Ocado - Lebensmittel per Internet - 500 Beiträge pro Seite

eröffnet am 23.09.10 13:45:21 von

neuester Beitrag 14.07.21 16:45:29 von

neuester Beitrag 14.07.21 16:45:29 von

Beiträge: 26

ID: 1.160.075

ID: 1.160.075

Aufrufe heute: 0

Gesamt: 3.940

Gesamt: 3.940

Aktive User: 0

ISIN: GB00B3MBS747 · WKN: A1C2GZ · Symbol: 0OC

4,0460

EUR

-1,32 %

-0,0540 EUR

Letzter Kurs 09:30:20 Tradegate

Neuigkeiten

16.10.23 · dpa-AFX |

21.09.23 · dpa-AFX |

26.07.23 · dpa-AFX |

24.07.23 · dpa-AFX |

24.07.23 · dpa-AFX |

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,9500 | +76,47 | |

| 40,01 | +29,06 | |

| 15,370 | +14,36 | |

| 6,0000 | +13,21 | |

| 51,88 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 19,000 | -13,64 | |

| 2,2200 | -14,62 | |

| 1,7000 | -15,00 | |

| 1,8153 | -16,73 | |

| 29,13 | -19,08 |

aus England, seit kurzem an der Börse und SEHR teuer;

7 September 2010

Ocado Group plc

Interim Management Statement

'Strong Growth Continues'

Financial Highlights

· Gross sales increased 29.5% to £126.5m for the 12 weeks to 8 August 2010 (2009: £97.7m)

· Gross sales increased 29.8% to £372.2m for the 36 weeks to 8 August 2010 (2009: £286.8m)

· Average orders per week for the 12 weeks to 8 August 2010: 92,834 (70,968 in equivalent period in 2009)

· Average order size for the 12 weeks to 8 August 2010: £113.59 (£114.73 in equivalent period in 2009)

· At 8 August the Group had cash and cash equivalents, including monies on deposit, of £205.9m, borrowings of £119.9m and undrawn available facilities of £110.0m

Operational Update

· Ocado's strong sales momentum, as demonstrated in the first half of the year, has continued with a strong performance over the 12 weeks to 8 August and continued year-on-year growth in the period since then. Sales for the 36 weeks to 8 August increased 29.8% to £372.2m, with growth in both the number of customers and the spend-per-customer.

· Improving the customer experience is a core strategic priority for Ocado; this has been demonstrated by an increase in the proportion of sales through the mobile channel (via iPhone and Android devices) as well as the increasing take up of new products categories, such as the service counter1. Ocado's superior customer proposition continues to be recognised by third parties, most recently at the Grocer Gold Awards 2010, where Ocado was awarded "Online Retailer of the Year".

· The impact of the Delivery Pass2 on basket size has substantially diminished, with a consequent slowing in the rate of decline in basket size (down 1% year-on-year in the 12 weeks to 8 August).

· Gross margins have been stable over the period, remaining at similar levels to those reported for the first half.

· The uplift in volumes continues to drive increased customer density, resulting in improved efficiency in delivery and an associated increase in deliveries per van per week. In the CFC two new chill aisles opened on schedule and on budget in August, this has removed trolley picking in the chill zone that had been temporarily reinstated earlier in the year, as previously outlined.

· Capital investment plans to service the growing demand for Ocado are progressing as previously outlined at the time of the IPO. Potential sites for CFC2 and spokes in the South of England have been identified and negotiations are progressing.

· As previously announced Ocado and Waitrose signed a new agreement on 25 May giving Ocado the right to sell Waitrose goods until 2020. This contract is the longest contract Ocado and Waitrose have signed, showing the commitment of both sides to the relationship.

Tim Steiner, Chief Executive Officer of Ocado, said:

"In this period, Ocado entered the next phase of its development, becoming a public company, and we welcome our new shareholders. I would also like to thank our customers, our staff and our partners at Waitrose for their continued support. Given increased customer demand and our need to increase capacity it was an appropriate time for the company to raise capital for growth. We now have the funds required to finish the build out of CFC1 and to build CFC2."

Andrew Bracey, Chief Financial Officer of Ocado, said:

"Operationally this was another strong quarter for Ocado, with gross sales increasing by 29.5%. As a consequence both sales and EBITDA growth continued the trend observed in the first half of the year, with gross margins remaining stable."

7 September 2010

Ocado Group plc

Interim Management Statement

'Strong Growth Continues'

Financial Highlights

· Gross sales increased 29.5% to £126.5m for the 12 weeks to 8 August 2010 (2009: £97.7m)

· Gross sales increased 29.8% to £372.2m for the 36 weeks to 8 August 2010 (2009: £286.8m)

· Average orders per week for the 12 weeks to 8 August 2010: 92,834 (70,968 in equivalent period in 2009)

· Average order size for the 12 weeks to 8 August 2010: £113.59 (£114.73 in equivalent period in 2009)

· At 8 August the Group had cash and cash equivalents, including monies on deposit, of £205.9m, borrowings of £119.9m and undrawn available facilities of £110.0m

Operational Update

· Ocado's strong sales momentum, as demonstrated in the first half of the year, has continued with a strong performance over the 12 weeks to 8 August and continued year-on-year growth in the period since then. Sales for the 36 weeks to 8 August increased 29.8% to £372.2m, with growth in both the number of customers and the spend-per-customer.

· Improving the customer experience is a core strategic priority for Ocado; this has been demonstrated by an increase in the proportion of sales through the mobile channel (via iPhone and Android devices) as well as the increasing take up of new products categories, such as the service counter1. Ocado's superior customer proposition continues to be recognised by third parties, most recently at the Grocer Gold Awards 2010, where Ocado was awarded "Online Retailer of the Year".

· The impact of the Delivery Pass2 on basket size has substantially diminished, with a consequent slowing in the rate of decline in basket size (down 1% year-on-year in the 12 weeks to 8 August).

· Gross margins have been stable over the period, remaining at similar levels to those reported for the first half.

· The uplift in volumes continues to drive increased customer density, resulting in improved efficiency in delivery and an associated increase in deliveries per van per week. In the CFC two new chill aisles opened on schedule and on budget in August, this has removed trolley picking in the chill zone that had been temporarily reinstated earlier in the year, as previously outlined.

· Capital investment plans to service the growing demand for Ocado are progressing as previously outlined at the time of the IPO. Potential sites for CFC2 and spokes in the South of England have been identified and negotiations are progressing.

· As previously announced Ocado and Waitrose signed a new agreement on 25 May giving Ocado the right to sell Waitrose goods until 2020. This contract is the longest contract Ocado and Waitrose have signed, showing the commitment of both sides to the relationship.

Tim Steiner, Chief Executive Officer of Ocado, said:

"In this period, Ocado entered the next phase of its development, becoming a public company, and we welcome our new shareholders. I would also like to thank our customers, our staff and our partners at Waitrose for their continued support. Given increased customer demand and our need to increase capacity it was an appropriate time for the company to raise capital for growth. We now have the funds required to finish the build out of CFC1 and to build CFC2."

Andrew Bracey, Chief Financial Officer of Ocado, said:

"Operationally this was another strong quarter for Ocado, with gross sales increasing by 29.5%. As a consequence both sales and EBITDA growth continued the trend observed in the first half of the year, with gross margins remaining stable."

Ocado IPO polarises opinion on true value

By Andrea Felsted, Kate Burgess and Neil Hume

Published: July 9 2010 23:31 | Last updated: July 9 2010 23:31

Ocado’s float is polarising the City and is set to spark a debate that will rage far outside its home counties heartland.

OcadoOn one side are the supporters who argue that the online grocer, which sells Waitrose food, is changing the face of retail.

However, critics of the float are just as vocal.

“The company needs the money”, says Richard Buxton, head of UK equities at Schroders, pointing to a series of warning signs.

The business model is under threat, he says; the assumptions on earnings growth are heroic and the valuation put on the float is way above its peers; a change in policy introduced recently has helped to cut the depreciation charge in half; and, he adds, some of the founders are selling large amounts of their holdings.

