(DND.TO) Mkap 24 M$/ FDA-Entscheidung für 3.Produkt am 29.Mai =1000% - 500 Beiträge pro Seite

eröffnet am 22.01.12 18:42:42 von

neuester Beitrag 26.09.15 16:20:48 von

neuester Beitrag 26.09.15 16:20:48 von

Beiträge: 26

ID: 1.171.832

ID: 1.171.832

Aufrufe heute: 2

Gesamt: 4.262

Gesamt: 4.262

Aktive User: 0

ISIN: CA17253X1050 · WKN: A0B85L · Symbol: CPH

8,5100

CAD

-3,41 %

-0,3000 CAD

Letzter Kurs 24.04.24 Toronto

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0000 | +25,00 | |

| 9,2900 | +20,96 | |

| 111,75 | +18,87 | |

| 0,6400 | +18,52 | |

| 1,0900 | +14,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5058 | -12,79 | |

| 0,8410 | -17,06 | |

| 9,7200 | -19,60 | |

| 2,7280 | -29,14 | |

| 14,510 | -32,32 |

Glaubt mir ich bin der letzte der die zahl 1000% in den mund nimmt aber hier ist es absolut begründet zumal die Aktie gerade mal eine Marktkap von 24 million $ hat .

Ich werde versuchen euch zu erklären warum diese Aktie eine pure Goldmine ist auch wenn mein deutsch nicht sehr gut ist.Los gehts..

Cipher hat bereits 2 Produkte (Einmaltäglich tramadol und Cholesterinsenker) am Markt .

Lipofen (cholesterinsenker) ist seit dem 4Q 2007 in USA & Kanada erhältlich , Conzip (Einmaltäglich Tramadol) ist erst seit 3Q 2011 in USA erhältlich und in diesem Quartal folgt Kanada .

Am 29.Mai kommt falls die FDA mitspielt der endgültige game changer und BEST IN CLASS kandidat Cip-isotretinoin (starke Akne) auf dem Markt .Der Jahresumsatz für Cip isotretinoin wird auf ca 200 M Dollar geschätzt . Mit Ranbaxy hat Cipher hier einen super Partner für Cip-Isotretinoin .SOWEIT SO GUT

Manche würden villeicht jetzt sagen 200 M wäre nicht soviel ABER man darf nicht vergessen das Cipher eine Burn-rate von gerade mal 1 M$ pro Jahr hat tendenz fallend da Cipher alle studien abgeschlossen hat .

Das beste an der geschichte ist das wir vermutlich schon sehr bald auch ohne den game changer die profitabilität erreichen werden dank Lipofen und Conzip das gerade erst seit kurzem in USA und in diesem Quartal auch in Kanada erhältlich sein wird .

Cipher hat schon bereits 10,3 M$ cash dazu kommen noch 9 M$ milestones für FDA zulassung und 15% royalties von Ranbaxy .

Cipher wird gerade gehandelt als wäre es eine Pleitekandidat aber das liegt nur daran das die Aktie so gut wie unbekannt ist .Ich kann euch versichern das das Management sein bestes tut um aus diesem Unternehmen eine Cash Cow zu machen hab schon einigemale mit denen gemailt .

aber das liegt nur daran das die Aktie so gut wie unbekannt ist .Ich kann euch versichern das das Management sein bestes tut um aus diesem Unternehmen eine Cash Cow zu machen hab schon einigemale mit denen gemailt .

Also fassen wir zusammen :

Cipher ist so gut wie sicher Profitabel auch ohne Cip-Isotretinoin , Cipher wird nie wieder geld brauchen ,Cipher hat eine sehr geringe float was für heftige kurssprünge sorgt ,Management hält 75% der außenstehenden Aktien ,Gute Zulassungs chancen für Cip isotretinoin .

Ich hoffe das ich euch das MONSTER POTENTIAL die diese Aktie birgt rüberbringen . Übrigens 1000% würden gerade mal dafür sorgen das die Marktkap auf 240 M steigt was nicht gerade viel ist .

Das Potential ist einfach nur gigantisch während das downside risiko sehr sehr begrenzt ist .

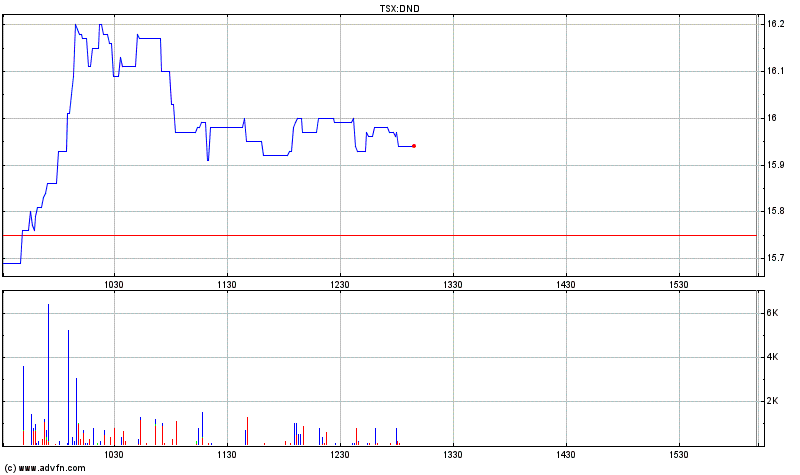

Cipher Pharma (DND.TO)

Marktkap: 24,2 M$

Cash: 10,3 M$

Kurs: 1 $

SCHULDENFREI

Shares Out: 24.2 M <<< ca. 16 M aktien sind im besitz von Management und Institutionen

Pipeline:

http://cipherpharma.com/pipeline.html

Insiderkäufe:

http://canadianinsider.com/node/7?menu_tickersearch=dnd

Initiating Coverage of Cipher Pharma

Jason Napodano, CFA

We are initiating coverage of Cipher Pharmaceuticals Inc. (DND.TO, T.DND) with an ‘Outperform’ rating and $2.25 price target, or a market capitalization of $50 million. Cipher currently trades with a market capitalization of only $16 million. We believe the story is largely de-risked and under-appreciated by the Street. Cipher currently has two revenue streams in place with royalties and milestones on sales of Lipofen (CIP-fenofibrate) at Kowa Pharma in the U.S. and the recently launched ConZip (CIP-tramadol-ER) at Vertical Pharma in the U.S. We expect a third royalty and milestone stream from the launch of Durela (CIP-tramadol-ER) at Medical Futures within the next few months.

We have established what we believe to be conservative forecasts for these revenue streams going forward to patent expiration on each product, Lipofen (Q1-2015) and ConZip/Durela (2022). We remind investors that Cipher has little to no ongoing costs associated with either product. Therefore, the best way to value these revenue streams is through the net present value (NYSE:NPV - News) of the cash flows using a 20% discount rate. We believe royalties and milestones on Lipofen are worth approximately $7 million in value. Royalties and milestones on ConZip / Durela are worth another $8 million in value. Finally, we forecast that Cipher will exit 2011 with approximately $9 million in cash and equivalents.

…CIP-Isotretinoin Offers Big Upside…

Based on our model, the stock is currently trading below the net present value of the cash flows from Lipofen and ConZip / Durela, plus the cash on hand. That means investors can purchase the stock today and get the CIP-Isotretinoin product, a potential $200 million opportunity in the U.S., for free. Cipher has licenses the rights to CIP-Isotretinoin to Ranbaxy, a major player in the generic Isotretinoin market with branded Sotret. Sotret posted U.S. sales over $120 million in 2008 prior to the FDA mandating a recall on the product due to quality control / GMP issues at the company’s plant in India. We believe that Cipher’s CIP-Isotretinoin, with its superior absorption and bioavailability characteristics will move into the primary detail position for Ranbaxy’s efforts around Isotretinoin.

Cipher is entitled to receive a mid-teens royalty on sales of CIP-Isotretinoin at Ranbaxy, along with the potential for $19 million in milestones ($9 million upon approval and two $5 million cumulative sales related) with roughly 50% economics to Cipher after it pays the sub-royalty to Galephar.

Cipher becomes a different company with CIP-Isotretinoin on the market in the U.S. By 2016, the royalties on CIP-Isotretinoin alone will account for greater than 80% of the top-line.

We also remind investors that Cipher has filed an application for approval with Health Canada. We estimate the Canadian opportunity with CIP-Isotretinoin is around $10 million, and we expect that Cipher will seek to commercialize the drug on its own through the formation of a small internal sales force of 6 to 8 representatives. We assume Canadian approval in mid-2013.

…Keep Risks In Mind…

Approval of CIP-Isotretinoin is paramount to our investment thesis. The application is not without risks however. The U.S. FDA has rejected Cipher’s NDA on CIP-Isotretinoin twice in the past five years. The second letter called for Cipher to conduct a phase 3 safety trial, which Cipher completed and presented data on in June 2011.

Of the 925 patients who enrolled in the study, 813 patients completed the 20-week trial. The safety data revealed no overall statistical differences in the adverse event profile or the pharmacokinetics between CIP-Isotretinoin and a commercially available generic Isotretinoin product. Unfortunately, the efficacy component offers mixed results. The efficacy component of the study had two co-primary endpoints: 1) the total change in lesion counts between baseline and at the end of week 20; and 2) the total number of subjects that had at least a 90% clearing at the end of 20 weeks of treatment. These two co-primary endpoints were analyzed using the per-protocol population (:PP) as well as the intent-to-treat population (NYSE:ITT - News) last observation carry forward (:LOCF).

