MakeMyTrip - indisches Online-Reisebüro - 500 Beiträge pro Seite

eröffnet am 26.09.10 10:35:02 von

neuester Beitrag 20.09.19 17:20:23 von

neuester Beitrag 20.09.19 17:20:23 von

Beiträge: 66

ID: 1.160.124

ID: 1.160.124

Aufrufe heute: 0

Gesamt: 5.739

Gesamt: 5.739

Aktive User: 0

ISIN: MU0295S00016 · WKN: A1C3UJ · Symbol: MY1

60,44

EUR

-2,70 %

-1,68 EUR

Letzter Kurs 15:39:13 Tradegate

Neuigkeiten

15.02.24 · Business Wire (engl.) |

18.01.24 · Business Wire (engl.) |

21.10.23 · Business Wire (engl.) |

09.08.23 · Business Wire (engl.) |

21.07.23 · Business Wire (engl.) |

Werte aus der Branche Hotels/Tourismus

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8954 | +9,01 | |

| 8,7200 | +5,06 | |

| 21,000 | +3,96 | |

| 26,00 | +2,36 | |

| 5,0900 | +2,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,150 | -4,29 | |

| 6,6840 | -4,79 | |

| 3,3800 | -4,79 | |

| 1,5040 | -4,94 | |

| 5,8500 | -5,65 |

On Thursday September 16, 2010, 12:21 pm EDT

NEW YORK (AP) -- Shares of MakeMyTrip Ltd. climbed Thursday after an analyst started coverage of the Indian online travel company with a "Buy" rating, predicting strong growth over the next several years.

MakeMyTrip started as a Web site in the U.S., mainly serving Indian ex-patriots planning to travel to India. It began operations in India in 2005, offering airline tickets as well as hotel bookings, bus tickets and other services to the country's fast growing demographic of middle-class consumers.

THE SPARK: Analyst Sandeep Aggarwal of Caris & Co. believes MakeMyTrip could achieve 50 percent to 60 percent top line growth and 80 percent to 100 percent bottom line growth in part because the Indian travel industry is expanding at a rapid pace.

THE BIG PICTURE: MakeMyTrip debuted on the Nasdaq exchange last month, leaping 89 percent in its first day of trading. It was the best first-day performance for an initial public offering since Athenahealth Inc. debuted in September 2007 and finished up 97 percent.

MakeMyTrip looks to capitalize on India's young demographic and increasing Internet usage.

THE ANALYSIS: In a client note, Aggarwal said India's booming economy is giving way to higher income levels. This gives people more discretionary cash, which could bode well for MakeMyTrip if people decide to spend that money on vacations.

Aggarwal gave a $46 price target, but cautioned that MakeMyTrip is a high-risk investment partly because of its limited history of operations and exposure to emerging market risks.

NEW YORK (AP) -- Shares of MakeMyTrip Ltd. climbed Thursday after an analyst started coverage of the Indian online travel company with a "Buy" rating, predicting strong growth over the next several years.

MakeMyTrip started as a Web site in the U.S., mainly serving Indian ex-patriots planning to travel to India. It began operations in India in 2005, offering airline tickets as well as hotel bookings, bus tickets and other services to the country's fast growing demographic of middle-class consumers.

THE SPARK: Analyst Sandeep Aggarwal of Caris & Co. believes MakeMyTrip could achieve 50 percent to 60 percent top line growth and 80 percent to 100 percent bottom line growth in part because the Indian travel industry is expanding at a rapid pace.

THE BIG PICTURE: MakeMyTrip debuted on the Nasdaq exchange last month, leaping 89 percent in its first day of trading. It was the best first-day performance for an initial public offering since Athenahealth Inc. debuted in September 2007 and finished up 97 percent.

MakeMyTrip looks to capitalize on India's young demographic and increasing Internet usage.

THE ANALYSIS: In a client note, Aggarwal said India's booming economy is giving way to higher income levels. This gives people more discretionary cash, which could bode well for MakeMyTrip if people decide to spend that money on vacations.

Aggarwal gave a $46 price target, but cautioned that MakeMyTrip is a high-risk investment partly because of its limited history of operations and exposure to emerging market risks.

the tickerspy.com Staff, On Thursday September 23, 2010, 2:22 pm EDT

Indian dotcom travel firm MakeMyTrip (NASDAQ: MMYT - News), which debuted on the Nasdaq in August, rebounded by 11% on Thursday after Oppenheimer started the stock at "Perform." The analyst noted that shares appear fully valued at their current levels, but touted the company's growth prospects. Oppenheimer expects the firm's margins to expand by 40 basis points from fiscal 2010 to 2012, and the analyst forecast 52% top-line growth in 2011 and 2012. Caris & Co. initiated MakeMyTrip at "Buy" with a $46 price target on September 16, and Soleil downgraded the stock to "Hold" from "Buy"on Tuesday.

As a whole, the Dotcom Travel Stocks Index is up by 3% today with Orbitz Worldwide (NYSE: OWW - News) and Travelzoo Inc (NASDAQ: TZOO - News) among the top performers. The Index has now outperformed the S&P 500 by 20% over the last month with three components trading higher by more than 30% for the period.

Elsewhere in the sector, Priceline.com (NASDAQ: PCLN - News) and Expedia (NASDAQ: EXPE - News) are the two largest dotcom travel plays by market cap, but they weren't the most popular among Pro investors at the end of the second quarter. That title belongs to Chinese player Ctrip.com Internatinoal (NASDAQ: CTRP - News), which was in the top-15 U.S.-listed equity holdings of 22 13F-filing asset managers heading into Q3. Recently, Ctrip.com is among the sector's worst performers, gaining just 5% over the last month.

It will be interesting to see whether MakeMyTrip can maintain its post-IPO momentum. Shares are already ahead by more than 135% from their initial pricing. Investors can track the Dotcom Travel Stocks Index for performance trends and a suite of other metrics at tickerspy.com.

Indian dotcom travel firm MakeMyTrip (NASDAQ: MMYT - News), which debuted on the Nasdaq in August, rebounded by 11% on Thursday after Oppenheimer started the stock at "Perform." The analyst noted that shares appear fully valued at their current levels, but touted the company's growth prospects. Oppenheimer expects the firm's margins to expand by 40 basis points from fiscal 2010 to 2012, and the analyst forecast 52% top-line growth in 2011 and 2012. Caris & Co. initiated MakeMyTrip at "Buy" with a $46 price target on September 16, and Soleil downgraded the stock to "Hold" from "Buy"on Tuesday.

As a whole, the Dotcom Travel Stocks Index is up by 3% today with Orbitz Worldwide (NYSE: OWW - News) and Travelzoo Inc (NASDAQ: TZOO - News) among the top performers. The Index has now outperformed the S&P 500 by 20% over the last month with three components trading higher by more than 30% for the period.

Elsewhere in the sector, Priceline.com (NASDAQ: PCLN - News) and Expedia (NASDAQ: EXPE - News) are the two largest dotcom travel plays by market cap, but they weren't the most popular among Pro investors at the end of the second quarter. That title belongs to Chinese player Ctrip.com Internatinoal (NASDAQ: CTRP - News), which was in the top-15 U.S.-listed equity holdings of 22 13F-filing asset managers heading into Q3. Recently, Ctrip.com is among the sector's worst performers, gaining just 5% over the last month.

It will be interesting to see whether MakeMyTrip can maintain its post-IPO momentum. Shares are already ahead by more than 135% from their initial pricing. Investors can track the Dotcom Travel Stocks Index for performance trends and a suite of other metrics at tickerspy.com.

Hier gibt es eine schöne Präsentation vom 15.9.2010: http://investors.makemytrip.com/events.cfm

* Q3 adj EPS $0.05 vs est $0.04

* Revenue up 57 pct

* Sees 2011 rev $59-$61 mln vs est $56.6 mln

Feb 9 (Reuters) - India-based online travel booking company MakeMyTrip Ltd reported quarterly results that beat analysts' expectations, helped by higher air ticketing and hotel and packages transactions.

The company said it expects 2011 revenue of $59-$61 million, compared with analysts' expectations of $56.6 million, according to Thomson Reuters I/B/E/S.

The company also said it will acquire a 79 percent stake in Singapore-based travel agency Luxury Tours&Travel Pte Ltd for an initial sum of $3 million in cash, as it seeks to expand through tie-ups with local hotels in South-East Asia.

The company, which debuted on Nasdaq in August, reported third-quarter earnings of $1.63 million, or 4 cents a share, compared with $0.6 million, or 2 cents a share, a year ago.

On an adjusted basis it earned 5 cents a share. Revenue rose 57 percent to $35.8 million.

Air ticketing and hotels and packages transactions rose 59 percent, as more customers used its online service to book winter holidays.

Analysts on an average were expecting earnings of 4 cents a share on revenue of $15.1 million.

The company's shares, which have fallen 19 percent in the last three months, closed at $26.80 on Wednesday on Nasdaq.

* Revenue up 57 pct

* Sees 2011 rev $59-$61 mln vs est $56.6 mln

Feb 9 (Reuters) - India-based online travel booking company MakeMyTrip Ltd reported quarterly results that beat analysts' expectations, helped by higher air ticketing and hotel and packages transactions.

The company said it expects 2011 revenue of $59-$61 million, compared with analysts' expectations of $56.6 million, according to Thomson Reuters I/B/E/S.

The company also said it will acquire a 79 percent stake in Singapore-based travel agency Luxury Tours&Travel Pte Ltd for an initial sum of $3 million in cash, as it seeks to expand through tie-ups with local hotels in South-East Asia.

The company, which debuted on Nasdaq in August, reported third-quarter earnings of $1.63 million, or 4 cents a share, compared with $0.6 million, or 2 cents a share, a year ago.

On an adjusted basis it earned 5 cents a share. Revenue rose 57 percent to $35.8 million.

Air ticketing and hotels and packages transactions rose 59 percent, as more customers used its online service to book winter holidays.

Analysts on an average were expecting earnings of 4 cents a share on revenue of $15.1 million.

The company's shares, which have fallen 19 percent in the last three months, closed at $26.80 on Wednesday on Nasdaq.

...damit wird das KBV endlich kleiner als 11...:

On Friday May 27, 2011, 10:33 am EDT

NEW YORK (AP) -- Indian online travel company MakeMyTrip Ltd. said Friday that it has priced its public offering of 5.2 million shares at $24 apiece, a 1.8 percent discount to its previous closing price.

Its shares fell 90 cents, or 3.7 percent, to $23.54 in morning trading Friday.

About 1.5 million shares were offered by the company and the rest were offered by shareholders. The company and shareholders also gave underwriters an option to buy up to an additional 786,600 shares to cover any overallotments.

MakeMyTrip expects to use its share of the net proceeds to acquire or invest in other businesses as well as for general corporate purposes. The company is based in Gurgaon, India.