His worries are echoed by other big UK long-only institutional investors. One told the FT: “The valuation makes no sense at all. It is more like one of the technology IPOs of the late 1990s. And we have told the advisers at Goldman Sachs as much”.

Several independent analysts have argued this week that Ocado, which has never made a pre-tax profit and last year reported a £25.5m ($38.4m) pre-tax loss on sales of £402m, is worth considerably less than the £800m-£1.1bn range that the retailer set out on Tuesday. They put its value at about £500m-£600m.

Ocado is unbowed. It remains confident that it can achieve the outlined valuation and is set to ride out the storm. While there are vocal critics, there are also some supportive fund managers.

But it is not just the valuation that is causing concern. Other points aired in Ocado’s 280-page prospectus this week have raised questions in the City.

The first is Ocado’s contract with Waitrose, which dates back to 2000, when Charlie Mayfield, chairman of the John Lewis Partnership – then head of business development – struck a deal with three former Goldman Sachs bankers starting up Ocado.

A series of agreements followed, culminating in a fresh accord in May, hammered out just weeks before the announcement of the float.

This extends the contract until September 2020. It had been previously due to expire in September 2013. But Ocado’s prospectus reveals that the new contract can be terminated by either party as early as March 2017, so long as 18 months’ written notice is provided.

This in turn leads to questions over Waitrose’s future relationship with Ocado.

At the moment, the supermarket chain is more of a supplier than a competitor. Its ability to roll out its own delivery service in London has been limited by the terms of the contract between the two companies.

However, the prospectus states that between January and June next year Waitrose will be able to gradually deliver online orders within the M25. By July, it will be free to compete with Ocado in this lucrative area. According to research produced by analysts at Jefferies, the investment bank, London is Ocado’s biggest market.

The threat will not be immediate. Waitrose’s own delivery service – Waitrose Deliver – is store-based and at present there are only about 40 stores in the London area capable of running a Deliver service next year.

Nevertheless, the new agreement does raise the prospect that the relationship between the two could gradually become more competitive.

The new deal also provides for a higher sourcing fee payable by Ocado to Waitrose. The directors estimate that the £4.7m sourcing fee that Ocado paid in the year to November 2009 would have been £6.4m under the new agreement. Supporters argue that the new fee is only marginally higher.

Meanwhile, the prospectus also reveals that under a new £100m banking facility, entered into this week with Barclays, HSBC and Lloyds TSB, termination of the sourcing agreement will trigger a default on the debt, raising some eyebrows.

Supporters argue that this is standard and also point out that the prospectus contains only some parts of the Waitrose deal – not the whole thing – because it is covered by a confidentiality agreement, giving a potentially misleading view.

But there are other issues surrounding the company that have raised questions.

Some investors have noted a change in depreciation policy, in October 2008, which doubled the useful life of the majority of assets from five to 10 years. Had this not been revised, then the depreciation charge would have been £5m higher in the year to November 2009.

Others suggest this is a “red herring”, which reflects increased confidence in the operating model.

Meanwhile, some investors believe Ocado needs the money.

The prospectus states that Ocado’s going-concern basis relies on the group raising £200m from the IPO.

Supporters say this is a technical point. They argue that there is already significant support for the £200m of new money, making questions around the going- concern status irrelevant.

The debate is hotting up. As Ocado enters the final stages of its roadshow next week, it will need strong powers of persuasion to convince its detractors to back the float.

By Andrea Felsted, Kate Burgess and Neil Hume

Published: July 9 2010 23:31 | Last updated: July 9 2010 23:31

Ocado’s float is polarising the City and is set to spark a debate that will rage far outside its home counties heartland.

OcadoOn one side are the supporters who argue that the online grocer, which sells Waitrose food, is changing the face of retail.

However, critics of the float are just as vocal.

“The company needs the money”, says Richard Buxton, head of UK equities at Schroders, pointing to a series of warning signs.

The business model is under threat, he says; the assumptions on earnings growth are heroic and the valuation put on the float is way above its peers; a change in policy introduced recently has helped to cut the depreciation charge in half; and, he adds, some of the founders are selling large amounts of their holdings.

His worries are echoed by other big UK long-only institutional investors. One told the FT: “The valuation makes no sense at all. It is more like one of the technology IPOs of the late 1990s. And we have told the advisers at Goldman Sachs as much”.

Several independent analysts have argued this week that Ocado, which has never made a pre-tax profit and last year reported a £25.5m ($38.4m) pre-tax loss on sales of £402m, is worth considerably less than the £800m-£1.1bn range that the retailer set out on Tuesday. They put its value at about £500m-£600m.

Ocado is unbowed. It remains confident that it can achieve the outlined valuation and is set to ride out the storm. While there are vocal critics, there are also some supportive fund managers.

But it is not just the valuation that is causing concern. Other points aired in Ocado’s 280-page prospectus this week have raised questions in the City.

The first is Ocado’s contract with Waitrose, which dates back to 2000, when Charlie Mayfield, chairman of the John Lewis Partnership – then head of business development – struck a deal with three former Goldman Sachs bankers starting up Ocado.

A series of agreements followed, culminating in a fresh accord in May, hammered out just weeks before the announcement of the float.

This extends the contract until September 2020. It had been previously due to expire in September 2013. But Ocado’s prospectus reveals that the new contract can be terminated by either party as early as March 2017, so long as 18 months’ written notice is provided.

This in turn leads to questions over Waitrose’s future relationship with Ocado.

At the moment, the supermarket chain is more of a supplier than a competitor. Its ability to roll out its own delivery service in London has been limited by the terms of the contract between the two companies.

However, the prospectus states that between January and June next year Waitrose will be able to gradually deliver online orders within the M25. By July, it will be free to compete with Ocado in this lucrative area. According to research produced by analysts at Jefferies, the investment bank, London is Ocado’s biggest market.

The threat will not be immediate. Waitrose’s own delivery service – Waitrose Deliver – is store-based and at present there are only about 40 stores in the London area capable of running a Deliver service next year.

Nevertheless, the new agreement does raise the prospect that the relationship between the two could gradually become more competitive.

The new deal also provides for a higher sourcing fee payable by Ocado to Waitrose. The directors estimate that the £4.7m sourcing fee that Ocado paid in the year to November 2009 would have been £6.4m under the new agreement. Supporters argue that the new fee is only marginally higher.

Meanwhile, the prospectus also reveals that under a new £100m banking facility, entered into this week with Barclays, HSBC and Lloyds TSB, termination of the sourcing agreement will trigger a default on the debt, raising some eyebrows.

Supporters argue that this is standard and also point out that the prospectus contains only some parts of the Waitrose deal – not the whole thing – because it is covered by a confidentiality agreement, giving a potentially misleading view.

But there are other issues surrounding the company that have raised questions.

Some investors have noted a change in depreciation policy, in October 2008, which doubled the useful life of the majority of assets from five to 10 years. Had this not been revised, then the depreciation charge would have been £5m higher in the year to November 2009.

Others suggest this is a “red herring”, which reflects increased confidence in the operating model.

Meanwhile, some investors believe Ocado needs the money.

The prospectus states that Ocado’s going-concern basis relies on the group raising £200m from the IPO.

Supporters say this is a technical point. They argue that there is already significant support for the £200m of new money, making questions around the going- concern status irrelevant.

The debate is hotting up. As Ocado enters the final stages of its roadshow next week, it will need strong powers of persuasion to convince its detractors to back the float.

Ich bin durch den Geld-Anlage-Report auf diese Aktie aufmerksam geworden, hier die Infos:

Lebensmittel übers Internet

Übrigens: Auch wenn Sie lieber zu Hause speisen, wird das Internet immer hilfreicher. Zumindest in England: Dort unternimmt der Lebensmittelhändler Ocado (WKN A1C2GZ; Kürzel: 0OC) einen neuen Versuch, einen erfolgreichen Internet-Supermarkt zu starten.