In the PP analysis, both co-primary endpoints met the non-inferiority margins established for the study. In the LOCF analysis of the ITT population, the first primary endpoint (total change in lesion count) was achieved while the second endpoint (at least 90% clearing) fell narrowly (less than 0.5%) outside the non-inferiority margin target. However, we do not believe this will be an issue to hold up approval in the U.S. We think the FDA was far more interested in the safety analysis from the trial. The trial was set up as a safety and PK analysis. The FDA has traditionally approved reformulations in the past on PK / bioavailability data alone. Cipher went above and beyond a traditional reformulation application by conducting the extensive safety analysis requested by the agency. However, a missed endpoint presents risk, and this is the single biggest risk to owning the stock ahead of the May 29, 2012 U.S. FDA PDUFA action date.

DCF Model Shows Fair-Value at $2.25

We have conducted a discounted cash flow ( CF) analysis to value the shares of Cipher Pharmaceuticals Inc. Above we note that our NPV / Sum-of-Parts analysis for the cash flow from Lipofen and ConZip / Durela alone shows a market value of $23.8 million. However, this is just to give investors a sense of the downside to the Cipher story. At today’s value, the stock is trading on the present value of these cash flows. We see little downside in the stock price as long as Lipofen and ConZip / Durela meet our forecasts.

CF) analysis to value the shares of Cipher Pharmaceuticals Inc. Above we note that our NPV / Sum-of-Parts analysis for the cash flow from Lipofen and ConZip / Durela alone shows a market value of $23.8 million. However, this is just to give investors a sense of the downside to the Cipher story. At today’s value, the stock is trading on the present value of these cash flows. We see little downside in the stock price as long as Lipofen and ConZip / Durela meet our forecasts.

Upside comes with the approval of CIP-Isotretinoin. Cipher will receive a net $4.5 million cash payment from Ranbaxy if the U.S. FDA approves CIP-Isotretinoin. Our model (posted below) shows that operating cash flow should turn positive immediately after the approval of CIP-Isotretinoin. That means that by the end of 2012, Cipher could be collecting revenues from three approved products in the U.S., with a growing cash balance of over $10 million in the bank, and generating positive cash flow. We think that this presents the clear opportunity to in-licenses yet another 505(b)(2)-like product for late-stage development and commercialization in 2013. We would be buyers of Cipher’s stock today, ahead of what we see as a transformational 2012 coming with the potential approval of CIP-Isotretinoin. Our rating is ‘Outperform’.

Ich werde versuchen euch zu erklären warum diese Aktie eine pure Goldmine ist auch wenn mein deutsch nicht sehr gut ist.Los gehts..

Cipher hat bereits 2 Produkte (Einmaltäglich tramadol und Cholesterinsenker) am Markt .

Lipofen (cholesterinsenker) ist seit dem 4Q 2007 in USA & Kanada erhältlich , Conzip (Einmaltäglich Tramadol) ist erst seit 3Q 2011 in USA erhältlich und in diesem Quartal folgt Kanada .

Am 29.Mai kommt falls die FDA mitspielt der endgültige game changer und BEST IN CLASS kandidat Cip-isotretinoin (starke Akne) auf dem Markt .Der Jahresumsatz für Cip isotretinoin wird auf ca 200 M Dollar geschätzt . Mit Ranbaxy hat Cipher hier einen super Partner für Cip-Isotretinoin .SOWEIT SO GUT

Manche würden villeicht jetzt sagen 200 M wäre nicht soviel ABER man darf nicht vergessen das Cipher eine Burn-rate von gerade mal 1 M$ pro Jahr hat tendenz fallend da Cipher alle studien abgeschlossen hat .

Das beste an der geschichte ist das wir vermutlich schon sehr bald auch ohne den game changer die profitabilität erreichen werden dank Lipofen und Conzip das gerade erst seit kurzem in USA und in diesem Quartal auch in Kanada erhältlich sein wird .

Cipher hat schon bereits 10,3 M$ cash dazu kommen noch 9 M$ milestones für FDA zulassung und 15% royalties von Ranbaxy .

Cipher wird gerade gehandelt als wäre es eine Pleitekandidat

aber das liegt nur daran das die Aktie so gut wie unbekannt ist .Ich kann euch versichern das das Management sein bestes tut um aus diesem Unternehmen eine Cash Cow zu machen hab schon einigemale mit denen gemailt .

aber das liegt nur daran das die Aktie so gut wie unbekannt ist .Ich kann euch versichern das das Management sein bestes tut um aus diesem Unternehmen eine Cash Cow zu machen hab schon einigemale mit denen gemailt .Also fassen wir zusammen :

Cipher ist so gut wie sicher Profitabel auch ohne Cip-Isotretinoin , Cipher wird nie wieder geld brauchen ,Cipher hat eine sehr geringe float was für heftige kurssprünge sorgt ,Management hält 75% der außenstehenden Aktien ,Gute Zulassungs chancen für Cip isotretinoin .

Ich hoffe das ich euch das MONSTER POTENTIAL die diese Aktie birgt rüberbringen . Übrigens 1000% würden gerade mal dafür sorgen das die Marktkap auf 240 M steigt was nicht gerade viel ist .

Das Potential ist einfach nur gigantisch während das downside risiko sehr sehr begrenzt ist .

Cipher Pharma (DND.TO)

Marktkap: 24,2 M$

Cash: 10,3 M$

Kurs: 1 $

SCHULDENFREI

Shares Out: 24.2 M <<< ca. 16 M aktien sind im besitz von Management und Institutionen

Pipeline:

http://cipherpharma.com/pipeline.html

Insiderkäufe:

http://canadianinsider.com/node/7?menu_tickersearch=dnd

Initiating Coverage of Cipher Pharma

Jason Napodano, CFA

We are initiating coverage of Cipher Pharmaceuticals Inc. (DND.TO, T.DND) with an ‘Outperform’ rating and $2.25 price target, or a market capitalization of $50 million. Cipher currently trades with a market capitalization of only $16 million. We believe the story is largely de-risked and under-appreciated by the Street. Cipher currently has two revenue streams in place with royalties and milestones on sales of Lipofen (CIP-fenofibrate) at Kowa Pharma in the U.S. and the recently launched ConZip (CIP-tramadol-ER) at Vertical Pharma in the U.S. We expect a third royalty and milestone stream from the launch of Durela (CIP-tramadol-ER) at Medical Futures within the next few months.

We have established what we believe to be conservative forecasts for these revenue streams going forward to patent expiration on each product, Lipofen (Q1-2015) and ConZip/Durela (2022). We remind investors that Cipher has little to no ongoing costs associated with either product. Therefore, the best way to value these revenue streams is through the net present value (NYSE:NPV - News) of the cash flows using a 20% discount rate. We believe royalties and milestones on Lipofen are worth approximately $7 million in value. Royalties and milestones on ConZip / Durela are worth another $8 million in value. Finally, we forecast that Cipher will exit 2011 with approximately $9 million in cash and equivalents.

…CIP-Isotretinoin Offers Big Upside…

Based on our model, the stock is currently trading below the net present value of the cash flows from Lipofen and ConZip / Durela, plus the cash on hand. That means investors can purchase the stock today and get the CIP-Isotretinoin product, a potential $200 million opportunity in the U.S., for free. Cipher has licenses the rights to CIP-Isotretinoin to Ranbaxy, a major player in the generic Isotretinoin market with branded Sotret. Sotret posted U.S. sales over $120 million in 2008 prior to the FDA mandating a recall on the product due to quality control / GMP issues at the company’s plant in India. We believe that Cipher’s CIP-Isotretinoin, with its superior absorption and bioavailability characteristics will move into the primary detail position for Ranbaxy’s efforts around Isotretinoin.

Cipher is entitled to receive a mid-teens royalty on sales of CIP-Isotretinoin at Ranbaxy, along with the potential for $19 million in milestones ($9 million upon approval and two $5 million cumulative sales related) with roughly 50% economics to Cipher after it pays the sub-royalty to Galephar.

Cipher becomes a different company with CIP-Isotretinoin on the market in the U.S. By 2016, the royalties on CIP-Isotretinoin alone will account for greater than 80% of the top-line.

We also remind investors that Cipher has filed an application for approval with Health Canada. We estimate the Canadian opportunity with CIP-Isotretinoin is around $10 million, and we expect that Cipher will seek to commercialize the drug on its own through the formation of a small internal sales force of 6 to 8 representatives. We assume Canadian approval in mid-2013.

…Keep Risks In Mind…

Approval of CIP-Isotretinoin is paramount to our investment thesis. The application is not without risks however. The U.S. FDA has rejected Cipher’s NDA on CIP-Isotretinoin twice in the past five years. The second letter called for Cipher to conduct a phase 3 safety trial, which Cipher completed and presented data on in June 2011.

Of the 925 patients who enrolled in the study, 813 patients completed the 20-week trial. The safety data revealed no overall statistical differences in the adverse event profile or the pharmacokinetics between CIP-Isotretinoin and a commercially available generic Isotretinoin product. Unfortunately, the efficacy component offers mixed results. The efficacy component of the study had two co-primary endpoints: 1) the total change in lesion counts between baseline and at the end of week 20; and 2) the total number of subjects that had at least a 90% clearing at the end of 20 weeks of treatment. These two co-primary endpoints were analyzed using the per-protocol population (:PP) as well as the intent-to-treat population (NYSE:ITT - News) last observation carry forward (:LOCF).