Morgan Stanley and Deutsche Bank Securities Inc. acted as joint book running managers of the offering. Pacific Crest Securities LLC and Oppenheimer & Co. Inc. were co-managers.

On Friday May 27, 2011, 10:33 am EDT

NEW YORK (AP) -- Indian online travel company MakeMyTrip Ltd. said Friday that it has priced its public offering of 5.2 million shares at $24 apiece, a 1.8 percent discount to its previous closing price.

Its shares fell 90 cents, or 3.7 percent, to $23.54 in morning trading Friday.

About 1.5 million shares were offered by the company and the rest were offered by shareholders. The company and shareholders also gave underwriters an option to buy up to an additional 786,600 shares to cover any overallotments.

MakeMyTrip expects to use its share of the net proceeds to acquire or invest in other businesses as well as for general corporate purposes. The company is based in Gurgaon, India.

Morgan Stanley and Deutsche Bank Securities Inc. acted as joint book running managers of the offering. Pacific Crest Securities LLC and Oppenheimer & Co. Inc. were co-managers.

Antwort auf Beitrag Nr.: 41.568.958 von R-BgO am 27.05.11 18:19:51Hallo!

MMYT hat kürzlich Geschäftszahlen für das erste Quartal des laufenden Geschäftsjahres 2011/2012 vorgelegt, siehe: http://www.marketwatch.com/story/makemytrip-limited-announce…

Diese fielen weitestgehend im Rahmen der Erwartungen aus bzw. lagen sogar leicht über den Konsensusprognosen der Analysten. Darüber hinaus erfreute das Unternehmen den Markt mit einer nochmaligen Bestätigung der Umsatz- und Gewinnprognosen für das laufende Geschäftsjahr 2012e.

Alles in allem konnte die Aktie des indischen Online-Reisebüros so im Zuge der Quartalszahlen deutliche Kursgewinne verzeichnen und eroberte sogar kurzzeitig die 20$ Marke zurück. Wenngleich es zuletzt in einem wieder etwas schwächeren Marktumfeld wieder leicht abwärts ging, so zeigen sich die Analysten weiterhin optimistisch gegenüber der Aktie. So empfahl das Haus Oppenheimer die Aktie erst vor ein paar Wochen zum Kauf und auch die Analysten der Deutschen Bank bestätigten zuletzt nochmal ihre Kaufempfehlung, wenngleich das Kursziel dabei leicht abgesenkt wurde.

Angesichts des großen Potenzials des indischen Reisemarktes sehe auch ich die MMYT Aktie tendenziell weiter positiv und kann mir hier weitere Kurssteigerungen bis in den Bereich 30$ problemlos vorstellen. Zumal insbesondere der indische Online-Markt dank eines verstärkten Ausbau der Internet-Infrastruktur durch die Regierung zukünftig ein noch besseres Umfeld vorfinden wird. Zudem wächst zurzeit endlich auch in Indien eine kaufkräftigere Mittelschicht heran, die m.E. in Zukunft verstärkt Urlaub buchen und dies auch via Internet tun wird. Insofern steht MMYT noch ein explosionsartiges Wachstum bevor, wie es PCLN oder CTRP in der Vergangenheit schon erlebt haben. Unter 20$ sollte man die MMYT Aktie daher meiner bescheidenen Meinung nach langsam aber sicher einsammeln...

Dafür jedenfalls spricht auch, dass die Aktie in Deutschland kaum bekannt ist, wie ein Blick auf die Datenbank der Aktien-Community sharewise zeigt: https://www.de.sharewise.com/aktien/MU0295S00016-makemytrip/…

Denn dort gibt es derzeit gerade mal eine einzige mickrige Kaufempfehlung mit einem Kursziel in Höhe von 25,00 Euro, was gegenüber den heutigen Kursen fast schon einer Verdopplung gleich käme. Mutige Spekulaten sollten daher die MMYT Aktie derzeit unter 20$ unbedingt einsammeln/kaufen!!

LG Enzo

MMYT hat kürzlich Geschäftszahlen für das erste Quartal des laufenden Geschäftsjahres 2011/2012 vorgelegt, siehe: http://www.marketwatch.com/story/makemytrip-limited-announce…

Diese fielen weitestgehend im Rahmen der Erwartungen aus bzw. lagen sogar leicht über den Konsensusprognosen der Analysten. Darüber hinaus erfreute das Unternehmen den Markt mit einer nochmaligen Bestätigung der Umsatz- und Gewinnprognosen für das laufende Geschäftsjahr 2012e.

Alles in allem konnte die Aktie des indischen Online-Reisebüros so im Zuge der Quartalszahlen deutliche Kursgewinne verzeichnen und eroberte sogar kurzzeitig die 20$ Marke zurück. Wenngleich es zuletzt in einem wieder etwas schwächeren Marktumfeld wieder leicht abwärts ging, so zeigen sich die Analysten weiterhin optimistisch gegenüber der Aktie. So empfahl das Haus Oppenheimer die Aktie erst vor ein paar Wochen zum Kauf und auch die Analysten der Deutschen Bank bestätigten zuletzt nochmal ihre Kaufempfehlung, wenngleich das Kursziel dabei leicht abgesenkt wurde.

Angesichts des großen Potenzials des indischen Reisemarktes sehe auch ich die MMYT Aktie tendenziell weiter positiv und kann mir hier weitere Kurssteigerungen bis in den Bereich 30$ problemlos vorstellen. Zumal insbesondere der indische Online-Markt dank eines verstärkten Ausbau der Internet-Infrastruktur durch die Regierung zukünftig ein noch besseres Umfeld vorfinden wird. Zudem wächst zurzeit endlich auch in Indien eine kaufkräftigere Mittelschicht heran, die m.E. in Zukunft verstärkt Urlaub buchen und dies auch via Internet tun wird. Insofern steht MMYT noch ein explosionsartiges Wachstum bevor, wie es PCLN oder CTRP in der Vergangenheit schon erlebt haben. Unter 20$ sollte man die MMYT Aktie daher meiner bescheidenen Meinung nach langsam aber sicher einsammeln...

Dafür jedenfalls spricht auch, dass die Aktie in Deutschland kaum bekannt ist, wie ein Blick auf die Datenbank der Aktien-Community sharewise zeigt: https://www.de.sharewise.com/aktien/MU0295S00016-makemytrip/…

Denn dort gibt es derzeit gerade mal eine einzige mickrige Kaufempfehlung mit einem Kursziel in Höhe von 25,00 Euro, was gegenüber den heutigen Kursen fast schon einer Verdopplung gleich käme. Mutige Spekulaten sollten daher die MMYT Aktie derzeit unter 20$ unbedingt einsammeln/kaufen!!

LG Enzo

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam, Werbung!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam, Werbung!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: themenfremder Inhalt

Auch das ist ein Wert aus Indien, ich beobachte die Börse dort und freue

mich über News zu dieser Aktie.

mich über News zu dieser Aktie.

Kurs ist schön zurückgekommen; KBV beträgt "nur" noch rund 6 und KUV noch rund 3,5

Operativ wachsen sie weiter mit rund 50%...

Ist es jetzt schon Zeit zu kaufen, oder weiter warten?

Zahlen kommen am 24.5.

Operativ wachsen sie weiter mit rund 50%...

Ist es jetzt schon Zeit zu kaufen, oder weiter warten?

Zahlen kommen am 24.5.

Kurs ging nach den Zahlen noch mal deutlich runter; operativ wurde in Q4 nix verdient, das Jahresergebnis kommt fast ganz aus einem Steuereffekt.

KBV jetzt unter 5.

Warte weiter...

KBV jetzt unter 5.

Warte weiter...

MakeMyTrip Limited Announces Acquisition of Majority Interest in ITC Group

NEW DELHI and NEW YORK, Nov.26, 2012 /PRNewswire/ --MakeMyTrip Limited (Nasdaq:MMYT), India's leading online travel company and the parent company of MakeMyTrip (India) Private Limited and MakeMyTrip.com Inc. today announced that it acquired an effective majority equity interest in a group of companies known as the "ITC Group". The ITC Group comprises of InternationalTour Center Co. Ltd., ITC Bangkok Co. Ltd. and ITC South Co. Ltd. Pursuant to the transaction documents signed with the ITC Group and its existing shareholders, MakeMyTrip paid USD 2.2 million to the existing shareholders for the sale of their shares in the ITC Group and paid USD 1 million for subscription of new shares in the ITC Group. MakeMyTrip will also acquire the remaining shares of the ITC Group from the existing shareholders in cash, payable in four tranches, over an earn-out period ending December 2016, at such price based on valuation linked to the future profitability of the ITC Group.

ITC Group is a well-established hotel aggregator and tour operator for Thailand. The ITC Group has relationships with a number of hotels and other local vendors in Thailand to provide hotel reservations, excursion tours and other travel related services for inbound and outbound travellers in Thailand and the South East Asia region. The acquisition will help MakeMyTrip further expand its presence in Thailand, a key market for its outbound holidays business, by establishing more direct hotel relationships in the country.

Thailand is an important outbound travel destination from India and has accounted for approximately one million Indian visitors this year. Airlines in India, including low cost carriers, are aligning their fleet for direct flights from various cities in India to Thailand. MakeMyTrip believes that these developments are positioning travel and tourism to Thailand for strong growth by making travel to the country easily accessible and affordable to the middle class in India.

NEW DELHI and NEW YORK, Nov.26, 2012 /PRNewswire/ --MakeMyTrip Limited (Nasdaq:MMYT), India's leading online travel company and the parent company of MakeMyTrip (India) Private Limited and MakeMyTrip.com Inc. today announced that it acquired an effective majority equity interest in a group of companies known as the "ITC Group". The ITC Group comprises of InternationalTour Center Co. Ltd., ITC Bangkok Co. Ltd. and ITC South Co. Ltd. Pursuant to the transaction documents signed with the ITC Group and its existing shareholders, MakeMyTrip paid USD 2.2 million to the existing shareholders for the sale of their shares in the ITC Group and paid USD 1 million for subscription of new shares in the ITC Group. MakeMyTrip will also acquire the remaining shares of the ITC Group from the existing shareholders in cash, payable in four tranches, over an earn-out period ending December 2016, at such price based on valuation linked to the future profitability of the ITC Group.

ITC Group is a well-established hotel aggregator and tour operator for Thailand. The ITC Group has relationships with a number of hotels and other local vendors in Thailand to provide hotel reservations, excursion tours and other travel related services for inbound and outbound travellers in Thailand and the South East Asia region. The acquisition will help MakeMyTrip further expand its presence in Thailand, a key market for its outbound holidays business, by establishing more direct hotel relationships in the country.

Thailand is an important outbound travel destination from India and has accounted for approximately one million Indian visitors this year. Airlines in India, including low cost carriers, are aligning their fleet for direct flights from various cities in India to Thailand. MakeMyTrip believes that these developments are positioning travel and tourism to Thailand for strong growth by making travel to the country easily accessible and affordable to the middle class in India.