Nach dem Misserfolg der eingangs erwähnten Webvan, scheint Ocado in der Erfolgsspur. Insgesamt 1,5 Millionen Briten kaufen zumindest sporadisch ihre Lebensmittel über das Internet ein. Mehr als 21.000 verschiedene Produkte stehen zur Auswahl.

In den ersten neun Monaten des aktuellen Geschäftsjahrs schaffte Ocado bereits einen Umsatz von 445 Millionen Euro. Die Steigerungsrate gegenüber dem Vorjahr lag im letzten Quartal bei knapp 30 Prozent. Das kann sich sehen lassen. In 2011 prognostizieren Analysten den Sprung in die Gewinnzone.

Charttechnisch hat die Aktie am Freitag nach dem Fall auf ein neues 52-Wochen-Tief nach oben gedreht. Möglicherweise kann die Aktie des erst seit Juli börsennotierten Unternehmens nun die Trendwende schaffen.

Lebensmittel übers Internet

Übrigens: Auch wenn Sie lieber zu Hause speisen, wird das Internet immer hilfreicher. Zumindest in England: Dort unternimmt der Lebensmittelhändler Ocado (WKN A1C2GZ; Kürzel: 0OC) einen neuen Versuch, einen erfolgreichen Internet-Supermarkt zu starten.

Nach dem Misserfolg der eingangs erwähnten Webvan, scheint Ocado in der Erfolgsspur. Insgesamt 1,5 Millionen Briten kaufen zumindest sporadisch ihre Lebensmittel über das Internet ein. Mehr als 21.000 verschiedene Produkte stehen zur Auswahl.

In den ersten neun Monaten des aktuellen Geschäftsjahrs schaffte Ocado bereits einen Umsatz von 445 Millionen Euro. Die Steigerungsrate gegenüber dem Vorjahr lag im letzten Quartal bei knapp 30 Prozent. Das kann sich sehen lassen. In 2011 prognostizieren Analysten den Sprung in die Gewinnzone.

Charttechnisch hat die Aktie am Freitag nach dem Fall auf ein neues 52-Wochen-Tief nach oben gedreht. Möglicherweise kann die Aktie des erst seit Juli börsennotierten Unternehmens nun die Trendwende schaffen.

Ocado to create over 2,000 jobs in North Warwickshire with its second CFC

12 October 2010

Ocado Group plc ("Ocado"), the online grocer, announces it has exchanged contracts to acquire a 35.2 acre site at Birch Coppice Business Park, Dordon, North Warwickshire, on which it will construct a 350,000 sq ft Customer Fulfilment Centre ("CFC"). This site will be the location for Ocado's second CFC doubling the potential capacity of the business.

At peak capacity, this CFC is expected to generate in excess of 2,000 jobs in the region, and will enable Ocado both to expand its geographic coverage and increase order capacity in its current coverage area where it is experiencing strong customer growth.

Preparatory works will begin immediately and the CFC is expected to be able to commence operations at the end of 2012. It will have a capacity of approximately 120,000 orders per week at initiation of operations, increasing to approximately 180,000 orders per week. The expected total capital cost of the CFC is approximately £210m. This will be financed through a combination of current reserves and existing banking facilities.

The cost to acquire the site on a 999 year lease is £17.74m payable in cash. In addition Ocado will make a contribution of up to £3.54m towards the provision of utilities to the site. Outline planning consent has already been granted for the site. The agreement with IM Properties (Dordon) Limited is conditional on the grant of reserved matters planning consent and completion of certain preparatory ground and utilities works. The longstop date in the contract for the satisfaction of all conditions is 1 July 2011. The 999 year lease will be granted once conditions have been satisfied. Following this Ocado will commence construction of the CFC.

Tim Steiner, Chief Executive Officer of Ocado, said:

"We are delighted to have secured an outstanding site for our second CFC. Ocado is growing rapidly across the country and this location ensures we will have capacity to provide more customers with the leading online grocery offering. Upon completion, the new CFC will create over 2,000 jobs in the region. The Ocado team is looking forward to being a part of the local Dordon and Tamworth communities and becoming a major employer in the region."

12 October 2010

Ocado Group plc ("Ocado"), the online grocer, announces it has exchanged contracts to acquire a 35.2 acre site at Birch Coppice Business Park, Dordon, North Warwickshire, on which it will construct a 350,000 sq ft Customer Fulfilment Centre ("CFC"). This site will be the location for Ocado's second CFC doubling the potential capacity of the business.

At peak capacity, this CFC is expected to generate in excess of 2,000 jobs in the region, and will enable Ocado both to expand its geographic coverage and increase order capacity in its current coverage area where it is experiencing strong customer growth.

Preparatory works will begin immediately and the CFC is expected to be able to commence operations at the end of 2012. It will have a capacity of approximately 120,000 orders per week at initiation of operations, increasing to approximately 180,000 orders per week. The expected total capital cost of the CFC is approximately £210m. This will be financed through a combination of current reserves and existing banking facilities.

The cost to acquire the site on a 999 year lease is £17.74m payable in cash. In addition Ocado will make a contribution of up to £3.54m towards the provision of utilities to the site. Outline planning consent has already been granted for the site. The agreement with IM Properties (Dordon) Limited is conditional on the grant of reserved matters planning consent and completion of certain preparatory ground and utilities works. The longstop date in the contract for the satisfaction of all conditions is 1 July 2011. The 999 year lease will be granted once conditions have been satisfied. Following this Ocado will commence construction of the CFC.

Tim Steiner, Chief Executive Officer of Ocado, said:

"We are delighted to have secured an outstanding site for our second CFC. Ocado is growing rapidly across the country and this location ensures we will have capacity to provide more customers with the leading online grocery offering. Upon completion, the new CFC will create over 2,000 jobs in the region. The Ocado team is looking forward to being a part of the local Dordon and Tamworth communities and becoming a major employer in the region."

Ocado expands to South-West and Wales

Daily Mail

25 October 2010, 8:52am

Online grocer Ocado says it will be able to commence deliveries to South-West England and South Wales next year after acquiring a small distribution site near Bristol, creating 100 new jobs.

It plans to serve 1.5m households in Bristol, Bath, Cardiff and surrounding areas.

It follows news earlier this month of its plan to build a £210m distribution centre that will create 2,000 jobs in the Midlands. The warehouse, which will be sited in Dordon, North Warwickshire, will double the loss-making retailer's capacity.

Daily Mail

25 October 2010, 8:52am

Online grocer Ocado says it will be able to commence deliveries to South-West England and South Wales next year after acquiring a small distribution site near Bristol, creating 100 new jobs.

It plans to serve 1.5m households in Bristol, Bath, Cardiff and surrounding areas.

It follows news earlier this month of its plan to build a £210m distribution centre that will create 2,000 jobs in the Midlands. The warehouse, which will be sited in Dordon, North Warwickshire, will double the loss-making retailer's capacity.

M&S looked at a takeover of Ocado

By Neil Craven

12 December 2010, 12:52pm

Marks & Spencer looked 'very closely' at buying Ocado before the online grocery retailer floated on the London Stock Exchange, but walked away after talks collapsed.

Discussions were held between Ocado and M&S management, led then by chief executive Stuart Rose and finance director Ian Dyson, more than a year before Ocado's owners decided to float the business.

Sources said the numbers 'didn't add up', but news that close negotiations took place will fuel speculation new M&S boss Mark Bolland could resurrect the plan.

Ocado floated earlier this year, but shares have never risen above the float price of 170p.

Ocado would have provided M&S with a ready-made online grocery business, a field where the group has lagged behind the big supermarket chains.

'They looked at it long and hard, but decided it was too much to take on strategically and financially,' said one source.

The board ditched the plan and has since launched a limited service whereby shoppers can collect food orders from stores.

However, it has yet to reveal any food home delivery plans, unlike most of its supermarket rivals.

