RRS - 4,6 mio CAD für aussichtsreiche Projekte in CAN - 500 Beiträge pro Seite

eröffnet am 16.06.11 18:26:06 von

neuester Beitrag 10.10.12 19:38:56 von

neuester Beitrag 10.10.12 19:38:56 von

Beiträge: 59

ID: 1.166.975

ID: 1.166.975

Aufrufe heute: 0

Gesamt: 4.005

Gesamt: 4.005

Aktive User: 0

ISIN: CA77536Q2027 · WKN: A2AP5U · Symbol: RRS

0,0350

CAD

0,00 %

0,0000 CAD

Letzter Kurs 24.04.24 TSX Venture

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 15,970 | +16,83 | |

| 29,51 | +15,82 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 7,2100 | -7,80 | |

| 2,1800 | -9,17 | |

| 0,5580 | -30,25 |

PP geschlossen - somit sollte ein dazugehöriger Thread nicht fehlen!!!

Ein paar Basics - vor dem PP:

- shares 19,8 mio

- FD 27,3

- price/share 0,295

- MK 5,841 mio CAD

- MK FD 8,0535 mio CAD

Homepage

http://www.roguemining.com/s/home.asp

Presi May 2011

http://www.roguemining.com/i/pdf/CorporatePresentation.pdf

Ein paar Basics - vor dem PP:

- shares 19,8 mio

- FD 27,3

- price/share 0,295

- MK 5,841 mio CAD

- MK FD 8,0535 mio CAD

Homepage

http://www.roguemining.com/s/home.asp

Presi May 2011

http://www.roguemining.com/i/pdf/CorporatePresentation.pdf

Antwort auf Beitrag Nr.: 41.657.709 von SteirerMan am 16.06.11 18:26:06

Eine PP wurde von 3 mio auf 4 mio CAD erhöht, und heute mit 4,6 mio CAD geschlossen!!!! Die Feinheiten

Rogue Resources Closes $4.6 Million Financing, 15% Overallotment Option Exercised

Jun. 16, 2011 (Marketwire Canada) --

VANCOUVER, BRITISH COLUMBIA --

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce that it has completed its previously announced $4 million dollar unit financing with full exercise of the 15% over-allotment option.

The Company raised an aggregate of $4,600,000 from the sale of (i) 12,722,000 non-flow through units ("Units") at a price of $0.25 per Unit, and (ii) 4,301,514 flow through units ("FT Units") at a price of $0.33 per FT Unit (collectively, the "Offering"). Except for 200,000 Units issued on a non-brokered basis, the Offering was conducted on a best efforts agency basis through Jennings Capital Inc. as sole agent (the "Agent").

Each Unit consists of one common share of the Company and one half of one transferrable common share purchase warrant (each whole warrant, a "Warrant") with each Warrant entitling the holder thereof to purchase one common share of the Company at an exercise price of C$0.37 per share for a period of 24 months following the closing of the Offering. Each FT Unit consists of one flow-through common share of the Company and one half of one Warrant. With the exception of Warrants comprising part of 200,000 Units sold on a non-brokered basis, the Warrants were issued under a warrant indenture between the Company and Computershare Trust Company of Canada as warrant agent.

The proceeds from the issuance of FT Units will be used to fund exploration expenditures on the Company's Canadian mineral projects and will qualify as Canadian exploration expenses (as defined in the Income Tax Act) that will be renounced to the investors no later than December 31, 2011. The Company intends to use the net proceeds of the Offering primarily for expenditures on the Company's Radio Hill Property and for general working capital.

The Agent was paid a cash commission equal to 7.5% of the aggregate gross proceeds of the brokered part of the Offering. The Agent was also granted 1,261,763 non-transferable compensation options ("Compensation Options"). Each Compensation Option entitles the holder to purchase, for a period of 24 months from the Closing Date at an exercise price of $0.25, one Unit described above.

All securities issued under the Offering are subject to a four-month hold period expiring on October 17, 2011.

Eine PP wurde von 3 mio auf 4 mio CAD erhöht, und heute mit 4,6 mio CAD geschlossen!!!! Die Feinheiten

Rogue Resources Closes $4.6 Million Financing, 15% Overallotment Option Exercised

Jun. 16, 2011 (Marketwire Canada) --

VANCOUVER, BRITISH COLUMBIA --

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce that it has completed its previously announced $4 million dollar unit financing with full exercise of the 15% over-allotment option.

The Company raised an aggregate of $4,600,000 from the sale of (i) 12,722,000 non-flow through units ("Units") at a price of $0.25 per Unit, and (ii) 4,301,514 flow through units ("FT Units") at a price of $0.33 per FT Unit (collectively, the "Offering"). Except for 200,000 Units issued on a non-brokered basis, the Offering was conducted on a best efforts agency basis through Jennings Capital Inc. as sole agent (the "Agent").

Each Unit consists of one common share of the Company and one half of one transferrable common share purchase warrant (each whole warrant, a "Warrant") with each Warrant entitling the holder thereof to purchase one common share of the Company at an exercise price of C$0.37 per share for a period of 24 months following the closing of the Offering. Each FT Unit consists of one flow-through common share of the Company and one half of one Warrant. With the exception of Warrants comprising part of 200,000 Units sold on a non-brokered basis, the Warrants were issued under a warrant indenture between the Company and Computershare Trust Company of Canada as warrant agent.

The proceeds from the issuance of FT Units will be used to fund exploration expenditures on the Company's Canadian mineral projects and will qualify as Canadian exploration expenses (as defined in the Income Tax Act) that will be renounced to the investors no later than December 31, 2011. The Company intends to use the net proceeds of the Offering primarily for expenditures on the Company's Radio Hill Property and for general working capital.

The Agent was paid a cash commission equal to 7.5% of the aggregate gross proceeds of the brokered part of the Offering. The Agent was also granted 1,261,763 non-transferable compensation options ("Compensation Options"). Each Compensation Option entitles the holder to purchase, for a period of 24 months from the Closing Date at an exercise price of $0.25, one Unit described above.

All securities issued under the Offering are subject to a four-month hold period expiring on October 17, 2011.

Antwort auf Beitrag Nr.: 41.657.750 von SteirerMan am 16.06.11 18:33:48Radio Hill - Iron Ore - historic res 427 mio t grading 27,3%

...nachdem die Moneten hauptsächlich für den schönen Radio Hill aufgebracht werden, ein paar Facts aus der News vom 27.April 2011:

“We’ve got a great iron asset, less than 20 million shares outstanding, and a team finalizing a plan to aggressively advance the project to bring its valuation in line with our peers in the iron market. The historical resource gives an indication to the potential size of the project and our focus is now to upgrade the historic resources to 43-101 compliancy,” comments Company President, Steve de Jong. “The Technical Report completed on Radio Hill in April 2010 outlined the program required to upgrade the historical resources and the Company is now taking the necessary steps to make this program a reality.”

Project Highlights:

The Radio Hill deposit has had historically, extensive sampling, drilling, and metallurgical work completed in support of the planning and development of an iron mine. Highlights of this work include:

- Approximately $10,000,000 spent on drilling, bulk sampling, metallurgical work and other studies

- Resource estimate as high as 427 million tons at 27.3% iron

- Metallurgical work indicating a 3.5 concentration ratio (3.5 tonnes of ore : 1 ton of concentrate) bringing the concentrate to 67%

- Metallurgical test work indicating a commercially acceptable iron concentrate could be produced from Radio Hill mineralized material

- Historical mine planning work, indicating a stripping ratio of approximately 1:1

- Railway bed constructed to the deposit from CN mainline 4km to the south.

...nachdem die Moneten hauptsächlich für den schönen Radio Hill aufgebracht werden, ein paar Facts aus der News vom 27.April 2011:

“We’ve got a great iron asset, less than 20 million shares outstanding, and a team finalizing a plan to aggressively advance the project to bring its valuation in line with our peers in the iron market. The historical resource gives an indication to the potential size of the project and our focus is now to upgrade the historic resources to 43-101 compliancy,” comments Company President, Steve de Jong. “The Technical Report completed on Radio Hill in April 2010 outlined the program required to upgrade the historical resources and the Company is now taking the necessary steps to make this program a reality.”

Project Highlights:

The Radio Hill deposit has had historically, extensive sampling, drilling, and metallurgical work completed in support of the planning and development of an iron mine. Highlights of this work include:

- Approximately $10,000,000 spent on drilling, bulk sampling, metallurgical work and other studies

- Resource estimate as high as 427 million tons at 27.3% iron

- Metallurgical work indicating a 3.5 concentration ratio (3.5 tonnes of ore : 1 ton of concentrate) bringing the concentrate to 67%

- Metallurgical test work indicating a commercially acceptable iron concentrate could be produced from Radio Hill mineralized material

- Historical mine planning work, indicating a stripping ratio of approximately 1:1

- Railway bed constructed to the deposit from CN mainline 4km to the south.

