Turnkey-Driller, Explorer und Entwickler mit KGV und KCV von 1 ! - 500 Beiträge pro Seite

eröffnet am 16.12.10 19:10:36 von

neuester Beitrag 14.02.11 19:51:42 von

neuester Beitrag 14.02.11 19:51:42 von

Beiträge: 4

ID: 1.162.044

ID: 1.162.044

Aufrufe heute: 0

Gesamt: 1.336

Gesamt: 1.336

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 01:29 | 331 | |

| heute 00:17 | 257 | |

| gestern 13:40 | 245 | |

| gestern 21:33 | 135 | |

| gestern 23:24 | 112 | |

| vor 1 Stunde | 102 | |

| gestern 21:02 | 99 | |

| gestern 22:40 | 99 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.179,00 | +1,33 | 218 | |||

| 2. | 2. | 160,89 | +13,26 | 156 | |||

| 3. | 3. | 0,1910 | +4,95 | 77 | |||

| 4. | 4. | 2.321,60 | -0,03 | 59 | |||

| 5. | 5. | 0,0313 | +95,63 | 49 | |||

| 6. | 6. | 43,75 | -3,42 | 45 | |||

| 7. | 7. | 4,7480 | +3,15 | 43 | |||

| 8. | 8. | 14,475 | +5,46 | 41 |

Allied Energy Group Inc: Achtung hochexplosiv!

Normalerweise handelt es sich bei Rohstoffwerten um Werte, die in Zukunft auf der Basis von Entwicklungsplänen in Zukunft Geld verdienen wollen. Die Allied Energy Group Inc. hat dies schon seit Jahren profitabel bewiesen, belegt durch testierte Abschlüsse aus den leztten Jahren.

Aktuell habe ich diesen Wert auf der Watch, der 2008 und 2009

profitabel war und nu im Q3 den Turbo eingelegt hat:

Annualisiert ergeben sich folgende Kennziffern:

KGV = 1

KCV = 1

keine Bankdarlehn

Cash > 5 Mill. Dollar

Berwertung 14 Mill. Dollar bei diluted shares von 70 Mill. gemäß Angabe Q3 bei 20 Cent. Derzeit steigt der Wert bei niedrigem Volumen täglich auf aktuell 27 Cent.

Alle Infos nachzulesen auf:

http://www.alliedenergy.com/images/top_06.jpg

Hier ein Auszug der vorzüglichen News:

Allied Energy Announces Record Earnings and Continued Growth for First 9 Months of 2010

.

Companies:Allied Energy, Inc..

Allied Howard #2H Drilling Operation

Related Quotes

Symbol Price Change

AGGI.PK 0.20 0.00

Allied Energy, Inc. On Monday November 1, 2010, 4:59 pm EDT

BOWLING GREEN, KY--(Marketwire - 11/01/10) - Allied Energy (Pinksheets:AGGI - News) announced today record earnings and continued growth for the combined first, second and third quarters of 2010. The company's unaudited financial statements are now available at www.alliedenergy.com

For the nine months ended September 30, 2010, the Company reported total revenue of $20.8 million, which is a 96% increase from the same period for 2009. Of this amount, for the 2010 period, $19.9 million in revenue is turnkey drilling revenue, and $875,600 is oil and gas production revenue. During the first nine months of 2009, the Company had $10.2 million of turnkey drilling revenue and $424,800 of oil and gas production revenue.

Also for the nine months ended September 30, 2010, the Company's earnings before income taxes (EBIT) of $5.6 million increased by 936% when compared to the Company's earnings for the same period of 2009. Net income was $3.4 million for the first nine months of 2010 as compared with a net loss of $664,748 for the same period of 2009. The Company attributes the majority of this increase to the Company's experienced personnel, management team, subsidiaries, progress in the field and strategic industry partners.

The Company serves as the managing general partner for a number of general and limited partnerships in oil and natural gas development. These partnerships' aggregate oil and natural gas exploration and development costs for 2010 increased to $10.6 million from $7.7 million in 2009 as a direct result of the Company's continued aggressive acquisition and re-investment program including but not limited to increased participation in horizontal drilling programs, sponsorship of partnerships, lease acquisitions in Central-East Texas, well reworks and completions, building of gas line infrastructure, and the formation of the Company's wholly-owned operating companies, Allied Operating Oklahoma, LLC and Allied Operating Texas, LLC.

For the three months ended September 30, 2010, the Company's total revenue was $10.8 million, including $10.5 million from turnkey drilling revenue and $384,600 from oil and gas production revenue. Also for the three months ended September 30, 2010, the Company's earnings before income taxes were $5.0 million as compared with $999,600 for the same period of 2009, and the Company's net income was $3.0 million as compared with net income of $999,599 for year-earlier period.

Earlier this spring, the Allied Operating Howard #1H, Allied's first horizontal well, was drilled to a total measured depth of approximately 17,000 feet, including a vertical depth of approximately 11,000 feet and horizontal length of approximately 6,000 feet, in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / George-town Limestone Formation.

On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~ 2,000 MCFD of gas with 25 to 30 BCPD while maintaining ~ 2250 PSI FTP.

"We are extremely pleased with the results we have seen thus far for our horizontal programs in Grimes County, Texas and the overall execution of our business model for the first nine months of 2010," said Steve Stengell, Allied's Chief Executive Officer.

Allied Energy, Inc. contracted Allied Gas Transmission, a majority-owned subsidiary of Allied, to trench, lay line and connect the Howard #1H to the local gas market. Allied Energy, Inc. recently signed and executed a pipeline connection agreement with Atmos Pipeline - Texas, a division of Atmos Energy Corporation, in order to sell its gas in Grimes County, Texas.

Allied Operating Texas, LLC, a wholly-owned subsidiary, was formed in 2009 for the purposes of operating and developing Allied Energy's vertical and horizontal drilling programs in Central-East Texas Basins.