Bryan Roberts of research firm Kantar Retail said: 'Buying Ocado would be a way of providing Marks & Spencer with the infrastructure and expertise it needs to build market share quickly. I dare say the plan hasn't completely fallen off the agenda.'

Bolland is undertaking a wide-ranging review of the management structure and supply chain at M&S. Rose is due to leave as chairman on January 4 and key management changes could follow, sources have suggested.

One observer said the 'tremendous amount of change' means that Bolland is unlikely to prioritise food delivery plans or any acquisitions in the short term.

Were he to decide to buy Ocado, Bolland would also have to convince shareholders of the value of such a deal.

The main complication would be Ocado's contract to supply Waitrose goods on which its £891m market value is based. Bolland would also have to factor in a termination fee of £40m to Waitrose if he decided to press ahead.

M&S said: 'We are not going to comment on something that may or may not have happened a long time ago.'

Read more: http://www.thisismoney.co.uk/markets/article.html?in_article…

By Neil Craven

12 December 2010, 12:52pm

Marks & Spencer looked 'very closely' at buying Ocado before the online grocery retailer floated on the London Stock Exchange, but walked away after talks collapsed.

Discussions were held between Ocado and M&S management, led then by chief executive Stuart Rose and finance director Ian Dyson, more than a year before Ocado's owners decided to float the business.

Sources said the numbers 'didn't add up', but news that close negotiations took place will fuel speculation new M&S boss Mark Bolland could resurrect the plan.

Ocado floated earlier this year, but shares have never risen above the float price of 170p.

Ocado would have provided M&S with a ready-made online grocery business, a field where the group has lagged behind the big supermarket chains.

'They looked at it long and hard, but decided it was too much to take on strategically and financially,' said one source.

The board ditched the plan and has since launched a limited service whereby shoppers can collect food orders from stores.

However, it has yet to reveal any food home delivery plans, unlike most of its supermarket rivals.

Bryan Roberts of research firm Kantar Retail said: 'Buying Ocado would be a way of providing Marks & Spencer with the infrastructure and expertise it needs to build market share quickly. I dare say the plan hasn't completely fallen off the agenda.'

Bolland is undertaking a wide-ranging review of the management structure and supply chain at M&S. Rose is due to leave as chairman on January 4 and key management changes could follow, sources have suggested.

One observer said the 'tremendous amount of change' means that Bolland is unlikely to prioritise food delivery plans or any acquisitions in the short term.

Were he to decide to buy Ocado, Bolland would also have to convince shareholders of the value of such a deal.

The main complication would be Ocado's contract to supply Waitrose goods on which its £891m market value is based. Bolland would also have to factor in a termination fee of £40m to Waitrose if he decided to press ahead.

M&S said: 'We are not going to comment on something that may or may not have happened a long time ago.'

Read more: http://www.thisismoney.co.uk/markets/article.html?in_article…

Ocado jumps above 180p flotation price for the first time

Ocado looks like it will close above its flotation price for the first time since it controversially joined the stock market last July.

The online retailer - whose main business is an agreement to sell products from upmarket grocer Waitrose - was forced to drop its IPO price from an initial range of 200p-275p to 180p and, until now, has never reached even that reduced level. But ahead of a trading update due on Monday, Ocado is now sitting 15.3p higher at 193.6p, making it the biggest riser in the FTSE 250 and providing flotation investors with a profit for the first time.

Recently the company has been tipped as a possible takeover target for a larger supermarket group such as Morrisons, and traders also believe a bear squeeze - with people shorting the stock needing to cover their positions - could be helping to drive the price up. More fundamentally, Goldman Sachs last month raised its target price on the business from 200p to 224p.

Ocado looks like it will close above its flotation price for the first time since it controversially joined the stock market last July.

The online retailer - whose main business is an agreement to sell products from upmarket grocer Waitrose - was forced to drop its IPO price from an initial range of 200p-275p to 180p and, until now, has never reached even that reduced level. But ahead of a trading update due on Monday, Ocado is now sitting 15.3p higher at 193.6p, making it the biggest riser in the FTSE 250 and providing flotation investors with a profit for the first time.

Recently the company has been tipped as a possible takeover target for a larger supermarket group such as Morrisons, and traders also believe a bear squeeze - with people shorting the stock needing to cover their positions - could be helping to drive the price up. More fundamentally, Goldman Sachs last month raised its target price on the business from 200p to 224p.

Ocado online grocery delivery firm reports first profit

LAST UPDATED AT 01 FEB 2011, 10:51 GMT

Online grocery delivery company Ocado has reported its first profit for the final quarter of last year.

The company, which mainly delivers Waitrose products, reported a pre-tax profit of £300,000 for the period.

However, for 2010 as a whole it made a loss of £12.2m, including £3.5m costs related to last year's share flotation.

Ocado, which was formed in 2000 by which was formed by three former Goldman Sachs bankers, joined the stock market in July.

Its shares floated at 180p each, well below the price initially hoped for, although they have since risen.

Following the release of the results, Ocado's shares jumped 5% to 229p, before shedding some of that gain to 220p.

The company said in a statement that growth had continued into the new financial year and that gross sales had risen by 25%.

LAST UPDATED AT 01 FEB 2011, 10:51 GMT

Online grocery delivery company Ocado has reported its first profit for the final quarter of last year.

The company, which mainly delivers Waitrose products, reported a pre-tax profit of £300,000 for the period.

However, for 2010 as a whole it made a loss of £12.2m, including £3.5m costs related to last year's share flotation.

Ocado, which was formed in 2000 by which was formed by three former Goldman Sachs bankers, joined the stock market in July.

Its shares floated at 180p each, well below the price initially hoped for, although they have since risen.

Following the release of the results, Ocado's shares jumped 5% to 229p, before shedding some of that gain to 220p.

The company said in a statement that growth had continued into the new financial year and that gross sales had risen by 25%.

Ocado in fiasco after Christmas deliveries leave online shoppers furious

By NEIL CRAVEN

Last updated at 10:37 AM on 1st January 2012

Ocado has again angered some of its customers after it released highly prized delivery slots just two days before Christmas.

The release of additional Christmas Eve delivery times on December 23 infuriated customers who had settled for less convenient slots.

The fiasco comes after Ocado was forced to issue a profits warning on the Monday before Christmas.

Fiasco: Ocado has again angered some of its customers after it released highly prized delivery slots just two days before Christmas

The shares fell 17 per cent to 59p that day and closed at 54p on the last trading day of the month, a new low.

The retailer blamed ‘continued capacity constraints’ for the likely drop in profits, which it said would be 15 to 20 per cent lower than expected.

The financial performance of rival internet delivery services cannot be monitored because Tesco, Sainsbury’s and Asda do not issue separate figures for their online divisions.

Its delivery service, which sells Waitrose products, is said to leave some slack in the system to allow shoppers to add to orders. If they do not, it can release extra capacity.

But the situation has driven speculation that customers cancelled deliveries for fear of orders turning up late, thereby opening up the slots. Ocado released slots to its Delivery Pass Members on November 26 and to everyone else three days later.

One shopper complained on an internet forum on December 23: ‘I have just got an email. Yet when I was booking my Christmas delivery weeks ago, Wednesday (December 21) was the closest I could get.’

Another admitted to abusing the system by reserving a prized slot and completely revising the order at the last minute.

‘I just put a load of booze in first to get to the minimum order level then do the proper order two days before,’ the customer said.

Financial Mail warned in the first week of December that a growing number of Ocado orders were arriving late entering the festive season.

Ocado has told investors that it has limited capacity at its central distribution depot in Hatfield, Hertfordshire, and that it will not have its second automated centre operational until 2013.

Orders are either sent from Hatfield direct to customers or are dropped off at ‘hubs’ such as Wimbledon, south-west London, or West Byfleet, Surrey, for onward delivery.

Other retailers chiefly deliver direct from stores or from ‘dark’ stores, which are laid out like supermarkets, with deliveries picked by staff rather than machines.

