WKN 909038 Golden Phoenix: Und sie lebt wieder !! 100% Chance..... - 500 Beiträge pro Seite

eröffnet am 23.10.10 00:22:54 von

neuester Beitrag 13.05.12 01:27:53 von

neuester Beitrag 13.05.12 01:27:53 von

Beiträge: 107

ID: 1.160.680

ID: 1.160.680

Aufrufe heute: 0

Gesamt: 3.195

Gesamt: 3.195

Aktive User: 0

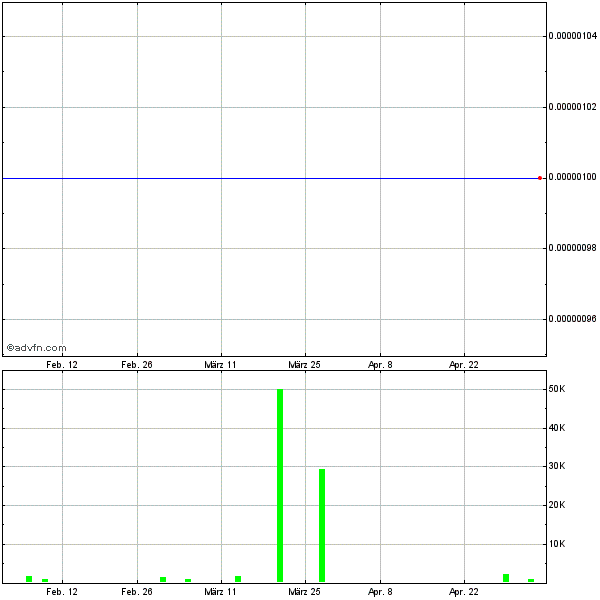

ISIN: US3811491030 · WKN: 909038 · Symbol: GPXM

0,0000

USD

0,00 %

0,0000 USD

Letzter Kurs 28.03.24 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 | |

| 0,5500 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7145 | -8,92 | |

| 2,1800 | -9,17 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 | |

| 46,74 | -98,00 |

Das Mangement hat vor kurzem angekündigt bis zu 20% der eigenen Aktien innerhalb von 12 Monaten zurück zu kaufen. (siehe auch www.finanznachrichten.de WKN 909038)

Mittlerweile kann man sagen, dass diese Nachricht gut angekommen ist: Satte 100% plus in den letzen Wochen ! (und das ohne das die 44 Mio Shares aus dem Aktienrückkauf schon über den Tisch gegangen wären !!)

Mein Gefühl sagt mir aber, dass hier noch mehr dahinter steckt...

Dass neue Geschäftsmodell (Beiteiligungen an vielversprechenden Rohstoff-Explorern kaufen / aufbauen) scheint sehr gut Anklang bei den Aktionären zu finden und für richtig Fantasie zu sorgen, Fazit: Neues Jahreshoch knapp unter 0,1 US.....

Beim 5 Jahreschart hellt sich das Bild immer mehr auf, und wenn die 0,1 US fallen scheinen die 0,2 US nur

noch Formsache zu sein.....

Mein Kursziel für dien nächsten 3-6 Monate: mind. 0,2 Euro....

gruß

massel

Mittlerweile kann man sagen, dass diese Nachricht gut angekommen ist: Satte 100% plus in den letzen Wochen ! (und das ohne das die 44 Mio Shares aus dem Aktienrückkauf schon über den Tisch gegangen wären !!)

Mein Gefühl sagt mir aber, dass hier noch mehr dahinter steckt...

Dass neue Geschäftsmodell (Beiteiligungen an vielversprechenden Rohstoff-Explorern kaufen / aufbauen) scheint sehr gut Anklang bei den Aktionären zu finden und für richtig Fantasie zu sorgen, Fazit: Neues Jahreshoch knapp unter 0,1 US.....

Beim 5 Jahreschart hellt sich das Bild immer mehr auf, und wenn die 0,1 US fallen scheinen die 0,2 US nur

noch Formsache zu sein.....

Mein Kursziel für dien nächsten 3-6 Monate: mind. 0,2 Euro....

gruß

massel

Antwort auf Beitrag Nr.: 40.377.631 von Massel am 23.10.10 00:22:54Stand 30.06.10:

5,3 Mio Cash&Short Term Invest.

3,75 Mio Short Term Verbindlichkeiten

= 1,55 Mio Working Capital

Lt deinen Angaben sollen 44 Mio AKtien zurückgekauft werden, das entspräche beim aktuellen Kurs einem Gegenwert von 4,1 Mio Dollar. Daraus resultieren zwei Fragen:

- von welchem Geld soll der Aktienrückkauf finanziert werden?

- von welchem Geld soll (danach/parallel) das angebliche neue Geschäftsmodell finanziert werden?

Den Sinn, bei knappen finanziellen Ressourcen ein derartiges Aktienrückkaufprogramm aufzulegen, erfrage ich schon gar nicht.

5,3 Mio Cash&Short Term Invest.

3,75 Mio Short Term Verbindlichkeiten

= 1,55 Mio Working Capital

Lt deinen Angaben sollen 44 Mio AKtien zurückgekauft werden, das entspräche beim aktuellen Kurs einem Gegenwert von 4,1 Mio Dollar. Daraus resultieren zwei Fragen:

- von welchem Geld soll der Aktienrückkauf finanziert werden?

- von welchem Geld soll (danach/parallel) das angebliche neue Geschäftsmodell finanziert werden?

Den Sinn, bei knappen finanziellen Ressourcen ein derartiges Aktienrückkaufprogramm aufzulegen, erfrage ich schon gar nicht.

Antwort auf Beitrag Nr.: 40.377.927 von MFC500 am 23.10.10 09:27:21Ich bin da auch noch am recherchieren...

Hier die Meldung zum Aktienrückkauf:

http://www.finanznachrichten.de/nachrichten-2010-09/18084536…

...."Board of Directors has approved the repurchase of an aggregate of up to 20% of its outstanding Common Stock, effective immediately.

"Based on current market prices, we believe the repurchase program is in the best interests of our shareholders," stated Tom Klein, CEO of Golden Phoenix.

The repurchases will be made from time to time on the open market at prevailing market prices or in negotiated transactions off the market. The repurchase program is expected to continue over the next twelve (12) months unless extended or shortened by the Board of Directors".....

...............

Zu deinen Fragen:

Golden Phoenix war mal Moly-Producer, hat dann aber diesen Zweig (damalig zu tiefer Moly-Preis) an seinen Partner verkauft. Zahlungen sollen in Raten erfolgen:

...."The operations of the Ashdown LLC historically funded a portion of the Company’s operating costs and expenses. On May 13, 2009, the Company completed an agreement to sell 100% of its ownership interest in the Ashdown LLC to Win-Eldrich Gold, Inc. (“WEG”). The $5.3 million purchase price due the Company in the form of a secured promissory note was initially payable over a 72 month term".....

(http://www.sec.gov/Archives/edgar/data/1042784/0001096906100…

Hier kommt also anscheinend ein Teil des Geldes her...

Vielleicht geht das Management schon davon aus kurzfristig neue Einnahmequellen zu bekommen,

dafür müsste man sich mal den Stand der Dinge bei den jeweiligen Projekten anschauen....(werde ich in den nächsten Tage mal machen..)

Der Newsflow stimmt zumindest mal:

http://www.golden-phoenix.com/pr/GPXMPR102210SG.pdf

Auch interessantes Indiz:

http://www.sec.gov/Archives/edgar/data/1042784/0001140361100…

Gruß

massel

Hier die Meldung zum Aktienrückkauf:

http://www.finanznachrichten.de/nachrichten-2010-09/18084536…

...."Board of Directors has approved the repurchase of an aggregate of up to 20% of its outstanding Common Stock, effective immediately.

"Based on current market prices, we believe the repurchase program is in the best interests of our shareholders," stated Tom Klein, CEO of Golden Phoenix.

The repurchases will be made from time to time on the open market at prevailing market prices or in negotiated transactions off the market. The repurchase program is expected to continue over the next twelve (12) months unless extended or shortened by the Board of Directors".....

...............

Zu deinen Fragen:

Golden Phoenix war mal Moly-Producer, hat dann aber diesen Zweig (damalig zu tiefer Moly-Preis) an seinen Partner verkauft. Zahlungen sollen in Raten erfolgen:

...."The operations of the Ashdown LLC historically funded a portion of the Company’s operating costs and expenses. On May 13, 2009, the Company completed an agreement to sell 100% of its ownership interest in the Ashdown LLC to Win-Eldrich Gold, Inc. (“WEG”). The $5.3 million purchase price due the Company in the form of a secured promissory note was initially payable over a 72 month term".....

(http://www.sec.gov/Archives/edgar/data/1042784/0001096906100…

Hier kommt also anscheinend ein Teil des Geldes her...