At October 31, 2010, the Company, either directly or through its partnership interests, owned interests in 70 producing wells and/or wells awaiting hook-up, four wells in various stages of testing or completion, 2 wells in process of being drilled, and 20 additional wells scheduled to commence drilling on or before December 31, 2010. The Company is currently drilling its second horizontal location in Grimes County, the Allied Howard #2H, and is making plans to begin drilling a third location in the future.

No assurances can be made as to the Company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to accurately estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Although the Company has thoroughly reviewed this information, these financial statements are unaudited.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently nominated by an independent selection committee as one of three finalists for the Bowing Green "Outstanding Business of the Year" award for 2010.

About Allied Energy

Allied Energy, Inc. (Pinksheets:AGGI - News) is an independent energy development firm primarily engaged in the exploration, development, and production of oil and natural gas in the continental United States. The Company relies upon its industry partners, well operators, geologists, petroleum engineers, and other operational personnel whose combined industry experience is essential to each project. Allied Energy's strategic focus is the development of oil and natural gas reserves.

For more information: www.alliedenergy.com

Allied Energy Announces Plans for Horizontal Drilling Program in Leon County, Texas .

Companies:Allied Energy, Inc..Related Quotes

Symbol Price Change

AGGI.PK 0.20 0.00

BOWLING GREEN, KY--(Marketwire - 11/08/10) - Allied Energy (Pinksheets:AGGI - News) announced today its plans to drill its first horizontal well in Leon County, Texas.

The Company plans to drill 7,000 feet +/- vertical and approximately 4,000 feet horizontal to test the oil bearing Woodbine Formation utilizing new and evolving fracture stimulation methodologies.

Over the last year, there have been a series of horizontal Woodbine wells on trend, which were drilled and completed for production and reported average initial production rates of approximately 200 to 300 BO per day. Allied plans to mimic the most prolific wells in the play, which utilize the combination of horizontal laterals with multi-stage hydraulic fracture treatments. The ability to drill horizontal laterals and apply multi-stage treatments to the Woodbine Formation has created what appears to be a growing trend of horizontal drilling activity in the regional area of the East Texas Basin.

Earlier this year in Grimes County, Texas, Allied Operating Texas, LLC drilled and completed the Howard #1H, Allied's first horizontal well. The Howard #1H was drilled to a total measured depth of approximately 17,000 feet, including a vertical depth of approximately 12,500 +/- feet and horizontal length of approximating more than 4,500 feet, in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / Georgetown Limestone Formation. On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~2,000 MCFD of gas with 25 to 30 BCPD while maintaining strong FTP.

"We are extremely pleased with the results we have seen for our Grimes County project and are also excited about utilizing many of the latest technological advances for horizontal drilling in Leon County as well," said Steve Stengell, Allied's Chief Executive Officer. "The price for oil makes this project even more attractive."

Allied Operating Texas, LLC, a wholly-owned subsidiary, was formed in 2009 for the purposes of operating and developing Allied Energy's vertical and horizontal drilling programs in Central-East Texas Basins.

No assurances can be made as to the company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to accurately estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently nominated by an independent selection committee as one of three finalists for the Bowing Green "Outstanding Business of the Year" award for 2010.

PS: Andere Companys wie New Gulf Energy berichten in Leon County von Bohrergebnissen mit 1.000 Barrel/T und Pay-Back-Zeiten von 3-4 Monaten aus der Woodbine Formation.

http://www.kuam.com/Global/story.asp?s=12855179&clienttype=p…

Normalerweise handelt es sich bei Rohstoffwerten um Werte, die in Zukunft auf der Basis von Entwicklungsplänen in Zukunft Geld verdienen wollen. Die Allied Energy Group Inc. hat dies schon seit Jahren profitabel bewiesen, belegt durch testierte Abschlüsse aus den leztten Jahren.

Aktuell habe ich diesen Wert auf der Watch, der 2008 und 2009

profitabel war und nu im Q3 den Turbo eingelegt hat:

Annualisiert ergeben sich folgende Kennziffern:

KGV = 1

KCV = 1

keine Bankdarlehn

Cash > 5 Mill. Dollar

Berwertung 14 Mill. Dollar bei diluted shares von 70 Mill. gemäß Angabe Q3 bei 20 Cent. Derzeit steigt der Wert bei niedrigem Volumen täglich auf aktuell 27 Cent.

Alle Infos nachzulesen auf:

http://www.alliedenergy.com/images/top_06.jpg

Hier ein Auszug der vorzüglichen News:

Allied Energy Announces Record Earnings and Continued Growth for First 9 Months of 2010

.

Companies:Allied Energy, Inc..

Allied Howard #2H Drilling Operation

Related Quotes

Symbol Price Change

AGGI.PK 0.20 0.00

Allied Energy, Inc. On Monday November 1, 2010, 4:59 pm EDT

BOWLING GREEN, KY--(Marketwire - 11/01/10) - Allied Energy (Pinksheets:AGGI - News) announced today record earnings and continued growth for the combined first, second and third quarters of 2010. The company's unaudited financial statements are now available at www.alliedenergy.com

For the nine months ended September 30, 2010, the Company reported total revenue of $20.8 million, which is a 96% increase from the same period for 2009. Of this amount, for the 2010 period, $19.9 million in revenue is turnkey drilling revenue, and $875,600 is oil and gas production revenue. During the first nine months of 2009, the Company had $10.2 million of turnkey drilling revenue and $424,800 of oil and gas production revenue.

Also for the nine months ended September 30, 2010, the Company's earnings before income taxes (EBIT) of $5.6 million increased by 936% when compared to the Company's earnings for the same period of 2009. Net income was $3.4 million for the first nine months of 2010 as compared with a net loss of $664,748 for the same period of 2009. The Company attributes the majority of this increase to the Company's experienced personnel, management team, subsidiaries, progress in the field and strategic industry partners.