Antwort auf Beitrag Nr.: 41.657.847 von SteirerMan am 16.06.11 18:49:28Langmuir - Nickel, Copper - Open Pit

Deposit Highlights:

- 7,5 mio CAD spent, over 18 mio pounds or nickel defined

- Over 80 holes drilled on deposit

- Metallurgical testing underway, scoping commenced 2011

- fully operational nickel mill 7 km to the west

- Upside potential exists in deep geophysical targets not fully tested with diamond drilling

Deposit Highlights:

- 7,5 mio CAD spent, over 18 mio pounds or nickel defined

- Over 80 holes drilled on deposit

- Metallurgical testing underway, scoping commenced 2011

- fully operational nickel mill 7 km to the west

- Upside potential exists in deep geophysical targets not fully tested with diamond drilling

Antwort auf Beitrag Nr.: 41.657.946 von SteirerMan am 16.06.11 19:07:04...es gibt noch andere Projekte, die in der Presi und auf der HP angeführt werden!!

Aber aus der Presi May 2011 - Rogue Growth Drivers/Blue Sky:

- Updated 43-101 resource estimate on Radio Hill Iron Projekt

- Discovery of second deposit at Langmuir

- Metallurgical testing on Langmuir, PEA initiated

- Scoping studies/PEA showing positive valuation

- Joint ventures in place for Ontario projects

- Announcement of executives and management

- Increasing demand for iron projects and appreciating nickel prices

Aber aus der Presi May 2011 - Rogue Growth Drivers/Blue Sky:

- Updated 43-101 resource estimate on Radio Hill Iron Projekt

- Discovery of second deposit at Langmuir

- Metallurgical testing on Langmuir, PEA initiated

- Scoping studies/PEA showing positive valuation

- Joint ventures in place for Ontario projects

- Announcement of executives and management

- Increasing demand for iron projects and appreciating nickel prices

Antwort auf Beitrag Nr.: 41.657.709 von SteirerMan am 16.06.11 18:26:06moin & thx für thr.- eröffnung, SM

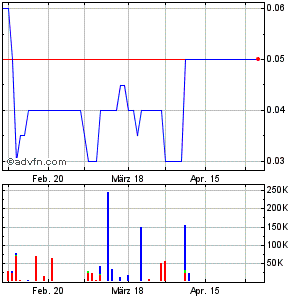

wie aufm chart ersichtlich, sehen wir akt. 12-monats- TIEF.......gut möglich, daß

news über geschl. PP für NEU- interesse sorgen kann

SK zum WE....cad 0,28

bin mal gespannt auf den wochenauftakt !!!

wie aufm chart ersichtlich, sehen wir akt. 12-monats- TIEF.......gut möglich, daß

news über geschl. PP für NEU- interesse sorgen kann

SK zum WE....cad 0,28

bin mal gespannt auf den wochenauftakt !!!

Antwort auf Beitrag Nr.: 41.667.478 von hbg55 am 19.06.11 12:28:30...wer interesse an den Teilnehmern des PP's hat!

Rogue Resources 17,023,514-share private placement

2011-06-30 18:11 ET - Private Placement

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced May 26, 2011, and June 2, 2011.

Number of shares: 12,722,000 non-flow-through shares and 4,301,514 flow-through shares

Purchase price: 25 cents per non-flow-through share and 33 cents per flow-through shares

Warrants: 8,511,757 share purchase warrants to purchase 8,511,757 shares

Warrant exercise price: 37 cents for a two-year period

Hidden placees: 94 hidden placees

Pro groups:

BMO Resource Fund, 1.2 million;

Nancy Peck, 100,000 FT;

Jason Baibokas, 200,000 FT;

Doug Van Peteghem, 75,000 FT and 200,000;

Grant Beasley, 257,600 FT and 160,000;

Angela Degasperis, 50,000 FT;

Arie Papernick, 50,000 FT;

Kirk Fyffe, 100,000 FT;

Rick Roussel, 50,000 FT;

Ian Charles, 15,000 FT;

Marcio B. Fonseca, 150,000 FT;

Simion Candrea, 60,000;

Robert Dzisiak, 75,000;

Petco (Angelo P. Comi), 100,000;

Angelo P. Comi, 100,000;

Anthony Comi, 50,000;

Angela Comi, 50,000;

Ricky Chan, 160,000;

Daryl Hodges, 100,000;

David Giacomodonato, 60,000;

Annette Mancini, 240,000;

Christopher Syme, 80,000;

Bill Mantzoutsos, 50,000;

Paulette Darcy, 50,000;

Christine Comi, 100,000;

John Comi, 200,000;

Michele Cappuccitti, 100,000;

Christine Cappuccitti, 200,000;

Gordon Fernandes, 50,000;

Sabrina Vella, 50,000;

Mark Wayne, 300,000;

Catherine Sinclair, 50,000

Insiders:

Frank Durant, 15,000 FT;

Durant Developments Ltd. (Frank Durant), 40,000;

Diana Mark, 20,000;

John de Jong, 50,000;

Stephen de Jong, 75,000

Finder's fee: Jennings Capital Inc. receives $341,249.97 and 1,261,763 non-transferable warrants, each exercisable for one share at a price of 37 cents per share for a two-year period.

Rogue Resources 17,023,514-share private placement

2011-06-30 18:11 ET - Private Placement

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced May 26, 2011, and June 2, 2011.

Number of shares: 12,722,000 non-flow-through shares and 4,301,514 flow-through shares

Purchase price: 25 cents per non-flow-through share and 33 cents per flow-through shares

Warrants: 8,511,757 share purchase warrants to purchase 8,511,757 shares

Warrant exercise price: 37 cents for a two-year period

Hidden placees: 94 hidden placees

Pro groups:

BMO Resource Fund, 1.2 million;

Nancy Peck, 100,000 FT;

Jason Baibokas, 200,000 FT;

Doug Van Peteghem, 75,000 FT and 200,000;

Grant Beasley, 257,600 FT and 160,000;

Angela Degasperis, 50,000 FT;

Arie Papernick, 50,000 FT;

Kirk Fyffe, 100,000 FT;

Rick Roussel, 50,000 FT;

Ian Charles, 15,000 FT;

Marcio B. Fonseca, 150,000 FT;

Simion Candrea, 60,000;

Robert Dzisiak, 75,000;

Petco (Angelo P. Comi), 100,000;

Angelo P. Comi, 100,000;

Anthony Comi, 50,000;

Angela Comi, 50,000;

Ricky Chan, 160,000;

Daryl Hodges, 100,000;

David Giacomodonato, 60,000;

Annette Mancini, 240,000;

Christopher Syme, 80,000;

Bill Mantzoutsos, 50,000;

Paulette Darcy, 50,000;

Christine Comi, 100,000;

John Comi, 200,000;

Michele Cappuccitti, 100,000;

Christine Cappuccitti, 200,000;

Gordon Fernandes, 50,000;

Sabrina Vella, 50,000;

Mark Wayne, 300,000;

Catherine Sinclair, 50,000

Insiders:

Frank Durant, 15,000 FT;

Durant Developments Ltd. (Frank Durant), 40,000;

Diana Mark, 20,000;

John de Jong, 50,000;

Stephen de Jong, 75,000

Finder's fee: Jennings Capital Inc. receives $341,249.97 and 1,261,763 non-transferable warrants, each exercisable for one share at a price of 37 cents per share for a two-year period.

PRESS RELEASES 7/12/2011 8:30:00 AM | CCNMatthews

Rogue Resources Acquires Kachelly Property, Secures Extension to 12 km Nat River Iron Formation

July 12, 2011 - 08:30:00 AM VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 12, 2011) - Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce that it has purchased a 100% interest in the Kachelly property, located contiguous to the northernmost corner of its Radio Hill property. The property comprises part of the Nat River Iron Formation of which the Company presently holds about 12km in strike length. The Nat River iron Formation may potentially host additional iron ore resources which could supplement any future development at the Radio Hill project. The Company will be announcing exploration plans for the Radio Hill Project in the near future.

