Jahre war??

PP`s werden nicht an einem Tag durchgeführt! Vor kurzem stand der Kurs noch bei 0,06Cad.

Außerdem muss man Großinvestoren mit Vorzügen bedienen. Oder wollt ihr paar Mio`s hier zur Verfügung stellen?

Aus meiner Sicht ist das PP aus folgenden Gründen gelungen.

-Großinvestoren + Insider haben ordentlich zugelangt! Das würden sie wohl kaum machen wenn sie nicht an den Laden glauben würden.

Der Bezugskurs ist absolut nicht ZU niedrig wenn man den Kurs der letzten Monate betrachtet!

-Die Verwässerung ist bereits im akt. Kurs enthalten. Wenn man bedenkt wo sich der Kurs aktuell befindet + die neuen Shares hat die MK bedeutend zugelegt!!

Meiner Meinung nach absolute Einstiegskurse. Gehe davon aus, dass wir nun, da das PP abgeschlossen ist WEITER steigende Kurse sehen werden!

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.432.160 von Kelthe am 30.04.10 11:52:39

...die börse siehts ähnlich und zieht weiter gen norden.....

Recent Trades - Last 10 of 32

Time ET Ex Price Change Volume Buyer Seller Markers

10:15:36 V 0.155 0.015 7,000 85 Scotia 7 TD Sec K

10:15:36 V 0.155 0.015 6,000 85 Scotia 85 Scotia K

10:11:53 V 0.14 0.00 9,000 83 Mackie 7 TD Sec K

10:11:52 V 0.145 0.005 10,000 99 Jitney 7 TD Sec K

10:10:07 V 0.15 0.01 2,000 80 National Bank 7 TD Sec K

10:10:07 V 0.15 0.01 2,000 79 CIBC 7 TD Sec K

10:10:07 V 0.155 0.015 4,000 79 CIBC 85 Scotia K

10:03:59 V 0.15 0.01 15,000 7 TD Sec 7 TD Sec K

10:03:59 V 0.15 0.01 5,000 79 CIBC 7 TD Sec K

10:00:24 V 0.15 0.01 13,000 79 CIBC 2 RBC K

...die börse siehts ähnlich und zieht weiter gen norden.....

Recent Trades - Last 10 of 32

Time ET Ex Price Change Volume Buyer Seller Markers

10:15:36 V 0.155 0.015 7,000 85 Scotia 7 TD Sec K

10:15:36 V 0.155 0.015 6,000 85 Scotia 85 Scotia K

10:11:53 V 0.14 0.00 9,000 83 Mackie 7 TD Sec K

10:11:52 V 0.145 0.005 10,000 99 Jitney 7 TD Sec K

10:10:07 V 0.15 0.01 2,000 80 National Bank 7 TD Sec K

10:10:07 V 0.15 0.01 2,000 79 CIBC 7 TD Sec K

10:10:07 V 0.155 0.015 4,000 79 CIBC 85 Scotia K

10:03:59 V 0.15 0.01 15,000 7 TD Sec 7 TD Sec K

10:03:59 V 0.15 0.01 5,000 79 CIBC 7 TD Sec K

10:00:24 V 0.15 0.01 13,000 79 CIBC 2 RBC K

jetzt wird klar weshalb die konsolidierung in den letzten tagen

bin auch der meinung-die besseren konditionen für großinvestoren

sind volkomen gerechtfertigt,wenn man abruft bei welchen kursen

Kinross die erstbeteiligung eingegangen hat...

bin auch der meinung-die besseren konditionen für großinvestoren

sind volkomen gerechtfertigt,wenn man abruft bei welchen kursen

Kinross die erstbeteiligung eingegangen hat...

Dafür das der Dow nur knapp über TT geschlossen hat mit immerhin über 1,4% minus können wir doch mit 14%+ nach vollendetem PP und der damit eingetretenen Verwässerung ganz zufrieden sein, oder?

Die Leute die gestern nicht eingesehen haben 0,14 an der Börse zu zahlen müssen am Montag schon 0,16 auf den Tisch legen wenn sie dabei sein wollen...

Gruß Kelthe

Die Leute die gestern nicht eingesehen haben 0,14 an der Börse zu zahlen müssen am Montag schon 0,16 auf den Tisch legen wenn sie dabei sein wollen...

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.437.849 von Kelthe am 01.05.10 07:59:42Na, Kelthe,

Hochmut kommt vor dem Fall. Schon für 0,135 nachgelegt?

hbg

sorry, der musste einfach sein.

Hochmut kommt vor dem Fall. Schon für 0,135 nachgelegt?

hbg

sorry, der musste einfach sein.

Antwort auf Beitrag Nr.: 39.447.741 von Timesystem1002 am 03.05.10 20:28:11Ob wirklich das PP für den heutigen KVerlauf verantwortlich war

Denke eher das heute einige Rohstoffwerte Federn gelassen haben...

Aber möchte dir deinen Spaß nicht nehmen.