The Company serves as the managing general partner for a number of general and limited partnerships in oil and natural gas development. These partnerships' aggregate oil and natural gas exploration and development costs for 2010 increased to $10.6 million from $7.7 million in 2009 as a direct result of the Company's continued aggressive acquisition and re-investment program including but not limited to increased participation in horizontal drilling programs, sponsorship of partnerships, lease acquisitions in Central-East Texas, well reworks and completions, building of gas line infrastructure, and the formation of the Company's wholly-owned operating companies, Allied Operating Oklahoma, LLC and Allied Operating Texas, LLC.

For the three months ended September 30, 2010, the Company's total revenue was $10.8 million, including $10.5 million from turnkey drilling revenue and $384,600 from oil and gas production revenue. Also for the three months ended September 30, 2010, the Company's earnings before income taxes were $5.0 million as compared with $999,600 for the same period of 2009, and the Company's net income was $3.0 million as compared with net income of $999,599 for year-earlier period.

Earlier this spring, the Allied Operating Howard #1H, Allied's first horizontal well, was drilled to a total measured depth of approximately 17,000 feet, including a vertical depth of approximately 11,000 feet and horizontal length of approximately 6,000 feet, in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / George-town Limestone Formation.

On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~ 2,000 MCFD of gas with 25 to 30 BCPD while maintaining ~ 2250 PSI FTP.

"We are extremely pleased with the results we have seen thus far for our horizontal programs in Grimes County, Texas and the overall execution of our business model for the first nine months of 2010," said Steve Stengell, Allied's Chief Executive Officer.

Allied Energy, Inc. contracted Allied Gas Transmission, a majority-owned subsidiary of Allied, to trench, lay line and connect the Howard #1H to the local gas market. Allied Energy, Inc. recently signed and executed a pipeline connection agreement with Atmos Pipeline - Texas, a division of Atmos Energy Corporation, in order to sell its gas in Grimes County, Texas.

Allied Operating Texas, LLC, a wholly-owned subsidiary, was formed in 2009 for the purposes of operating and developing Allied Energy's vertical and horizontal drilling programs in Central-East Texas Basins.

At October 31, 2010, the Company, either directly or through its partnership interests, owned interests in 70 producing wells and/or wells awaiting hook-up, four wells in various stages of testing or completion, 2 wells in process of being drilled, and 20 additional wells scheduled to commence drilling on or before December 31, 2010. The Company is currently drilling its second horizontal location in Grimes County, the Allied Howard #2H, and is making plans to begin drilling a third location in the future.

No assurances can be made as to the Company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to accurately estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Although the Company has thoroughly reviewed this information, these financial statements are unaudited.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently nominated by an independent selection committee as one of three finalists for the Bowing Green "Outstanding Business of the Year" award for 2010.

About Allied Energy

Allied Energy, Inc. (Pinksheets:AGGI - News) is an independent energy development firm primarily engaged in the exploration, development, and production of oil and natural gas in the continental United States. The Company relies upon its industry partners, well operators, geologists, petroleum engineers, and other operational personnel whose combined industry experience is essential to each project. Allied Energy's strategic focus is the development of oil and natural gas reserves.

For more information: www.alliedenergy.com

Allied Energy Announces Plans for Horizontal Drilling Program in Leon County, Texas .

Companies:Allied Energy, Inc..Related Quotes

Symbol Price Change

AGGI.PK 0.20 0.00

BOWLING GREEN, KY--(Marketwire - 11/08/10) - Allied Energy (Pinksheets:AGGI - News) announced today its plans to drill its first horizontal well in Leon County, Texas.

The Company plans to drill 7,000 feet +/- vertical and approximately 4,000 feet horizontal to test the oil bearing Woodbine Formation utilizing new and evolving fracture stimulation methodologies.

Over the last year, there have been a series of horizontal Woodbine wells on trend, which were drilled and completed for production and reported average initial production rates of approximately 200 to 300 BO per day. Allied plans to mimic the most prolific wells in the play, which utilize the combination of horizontal laterals with multi-stage hydraulic fracture treatments. The ability to drill horizontal laterals and apply multi-stage treatments to the Woodbine Formation has created what appears to be a growing trend of horizontal drilling activity in the regional area of the East Texas Basin.

Earlier this year in Grimes County, Texas, Allied Operating Texas, LLC drilled and completed the Howard #1H, Allied's first horizontal well. The Howard #1H was drilled to a total measured depth of approximately 17,000 feet, including a vertical depth of approximately 12,500 +/- feet and horizontal length of approximating more than 4,500 feet, in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / Georgetown Limestone Formation. On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~2,000 MCFD of gas with 25 to 30 BCPD while maintaining strong FTP.

"We are extremely pleased with the results we have seen for our Grimes County project and are also excited about utilizing many of the latest technological advances for horizontal drilling in Leon County as well," said Steve Stengell, Allied's Chief Executive Officer. "The price for oil makes this project even more attractive."

Allied Operating Texas, LLC, a wholly-owned subsidiary, was formed in 2009 for the purposes of operating and developing Allied Energy's vertical and horizontal drilling programs in Central-East Texas Basins.

No assurances can be made as to the company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to accurately estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently nominated by an independent selection committee as one of three finalists for the Bowing Green "Outstanding Business of the Year" award for 2010.

PS: Andere Companys wie New Gulf Energy berichten in Leon County von Bohrergebnissen mit 1.000 Barrel/T und Pay-Back-Zeiten von 3-4 Monaten aus der Woodbine Formation.

http://www.kuam.com/Global/story.asp?s=12855179&clienttype=p…

"Allied Energy Group to become a fully reporting company!"

Allied Energy Shareholders Elect Directors; Board Elects Brady as Interim CFO and Turner as Vice President of Operations

.