Vielleicht geht das Management schon davon aus kurzfristig neue Einnahmequellen zu bekommen,

dafür müsste man sich mal den Stand der Dinge bei den jeweiligen Projekten anschauen....(werde ich in den nächsten Tage mal machen..)

Der Newsflow stimmt zumindest mal:

http://www.golden-phoenix.com/pr/GPXMPR102210SG.pdf

Auch interessantes Indiz:

http://www.sec.gov/Archives/edgar/data/1042784/0001140361100…

Gruß

massel

Antwort auf Beitrag Nr.: 40.377.927 von MFC500 am 23.10.10 09:27:21"Den Sinn, bei knappen finanziellen Ressourcen ein derartiges Aktienrückkaufprogramm aufzulegen, erfrage ich schon gar nicht. "

Wie gesagt, momentan sagt mir mein Bauchgefühl, dass sich hier was abzeichnet...

Das Phoenix-Mangement war schon immer sehr transparent und Aktionärs freundlich eingestellt.

So konnte man zu den Zeiten als Phoenix noch Moly-Produzent war auch ohne weiteres

die Produktionsstätten besichtigen usw..... Von daher halte ich deren Aussagen schon für

"integer".... Vielleicht steckt dahinter ganz einfach das klare Signal an die Aktionäre das das neue Geschäftsmodell funktionieren wird, bzw. die 100% ige Überzeugung....oder schon das Wissen ??

Es ist noch zu früh um sich ein abschließendes Urteil über das Aktienrückkaufprogramm erlauben zu können, sowas ist mir aber allemal lieber als der Großteil der anderen AG die immer wieder mit

neuen Aktien den Aktionären das Geld aus der Tasche ziehen...

Gruß

massel

Wie gesagt, momentan sagt mir mein Bauchgefühl, dass sich hier was abzeichnet...

Das Phoenix-Mangement war schon immer sehr transparent und Aktionärs freundlich eingestellt.

So konnte man zu den Zeiten als Phoenix noch Moly-Produzent war auch ohne weiteres

die Produktionsstätten besichtigen usw..... Von daher halte ich deren Aussagen schon für

"integer".... Vielleicht steckt dahinter ganz einfach das klare Signal an die Aktionäre das das neue Geschäftsmodell funktionieren wird, bzw. die 100% ige Überzeugung....oder schon das Wissen ??

Es ist noch zu früh um sich ein abschließendes Urteil über das Aktienrückkaufprogramm erlauben zu können, sowas ist mir aber allemal lieber als der Großteil der anderen AG die immer wieder mit

neuen Aktien den Aktionären das Geld aus der Tasche ziehen...

Gruß

massel

Na das Passt ja....

am Freitag den 22.10. gab es einen Conference-Call;

Für alle die sich ernsthaft mit Golden Phoenix befassen wollen ein muss,

ES LOHNT SICH...

hier der Link zum Audio-Mitschnitt (ca.50min):

http://www.golden-phoenix.com/audio/GPXMCC.10.22.10.mp3

Besonders interessant:

- ab Min. 7.30

- ab Min 10.30

- ab Min 21.50

- ab Min 30 bis Ende

Was mir gefallen hat (Kurzform):

- Mineral Ridge soll 2011 in Produktion gehen

- Ab April 2011 werden 5 Jahre lange , jeden Monat 96 Tsd USD an Phoenix überwiesen (aus Verkauf der Moly-Mine)

- Das Wort "shareholder-value" fällt sehr sehr oft.....

gruß

massel

am Freitag den 22.10. gab es einen Conference-Call;

Für alle die sich ernsthaft mit Golden Phoenix befassen wollen ein muss,

ES LOHNT SICH...

hier der Link zum Audio-Mitschnitt (ca.50min):

http://www.golden-phoenix.com/audio/GPXMCC.10.22.10.mp3

Besonders interessant:

- ab Min. 7.30

- ab Min 10.30

- ab Min 21.50

- ab Min 30 bis Ende

Was mir gefallen hat (Kurzform):

- Mineral Ridge soll 2011 in Produktion gehen

- Ab April 2011 werden 5 Jahre lange , jeden Monat 96 Tsd USD an Phoenix überwiesen (aus Verkauf der Moly-Mine)

- Das Wort "shareholder-value" fällt sehr sehr oft.....

gruß

massel

Nachtrag:

Volumen ist natürlich in Deutschland mau....

Wenn dann USA....

Realtime findet man hier:

http://realtime.bigcharts.com/chart.asp?type=100style=45&siz…

Gruß

Massel

Volumen ist natürlich in Deutschland mau....

Wenn dann USA....

Realtime findet man hier:

http://realtime.bigcharts.com/chart.asp?type=100style=45&siz…

Gruß

Massel

USA: Gestern 20%

Antwort auf Beitrag Nr.: 40.384.785 von Massel am 25.10.10 16:02:18thx massel - war in der tat überfällig für GPXM wieder eine akt.

platform einzurichten !!!

auch HIER mal paaaaar charts fürn schnellen überblick........

SK gestern....usd 0,113

platform einzurichten !!!

auch HIER mal paaaaar charts fürn schnellen überblick........

SK gestern....usd 0,113

Antwort auf Beitrag Nr.: 40.388.896 von hbg55 am 26.10.10 09:06:23@hbg55

Cool...

schön das Du da bist....

Gruß

massel

Cool...

schön das Du da bist....

Gruß

massel

Antwort auf Beitrag Nr.: 40.391.224 von Massel am 26.10.10 13:43:36

...habs leider verpaßt jüngst entscheidend zu verbilligen, aber

freu mich dennoch über die ´nachhaltige´ erholung........auch HEUTE

wieder mit ausserordtl. end- rallly

...habs leider verpaßt jüngst entscheidend zu verbilligen, aber

freu mich dennoch über die ´nachhaltige´ erholung........auch HEUTE

wieder mit ausserordtl. end- rallly

Antwort auf Beitrag Nr.: 40.396.087 von hbg55 am 27.10.10 00:16:36JEP... wieder 8% druff....

Golden Phoenix = wie der Phoenix aus der Asche....

Jetzt fehlt nur noch ne Hammernews obendrauf,

(Bohrergebnisse sind ja für dieses Jahr noch angekündigt und ich kann mir gut vorstellen, dass vor der HV noch ein Bonbon für die Aktionäre kommt..)

dann geht die Post erst richtig ab...

Gruß

massel

Golden Phoenix = wie der Phoenix aus der Asche....

Jetzt fehlt nur noch ne Hammernews obendrauf,

(Bohrergebnisse sind ja für dieses Jahr noch angekündigt und ich kann mir gut vorstellen, dass vor der HV noch ein Bonbon für die Aktionäre kommt..)

dann geht die Post erst richtig ab...

Gruß

massel

Schluss Vortag 0,123

Eröffnung 0,146 US

Hoch 0,146

Momentan bei 0.125 US Realtime

das kann ja heiter werden.....

Eröffnung 0,146 US

Hoch 0,146

Momentan bei 0.125 US Realtime

das kann ja heiter werden.....

sachen gibt es....

Warum kauf jemand so teuer in Frankfurt ein ???

Hoffentlich gibts heute noch Nachahmer in den USA

Warum kauf jemand so teuer in Frankfurt ein ???

Hoffentlich gibts heute noch Nachahmer in den USA

Antwort auf Beitrag Nr.: 40.401.501 von Massel am 27.10.10 17:56:57Pustekuchen

SK -2% in USA....

man , da bin ich aber SOWAS von entäuscht

....

SK -2% in USA....

man , da bin ich aber SOWAS von entäuscht

....

28.10.10 21:59 Uhr

0,129 USD

7,50% [0,009]

0,129 USD

7,50% [0,009]

NEWS

http://www.prnewswire.com/news-releases/golden-phoenix-secur…

Golden Phoenix Secures Facility in Peru to Process Molybdenite Stockpiles at Porvenir; Anticipated Production Targets 1st Quarter 2011

SPARKS, Nev., Oct. 28 /PRNewswire/ -- Golden Phoenix Minerals, Inc. (the "Company") (OTC Bulletin Board: GPXM) is pleased to announce it has secured a milling facility in southern Peru to process the molybdenite currently stockpiled at the Porvenir property, with production of molybdenum concentrates anticipated to commence during the first quarter of 2011.

Earlier this month, Golden Phoenix entered into a definitive agreement with Salwell International ("Salwell") to form a strategic alliance ("Alliance") in order to develop certain defined properties in Peru, as well as to identify, acquire and develop future mining opportunities within Central and South America.

Roberto Salaverria, Managing Member of Salwell, stated, "Locating and securing a concentration plant is a key component to the Alliance strategy of monetizing the molybdenite that is contained in the surface stockpiles on the Porvenir property. The contract allows us operational control over this facility for the next two years and can be extended as additional development warrants."