Gruß Kelthe

Denke eher das heute einige Rohstoffwerte Federn gelassen haben...

Aber möchte dir deinen Spaß nicht nehmen.

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.448.358 von Kelthe am 03.05.10 21:57:25Kelthe

mit Spass hat das weniger zu tun, hier oben im Norden ist man nur- mit solchen Aussagen..." bla,bla, bla,bla...um dabeizusein muss man schon..usw." etwas vorsichtiger. Das fällt einem (fast) immer auf die Füsse...

BC bleibt trotzdem ein guter Wert.

mit Spass hat das weniger zu tun, hier oben im Norden ist man nur- mit solchen Aussagen..." bla,bla, bla,bla...um dabeizusein muss man schon..usw." etwas vorsichtiger. Das fällt einem (fast) immer auf die Füsse...

BC bleibt trotzdem ein guter Wert.

Antwort auf Beitrag Nr.: 39.448.408 von Timesystem1002 am 03.05.10 22:04:15Vielleicht hast du ja Glück und kommst noch zu den PP Kursen rein, wer weiß...

Hoffe du musst nicht zuschauen...

Gruß Kelthe

Hoffe du musst nicht zuschauen...

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.448.453 von Kelthe am 03.05.10 22:11:29Ja, hoffe ich auch... bin noch am überlegen, zwecks Einstiegslimit...

Antwort auf Beitrag Nr.: 39.448.687 von Timesystem1002 am 03.05.10 22:50:00was gibt es noch zu überlegen...,

sich in sein allerwertesten treten

und erste position kaufen

sich in sein allerwertesten treten

und erste position kaufen

DOW zeitweise um über 1000Punkte gefallen und wir halten uns HERVORRAGEND!!!!

Azfgrund dieser News!??

Marketwire

BCGold Corp.

TSX VENTURE: BCG

Other Recent News

May 6, 2010

BCGold Corp. Mobilizes for Underground Drill Program at Engineer Gold Mine Property, B.C.

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 6, 2010) - BCGold Corp. (the "Company") (TSX VENTURE:BCG) is pleased to announce preparations to diamond drill extensions of 2 high-grade gold veins at Engineer Mine (or the "Mine"). The Company has contracted Ampex Mining Ltd. of Whitehorse, Yukon and Lyncorp Drilling Services Inc. of Smithers, B.C. to conduct a minimum $250,000 Phase I underground diamond drill program, scheduled to commence June 1, 2010. Crews will mobilize to site on May 15th to prepare the camp and set up a diamond drill on Level 5 of the mine, the main access level.

BCGold Corp. intends to drill at least 700 metres in 6 holes between the 5th and 8th levels of the Mine. The Company will target the dip extensions of 2 high-grade shoots defined by historic and recent sampling on the Engineer and Double Decker veins. BCGold Corp. recently reported channel sample results averaging up to 794.0 grams/tonne (g/t) gold and 642.3 g/t silver over 0.5 metres from the Engineer Vein and 537.7 g/t gold and 298.8 g/t silver over 0.48 metres from the Double Decker Vein. The samples were extracted from accessible vein exposures on Level 5 of the mine. (See BCGold Corp. News Release dated March 3, 2010). On Level 8, the deepest level of the Mine, historic sampling records indicate a 24.7 metre section of the Double Decker Vein averaging 38.0 g/t gold, including a 10.0 metre interval averaging 84.3 g/t gold, across the width of the drift (Brinker Report, 1927).

Potential Mineral Target

Engineer Mine currently has no publically reported mineral resources or reserves, but has a potential mineral target of 100,000 - 150,000 tonnes averaging 8 - 12 g/t gold, containing 26,000 - 57,000 ounces gold (see BCGold News Release dated March 18, 2009). This potential quantity and grade is conceptual in nature, based on a 3-D Vulcan(TM) model developed by BCGold Corp. that incorporates historic geological maps and sections, chip samples and production records. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in this target being delineated as a mineral resource.

Near Term Production Potential

The project offers excellent potential for near-term, small-scale gold production from existing underground headings on the formerly producing Engineer, Double Decker and Boulder veins. A successful 2010 drill program verifying recent and historic high gold grades from the Engineer and Double Decker veins could provide the Company with the motivation to dewater the 3 lowest levels of the Mine, which have been flooded since the early 1930s. BCGold Corp. holds a permit entitling it to dewater the Mine until April 15, 2011. Dewatering the Mine would provide access for rehabilitation, geological mapping, sampling and exploration followed by resource definition drilling, bulk sampling and test mining. A fully operational and permitted 25 tonne per day gravity separation mill at the Mine allows the Company to process bulk sample material immediately and on site.

About the Engineer Mine Property

The historic Engineer Mine was a high-grade gold producer that reached its zenith in the mid-1920s and ceased production in the early 1930s primarily due to water ingress issues and an antiquated mine water pumping system. There are more than 25 known veins on the property and only 4 have had limited production and exploration to date. All veins remain open at depth and little exploration has been conducted deeper than 200 metres below surface. Significant potential also exists for a bulk tonnage, lower grade gold resource associated with the Shear Zone "A" hydrothermal breccia system, partially drill tested by BCGold Corp. in 2008 (See BCGold Corp. News Release dated December 2, 2008).

