Argus Metals Corp.- Kann das die nächste ATC werden ??? - 500 Beiträge pro Seite

eröffnet am 02.03.12 18:51:45 von

neuester Beitrag 24.12.12 13:16:22 von

neuester Beitrag 24.12.12 13:16:22 von

Beiträge: 22

ID: 1.172.819

ID: 1.172.819

Aufrufe heute: 0

Gesamt: 1.264

Gesamt: 1.264

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 01.04.24, 10:52 | 162 | |

| gestern 19:37 | 136 | |

| gestern 21:20 | 135 | |

| vor 1 Stunde | 120 | |

| 22.06.20, 20:50 | 84 | |

| gestern 22:23 | 78 | |

| heute 00:34 | 74 | |

| gestern 21:47 | 70 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.737,36 | -0,56 | 198 | |||

| 2. | 2. | 147,05 | -1,92 | 95 | |||

| 3. | 7. | 6,6320 | -1,43 | 70 | |||

| 4. | 5. | 0,1810 | -1,90 | 51 | |||

| 5. | Neu! | 713,65 | -23,14 | 46 | |||

| 6. | 8. | 3,7700 | +0,80 | 45 | |||

| 7. | 17. | 7,2900 | -0,21 | 43 | |||

| 8. | 4. | 2.390,60 | 0,00 | 41 |

January 31, 2012

Capital Structure

Authorized Capital: unlimited

Issued Capital: 57,084,366

Stock options: 5,708,000

Outstanding Warrants: 13,041,440

Fully Diluted Capital 76,713,806

http://www.argusmetalscorp.com/i/pdf/CorporatePresentation.p…

News:

March 02, 2012 Argus Hires New VP of Corporate Development

March 01, 2012 Argus Files NI 43-101 Resource Technical Report on the Hyland Gold Project and Presents at the PDAC Mining Investment

Show

http://www.argusmetalscorp.com/i/pdf/Hyland_Gold_Project_201…

January 31, 2012 Argus Metals Corp. announces $2,000,000 private placement

January 31, 2012 Argus Receives Title and Uranium Licence for the Large-Scale, Drill-Ready Kaituma Uranium/Gold Project

January 19, 2012 Argus Increases the Hyland Main Zone Gold Deposit Resource Estimate to a NI 43-101 Compliant 361,692 oz Gold and 2,248,948 oz Silver

January 04, 2012 Argus releases final Hyland Gold Project drillholes, completes earn-in work expenditure requirements, waits on regional data and N.I. 43-101 compliant resource

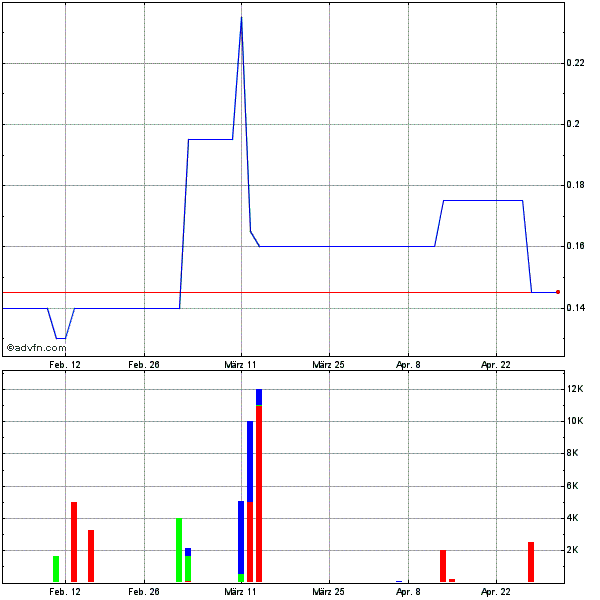

Chart:

Schwerpunkt bei AML liegt z.Z. eindeutig auf dem Hyland Projekt, im Yukon.Wobei man die anderen Projekte auch im Auge behalten soll.

Beim PP wurde jetzt auch die erste Tranche geschlossen (http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAML-19322…)

bs

PP ist jetzt auch komplett & einen kleinen Insiderkauf haben wir auch....

Argus Metals 1.45-million-share private placement

2012-03-20 20:00 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to the second tranche of a non-brokered private placement for Argus Metals Corp. announced Jan. 31, 2012:

Number of shares: 1.45 million shares

Purchase price: 10 cents per share

Warrants: 725,000 share purchase warrants to purchase 725,000 shares

Warrant exercise price: 15 cents for an 18-month period

Placees: 10

Quelle: www.stockwatch.com

March 21, 2012

Capital Structure

Authorized Capital: unlimited

Issued Capital: 64,585,866

Stock options: 5,905,000

Outstanding Warrants: 16,808,467

Fully Diluted Capital 87,299,333

Mar 19/12 Mar 14/12 Collins, John Michael William Direct Ownership Common Shares 10 - Acquisition in the public market 60,000 $0.070

Quelle: http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

Argus Metals 1.45-million-share private placement

2012-03-20 20:00 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to the second tranche of a non-brokered private placement for Argus Metals Corp. announced Jan. 31, 2012:

Number of shares: 1.45 million shares

Purchase price: 10 cents per share

Warrants: 725,000 share purchase warrants to purchase 725,000 shares

Warrant exercise price: 15 cents for an 18-month period

Placees: 10

Quelle: www.stockwatch.com

March 21, 2012

Capital Structure

Authorized Capital: unlimited

Issued Capital: 64,585,866

Stock options: 5,905,000

Outstanding Warrants: 16,808,467

Fully Diluted Capital 87,299,333

Mar 19/12 Mar 14/12 Collins, John Michael William Direct Ownership Common Shares 10 - Acquisition in the public market 60,000 $0.070

Quelle: http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

March 26, 2012 11:13 ET

Argus Provides Shareholder Update

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 26, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) provides a first quarter 2012 corporate update.

