Pretium - Goldexplorer in BC - 500 Beiträge pro Seite (Seite 3)

eröffnet am 13.08.11 17:40:30 von

neuester Beitrag 15.03.22 11:42:40 von

neuester Beitrag 15.03.22 11:42:40 von

Beiträge: 1.042

ID: 1.168.305

ID: 1.168.305

Aufrufe heute: 0

Gesamt: 73.231

Gesamt: 73.231

Aktive User: 0

ISIN: CA74139C1023 · WKN: A1H4B5

15,120

USD

-0,85 %

-0,130 USD

Letzter Kurs 08.03.22 NYSE Arca

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9900 | +90,38 | |

| 1,0800 | +34,98 | |

| 5,1500 | +19,35 | |

| 1,6400 | +13,89 | |

| 429,65 | +10,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9300 | -7,33 | |

| 225,60 | -8,33 | |

| 6.200,00 | -8,82 | |

| 107,78 | -9,41 | |

| 35,10 | -15,93 |

Es gibt keine Asset-Inflation,

ein Asset wird bezahlt zwischen den Marktteilnehmern, nehmen Sie am Marktgeschehen nicht Teil

fallen Sie nicht unter die Inflation.

Z.B kann die von Ihnen so benannte Asset Inflation von einer kleinen Gruppe ausgelöst werden,

die inzestartig diesen scheinbaren Markt aufzieht.

z.B Diamantenhandel, Kunsthandel, Edelsteinhandel oder andere.

Ansonsten reden Sie wohl mehr dass Sie Geld in sogenannte Assets swapen wollen.

Dies muss aber im strengen Sinn keiner tun.

ein Asset wird bezahlt zwischen den Marktteilnehmern, nehmen Sie am Marktgeschehen nicht Teil

fallen Sie nicht unter die Inflation.

Z.B kann die von Ihnen so benannte Asset Inflation von einer kleinen Gruppe ausgelöst werden,

die inzestartig diesen scheinbaren Markt aufzieht.

z.B Diamantenhandel, Kunsthandel, Edelsteinhandel oder andere.

Ansonsten reden Sie wohl mehr dass Sie Geld in sogenannte Assets swapen wollen.

Dies muss aber im strengen Sinn keiner tun.

Da müßte einer eine an der Waffel haben, um Lundin zu übernehmen.

Die sollen erstmal 3 Jahre ihren Schuldenberg tilgen.

Zumindest kann dort kein Ihnen genehmer Preis bezahlt werden.

Die sollen erstmal 3 Jahre ihren Schuldenberg tilgen.

Zumindest kann dort kein Ihnen genehmer Preis bezahlt werden.

Antwort auf Beitrag Nr.: 65.552.860 von dosto am 30.10.20 18:52:09

Newcrest wird nicht nur den 32% Stake halten. Die Frage ist nur, welchen Preis sie am Ende bezahlen, um die Lundin Familie zufriedenzustellen.

Die Schulden wurden größtenteils von Newcrest schon aufgekauft.

Und wenn du dich noch erinnerst, auch bei CNL hattest du eine Übernahme ausgschlossen, obwohl ich dir das immer und immer wieder erklärt hatte Wie ist es gekommen? Das Gleiche bei Probe Mines.

Wie ist es gekommen? Das Gleiche bei Probe Mines.

Flz

Zitat von dosto: Da müßte einer eine an der Waffel haben, um Lundin zu übernehmen.

Die sollen erstmal 3 Jahre ihren Schuldenberg tilgen.

Zumindest kann dort kein Ihnen genehmer Preis bezahlt werden.

Newcrest wird nicht nur den 32% Stake halten. Die Frage ist nur, welchen Preis sie am Ende bezahlen, um die Lundin Familie zufriedenzustellen.

Die Schulden wurden größtenteils von Newcrest schon aufgekauft.

Und wenn du dich noch erinnerst, auch bei CNL hattest du eine Übernahme ausgschlossen, obwohl ich dir das immer und immer wieder erklärt hatte

Wie ist es gekommen? Das Gleiche bei Probe Mines.

Wie ist es gekommen? Das Gleiche bei Probe Mines.Flz

CNL wurde zum eingesetzten Kapital übernommen, also kein außerordentlicher guter Deal.

Probe, ich denke es handelt sich um LongCanyon, eine völlige Blödsinnsübernahme seitens Newmont,

lag Jahrelang rum ist jung an Produktion, völlig Bedeutungslos im Hause Newmont.

Nicht gerade ein Super-Beispiel einer Übernahme.

Newcrest hat ein Riesenprojekt mit Wafi-Golpu an der Backe das Milliarden verschlingen wird

und zur Zeit mit Red Chris eine heruntergekomme MIne sich von einem hochbejubelten Milliardär

übernommen, dem auch schon Wunder nachgesagt wurden, dann aber das Ding voll

mit seinem Tailing-Damm Bruch vermasselte, bezahlt hat er dafür wohl nicht.Wie lange Telfer noch durchmacht weiß ich nicht. Jedoch Hurra, ich darf wieder Reisen bin also nächstens in Australia

und werde mir einige Töpfe anschauen.

-also mein Freund Ihre Deals CNL und Probe waren aus meiner Sicht eh nur lasche Suppe ohne Fettaugen. Da maschierten alle Australischen Miner ohne Übernahmespekulation wesentlich besser

und ruhiger.

Probe, ich denke es handelt sich um LongCanyon, eine völlige Blödsinnsübernahme seitens Newmont,

lag Jahrelang rum ist jung an Produktion, völlig Bedeutungslos im Hause Newmont.

Nicht gerade ein Super-Beispiel einer Übernahme.

Newcrest hat ein Riesenprojekt mit Wafi-Golpu an der Backe das Milliarden verschlingen wird

und zur Zeit mit Red Chris eine heruntergekomme MIne sich von einem hochbejubelten Milliardär

übernommen, dem auch schon Wunder nachgesagt wurden, dann aber das Ding voll

mit seinem Tailing-Damm Bruch vermasselte, bezahlt hat er dafür wohl nicht.Wie lange Telfer noch durchmacht weiß ich nicht. Jedoch Hurra, ich darf wieder Reisen bin also nächstens in Australia

und werde mir einige Töpfe anschauen.

-also mein Freund Ihre Deals CNL und Probe waren aus meiner Sicht eh nur lasche Suppe ohne Fettaugen. Da maschierten alle Australischen Miner ohne Übernahmespekulation wesentlich besser

und ruhiger.

Antwort auf Beitrag Nr.: 65.553.247 von dosto am 30.10.20 19:26:51Gerade weil Newcrest mit vielen anderen Projekten einiges zu tun hat, werden sie eine Cash Cow wie Lundin im Portfolio haben wollen. Sie würden die beste Mine weltweit erwerben.

Interessant auch, das Newcrest schon die anteiligen Unzen aus dem 32% Anteil bei sich ausweisen. Nur eine Frage der Zeit, bis sie Lundin vollständig konsolidieren.

Mit CNL und PRobe wollte ich nur aufzeigen, wie gut ich Übernahmekandidaten erkenne

Flz

Interessant auch, das Newcrest schon die anteiligen Unzen aus dem 32% Anteil bei sich ausweisen. Nur eine Frage der Zeit, bis sie Lundin vollständig konsolidieren.

Mit CNL und PRobe wollte ich nur aufzeigen, wie gut ich Übernahmekandidaten erkenne

Flz

Probe Mines

Newmont möge mich entschuldigen

die waren nicht schuld, es war die Möchte-gern-ganz-groß sein Company die Borden gehörte, Goldcorp

Goldcorp war der Prototyp wie man durch größenwahnsinnige Zukaufe letztendlich in die Binsen ging.

Und den weissen Ritter Newmont brauchte.

Long Canyon gehörte Fronteer Gold, der Kauf war auch nicht das goldene Ei.

ist halt lange her 2015 und mein Gedächtnis auch nicht mehr das Beste.

Deshalb, mea culpa, ich korrigiere

Newmont möge mich entschuldigen

die waren nicht schuld, es war die Möchte-gern-ganz-groß sein Company die Borden gehörte, Goldcorp

Goldcorp war der Prototyp wie man durch größenwahnsinnige Zukaufe letztendlich in die Binsen ging.

Und den weissen Ritter Newmont brauchte.

Long Canyon gehörte Fronteer Gold, der Kauf war auch nicht das goldene Ei.

ist halt lange her 2015 und mein Gedächtnis auch nicht mehr das Beste.

Deshalb, mea culpa, ich korrigiere

Mit CNL und PRobe wollte ich nur aufzeigen, wie gut ich Übernahmekandidaten erkenne

-----------------------------------------------------

ja ich kann mich erinnern wie sie in Columbien hin und her irrten und CNL wurde nicht

durch deren Stärke sondern durch deren Schwäche übernommen. Die konnten ja nicht mal

einen anständigen Preis aushandeln diese Flaschen.

-----------------------------------------------------

ja ich kann mich erinnern wie sie in Columbien hin und her irrten und CNL wurde nicht

durch deren Stärke sondern durch deren Schwäche übernommen. Die konnten ja nicht mal

einen anständigen Preis aushandeln diese Flaschen.

Sie würden die beste Mine weltweit erwerben

-------------------------------------------------------------------------------------------

ich streite mich zu gerne und bezeichne das als Blödsinn.

Die weltbeste Mine hat immer noch Freeport mit Grasberg

und dann kommt wenn schon denn schon Newcrest Lihir (übrigens ein damaliger Tipp meinerseits,

der zudem viel Geld brachte)

Nun arbeiten Sie mal Fruta an die 500.000 Unzen heran, dann kommen Sie wieder.

Das ist die Größe bei der sich meine Augenbraue bewegt.

Das drunter ist für Kleinkinder

-------------------------------------------------------------------------------------------

ich streite mich zu gerne und bezeichne das als Blödsinn.

Die weltbeste Mine hat immer noch Freeport mit Grasberg

und dann kommt wenn schon denn schon Newcrest Lihir (übrigens ein damaliger Tipp meinerseits,

der zudem viel Geld brachte)

Nun arbeiten Sie mal Fruta an die 500.000 Unzen heran, dann kommen Sie wieder.

Das ist die Größe bei der sich meine Augenbraue bewegt.

Das drunter ist für Kleinkinder

Antwort auf Beitrag Nr.: 65.553.550 von dosto am 30.10.20 20:01:56

Durch die Erweiterung der Verarbeitungslage werden wir ab 2022 an die 600k Unzen pro Jahr produzieren. Mega

Flz

Zitat von dosto: Sie würden die beste Mine weltweit erwerben

-------------------------------------------------------------------------------------------

ich streite mich zu gerne und bezeichne das als Blödsinn.

Die weltbeste Mine hat immer noch Freeport mit Grasberg

und dann kommt wenn schon denn schon Newcrest Lihir (übrigens ein damaliger Tipp meinerseits,

der zudem viel Geld brachte)

Nun arbeiten Sie mal Fruta an die 500.000 Unzen heran, dann kommen Sie wieder.

Das ist die Größe bei der sich meine Augenbraue bewegt.

Das drunter ist für Kleinkinder

Durch die Erweiterung der Verarbeitungslage werden wir ab 2022 an die 600k Unzen pro Jahr produzieren. Mega

Flz

Antwort auf Beitrag Nr.: 65.543.455 von Dirkix am 30.10.20 00:41:41Ich frage mich bei diesen Zahlen folgendes, es macht doch keinen Sinn,

in einem Umfeld von Nullzinsen (= negativer Realverzinsung) 175 mio Dollar Cash aufzubauen,

wenn ich auf der anderen Seite noch Schulden in Höhe von 368 mio Dollar habe, für die ich Zins und Zinseszins bezahlen muss.

Also entweder, ich DARF nicht mehr tilgen (entsprechende Klausel im Kreditvertrag, z.B. Vorfälligkeitsentschädigung), oder

ich WILL nicht mehr tilgen,

nämlich dann, wenn ich mit dem Geld etwas anderes vorhabe! Aber dann stellt sich die Frage was will ich mit dem Geld kaufen (bzw. wen, wenn ich mal den Plan unterstelle zuzukaufen).

ASCOT ist mit 340 mio viel zu schwer;

Teuton, Scottie, Eskay, Seabridge, ... ???

in einem Umfeld von Nullzinsen (= negativer Realverzinsung) 175 mio Dollar Cash aufzubauen,

wenn ich auf der anderen Seite noch Schulden in Höhe von 368 mio Dollar habe, für die ich Zins und Zinseszins bezahlen muss.

Also entweder, ich DARF nicht mehr tilgen (entsprechende Klausel im Kreditvertrag, z.B. Vorfälligkeitsentschädigung), oder

ich WILL nicht mehr tilgen,

nämlich dann, wenn ich mit dem Geld etwas anderes vorhabe! Aber dann stellt sich die Frage was will ich mit dem Geld kaufen (bzw. wen, wenn ich mal den Plan unterstelle zuzukaufen).