BCGold Corp. has an option to earn 100% interest in the Engineer Mine Property and has spent approximately $1.4 million in exploration since acquiring the property in January, 2007.

About BCGold Corp.

BCGold Corp. (TSX VENTURE:BCG) is a Vancouver-based junior resource company focused on copper and gold exploration in under-explored, historic and emerging mining districts in British Columbia and Yukon. BCGold Corp. acquires and develops conceptual, early and mid-stage exploration opportunities and advances them towards resource development by using internal expertise, engaging preferred joint venture partners and creating strategic alliances with major exploration and mining companies.

On behalf of the Board of Directors,

Brian P. Fowler, P. Geo., President & CEO

Some statements in this news release contain forward-looking information. These statements include, but are not limited to, statements with respect to future payments, expenditures and unit issuances and exploration, development and production activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, among others, the timing of future payments, expenditures and unit issuances and the timing and success of future exploration, development and production activities.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

BCGold Corp.

Investor Relations

604-646-1589

Fax: 604-642-2411

info@bcgoldcorp.com

Azfgrund dieser News!??

Marketwire

BCGold Corp.

TSX VENTURE: BCG

Other Recent News

May 6, 2010

BCGold Corp. Mobilizes for Underground Drill Program at Engineer Gold Mine Property, B.C.

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 6, 2010) - BCGold Corp. (the "Company") (TSX VENTURE:BCG) is pleased to announce preparations to diamond drill extensions of 2 high-grade gold veins at Engineer Mine (or the "Mine"). The Company has contracted Ampex Mining Ltd. of Whitehorse, Yukon and Lyncorp Drilling Services Inc. of Smithers, B.C. to conduct a minimum $250,000 Phase I underground diamond drill program, scheduled to commence June 1, 2010. Crews will mobilize to site on May 15th to prepare the camp and set up a diamond drill on Level 5 of the mine, the main access level.

BCGold Corp. intends to drill at least 700 metres in 6 holes between the 5th and 8th levels of the Mine. The Company will target the dip extensions of 2 high-grade shoots defined by historic and recent sampling on the Engineer and Double Decker veins. BCGold Corp. recently reported channel sample results averaging up to 794.0 grams/tonne (g/t) gold and 642.3 g/t silver over 0.5 metres from the Engineer Vein and 537.7 g/t gold and 298.8 g/t silver over 0.48 metres from the Double Decker Vein. The samples were extracted from accessible vein exposures on Level 5 of the mine. (See BCGold Corp. News Release dated March 3, 2010). On Level 8, the deepest level of the Mine, historic sampling records indicate a 24.7 metre section of the Double Decker Vein averaging 38.0 g/t gold, including a 10.0 metre interval averaging 84.3 g/t gold, across the width of the drift (Brinker Report, 1927).

Potential Mineral Target

Engineer Mine currently has no publically reported mineral resources or reserves, but has a potential mineral target of 100,000 - 150,000 tonnes averaging 8 - 12 g/t gold, containing 26,000 - 57,000 ounces gold (see BCGold News Release dated March 18, 2009). This potential quantity and grade is conceptual in nature, based on a 3-D Vulcan(TM) model developed by BCGold Corp. that incorporates historic geological maps and sections, chip samples and production records. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in this target being delineated as a mineral resource.

Near Term Production Potential

The project offers excellent potential for near-term, small-scale gold production from existing underground headings on the formerly producing Engineer, Double Decker and Boulder veins. A successful 2010 drill program verifying recent and historic high gold grades from the Engineer and Double Decker veins could provide the Company with the motivation to dewater the 3 lowest levels of the Mine, which have been flooded since the early 1930s. BCGold Corp. holds a permit entitling it to dewater the Mine until April 15, 2011. Dewatering the Mine would provide access for rehabilitation, geological mapping, sampling and exploration followed by resource definition drilling, bulk sampling and test mining. A fully operational and permitted 25 tonne per day gravity separation mill at the Mine allows the Company to process bulk sample material immediately and on site.

About the Engineer Mine Property

The historic Engineer Mine was a high-grade gold producer that reached its zenith in the mid-1920s and ceased production in the early 1930s primarily due to water ingress issues and an antiquated mine water pumping system. There are more than 25 known veins on the property and only 4 have had limited production and exploration to date. All veins remain open at depth and little exploration has been conducted deeper than 200 metres below surface. Significant potential also exists for a bulk tonnage, lower grade gold resource associated with the Shear Zone "A" hydrothermal breccia system, partially drill tested by BCGold Corp. in 2008 (See BCGold Corp. News Release dated December 2, 2008).

BCGold Corp. has an option to earn 100% interest in the Engineer Mine Property and has spent approximately $1.4 million in exploration since acquiring the property in January, 2007.