Press Release Source: Allied Energy, Inc. On Wednesday November 24, 2010, 10:30 am EST

BOWLING GREEN, KY--(Marketwire - 11/24/10) - Allied Energy, Inc. (Pinksheets:AGGI - News) held its Annual Meeting of Shareholders and Board of Directors Meeting on October 28, 2010.

At the Annual Meeting of Shareholders, Dirk Olsen, Steve Stengell, Robert "Bob" Cueto and Scott Harris were re-elected to serve as members of the Board of Directors.

At the Board of Directors meeting later in the day, Steve Stengell was elected to serve as the Chairman of the Board, Tim Brady was elected as the Company's Interim Chief Financial Officer, and Joe Turner was elected as Vice President of Operations. Re-elected officers included Steve Stengell as Chairman of the Board and President, and Scott Harris and Bob Cueto as Executive Vice President.

The Company also discussed various operating activities, including its Rogers County, Oklahoma field operations, its Giddings Field, Texas horizontal project, its Leon County, Texas horizontal project, and its plan to become a fully reporting company.

On November 12, 2010, Allied was named "Outstanding Business of the Year" for the Bowling Green area and received their "Community Impact Award of Southern Kentucky" at a banquet held at the National Corvette Museum.

Allied Energy Receives Current Rating From OTCmarkets.com .

Companies:ALLIED ENERGY GROUP.Related Quotes

Symbol Price Change

AGGI.PK 0.29 0.00

{"s" : "aggi.pk","k" : "a00,a50,b00,b60,c10,g00,h00,l10,p20,t10,v00","o" : "","j" : ""} Press Release Source: Allied Energy, Inc. On Thursday December 2, 2010, 12:56 pm EST

BOWLING GREEN, KY--(Marketwire - 12/02/10) - Allied Energy (Pinksheets:AGGI - News) announced today that the Company has received a current status rating as it relates to information disclosure to the general public from www.otcmarkets.com. The Company's financial statements and other corporate information are available at www.alliedenergy.com and www.otcmarkets.com

Earlier this spring, the Allied Operating Howard #1H, Allied's first horizontal well, was drilled to a total measured depth of approximately 17,000' in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / Georgetown Limestone Formation.

On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~ 2,000 MCFD of gas with 25 to 30 BCPD while maintaining ~ 2250 PSI FTP.

The Company is currently drilling its second well in Grimes County, Texas, the Allied Howard #2H, and is scheduled to begin drilling its first horizontal well in Leon County, Texas in the next week or two.

"We are extremely pleased with the results we have seen thus far for 2010 field operations in Texas and Oklahoma and are ultimately pleased with the transparency provided by OTCmarkets.com," said Steve Stengell, Allied's President and CEO.

No assurance can be made as to the Company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances can be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently awarded, by an independent selection committee, Bowling Green's "Outstanding Business of the Year" for 2010.

Allied Energy Shareholders Elect Directors; Board Elects Brady as Interim CFO and Turner as Vice President of Operations

.

Press Release Source: Allied Energy, Inc. On Wednesday November 24, 2010, 10:30 am EST

BOWLING GREEN, KY--(Marketwire - 11/24/10) - Allied Energy, Inc. (Pinksheets:AGGI - News) held its Annual Meeting of Shareholders and Board of Directors Meeting on October 28, 2010.

At the Annual Meeting of Shareholders, Dirk Olsen, Steve Stengell, Robert "Bob" Cueto and Scott Harris were re-elected to serve as members of the Board of Directors.

At the Board of Directors meeting later in the day, Steve Stengell was elected to serve as the Chairman of the Board, Tim Brady was elected as the Company's Interim Chief Financial Officer, and Joe Turner was elected as Vice President of Operations. Re-elected officers included Steve Stengell as Chairman of the Board and President, and Scott Harris and Bob Cueto as Executive Vice President.

The Company also discussed various operating activities, including its Rogers County, Oklahoma field operations, its Giddings Field, Texas horizontal project, its Leon County, Texas horizontal project, and its plan to become a fully reporting company.

On November 12, 2010, Allied was named "Outstanding Business of the Year" for the Bowling Green area and received their "Community Impact Award of Southern Kentucky" at a banquet held at the National Corvette Museum.

Allied Energy Receives Current Rating From OTCmarkets.com .

Companies:ALLIED ENERGY GROUP.Related Quotes

Symbol Price Change

AGGI.PK 0.29 0.00

{"s" : "aggi.pk","k" : "a00,a50,b00,b60,c10,g00,h00,l10,p20,t10,v00","o" : "","j" : ""} Press Release Source: Allied Energy, Inc. On Thursday December 2, 2010, 12:56 pm EST

BOWLING GREEN, KY--(Marketwire - 12/02/10) - Allied Energy (Pinksheets:AGGI - News) announced today that the Company has received a current status rating as it relates to information disclosure to the general public from www.otcmarkets.com. The Company's financial statements and other corporate information are available at www.alliedenergy.com and www.otcmarkets.com

Earlier this spring, the Allied Operating Howard #1H, Allied's first horizontal well, was drilled to a total measured depth of approximately 17,000' in two horizontal laterals oriented northwest and southeast along existing trends. The Howard #1H encountered a series of natural gas bearing intervals while drilling through the primary objective Buda / Georgetown Limestone Formation.

On May 15, 2010, the Howard #1H had an initial flowing test rate of 4,011 MCFGD on a 20/64" choke with associated condensate and has initially produced, as expected, at an estimated sales rate of ~ 2,000 MCFD of gas with 25 to 30 BCPD while maintaining ~ 2250 PSI FTP.

The Company is currently drilling its second well in Grimes County, Texas, the Allied Howard #2H, and is scheduled to begin drilling its first horizontal well in Leon County, Texas in the next week or two.

"We are extremely pleased with the results we have seen thus far for 2010 field operations in Texas and Oklahoma and are ultimately pleased with the transparency provided by OTCmarkets.com," said Steve Stengell, Allied's President and CEO.