Over the coming months the Alliance will focus on expansion of the mill's capacity to further optimize concentrate production and cash flow. Efforts will also include evaluating the potential to reactivate molybdenum mining at Porvenir as well as commencing exploration for economic gold mineralization on the adjacent lands now under Alliance control.

Tom Klein, CEO of Golden Phoenix concluded: "Our control of a production facility in Peru will expedite the monetization of the Porvenir stockpiles and facilitate the development of other recently acquired South American projects."

Please visit the Golden Phoenix website at: www.golden-phoenix.com.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company whose focus is Royalty Mining in the Americas. Golden Phoenix is committed to delivering shareholder value by identifying, acquiring, developing and mining superior precious and strategic metal deposits throughout North, Central and South America using competitive business practices balanced by principles of ethical stewardship. Golden Phoenix is a 30% joint venture partner with Scorpio Gold on the Mineral Ridge gold and silver property near Silver Peak, Nevada, and owns the Adams Mine and Duff Claim Block near Denio, Nevada, and the Northern Champion molybdenum mine in Ontario, Canada. Golden Phoenix has an option to earn an 80% interest in the Vanderbilt Silver and Gold Project, and the Coyote Fault Gold and Silver Project, both of which are adjacent to the Mineral Ridge gold and silver property near Silver Peak, Nevada. Golden Phoenix has entered into a Memorandum of Understanding to acquire an 80% interest in five gold and molybdenum properties in Peru; two on the Pataz Gold Trend in the north and three in the Porvenir area in the south. Golden Phoenix has entered into a Definitive Acquisition Agreement to acquire a 100% interest in four gold and base metal properties in the Shining Tree Mining District in Ontario, Canada.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: The statements by officers of the Company, and other statements regarding optimism related to the business, expanding exploration and development activities and other statements in this press release are forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995. Such statements are based on current expectations, estimates and projections about the Company's business. Words such as expects, anticipates, intends, plans, believes, sees, estimates and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Actual results could vary materially from the description contained herein due to many factors including continued market prices for the Company's mineral products. In addition, actual results could vary materially based on changes or slower growth in the gold and base and precious metals markets; the potential inability to realize expected benefits and synergies in the Company's mining operations; domestic and international business and economic conditions; changes in the mining industry for base and precious minerals; unexpected difficulties in restarting or expanding production at the Company's mines; the need for additional capital and other risk factors listed from time to time in the Company's Securities and Exchange Commission (SEC) filings under "risk factors" and elsewhere. The forward-looking statements contained in this press release speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release.

For More Information Contact:

Robert Ian, Director of Corporate Communications (775) 453-4741

robertian@golden-phoenix.com

http://www.prnewswire.com/news-releases/golden-phoenix-secur…

Golden Phoenix Secures Facility in Peru to Process Molybdenite Stockpiles at Porvenir; Anticipated Production Targets 1st Quarter 2011

SPARKS, Nev., Oct. 28 /PRNewswire/ -- Golden Phoenix Minerals, Inc. (the "Company") (OTC Bulletin Board: GPXM) is pleased to announce it has secured a milling facility in southern Peru to process the molybdenite currently stockpiled at the Porvenir property, with production of molybdenum concentrates anticipated to commence during the first quarter of 2011.

Earlier this month, Golden Phoenix entered into a definitive agreement with Salwell International ("Salwell") to form a strategic alliance ("Alliance") in order to develop certain defined properties in Peru, as well as to identify, acquire and develop future mining opportunities within Central and South America.

Roberto Salaverria, Managing Member of Salwell, stated, "Locating and securing a concentration plant is a key component to the Alliance strategy of monetizing the molybdenite that is contained in the surface stockpiles on the Porvenir property. The contract allows us operational control over this facility for the next two years and can be extended as additional development warrants."

Over the coming months the Alliance will focus on expansion of the mill's capacity to further optimize concentrate production and cash flow. Efforts will also include evaluating the potential to reactivate molybdenum mining at Porvenir as well as commencing exploration for economic gold mineralization on the adjacent lands now under Alliance control.

Tom Klein, CEO of Golden Phoenix concluded: "Our control of a production facility in Peru will expedite the monetization of the Porvenir stockpiles and facilitate the development of other recently acquired South American projects."

Please visit the Golden Phoenix website at: www.golden-phoenix.com.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company whose focus is Royalty Mining in the Americas. Golden Phoenix is committed to delivering shareholder value by identifying, acquiring, developing and mining superior precious and strategic metal deposits throughout North, Central and South America using competitive business practices balanced by principles of ethical stewardship. Golden Phoenix is a 30% joint venture partner with Scorpio Gold on the Mineral Ridge gold and silver property near Silver Peak, Nevada, and owns the Adams Mine and Duff Claim Block near Denio, Nevada, and the Northern Champion molybdenum mine in Ontario, Canada. Golden Phoenix has an option to earn an 80% interest in the Vanderbilt Silver and Gold Project, and the Coyote Fault Gold and Silver Project, both of which are adjacent to the Mineral Ridge gold and silver property near Silver Peak, Nevada. Golden Phoenix has entered into a Memorandum of Understanding to acquire an 80% interest in five gold and molybdenum properties in Peru; two on the Pataz Gold Trend in the north and three in the Porvenir area in the south. Golden Phoenix has entered into a Definitive Acquisition Agreement to acquire a 100% interest in four gold and base metal properties in the Shining Tree Mining District in Ontario, Canada.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: The statements by officers of the Company, and other statements regarding optimism related to the business, expanding exploration and development activities and other statements in this press release are forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995. Such statements are based on current expectations, estimates and projections about the Company's business. Words such as expects, anticipates, intends, plans, believes, sees, estimates and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Actual results could vary materially from the description contained herein due to many factors including continued market prices for the Company's mineral products. In addition, actual results could vary materially based on changes or slower growth in the gold and base and precious metals markets; the potential inability to realize expected benefits and synergies in the Company's mining operations; domestic and international business and economic conditions; changes in the mining industry for base and precious minerals; unexpected difficulties in restarting or expanding production at the Company's mines; the need for additional capital and other risk factors listed from time to time in the Company's Securities and Exchange Commission (SEC) filings under "risk factors" and elsewhere. The forward-looking statements contained in this press release speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release.

For More Information Contact:

Robert Ian, Director of Corporate Communications (775) 453-4741

robertian@golden-phoenix.com

29.10.10 21:58 Uhr

0,134 USD

3,88% [0,005]

Das war mal ne richtig gute Woche !

0,134 USD

3,88% [0,005]

Das war mal ne richtig gute Woche !

Antwort auf Beitrag Nr.: 40.420.096 von Massel am 30.10.10 00:20:51schön, dass sich hier mal wieder jemand meldet. Hatte selber schon daran gedacht einen neuen Thread aufzumachen. Bin schon 2005 mit einer kleineren Menge eingestiegen und hatte damals während des Moly-Booms auch gute Buchgewinne verzeichnet, welche sich nach der Finanzkrise in Luft aufgelöst haben. Dann hab ich beim Kurs von 0,008 € nochmal um 220.000 Stk erhöht (leider nicht mehr  ). Bin also mit der derzeitigen Kursentwicklung ganz zufrieden. Jetzt frage ich mich natürlich ob der Kursanstieg allein auf dem Aktienrückkaufprogramm beruht oder ob das neue Geschäftsmodell die Aktie langfristig in neue Höhen treibt. Das Management hat meiner Meinung nach in der Krise gut reagiert, die Mine schnell geschlossen und dann verkauft und sich nun auf ein etwas weniger riskantes Geschäftsmodell hin orientiert. Der Newsflow hat zudem in den letzten Wochen massiv zugenommen.

). Bin also mit der derzeitigen Kursentwicklung ganz zufrieden. Jetzt frage ich mich natürlich ob der Kursanstieg allein auf dem Aktienrückkaufprogramm beruht oder ob das neue Geschäftsmodell die Aktie langfristig in neue Höhen treibt. Das Management hat meiner Meinung nach in der Krise gut reagiert, die Mine schnell geschlossen und dann verkauft und sich nun auf ein etwas weniger riskantes Geschäftsmodell hin orientiert. Der Newsflow hat zudem in den letzten Wochen massiv zugenommen.

). Bin also mit der derzeitigen Kursentwicklung ganz zufrieden. Jetzt frage ich mich natürlich ob der Kursanstieg allein auf dem Aktienrückkaufprogramm beruht oder ob das neue Geschäftsmodell die Aktie langfristig in neue Höhen treibt. Das Management hat meiner Meinung nach in der Krise gut reagiert, die Mine schnell geschlossen und dann verkauft und sich nun auf ein etwas weniger riskantes Geschäftsmodell hin orientiert. Der Newsflow hat zudem in den letzten Wochen massiv zugenommen.