Within the Company's NI43-101 compliant Radio Hill Technical Report (April 2010) Micon International Ltd. noted the property contained two potentially significant iron deposits, the Radio Hill and the Nat River Iron Formations. The summary provided in the report on the previous work on the Nat River Iron Formation: "A total of six diamond core holes were started at Nat River with five being completed during 1959 for a total of 1,235 m drilled. The amount of information collected was not enough to report a mineral resource, however, Gerson reports a 'potential' of 30 million long tons per 100 ft of depth. The estimate is based on the five drill holes along with the magnetometer work completed on the property during 1959. Micon considers that this estimate is very approximate and does not conform to any modern or previous reporting standards. It is recommended by Micon that GCR (now Rogue) should consider Nat River as unexplored with an extensive amount of drilling and metallurgical test work required before any resource could be determined."

To view maps of the Radio Hill Project, please click on the following links:

Geology: http://www.brmstatpack.com/lt/1001/1185/kachelly-geo-map

Geophysics: http://www.brmstatpack.com/lt/1001/1186/kachelly-mag-map

The Company considers the Nat River Iron Formation a relatively unexplored target. In 2008 the Company had GEOTECH Ltd. conduct an airborne VTEM/Mag survey over the 12,000 hectare Radio Hill claim group which clearly defined both the Nat River and Radio Hill iron formations, no follow up drilling has been done to date. The Kachelly Property comprises an important extension to the Nat River iron formation and adds significant value to the Company's existing land package.

The Kachelly property consists of one, 12-unit claim in the Kenogaming Township, Ontario and is located approximately 10km east of the Radio Hill historic resource(i) and is accessible by road from Highway 101. The property contains a known section of the Nat River iron formation which was originally mapped by the Geological Survey of Canada in 1950's and was explored in 1960 by Kukatush Mining Corp, the company that completed a feasibility study (1965) on the Radio Hill project.

The geology of the Nat River Iron Formation is similar to that at the Radio Hill historic resource which is a magnetite rich, taconite type of iron formation that holds the potential for both iron ore and gold deposits. The Nat River Iron Formation in the area of Benbow Lake is folded and averages 200 feet in thickness and could provide considerable tonnage over its strike length. Exploration efforts this year will focus on updating the historical resource at Radio Hill; however, the Kachelly property and the Nat River Iron Formation remain a high priority exploration target and a possible source of additional iron ore to compliment Rogue's Radio Hill project. Freeman Smith, P.Geo. is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

In consideration for 100% ownership of the Kachelly property the Company will issue 75,000 shares to the Vendor. There is a 3% NSR payable on all metals. The Company may buyback 2% of the NSR for $2,000,000 (in $1,000,000 increments) and the remaining 1% of the NSR on the iron rights for $1,000,000. If the Company was to purchase the final 1% iron ore royalty the Vendors would retain a 1% royalty on non-iron minerals.

The Company would also like to announce it has retained Venture Liquidity Providers Inc. ("VLP") to initiate its Market Making Service to provide assistance in maintaining an orderly trading market for the Company's common shares. The Market Making Service will be undertaken by VLP through a registered broker, W.D. Latimer Co. Limited, in compliance with the guidelines of the TSX Venture Exchange. VLP is a specialized consulting firm based in Toronto providing a variety of services focused on TSX Venture Exchange-listed issuers. In consideration for their services, Rogue has agreed to pay VLP $5,000 per month for a period of 12 months. The agreement may be terminated at any time by Rogue or VLP. Rogue and VLP act at arm's length, and VLP has no present interest, directly or indirectly, in the Company or its securities. The agreement is subject to regulatory approval.

Rogue Resources Acquires Kachelly Property, Secures Extension to 12 km Nat River Iron Formation

July 12, 2011 - 08:30:00 AM VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 12, 2011) - Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce that it has purchased a 100% interest in the Kachelly property, located contiguous to the northernmost corner of its Radio Hill property. The property comprises part of the Nat River Iron Formation of which the Company presently holds about 12km in strike length. The Nat River iron Formation may potentially host additional iron ore resources which could supplement any future development at the Radio Hill project. The Company will be announcing exploration plans for the Radio Hill Project in the near future.

Within the Company's NI43-101 compliant Radio Hill Technical Report (April 2010) Micon International Ltd. noted the property contained two potentially significant iron deposits, the Radio Hill and the Nat River Iron Formations. The summary provided in the report on the previous work on the Nat River Iron Formation: "A total of six diamond core holes were started at Nat River with five being completed during 1959 for a total of 1,235 m drilled. The amount of information collected was not enough to report a mineral resource, however, Gerson reports a 'potential' of 30 million long tons per 100 ft of depth. The estimate is based on the five drill holes along with the magnetometer work completed on the property during 1959. Micon considers that this estimate is very approximate and does not conform to any modern or previous reporting standards. It is recommended by Micon that GCR (now Rogue) should consider Nat River as unexplored with an extensive amount of drilling and metallurgical test work required before any resource could be determined."

To view maps of the Radio Hill Project, please click on the following links:

Geology: http://www.brmstatpack.com/lt/1001/1185/kachelly-geo-map

Geophysics: http://www.brmstatpack.com/lt/1001/1186/kachelly-mag-map

The Company considers the Nat River Iron Formation a relatively unexplored target. In 2008 the Company had GEOTECH Ltd. conduct an airborne VTEM/Mag survey over the 12,000 hectare Radio Hill claim group which clearly defined both the Nat River and Radio Hill iron formations, no follow up drilling has been done to date. The Kachelly Property comprises an important extension to the Nat River iron formation and adds significant value to the Company's existing land package.

The Kachelly property consists of one, 12-unit claim in the Kenogaming Township, Ontario and is located approximately 10km east of the Radio Hill historic resource(i) and is accessible by road from Highway 101. The property contains a known section of the Nat River iron formation which was originally mapped by the Geological Survey of Canada in 1950's and was explored in 1960 by Kukatush Mining Corp, the company that completed a feasibility study (1965) on the Radio Hill project.

The geology of the Nat River Iron Formation is similar to that at the Radio Hill historic resource which is a magnetite rich, taconite type of iron formation that holds the potential for both iron ore and gold deposits. The Nat River Iron Formation in the area of Benbow Lake is folded and averages 200 feet in thickness and could provide considerable tonnage over its strike length. Exploration efforts this year will focus on updating the historical resource at Radio Hill; however, the Kachelly property and the Nat River Iron Formation remain a high priority exploration target and a possible source of additional iron ore to compliment Rogue's Radio Hill project. Freeman Smith, P.Geo. is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

In consideration for 100% ownership of the Kachelly property the Company will issue 75,000 shares to the Vendor. There is a 3% NSR payable on all metals. The Company may buyback 2% of the NSR for $2,000,000 (in $1,000,000 increments) and the remaining 1% of the NSR on the iron rights for $1,000,000. If the Company was to purchase the final 1% iron ore royalty the Vendors would retain a 1% royalty on non-iron minerals.

The Company would also like to announce it has retained Venture Liquidity Providers Inc. ("VLP") to initiate its Market Making Service to provide assistance in maintaining an orderly trading market for the Company's common shares. The Market Making Service will be undertaken by VLP through a registered broker, W.D. Latimer Co. Limited, in compliance with the guidelines of the TSX Venture Exchange. VLP is a specialized consulting firm based in Toronto providing a variety of services focused on TSX Venture Exchange-listed issuers. In consideration for their services, Rogue has agreed to pay VLP $5,000 per month for a period of 12 months. The agreement may be terminated at any time by Rogue or VLP. Rogue and VLP act at arm's length, and VLP has no present interest, directly or indirectly, in the Company or its securities. The agreement is subject to regulatory approval.

Antwort auf Beitrag Nr.: 41.777.148 von allida am 12.07.11 16:22:41hallo und  allida!

allida!

wer sich die erweiterung auch visuell zu gemüte führen möcht, kann dies in der neuen July 2011 Presi machen:

http://www.roguemining.com/i/pdf/CorporatePresentation.pdf

es gibt nicht viel neues, aber auf seite 17 + 18 der presi kann die kleine aber strategisch wichtige erweiterung begutachten werden!

Hier noch ein paar interessante auszüge aus der News:

- The Company will be announcing exploration plans for the Radio Hill Project in the near future.

- The geology of the Nat River Iron Formation is similar to that at the Radio Hill historic resource which is a magnetite rich, taconite type of iron formation that holds the potential for both iron ore and gold deposits

allida!

allida!wer sich die erweiterung auch visuell zu gemüte führen möcht, kann dies in der neuen July 2011 Presi machen:

http://www.roguemining.com/i/pdf/CorporatePresentation.pdf

es gibt nicht viel neues, aber auf seite 17 + 18 der presi kann die kleine aber strategisch wichtige erweiterung begutachten werden!

Hier noch ein paar interessante auszüge aus der News:

- The Company will be announcing exploration plans for the Radio Hill Project in the near future.