Read more: http://www.thisismoney.co.uk/money/markets/article-2080724/O…

By NEIL CRAVEN

Last updated at 10:37 AM on 1st January 2012

Ocado has again angered some of its customers after it released highly prized delivery slots just two days before Christmas.

The release of additional Christmas Eve delivery times on December 23 infuriated customers who had settled for less convenient slots.

The fiasco comes after Ocado was forced to issue a profits warning on the Monday before Christmas.

Fiasco: Ocado has again angered some of its customers after it released highly prized delivery slots just two days before Christmas

The shares fell 17 per cent to 59p that day and closed at 54p on the last trading day of the month, a new low.

The retailer blamed ‘continued capacity constraints’ for the likely drop in profits, which it said would be 15 to 20 per cent lower than expected.

The financial performance of rival internet delivery services cannot be monitored because Tesco, Sainsbury’s and Asda do not issue separate figures for their online divisions.

Its delivery service, which sells Waitrose products, is said to leave some slack in the system to allow shoppers to add to orders. If they do not, it can release extra capacity.

But the situation has driven speculation that customers cancelled deliveries for fear of orders turning up late, thereby opening up the slots. Ocado released slots to its Delivery Pass Members on November 26 and to everyone else three days later.

One shopper complained on an internet forum on December 23: ‘I have just got an email. Yet when I was booking my Christmas delivery weeks ago, Wednesday (December 21) was the closest I could get.’

Another admitted to abusing the system by reserving a prized slot and completely revising the order at the last minute.

‘I just put a load of booze in first to get to the minimum order level then do the proper order two days before,’ the customer said.

Financial Mail warned in the first week of December that a growing number of Ocado orders were arriving late entering the festive season.

Ocado has told investors that it has limited capacity at its central distribution depot in Hatfield, Hertfordshire, and that it will not have its second automated centre operational until 2013.

Orders are either sent from Hatfield direct to customers or are dropped off at ‘hubs’ such as Wimbledon, south-west London, or West Byfleet, Surrey, for onward delivery.

Other retailers chiefly deliver direct from stores or from ‘dark’ stores, which are laid out like supermarkets, with deliveries picked by staff rather than machines.

Read more: http://www.thisismoney.co.uk/money/markets/article-2080724/O…

upps!

Kurs ist ja dieses Jahr durch die Decke gegangen...

Kurs ist ja dieses Jahr durch die Decke gegangen...

wesentlich besser gehalten als gedacht...

Investment idea: Long Ocado

http://www.marketfolly.com/2016/06/dan-abrahams-long-ocado-l…

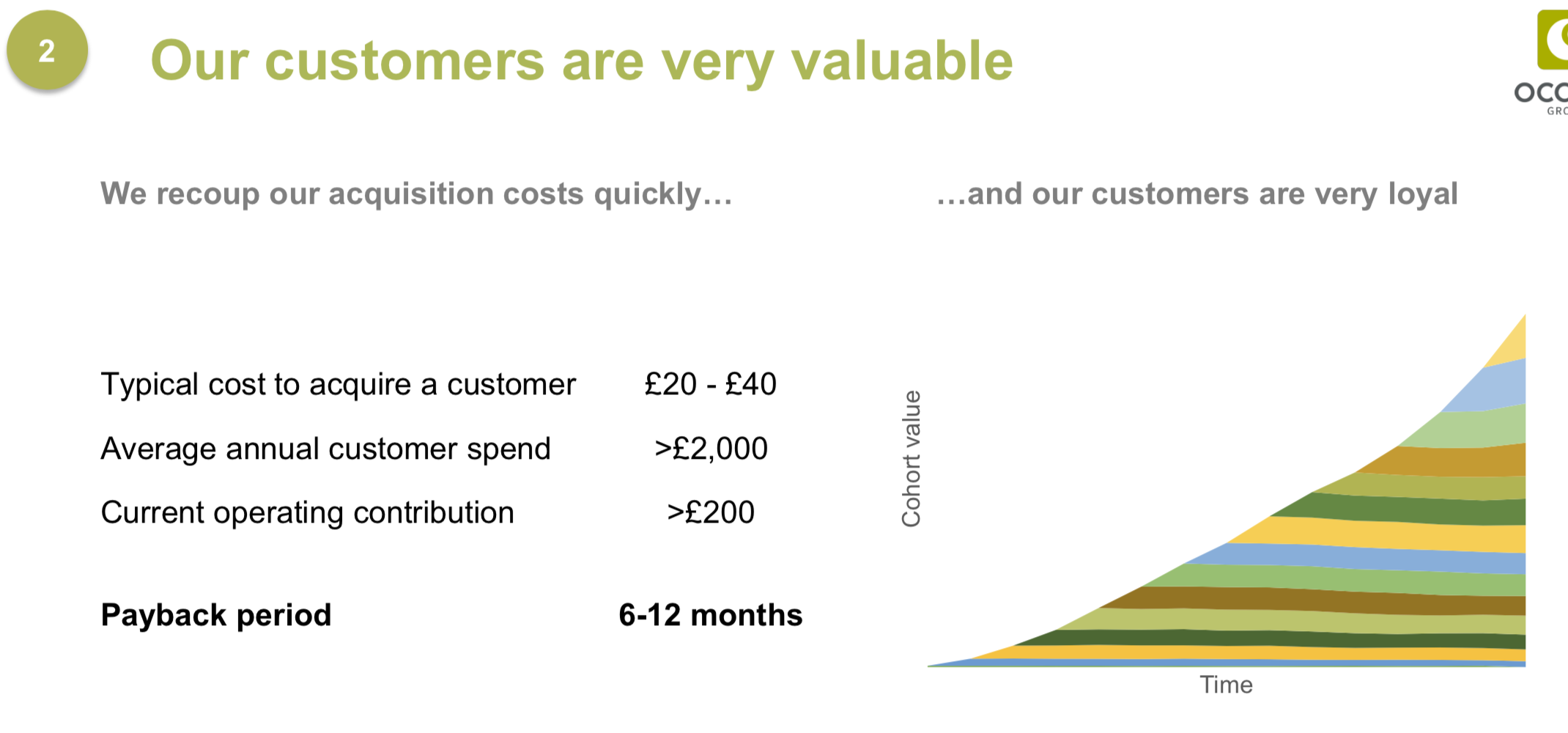

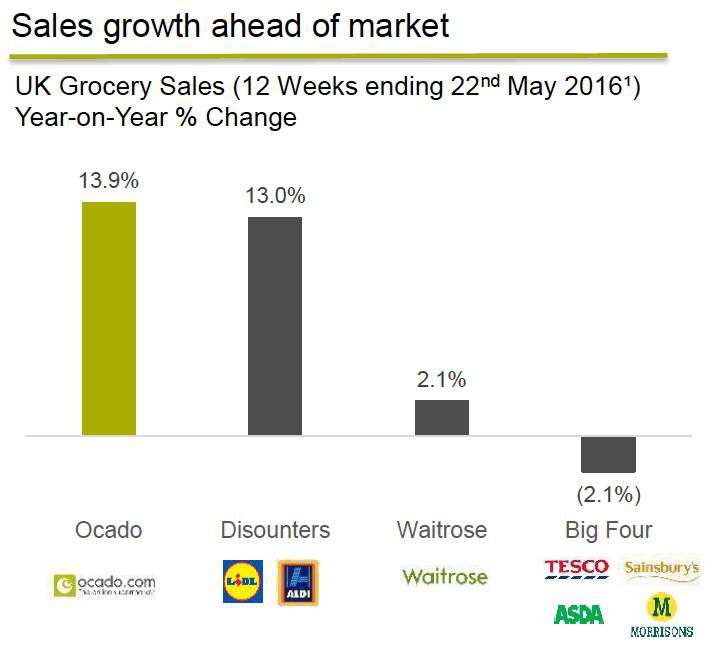

Ocado is a popular short with long short funds. It trades on a P/E of over 100x and does not have significant market share at present.