). Bin also mit der derzeitigen Kursentwicklung ganz zufrieden. Jetzt frage ich mich natürlich ob der Kursanstieg allein auf dem Aktienrückkaufprogramm beruht oder ob das neue Geschäftsmodell die Aktie langfristig in neue Höhen treibt. Das Management hat meiner Meinung nach in der Krise gut reagiert, die Mine schnell geschlossen und dann verkauft und sich nun auf ein etwas weniger riskantes Geschäftsmodell hin orientiert. Der Newsflow hat zudem in den letzten Wochen massiv zugenommen.

Antwort auf Beitrag Nr.: 40.421.119 von R2-D2 am 30.10.10 13:35:19HI R2-D2,

schön das Du dich gemeldet hast. Nun sind wir schon zu Dritt hier..

Ich denke das Mangement wird Phoenix schon auf Kurs bringen.

Der Newsflow stimmt 100% und vor/zu der HV am 19.11 dürfte

es noch was Positives geben...

Wenn Mineral-Ridge 2011 in Produktion geht,

die Raten für die alte Molymine sauber fließen,

wird die Firma finanziell immer stabiler dastehen, welches sich dann auch im

Kurs wiederstiegeln dürfte. Wenn alles positiv erläuft könnten wir 2011

wieder an den 0,5 US kratzen.....

Hast Du die den Audio-Stream vom letzten Conference-Call angehört ??

wenn ja, Deine Meinung zu den Aussagen ?

Gruß

massel

PS: Ich finde es sehr interessant, dass man mit Golden Phoenix nun einen Wert im Depot hat,

mit dem man ggf. an dem Erfolg gleich mehrerer Explorer beteiligt ist,

bzw. gleich verschiedene Rohstoffe damit abdeckt.

schön das Du dich gemeldet hast. Nun sind wir schon zu Dritt hier..

Ich denke das Mangement wird Phoenix schon auf Kurs bringen.

Der Newsflow stimmt 100% und vor/zu der HV am 19.11 dürfte

es noch was Positives geben...

Wenn Mineral-Ridge 2011 in Produktion geht,

die Raten für die alte Molymine sauber fließen,

wird die Firma finanziell immer stabiler dastehen, welches sich dann auch im

Kurs wiederstiegeln dürfte. Wenn alles positiv erläuft könnten wir 2011

wieder an den 0,5 US kratzen.....

Hast Du die den Audio-Stream vom letzten Conference-Call angehört ??

wenn ja, Deine Meinung zu den Aussagen ?

Gruß

massel

PS: Ich finde es sehr interessant, dass man mit Golden Phoenix nun einen Wert im Depot hat,

mit dem man ggf. an dem Erfolg gleich mehrerer Explorer beteiligt ist,

bzw. gleich verschiedene Rohstoffe damit abdeckt.

So, bin mal gespannt wie diese Woche anfängt und vorallem ob der positve Trend der vergangenen

Wochen fortgesetzt werden kann:

Quelle Comdirect:

Direkte Kennzahlen (OTC)

1 Woche 1 Monat 3 Monate 1 Jahr 3 Jahre 5 Jahre

Performance +42,55% +135,09% +262,16% +106,15% -55,33% -27,57%

Hoch 0,146 0,146 0,146 0,146 0,32 0,56

Tief 0,095 0,055 0,033 0,031 0,0079 0,0079

Volatilität (%) 121,9216 96,6326 83,5995 110,4958 145,9378 121,4253

5 Tage 30 Tage 100 Tage 250 Tage

Ø-Preis 0,12 0,07 0,05 0,05

Ø-Volumen 147.461,18 65.049,80 23.936,55 19.801,57

Massel

Wochen fortgesetzt werden kann:

Quelle Comdirect:

Direkte Kennzahlen (OTC)

1 Woche 1 Monat 3 Monate 1 Jahr 3 Jahre 5 Jahre

Performance +42,55% +135,09% +262,16% +106,15% -55,33% -27,57%

Hoch 0,146 0,146 0,146 0,146 0,32 0,56

Tief 0,095 0,055 0,033 0,031 0,0079 0,0079

Volatilität (%) 121,9216 96,6326 83,5995 110,4958 145,9378 121,4253

5 Tage 30 Tage 100 Tage 250 Tage

Ø-Preis 0,12 0,07 0,05 0,05

Ø-Volumen 147.461,18 65.049,80 23.936,55 19.801,57

Massel

Antwort auf Beitrag Nr.: 40.422.771 von Massel am 31.10.10 09:46:06den Audio-Stream lade ich mir gerade runter. Den werd ich nachher vor dem Einschlafen per mp3-Player hören. Wenn ich Ihn bis zum Ende durchhalte kaufe ich morgen nochmal 50000 Stk., falls ich vorzeitig einschlafe trenn ich mich von meinen Anteilen.

Ich finde auch, dass Golden Phoenix eine gute Möglichkeit bietet, sich an verschiedenen Rohstoffunternehmen mit laufender oder bald beginnender Förderung zu beteiligen und man trotzdem von der Explorerphantasie profitieren kann.

Ich finde auch, dass Golden Phoenix eine gute Möglichkeit bietet, sich an verschiedenen Rohstoffunternehmen mit laufender oder bald beginnender Förderung zu beteiligen und man trotzdem von der Explorerphantasie profitieren kann.

Hi,

bin auch da. Hab vor vor Monaten mal für 0,02 ein paar gekauft. Einfach nur mal so just for fun in der Krise. Rohstoffe waren da grade noch günstig. Bei Gold hatte ich da auch einen ganz guten Lauf. Irgendwie gefällt mir Golden Phoenix, was die Politik der Geschäftsleitung betrifft. Wie hoch denkt ihr kann der Kurs noch gehen mittelfristig? 0,5 / 0,8 7 oder auch 1US$?

bin auch da. Hab vor vor Monaten mal für 0,02 ein paar gekauft. Einfach nur mal so just for fun in der Krise. Rohstoffe waren da grade noch günstig. Bei Gold hatte ich da auch einen ganz guten Lauf. Irgendwie gefällt mir Golden Phoenix, was die Politik der Geschäftsleitung betrifft. Wie hoch denkt ihr kann der Kurs noch gehen mittelfristig? 0,5 / 0,8 7 oder auch 1US$?

Antwort auf Beitrag Nr.: 40.431.777 von R2-D2 am 01.11.10 21:07:59exakt....wer kann schon alle Explorer im Auge

halten und vorallem den dazugehöhrigen Newsflow....

Phoenix-Kursverlauf "Bomben stabil" heute. Jeder Verkauf wird aufgesaugt.

Eine News und die 0,15 US sind reine Formsache.

01.11.10 20:45 Uhr

0,1397 USD

4,25% [0,0057]

Gruß

Massel

PS: Und schlaf blos nicht vorzeitig ein.....

halten und vorallem den dazugehöhrigen Newsflow....

Phoenix-Kursverlauf "Bomben stabil" heute. Jeder Verkauf wird aufgesaugt.

Eine News und die 0,15 US sind reine Formsache.

01.11.10 20:45 Uhr

0,1397 USD

4,25% [0,0057]

Gruß

Massel

PS: Und schlaf blos nicht vorzeitig ein.....

Antwort auf Beitrag Nr.: 40.431.864 von Jackspoon am 01.11.10 21:19:18HI Jackspoon,

jetzt kommt aber richtig Leben in den Thread...

Die 0,50 US dürfte ne harte Nuss werden,

aber das Segment lebt natürlich vom Newsflow,

bei positvem Newsflow ist alles möglich...

Gruß

massel

jetzt kommt aber richtig Leben in den Thread...

Die 0,50 US dürfte ne harte Nuss werden,

aber das Segment lebt natürlich vom Newsflow,

bei positvem Newsflow ist alles möglich...

Gruß

massel

Antwort auf Beitrag Nr.: 40.422.771 von Massel am 31.10.10 09:46:06bin hier auch dabei mit einer kleinen Position, leider noch im Verlust, da im Frühjahr 2008 zu 0,14 E eingestiegen. Hab damals geglaubt, das wäre der Tiefpunkt.

Nun ja, irgendwann wird es auch hier mal wieder schwarze Zahlen geben.

Nun ja, irgendwann wird es auch hier mal wieder schwarze Zahlen geben.

Antwort auf Beitrag Nr.: 40.432.535 von Looe am 01.11.10 22:39:02

jetzt muss ich glatt mal anfangen die User hier zu zählen....

jetzt muss ich glatt mal anfangen die User hier zu zählen....