Further to the closing of the second tranche of the Company's recent private placement, management wishes to outline its strategy and initiatives for the second quarter, 2012.

The Kaituma Uranium/Gold Project

Proceeds from the private placement will be used to drill test its 100% owned Kaituma Uranium/Gold Project in Guyana. The Company has outlined a first phase, ten-hole drill program consisting of two fences of five drill holes designed to test uranium mineralization across the one kilometre wide Kaituma coincident radiometric/uranium-in-soils geochemical anomaly. To date, historic exploration work has sampled only the leached laterite horizons of the cap rock. Argus is targeting the near surface, potentially un-leached lithologies which are interpreted to underlie this cap rock.

The Kaituma Project represents a potential low cost uranium production target with a low exploration (discovery) costs, solid infrastructure and a rapid timeline to a conceptual resource definition and development.

The Kaituma Project is located in northwest Guyana, 1.5 kilometres from a deep water port, town and paved regularly serviced airfield. Topography on the Project is rolling and subdued with a change in relief of only 100m. Access is defined by an all weather road that runs along a central ridge on the project and is augmented by an historic railway grade and secondary logging roads and trails.

The Kaituma geophysical/geochemical uranium target is hosted in an episyenite intrusive in Guyana Shield Greenstone Belt with similar geological models as deposits like the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The opportunity for the discovery of similar uranium grades and tonnage exists on the Kaituma Property and the proposed drilling program will test this potential. The high priority Kaituma target has a strike of ten kilometres and a width of one kilometre and grades from trace up to 0.23% U3O8 in saprolite trenches and trace up to 0.0948% U3O8 in weathered outcrop.

Historical exploration work on the Kaituma Project includes airborne/ground based geophysical surveys by Cogema (now Areva) in the early 1980s followed by a 1996 - 1998, BHP High Sense airborne magnetic/radiometric survey and regional BLEG-ICP stream sediment and soil geochemistry programs. A large 70 square kilometres radiometric anomaly was identified by both the airborne surveys, and a significant stream sediment gold anomaly was also identified on the property. The BHP stream sediment and soil geochemistry surveys did not assay for uranium. Work in 2006 by StrataGold validated the uranium target with conformational ground based radiometric, soils and trenched uranium anomalies (with values from trace up to 0.23% U3O8) as well as delineated three gold anomalies on the property associated with over 100 years of placer mining.

President Michael Collins stated: "Argus is excited to be drill testing the Kaituma uranium/gold anomaly. The Kaituma target has the scale and pedigree to develop into a major uranium deposit."

Financing Outlook

The Company is confident it will obtain sufficient working capital going forward to fund its planned exploration activities through a strategy of; divesting or joint venturing its non-core assets combined with capital raising in the public market.

About Argus

Argus Metals is a Vancouver based exploration and development company with a strong portfolio of assets focused on gold in the Yukon and uranium in Guyana. The 100% owned Hyland project in the Yukon is a highly prospective gold project with the potential to substantially increase its existing NI 43-101 Au equivalent resource. The 100% owned Kaituma project in Guyana has undergone extensive surface and shallow depth sampling and will be drilled as soon as practicable. Kaituma has the potential to develop into a major uranium deposit and has similar geological features to the Husab (Rossing South) uranium deposit of Extract Resources.

The Company's directors and officers are a geologically focused team whose objective is to build shareholder value through exploration and development of existing projects and through identifying assets with company making potential.

Paul D. Gray, P.Geo., the Company's Qualified Person, and has reviewed and approved this news release.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Collins, President and CEO

Quelle:http://www.marketwire.com/press-release/argus-provides-share…

bs

Argus Provides Shareholder Update

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 26, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) provides a first quarter 2012 corporate update.

Further to the closing of the second tranche of the Company's recent private placement, management wishes to outline its strategy and initiatives for the second quarter, 2012.

The Kaituma Uranium/Gold Project

Proceeds from the private placement will be used to drill test its 100% owned Kaituma Uranium/Gold Project in Guyana. The Company has outlined a first phase, ten-hole drill program consisting of two fences of five drill holes designed to test uranium mineralization across the one kilometre wide Kaituma coincident radiometric/uranium-in-soils geochemical anomaly. To date, historic exploration work has sampled only the leached laterite horizons of the cap rock. Argus is targeting the near surface, potentially un-leached lithologies which are interpreted to underlie this cap rock.

The Kaituma Project represents a potential low cost uranium production target with a low exploration (discovery) costs, solid infrastructure and a rapid timeline to a conceptual resource definition and development.

The Kaituma Project is located in northwest Guyana, 1.5 kilometres from a deep water port, town and paved regularly serviced airfield. Topography on the Project is rolling and subdued with a change in relief of only 100m. Access is defined by an all weather road that runs along a central ridge on the project and is augmented by an historic railway grade and secondary logging roads and trails.

The Kaituma geophysical/geochemical uranium target is hosted in an episyenite intrusive in Guyana Shield Greenstone Belt with similar geological models as deposits like the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The opportunity for the discovery of similar uranium grades and tonnage exists on the Kaituma Property and the proposed drilling program will test this potential. The high priority Kaituma target has a strike of ten kilometres and a width of one kilometre and grades from trace up to 0.23% U3O8 in saprolite trenches and trace up to 0.0948% U3O8 in weathered outcrop.

