SHIMANO - Fahrradkomponenten - 500 Beiträge pro Seite

eröffnet am 29.04.10 17:33:13 von

neuester Beitrag 13.02.19 10:48:58 von

neuester Beitrag 13.02.19 10:48:58 von

Beiträge: 65

ID: 1.157.480

ID: 1.157.480

Aufrufe heute: 0

Gesamt: 9.850

Gesamt: 9.850

Aktive User: 0

ISIN: JP3358000002 · WKN: 865682 · Symbol: SHM

149,60

EUR

-0,73 %

-1,10 EUR

Letzter Kurs 20:42:22 Tradegate

Neuigkeiten

11.04.24 · wO Chartvergleich |

13.03.24 · wallstreetONLINE Redaktion |

02.01.24 · Aktienwelt360 |

30.08.23 · Aktienwelt360 |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21.500,00 | +27,22 | |

| 210,50 | +18,89 | |

| 2,4000 | +14,01 | |

| 65,43 | +12,54 | |

| 3,6750 | +10,53 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,900 | -9,85 | |

| 90,33 | -9,92 | |

| 0,5020 | -16,33 | |

| 7,6100 | -51,00 | |

| 3.333,00 | -90,37 |

War letzte Woche beim Fahrradhändler und habe ihn gefragt, bei wieviel Prozent seiner Räder Shimano-Ausstattungen verwendet werden.

Antwort: 100%; und sie haben Lieferschwierigkeiten...:

07.04.2010 02:24

Japan Hot Stocks-Shimano rises after announcing share buy-back

TOKYO, April 7 (Reuters) - The benchmark Nikkei average was little changed and the broader TOPIX edged up 0.2 percent on Wednesday.

The following stock was on the move:

**SHIMANO RISES AFTER ANNOUNCING SHARE BUY-BACK**

Bicycle parts maker Shimano Inc climbed 3.6 percent to 4,340 yen after saying it would buy back up to 4.0 billion yen ($42.64 million) of its own shares, or 1.1 percent of its shares outstanding, between April 7-26.

Antwort: 100%; und sie haben Lieferschwierigkeiten...:

07.04.2010 02:24

Japan Hot Stocks-Shimano rises after announcing share buy-back

TOKYO, April 7 (Reuters) - The benchmark Nikkei average was little changed and the broader TOPIX edged up 0.2 percent on Wednesday.

The following stock was on the move:

**SHIMANO RISES AFTER ANNOUNCING SHARE BUY-BACK**

Bicycle parts maker Shimano Inc climbed 3.6 percent to 4,340 yen after saying it would buy back up to 4.0 billion yen ($42.64 million) of its own shares, or 1.1 percent of its shares outstanding, between April 7-26.

Für Japaner ungewöhnlich: GJ = KJ

Schön, dass es für Shimano einen Thread gibt.

http://corporate.shimano.com/publish/content/global_corp/en/…

Ansonsten ist die Firma mit Infos sehr zurückhaltend. Der Kurs ist inzwischen auf einem ziemlich hohen Niveau angelangt.

http://corporate.shimano.com/publish/content/global_corp/en/…

Ansonsten ist die Firma mit Infos sehr zurückhaltend. Der Kurs ist inzwischen auf einem ziemlich hohen Niveau angelangt.

Antwort auf Beitrag Nr.: 39.427.391 von cmeise am 29.04.10 18:17:45Stimmt, die Bude ist teuer; habe vor 3 Jahren schonmal dasselbe gedacht und nichts gekauft.

Jetzt habe ich ein paar Ansichtsstücke, um einen evtl. Dip mitzubekommen...

Jetzt habe ich ein paar Ansichtsstücke, um einen evtl. Dip mitzubekommen...

Antwort auf Beitrag Nr.: 39.427.646 von R-BgO am 29.04.10 18:56:01Unter 30€ wirds wieder interessant. Die Dividenden lohnen bislang leider nicht - das sind nicht mal 50 Cent.

Ein Bekannter von mir der angelt, hat erzählt, dass die Shimano Produkte in der Szene auch einen guten Ruf haben.

Ein Bekannter von mir der angelt, hat erzählt, dass die Shimano Produkte in der Szene auch einen guten Ruf haben.

Antwort auf Beitrag Nr.: 39.427.767 von cmeise am 29.04.10 19:11:25Kann ich bestätigen- alle meine Fahrräder hatten Shimano Teile, und ich bin immer gut damit gefahren.

The Best Peak Oil Investments: Shimano

Tom Konrad CFA

I missed Shimano (SHMDF.PK) in my recent list of bicycle and scooter stocks, but in many ways, Shimano is the best of the lot.

Shimano Inc. manufactures bicycle components and fishing and rowing gear, with the bike segment accounting for about four-fifths of sales, but I had not realized that they were public until I received a note from a reader in response to my recent article on bike and moped stocks.

In that article, I noted that, while bike sales rose in response to rising oil prices in 2008, bicycle repairs surged far more. As a manufacturer of components, Shimano may be better placed than other bike companies such as Giant Manufacturing (GTMUF.PK) and Dorel Industries, Inc (DIIBF.PK) to take advantage of a surge in bike repairs.

Shimano has a 70% market share in some key components such as gear wheels, derailleurs, and brakes. This is possibly due in part to a corporate philosophy that keeps Shimano from competing with its customers by not building complete bikes. If Shimano did build complete bikes, many bike manufacturing firms might feel compelled to return the favor by making their own high-end components. As it is, Shimano's place in the bicycle industry is a lot like Intel's place in the computer industry: the maker of many of the highest tech components manufactured with great precision to exacting specifications, and, in fact, Shimano has often been called "The Intel of the bicycle industry." Many bicycle buyers care more that it is made with Shimano parts than which manufacturer does the final assembly.