Looe,

bin mir ziemlich sicher, dass Du noch dieses Jahr ins Plus kommen wirst

Gruß

massel

jetzt muss ich glatt mal anfangen die User hier zu zählen....

jetzt muss ich glatt mal anfangen die User hier zu zählen....Looe,

bin mir ziemlich sicher, dass Du noch dieses Jahr ins Plus kommen wirst

Gruß

massel

RT 0,15 US

bravo so....

bravo so....

so.... heute könnte mal wieder ein Tag für eine News sein.....

Antwort auf Beitrag Nr.: 40.431.864 von Jackspoon am 01.11.10 21:19:18Denke das wir bis zur HV am 19.11 die 0,20 US sehen werden....

Wichtige Impulse für den Aktienmarkt kommen noch heute:

- 20:15 Uhr: Bekanntgabe des Ergebnisses der Ratssitzung der Federal Reserve Bank

- 20:15 Uhr: Bekanntgabe des Ergebnisses der Ratssitzung der Federal Reserve Bank

Antwort auf Beitrag Nr.: 40.447.090 von Massel am 03.11.10 17:55:38na bin dann doch nicht eingeschlafen beim Hören des conference call. Das Management macht schon einen seriösen Eindruck und die Strategie scheint fürs erste schlüssig. Momentan wird überwiegend Wert auf die Erhöhung des Aktienkurses gelegt. Dadurch sollen die Möglichkeiten verbessert werden, weitere Zukäufe zu finanzieren. Etwas schwammig waren die Aussagen zu den möglichen Erträgen aus dem Mineral Ridge Projekt. Das Potential der anderen Beteiligungen bleibt auch weitestgehend im unklaren. Dafür werden für 2011 Einnahmen aus der Ashdown Mine und von Mineral Ridge avisiert, eventuell auch aus dem Moly-Lager in Peru. Die Einnahmen sollen für die Weiterentwicklung der zugekauften Lagerstätten und für weitere Acquisitionen verwendet werden. Außerdem versucht das Management, möglichst viele auch institutionelle Investoren zu gewinnen. Hoffen wir mal auf anhaltenden Newsflow und steigende Kurse.

Hallo @all

ab jetzt bin ich auch dabei.

Zwar bin ich noch ein quasi "Altaktionär", seit 2006,

und hab eine Bauchlandung mit Phoenix hingelegt, aber es ist schön zu sehen das hier wieder Leben reinkommt!

Wird wohl nur noch ein paar Monate dauern bis ich die rote 0 sehe.

Da ich durch Zufall über den Thread "gestolpert" bin muss ich mich erstmal einlessen.

Also das Golden Phoenix sich aus dem Moly Geschäft verabschiedet hat ab ich noch mitbekommen. Und was ist dann alles passiert???

Gruß

Balu

ab jetzt bin ich auch dabei.

Zwar bin ich noch ein quasi "Altaktionär", seit 2006,

und hab eine Bauchlandung mit Phoenix hingelegt, aber es ist schön zu sehen das hier wieder Leben reinkommt!

Wird wohl nur noch ein paar Monate dauern bis ich die rote 0 sehe.

Da ich durch Zufall über den Thread "gestolpert" bin muss ich mich erstmal einlessen.

Also das Golden Phoenix sich aus dem Moly Geschäft verabschiedet hat ab ich noch mitbekommen. Und was ist dann alles passiert???

Gruß

Balu

Antwort auf Beitrag Nr.: 40.451.822 von BaluBM am 04.11.10 10:24:48WILLKOMMEN BALU !

Hier mal Info von der Golden-Phoenix-Homepage warum

die meinen, dass man investieren sollte:

http://www.golden-phoenix.com/whygoldenphoenix.html

Why Golden Phoenix?

Golden Phoenix Strategy Golden Phoenix has emerged from the global credit collapse with a Royalty Mining Growth Strategy and an initial 24 month acquisition plan to target advanced projects with near-term production throughout the Americas.

We anticipate analyzing up to 50 prospective properties, with a view towards optioning up to 10 of those properties on terms and conditions acceptable to the Company. From these optioned properties, the Company hopes to identify up to 5 projects that can be advanced toward commercial production.

The sum of five such projects has the potential, in our opinion, to add up to more than one project without the risk of investing in just a single mining project.

Royalty Mining Advantage Golden Phoenix expects to retain up to a 30% interest in each project it undertakes. The Company anticipates its cash flow will be leveraged to the price of gold or the underlying strategic metal. Ultimately, the Company intends to convert some of its interests into Royalty agreements. The strategy is called “Royalty Mining in the Americas.”

Market Opportunity Golden Phoenix has conducted extensive market research and concluded that because of the global credit crisis, many junior mining companies with significant upside potential remain frozen out of the capital markets.

Acquiring and adding value to advanced stage projects is how Golden Phoenix intends to add value for our shareholders. Our plan involves:

1. Acquiring a property that, on terms and conditions acceptable to the Company, requires financing or geological expertise.

2. Improving the property by providing permitting, bonding, drilling and/or financial support

3. Securing a mine operator with the experience necessary to take the project into commercial production.

4. Retaining up to a 30% interest in each project, and ultimately converting some of those interests into Royalty agreements.

5. Repeating the process and providing continuous advancement for each project we undertake. Golden Phoenix is planning to analyze up to 50 prospective properties, with a view towards optioning up to 10 of those properties on terms and conditions acceptable to the Company. From these optioned properties, the Company hopes to identify up to 5 projects that can be advanced toward commercial production.

Commercial Production When a project achieves commercial production, Golden Phoenix expects to receive royalty payments leveraged to the price gold or the underlying strategic metal. Royalty payments are anticipated to continue for a specified period of time or until the Company sells its interest in that project at a price it anticipates will be a premium to what the Company has invested in the project.

Diversified Properties When our CEO, Tom Klein, joined Golden Phoenix in the depths of the global credit crisis, he brought a new perspective on the kind of business model that would be required to transform a small company like Golden Phoenix, into a much larger, multi-project company with diversified properties throughout the Americas.

Rapid Advancement Project #1 is Mineral Ridge operated by Peter Hawley of Scorpio Gold. As Golden Phoenix moves forward, we intend to make every effort to replicate the advancement of Mineral Ridge with each project we undertake.

-------------------------------------

Aus 50 Explorer-Anwärtern letztendlich 5 TOP´s heraus zu filtern die in Produktion gehen; da hat das Mangement sich ordentlich was vorgenommen.

Normerweise stellt man sich bei den Managern von AG´s ja immer wieder die Frage

was diese Herrschaften so den ganzen lieben Tag für Ihr Geld machen....

Ich glaube beim Phoenix-Mangement braucht man sich diese Frage, bei dieser Aufgabenstellung nicht zu stellen;

ich nenn das verdammt AMBITIONIERT was die vorhaben und dies

eröffnet wiederum ein riesen Phantasiepotential für den Aktienkurs.

gruß

massel

Hier mal Info von der Golden-Phoenix-Homepage warum

die meinen, dass man investieren sollte:

http://www.golden-phoenix.com/whygoldenphoenix.html

Why Golden Phoenix?

Golden Phoenix Strategy Golden Phoenix has emerged from the global credit collapse with a Royalty Mining Growth Strategy and an initial 24 month acquisition plan to target advanced projects with near-term production throughout the Americas.

We anticipate analyzing up to 50 prospective properties, with a view towards optioning up to 10 of those properties on terms and conditions acceptable to the Company. From these optioned properties, the Company hopes to identify up to 5 projects that can be advanced toward commercial production.

The sum of five such projects has the potential, in our opinion, to add up to more than one project without the risk of investing in just a single mining project.

Royalty Mining Advantage Golden Phoenix expects to retain up to a 30% interest in each project it undertakes. The Company anticipates its cash flow will be leveraged to the price of gold or the underlying strategic metal. Ultimately, the Company intends to convert some of its interests into Royalty agreements. The strategy is called “Royalty Mining in the Americas.”

Market Opportunity Golden Phoenix has conducted extensive market research and concluded that because of the global credit crisis, many junior mining companies with significant upside potential remain frozen out of the capital markets.

Acquiring and adding value to advanced stage projects is how Golden Phoenix intends to add value for our shareholders. Our plan involves:

1. Acquiring a property that, on terms and conditions acceptable to the Company, requires financing or geological expertise.

2. Improving the property by providing permitting, bonding, drilling and/or financial support

3. Securing a mine operator with the experience necessary to take the project into commercial production.

4. Retaining up to a 30% interest in each project, and ultimately converting some of those interests into Royalty agreements.

5. Repeating the process and providing continuous advancement for each project we undertake. Golden Phoenix is planning to analyze up to 50 prospective properties, with a view towards optioning up to 10 of those properties on terms and conditions acceptable to the Company. From these optioned properties, the Company hopes to identify up to 5 projects that can be advanced toward commercial production.