Historical exploration work on the Kaituma Project includes airborne/ground based geophysical surveys by Cogema (now Areva) in the early 1980s followed by a 1996 - 1998, BHP High Sense airborne magnetic/radiometric survey and regional BLEG-ICP stream sediment and soil geochemistry programs. A large 70 square kilometres radiometric anomaly was identified by both the airborne surveys, and a significant stream sediment gold anomaly was also identified on the property. The BHP stream sediment and soil geochemistry surveys did not assay for uranium. Work in 2006 by StrataGold validated the uranium target with conformational ground based radiometric, soils and trenched uranium anomalies (with values from trace up to 0.23% U3O8) as well as delineated three gold anomalies on the property associated with over 100 years of placer mining.

President Michael Collins stated: "Argus is excited to be drill testing the Kaituma uranium/gold anomaly. The Kaituma target has the scale and pedigree to develop into a major uranium deposit."

Financing Outlook

The Company is confident it will obtain sufficient working capital going forward to fund its planned exploration activities through a strategy of; divesting or joint venturing its non-core assets combined with capital raising in the public market.

About Argus

Argus Metals is a Vancouver based exploration and development company with a strong portfolio of assets focused on gold in the Yukon and uranium in Guyana. The 100% owned Hyland project in the Yukon is a highly prospective gold project with the potential to substantially increase its existing NI 43-101 Au equivalent resource. The 100% owned Kaituma project in Guyana has undergone extensive surface and shallow depth sampling and will be drilled as soon as practicable. Kaituma has the potential to develop into a major uranium deposit and has similar geological features to the Husab (Rossing South) uranium deposit of Extract Resources.

The Company's directors and officers are a geologically focused team whose objective is to build shareholder value through exploration and development of existing projects and through identifying assets with company making potential.

Paul D. Gray, P.Geo., the Company's Qualified Person, and has reviewed and approved this news release.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Collins, President and CEO

Quelle:http://www.marketwire.com/press-release/argus-provides-share…

bs

Grandich Client Argus Metals

Argus put out a corporate update yesterday; I spoke with Michael Collins, Argus’s president to get some further insight as to what we might expect for this year.

PG: I see off the bat, that you are getting started on the Kaituma uranium project. While it hasn’t really been highlighted before, I guess that from a seasonal point of view, this uranium project in Guyana can fill out the year’s hopeful news flow.

MC: Yes, while this was not by design, due to the shorter nature of the working season in the Yukon and the near year-round ability to work in Guyana, we should be able to provide the market with constant news flow through the year. We had been diligently working in the background for the past 2 years on finalizing title and an exploration license for Kaituma. While we were excited about the project due to its prospective size, geology and the existing infrastructure and logistics, we needed to refrain from over promising timeframes as much of that was out of our hands and in those of the Guyana government’s. But now that all is in place we are ready to go!

PG: Ok, you have spoken in the past of the existing infrastructure – close proximity to deep-sea port, roads, rail grade and active airstrip with scheduled service; as well as potential world-class size. Can you fill us in a little more on the background of the project and what indications do you have on the potential of the property.

MC: Sure, and just want to mention that there is a lot of detail available on the website. As to the potential of the project without getting too technical, quite simply, it is one of the largest un-drilled uranium targets in the world with historic data, radiometric/magnetic surveys, groundwork, sampling and regional geology all pointing to the potential for world-class size, economic uranium mineralization. We just need to drill!

Our approach to the Kaituma project is not unlike that of our project in the Yukon. Argus has looked at both of these opportunities from a highly technical point of view, reviewing as much geological data and evidence as possible. As you probably have mentioned in the past, the Company is lead by two professional geologists who study these projects before claims are staked or the drills start turning in order to improve the odds for success as much as possible. This methodology is a large part of our success last year in the Yukon where we were able to triple the historic gold resource with just a handful of drill holes.

In the case of Kaituma, there has been substantial geological work done over the large licensed area for which we own much of the data. Historic exploration work includes ground uranium surveys by Cogema in 1980 and airborne magnetic/radiometric surveys by BHP in 1996-98 where a large, 70 square kilometer radiometric anomaly was identified. Further work programs in 2007 by Stratagold show a high correlation between BHP’s radiometric surveys and Cogema’s groundwork.

Geologically, similar uranium deposits have been discovered in northeastern Brazil including the Lago Real and Itataia uranium mines and the Rossing Mine and the Husab uranium deposits in Namibia. These types of deposits are typically large, over 100 million pounds containing low to moderate uranium grades and have been mined by open pit in Africa, Eastern Europe and South America.

PG: When are you anticipating to have the drill turning and how soon should we have results from the first phase?

MC: As mentioned in our news release, in the first phase we are going to drill three fences of 5 holes each across the 1 kilometer width of the 1 kilometer X 10 kilometer target area. We expect to have the drill mobilized to Guyana in the next 2 weeks. These initial holes are relatively shallow to test for the uranium mineralization close to surface and in the horizons just beneath the weathered cap rock, approximately 20-30 meters deep. We would anticipate results to start coming back before summer this year.

PG: In regards to the Yukon, I have iterated to my readers that last year did not live up to expectations, could you comment on that, and how it relates to Argus?

MC: Yes, with such a short time window in the Yukon, it was a tough time for everyone up there last year with weather and laboratory related delays. As well perhaps because of the shortened window, some the bigger plays weren’t able to live up to initial expectations. I personally still believe that there is a huge potential yet to be played out up there. For Argus, due in part to our technical background and corporate culture, we entered into last season with the belief that we had the potential to prove up a district-sized gold deposit/series of deposits in and around an existing, yet small historic gold resource – yet we wanted to make sure that we had the best chances for results without “blowing our brains out”. As a result, we were able to increase and upgrade the historic gold resource at the Main Zone by 200%+ and make new discoveries to extend the reaches of what we believe could be a gold mining district.