Revenues by segment

Two Edged Sword

For investors, the high-end nature of Shimano's products is a two-edged sword. The benefit is that Shimano's continual research into new technology and strong brand recognition create barriers that help the company maintain market share and margins. The company's large market share also helps reduce unit cost of production, allowing the company to fend off competition with relatively low prices while maintaining profit margins. The problem is that the high-end components in which Shimano specializes are less likely to appeal to more casual riders who are interested in using their bikes to run a few local errands than to more hard-core cyclists. It was this class of casual rider that accounted for most of the new riders in 2008, when high gas prices caused a surge in interest in cycling.

On the other hand, not all of Shimano's products are made for the wanna-be Lance Armstrongs of the world. For instance, Shimano introduced an automatic gear shifter for bicycles in 2003, designed with the urban commuter in mind. For someone whose largest concern is dodging traffic and the morning meeting he's preparing for, an automatic shifter is just the thing.

Valuation

Shimano has an extremely strong balance sheet, a large plus in the current economic climate. The company has no net debt, an extremely high current ratio of over 5, and strong cash flow from operations even when revenues were depressed by the recession in 2009.

With so much going for the company, the stock trades at a very high valuation. At the recent ¥4,350 ($52.50) stock price, the company pays a 1.4% annual dividend, and trades at a P/E ratio of about 32. As a value investor, I'd like to see the stock drop 30-50% before I'd be ready to buy it. At the right price, this is certainly a company I'd like to own.

DISCLOSURE: No position.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Posted by Tom Konrad on August 21, 2010 12:45 AM

Tom Konrad CFA

I missed Shimano (SHMDF.PK) in my recent list of bicycle and scooter stocks, but in many ways, Shimano is the best of the lot.

Shimano Inc. manufactures bicycle components and fishing and rowing gear, with the bike segment accounting for about four-fifths of sales, but I had not realized that they were public until I received a note from a reader in response to my recent article on bike and moped stocks.

In that article, I noted that, while bike sales rose in response to rising oil prices in 2008, bicycle repairs surged far more. As a manufacturer of components, Shimano may be better placed than other bike companies such as Giant Manufacturing (GTMUF.PK) and Dorel Industries, Inc (DIIBF.PK) to take advantage of a surge in bike repairs.

Shimano has a 70% market share in some key components such as gear wheels, derailleurs, and brakes. This is possibly due in part to a corporate philosophy that keeps Shimano from competing with its customers by not building complete bikes. If Shimano did build complete bikes, many bike manufacturing firms might feel compelled to return the favor by making their own high-end components. As it is, Shimano's place in the bicycle industry is a lot like Intel's place in the computer industry: the maker of many of the highest tech components manufactured with great precision to exacting specifications, and, in fact, Shimano has often been called "The Intel of the bicycle industry." Many bicycle buyers care more that it is made with Shimano parts than which manufacturer does the final assembly.

Revenues by segment

Two Edged Sword

For investors, the high-end nature of Shimano's products is a two-edged sword. The benefit is that Shimano's continual research into new technology and strong brand recognition create barriers that help the company maintain market share and margins. The company's large market share also helps reduce unit cost of production, allowing the company to fend off competition with relatively low prices while maintaining profit margins. The problem is that the high-end components in which Shimano specializes are less likely to appeal to more casual riders who are interested in using their bikes to run a few local errands than to more hard-core cyclists. It was this class of casual rider that accounted for most of the new riders in 2008, when high gas prices caused a surge in interest in cycling.

On the other hand, not all of Shimano's products are made for the wanna-be Lance Armstrongs of the world. For instance, Shimano introduced an automatic gear shifter for bicycles in 2003, designed with the urban commuter in mind. For someone whose largest concern is dodging traffic and the morning meeting he's preparing for, an automatic shifter is just the thing.

Valuation

Shimano has an extremely strong balance sheet, a large plus in the current economic climate. The company has no net debt, an extremely high current ratio of over 5, and strong cash flow from operations even when revenues were depressed by the recession in 2009.

With so much going for the company, the stock trades at a very high valuation. At the recent ¥4,350 ($52.50) stock price, the company pays a 1.4% annual dividend, and trades at a P/E ratio of about 32. As a value investor, I'd like to see the stock drop 30-50% before I'd be ready to buy it. At the right price, this is certainly a company I'd like to own.

DISCLOSURE: No position.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Posted by Tom Konrad on August 21, 2010 12:45 AM

Nach q3 Zahlen ist der Ausblick etwas reduziert worden.

http://corporate.shimano.com/publish/content/global_corp/en/…

http://corporate.shimano.com/publish/content/global_corp/en/…

Antwort auf Beitrag Nr.: 40.407.454 von cmeise am 28.10.10 13:52:11Habe mir jetzt doch noch ein paar zusätzliche geholt. Mir gefällt einfach das Langfristige...

Antwort auf Beitrag Nr.: 40.678.400 von R-BgO am 09.12.10 10:11:41Hab mir kürzlich einen Nabendynamo einbauen lassen. Gefällt mir auch gut...

So, bin dann mal drin. Schön viel Eigenkapital, Kurs ist winterbedingt etwas eingeknickt, Frühjahr voraus

Gruß

Gruß

Antwort auf Beitrag Nr.: 41.089.087 von audiodelta am 23.02.11 08:58:53Hallo,

habt Ihr Informationen über die Aktionärsstruktur von Shimano? Konnte dazu nichts finden.

VG

Lukoil

habt Ihr Informationen über die Aktionärsstruktur von Shimano? Konnte dazu nichts finden.

