GOLDRUSH Res. - aussichtsreicher Small Cap in Burkina Faso - 500 Beiträge pro Seite

eröffnet am 07.04.11 19:45:40 von

neuester Beitrag 02.08.12 11:12:54 von

neuester Beitrag 02.08.12 11:12:54 von

Beiträge: 116

ID: 1.165.386

ID: 1.165.386

Aufrufe heute: 0

Gesamt: 5.823

Gesamt: 5.823

Aktive User: 0

ISIN: CA3814531099 · WKN: 675308

0,0160

EUR

+23,08 %

+0,0030 EUR

Letzter Kurs 12.01.16 München

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 0,5998 | +22,41 | |

| 0,6200 | +21,57 | |

| 4,8450 | +11,64 | |

| 27,85 | +10,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5700 | -11,63 | |

| 500,00 | -13,04 | |

| 15.280,00 | -16,14 | |

| 3,5700 | -16,78 | |

| 5.153,50 | -27,60 |

bin überrascht nicht schon nen thread zu diesem wert hier bei WO entdeckt zu haben, denn dieses baby hat so einiges aufzuweisen, was aufhorchen läßt....IMO

....der blick auf obiges chart- bild zeigt, daß sich

zzt. hervorragende zustiegs- chancen eröffnen, bevor sie

sich gen norden verabschiedet !!!

gibt zzt. 115mio shares, was ner MK von knapp cad-mios

18,- entspricht - NICHT zu viel für dies kaliber und empfehl

euch beim studium der folg. presi aus 03.2011 selbst davon

zu überzeugen.........

http://www.goldrushresources.ca/pdf/goldrush_ppt_2011.pdf

....uuuuund wie immmmmmer: viel spaszszsz beim gewinnen neuer

erkenntnisse und fortan regen teilnahme in diesem thread

grad jüngst gabs ergebn. ausm SALBO- proj., das nur unweit von künftiger

HRG- mine entfernt liegt.........

Goldrush's RAB Drilling at Salbo Permit Confirms Presence of Significant Near Surface Gold Mineralization

Mar. 23, 2011 (Marketwire Canada) --

VANCOUVER, BRITISH COLUMBIA -- Goldrush Resources Ltd. (TSX VENTURE:GOD). President and CEO Len Brownlie reports that assay results have been received from 85 Rotary Air Blast ("RAB") drill holes on the Company's Salbo permit which is located 50 kilometers north of Ouagadougou, the capital of Burkina Faso, West Africa.

The permit is situated immediately south of High River Gold Mines Ltd's. Bissa Project area which has received a positive feasibility study, and approximately 35 kilometers south of Goldrush's 249,000 ounce inferred Ronguen gold deposit [5.9 million tonnes at a grade of 1.31 g/t Au] that will be subject to an upgraded resource estimate in 2011. Access is by paved highway from Ouagadougou.

Assay results returned the following significant composites:

* 1.74 g/t Au over 8 metres in hole SLBB11-023

* 2.12 g/t Au over 6 metres in hole SLBB11-030

* 1.81 g/t Au over 6 metres in hole SLBB11-055

* 2.56 g/t Au over 4 metres in hole SLBB11-048

* 2.64 g/t Au over 3 metres in hole SLBB11-001

The RAB drilling program was the first drilling program to test three northeast-southwest anomalous gold trends located in the central western part of the permit (see drill hole location composite map at www.goldrushresources.ca). The 11 fences of holes were collared to (i) cut surface gold occurrences of up to 30.9 g/t Au returned from previous mapping and prospecting, and (ii) to test the extension of the gold mineralization along the trend approximately 80 metres on strike from the main surface occurrences. In addition, two fences of holes were designed to test an isolated gold occurrence grading 9.94 g/t Au located between "Trend 1" and "Trend 2", and another fence of holes was positioned to cross a zone of quartz veining located northeast of the 9.94 g/t gold occurrence.

Because of highly resistant country rocks, 32 of the 50 RAB holes (1,419 metres) drilled in six fences along 850 metres of the 3.5 kilometre long "Trend 1" failed to reach the target depth of 45 metres, with seven holes penetrating to a depth of only 10 metres. On the 500 metre long "Trend 2", a continuous zone of orpaillage (local gold workers) shafts and diggings was tested by three fences of nine drill holes (439 metres), all of which reached target depth. "Trend 3" was tested by nine RAB drill holes (264 metres) on two fences covering about 100 metres of the 300 metre Trend 3 strike length. Seven of the drill holes could not be completed to the planned length because of the hardness of the country rock. To assist in completing the holes to the planned depth, the hammer tool was used continuously.

Despite the drilling difficulties, a number of holes contained anomalous gold content at the bottom of the hole (holes SLBB11-001, 22B, 23, 30, 38, 35, 55 29A and 44A), here suggesting intersection of the upper part of a gold zone. The shallow drilling program also successfully extended the gold occurrences from surface to shallow depths with significant gold intersections cut in deformed granitoids and paragneisses.

At Salbo, gold mineralization at surface is hosted in massive quartz veins up to one metre thick. The main alteration minerals associated with the mineralization are sericite, chlorite and limonite, and pyrite was the main sulphide observed near surface in the quartz veining. Relatively low amounts of quartz (1 to 2%) were noted in the mineralized intervals of the RAB holes, while the main sulphide noted was arsenopyrite (up to 5%).

Comparison of the significant RAB holes with induced polarization (IP) chargeability and resistivity surveying results show that gold mineralized holes are clearly associated with strong chargeable and resistive anomalies that extend to the limits of the current one square kilometre IP grid areas.

Future exploration will test the IP anomalism which indicates the potential for extending the gold-bearing mineralization on strike, as well as focussing on the strong targets identified at deeper levels, using both reverse circulation (RC) and core drilling.

Assay Results

Significant assay results from the trenching and RAB drilling programs are noted above and in the following table:

Target Trench/Hole ID WGS 84

Co-ordinate WGS 84

Co-ordinate From To Length* Gold Grade

UTM X (m)* UTM Y (m)* (m) (m) (m) (g Au/t)

Trend 1 SLBB11-023 663,051 1,431,558 20 28 8** 1.74

Including 24 26 2 4.56

SLBB11-030 663,017 1,431,502 18 24 6** 2.12

Including 20 22 2 3.23

SLBB11-041A 663,251 1,431,766 0 2 2 1.52

SLBB11-043 663,218 1,431,800 8 12 4 1.29

SLBB11-046B 663,320 1,431,874 8 10 2 1.83

SLBB11-048 663,292 1,431,897 28 32 4 2.56

Trend 2 SLBB11-001 661,020 1,431,782 42 45 3** 2.64

SLBB11-002 661,038 1,431,764 4 14 10 0.71

SLBB11-004 660,939 1,431,663 0 2 2 0.53

SLBB11-005 660,957 1,431,648 6 8 2 3.05

Trend 3 SLBB11-55 664,899 1,431,667 14 20 6 1.81

Quartz vein SLBB11-011 661,643 1,431,043 24 26 2 0.73

between

Trend 1 and 2 SLBB11-015 661,621 1,430,992 16 18 2 3.11

SLBB11-016B 661,653 1,430,968 2 4 2 0.60

*Lengths shown are core lengths: true widths will be determined with additional drilling

** Hole ended in mineralization

Drill hole lengths varied from 8 to 54 metres, with inclinations of -45 degrees and azimuths of N135° (holes SLBB11-001 to 017, 19 to 21B, and 41A to 059), or N315° (holes SLBB11-018A, and 22A to 040). A total of 1,350 RAB samples and 160 QA/QC samples were submitted for assaying.

Ongoing Exploration

Assay results from a 3,271metre RAB drilling program on the two permits that host the Ronguen Gold Deposit have been received and will be released once the results have been compiled and analyzed.

On March 16, Goldrush began an expanded 8,000 metre RC drilling program that includes 4,000 metres on the Ronguen Gold Deposit permits; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program, and has averaged 232 metres per day.

Quality Assurance/Quality Control

Goldrush maintains a rigorous quality control program involving the use of certified standards from an accredited Canadian laboratory, inserted blanks, and the use of repeat assays. Details of Goldrush's quality control program are provided in the Company's News Release #2010-13, dated October 25, 2010.

The ALS Chemex laboratory in Ouagadougou, Burkina Faso was used for sample analysis. For its internal control, ALS Chemex inserted two certified standards and one blank, and analyzed one random duplicate for approximately each 25 samples submitted. For its certified standard and blank samples included in the QA-QC procedure, Goldrush averaged 11.8% of the total samples submitted.

The drilling was contracted to a subsidiary of Forage Technic-Eau based in Ouagadougou, Burkina Faso.

Mr. Driffield Cameron, P. Geo., Director of Goldrush, is the Qualified Person for this press release for the purposes of National Instrument 43-101 and has reviewed the technical information contained herein.

For further information on Goldrush Resources Ltd., shareholders and other interested parties are invited to visit the Company's website at www.goldrushresources.ca.