I guess our prudence paid off, as we got a big foot-in-the-door with very little capital expended last year with results validating and warranting a much larger scale program for this year. We will be announcing the program for this year once it is finalized.

PG: One last question regarding the financing of the company for these activities this year, how’s that coming along?

MC: All things being equal, we are quite confident that we will be able to continue to raise the capital for this year’s program through the current equity raise as well as potential JV or sale of non-core assets. The response has been positive on the recent equity raise despite the quiet capital markets as of late, and we have had several inquiries into some of our other projects. We will continue to keep the market informed as things develop.

PG: Thank you for the insight Mike.

Quelle:http://www.grandich.com/

bs

Argus put out a corporate update yesterday; I spoke with Michael Collins, Argus’s president to get some further insight as to what we might expect for this year.

PG: I see off the bat, that you are getting started on the Kaituma uranium project. While it hasn’t really been highlighted before, I guess that from a seasonal point of view, this uranium project in Guyana can fill out the year’s hopeful news flow.

MC: Yes, while this was not by design, due to the shorter nature of the working season in the Yukon and the near year-round ability to work in Guyana, we should be able to provide the market with constant news flow through the year. We had been diligently working in the background for the past 2 years on finalizing title and an exploration license for Kaituma. While we were excited about the project due to its prospective size, geology and the existing infrastructure and logistics, we needed to refrain from over promising timeframes as much of that was out of our hands and in those of the Guyana government’s. But now that all is in place we are ready to go!

PG: Ok, you have spoken in the past of the existing infrastructure – close proximity to deep-sea port, roads, rail grade and active airstrip with scheduled service; as well as potential world-class size. Can you fill us in a little more on the background of the project and what indications do you have on the potential of the property.

MC: Sure, and just want to mention that there is a lot of detail available on the website. As to the potential of the project without getting too technical, quite simply, it is one of the largest un-drilled uranium targets in the world with historic data, radiometric/magnetic surveys, groundwork, sampling and regional geology all pointing to the potential for world-class size, economic uranium mineralization. We just need to drill!

Our approach to the Kaituma project is not unlike that of our project in the Yukon. Argus has looked at both of these opportunities from a highly technical point of view, reviewing as much geological data and evidence as possible. As you probably have mentioned in the past, the Company is lead by two professional geologists who study these projects before claims are staked or the drills start turning in order to improve the odds for success as much as possible. This methodology is a large part of our success last year in the Yukon where we were able to triple the historic gold resource with just a handful of drill holes.

In the case of Kaituma, there has been substantial geological work done over the large licensed area for which we own much of the data. Historic exploration work includes ground uranium surveys by Cogema in 1980 and airborne magnetic/radiometric surveys by BHP in 1996-98 where a large, 70 square kilometer radiometric anomaly was identified. Further work programs in 2007 by Stratagold show a high correlation between BHP’s radiometric surveys and Cogema’s groundwork.

Geologically, similar uranium deposits have been discovered in northeastern Brazil including the Lago Real and Itataia uranium mines and the Rossing Mine and the Husab uranium deposits in Namibia. These types of deposits are typically large, over 100 million pounds containing low to moderate uranium grades and have been mined by open pit in Africa, Eastern Europe and South America.

PG: When are you anticipating to have the drill turning and how soon should we have results from the first phase?

MC: As mentioned in our news release, in the first phase we are going to drill three fences of 5 holes each across the 1 kilometer width of the 1 kilometer X 10 kilometer target area. We expect to have the drill mobilized to Guyana in the next 2 weeks. These initial holes are relatively shallow to test for the uranium mineralization close to surface and in the horizons just beneath the weathered cap rock, approximately 20-30 meters deep. We would anticipate results to start coming back before summer this year.

PG: In regards to the Yukon, I have iterated to my readers that last year did not live up to expectations, could you comment on that, and how it relates to Argus?

MC: Yes, with such a short time window in the Yukon, it was a tough time for everyone up there last year with weather and laboratory related delays. As well perhaps because of the shortened window, some the bigger plays weren’t able to live up to initial expectations. I personally still believe that there is a huge potential yet to be played out up there. For Argus, due in part to our technical background and corporate culture, we entered into last season with the belief that we had the potential to prove up a district-sized gold deposit/series of deposits in and around an existing, yet small historic gold resource – yet we wanted to make sure that we had the best chances for results without “blowing our brains out”. As a result, we were able to increase and upgrade the historic gold resource at the Main Zone by 200%+ and make new discoveries to extend the reaches of what we believe could be a gold mining district.

I guess our prudence paid off, as we got a big foot-in-the-door with very little capital expended last year with results validating and warranting a much larger scale program for this year. We will be announcing the program for this year once it is finalized.

PG: One last question regarding the financing of the company for these activities this year, how’s that coming along?

MC: All things being equal, we are quite confident that we will be able to continue to raise the capital for this year’s program through the current equity raise as well as potential JV or sale of non-core assets. The response has been positive on the recent equity raise despite the quiet capital markets as of late, and we have had several inquiries into some of our other projects. We will continue to keep the market informed as things develop.

PG: Thank you for the insight Mike.

Quelle:http://www.grandich.com/

bs

Neues Factsheet&Präsentation online.....

http://www.argusmetalscorp.com/i/pdf/ALM-Presentation-April2…

http://www.argusmetalscorp.com/i/pdf/Factsheet-April2012.pdf

bs

http://www.argusmetalscorp.com/i/pdf/ALM-Presentation-April2…

http://www.argusmetalscorp.com/i/pdf/Factsheet-April2012.pdf

bs

Moin,

so hier gehts jetzt auch los...