VG

Lukoil

Antwort auf Beitrag Nr.: 41.250.571 von mr.lukoil am 22.03.11 23:18:37Hier ist ja richtig Leben

First half 2011

http://corporate.shimano.com/publish/content/global_corp/en/…

http://corporate.shimano.com/publish/content/global_corp/en/…

Starke Prognose für 2012, +20,8% Jahresüberschuss.

Bärenstarke Bilanz.

Und die Mission gefällt mir sowieso: The Mission of Shimano Group is "To promote health and happiness through the enjoyment of nature and the world around us."

Bärenstarke Bilanz.

Und die Mission gefällt mir sowieso: The Mission of Shimano Group is "To promote health and happiness through the enjoyment of nature and the world around us."

Antwort auf Beitrag Nr.: 42.723.992 von Haettsch am 09.02.12 10:55:46dem Kurs scheint's auch zu gefallen;

ist 'ne echte Bank

ist 'ne echte Bank

...

Damit nicht der falsche Eindruck entsteht, außer Rauchen und Trinken hätten die Bewohner Asiens und Südamerikas nichts im Sinn: Auch der japanische Fahrradteilehersteller Shimano profitiert von der Konsumlaune in der ehemaligen Dritten Welt: Im Gegensatz zu Daimler oder BMW ist das schicke Zweirad auch für die Masse der Einwohner Chinas, Indiens, Indonesiens oder Thailands erschwinglich. Weltweit fahren mehr als 80 Prozent aller neueren Fahrräder mit Schaltungen und Bremsen von Shimano. Inzwischen stammen mehr als 35 Prozent der Umsätze aus Asien außerhalb Japans.

...

http://www.handelsblatt.com/finanzen/aktien/aktien-im-fokus/…

Damit nicht der falsche Eindruck entsteht, außer Rauchen und Trinken hätten die Bewohner Asiens und Südamerikas nichts im Sinn: Auch der japanische Fahrradteilehersteller Shimano profitiert von der Konsumlaune in der ehemaligen Dritten Welt: Im Gegensatz zu Daimler oder BMW ist das schicke Zweirad auch für die Masse der Einwohner Chinas, Indiens, Indonesiens oder Thailands erschwinglich. Weltweit fahren mehr als 80 Prozent aller neueren Fahrräder mit Schaltungen und Bremsen von Shimano. Inzwischen stammen mehr als 35 Prozent der Umsätze aus Asien außerhalb Japans.

...

http://www.handelsblatt.com/finanzen/aktien/aktien-im-fokus/…

Die Pedelecs sind der Trend. Nehme an, dass Shimano auch hier zuliefert...

http://corporate.shimano.com/publish/content/global_corp/en/…

Sehr gute Zahlen. Umsatz und Gewinn plus 15%, wobei SOA und Südamerika im wesentlichen dafür verantwortlich sind.

Sehr gute Zahlen. Umsatz und Gewinn plus 15%, wobei SOA und Südamerika im wesentlichen dafür verantwortlich sind.

weiss jemand warum es bergab geht ? für mich sieht es eher aus wie eine gute chance nachzukaufen, oder habe ich etwas uebersehen ?

Die Zahlen von Ende Oktober waren recht gut.

http://corporate.shimano.com/publish/content/global_corp/en/…

http://corporate.shimano.com/publish/content/global_corp/en/…

Hab mir die Woche auch mal ein paar ins Depot gelegt, denke dass wir nochmal Richtung 70 Euro laufen werden.

Ganzjahreszahlen kamen vor einem Monat; Gewinn +>20%

Divi von 75 Yen auf 87 Yen

Divi von 75 Yen auf 87 Yen

Auch die Q1 Zahlen sehr gut, nicht zuletzt wegen des milden Winters in Europa.

http://corporate.shimano.com/content/Corporate/english/index…

http://corporate.shimano.com/content/Corporate/english/index…

vor 3 Wochen kamen die9M-Zahlen: Gewinn bereits fast so hoch, wie im ganzen Jahr 2013;

heute -6%

heute -6%

Die Zahlen sind wirklich excellent!

Umsatz-Mrd./eps (in Yen):

12: 245,8/296,5

13: 271/378,5

14: 333/552,7 (e280/339,8)

e15: 355/571,71 (forecast shimano)

Die Schätzungen von Shimano für dieses Jahr dürften wieder sehr konservativ sein. Für 2014 waren sie es mit 280 Mrd Yen Umsatz und 339,8 Yen Gewinn pro Aktie jedenfalls.

Momentan trotzdem recht teuer.

Umsatz-Mrd./eps (in Yen):

12: 245,8/296,5

13: 271/378,5

14: 333/552,7 (e280/339,8)

e15: 355/571,71 (forecast shimano)

Die Schätzungen von Shimano für dieses Jahr dürften wieder sehr konservativ sein. Für 2014 waren sie es mit 280 Mrd Yen Umsatz und 339,8 Yen Gewinn pro Aktie jedenfalls.

Momentan trotzdem recht teuer.

Antwort auf Beitrag Nr.: 49.057.259 von Haettsch am 12.02.15 23:53:24Domo Arigato für die Schlußdividende gestern! :-)

Als Hobbyrennradfahrer habe ich eigentlich eher aus Sympathie und Zufriedenheit mit den Gruppen 105 und Ultegra im Sommer 2013 bei 67 Euro gekauft, nichtsahnend daß das meine mit Abstand beste Position im Depot werden würde...

Shimano ist zunehmend verstärkt im lukrativen E-Bike Business aktiv, für den Modelljahrgang 2016 wurde z.B. die SD-C6000 für E-Bikes bis 130kg Gesamtgewicht angekündigt, oder die "Symphomatic" genannte Schaltautomatic für die STEPS Di2 Gruppen.

