Sempcorp Industries - asiatische Infrastruktur - 500 Beiträge pro Seite

eröffnet am 14.05.10 14:51:43 von

neuester Beitrag 01.03.19 22:56:51 von

neuester Beitrag 01.03.19 22:56:51 von

Beiträge: 20

ID: 1.157.804

ID: 1.157.804

Aufrufe heute: 0

Gesamt: 1.765

Gesamt: 1.765

Aktive User: 0

ISIN: SG1R50925390 · WKN: A0ET60 · Symbol: SBOA

3,7200

EUR

+3,91 %

+0,1400 EUR

Letzter Kurs 18.04.24 Tradegate

Neuigkeiten

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6087 | +14,85 | |

| 1,0360 | +12,85 | |

| 3,7200 | +3,91 | |

| 0,6150 | +3,36 | |

| 26,60 | +3,10 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,00 | -3,85 | |

| 1,6260 | -4,01 | |

| 1,2000 | -6,25 | |

| 0,7080 | -6,35 | |

| 0,7500 | -7,41 |

...derzeit knapp 4% Div.rendite und ein Hedge gegen Europa

Sembcorp Industries is a leading utilities and marine group. With facilities with over 3,300 megawatts of installed power capacity and over 4 million cubic metres of water under management per day, Sembcorp is a trusted provider of essential energy and water solutions to customers in Singapore, China, Vietnam, the United Kingdom and the Middle East. In addition, it is a world leader in marine & offshore engineering, an established developer of integrated industrial townships in Asia and a provider of environmental solutions.

Sembcorp Industries has total assets of over S$9 billion and employs around 6,500 employees. Listed on the main board of the Singapore Exchange, it is a component stock of the Straits Times Index and several MSCI indices.

Sembcorp Industries is a leading utilities and marine group. With facilities with over 3,300 megawatts of installed power capacity and over 4 million cubic metres of water under management per day, Sembcorp is a trusted provider of essential energy and water solutions to customers in Singapore, China, Vietnam, the United Kingdom and the Middle East. In addition, it is a world leader in marine & offshore engineering, an established developer of integrated industrial townships in Asia and a provider of environmental solutions.

Sembcorp Industries has total assets of over S$9 billion and employs around 6,500 employees. Listed on the main board of the Singapore Exchange, it is a component stock of the Straits Times Index and several MSCI indices.

SEMBCORP ESTABLISHES FIRST POWER PROJECT IN INDIA

SINGAPORE, May 25, 2010 - Sembcorp Industries (Sembcorp), a leading energy and water

company, today announces that its fully-owned utilities subsidiary, Sembcorp Utilities has entered

into an agreement to acquire a 49% stake in Thermal Powertech Corporation India (TPCIL), which

is set to build, own and operate a coastal power plant in Krishnapatnam, SPSR Nellore District,

Andhra Pradesh, India.

Sembcorp Utilities signed a joint venture agreement with Gayatri Energy Ventures (GEVL) to

invest in a 49% stake in TPCIL. The consideration for this equity stake is about Rs 1,042 crores

(S$319 million), to be funded through internal funds and / or borrowings. Completion of the

acquisition is expected to take place in mid-2010 upon the satisfaction of conditions precedent

typical for the implementation of power projects in India. This investment by Sembcorp is one of

the largest by a Singapore company in India and amongst one of the more major foreign direct

investments into the Indian power sector in recent times.

GEVL, a wholly-owned subsidiary of Gayatri Projects, an established construction company which

is publicly listed on the Bombay Stock Exchange, will continue to hold the remaining 51% stake in

TPCIL. TPCIL will invest approximately Rs 6,869 crores (S$2.1 billion) to build, own and operate a

1,320 megawatt coal-fired power plant in Krishnapatnam. The plant will be operated and

maintained by an O&M company, which will be 70% owned by Sembcorp and 30% owned by

GEVL, and for which Sembcorp and GEVL also signed a separate joint venture agreement today.

The project will be well-positioned to meet the growing power demand in the southern, western

and northern regions of India, which the Central Electricity Authority of India expects to increase at

a compounded annual growth rate of 9% over the next 10 years.

The signings took place in Hyderabad today, in a ceremony witnessed by India’s Union Minister for

Power Mr Sushil Kumar Shinde, the Chief Minister of Andhra Pradesh Dr K Rosaiah, the founder

of GEVL and Member of Parliament (Rajya Sabha) Dr T S Reddy and Sembcorp’s Group

President & CEO Mr Tang Kin Fei.

SINGAPORE, May 25, 2010 - Sembcorp Industries (Sembcorp), a leading energy and water

company, today announces that its fully-owned utilities subsidiary, Sembcorp Utilities has entered

into an agreement to acquire a 49% stake in Thermal Powertech Corporation India (TPCIL), which

is set to build, own and operate a coastal power plant in Krishnapatnam, SPSR Nellore District,

Andhra Pradesh, India.

Sembcorp Utilities signed a joint venture agreement with Gayatri Energy Ventures (GEVL) to

invest in a 49% stake in TPCIL. The consideration for this equity stake is about Rs 1,042 crores

(S$319 million), to be funded through internal funds and / or borrowings. Completion of the

acquisition is expected to take place in mid-2010 upon the satisfaction of conditions precedent

typical for the implementation of power projects in India. This investment by Sembcorp is one of

the largest by a Singapore company in India and amongst one of the more major foreign direct

investments into the Indian power sector in recent times.

GEVL, a wholly-owned subsidiary of Gayatri Projects, an established construction company which

is publicly listed on the Bombay Stock Exchange, will continue to hold the remaining 51% stake in

TPCIL. TPCIL will invest approximately Rs 6,869 crores (S$2.1 billion) to build, own and operate a

1,320 megawatt coal-fired power plant in Krishnapatnam. The plant will be operated and

maintained by an O&M company, which will be 70% owned by Sembcorp and 30% owned by

GEVL, and for which Sembcorp and GEVL also signed a separate joint venture agreement today.

The project will be well-positioned to meet the growing power demand in the southern, western

and northern regions of India, which the Central Electricity Authority of India expects to increase at

a compounded annual growth rate of 9% over the next 10 years.

The signings took place in Hyderabad today, in a ceremony witnessed by India’s Union Minister for

Power Mr Sushil Kumar Shinde, the Chief Minister of Andhra Pradesh Dr K Rosaiah, the founder

of GEVL and Member of Parliament (Rajya Sabha) Dr T S Reddy and Sembcorp’s Group

President & CEO Mr Tang Kin Fei.

BIWATER TENDERS ITS 58.4% STAKE IN CASCAL TO SEMBCORP

Sembcorp Industries (Sembcorp) today announces that following the commencement of its wholly-owned subsidiary Sembcorp Utilities' tender offer for all of the issued and outstanding common shares of Cascal N.V. (Cascal) on May 21, 2010, Biwater Investments Limited, the majority stockholder of Cascal, has tendered its 17,868,543 shares of Cascal in the tender offer in accordance with the previously disclosed tender offer and stockholder support agreement. This represents approximately 58.4% of the outstanding common shares of Cascal, based on the 30,581,343 shares reported by Cascal to be issued and outstanding as of December 31, 2009.

Sembcorp is offering to acquire all the common shares of Cascal in its ongoing tender offer at a price of US$6.75 per share, provided that at least 80% of the issued and outstanding shares of Cascal on a fully diluted basis are validly tendered and not withdrawn. If at the time of the scheduled expiration of the tender offer, less than 80% of the outstanding common shares of Cascal on a fully diluted basis have been validly tendered and not withdrawn, Sembcorp will reduce the tender offer price to US$6.40 per share. The offer and withdrawal rights will expire at 11:00 a.m. New York City time on June 21, 2010, unless extended.