May 10, 2012 12:15 ET

Argus to Drill Kaituma Uranium/Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 10, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) has contracted AK Drilling International S.A. (AK Drilling) to execute a minimum 2,500m drill program on its 100% owned Kaituma uranium and gold project, north-west Guyana. Drilling is expected to get underway before the end of May 2012.

President Michael Collins stated, "The Kaituma Uranium/Gold Project is one of the few undrilled global uranium exploration targets with the potential size to have a significant impact on uranium markets. With exceptional infrastructure in place, Argus expects this drill program to quickly and efficiently test this outstanding uranium target."

AK Drilling has been contracted to execute a minimum 2,500 metres of reverse circulation drilling in a series of 150m long drillholes over five fences targeting uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP, AREVA (nee Cogema) and confirmed by the Company's own ground-based exploration programs in 2010.

The Kaituma Uranium/Gold Project represents a geophysical/geochemical uranium target within an episyenite intrusive in Guyana Shield Greenstone Belt with similar geological models as deposits such as the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The high priority Kaituma uranium target has a strike of over 10 kilometres and a width of approximately one kilometre punctuated by grades from trace up to 0.23% U in saprolite trenches and from trace up to 0.0948% eU in weathered outcrop.

Historically, the Kaituma Project has been explored by various companies including AREVA (nee Cogema) and BHP, with exploration work including airborne geophysics, ground-based geophysics, soil sampling and trenching. The Kaituma East and West PLs covers over 10 km strike length of radiometric anomalies defined by a 1982 Cogema soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. The results of these programs have demonstrated a high level of correlation of results among operators and survey techniques.

Work on the Kaituma West PL, (PL29/2011) has also identified three gold anomalies with grades from trace and up to 827 ppb Au (averaging 9 ppb) and demonstrates an association with both hydrothermal alteration in greenstones on the margins of the intrusive (Anomalies #1 and 2), and also shear related mineralization internal to the intrusive rock (Anomaly #3).

The Kaituma project was purchased from StrataGold Corporation (a subsidiary of Victoria Gold Corp., ["VIT"]) and Newmont Overseas Exploration Limited ("Newmont") and is subject a 2% NSR with a provisional buy back of 0.75% of the NSR for $1,250,000 USD.

Quelle: http://www.marketwire.com/press-release/argus-to-drill-kaitu…

bs

so hier gehts jetzt auch los...

May 10, 2012 12:15 ET

Argus to Drill Kaituma Uranium/Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 10, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) has contracted AK Drilling International S.A. (AK Drilling) to execute a minimum 2,500m drill program on its 100% owned Kaituma uranium and gold project, north-west Guyana. Drilling is expected to get underway before the end of May 2012.

President Michael Collins stated, "The Kaituma Uranium/Gold Project is one of the few undrilled global uranium exploration targets with the potential size to have a significant impact on uranium markets. With exceptional infrastructure in place, Argus expects this drill program to quickly and efficiently test this outstanding uranium target."

AK Drilling has been contracted to execute a minimum 2,500 metres of reverse circulation drilling in a series of 150m long drillholes over five fences targeting uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP, AREVA (nee Cogema) and confirmed by the Company's own ground-based exploration programs in 2010.

The Kaituma Uranium/Gold Project represents a geophysical/geochemical uranium target within an episyenite intrusive in Guyana Shield Greenstone Belt with similar geological models as deposits such as the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The high priority Kaituma uranium target has a strike of over 10 kilometres and a width of approximately one kilometre punctuated by grades from trace up to 0.23% U in saprolite trenches and from trace up to 0.0948% eU in weathered outcrop.

Historically, the Kaituma Project has been explored by various companies including AREVA (nee Cogema) and BHP, with exploration work including airborne geophysics, ground-based geophysics, soil sampling and trenching. The Kaituma East and West PLs covers over 10 km strike length of radiometric anomalies defined by a 1982 Cogema soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. The results of these programs have demonstrated a high level of correlation of results among operators and survey techniques.

Work on the Kaituma West PL, (PL29/2011) has also identified three gold anomalies with grades from trace and up to 827 ppb Au (averaging 9 ppb) and demonstrates an association with both hydrothermal alteration in greenstones on the margins of the intrusive (Anomalies #1 and 2), and also shear related mineralization internal to the intrusive rock (Anomaly #3).

The Kaituma project was purchased from StrataGold Corporation (a subsidiary of Victoria Gold Corp., ["VIT"]) and Newmont Overseas Exploration Limited ("Newmont") and is subject a 2% NSR with a provisional buy back of 0.75% of the NSR for $1,250,000 USD.

Quelle: http://www.marketwire.com/press-release/argus-to-drill-kaitu…

bs

Moin,

Argus Metals begins 2,500-metre drilling at Kaituma

2012-05-22 14:10 ET - News Release

Mr. Michael Collins reports

ARGUS METALS CORP.: DRILLING COMMENCES ON KAITUMA URANIUM/GOLD PROJECT

Argus Metals Corp., further to its news release dated May 10, 2012, has commenced the 2,500-metre drill program on its 100-per-cent-owned Kaituma uranium and gold project in northwest Guyana.

President Michael Collins stated: "The Kaituma uranium/gold project is one of the few undrilled global uranium exploration targets with the potential size to have a significant impact on uranium markets. With exceptional infrastructure in place, Argus expects this drill program to quickly and efficiently test this outstanding uranium target."

AK Drilling has been contracted to execute a minimum 2,500 metres of reverse circulation drilling in a series of 150-metre-long drill holes over five fences targeting uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP Billiton and AREVA SA (previously Cogema SA), and confirmed by the company's own ground-based exploration programs in 2010.

Paul D. Gray, PGeo, is the company's qualified person with respect to the Kaituma project, and has reviewed and approved this press release.