ASCOT ist mit 340 mio viel zu schwer;

Teuton, Scottie, Eskay, Seabridge, ... ???

Schöner Anstieg heute, lag aber eher am Goldpreis als an den news:

Pretivm Streamlines Management Structure

VANCOUVER, British Columbia, Nov. 05, 2020 - Pretium Resources Inc. (TSX/NYSE: PVG) announces that, as part of an effort to streamline its management structure,

Michelle Romero, Executive Vice President, Corporate Affairs and Sustainability, will be departing the Company in December and that

John Hayes, Senior Vice President, Business Development and Investor Relations will be departing the Company on November 6, 2020.

Pretivm Streamlines Management Structure

VANCOUVER, British Columbia, Nov. 05, 2020 - Pretium Resources Inc. (TSX/NYSE: PVG) announces that, as part of an effort to streamline its management structure,

Michelle Romero, Executive Vice President, Corporate Affairs and Sustainability, will be departing the Company in December and that

John Hayes, Senior Vice President, Business Development and Investor Relations will be departing the Company on November 6, 2020.

Antwort auf Beitrag Nr.: 65.560.378 von Dirkix am 01.11.20 00:28:09(Kleinere) Explorer/Developer in der Nähe oder ein erster Schritt Richtung Multi-Miner, der dann auch mal vielleicht nicht im Golden Triangle, BC erfolgen muss.

Das ist hier OK mit den Schulden mMn, denn nächstes Jahre steht mMn bei Gold-Minern wieder erhöht M&A auf dem Plan nach eher Pause in 2020.

Um diese Frage kommt Pretium irgendwann überhaupt nicht herum und sie können Ziel oder Jäger sein (mMn).

Wie ja selbst erwähnt, manchmal ist der Schuldenabbau mit erhöhten Kosten verbunden.

Dann dienen Zinsen auch in Kanada sicherlich auch zur Vermeidung von zuviel Steuern

Income taxes paid:

2019Q3: USD1.4m

2020Q3: USD1.7m

Deferred income tax liability:

2019Q3: USD62m

2020Q3: USD116m

Auch finden die einschlägigen Häuser im Schnitt immer weniger gute und geeignete Schuldner unter den Goldminern. Keine Kredite, kein Umsatz.

Wer weiß, vielleicht will Pretium den Gläubigern Bank of Nova Scotia, ING Capital und SG Americas Securities auch für später zeigen, was für ein guter Kreditnehmer sie sind. Wie gesagt, M&A.

Schulden sichern auch immer ein Stück weit die Unabhängigkeit (*). Gut, bei Pretium immer weniger. Zuletzt ziemlich konstant bei so ~CAD100m auf Sicht von 12m (Current Portion of Long Term Debt).

(*) wenn der Jäger-CEO alle Tassen im Schrank hat. Das haben die aber erwiesenermaßen nicht immer

Ich verbuche diese USD368m Schulden so gesehen als strategischen Bilanzposten.

___

so ganz nebenbei aus den: CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

...

United States class action

Two putative class action complaints were filed against the Company and certain of its officers in the United States District Court for the Southern District of New York, one on September 7, 2018 and the other on October 19, 2018.

.......

On July 9, 2020, the District Court denied the plaintiffs’ motion to amend their complaint. The deadline for the plaintiffs to appeal the District Court’s dismissal of the motion to amend their complaint passed in August 2020 without an appeal being filed. As a result, this matter is now concluded.

Das ist hier OK mit den Schulden mMn, denn nächstes Jahre steht mMn bei Gold-Minern wieder erhöht M&A auf dem Plan nach eher Pause in 2020.

Um diese Frage kommt Pretium irgendwann überhaupt nicht herum und sie können Ziel oder Jäger sein (mMn).

Wie ja selbst erwähnt, manchmal ist der Schuldenabbau mit erhöhten Kosten verbunden.

Dann dienen Zinsen auch in Kanada sicherlich auch zur Vermeidung von zuviel Steuern

Income taxes paid:

2019Q3: USD1.4m

2020Q3: USD1.7m

Deferred income tax liability:

2019Q3: USD62m

2020Q3: USD116m

Auch finden die einschlägigen Häuser im Schnitt immer weniger gute und geeignete Schuldner unter den Goldminern. Keine Kredite, kein Umsatz.

Wer weiß, vielleicht will Pretium den Gläubigern Bank of Nova Scotia, ING Capital und SG Americas Securities auch für später zeigen, was für ein guter Kreditnehmer sie sind. Wie gesagt, M&A.

Schulden sichern auch immer ein Stück weit die Unabhängigkeit (*). Gut, bei Pretium immer weniger. Zuletzt ziemlich konstant bei so ~CAD100m auf Sicht von 12m (Current Portion of Long Term Debt).

(*) wenn der Jäger-CEO alle Tassen im Schrank hat. Das haben die aber erwiesenermaßen nicht immer

Ich verbuche diese USD368m Schulden so gesehen als strategischen Bilanzposten.

___

so ganz nebenbei aus den: CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

...

United States class action

Two putative class action complaints were filed against the Company and certain of its officers in the United States District Court for the Southern District of New York, one on September 7, 2018 and the other on October 19, 2018.

.......

On July 9, 2020, the District Court denied the plaintiffs’ motion to amend their complaint. The deadline for the plaintiffs to appeal the District Court’s dismissal of the motion to amend their complaint passed in August 2020 without an appeal being filed. As a result, this matter is now concluded.

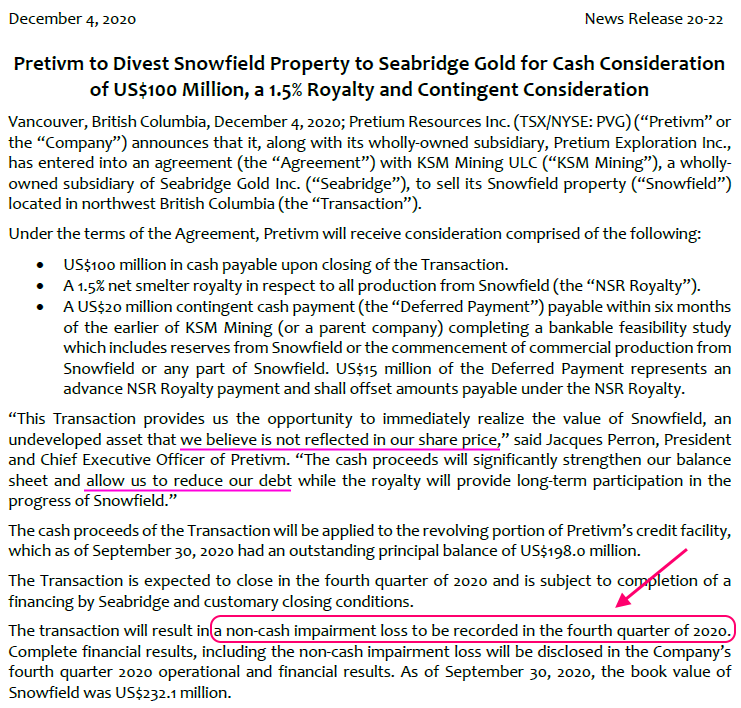

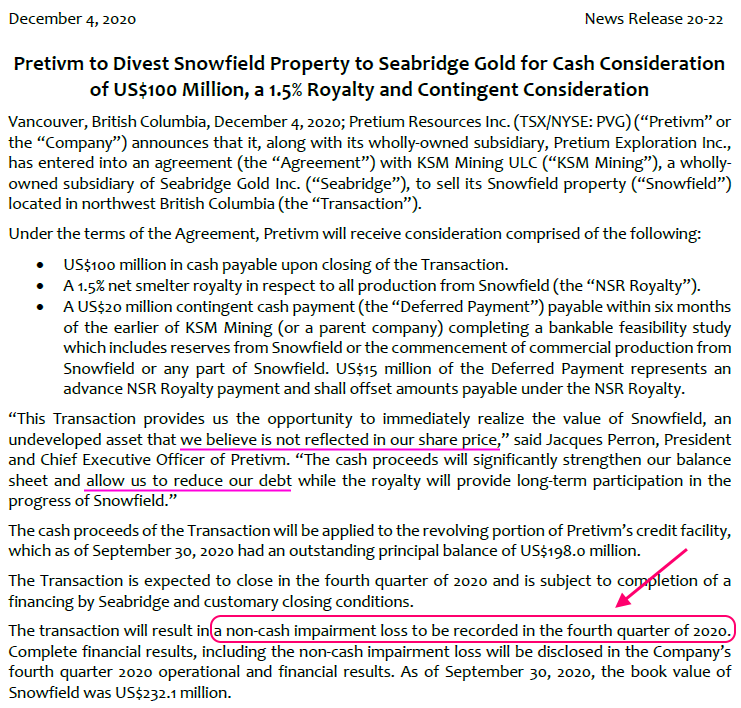

Antwort auf Beitrag Nr.: 65.624.348 von faultcode am 06.11.20 23:46:31Geld in die Kasse -- allerdings mit satter Wertberichtigung von USD???m in Q4 (non-cash)

4.12.

Pretivm to Divest Snowfield Property to Seabridge Gold for Cash Consideration of US$100 Million, a 1.5% Royalty and Contingent Consideration

https://www.pretivm.com/news/news-release-details/2020/Preti…

...

4.12.

Pretivm to Divest Snowfield Property to Seabridge Gold for Cash Consideration of US$100 Million, a 1.5% Royalty and Contingent Consideration

https://www.pretivm.com/news/news-release-details/2020/Preti…

...

Antwort auf Beitrag Nr.: 65.951.430 von faultcode am 04.12.20 17:11:16

=> über USD100m werden es wohl werden:

The Snowfield property currently has a book value of US$232.1 million for Pretium, resulting in a significant impairment of over US$100 million which will be recorded in the fourth quarter of 2020.

https://thedeepdive.ca/pretium-resources-sells-snowfield-pro…

=> $PVG z.Z. mit -1.2% (dünner Handel) bei XAU um die Null

Zitat von faultcode: Geld in die Kasse -- allerdings mit satter Wertberichtigung von USD???m in Q4 (non-cash)...

=> über USD100m werden es wohl werden:

The Snowfield property currently has a book value of US$232.1 million for Pretium, resulting in a significant impairment of over US$100 million which will be recorded in the fourth quarter of 2020.

https://thedeepdive.ca/pretium-resources-sells-snowfield-pro…

=> $PVG z.Z. mit -1.2% (dünner Handel) bei XAU um die Null

Im Kino bei Wall Street hieß das "Fire Sale"

Antwort auf Beitrag Nr.: 65.951.430 von faultcode am 04.12.20 17:11:16Also die hatten Snowfield mit 232 million bilanziert und jetzt für 100 mio richtiges Geld verkauft, das ist ja nur ein Buchverlust - kann man den steuerlich geltend machen...?

Ich hatte eigentlich gedacht Pretium lässt Snowfield in der Hinterhand um es irgendwann in der Zukunft selbst zu entwickeln, wenn alle Schulden soweit abbezahlt sind.

Und dieser Tag rückt näher, beim letzten quarterly hatten sie 175 mio Dollar Cash und Schulden in Höhe von 368 mio Dollar.

Jetzt die die 100 mio für Snowfields + ca. 30 mio net earning (=> 305 mio Cash) bleibt nur noch eine

lächerliche (Netto-)Restschuld von 60mio Dollar = keine zwei Quartale!!!

Ich hatte eigentlich gedacht Pretium lässt Snowfield in der Hinterhand um es irgendwann in der Zukunft selbst zu entwickeln, wenn alle Schulden soweit abbezahlt sind.

Und dieser Tag rückt näher, beim letzten quarterly hatten sie 175 mio Dollar Cash und Schulden in Höhe von 368 mio Dollar.

Jetzt die die 100 mio für Snowfields + ca. 30 mio net earning (=> 305 mio Cash) bleibt nur noch eine

lächerliche (Netto-)Restschuld von 60mio Dollar = keine zwei Quartale!!!

Die Brokerhäuser bewerten den Deal für Pretium als positiv , da es sich um kein Core Asset handelt.

Bei Seabridge vertrete ich immer schon die >Meinung , daß es ein reiner Promotion Deal ist!

Wie alle Beteiligten wissen , kann man bei Snowfield in der Tat nur einige Mio Unzen wirklich fördern.

Neue Kursziele hat Canaccord mit 17,50 C$

und Scotia um die 14 C$..

Bei Seabridge vertrete ich immer schon die >Meinung , daß es ein reiner Promotion Deal ist!

Wie alle Beteiligten wissen , kann man bei Snowfield in der Tat nur einige Mio Unzen wirklich fördern.

Neue Kursziele hat Canaccord mit 17,50 C$

und Scotia um die 14 C$..

Antwort auf Beitrag Nr.: 65.957.886 von stephansdom am 05.12.20 12:20:39Es gibt noch 3 neue Ratings zwischen 18 und 21 Dollar.Cormark Securities, RBC und ??