Und die Domäne der herkömmlichen Schaltgruppen wird ja ohnehin permanent weiterentwicklt, was sich auch in der Verwendung bei den 17 Profiteams der UCI widerspiegelt: die Zahl der Shimano Dura Ace Gruppe ist von 6 (2010) auf mittlerweile 13 (2015) angestiegen, 3 Teams verwenden noch Campagnolo (2012: 5) und nur noch 1 fährt mit SRAM (2012 waren es noch 5).

Vielleicht sollte man doch noch mal nachkaufen?

Als Hobbyrennradfahrer habe ich eigentlich eher aus Sympathie und Zufriedenheit mit den Gruppen 105 und Ultegra im Sommer 2013 bei 67 Euro gekauft, nichtsahnend daß das meine mit Abstand beste Position im Depot werden würde...

Shimano ist zunehmend verstärkt im lukrativen E-Bike Business aktiv, für den Modelljahrgang 2016 wurde z.B. die SD-C6000 für E-Bikes bis 130kg Gesamtgewicht angekündigt, oder die "Symphomatic" genannte Schaltautomatic für die STEPS Di2 Gruppen.

Und die Domäne der herkömmlichen Schaltgruppen wird ja ohnehin permanent weiterentwicklt, was sich auch in der Verwendung bei den 17 Profiteams der UCI widerspiegelt: die Zahl der Shimano Dura Ace Gruppe ist von 6 (2010) auf mittlerweile 13 (2015) angestiegen, 3 Teams verwenden noch Campagnolo (2012: 5) und nur noch 1 fährt mit SRAM (2012 waren es noch 5).

Vielleicht sollte man doch noch mal nachkaufen?

Antwort auf Beitrag Nr.: 49.468.436 von Modulor am 31.03.15 20:03:58Interessant, war mit gar nicht bewusst, dass Shimano bei den Profis schon so dominant ist.

Bin auch leidenschaftlicher Radler, PKW 2006 verkauft, dafür mittlerweile 4 Räder und ein Lastenhänger. An allen Rädern sind Shimano-Komponeten verbaut.

Im April 2008 hab ich mir ein Rennrad mit Ultegra-Gruppe zugelegt. Die überzeugene Qualität war mit ein Grund 4 Monate später Shimano Aktien zu erwerben, for the long run.

Der Rest ist Geschichte.

Ob jetzt ein guter Zeitpunkt zum nachkaufen ist? Ich weiss es nicht, kaufe auf jetzigem Bewertungsniveau nicht (auch wenn die japanische Notenbank Aktienindexfonds kauft und Ehrhardt Japan für attraktiv hält).

Kommt natürlich auch auf deinen Zeithorizont an.

Bin auch leidenschaftlicher Radler, PKW 2006 verkauft, dafür mittlerweile 4 Räder und ein Lastenhänger. An allen Rädern sind Shimano-Komponeten verbaut.

Im April 2008 hab ich mir ein Rennrad mit Ultegra-Gruppe zugelegt. Die überzeugene Qualität war mit ein Grund 4 Monate später Shimano Aktien zu erwerben, for the long run.

Der Rest ist Geschichte.

Ob jetzt ein guter Zeitpunkt zum nachkaufen ist? Ich weiss es nicht, kaufe auf jetzigem Bewertungsniveau nicht (auch wenn die japanische Notenbank Aktienindexfonds kauft und Ehrhardt Japan für attraktiv hält).

Kommt natürlich auch auf deinen Zeithorizont an.

Wieder starke HJ Zahlen:

http://corporate.shimano.com/content/Corporate/english/index…

http://corporate.shimano.com/content/Corporate/english/index…

Antwort auf Beitrag Nr.: 49.469.708 von Haettsch am 31.03.15 22:25:36Gestern und heute Zukauf. Bewertung erscheint mehr jetzt wieder attraktiv, langfristig sowieso.

Antwort auf Beitrag Nr.: 48.339.319 von R-BgO am 17.11.14 13:28:50So etwas wiederholt sich wohl alljährlich:

http://corporate.shimano.com/content/Corporate/english/index…

http://corporate.shimano.com/content/Corporate/english/index…

Antwort auf Beitrag Nr.: 50.978.445 von cmeise am 01.11.15 09:41:29ist doch nett, oder?

und wieder Bombenzahlen

so "günstig" wie jetzt war sie lange nicht mit KGV 20allerdings prognostizieren sie fürs laufende Jahr einen dicken Gewinnrückgang?

Eine Tragödie wenn ich mir den Chart ansehe und nicht investiert bin. Nie gekauft weil die Aktie immer "zu teuer" war.

Kenne zwar die Weisheit von Buffett "Lieber ein hervorragendes Unternehmen zu einem akzeptablen Preis als ein akzeptables Unternehmen zu einem hervorragenden Preis" hab aber nicht danach gehandelt.

Kann mir vorstellen dass der Trend zur Verstädterung und steigenden Wohlstand wieder zurück zum Radeln führt. In Kopenhagen , einer der reichsten Städte der Welt fahren heute schon 50% mitm Rad zur Arbeit. Lediglich in 3te Welt Ländern sind die Räder noch(!) auf dem Rückzug, weil die Leute ihr Auto als Statussymbol benötigen selbst wenn sie damit nur im Smog im Stau stehen...

Kenne zwar die Weisheit von Buffett "Lieber ein hervorragendes Unternehmen zu einem akzeptablen Preis als ein akzeptables Unternehmen zu einem hervorragenden Preis" hab aber nicht danach gehandelt.