Quelle: http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAML-19612…

.....und dazu noch Grandich....

Grandich Client Argus Metals Corp.

Despite the worst junior resource market in years, Argus’s management group continues to do what they said they would do (yet their stock has languished to ultra low levels along with many others). Argus has just announced that their drill program at the Kaituma Uranium project has begun.

Having witnessed the success they had in their small-yet-effective methods last year in the Yukon, I needed to know just how meaningful and how quickly this initial drill program would take (given the much larger world’s largest un-drilled uranium prospect size potential of this project).

Management has indicated to to me that, the initial 2,500 meter program consisting of 5 fences of ~150 meter deep holes, should give a pretty clear indication of what the geology underneath the oxidized layer could yield in a relatively short time frame. The Company expects drilling to only take a couple of weeks to complete, with assays to follow shortly thereafter.

To briefly reiterate, the project covers over 10 km strike length by 1 km width of radiometric anomalies defined by a 1982 Cogema (now AREVA) soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. Kaituma has a similar geological model to that of deposits such as the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The project is conveniently located near existing infrastructure – close proximity to deep-sea port, roads, rail grade and active airstrip with scheduled service, which makes this even that much more attractive if drilling testing proves positive

One potential bright spot in a dismal market is what newsletter writer John Kaiser said; “the market has returned to the ‘Big Anomaly’ play.”

Here’s hoping that goes from John’s mouth to God’s ears!

Quelle: http://www.grandich.com/2012/05/grandich-client-argus-metals…

bs

Argus Metals begins 2,500-metre drilling at Kaituma

2012-05-22 14:10 ET - News Release

Mr. Michael Collins reports

ARGUS METALS CORP.: DRILLING COMMENCES ON KAITUMA URANIUM/GOLD PROJECT

Argus Metals Corp., further to its news release dated May 10, 2012, has commenced the 2,500-metre drill program on its 100-per-cent-owned Kaituma uranium and gold project in northwest Guyana.

President Michael Collins stated: "The Kaituma uranium/gold project is one of the few undrilled global uranium exploration targets with the potential size to have a significant impact on uranium markets. With exceptional infrastructure in place, Argus expects this drill program to quickly and efficiently test this outstanding uranium target."

AK Drilling has been contracted to execute a minimum 2,500 metres of reverse circulation drilling in a series of 150-metre-long drill holes over five fences targeting uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP Billiton and AREVA SA (previously Cogema SA), and confirmed by the company's own ground-based exploration programs in 2010.

Paul D. Gray, PGeo, is the company's qualified person with respect to the Kaituma project, and has reviewed and approved this press release.

Quelle: http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAML-19612…

.....und dazu noch Grandich....

Grandich Client Argus Metals Corp.

Despite the worst junior resource market in years, Argus’s management group continues to do what they said they would do (yet their stock has languished to ultra low levels along with many others). Argus has just announced that their drill program at the Kaituma Uranium project has begun.

Having witnessed the success they had in their small-yet-effective methods last year in the Yukon, I needed to know just how meaningful and how quickly this initial drill program would take (given the much larger world’s largest un-drilled uranium prospect size potential of this project).

Management has indicated to to me that, the initial 2,500 meter program consisting of 5 fences of ~150 meter deep holes, should give a pretty clear indication of what the geology underneath the oxidized layer could yield in a relatively short time frame. The Company expects drilling to only take a couple of weeks to complete, with assays to follow shortly thereafter.

To briefly reiterate, the project covers over 10 km strike length by 1 km width of radiometric anomalies defined by a 1982 Cogema (now AREVA) soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. Kaituma has a similar geological model to that of deposits such as the Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The project is conveniently located near existing infrastructure – close proximity to deep-sea port, roads, rail grade and active airstrip with scheduled service, which makes this even that much more attractive if drilling testing proves positive

One potential bright spot in a dismal market is what newsletter writer John Kaiser said; “the market has returned to the ‘Big Anomaly’ play.”

Here’s hoping that goes from John’s mouth to God’s ears!

Quelle: http://www.grandich.com/2012/05/grandich-client-argus-metals…

bs

Sunday June 03, 2012

11:40Workshop Room 3 Argus Metals Corp. Corporate Presentation

Argus Metals 2,559,400-share private placement

2012-06-14 19:57 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to the first tranche of a non-brokered private placement for Argus Metals Corp. announced May 15, 2012:

Number of shares: 2,559,400 shares

Purchase price: five cents per share

Warrants: 2,559,400 share purchase warrants to purchase 2,559,400 shares

Warrant exercise price: 10 cents for a one-year period

Placees: 14

Quelle. www.stockwatch.com

bs

2012-06-14 19:57 ET - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to the first tranche of a non-brokered private placement for Argus Metals Corp. announced May 15, 2012:

Number of shares: 2,559,400 shares

Purchase price: five cents per share

Warrants: 2,559,400 share purchase warrants to purchase 2,559,400 shares

Warrant exercise price: 10 cents for a one-year period

Placees: 14

Quelle. www.stockwatch.com

bs

Der gebeutelte Explorationssektor im Yukon nimmt wieder Fahrt auf

18. Juni 2012 um 20:14 von Oliver Groß

m kanadischen Yukon ist die Exploration von Rohstoffprojekten aufgrund des langen und harten Winters lediglich auf ein paar Monate im Jahr begrenzt. Gewöhnlich werden die ersten Explorationstätigkeiten erst im Mai aufgenommen, die letzten bereits im September beendet. Es gibt nur wenige Projekte, die ganzjährig exploriert und entwickelt werden können. Meistens liegen diese Projekte im Süden oder in einer vorteilhaften Region, die den Wetterkonditionen etwas trotzen kann.