Abrahams likes self-reinforcing virtuous circle business models. Over the last 30 years supermarkets grew at 22% per year. Ocado can experience the same kind of growth. They already have the leading customer proposition in the British grocery sector. Over 50% of people order their groceries from Ocado using a smart phone. It takes on average about 3 minutes to make the order. Ocado offers a price guarantee to customers and delivers the shopping directly to their door.

In terms of freshness Ocado has the shortest supply chain. It can get the food from the farm to customer’s house quicker than a supermarket. It offers twice as much choice as the largest supermarket. It does all this with industry leading margins.

Can Ocado’s model be replicated? Abrahams thinks not because the weekly grocery shop consists of on average 50 items that need to be treated in different ways – frozen, chilled and ambient. The packing needs to be done carefully so as not to squash items. Ocado has adopted a unique approach to picking using automation and robotics. The existing supermarkets have to send workers out to pick individual online orders off the shelves. The inefficiency of their approach means that they make a loss on online orders.

Can Ocado compete against Amazon? Amazon is rolling out Amazon Fresh in the US and will probably do the same in the UK soon. The bricks and mortar supermarkets are likely to lose out to Amazon just as books and electronics retailers already have. Amazon’s entry into the food sector is an opportunity for Ocado. Ocado can sell their technology to Amazon. Morrisson’s are already partnering with Ocado. Alfreton Capital’s research indicates that Ocado have the only solution to online grocery shopping.

Ocado’s CEO and CFO have large shareholdings in the business so are aligned with other shareholders. Grocery is the largest retail category – double the size of everything else. There is plenty of room for Ocado to grow as customers move online.

http://www.marketfolly.com/2016/06/dan-abrahams-long-ocado-l…

Ocado is a popular short with long short funds. It trades on a P/E of over 100x and does not have significant market share at present.

Abrahams likes self-reinforcing virtuous circle business models. Over the last 30 years supermarkets grew at 22% per year. Ocado can experience the same kind of growth. They already have the leading customer proposition in the British grocery sector. Over 50% of people order their groceries from Ocado using a smart phone. It takes on average about 3 minutes to make the order. Ocado offers a price guarantee to customers and delivers the shopping directly to their door.

In terms of freshness Ocado has the shortest supply chain. It can get the food from the farm to customer’s house quicker than a supermarket. It offers twice as much choice as the largest supermarket. It does all this with industry leading margins.

Can Ocado’s model be replicated? Abrahams thinks not because the weekly grocery shop consists of on average 50 items that need to be treated in different ways – frozen, chilled and ambient. The packing needs to be done carefully so as not to squash items. Ocado has adopted a unique approach to picking using automation and robotics. The existing supermarkets have to send workers out to pick individual online orders off the shelves. The inefficiency of their approach means that they make a loss on online orders.

Can Ocado compete against Amazon? Amazon is rolling out Amazon Fresh in the US and will probably do the same in the UK soon. The bricks and mortar supermarkets are likely to lose out to Amazon just as books and electronics retailers already have. Amazon’s entry into the food sector is an opportunity for Ocado. Ocado can sell their technology to Amazon. Morrisson’s are already partnering with Ocado. Alfreton Capital’s research indicates that Ocado have the only solution to online grocery shopping.

Ocado’s CEO and CFO have large shareholdings in the business so are aligned with other shareholders. Grocery is the largest retail category – double the size of everything else. There is plenty of room for Ocado to grow as customers move online.

Ansichtsstücke geholt

Antwort auf Beitrag Nr.: 52.724.566 von R-BgO am 29.06.16 17:58:14gut gelaufen bisher

Automatisierte Lagerhaeuser: Ein riesiger Nerd-Traum

Halbautonome IoT-Roboter, ein selbstgebautes 4G-Netz und ein ungewoehnliches Rechenzentrum: Viel mehr braucht es nicht fuer einen Supermarkt.

Der Anbieter Ocado will mit diesem Konzept in Europa expandieren, doch die groessten Probleme liegen nicht an der Technik.

Artikel

28 November 2017

Ocado Group plc / Groupe Casino

Announcement of international partnership between Ocado Solutions and Groupe Casino

We are pleased to announce the signing of an agreement between Ocado Group plc ("Ocado") and Groupe Casino to develop the Ocado Smart Platform ("OSP") in France.

Ocado is the world's leading dedicated on-line grocery retailer with a strong technological advantage. The scalable, modular end-to-end solution provided by the OSP is a unique answer to the opportunities and challenges posed by shifting offline/online trends in grocery.

This highly innovative and effective commercial formula will be achieved through access to Ocado's end-to-end solution, including the construction of its latest generation, state-of-the-art automated warehouse (for which Ocado will invest to install its grid and its robots), Ocado's best-in-class front-end web site functionality, last-mile routing management and big data, real time implementation.

Groupe Casino's banners will benefit from this innovative grocery e-commerce platform, firstly Monoprix.fr, which will provide its customers with the largest assortment of food items at the best levels of service and costs.

The agreement sets out plans for the immediate initiation of the development of a Customer Fulfilment Centre ("CFC") using Ocado's proprietary mechanical handling equipment ("MHE") to serve the Greater Paris area, the Normandie and Hauts de France Regions. The build and launch is expected to take at least two years.

In consideration of the investments made by Ocado, of maintenance and of provision of technology, Groupe Casino will pay Ocado certain upfront fees upon signing, and during the development phase, then ongoing fees linked to its utilisation of capacity within the CFC and service criteria.

In addition to the initial CFC, Groupe Casino and Ocado will consider further development of other CFCs close to other large urban areas.

Jean-Charles Naouri, CEO of Groupe Casino, said:

"Groupe Casino is pleased to announce the agreement with Ocado Group which will allow it to develop an integrated customer and logistics platform, considered the best in the market.

"This agreement is a major leap in terms of quality: 50,000 food items will be offered in the first stage to customers in the Greater Paris area with precise and speedy delivery at home and through a platform which makes it achievable to do this profitably. Groupe Casino is very proud to have sealed this deal with Ocado which will further strengthen the quality of service available to its customers, at the core of its commitments for 120 years."

Tim Steiner, CEO of Ocado, said:

"We are delighted that Groupe Casino has decided to partner with Ocado Solutions to grow and develop its online food business. We believe that the scalable, modular end-to-end solutions provided by the Ocado Smart Platform, will allow retailers such as Groupe Casino to build their online grocery offer in a way that is profitable and sustainable, creating value for customers, suppliers and shareholders.

"We continue to make investments to commercialise our proprietary platform and expect this deal to be one of many successful collaborations with leading retailers to use it the world over."

Luke Jensen, CEO Ocado Solutions, said:

"Groupe Casino is a successful multi-format, multi-banner and multi-channel business with top-three market positions in all the countries in which it trades. Its decision to adopt the Ocado Smart Platform to build and drive its online food business in France gives it a unique, innovative, and world-leading solution to the challenge of delivering groceries profitably online. We look forward to working closely with Groupe Casino going forward".

Expected financial impact for Ocado

Ocado expects this deal to create significant long term value to the business. It will have minimal impact to earnings in FY17, given the current financial year ends on 3 December 2017. In FY18, Ocado expects the transaction to be earnings neutral with the costs of establishing the partnership, offsetting the initial fees payable. Ocado expects to incur additional capex of £15m in the FY18 to support this partnership and accelerate the development of the platform, with further capex in future years.

In FY19 and beyond, the profitability of Ocado Solutions is likely to grow as the fees from the transaction increase and as other deals are signed.

In order to provide greater clarity on the split between Ocado Retail and Ocado Solutions Ocado will, from the publication of FY17 results, be introducing segmental reporting of sales and EBITDA. The Group will be hosting a call in mid-January when it will publish historic numbers for each segment to enable analysts and investors to prepare their numbers accordingly.

Ocado Group plc / Groupe Casino

Announcement of international partnership between Ocado Solutions and Groupe Casino

We are pleased to announce the signing of an agreement between Ocado Group plc ("Ocado") and Groupe Casino to develop the Ocado Smart Platform ("OSP") in France.