Kann mir vorstellen dass der Trend zur Verstädterung und steigenden Wohlstand wieder zurück zum Radeln führt. In Kopenhagen , einer der reichsten Städte der Welt fahren heute schon 50% mitm Rad zur Arbeit. Lediglich in 3te Welt Ländern sind die Räder noch(!) auf dem Rückzug, weil die Leute ihr Auto als Statussymbol benötigen selbst wenn sie damit nur im Smog im Stau stehen...

Shimano hat 2015 ausserordentlich gut verdient. Begründet wird dies mit dem niedrigen Ölreis durch dem die Konsumenten mehr Geld im Geldbeutel hatten.

(Damit ist es auch eines der wenigen Unternehmen das uns nicht weismachen will, das der niedrige Ölpreis schlecht für uns ist )

)

2016 erwartet Shimano daher ein im Vergleich zum Vorjahr etwas schwächeres Jahr.

Für jemanden der in Shimano einsteigen möchte, da er langfristig an die Zukunft des Fahrradmarktes glaubt, dürften sich derzeit gute Gelegenheiten bieten.

KGV von 20, dazu schuldenfrei und jede Menge Cash

Spielraum für Dividendenerhöhungen ist dazu auch vorhanden (Payoutratio unter 2%)

(Damit ist es auch eines der wenigen Unternehmen das uns nicht weismachen will, das der niedrige Ölpreis schlecht für uns ist

)

)2016 erwartet Shimano daher ein im Vergleich zum Vorjahr etwas schwächeres Jahr.

Für jemanden der in Shimano einsteigen möchte, da er langfristig an die Zukunft des Fahrradmarktes glaubt, dürften sich derzeit gute Gelegenheiten bieten.

KGV von 20, dazu schuldenfrei und jede Menge Cash

Spielraum für Dividendenerhöhungen ist dazu auch vorhanden (Payoutratio unter 2%)

Wenn ich das alles richtig mitbekommen habe ist Shimano ja auch berühmt dafür megakonservativ mit den Prognosen zu sein. Somit ist es nicht unbedingt ausgemacht, dass der Gewinneinbruch statt findet. In dieser Hinsicht nicht zu vergleichen mit Tesla. ;-)

Da der Yen anscheinend mal wieder Kapriolen schlägt sind bei den Ergebnissen sicher Beulen oder Dellen drin. Werd mir wohl demnächst ein paar STücke kaufen müssen...

Da der Yen anscheinend mal wieder Kapriolen schlägt sind bei den Ergebnissen sicher Beulen oder Dellen drin. Werd mir wohl demnächst ein paar STücke kaufen müssen...

Shimanos Prognosen sind in der Tat sehr konservativ.

Genauso wie ihre Bilanz die mir ganz gut gefällt auch wenn die Dividende etwas mickrig ausfällt und Luft nach oben hätte (Payout unter 2%)

Die Begründung für den Gewinnrückgang finde ich irgendwie auch erfrischend. Nach dem herausragenden Jahr erwartet man wohl eher normale Umsätze.

Fällt wohl eher in die Kategorie „Jammern auf hohen Niveau“ statt das es irgendwo Probleme gäbe.

Mal kein Unternehmen das über den zu niedrigen Ölpreis jammert, sondern den auch als Chance sieht das dadurch die Konjunktur profitiert wenn der Bürger eben mehr im Geldbeutel hat.

Wichtig ist aber ohnehin die langfristige Perspektive und da sehe ich den Fahrradmarkt genauso wie den Freizeitmarkt positiv.

Denn die Büromenschen wollen sich in der Freizeit sportlich betätigen und dazu ist das Fahrrad in überfüllten Grossstädten eine sinnvolle Alternative zu Autos.

Genauso wie ihre Bilanz die mir ganz gut gefällt auch wenn die Dividende etwas mickrig ausfällt und Luft nach oben hätte (Payout unter 2%)

Die Begründung für den Gewinnrückgang finde ich irgendwie auch erfrischend. Nach dem herausragenden Jahr erwartet man wohl eher normale Umsätze.

Fällt wohl eher in die Kategorie „Jammern auf hohen Niveau“ statt das es irgendwo Probleme gäbe.

Mal kein Unternehmen das über den zu niedrigen Ölpreis jammert, sondern den auch als Chance sieht das dadurch die Konjunktur profitiert wenn der Bürger eben mehr im Geldbeutel hat.

Wichtig ist aber ohnehin die langfristige Perspektive und da sehe ich den Fahrradmarkt genauso wie den Freizeitmarkt positiv.

Denn die Büromenschen wollen sich in der Freizeit sportlich betätigen und dazu ist das Fahrrad in überfüllten Grossstädten eine sinnvolle Alternative zu Autos.

Payout unter 2%

Hi Com, woher nimmst du diese Zahl? Weder wenn ich das EPS noch den Operating Cash Flow (wie man es auch eigentlich machen muss) betrachte, komme ich auch nur annähernd in die Region von 2%.

Hi Com, woher nimmst du diese Zahl? Weder wenn ich das EPS noch den Operating Cash Flow (wie man es auch eigentlich machen muss) betrachte, komme ich auch nur annähernd in die Region von 2%.

Antwort auf Beitrag Nr.: 52.339.765 von Larry.Livingston am 04.05.16 08:28:08

Ich hatte das aus einer Quelle, wo offenbar das Komma verrutscht ist.

Payout müsste so bei 20% liegen, oder wie siehst du das?

Zitat von Larry.Livingston: Payout unter 2%

Hi Com, woher nimmst du diese Zahl? Weder wenn ich das EPS noch den Operating Cash Flow (wie man es auch eigentlich machen muss) betrachte, komme ich auch nur annähernd in die Region von 2%.

Ich hatte das aus einer Quelle, wo offenbar das Komma verrutscht ist.