Do Hedge Funds and Insiders Love MakeMyTrip Limited (MMYT)?:

http://www.insidermonkey.com/blog/do-hedge-funds-and-insider…

http://www.insidermonkey.com/blog/do-hedge-funds-and-insider…

"Indians are ready to book hotels online": MakeMyTrip's Manish Kalra

http://www.afaqs.com/interviews/index.html?id=359_Indians-ar…

http://www.afaqs.com/interviews/index.html?id=359_Indians-ar…

Kurs jetzt wieder ungefähr bei meinem Einstand, weiter Verluste

Zahlen kamen diese Woche:

Umsatz wächst weiter kräftig, Verlust sinkt minimal

Fange aber an, ganz zarte Skaleneffekte zu sehen.

Finde beeindruckend, dass ich die Bude nun schon 5 Jahre verfolge...

Umsatz wächst weiter kräftig, Verlust sinkt minimal

Fange aber an, ganz zarte Skaleneffekte zu sehen.

Finde beeindruckend, dass ich die Bude nun schon 5 Jahre verfolge...

habe mich mal zu einem ersten Aufstocken durchgerungen

Wettbewerber sind privat:

http://www.cleartrip.com/about/investors/http://www.yatra.com/online/about-yatra.html

MakeMyTrip to Invest $15 Million in HolidayIQ

Both companies to jointly scale-up HolidayIQ, a popular Indian traveller opinion engineFocus on enhancing capabilities to generate hotel and holiday reviews and disseminate holiday advice to travellers on mobile phones

This capital to be used to further strengthen Content, Mobile and technology offerings on HolidayIQ

Delhi, July 22, 2015:

MakeMyTrip, India's leading online travel company (the "Company"), announced signing of agreement for the acquisition of a minority stake in HolidayIQ, a popular Indian travel community and holidays-planning recommendation engine. The company will pick up around 28% stake in HolidayIQ for $15 million. The transaction is scheduled to complete in July 2015. This strategic investment will enable both companies to rapidly scale up hotel content and reviews for Indian customers, and provide more compelling offerings to their visitors.

Speaking on the investment, Deep Kalra, Founder and Group CEO, MakeMyTrip.com said, "HolidayIQ operates in a very exciting space in the Indian online travel market. Their pace and appetite for innovation matches ours, and we see great synergy in our focus on Hotels and Mobile. The opportunity to drive scale jointly is fairly significant."

According to HolidayIQ, the funds will mainly be used to further strengthen its capabilities on Content, Mobile and Product. HolidayIQ had raised series A before from Tiger Global and Accel Partners. The focus at HolidayIQ is to become the "authentic voice of Indian travellers, by encouraging all Indian travellers to share reviews & express opinion on all their travel". Currently, HolidayIQ has over a million holiday reviews from Indian travellers which it expects to increase over the next two years.

Said Hari Nair, Founder & CEO of HolidayIQ - 'Disruption is a way of life at HolidayIQ and today we power millions of travellers every month in making smarter travel decisions based on the reviews and insights from other Indian travellers. Mobile is creating new unprecedented opportunities for growth and innovation. This capital gives us additional resources to expand quickly and strategically and accelerate pace of product innovation. We look forward to working closely with MMT in getting a much larger number of Indian travellers to participate in the creation of Indian traveller opinion '.

Rajesh Magow, Co-Founder and CEO-India, MakeMyTrip.com shared, "This tie-up will power our hotel-growth strategy, and also provide immense value to Indian travellers in the form of user generated and curated trip-planning content. We also expect to rapidly scale our reviews and recommendation engine as an outcome of this investment."

Consumer behavior and preferences are rapidly evolving in the travel sector and HolidayIQ has been clued in to the pulse of this evolution, releasing many interesting offerings especially in the mobile space such as offline guides for 1300 Indian destinations, India's first mobile only holidays marketplace and reviews for journey options.

HolidayIQ's mobile app has consistently witnessed high customer traction, with a high user rating of 4.3 on 5 on Google Play Store. One can download the app using http://www.holidayiq.com/ mobile/app .

..muss mich hier mal einlesen...

MakeMyTrip Announces Investment by Ctrip

MakeMyTrip expects to use the capital to further strengthen its leadership in India's online travel marketsGurgaon, India 7 January, 2016 - MakeMyTrip Limited (NASDAQ: MMYT) ("MakeMyTrip" or "Company"),

India's leading online travel company, announced today an agreement under which Ctrip.com International, Ltd. (NASDAQ: CTRP), a leading travel service provider of accommodation reservation, transportation ticketing, packaged tours and corporate travel management in China ("Ctrip"), has agreed to make an investment in MakeMyTrip.

Upon completion of the transaction, Ctrip will invest US$180 million in MakeMyTrip through convertible bonds. In addition, MakeMyTrip has granted Ctrip permission to acquire MakeMyTrip shares in the open market, so that combined with shares convertible under the convertible bonds, Ctrip may beneficially own up to 26.6% of MakeMyTrip's outstanding shares. Upon completion of the investment, Ctrip will acquire the right to appoint a director to the MakeMyTrip board of directors.

The Company will focus on further strengthening its leading market share in the Indian online travel market by offering customers the best mobile booking experience across its full service travel products platform, especially as rising smart-phone penetration is driving an inflection point in India's online travel opportunity.

Deep Kalra, Founder and Group CEO, MakeMyTrip said "We are delighted to have Ctrip invest in us. Ctrip is the dominant market leader in the online travel market in China. We believe there are many similarities in the Indian and Chinese online travel markets and we expect this strategic relationship between two market leaders to be mutually beneficial."

Ctrip CEO and Co-Founder, James Liang commented, "Today's announcement marks the beginning of the strategic relationship between Ctrip and MakeMyTrip. Through this transaction, Ctrip has now gained exposure to India's fast growing online travel market."

Morgan Stanley acted as the exclusive financial advisor to MakeMyTrip while Latham & Watkins LLP served as the legal advisor to MakeMyTrip on this transaction.

=> die Kohle können sie gut gebrauchen, sie verbrennen kontinuierlich mehr...

finde komisch, dass so gar nichts zu den Terms des Wandlers gesagt wird

Antwort auf Beitrag Nr.: 51.610.750 von R-BgO am 29.01.16 13:10:53

Laufzeit 5 Jahre

Verzinsung 4,25%

strike 21,45$

als Referenzpreis (z.B. für Anpassungen) haben sie wohl 16,50 genommen, passt zum Börsenkurs vor announcement;

das Aufgeld wäre dann 30%, wovon sie 21,25 über die Zinsen wieder reinbekommen;

wie muss man das nun werten?

1) MMYT bekommt einen Haufen "Firepower", aus 84 MUSD cash & Festgeld werden rund 260 MUSD

2) sie müssen den Kurs innerhalb der 5 Jahre über den strike bringen, sonst werden sie höchstwahrscheinlich "distressed"

3) die Verwässerung "geht noch", mit 16,6% Anteil an der neuen Aktienzahl nach Wandlung

4) wofür die "Erlaubnis" an Trip, nochmal 10% über die Börse zu kaufen, gut ist verstehe ich nicht; Kurspflege?

ok,im 13D steht's drin:

http://services.corporate-ir.net/SEC/Document.Service?id=P3V…Laufzeit 5 Jahre

Verzinsung 4,25%

strike 21,45$

als Referenzpreis (z.B. für Anpassungen) haben sie wohl 16,50 genommen, passt zum Börsenkurs vor announcement;

das Aufgeld wäre dann 30%, wovon sie 21,25 über die Zinsen wieder reinbekommen;

wie muss man das nun werten?

1) MMYT bekommt einen Haufen "Firepower", aus 84 MUSD cash & Festgeld werden rund 260 MUSD

2) sie müssen den Kurs innerhalb der 5 Jahre über den strike bringen, sonst werden sie höchstwahrscheinlich "distressed"

3) die Verwässerung "geht noch", mit 16,6% Anteil an der neuen Aktienzahl nach Wandlung

4) wofür die "Erlaubnis" an Trip, nochmal 10% über die Börse zu kaufen, gut ist verstehe ich nicht; Kurspflege?

Antwort auf Beitrag Nr.: 51.610.750 von R-BgO am 29.01.16 13:10:53

weitere Meinung von SA:

http://seekingalpha.com/article/3798686-does-the-makemytrip-… Asia’s budget hotel aggregators spread their wings

Mar 29.2016Asia’s established budget hotel aggregators continue to expand at the same time as new investors pump cash into the sector.

India’s Vista Rooms is less than a year-old, which might be stretching the definition of an established player. Nonetheless, it has already built up a portfolio of 800 or so properties in more than 80 cities, finding niches in tier 2 and tier 3 locations where it claims to be the market leader.

It has now taken the brand into Sri Lanka, partnering with 200 properties there. And it is planning a presence in at least four other countries by the end of the year.

The brand works with boutique hotels, guesthouses, serviced apartments, private villas and home stays. It also has a B2B model where it offers hotel partners access to its technology, which can be used to handle distribution and manage properties.

As well as its brand dotcom vistarooms.com (or www.vistarooms.lk for Sri Lanka) Vista also helps its partners access third-party channels such as Cleartrip.

While the focus is clearly on Indian travellers visiting the neighbouring island, one of Vista’s three co-founders Ankita Sheth has her eye on helping Sri Lanka’s overall tourism industry.

“We are working with our hand-picked hotels to change the perception of budget hotels. We want travelers, coming to Sri Lanka, from all across the world to no longer worry whether their bathroom will be hygienic or whether the AC will be working when they stay at a budget hotel.”

Elsewhere, Malaysia and Indonesia specialist Nida Rooms is opening an office in Bangkok and wants to have 3,000 Thai properties on its books by year-end, a significant hike on its portfolio of 1,400 Thai properties.

That’s impressive because Nida is even younger than Vista Rooms and claims to be “Asia’s fastest growing virtual hotel operator.” on its FAQ page The tagline on its homepage claims that it is “the largest hotel chain in Asia”.

Nida’s Crunchbase entry says its parent company Global Rooms Limited secured an undisclosed seed round in September 2015, followed up by a further $1.3m in November, backed by East Pacific Capital and True Capital Partners.

Elsewhere, Room on Call has raised $2 million and is looking to expand its footprint in India beyond its current 400 or so properties in 42 locations. It was founded in May 2015 and picked up $300,000 from US-based investor and Yahoo! exec Payal Syal in September.

The latest round comes from India’s Cash Ur Drive, whose core business is putting adverts on cars and buses.

A blog post from Room on Call says it is booking 20,000 room nights each month.

It is trying to find a niche by focusing on people who would prefer to phone a call centre to make a booking, arguing that there are 975 million mobile phone users in India — only 3% of whom use apps.

Having said that, the company has now also launched an app to target that segment.