ON BEHALF OF THE BOARD OF DIRECTORS,

GOLDRUSH RESOURCES LTD.

"Len Brownlie"

Len Brownlie – President and Chief Executive Officer

About Goldrush: Goldrush is a mineral exploration company focused on gold exploration in West Africa, where the company has discovered, and is currently expanding and defining the 249,000 ounce Ronguen gold deposit in Burkina Faso.

FORWARD-LOOKING STATEMENTS: This news release contains certain "forward-looking statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Except for statements of historical fact relating to the company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project cost overruns or unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and other factors. The Company undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Goldrush Resources Ltd.

VP Corporate Development

604-602-9973

604-681-5910 (FAX)

info@goldrushresources.ca

www.goldrushresources.ca

Equicom Group

(416) 815-0700 Ext. 243

jracanelli@equicomgroup.com

Equicom Group

(416) 815-0700 Ext. 264

bpedram@equicomgroup.com

www.equicomgroup.com

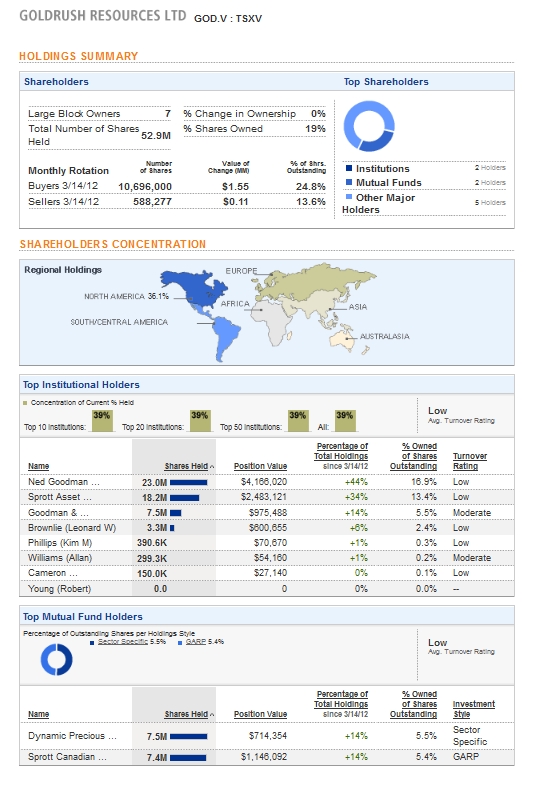

paaaaar INSIDER, ua der CEO, schnappten jüngst auch schon mal

abisl zu...........

Goldrush Resources Ltd. (GOD)

As of April 6th, 2011

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Mar 14/11 Mar 14/11 Brownlie, Leonard William Direct Ownership Common Shares 10 - Acquisition in the public market 25,000 $0.155

Mar 14/11 Mar 10/11 Brownlie, Leonard William Direct Ownership Common Shares 10 - Acquisition in the public market 25,000 $0.155

Mar 11/11 Feb 25/11 Willoughby, Donald Grant Direct Ownership Options 50 - Grant of options 100,000 $0.200

Mar 02/11 Feb 25/11 Williams, Allan William Direct Ownership Options 50 - Grant of options 200,000 $0.200

Feb 27/11 Feb 25/11 Cameron, Driffield McCara Direct Ownership Options 50 - Grant of options 150,000 $0.200

Feb 25/11 Feb 25/11 Young, Robert John Direct Ownership Options 50 - Grant of options 300,000 $0.200

Feb 25/11 Feb 25/11 Brownlie, Leonard William Direct Ownership Options 50 - Grant of options 400,000 $0.200

Feb 25/11 Feb 25/11 Phillips, Kim Martin Direct Ownership Options 50 - Grant of options 300,000 $0.200

http://www.canadianinsider.com/coReport/allTransactions.php?…

RT....cad 0,155

wer JETZT noch 15min. entbehren kann, dem sei die jüngste presi vor geladenen

gästen im RICHMOND CLUB, toronto empfohlen..........

Goldrush VP Corporate Development Don Willoughby gave a corporate presentation to members of The Richmond Club as part of a luncheon corporate presentation series held in the National Club in downtown Toronto.

The entire presentation can be observed at Richmond Club Presentation.

http://www.richmondclub.com/Luncheon%20Videos/GoldrushMar231…

gästen im RICHMOND CLUB, toronto empfohlen..........

Goldrush VP Corporate Development Don Willoughby gave a corporate presentation to members of The Richmond Club as part of a luncheon corporate presentation series held in the National Club in downtown Toronto.

The entire presentation can be observed at Richmond Club Presentation.

http://www.richmondclub.com/Luncheon%20Videos/GoldrushMar231…

gold- kurs eilt derweil von HOCH zu HOCH......

akt......usd 1469,30 oz

na DAS nenn ich ´timing´........mit deutlichem vol.- ansprung gehts

heute UPPPPP........

RT....cad 0,18

Antwort auf Beitrag Nr.: 41.341.518 von hbg55 am 08.04.11 16:55:22

....jetzt schon bei cad 0,19........und schon 800k vol.....

Recent Trades - Last 10 of 34

Time ET Ex Price Change Volume Buyer Seller Markers

10:47:40 V 0.185 0.03 9,000 7 TD Sec 7 TD Sec K

10:44:46 V 0.19 0.035 10,000 124 Questrade 79 CIBC K

10:43:26 V 0.18 0.025 23,500 7 TD Sec 19 Desjardins K

10:43:26 V 0.18 0.025 18,500 7 TD Sec 2 RBC K

10:43:24 V 0.18 0.025 2,500 7 TD Sec 2 RBC K

10:43:24 V 0.18 0.025 10,000 7 TD Sec 7 TD Sec K

10:43:24 V 0.18 0.025 7,500 7 TD Sec 7 TD Sec K

10:43:20 V 0.18 0.025 2,500 9 BMO Nesbitt 7 TD Sec K

10:43:20 V 0.18 0.025 14,000 9 BMO Nesbitt 7 TD Sec K

10:43:20 V 0.18 0.025 77,500 9 BMO Nesbitt 85 Scotia K

....jetzt schon bei cad 0,19........und schon 800k vol.....

Recent Trades - Last 10 of 34

Time ET Ex Price Change Volume Buyer Seller Markers

10:47:40 V 0.185 0.03 9,000 7 TD Sec 7 TD Sec K

10:44:46 V 0.19 0.035 10,000 124 Questrade 79 CIBC K

10:43:26 V 0.18 0.025 23,500 7 TD Sec 19 Desjardins K

10:43:26 V 0.18 0.025 18,500 7 TD Sec 2 RBC K

10:43:24 V 0.18 0.025 2,500 7 TD Sec 2 RBC K

10:43:24 V 0.18 0.025 10,000 7 TD Sec 7 TD Sec K

10:43:24 V 0.18 0.025 7,500 7 TD Sec 7 TD Sec K

10:43:20 V 0.18 0.025 2,500 9 BMO Nesbitt 7 TD Sec K

10:43:20 V 0.18 0.025 14,000 9 BMO Nesbitt 7 TD Sec K

10:43:20 V 0.18 0.025 77,500 9 BMO Nesbitt 85 Scotia K

Antwort auf Beitrag Nr.: 41.341.610 von hbg55 am 08.04.11 17:07:18...Und die Begründung für den Run möchte ich dann bitte liefern..

TSX VENTURE: RVS

FRANKFURT: 3RV

Riverstone Resources Inc.

Apr 08, 2011 09:25 ET

Riverstone Reports 28.61 g/t Au Over 20 Metres on Yaramoko Gold Project, Burkina Faso, West Africa

VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 8, 2011) - Riverstone Resources Inc. (TSX VENTURE:RVS)(FRANKFURT:3RV) (the "Company") is pleased to report the final series assays from its Yaramoko gold concession in western Burkina Faso, West Africa. Assays include data from 19 of the 33 reverse circulation holes (1,468 out of 2,723 metres) drilled in December 2010 and January 2011 (YRM-10-RC023 through YRM-11-RC055) of which 17 targeted Bagassi South mineralization, 7 Bagassi Central targets and 9 Bagassi North targets.

Riverstone entered into an agreement to option a 60% interest in the property to Roxgold Inc. ("Roxgold") in July 2010. Under the terms of the agreement, Roxgold is to incur exploration expenditures of $1.5 million, issue 360,000 shares and make payments totalling $100,000 to earn a 60% interest in the property. The term of the agreement is three years and Riverstone will be the operator for the initial work programs on the property.