- The geology of the Nat River Iron Formation is similar to that at the Radio Hill historic resource which is a magnetite rich, taconite type of iron formation that holds the potential for both iron ore and gold deposits

Antwort auf Beitrag Nr.: 41.788.956 von SteirerMan am 14.07.11 15:19:05

Jul 13, 2011

Rogue Resources Launches Social Media Program

VANCOUVER, BC - Rogue Resources Inc. (TSX-V: RRS) (the "Company") is pleased to announce it has retained the services of RBL Communications ("RBL") (http://www.rblcommunications.com) to implement and manage a complete social media program. The program is designed to provide the Company with a greater online presence, as well as improved investor communication and corporate branding.

LAUNCH OF ROGUE SOCIAL MEDIA COMMUNITY

Effective immediately, investors can access and join the following Rogue social media channels:

Facebook: http://www.facebook.com/pages/Rogue-Resources-Inc/1158162018…

Twitter: http://twitter.com/rogueresources

YouTube: http://www.youtube.com/rogueresources

Flickr: http://www.flickr.com/rogueresources/

The Rogue social media program will allow for near real-time distribution of Rogue news, updates, interviews, and media as well as provide investors with a brand new platform to stay current and up to date on the latest Company developments.

THE ROGUE MICRO SITE

Effective immediately, a fully customized Rogue Micro Site will be available at http://rblcommunications.com/rogue.html." target="_blank" rel="nofollow ugc noopener">http://rblcommunications.com/rogue.html. The micro site is updated in near real-time and provides a comprehensive snapshot of all relevant information on Rogue. The micro site also allows investors to sign up to the Rogue email list as well as a dedicated Rogue RSS feed.

ABOUT RBL COMMUNICATIONS

With over 10 years of experience, RBL Communications (http://rblcommunications.com) is the leader in providing fully integrated Social Media solutions to Small Cap companies trading on every recognized stock exchange worldwide. RBL's fully managed programs are designed to communicate your message to the vast and ever-growing Social Media and Web 2.0 community.

Jul 13, 2011

Rogue Resources Launches Social Media Program

VANCOUVER, BC - Rogue Resources Inc. (TSX-V: RRS) (the "Company") is pleased to announce it has retained the services of RBL Communications ("RBL") (http://www.rblcommunications.com) to implement and manage a complete social media program. The program is designed to provide the Company with a greater online presence, as well as improved investor communication and corporate branding.

LAUNCH OF ROGUE SOCIAL MEDIA COMMUNITY

Effective immediately, investors can access and join the following Rogue social media channels:

Facebook: http://www.facebook.com/pages/Rogue-Resources-Inc/1158162018…

Twitter: http://twitter.com/rogueresources

YouTube: http://www.youtube.com/rogueresources

Flickr: http://www.flickr.com/rogueresources/

The Rogue social media program will allow for near real-time distribution of Rogue news, updates, interviews, and media as well as provide investors with a brand new platform to stay current and up to date on the latest Company developments.

THE ROGUE MICRO SITE

Effective immediately, a fully customized Rogue Micro Site will be available at http://rblcommunications.com/rogue.html." target="_blank" rel="nofollow ugc noopener">http://rblcommunications.com/rogue.html. The micro site is updated in near real-time and provides a comprehensive snapshot of all relevant information on Rogue. The micro site also allows investors to sign up to the Rogue email list as well as a dedicated Rogue RSS feed.

ABOUT RBL COMMUNICATIONS

With over 10 years of experience, RBL Communications (http://rblcommunications.com) is the leader in providing fully integrated Social Media solutions to Small Cap companies trading on every recognized stock exchange worldwide. RBL's fully managed programs are designed to communicate your message to the vast and ever-growing Social Media and Web 2.0 community.

Antwort auf Beitrag Nr.: 41.788.969 von SteirerMan am 14.07.11 15:21:53

ein erster produktiver schritt richtung update der historischen ressourcen!!

Jul 14, 2011

Rogue Resources Signs 10,000 Meter Drill Contract for Radio Hill Iron Ore Property

VANCOUVER, BC - Rogue Resources Inc. (TSX-V: RRS) (the "Company") announces it has signed a drill contract with Orbit Garant Drilling Inc. (TSX: OGD) for a minimum of 10,000 meters of drilling on the Company's flagship Radio Hill Iron Ore property, located 85km southwest of Timmins, Ontario. Drilling is expected to be completed in 2011 and will culminate with an updated resource estimate on the Radio Hill historical resource*. The contract allows for a second rig to be added as needed.

"The Company's arrangement with Orbit Garant will allow us to keep on track with our objectives through the fall of 2011 and an updated resource in 2012," stated Steve de Jong, Company CEO." Rogue is well financed for the upcoming program and we are working with consultants now to outline an aggressive exploration and resource definition campaign to bring the project to the next level. We expect to announce detailed plans for this program in the near future."

The Radio Hill historical resource* was developed in the 1960's by Kukatush Mining Corp. who spent an estimated $10 million on exploration and metallurgical work including one hundred and forty drill holes and a number of metallurgical studies. Following resource definition a feasibility study was completed by FENCO Ltd. after which a railway siding and grade from the CN mainline to the deposit were built, a distance of about 4 km.

The historical feasibility study indicated a 3.5 concentration ratio (3.5 tons of iron ore produced 1 ton of concentrate) which would produce a concentrate grade of between 66% and 68%. At the time recovery and pelletizing tests were also conducted which included laboratory and pilot testing of grinding, concentrating and pelletizing practices to a complete feasibility study of a Radio Hill pelletizing operation (Neal and Ridell, 1965).

The Radio Hill Project is located 85 km southwest of Timmins an area known for its excellent infrastructure and access to mining expertise. The properties excellent location is complimented by its easy access to rail, with the southern portion of the project being transected by the CN Railway mainline.

Freeman Smith, P.Geo. is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

ein erster produktiver schritt richtung update der historischen ressourcen!!

Jul 14, 2011

Rogue Resources Signs 10,000 Meter Drill Contract for Radio Hill Iron Ore Property

VANCOUVER, BC - Rogue Resources Inc. (TSX-V: RRS) (the "Company") announces it has signed a drill contract with Orbit Garant Drilling Inc. (TSX: OGD) for a minimum of 10,000 meters of drilling on the Company's flagship Radio Hill Iron Ore property, located 85km southwest of Timmins, Ontario. Drilling is expected to be completed in 2011 and will culminate with an updated resource estimate on the Radio Hill historical resource*. The contract allows for a second rig to be added as needed.

"The Company's arrangement with Orbit Garant will allow us to keep on track with our objectives through the fall of 2011 and an updated resource in 2012," stated Steve de Jong, Company CEO." Rogue is well financed for the upcoming program and we are working with consultants now to outline an aggressive exploration and resource definition campaign to bring the project to the next level. We expect to announce detailed plans for this program in the near future."

The Radio Hill historical resource* was developed in the 1960's by Kukatush Mining Corp. who spent an estimated $10 million on exploration and metallurgical work including one hundred and forty drill holes and a number of metallurgical studies. Following resource definition a feasibility study was completed by FENCO Ltd. after which a railway siding and grade from the CN mainline to the deposit were built, a distance of about 4 km.

The historical feasibility study indicated a 3.5 concentration ratio (3.5 tons of iron ore produced 1 ton of concentrate) which would produce a concentrate grade of between 66% and 68%. At the time recovery and pelletizing tests were also conducted which included laboratory and pilot testing of grinding, concentrating and pelletizing practices to a complete feasibility study of a Radio Hill pelletizing operation (Neal and Ridell, 1965).

The Radio Hill Project is located 85 km southwest of Timmins an area known for its excellent infrastructure and access to mining expertise. The properties excellent location is complimented by its easy access to rail, with the southern portion of the project being transected by the CN Railway mainline.

Freeman Smith, P.Geo. is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

Antwort auf Beitrag Nr.: 41.789.018 von SteirerMan am 14.07.11 15:30:18

Rogue Resources Announces Exploration Plans on Radio Hill Iron Ore Property

8/16/2011 8:30:07 AM - Market Wire

VANCOUVER, BRITISH COLUMBIA, Aug 16, 2011 (Marketwire via COMTEX News Network) --

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") announces it has initiated its exploration program on the Company's flagship Radio Hill Iron Ore property, located 85 km southwest of Timmins, Ontario. Drilling is expected to commence this month. The Company announced in July it has entered into a drilling contract with Orbit Garant Drilling Inc. (TSX:OGD). The first phase of work will begin with drilling on the southern portion of the project and is part of a larger 10,000 m program. The Radio Hill deposit(i) was developed in the 1960s by Kukatush Mining Corp. who spent an estimated $10 million on exploration and metallurgical work including 140 drill holes and a number of metallurgical studies. Following resource definition a feasibility study was initiated and was deemed encouraging enough that Kukatush built a railway siding and grade from the Canadian National (CN) mainline to the deposit, a distance of about 4 km.