No assurance can be made as to the Company's future success and/or ability to sponsor general partnerships or other oil and natural gas projects. Nor can assurances can be made as it relates to present or future production rates or estimated reserves for any given project. Tremendous risks and uncertainty are associated with oil and gas drilling, completion, development and production operations. It is impossible to estimate future rates and/or declines in production operations for oil, condensate and natural gas.

Allied Energy has achieved the "Best of Bowling Green" award for the category of crude oil and natural gas production for the last two years and was recently awarded, by an independent selection committee, Bowling Green's "Outstanding Business of the Year" for 2010.

Hallo,

danke für die Info bei mir im Thread....

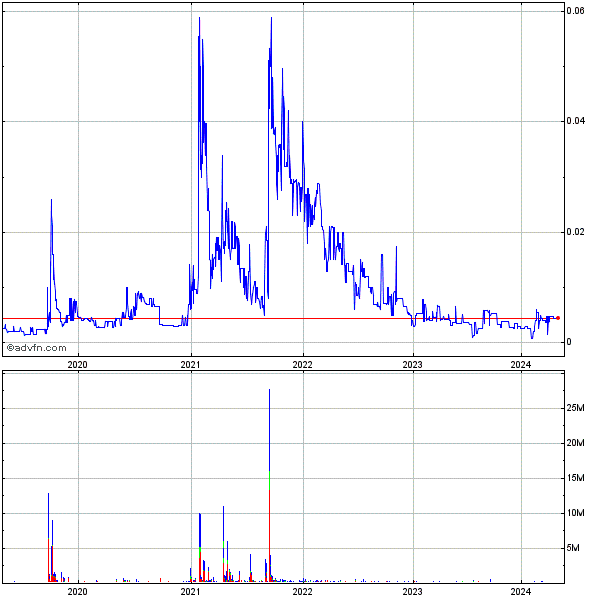

habe mir mal die Charts angeschaut.....

Gruß

TimLuca

danke für die Info bei mir im Thread....

habe mir mal die Charts angeschaut.....

Gruß

TimLuca

Hier ein Update der News von Allied Energy;

"We are confident that our new corporate headquarters should better facilitate Allied's future growth."

BOWLING GREEN, KY--(Marketwire - 02/03/11) - Allied Energy, Inc. (Pinksheets:AGGI - News) announced today that the company has signed a letter of intent to purchase its new corporate headquarters in Bowling Green, Kentucky. The property is located at 2427 Russellville Road and is the former State Farm claims service center.

Allied's new building is located on ~4.6 acres (zoned highway business) and consists of ~11,200 square feet of existing office space. Allied has plans to immediately build out and expand to up to ~13,500' total office space in an effort to facilitate continued record sales and growth for the company.

For the nine months ended September 30, 2010, the Company reported total revenue of $20.8 million, which was a 96% increase from the same period for 2009. Of this amount, for the 2010 period, $19.9 million in revenue was turnkey drilling revenue, and $875,600 was oil and gas production revenue. During the first nine months of 2009, the Company had $10.2 million of turnkey drilling revenue and $424,800 of oil and gas production revenue. The Company's earnings before income taxes (EBIT) of $5.0 million increased by 845% when compared to the Company's earnings for the same period of 2009. Net income was $2.8 million for the first nine months of 2010 as compared with a net loss of $664,748 for the same period of 2009.

Allied Energy, Inc. is an independent oil and natural gas operator engaged in the exploration, development, and production of oil and natural gas, primarily in Texas and Oklahoma. Through its wholly owned subsidiaries, Allied Operating Oklahoma LLC and Allied Operating Texas LLC, and its Allied Gas Transmission, a majority owned subsidiary, Allied Energy, Inc. operates its oil and natural gas properties. The company's strategic focus is the development of reserves through the utilization of the latest horizontal drilling and production technology in Central-East Texas.

"We are confident that our new corporate headquarters should better facilitate Allied's future growth, business model and overall operations as an independent producer and operator in Texas and Oklahoma," said Steve Stengell, Allied's President and CEO.

"We are in the process of implementing a corporate governance standards program that is consistent with public company standards in anticipation of becoming a fully reporting company."

BOWLING GREEN, KY--(Marketwire - 01/18/11) - Allied Energy, Inc. (Pinksheets:AGGI - News) today announced that it has engaged Moody, Famiglietti & Andronico, LLP, of Tewksbury, MA, a Public Company Accounting Oversight Board member firm (www.pcaobus.org), to act as auditor to the Company and to audit its financial statements for year-end 2010.

The hiring coincides with the Company's plan to become a fully reporting company with the SEC under the Securities Exchange Act of 1934 during 2011 and for its shares to be traded on the NASD Over-The-Counter Bulletin Board (OTCBB).

Steve Stengell, Allied's Chief Executive Officer, stated, "We are in the process of implementing a corporate governance standards program that is consistent with public company standards in anticipation of becoming a fully reporting company. Engaging Moody, Famiglietti & Andronico, LLP, a firm with significant public company auditing experience, is a positive step in meeting the standards that we have set for the Company."

Through its wholly-owned subsidiaries, Allied Operating Oklahoma LLC and Allied Operating Texas LLC, and its majority-owned subsidiary, Allied Gas Transmission, Inc. Allied Energy, Inc. operates its oil and natural gas properties in both Texas and Oklahoma.

Allied Energy, Inc. is an independent oil and natural gas developer primarily engaged in the exploration, development, and production of oil and natural gas in the continental United States. The Company relies upon its strategic industry partners, subsidiaries, geologists, petroleum engineers, and other operational personnel whose combined industry experience is essential to each project. Allied Energy's strategic focus is the development of oil and natural gas reserves.