Commercial Production When a project achieves commercial production, Golden Phoenix expects to receive royalty payments leveraged to the price gold or the underlying strategic metal. Royalty payments are anticipated to continue for a specified period of time or until the Company sells its interest in that project at a price it anticipates will be a premium to what the Company has invested in the project.

Diversified Properties When our CEO, Tom Klein, joined Golden Phoenix in the depths of the global credit crisis, he brought a new perspective on the kind of business model that would be required to transform a small company like Golden Phoenix, into a much larger, multi-project company with diversified properties throughout the Americas.

Rapid Advancement Project #1 is Mineral Ridge operated by Peter Hawley of Scorpio Gold. As Golden Phoenix moves forward, we intend to make every effort to replicate the advancement of Mineral Ridge with each project we undertake.

-------------------------------------

Aus 50 Explorer-Anwärtern letztendlich 5 TOP´s heraus zu filtern die in Produktion gehen; da hat das Mangement sich ordentlich was vorgenommen.

Normerweise stellt man sich bei den Managern von AG´s ja immer wieder die Frage

was diese Herrschaften so den ganzen lieben Tag für Ihr Geld machen....

Ich glaube beim Phoenix-Mangement braucht man sich diese Frage, bei dieser Aufgabenstellung nicht zu stellen;

ich nenn das verdammt AMBITIONIERT was die vorhaben und dies

eröffnet wiederum ein riesen Phantasiepotential für den Aktienkurs.

gruß

massel

Antwort auf Beitrag Nr.: 40.452.642 von Massel am 04.11.10 11:47:52

eröffnet wiederum ein riesen Phantasiepotential für den Aktienkurs.

Ja bei uns nennt sich das Phantasialand !!!

Aber mal im Ernst, wenn ich das richtig sehe haben die Herren genau das gleiche vor wie wir auch. -> Die Richtigen heraus zu Filtern! Bin mal gespannt wie gut sie sind.

Gemütlichkeit

Balu

eröffnet wiederum ein riesen Phantasiepotential für den Aktienkurs.

Ja bei uns nennt sich das Phantasialand !!!

Aber mal im Ernst, wenn ich das richtig sehe haben die Herren genau das gleiche vor wie wir auch. -> Die Richtigen heraus zu Filtern! Bin mal gespannt wie gut sie sind.

Gemütlichkeit

Balu

Antwort auf Beitrag Nr.: 40.453.623 von BaluBM am 04.11.10 13:39:37Gemütlichkeit o.k. ;

aber nicht einschalfen und vorallem nicht VERSCHLAFEN

NEWS:

http://www.prnewswire.com/news-releases/golden-phoenix-to-be…

Golden Phoenix to Begin Phase I Surface Mapping Update at 100% Owned Northern Champion Molybdenum Property; Prepares for 2011 Exploration

SPARKS, Nev., Nov. 4, 2010 /PRNewswire/ -- Golden Phoenix Minerals, Inc. (the "Company") (OTC Bulletin Board: GPXM) is pleased to announce it will begin mapping the geologic surface features and topography of its Northern Champion molybdenum claims, located in Ontario, Canada, into a single, regional metric scale map. Line cutting and mapping are planned for early November ahead of the first significant snowfall.

"Golden Phoenix is preparing to advance our Northern Champion molybdenum property in 2011," stated Tom Klein, CEO of Golden Phoenix. "Mapping the property now will help expedite our development efforts next year."

Once the mapping is complete, the Company expects to begin Phase II planning for trenching, geochemical sampling and/or drilling of previously indentified zones to the east of the current open-cut mine. An IP (induced polarization) anomaly to the north of the open-cut zone will also be investigated.

Mr. Klein concluded: "Given the recent strategic alliance and potential acquisition of molybdenum properties in Peru, coupled with a global interest in the availability of moly in both the short and long term, we believe developing our Northern Champion property makes strategic sense going forward."

The Northern Champion property consists of approximately 880 acres in Griffith and Brougham Townships in the Province of Ontario, Canada. Historical records indicate that molybdenum was actively mined on the property during the last century. In 2006, Golden Phoenix executed a Purchase Agreement to acquire five (5) registered claims totaling 22 units on the Northern Champion Property together with a NI 43-101 Technical Report and Feasibility Study describing a molybdenite deposit within the area of the claims.

Please visit the Golden Phoenix website at: www.golden-phoenix.com.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company whose focus is Royalty Mining in the Americas. Golden Phoenix is committed to delivering shareholder value by identifying, acquiring, developing and mining superior precious and strategic metal deposits throughout North, Central and South America using competitive business practices balanced by principles of ethical stewardship. Golden Phoenix is a 30% joint venture partner with Scorpio Gold on the Mineral Ridge gold and silver property near Silver Peak, Nevada, and owns the Adams Mine and Duff Claim Block near Denio, Nevada, and the Northern Champion molybdenum mine in Ontario, Canada. Golden Phoenix has an option to earn an 80% interest in the Vanderbilt Silver and Gold Project, and the Coyote Fault Gold and Silver Project, both of which are adjacent to the Mineral Ridge gold and silver property near Silver Peak, Nevada. Golden Phoenix has entered into a Memorandum of Understanding to acquire an 80% interest in five gold and molybdenum properties in Peru; two on the Pataz Gold Trend in the north and three in the Porvenir area in the south. Golden Phoenix has entered into a Definitive Acquisition Agreement to acquire a 100% interest in four gold and base metal properties in the Shining Tree Mining District in Ontario, Canada.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: The statements by officers of the Company, and other statements regarding optimism related to the business, expanding exploration and development activities and other statements in this press release are forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995. Such statements are based on current expectations, estimates and projections about the Company's business. Words such as expects, anticipates, intends, plans, believes, sees, estimates and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Actual results could vary materially from the description contained herein due to many factors including continued market prices for the Company's mineral products. In addition, actual results could vary materially based on changes or slower growth in the gold and base and precious metals markets; the potential inability to realize expected benefits and synergies in the Company's mining operations; domestic and international business and economic conditions; changes in the mining industry for base and precious minerals; unexpected difficulties in restarting or expanding production at the Company's mines; the need for additional capital and other risk factors listed from time to time in the Company's Securities and Exchange Commission (SEC) filings under "risk factors" and elsewhere. The forward-looking statements contained in this press release speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release.

For More Information Contact:

Robert Ian, Director of Corporate Communications (775) 453-4741

robertian@golden-phoenix.com

----------------------------

Gruß

massel

aber nicht einschalfen und vorallem nicht VERSCHLAFEN

NEWS:

http://www.prnewswire.com/news-releases/golden-phoenix-to-be…

Golden Phoenix to Begin Phase I Surface Mapping Update at 100% Owned Northern Champion Molybdenum Property; Prepares for 2011 Exploration

SPARKS, Nev., Nov. 4, 2010 /PRNewswire/ -- Golden Phoenix Minerals, Inc. (the "Company") (OTC Bulletin Board: GPXM) is pleased to announce it will begin mapping the geologic surface features and topography of its Northern Champion molybdenum claims, located in Ontario, Canada, into a single, regional metric scale map. Line cutting and mapping are planned for early November ahead of the first significant snowfall.

"Golden Phoenix is preparing to advance our Northern Champion molybdenum property in 2011," stated Tom Klein, CEO of Golden Phoenix. "Mapping the property now will help expedite our development efforts next year."

Once the mapping is complete, the Company expects to begin Phase II planning for trenching, geochemical sampling and/or drilling of previously indentified zones to the east of the current open-cut mine. An IP (induced polarization) anomaly to the north of the open-cut zone will also be investigated.

Mr. Klein concluded: "Given the recent strategic alliance and potential acquisition of molybdenum properties in Peru, coupled with a global interest in the availability of moly in both the short and long term, we believe developing our Northern Champion property makes strategic sense going forward."

The Northern Champion property consists of approximately 880 acres in Griffith and Brougham Townships in the Province of Ontario, Canada. Historical records indicate that molybdenum was actively mined on the property during the last century. In 2006, Golden Phoenix executed a Purchase Agreement to acquire five (5) registered claims totaling 22 units on the Northern Champion Property together with a NI 43-101 Technical Report and Feasibility Study describing a molybdenite deposit within the area of the claims.