The Company's exploration and management team conducted a site visit in July with its consulting group, SGS Geostat ("SGS"), who have been retained to compile a NI 43-101 compliant resource calculation for Radio Hill. Following a review of the historical work, an initial 3,100 m drill program will be conducted to confirm the historical geological model and to determine the subsequent steps in the exploration program. This first phase of drilling will comprise the twinning of some historical holes to test the accuracy and geometry of the historical model built in the 1960s. Recent work has focused on locating and geo-referencing historical drill holes.

While building a new resource estimate, the Company will try to use as much of the historical data as possible. In order to confirm the geometry of the old geological model the sedimentary unit that forms the footwall to the banded iron formation will be used as a geological reference. This footwall contact to the south of the deposit is well defined in the historic sections and easily identified in drill core and should provide a good test of the historic model. The proposed drilling program investigates this sedimentary contact over a 1,600 m strike length and should allow for some conclusions on the historical work, its accuracy, and how much duplication of the old work will be required in order to produce a NI 43-101 compliant resource estimate. If the review of the historical geological model satisfies the qualified persons for the project, the Company will proceed with digitizing the historical work for further modelling of the resources. This Phase I drilling could, if desired, also be used to conduct a preliminary resource estimation of the southern portion of the deposit.

Drilling will be conducted by Orbit Garant Drilling Inc. of Val-d'Or and core logging will be conducted in Rogue's exploration office (Falconbridge's former facility) in the city of Timmins.

Rogue Resources Announces Exploration Plans on Radio Hill Iron Ore Property

8/16/2011 8:30:07 AM - Market Wire

VANCOUVER, BRITISH COLUMBIA, Aug 16, 2011 (Marketwire via COMTEX News Network) --

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") announces it has initiated its exploration program on the Company's flagship Radio Hill Iron Ore property, located 85 km southwest of Timmins, Ontario. Drilling is expected to commence this month. The Company announced in July it has entered into a drilling contract with Orbit Garant Drilling Inc. (TSX:OGD). The first phase of work will begin with drilling on the southern portion of the project and is part of a larger 10,000 m program. The Radio Hill deposit(i) was developed in the 1960s by Kukatush Mining Corp. who spent an estimated $10 million on exploration and metallurgical work including 140 drill holes and a number of metallurgical studies. Following resource definition a feasibility study was initiated and was deemed encouraging enough that Kukatush built a railway siding and grade from the Canadian National (CN) mainline to the deposit, a distance of about 4 km.

The Company's exploration and management team conducted a site visit in July with its consulting group, SGS Geostat ("SGS"), who have been retained to compile a NI 43-101 compliant resource calculation for Radio Hill. Following a review of the historical work, an initial 3,100 m drill program will be conducted to confirm the historical geological model and to determine the subsequent steps in the exploration program. This first phase of drilling will comprise the twinning of some historical holes to test the accuracy and geometry of the historical model built in the 1960s. Recent work has focused on locating and geo-referencing historical drill holes.

While building a new resource estimate, the Company will try to use as much of the historical data as possible. In order to confirm the geometry of the old geological model the sedimentary unit that forms the footwall to the banded iron formation will be used as a geological reference. This footwall contact to the south of the deposit is well defined in the historic sections and easily identified in drill core and should provide a good test of the historic model. The proposed drilling program investigates this sedimentary contact over a 1,600 m strike length and should allow for some conclusions on the historical work, its accuracy, and how much duplication of the old work will be required in order to produce a NI 43-101 compliant resource estimate. If the review of the historical geological model satisfies the qualified persons for the project, the Company will proceed with digitizing the historical work for further modelling of the resources. This Phase I drilling could, if desired, also be used to conduct a preliminary resource estimation of the southern portion of the deposit.

Drilling will be conducted by Orbit Garant Drilling Inc. of Val-d'Or and core logging will be conducted in Rogue's exploration office (Falconbridge's former facility) in the city of Timmins.

Antwort auf Beitrag Nr.: 41.657.709 von SteirerMan am 16.06.11 18:26:06lesenzeichen

Danke für die Infos... bin mich gerade am einlesen... duch OdeBero auf RRS gestoss Thx!!!

Thx!!!

Danke für die Infos... bin mich gerade am einlesen... duch OdeBero auf RRS gestoss

Thx!!!

Thx!!!

...dürfte mal zumindest ein interessanter Herbst und Winter werden.

IMO befindet sich unser Tief-Tief gerade in unserer unmittelbaren Umgebung (wir verfügen über ausreichend cash, überverkauft, andere indikatoren drehen gerade ein wenig, seit längerem die ersten grünen Kerzen).

Schauen wir mal

Rogue Resources Intersects 1.2% Nickel Over 29 Meters at Langmuir

9/21/2011 8:46:24 AM - Market Wire

- OTHER HIGHLIGHTS FROM METALLURGICAL DRILLING (HQ) INCLUDE 1.68% NICKEL OVER 17.3 METERS - HIGHLIGHTS FROM EXPLORATION DRILLING (NQ) INCLUDE 1.54% NICKEL OVER 9.4 METERS - LATEST DRILLING TO BE INCORPERATED INTO RESOURCE MODEL USED FOR SCOPING STUDY

VANCOUVER, BRITISH COLUMBIA, Sep 21, 2011 (MARKETWIRE via COMTEX News Network) --

Rogue Resources Inc. (TSX VENTURE: RRS) (the "Company") is pleased to announce assay results from diamond drilling conducted on its W4 Langmuir Nickel Deposit earlier this year. The Langmuir property is located 35 km south of the city of Timmins, Ontario. The company drilled 13 diamond drill holes totaling 2,282 meters. Six HQ sized holes were drilled for the purposes of metallurgical testing on the A zone and seven NQ sized holes were drilled to test for extensions on the east side of the W4 deposit. Drilling intersected significant mineralization in both the metallurgical and exploration drill holes (see complete results tabulated below).

The seven exploration holes tested the eastern portion of the W4 Deposit, the eastern strike extension of the W4 deposit and the western portion of the W3 area. Four of the seven exploration holes intersected the eastern margin of the W4 nickel deposit with hole RL11-09 returning 1.54% Ni over 9.4 m near surface. Hole RL11-11 was drilled 50 m east of the W4 deposit and encountered anomalous nickel mineralization in the host ultramafic flow within the A Zone; Hole RL11-12 150 m east of the W4 deposit encountered a diabase dyke and only minor ultramafics; and Hole RL11-13 intersected the target ultramafic volcanic flows, however, no significant nickel sulphides were observed.

Hier giebts die Tabelle:

http://tmx.quotemedia.com/article.php?newsid=44678040&qm_sym…

For the resource statement reported on April 2010, a total of sixty-nine core drillholes for 22,152 meters were used. Seven (NQ) of the holes reported today were drilled to test mineralization extensions to the east, and the remaining six (HQ) drilled to primarily provide material for metallurgical testing in support of a scoping level study. The additional drilling is being used to update the resource model, which is currently being applied in scoping level studies by SRK Consulting (Canada) Inc. The new drilling has allowed a more confident definition of nickel mineralization for the mining studies and has provided material for low, medium and high grade composite metallurgical samples which have allowed a better understanding of the metallurgical properties of the nickel mineralization.

"The discovery of additional near-surface mineralization has the potential to enhance the overall viability of mining at Langmuir," stated Company CEO, Steve de Jong. "Langmuir will continue to play an important role in the Company's strategy and as we work towards a scoping study we will continue to assess various options to help realize the full value of the project. We are also pleased to announce drilling is progressing well on our Radio Hill Iron Ore Project and expect to see results through the fall and into 2012."

The Company also announces that the Board of Directors of the Company has elected to adopt a shareholder rights plan that will be presented for ratification by the shareholders of the Company at the Company's annual general meeting to be held on October 17, 2011. The Rights Plan is subject to the approval of the TSX Venture Exchange.

The shareholder rights plan has been adopted to ensure the fair treatment of all shareholders with respect to any takeover bid for the common shares of the Company. It is designed to provide shareholders with an opportunity to properly consider a takeover bid without undue time constraints. In addition, it will provide the board with additional time for review and consideration of an unsolicited takeover bid and, if necessary, for the consideration of alternatives. Additional details regarding the shareholder rights plan will be provided in the Information Circular that will be available for viewing on SEDAR and mailed to the shareholders of the Company prior to the annual general meeting.