Sembcorp Industries (Sembcorp) today announces that following the commencement of its wholly-owned subsidiary Sembcorp Utilities' tender offer for all of the issued and outstanding common shares of Cascal N.V. (Cascal) on May 21, 2010, Biwater Investments Limited, the majority stockholder of Cascal, has tendered its 17,868,543 shares of Cascal in the tender offer in accordance with the previously disclosed tender offer and stockholder support agreement. This represents approximately 58.4% of the outstanding common shares of Cascal, based on the 30,581,343 shares reported by Cascal to be issued and outstanding as of December 31, 2009.

Sembcorp is offering to acquire all the common shares of Cascal in its ongoing tender offer at a price of US$6.75 per share, provided that at least 80% of the issued and outstanding shares of Cascal on a fully diluted basis are validly tendered and not withdrawn. If at the time of the scheduled expiration of the tender offer, less than 80% of the outstanding common shares of Cascal on a fully diluted basis have been validly tendered and not withdrawn, Sembcorp will reduce the tender offer price to US$6.40 per share. The offer and withdrawal rights will expire at 11:00 a.m. New York City time on June 21, 2010, unless extended.

01.06.2010 19:00

Cascal Files Schedule 14D-9 in Response to Unsolicited Sembcorp Tender Offer to Purchase All Shares of Cascal N.V.

LONDON, June 1, 2010 /PRNewswire/ --

The Board of Directors Unanimously Recommends that Stockholders (other than Biwater) Reject the Offer and NOT Tender Their Shares into the Offer

Highlights of 14D-9 Filing:

-- Offer undervalues the shares based on the Company's historical financial performance and future operational and strategic opportunities

-- Board of Directors believes that Biwater agreed to sell the Biwater stake as a result of Biwater's significant financial distress due to pressure exerted by its principal lender, HSBC, which also acted as its financial advisor in negotiating the sale to Sembcorp

-- The Board of Directors' commitment to exploring strategic alternatives to maximize stockholder value of the Shares for the benefit of stockholders, including seeking a superior alternative to the Offer, which may include a business combination of the Company with third parties or other strategic or financial alternatives that could deliver higher stockholder value than the Offer

Cascal N.V. (NYSE: HOO) (the Company) announced today that that it has filed a Schedule 14D-9 Solicitation/Recommendation Statement with the Securities and Exchange Commission (the "SEC"), in response to an unsolicited tender offer (the "Offer") by Sembcorp Utilities PTE Ltd and Sembcorp Industries ("Sembcorp"), to purchase all shares of Cascal N.V. at a purchase price of US$6.75 (or US$6.40 , if certain conditions of the Offer are not met) net per share in cash, without interest, upon the terms and conditions set forth in the Offer to Purchase dated May 21, 2010 ("Offer to Purchase") and in the related Letter of Transmittal (which, together with the Offer to Purchase and any amendments or supplements thereto, collectively constitute the "Offer") contained in the Schedule TO filed by Sembcorp (the "Schedule TO") with the SEC on May 21, 2010.

At a meeting held on May 30, 2010, following a discussion among the independent members of the Board of Directors and advice from its financial, strategic and legal advisors, the Board of Directors, by unanimous vote (with Directors D. Lawrence Magor and Adrian White recusing themselves due to Biwater's interest in the Offer), determined that the Offer was inadequate to the holders of shares other than Biwater and not in the best interests of the Company's stockholders. It is the Board's belief that the Offer undervalues the Shares based on the Company's historical financial performance and future opportunities.

The Board of Directors recommends that stockholders reject the offer and not tender their shares into the Offer. The Board further recommends that stockholders that have tendered their shares into the Offer, withdraw their shares. In addition, it recommends that if shares are held through a broker or nominee, stockholders should instruct their broker to register the shares in the name of the stockholder.

"Cascal's position on the Sembcorp tender offer remains unchanged -- that it is inadequate and not in the best interest of stockholders. The offer grossly undervalues the strength and consistency of Cascal's historical operational and financial results and the fact that management has successfully and consistently executed our plan to grow both organically and through strategic acquisitions," said Michael Wager, spokesperson for Cascal. "It should also be noted that we have reached out to Sembcorp on three separate occasions in the last month to negotiate improved terms for stockholders, only to have them refuse to come to the table. In light of Sembcorp's actions, we are actively holding discussions and negotiating strategic alternatives that we hope can result in a superior transaction for stockholders of Cascal. "

In reaching the conclusion that the Offer is inadequate and not in the best interests of Cascal's stockholders, and in making the recommendations set forth above, the Board of Directors consulted with management of the Company and the Company's financial, strategic and legal advisors and took into account numerous factors, including, but not limited to, the following:

- The Board of Directors belief that the Offer price is inadequate and substantially undervalues the Company. - The Board of Directors belief that Biwater agreed to sell the Biwater Stake as a result of the significant financial distress of Biwater and BHL and as a direct result of pressure exerted by its principal lender, HSBC, which also acted as its financial advisor in negotiating the sale to Sembcorp. - The fact that by insisting on Biwater's commitment to tender and not withdraw the Biwater Stake pursuant to the Tender Offer and Stockholder Support Agreement, Sembcorp has attempted to prevent other potential bidders from proposing a superior transaction. - The fact that by announcing that Sembcorp intends to delist and deregister the Shares, Sembcorp is attempting to force the Company's stockholders to make the unfair choice between tendering into a two-tiered, undervalued tender offer or holding their Shares in the face of Sembcorp's announced intention to seek delisting and deregistration, thereby eliminating both a future market for the Shares and information to be filed with the SEC. - The Board of Directors' commitment to exploring strategic alternatives to maximize stockholder value of the Shares for the benefit of stockholders, including seeking a superior alternative to the Offer, which may include a business combination of the Company with third parties or other strategic or financial alternatives that could deliver higher stockholder value than the Offer. The Company has received indications of interest from third parties with respect to possible business combination transactions involving the Company since the Offer was commenced at higher consideration per Share to stockholders. - The fact that the Offer, if successful, could preclude Cascal from consummating an alternative transaction that could provide superior value to the Company's stockholders. In order to afford the Company an opportunity to explore strategic alternatives, the Board of Directors has considered and may implement a number of defensive actions against the Offer. - On May 30, 2010, Janney Montgomery Scott LLC ("Janney"), the Company's financial advisor, rendered an oral opinion to the Board of Directors, which was subsequently confirmed in writing, to the effect that, as of that date and subject to certain assumptions and qualifications, the Offer consideration of US$6.75 (or US$6.40) per Share in cash was inadequate from a financial point of view to the stockholders of the Company (specifically excluding Biwater, as to which no view was expressed).

The Company's 14D-9 filing is available on the SEC's website, http://www.sec.gov. In addition, the 14D-9 filing, this press release and other information related to its dispute with Sembcorp can be accessed from the section titled "Sembcorp Hostile Bid," the navigation atop the Company's home page at http://www.cascal.co.uk.

Janney Montgomery Scott LLC is serving as financial advisors, and Squire, Sanders&Dempsey LLP and Stibbe N.V. are serving as legal counsel to Cascal and its Board of Directors.

Cascal Files Schedule 14D-9 in Response to Unsolicited Sembcorp Tender Offer to Purchase All Shares of Cascal N.V.