In the PP analysis, both co-primary endpoints met the non-inferiority margins established for the study. In the LOCF analysis of the ITT population, the first primary endpoint (total change in lesion count) was achieved while the second endpoint (at least 90% clearing) fell narrowly (less than 0.5%) outside the non-inferiority margin target. However, we do not believe this will be an issue to hold up approval in the U.S. We think the FDA was far more interested in the safety analysis from the trial. The trial was set up as a safety and PK analysis. The FDA has traditionally approved reformulations in the past on PK / bioavailability data alone. Cipher went above and beyond a traditional reformulation application by conducting the extensive safety analysis requested by the agency. However, a missed endpoint presents risk, and this is the single biggest risk to owning the stock ahead of the May 29, 2012 U.S. FDA PDUFA action date.

DCF Model Shows Fair-Value at $2.25

We have conducted a discounted cash flow (

CF) analysis to value the shares of Cipher Pharmaceuticals Inc. Above we note that our NPV / Sum-of-Parts analysis for the cash flow from Lipofen and ConZip / Durela alone shows a market value of $23.8 million. However, this is just to give investors a sense of the downside to the Cipher story. At today’s value, the stock is trading on the present value of these cash flows. We see little downside in the stock price as long as Lipofen and ConZip / Durela meet our forecasts.

CF) analysis to value the shares of Cipher Pharmaceuticals Inc. Above we note that our NPV / Sum-of-Parts analysis for the cash flow from Lipofen and ConZip / Durela alone shows a market value of $23.8 million. However, this is just to give investors a sense of the downside to the Cipher story. At today’s value, the stock is trading on the present value of these cash flows. We see little downside in the stock price as long as Lipofen and ConZip / Durela meet our forecasts.Upside comes with the approval of CIP-Isotretinoin. Cipher will receive a net $4.5 million cash payment from Ranbaxy if the U.S. FDA approves CIP-Isotretinoin. Our model (posted below) shows that operating cash flow should turn positive immediately after the approval of CIP-Isotretinoin. That means that by the end of 2012, Cipher could be collecting revenues from three approved products in the U.S., with a growing cash balance of over $10 million in the bank, and generating positive cash flow. We think that this presents the clear opportunity to in-licenses yet another 505(b)(2)-like product for late-stage development and commercialization in 2013. We would be buyers of Cipher’s stock today, ahead of what we see as a transformational 2012 coming with the potential approval of CIP-Isotretinoin. Our rating is ‘Outperform’.

Q3 2011 Summary

Cipher's U.S. marketing partner, Vertical Pharmaceuticals, launched extended-release tramadol (CIP-TRAMADOL ER) under the name ConZip™.

Received Health Canada approval for CIP-TRAMADOL ER.

Completed Canadian distribution and supply agreement for CIP-TRAMADOL ER with Medical Futures Inc.; product to be launched in Q1 2012 under the name Durela™.

Strengthened balance sheet at quarter end with cash of $9.2 million and no debt.

"With Lipofen® generating steady revenue and our tramadol product now being marketed in the U.S. and set for a Canadian launch in early 2012, we have multiple product revenue streams contributing to our performance for the first time," said Larry Andrews , President and CEO of Cipher. "We are also on track to file Health Canada and FDA submissions this quarter for our high-potential acne product, CIP-ISOTRETINOIN, which is expected to trigger a $1 million milestone payment from our U.S. partner. Our balance sheet remains strong, and we believe the combination of increasing product revenues and future milestone payments from our marketing partners positions us well for future growth."

Financial Review

Revenue in Q3 2011 was $1.1 million , similar to Q3 2010. Prior year Q3 results included $0.5 million non-cash revenue from the original up-front licensing payment on Lipofen®, as well as a milestone payment received in 2009, both of which were being recognized over several quarters, ending in 2010. Results for Q3 2011 include $0.5 million of revenue from extended-release tramadol, representing the Company's first revenue from this product. Royalty revenue from Lipofen® increased by approximately $0.1 million in Q3 2011 compared to Q3 2010.

Research and Development ("R&D") expense for Q3 2011 was $0.5 million , an increase of $0.3 million compared to Q3 2010. The year-over-year increase reflects spending on the CIP-ISOTRETINOIN clinical study, which is now completed. The reported R&D for Q3 2011 is net of $0.2 million of reimbursed R&D costs related to the CIP-ISOTRETINOIN Phase III clinical study. The Company does not expect to incur any additional material clinical development costs for CIP-ISOTRETINOIN in the current year.

Operating, General and Administrative ("OG&A") expenses for Q3 2011 were $0.7 million , compared with $0.9 million in Q3 2010. Net loss in Q3 2011 was $0.2 million ( $0.01 per share), the same as in Q3 2010.

The Company's financial position strengthened during the quarter. At September 30, 2011 , Cipher had cash of $9.2 million , compared with $8.6 million at June 30, 2010 and continued to have no debt. The Company expects to receive additional milestone payments in the coming quarters from the distribution and supply agreements in place on its current products.

Product Update

Lipofen®

Lipofen® monthly prescriptions remained steady in Q3 2011 relative to the prior quarter. The product continues to be actively promoted by Cipher's U.S. distribution partner, Kowa.

CIP-ISOTRETINOIN

During Q3 2011, Cipher continued to prepare its revised New Drug Application (NDA) for submission to the FDA in Q4 2011. The FDA review under PDUFA is expected to be six months. A regulatory submission to Health Canada is also planned for Q4 2011.

CIP-TRAMADOL ER (ConZip™/Durela™)

In September 2011 , Cipher's U.S. marketing partner, Vertical Pharmaceuticals, launched ConZip™ with a sales force of approximately 60 representatives initially. In September 2011 , Cipher also received Health Canada approval and, subsequently, completed a distribution and supply agreement under which Cipher has granted Medical Futures the exclusive right to market, sell and distribute CIP-TRAMADOL ER in Canada . Medical Futures plans to launch the product in Q1 2012 under the trade name Durela™. Under the terms of the agreement with Medical Futures, Cipher receives upfront payments totaling CAD$0.3 million with additional payments contingent upon the achievement of certain net sales milestones. In addition, Cipher will receive a double-digit royalty on net sales.

New Products and Out-Licensing Activities

Cipher continues to actively pursue additional product candidates and advance out-licensing discussions for its current products in other territories.

Cipher's U.S. marketing partner, Vertical Pharmaceuticals, launched extended-release tramadol (CIP-TRAMADOL ER) under the name ConZip™.

Received Health Canada approval for CIP-TRAMADOL ER.

Completed Canadian distribution and supply agreement for CIP-TRAMADOL ER with Medical Futures Inc.; product to be launched in Q1 2012 under the name Durela™.

Strengthened balance sheet at quarter end with cash of $9.2 million and no debt.

"With Lipofen® generating steady revenue and our tramadol product now being marketed in the U.S. and set for a Canadian launch in early 2012, we have multiple product revenue streams contributing to our performance for the first time," said Larry Andrews , President and CEO of Cipher. "We are also on track to file Health Canada and FDA submissions this quarter for our high-potential acne product, CIP-ISOTRETINOIN, which is expected to trigger a $1 million milestone payment from our U.S. partner. Our balance sheet remains strong, and we believe the combination of increasing product revenues and future milestone payments from our marketing partners positions us well for future growth."

Financial Review

Revenue in Q3 2011 was $1.1 million , similar to Q3 2010. Prior year Q3 results included $0.5 million non-cash revenue from the original up-front licensing payment on Lipofen®, as well as a milestone payment received in 2009, both of which were being recognized over several quarters, ending in 2010. Results for Q3 2011 include $0.5 million of revenue from extended-release tramadol, representing the Company's first revenue from this product. Royalty revenue from Lipofen® increased by approximately $0.1 million in Q3 2011 compared to Q3 2010.

Research and Development ("R&D") expense for Q3 2011 was $0.5 million , an increase of $0.3 million compared to Q3 2010. The year-over-year increase reflects spending on the CIP-ISOTRETINOIN clinical study, which is now completed. The reported R&D for Q3 2011 is net of $0.2 million of reimbursed R&D costs related to the CIP-ISOTRETINOIN Phase III clinical study. The Company does not expect to incur any additional material clinical development costs for CIP-ISOTRETINOIN in the current year.

Operating, General and Administrative ("OG&A") expenses for Q3 2011 were $0.7 million , compared with $0.9 million in Q3 2010. Net loss in Q3 2011 was $0.2 million ( $0.01 per share), the same as in Q3 2010.

The Company's financial position strengthened during the quarter. At September 30, 2011 , Cipher had cash of $9.2 million , compared with $8.6 million at June 30, 2010 and continued to have no debt. The Company expects to receive additional milestone payments in the coming quarters from the distribution and supply agreements in place on its current products.

Product Update

Lipofen®

Lipofen® monthly prescriptions remained steady in Q3 2011 relative to the prior quarter. The product continues to be actively promoted by Cipher's U.S. distribution partner, Kowa.