About BCGold Corp.

BCGold Corp. (TSX VENTURE:BCG) is a Vancouver-based junior resource company focused on copper and gold exploration in under-explored, historic and emerging mining districts in British Columbia and Yukon. BCGold Corp. acquires and develops conceptual, early and mid-stage exploration opportunities and advances them towards resource development by using internal expertise, engaging preferred joint venture partners and creating strategic alliances with major exploration and mining companies.

On behalf of the Board of Directors,

Brian P. Fowler, P. Geo., President & CEO

Some statements in this news release contain forward-looking information. These statements include, but are not limited to, statements with respect to future payments, expenditures and unit issuances and exploration, development and production activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, among others, the timing of future payments, expenditures and unit issuances and the timing and success of future exploration, development and production activities.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

BCGold Corp.

Investor Relations

604-646-1589

Fax: 604-642-2411

info@bcgoldcorp.com

Antwort auf Beitrag Nr.: 39.473.941 von Kelthe am 06.05.10 21:06:01...dies dürfte auch der ausserordtl. GOLD- perf. am

heutigen tage geschuldet sein......sprung ÜBER den

1200ter widerstand gelungen und bewegen uns weiter gen

norden.........

akt.schon....usd 1208,80

heutigen tage geschuldet sein......sprung ÜBER den

1200ter widerstand gelungen und bewegen uns weiter gen

norden.........

akt.schon....usd 1208,80

...und hier gehts zu brandakt. pres. 05.2010.....

http://www.bcgoldcorp.com/ckfinder/userfiles/files/BCG%20Cor…

Antwort auf Beitrag Nr.: 39.490.722 von hbg55 am 10.05.10 11:43:04hallo h5

... man sagt das management ist das entscheidende;

wenn aber auch die properties und die marktbewertung

vielversprächend ist, dann....

2010 soll ja recht aktiv werden

... und das gold( 1210) will partout nicht fallen..

... man sagt das management ist das entscheidende;

wenn aber auch die properties und die marktbewertung

vielversprächend ist, dann....

2010 soll ja recht aktiv werden

... und das gold( 1210) will partout nicht fallen..

Antwort auf Beitrag Nr.: 39.498.208 von runn64 am 11.05.10 11:26:10

moin.........jooo, 2010 könnte sich zu DEM jahr

des ´durchbruchs´ bei BCG entwickeln - das umfeld

schaut guuuut aus.......IMO

moin.........jooo, 2010 könnte sich zu DEM jahr

des ´durchbruchs´ bei BCG entwickeln - das umfeld

schaut guuuut aus.......IMO

Antwort auf Beitrag Nr.: 39.498.277 von hbg55 am 11.05.10 11:35:13moin h5

....2010 könnte.... nein nich könnte: wird....

oder wollen wir uns nachsagen lassen,wir hätten tomaten

auf den augen

ist dir aufgefallen wie viele KE im rohstoffbereich anstehen

ich werde letze zeit von cannacord zugeschüttet...

....2010 könnte.... nein nich könnte: wird....

oder wollen wir uns nachsagen lassen,wir hätten tomaten

auf den augen

ist dir aufgefallen wie viele KE im rohstoffbereich anstehen

ich werde letze zeit von cannacord zugeschüttet...

unser baby kommt leicht in bewegung mit festeren umsätzen

Antwort auf Beitrag Nr.: 39.672.700 von runn64 am 12.06.10 01:54:46

....joooo, sah doch gestern ganz ordtl. aus.......mit

TH sogar ins WE........

Recent Trades - Last 10 of 30

Time ET Ex Price Change Volume Buyer Seller Markers

15:59:12 V 0.14 0.02 4,000 85 Scotia 7 TD Sec K

15:59:12 V 0.14 0.02 46,000 85 Scotia 2 RBC K

15:58:50 V 0.14 0.02 4,000 85 Scotia 2 RBC K

15:58:50 V 0.14 0.02 1,000 85 Scotia 1 Anonymous K

15:58:34 V 0.14 0.02 1,000 99 Jitney 1 Anonymous K

15:29:59 V 0.135 0.015 40,000 85 Scotia 33 Canaccord K

15:24:43 V 0.135 0.015 500 85 Scotia 99 Jitney K

15:24:22 V 0.135 0.015 1,500 85 Scotia 9 BMO Nesbitt K

14:55:54 V 0.135 0.015 3,000 85 Scotia 9 BMO Nesbitt K

14:38:30 V 0.135 0.015 7,000 58 Qtrade 9 BMO Nesbitt K

...und bohr- programm sollte auch schon gestartet sein auf

Engineer Mine

....joooo, sah doch gestern ganz ordtl. aus.......mit

TH sogar ins WE........