Jedes Brokerhaus ist der Ansicht , daß die 5 Billion Capex von Snowfield

ein Hindernis für JEDEN ist. Ich denke Seabridge wird noch weitere 10 Jahre

die vielen Unzen pro Share vermarkten und das war es.

Jedes Brokerhaus ist der Ansicht , daß die 5 Billion Capex von Snowfield

ein Hindernis für JEDEN ist. Ich denke Seabridge wird noch weitere 10 Jahre

die vielen Unzen pro Share vermarkten und das war es.

Antwort auf Beitrag Nr.: 65.987.378 von stephansdom am 08.12.20 15:44:38Jedes Brokerhaus ist der Ansicht , daß die 5 Billion Capex von Snowfield ein Hindernis für JEDEN ist.

Snowfield ist aber auch wirklich ein MONSTER!!!

Mineral resources:

- 25.9 million ounces gold measured and indicated;

- 9.0 million ounces gold inferred resources;

- 75.8 million ounces silver measured and indicated;

- 51.0 million ounces silver inferred;

- 2.98 billion pounds copper measured and indicated;

- 1.10 billion pounds copper inferred;

- 258.3 million pounds molybdenum measured and indicated;

- 127.7 million pounds molybdenum inferred;

- 22.5 million ounces rhenium measured and indicated;

- 11.5 million ounces rhenium inferred;

Snowfield ist aber auch wirklich ein MONSTER!!!

Mineral resources:

- 25.9 million ounces gold measured and indicated;

- 9.0 million ounces gold inferred resources;

- 75.8 million ounces silver measured and indicated;

- 51.0 million ounces silver inferred;

- 2.98 billion pounds copper measured and indicated;

- 1.10 billion pounds copper inferred;

- 258.3 million pounds molybdenum measured and indicated;

- 127.7 million pounds molybdenum inferred;

- 22.5 million ounces rhenium measured and indicated;

- 11.5 million ounces rhenium inferred;

Vielleicht braucht man deswegen Snowfield nicht mehr in der Hinterhand:

DISCOVERY AT THE HANGING GLACIER ZONE WITH 2.1 G/T GOLD OVER 102 METERS, INCLUDING 9.5 G/T GOLD OVER 13 METERS DEMONSTRATES SIGNIFICANT NEAR-MINE EXPLORATION POTENTIAL AT BRUCEJACK

DISCOVERY AT THE HANGING GLACIER ZONE WITH 2.1 G/T GOLD OVER 102 METERS, INCLUDING 9.5 G/T GOLD OVER 13 METERS DEMONSTRATES SIGNIFICANT NEAR-MINE EXPLORATION POTENTIAL AT BRUCEJACK

Antwort auf Beitrag Nr.: 66.489.617 von faultcode am 18.01.21 15:35:06Goldminen sind nicht en vogue sonst wären wir hier bei 20 Euro.

Aber der Goldhebel ist schon gewaltig bei Produzenten.

Aber der Goldhebel ist schon gewaltig bei Produzenten.

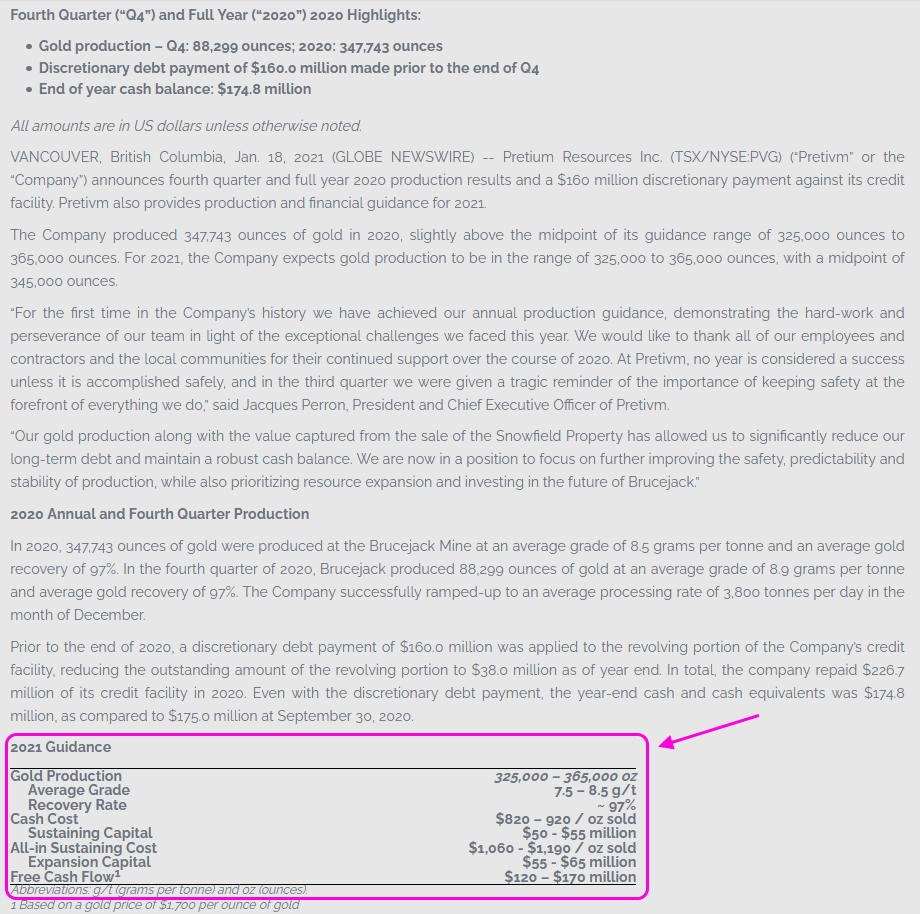

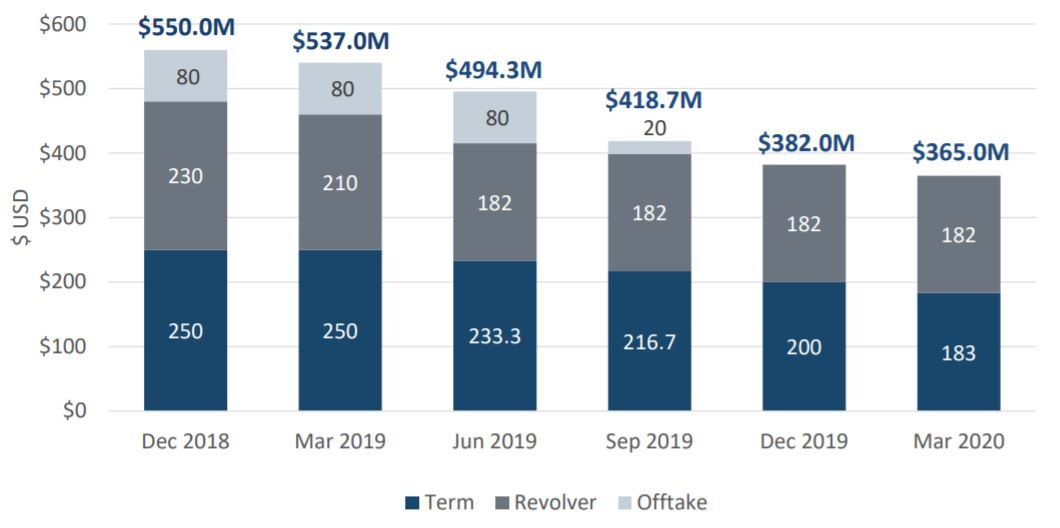

Antwort auf Beitrag Nr.: 66.489.617 von faultcode am 18.01.21 15:35:06Wir hatten in Q3 insgesamt 368mio debt offen, davon 182 mio revolving - die sind komplett getilgt (discretionary debt payment)!

Bleiben auf der einen Seite noch 183 mio long term, aber auf der anderen Seite year-end cash and cash equivalents 174.8 million

= schwarze Null, NETTO Schuldenfrei!!!