LONDON, June 1, 2010 /PRNewswire/ --

The Board of Directors Unanimously Recommends that Stockholders (other than Biwater) Reject the Offer and NOT Tender Their Shares into the Offer

Highlights of 14D-9 Filing:

-- Offer undervalues the shares based on the Company's historical financial performance and future operational and strategic opportunities

-- Board of Directors believes that Biwater agreed to sell the Biwater stake as a result of Biwater's significant financial distress due to pressure exerted by its principal lender, HSBC, which also acted as its financial advisor in negotiating the sale to Sembcorp

-- The Board of Directors' commitment to exploring strategic alternatives to maximize stockholder value of the Shares for the benefit of stockholders, including seeking a superior alternative to the Offer, which may include a business combination of the Company with third parties or other strategic or financial alternatives that could deliver higher stockholder value than the Offer

Cascal N.V. (NYSE: HOO) (the Company) announced today that that it has filed a Schedule 14D-9 Solicitation/Recommendation Statement with the Securities and Exchange Commission (the "SEC"), in response to an unsolicited tender offer (the "Offer") by Sembcorp Utilities PTE Ltd and Sembcorp Industries ("Sembcorp"), to purchase all shares of Cascal N.V. at a purchase price of US$6.75 (or US$6.40 , if certain conditions of the Offer are not met) net per share in cash, without interest, upon the terms and conditions set forth in the Offer to Purchase dated May 21, 2010 ("Offer to Purchase") and in the related Letter of Transmittal (which, together with the Offer to Purchase and any amendments or supplements thereto, collectively constitute the "Offer") contained in the Schedule TO filed by Sembcorp (the "Schedule TO") with the SEC on May 21, 2010.

At a meeting held on May 30, 2010, following a discussion among the independent members of the Board of Directors and advice from its financial, strategic and legal advisors, the Board of Directors, by unanimous vote (with Directors D. Lawrence Magor and Adrian White recusing themselves due to Biwater's interest in the Offer), determined that the Offer was inadequate to the holders of shares other than Biwater and not in the best interests of the Company's stockholders. It is the Board's belief that the Offer undervalues the Shares based on the Company's historical financial performance and future opportunities.

The Board of Directors recommends that stockholders reject the offer and not tender their shares into the Offer. The Board further recommends that stockholders that have tendered their shares into the Offer, withdraw their shares. In addition, it recommends that if shares are held through a broker or nominee, stockholders should instruct their broker to register the shares in the name of the stockholder.

"Cascal's position on the Sembcorp tender offer remains unchanged -- that it is inadequate and not in the best interest of stockholders. The offer grossly undervalues the strength and consistency of Cascal's historical operational and financial results and the fact that management has successfully and consistently executed our plan to grow both organically and through strategic acquisitions," said Michael Wager, spokesperson for Cascal. "It should also be noted that we have reached out to Sembcorp on three separate occasions in the last month to negotiate improved terms for stockholders, only to have them refuse to come to the table. In light of Sembcorp's actions, we are actively holding discussions and negotiating strategic alternatives that we hope can result in a superior transaction for stockholders of Cascal. "

In reaching the conclusion that the Offer is inadequate and not in the best interests of Cascal's stockholders, and in making the recommendations set forth above, the Board of Directors consulted with management of the Company and the Company's financial, strategic and legal advisors and took into account numerous factors, including, but not limited to, the following:

- The Board of Directors belief that the Offer price is inadequate and substantially undervalues the Company. - The Board of Directors belief that Biwater agreed to sell the Biwater Stake as a result of the significant financial distress of Biwater and BHL and as a direct result of pressure exerted by its principal lender, HSBC, which also acted as its financial advisor in negotiating the sale to Sembcorp. - The fact that by insisting on Biwater's commitment to tender and not withdraw the Biwater Stake pursuant to the Tender Offer and Stockholder Support Agreement, Sembcorp has attempted to prevent other potential bidders from proposing a superior transaction. - The fact that by announcing that Sembcorp intends to delist and deregister the Shares, Sembcorp is attempting to force the Company's stockholders to make the unfair choice between tendering into a two-tiered, undervalued tender offer or holding their Shares in the face of Sembcorp's announced intention to seek delisting and deregistration, thereby eliminating both a future market for the Shares and information to be filed with the SEC. - The Board of Directors' commitment to exploring strategic alternatives to maximize stockholder value of the Shares for the benefit of stockholders, including seeking a superior alternative to the Offer, which may include a business combination of the Company with third parties or other strategic or financial alternatives that could deliver higher stockholder value than the Offer. The Company has received indications of interest from third parties with respect to possible business combination transactions involving the Company since the Offer was commenced at higher consideration per Share to stockholders. - The fact that the Offer, if successful, could preclude Cascal from consummating an alternative transaction that could provide superior value to the Company's stockholders. In order to afford the Company an opportunity to explore strategic alternatives, the Board of Directors has considered and may implement a number of defensive actions against the Offer. - On May 30, 2010, Janney Montgomery Scott LLC ("Janney"), the Company's financial advisor, rendered an oral opinion to the Board of Directors, which was subsequently confirmed in writing, to the effect that, as of that date and subject to certain assumptions and qualifications, the Offer consideration of US$6.75 (or US$6.40) per Share in cash was inadequate from a financial point of view to the stockholders of the Company (specifically excluding Biwater, as to which no view was expressed).

The Company's 14D-9 filing is available on the SEC's website, http://www.sec.gov. In addition, the 14D-9 filing, this press release and other information related to its dispute with Sembcorp can be accessed from the section titled "Sembcorp Hostile Bid," the navigation atop the Company's home page at http://www.cascal.co.uk.

Janney Montgomery Scott LLC is serving as financial advisors, and Squire, Sanders&Dempsey LLP and Stibbe N.V. are serving as legal counsel to Cascal and its Board of Directors.

Sembcorp Marine Marks Major Milestone in Singapore

Sembcorp Marine

|

Monday, June 21, 2010

Sembcorp Marine marked a major milestone in its growth and expansion strategy with the ground-breaking of its Integrated New Yard Facility at Tuas View Extension. Representing Singapore's first integrated yard facility, this landmark development will further reinforce Sembcorp Marine’s competitive edge, enabling the Group to respond effectively to customers' requirements and future challenges.

Harnessing Sembcorp Marine's 47 years of proven expertise and track record in marine and offshore engineering and construction, the state-of-the-art new yard facility is designed to maximize operational synergy, production efficiency and critical mass with optimized docking and berthing facilities, an improved dock and quay ratio, a centralized work-efficient layout, and integrated facilities. When fully completed, the 206-hectare custom-designed, purpose-built yard will boost Sembcorp Marine's total dock capacity by 62 per cent to 3,075,000 dwt.

The New Yard's strategic location along major sea lanes in the west of Singapore enables it to tap on the vibrant market for ship repair and conversion and to serve large volumes of vessels trading in the region.

Mr. Lim Hng Kiang, Minister for Trade and Industry noted that Sembcorp Marine's New Yard also reflects its commitment towards raising productivity levels. Mr. Lim added, "Boosting productivity levels will be a key factor in ensuring that our marine and offshore industry continues to grow and achieve long term sustainable competitiveness."

The 206-hectare Integrated New Yard Facility will be built in 3 phases. The 73.3-hectare S$750 million Phase I New Yard Development will focus on ship repair & conversion activities and is scheduled to be completed by end 2013 with partial operations commencing in the second half of 2012. Phase I will feature 4 Very Large Crude Carrier (VLCC) drydocks totaling 1,550,000 deadweight tonnes, a 3,408-meter quay as well as workshops totaling 68,300 sqm for hull and fitting works, a blasting and painting chamber, warehouse and craneage facilities. It will also house a 1,925 sqm Health, Safety and Environment (HSE) Centre along with medical clinic facilities, a training centre of 2,725 sqm, owners' offices of 4,125 sqm and a 40,639 sqm multistorey dormitory for staff and the workforce.

Designed as a centralized and integrated "one-stop solutions" hub for ship repair & conversion, shipbuilding, rig building and offshore engineering & construction, the new yard facility is well-equipped to serve a wide range of vessels including VLCCs, new generations of mega containerships, LNG carriers and passenger ships as well as meet new regulatory requirements and environmental standards.