Recent Trades - Last 10 of 30

Time ET Ex Price Change Volume Buyer Seller Markers

15:59:12 V 0.14 0.02 4,000 85 Scotia 7 TD Sec K

15:59:12 V 0.14 0.02 46,000 85 Scotia 2 RBC K

15:58:50 V 0.14 0.02 4,000 85 Scotia 2 RBC K

15:58:50 V 0.14 0.02 1,000 85 Scotia 1 Anonymous K

15:58:34 V 0.14 0.02 1,000 99 Jitney 1 Anonymous K

15:29:59 V 0.135 0.015 40,000 85 Scotia 33 Canaccord K

15:24:43 V 0.135 0.015 500 85 Scotia 99 Jitney K

15:24:22 V 0.135 0.015 1,500 85 Scotia 9 BMO Nesbitt K

14:55:54 V 0.135 0.015 3,000 85 Scotia 9 BMO Nesbitt K

14:38:30 V 0.135 0.015 7,000 58 Qtrade 9 BMO Nesbitt K

...und bohr- programm sollte auch schon gestartet sein auf

Engineer Mine

BCGold Corp. Commences Underground Drill Program at Engineer Gold Mine Property, B.C.

8:30 AM ET, June 14, 2010

VANCOUVER, BRITISH COLUMBIA, Jun 14, 2010 (Marketwire via COMTEX) -- BCGold Corp. (or the "Company") (BCG) is pleased to announce that underground diamond drilling has commenced at the Company's historic high-grade gold Engineer Mine property, situated 32 kilometres west of Atlin, B.C.

Phase I drilling will entail up to 1,000 metres in 6 holes, targeting high-grade extensions defined by historic and recent sampling of the Engineer and Double Decker gold veins between the fifth and eighth levels of the mine. BCGold Corp. recently reported channel sample results averaging up to 794 grams/tonne (g/t) gold and 642 g/t silver over 0.5 metres from the Engineer Vein and 538 g/t gold and 299 g/t silver over 0.48 metres from the Double Decker Vein (see BCGold Corp. news release March 3, 2010). The samples were extracted from accessible vein exposures on the fifth level of the mine.

The objective of Phase I drilling is to confirm that high-grade gold shoots persist at depth and to substantiate a more extensive Phase II drill program directed at upgrading and increasing the current potential mineral target of 100,000 - 150,000 tonnes averaging 8 - 12 g/t gold, containing 26,000 - 57,000 ounces gold, to NI 43-101 standards.

The above target is conceptual in nature and based on a 3-D Vulcan(TM) model developed by BCGold Corp. that incorporates historic geological maps and sections, chip samples and production records. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in this target being delineated as a mineral resource. (See BCGold Corp. news release March 18, 2009)

Mr. Bruce Coates, P.Geo., the Qualified Person for the purposes of National Instrument 43-101, has reviewed the technical content of this news release.

About the Engineer Mine Property

BCGold Corp. has an option to earn 100% interest in the Engineer Mine Property.

Engineer Mine was a high-grade gold producer that peaked in the mid-1920s and ceased production in the early 1930s, primarily due to water ingress issues. There are more than 25 known veins on the property; only 4 have undergone limited production and exploration to date. All veins remain open at depth and little exploration has been conducted deeper than 200 metres below surface.

About BCGold Corp.

BCGold Corp. (BCG) is a Vancouver-based junior resource company focused on copper and gold exploration in under-explored, historic and emerging mining districts in British Columbia and Yukon. BCGold Corp. acquires and develops conceptual, early and mid-stage exploration opportunities and advances them towards resource development by using internal expertise, engaging preferred joint venture partners and creating strategic alliances with major exploration and mining companies.

On behalf of the Board of Directors,

Brian P. Fowler, P. Geo., President & CEO

Some statements in this news release contain forward-looking information. These statements include, but are not limited to, statements with respect to future payments, expenditures and unit issuances and exploration, development and production activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, among others, the timing of future payments, expenditures and unit issuances and the timing and success of future exploration, development and production activities.

SOURCE: BCGold Corp.

BCGold Corp.

Investor Relations

604-646-1589

604-642-2411 (FAX)

info@bcgoldcorp.com

www.BCGoldcorp.com

Copyright (C) 2010 Marketwire. All rights reserved.

8:30 AM ET, June 14, 2010

VANCOUVER, BRITISH COLUMBIA, Jun 14, 2010 (Marketwire via COMTEX) -- BCGold Corp. (or the "Company") (BCG) is pleased to announce that underground diamond drilling has commenced at the Company's historic high-grade gold Engineer Mine property, situated 32 kilometres west of Atlin, B.C.

Phase I drilling will entail up to 1,000 metres in 6 holes, targeting high-grade extensions defined by historic and recent sampling of the Engineer and Double Decker gold veins between the fifth and eighth levels of the mine. BCGold Corp. recently reported channel sample results averaging up to 794 grams/tonne (g/t) gold and 642 g/t silver over 0.5 metres from the Engineer Vein and 538 g/t gold and 299 g/t silver over 0.48 metres from the Double Decker Vein (see BCGold Corp. news release March 3, 2010). The samples were extracted from accessible vein exposures on the fifth level of the mine.