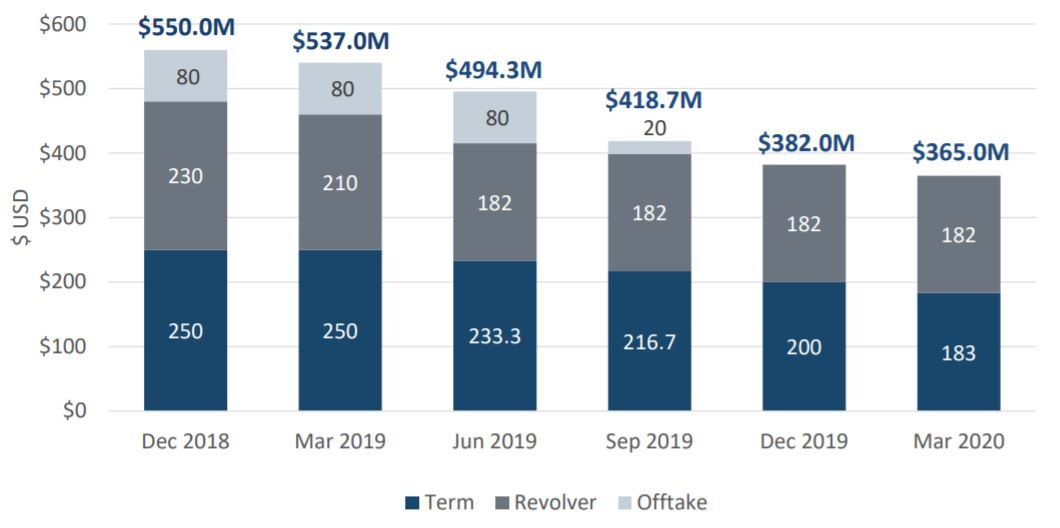

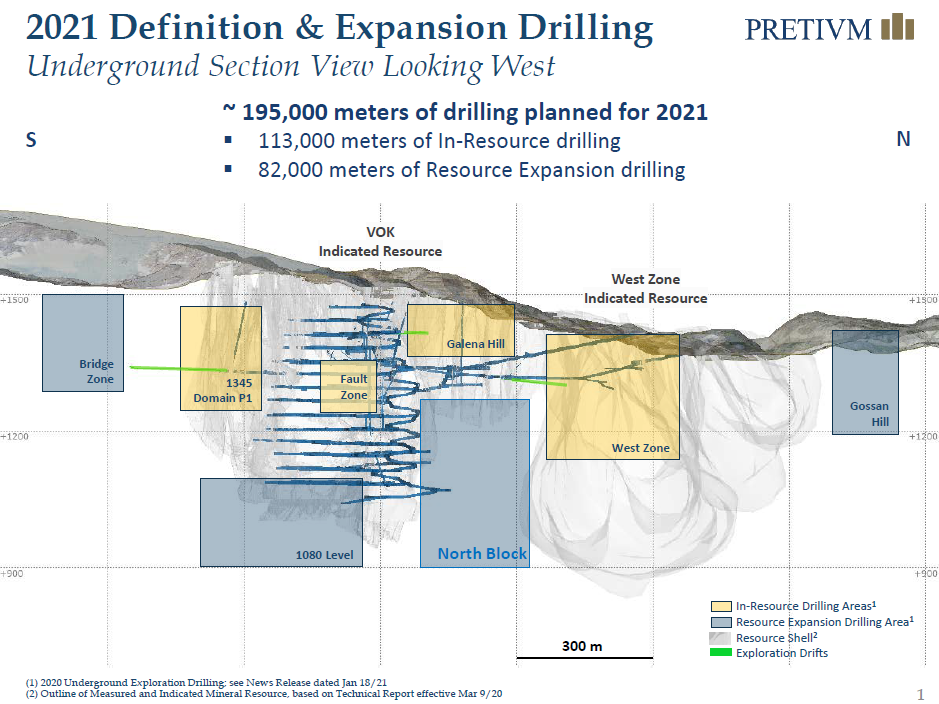

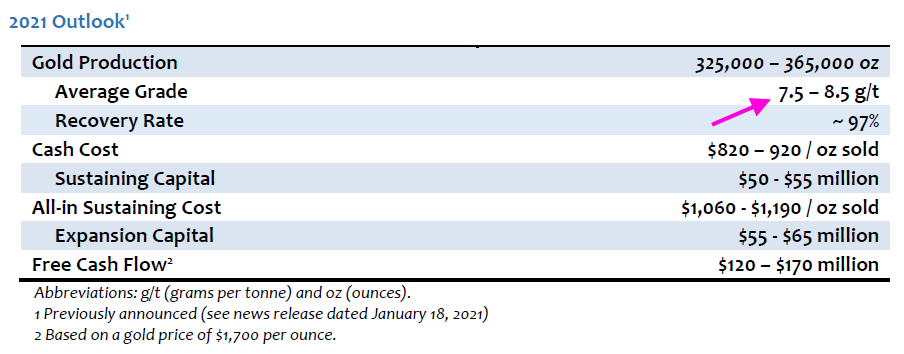

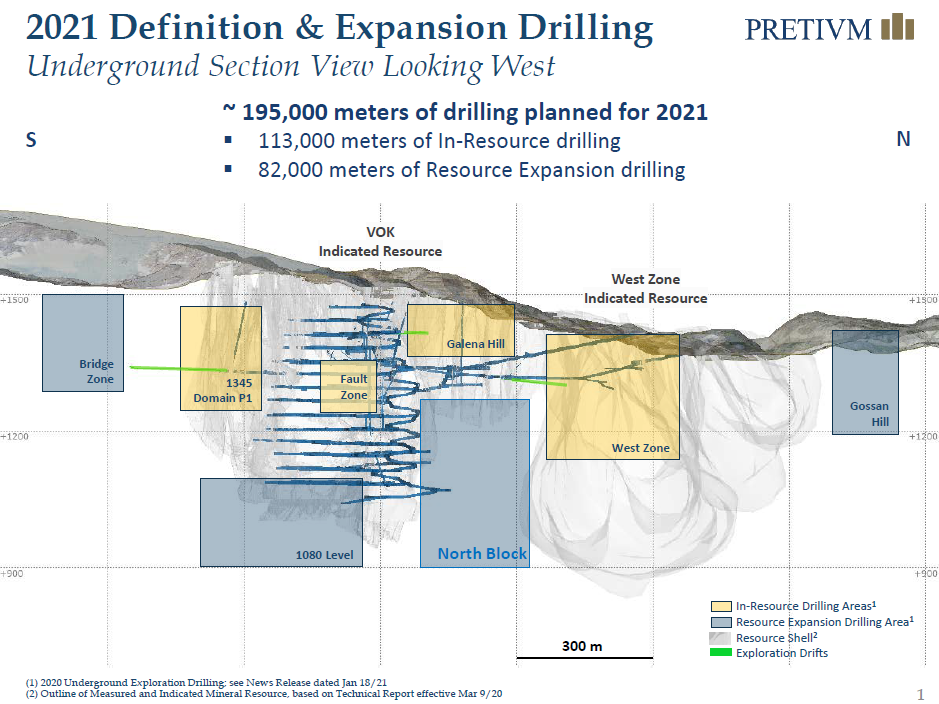

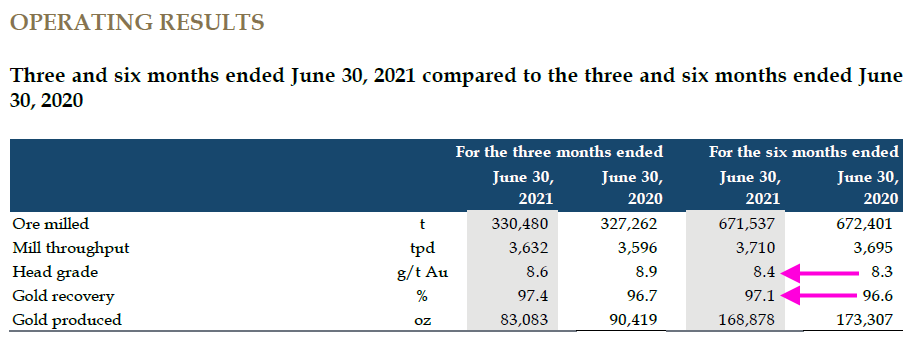

Die AISC scheinen leider zu steigen, leicht geringere grades plus 195,000 meter diamond drill program!

Q3 2020 AISC 1,016 $/oz

AISC for 2021 is expected to range from $1,060 to $1,190 per ounce of gold

Grades:

2020, 347,743 ounces of gold were produced at the Brucejack Mine at an average grade of 8.5 grams per tonne

2021 Production Guidance - Gold production at the Brucejack Mine for 2021 is expected to be in the range of 325,000 to 365,000 ounces. The processing rate is expected to average 3,800 tonnes per day with average annual gold grade ranging between 7.5 grams per tonne to 8.5 grams per tonne

Drilling:

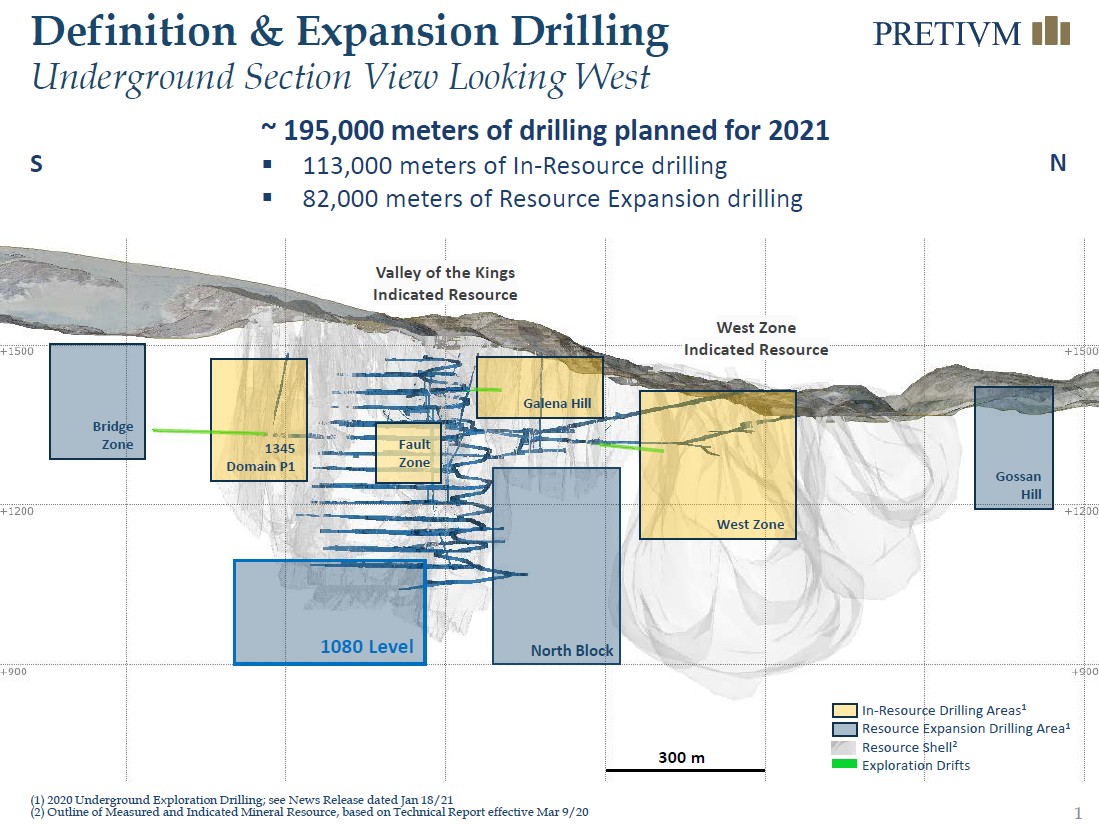

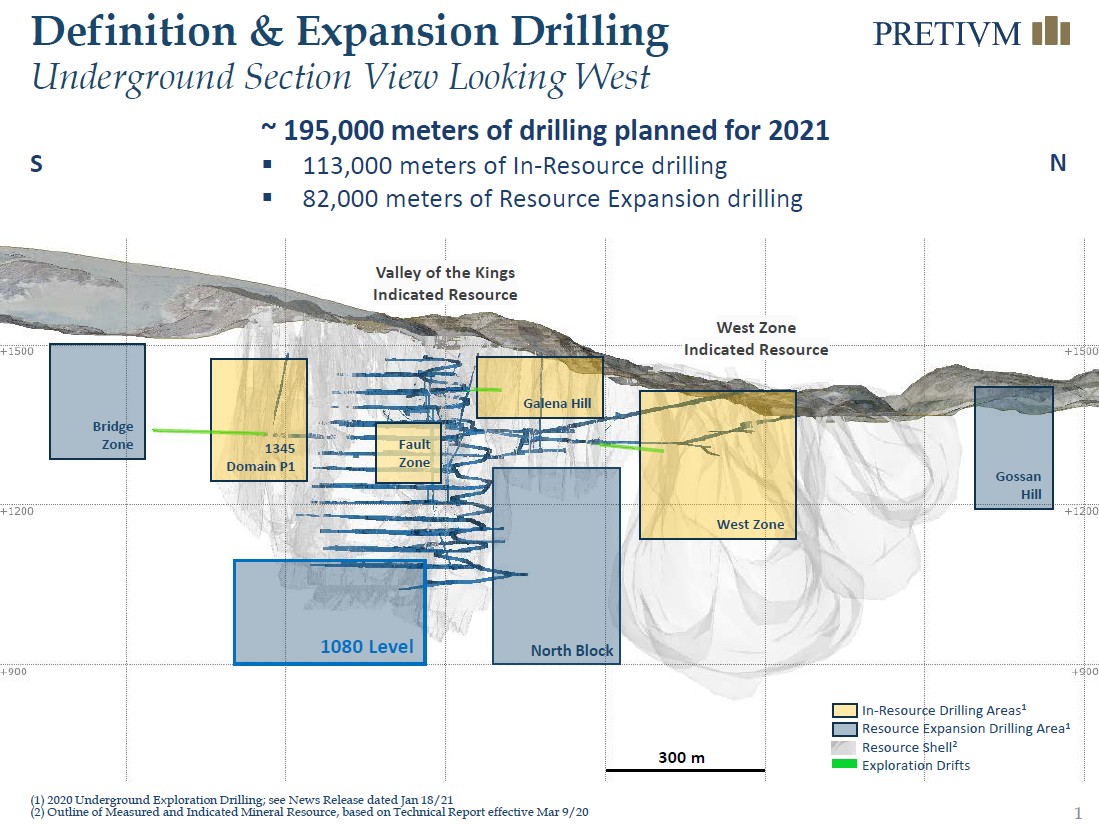

definition, sustaining and resource expansion drill programs are anticipated to total approximately 195,000 meters of diamond drilling at a cost of approximately $23 million, comprised of in-resource definition drilling (40%), in-resource and sustaining drilling (20%) and resource expansion drilling (40%).

Bleiben auf der einen Seite noch 183 mio long term, aber auf der anderen Seite year-end cash and cash equivalents 174.8 million

= schwarze Null, NETTO Schuldenfrei!!!

Die AISC scheinen leider zu steigen, leicht geringere grades plus 195,000 meter diamond drill program!

Q3 2020 AISC 1,016 $/oz

AISC for 2021 is expected to range from $1,060 to $1,190 per ounce of gold

Grades:

2020, 347,743 ounces of gold were produced at the Brucejack Mine at an average grade of 8.5 grams per tonne

2021 Production Guidance - Gold production at the Brucejack Mine for 2021 is expected to be in the range of 325,000 to 365,000 ounces. The processing rate is expected to average 3,800 tonnes per day with average annual gold grade ranging between 7.5 grams per tonne to 8.5 grams per tonne

Drilling:

definition, sustaining and resource expansion drill programs are anticipated to total approximately 195,000 meters of diamond drilling at a cost of approximately $23 million, comprised of in-resource definition drilling (40%), in-resource and sustaining drilling (20%) and resource expansion drilling (40%).

Antwort auf Beitrag Nr.: 66.495.113 von Dirkix am 18.01.21 21:26:00Merci für die gute Zusammenfassung!

Die Recovery Rate ist sensationell.....

Die Recovery Rate ist sensationell.....

Hallo zusammen,

nach eineinhalb Jahren habe ich jetzt ein Schlussstrich gezogen und bin wieder mit nem mini Gewinn raus. Meine anderen Mienenwerte sind alle mindestens 50% im Plus. Irgendwann wird der Kurs anziehen aber da ist keine Dynamik drin?

nach eineinhalb Jahren habe ich jetzt ein Schlussstrich gezogen und bin wieder mit nem mini Gewinn raus. Meine anderen Mienenwerte sind alle mindestens 50% im Plus. Irgendwann wird der Kurs anziehen aber da ist keine Dynamik drin?

Antwort auf Beitrag Nr.: 66.489.617 von faultcode am 18.01.21 15:35:0625.2.

Pretivm Reports 2020 Operating and Financial Results; Achieves Guidance, Delivers Record High Free Cash Flow and Significantly Reduces Debt

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

=> die head grades sollen weiter zurückgehen und damit die AISC nochmals nach oben (daher auch die Underperformance hier u.a.):

The decrease in production was due to decreased head grade resultant from the areas mined during the year partially offset by tonnes milled.

=> die Obergrenze liegt nun beim Ist-Stand 2020: 8.5g/t

Allerdings machte das PVG schon für 2020 so und stapelt möglicherweise tief:

The Company produced 347,743 ounces of gold in 2020, slightly above the midpoint of its guidance range of 325,000 ounces to 365,000 ounces. The average annual gold grade was 8.5 grams per tonne, on the high-end of our guidance range of 7.6 grams per tonne to 8.5 grams per tonne at an average gold recovery of 97.0%.

