Africa Oil Corp. - World-Class East Africa Oil Exploration

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 13.04.24 22:53:21 von

neuester Beitrag 13.04.24 22:53:21 von

Beiträge: 4.116

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 1

Gesamt: 628.200

Gesamt: 628.200

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AOI

1,6700

EUR

-0,12 %

-0,0020 EUR

Letzter Kurs 17.04.24 Tradegate

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 02.04.24 | ||

| 27.03.24 |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,4900 | +22,79 | |

| 38.600,00 | +9,66 | |

| 6,8000 | +8,97 | |

| 5,9700 | +8,74 | |

| 8,3000 | +8,50 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.050,01 | -14,28 | |

| 12,740 | -17,22 | |

| 1,3900 | -17,51 | |

| 3,7900 | -19,19 | |

| 1,1101 | -32,72 |

Beitrag zu dieser Diskussion schreiben

KRIEG IM NAHEN OSTEN; WAS DENKT IHR? WIRD DIE AKTIE MASSIV ZULEGEN? WIR WERDET IHR REAGIEREN?

Total scheint von Venus begeistert zu sein, Hat sich aber noch nicht bis zu den AOI Aktionären durchgesprochen oder die haben nur einen kurzfristigen Horizont.

Top TotalEnergies executive eyes 2024 project launch for 'impressive' Venus discovery

"TotalEnergies is set to launch its huge Venus development offshore Namibia later this year, according to a top executive at the supermajor, who cites the discovery's "impressive" reservoir characteristics. The French giant two years ago discovered Venus in the Orange basin and has moved fast to appraise this major ultra-deepwater field in an effort to fast-track its development via at least one floating production, storage and offloading vessel.

Kevin McLachlan, TotalEnergies' head of exploration, at last week’s BEOS event — organised by AAPG and GESGB — revealed intriguing details about Venus to a rapt audience, focusing on the “impressive” sub-surface findings to date from the discovery well and two completed drill stem tests, with another two DSTs under way. “We’re really pleased with what we have here. We’re still integrating results to confirm a development, but we think we will be there with the discoveries (Venus and Mangetti) we’ve made. We expect to see a first project confirmed later this year.”

In what was something of an understatement for an auditorium full of geologists, geophysicists and sedimentologists, McLachlan said: “I know all of you are keen to hear more about Venus,” before going on to highlight the scale of just one reservoir system uncovered by both TotalEnergies in Block 2913B and Shell in neighbouring Block 2913A. “It's very impressive. We're talking about a 150-kilometre system,” he said, stressing that the Albian reservoir is comprised of turbidites sitting directly on the source rock, so perfectly placed for being charged with hydrocarbons.

“We’ve interpreted a series of constrained flow systems that are very far-reaching and then spread out into very large, widespread channel lobes.” McLachlan said what is particularly “impressive” about Venus is the reservoir connectivity. “The vertical connectivity is very, very good. It's perfectly connected,” he explained, highlighting there is also “a good pressure connection between the appraisal well and the discovery well". TotalEnergies’ head of exploration said that the gas-oil-ratio is “high" and porosities are “good” and although permeabilities are “low”, the oil’s viscosity is “very good” which helps counteract this constraint. It is understood that while low permeability would be an issue with many oil reservoirs, the upside for Venus is that its crude has "super-low viscosity".

McLachlan said Venus’ oil in place reserves are “impressive” while stressing that it is “of course, about the recoverable resource”, which is what the supermajor is working on now. He did not reveal the size of Venus, although Namibia's authorities have previously stated the discovery holds 5 billion barrels of oil in place, of which 2 billion barrels are recoverable. As for Mangetti, Upstream was told recently that it could house 1.5 billion barrels of in-place reserves, with potential recoverable reserves of perhaps 600 million barrels."

https://www.upstreamonline.com/exploration/top-totalenergies…

Top TotalEnergies executive eyes 2024 project launch for 'impressive' Venus discovery

"TotalEnergies is set to launch its huge Venus development offshore Namibia later this year, according to a top executive at the supermajor, who cites the discovery's "impressive" reservoir characteristics. The French giant two years ago discovered Venus in the Orange basin and has moved fast to appraise this major ultra-deepwater field in an effort to fast-track its development via at least one floating production, storage and offloading vessel.

Kevin McLachlan, TotalEnergies' head of exploration, at last week’s BEOS event — organised by AAPG and GESGB — revealed intriguing details about Venus to a rapt audience, focusing on the “impressive” sub-surface findings to date from the discovery well and two completed drill stem tests, with another two DSTs under way. “We’re really pleased with what we have here. We’re still integrating results to confirm a development, but we think we will be there with the discoveries (Venus and Mangetti) we’ve made. We expect to see a first project confirmed later this year.”