The objective of Phase I drilling is to confirm that high-grade gold shoots persist at depth and to substantiate a more extensive Phase II drill program directed at upgrading and increasing the current potential mineral target of 100,000 - 150,000 tonnes averaging 8 - 12 g/t gold, containing 26,000 - 57,000 ounces gold, to NI 43-101 standards.

The above target is conceptual in nature and based on a 3-D Vulcan(TM) model developed by BCGold Corp. that incorporates historic geological maps and sections, chip samples and production records. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in this target being delineated as a mineral resource. (See BCGold Corp. news release March 18, 2009)

Mr. Bruce Coates, P.Geo., the Qualified Person for the purposes of National Instrument 43-101, has reviewed the technical content of this news release.

About the Engineer Mine Property

BCGold Corp. has an option to earn 100% interest in the Engineer Mine Property.

Engineer Mine was a high-grade gold producer that peaked in the mid-1920s and ceased production in the early 1930s, primarily due to water ingress issues. There are more than 25 known veins on the property; only 4 have undergone limited production and exploration to date. All veins remain open at depth and little exploration has been conducted deeper than 200 metres below surface.

About BCGold Corp.

BCGold Corp. (BCG) is a Vancouver-based junior resource company focused on copper and gold exploration in under-explored, historic and emerging mining districts in British Columbia and Yukon. BCGold Corp. acquires and develops conceptual, early and mid-stage exploration opportunities and advances them towards resource development by using internal expertise, engaging preferred joint venture partners and creating strategic alliances with major exploration and mining companies.

On behalf of the Board of Directors,

Brian P. Fowler, P. Geo., President & CEO

Some statements in this news release contain forward-looking information. These statements include, but are not limited to, statements with respect to future payments, expenditures and unit issuances and exploration, development and production activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, among others, the timing of future payments, expenditures and unit issuances and the timing and success of future exploration, development and production activities.

SOURCE: BCGold Corp.

BCGold Corp.

Investor Relations

604-646-1589

604-642-2411 (FAX)

info@bcgoldcorp.com

www.BCGoldcorp.com

Copyright (C) 2010 Marketwire. All rights reserved.

Antwort auf Beitrag Nr.: 39.678.326 von hbg55 am 14.06.10 15:44:01erfreulich,daß es vorran geht

wenn man sich die bekannten daten vor augen führt

vor augen führt

ist es recht unwahrscheinlich daß die bohrung

leere geht - als für mich ein geheimfavoritt

hoffe nur,daß noch etwas zeit bleibt bevor die "banksters"

die währungen kolabieren lassen

wenn man sich die bekannten daten

vor augen führt

vor augen führtist es recht unwahrscheinlich daß die bohrung

leere geht - als für mich ein geheimfavoritt

hoffe nur,daß noch etwas zeit bleibt bevor die "banksters"

die währungen kolabieren lassen

Antwort auf Beitrag Nr.: 39.679.976 von runn64 am 14.06.10 20:06:17Denke auch das der Sommer hier heiß werden kann...

Um die Währungen mache ich mir erstmal keine Sorgen.

Wenn dann laufen wir in eine Inflation. Wo könnte man dann besser Geld anlegen als in einem "Goldexplorer"?

Der Hebel bei guten Ergebnissen und dann extrem hohen Goldpreis wäre fast zu schön um wahr zu sein...

Wenn es nicht so viele negative Eigenschaften für den Großteil der Bevölkerung hätte könnte man sich glatt mit solch einem Szenario anfreunden...

Gruß Kelthe

Um die Währungen mache ich mir erstmal keine Sorgen.

Wenn dann laufen wir in eine Inflation. Wo könnte man dann besser Geld anlegen als in einem "Goldexplorer"?

Der Hebel bei guten Ergebnissen und dann extrem hohen Goldpreis wäre fast zu schön um wahr zu sein...

Wenn es nicht so viele negative Eigenschaften für den Großteil der Bevölkerung hätte könnte man sich glatt mit solch einem Szenario anfreunden...

Gruß Kelthe

Antwort auf Beitrag Nr.: 39.680.085 von Kelthe am 14.06.10 20:29:27um währungen mache ich mir keine sorgen

ich schon ,vielmehr um die märkte wenn die währungen

craschen:"DIE" haben soviel von dem paier weltweit gedruckt,daß

daß sogar geschichtlich gesehen kein präzedenzfall gibt;spätestens

nach "BAIL OUT" Griehenlands- sitzt der euro mit dem $ in einem boot

...besser geld anlegen...

besser- durchaus ;sicherer ist man im physischen edelmetall

;sicherer ist man im physischen edelmetall

aufgehoben-dem wahren geld seit d.menschheitsgeschihte

aropos wenn wir mal von den microcaps expl.absehen, so habem !