CIP-ISOTRETINOIN

During Q3 2011, Cipher continued to prepare its revised New Drug Application (NDA) for submission to the FDA in Q4 2011. The FDA review under PDUFA is expected to be six months. A regulatory submission to Health Canada is also planned for Q4 2011.

CIP-TRAMADOL ER (ConZip™/Durela™)

In September 2011 , Cipher's U.S. marketing partner, Vertical Pharmaceuticals, launched ConZip™ with a sales force of approximately 60 representatives initially. In September 2011 , Cipher also received Health Canada approval and, subsequently, completed a distribution and supply agreement under which Cipher has granted Medical Futures the exclusive right to market, sell and distribute CIP-TRAMADOL ER in Canada . Medical Futures plans to launch the product in Q1 2012 under the trade name Durela™. Under the terms of the agreement with Medical Futures, Cipher receives upfront payments totaling CAD$0.3 million with additional payments contingent upon the achievement of certain net sales milestones. In addition, Cipher will receive a double-digit royalty on net sales.

New Products and Out-Licensing Activities

Cipher continues to actively pursue additional product candidates and advance out-licensing discussions for its current products in other territories.

Lipofen (cholesterinseker)

Erhältlich in Kanada und USA seit 4Q 2007

Einmaltäglich-Tramadol (24h Schmerztablette)Best in Class

In USA als ConZip benannt ist erst seit 3Q 2011 erhältlich

In Kanada als Durela bennant wird in diesem Quartal erhältlich sein

Cip-Isotretinoin (gegen starke Akne) Best in Class

Wird voraussichtlich im 4Q 2012 in USA erhältlich sein und im 1H 2013 folgt Kanada

Cipher hat keine Schulden und seit November auch so gut wie keine R&D kosten das bedeutet Cipher könnte/müsste bei den nächsten Quartalzahlen anfang März profitabel sein .

Außerdem ist Cipher gerade dabei ein late-stage produkt zu akquirieren also auch von dieser seite dürfte es bald gute Nachrichten geben .

Falls es keinen Eurocrash oder ähnliches gibt dann dürfte diese Aktie mit der FDA zulassung meine angegebene 1000% innerhalb von ca 2 jahren erreichen .

Die letzte Presentation ist zwar von September aber trotzdem gut für infos

http://cipherpharma.com/downloads/Rodman%202011%20Presentati…

Erhältlich in Kanada und USA seit 4Q 2007

Einmaltäglich-Tramadol (24h Schmerztablette)Best in Class

In USA als ConZip benannt ist erst seit 3Q 2011 erhältlich

In Kanada als Durela bennant wird in diesem Quartal erhältlich sein

Cip-Isotretinoin (gegen starke Akne) Best in Class

Wird voraussichtlich im 4Q 2012 in USA erhältlich sein und im 1H 2013 folgt Kanada

Cipher hat keine Schulden und seit November auch so gut wie keine R&D kosten das bedeutet Cipher könnte/müsste bei den nächsten Quartalzahlen anfang März profitabel sein .

Außerdem ist Cipher gerade dabei ein late-stage produkt zu akquirieren also auch von dieser seite dürfte es bald gute Nachrichten geben .

Falls es keinen Eurocrash oder ähnliches gibt dann dürfte diese Aktie mit der FDA zulassung meine angegebene 1000% innerhalb von ca 2 jahren erreichen .

Die letzte Presentation ist zwar von September aber trotzdem gut für infos

http://cipherpharma.com/downloads/Rodman%202011%20Presentati…

Der einzige Nachteil bei Cipher ist das die Aktie nicht in USA gelistet ist andererseits würde man diese perle mit sicherheit nicht zu diesen dumpingpreisen bekommen .

Die Kanadier interessieren sich so gut wie gar nicht für Biotechs deshalb sind die so massiv unterbewertet .

Das Management zumindest nutzt jede gelegenheit um aufzustocken und das tun die schon seit etlichen Monaten was natürlich ein sehr gutes zeichen ist .Die meisten Aktien haben die übrigens zu kursen über 1,50 gekauft und noch NIE wurde nicht mal eine einzige Aktie verkauft .

Sobald Cipher die profitabilität und die Zulassung für den game changer Cip-Isotretinoin erhält wird man die Aktie garantiert nicht mehr ignorieren können .

Insiderkäufe

http://www.canadianinsider.com/node/7?menu_tickersearch=DND+…

Die Kanadier interessieren sich so gut wie gar nicht für Biotechs deshalb sind die so massiv unterbewertet .

Das Management zumindest nutzt jede gelegenheit um aufzustocken und das tun die schon seit etlichen Monaten was natürlich ein sehr gutes zeichen ist .Die meisten Aktien haben die übrigens zu kursen über 1,50 gekauft und noch NIE wurde nicht mal eine einzige Aktie verkauft .

Sobald Cipher die profitabilität und die Zulassung für den game changer Cip-Isotretinoin erhält wird man die Aktie garantiert nicht mehr ignorieren können .

Insiderkäufe

http://www.canadianinsider.com/node/7?menu_tickersearch=DND+…

Health Canada akzeptiert Zulassungsantrag ....

Cipher's CIP-ISOTRETINOIN New Drug Submission accepted for review by Health Canada

GroupPress Release: Cipher Pharmaceuticals Inc. – 12 minutes ago

http://finance.yahoo.com/news/Cipher-CIP-ISOTRETINOIN-New-cn…

Toronto Stock Exchange Symbol: DND

MISSISSAUGA, ON, Jan. 30, 2012 /CNW/ - Cipher Pharmaceuticals Inc. (TSX: DND.TO - News) ("Cipher" or "the Company") today announced that its New Drug Submission for CIP-ISOTRETINOIN, a novel, patented formulation of the acne medication isotretinoin, has been accepted for review by Health Canada . The Company expects a response from Health Canada in the first quarter of 2013.

"Health Canada's acceptance moves us a step closer to the commercialization of CIP-ISOTRETINOIN in Canada ," said Larry Andrews , President and CEO of Cipher. "It has been our strategic intent to capitalize on this product's potential in markets beyond the U.S., and we believe there is a meaningful opportunity in Canada ."

Cipher's CIP-ISOTRETINOIN New Drug Submission accepted for review by Health Canada

GroupPress Release: Cipher Pharmaceuticals Inc. – 12 minutes ago

http://finance.yahoo.com/news/Cipher-CIP-ISOTRETINOIN-New-cn…

Toronto Stock Exchange Symbol: DND

MISSISSAUGA, ON, Jan. 30, 2012 /CNW/ - Cipher Pharmaceuticals Inc. (TSX: DND.TO - News) ("Cipher" or "the Company") today announced that its New Drug Submission for CIP-ISOTRETINOIN, a novel, patented formulation of the acne medication isotretinoin, has been accepted for review by Health Canada . The Company expects a response from Health Canada in the first quarter of 2013.

"Health Canada's acceptance moves us a step closer to the commercialization of CIP-ISOTRETINOIN in Canada ," said Larry Andrews , President and CEO of Cipher. "It has been our strategic intent to capitalize on this product's potential in markets beyond the U.S., and we believe there is a meaningful opportunity in Canada ."

Wäre Cipher an der Nasdaq gelistet dann würde die Aktie mit sicherheit 3-5x höher notieren .Ich versuche schon seit tagen weitere Aktien unter 90 cents zu ergattern aber bisher ohne erfolg .

News fürs 1Q 2012 :

Markteinführung von Durela (Einmaltäglich Tramadol) in Kanada

Quartalszahlen anfang März

ZACKS empfehlung wurde nochmal aktualisiert .

DND.TO - Health Canada Accepts CIP-Isotretinoin NDS

01/30/2012

http://zacks.q4web.com/News/Press-Releases/Press-Release-Det…

News fürs 1Q 2012 :

Markteinführung von Durela (Einmaltäglich Tramadol) in Kanada

Quartalszahlen anfang März

ZACKS empfehlung wurde nochmal aktualisiert .

DND.TO - Health Canada Accepts CIP-Isotretinoin NDS

01/30/2012

http://zacks.q4web.com/News/Press-Releases/Press-Release-Det…

15000 st befinden sich im BID bei $1 und nur 2000 st bei 1.05 im ASK .

Deshalb mag ich Low float Aktien nur mit wenig stücken kann man eine Aktie zum fliegen bringen.

Ich bin gerade dabei Cipher etwas bekannter in den foren zu machen .

Deshalb mag ich Low float Aktien nur mit wenig stücken kann man eine Aktie zum fliegen bringen.

Ich bin gerade dabei Cipher etwas bekannter in den foren zu machen .

BID/ASK aktuell : 5000st im BID bei 1.04 und lediglich 500st bei 1.15 im ASK .

Hallo Biohero,

bin schon lange in Cipher Pharma investiert. Es gibt nur wenige Firmen welche so finanziell auf guten Füßen stehen, gleichzeitig bereits 2 Produkte haben und ein dermaßen niedrigen Marktkapital haben. Ich denke es wird, falls das 3. Produkt zugelassen wird, spannend. Möglicherweise gibt es dann Kaufinteressenten.

bin schon lange in Cipher Pharma investiert. Es gibt nur wenige Firmen welche so finanziell auf guten Füßen stehen, gleichzeitig bereits 2 Produkte haben und ein dermaßen niedrigen Marktkapital haben. Ich denke es wird, falls das 3. Produkt zugelassen wird, spannend. Möglicherweise gibt es dann Kaufinteressenten.