Mr. Goh Geok Ling, Chairman of Sembcorp Marine said, "The ground-breaking of our Phase I Integrated New Yard Facility marks a defining moment in our history and a significant leap forward as we forge ahead into our next phase of growth. With its innovative work-efficient design, the state-of-the-art yard development will further bolster our home-base capabilities to deliver value-added cost-competitive solutions to our customer partners. The New Yard will be an invaluable asset which will be a key catalyst in sharpening Sembcorp Marine's competitive edge for long-term sustainable growth."

Sembcorp Marine

|

Monday, June 21, 2010

Sembcorp Marine marked a major milestone in its growth and expansion strategy with the ground-breaking of its Integrated New Yard Facility at Tuas View Extension. Representing Singapore's first integrated yard facility, this landmark development will further reinforce Sembcorp Marine’s competitive edge, enabling the Group to respond effectively to customers' requirements and future challenges.

Harnessing Sembcorp Marine's 47 years of proven expertise and track record in marine and offshore engineering and construction, the state-of-the-art new yard facility is designed to maximize operational synergy, production efficiency and critical mass with optimized docking and berthing facilities, an improved dock and quay ratio, a centralized work-efficient layout, and integrated facilities. When fully completed, the 206-hectare custom-designed, purpose-built yard will boost Sembcorp Marine's total dock capacity by 62 per cent to 3,075,000 dwt.

The New Yard's strategic location along major sea lanes in the west of Singapore enables it to tap on the vibrant market for ship repair and conversion and to serve large volumes of vessels trading in the region.

Mr. Lim Hng Kiang, Minister for Trade and Industry noted that Sembcorp Marine's New Yard also reflects its commitment towards raising productivity levels. Mr. Lim added, "Boosting productivity levels will be a key factor in ensuring that our marine and offshore industry continues to grow and achieve long term sustainable competitiveness."

The 206-hectare Integrated New Yard Facility will be built in 3 phases. The 73.3-hectare S$750 million Phase I New Yard Development will focus on ship repair & conversion activities and is scheduled to be completed by end 2013 with partial operations commencing in the second half of 2012. Phase I will feature 4 Very Large Crude Carrier (VLCC) drydocks totaling 1,550,000 deadweight tonnes, a 3,408-meter quay as well as workshops totaling 68,300 sqm for hull and fitting works, a blasting and painting chamber, warehouse and craneage facilities. It will also house a 1,925 sqm Health, Safety and Environment (HSE) Centre along with medical clinic facilities, a training centre of 2,725 sqm, owners' offices of 4,125 sqm and a 40,639 sqm multistorey dormitory for staff and the workforce.

Designed as a centralized and integrated "one-stop solutions" hub for ship repair & conversion, shipbuilding, rig building and offshore engineering & construction, the new yard facility is well-equipped to serve a wide range of vessels including VLCCs, new generations of mega containerships, LNG carriers and passenger ships as well as meet new regulatory requirements and environmental standards.

Mr. Goh Geok Ling, Chairman of Sembcorp Marine said, "The ground-breaking of our Phase I Integrated New Yard Facility marks a defining moment in our history and a significant leap forward as we forge ahead into our next phase of growth. With its innovative work-efficient design, the state-of-the-art yard development will further bolster our home-base capabilities to deliver value-added cost-competitive solutions to our customer partners. The New Yard will be an invaluable asset which will be a key catalyst in sharpening Sembcorp Marine's competitive edge for long-term sustainable growth."

Sembcorp has 87% shares in Cascal

02:50 PM Jun 22, 2010

SINGAPORE - Conglomerate Sembcorp Industries said it has accumulated some 87 per cent of shares in the US-listed Dutch water firm Cascal as at last Friday.

According to its tender offer for Cascal shares, this will mean that Sembcorp will pay the higher price of US$6.75 per share, provided there are no withdrawals by the deadline that will take its stake below 80 per cent.

The tender offer was supposed to expire yesterday, but the deadline has been extended to July 8, said Sembcorp in a statement yesterday.

Sembcorp had negotiated with British-based Biwater Investments to acquire its 58.4-per-cent stake in Cascal in April this year. Sembcorp then offered to buy all the remaining Cascal shares it did not own at US$6.75 per share if it secured at least 80 per cent of Cascal shares when the tender offer closed. Otherwise, Sembcorp will pay US$6.40 per share. Jo-ann Huang

02:50 PM Jun 22, 2010

SINGAPORE - Conglomerate Sembcorp Industries said it has accumulated some 87 per cent of shares in the US-listed Dutch water firm Cascal as at last Friday.

According to its tender offer for Cascal shares, this will mean that Sembcorp will pay the higher price of US$6.75 per share, provided there are no withdrawals by the deadline that will take its stake below 80 per cent.

The tender offer was supposed to expire yesterday, but the deadline has been extended to July 8, said Sembcorp in a statement yesterday.

Sembcorp had negotiated with British-based Biwater Investments to acquire its 58.4-per-cent stake in Cascal in April this year. Sembcorp then offered to buy all the remaining Cascal shares it did not own at US$6.75 per share if it secured at least 80 per cent of Cascal shares when the tender offer closed. Otherwise, Sembcorp will pay US$6.40 per share. Jo-ann Huang

Antwort auf Beitrag Nr.: 39.718.573 von R-BgO am 22.06.10 10:53:09Sembcorp completes tender offer for Cascal shares

By Ephraim Seow | Posted: 09 July 2010 1349 hrs

SINGAPORE: Conglomerate Sembcorp Industries says it has successfully completed the initial tender offer for all of the issued and outstanding common shares of its takeover target, Cascal.

The offer period expired at 5pm New York City time on Thursday, July 8.

Sembcorp now owns 92.26 per cent of the shares in US-listed Dutch water firm Cascal.

The total consideration for the stake amounts to some US$192 million US, at US$6.75 per share.

Sembcorp Group President Tang Kin Fei says the acquisition is strategic and will transform the group into a global water player with enhanced capabilities to serve the water and wastewater needs of both industrial and municipal customers.

Now that the tender offer is completed, Sembcorp intends to delist Cascal shares from the New York Stock Exchange.

It will also suspend Cascal's obligation to file reports under Securities Exchange Act of 1934 and terminate the registration of the shares under the Exchange Act.

Sembcorp adds that remaining shareholders are given till July 30 to divest their shares to Sembcorp Utilities.

It has commenced a subsequent offer period for the remaining shares, which will expire at 5pm New York City time on Friday July 30.

Sembcorp says any shares validly tendered will be immediately accepted for payment.

Tendering shareholders will be paid US$6.75 per share in cash, less any withholding taxes and without interest.

This is the same amount per share that was offered and paid to Cascal shareholders who previously tendered during the initial offer period.

Should Sembcorp own at least 95 per cent of the shares after the subsequent offering period expires, it intends to complete the acquisition by effecting squeeze-out proceedings under the Dutch Civil Code.

The price paid to minority stockholders in such proceedings would be determined by the Dutch Court.

Upon the completion of a squeeze-out proceeding, Cascal will no longer be a public company.

Sembcorp says the transaction is not expected to have a material impact on its earnings per share for the current financial year.

It adds that transaction costs will be incurred within the first year of acquisition.

The transaction is expected to be accretive to earnings starting from the second year after the acquisition.

Sembcorp first announced that it would be acquiring Cascal in April, after negotiating a private deal with Britain-based Biwater Investments to buy its entire 58.4 per cent stake in Cascal. - CNA/jm

By Ephraim Seow | Posted: 09 July 2010 1349 hrs

SINGAPORE: Conglomerate Sembcorp Industries says it has successfully completed the initial tender offer for all of the issued and outstanding common shares of its takeover target, Cascal.

The offer period expired at 5pm New York City time on Thursday, July 8.

Sembcorp now owns 92.26 per cent of the shares in US-listed Dutch water firm Cascal.