The online branded budget accommodation aggregator model isn’t a million miles away from the franchise model used by hotel chains in the US and elsewhere. But the growth potential of these business in India and Asia is massive because the region is home to so many budget accommodation options.

When Tnooz talked to Vista Rooms last August, its chief technology officer, Pranav Maheshwari, told us:

“The market is huge…We think there are around 150,000 properties in India which could move over to this branded sector. The major players have got, say, 2,500 between them. So we’ve just scratched the surface.”

The surface might be a bit more than scratched seven months on, but his point remains valid. Throw in the rest of Asia and you have a big fragmented market in need of some digital love. Surely it’s only a matter of time before some of the major global players start taking a look at this (especially if you can get to 20,000 room nights a month in less than a year for an investment of $300K).

im Q4 ham' se richtig Gas gegeben mit Marketing;

Ergebnis:Nettoverlust fürs Gesamtjahr von 18 auf 89 MUSD gestiegen (+394%)

Umsatz aber nur von 300 auf 336 MUSD (+12%), wenigstens waren es im Q4 plus 28%

gleichzeitig scheinen sie Aktien ZURÜCKgekauft zu haben, Anzahl sinkt

bilanziell sind wir bei einem KBV von gut 8 angekommen

wenigstens liegen sie vorne, sogar vor booking.com

Antwort auf Beitrag Nr.: 50.736.216 von R-BgO am 29.09.15 17:31:47verdoppelt

Hört sich ja nicht so gut an, obwohl das Potenzial von MMT noch sehr groß ist. Ist noch zu teuer die Aktie oder?

Antwort auf Beitrag Nr.: 52.600.226 von Kalbaran am 13.06.16 01:42:46

jeglicher Wert liegt in der Hoffnung, dass sie zukünftig Geld verdienen können.

Die Indizien, auf die ich mich stütze, sind hauptsächlich die Marktführerposition, das Wachstumspotenzial für Indien und das CTrip-Investment.

Nachgekauft habe ich zur Verbilligung und Erhöhung meines Aufmerksamkeitslevels - ein bisschen wie wenn man beim Pokern eine runde mitgeht-.

Wie bewertest Du?

kommt drauf an, wie Du "teuer" definierst...

fundamental, nach realisierten Erträgen bewertet, ist die Aktie nichts wert;jeglicher Wert liegt in der Hoffnung, dass sie zukünftig Geld verdienen können.

Die Indizien, auf die ich mich stütze, sind hauptsächlich die Marktführerposition, das Wachstumspotenzial für Indien und das CTrip-Investment.

Nachgekauft habe ich zur Verbilligung und Erhöhung meines Aufmerksamkeitslevels - ein bisschen wie wenn man beim Pokern eine runde mitgeht-.

Wie bewertest Du?

Das geringe Umsatzwachstum hat mich etwas stutzig gemacht. Hat dennoch viel Zukunftspotential (übernahmen, Indien Wachstum der Mittelschicht etc...).

Dennoch werde ich noch abwarten und die zukünftigen Quartalszahlen abwarten, kann da nicht einschätzen ob es in den nächsten Monaten eher hoch oder runter gehen wird.

Dennoch werde ich noch abwarten und die zukünftigen Quartalszahlen abwarten, kann da nicht einschätzen ob es in den nächsten Monaten eher hoch oder runter gehen wird.

Hatte überlegt bei 15$ einzusteigen, ist aber in den letzten Tagen wieder so hochgeschossen. :/

Mal schauen ob es vielleicht mal wieder runter geht in den nächsten Monaten.

Mal schauen ob es vielleicht mal wieder runter geht in den nächsten Monaten.

Wettbewerbstemperatur steigt:

Thread: Yatra.com

Hat auf jeden Fall eine ansprechendere Homepage als MMT.

Glaubst du das sie das Potential haben an MMT aufzuschließen, in Sachen Marktanteil?

Glaubst du das sie das Potential haben an MMT aufzuschließen, in Sachen Marktanteil?

Antwort auf Beitrag Nr.: 52.848.916 von Kalbaran am 16.07.16 19:46:04

=============================================

noch einer:

German media giant invests in Indian budget hotel startup

Jul 22.2016

India’s Treebo Hotels has picked up $16.7 million in Series B funding, with the Indian-based investment arm of Germany’s Bertelsmann taking part.

Bangalore-based Treebo is a tech-enabled budget hotel chain franchise which is just over a year old and picked up $6 million Series A funding last June. It currently has 125 partner hotels with more than 3,000 rooms in 25 Indian cities.

That round was led by SAIF Partners and Matrix Partners India, both of whom are also involved in the Series B, with Bertelsmann Investments India. (BII).

BII “focuses on early stage, as well as growth stage investments” and the Treebo deal is its first foray into travel and hospitality. German media giant Bertelsmann also has investment funds for Brazil, Asia and digital media and has stakes in more than 100 companies.

One of BII’s criteria for investments is a desire to expand internationally, although there are no signs that Treebo is looking to move beyond India.

Instead, it has earmarked the cash to help expand its footprint in India to 450 properties in more than 60 cities over the next 12 months. It is also looking to launch mid-scale and leisure brands.

The tech focus comes in many guises, with an emphasis on helping its hotel partners improve operations – earlier this year it launched “Bumblebee” which it claims is the first tablet-based property management system in the industry.

Treebo’s $16.7 million comes a month or so after another budget hotel aggregator, Fab Hotels, reportedly picked up a Series A round worth $8 million.

Requests for confirmation of the Fab deal were not responded to, although the official FabHotels Twitter account posted links to the coverage.

keine Ahnung;

Potential ist sicher prinzipiell immer vorhanden, Frage ist: wie groß?=============================================

noch einer:

German media giant invests in Indian budget hotel startup

Jul 22.2016

India’s Treebo Hotels has picked up $16.7 million in Series B funding, with the Indian-based investment arm of Germany’s Bertelsmann taking part.

Bangalore-based Treebo is a tech-enabled budget hotel chain franchise which is just over a year old and picked up $6 million Series A funding last June. It currently has 125 partner hotels with more than 3,000 rooms in 25 Indian cities.

That round was led by SAIF Partners and Matrix Partners India, both of whom are also involved in the Series B, with Bertelsmann Investments India. (BII).

BII “focuses on early stage, as well as growth stage investments” and the Treebo deal is its first foray into travel and hospitality. German media giant Bertelsmann also has investment funds for Brazil, Asia and digital media and has stakes in more than 100 companies.

One of BII’s criteria for investments is a desire to expand internationally, although there are no signs that Treebo is looking to move beyond India.

Instead, it has earmarked the cash to help expand its footprint in India to 450 properties in more than 60 cities over the next 12 months. It is also looking to launch mid-scale and leisure brands.

The tech focus comes in many guises, with an emphasis on helping its hotel partners improve operations – earlier this year it launched “Bumblebee” which it claims is the first tablet-based property management system in the industry.

Treebo’s $16.7 million comes a month or so after another budget hotel aggregator, Fab Hotels, reportedly picked up a Series A round worth $8 million.

Requests for confirmation of the Fab deal were not responded to, although the official FabHotels Twitter account posted links to the coverage.

Wäre ich mal bei 15$ eingestiegen.

Antwort auf Beitrag Nr.: 52.949.467 von Kalbaran am 29.07.16 20:34:22MakeMyTrip increases margins, mobile, ad spend (and losses)

Jul 28.2016

Indian OTA MakeMyTrip remains committed to building on its market-leading position as its Q1s reveal a double-digit lift in revenues and a triple-digit increase in sales and marketing costs.

In cash terms this equates to revenues of $121 million, up 29.4% on the same period last year; sales and marketing expenses were $52.7 million, up by 329.2%. Losses “as per IFRS” were also up – $14 million this time compared with $7 million.

Its financials for the April-June quarter said that that the increase in sales and marketing costs was “the result of significant customer inducement/acquisition programs…an increase in mobile application download and referral cost….[and] other brand advertisement expenses.”

It acknowledged that “the customer inducement/acquisition expenses are primarily incentives given to customers for accelerating growth in our standalone hotel booking business”.

And the approach appears to be working. The standout growth figures in the results are from hotels – overall online hotel bookings were up, in volume terms, by 478% compared with the same period last year; the volume of hotel bookings from mobile was up 871%.

Nearly three in four domestic hotels and 44% of domestic flights were booked on mobile in the quarter.

CEO Deep Kalra shared some more details on the earnings call with analysts. He noted that at the end of the quarter MakeMyTrip could claim 5.2m monthly active users of its app, compared with 4.2 million at the end of the previous quarter. So far the app has been downloaded more than 23 million times.

Air, generally, gets less attention than hotels in the OTA world because the margins and mark-up on beds are more compelling than seats.

MakeMyTrip however still has strong domestic and international air sales, lifting transaction volumes by 34% in the quarter. In Q1 MakeMyTrip’s net revenue margin was 10.1% – up from 7.8% last time, based on flight margins of 6.5% (up from 5.5%) and hotel and packages margins of 16.9% (up from 13.3%).

Kalra noted that this part of the business is likely to continue growing as a result of the Indian government’s recent decision to allow foreign businesses to invest up to 100% in its airlines and airports. The government will also encourage the use of underused airports in smaller town and cities.

The results of these changes is that the government expects 300 million domestic air trips to be taken in 2022 compared with 81 million in 2015.