Antwort auf Beitrag Nr.: 42.996.826 von Danny767 am 03.04.12 19:01:44Nur noch wenige wochen bis zur FDA Entscheidung ( 29.Mai) für CIP-Isotretinoin . Management kauft schon im vorfeld aktien wie verrückt obwohl die schon rund 15 Million von den 24 Million ausstehenden aktien besitzen allein der CEO hält rund 10 Mil aktien .

http://canadianinsider.com/node/7?menu_tickersearch=dnd

Mar 30/12 Mar 26/12 Claypool, William Direct Ownership Common Shares 10 - Acquisition in the public market 14,700 $1.33

Mar 16/12 Mar 15/12 Claypool, William Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,479 $1.05

Mar 16/12 Mar 15/12 Aigner, Stefan Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,480 $1.05

Mar 16/12 Mar 15/12 Andrews, Larry Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 2,341 $1.05

Mar 16/12 Mar 15/12 Garriock, William Charles Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 1,932 $1.05

Mar 16/12 Mar 15/12 McDole, Gerald P. Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,092 $1.05

Mar 16/12 Mar 15/12 Evans, Norman Charles Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 1,596 $1.05

http://canadianinsider.com/node/7?menu_tickersearch=dnd

Mar 30/12 Mar 26/12 Claypool, William Direct Ownership Common Shares 10 - Acquisition in the public market 14,700 $1.33

Mar 16/12 Mar 15/12 Claypool, William Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,479 $1.05

Mar 16/12 Mar 15/12 Aigner, Stefan Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,480 $1.05

Mar 16/12 Mar 15/12 Andrews, Larry Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 2,341 $1.05

Mar 16/12 Mar 15/12 Garriock, William Charles Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 1,932 $1.05

Mar 16/12 Mar 15/12 McDole, Gerald P. Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 3,092 $1.05

Mar 16/12 Mar 15/12 Evans, Norman Charles Direct Ownership Common Shares 30 - Acquisition under a purchase/ownership plan 1,596 $1.05

Die FDA-Entscheidung findet nächste Woche statt ,sollte cipher die zulassung bekommen dann sollten mindestens 5-7 dollar für dieses jahr noch drin sein und mehr falls sich isotretinoin am markt so entwickelt wie erhofft .

Aktuelle Präsentation

http://cipherpharma.com/Theme/CipherPharma/files/DND%20April…

Aktuelle Präsentation

http://cipherpharma.com/Theme/CipherPharma/files/DND%20April…

Cipher Pharmaceuticals announces FDA approval of CIP-ISOTRETINOIN

Product to be launched as Absorica™

Toronto Stock Exchange Symbol: DND

MISSISSAUGA, ON, May 27, 2012 /PRNewswire/ - Cipher Pharmaceuticals Inc. (TSX: DND; OTC: CPHMF.PK) announced today that the U.S. Food and Drug Administration (FDA) has approved Absorica™, Cipher's novel, patented brand formulation of the acne medication isotretinoin, for the treatment of severe recalcitrant nodular acne. Absorica is expected to be launched in the U.S. in Q4 2012.

"Approval of Absorica represents our third FDA approval and most important milestone to date, reflecting the great work by our Scientific Affairs team at Cipher and our partner, Galephar Pharmaceutical Research," said Larry Andrews, President and CEO of Cipher. "We look forward to working closely with our partner, Ranbaxy Laboratories Inc., in preparation for the upcoming U.S. launch of the product through its dermatology sales force."

"We are thrilled to make Absorica available as a valuable option for the dermatologist and patients who need treatment for severe recalcitrant nodular acne. Absorica is a critical milestone in our commitment to serve the dermatology community and will be the flagship brand for Ranbaxy's specialized dermatology sales force," said Venkat Krishnan, Senior Vice President and Regional Director, Americas.

As a result of the FDA approval of Absorica, Cipher will receive a US$9.0 million milestone from Ranbaxy, approximately US$4.5 million of which will be shared with Galephar. This milestone will be reflected in Cipher's cash balance at the end of Q2 2012. Going forward, Cipher will also receive royalties on net U.S. sales and is eligible for future milestone payments based on sales targets. Under the agreement with Ranbaxy, Cipher is responsible for product supply and manufacturing.

About Cipher Pharmaceuticals Inc.

Cipher Pharmaceuticals (TSX: DND; OTC: CPHMF.PK) is a growing specialty pharmaceutical company that commercializes novel formulations of successful, currently marketed molecules. Cipher's strategy is to in-license clearly differentiated products, advance them through the clinical development and regulatory approval stages, and out-license to international marketing partners. The Company's first product is a fenofibrate formulation marketed in the United States as Lipofen®. Cipher's second product, an extended-release tramadol, is marketed in the United States as ConZip™ and is marketed in Canada as Durela™. Cipher's third product, a novel formulation of the acne treatment isotretinoin, was recently approved by the FDA and is expected to be launched in Q4 2012 as Absorica™. The product is also currently being reviewed by Health Canada. For more information, please visit www.cipherpharma.com.

About Ranbaxy Laboratories Inc.

Ranbaxy Laboratories Inc. (RLI) is a U.S. based wholly owned subsidiary of Ranbaxy Laboratories Limited (RLL). RLI is focused on the promotion of branded prescription products in the U.S. RLI has been expanding and growing on the strength of Ranbaxy's R&D efforts, and continuing exploration of novel drug delivery systems (NDDS), licensing activities, mergers and acquisitions. RLI is expanding the visibility and presence of the Ranbaxy name by bringing value-added brand products to the market. For more information, please visit www. ranbaxyusa.com.

Forward-Looking Statements

Statements made in this news release, other than those concerning historical financial information, may be forward-looking and therefore subject to various risks and uncertainties. The words "may", "will", "could", "should", "would", "suspect", "outlook", "believe", "plan", "anticipate", "estimate", "expect", "intend", "forecast", "objective", "hope" and "continue" (or the negative thereof), and words and expressions of similar import, are intended to identify forward-looking statements. Certain material factors or assumptions are applied in making forward-looking statements and actual results may differ materially from those expressed or implied in such statements. Factors that could cause results to vary include those identified in the Company's Annual Information Form and other filings with Canadian securities regulatory authorities. These factors include, but are not limited to losses; the applicability of patents and proprietary technology; possible patent litigation; approval of products in the Company's pipeline; marketing of products; meeting projected drug development timelines and goals; product liability and insurance; dependence on strategic partnerships and licensees; concentration of the Company's revenue; substantial competition and rapid technological change in the pharmaceutical industry; the publication of negative results of clinical trials of the Company's products; the ability to access capital; the ability to attract and retain key personnel; changes in government regulation or regulatory approval processes; dependence on contract research organizations; third party reimbursement; the success of the Company's strategic investments; the achievement of development goals and time frames; the possibility of shareholder dilution; market price volatility of securities; and the existence of significant shareholders. All forward-looking statements presented herein should be considered in conjunction with such filings. Except as required by Canadian securities laws, the Company does not undertake to update any forward-looking statements; such statements speak only as of the date made.

SOURCE Cipher Pharmaceuticals Inc.

Back to top

Source: PR Newswire (http://s.tt/1cQ8i)

Product to be launched as Absorica™

Toronto Stock Exchange Symbol: DND

MISSISSAUGA, ON, May 27, 2012 /PRNewswire/ - Cipher Pharmaceuticals Inc. (TSX: DND; OTC: CPHMF.PK) announced today that the U.S. Food and Drug Administration (FDA) has approved Absorica™, Cipher's novel, patented brand formulation of the acne medication isotretinoin, for the treatment of severe recalcitrant nodular acne. Absorica is expected to be launched in the U.S. in Q4 2012.

"Approval of Absorica represents our third FDA approval and most important milestone to date, reflecting the great work by our Scientific Affairs team at Cipher and our partner, Galephar Pharmaceutical Research," said Larry Andrews, President and CEO of Cipher. "We look forward to working closely with our partner, Ranbaxy Laboratories Inc., in preparation for the upcoming U.S. launch of the product through its dermatology sales force."

"We are thrilled to make Absorica available as a valuable option for the dermatologist and patients who need treatment for severe recalcitrant nodular acne. Absorica is a critical milestone in our commitment to serve the dermatology community and will be the flagship brand for Ranbaxy's specialized dermatology sales force," said Venkat Krishnan, Senior Vice President and Regional Director, Americas.

As a result of the FDA approval of Absorica, Cipher will receive a US$9.0 million milestone from Ranbaxy, approximately US$4.5 million of which will be shared with Galephar. This milestone will be reflected in Cipher's cash balance at the end of Q2 2012. Going forward, Cipher will also receive royalties on net U.S. sales and is eligible for future milestone payments based on sales targets. Under the agreement with Ranbaxy, Cipher is responsible for product supply and manufacturing.

About Cipher Pharmaceuticals Inc.

Cipher Pharmaceuticals (TSX: DND; OTC: CPHMF.PK) is a growing specialty pharmaceutical company that commercializes novel formulations of successful, currently marketed molecules. Cipher's strategy is to in-license clearly differentiated products, advance them through the clinical development and regulatory approval stages, and out-license to international marketing partners. The Company's first product is a fenofibrate formulation marketed in the United States as Lipofen®. Cipher's second product, an extended-release tramadol, is marketed in the United States as ConZip™ and is marketed in Canada as Durela™. Cipher's third product, a novel formulation of the acne treatment isotretinoin, was recently approved by the FDA and is expected to be launched in Q4 2012 as Absorica™. The product is also currently being reviewed by Health Canada. For more information, please visit www.cipherpharma.com.