The total consideration for the stake amounts to some US$192 million US, at US$6.75 per share.

Sembcorp Group President Tang Kin Fei says the acquisition is strategic and will transform the group into a global water player with enhanced capabilities to serve the water and wastewater needs of both industrial and municipal customers.

Now that the tender offer is completed, Sembcorp intends to delist Cascal shares from the New York Stock Exchange.

It will also suspend Cascal's obligation to file reports under Securities Exchange Act of 1934 and terminate the registration of the shares under the Exchange Act.

Sembcorp adds that remaining shareholders are given till July 30 to divest their shares to Sembcorp Utilities.

It has commenced a subsequent offer period for the remaining shares, which will expire at 5pm New York City time on Friday July 30.

Sembcorp says any shares validly tendered will be immediately accepted for payment.

Tendering shareholders will be paid US$6.75 per share in cash, less any withholding taxes and without interest.

This is the same amount per share that was offered and paid to Cascal shareholders who previously tendered during the initial offer period.

Should Sembcorp own at least 95 per cent of the shares after the subsequent offering period expires, it intends to complete the acquisition by effecting squeeze-out proceedings under the Dutch Civil Code.

The price paid to minority stockholders in such proceedings would be determined by the Dutch Court.

Upon the completion of a squeeze-out proceeding, Cascal will no longer be a public company.

Sembcorp says the transaction is not expected to have a material impact on its earnings per share for the current financial year.

It adds that transaction costs will be incurred within the first year of acquisition.

The transaction is expected to be accretive to earnings starting from the second year after the acquisition.

Sembcorp first announced that it would be acquiring Cascal in April, after negotiating a private deal with Britain-based Biwater Investments to buy its entire 58.4 per cent stake in Cascal. - CNA/jm

8-3-10 12:30 AM EDT

By Gaurav Raghuvanshi

Of DOW JONES NEWSWIRES

SINGAPORE -(Dow Jones)- Singapore's Sembcorp Industries Ltd. (U96.SG) is seeking to buy a stake in a power plant in Vietnam from BP PLC (BP.LN), joining companies across the world keen to pick assets being sold by the energy major to help pay for the cleanup of the Gulf of Mexico oil spill.

"We are interested. We can't share more details at this stage," a spokeswoman for Singapore-listed Sembcorp told Dow Jones Newswires. The spokeswoman's comments followed a report in the Business Times Tuesday that Sembcorp Utilities Ltd. is keen on buying BP's one-third stake in the Phu My 3 Power Co. natural gas-fired plant.

Sembcorp Utilities and BP each own one-third of the 728-megawatt plant, located 70 kilometers from Ho Chi Minh City, with the rest split between Japan's Kyushu Electric Power Co. (9508.TO) and Sojitz Corp. The plant uses gas from offshore fields operated by BP.

A BP spokeswoman in Singapore declined comment saying "we don't comment on market speculation."

BP has said it will sell some of its Vietnam assets, principally the Nam Con Son gas project, as part of a $30 billion divestment process to raise money to cover the cost of the Gulf of Mexico oil spill.

The company had informed staff and government that it planned to divest the project by the end of the year, a BP spokesman said on July 29, declining to state a value for the assets.

The divestments won't include BP's downstream businesses in Vietnam, the spokesman had said.

On July 27, a consortium of four Indian state-run companies said they will likely join with Vietnam Oil and Gas Group, or PetroVietnam, to buy BP stake in the Nam Con Son gas project.

The U.K. company, which has already spent about $4 billion on the spill and has agreed to pay $20 billion for a cleanup and compensation fund, has put assets in several parts of the world, including the U.S., Canada, Pakistan and Vietnam on sale to generate money.

BP agreed to sell $7 billion of oil and gas assets in North America and Egypt to Apache Corp. (APA) on July 20, a deal investors said demonstrated the embattled company's ability to raise funds easily without resorting to a 'fire sale'.

By Gaurav Raghuvanshi

Of DOW JONES NEWSWIRES

SINGAPORE -(Dow Jones)- Singapore's Sembcorp Industries Ltd. (U96.SG) is seeking to buy a stake in a power plant in Vietnam from BP PLC (BP.LN), joining companies across the world keen to pick assets being sold by the energy major to help pay for the cleanup of the Gulf of Mexico oil spill.

"We are interested. We can't share more details at this stage," a spokeswoman for Singapore-listed Sembcorp told Dow Jones Newswires. The spokeswoman's comments followed a report in the Business Times Tuesday that Sembcorp Utilities Ltd. is keen on buying BP's one-third stake in the Phu My 3 Power Co. natural gas-fired plant.

Sembcorp Utilities and BP each own one-third of the 728-megawatt plant, located 70 kilometers from Ho Chi Minh City, with the rest split between Japan's Kyushu Electric Power Co. (9508.TO) and Sojitz Corp. The plant uses gas from offshore fields operated by BP.

A BP spokeswoman in Singapore declined comment saying "we don't comment on market speculation."

BP has said it will sell some of its Vietnam assets, principally the Nam Con Son gas project, as part of a $30 billion divestment process to raise money to cover the cost of the Gulf of Mexico oil spill.

The company had informed staff and government that it planned to divest the project by the end of the year, a BP spokesman said on July 29, declining to state a value for the assets.

The divestments won't include BP's downstream businesses in Vietnam, the spokesman had said.

On July 27, a consortium of four Indian state-run companies said they will likely join with Vietnam Oil and Gas Group, or PetroVietnam, to buy BP stake in the Nam Con Son gas project.

The U.K. company, which has already spent about $4 billion on the spill and has agreed to pay $20 billion for a cleanup and compensation fund, has put assets in several parts of the world, including the U.S., Canada, Pakistan and Vietnam on sale to generate money.

BP agreed to sell $7 billion of oil and gas assets in North America and Egypt to Apache Corp. (APA) on July 20, a deal investors said demonstrated the embattled company's ability to raise funds easily without resorting to a 'fire sale'.

Sembcorp Expands In New Growth Area Of Jurong Island

- New anchor customer JAC secured

- Sembcorp to develop new multi-utilities facility and cogeneration plant

SINGAPORE, August 25, 2010 – Sembcorp is pleased to announce that it has secured its

first anchor multi-utilities customer in the new growth area in the west of Singapore’s Jurong

Island petrochemical cluster. It signed a 20-year long-term utilities services agreement with

Jurong Aromatics Corporation (JAC) today for the supply of steam and other water and

wastewater treatment services to JAC’s upcoming aromatics complex. To provide these

services to JAC, Sembcorp will build a multi-utilities facility adjacent to the JAC aromatics

complex and a new gas-fired combined-cycle gas turbine cogeneration plant close to the JAC

aromatics complex, to provide integrated supply of steam, water and wastewater treatment

services.

With a total investment cost of approximately S$800 million, the new multi-utilities facility and

cogeneration plant are expected to be completed by the third quarter of 2013, and are

expected to be funded through a mix of bank borrowings and internal sources. Occupying a

land area of around 5.3 hectares, the new multi-utilities facility will be similar to Sembcorp’s

existing multi-utilities centre in Jurong Island’s Sakra district and will supply around 350

tonnes of steam per hour, as well as other water and wastewater treatment services. The new

combined-cycle gas turbine cogeneration plant will have a capacity of 400 megawatts of

power and 200 tonnes per hour of process steam in its initial phase. The development of the

cogeneration plant is subject to the approval of relevant authorities.

Sembcorp’s expansion in the upcoming growth area in the west of Jurong Island will

complement its current operations in the Sakra and Seraya districts of the island. Earlier in

June, Sembcorp had announced that it had secured a long-term wastewater treatment

contract from Lanxess for its upcoming butyl rubber production facility in Tembusu.