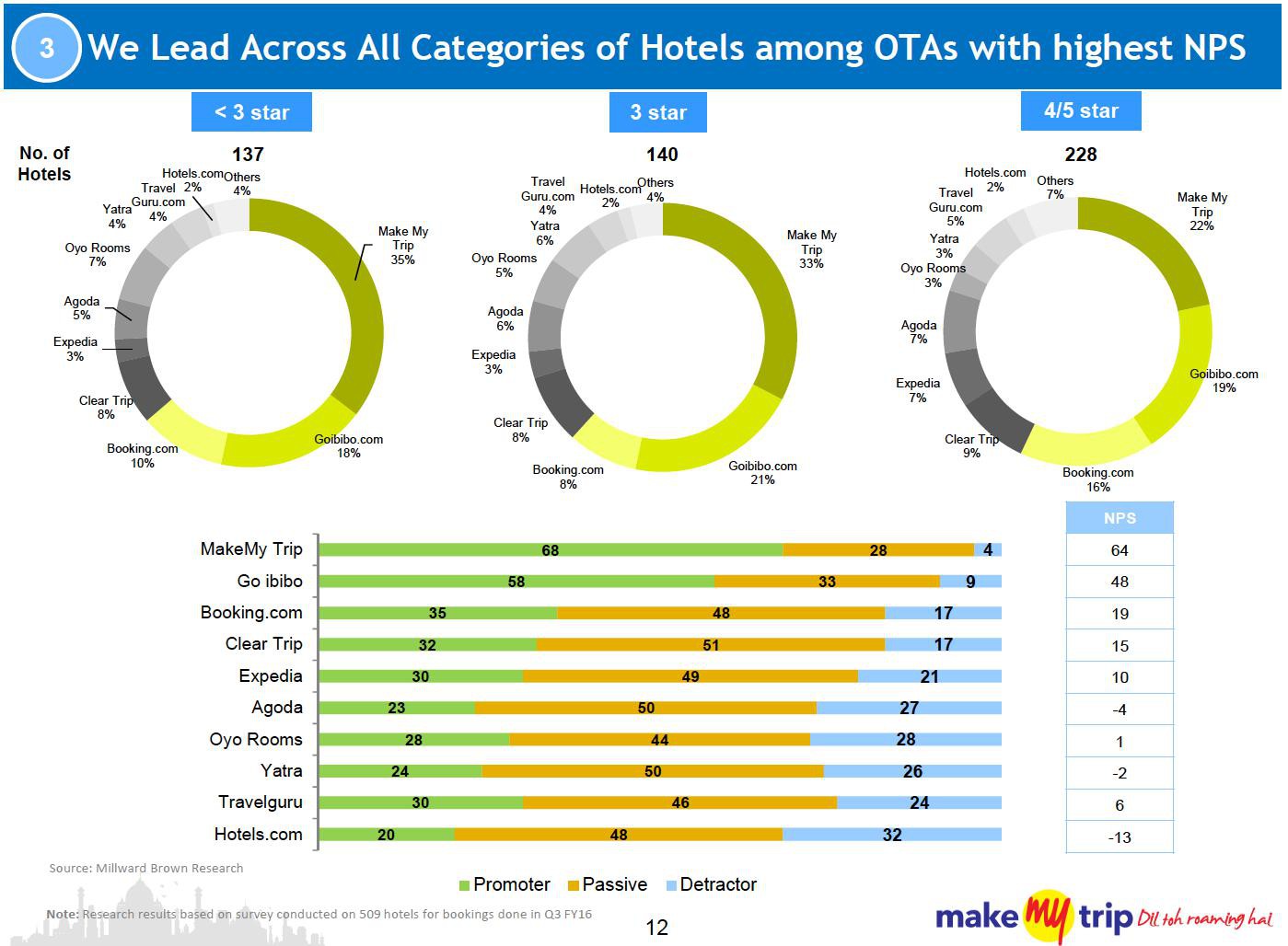

MakeMyTrip is well positioned to take advantage of this on two counts. On the call Kalra kept referring to Millward Brown stats around its market share which confirmed not only its market leading position but also the scale of its lead over its competitors.

So for domestic hotel bookings MakeMyTrip has 28% of the OTA market, 7% ahead of its nearest rival; its 51% share of the domestic market is a “significant lead” over the number two OTA; for international outbound air it has a share of nearly 50%, a 27% lead.

Karla also mentioned that its recently opened development centre in Bangalore has been working on ways to optimise the MakeMyTrip platform for users in areas of the country with low bandwidth or users with low capability devices.

Analysts on the call were persistent in asking about India’s competitive landscape in light of Yatra’s recent announcement that it had received around $100m funding as part of a reverse merger that would result in its being listed on NASDAQ alongside MakeMyTrip.

Kalra said:

“We believe that typically it’s the weaker players who will get hurt much more…We have a strong position in air and hotels but we definitely expect Yatra to up the marketing and the promo trajectory that they’ve been on, but I think it will be more other players who will be hit.”

Jul 28.2016

Indian OTA MakeMyTrip remains committed to building on its market-leading position as its Q1s reveal a double-digit lift in revenues and a triple-digit increase in sales and marketing costs.

In cash terms this equates to revenues of $121 million, up 29.4% on the same period last year; sales and marketing expenses were $52.7 million, up by 329.2%. Losses “as per IFRS” were also up – $14 million this time compared with $7 million.

Its financials for the April-June quarter said that that the increase in sales and marketing costs was “the result of significant customer inducement/acquisition programs…an increase in mobile application download and referral cost….[and] other brand advertisement expenses.”

It acknowledged that “the customer inducement/acquisition expenses are primarily incentives given to customers for accelerating growth in our standalone hotel booking business”.

And the approach appears to be working. The standout growth figures in the results are from hotels – overall online hotel bookings were up, in volume terms, by 478% compared with the same period last year; the volume of hotel bookings from mobile was up 871%.

Nearly three in four domestic hotels and 44% of domestic flights were booked on mobile in the quarter.

CEO Deep Kalra shared some more details on the earnings call with analysts. He noted that at the end of the quarter MakeMyTrip could claim 5.2m monthly active users of its app, compared with 4.2 million at the end of the previous quarter. So far the app has been downloaded more than 23 million times.

Air, generally, gets less attention than hotels in the OTA world because the margins and mark-up on beds are more compelling than seats.

MakeMyTrip however still has strong domestic and international air sales, lifting transaction volumes by 34% in the quarter. In Q1 MakeMyTrip’s net revenue margin was 10.1% – up from 7.8% last time, based on flight margins of 6.5% (up from 5.5%) and hotel and packages margins of 16.9% (up from 13.3%).

Kalra noted that this part of the business is likely to continue growing as a result of the Indian government’s recent decision to allow foreign businesses to invest up to 100% in its airlines and airports. The government will also encourage the use of underused airports in smaller town and cities.

The results of these changes is that the government expects 300 million domestic air trips to be taken in 2022 compared with 81 million in 2015.

MakeMyTrip is well positioned to take advantage of this on two counts. On the call Kalra kept referring to Millward Brown stats around its market share which confirmed not only its market leading position but also the scale of its lead over its competitors.

So for domestic hotel bookings MakeMyTrip has 28% of the OTA market, 7% ahead of its nearest rival; its 51% share of the domestic market is a “significant lead” over the number two OTA; for international outbound air it has a share of nearly 50%, a 27% lead.

Karla also mentioned that its recently opened development centre in Bangalore has been working on ways to optimise the MakeMyTrip platform for users in areas of the country with low bandwidth or users with low capability devices.

Analysts on the call were persistent in asking about India’s competitive landscape in light of Yatra’s recent announcement that it had received around $100m funding as part of a reverse merger that would result in its being listed on NASDAQ alongside MakeMyTrip.

Kalra said:

“We believe that typically it’s the weaker players who will get hurt much more…We have a strong position in air and hotels but we definitely expect Yatra to up the marketing and the promo trajectory that they’ve been on, but I think it will be more other players who will be hit.”

MakeMyTrip expands Indian business into Airbnb territory

Oct 6.2016

https://www.tnooz.com/article/makemytrip-expands-indian-busi…

India’s MakeMyTrip has launched Rightstay, a standalone brand dedicated to alternative accommodation across the country.

The inventory includes villas, apartments, home-stays and guesthouses. The website and Android app are live today with 10,000 bookable properties in 200 cities. One reason cited for the launch is that the brand will open up to Indian travellers “remote parts of the country that were earlier out of reach as conventional stay option of hotels are scarce in these regions.”

The model is familiar – hosts can register their properties and communicate with guests through the platform before booking.

And the phrasing of the release talks the talk in terms of “enabling customers to rent unique places that offer a great, authentic experience” and “connecting travelers to local hosts and building a strong community.”

Airbnb is the obvious reference point here. In an interview with Forbes India in September, its country manager Amanpreet Bajaj said that India was a strategic priority for the business, and that Airbnb was currently looking to raise awareness of the brand for domestic and outbound travel.

It has a deal with Thomas Cook India, allowing Indians to book an Airbnb package at a high street agent, and has a marketing tie-up in place with The Times Group, India’s biggest media group. Earlier this month it started working with authorities in the state of Gujarat to boost domestic and international tourism to the region.

MakeMyTrip’s rivals also have an interest in alternative accommodation – Yatra.com operates TG Stays brand, while heavily funded IbiboGroup has GoStays.

And there are some smaller players involved as well – Stayzilla has picked up some $30m in funding since its launch in 2013 and claims to have 30,000 properties on its books. Airbnb has 18,000.

MakeMyTrip wants Rightstay to have 100,000 by the end of next year.

Deepak Tuli, senior VP growth business at MakeMyTrip, is running Rightstay and has a dedicated team in place. He said in the statement that “we hope to leverage the demand, traffic and brand advantage that we have to create a unique position for ourselves in the alternate accommodation category.”

The fragmented nature of accommodation in India saw the branded budget aggregators such as OYO comes to fore a year or so ago. It now looks as if alternative accommodation is, as MakeMyTrip’s CEO India Rajesh Magow said, “the next big thing”.

Oct 6.2016

https://www.tnooz.com/article/makemytrip-expands-indian-busi…

India’s MakeMyTrip has launched Rightstay, a standalone brand dedicated to alternative accommodation across the country.

The inventory includes villas, apartments, home-stays and guesthouses. The website and Android app are live today with 10,000 bookable properties in 200 cities. One reason cited for the launch is that the brand will open up to Indian travellers “remote parts of the country that were earlier out of reach as conventional stay option of hotels are scarce in these regions.”

The model is familiar – hosts can register their properties and communicate with guests through the platform before booking.

And the phrasing of the release talks the talk in terms of “enabling customers to rent unique places that offer a great, authentic experience” and “connecting travelers to local hosts and building a strong community.”

Airbnb is the obvious reference point here. In an interview with Forbes India in September, its country manager Amanpreet Bajaj said that India was a strategic priority for the business, and that Airbnb was currently looking to raise awareness of the brand for domestic and outbound travel.

It has a deal with Thomas Cook India, allowing Indians to book an Airbnb package at a high street agent, and has a marketing tie-up in place with The Times Group, India’s biggest media group. Earlier this month it started working with authorities in the state of Gujarat to boost domestic and international tourism to the region.

MakeMyTrip’s rivals also have an interest in alternative accommodation – Yatra.com operates TG Stays brand, while heavily funded IbiboGroup has GoStays.

And there are some smaller players involved as well – Stayzilla has picked up some $30m in funding since its launch in 2013 and claims to have 30,000 properties on its books. Airbnb has 18,000.

MakeMyTrip wants Rightstay to have 100,000 by the end of next year.

Deepak Tuli, senior VP growth business at MakeMyTrip, is running Rightstay and has a dedicated team in place. He said in the statement that “we hope to leverage the demand, traffic and brand advantage that we have to create a unique position for ourselves in the alternate accommodation category.”

The fragmented nature of accommodation in India saw the branded budget aggregators such as OYO comes to fore a year or so ago. It now looks as if alternative accommodation is, as MakeMyTrip’s CEO India Rajesh Magow said, “the next big thing”.

MakeMyTrip will keep growing with Ibibo on board

Oct 28.2016

MakeMyTrip’s merger with Ibibo Group means that profitability is “closer now than before,” but growth still dominates the corporate agenda.

Deep Kalra, group chairman and CEO, told analysts on this week’s earnings call:

“I don’t think we’re in the space where we’re going to give a premium right now to turning profitable over growth. Growth remains our top-most priority, especially in hotels and if we keep seeing growth coming in like we have reported we are not in the mindset to stop that.”