BOWLING GREEN, KY--(Marketwire - 01/11/11) - Allied Energy (Pinksheets:AGGI - News) provided the following report for its horizontal drilling and other current field operations in Grimes and Leon Counties, Texas and Northern Ohio.

Allied Howard #1H (Grimes County, Texas) -- Production Operations

The Allied Howard #1H produced and sold 67 million cubic feet of natural gas equivalent, including approximately 45 million cubic feet of methane gas and 840 BOE (barrels of oil equivalent) of condensate and NGL (natural gas liquids) for the 31-day period from December 1, 2010 to December 31, 2010. Excluding downtime of approximately five days, the well actually produced at a rate approximating 80 million cubic feet of gas (MCFG) for the month while in its first month of production.

It generally takes 4-6 months to better manage downtime and lease operating expenses (LOE) for a horizontal well of this size and depth. Typically, LOEs decline as a percentage of gross revenue for a significant portion of the life of the well. Although production for this well may or may not increase over the short-term, oil and gas wells typically decline for the long-term. The Company is projecting LOEs equal to 10% of gross revenues for the long-term although they may be higher for the short-term. These LOEs include but are not limited to water disposal/hauling, electricity, pumping/administration, gas transmission, severance taxes, compression and general maintenance.

Allied Howard #2H -- Production Test

The Howard #2H tested at a rate of approximately 4,000 MCFG per day with associated condensate. We have constructed production facilities, gas flow lines, processing facilities and other necessary surface equipment in preparation to begin ongoing production operations for the Howard #2H.

The Company is pleased with the volumes of gas, wellhead pressure, etc. demonstrated during the production test for the Allied Howard #2H and expects to have the well on-line as early as this week. Although no assurances can be made and risks do exist, we would like to target approximately 100 million cubic feet of gas equivalent per month for an initial production rate for this well in the near future including methane, condensate and NGL sales. Again, this is a target estimate for an initial production rate for the well, and whatever the level of initial production, it will decline in the near future and over the life of the well. No assurances can be made that this level of initial production will be achieved.

The Company has an approximate 13% working interest and a 9.75% net revenue interest in the Allied Howard #2H well.

Allied "Champion Ranch" Wallrath #1H Drilling Operations -- Leon County, Texas

Allied Operating Texas successfully drilled the directional curve and set / cemented casing in preparation to begin drilling our horizontal lateral in the Woodbine formation for the Wallrath #1H in Leon County, Texas. A formal oil show was encountered immediately upon drilling the curve into the Woodbine Sand and the well had a continued oil show reported by the mudlogger while drilling the majority section of the lateral. Although oil and/or gas shows are considered favorable indications that the well may be capable of production, there are numerous wells that have such shows but that never become capable of commercial production for any of a number of reasons. Halliburton Services is tentatively scheduled to perform a frac treatment for the Wallrath #1H in the latter part of February. We will keep you updated as to our projected timelines.

The Company has an approximate 13% working interest and a 9.75% net revenue interest in the Wallrath #1H well.

Allied A-1 "SubClarksville" Re-entry (Leon County, Texas)

Upon drilling through the SubClarksville formation in Leon County, we encountered an increase in the rate of penetration and had a formal gas show reported by the mudlog. As stated above, although gas shows are considered favorable, they are not determinative of commercial production, and many wells with formal gas shows never become commercially productive. The Company plans to move directly to the A-1 re-entry well-bore immediately following the treatment and completion of the above Wallrath #1H horizontal well. Our tentative operations re-entry schedule is February-March 2011. The Company has an approximate 20% working interest and a 15% net revenue interest in the A-1 well-bore.

Northern Ohio -- Trempeleau Drilling Project

Allied participated as a non-operator in this exploratory drilling program with a subcontracted operator and industry partner in Ohio. The Dumbaugh #1 was drilled to approximately 3,400' to test the Trempeleau Dolomite formation and any other potentially productive reservoirs. Oil shows and increased porosity were reported in several intervals at the target depth; however, oil shows often do not result in commercial production. The Company is now evaluating its plans for completion. The Company has an approximate 50% working interest and a 40% net revenue interest in the Dumbaugh #1 well.

Saltwater Disposal Well -- Grimes County, Texas

We just recently received our approved injection permit and are working to secure a rig in the very near future to begin drilling our water disposal well in Grimes County. This should allow us to dispose of water directly into a well-bore and prevent us from continued hauling at a much more expensive cost to Allied and its partners in the Howard #1H and #2H wells.

2011 Horizontal JV Program -- Grimes County, Texas

We have selected our planned location as a direct offset to the Apache Wells E #1H location and are currently making preparations to drill in the future. The Apache Wells E #1H well, to date, has been the best producer in this area, as per reported by the Texas Railroad Commission and DrillingInfo.com. It is anticipated that the Company will have an approximate 13% of working interest and a 9.75% net revenue interest in this well. The actual amounts are yet to be determined based on a number of currently unknown factors.

"We are currently making preparations to drill our third horizontal well in Grimes County and plan to utilize many the latest technological advancements in horizontal drilling in this area of Texas," said Steve Stengell, Allied's President and CEO.

Zur Bedeutung der Öl- und Gasvorkommen in Grimes County und Leon County Texas:

Lower Woodbine may be the new oil play to watch in southeast Texas

By Oil & Gas Financial Journal staff

There is a new oil play to watch in southeast Texas that may be of interest to those fascinated by the Eagle Ford shale.

In Madison, Leon, and Grimes counties, just above the Buda lime is an organic rich, laminated sand section that some operators refer to as the 'Lower Woodbine.’ A February 10 research note from Jefferies & Co. Inc. says the zone is “equivalent to the Lower Eagle Ford of South Texas,” but cautions the rock is different, and “perhaps more challenging.” Despite the potential challenges, Jefferies remains “cautiously optimistic” about the play.