Payout müsste so bei 20% liegen, oder wie siehst du das?

Wenn ich nur das EPS Payout Ratio betrachte komme ich auf deine ca. 26% +/- ein paar, dann passt es ja. Dachte schon ich hätte mich verrechnet.

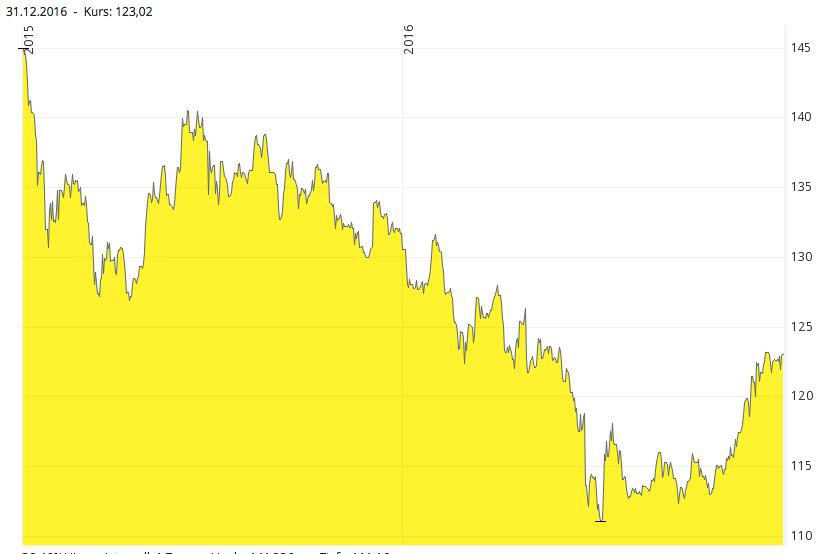

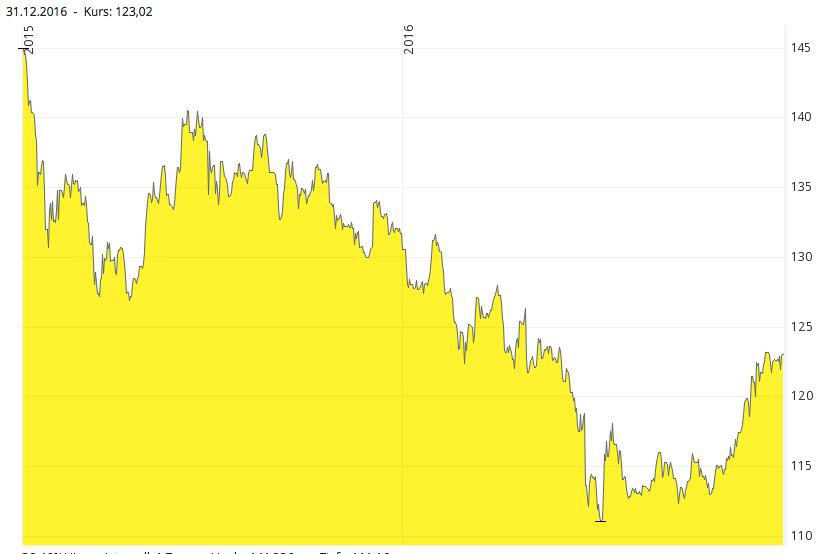

Der prognostizierte Gewinnrückgang 2016 tritt nun wohl ein. Im 1 HJ ging der Gewinn um gut 20% runter, auf 250Y pro Aktie. Fürs Gesamtjahr wird mit ca. 550Y gerechnet. (Vorjahr mehr als 800)

Kurs derzeit 15000Y.

Begründet wurde das mit dem starken Yen, schlechtem Wetter im Europa in den Monaten März und April sowie hohen Lagerbeständen. KGV ist somit bei knapp 30. Eine rasche Wiederaufnahme des Wachstumstrend ist somit schon antizipiert.

Kurs derzeit 15000Y.

Begründet wurde das mit dem starken Yen, schlechtem Wetter im Europa in den Monaten März und April sowie hohen Lagerbeständen. KGV ist somit bei knapp 30. Eine rasche Wiederaufnahme des Wachstumstrend ist somit schon antizipiert.

Antwort auf Beitrag Nr.: 53.136.435 von Steigerwälder am 25.08.16 15:08:18Was hat die Kursexplosion 2012-2015 ausgelöst?

Leber zu Shimano

Klingt schon fast, wie eine Liebeserklärung:...

Beispiel 2: Shimano Aus Nachhaltigkeits- wie auch aus fundamentalen Gründen gehört der japanische Hersteller von Fahrrad-und Angelkomponenten, Shimano, zu Lebers Lieblingsaktien. Das Unternehmen werde in den kommenden Jahren vor allem in den Emerging Markets stark wachsen. Hier fangen die Leute an, Spaß am Fahrrad fahren zu entwickeln bzw. sie upgraden ihre Bikes. „Wir erwarten ein stetiges, zweistelliges Wachstum über die nächsten Jahre“, erklärt Leber. Schon heute liegt der weltweite Marktanteil bei Fahrradkomponenten wie etwa Schaltungen und Bremsen bei sagenhaften 80 Prozent. „Shimano ist eine der besten Firmen in Japan, mit riesigem Potential in den Emerging Markets“, zeigt sich Leber begeistert. „Shimano ist eine Traumfirma. Die Aktie hat zwar einen ziemlich stolzen Preis, aber dahinter steckt auch ein wunderbares Geschäftsmodel.“ Und die Nachhaltigkeitsgründe liegen auf der Hand: Was gibt es Umweltschonenderes als Fahrrad fahren und Angeln? Wie gesagt: Eine Traumfirma und eine Traumaktie!