About Ranbaxy Laboratories Inc.

Ranbaxy Laboratories Inc. (RLI) is a U.S. based wholly owned subsidiary of Ranbaxy Laboratories Limited (RLL). RLI is focused on the promotion of branded prescription products in the U.S. RLI has been expanding and growing on the strength of Ranbaxy's R&D efforts, and continuing exploration of novel drug delivery systems (NDDS), licensing activities, mergers and acquisitions. RLI is expanding the visibility and presence of the Ranbaxy name by bringing value-added brand products to the market. For more information, please visit www. ranbaxyusa.com.

Forward-Looking Statements

Statements made in this news release, other than those concerning historical financial information, may be forward-looking and therefore subject to various risks and uncertainties. The words "may", "will", "could", "should", "would", "suspect", "outlook", "believe", "plan", "anticipate", "estimate", "expect", "intend", "forecast", "objective", "hope" and "continue" (or the negative thereof), and words and expressions of similar import, are intended to identify forward-looking statements. Certain material factors or assumptions are applied in making forward-looking statements and actual results may differ materially from those expressed or implied in such statements. Factors that could cause results to vary include those identified in the Company's Annual Information Form and other filings with Canadian securities regulatory authorities. These factors include, but are not limited to losses; the applicability of patents and proprietary technology; possible patent litigation; approval of products in the Company's pipeline; marketing of products; meeting projected drug development timelines and goals; product liability and insurance; dependence on strategic partnerships and licensees; concentration of the Company's revenue; substantial competition and rapid technological change in the pharmaceutical industry; the publication of negative results of clinical trials of the Company's products; the ability to access capital; the ability to attract and retain key personnel; changes in government regulation or regulatory approval processes; dependence on contract research organizations; third party reimbursement; the success of the Company's strategic investments; the achievement of development goals and time frames; the possibility of shareholder dilution; market price volatility of securities; and the existence of significant shareholders. All forward-looking statements presented herein should be considered in conjunction with such filings. Except as required by Canadian securities laws, the Company does not undertake to update any forward-looking statements; such statements speak only as of the date made.

SOURCE Cipher Pharmaceuticals Inc.

Back to top

Source: PR Newswire (http://s.tt/1cQ8i)

Schon eigenartig das sich kaum jemand für diese Aktie interessiert.

Dabei geht es hier nicht mehr um Spekulationen, sondern das 3.Produkt ist zugelassen. Keine Schulden, genügend Cash usw...

Dabei geht es hier nicht mehr um Spekulationen, sondern das 3.Produkt ist zugelassen. Keine Schulden, genügend Cash usw...

bin seit 80€cent dabei. Denke auch, dass man mit einem Invest hier wenig falsch machen kann.

..DND.TO - Cipher Posts Solid Second Quarter Results

Zacks Small Cap Research – 17 hours ago....Email

Share0Print.....Companies:...Cipher Pharmaceuticals, Inc.Cipher Pharmaceuticals, Inc. . ..RELATED QUOTES.

.Symbol Price Change

DND.TO 1.55 0.00

CPHMF 1.3815

..........

By Jason Napodano, CFA

On July 25, 2012, Cipher Pharmaceuticals (Toronto ND.TO) / (OTC Markets:CPHMF) reported financial results for the second quarter ended June 30, 2012. Results were outstanding, beating our projections for both revenues and earnings.

ND.TO) / (OTC Markets:CPHMF) reported financial results for the second quarter ended June 30, 2012. Results were outstanding, beating our projections for both revenues and earnings.

Revenues in the quarter totaled $1.629 million, nicely above our forecast of $1.0 million. Revenues consisted of approximately $0.9 million in royalties and milestones on Lipofen, $0.4 million in royalties and milestones in ConZip/Durela, and $0.3 million in milestones on Absorica (CIP-Isotretinoin).

Cipher reported net income of $0.210 million during the second quarter 2012. This was significantly better than our model had forecasted. Management continues to do an excellent job of maintaining low operating expenses despite the growing top-line and strong cash balance. Operating expenses consisted of $0.9 million in operating overhead, $0.4 million in research & development, and $0.2 million in amortization and depreciation. Net income per share was $0.02 based on 24.4 million shares outstanding.

This was Cipher’s second profitable quarter in a row. We are expecting a profit in the third quarter 2012 based on the one-time catch-up in Lipofen royalties; and, with Absorica expected to launch in the fourth quarter 2012, we think that Cipher could report positive net income in every quarter in 2012.

Cipher exited the quarter 2012 with $14.4 million in cash and equivalents. We find this to be sufficient to fund operations for the foreseeable future and even to cash flow positive operations now that Absorica has been approved in the U.S.

Lipofen

As noted above, Lipofen contributed $0.9 million in the second quarter 2012. Lipofen prescriptions continue to growth at an impressive rate. In fact, subsequent to the quarter end, Cipher achieved a contractual sales goal for product sales resulting in a royalty percentage increase by 3% (we model from 15% to 18%). We note this change in Lipofen royalty is retroactive to October 2011, so we are expecting a one-time catch-up payment on Lipofen royalties to be recorded in the third quarter 2012 of roughly $0.35 million.

We expect that net Lipofen revenues for the full year 2012 will total about $4.8 million, driven by $4.4 million in royalties and catch-up payments and $0.35 million in the recognition of the milestone payment for KPA noted above for the TTM sales eclipsing $25 million. We forecast royalties will continue to grow in 2013 and beyond, up to $4.6 million in 2014 when the patent expires.

ConZip / Durela

Cipher's extended-release tramadol (CIP-Tramadol-ER) was launched in the U.S. by Vertical Pharmaceuticals in September 2011 under the trade name ConZip. ConZip revenues in the second quarter totaled $0.4 million, up from $0.3 million in the first quarter 2012. We think that ConZip has a unique opportunity in the tramadol-ER market based on a differentiated profile in a large unpenetrated market.

The formulation is designed to provide a smooth consistent plasma level over an extended period of time. ConZip absorption is pH-independent, enabling the product to be taken with or without food – a key differentiator to generic tramadol-ER. ConZip also provides remarkably fast absorption, allowing for peak therapeutic plasma concentrations to be achieved in as little as 60 minutes – again superior to generic tramadol-ER.

There were over 36 million tramadol prescriptions written in 2011, up nearly 20% from 2010. Only 2.5% of those prescriptions were for extended release (-ER) formulations. All tramadol-ER products generated revenues of approximately $130 million in 2011. This was on a lack of real promotion from the primary players. We think a significant opportunity exists for Vertical Pharmaceuticals, Inc., Cipher's U.S. commercialization partner for ConZip, to actively promote the highly differentiated ConZip.

Vertical officially launched the product in September 2011 under the brand name ConZip. Vertical has dedicated an initial sales force of 60 representatives, with plans for further expansion in the fourth quarter 2012. Cipher is still eligible for $3.8 million in milestones, plus royalties on sales, from Vertical Pharma.

In Canada, Cipher's partner, Medical Futures, recently launched CIP-Tramadol-ER as Durela in March 2012. The Canadian market opportunity for tramadol is much smaller than the U.S., but we are pleased to see management at Cipher monetizing their assets and finding new revenue streams. We expect that, albeit small, Durela will start contributing reportable positive cash flow for Cipher in the third quarter 2012.

Absorica / CIP-Iso

On May 27, 2012, Cipher announced it had received U.S. FDA approval of Absorica, the company's novel, patented brand formulation of the acne medication isotretinoin, for the treatment of severe recalcitrant nodular acne.

Approval triggered two milestone payments to Cipher totaling $9.0 million from commercialization partner Ranbaxy, of which Cipher to retained 50% after paying sub-milestones to Galephar. Cipher will also receive royalties (mid-teens) on net U.S. sales and is eligible for future milestone payments (totaling net $5 million to Cipher) based on sales targets. Through conversations with management, we believe the two net $2.5 million sales-related milestones are achievable under the current expected plans with Ranbaxy.

Absorica's offers more consistent absorption day-in and day-out over the course of a typical 3- to 5-month treatment period. We think this will be a significant marketing advantage for the drug. There are currently no promoted branded Isotretinoin products in the U.S. Existing branded products, Teva’s Claravis and Mylan’s Amnesteem, rely on previous patient and physician experience with Roche’s Accutane (isotretinoin) to drive sales. The efficacy profile of Isotretinoin is powerful enough that over one million prescriptions were written in 2011 despite this lack of active promotion.

All three products discussed above exhibit significant reductions in absorption under fasting conditions. We note this this is not a problem for Cipher’s Absorica (CIP-Isotretinoin). In total, Isotretinoin products posted sales of $466 million in 2010, up over 10% from 2009. We think Absorica will benefit from all of the known efficacy benefits of generic Isotretinoin, but with the improved formulation market share gains should be meaningful. We note that the FDA has labeled Absorica so that it is not substitutable with generic Isotretinoin. We see this is a meaningful advantage for Cipher.