The Company has no knowledge of any pending or threatened takeover bids for the Company, and has no reason to believe that any takeover offer for the Company's shares is imminent. This rights plan is not being adopted in response to any proposal to acquire control of the Company.

Antwort auf Beitrag Nr.: 41.960.706 von SteirerMan am 16.08.11 20:42:50

Rogue Resources Announces Preliminary Results From Drilling at Radio Hill Iron Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 13, 2011) -

SIX HOLES COMPLETED IN SOUTHERN PORTION OF HISTORIC RESOURCE MODEL, UP TO 293 METERS OF IRON FORMATION INTERSECTED

1,840 METERS OF CORE SENT FOR IRON GRADE DEFINITION ANALYSIS TO SGS LABORATORY IN LAKEFIELD, ONTARIO

INTERVIEW WITH CEO DISCUSSING INITIAL RESULTS INCLUDED IN PRESS RELEASE

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce a diamond drilling update at its 100% owned Radio Hill Iron Ore project, located 80 km southwest of Timmins, Ontario. Contracted drilling company Orbit Garant ("Orbit") has completed 6 diamond drill holes as of September 26, 2011 for a total of 1,200 meters (see Figure 1. below). The first phase of the recently announced 10,000 meter drilling campaign is 15 holes for a total of 3,140 meters. To date, a total of 372 samples, representing 1,840 meters of core, have been sent to SGS Laboratory in Lakefield. This includes sampling of two 2008 drill holes and one 2010 drill hole that were not sampled for iron ore.

FIGURE 1.

Hole Name Total Depth Iron Formation Thickness* Number of Samples

RH-11-01 110m 87m 20

RH-11-02 120m 94m 24

RH-11-03 270m 155m 47

RH-11-05 312m 293m 62

RH-11-16 187m 114m 24

RH-11-17 201m 114m 31

* Iron Formation Thickness represents measured lengths along the core from lithological logging

To listen to an audio interview with the CEO in accordance with this release please click on the following link:

http://bit.ly/ok7ize

To view a PDF of the project with the current drill holes outlined please click on the link below:

http://bit.ly/pNZBMV

The objective of the ongoing drilling campaign is to assess the historical geological model by twinning existing holes and investigating footwall contact with the sediments. Field drill supervision and core logging is executed by SGS Canada Inc. (Geostat Office), which is also contracted to complete a 43-101 compliant resource estimation at Radio Hill.

Sampling is being completed on core length from 3 meters to 6 meters and assaying includes whole rock XRF analysis, Satmagan testing and Davis Tube Recovery testing with concentrate assaying. This assay data set will allow for a more accurate, updated resource estimate, together with a general picture of the geochemistry of the Iron Ore from the Radio Hill Deposit.

RADIO HILL

The Radio Hill deposit* was developed in the 1960s by Kukatush Mining Corp. who spent an estimated $10 million in 2011 dollars on exploration and metallurgical work including 140 drill holes and a number of metallurgical studies. Following resource definition, a feasibility study was initiated on the upper portion of the deposit and was deemed encouraging enough that Kukatush build a railway siding and grade from the Canadian National (CN) mainline to the deposit, a distance of about 4 km. The historical feasibility study determined by FENCO Ltd. indicated a 3.5 concentration ratio (3.5 tons of iron ore produced 1 ton of concentrate) which would produce a concentrate grade of between 66% and 68.5%. At that time recovery and pelletizing tests were also conducted which included both laboratory and pilot testing of grinding, concentrating and pelletizing practices (Neal and Ridell, 1965). This historic metallurgical test work indicated the potential for a commercially acceptable iron concentrate to be produced from Radio Hill mineralized material using magnetic separation followed by flotation.

Kevin Montgomery, P.Geo., is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

Rogue Resources Announces Preliminary Results From Drilling at Radio Hill Iron Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 13, 2011) -

SIX HOLES COMPLETED IN SOUTHERN PORTION OF HISTORIC RESOURCE MODEL, UP TO 293 METERS OF IRON FORMATION INTERSECTED

1,840 METERS OF CORE SENT FOR IRON GRADE DEFINITION ANALYSIS TO SGS LABORATORY IN LAKEFIELD, ONTARIO

INTERVIEW WITH CEO DISCUSSING INITIAL RESULTS INCLUDED IN PRESS RELEASE

Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce a diamond drilling update at its 100% owned Radio Hill Iron Ore project, located 80 km southwest of Timmins, Ontario. Contracted drilling company Orbit Garant ("Orbit") has completed 6 diamond drill holes as of September 26, 2011 for a total of 1,200 meters (see Figure 1. below). The first phase of the recently announced 10,000 meter drilling campaign is 15 holes for a total of 3,140 meters. To date, a total of 372 samples, representing 1,840 meters of core, have been sent to SGS Laboratory in Lakefield. This includes sampling of two 2008 drill holes and one 2010 drill hole that were not sampled for iron ore.

FIGURE 1.

Hole Name Total Depth Iron Formation Thickness* Number of Samples

RH-11-01 110m 87m 20

RH-11-02 120m 94m 24

RH-11-03 270m 155m 47

RH-11-05 312m 293m 62

RH-11-16 187m 114m 24

RH-11-17 201m 114m 31

* Iron Formation Thickness represents measured lengths along the core from lithological logging

To listen to an audio interview with the CEO in accordance with this release please click on the following link:

http://bit.ly/ok7ize

To view a PDF of the project with the current drill holes outlined please click on the link below:

http://bit.ly/pNZBMV

The objective of the ongoing drilling campaign is to assess the historical geological model by twinning existing holes and investigating footwall contact with the sediments. Field drill supervision and core logging is executed by SGS Canada Inc. (Geostat Office), which is also contracted to complete a 43-101 compliant resource estimation at Radio Hill.

Sampling is being completed on core length from 3 meters to 6 meters and assaying includes whole rock XRF analysis, Satmagan testing and Davis Tube Recovery testing with concentrate assaying. This assay data set will allow for a more accurate, updated resource estimate, together with a general picture of the geochemistry of the Iron Ore from the Radio Hill Deposit.

RADIO HILL

The Radio Hill deposit* was developed in the 1960s by Kukatush Mining Corp. who spent an estimated $10 million in 2011 dollars on exploration and metallurgical work including 140 drill holes and a number of metallurgical studies. Following resource definition, a feasibility study was initiated on the upper portion of the deposit and was deemed encouraging enough that Kukatush build a railway siding and grade from the Canadian National (CN) mainline to the deposit, a distance of about 4 km. The historical feasibility study determined by FENCO Ltd. indicated a 3.5 concentration ratio (3.5 tons of iron ore produced 1 ton of concentrate) which would produce a concentrate grade of between 66% and 68.5%. At that time recovery and pelletizing tests were also conducted which included both laboratory and pilot testing of grinding, concentrating and pelletizing practices (Neal and Ridell, 1965). This historic metallurgical test work indicated the potential for a commercially acceptable iron concentrate to be produced from Radio Hill mineralized material using magnetic separation followed by flotation.

Kevin Montgomery, P.Geo., is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

...derweilen, nutzen der CEO sowie ein Director die runtergebrügelten Kurse, um sich ein paar am freien Markt zu besorgen

Oct 27/11 Oct 27/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.155

Oct 26/11 Oct 26/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.135

Oct 26/11 Oct 25/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.145

Oct 24/11 Oct 24/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.160

Oct 05/11 Oct 05/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 6,000 $0.210

Oct 05/11 Oct 05/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 9,000 $0.200

Sep 27/11 Sep 27/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $0.230

Sep 26/11 Sep 26/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.220

Oct 27/11 Oct 27/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.155

Oct 26/11 Oct 26/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.135

Oct 26/11 Oct 25/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.145

Oct 24/11 Oct 24/11 Durant, Frank Norman Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.160

Oct 05/11 Oct 05/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 6,000 $0.210

Oct 05/11 Oct 05/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 9,000 $0.200

Sep 27/11 Sep 27/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $0.230

Sep 26/11 Sep 26/11 De Jong, Stephen Edward Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.220

Rogue Resources Appoints Freeman Smith Executive VP &Director, Smith has worked with a number of exploration +production companies, including BHP +Teck ; Completes PhaseI, @Radio Hill; Steve de Jong: "As Executive VP, Mr. Smith's initial focus will be to spearhead the ongoing recruitment +development of our technical team as we look to capitalize on our competitive advantage. Rogue's advantage will be found in its ability to decrease overall time to market by utilizing existing infrastructure +access to a nearby mining-savvy workforce. Strong iron ore prices +this exceptional infrastructure, combined with detailed knowledge of the deposit through the extensive historical work have removed a lot of the unknowns typical of an exploration project " - Nov 22, 2011