NEW GOLD DISCOVERY IN "BAGASSI CENTRAL"

Drill holes YMR-10-RC035 through YMR-10-RC039 and 048 and 055 have been completed in the Bagassi Central discovery. While additional drilling is needed to better understand the mineralized structure, drill hole YMR-10-RC055, which was collared approximately 80 metres north west of YMR-10-RC036 intersected two zones of significant mineralization including 20 metres of 28.61 GPT and 11 metres grading 4.88 GPT. Significant results from the Bagassi Central drilling are as follows:

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YMR-10-RC035(1) 469324 1299191 220 -55 51 No significant intercepts – hole lost prior to target depth

YMR-10-RC036(1) 469435 1299188 220 -55 90 76 86 10 14.91

including 82 84 2 70.50

YMR-10-RC048 469343 1299078 360 -55 59 No significant intercepts – hole lost prior to target depth

YMR-10-RC055 469358 1299163 180 -55 49 6 26 20 28.61

Including 16 22 6 85.53

and 38 49 11 4.88

Including 42 44 2 18.50

(1) Results were previously released February 28, 2011

YRM-10-RC037 through YRM-10-RC039 were step outs of 350 metres to 650 metres from YRM-10-RC036 and only intersected weakly anomalous mineralization. YRM-10-RC048 was collared in the general area of YRM-10-RC036, but drilled at an azimuth of 360°.

YRM-10-RC036 encountering intensely silicified and pyritized intrusive rocks below the surface anomaly and the hole was lost at a depth of 90 metres. YRM-10-RC055 intersected similar silicified and pyritized intrusive rocks from 16 to 22 metres. As noted in the February 28, 2011 news release, this zone yielded abundant visible gold when the tailings material was panned. Approximately 16 metres down hole a second intercept was encountered in YMR-10-RC055, just prior to the end of the hole at 49 metres. It is believed that YRM-10-RC036 was lost prior to the expected intersection of this second zone intersected in YMR-10-RC055. A program of metallic assays and cyanide leaching is underway to confirm the high grade tenor of the mineralization encountered.

While YRM-10-RC036 and YRM-10-RC055 were collared approximately 80 metres apart, given Hole YRM-10-RC036 was drilled at an azimuth of 220° while YRM-10-RC055 was drilled at an azimuth of 180° the actual distance between the two intercepts would be less than 80 metres.

RAB drilling is expected to commence shortly to better define the soil geochemistry as extensive artisanal workings in the area have caused surface disturbance precluding the use of standard soil geochemistry techniques. Once this information is available the Bagassi Central discovery will be the focus of additional drilling during Phase 2 work at Yaramoko in the upcoming months, pending drill rig availability.

BAGASSI NORTH DRILLING

An additional nine holes were completed at the Bagassi North target which lies approximately one kilometres north-north west of the Bagassi Central discovery. Results are as follows:

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YRM-11-RC-41 468822 1300170 220 -55 85 48 50 2 1.730

YRM-11-RC-42 468682 1300774 215 -55 116 92 98 6 0.898

YRM-11-RC-43 468741 1300533 215 -55 49 38 40 2 1.140

YRM-11-RC-44 468744 1300533 360 -90 72 58 62 4 0.724

YRM-11-RC-45 468815 1300398 215 -55 61 34 42 8 0.615

YRM-11-RC-46 468827 1300411 215 -55 79 No significant intercepts

YRM-11-RC-47 468839 1300316 215 -55 43 12 20 8 0.506

YRM-11-RC-48 469343 1299078 360 -55 59 No significant intercepts

YRM-11-RC-49 469247 1300329 215 -55 83 32 34 2 0.801

BAGASSI SOUTH DRILLING

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YRM-11-RC-50 470124 1296899 40 -55 80 38 48 10 0.877

including 40 42 2 1.740

and including 46 48 2 2.020

54 79 25 0.592

including 54 56 2 2.020

and including 62 66 4 0.879

including 78 79 1 2.22

YRM-11-RC-51 470203 1296875 40 -55 60 No significant intercepts

YRM-11-RC-52 469998 1297022 215 -55 106 58 60 2 3.260

YRM-11-RC-53 469807 1297285 220 -55 103 No significant intercepts

YRM-11-RC-54 469785 1297197 200 -55 102 No significant intercepts

QUALITY ASSURANCE/QUALITY CONTROL

Riverstone Resources Inc. is the operator of the current program and maintains a quality control program involving the use of repeat assays, inserted blanks and the use of certified standards from an accredited Canadian laboratory. All Yaramoko samples were assayed using standard fire assay with atomic absorption techniques, with samples grading over one gram gold per tonne re-assayed with a gravimetric finish, at the independent Abilab Burkina SARL laboratories in Ouagadougou, Burkina Faso, which is part of the ALS Chemex group.

In addition to the normal gold assaying procedures for each drill sample submitted, all 2 metre drill samples from Yaramoko in which visible gold was noted after panning (approximately 40), were assayed for gold using a 2 kg sample and cyanide leaching and these results are pending. A high level of exploration and development activity in the gold sector in Burkina Faso has resulted in an increase in the turnaround time for receiving all gold assays.

Riverstone Resources Inc. is active in gold exploration in Burkina Faso, West Africa, where the Company holds an extensive portfolio of six high quality exploration projects covering 2,300 square kilometres. For further information about the Company and its activities, please refer to the Company's website at www.riverstoneresources.com and under the Company's profile at www.sedar.com.

ON BEHALF OF THE BOARD

Michael D. McInnis, P.Eng., President & CEO

Paul Anderson, P.Geo., is a Qualified Person for RVS and has reviewed and approved the contents of this release.

Certain statements made and information contained in this news release and elsewhere constitutes "forward-looking information" within the meaning of the Ontario Securities Act. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development results will not be consistent with the Company's expectations, accidents, equipment breakdowns, title matters and surface access, labour disputes, the potential for delays in exploration activities, the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, failure to obtain adequate financing on a timely basis and other risks and uncertainties, including those described under Risk Factors in each management discussion and analysis. In addition, forward-looking information is based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour and that the political environment within Burkina Faso will continue to support the development of environmentally safe mining projects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact

Riverstone Resources Inc. - Vancouver Office

Michael D. McInnis

President

604-801-5020

or

Riverstone Resources Inc.

Raju Wani

Investor Relations

403-240-0555

or

Riverstone Resources Inc.

Ron Cooper

Investor Relations

604-986-0112

info@riverstoneresources.com

www.riverstoneresources.com

Man sehe auch den Run bei ROG heute... Wenn mich nicht alles täuscht besitzen die eine Leigenschaft 35km nördlich von GOD...

Dürfte also eine interessante area sein...

Gruß Kelthe

TSX VENTURE: RVS

FRANKFURT: 3RV

Riverstone Resources Inc.

Apr 08, 2011 09:25 ET

Riverstone Reports 28.61 g/t Au Over 20 Metres on Yaramoko Gold Project, Burkina Faso, West Africa

VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 8, 2011) - Riverstone Resources Inc. (TSX VENTURE:RVS)(FRANKFURT:3RV) (the "Company") is pleased to report the final series assays from its Yaramoko gold concession in western Burkina Faso, West Africa. Assays include data from 19 of the 33 reverse circulation holes (1,468 out of 2,723 metres) drilled in December 2010 and January 2011 (YRM-10-RC023 through YRM-11-RC055) of which 17 targeted Bagassi South mineralization, 7 Bagassi Central targets and 9 Bagassi North targets.

Riverstone entered into an agreement to option a 60% interest in the property to Roxgold Inc. ("Roxgold") in July 2010. Under the terms of the agreement, Roxgold is to incur exploration expenditures of $1.5 million, issue 360,000 shares and make payments totalling $100,000 to earn a 60% interest in the property. The term of the agreement is three years and Riverstone will be the operator for the initial work programs on the property.

NEW GOLD DISCOVERY IN "BAGASSI CENTRAL"

Drill holes YMR-10-RC035 through YMR-10-RC039 and 048 and 055 have been completed in the Bagassi Central discovery. While additional drilling is needed to better understand the mineralized structure, drill hole YMR-10-RC055, which was collared approximately 80 metres north west of YMR-10-RC036 intersected two zones of significant mineralization including 20 metres of 28.61 GPT and 11 metres grading 4.88 GPT. Significant results from the Bagassi Central drilling are as follows:

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YMR-10-RC035(1) 469324 1299191 220 -55 51 No significant intercepts – hole lost prior to target depth

YMR-10-RC036(1) 469435 1299188 220 -55 90 76 86 10 14.91

including 82 84 2 70.50

YMR-10-RC048 469343 1299078 360 -55 59 No significant intercepts – hole lost prior to target depth

YMR-10-RC055 469358 1299163 180 -55 49 6 26 20 28.61

Including 16 22 6 85.53

and 38 49 11 4.88

Including 42 44 2 18.50

(1) Results were previously released February 28, 2011

YRM-10-RC037 through YRM-10-RC039 were step outs of 350 metres to 650 metres from YRM-10-RC036 and only intersected weakly anomalous mineralization. YRM-10-RC048 was collared in the general area of YRM-10-RC036, but drilled at an azimuth of 360°.