Ocado is the world's leading dedicated on-line grocery retailer with a strong technological advantage. The scalable, modular end-to-end solution provided by the OSP is a unique answer to the opportunities and challenges posed by shifting offline/online trends in grocery.

This highly innovative and effective commercial formula will be achieved through access to Ocado's end-to-end solution, including the construction of its latest generation, state-of-the-art automated warehouse (for which Ocado will invest to install its grid and its robots), Ocado's best-in-class front-end web site functionality, last-mile routing management and big data, real time implementation.

Groupe Casino's banners will benefit from this innovative grocery e-commerce platform, firstly Monoprix.fr, which will provide its customers with the largest assortment of food items at the best levels of service and costs.

The agreement sets out plans for the immediate initiation of the development of a Customer Fulfilment Centre ("CFC") using Ocado's proprietary mechanical handling equipment ("MHE") to serve the Greater Paris area, the Normandie and Hauts de France Regions. The build and launch is expected to take at least two years.

In consideration of the investments made by Ocado, of maintenance and of provision of technology, Groupe Casino will pay Ocado certain upfront fees upon signing, and during the development phase, then ongoing fees linked to its utilisation of capacity within the CFC and service criteria.

In addition to the initial CFC, Groupe Casino and Ocado will consider further development of other CFCs close to other large urban areas.

Jean-Charles Naouri, CEO of Groupe Casino, said:

"Groupe Casino is pleased to announce the agreement with Ocado Group which will allow it to develop an integrated customer and logistics platform, considered the best in the market.

"This agreement is a major leap in terms of quality: 50,000 food items will be offered in the first stage to customers in the Greater Paris area with precise and speedy delivery at home and through a platform which makes it achievable to do this profitably. Groupe Casino is very proud to have sealed this deal with Ocado which will further strengthen the quality of service available to its customers, at the core of its commitments for 120 years."

Tim Steiner, CEO of Ocado, said:

"We are delighted that Groupe Casino has decided to partner with Ocado Solutions to grow and develop its online food business. We believe that the scalable, modular end-to-end solutions provided by the Ocado Smart Platform, will allow retailers such as Groupe Casino to build their online grocery offer in a way that is profitable and sustainable, creating value for customers, suppliers and shareholders.

"We continue to make investments to commercialise our proprietary platform and expect this deal to be one of many successful collaborations with leading retailers to use it the world over."

Luke Jensen, CEO Ocado Solutions, said:

"Groupe Casino is a successful multi-format, multi-banner and multi-channel business with top-three market positions in all the countries in which it trades. Its decision to adopt the Ocado Smart Platform to build and drive its online food business in France gives it a unique, innovative, and world-leading solution to the challenge of delivering groceries profitably online. We look forward to working closely with Groupe Casino going forward".

Expected financial impact for Ocado

Ocado expects this deal to create significant long term value to the business. It will have minimal impact to earnings in FY17, given the current financial year ends on 3 December 2017. In FY18, Ocado expects the transaction to be earnings neutral with the costs of establishing the partnership, offsetting the initial fees payable. Ocado expects to incur additional capex of £15m in the FY18 to support this partnership and accelerate the development of the platform, with further capex in future years.

In FY19 and beyond, the profitability of Ocado Solutions is likely to grow as the fees from the transaction increase and as other deals are signed.

In order to provide greater clarity on the split between Ocado Retail and Ocado Solutions Ocado will, from the publication of FY17 results, be introducing segmental reporting of sales and EBITDA. The Group will be hosting a call in mid-January when it will publish historic numbers for each segment to enable analysts and investors to prepare their numbers accordingly.

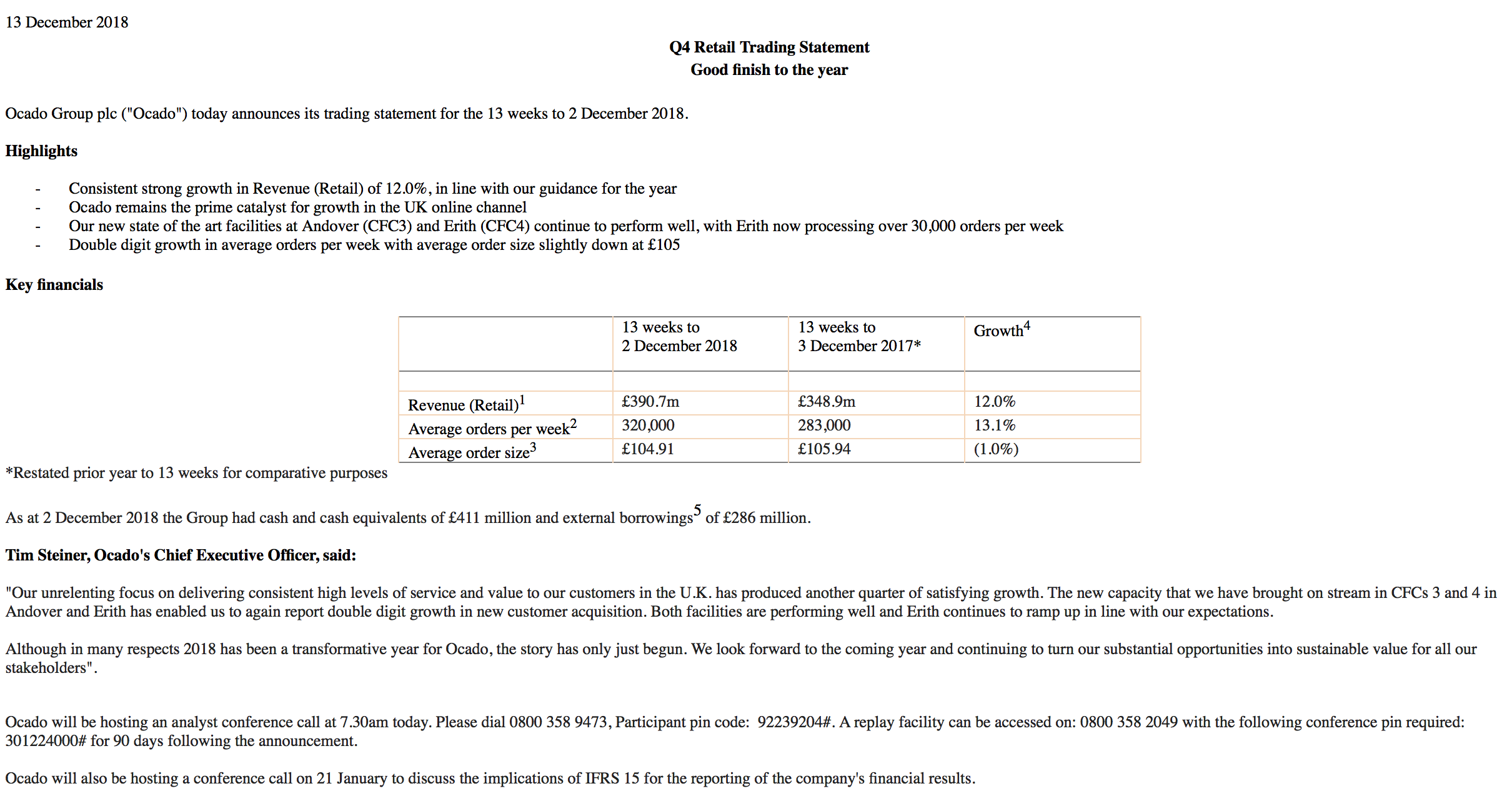

heute kamen Jahreszahlen,

und sie machen eine KE:OCADO GROUP PLC

Proposed placing of new Ordinary Shares

Ocado Group plc (“Ocado” or the “Company”), today announces its intention to conduct a non- pre-emptive placing of up to 31,463,500 new ordinary shares in the capital of the Company (the “Placing Shares”) to institutional investors (the “Placing”), which represents approximately 5% of the existing issued share capital of the Company.