In what was something of an understatement for an auditorium full of geologists, geophysicists and sedimentologists, McLachlan said: “I know all of you are keen to hear more about Venus,” before going on to highlight the scale of just one reservoir system uncovered by both TotalEnergies in Block 2913B and Shell in neighbouring Block 2913A. “It's very impressive. We're talking about a 150-kilometre system,” he said, stressing that the Albian reservoir is comprised of turbidites sitting directly on the source rock, so perfectly placed for being charged with hydrocarbons.

“We’ve interpreted a series of constrained flow systems that are very far-reaching and then spread out into very large, widespread channel lobes.” McLachlan said what is particularly “impressive” about Venus is the reservoir connectivity. “The vertical connectivity is very, very good. It's perfectly connected,” he explained, highlighting there is also “a good pressure connection between the appraisal well and the discovery well". TotalEnergies’ head of exploration said that the gas-oil-ratio is “high" and porosities are “good” and although permeabilities are “low”, the oil’s viscosity is “very good” which helps counteract this constraint. It is understood that while low permeability would be an issue with many oil reservoirs, the upside for Venus is that its crude has "super-low viscosity".

McLachlan said Venus’ oil in place reserves are “impressive” while stressing that it is “of course, about the recoverable resource”, which is what the supermajor is working on now. He did not reveal the size of Venus, although Namibia's authorities have previously stated the discovery holds 5 billion barrels of oil in place, of which 2 billion barrels are recoverable. As for Mangetti, Upstream was told recently that it could house 1.5 billion barrels of in-place reserves, with potential recoverable reserves of perhaps 600 million barrels."

https://www.upstreamonline.com/exploration/top-totalenergies…

Antwort auf Beitrag Nr.: 75.528.801 von texas2 am 27.03.24 20:48:51

Antwort auf Beitrag Nr.: 75.528.285 von oboneo am 27.03.24 19:45:37TotalEnergies starts new flow tests on mighty Venus discovery in Namibia

"TotalEnergies is running simultaneous flow tests in a pair of wells on its huge Venus oil discovery offshore Namibia, according to head of exploration Kevin McLachlan. The supermajor currently has two rigs involved in appraising Venus — the drillship Tungsten Explorer, which it partly owns, and the semi-submersible drilling rig Deepsea Mira — in the prolific Orange basin.

MacLachlan told delegates at the BEOS event — organised by GESGB and AAPG — on Tuesday that “two DSTs are ongoing”, but did not go into detail. However, Upstream understands that the flow tests are being carried out on the Venus-2A appraisal well by Deepsea Mira and on the Mangetti-1X probe by Tungsten Explorer. The latter well made a major discovery at the shallower Mangetti prospect, and successfully drilled deeper to hit a northern extension of Venus. It is this deeper Venus section of this well that is being tested.

McLachlan pointed out that TotalEnergies has already carried out two successful drill stem tests on Venus, as it gathers more data to incorporate into a development plan for the ultra-deepwater scheme. Satellite data indicates hydrocarbons have so far flowed to the surface — as evidenced by flares — at the Mangetti-1X location on two occasions this month, 18 and 21 March. On Venus-2A, flares began to be spotted on satellite data yesterday, on two separate occasions."

https://www.upstreamonline.com/exploration/totalenergies-sta…

"TotalEnergies is running simultaneous flow tests in a pair of wells on its huge Venus oil discovery offshore Namibia, according to head of exploration Kevin McLachlan. The supermajor currently has two rigs involved in appraising Venus — the drillship Tungsten Explorer, which it partly owns, and the semi-submersible drilling rig Deepsea Mira — in the prolific Orange basin.

MacLachlan told delegates at the BEOS event — organised by GESGB and AAPG — on Tuesday that “two DSTs are ongoing”, but did not go into detail. However, Upstream understands that the flow tests are being carried out on the Venus-2A appraisal well by Deepsea Mira and on the Mangetti-1X probe by Tungsten Explorer. The latter well made a major discovery at the shallower Mangetti prospect, and successfully drilled deeper to hit a northern extension of Venus. It is this deeper Venus section of this well that is being tested.

McLachlan pointed out that TotalEnergies has already carried out two successful drill stem tests on Venus, as it gathers more data to incorporate into a development plan for the ultra-deepwater scheme. Satellite data indicates hydrocarbons have so far flowed to the surface — as evidenced by flares — at the Mangetti-1X location on two occasions this month, 18 and 21 March. On Venus-2A, flares began to be spotted on satellite data yesterday, on two separate occasions."

https://www.upstreamonline.com/exploration/totalenergies-sta…

Läuft sehr gut. Ich erhöhe. Immer noch starkes undervalue. Was habt ihr für einen Anlagehorizont?

die Infos aus den letzten beiden Beiträgen finde ich gut.