We see a significant opportunity for Absorica once launched. Despite strict FDA monitoring around prescriptions of isotretinoin, the market remains quite robust. Generic isotretinoin does around $450 million in sales in the U.S., and that is with no promotion. Prescriptions have remained fairly consistent over the past few years, perhaps trending down slightly since late 2009 once Roche exited promoting Accutane.

We estimate that in terms of a “branded” opportunity, the Isotretinoin market is nearly $1 billion in size. We remind investors that Roche had Accutane sales over $750 million at peak. We believe that Cipher’s Absorica product, being the only promoted branded Isotretinoin on the market, could achieve peak sales near $200 million. Absorica offers significant advantages over generic isotretinoin in terms of dosing flexibility. The market is currently dominated by two un-promoted branded products, Mylan’s Amnesteem and Teva’s Claravis. Amnesteem posted sales of $136 million in 2010 on 386K scripts. Claravis posted sales of $330 million in 2010 on 670K scripts.

Cipher is seeking approval for CIP-Isotretinoin in Canada. The new drug submission (NDS) was accepted for review in January 2012. We are expecting a decision out of Health Canada in the first quarter 2013. We view CIP-Isotretinoin as a potential $10 million opportunity in Canada. The total Isotretinoin market is Canada is small, only around $20 million total.

Only two products, Roche’s Accutane and Mylan’s Clarus are on the market, with little to no promotion. Therefore, we believe that a sales force of 6 to 8 representatives could effectively promote the product in-house. We expect that Cipher will seek to commercialize the drug on its own in 2013. We think approval of CIP-Iso in Canada will create a meaningful shift in the company’s future development plans, as Cipher seeks to become a specialty pharmaceutical company with multiple products and its own sales force in Canada over time.

Accordingly, we think Cipher will in-license another late-stage or Health Canada approved dermatology or pediatric product in 2013. We think CIP-Isotretinoin becomes cash flow positive for Cipher in Canada at sales around $3 million. We think this can be achieved in the third year post-launch.

Valuation & Recommendation

We have conducted a discounted cash flow analysis to value the shares of Cipher Pharmaceuticals Inc. Our model now shows that Cipher is worth $3.00 per share. Our model (found in our full report) shows that operating cash flow should turn positive in 2013 on a sustained basis.

By the end of 2012, Cipher will be collecting revenues from three approved products in the U.S., with a growing cash balance of over $14 million in the bank, no debt, and generating positive cash flow. Cipher is now three-for-three. It's time for U.S. investors to take notice. This is a stock to own. Our rating is ‘Buy’.

Please click here for our full report >> Cipher Pharma Reports Strong Q2 Results

Please visit SCR.Zacks.com for additional information.

..

Zacks Small Cap Research – 17 hours ago....Email

Share0Print.....Companies:...Cipher Pharmaceuticals, Inc.Cipher Pharmaceuticals, Inc. . ..RELATED QUOTES.

.Symbol Price Change

DND.TO 1.55 0.00

CPHMF 1.3815

..........

By Jason Napodano, CFA

On July 25, 2012, Cipher Pharmaceuticals (Toronto

ND.TO) / (OTC Markets:CPHMF) reported financial results for the second quarter ended June 30, 2012. Results were outstanding, beating our projections for both revenues and earnings.

ND.TO) / (OTC Markets:CPHMF) reported financial results for the second quarter ended June 30, 2012. Results were outstanding, beating our projections for both revenues and earnings.Revenues in the quarter totaled $1.629 million, nicely above our forecast of $1.0 million. Revenues consisted of approximately $0.9 million in royalties and milestones on Lipofen, $0.4 million in royalties and milestones in ConZip/Durela, and $0.3 million in milestones on Absorica (CIP-Isotretinoin).

Cipher reported net income of $0.210 million during the second quarter 2012. This was significantly better than our model had forecasted. Management continues to do an excellent job of maintaining low operating expenses despite the growing top-line and strong cash balance. Operating expenses consisted of $0.9 million in operating overhead, $0.4 million in research & development, and $0.2 million in amortization and depreciation. Net income per share was $0.02 based on 24.4 million shares outstanding.

This was Cipher’s second profitable quarter in a row. We are expecting a profit in the third quarter 2012 based on the one-time catch-up in Lipofen royalties; and, with Absorica expected to launch in the fourth quarter 2012, we think that Cipher could report positive net income in every quarter in 2012.

Cipher exited the quarter 2012 with $14.4 million in cash and equivalents. We find this to be sufficient to fund operations for the foreseeable future and even to cash flow positive operations now that Absorica has been approved in the U.S.

Lipofen

As noted above, Lipofen contributed $0.9 million in the second quarter 2012. Lipofen prescriptions continue to growth at an impressive rate. In fact, subsequent to the quarter end, Cipher achieved a contractual sales goal for product sales resulting in a royalty percentage increase by 3% (we model from 15% to 18%). We note this change in Lipofen royalty is retroactive to October 2011, so we are expecting a one-time catch-up payment on Lipofen royalties to be recorded in the third quarter 2012 of roughly $0.35 million.

We expect that net Lipofen revenues for the full year 2012 will total about $4.8 million, driven by $4.4 million in royalties and catch-up payments and $0.35 million in the recognition of the milestone payment for KPA noted above for the TTM sales eclipsing $25 million. We forecast royalties will continue to grow in 2013 and beyond, up to $4.6 million in 2014 when the patent expires.

ConZip / Durela

Cipher's extended-release tramadol (CIP-Tramadol-ER) was launched in the U.S. by Vertical Pharmaceuticals in September 2011 under the trade name ConZip. ConZip revenues in the second quarter totaled $0.4 million, up from $0.3 million in the first quarter 2012. We think that ConZip has a unique opportunity in the tramadol-ER market based on a differentiated profile in a large unpenetrated market.

The formulation is designed to provide a smooth consistent plasma level over an extended period of time. ConZip absorption is pH-independent, enabling the product to be taken with or without food – a key differentiator to generic tramadol-ER. ConZip also provides remarkably fast absorption, allowing for peak therapeutic plasma concentrations to be achieved in as little as 60 minutes – again superior to generic tramadol-ER.

There were over 36 million tramadol prescriptions written in 2011, up nearly 20% from 2010. Only 2.5% of those prescriptions were for extended release (-ER) formulations. All tramadol-ER products generated revenues of approximately $130 million in 2011. This was on a lack of real promotion from the primary players. We think a significant opportunity exists for Vertical Pharmaceuticals, Inc., Cipher's U.S. commercialization partner for ConZip, to actively promote the highly differentiated ConZip.

Vertical officially launched the product in September 2011 under the brand name ConZip. Vertical has dedicated an initial sales force of 60 representatives, with plans for further expansion in the fourth quarter 2012. Cipher is still eligible for $3.8 million in milestones, plus royalties on sales, from Vertical Pharma.

In Canada, Cipher's partner, Medical Futures, recently launched CIP-Tramadol-ER as Durela in March 2012. The Canadian market opportunity for tramadol is much smaller than the U.S., but we are pleased to see management at Cipher monetizing their assets and finding new revenue streams. We expect that, albeit small, Durela will start contributing reportable positive cash flow for Cipher in the third quarter 2012.

Absorica / CIP-Iso

On May 27, 2012, Cipher announced it had received U.S. FDA approval of Absorica, the company's novel, patented brand formulation of the acne medication isotretinoin, for the treatment of severe recalcitrant nodular acne.

Approval triggered two milestone payments to Cipher totaling $9.0 million from commercialization partner Ranbaxy, of which Cipher to retained 50% after paying sub-milestones to Galephar. Cipher will also receive royalties (mid-teens) on net U.S. sales and is eligible for future milestone payments (totaling net $5 million to Cipher) based on sales targets. Through conversations with management, we believe the two net $2.5 million sales-related milestones are achievable under the current expected plans with Ranbaxy.

Absorica's offers more consistent absorption day-in and day-out over the course of a typical 3- to 5-month treatment period. We think this will be a significant marketing advantage for the drug. There are currently no promoted branded Isotretinoin products in the U.S. Existing branded products, Teva’s Claravis and Mylan’s Amnesteem, rely on previous patient and physician experience with Roche’s Accutane (isotretinoin) to drive sales. The efficacy profile of Isotretinoin is powerful enough that over one million prescriptions were written in 2011 despite this lack of active promotion.

All three products discussed above exhibit significant reductions in absorption under fasting conditions. We note this this is not a problem for Cipher’s Absorica (CIP-Isotretinoin). In total, Isotretinoin products posted sales of $466 million in 2010, up over 10% from 2009. We think Absorica will benefit from all of the known efficacy benefits of generic Isotretinoin, but with the improved formulation market share gains should be meaningful. We note that the FDA has labeled Absorica so that it is not substitutable with generic Isotretinoin. We see this is a meaningful advantage for Cipher.

We see a significant opportunity for Absorica once launched. Despite strict FDA monitoring around prescriptions of isotretinoin, the market remains quite robust. Generic isotretinoin does around $450 million in sales in the U.S., and that is with no promotion. Prescriptions have remained fairly consistent over the past few years, perhaps trending down slightly since late 2009 once Roche exited promoting Accutane.