The transaction is due to complete at the end of the year. Synergies will come quickly after completion, he said.

In the July-to-September quarter, its standalone domestic hotel business performed strongly, with MakeMyTrip now having a market-leading share of 27% of India’s online bookings. Kalra was keen to point out that there is a massive tailwind here, as currently only between 12-15% of hotels are booked online.

So in the quarter — which is traditionally India’s quietest period for travel — hotel transactions were up by 293%, at nearly 1.4m, of which more than one million were made by mobile, a 453% increase on the same period last year.

The mobile landscape generally is, Kalra noted, another tailwind for its business, with 4G now being rolled out across India in conjunction with better pricing for data access. MakeMyTrip’s cumulative downloads of its apps is now 27.5 million, 4.5 million more than at the end of March. Active monthly users are also up to 5.4 million.

Some analysts were interested in international hotels, with Kalra admitting that its international hotels business was “still small.” However, it has targeted 20 key overseas cities, popular with Indian travellers, to focus on, as it looks to build this business line.

A few weeks before the Ibibo announcement, MakeMyTrip launched Rightstay, a new brand focussed on alternative accommodations. Kalra told analysts that this would be “a large growth driver for years to come” and that it already has 9,000 bookable properties available.

He added that RightStay had been launched as an app-only business but was now also available on desktop. He admitted that it is currently getting only 100 bookings a day but was improving all the time.

Another analyst asked for an update on easytobook.com, the Amsterdam-based hotel booking site it bought for a reported $5 million at the start of 2014 before moving a lot of its operations back to India at the end of 2015.

The response was that easytobook is “not material” in terms of MakeMyTrip’s overall hotel business.

Despite the focus on hotels, air is still a big part of MakeMyTrip’s business. Its domestic air bookings were up 35%, year-on-year, compared with the overall market growth of 24%. And 49% of its domestic flight bookings are made on mobile.

Overall, revenues for the three months to end-Sept came in at $83.1 million, up from $65.5 million a year earlier. Its net loss came in a $39.4 million, compared with $12.2 million — mainly due to the sales and marketing costs associated with growing the business. It spent $48.4 million in the quarter compared with $14.8 million last time.

Oct 28.2016

MakeMyTrip’s merger with Ibibo Group means that profitability is “closer now than before,” but growth still dominates the corporate agenda.

Deep Kalra, group chairman and CEO, told analysts on this week’s earnings call:

“I don’t think we’re in the space where we’re going to give a premium right now to turning profitable over growth. Growth remains our top-most priority, especially in hotels and if we keep seeing growth coming in like we have reported we are not in the mindset to stop that.”

The transaction is due to complete at the end of the year. Synergies will come quickly after completion, he said.

In the July-to-September quarter, its standalone domestic hotel business performed strongly, with MakeMyTrip now having a market-leading share of 27% of India’s online bookings. Kalra was keen to point out that there is a massive tailwind here, as currently only between 12-15% of hotels are booked online.

So in the quarter — which is traditionally India’s quietest period for travel — hotel transactions were up by 293%, at nearly 1.4m, of which more than one million were made by mobile, a 453% increase on the same period last year.

The mobile landscape generally is, Kalra noted, another tailwind for its business, with 4G now being rolled out across India in conjunction with better pricing for data access. MakeMyTrip’s cumulative downloads of its apps is now 27.5 million, 4.5 million more than at the end of March. Active monthly users are also up to 5.4 million.

Some analysts were interested in international hotels, with Kalra admitting that its international hotels business was “still small.” However, it has targeted 20 key overseas cities, popular with Indian travellers, to focus on, as it looks to build this business line.

A few weeks before the Ibibo announcement, MakeMyTrip launched Rightstay, a new brand focussed on alternative accommodations. Kalra told analysts that this would be “a large growth driver for years to come” and that it already has 9,000 bookable properties available.

He added that RightStay had been launched as an app-only business but was now also available on desktop. He admitted that it is currently getting only 100 bookings a day but was improving all the time.

Another analyst asked for an update on easytobook.com, the Amsterdam-based hotel booking site it bought for a reported $5 million at the start of 2014 before moving a lot of its operations back to India at the end of 2015.

The response was that easytobook is “not material” in terms of MakeMyTrip’s overall hotel business.

Despite the focus on hotels, air is still a big part of MakeMyTrip’s business. Its domestic air bookings were up 35%, year-on-year, compared with the overall market growth of 24%. And 49% of its domestic flight bookings are made on mobile.

Overall, revenues for the three months to end-Sept came in at $83.1 million, up from $65.5 million a year earlier. Its net loss came in a $39.4 million, compared with $12.2 million — mainly due to the sales and marketing costs associated with growing the business. It spent $48.4 million in the quarter compared with $14.8 million last time.

Antwort auf Beitrag Nr.: 53.575.710 von R-BgO am 28.10.16 16:34:29MakeMyTrip Limited and ibibo Group Announce Transaction to Consolidate their Indian Travel Businesses

NEW DELHI & NEW YORK & CAPE TOWN, South Africa--(BUSINESS WIRE)--Oct. 18, 2016--

Two leading travel groups in India, MakeMyTrip Limited (NASDAQ:MMYT) and ibibo Group (owned by global technology group Naspers Limited (JSE: NPN.SJ and LSE: NPSN)), have agreed to pursue a transaction that will combine the two businesses under MMYT, creating one of the leading travel groups in India that provides a one-stop shop for all Indian travellers and serves as a critical partner for travel industry suppliers.

The combination will bring together a bouquet of leading consumer travel brands, including MakeMyTrip, goibibo, redBus, Ryde and Rightstay, which together processed 34.1 mm transactions during FY2016.

The transaction is expected to unlock value for customers, supply partners and shareholders, by combining the complementary strengths of each business. MakeMyTrip brings its strong brand, robust mix of domestic and outbound hotels and packages business and strong position in the air ticketing business. ibibo Group, via its brand goibibo and redBus, comes with a strong presence in various fast growing travel segments including hotels, bus bookings and air ticketing.

Following the closing of the proposed transaction, Founder Deep Kalra will remain Group CEO and Executive Chairman of MakeMyTrip and Co-founder Rajesh Magow will continue to remain CEO India of MakeMyTrip. Founder and CEO of ibibo Group, Ashish Kashyap, will join MakeMyTrip's executive team as a Co-founder and President of the organization.

Deep Kalra, Chairman and Group CEO of MakeMyTrip, said: "Today's announcement is a significant step forward for the rapidly growing travel industry in India. We expect this deal to create an even more scalable business with the expertise to transform the booking experience for Indian travellers. I am delighted to be leading such a strong team in our next chapter of high-growth in this dynamic industry."

Rajesh Magow, co-founder and CEO India of MakeMyTrip added: "We welcome the ibibo team to the newly expanded MakeMyTrip family. The combination of these two enterprises, with their deep understanding of customer preferences, will help us provide an even stronger value proposition to our users and offer further career growth opportunities for all employees"

Ashish Kashyap, CEO ibibo Group, said: "Since I founded ibibo in 2007, we have innovated and grown to become one of the leading travel companies in India, providing solutions not just for travellers, but for suppliers too. Deep, Rajesh and I saw a great opportunity to join forces, and I am excited that this merger enables all of us to continue a great journey together as the leading travel group in India."

According to Bob van Dijk, CEO Naspers: "India is a key market for Naspers, and this deal reinforces our commitment to the country. ibibo and MakeMyTrip have built leading companies through their innovative use of technology to create exceptional experiences for people traveling throughout India and, increasingly, beyond. Today's announcement underlines the continued ambition of Deep, Rajesh and Ashish and their teams, and I look forward to seeing the future success of this new and even stronger business."

Naspers and Tencent, through their jointly owned holding company (91% owned by Naspers and 9% owned by Tencent), are selling ibibo Group to MakeMyTrip in exchange for an issuance of new shares by MakeMyTrip. Upon closing of the transaction, MakeMyTrip will own 100% of ibibo Group. Naspers and Tencent will become the single largest shareholder in MakeMyTrip, owning a 40% stake, and will contribute proportionate working capital upon closing.

Additionally, prior to closing , the US$180 million, 5-year convertible notes issued by MakeMyTrip Limited to Ctrip.com International, Ltd. ("Ctrip") (NASDAQ: CTRP) in January 2016 will also be converted into common equity, resulting in Ctrip having an approximately 10% stake in the combined entity.

The transaction is expected to close by the end of December 2016 and is subject to approval by MakeMyTrip shareholders and regulatory approvals.

NEW DELHI & NEW YORK & CAPE TOWN, South Africa--(BUSINESS WIRE)--Oct. 18, 2016--

Two leading travel groups in India, MakeMyTrip Limited (NASDAQ:MMYT) and ibibo Group (owned by global technology group Naspers Limited (JSE: NPN.SJ and LSE: NPSN)), have agreed to pursue a transaction that will combine the two businesses under MMYT, creating one of the leading travel groups in India that provides a one-stop shop for all Indian travellers and serves as a critical partner for travel industry suppliers.

The combination will bring together a bouquet of leading consumer travel brands, including MakeMyTrip, goibibo, redBus, Ryde and Rightstay, which together processed 34.1 mm transactions during FY2016.

The transaction is expected to unlock value for customers, supply partners and shareholders, by combining the complementary strengths of each business. MakeMyTrip brings its strong brand, robust mix of domestic and outbound hotels and packages business and strong position in the air ticketing business. ibibo Group, via its brand goibibo and redBus, comes with a strong presence in various fast growing travel segments including hotels, bus bookings and air ticketing.

Following the closing of the proposed transaction, Founder Deep Kalra will remain Group CEO and Executive Chairman of MakeMyTrip and Co-founder Rajesh Magow will continue to remain CEO India of MakeMyTrip. Founder and CEO of ibibo Group, Ashish Kashyap, will join MakeMyTrip's executive team as a Co-founder and President of the organization.

Deep Kalra, Chairman and Group CEO of MakeMyTrip, said: "Today's announcement is a significant step forward for the rapidly growing travel industry in India. We expect this deal to create an even more scalable business with the expertise to transform the booking experience for Indian travellers. I am delighted to be leading such a strong team in our next chapter of high-growth in this dynamic industry."

Rajesh Magow, co-founder and CEO India of MakeMyTrip added: "We welcome the ibibo team to the newly expanded MakeMyTrip family. The combination of these two enterprises, with their deep understanding of customer preferences, will help us provide an even stronger value proposition to our users and offer further career growth opportunities for all employees"

Ashish Kashyap, CEO ibibo Group, said: "Since I founded ibibo in 2007, we have innovated and grown to become one of the leading travel companies in India, providing solutions not just for travellers, but for suppliers too. Deep, Rajesh and I saw a great opportunity to join forces, and I am excited that this merger enables all of us to continue a great journey together as the leading travel group in India."