Please visit the Golden Phoenix website at: www.golden-phoenix.com.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company whose focus is Royalty Mining in the Americas. Golden Phoenix is committed to delivering shareholder value by identifying, acquiring, developing and mining superior precious and strategic metal deposits throughout North, Central and South America using competitive business practices balanced by principles of ethical stewardship. Golden Phoenix is a 30% joint venture partner with Scorpio Gold on the Mineral Ridge gold and silver property near Silver Peak, Nevada, and owns the Adams Mine and Duff Claim Block near Denio, Nevada, and the Northern Champion molybdenum mine in Ontario, Canada. Golden Phoenix has an option to earn an 80% interest in the Vanderbilt Silver and Gold Project, and the Coyote Fault Gold and Silver Project, both of which are adjacent to the Mineral Ridge gold and silver property near Silver Peak, Nevada. Golden Phoenix has entered into a Memorandum of Understanding to acquire an 80% interest in five gold and molybdenum properties in Peru; two on the Pataz Gold Trend in the north and three in the Porvenir area in the south. Golden Phoenix has entered into a Definitive Acquisition Agreement to acquire a 100% interest in four gold and base metal properties in the Shining Tree Mining District in Ontario, Canada.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: The statements by officers of the Company, and other statements regarding optimism related to the business, expanding exploration and development activities and other statements in this press release are forward-looking statements within the meaning of the Securities Litigation Reform Act of 1995. Such statements are based on current expectations, estimates and projections about the Company's business. Words such as expects, anticipates, intends, plans, believes, sees, estimates and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Actual results could vary materially from the description contained herein due to many factors including continued market prices for the Company's mineral products. In addition, actual results could vary materially based on changes or slower growth in the gold and base and precious metals markets; the potential inability to realize expected benefits and synergies in the Company's mining operations; domestic and international business and economic conditions; changes in the mining industry for base and precious minerals; unexpected difficulties in restarting or expanding production at the Company's mines; the need for additional capital and other risk factors listed from time to time in the Company's Securities and Exchange Commission (SEC) filings under "risk factors" and elsewhere. The forward-looking statements contained in this press release speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release.

For More Information Contact:

Robert Ian, Director of Corporate Communications (775) 453-4741

robertian@golden-phoenix.com

----------------------------

Gruß

massel

Mal sehen was heute so passiert....

Antwort auf Beitrag Nr.: 40.463.400 von Massel am 05.11.10 14:43:59Hallo, mich wundern immer die Ausschläge bei ganz geringem Umsatz. Liegt es daran das die Aktie allgemein wenig gehandelt wird?

Wie nennt man das nochmal ??

Börse Nasdaq OTC Bulletin Board

Aktuell 0,135 USD

Zeit 11.11.1022:00

Diff. Vortag +32,35%

Tages-Vol. --

Gehandelte Stück 703.500

Gruß

massel

Börse Nasdaq OTC Bulletin Board

Aktuell 0,135 USD

Zeit 11.11.1022:00

Diff. Vortag +32,35%

Tages-Vol. --

Gehandelte Stück 703.500

Gruß

massel

Das sollte heute ein ganz interessanter Tag werden...

Aber auch mal eine Auge auf Vantex werfen... Geile Bohr - News...

Gruß

massel

Aber auch mal eine Auge auf Vantex werfen... Geile Bohr - News...

Gruß

massel

Nur noch 4 Tage bis zur HV und ich würde ne Wette machen, dass wir bis dahin/ zur HV

die 0.15 US knacken....

Gruß

massel

die 0.15 US knacken....

Gruß

massel

olden Phoenix Mineral Ridge Property Scheduled to Begin Gold Production in First Quarter 2011

SPARKS, NV, NOVEMBER 17, 2010 - Golden Phoenix Minerals, Inc. (the "Company") (OTC Bulletin Board: GPXM) is pleased to announce gold production is scheduled to begin in the first quarter of 2011 on its Mineral Ridge property; which the Company maintains a thirty percent (30%) interest in via its membership interest in Mineral Ridge Gold, LLC; the joint venture entity that owns and operates the Mineral Ridge property with Scorpio Gold ("Scorpio").

Mr. Peter J. Hawley, CEO of Scorpio Gold, has reported that gold production is scheduled to commence in the first quarter of 2011, with material previously mined that is available for restacking and releaching. Ramp up will take place using this material and then be followed with newly mined material from the Drinkwater pit. Production is expected to reach a steady state by June and then continue to track positively in the second half of 2011.

Permitting

On Nov. 2, 2010, Scorpio underwent a successful inspection by representatives of the Nevada Division of Environmental Protection Bureau of Mining Regulation and Reclamation. This prestart-up inspection verified the compliance of the company's process facilities with its NDEP water-pollution-control permit and the mining regulations of the state of Nevada.

On Nov. 10, 2010, Scorpio received approval from the Nevada Division of Water Resources to drill water-monitoring wells for the leach pad. This approval was required in addition to the NDEP approval of the monitoring-well plan.

Site operations

Leach-pad rehabilitation is well advanced, with the new drainage system nearing completion. Crushing of the over-liner drainage total and covering of the exposed liner will be completed by the end of November.

Crushing the previously mined and placed material is scheduled to begin in the latter half of December, with leach-solution application commencing in January.

Sludge removal from the barren pond was completed and all necessary liner repairs were performed. The barren pond is now fully operational.

Removal of coarse material from the pregnant pond is under way and scheduled for completion by month-end.

The on-site assay laboratory expansion is in progress and scheduled for completion in February.

Carbon columns in the adsorption-desorption-recovery (ADR) plant have been replaced and will be operational by mid-December.

Contractual arrangements for the stripping of carbon and refining of gold with outside parties are currently being finalized, with first shipments scheduled to take place in January.

Exploration planning

Scorpio's successful exploration and modeling of the mineralized deposits and related structures at Mineral Ridge has led to an extensive staking program adding an additional 2,934 hectares (7,250 acres) of unpatented mining claims with no underlying royalties to the property. The over-all land package now consists of 351 claims, which encompass 4,118 hectares (10,176 acres), representing an increase of 348 per cent from the original holdings. Exploration targets on the new claims are currently being mapped and sampled, with several drill targets having already been identified. The 2011 exploration plan includes 13,000 metres of drilling.

Planning for exploration drilling in areas adjacent to the historical Oromonte underground mine is in progress. Wide-spaced drilling conducted by previous companies in the 1990s intersected significant intervals of gold mineralization, which warrant additional closer-spaced drilling. Recent surface mapping and sampling has identified several additional targets that are being planned for drilling.

Exploration targets are being defined in the Bluelite area, where drilling by previous operators intersected multiple shallow horizons of gold mineralization. In addition, there is evidence for the presence of a high-angle, high-grade mineralized structure that has not been adequately tested.

Exploration targets are also being defined in the Solberry area between Bluelite and Oromonte, where shallow-dipping gold-bearing quartz veins crop out at the surface. The area is the site of historic underground mining operations. Holes drilled by previous operators intersected significant gold mineralization warranting additional exploration.

Amendments to both the Mineral Ridge mine plan of operations and the associated environmental assessment are well advanced, upon completion of which Scorpio will proceed with additional exploration drilling.

Mr. Peter J. Hawley, PGeo, is Scorpio Gold's Qualified Person and CEO for the various Scorpio Gold projects. Mr. Hawley is responsible for the current exploration and development program at Mineral Ridge.

Please visit the Golden Phoenix website at: http://www.golden-phoenix.com.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company whose focus is Royalty Mining in the Americas. Golden Phoenix is committed to delivering shareholder value by identifying, acquiring, developing and mining superior precious and strategic metal deposits throughout North, Central, and South America using competitive business practices balanced by principles of ethical stewardship. Golden Phoenix is a 30% joint venture partner with Scorpio Gold on the Mineral Ridge gold and silver property near Silver Peak, Nevada, and owns the Adams Mine and Duff Claim Block near Denio, Nevada, and the Northern Champion molybdenum mine in Ontario, Canada. Golden Phoenix has an option to earn an 80% interest in the Vanderbilt Silver and Gold Project, and the Coyote Fault Gold and Silver Project, both of which are adjacent to the Mineral Ridge gold and silver property near Silver Peak, Nevada. Golden Phoenix has entered into a Memorandum of Understanding to acquire an 80% interest in five gold and molybdenum properties in Peru; two on the Pataz Gold Trend in the north, and three in the Porvenir area in the south. Golden Phoenix has entered into a Definitive Acquisition Agreement to acquire a 100% interest in four gold and base metal properties in the Shining Tree Mining District in Ontario, Canada.

Source:

Golden Phoenix Minerals, Inc.

-------------

Gruß

massel

Scorpio Gold Update on Its Nevada Based Mineral Ridge Gold Project

http://www.marketwire.com/press-release/Scorpio-Gold-Update-…

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 17, 2010) - Scorpio Gold Corporation (the "Company") (TSX VENTURE:SGN) today provided an update on rehabilitation work being carried out at the Mineral Ridge Gold Project acquired from Golden Phoenix this spring with a view to recommencing gold production.

Permitting

On November 2, 2010, the Company underwent a successful inspection by representatives of the Nevada Division of Environmental Protection (NDEP) – Bureau of Mining Regulation and Reclamation. This pre-start-up inspection verified the compliance of the Company's process facilities with its NDEP Water Pollution Control Permit and the mining regulations of the State of Nevada.