We estimate that in terms of a “branded” opportunity, the Isotretinoin market is nearly $1 billion in size. We remind investors that Roche had Accutane sales over $750 million at peak. We believe that Cipher’s Absorica product, being the only promoted branded Isotretinoin on the market, could achieve peak sales near $200 million. Absorica offers significant advantages over generic isotretinoin in terms of dosing flexibility. The market is currently dominated by two un-promoted branded products, Mylan’s Amnesteem and Teva’s Claravis. Amnesteem posted sales of $136 million in 2010 on 386K scripts. Claravis posted sales of $330 million in 2010 on 670K scripts.

Cipher is seeking approval for CIP-Isotretinoin in Canada. The new drug submission (NDS) was accepted for review in January 2012. We are expecting a decision out of Health Canada in the first quarter 2013. We view CIP-Isotretinoin as a potential $10 million opportunity in Canada. The total Isotretinoin market is Canada is small, only around $20 million total.

Only two products, Roche’s Accutane and Mylan’s Clarus are on the market, with little to no promotion. Therefore, we believe that a sales force of 6 to 8 representatives could effectively promote the product in-house. We expect that Cipher will seek to commercialize the drug on its own in 2013. We think approval of CIP-Iso in Canada will create a meaningful shift in the company’s future development plans, as Cipher seeks to become a specialty pharmaceutical company with multiple products and its own sales force in Canada over time.

Accordingly, we think Cipher will in-license another late-stage or Health Canada approved dermatology or pediatric product in 2013. We think CIP-Isotretinoin becomes cash flow positive for Cipher in Canada at sales around $3 million. We think this can be achieved in the third year post-launch.

Valuation & Recommendation

We have conducted a discounted cash flow analysis to value the shares of Cipher Pharmaceuticals Inc. Our model now shows that Cipher is worth $3.00 per share. Our model (found in our full report) shows that operating cash flow should turn positive in 2013 on a sustained basis.

By the end of 2012, Cipher will be collecting revenues from three approved products in the U.S., with a growing cash balance of over $14 million in the bank, no debt, and generating positive cash flow. Cipher is now three-for-three. It's time for U.S. investors to take notice. This is a stock to own. Our rating is ‘Buy’.

Please click here for our full report >> Cipher Pharma Reports Strong Q2 Results

Please visit SCR.Zacks.com for additional information.

..

Die letzten 2 Tage ein kräftiger Anstieg. Anscheinend werden heute interessante Neuigkeiten kommen.

MISSISSAUGA, ON, Oct. 4, 2012 /CNW/ - Cipher Pharmaceuticals Inc. (TSX: DND; OTC: CPHMF) today announced it will host a conference call for its Q3 2012 financial results on Wednesday, October 24, 2012 at 8:30AM ET .

Q3 2012 CONFERENCE CALL

WHEN: Wednesday, October 24, 2012 at 8:30AM ET

CONFERENCE CALL/WEBCAST: You can join the call by dialing 647-427-7450 or 1-888-231-8191. A live audio webcast will be available through http://www.cipherpharma.com or http://www.newswire.ca. An archived replay of the webcast will be available for 365 days.

About Cipher Pharmaceuticals Inc.

Cipher Pharmaceuticals (TSX: DND; OTC: CPHMF) is a growing specialty pharmaceutical company that commercializes novel formulations of successful, currently marketed molecules. Cipher's strategy is to in-license clearly differentiated products, advance them through the clinical development and regulatory approval stages, and out-license to international marketing partners. The Company's first product is a fenofibrate formulation marketed in the United States as Lipofen®. Cipher's second product, an extended-release tramadol, is marketed in the United States as ConZip® and is marketed in Canada as Durela® Cipher's third product, a novel formulation of the acne treatment isotretinoin, was recently approved by the FDA and is expected to be launched in Q4 2012 as Absorica™. The product is also currently being reviewed by Health Canada. For more information, please visitwww.cipherpharma.com.

MISSISSAUGA, ON, Oct. 4, 2012 /CNW/ - Cipher Pharmaceuticals Inc. (TSX: DND; OTC: CPHMF) today announced it will host a conference call for its Q3 2012 financial results on Wednesday, October 24, 2012 at 8:30AM ET .

Q3 2012 CONFERENCE CALL

WHEN: Wednesday, October 24, 2012 at 8:30AM ET

CONFERENCE CALL/WEBCAST: You can join the call by dialing 647-427-7450 or 1-888-231-8191. A live audio webcast will be available through http://www.cipherpharma.com or http://www.newswire.ca. An archived replay of the webcast will be available for 365 days.

About Cipher Pharmaceuticals Inc.

Cipher Pharmaceuticals (TSX: DND; OTC: CPHMF) is a growing specialty pharmaceutical company that commercializes novel formulations of successful, currently marketed molecules. Cipher's strategy is to in-license clearly differentiated products, advance them through the clinical development and regulatory approval stages, and out-license to international marketing partners. The Company's first product is a fenofibrate formulation marketed in the United States as Lipofen®. Cipher's second product, an extended-release tramadol, is marketed in the United States as ConZip® and is marketed in Canada as Durela® Cipher's third product, a novel formulation of the acne treatment isotretinoin, was recently approved by the FDA and is expected to be launched in Q4 2012 as Absorica™. The product is also currently being reviewed by Health Canada. For more information, please visitwww.cipherpharma.com.

..Cipher Reports Strong Q3 2012 Financial Results

Press Release: Cipher Pharmaceuticals Inc. – 4 hours ago....Email

Share0Print.....RELATED QUOTES.

.Symbol Price Change

DND.TO 2.00 -0.15

......

- Results highlighted by strong revenue and earnings growth -

MISSISSAUGA, ON, Oct. 24, 2012 /CNW/ - Cipher Pharmaceuticals Inc. (DND.TO) (CPHMF) today announced its financial and operational results for the three months ended September 30, 2012 ("Q3 2012").

Q3 2012 Summary

•Achieved quarterly net revenue of $2.1 million , an 89% increase over Q3 2011.

•EBITDA of $1.0 million versus nil in Q3 2011.

•Net income in Q3 2012 was $0.8 million , compared with a loss of $0.2 million in Q3 2011.

•Cash balance increased to $15.1 million , compared with $14.4 million as at June 30, 2012 and $9.6 million at December 31, 2011 .

•Acquired the Canadian license and distribution rights for the Betesil® Patch, a novel treatment for inflammatory skin conditions such as plaque psoriasis.

"Strong third-quarter revenues combined with consistent expense levels year over year allowed us to achieve substantially higher earnings and strengthened our cash balance," said Larry Andrews , President and CEO of Cipher. "The near-term launch of Absorica in the U.S., our highest-potential product to date, positions us well for the balance of 2012 and for continued strong revenue growth in 2013."

Financial Review

Net revenue in Q3 2012 was $2.1 million , an increase of 89% compared with $1.1 million in Q3 2011. Net revenue from Lipofen® increased to $1.3 million during Q3 2012, compared with $0.5 million in Q3 2011. Net revenue from ConZip® was $0.3 million in Q3 2012, compared with $0.5 million in Q3 2011. ConZip® revenue was higher in the prior year as a result of the impact of initial shipments to support the product's launch in Q3 2011. Revenue from Durela® was not significant during Q3 2012 as the product was only launched in mid-March 2012. Absoricaä contributed $0.5 million of net revenue, compared with $0.1 million in Q3 2011, reflecting recognition of a portion of milestone payments received to date.

Research and Development expense decreased during Q3 2012 to $0.3 million , compared with $0.5 million in Q3 2011. Operating, General and Administrative expenses for Q3 2012 were $0.8 million , compared to $0.7 million in Q3 2011. Net income in Q3 2012 was $0.8 million , or $0.03 per share, compared with a net loss of $0.2 million , or $0.01 per share, in Q3 2011.

The Company's cash position increased at quarter end. As at September 30, 2012 , Cipher had cash and cash equivalents of $15.1 million , compared with $14.4 million as at June 30, 2012 and $9.6 million at December 31, 2011 .

Product Update

Lipofen®

During Q3 2012, Kowa's promotional effort resulted in Lipofen® monthly prescriptions and sales increasing significantly as reflected in an 89% increase in Cipher's net revenue over Q3 2011. During Q3 2012, Cipher achieved another contractual sales goal for the product and as a result, the royalty percentage for Lipofen increased by three percentage points. This change was retroactive to October 2011 and resulted in a one-time catch-up payment which was recorded in Q3 2012.

CIP-TRAMADOL ER (ConZip®/Durela®)

Cipher's extended-release tramadol for the treatment of moderate to moderately severe chronic pain, was launched in the U.S. by Vertical Pharmaceuticals in September 2011 under the trade name ConZip®. Vertical's dedicated sales force comprises approximately 60 representatives.

In Canada , Medical Futures launched the product in March 2012 under the trade name Durela®, with a dedicated sales force comprising 22 representatives.

With CIP-TRAMADOL ER's best-in-class product attributes, Cipher is optimistic revenues will grow in the coming quarters in both the U.S. and Canada .

In addition, Cipher is actively pursuing out-licensing discussions for CIP-TRAMADOL ER in other territories, including Latin America.

CIP-ISOTRETINOIN (Absorica™)

During Q3 2012, Cipher and its U.S. partner, Ranbaxy Pharmaceuticals, continued with pre-commercial activities, including commercial batch manufacturing and marketing planning, in anticipation of a product launch in Q4 2012. Cipher is responsible for supplying Ranbaxy with commercial product.