- New anchor customer JAC secured

- Sembcorp to develop new multi-utilities facility and cogeneration plant

SINGAPORE, August 25, 2010 – Sembcorp is pleased to announce that it has secured its

first anchor multi-utilities customer in the new growth area in the west of Singapore’s Jurong

Island petrochemical cluster. It signed a 20-year long-term utilities services agreement with

Jurong Aromatics Corporation (JAC) today for the supply of steam and other water and

wastewater treatment services to JAC’s upcoming aromatics complex. To provide these

services to JAC, Sembcorp will build a multi-utilities facility adjacent to the JAC aromatics

complex and a new gas-fired combined-cycle gas turbine cogeneration plant close to the JAC

aromatics complex, to provide integrated supply of steam, water and wastewater treatment

services.

With a total investment cost of approximately S$800 million, the new multi-utilities facility and

cogeneration plant are expected to be completed by the third quarter of 2013, and are

expected to be funded through a mix of bank borrowings and internal sources. Occupying a

land area of around 5.3 hectares, the new multi-utilities facility will be similar to Sembcorp’s

existing multi-utilities centre in Jurong Island’s Sakra district and will supply around 350

tonnes of steam per hour, as well as other water and wastewater treatment services. The new

combined-cycle gas turbine cogeneration plant will have a capacity of 400 megawatts of

power and 200 tonnes per hour of process steam in its initial phase. The development of the

cogeneration plant is subject to the approval of relevant authorities.

Sembcorp’s expansion in the upcoming growth area in the west of Jurong Island will

complement its current operations in the Sakra and Seraya districts of the island. Earlier in

June, Sembcorp had announced that it had secured a long-term wastewater treatment

contract from Lanxess for its upcoming butyl rubber production facility in Tembusu.

$1,50/kW; scheint nicht teuer...

SINGAPORE, September 13, 2010 - Sembcorp Industries (Sembcorp) is pleased to

announce that Thermal Powertech Corporation India (TPCIL) has signed financing

arrangements with its lenders for the development of its 1,320 megawatt power plant in

Andhra Pradesh, India. The financing covers approximately 75% of the project cost of Rs

6,869 crores (around S$2 billion), and the financial documentation was signed in Hyderabad

today.

In May 2010, Sembcorp’s fully-owned utilities subsidiary, Sembcorp Utilities, announced that it

had entered into an agreement with Gayatri Energy Ventures Limited to acquire a 49% stake

in TPCIL which is set to build, own and operate a coastal power plant in Krishnapatnam,

SPSR Nellore District, Andhra Pradesh, India. The completion of this joint venture is pending

the satisfaction of certain conditions precedent. The signing of these financing arrangements

marks a key milestone in closing out the conditions.

SINGAPORE, September 13, 2010 - Sembcorp Industries (Sembcorp) is pleased to

announce that Thermal Powertech Corporation India (TPCIL) has signed financing

arrangements with its lenders for the development of its 1,320 megawatt power plant in

Andhra Pradesh, India. The financing covers approximately 75% of the project cost of Rs

6,869 crores (around S$2 billion), and the financial documentation was signed in Hyderabad

today.

In May 2010, Sembcorp’s fully-owned utilities subsidiary, Sembcorp Utilities, announced that it

had entered into an agreement with Gayatri Energy Ventures Limited to acquire a 49% stake

in TPCIL which is set to build, own and operate a coastal power plant in Krishnapatnam,

SPSR Nellore District, Andhra Pradesh, India. The completion of this joint venture is pending

the satisfaction of certain conditions precedent. The signing of these financing arrangements

marks a key milestone in closing out the conditions.

Sembcorp Industries (Sembcorp) delivered a strong performance in 2010, reporting a 16% growth in net profit attributable to shareholders of the Company (net profit) for the full year 2010 (FY2010). Group net profit was S$792.9 million compared to S$682.7 million, while turnover was S$8.8 billion compared to S$9.6 billion in FY2009.

In FY2010, Marine’s contribution to Group net profit grew 15% from S$430.2 million to S$492.8 million, while Utilities’ net profit increased 2% from S$226.7 million to S$231.3 million. Industrial Parks’ net profit improved 30% from S$28.3 million to S$36.9 million. Return on equity for the Group was a healthy 22.2% and earnings per share amounted to 44.4 cents. Economic value added was a positive S$809.4 million, while cash and cash equivalents stood at a strong S$3.5 billion.

In the fourth quarter of 2010 (4Q2010), Group net profit was S$228.7 million compared to S$259.0 million the previous year. In 4Q2010, profit contribution from the Marine business was lower due to the resumption of margin recognition for some of its projects upon securing buyers in 4Q2009, while the Utilities business was affected by the one-off write-down of certain ageing assets in the UK during the quarter. 4Q2010 turnover was S$2.1 billion compared to S$2.4 billion in 4Q2009.

Mr Tang Kin Fei, Group President & CEO of Sembcorp Industries, said: “In 2010, Sembcorp delivered a solid financial performance and made significant progress in broadening our asset portfolio through organic growth and strategic investments. In Singapore, we will develop a new cogeneration plant to increase our generation capacity from 800 megawatts to 1,200 megawatts and install new steam production and wastewater treatment facilities to support growth on Jurong Island. Marking a major milestone for our Utilities business in the fast-growing water sector, we also successfully acquired Cascal, a leading municipal water provider. Sembcorp is now a global water service provider with capabilities to serve both industrial and municipal customers. Other milestones achieved during the year included our entry into the fast-growing Indian power market as well as our expansion of shipyard capacities in Singapore and Brazil.

“With a global footprint across six continents and the healthy pipeline of projects we have built up, we are well-positioned to continue to deliver shareholder value and sustainable growth in the long term.”

2010 Dividend

The Board of Directors is pleased to propose a final tax exempt one-tier dividend of 17.0 cents per ordinary share comprising an ordinary dividend of 15.0 cents and a bonus dividend of 2.0 cents per ordinary share for 2010. Together, this marks an increase of 13% from 2009’s 15 cents per ordinary share. If approved by shareholders, this will be paid on May 13, 2011.

FY2011 Outlook

The world economy is on the path to recovery. However, recent events in the Middle East and North Africa could create uncertainties and threaten global economic recovery. Our projects in the region, in Oman and the UAE, are not affected by the current unrest. Nonetheless, we continue to closely monitor the situation in the region.

Our Marine business has a current net orderbook of S$4.8 billion (2009: S$5.5 billion) with completions and deliveries stretching till second quarter of 2013. Enquiries have improved though competition remains keen.

For FY2011, our Utilities and Industrial Parks businesses are expected to deliver a steady performance.

Highlights from Sembcorp’s FY2010 Financial Results

• Turnover of S$8.8 billion, down 8%

• Net profit before EI of S$760.8 million, up 11%

• Net profit after EI of S$792.9 million, up 16%

• ROE at 22.2%

• EVA at S$809.4 million

• Strong balance sheet and cash flow

- Net cash position

- Operating cash flow (before changes in working capital) of S$1,440.2 million

• Proposing final tax exempt one-tier dividend of 17.0 cents per ordinary share, comprising an ordinary dividend of 15.0 cents and a bonus dividend of 2.0 cents, up 13%

– END –

In FY2010, Marine’s contribution to Group net profit grew 15% from S$430.2 million to S$492.8 million, while Utilities’ net profit increased 2% from S$226.7 million to S$231.3 million. Industrial Parks’ net profit improved 30% from S$28.3 million to S$36.9 million. Return on equity for the Group was a healthy 22.2% and earnings per share amounted to 44.4 cents. Economic value added was a positive S$809.4 million, while cash and cash equivalents stood at a strong S$3.5 billion.