...

Aktien: Möbel, Fahrräder & die Angst vor einem spätpubertierenden US-Kandidaten | wallstreet-online.de - Vollständiger Artikel unter:

http://www.wallstreet-online.de/nachricht/9003872-aktien-moe…

@kainza

Der Gewinnanstieg in besagtem Zeitraum faellt zeitlich zusammen mit einem Starken Yeneinbruch von 1:100 auf fast 150. Ich denke dass das zumindest erheblich geholfen hat.

daher auch der Rueckgang bei den Gewinnen. Kurzfristig koennen den Yenkapriolen den langfristigen Wachstumstrend sowohl verstaerken als auch uebertuenchen.

Der Gewinnanstieg in besagtem Zeitraum faellt zeitlich zusammen mit einem Starken Yeneinbruch von 1:100 auf fast 150. Ich denke dass das zumindest erheblich geholfen hat.

daher auch der Rueckgang bei den Gewinnen. Kurzfristig koennen den Yenkapriolen den langfristigen Wachstumstrend sowohl verstaerken als auch uebertuenchen.

Die letzten Zahlen: Gewinn in den ersten 9 Monaten: 397Yen pro Aktie. Jahresgewinn prognostiziert: 512!

KGV 2016 ist damit bei über 35. Das ist mir auch für eine sehr gute Aktie zu teuer! Ich werde abwarten.

KGV 2016 ist damit bei über 35. Das ist mir auch für eine sehr gute Aktie zu teuer! Ich werde abwarten.

Jahreszahlen kamen gestern raus:

500 Yen pro Aktie nach gut 800 im Vorjahr. KGV 2016 etwa 33.

Für das erste halbjahr 2017 wird ein weiterer Rückgang prognostiziert. 230 Yen sollen es werden.

Aktie ist in Tokyo um 5 % auf 16.500 Yen gefallen. Glaube trotzdem dass das langfristige Kaufkurse sind. Früher oder später werden die gewinne wieder die alten Niveaus (und darüber hinaus) erreichen.

500 Yen pro Aktie nach gut 800 im Vorjahr. KGV 2016 etwa 33.

Für das erste halbjahr 2017 wird ein weiterer Rückgang prognostiziert. 230 Yen sollen es werden.

Aktie ist in Tokyo um 5 % auf 16.500 Yen gefallen. Glaube trotzdem dass das langfristige Kaufkurse sind. Früher oder später werden die gewinne wieder die alten Niveaus (und darüber hinaus) erreichen.

Dann geb' ich mal den Klugsch...

2016 wurden 550Yen pro Aktie verdient.

Für 2017 werden 502 in Aussicht gestellt.

Hatte man die Jahre zuvor die eigenen Schätzungen immer deutlich getoppt, wurde sie für 2016 erstmals recht deutlich verfehlt. Ich gehe davon aus, dass der Ausblick diesmal deswegen besonders defensiv ausgefallen ist (Unsicherheiten werden betont, wg. Brexit, Wahlen Europa, Veränderungen in USA durch neue Administration).

2016 wurden 550Yen pro Aktie verdient.

Für 2017 werden 502 in Aussicht gestellt.

Hatte man die Jahre zuvor die eigenen Schätzungen immer deutlich getoppt, wurde sie für 2016 erstmals recht deutlich verfehlt. Ich gehe davon aus, dass der Ausblick diesmal deswegen besonders defensiv ausgefallen ist (Unsicherheiten werden betont, wg. Brexit, Wahlen Europa, Veränderungen in USA durch neue Administration).

Antwort auf Beitrag Nr.: 54.325.051 von Haettsch am 15.02.17 12:10:06

das ist für eine high-quality Firma doch ein bisschen viel, insbesondere weil andere Fahrradbuden (z.B. Accell) eigentlich ein gutes Jahr hatten.

Oder ist es stumpf einfach nur der Yen?:

Wenn ich da mal zwei Durchschnittsniveaus reinzulegen versuche, würde ich vielleicht auf gut 135 für 2015 und gut 120 für 2016 tippen.

135/120 = 1,125

ggü. dem Dollar dürfte der Effekt allerdings etwas schwächer sein, da der ja aufgewertet hat

mich würde ja doch interessieren,

wo mal "so eben" 15% Umsatzrückgang herkommen...das ist für eine high-quality Firma doch ein bisschen viel, insbesondere weil andere Fahrradbuden (z.B. Accell) eigentlich ein gutes Jahr hatten.

Oder ist es stumpf einfach nur der Yen?:

Wenn ich da mal zwei Durchschnittsniveaus reinzulegen versuche, würde ich vielleicht auf gut 135 für 2015 und gut 120 für 2016 tippen.

135/120 = 1,125

ggü. dem Dollar dürfte der Effekt allerdings etwas schwächer sein, da der ja aufgewertet hat

Antwort auf Beitrag Nr.: 54.325.366 von R-BgO am 15.02.17 12:41:46Der Heimatmarkt und China waren schwach. Der Rest mäßig. Währungen unvorteilhaft. Der Finanzbericht gibt für mich Amateur auch keine endgültige Erklärung für die Umsatzschwäche.

Und warum gibt's eigentlich keinen Finanzkalender?

HJ-Zahlen kommen nicht gut an

heute aufgestockt

Antwort auf Beitrag Nr.: 55.396.043 von R-BgO am 26.07.17 14:22:40

http://www.shimano.com/en/ir/library/cms/contents/Summary%20…" target="_blank" rel="nofollow ugc noopener">http://www.shimano.com/en/ir/library/cms/contents/Summary%20…

Zitat von R-BgO: heute aufgestockt

http://www.shimano.com/en/ir/library/cms/contents/Summary%20…" target="_blank" rel="nofollow ugc noopener">http://www.shimano.com/en/ir/library/cms/contents/Summary%20…

Die Jahresgewinnprognose wurde von 474Yen auf jetzt 454 Yen pro Aktie gesenkt. Vorjahresgewinn war 550 Yen.