On November 10, 2010 the Company received approval from the Nevada Division of Water Resources (NDWR) to drill water monitoring wells for the leach pad. This approval was required in addition to the NDEP approval of the monitoring well plan.

Site Operations

Leach pad rehabilitation is well advanced with the new drainage system nearing completion. Crushing of the over-liner drainage aggregate and covering of the exposed liner will be completed by the end of November.

Crushing the previously mined and placed Golden Phoenix material is scheduled to begin in the latter half of December with leach solution application commencing in January.

Sludge removal from the barren pond was completed and all necessary liner repairs were performed. The barren pond is now fully operational.

Removal of coarse material from the pregnant pond is underway and scheduled for completion by month end.

The on-site assay laboratory expansion is in progress and scheduled for completion in February.

Carbon columns in the adsorption desorption recovery (ADR) plant have been replaced and will be operational by mid December.

Contractual arrangements for the stripping of carbon and refining of gold with outside parties are currently being finalized with first shipments scheduled to take place in January.

Exploration Planning

Scorpio Gold's successful exploration and modeling of the mineralized deposits and related structures at Mineral Ridge has led to an extensive staking program adding an additional 2,934 hectares (7,250 acres) of unpatented mining claims with no underlying royalties to the property. The overall land package now consists of 351 claims which encompasses 4,118 hectares (10,176 acres) representing an increase of 348% from the original Golden Phoenix holdings. Exploration targets on the new claims are currently being mapped and sampled with several drill targets having already been identified. The 2011 exploration plan includes 13,000 meters of drilling.

Planning for exploration drilling in areas adjacent to the historical Oromonte underground mine is in progress. Wide spaced drilling conducted by previous companies in the 1990's intersected significant intervals of gold mineralization which warrant additional closer spaced drilling. Recent surface mapping and sampling has identified several additional targets which are being planned for drilling.

Exploration targets are being defined in the Bluelite area where drilling by previous operators intersected multiple, shallow horizons of gold mineralization. In addition, there is evidence for the presence of a high angle, high grade mineralized structure that has not been adequately tested.

Exploration targets are also being defined in the Solberry area between Bluelite and Oromonte, where shallow dipping gold-bearing quartz veins crop out at the surface. The area is the site of historic underground mining operations. Holes drilled by previous operators intersected significant gold mineralization warranting additional exploration.

Amendments to both the Mineral Ridge Mine Plan of Operations and the associated Environmental Assessment ("EA") are well advanced, upon completion of which the Company will proceed with additional exploration drilling.

Outlook

Gold production is scheduled to commence in the first quarter of 2011 with material previously mined by Golden Phoenix that is available for restacking and re-leaching. Ramp up will take place using this material and then followed with newly mined material from the Drinkwater pit. Production is expected to reach a steady state by June and then continue to track positively in the second half of 2011.

Mr. Peter Hawley, PGeo, is the Company's Chief Executive Officer and Qualified Person for the various Company projects. He is responsible for the current exploration and development programs and has reviewed the content of this release.

For additional information please see the Company's website at www.scorpiogold.com.

ON BEHALF OF THE BOARD SCORPIO GOLD CORPORATION

Peter J. Hawley, Chief Executive Officer and Director

The Company relies on litigation protection for "forward-looking" statements. This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur, and include, without limitation, statements regarding the Company's plans with respect to the development of its Mineral Ridge project and commencement of gold production. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements, including risks relating to commencing production from a mining project. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

gruß

massel

http://www.marketwire.com/press-release/Scorpio-Gold-Update-…

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 17, 2010) - Scorpio Gold Corporation (the "Company") (TSX VENTURE:SGN) today provided an update on rehabilitation work being carried out at the Mineral Ridge Gold Project acquired from Golden Phoenix this spring with a view to recommencing gold production.

Permitting

On November 2, 2010, the Company underwent a successful inspection by representatives of the Nevada Division of Environmental Protection (NDEP) – Bureau of Mining Regulation and Reclamation. This pre-start-up inspection verified the compliance of the Company's process facilities with its NDEP Water Pollution Control Permit and the mining regulations of the State of Nevada.

On November 10, 2010 the Company received approval from the Nevada Division of Water Resources (NDWR) to drill water monitoring wells for the leach pad. This approval was required in addition to the NDEP approval of the monitoring well plan.

Site Operations

Leach pad rehabilitation is well advanced with the new drainage system nearing completion. Crushing of the over-liner drainage aggregate and covering of the exposed liner will be completed by the end of November.

Crushing the previously mined and placed Golden Phoenix material is scheduled to begin in the latter half of December with leach solution application commencing in January.

Sludge removal from the barren pond was completed and all necessary liner repairs were performed. The barren pond is now fully operational.

Removal of coarse material from the pregnant pond is underway and scheduled for completion by month end.

The on-site assay laboratory expansion is in progress and scheduled for completion in February.

Carbon columns in the adsorption desorption recovery (ADR) plant have been replaced and will be operational by mid December.

Contractual arrangements for the stripping of carbon and refining of gold with outside parties are currently being finalized with first shipments scheduled to take place in January.

Exploration Planning

Scorpio Gold's successful exploration and modeling of the mineralized deposits and related structures at Mineral Ridge has led to an extensive staking program adding an additional 2,934 hectares (7,250 acres) of unpatented mining claims with no underlying royalties to the property. The overall land package now consists of 351 claims which encompasses 4,118 hectares (10,176 acres) representing an increase of 348% from the original Golden Phoenix holdings. Exploration targets on the new claims are currently being mapped and sampled with several drill targets having already been identified. The 2011 exploration plan includes 13,000 meters of drilling.

Planning for exploration drilling in areas adjacent to the historical Oromonte underground mine is in progress. Wide spaced drilling conducted by previous companies in the 1990's intersected significant intervals of gold mineralization which warrant additional closer spaced drilling. Recent surface mapping and sampling has identified several additional targets which are being planned for drilling.

Exploration targets are being defined in the Bluelite area where drilling by previous operators intersected multiple, shallow horizons of gold mineralization. In addition, there is evidence for the presence of a high angle, high grade mineralized structure that has not been adequately tested.

Exploration targets are also being defined in the Solberry area between Bluelite and Oromonte, where shallow dipping gold-bearing quartz veins crop out at the surface. The area is the site of historic underground mining operations. Holes drilled by previous operators intersected significant gold mineralization warranting additional exploration.

Amendments to both the Mineral Ridge Mine Plan of Operations and the associated Environmental Assessment ("EA") are well advanced, upon completion of which the Company will proceed with additional exploration drilling.

Outlook

Gold production is scheduled to commence in the first quarter of 2011 with material previously mined by Golden Phoenix that is available for restacking and re-leaching. Ramp up will take place using this material and then followed with newly mined material from the Drinkwater pit. Production is expected to reach a steady state by June and then continue to track positively in the second half of 2011.

Mr. Peter Hawley, PGeo, is the Company's Chief Executive Officer and Qualified Person for the various Company projects. He is responsible for the current exploration and development programs and has reviewed the content of this release.

For additional information please see the Company's website at www.scorpiogold.com.

ON BEHALF OF THE BOARD SCORPIO GOLD CORPORATION

Peter J. Hawley, Chief Executive Officer and Director

The Company relies on litigation protection for "forward-looking" statements. This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur, and include, without limitation, statements regarding the Company's plans with respect to the development of its Mineral Ridge project and commencement of gold production. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements, including risks relating to commencing production from a mining project. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

gruß

massel

Einfach nur Lesenswert:

http://seacoast-consulting.com/site/2010/11/29/golden-phoeni…

NOVEMBER 29TH, 2010

Golden Phoenix Minerals:Risen from the Ashes Yet Again

Golden Phoenix Minerals (GPXM):

Risen from the Ashes Yet Again

Preface: The US and its entire system is on the brink of collapse regardless of what the “feel good” news of the moment might be–especially during the Holiday Season when we are inundated with Black Friday, Cyper Monday and Shop Till you Drop (or are run over–see www.fedupusa.com) headlines.

The unemployment rate in this country is at least double what the government is posting–closer to 20% than to 10%; in some areas 30-35%. Areas such as Detroit. Most of us are going to have to wake up to reality–especially the Middle Class. I have hopes of creating United We Will Stand, a website devoted to Americans who understand the power of numbers and critical mass.

We all need to make a living and/or invest well if we have any investing capital at all. I want you to do well because Americans are a family without a Patriarch. We need to survive and provide for our families. All signals for me point to a stock market being propped up. I am going to start mentioning a few high risk-high reward junior mining stocks as that was my beat back in the day. Please do your own due diligence and don’t take anyone’s word on anything–including me. God Speed.

November 2010

“The Down and Dirty”