In the fourth quarter of 2010 (4Q2010), Group net profit was S$228.7 million compared to S$259.0 million the previous year. In 4Q2010, profit contribution from the Marine business was lower due to the resumption of margin recognition for some of its projects upon securing buyers in 4Q2009, while the Utilities business was affected by the one-off write-down of certain ageing assets in the UK during the quarter. 4Q2010 turnover was S$2.1 billion compared to S$2.4 billion in 4Q2009.

Mr Tang Kin Fei, Group President & CEO of Sembcorp Industries, said: “In 2010, Sembcorp delivered a solid financial performance and made significant progress in broadening our asset portfolio through organic growth and strategic investments. In Singapore, we will develop a new cogeneration plant to increase our generation capacity from 800 megawatts to 1,200 megawatts and install new steam production and wastewater treatment facilities to support growth on Jurong Island. Marking a major milestone for our Utilities business in the fast-growing water sector, we also successfully acquired Cascal, a leading municipal water provider. Sembcorp is now a global water service provider with capabilities to serve both industrial and municipal customers. Other milestones achieved during the year included our entry into the fast-growing Indian power market as well as our expansion of shipyard capacities in Singapore and Brazil.

“With a global footprint across six continents and the healthy pipeline of projects we have built up, we are well-positioned to continue to deliver shareholder value and sustainable growth in the long term.”

2010 Dividend

The Board of Directors is pleased to propose a final tax exempt one-tier dividend of 17.0 cents per ordinary share comprising an ordinary dividend of 15.0 cents and a bonus dividend of 2.0 cents per ordinary share for 2010. Together, this marks an increase of 13% from 2009’s 15 cents per ordinary share. If approved by shareholders, this will be paid on May 13, 2011.

FY2011 Outlook

The world economy is on the path to recovery. However, recent events in the Middle East and North Africa could create uncertainties and threaten global economic recovery. Our projects in the region, in Oman and the UAE, are not affected by the current unrest. Nonetheless, we continue to closely monitor the situation in the region.

Our Marine business has a current net orderbook of S$4.8 billion (2009: S$5.5 billion) with completions and deliveries stretching till second quarter of 2013. Enquiries have improved though competition remains keen.

For FY2011, our Utilities and Industrial Parks businesses are expected to deliver a steady performance.

Highlights from Sembcorp’s FY2010 Financial Results

• Turnover of S$8.8 billion, down 8%

• Net profit before EI of S$760.8 million, up 11%

• Net profit after EI of S$792.9 million, up 16%

• ROE at 22.2%

• EVA at S$809.4 million

• Strong balance sheet and cash flow

- Net cash position

- Operating cash flow (before changes in working capital) of S$1,440.2 million

• Proposing final tax exempt one-tier dividend of 17.0 cents per ordinary share, comprising an ordinary dividend of 15.0 cents and a bonus dividend of 2.0 cents, up 13%

– END –

November 9, 2012

SEMBCORP RECORDS NET PROFIT OF S$548.6 MILLION IN 9M2012

- Utilities business delivers strong profit growth of 36%

Sembcorp Industries (Sembcorp) reported a net profit of S$548.6 million in the first nine months of 2012 (9M2012). Group net profit in 9M2011 was S$557.4 million. In 9M2012, turnover increased 8% to S$7.4 billion from S$6.8 billion in 9M2011. Sembcorp's main profit contributors continued to be its Utilities and Marine businesses, which contributed 52% and 40% of Group net profit respectively.

In 9M2012, the Utilities business delivered strong profit growth with net profit increasing 36%. The businesses' 9M2012 net profit grew to S$293.5 million from S$216.2 million, underpinned by robust growth from its Singapore operations. The Marine business contributed S$225.4 million in net profit in 9M2012 compared to S$317.9 million in 9M2011 mainly due to lower margin from new design rigs and resumption of margin recognition on completion and delivery of the Songa Eclipse semi-submersible rig in 9M2011. The Urban Development business recorded an 8% increase in net profit to S$19.3 million from S$17.9 million over the same period.

For 9M2012, return on equity (annualised) for the Group was 17.0% and earnings per share amounted to 30.7 cents. Economic value added was a positive S$404.1 million while cash and cash equivalents stood at S$1.9 billion.

In the third quarter of 2012 (3Q2012), Group net profit was S$181.2 million compared to S$222.4 million in 3Q2011, while turnover was S$2.3 billion compared to S$2.6 billion.

Tang Kin Fei, Group President & CEO of Sembcorp Industries said, "Backed by strong growth from our Singapore operations and contribution from the newly-completed Salalah Independent Water and Power Plant in Oman, our Utilities business delivered a strong profit growth of 36%. In addition, we achieved a significant milestone in our strategy to grow our renewable energy capabilities with the completion of our acquisition of wind power assets in China. Meanwhile, our Marine business continued to secure significant new orders that have brought its total orderbook to a record S$12.1 billion. Underpinned by sound business fundamentals and a healthy pipeline of projects and orderbook. Sembcorp is well-positioned to continue to deliver shareholder value and long-term growth".

FY2012 Outlook

Utilities

Our Utilities business is expected to deliver a better performance in FY2012 compared to last year.

With the execution of our pipeline of projects as well as the active pursuit of new growth opportunities, the business continues to be well-positioned to deliver long-term growth.

Marine

Our Marine business secured contract orders worth a total of S$9.1 billion since the start of the year, growing its net orderbook to a record high of S$12.1 billion, with completion and deliveries extending till 2019.

Overall, enquiries continue to be healthy although competition remains keen and affects margin.

Urban Development

While the slowdown in the global economy may affect the pace of land sales, our Urban Development business is expected to deliver a steady performance in 2012.

Group

The Group, underpinned by resilient businesses and a healthy pipeline of projects, will continue to make every effort to position our businesses for sustained growth.

Highlights from Sembcorp Marine's 9M2012 Financial Results

• Turnover at S$5.1 billion, up 22%

• Profit from Operations at S$932.3 million, up 1%

• Net profit at S$548.6 million, down 2%

• EPS at 30.7 cents

• ROE (annualised) at 17.0%

• Continued strong performance from Utilities, net profit up 36%

*Profit from Operations = Earnings before Interest and Tax + Share of Associates and JVs' result (net of tax)

- END -

SEMBCORP RECORDS NET PROFIT OF S$548.6 MILLION IN 9M2012

- Utilities business delivers strong profit growth of 36%

Sembcorp Industries (Sembcorp) reported a net profit of S$548.6 million in the first nine months of 2012 (9M2012). Group net profit in 9M2011 was S$557.4 million. In 9M2012, turnover increased 8% to S$7.4 billion from S$6.8 billion in 9M2011. Sembcorp's main profit contributors continued to be its Utilities and Marine businesses, which contributed 52% and 40% of Group net profit respectively.

In 9M2012, the Utilities business delivered strong profit growth with net profit increasing 36%. The businesses' 9M2012 net profit grew to S$293.5 million from S$216.2 million, underpinned by robust growth from its Singapore operations. The Marine business contributed S$225.4 million in net profit in 9M2012 compared to S$317.9 million in 9M2011 mainly due to lower margin from new design rigs and resumption of margin recognition on completion and delivery of the Songa Eclipse semi-submersible rig in 9M2011. The Urban Development business recorded an 8% increase in net profit to S$19.3 million from S$17.9 million over the same period.

For 9M2012, return on equity (annualised) for the Group was 17.0% and earnings per share amounted to 30.7 cents. Economic value added was a positive S$404.1 million while cash and cash equivalents stood at S$1.9 billion.

In the third quarter of 2012 (3Q2012), Group net profit was S$181.2 million compared to S$222.4 million in 3Q2011, while turnover was S$2.3 billion compared to S$2.6 billion.