YRM-10-RC036 encountering intensely silicified and pyritized intrusive rocks below the surface anomaly and the hole was lost at a depth of 90 metres. YRM-10-RC055 intersected similar silicified and pyritized intrusive rocks from 16 to 22 metres. As noted in the February 28, 2011 news release, this zone yielded abundant visible gold when the tailings material was panned. Approximately 16 metres down hole a second intercept was encountered in YMR-10-RC055, just prior to the end of the hole at 49 metres. It is believed that YRM-10-RC036 was lost prior to the expected intersection of this second zone intersected in YMR-10-RC055. A program of metallic assays and cyanide leaching is underway to confirm the high grade tenor of the mineralization encountered.

While YRM-10-RC036 and YRM-10-RC055 were collared approximately 80 metres apart, given Hole YRM-10-RC036 was drilled at an azimuth of 220° while YRM-10-RC055 was drilled at an azimuth of 180° the actual distance between the two intercepts would be less than 80 metres.

RAB drilling is expected to commence shortly to better define the soil geochemistry as extensive artisanal workings in the area have caused surface disturbance precluding the use of standard soil geochemistry techniques. Once this information is available the Bagassi Central discovery will be the focus of additional drilling during Phase 2 work at Yaramoko in the upcoming months, pending drill rig availability.

BAGASSI NORTH DRILLING

An additional nine holes were completed at the Bagassi North target which lies approximately one kilometres north-north west of the Bagassi Central discovery. Results are as follows:

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YRM-11-RC-41 468822 1300170 220 -55 85 48 50 2 1.730

YRM-11-RC-42 468682 1300774 215 -55 116 92 98 6 0.898

YRM-11-RC-43 468741 1300533 215 -55 49 38 40 2 1.140

YRM-11-RC-44 468744 1300533 360 -90 72 58 62 4 0.724

YRM-11-RC-45 468815 1300398 215 -55 61 34 42 8 0.615

YRM-11-RC-46 468827 1300411 215 -55 79 No significant intercepts

YRM-11-RC-47 468839 1300316 215 -55 43 12 20 8 0.506

YRM-11-RC-48 469343 1299078 360 -55 59 No significant intercepts

YRM-11-RC-49 469247 1300329 215 -55 83 32 34 2 0.801

BAGASSI SOUTH DRILLING

Drill hole # Collar Northing Collar Easting Az Dip Total Depth (m) from to intercept Grade (g/t)

YRM-11-RC-50 470124 1296899 40 -55 80 38 48 10 0.877

including 40 42 2 1.740

and including 46 48 2 2.020

54 79 25 0.592

including 54 56 2 2.020

and including 62 66 4 0.879

including 78 79 1 2.22

YRM-11-RC-51 470203 1296875 40 -55 60 No significant intercepts

YRM-11-RC-52 469998 1297022 215 -55 106 58 60 2 3.260

YRM-11-RC-53 469807 1297285 220 -55 103 No significant intercepts

YRM-11-RC-54 469785 1297197 200 -55 102 No significant intercepts

QUALITY ASSURANCE/QUALITY CONTROL

Riverstone Resources Inc. is the operator of the current program and maintains a quality control program involving the use of repeat assays, inserted blanks and the use of certified standards from an accredited Canadian laboratory. All Yaramoko samples were assayed using standard fire assay with atomic absorption techniques, with samples grading over one gram gold per tonne re-assayed with a gravimetric finish, at the independent Abilab Burkina SARL laboratories in Ouagadougou, Burkina Faso, which is part of the ALS Chemex group.

In addition to the normal gold assaying procedures for each drill sample submitted, all 2 metre drill samples from Yaramoko in which visible gold was noted after panning (approximately 40), were assayed for gold using a 2 kg sample and cyanide leaching and these results are pending. A high level of exploration and development activity in the gold sector in Burkina Faso has resulted in an increase in the turnaround time for receiving all gold assays.

Riverstone Resources Inc. is active in gold exploration in Burkina Faso, West Africa, where the Company holds an extensive portfolio of six high quality exploration projects covering 2,300 square kilometres. For further information about the Company and its activities, please refer to the Company's website at www.riverstoneresources.com and under the Company's profile at www.sedar.com.

ON BEHALF OF THE BOARD

Michael D. McInnis, P.Eng., President & CEO

Paul Anderson, P.Geo., is a Qualified Person for RVS and has reviewed and approved the contents of this release.

Certain statements made and information contained in this news release and elsewhere constitutes "forward-looking information" within the meaning of the Ontario Securities Act. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development results will not be consistent with the Company's expectations, accidents, equipment breakdowns, title matters and surface access, labour disputes, the potential for delays in exploration activities, the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, failure to obtain adequate financing on a timely basis and other risks and uncertainties, including those described under Risk Factors in each management discussion and analysis. In addition, forward-looking information is based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour and that the political environment within Burkina Faso will continue to support the development of environmentally safe mining projects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact

Riverstone Resources Inc. - Vancouver Office

Michael D. McInnis

President

604-801-5020

or

Riverstone Resources Inc.

Raju Wani

Investor Relations

403-240-0555

or

Riverstone Resources Inc.

Ron Cooper

Investor Relations

604-986-0112

info@riverstoneresources.com

www.riverstoneresources.com

Man sehe auch den Run bei ROG heute... Wenn mich nicht alles täuscht besitzen die eine Leigenschaft 35km nördlich von GOD...

Dürfte also eine interessante area sein...

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.341.740 von Kelthe am 08.04.11 17:27:02

joooo.......auch grad im SH- board gesehen - sind dort auch für GOD

recht opt......zumindest als ´area- play´

haben sich ja auch ein wirklich int. port. in den letzten jahren

aufgebaut.......mit eindeutigem schwerpunkt der IN- region burkina faso !!!

joooo.......auch grad im SH- board gesehen - sind dort auch für GOD

recht opt......zumindest als ´area- play´

haben sich ja auch ein wirklich int. port. in den letzten jahren

aufgebaut.......mit eindeutigem schwerpunkt der IN- region burkina faso !!!

Antwort auf Beitrag Nr.: 41.341.830 von hbg55 am 08.04.11 17:39:24

bytheway.....auch ne IXI scheint MIR in der region gaaaaanz hervorragend positioniert zu sein und weißt akt. grad mal ne MK von knapp cad-mios 14,- auf

( dazu demnächst ein sep. thr. !! )

bytheway.....auch ne IXI scheint MIR in der region gaaaaanz hervorragend positioniert zu sein und weißt akt. grad mal ne MK von knapp cad-mios 14,- auf

( dazu demnächst ein sep. thr. !! )

Antwort auf Beitrag Nr.: 41.341.830 von hbg55 am 08.04.11 17:39:24Hier werden wir ja in absehbarer Zukunft auch News bekommen... Mal sehen was in unserem Gebiet erdrillt wurde... Könnte hier auch schnell UPP gehen wie bei ROG...

Gruß Kelthe

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.341.936 von Kelthe am 08.04.11 17:58:16

....dein ´gemecker´ wurde erhört

SIE knackt grad die 0,20

....dein ´gemecker´ wurde erhört

SIE knackt grad die 0,20

Antwort auf Beitrag Nr.: 41.341.931 von hbg55 am 08.04.11 17:57:36Gebe dir was IXI angeht recht, für mich jedoch kein Thema...

Kennst doch meine "Zwänge"...

Gruß Kelthe

Kennst doch meine "Zwänge"...

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.341.995 von Kelthe am 08.04.11 18:10:08

...da scheint MIR jemand mächtig appetit auf unser baby bekommen zu haben -

wenn das so weiter geht, wird gleich auch noch ATH bei 0,305 geknackt

...da scheint MIR jemand mächtig appetit auf unser baby bekommen zu haben -

wenn das so weiter geht, wird gleich auch noch ATH bei 0,305 geknackt

RT...cad 0,25

wooow nice performed ! Falls es noch mal nen Rücksetzer geben sollte, spring ich mit auf.

schönes we@all

schönes we@all

Schade, hatte gestern morgen eine Order aufgegeben, die wegen einem halben cent nicht ausgeführt wurde. Habe dann, als ich Abends heim kam vom Arbeiten, die erste Position fast auf Tageshoch aufgenommen.

Freundliche Grüsse in die Runde,

Bonderman, High-Risk Manager

Freundliche Grüsse in die Runde,

Bonderman, High-Risk Manager

zur abrundung der eindrücke bietet sich unter folg. link ein

kurz- interview mit dem CEO vom monatsanfang........

http://www.stockhouse.com/InvestorRelationship/VideoDetails.…

kurz- interview mit dem CEO vom monatsanfang........

http://www.stockhouse.com/InvestorRelationship/VideoDetails.…

Antwort auf Beitrag Nr.: 41.344.069 von hbg55 am 09.04.11 13:02:05Auch interessant dürfte sein, wer sich bei dem doch sehr großen PP letzten Jahres eingekauft hat...---SPROTT--- und gar nicht mal soooo wenige...

und gar nicht mal soooo wenige...

Goldrush Resources 40-million-share private placement

2010-10-20 18:20 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced Sept. 24, 2010.