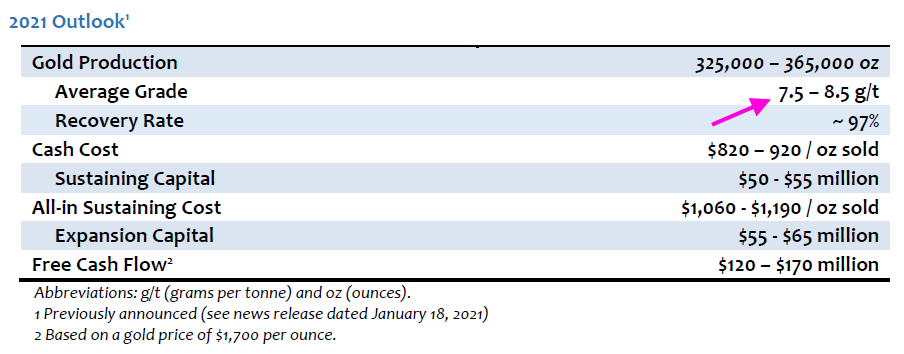

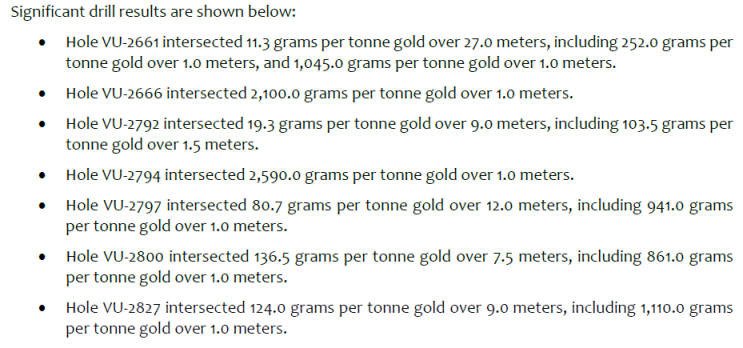

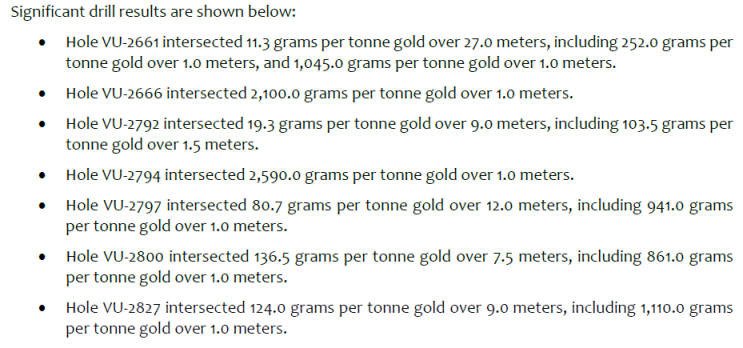

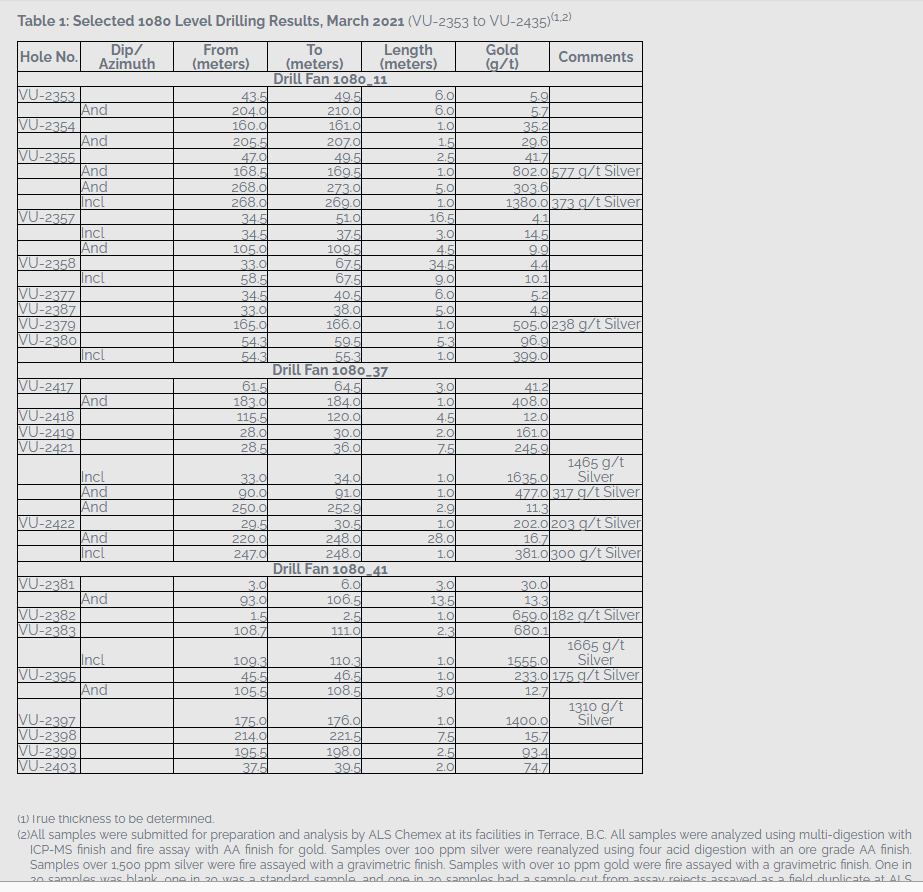

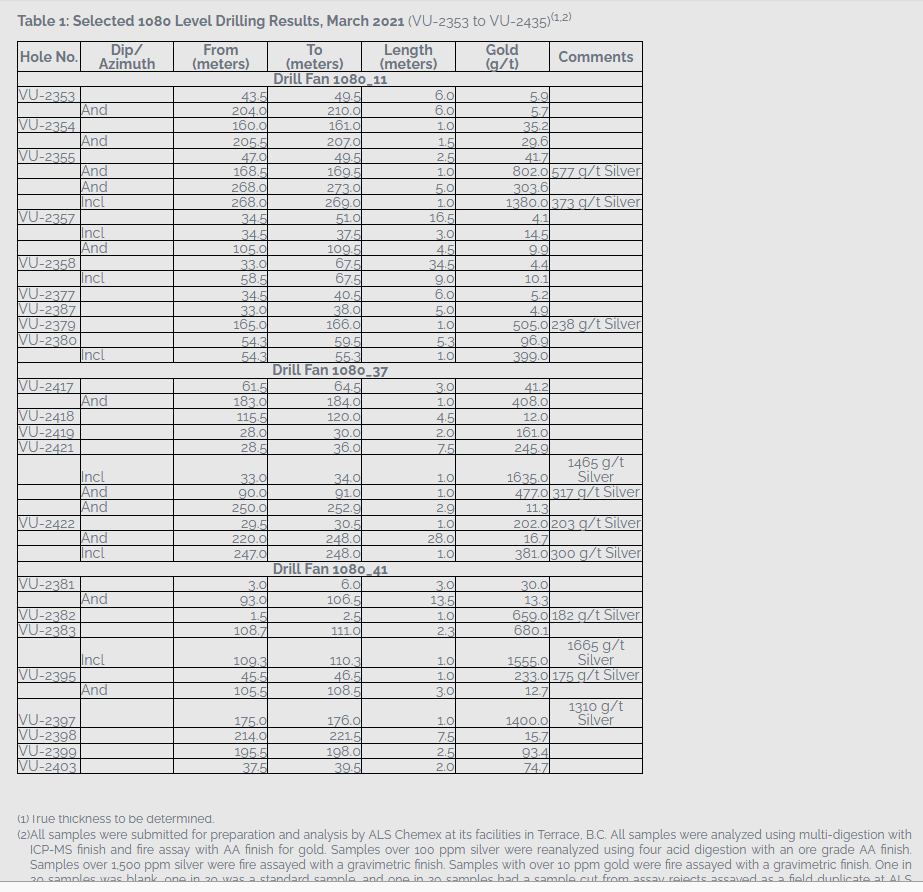

Aber was mMn interessanter ist, war die Explorationsmeldung dieser Woche - die fiel nämlich sehr gut aus:

25.2.

Underground Exploration Drilling at Brucejack Extends Mineralization with High-Grade Intercepts

https://www.pretivm.com/news/news-release-details/2021/Under…

...

<True thickness to be determined.>

...

...

Pretivm Reports 2020 Operating and Financial Results; Achieves Guidance, Delivers Record High Free Cash Flow and Significantly Reduces Debt

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

=> die head grades sollen weiter zurückgehen und damit die AISC nochmals nach oben (daher auch die Underperformance hier u.a.):

The decrease in production was due to decreased head grade resultant from the areas mined during the year partially offset by tonnes milled.

=> die Obergrenze liegt nun beim Ist-Stand 2020: 8.5g/t

Allerdings machte das PVG schon für 2020 so und stapelt möglicherweise tief:

The Company produced 347,743 ounces of gold in 2020, slightly above the midpoint of its guidance range of 325,000 ounces to 365,000 ounces. The average annual gold grade was 8.5 grams per tonne, on the high-end of our guidance range of 7.6 grams per tonne to 8.5 grams per tonne at an average gold recovery of 97.0%.

Aber was mMn interessanter ist, war die Explorationsmeldung dieser Woche - die fiel nämlich sehr gut aus:

25.2.

Underground Exploration Drilling at Brucejack Extends Mineralization with High-Grade Intercepts

https://www.pretivm.com/news/news-release-details/2021/Under…

...

<True thickness to be determined.>

...

...

Antwort auf Beitrag Nr.: 67.216.779 von faultcode am 26.02.21 11:42:30Das Problem der Kursentwicklung aktuell ist doch nicht die Frage, ob Pretium für 2021 nun head grades von 7,5 g oder 8,5 g hat, sondern die Schwäche beim Goldpreis nervt!!! Seit SIEBEN Monaten, seit Anfang August 2020 "konsolisiert" Gold jetzt schon - wer länger dabei ist, bei dem werden Erinnerungen an 2011 wach (und in Teilen auch an 2016).

Manchmal frage ich mich, macht der shitcoin den Goldpreis kaputt? Das sind doch alles Gelder die sonst eher in Edelmetalle geflossen wären.

Und bei den drill results wundert der Verkauf von snowfield nicht weiter. Vielleicht übersteigt das den FY2020 mine depletion und erhöht wieder die Mineral Resources und unsere LOM!

Manchmal frage ich mich, macht der shitcoin den Goldpreis kaputt? Das sind doch alles Gelder die sonst eher in Edelmetalle geflossen wären.

Und bei den drill results wundert der Verkauf von snowfield nicht weiter. Vielleicht übersteigt das den FY2020 mine depletion und erhöht wieder die Mineral Resources und unsere LOM!

Antwort auf Beitrag Nr.: 67.216.779 von faultcode am 26.02.21 11:42:303.5.

Pretium Resources Inc.: Underground Exploration Drilling at Brucejack Extends Mineralization Below the Current Mining Levels and Intercepts High-Grade Gold to the East

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

...

Pretium Resources Inc.: Underground Exploration Drilling at Brucejack Extends Mineralization Below the Current Mining Levels and Intercepts High-Grade Gold to the East

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

...

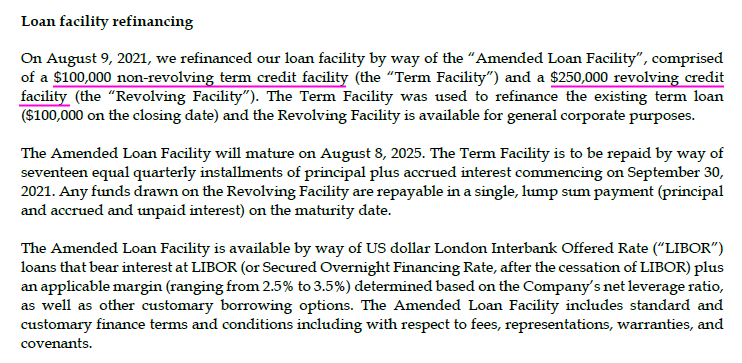

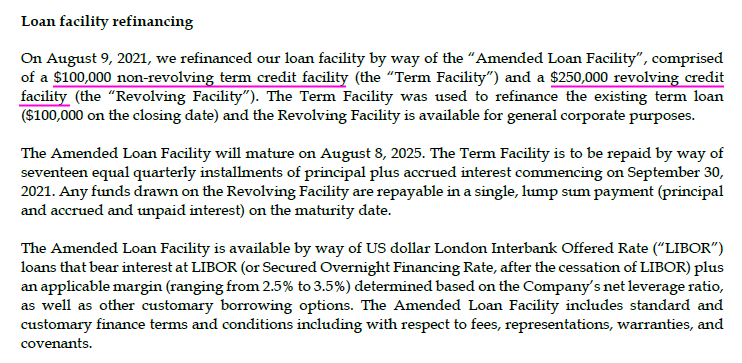

Achtung! M&A droht hier mMn, im Guten, wie im Schlechten:

Aug 9. 2021

Pretivm Refinances Credit Facility

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

“The increase in available liquidity combined with our strong financial performance provides us with flexibility and positions us to seize operational and strategic opportunities as they arise,” said Jacques Perron, President and Chief Executive Officer of Pretivm.