The Placing is being conducted, subject to satisfaction of certain conditions set out in the Appendix to this announcement, through an accelerated bookbuild process (the “Bookbuild”) which will be launched immediately following this placing announcement (the “Announcement”). Goldman Sachs International (“Goldman Sachs”) and Numis Securities Limited (“Numis”), are acting as joint bookrunners (the “Bookrunners”) in connection with the Placing.

The Company has also published today its preliminary annual financial results for the 53 weeks ended 3rd December 2017.

Rationale for the Placing and use of proceeds

The last twelve months have been transformational for Ocado. Ocado believes that its Ocado Solutions (“Ocado Solutions”) technology platform is primed for growth and has been validated internationally through its latest partnerships with Groupe Casino and Sobeys. Ocado is therefore confident that Ocado Solutions will be able to enter into further international partnerships, with the momentum of such transactions building over time.

The net proceeds of the Placing will be used to facilitate the signing of new Ocado Solutions partnerships globally, to commit funding to associated investment capital expenditure and to increase Ocado’s technology engineering and software capabilities. The net proceeds will also enable Ocado to bring forward investment in its customer fulfilment centres (“CFC”) located at Erith and Andover in order to accelerate their fulfilment capacity.

The Company believes that the time is right to accelerate these growth opportunities and drive scale.

Ocado expects the earnings from its partnerships with Groupe Casino and Sobeys to be neutral in FY 2018 and profitable and growing from FY 2019. The Company anticipates that total capital expenditure in FY 2018 will be approximately £210m for its increased capacity and for further investments in its Ocado Solutions platform. A typical single CFC transaction has expected £30m peak cash outflow due to capital costs of installing Ocado’s mechanical handling equipment.

The Company believes that it is this pace and scale which will make its virtuous cycle turn faster in the years ahead, translating into significantly higher profitability.

Outlook

Assuming economic conditions remain broadly stable, in FY 2018 Ocado is confident in achieving revenue growth in its Retail business of between 10-15% as it increases its fulfilment capacity and grows its market share in the UK.

In FY 2018 Group EBITDA will reflect the fixed costs of Ocado’s largest ever CFC in Erith, the ramp up of Ocado’s proprietary solution in both Andover and Erith and an acceleration in the development of its Ocado Solutions platform. The Company expects the trends in EBITDA to improve significantly in FY 2019.

Details of the Placing

The Bookbuild will open with immediate effect following this Announcement. The number of Placing Shares and the price at which the Placing Shares are to be placed (the “Placing Price”) will be agreed between the Bookrunners and the Company following completion of the Bookbuild. The timing of the closing of the Bookbuild, pricing and allocations are at the discretion of the Bookrunners and the Company. Details of the Placing Price and the number of Placing Shares will be announced as soon as practicable after the close of the Bookbuild.

The Placing is subject to the terms and conditions set out in the placing agreement entered into between the Company and the Bookrunners (the “Placing Agreement”). Further details of the Placing Agreement can be found in the terms and conditions contained in the Appendix to this Announcement.

The Placing Shares will, when issued, be credited as fully paid and will be issued subject to the Company’s articles of association and will rank pari passu in all respects with the existing issued ordinary shares in the capital of the Company, including the right to receive all dividends and other distributions declared, made or paid on or in respect of such shares by reference to a record date falling after their issue.

Application will be made for the Placing Shares to be admitted to the premium listing segment of the Official List of the Financial Conduct Authority and to be admitted to trading on the main market for listed securities of the London Stock Exchange plc (together, “Admission”). Settlement for the

Placing Shares and Admission is expected to take place at 8.00 a.m. (London time) on 8 February 2018. The Placing is conditional, among other things, upon Admission becoming effective. The Placing is also conditional upon the Placing Agreement not being terminated.

Your attention is drawn to the detailed terms and conditions of the Placing described in the Appendix to this Announcement (which forms part of this Announcement). By choosing to participate in the Placing and by making an oral and legally binding offer to subscribe for Placing Shares, investors will be deemed to have read and understood this Announcement in its entirety (including the Appendix) and to be making such offer on the terms and subject to the conditions in it, and to be providing the representations, warranties, acknowledgments and undertakings contain in the Appendix. In particular, investors should read and understand the information provided in the “Important Information on the Placing for Invited Placees Only” section of the Appendix.

interessante Entwicklung:

Sie haben ihre eigene Retail-Operation in UK in ein 50:50 JV mit Marks&Spencer eingebracht.Damit haben sie sich von einem Wettbewerber ihrer Lösungskunden ein Stück weit wegentwickelt zu einem reinen Lösungsanbieter, der bei einem von 8 Kunden auch beteiligt ist.

Macht strategisch m.E. großen Sinn:

So werden sie asset-light und (fast) reiner Technologieanbieter.

hab mir heute ein paar stücke zugelegt - mal schauen

Diese Aktie fliegt völlig unter dem Radar vieler Investoren...

1.000.000 Kunden auf der Warteliste... Umsatz deutlich gesteigert, 2020 voraussichtlich erstmalig Gewinn trotz gigantischer Investitionen.

Für mich eines der heissten Stocks überhaupt... war auch in der TOP 15 Aktien in Europa soweit ich weiss.

Ich mache Buy & Hold - Wir werden sehen wo der Laden in paar Jahren dann steht.

Ocado ist ein halbes Tech Unternehmen nachdem Sie die ganzen Roboter für die Lagerlogistik haben. Hier war sogar Amazon zu Besuch um noch was zu lernen. Das heisst was.

Zudem gibt es im Online Grocery Bereich nichts besseres und kundenfreundlicheres. Schaut man sich die Benutzeroberfläche an sieht man wie einfach das Shopping ist.

Ocado ist extrem innovativ und sie kommen immer wieder mit neuen Ideen. Zudem denken sie auch an den Aspekt Nachhaltigkeit.

1.000.000 Kunden auf der Warteliste... Umsatz deutlich gesteigert, 2020 voraussichtlich erstmalig Gewinn trotz gigantischer Investitionen.

Für mich eines der heissten Stocks überhaupt... war auch in der TOP 15 Aktien in Europa soweit ich weiss.

Ich mache Buy & Hold - Wir werden sehen wo der Laden in paar Jahren dann steht.

Ocado ist ein halbes Tech Unternehmen nachdem Sie die ganzen Roboter für die Lagerlogistik haben. Hier war sogar Amazon zu Besuch um noch was zu lernen. Das heisst was.

Zudem gibt es im Online Grocery Bereich nichts besseres und kundenfreundlicheres. Schaut man sich die Benutzeroberfläche an sieht man wie einfach das Shopping ist.

Ocado ist extrem innovativ und sie kommen immer wieder mit neuen Ideen. Zudem denken sie auch an den Aspekt Nachhaltigkeit.

Bin hier mal mit einer guten Position dabei. Finde die Entwicklung schon beachtlich.

Was mich betrifft, ist es besser, in Kindersicherungsanwendungen zu investieren! Nachdem ich herausgefunden hatte, dass mSpy kosten, dachte ich sofort darüber nach.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -1,89 | |

| +0,01 | |

| +0,44 | |

| -0,15 | |

| +1,40 | |

| +0,01 | |

| +0,62 | |

| -0,08 | |

| +0,06 | |

| +1,04 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 174 | ||

| 123 | ||

| 89 | ||

| 84 | ||

| 71 | ||

| 42 | ||

| 37 | ||

| 35 | ||

| 30 | ||

| 28 |

16.10.23 · dpa-AFX · Telecom Italia |

21.09.23 · dpa-AFX · Airbus |

26.07.23 · dpa-AFX · Banco Santander |

24.07.23 · dpa-AFX · Boeing |

24.07.23 · dpa-AFX · Boeing |

18.07.23 · dpa-AFX · Morgan Stanley |

28.06.23 · dpa-AFX · Amazon |

22.06.23 · dpa-AFX · Amazon |

22.06.23 · dpa-AFX · PUMA |

22.06.23 · dpa-AFX · Merck |