AFRICA OIL ANNOUNCES OFFER TO MINORITY SHAREHOLDERS IN IMPACT OIL & GAS

VANCOUVER, BC, 18. März 2024 /CNW/ – (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. („Africa Oil“ oder das „Unternehmen“) hat ein Barangebot („Angebot“) gemacht. ), um von Minderheitsaktionären von Impact Oil and Gas Limited („Impact“) bis zu 8,0 % der ausgegebenen Aktien von Impact zu erwerben. Das Angebot erfolgt zu einem Preis von 0,728 US-Dollar pro Impact-Aktie für einen Gegenwert von bis zu etwa 64 Millionen US-Dollar, was einer Bewertung von 805 Millionen US-Dollar für 100 % des ausgegebenen Aktienkapitals von Impact entspricht. Africa Oil hält derzeit einen Anteil von 31,1 % an Impact. PDF-Version ansehenDer Aktienkauf ist vom Abschluss der am 10. Januar 2024 angekündigten Farm-Down-Transaktion für Impacts Namibia-Vermögenswerte abhängig. Das Angebot richtet sich an ausgewählte Minderheitsaktionäre und kann bis zum 5. April 2024 angenommen werden. Africa Oil ist nicht zum Kauf verpflichtet eine bestimmte Anzahl an Impact-Aktien.

Dr. Roger Tucker, Chief Executive Officer von Africa Oil, kommentierte: „Die Farm-Down-Vereinbarung mit TotalEnergies stärkt Impacts Investitionsargumente für Africa Oil erheblich.“ Ohne Vorabkosten sind wir weiterhin an der Venus-Entwicklung und dem erheblichen Folgepotenzial für die Blöcke 2912/2913B beteiligt. Es wird erwartet, dass Venus von Ende der 2020er bis 2030er Jahre das Portfolio von Africa Oil um erhebliche Reserven und Produktion erweitern wird.

Dieser maßvolle Fortschritt in unserer strategischen Beteiligung stärkt unseren Einfluss auf Impact im Einklang mit unseren Zielen für 2024. Dazu gehört die Positionierung von Africa Oil als führendes unabhängiges E&P-Unternehmen im Orange Basin, gestützt durch seine über Impact gehaltenen Beteiligungen und seine direkte Position in Block 3B/4B mit einem verbleibenden Anteil von 17 % nach Abschluss der Farm-Down-Vereinbarung mit TotalEnergies und QatarEnergy, bekannt gegeben am 6. März 2024.

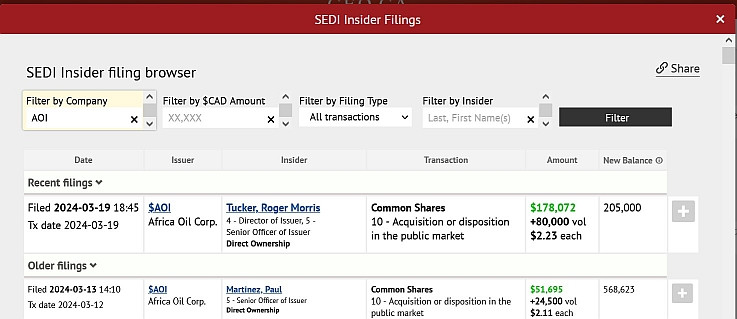

Dies ist ein kalibrierter Kapitalallokationsschritt, der die Fähigkeit von Impact widerspiegelt, die Bewertung und das zukünftige Wachstum von Africa Oil voranzutreiben, parallel zu unseren derzeit laufenden Aktienrückkauf- und Dividendenprogrammen. Wir sind entschlossen, den Wert unseres Unternehmens zu steigern und gleichzeitig unseren Aktionären sofortige Kapitalrenditen zu bieten. Ab heute werden wir das tägliche Volumen der Aktienrückkäufe im Rahmen des aktuellen Rückkaufprogramms erhöhen.'

https://ceo.ca/@newswire/africa-oil-announces-offer-to-minor…

Antwort auf Beitrag Nr.: 75.426.893 von texas2 am 10.03.24 12:10:16Ja, der Brief trifft es. Natürlich wissen die Leute von Aoi das auchl...sind Jahrzehnte im Geschäft. Ergo ist denen das völlig Latte. Man muss sich den Großaktionâr angeln und das Board entfernen. Das Problem: Board u. Großaktionär handeln möglicherweise kollusiv = der Großaktionär verkauft lustig in das Rückkaufprogramm.

Man kann übrigens noch hinzufügen, warum der Laden in Canada + Schweden gelistet sein muss (kostet mehr Geld) ?

Schweden würde ich als Erstes beenden und dafür lieber Nyse in Erwägung ziehen. M.E. ist das schwedische Listing ohnehin der Hauptgrund für die underperformance. Die Pennyflipoer dort verkaufen alle 2 Cent Kursgewinn, was möglicherweise an Derivaten liegt, die dort verfügbar sind.

Man kann übrigens noch hinzufügen, warum der Laden in Canada + Schweden gelistet sein muss (kostet mehr Geld) ?

Schweden würde ich als Erstes beenden und dafür lieber Nyse in Erwägung ziehen. M.E. ist das schwedische Listing ohnehin der Hauptgrund für die underperformance. Die Pennyflipoer dort verkaufen alle 2 Cent Kursgewinn, was möglicherweise an Derivaten liegt, die dort verfügbar sind.