...

Aug 9. 2021

Pretivm Refinances Credit Facility

https://www.pretivm.com/news/news-release-details/2021/Preti…

...

“The increase in available liquidity combined with our strong financial performance provides us with flexibility and positions us to seize operational and strategic opportunities as they arise,” said Jacques Perron, President and Chief Executive Officer of Pretivm.

...

Antwort auf Beitrag Nr.: 69.008.837 von faultcode am 10.08.21 12:34:00

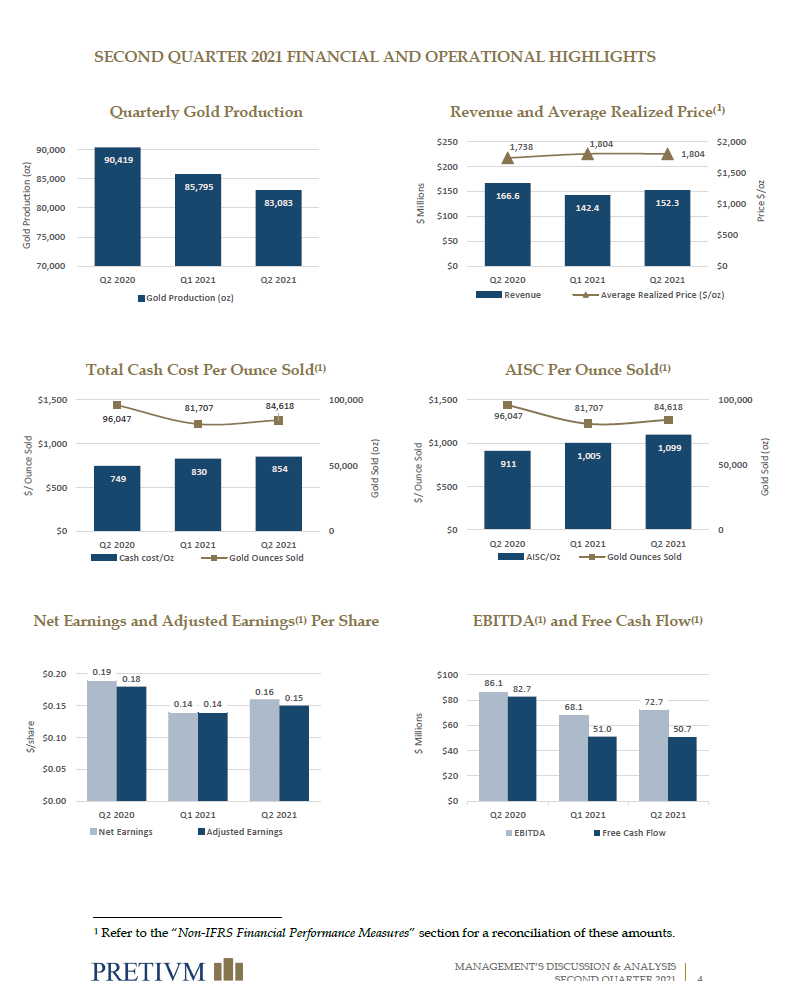

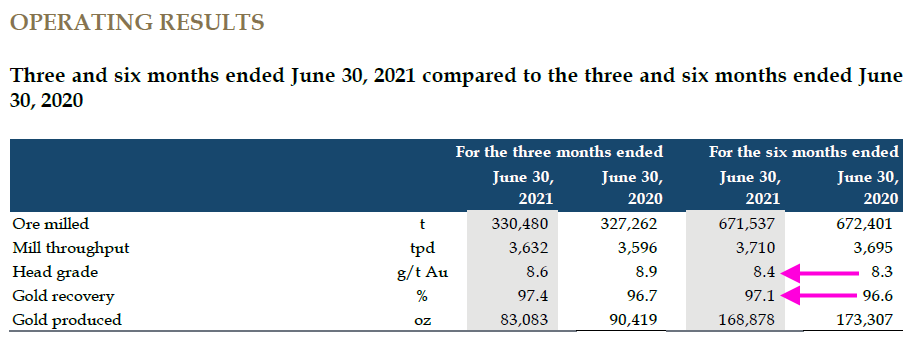

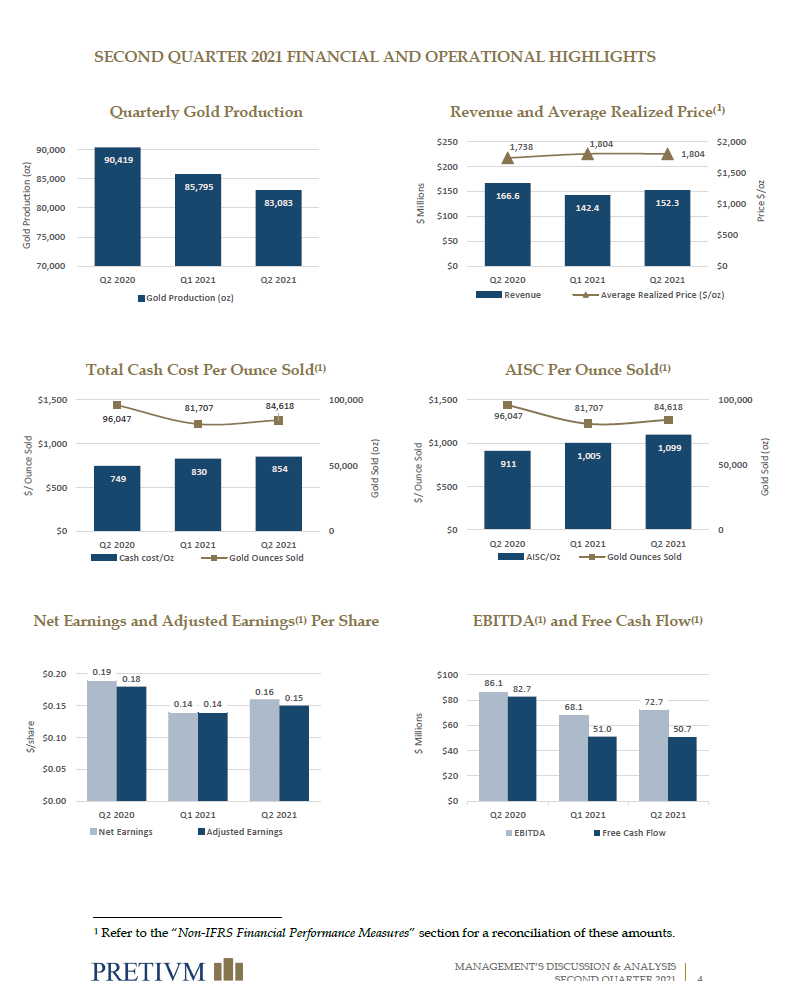

so sieht es mit den Aussagen zum Q2 aus: https://www.pretivm.com/investors/financials/default.aspx

<ein längeres Posting, meistens auf der Basis von: MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020>

...

...

___

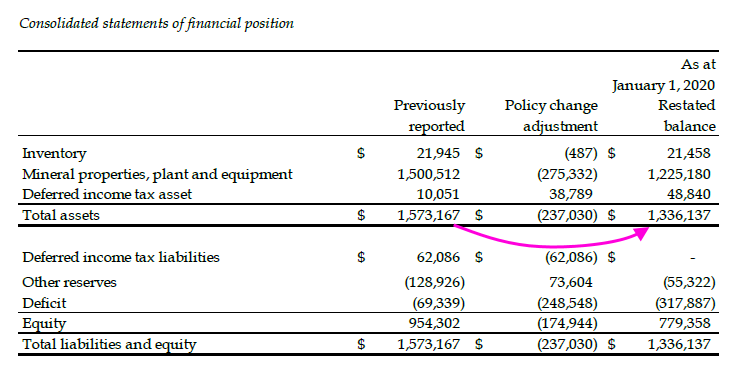

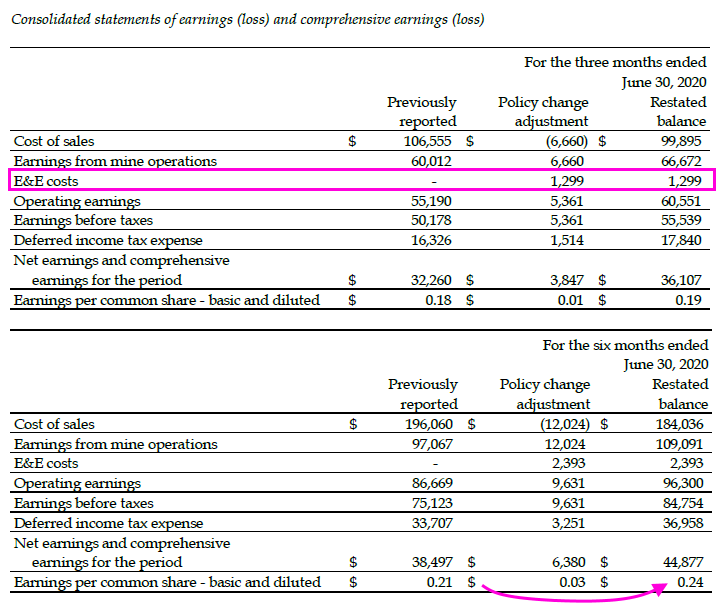

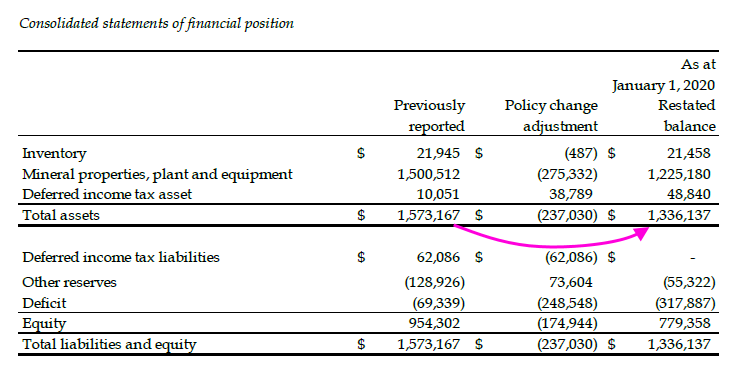

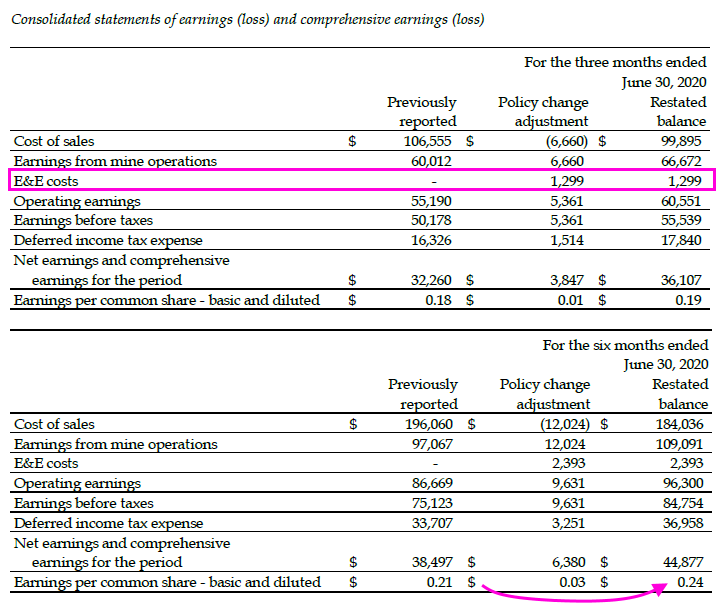

PVG hat nun E&E rückwirkend buchhalterisch den allgemeineren Gepflogenheiten angepasst --> mMn: mehr Gewinn, geschrumpfte Bilanz (ganz grob):

Change in accounting policy – E&E expenditures (E&E = exploration and evaluation)

We adopted a voluntary change in our accounting policy for E&E expenditures, effective January 1, 2021 applying the change fully retrospectively.

As a result, balances of comparative periods have been restated. Under the new policy, we recognize these expenditures as E&E costs in the statement of earnings in the period incurred until management concludes the technical feasibility and commercial viability of a mineral deposit has been established. Costs that represent the acquisition of rights to explore a mineral deposit continue to be capitalized. Prior to January 1, 2021, our policy was to capitalize E&E expenditures as E&E assets.

Management believes this change in accounting policy results in a more relevant and reliable policy as it is better aligned with IFRS conceptual framework with respect to the definition of an asset and more consistent with our peer group.