Die im Yukon aktiven Rohstoffunternehmen stehen deswegen jedes Jahr vor einer neuen Herausforderung, da sie die relativ kurze Saison besonders effektiv nutzen müssen. Über den Winter sollte daher so umfassend und detailliert geplant werden, dass während der Sommermonate alles problemlos verlaufen kann. Hierbei sind das Management und das Board gefordert, die Hand in Hand diszipliniert und professionell koordinieren müssen. Das setzt nicht nur fachliche Kompetenz voraus, sondern auch spezielle Kenntnisse und Erfahrungen mit den außergewöhnlichen klimatischen Bedingungen. Die Verantwortlichen müssen sich ebenfalls mit anderen, geologischen Begebenheiten auseinandersetzen.

Arbeitsabläufe, die sich in der Theorie einfach anhören, sind bekanntermaßen schwieriger als erwartet. So stehen auch die Unternehmen oft vor Problemen, an denen sie nicht schuld sein müssen und auch keinen Einfluss darauf haben. Eine Komplikation ergibt sich z.B. dadurch, dass es aufgrund der konzentrierten Explorationssaison zu Überlastungen und Engpässen bei den Geologie-Laboren kommen kann. Diese werten bekanntlich die Bohrkerne aus und geben den Unternehmen viele der wichtigsten Informationen zurück. Ein anderes Problem tritt auf, wenn die Bohrkerne z.B. aufgrund von anhaltenden Permafrostböden nur eine geringe Ausbeute vorweisen oder nur teilweise verwertet werden können (schlechte Recovery).

Ein weiteres Problem stellen der Zugang zu den Rohstoffprojekten und die benötigten infrastrukturellen Anbindungen dar. Da der Yukon über Jahrzehnte nur wenig Interesse bei den Rohstoffunternehmen fand, sind Großteile der Liegenschaften mitten im Nirvana, d.h. es sind nur wenig gute Straßen, Flugplätze und relevante Zugänge zu Energie und Wasser vorhanden. Zudem gibt es im Yukon noch keine großen, aktiven Minenbezirke. Diese Tatsachen lassen die Explorations- und Bohrkosten signifikant ansteigen.

Aus welchen Gründen entstand überhaupt der Yukon-Hype?

Seniorproduzent Kinross Gold (WKN A0DM94) sorgte im März 2010 für Aufsehen, als sie einen kleinen Rohstoffexplorer namens Underworld Resources für 140 Millionen USD übernahmen. Underworld nahm an einigen Projektausschreibungen im Jahr 2007 teil und sicherte sich etliche Konzessionen, die ca. 90km südlich von Dawson City lokalisiert waren. Das ambitionierte Management schaffte es, trotz der Finanzkrise und mit der tatkräftigen Unterstützung von Kinross, signifikante Summen für Explorationsprogramme einzunehmen. Bereits 2008 konnte Underworld eine erste relevante Entdeckung erzielen und außergewöhnlich gute Bohrergebnisse auf ihrem Hauptprojekt White Gold vermelden. Es folgten kontinuierliche Bohrerfolge, die das Potential des Projektes auf ein signifikantes Goldverkommen, stark anstiegen ließen. Underworld sicherte sich in 2009 viele weitere Rechte an nahegelegenen Liegenschaften. Der Erfolg von Underworld sorgte für einen wahren Kaufrausch, in dem zahlreiche Edelmetall-Explorer nahezu alle kaufbaren Projekte rund um Underworld’s Konzessionen erwarben.

Dadurch entstand der sogenannte White Gold District, welcher nach dem früheren Hauptprojekt von Underworld benannt wurde. Die große Nachfrage nach Liegenschaften hält aufgrund anhaltender Explorationserfolge im Yukon bis heute an. Andere bedeutende Entdeckungen in dieser Region, wurden in den letzten Jahren z.B. von Kaminak Gold (WKN A0Q5PQ), Golden Predator (A1CYK1) oder Western Copper & Gold (WKN A1JMCZ) erzielt. Viele Experten spekulieren darauf, dass einige der historischen Goldvorkommen im Yukon – während des Goldrauschs Ende des 19. Jahrhundert – nur an der Oberfläche und überwiegend mit schlechten Hilfsmitteln und wenig Fachkompetenz exploriert wurden. Weiter haben sich die heutigen Explorationsmöglichkeiten und Instrumente massiv verbessert.

Dennoch geben all die guten Indikationen und sehenswerte Bohrerfolge noch keine Gewissheit darüber, ob in diesen Regionen wirklich profitabel gefördert werden kann. So hat z.B. zur Verwunderung vieler Beobachter, Senior Kinross Gold die Explorationsausgaben im White Gold District vorerst stark heruntergefahren und viele Programme auf Eis gelegt. Diese Vorgehensweise lässt darauf schließen, dass die erzielten Bohrerfolge alleine oft nicht ausreichen, eine ökonomische Ressource zu definieren.

Die Explorationsausgaben werden auf einem Rekordhoch bleiben

Wie nahezu alle Explorationsunternehmen, kamen auch die im Yukon aktiven Rohstoffgesellschaften während der letzten 12 Monate stark unter Druck. So fiel z.B. der Kurs von Atac Resources (WKN A0BKZG), die signifikante Entdeckungen im benannten Rackla Gold Belt erzielen konnte, von über 10 CAD auf zeitweise 2 CAD zurück. Trotz der teils drastischen Kursverlusten und vielen, operativen Komplikationen scheint der Investitionshunger aber weiter ungebremst. Das ist ein bedeutendes Vertrauenszeichen, das die Juniorunternehmen gerade mehr denn je benötigen.