Tang Kin Fei, Group President & CEO of Sembcorp Industries said, "Backed by strong growth from our Singapore operations and contribution from the newly-completed Salalah Independent Water and Power Plant in Oman, our Utilities business delivered a strong profit growth of 36%. In addition, we achieved a significant milestone in our strategy to grow our renewable energy capabilities with the completion of our acquisition of wind power assets in China. Meanwhile, our Marine business continued to secure significant new orders that have brought its total orderbook to a record S$12.1 billion. Underpinned by sound business fundamentals and a healthy pipeline of projects and orderbook. Sembcorp is well-positioned to continue to deliver shareholder value and long-term growth".

FY2012 Outlook

Utilities

Our Utilities business is expected to deliver a better performance in FY2012 compared to last year.

With the execution of our pipeline of projects as well as the active pursuit of new growth opportunities, the business continues to be well-positioned to deliver long-term growth.

Marine

Our Marine business secured contract orders worth a total of S$9.1 billion since the start of the year, growing its net orderbook to a record high of S$12.1 billion, with completion and deliveries extending till 2019.

Overall, enquiries continue to be healthy although competition remains keen and affects margin.

Urban Development

While the slowdown in the global economy may affect the pace of land sales, our Urban Development business is expected to deliver a steady performance in 2012.

Group

The Group, underpinned by resilient businesses and a healthy pipeline of projects, will continue to make every effort to position our businesses for sustained growth.

Highlights from Sembcorp Marine's 9M2012 Financial Results

• Turnover at S$5.1 billion, up 22%

• Profit from Operations at S$932.3 million, up 1%

• Net profit at S$548.6 million, down 2%

• EPS at 30.7 cents

• ROE (annualised) at 17.0%

• Continued strong performance from Utilities, net profit up 36%

*Profit from Operations = Earnings before Interest and Tax + Share of Associates and JVs' result (net of tax)

- END -

Jahreszahlen 2013 sind da:

Gewinn +9%

KGV rund 11

Gewinn +9%

KGV rund 11

aufgestockt

Antwort auf Beitrag Nr.: 49.348.880 von R-BgO am 17.03.15 10:47:21

war kein gutes Timing

Gesamtposition aktuell minus 33%

Antwort auf Beitrag Nr.: 53.206.500 von R-BgO am 05.09.16 09:31:25

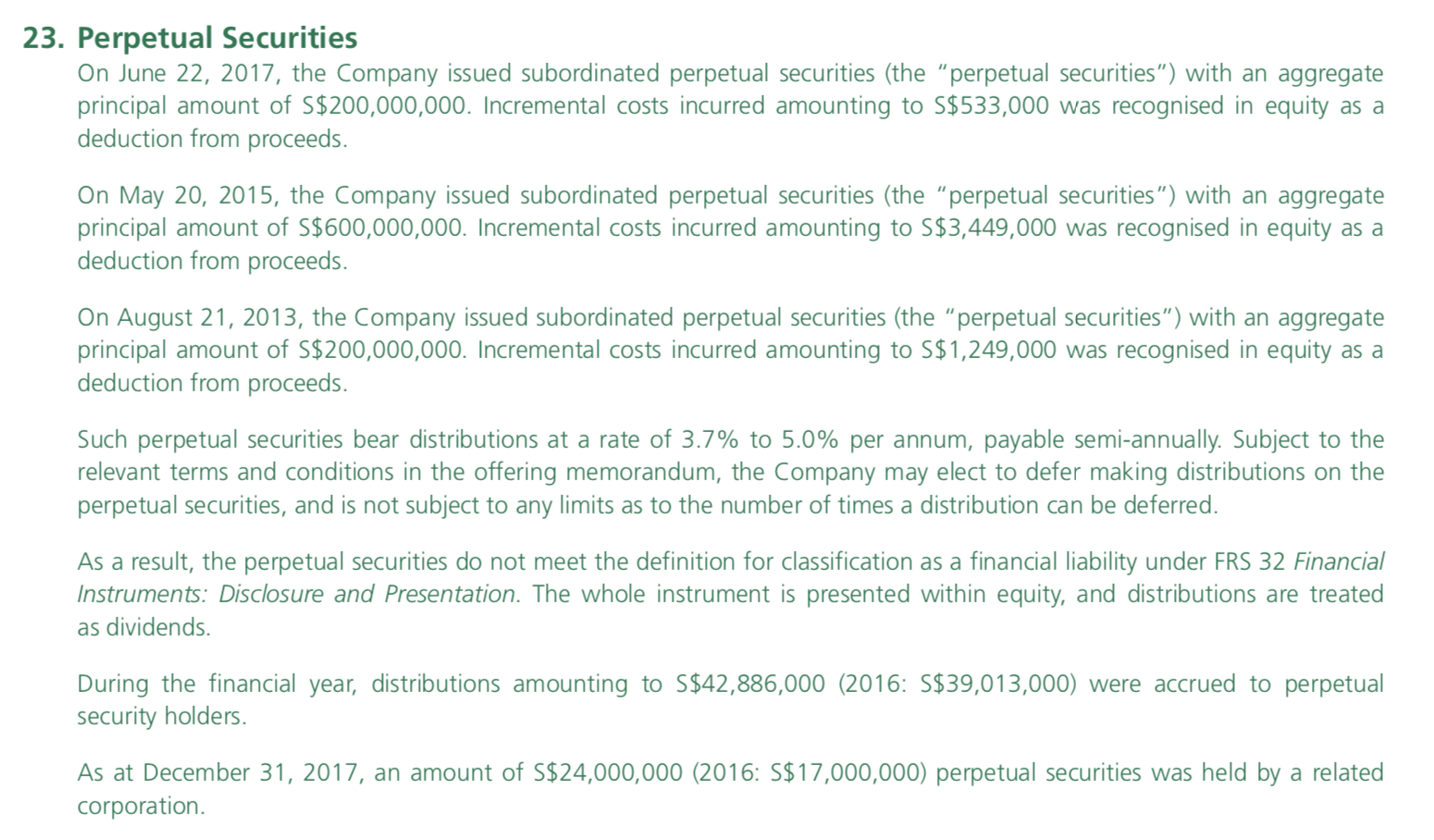

Hybridkapital sehe ich in Asien immer öfter:

Antwort auf Beitrag Nr.: 55.426.248 von R-BgO am 31.07.17 13:48:27Sembcorp to acquire 40MW rooftop solar project in Singapore

By Conor Ryan Jun 21, 2018

Sembcorp Solar Singapore, a wholly-owned subsidiary of Sembcorp Industries, has signed off on a deal to acquire a 40MW grid-tied rooftop solar power project that is currently under construction in Singapore.

As part of this acquisition, Sembcorp has acquired 100% of the equity interest in the project development company, MSOA Pte Ltd.

Sembcorp’s total investment in the project, which includes the cost to acquire the project development company and future investment to complete the construction of the project, is valued at US$55 million.

55/40 => $1,38/Wp

By Conor Ryan Jun 21, 2018

Sembcorp Solar Singapore, a wholly-owned subsidiary of Sembcorp Industries, has signed off on a deal to acquire a 40MW grid-tied rooftop solar power project that is currently under construction in Singapore.

As part of this acquisition, Sembcorp has acquired 100% of the equity interest in the project development company, MSOA Pte Ltd.

Sembcorp’s total investment in the project, which includes the cost to acquire the project development company and future investment to complete the construction of the project, is valued at US$55 million.

55/40 => $1,38/Wp

schleppt sich so dahin

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| +1,67 | |

| -1,44 | |

| -1,50 | |

| 0,00 | |

| +0,18 | |

| +0,56 | |

| -0,80 | |

| -0,56 | |

| -0,63 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 184 | ||

| 122 | ||

| 76 | ||

| 64 | ||

| 57 | ||

| 57 | ||

| 56 | ||

| 51 | ||

| 44 | ||

| 40 |