A few red flags noted by Jefferies include “higher clay content, lower reservoir pressure, and an under-pressured upper zone which may require an extra string of pipe.” To counter, however, the clay is non-swelling and thus less problematic; workable, lower pressure zones exist in parts of the Eagle Ford; and the cost of extra pipe may be partly offset by a shallower depth overall.

According to Jefferies, operators in the vicinity include Apache Corp. (NYSE: APA) and Gastar Exploration (NYSE: GST). Chesapeake Energy (NYSE: CHK) is currently drilling a well targeting the formation in north central Madison County and three other locations have been permitted in Madison and Leon Counties.

Also in the vicinity, but not the Lower Woodbine exactly, are a couple private operators reporting “several prolific horizontal Woodbine completions (up to 1,000 boe/d initial production) recently in the area,” notes Jefferies. These particular wells seem to be targeting the Woodbine channel sandstones above.

http://www.ogfj.com/index/oil-markets/oil-gas-companies/apac…

"We are confident that our new corporate headquarters should better facilitate Allied's future growth."

BOWLING GREEN, KY--(Marketwire - 02/03/11) - Allied Energy, Inc. (Pinksheets:AGGI - News) announced today that the company has signed a letter of intent to purchase its new corporate headquarters in Bowling Green, Kentucky. The property is located at 2427 Russellville Road and is the former State Farm claims service center.

Allied's new building is located on ~4.6 acres (zoned highway business) and consists of ~11,200 square feet of existing office space. Allied has plans to immediately build out and expand to up to ~13,500' total office space in an effort to facilitate continued record sales and growth for the company.

For the nine months ended September 30, 2010, the Company reported total revenue of $20.8 million, which was a 96% increase from the same period for 2009. Of this amount, for the 2010 period, $19.9 million in revenue was turnkey drilling revenue, and $875,600 was oil and gas production revenue. During the first nine months of 2009, the Company had $10.2 million of turnkey drilling revenue and $424,800 of oil and gas production revenue. The Company's earnings before income taxes (EBIT) of $5.0 million increased by 845% when compared to the Company's earnings for the same period of 2009. Net income was $2.8 million for the first nine months of 2010 as compared with a net loss of $664,748 for the same period of 2009.

Allied Energy, Inc. is an independent oil and natural gas operator engaged in the exploration, development, and production of oil and natural gas, primarily in Texas and Oklahoma. Through its wholly owned subsidiaries, Allied Operating Oklahoma LLC and Allied Operating Texas LLC, and its Allied Gas Transmission, a majority owned subsidiary, Allied Energy, Inc. operates its oil and natural gas properties. The company's strategic focus is the development of reserves through the utilization of the latest horizontal drilling and production technology in Central-East Texas.

"We are confident that our new corporate headquarters should better facilitate Allied's future growth, business model and overall operations as an independent producer and operator in Texas and Oklahoma," said Steve Stengell, Allied's President and CEO.

"We are in the process of implementing a corporate governance standards program that is consistent with public company standards in anticipation of becoming a fully reporting company."

BOWLING GREEN, KY--(Marketwire - 01/18/11) - Allied Energy, Inc. (Pinksheets:AGGI - News) today announced that it has engaged Moody, Famiglietti & Andronico, LLP, of Tewksbury, MA, a Public Company Accounting Oversight Board member firm (www.pcaobus.org), to act as auditor to the Company and to audit its financial statements for year-end 2010.

The hiring coincides with the Company's plan to become a fully reporting company with the SEC under the Securities Exchange Act of 1934 during 2011 and for its shares to be traded on the NASD Over-The-Counter Bulletin Board (OTCBB).

Steve Stengell, Allied's Chief Executive Officer, stated, "We are in the process of implementing a corporate governance standards program that is consistent with public company standards in anticipation of becoming a fully reporting company. Engaging Moody, Famiglietti & Andronico, LLP, a firm with significant public company auditing experience, is a positive step in meeting the standards that we have set for the Company."

Through its wholly-owned subsidiaries, Allied Operating Oklahoma LLC and Allied Operating Texas LLC, and its majority-owned subsidiary, Allied Gas Transmission, Inc. Allied Energy, Inc. operates its oil and natural gas properties in both Texas and Oklahoma.

Allied Energy, Inc. is an independent oil and natural gas developer primarily engaged in the exploration, development, and production of oil and natural gas in the continental United States. The Company relies upon its strategic industry partners, subsidiaries, geologists, petroleum engineers, and other operational personnel whose combined industry experience is essential to each project. Allied Energy's strategic focus is the development of oil and natural gas reserves.

BOWLING GREEN, KY--(Marketwire - 01/11/11) - Allied Energy (Pinksheets:AGGI - News) provided the following report for its horizontal drilling and other current field operations in Grimes and Leon Counties, Texas and Northern Ohio.

Allied Howard #1H (Grimes County, Texas) -- Production Operations

The Allied Howard #1H produced and sold 67 million cubic feet of natural gas equivalent, including approximately 45 million cubic feet of methane gas and 840 BOE (barrels of oil equivalent) of condensate and NGL (natural gas liquids) for the 31-day period from December 1, 2010 to December 31, 2010. Excluding downtime of approximately five days, the well actually produced at a rate approximating 80 million cubic feet of gas (MCFG) for the month while in its first month of production.

It generally takes 4-6 months to better manage downtime and lease operating expenses (LOE) for a horizontal well of this size and depth. Typically, LOEs decline as a percentage of gross revenue for a significant portion of the life of the well. Although production for this well may or may not increase over the short-term, oil and gas wells typically decline for the long-term. The Company is projecting LOEs equal to 10% of gross revenues for the long-term although they may be higher for the short-term. These LOEs include but are not limited to water disposal/hauling, electricity, pumping/administration, gas transmission, severance taxes, compression and general maintenance.

Allied Howard #2H -- Production Test

The Howard #2H tested at a rate of approximately 4,000 MCFG per day with associated condensate. We have constructed production facilities, gas flow lines, processing facilities and other necessary surface equipment in preparation to begin ongoing production operations for the Howard #2H.