In Tokyo ist der Kurs heute morgen um 10% abgestürzt. Auf jetzt 16.270 Yen. (125€)

Marktstellung und Bilanz sind zwar überirdisch, bei einem KGV immer noch jenseits der 30 dürften die Gewinn aber langsam auch mal wieder wachsen.

In Tokyo ist der Kurs heute morgen um 10% abgestürzt. Auf jetzt 16.270 Yen. (125€)

Marktstellung und Bilanz sind zwar überirdisch, bei einem KGV immer noch jenseits der 30 dürften die Gewinn aber langsam auch mal wieder wachsen.

Antwort auf Beitrag Nr.: 55.396.043 von R-BgO am 26.07.17 14:22:40

1) wird der Fahrradmarkt nicht mehr weiter wachsen? - Ich glaube doch

2) wird der relative Anteil für Shimano-Segmente abnehmen? Ich glaube nein

3) wird Shimano-Marktanteil abnehmen und/oder Druck auf die Preise kommen? - schon schwieriger; angesichts von ca. 80% Marktanteil müssen andere schon spektakulär zulegen, um überhaupt einen messbaren Effekt zu verursachen; gegen die Preisdrucktheorie spricht auch, dass die Marge bisher hält

TROTZDEM: muss eher "weiß nicht" sagen

Was erklärt dann den kapitalen Gewinnrückgang?

je länger ich mir das begucke, desto mehr verdächtige ich den Yen

Da ich mir vor Kurzem ein Fahrrad kaufen wollte und in ALLEN Geschäften die Auskunft bekam "wir sind fast komplett ausverkauft", habe ich eben nochmal aufgestockt;

mal sehen, ob ich das demnächst bereue oder bejuble

es ging weiter runter...

nun stellen sich die Fragen:1) wird der Fahrradmarkt nicht mehr weiter wachsen? - Ich glaube doch

2) wird der relative Anteil für Shimano-Segmente abnehmen? Ich glaube nein

3) wird Shimano-Marktanteil abnehmen und/oder Druck auf die Preise kommen? - schon schwieriger; angesichts von ca. 80% Marktanteil müssen andere schon spektakulär zulegen, um überhaupt einen messbaren Effekt zu verursachen; gegen die Preisdrucktheorie spricht auch, dass die Marge bisher hält

TROTZDEM: muss eher "weiß nicht" sagen

Was erklärt dann den kapitalen Gewinnrückgang?

je länger ich mir das begucke, desto mehr verdächtige ich den Yen

Da ich mir vor Kurzem ein Fahrrad kaufen wollte und in ALLEN Geschäften die Auskunft bekam "wir sind fast komplett ausverkauft", habe ich eben nochmal aufgestockt;

mal sehen, ob ich das demnächst bereue oder bejuble

Q2 Zahlen

Sehen gut aus. Forecast angehoben.http://www.shimano.com/en/ir/library/cms/contents/Summary%20…

Q3-Zahlen

Am 23.10. wurden die Q3-Zahlen veröffentlicht. Umsatzprognose 2018 wurde gegenüber Q2-Veröffentlichung um 1,5 Prozentpunkte gesenkt, für den Nettogewinn um 6 % angehoben.http://www.shimano.com/en/ir/library/cms/contents/Summary%20…

Der Kurs hat vorher schon geschwächelt und auf die Veröffentlichung kaum reagiert.

Seit 2015 pendelt der Kurs jetzt zwischen ungefähr 14 und 19.000 Yen. Auf jetzigem Niveau bei 15.000 sollte sich ein Einstieg lohnen, langfristig oder auch nur als Trade.

Die Radbranche ist und bleibt bestens für die Zukunft aufgestellt: gesund, klimafreundlich, abgasfrei, platzsparend und schnell in der Stadt.

Der Fahrradmarkt, zumindest in Deutschland, tendiert weiter zu höherwertigen Rädern und Pedelecs.

Wie im ARD-Beitrag erwähnt, stellt sich dem Aktionär natürlich die Frage, welche Gewinnmultiples Shimano zugestanden werden. Die (schlecht erklärten) Prognoseverfehlungen '16,'17 haben dem Hochbewertungsstatus sicherlich geschadet.

Gruß Haettsch

Beim Thema Radboom nicht vergessen: Accell.

Zahlen kamen heute

keine Überraschungen

Antwort auf Beitrag Nr.: 59.850.739 von R-BgO am 12.02.19 11:34:52führte aber dazu, dass heute jemand im deutschen Handel zugegriffen hat.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -1,40 | |

| -1,41 | |

| +1,27 | |

| +0,55 | |

| -0,57 | |

| -0,01 | |

| +0,38 | |

| +0,48 | |

| +0,06 | |

| +0,64 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 215 | ||

| 196 | ||

| 192 | ||

| 72 | ||

| 32 | ||

| 32 | ||

| 29 | ||

| 28 | ||

| 28 | ||

| 27 |

11.04.24 · wO Chartvergleich · Biomarin Pharmaceutical |

13.03.24 · wallstreetONLINE Redaktion · Itochu Shoji |

02.01.24 · Aktienwelt360 · ENCAVIS |

30.08.23 · Aktienwelt360 · Shimano |

26.04.23 · wO Chartvergleich · Berkshire Hathaway Registered (A) |

| Zeit | Titel |

|---|---|

| 11.04.24 |