...

=>

...

...

...

___

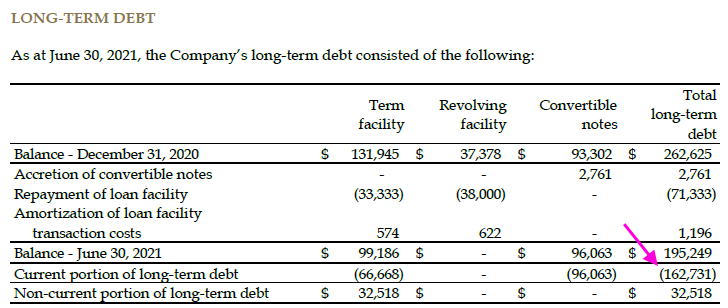

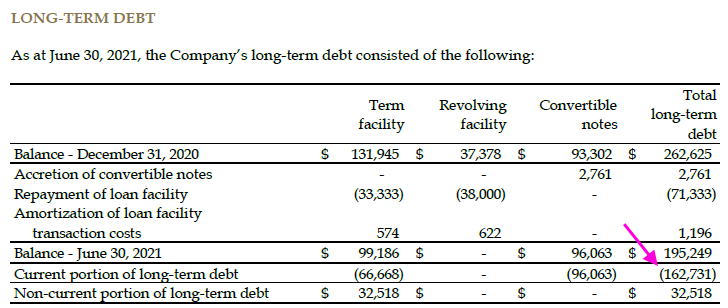

Anfang August wurde dieser Teil des Long-term debt refinanziert...

....und das in erhöhtem Umfang als der Current portion of long-term debt zum 30.6.2021 mit ~USD163M ausgewiesen:

...

=> für mich heißt das eben wie oben gesagt: M&A droht hier mMn, im Guten, wie im Schlechten

Q2 2021

Zitat von faultcode: Achtung! M&A droht hier mMn, im Guten, wie im Schlechten:

...

so sieht es mit den Aussagen zum Q2 aus: https://www.pretivm.com/investors/financials/default.aspx

<ein längeres Posting, meistens auf der Basis von: MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020>

...

...

___

PVG hat nun E&E rückwirkend buchhalterisch den allgemeineren Gepflogenheiten angepasst --> mMn: mehr Gewinn, geschrumpfte Bilanz (ganz grob):

Change in accounting policy – E&E expenditures (E&E = exploration and evaluation)

We adopted a voluntary change in our accounting policy for E&E expenditures, effective January 1, 2021 applying the change fully retrospectively.

As a result, balances of comparative periods have been restated. Under the new policy, we recognize these expenditures as E&E costs in the statement of earnings in the period incurred until management concludes the technical feasibility and commercial viability of a mineral deposit has been established. Costs that represent the acquisition of rights to explore a mineral deposit continue to be capitalized. Prior to January 1, 2021, our policy was to capitalize E&E expenditures as E&E assets.

Management believes this change in accounting policy results in a more relevant and reliable policy as it is better aligned with IFRS conceptual framework with respect to the definition of an asset and more consistent with our peer group.

...

=>

...

...

...

___

Anfang August wurde dieser Teil des Long-term debt refinanziert...

....und das in erhöhtem Umfang als der Current portion of long-term debt zum 30.6.2021 mit ~USD163M ausgewiesen:

...

=> für mich heißt das eben wie oben gesagt: M&A droht hier mMn, im Guten, wie im Schlechten

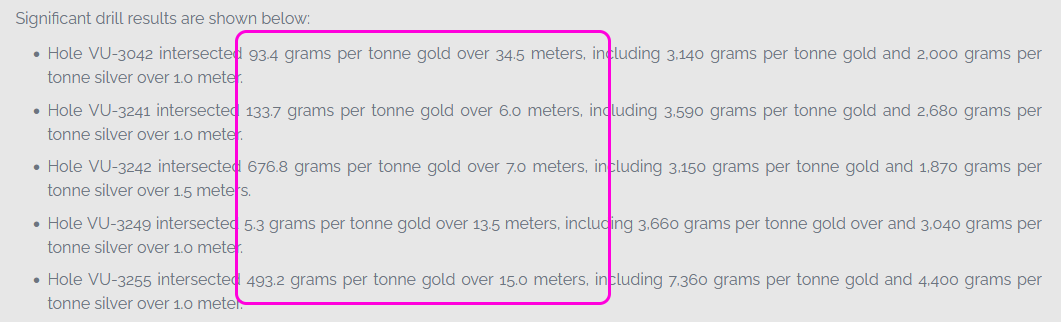

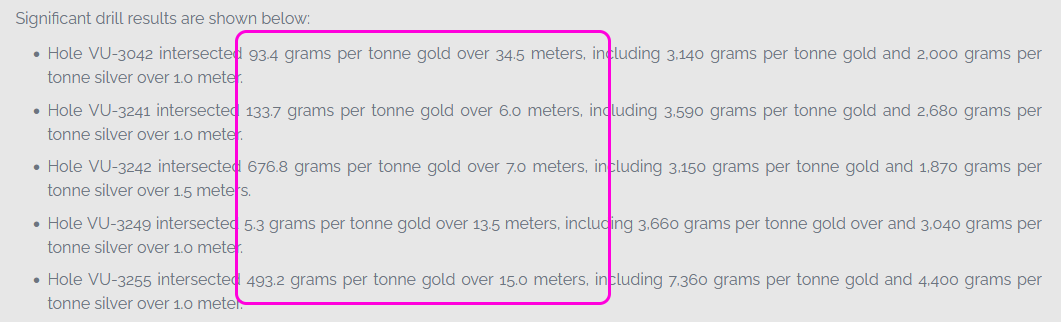

13.9.

Resource Expansion Drilling Continues to Intersect High-Grade Gold Mineralization in the North Block Zone

https://www.pretivm.com/news/news-release-details/2021/Resou…

...

...

“These new drill results from the North Block zone increase our confidence in the continuity of high-grade gold mineralization to the north of the Valley of the Kings deposit.

An updated Mineral Resource estimate is expected to be released in the first half of next year and it will include the North Block zone,” said Jacques Perron, President and Chief Executive Officer of Pretivm.

“Phase 4 of the North Block drilling program is currently underway to test the potential to the west of the first three phases of drilling.”

...

Resource Expansion Drilling Continues to Intersect High-Grade Gold Mineralization in the North Block Zone

https://www.pretivm.com/news/news-release-details/2021/Resou…

...

...

“These new drill results from the North Block zone increase our confidence in the continuity of high-grade gold mineralization to the north of the Valley of the Kings deposit.

An updated Mineral Resource estimate is expected to be released in the first half of next year and it will include the North Block zone,” said Jacques Perron, President and Chief Executive Officer of Pretivm.

“Phase 4 of the North Block drilling program is currently underway to test the potential to the west of the first three phases of drilling.”

...

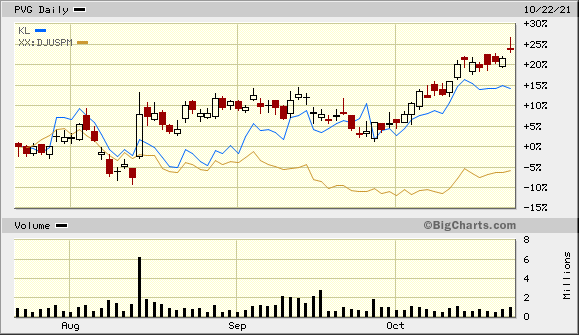

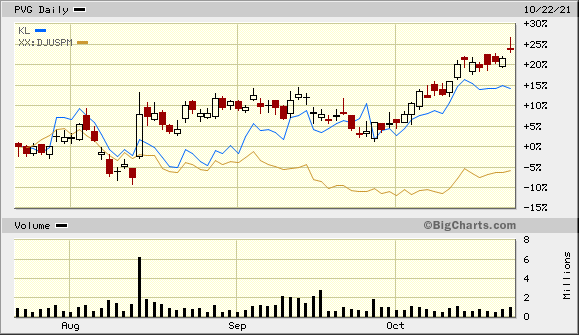

Hmmmm:

nicht mal Kirkland ist zuletzt so stark gestiegen. Gut, bei denen ist die Luft mittlerweise raus.

nicht mal Kirkland ist zuletzt so stark gestiegen. Gut, bei denen ist die Luft mittlerweise raus.

Antwort auf Beitrag Nr.: 69.680.550 von faultcode am 23.10.21 00:19:29Die Expansion Drillings in der North Block Zone waren ja auch sensatinell gut (500g/t über 7 Meter; 678g/t über 7 Meter; 94g/t über 34 Meter), hast du ja schon gepostet, so kommen wir aus eigener Kraft (ohne Zukäufe oder Übernahmen) zu einer Ausweitung der Resource trotz Produktion (increasing Mineral Resources post mine depletion)

= längere LOM und/oder höhere Produktion;

Das stützt den Kurs!

Jetzt müsste nur noch die Inflation weiter anziehen und die Zinsen weiter niedrig bleiben...!

= längere LOM und/oder höhere Produktion;

Das stützt den Kurs!

Jetzt müsste nur noch die Inflation weiter anziehen und die Zinsen weiter niedrig bleiben...!

Antwort auf Beitrag Nr.: 69.680.613 von Dirkix am 23.10.21 00:51:43es waren 500g/t über 15 Meter nicht 7 Meter!

Den Markt freut es, +7 Prozent auf 15,00 CAD

New High-Grade Gold Exploration Discovery at the Golden Marmot Zone Affirms the District-Scale Potential of Brucejack

VANCOUVER, British Columbia, Oct. 25, 2021 (GLOBE NEWSWIRE) -- Pretium Resources Inc. (TSX/NYSE: PVG) today announced a new high-grade gold exploration discovery at the Golden Marmot Zone on its Brucejack Property in Northern British Columbia. The Golden Marmot Zone is located 3.5 kilometers north of the Valley of the Kings deposit.

To date, assays have been received for the first nine drill holes of which eight drill holes intersected gold. A highlight was drill hole SU-786, which intersected four bands of high-grade gold mineralization over 53.5 meters with 72.5 g/t Gold, including 6,700 g/t Gold Over 0.5 Meters.

Selected highlights include:

- SU-786 intersected 72.5 grams per tonne gold over 53.5 meters, including 6,700 grams per tonne gold and 3,990 grams per tonne silver over 0.5 meters and including 787 grams per tonne gold over 0.5 meters.

- SU-778 intersected 46.1 grams per tonne gold over 5.8 meters, including 208 grams per tonne gold over 1.0 meter.

- SU-772 intersected 22.8 grams per tonne gold over 38.0 meters, including 268 grams per tonne gold over 1.0 meter and including 188.4 grams per tonne gold over 2.13 meters.

https://ml.globenewswire.com/Resource/Download/749bcf27-7b97…

New High-Grade Gold Exploration Discovery at the Golden Marmot Zone Affirms the District-Scale Potential of Brucejack

VANCOUVER, British Columbia, Oct. 25, 2021 (GLOBE NEWSWIRE) -- Pretium Resources Inc. (TSX/NYSE: PVG) today announced a new high-grade gold exploration discovery at the Golden Marmot Zone on its Brucejack Property in Northern British Columbia. The Golden Marmot Zone is located 3.5 kilometers north of the Valley of the Kings deposit.

To date, assays have been received for the first nine drill holes of which eight drill holes intersected gold. A highlight was drill hole SU-786, which intersected four bands of high-grade gold mineralization over 53.5 meters with 72.5 g/t Gold, including 6,700 g/t Gold Over 0.5 Meters.

Selected highlights include:

- SU-786 intersected 72.5 grams per tonne gold over 53.5 meters, including 6,700 grams per tonne gold and 3,990 grams per tonne silver over 0.5 meters and including 787 grams per tonne gold over 0.5 meters.

- SU-778 intersected 46.1 grams per tonne gold over 5.8 meters, including 208 grams per tonne gold over 1.0 meter.