According to Bob van Dijk, CEO Naspers: "India is a key market for Naspers, and this deal reinforces our commitment to the country. ibibo and MakeMyTrip have built leading companies through their innovative use of technology to create exceptional experiences for people traveling throughout India and, increasingly, beyond. Today's announcement underlines the continued ambition of Deep, Rajesh and Ashish and their teams, and I look forward to seeing the future success of this new and even stronger business."

Naspers and Tencent, through their jointly owned holding company (91% owned by Naspers and 9% owned by Tencent), are selling ibibo Group to MakeMyTrip in exchange for an issuance of new shares by MakeMyTrip. Upon closing of the transaction, MakeMyTrip will own 100% of ibibo Group. Naspers and Tencent will become the single largest shareholder in MakeMyTrip, owning a 40% stake, and will contribute proportionate working capital upon closing.

Additionally, prior to closing , the US$180 million, 5-year convertible notes issued by MakeMyTrip Limited to Ctrip.com International, Ltd. ("Ctrip") (NASDAQ: CTRP) in January 2016 will also be converted into common equity, resulting in Ctrip having an approximately 10% stake in the combined entity.

The transaction is expected to close by the end of December 2016 and is subject to approval by MakeMyTrip shareholders and regulatory approvals.

Antwort auf Beitrag Nr.: 53.579.550 von R-BgO am 29.10.16 09:23:21

trotz mehrfachem Aufstocken ist es ein sehr überschaubarer Betrag und die Aktie finde ich nun extrem teuer.

Natürlich muss man erstmal die Bilanz sehen, nachdem die ganzen Neuigkeiten verarbeitet sind, u.a. die Wandlung wird das EK gewaltig stärken.

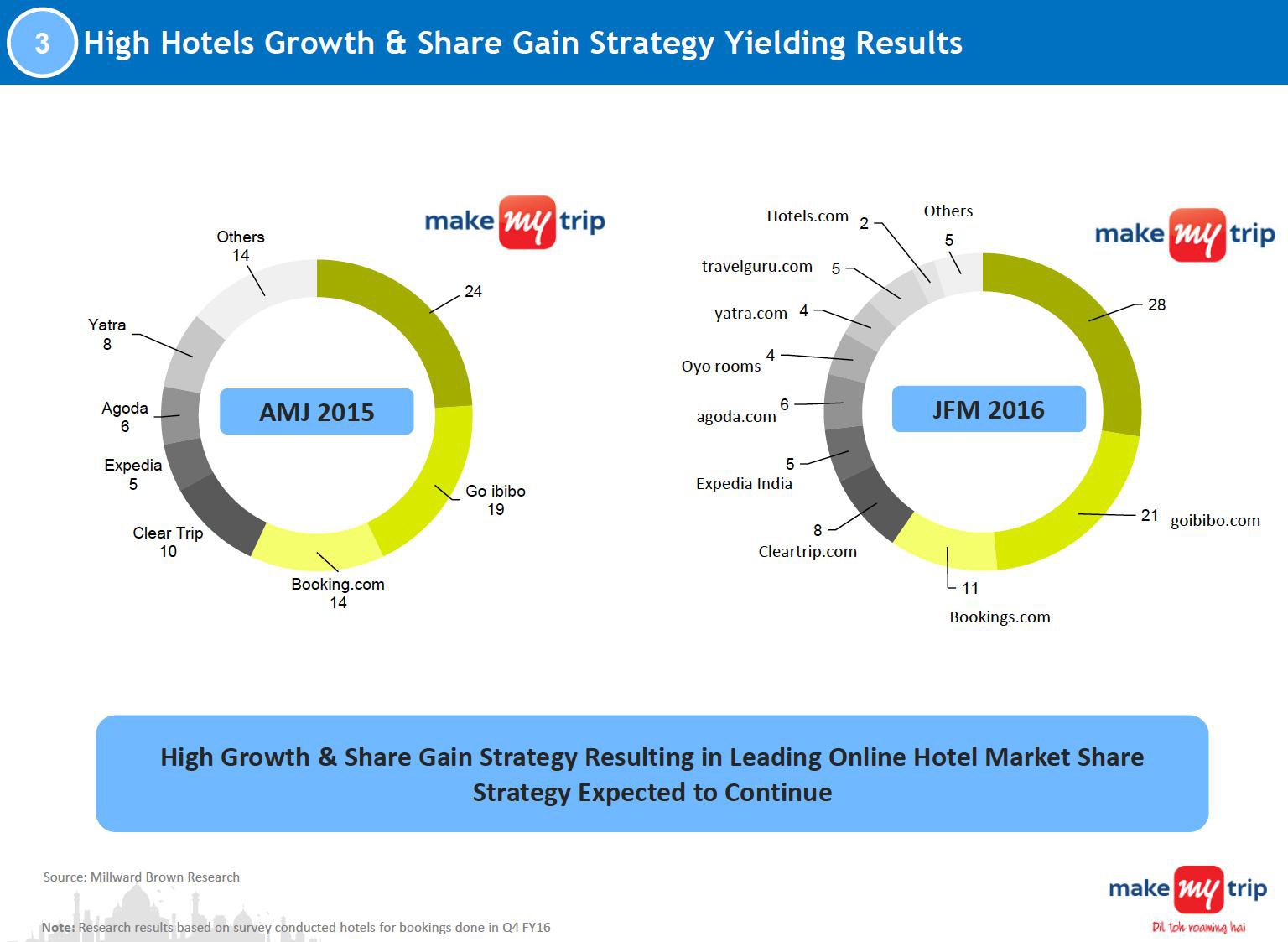

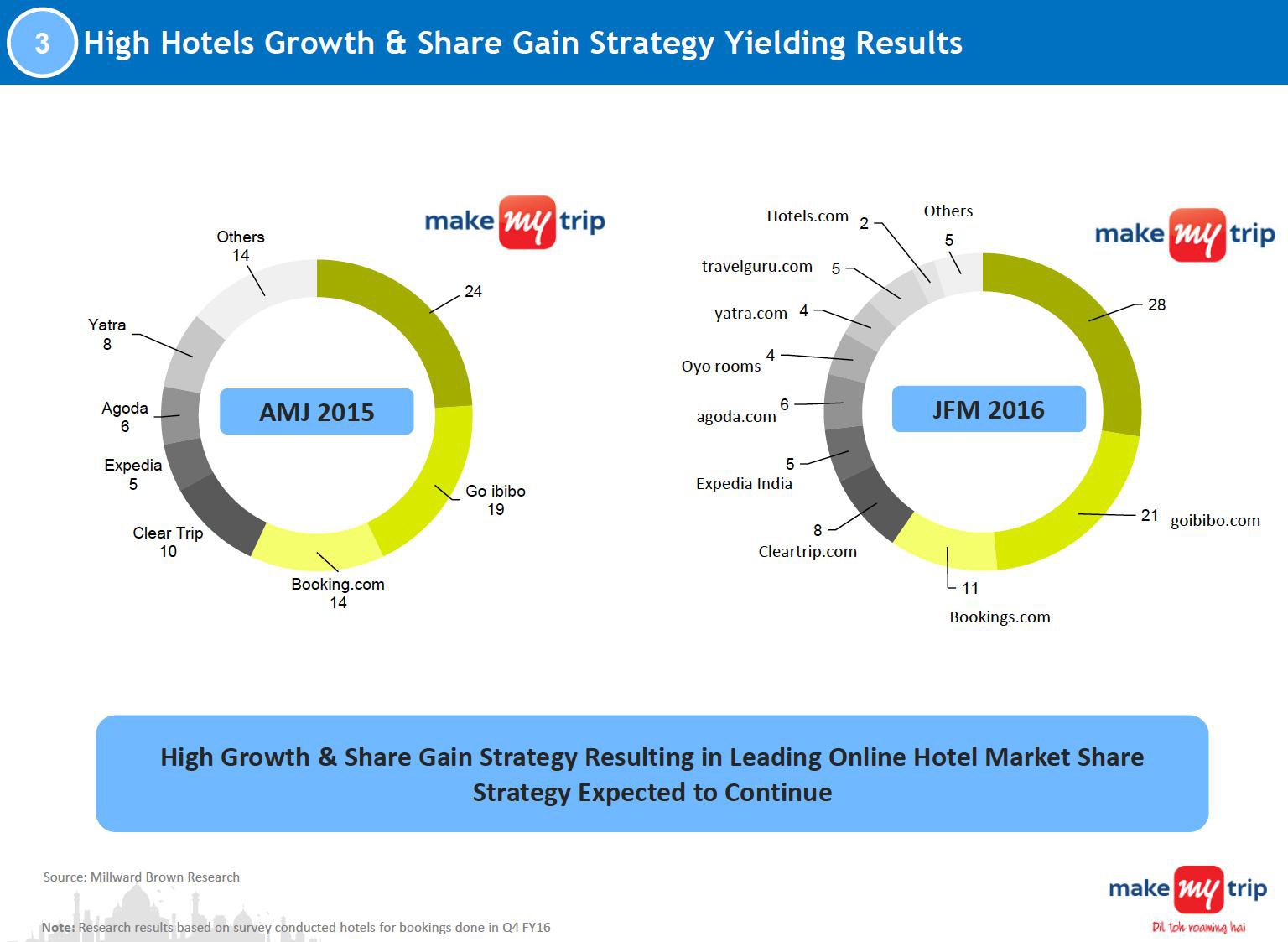

Auch marktseitig sieht das schon recht beeindruckend aus (aus der Präsi vom Sep, mal sehen wie schnell booking.com aufholt, wenn überhaupt):

Und auch vom absoluten Volumen her ist man schon mehr als ein Fliegenschoß: 34,1 Mio. Transaktionen in FY16 entsprechen (Achtung: Milchmädchenvergleich!) bei 1,1 Mio. room nights per day von booking.com immerhin schon mehr als einem Zwölftel von booking.

Market-cap NACH Merger würde ich ganz grob auf 2,0-2,5 Mrd. USD schätzen (derzeit rund 1,2 x 100/60 = 2 plus Wandlung).

=> es gibt also sicher noch Luft nach oben

Zwischenfazit:

bleibe dabei, aber Aufstocken muss ich mir noch gut überlegen

die Meldung war der Börse +46% an einem Tag wert...

und jetzt beißt mich mein konservatives Positionsgrößenmanagement:trotz mehrfachem Aufstocken ist es ein sehr überschaubarer Betrag und die Aktie finde ich nun extrem teuer.

Natürlich muss man erstmal die Bilanz sehen, nachdem die ganzen Neuigkeiten verarbeitet sind, u.a. die Wandlung wird das EK gewaltig stärken.

Auch marktseitig sieht das schon recht beeindruckend aus (aus der Präsi vom Sep, mal sehen wie schnell booking.com aufholt, wenn überhaupt):

Und auch vom absoluten Volumen her ist man schon mehr als ein Fliegenschoß: 34,1 Mio. Transaktionen in FY16 entsprechen (Achtung: Milchmädchenvergleich!) bei 1,1 Mio. room nights per day von booking.com immerhin schon mehr als einem Zwölftel von booking.