HL:

+ PhaseI: 3,100meters of Drilling Completed, Preliminary results from PhaseI have been encouraging +the historical work appears to be consistent with new data

+ PhaseII: Drilling Commenced; Will Conclude with 43-101 Resource Estimate

+ Initial Assays Received +Being Compiled with Davis Tube Results

+ Management Building Technical Team to Move Radio Hill Toward the Next Stage of Exploration +Development ...

www.marketwire.com/press-release/rogue-resources-appoints-fr…

HL:

+ PhaseI: 3,100meters of Drilling Completed, Preliminary results from PhaseI have been encouraging +the historical work appears to be consistent with new data

+ PhaseII: Drilling Commenced; Will Conclude with 43-101 Resource Estimate

+ Initial Assays Received +Being Compiled with Davis Tube Results

+ Management Building Technical Team to Move Radio Hill Toward the Next Stage of Exploration +Development ...

www.marketwire.com/press-release/rogue-resources-appoints-fr…

News:

Rogue Resources Intersects 141 Meters of 41% Iron at Radio Hill Iron Project in Timmins, Ontario

http://www.theglobeandmail.com/globe-investor/news-sources/?…

Rogue Resources Intersects 141 Meters of 41% Iron at Radio Hill Iron Project in Timmins, Ontario

http://www.theglobeandmail.com/globe-investor/news-sources/?…

Rogue Resources Intersects 141 Meters of 41% Iron, @Radio Hill Iron Project in Timmins, Ontario - Nov 30, 2011

+ 141 Meter Intersection Includes 62 Meters of 49% Iron @Davis Tube Weight Recovery(DTWR) of 39%

+ Thicker Sections of Iron Formation to Be Targeted in PhaseII Drilling, Commenced This Week

+ Historical Concentration Tests Indicate the Potential Ability to Produce a High-Grade Concentrate of 68.3%(Neal +Ridell 1965, pg 53a) Iron With Minimal Contaminants

+ Drilling Focused on 5km Radio Hill Iron Formation, Property Also Contains 12km Long Nat River Iron Formation

+ 1st Drill Program Since ´65: Total Iron Content Noticeably Higher Than Historically Reported Acid-Soluble Iron Content ...

www.marketwire.com/press-release/rogue-resources-intersects-…

www.roguemining.com/i/pdf/11-11%2D30-RRS-Drill-Table-for-Web…

www.brmstatpack.com/lt/1001/1217/radio-hill-geology-and-geop…

"VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 30, 2011) - Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce the first results from Phase 1 drilling on its Radio Hill Iron ore project ("Radio Hill") near Timmins, Ontario. The Radio Hill property is transected by a heavy gauge portion of the CN Rail mainline with an active rail siding. There is power and water in the immediate vicinity and highway 101 to Timmins is located only 8 km to the north of present drilling. In addition to the 5 km strike length of the Radio Hill formation the property contains a 12 km long magnetic feature known as the Nat River iron formation which is easily identified in both Company geophysical and government geological maps. The Nat River iron formation has not been explored aside from 6 drill holes in a concentrated area in 1960.

"These iron results are the first for the project in almost 50 years and we are excited by what we are seeing. There are very few iron projects with this type of infrastructure and access to mining expertise

There are very few iron projects with this type of infrastructure and access to mining expertise  and now that we are seeing better than expected results we plan on doing everything we can to ensure we capitalize on our numerous competitive advantages

and now that we are seeing better than expected results we plan on doing everything we can to ensure we capitalize on our numerous competitive advantages

," comments Company President and CEO, Steve de Jong. "We look forward to seeing results from the second phase of drilling which will focus on the thicker portion of the Radio Hill formation as phase one focused primarily on confirming the geological structure in the southern portion outlined in historic work."

," comments Company President and CEO, Steve de Jong. "We look forward to seeing results from the second phase of drilling which will focus on the thicker portion of the Radio Hill formation as phase one focused primarily on confirming the geological structure in the southern portion outlined in historic work."

To view geological and geophysical maps of the Radio Hill Project including the Nat River Iron Formation please click on the following link:

www.brmstatpack.com/lt/1001/1217/radio-hill-geology-and-geophysics

The recently completed first phase of drilling (3,140 metres) was comprised primarily of shallow drilling on the southern limit of the formation and Phase Two will target thicker sections. The first phase was conducted to confirm the historical assays and geological model. Assays for three holes have been received so far and as the Company has consistently submitted drill samples on a weekly basis since September a steady flow of results is expected into the spring. In addition to samples from Phase 1 drilling the Company has submitted core samples for two holes drilled in 2008 (RH 08-01, 02) and one in 2010 (RH 10-01). These holes were drilled for assessment purposes and to test for gold potential within the iron formation and were never analyzed for iron.

Table 1: First Assay results from Radio Hill

Hole - Core interval(m)** - From(m) - To(m) - Total Fe(%) - DTWR(%)***

RH-08-01* 141m 72 213 40.6 27.1

including 62m 145 207 49.0 39.0

RH-11-14 23m 31 54 41.6 35.2

including 16m 34 50 47.4 43.0

and 75m 64 139 46.0 33.0

including 52m 66 117 47.7 40.3

RH-11-15 34m 18 52 42.2 24.0

including 20m 18 38 46.5 33.4

And 62m 95 157 41.2 25.8

including 21m 132 153 41.5 33.4

* Hole RH-08-01 was drilled in 2008 for assessment purposes on non-iron targets and was not analyzed for iron content until Sept, 2011.

** Core intervals lengths are between 70 and 90% of true width

*** DTWR: Davis Tube Weight Recovery

A complete drill table for the above results is available on the Company website by clicking on the following link:

www.roguemining.com/i/pdf/11-11%2D30-RRS-Drill-Table-for-Website.pdf

The Company has now begun drilling the main portion of the formation in order to complete and publish a NI 43-101 compliant resource estimate likely in the inferred category after which point the Company will determine if a PEA is warranted.

HISTORICAL WORK AT RADIO HILL

The values, estimates, and quotes referenced below and in the section HISTORICAL WORK AT RADIO HILL are used by the Company to provide a target range and help guide exploration and are stated here for information purposes to inform the reader why the Company is interested in the area and should not be relied upon. Accordingly these rough estimates should not be relied upon for making investment decisions. Significant work needs to be completed by the Company prior to any publication of known resources or concentration characteristics of mineralized material at Radio Hill.

The Radio Hill project was first developed in the late 1950s and early 1960s by Kukatush Mining Corp. who spent an estimated $10 million in 2011 dollars on exploration and metallurgical work, including 140 drill holes and a number of metallurgical studies. Following resource definition, a study to determine the feasibility of a mine being put into production was conducted. The historical feasibility study conducted by FENCO Ltd. indicated a 3.5 concentration ratio (3.5 tons of iron ore produced 1 ton of concentrate) which would produce a high-grade concentrate of between 66% and 68.5%. At that time recovery and pelletizing tests were also conducted which included both laboratory and pilot testing of grinding, concentrating and pelletizing practices (Neal and Ridell, 1965). Historical metallurgical work (shown below) indicated material from Radio Hill could be concentrated to a high-grade, high quality concentrate with minimal residual deleterious elements. As background information for the reader, iron's benchmark price is commonly set using a 62% Fe concentrate with recent premiums for higher grade concentrations as high as $5.00 for every 1% higher than 62%, and even higher increases above the 65% level. Although the rail bed was laid the 3.5km from the railway to Radio Hill, the project never advanced through to production due to weak iron prices.

To help guide exploration strategies at Radio Hill formation the Company has used the historic resource of 427 million tons of 27.3% iron (Gerson 1961) as a target. It is important to note the 27.3% iron refers to acid-soluble iron content whereas resources reported today are often reported using total iron content in addition to other analyses. Total iron content in drilling so far appears to be noticeably higher than the acid-soluble content reported in drilling in the 1960s. A number of drill holes reported today had significant drill intersections between 40 and 50% total iron with Davis Tube weight recoveries as high as 43%.

Highlights from historical reports at Radio Hill:

+ Radio Hill Formation (Group): "The potential of this group is estimated at one billion tons. " (Gerson 1961, pg2 - reference to a 7,000 foot portion of the 3 mile (4.8 km) Radio Hill Iron Formation after the completion of 52,592 feet of diamond drilling, mapping, geophysical work and a 3,000 ton bulk sample.