- SU-772 intersected 22.8 grams per tonne gold over 38.0 meters, including 268 grams per tonne gold over 1.0 meter and including 188.4 grams per tonne gold over 2.13 meters.

https://ml.globenewswire.com/Resource/Download/749bcf27-7b97…

Antwort auf Beitrag Nr.: 69.680.550 von faultcode am 23.10.21 00:19:29

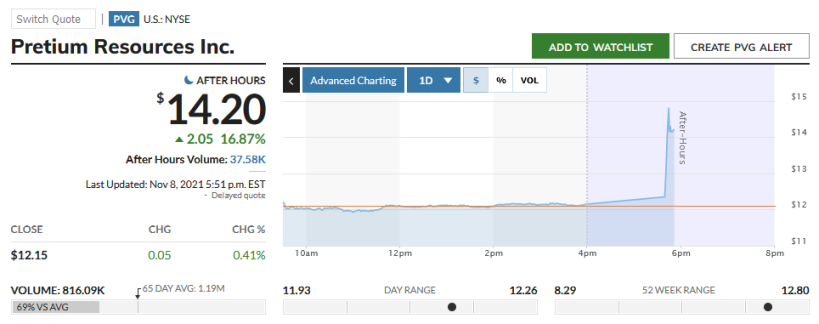

M&A --- wie bei KL vor Kurzem:

Newcrest to Acquire Pretivm for C$18.50 in Cash and Shares

Nov 8. 2021

• Premium of 23% to the closing price and 29% to the 20-day volume-weighted-average price, respectively, on November 8, 2021 for Pretivm shareholders

• Option to select cash or Newcrest shares, subject to proration

• Opportunity to retain exposure to Brucejack, while gaining exposure to Newcrest’s diversified portfolio of high-quality, long life, tier one assets

• Newcrest is a respected partner of the First Nations in northwest British Columbia

• Newcrest intends to pursue growth with continued investment in Brucejack

• Offer unanimously recommended by Pretivm’s Board of Directors

• Investor conference call at 3:30 pm PT (6:30 pm ET) November 8, 2021

...

https://www.pretivm.com/news/news-release-details/2021/Newcr…

Zitat von faultcode: ...

nicht mal Kirkland ist zuletzt so stark gestiegen. Gut, bei denen ist die Luft mittlerweise raus.

M&A --- wie bei KL vor Kurzem:

Newcrest to Acquire Pretivm for C$18.50 in Cash and Shares

Nov 8. 2021

• Premium of 23% to the closing price and 29% to the 20-day volume-weighted-average price, respectively, on November 8, 2021 for Pretivm shareholders

• Option to select cash or Newcrest shares, subject to proration

• Opportunity to retain exposure to Brucejack, while gaining exposure to Newcrest’s diversified portfolio of high-quality, long life, tier one assets

• Newcrest is a respected partner of the First Nations in northwest British Columbia

• Newcrest intends to pursue growth with continued investment in Brucejack

• Offer unanimously recommended by Pretivm’s Board of Directors

• Investor conference call at 3:30 pm PT (6:30 pm ET) November 8, 2021

...

https://www.pretivm.com/news/news-release-details/2021/Newcr…

Antwort auf Beitrag Nr.: 69.851.624 von faultcode am 08.11.21 23:52:43Wirklich Schade!!!

Ich hätte meine Pretium lieber noch viiiiiiiiel länger gehalten, die waren finanziell (dept free) und von den Assets (klasse neue drill results!) her super aufgestellt! Brucejack war gerade jetzt auf dem Weg zur Gelddruckmaschine!

Ich hätte meine Pretium lieber noch viiiiiiiiel länger gehalten, die waren finanziell (dept free) und von den Assets (klasse neue drill results!) her super aufgestellt! Brucejack war gerade jetzt auf dem Weg zur Gelddruckmaschine!

Handeln gerade in D mit 11,88 Euro weit unter pari von 18,50 CAD = 12,93 Euro - macht fast einen Euro Gewinn je Aktie...!

Ist zwar leider nicht mehr relevant...!

Pretivm Records Solid Third Quarter 2021

VANCOUVER, British Columbia, Nov. 11, 2021 GLOBE NEWSWIRE

Pretium Resources Inc. (TSX/NYSE:PVG) announces operating and financial results for the third quarter 2021.

All amounts are expressed in thousands of US dollars unless otherwise noted. This release should be read in conjunction with the Company’s Financial Statements and Management’s Discussion and Analysis (“MD&A”) for the three and nine months ended September 30, 2021 and 2020, available on the Company’s website and on SEDAR and EDGAR.

Third Quarter 2021 Highlights

Our first priority is the health and safety of our employees, contractors and neighbouring communities in northwest British Columbia (“BC”). As of September 19, 2021, direct Pretivm employees achieved one year of work with no lost-time injuries, which is equivalent to approximately 1.75 million hours. This is a significant achievement in our commitment to Health and Safety. Additionally, our employees and contractors worked over 780,000 hours with no lost-time injuries during the third quarter of 2021.

Newcrest Mining Limited (“Newcrest”) is to acquire Pretivm for C$18.50 in cash or shares, subject to proration (see news release dated November 8, 2021). The acquisition will require the approval of Pretivm shareholders and is subject to regulatory approvals. The acquisition is expected to be completed in the first quarter of 2022. Pretivm’s Board of Directors have determined the acquisition is in the best interest of the Company and unanimously recommend that shareholders vote in favour of the acquisition.

Production was 90,673 ounces of gold in the third quarter of 2021, compared with 86,136 ounces in the third quarter of 2020. Higher production reflects the increased tonnes milled in the period and the reduction in gold remaining in-circuit from 7,718 ounces at June 30, 2021 to 1,677 ounces at September 30, 2021, partially offset by lower head grade.

Revenue of $146.8 million from the sale of 81,626 ounces of gold. Revenue in the third quarter 2021 represents a 5.2% decrease from the third quarter of 2020 driven primarily by a 7.0% decrease in the average realized price of gold to $1,799 per ounce, partially offset by a 0.7% increase in gold ounces sold. Gold sold in the quarter was lower than production due to mining of higher grade stopes at the end of the quarter and timing of gold sales.

Another profitable quarter, with $0.12 in net earnings per share and $0.13 in adjusted earnings per share ( 1 , 2 ) . Net earnings were $22.0 million and adjusted earnings(1,2) were $24.3 million for the quarter, compared to net earnings of $31.2 million and adjusted earnings(1,2) of $32.0 million in the third quarter of 2020. The decrease in net earnings was primarily due to lower realized gold prices and higher production costs as well as higher relative deferred income tax expenses, partially offset by decreases in corporate and administrative, exploration and evaluation and interest and finance expenses.

EBITDA (1) of $67.0 million and free cash flow (1) of $23.6 million. EBITDA(1) and free cash flow(1) in the third quarter 2021 decreased compared to the third quarter 2020 ($77.9 million and $66.8 million, respectively) due to substantial investment in expansion capital expenditures over the summer construction period at the Brucejack Mine, lower revenues and higher production costs reflecting higher levels of throughput and increased drilling.

AISC (1) of $1,071 per ounce of gold sold is within annual guidance. AISC(1) in the third quarter 2021 was higher than AISC(1) of $1,016 per ounce of gold sold in the third quarter of 2020 due to the strengthening Canadian dollar and higher production costs.

We remain on track to achieve our 2021 guidance of 325,000 to 365,000 ounces of gold produced at an AISC (1) between $1,060 and $1,190 per ounce of gold sold with $40.0 - $45.0 million of sustaining capital expenditures and $65.0 - $75.0 million of expansion capital expenditures.

Cash and cash equivalents increased to $213.4 million as at September 30, 2021 from $174.8 million as at December 31, 2020 and included the repayment of $5.9 million in debt in the quarter. As at September 30, 2021, we had long term debt of $189.8 million and available liquidity of $461.8 million including cash and cash equivalents and the undrawn revolving portion of our Amended Loan Facility.

On August 9, 2021, we completed a refinancing of our Loan Facility. The amended Loan Facility (the “Amended Loan Facility”) consists of a $100.0 million amortizing, non-revolving term credit facility, (the “Term Facility”) and a $250.0 million revolving credit facility (the “Revolving Facility”), further increasing our liquidity as well as reducing our quarterly repayments under the Term Facility.

Pretivm Records Solid Third Quarter 2021

VANCOUVER, British Columbia, Nov. 11, 2021 GLOBE NEWSWIRE

Pretium Resources Inc. (TSX/NYSE:PVG) announces operating and financial results for the third quarter 2021.

All amounts are expressed in thousands of US dollars unless otherwise noted. This release should be read in conjunction with the Company’s Financial Statements and Management’s Discussion and Analysis (“MD&A”) for the three and nine months ended September 30, 2021 and 2020, available on the Company’s website and on SEDAR and EDGAR.

Third Quarter 2021 Highlights

Our first priority is the health and safety of our employees, contractors and neighbouring communities in northwest British Columbia (“BC”). As of September 19, 2021, direct Pretivm employees achieved one year of work with no lost-time injuries, which is equivalent to approximately 1.75 million hours. This is a significant achievement in our commitment to Health and Safety. Additionally, our employees and contractors worked over 780,000 hours with no lost-time injuries during the third quarter of 2021.

Newcrest Mining Limited (“Newcrest”) is to acquire Pretivm for C$18.50 in cash or shares, subject to proration (see news release dated November 8, 2021). The acquisition will require the approval of Pretivm shareholders and is subject to regulatory approvals. The acquisition is expected to be completed in the first quarter of 2022. Pretivm’s Board of Directors have determined the acquisition is in the best interest of the Company and unanimously recommend that shareholders vote in favour of the acquisition.

Production was 90,673 ounces of gold in the third quarter of 2021, compared with 86,136 ounces in the third quarter of 2020. Higher production reflects the increased tonnes milled in the period and the reduction in gold remaining in-circuit from 7,718 ounces at June 30, 2021 to 1,677 ounces at September 30, 2021, partially offset by lower head grade.

Revenue of $146.8 million from the sale of 81,626 ounces of gold. Revenue in the third quarter 2021 represents a 5.2% decrease from the third quarter of 2020 driven primarily by a 7.0% decrease in the average realized price of gold to $1,799 per ounce, partially offset by a 0.7% increase in gold ounces sold. Gold sold in the quarter was lower than production due to mining of higher grade stopes at the end of the quarter and timing of gold sales.

Another profitable quarter, with $0.12 in net earnings per share and $0.13 in adjusted earnings per share ( 1 , 2 ) . Net earnings were $22.0 million and adjusted earnings(1,2) were $24.3 million for the quarter, compared to net earnings of $31.2 million and adjusted earnings(1,2) of $32.0 million in the third quarter of 2020. The decrease in net earnings was primarily due to lower realized gold prices and higher production costs as well as higher relative deferred income tax expenses, partially offset by decreases in corporate and administrative, exploration and evaluation and interest and finance expenses.

EBITDA (1) of $67.0 million and free cash flow (1) of $23.6 million. EBITDA(1) and free cash flow(1) in the third quarter 2021 decreased compared to the third quarter 2020 ($77.9 million and $66.8 million, respectively) due to substantial investment in expansion capital expenditures over the summer construction period at the Brucejack Mine, lower revenues and higher production costs reflecting higher levels of throughput and increased drilling.

AISC (1) of $1,071 per ounce of gold sold is within annual guidance. AISC(1) in the third quarter 2021 was higher than AISC(1) of $1,016 per ounce of gold sold in the third quarter of 2020 due to the strengthening Canadian dollar and higher production costs.

We remain on track to achieve our 2021 guidance of 325,000 to 365,000 ounces of gold produced at an AISC (1) between $1,060 and $1,190 per ounce of gold sold with $40.0 - $45.0 million of sustaining capital expenditures and $65.0 - $75.0 million of expansion capital expenditures.

Cash and cash equivalents increased to $213.4 million as at September 30, 2021 from $174.8 million as at December 31, 2020 and included the repayment of $5.9 million in debt in the quarter. As at September 30, 2021, we had long term debt of $189.8 million and available liquidity of $461.8 million including cash and cash equivalents and the undrawn revolving portion of our Amended Loan Facility.

On August 9, 2021, we completed a refinancing of our Loan Facility. The amended Loan Facility (the “Amended Loan Facility”) consists of a $100.0 million amortizing, non-revolving term credit facility, (the “Term Facility”) and a $250.0 million revolving credit facility (the “Revolving Facility”), further increasing our liquidity as well as reducing our quarterly repayments under the Term Facility.

Ich werde die Übernahme nicht abwarten, ich habe jetzt für die Hälfte meines Bestandes eine Sell Order mit Limit 18,50 CAD gestellt. Den Rest lasse ich erstmal stehen bis in die Woche vor Weihnachten, dann verkaufe ich die auch an der Börse.

Auch wenn die Wahrscheinlichkeit für ein weiteres oder ein nachgebessertes Angebot sehr gering ist, so wahre ich mir somit immerhin noch die Chance darauf...!

Auch wenn die Wahrscheinlichkeit für ein weiteres oder ein nachgebessertes Angebot sehr gering ist, so wahre ich mir somit immerhin noch die Chance darauf...!

Newcrest Mining has now completed the acquisition of Pretium Resources.

The pretivm.com website will no longer operate as of the end of the day on March 14th, 2022.

Das war's!!!

The pretivm.com website will no longer operate as of the end of the day on March 14th, 2022.

Das war's!!!

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +3,09 | |

| +1,67 | |

| +2,42 | |

| +1,77 | |

| 0,00 | |

| +2,06 | |

| +1,44 | |

| +2,23 | |

| +1,97 | |

| +0,53 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 240 | ||

| 107 | ||

| 82 | ||

| 78 | ||

| 75 | ||

| 53 | ||

| 41 | ||

| 38 | ||

| 36 | ||

| 34 |