Market-cap NACH Merger würde ich ganz grob auf 2,0-2,5 Mrd. USD schätzen (derzeit rund 1,2 x 100/60 = 2 plus Wandlung).

=> es gibt also sicher noch Luft nach oben

Zwischenfazit:

bleibe dabei, aber Aufstocken muss ich mir noch gut überlegen

Antwort auf Beitrag Nr.: 53.579.634 von R-BgO am 29.10.16 09:45:56

Auszüge:

The regulatory approval will be from the Competition Commission of India. This will be interesting, because these are effectively the two largest OTA’s in India, especially when it comes to air travel. They’ll have to file for approval with the CCI within 30 days. “We’ll do it well within that time. It takes a month plus to get the go-ahead from CCI, and it could be longer depending upon on whether they have any more queries. That’s why budgeted for end of December for the transaction to close”.

Cautious about marketshare disclosures:

“Overall marketshare is unlikely to be material when it comes to bus and hotels, and the combined entity will be single digits in terms of marketshare. In case of air, we should be in the 20% mark.”

“We’ve had around 16% of the domestic flight market for MakeMyTrip. We haven’t gone down to looking at DGCA data overall and trying to calculate combined share.” (Editor: this last bit is hard to believe)

Combined entity:

34.1 million total transactions in FY16

9.7 million air transactions in FY16

6.6 million hotel transactions in FY16

17.5 million bus transactions.

45% transactions on mobile.

4 million total India transactions on mobile

3.2 million total air transactions on mobile

a additional background from SKIFT:

https://skift.com/2016/10/18/the-details-behind-the-merger-o…Auszüge:

The regulatory approval will be from the Competition Commission of India. This will be interesting, because these are effectively the two largest OTA’s in India, especially when it comes to air travel. They’ll have to file for approval with the CCI within 30 days. “We’ll do it well within that time. It takes a month plus to get the go-ahead from CCI, and it could be longer depending upon on whether they have any more queries. That’s why budgeted for end of December for the transaction to close”.

Cautious about marketshare disclosures:

“Overall marketshare is unlikely to be material when it comes to bus and hotels, and the combined entity will be single digits in terms of marketshare. In case of air, we should be in the 20% mark.”

“We’ve had around 16% of the domestic flight market for MakeMyTrip. We haven’t gone down to looking at DGCA data overall and trying to calculate combined share.” (Editor: this last bit is hard to believe)

Combined entity:

34.1 million total transactions in FY16

9.7 million air transactions in FY16

6.6 million hotel transactions in FY16

17.5 million bus transactions.

45% transactions on mobile.

4 million total India transactions on mobile

3.2 million total air transactions on mobile

MakeMyTrip sees Ibibo as key to capturing offline-to-online shift

Nov 17.2016

https://www.tnooz.com/article/makemytrip-sees-ibibo-as-key-t…

MakeMyTrip co-founder and India CEO Rajesh Magow believes that its recent merger with Ibibo Group will create a business capable of dominating all aspects of the Indian online travel market.

The deal structure left many in the market confused – MakeMyTrip owns 60% of the combined business (which gives Ctrip a 10% in the business). Ibibo Group’s was 91% owned by South Africa’s Naspers and 9% by China’s Tencent and has 40% of the combined business.

Magow, speaking on the sidelines of the Phocuswright Conference in Los Angeles, told Tnooz that “in every aspect, on a people and business level, this is a merger, not an acquisition.”

“The conversations were all forward-looking, all about where we can take the combined business, the new growth opportunities that we can tap into through the brands we now control,” he said.

MakeMyTrip is leading the group as India’s already dominant full-service online travel agency. But Magow noted a range of opportunities across the combined portfolio.

“We saw that Ibibo was growing its hotel volumes significantly, in the three/two star sector, whereas we are more four/five star hotels and packages. We liked the fact that it is an agile business, with no legacy code getting in the way,” he said.

He also noted that Ibibo’s RedBus business was “a distinct asset” and was excited around the potential of its interstate cab brand Ryde.

These three businesses will help MakeMyTrip attract new customers. “With Ibibo we can capture the shift in consumer behaviour which is being led by the smartphone. It’s not about moving existing online customers around the brands, it’s about moving offline customers to online,” he said.

Magow re-iterated that every vertical the combined business operates in has massive headroom for online growth, with the possible exception of domestic air where 50% of the market is already online. Hotels for example are “underpenetrated” running at 13/14% online penetration.

And the market dynamics are in its favour. “In India today, there are 330 million internet users, 250 million of whom access it via a smartphone. By 2020 there will 730 million people online with 700 million smartphones.”

A few weeks before the Ibibo merger, MakeMyTrip launched RightStay, an alternative accommodation brand which operates very much in the Airbnb space.

“This is very much an investment for the future,” Magow insisted. “There’s enough immediate potential in the organised hotel space, but we do think that consumer behaviour will change and when that change happens we want to be ready in the market with the technology and the supply.”

He expects RightStay to take “two to three years” before it starts making a material contribution to the combined business.

Another element Ibibo brings to the party is its expertise in digital wallets. While only 25 million Indians have credit card, there are 250 million debit card holders which help feed into an incredibly dynamic digital wallet ecosystem, all of which then make transacting via mobile or apps simple and secure.

“The idea that online has a limit because of the lack of credit cards is wrong, because digital payments generally are well established and accepted,” Magow said.

Together, MakeMyTrip and Ibibo want to become the one-stop shop for Indian domestic and outbound travel “so we are more like Ctrip than booking.com.”

The idea of MakeMyTrip becoming an Indian Ctrip, in which Ctrip owns a stake, is an ambitious aim, helped out by Ctrip-esque merger of a big, heavily funded rival. “Naspers is a deep-pocketed investor, so it’s good that we now have them on our side.”

Nov 17.2016

https://www.tnooz.com/article/makemytrip-sees-ibibo-as-key-t…

MakeMyTrip co-founder and India CEO Rajesh Magow believes that its recent merger with Ibibo Group will create a business capable of dominating all aspects of the Indian online travel market.

The deal structure left many in the market confused – MakeMyTrip owns 60% of the combined business (which gives Ctrip a 10% in the business). Ibibo Group’s was 91% owned by South Africa’s Naspers and 9% by China’s Tencent and has 40% of the combined business.

Magow, speaking on the sidelines of the Phocuswright Conference in Los Angeles, told Tnooz that “in every aspect, on a people and business level, this is a merger, not an acquisition.”

“The conversations were all forward-looking, all about where we can take the combined business, the new growth opportunities that we can tap into through the brands we now control,” he said.

MakeMyTrip is leading the group as India’s already dominant full-service online travel agency. But Magow noted a range of opportunities across the combined portfolio.

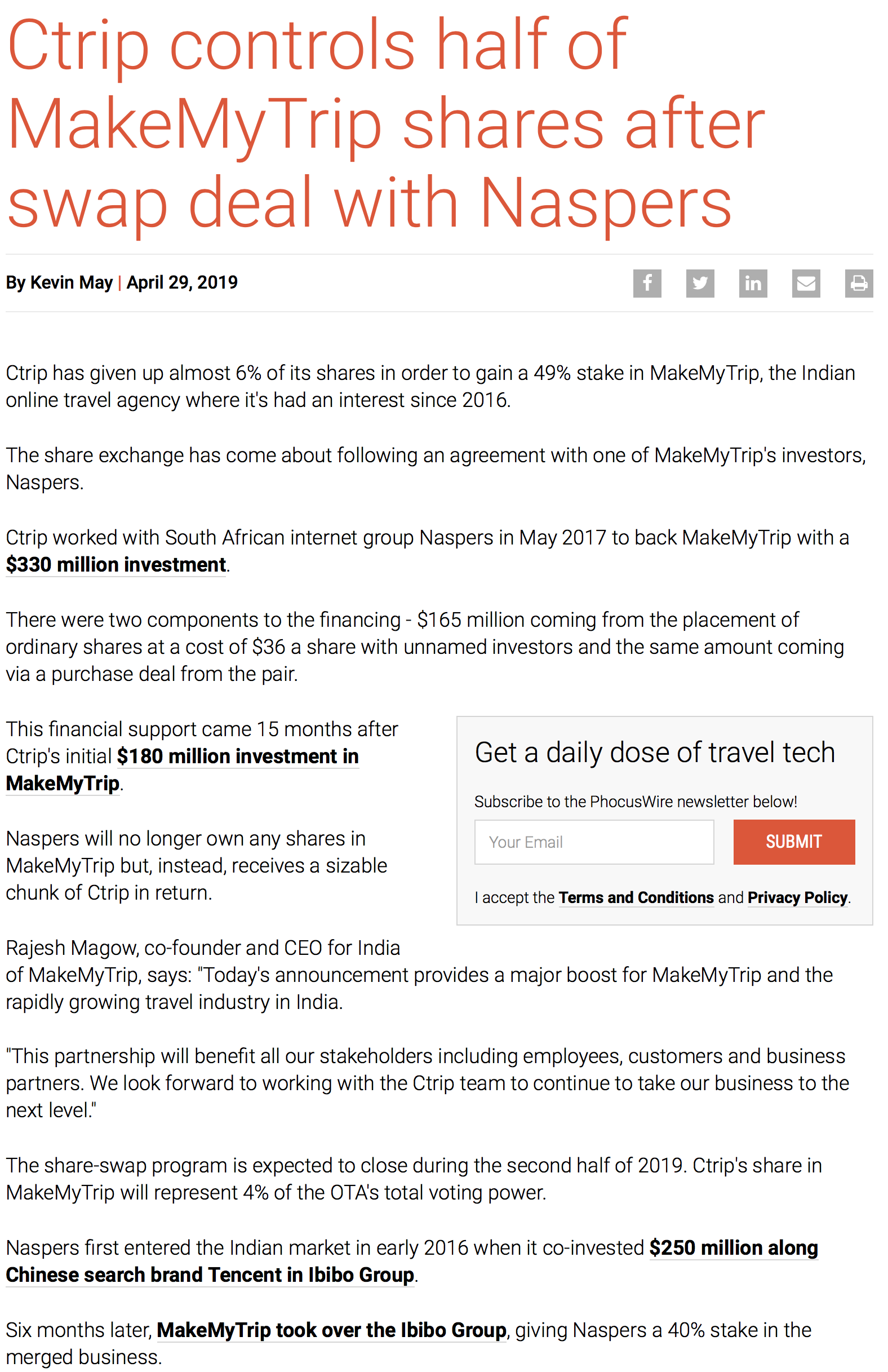

“We saw that Ibibo was growing its hotel volumes significantly, in the three/two star sector, whereas we are more four/five star hotels and packages. We liked the fact that it is an agile business, with no legacy code getting in the way,” he said.