Number of shares: 40 million shares

Purchase price: 10 cents per share

Hidden placees: 20 hidden placees

Insiders: CMP Gold Trust, 14 million; Sprott Asset Management LP, 10 million; Len Brownlie, 200,000

Pro groups: Richard Cohen, 200,000; Matthew Schmidt, 100,000; James Doyle, 30,000; Alexander Pope, 20,000; Anthony P. Fierro, 100,000; James Oleynick, 100,000; John D. Ellis, 150,000

Finders' fees: $121,200 and 1,212,000 finder warrants payable to Dundee Securities Corp.; $96,000 and 960,000 finder warrants payable to Pope & Company Ltd.; $7,200 and 72,000 finder warrants payable to PI Financial Corp.; $6,600 and 66,000 finder warrants payable to Canaccord Genuity Corp. (Each finder warrant is exercisable into one common share at 13 cents for a one-year period.)

Gruß Kelthe

und gar nicht mal soooo wenige...

und gar nicht mal soooo wenige...

Goldrush Resources 40-million-share private placement

2010-10-20 18:20 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced Sept. 24, 2010.

Number of shares: 40 million shares

Purchase price: 10 cents per share

Hidden placees: 20 hidden placees

Insiders: CMP Gold Trust, 14 million; Sprott Asset Management LP, 10 million; Len Brownlie, 200,000

Pro groups: Richard Cohen, 200,000; Matthew Schmidt, 100,000; James Doyle, 30,000; Alexander Pope, 20,000; Anthony P. Fierro, 100,000; James Oleynick, 100,000; John D. Ellis, 150,000

Finders' fees: $121,200 and 1,212,000 finder warrants payable to Dundee Securities Corp.; $96,000 and 960,000 finder warrants payable to Pope & Company Ltd.; $7,200 and 72,000 finder warrants payable to PI Financial Corp.; $6,600 and 66,000 finder warrants payable to Canaccord Genuity Corp. (Each finder warrant is exercisable into one common share at 13 cents for a one-year period.)

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.344.413 von Kelthe am 09.04.11 16:20:45In Anbetracht der Tatsache, dass hier extrem gedrillt wird (On March 16, Goldrush began an expanded 8,000 metre RC drilling program that includes 4,000

metre RC drilling program that includes 4,000 metres on the Ronguen Gold Deposit permits; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program, and has averaged 232 metres per day.), und der Namen der Großinvestoren und der schon nachgewiesenen Resourcen kann hier meiner Meinung nach nicht mehr von einem area play gesprochen werden. Wenngleich der gestrige Ausbruch natürlich eindeutig auf die News des "Nachbarn" zurückzuführen ist... Ein neuer "Ring of fire" ???

metres on the Ronguen Gold Deposit permits; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program, and has averaged 232 metres per day.), und der Namen der Großinvestoren und der schon nachgewiesenen Resourcen kann hier meiner Meinung nach nicht mehr von einem area play gesprochen werden. Wenngleich der gestrige Ausbruch natürlich eindeutig auf die News des "Nachbarn" zurückzuführen ist... Ein neuer "Ring of fire" ???

Wenn ja fühle ich mich bei GOD am besten aufgehoben...

Hier könnte es auf jeden Fall bei entsprechenden News RICHITG UPPPP gehen...

Wenn ich mich recht entsinne stand CAN schon bei 6CAD... BEI 200MIO SHARES...

Werden spannende Wochen...

Gruß Kelthe

metre RC drilling program that includes 4,000

metre RC drilling program that includes 4,000 metres on the Ronguen Gold Deposit permits; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program, and has averaged 232 metres per day.), und der Namen der Großinvestoren und der schon nachgewiesenen Resourcen kann hier meiner Meinung nach nicht mehr von einem area play gesprochen werden. Wenngleich der gestrige Ausbruch natürlich eindeutig auf die News des "Nachbarn" zurückzuführen ist... Ein neuer "Ring of fire" ???

metres on the Ronguen Gold Deposit permits; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program, and has averaged 232 metres per day.), und der Namen der Großinvestoren und der schon nachgewiesenen Resourcen kann hier meiner Meinung nach nicht mehr von einem area play gesprochen werden. Wenngleich der gestrige Ausbruch natürlich eindeutig auf die News des "Nachbarn" zurückzuführen ist... Ein neuer "Ring of fire" ???Wenn ja fühle ich mich bei GOD am besten aufgehoben...

Hier könnte es auf jeden Fall bei entsprechenden News RICHITG UPPPP gehen...

Wenn ich mich recht entsinne stand CAN schon bei 6CAD... BEI 200MIO SHARES...

Werden spannende Wochen...

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.344.413 von Kelthe am 09.04.11 16:20:45joooo....aktionär- struktur schon seeeehr auffällig, wie wir auch akt. presi

(seite 5) entnehmen können.........

MAJOR SHAREHOLDERS

CMP Gold Trust

Ravensden Alterna.ve Management

Sprott Asset Management

Pinetree Capital

ACC Resources (Private – Israel)

High River Gold Mines

Management

These groups of shareholders own over 60% of the company’s stock

...viiiiel bleibt da nicht mehr für den freien handel übrig !!!

(seite 5) entnehmen können.........

MAJOR SHAREHOLDERS

CMP Gold Trust

Ravensden Alterna.ve Management

Sprott Asset Management

Pinetree Capital

ACC Resources (Private – Israel)

High River Gold Mines

Management

These groups of shareholders own over 60% of the company’s stock

...viiiiel bleibt da nicht mehr für den freien handel übrig !!!

There’s room in every investment portfolio for shares in a speculative, junior exploraton company with spectacular upside potential.

THAT COMPANY IS GOLDRUSH!

Das Managment scheint jedenfalls ziemlich überzeugt zu sein, von der hauseigenen Aktie. Ich lass mich mal überraschen...

THAT COMPANY IS GOLDRUSH!

Das Managment scheint jedenfalls ziemlich überzeugt zu sein, von der hauseigenen Aktie. Ich lass mich mal überraschen...

VERY GOOD NEWS....

VERY GOOD NEWS....Goldrush Resources Ltd.: RAB Drilling at Ronguen Gold Deposit Extends Gold Deposit to North With Intersections of Up to 3.92g/t Au Over 10 Metres

07:00 EDT Monday, April 11, 2011

Print this article

VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 11, 2011) - Goldrush Resources Ltd. (TSX VENTURE:GOD) (the "Company") President and CEO Len Brownlie announced that drilling in the Ronguen North Zone (previously called the supergene enriched zone) has substantially expanded the footprint of this recently discovered mineralized area that is contiguous with, and to the north of, the Ronguen Main Zone, by over 5.7 hectares.

The drill program consisted of 85 shallow rotary air blast ("RAB") drill holes in 13 drill fences totaling 3,271 metres completed during February, 2011 on the Company's Kongoussi and Tikare permits in Burkina Faso, West Africa that host Goldrush's 249,000 ounce Ronguen gold deposit (inferred resource of 5.9 million tonnes at a grade of 1.31 g/t Au). The RAB program was primarily designed to test lateral extensions of the Ronguen gold deposit and to delineate regional drill targets for the Company's 9,660 metre reverse circulation drill program which began on March 16.

The RAB drilling program successfully extended the mineralization of the Ronguen deposit up to 180 metres north (between lines 900E and 1,220E) of the east northeasterly trending gold zone as intersected by RC hole KGRR10-096 (7.63 g/t gold over 15 metres and 3.17 g/t gold over 22 metres and 0.60 g/t gold over 9 metres) and RC hole KGRR10-099 (3.10 g/t gold over 34 metres) on Line 970E (see Goldrush news releases dated October 25 and November 17, 2010 for full details). The new zone remains open laterally and to depth. Based on the encouraging results of the RAB program, additional RC drill hole locations have been planned on this new "North Zone" with target depths of up to 80 metres to enable the North Zone gold mineralization to be easily incorporated into an upgraded 2011 Ronguen resource estimate.

Assay results returned the following significant composites:

* 3.92 g/t Au over 10 metres (including 9.38 g/t Au over 4 metres) in hole KRB11-0341

* 2.86 g/t Au over 6 metres in hole KGRB11-0338

* 0.62 g/t Au over 12 metres in hole KGRB11-0329

* 1.28 g/t Au over 4 metres in hole KGRB11-0331

* 1.15 g/t Au over 4 metres in hole KGRB11-0336

Comparison of the significant RAB holes with induced polarization (IP) chargeability and resistivity surveying results show that gold mineralized holes are associated with strong chargeable and resistive anomalies at the contacts of metasediments and diorites, and suggest that additional gold zones may exist at other metasediment-diorite contact zones identified with IP anomalies surrounding the main Ronguen deposit area.