" (Gerson 1961, pg2 - reference to a 7,000 foot portion of the 3 mile (4.8 km) Radio Hill Iron Formation after the completion of 52,592 feet of diamond drilling, mapping, geophysical work and a 3,000 ton bulk sample.

+ Nat River Formation (Group): "The potential of the magnetite bands as indicated by the ground magnometer survey is estimated at 30,000,000 gross tons of crude ore for every 100 feet of depth." (Gerson 1961, pg3, pg57 - reference to 2500 foot section of the 7.4 mile (12 km) Nat River Iron Formation after the completion of 4,053 feet of diamond drilling. Iron values as high as 39.8% Fe (acid-soluble) were intersected at Nat River although it was unclear from historic reports the widths over which these values occurred.

Given the Radio Hill formation is known to extend below 1200 feet in depth, the tonnage potential for Nat River remains a potential addition to the overall project and could possibly augment future resources at Radio Hill. The entire property had an airborne VTEM and Mag survey completed in 2008 including the Nat River in which both formations are clearly defined. Aside from the airborne survey the Nat River iron formation has not seen any modern day iron exploration.

Table 2: Historical Concentration Characteristics

Magnetic E&F Concentrate (%)

Soluble Iron 68.3

Total Iron 68.38

True Silica 4.09

Total Phosphorous 0.018

Manganese 0.06

Alumina 0.22

Sulfur 0.064

Copper Nil

Nickel Nil

Vanadium Nil

Titanium Less than 0.01

Arsenic Less than 0.01

Lead Less than 0.01

Zinc Less than 0.01

Source Data: FENCO Ltd. Feasibility Study by Neal and Ridell, 1965 (pg 53a)

The percentages in chart above are based on historical concentration tests and have been included to provide a scope of the type of concentration characteristics that might be expected at Radio Hill and also to show the depth of the work done in the 1960s. These concentration tests were reported prior to the implementation of NI 43-101 and therefore should not be relied upon. The Company will be conducting concentration and metallurgical test work as exploration progresses at Radio Hill and will update all concentration tests to current N1 43-101 standards.

Micon International Ltd stated in its 2010 Technical Report on the Radio Hill Iron Property, "The historical metallurgical testwork completed on the Radio Hill property was well done, but additional work, including pilot plant testing and representative blended samples, must be undertaken before the economics of potential production can be assessed."

QUALITY CONTROL AND ASSURANCE

All drill core samples have been split and shipped by the Company to SGS Lakefield, where the samples are prepared and analyzed by fusion with lithium tetraborate-XRF for SiO2, Al2O3, CaO, Fe2O3, K2O, MgO, TiO2, P, Mn and Cr2O3 and retained moisture (LOI) by multi-temperature. Satmagan readings are done on each sample. A magnetite concentrate is produced using Davis Tube concentrator (DT) giving a weight recovery percentage (DTWR). The concentrate is then analysed by fusion with lithium tetraborate-XRF for SiO2, Al2O3, CaO, Fe2O3, K2O, MgO, TiO2, P, Mn and Cr2O3 and retained moisture (LOI) by multi-temperature. The company inserts systematic duplicates, blanks and standard samples every 30 samples to verify and assure acceptable consistency of analysis. SGS labs is an internationally recognized leader in iron ore analysis.

Kevin Montgomery P.Geo. is the qualified person for the purposes of National Instrument 43-101 and has reviewed the technical contents of this press release.

INVESTOR RELATIONS

The Company also announces it has entered into a contract with Proconsul Capital Ltd. ("Proconsul"), a communications firm specializing in investor relations, marketing solutions and capital services for publicly-traded companies.

The terms of the contract are that the Company will pay Proconsul a fee of $5,000 plus HST per month, on a month-by-month basis, which contract is terminable with 30 days' notice. The Company also intends to issue 100,000 vested stock options to Proconsul at a price of $0.20 for a period of seven years, all subject to regulatory approval.

TRIAL PRESS RELEASE Q&A VIA EMAIL AND TWITTER

The Company is also pleased to announce it will be responding to questions regarding today's news sent via Twitter and Email between 10am and 2pm EST today. Please submit Question via email to rrs@rblcommunications.com, with subject line "RRS Question". Email questions will be answered via an upcoming audio interview.

To ask a question on Twitter please insert: @rogueresources and #RRSQA within your tweet. Twitter questions will be addressed in near-real time on the Company's official Twitter feed: www.twitter.com/rogueresources.

ABOUT ROGUE RESOURCES

Rogue Resources is an iron exploration and development company with offices in Vancouver BC, and Timmins, ON. The Company has 36.9 million shares outstanding and approximately $2.5M in cash. The Company's primary asset is its Radio Hill Iron Project located 85km southwest of Timmins, Ontario.

Key Company milestones expected in the near term are:

+ Ongoing results from drilling at Radio Hill Iron Project

+ Completion of Radio Hill resource estimate

+ Announcement of JVs or other partnerships on non-core assets

+ Appointment of key personnel to technical and management teams

ON BEHALF OF THE BOARD OF DIRECTORS

Steve de Jong, President & CEO "

+ 141 Meter Intersection Includes 62 Meters of 49% Iron @Davis Tube Weight Recovery(DTWR) of 39%

+ Thicker Sections of Iron Formation to Be Targeted in PhaseII Drilling, Commenced This Week

+ Historical Concentration Tests Indicate the Potential Ability to Produce a High-Grade Concentrate of 68.3%(Neal +Ridell 1965, pg 53a) Iron With Minimal Contaminants

+ Drilling Focused on 5km Radio Hill Iron Formation, Property Also Contains 12km Long Nat River Iron Formation

+ 1st Drill Program Since ´65: Total Iron Content Noticeably Higher Than Historically Reported Acid-Soluble Iron Content ...

www.marketwire.com/press-release/rogue-resources-intersects-…

www.roguemining.com/i/pdf/11-11%2D30-RRS-Drill-Table-for-Web…

www.brmstatpack.com/lt/1001/1217/radio-hill-geology-and-geop…

"VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 30, 2011) - Rogue Resources Inc. (TSX VENTURE:RRS) (the "Company") is pleased to announce the first results from Phase 1 drilling on its Radio Hill Iron ore project ("Radio Hill") near Timmins, Ontario. The Radio Hill property is transected by a heavy gauge portion of the CN Rail mainline with an active rail siding. There is power and water in the immediate vicinity and highway 101 to Timmins is located only 8 km to the north of present drilling. In addition to the 5 km strike length of the Radio Hill formation the property contains a 12 km long magnetic feature known as the Nat River iron formation which is easily identified in both Company geophysical and government geological maps. The Nat River iron formation has not been explored aside from 6 drill holes in a concentrated area in 1960.

"These iron results are the first for the project in almost 50 years and we are excited by what we are seeing.

There are very few iron projects with this type of infrastructure and access to mining expertise

There are very few iron projects with this type of infrastructure and access to mining expertise  and now that we are seeing better than expected results we plan on doing everything we can to ensure we capitalize on our numerous competitive advantages

and now that we are seeing better than expected results we plan on doing everything we can to ensure we capitalize on our numerous competitive advantages

," comments Company President and CEO, Steve de Jong. "We look forward to seeing results from the second phase of drilling which will focus on the thicker portion of the Radio Hill formation as phase one focused primarily on confirming the geological structure in the southern portion outlined in historic work."

," comments Company President and CEO, Steve de Jong. "We look forward to seeing results from the second phase of drilling which will focus on the thicker portion of the Radio Hill formation as phase one focused primarily on confirming the geological structure in the southern portion outlined in historic work."To view geological and geophysical maps of the Radio Hill Project including the Nat River Iron Formation please click on the following link:

www.brmstatpack.com/lt/1001/1217/radio-hill-geology-and-geophysics

The recently completed first phase of drilling (3,140 metres) was comprised primarily of shallow drilling on the southern limit of the formation and Phase Two will target thicker sections. The first phase was conducted to confirm the historical assays and geological model. Assays for three holes have been received so far and as the Company has consistently submitted drill samples on a weekly basis since September a steady flow of results is expected into the spring. In addition to samples from Phase 1 drilling the Company has submitted core samples for two holes drilled in 2008 (RH 08-01, 02) and one in 2010 (RH 10-01). These holes were drilled for assessment purposes and to test for gold potential within the iron formation and were never analyzed for iron.

Table 1: First Assay results from Radio Hill

Hole - Core interval(m)** - From(m) - To(m) - Total Fe(%) - DTWR(%)***

RH-08-01* 141m 72 213 40.6 27.1

including 62m 145 207 49.0 39.0

RH-11-14 23m 31 54 41.6 35.2