middle bis large caps merklich(!)schlechter performt als edelmetalle

um eine idee zu bekommen wohin die reise geht gehe mal auf www.goldsilver.com

was BC betrifft so scheint die korektur vorbei zu sein

war auch heute reichlich interesse

ich schon ,vielmehr um die märkte wenn die währungen

craschen:"DIE" haben soviel von dem paier weltweit gedruckt,daß

daß sogar geschichtlich gesehen kein präzedenzfall gibt;spätestens

nach "BAIL OUT" Griehenlands- sitzt der euro mit dem $ in einem boot

...besser geld anlegen...

besser- durchaus

;sicherer ist man im physischen edelmetall

;sicherer ist man im physischen edelmetall aufgehoben-dem wahren geld seit d.menschheitsgeschihte

aropos wenn wir mal von den microcaps expl.absehen, so habem !

middle bis large caps merklich(!)schlechter performt als edelmetalle

um eine idee zu bekommen wohin die reise geht gehe mal auf www.goldsilver.com

was BC betrifft so scheint die korektur vorbei zu sein

war auch heute reichlich interesse

Antwort auf Beitrag Nr.: 39.688.155 von runn64 am 16.06.10 01:28:01Wobei wir wieder bei dem sooo interessantem Thema des Vermögensaufbaus und Vermögenssicherung wären...

...und dabei ist eine breite Streuung unumgänglich...

BCG scheint jetzt wirlich wieder in Schwung zu kommen.

Wollen wir mal hoffen das uns diese Welle über 0,2CAD bringt.

Gruß Kelthe

...und dabei ist eine breite Streuung unumgänglich...

BCG scheint jetzt wirlich wieder in Schwung zu kommen.

Wollen wir mal hoffen das uns diese Welle über 0,2CAD bringt.

Gruß Kelthe

NEWS!!!

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 8, 2010) - BCGold Corp. (TSX VENTURE:BCG) (or the "Company") is pleased to announce that it received assay results for the first hole of its recently completed Phase I underground diamond drill program at the historic high-grade gold Engineer Mine property, situated 32 kilometres west of Atlin, B.C.

A total of five holes (640 metres) were drilled from a single underground setup on the fifth level of Engineer Mine (the "Mine"). Drilling targeted high-grade gold extensions, below the fifth and eighth levels of the Mine, which were partially defined by historic mining and recent sampling of the Engineer and Double Decker veins.

Drill hole BCGE10-01 intersected coarse visible gold in two stringer veins, between depths of 176.7 metres and 177.66 metres, which averaged 22.32 grams/tonne (g/t) (0.65 oz/ton ) gold and 7.94 g/t (0.23 oz/ton) silver over 0.96 metres (3.15 feet). On the eighth level of the Mine, 21 metres above this intercept, is a 24.7 metre long vein segment that was partially mined in the 1920s and averaged 38.0 g/t gold, including a 10.0 metre interval averaging 84.3 g/t gold, across the width of the drift (Brinker Report, 1927). BCGE10-01 is the deepest underground hole drilled on the Double Decker Vein to date.

Assay results for drill hole BCGE10-01 are presented below in Table 1. The reader is also referred to the following link for a longitudinal section view of drilling results to date: http://www.bcgoldcorp.com/ckfinder/userfiles/images/Engineer…

Table 1. Double Decker Vein Drill Hole Assay Results-----------------------------------------------------------------------------------------------------------------------------------------------------Drill Hole Sample From To Width Gold Silver Number Number (metres) (metres) (metres) (g/t) (g/t)------------------------------------------------------------------------------------------------------------------------------------------------------BCGE10-01 50751 175.10 176.10 1.00 0.015 0.22 ----------------------------------------------------------- 50753 176.10 176.70 0.60 0.015 0.32 ----------------------------------------------------------- 50754 176.70 176.83 0.13 67.15 69.6 ----------------------------------------------------------- 50756 176.83 177.25 0.42 0.27 0.5 ----------------------------------------------------------- 50757 177.25 177.66 0.41 30.69 18.6 ----------------------------------------------------------- 50759 177.66 177.90 0.24 0.64 0.58 ----------------------------------------------------------- 50760 177.90 178.40 0.50 0.03 0.28 ----------------------------------------------------------- 50762 178.40 179.40 1.00 0.015 0.26------------------------------------------------------------------------------------------------------------------------------------------------------ Average Grade 175.10 179.40 4.30 5.03 4.15--------------------------------------------------------------------------- Includes 176.70 177.66 0.96 22.32 7.94------------------------------------------------------------------------------------------------------------------------------------------------------

Drill hole BCGE10-02, which targeted the same high-grade gold shoot as drill hole BCGE10-1, above the eighth level of the Mine, broke through an existing stope nearly 11 metres above the level. This confirms at least a former presence of economic-grade material.

Drill hole BCGE10-03 targeted and intersected the Double Decker Vein 21 metres above the eighth level workings of the Mine. Drill holes BCGE10-04 and BCGE10-05 targeted oblique strike extensions of the Engineer Vein within 15 metres of the fifth level sill. Both holes intersected the Engineer Vein. Assay results for drill holes BCGE10-03, BCGE10-04 and BCGE10-05 are pending.