The Company is pleased with the volumes of gas, wellhead pressure, etc. demonstrated during the production test for the Allied Howard #2H and expects to have the well on-line as early as this week. Although no assurances can be made and risks do exist, we would like to target approximately 100 million cubic feet of gas equivalent per month for an initial production rate for this well in the near future including methane, condensate and NGL sales. Again, this is a target estimate for an initial production rate for the well, and whatever the level of initial production, it will decline in the near future and over the life of the well. No assurances can be made that this level of initial production will be achieved.

The Company has an approximate 13% working interest and a 9.75% net revenue interest in the Allied Howard #2H well.

Allied "Champion Ranch" Wallrath #1H Drilling Operations -- Leon County, Texas

Allied Operating Texas successfully drilled the directional curve and set / cemented casing in preparation to begin drilling our horizontal lateral in the Woodbine formation for the Wallrath #1H in Leon County, Texas. A formal oil show was encountered immediately upon drilling the curve into the Woodbine Sand and the well had a continued oil show reported by the mudlogger while drilling the majority section of the lateral. Although oil and/or gas shows are considered favorable indications that the well may be capable of production, there are numerous wells that have such shows but that never become capable of commercial production for any of a number of reasons. Halliburton Services is tentatively scheduled to perform a frac treatment for the Wallrath #1H in the latter part of February. We will keep you updated as to our projected timelines.

The Company has an approximate 13% working interest and a 9.75% net revenue interest in the Wallrath #1H well.

Allied A-1 "SubClarksville" Re-entry (Leon County, Texas)

Upon drilling through the SubClarksville formation in Leon County, we encountered an increase in the rate of penetration and had a formal gas show reported by the mudlog. As stated above, although gas shows are considered favorable, they are not determinative of commercial production, and many wells with formal gas shows never become commercially productive. The Company plans to move directly to the A-1 re-entry well-bore immediately following the treatment and completion of the above Wallrath #1H horizontal well. Our tentative operations re-entry schedule is February-March 2011. The Company has an approximate 20% working interest and a 15% net revenue interest in the A-1 well-bore.

Northern Ohio -- Trempeleau Drilling Project

Allied participated as a non-operator in this exploratory drilling program with a subcontracted operator and industry partner in Ohio. The Dumbaugh #1 was drilled to approximately 3,400' to test the Trempeleau Dolomite formation and any other potentially productive reservoirs. Oil shows and increased porosity were reported in several intervals at the target depth; however, oil shows often do not result in commercial production. The Company is now evaluating its plans for completion. The Company has an approximate 50% working interest and a 40% net revenue interest in the Dumbaugh #1 well.

Saltwater Disposal Well -- Grimes County, Texas

We just recently received our approved injection permit and are working to secure a rig in the very near future to begin drilling our water disposal well in Grimes County. This should allow us to dispose of water directly into a well-bore and prevent us from continued hauling at a much more expensive cost to Allied and its partners in the Howard #1H and #2H wells.

2011 Horizontal JV Program -- Grimes County, Texas

We have selected our planned location as a direct offset to the Apache Wells E #1H location and are currently making preparations to drill in the future. The Apache Wells E #1H well, to date, has been the best producer in this area, as per reported by the Texas Railroad Commission and DrillingInfo.com. It is anticipated that the Company will have an approximate 13% of working interest and a 9.75% net revenue interest in this well. The actual amounts are yet to be determined based on a number of currently unknown factors.

"We are currently making preparations to drill our third horizontal well in Grimes County and plan to utilize many the latest technological advancements in horizontal drilling in this area of Texas," said Steve Stengell, Allied's President and CEO.

Zur Bedeutung der Öl- und Gasvorkommen in Grimes County und Leon County Texas:

Lower Woodbine may be the new oil play to watch in southeast Texas

By Oil & Gas Financial Journal staff

There is a new oil play to watch in southeast Texas that may be of interest to those fascinated by the Eagle Ford shale.

In Madison, Leon, and Grimes counties, just above the Buda lime is an organic rich, laminated sand section that some operators refer to as the 'Lower Woodbine.’ A February 10 research note from Jefferies & Co. Inc. says the zone is “equivalent to the Lower Eagle Ford of South Texas,” but cautions the rock is different, and “perhaps more challenging.” Despite the potential challenges, Jefferies remains “cautiously optimistic” about the play.

A few red flags noted by Jefferies include “higher clay content, lower reservoir pressure, and an under-pressured upper zone which may require an extra string of pipe.” To counter, however, the clay is non-swelling and thus less problematic; workable, lower pressure zones exist in parts of the Eagle Ford; and the cost of extra pipe may be partly offset by a shallower depth overall.

According to Jefferies, operators in the vicinity include Apache Corp. (NYSE: APA) and Gastar Exploration (NYSE: GST). Chesapeake Energy (NYSE: CHK) is currently drilling a well targeting the formation in north central Madison County and three other locations have been permitted in Madison and Leon Counties.

Also in the vicinity, but not the Lower Woodbine exactly, are a couple private operators reporting “several prolific horizontal Woodbine completions (up to 1,000 boe/d initial production) recently in the area,” notes Jefferies. These particular wells seem to be targeting the Woodbine channel sandstones above.

http://www.ogfj.com/index/oil-markets/oil-gas-companies/apac…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 218 | ||

| 156 | ||

| 78 | ||

| 59 | ||

| 49 | ||

| 45 | ||

| 43 | ||

| 41 | ||

| 36 | ||

| 29 |

| Wertpapier | Beiträge | |

|---|---|---|

| 25 | ||

| 25 | ||

| 23 | ||

| 21 | ||

| 21 | ||

| 20 | ||

| 20 | ||

| 19 | ||

| 19 | ||

| 19 |