Assay Results

Significant assay results from the RAB drilling program are noted above and in the following table:

Hole ID Line

(Grid

Co-ord) Station

(Grid Co-ord) From To Intersection 1 Gold Grade

(m) (m) (m) (g Au/t )

KGRB11-0327 1220E 175N 0 2 2 0.67

and 16 18 2 0.51

KGRB11-0329 1060E 85N 26 38 12 0.62

KGRB11-0331 1060E 135N 4 8 4 1.28 VG2

KGRB11-0332 1060E 157.5N 0 2 2 0.85

and 24 26 2 0.72

KGRB11-0336 900E 125N 34 38 4 1.15

KGRB11-0337 900E 150N 24 26 2 0.66

KGRB11-0338 900E 175N 12 18 6 2.86 VG

KGRB11-0339A 900E 190.3N 6 10 4 0.79

KGRB11-0341 1220E 50N 0 10 10 3.92

including 0 4 4 9.38

KGRB11-0342 1220E 73.9N 0 4 4 0.54

KGRB11-0343A 1220E 85N 0 2 2 0.54

1 True widths are determined to be 90 to 95% of core intervals.

2 VG: Visible gold identified in the intersection

The rotary air blast drill hole lengths varied from 7 to 50 metres, averaging 36 metres on the easterly Grid 1 and averaging 46 metres on the westerly Grid 2, with inclinations of -45 degrees and azimuths of N340° (Grid 1) or N024° (Grid 2). RAB drilling is an inexpensive drilling method for obtaining relatively shallow samples of bedrock for analysis to help determine if the area being drilled warrants a further, more expensive and more definitive drilling technique such as reverse circulation or diamond drilling (core). A total of 1,641 RAB samples and 182 QA/QC samples were submitted for assaying.

Ongoing Exploration

As at April 6, Goldrush has completed 3,900 metres of a planned 9,660 metre RC drilling program that includes 3,440 metres on the Ronguen gold deposit; 2,220 metres on regional targets on the permits that host the Ronguen Deposit; 1,000 metres on the newly acquired Liki permit; and 3,000 metres on the highly prospective Nakiambouri and Gonaba Est permits. Drilling is being conducted on a two shift per day basis, thereby accelerating the program and is averaging 178 metres per 24 hours.

Quality Assurance/Quality Control

Goldrush maintains a rigorous quality control program involving the use of certified standards from an accredited Canadian laboratory, inserted blanks, and the use of repeat assays. Details of Goldrush's quality control program are provided in the Company's News Release #2010-13, dated October 25, 2010.

The ALS Chemex laboratory in Ouagadougou, Burkina Faso was used for sample analysis. For its internal control, ALS Chemex inserted two certified standards and one blank, and analyzed one random duplicate for approximately each 25 samples submitted. For its certified standard and blank samples included in the QA-QC procedure, Goldrush averaged 11.0% of the total samples submitted.

The drilling was contracted to a subsidiary of Forage Technic-Eau based in Ouagadougou, Burkina Faso.

Mr. Driffield Cameron, P. Geo., Director of Goldrush, is the Qualified Person for this press release for the purposes of National Instrument 43-101 and has reviewed the technical information contained herein.

For further information on Goldrush Resources Ltd., shareholders and other interested parties are invited to visit the Company's website at www.goldrushresources.ca.

ON BEHALF OF THE BOARD OF DIRECTORS,

GOLDRUSH RESOURCES LTD.

Len Brownlie, President and Chief Executive Officer

About Goldrush: Goldrush is a mineral exploration company focused on gold exploration in West Africa, where the company has discovered, and is currently expanding and defining the 249,000 ounce Ronguen gold deposit in Burkina Faso.

FORWARD-LOOKING STATEMENTS: This news release contains certain "forward-looking statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Except for statements of historical fact relating to the company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project cost overruns or unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and other factors. The Company undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Don WilloughbyGoldrush Resources Ltd.VP Corporate Development604-602-9973604-681-5910 (FAX)info@goldrushresources.cawww.goldrushresources.ca

OR

Babak PedramThe Equicom Group(416) 815-0700 Ext. 264bpedram@equicomgroup.com

OR

Joe RacanelliThe Equicom Group(416) 815-0700 Ext. 243jracanelli@equicomgroup.comwww.equicomgroup.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Gruß Kelthe

Antwort auf Beitrag Nr.: 41.349.068 von Kelthe am 11.04.11 15:21:05

.....NICE !!!

....lies mal reaktion eines SH- users.........

I expect to see this stock go well above 50 cents; in fact it is a good take over candidate.

GoldRush is one of the oldest junior exploration companies in Burkina Faso and during this long period; it has always had first class exploration geologists. GoldRush had first picks on many great artisanal mining properties.

After the above, GoldRush went through a down period due to the Russians with High River; take this as your measure, not many come out of Russian negotiations with a good deal. Most take a huge hair cuts and the rest get beheaded.

GoldRush escaped from the HighRiver strangle hold with a reasonable deal; this speaks well of management.

Consequently, GoldRush had to restructure its shareholder base and consolidate shares into new backers. This structuring and consolidation is now complete.

The chart tells the story; these shares are under accumulation by the new backers and GoldRush is one of a few African stocks that has not had a good run.

GoldRush has great properties, all with extensive artisanal mining; the Ronguen deposit has proven reserves that will probably hit 1 million OZ and will make a mine one day. All told GoldRush is very under valued.

I expect to see a financing at higher prices and these artisanal properties will be drilled and proven to have gold.

Note, artisanal properties need 1 oz gold per ton to get people working the grounds, so GoldRush will have good drill results.

I am looking for a lot higher share price.

.....NICE !!!

....lies mal reaktion eines SH- users.........

I expect to see this stock go well above 50 cents; in fact it is a good take over candidate.

GoldRush is one of the oldest junior exploration companies in Burkina Faso and during this long period; it has always had first class exploration geologists. GoldRush had first picks on many great artisanal mining properties.

After the above, GoldRush went through a down period due to the Russians with High River; take this as your measure, not many come out of Russian negotiations with a good deal. Most take a huge hair cuts and the rest get beheaded.

GoldRush escaped from the HighRiver strangle hold with a reasonable deal; this speaks well of management.

Consequently, GoldRush had to restructure its shareholder base and consolidate shares into new backers. This structuring and consolidation is now complete.

The chart tells the story; these shares are under accumulation by the new backers and GoldRush is one of a few African stocks that has not had a good run.

GoldRush has great properties, all with extensive artisanal mining; the Ronguen deposit has proven reserves that will probably hit 1 million OZ and will make a mine one day. All told GoldRush is very under valued.

I expect to see a financing at higher prices and these artisanal properties will be drilled and proven to have gold.

Note, artisanal properties need 1 oz gold per ton to get people working the grounds, so GoldRush will have good drill results.

I am looking for a lot higher share price.

Antwort auf Beitrag Nr.: 41.349.561 von hbg55 am 11.04.11 16:39:13Stimme in weiten Teilen dem User zu, jedoch bin ich bzgl."it is a good take over candidate"

anderer Meinung...

Es befinden sich über 60% der Shares bei Instis... Und bei Sprott und Pinetree etc. darf man meiner Meinung von festen Händen ausgehen...

Die werden sich wohl kaum die Butter vom Brot nehmen lassen...

Gruß Kelthe

anderer Meinung...

Es befinden sich über 60% der Shares bei Instis... Und bei Sprott und Pinetree etc. darf man meiner Meinung von festen Händen ausgehen...

Die werden sich wohl kaum die Butter vom Brot nehmen lassen...

Gruß Kelthe

Uiuiui....da haben wohl einige auf Zahlen wie bei der letzten Meldung von Riverstone gehofft??!

Mir solls recht sein. Mal sehen, ob ich noch ein paar shares zu CAD 0,185 abgreifen kann....

Mir solls recht sein. Mal sehen, ob ich noch ein paar shares zu CAD 0,185 abgreifen kann....

Antwort auf Beitrag Nr.: 41.349.674 von Kelthe am 11.04.11 16:53:20

...DA haste wohl recht, wobei auch INSTIS irgendwann mal ´schwach´

werden.............aaaaaaber mit sicherheit NICHT bei akt. kursniv....IMO

...DA haste wohl recht, wobei auch INSTIS irgendwann mal ´schwach´

werden.............aaaaaaber mit sicherheit NICHT bei akt. kursniv....IMO

Antwort auf Beitrag Nr.: 41.349.749 von hbg55 am 11.04.11 17:04:24Also bei 1 CAD würde ich schwach werden...

@ Homer

Also am Freitag der Anstieg war klar auf eine News eines Nachbarn zurück zuführen...

ICH kann mit den News gut leben! "3.92 g/t Au over 10 metres (including 9.38 g/t Au over 4 metres) in hole KRB11-0341

Ein guter Wert!! Wir erwarten ja noch einige News...

Dass wir jetzt nicht direkt auf 3CAD springen war mir jedenfalls klar. Denke, dass der heutige Kursrückgang nichts mit der News zu tun haben, sondern der Tatsache geschuldet, dass wir am Freitag schon so stark getiegen sind...

Bietet sich evtl. ein schöner Einstiegszeitpunkt...

Gruß Kelthe

@ Homer

Also am Freitag der Anstieg war klar auf eine News eines Nachbarn zurück zuführen...