"The Company is very pleased with Phase I drill results thus far," statesBrian P. Fowler, P.Geo., President and CEO of BCGold Corp. "The Engineer Mine mineralizing system, and more importantly high gold grades in the Double Decker Vein, clearly extend deeper than the current mine workings, all of which is highly suggestive of significant exploration potential and development possibilities."

The Company is now formulating plans to excavate a new drill bay on the fifth level of the Mine, 100 metres along strike and northwest of the previous drill setup. The new drill bay will be used to drill test portions of the Engineer Vein, below the fifth level of the Mine, that are known to host significant coarse visible gold. This will be part of Phase II drilling. Phase II drilling will be directed at upgrading and increasing the current potential mineral target to a NI 43-101 compliant mineral resource estimate.

Mr.Bruce Coates, P.Geo., a Qualified Person for the purposes of National Instrument 43-101, has reviewed the technical content of this news release.

About the EngineerMine Property

BCGold Corp. has an option to earn 100% interest in the EngineerMine Property.

Engineer Mine was a high-grade gold producer that peaked in the mid-1920s and ceased production in the early 1930s, primarily due to water ingress issues. There are more than 25 known veins on the property; only 4 have undergone limited production and exploration to date. All veins remain open at depth and little exploration has been conducted deeper than 200 metres below surface.

Sample Analysis and Quality Control

Drill core samples were prepared by Eco-Tech Laboratories Ltd., a subsidiary of the global Alex Stewart Group, BC Certified Assayers, in Whitehorse, Yukon; and assayed by an ISO 9001:2000 certified laboratory in Kamloops, B.C. Samples were delivered directly by a Company representative, with chain of custody documented. Quality control consisted of the insertion of certified reference materials (standards) and blanks into the sample shipment by BCGold Corp. personnel.

Gold was analysed by a metallic screen fire assay. Drill core samples were crushed to 70% passing through 10 mesh, then split to achieve a 250 gram subsample. The subsample was pulverized to 95% passing through -150 mesh. The entire sample was weighed, rolled and homogenized and then passed through a 150 mesh screen. The resulting -150 mesh fraction was homogenized and two subsample portions were fire assayed. All of the resulting +150 mesh oversize material was fire assayed. The resultant fire assay beads were digested with a nitric acid followed by hydrochloric acid, and then analyzed for gold by AAS to 0.03 g/t detection limit. The results for the two -150 mesh values and single +150 mesh value were then calculated based on the original sample weight providing a net gold value.

Additional analyses included a 46 element package of major and trace elements by ICP-AES/MS analysis following a four acid digestion.

About BCGold Corp.

BCGold Corp. (TSX VENTURE:BCG) is a Vancouver-based junior resource company focused on copper and gold exploration in under-explored, historic and emerging mining districts in British Columbia and Yukon. BCGold Corp. acquires and develops conceptual, early and mid-stage exploration opportunities and advances them towards resource development by using internal expertise, engaging preferred joint venture partners and creating strategic alliances with major exploration and mining companies.

On behalf of the Board of Directors,

Brian P. Fowler, P. Geo., President & CEO

Some statements in this news release contain forward-looking information. These statements include, but are not limited to, statements with respect to future payments, expenditures and unit issuances and exploration, development and production activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, among others, the timing of future payments, expenditures and unit issuances and the timing and success of future exploration, development and production activities.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT: BCGold Corp. Investor Relations

Gruß Kelthe

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 8, 2010) - BCGold Corp. (TSX VENTURE:BCG) (or the "Company") is pleased to announce that it received assay results for the first hole of its recently completed Phase I underground diamond drill program at the historic high-grade gold Engineer Mine property, situated 32 kilometres west of Atlin, B.C.

A total of five holes (640 metres) were drilled from a single underground setup on the fifth level of Engineer Mine (the "Mine"). Drilling targeted high-grade gold extensions, below the fifth and eighth levels of the Mine, which were partially defined by historic mining and recent sampling of the Engineer and Double Decker veins.

Drill hole BCGE10-01 intersected coarse visible gold in two stringer veins, between depths of 176.7 metres and 177.66 metres, which averaged 22.32 grams/tonne (g/t) (0.65 oz/ton ) gold and 7.94 g/t (0.23 oz/ton) silver over 0.96 metres (3.15 feet). On the eighth level of the Mine, 21 metres above this intercept, is a 24.7 metre long vein segment that was partially mined in the 1920s and averaged 38.0 g/t gold, including a 10.0 metre interval averaging 84.3 g/t gold, across the width of the drift (Brinker Report, 1927). BCGE10-01 is the deepest underground hole drilled on the Double Decker Vein to date.

Assay results for drill hole BCGE10-01 are presented below in Table 1. The reader is also referred to the following link for a longitudinal section view of drilling results to date: http://www.bcgoldcorp.com/ckfinder/userfiles/images/Engineer…