ICH kann mit den News gut leben! "3.92 g/t Au over 10 metres (including 9.38 g/t Au over 4 metres) in hole KRB11-0341

Ein guter Wert!! Wir erwarten ja noch einige News...

Dass wir jetzt nicht direkt auf 3CAD springen war mir jedenfalls klar. Denke, dass der heutige Kursrückgang nichts mit der News zu tun haben, sondern der Tatsache geschuldet, dass wir am Freitag schon so stark getiegen sind...

Bietet sich evtl. ein schöner Einstiegszeitpunkt...

Gruß Kelthe

thx h5,

wir hatten ja seinerzeit über HRG geplaudert und auch über GOD -remember ? -

nuuur hatten die damals wohl einen finanziellen engpass,denn

die liegenschaften waren und sind topp

dieser ist wohl überwunden(2 mille in der kasse )

weiss nicht ab wann Sprott u. Pintree drin sind , aber diletanten

sind die wohl nicht....

die angekündiogten aktivitäten werden in die tat umgesetzt

was bei aktuellen Edelmetallpreis mehr als erfreulich ist

verglichen mit konkurenten sieht der upside beachtlich

...schauen wir ob sich da was machen lässt....

wir hatten ja seinerzeit über HRG geplaudert und auch über GOD -remember ? -

nuuur hatten die damals wohl einen finanziellen engpass,denn

die liegenschaften waren und sind topp

dieser ist wohl überwunden(2 mille in der kasse )

weiss nicht ab wann Sprott u. Pintree drin sind , aber diletanten

sind die wohl nicht....

die angekündiogten aktivitäten werden in die tat umgesetzt

was bei aktuellen Edelmetallpreis mehr als erfreulich ist

verglichen mit konkurenten sieht der upside beachtlich

...schauen wir ob sich da was machen lässt....

Antwort auf Beitrag Nr.: 41.352.721 von runn64 am 12.04.11 09:57:21

moin r64,

WELCOME...dachte schon, du wärst NICHT mehr dabei....grad wo wir

jetzt vor ner soooo int. bohrsaison stehen

moin r64,

WELCOME...dachte schon, du wärst NICHT mehr dabei....grad wo wir

jetzt vor ner soooo int. bohrsaison stehen

Tach zusammen....durch den heutigen Rücksetzer wurde meine Order auch bedient.

Und ab geht die Post !!

Und ab geht die Post !!

Servus zusammen.....bin dann die Nummer 3

....ohoooooooh, liest sich NICHT gut........

15. April 2011, 11:17, NZZ Online

Meuterei der Präsidentengarde von Burkina Faso

Staatschef flüchtet aus der Hauptstadt Ouagadougou

Weil seine Präsidentengarde mit ihrer Bezahlung nicht zufrieden ist, musste der Staatschef von Burkina Faso Hals über Kopf aus der Hauptstadt fliehen.

Die Meuterei hat inzwischen auf mehrere Kasernen in Ouagadougou übergegriffen. Schuld daran ist auch Côte d'Ivoire..............

http://www.nzz.ch/nachrichten/politik/international/meuterei…

Antwort auf Beitrag Nr.: 41.375.494 von hbg55 am 15.04.11 17:08:29Ich habe diese news als Anlass genommen mich hier erst einmal an die Seitenlinie zu begeben.

Antwort auf Beitrag Nr.: 41.376.845 von Homer__Simpson am 15.04.11 20:42:04Richtig gehandelt wie ich finde... Habe nach dem Run 50% verkauft und gehofft diese nochmal günstiger zurück kaufen zu können... Nach dieser News habe ich statt dessen die anderen 50% auch noch verkauft... Zwar auch noch grün, aber die Trauer über ein verlorenes aussichtsreiches Invest überwiegt leider...

Damit ist auf längere Sicht ein Invest in diesem Land für mich Tabu...

Allen anderen noch viel Glück.

Gruß Kelthe

Damit ist auf längere Sicht ein Invest in diesem Land für mich Tabu...

Allen anderen noch viel Glück.

Gruß Kelthe

PRESS RELEASES 4/18/2011 7:00:00 AM

Goldrush Intersects 1.82 g/t Gold Over 37 Metres, Including 2.95 g/t Au Over 16 Metres in Step-Out Drilling at Ronguen Gold Deposit, Burkina Faso

April 18, 2011 - 07:00:00 AM VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 18, 2011) - Goldrush Resources Ltd. (TSX VENTURE:GOD) ("Goldrush" or the "Company") President & CEO Len Brownlie, Ph.D is pleased to report assay results from the first 15 holes of a Reverse Circulation ("RC") drilling program on the Company's Ronguen Gold Deposit (249,000 ounce inferred resource of 5.9 million tonnes at a grade of 1.31 g/t Au) in Burkina Faso, West Africa. The highlights of the drilling results are RC holes KGRR011-116 and 117 that were drilled on the new North Zone:

-- 1.82 g/t Au over 37 metres, including 2.95 g/t Au over 16 metres in hole

KGRR011-116 centered at a vertical depth of 20.5 metres

-- 1.87 g/t Au over 13 metres in hole KGRR011-117 centered at a vertical

depth of 22.5 metres

In hole KGRR011-116, visible gold was observed from 8 to 9, 22 to 23 and 102 to 103 metres down-hole. Gold grades in the mineralized interval ranged from 0.14 g/t to 6.06 g/t Au. In hole -117, drilled 55 metres north of hole 116 on the same section, visible gold was observed from 18 to 20 and 23 to 28 metres down-hole. Gold grades in the mineralized interval ranged from 0.11 g/t to 4.71 g/t Au.

Hole KGRR011-116 is located on the G1 grid, the eastern of two overlapping grids, on section 1100E, 25 metres north of the northern limit of the Main Zone gridding. This hole was collared approximately 130 metres northeast of hole KGRR010-096 that was drilled on section 970E and that intersected 7.63 g/t gold over 15 metres at a depth of 12.7 metres, and 3.17 g/t gold over 22 metres at a depth of 31.1 metres (Goldrush news release #13-2010, October 25, 2010).

Assays results received from thirteen additional RC holes on the G1 grid returned the following significant composites:

-- 1.59 g/t Au over 17 metres in hole KGRR011-121

-- 2.91 g/t Au over 3 metres in hole KGRR011-112

-- 1.03 g/t Au over 8 metres in hole KGRR011-109

-- 1.73 g/t Au over 4 metres in hole KGRR011-110

The assay results from RC holes 108 - 114, 116 - 119 and 121 have confirmed the presence of gold mineralization in areas of the new North Zone that had little prior drilling. The density of drill holes in this area is designed to define and to enable the North Zone gold mineralization to be easily incorporated into an upgraded 2011 Ronguen resource estimate. A surface plan showing the drill hole locations is available at www.goldrushresources.ca.

Assay Results

Significant intersections are noted above and in the following table:

---------------------------------------------------------------------------

Gold

Line Station Grade Vertical

(Grid (Grid From To Intersection (g depth

Hole ID Co-ord) Co-ord) Grid (m) (m) (m) Au/t) (m)(1)

---------------------------------------------------------------------------

KGRR011-108 1380 -95 G1 7 8 1 0.5 7.5

---------------------------------------------------------------------------

KGRR011-109 1260 -60 G1 45 46 1 0.97 45.5

---------------------------------------------------------------------------

and 49 57 8 1.03 53

---------------------------------------------------------------------------

and 63 65 2 1.12 64

---------------------------------------------------------------------------

KGRR011-110 1260 -120 G1 3 4 1 0.65 3.5

---------------------------------------------------------------------------

and 13 18 5 0.91 15.5

---------------------------------------------------------------------------

and 24 28 4 1.73 26

---------------------------------------------------------------------------

and 30 31 1 0.71VG 30.5

---------------------------------------------------------------------------

and 55 56 1 0.55 55.5

---------------------------------------------------------------------------

and 71 72 1 0.53VG 71.5

---------------------------------------------------------------------------

and 118 119 1 0.57 118.5

---------------------------------------------------------------------------

KGRR011-111 1260 0 G1 14 16 2 0.57 15

---------------------------------------------------------------------------

and 22 23 1 1.06 22.5

---------------------------------------------------------------------------

KGRR011-112 1180 -80 G1 5 6 1 .65 5.5

---------------------------------------------------------------------------

and 9 12 3 2.91 10.5

---------------------------------------------------------------------------

and 20 23 3 0.76 21.5

---------------------------------------------------------------------------

and 26 28 2 0.61 27

---------------------------------------------------------------------------

KGR011-113 1339 -80 G1 5 6 1 0.53 5.5

---------------------------------------------------------------------------

KGR011-114 1180 0 G1 11 14 3 0.99 12.5

---------------------------------------------------------------------------

and 5 7 2 0.58 6

---------------------------------------------------------------------------

and 34 37 3 0.87 35.5

---------------------------------------------------------------------------

and 41 42 1 0.57 41.5

---------------------------------------------------------------------------

KGR011-116 1100 25 G1 2 39 37 1.82 20.5

---------------------------------------------------------------------------

including 15 31 16 2.95 23

---------------------------------------------------------------------------

and 56 59 3 0.63 57.5

---------------------------------------------------------------------------

and 85 86 1 5.39 85.5

---------------------------------------------------------------------------

and 95 96 1 0.84 95.5

---------------------------------------------------------------------------

and 102 104 2 0.77VG 103

---------------------------------------------------------------------------

and 107 108 1 0.83 107.5

---------------------------------------------------------------------------

and 115 118 3 0.59 116.5

---------------------------------------------------------------------------

KGRR011-117 1100 80 G1 0 2 2 0.93 1

---------------------------------------------------------------------------

and 16 29 13 1.87VG 22.5

---------------------------------------------------------------------------

KGRR011-118 1060 77.5 G1 2 3 1 0.52 2.5

---------------------------------------------------------------------------

and 33 35 2 2.32 34

---------------------------------------------------------------------------

KGRR011-119 1060 120 G1 11 12 1 0.51 11.5

---------------------------------------------------------------------------

and 16 17 1 0.53 12.5

---------------------------------------------------------------------------

KGRR011-121 1015 -60 G1 23 40 17 1.59 31.5

---------------------------------------------------------------------------

and 47 48 1 0.63 47.5

---------------------------------------------------------------------------

and 58 59 1 5.90 58.5

---------------------------------------------------------------------------

(1) "Vertical depth" is the calculated depth to the centre of the

intersection.

(2) True widths are determined to be 90 to 95% of core intervals.

(3) VG: Visible gold identified in the intersection.

(4) Holes KGR011-107, -115 and -120 did not intersect any gold

mineralization at or above a cut-off of 0.5 g/t gold.

Drill hole lengths varied from 52 to 134 metres, with a common inclination of -45 degrees. A total of 1,416 metres was drilled in fifteen RC holes and continuously sampled at one metre intervals for assaying.

Ronguen Deposit Mineralization

The Ronguen gold deposit is located within the northeastern part of the highly prospective Birimian age Boromo greenstone belt in Burkina Faso. The local geology at Ronguen is dominated by an east northeast ("ENE") trending metasedimentary sequence consisting of interlayered siltstone, mudstone and minor conglomerates that are intruded by plugs, and narrow dykes and sills of gabbroic composition. The Ronguen mineralized zone is located in the structural footwall of a major ENE thrust fault which recorded a tectonic transport direction towards the north. The mineralized deformation corridor represents a major ENE trending high angle reverse fault zone, dipping moderately to steeply towards the south. Gold mineralization is found in both metasedimentary and mafic intrusive rock; there are no obvious lithological controls yet recognized at this epigenetic gold deposit. The gold mineralization is associated with quartz-carbonate veins/veinlets and with sulphides occuring as disseminations, veinlets and patches. Two sets of gold-bearing quartz veins are developed: subvertical shear veins parallel to the shear zone foliation and to the shear zone boundaries, and subhorizontal extension veins. Small quartz stockworks are present and represent a part of the gold mineralization.

Ongoing Exploration

The Company is awaiting reverse circulation drilling assay results from an additional seven holes drilled on the G1 Grid; seven holes drilled on the western G2 grid and 13 holes drilled on other target areas on the two permits that host the Ronguen gold deposit, as part of the Company's ongoing 9,660 metre RC drill program. As of April 14, the RC drill had demobilized from Ronguen and was moving to the new Liki permit, where it will complete an initial 1,000 metre program, to be followed by 3,000 metres at the Company's new and highly prospective Nakiambouri and Gonaba Est permits.

Quality Assurance/Quality Control

Goldrush maintains a rigorous quality control program involving the use of certified standards from an accredited Canadian laboratory, inserted blanks, and the use of repeat assays. Details of Goldrush's quality control program were provided in the Company's News Release #2010-13, dated October 25, 2010.

The ALS Chemex laboratory in Ouagadougou, Burkina Faso was used for sample analysis. For its internal control, ALS Chemex inserted two certified standards and one blank, and analyzed one random duplicate for approximately each 25 samples submitted. For its certified standard and blank samples included in the QA-QC procedure, Goldrush averaged 11.0% of the total samples submitted.

The drilling was contracted to West African Drilling, based in Ouagadougou, Burkina Faso.

Mr. Driffield Cameron, P.Geo., Director of Goldrush, is the Qualified Person for this press release for the purposes of National Instrument 43-101 and has reviewed the technical information herein.

For further information on Goldrush Resources Ltd., shareholders and other interested parties are invited to visit the Company's website at www.goldrushresources.ca.

ON BEHALF OF THE BOARD OF DIRECTORS,

GOLDRUSH RESOURCES LTD.

Len Brownlie - President and Chief Executive Officer

Goldrush Intersects 1.82 g/t Gold Over 37 Metres, Including 2.95 g/t Au Over 16 Metres in Step-Out Drilling at Ronguen Gold Deposit, Burkina Faso

April 18, 2011 - 07:00:00 AM VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 18, 2011) - Goldrush Resources Ltd. (TSX VENTURE:GOD) ("Goldrush" or the "Company") President & CEO Len Brownlie, Ph.D is pleased to report assay results from the first 15 holes of a Reverse Circulation ("RC") drilling program on the Company's Ronguen Gold Deposit (249,000 ounce inferred resource of 5.9 million tonnes at a grade of 1.31 g/t Au) in Burkina Faso, West Africa. The highlights of the drilling results are RC holes KGRR011-116 and 117 that were drilled on the new North Zone:

-- 1.82 g/t Au over 37 metres, including 2.95 g/t Au over 16 metres in hole

KGRR011-116 centered at a vertical depth of 20.5 metres

-- 1.87 g/t Au over 13 metres in hole KGRR011-117 centered at a vertical

depth of 22.5 metres

In hole KGRR011-116, visible gold was observed from 8 to 9, 22 to 23 and 102 to 103 metres down-hole. Gold grades in the mineralized interval ranged from 0.14 g/t to 6.06 g/t Au. In hole -117, drilled 55 metres north of hole 116 on the same section, visible gold was observed from 18 to 20 and 23 to 28 metres down-hole. Gold grades in the mineralized interval ranged from 0.11 g/t to 4.71 g/t Au.

Hole KGRR011-116 is located on the G1 grid, the eastern of two overlapping grids, on section 1100E, 25 metres north of the northern limit of the Main Zone gridding. This hole was collared approximately 130 metres northeast of hole KGRR010-096 that was drilled on section 970E and that intersected 7.63 g/t gold over 15 metres at a depth of 12.7 metres, and 3.17 g/t gold over 22 metres at a depth of 31.1 metres (Goldrush news release #13-2010, October 25, 2010).

Assays results received from thirteen additional RC holes on the G1 grid returned the following significant composites:

-- 1.59 g/t Au over 17 metres in hole KGRR011-121

-- 2.91 g/t Au over 3 metres in hole KGRR011-112

-- 1.03 g/t Au over 8 metres in hole KGRR011-109

-- 1.73 g/t Au over 4 metres in hole KGRR011-110

The assay results from RC holes 108 - 114, 116 - 119 and 121 have confirmed the presence of gold mineralization in areas of the new North Zone that had little prior drilling. The density of drill holes in this area is designed to define and to enable the North Zone gold mineralization to be easily incorporated into an upgraded 2011 Ronguen resource estimate. A surface plan showing the drill hole locations is available at www.goldrushresources.ca.

Assay Results

Significant intersections are noted above and in the following table:

---------------------------------------------------------------------------

Gold

Line Station Grade Vertical

(Grid (Grid From To Intersection (g depth

Hole ID Co-ord) Co-ord) Grid (m) (m) (m) Au/t) (m)(1)

---------------------------------------------------------------------------

KGRR011-108 1380 -95 G1 7 8 1 0.5 7.5

---------------------------------------------------------------------------

KGRR011-109 1260 -60 G1 45 46 1 0.97 45.5

---------------------------------------------------------------------------

and 49 57 8 1.03 53

---------------------------------------------------------------------------

and 63 65 2 1.12 64

---------------------------------------------------------------------------

KGRR011-110 1260 -120 G1 3 4 1 0.65 3.5

---------------------------------------------------------------------------

and 13 18 5 0.91 15.5

---------------------------------------------------------------------------

and 24 28 4 1.73 26

---------------------------------------------------------------------------

and 30 31 1 0.71VG 30.5

---------------------------------------------------------------------------

and 55 56 1 0.55 55.5

---------------------------------------------------------------------------

and 71 72 1 0.53VG 71.5

---------------------------------------------------------------------------

and 118 119 1 0.57 118.5

---------------------------------------------------------------------------

KGRR011-111 1260 0 G1 14 16 2 0.57 15

---------------------------------------------------------------------------

and 22 23 1 1.06 22.5

---------------------------------------------------------------------------

KGRR011-112 1180 -80 G1 5 6 1 .65 5.5

---------------------------------------------------------------------------