Mit einem Paukenschlag hat die kanadische Rohstoffbehörde vor einigen Wochen für Aufsehen gesorgt: Nach den jüngsten Schätzungen werden Rohstoffunternehmen dieses Jahr bis zu 320 Millionen USD im Yukon investieren (optimistisches Szenario). Diese Summe würde die letztjährigen Investitionen von 307 Millionen USD nochmals übersteigen. Die anhaltende Investitionsflut lässt erkennen, dass trotz der schwierigen Lage im Explorationssektor, die langfristigen Interessen untermauert werden. Ein erfreuliches Zeichen in einem schwierigen Markt.

In welche Projekte fließen größere Investitionen?

Viele Unternehmen haben erfolgreich vorgesorgt und konnten größere Finanzierungen in den letzten 3 Jahren stemmen. So sitzt Atac Resources z.B. noch auf Cashreserven von rund 20 Millionen USD. Das diesjährige Explorationsprogramm soll 15.000 Bohrmeter auf dem Flaggschiffprojekt Rackla Gold betragen. Atac hat für einen Projektteil bereits eine Goldressource definiert. Sie explorieren auf der riesigen Rackla Liegenschaft aber nicht nur noch Gold. Letztes Jahr konnte Atac auch eine erste Silber-, Blei- und Zink-Discovery erzielen. Das Rackla Gold Projekt wird wegen den geologischen Ähnlichkeiten schon längere Zeit als einziger, potentieller Goldbezirk gehandelt, der einen neuen ‚Carlin District‘ formen könnte (vgl. den ruhmreichen Carlin District in Nevada). Sollten sich die Spekulationen über einen neuen Carlin Trend aufgrund weiterer, herausragender Entdeckungen verdichten, könnte Atac Resources auf einem der begehrtesten Rohstoffprojekte der Welt sitzen.

Wenige Kilometer südlich der Entdeckungen durch die ehemalige Underworld Resources, hat Kaminak Gold bedeutende Bohrerfolge erzielen können. Kaminak besitzt das Coffee Gold Projekt. Das Unternehmen ist in mehreren Projektteilen auf ansehnliche, goldreiche Mineralstrukturen gestoßen, das hat die Chance auf ein großes Goldvorkommen stark erhöht. Mit prall gefüllten Kassen von 25 Millionen USD sollen dieses Jahr erstmals 50.000 Bohrmeter absolviert werden. Die erste Ressourcenschätzung wird nach Saisonabschluss mit Spannung erwartet.

Golden Predator ist ein weiteres Unternehmen, das schon lange Zeit im Yukon aktiv ist. Die Gesellschaft ist der mit Abstand größte Besitzer von Explorationsprojekten im Yukon (> 5.700 km²). Das lukrative Business-Model als Projekt-Generator, hat Golden Predator dazu verholfen, sich in etlichen aussichtsreichen Projekten zu beteiligen. Die Pipeline an attraktiven Rohstoffprojekten ist eine Augenweide und auf ihrem Hauptprojekt Brewery Creek (ehemalige Mine) verzeichneten sie während der letzten 24 Monate gute Fortschritte. Golden Predator plant das Flaggschiff-Projekt in den nächsten Jahren in Produktion zu bringen, um mit dem zukünftigen Cashflow eine intensive Exploration auf anderen Projekten zu ermöglichen. Aufgrund von stetigen Einnahmen aus Beteiligungen an aktiven Minen, können Teile der Exploration und Entwicklung der fokussierten Projekte, ohne zusätzliche Kapitalmaßnahmen finanziert werden. Diese Tatsache macht Golden Predator zunehmend attraktiv, da die Aktienstruktur infolgedessen geschont werden kann (Eindämmung der Verwässerung).

Weitere Unternehmen, die im Yukon dieses Jahr signifikante Kapitalsummen investieren: Ryan Gold (WKN A1H4UR), gegründet durch den bekannten Prospektor Shawn Ryan (Drahtzieher hinter der Discovery von Underworld und Kaminak, Prospector of the Year 2010), verfügt über einen Kassenbestand von ca. 43 Millionen USD. Zu den größeren Explorationsinvestoren zählen auch fortgeschrittene Unternehmen. So wird Silberproduzent Alexco Resources (WKN A0JKUP) z.B. für 12 Millionen USD Bohrprogramme mit über 30.000 Metern durchführen. Der Basismetallproduzent Capstone Mining (WKN A0JDER) wird die Liegenschaften rund um seine Mine im Yukon, nördlich von Carmacks, intensiv mit mehr wie 5 Millionen USD explorieren.

Eine alte Weisheit rückt wieder in den Fokus: Grade is King

Aufgrund der genannten Nachteile, die im Yukon Jahr für Jahr festzustellen sind, werden nur wenige Rohstoffprojekte langfristig das Interesse von den großen Produzenten wecken. Schon heute kann mit Gewissheit gesagt werden: Rohstoffprojekte im Yukon müssen besonders solide und ökonomische Kennzahlen vorweisen, um überhaupt als mögliche Mine eingestuft zu werden. In vielen Fällen müssen deswegen die Rohstoffgehalte stimmen (d.h. relativ hoch sein), und der mineralisierte Erzkörper sollte nicht zu tief liegen (Mining-Methode ‚Open-Pit‘ wird anvisiert). Außerdem sollten die indizierten Vorkommen eine attraktive Größe vorweisen, da die Kapitalkosten einer Mine verhältnismäßig hoch sein werden. Diese Voraussetzungen führen dazu, dass nur ein Bruchteil der gegenwärtig aktiven Explorations- und Entwicklungsunternehmen im Yukon nachhaltig erfolgreich sein wird.

Die hier angebotenen Artikel stellen keine Kauf- bzw. Verkaufsempfehlungen dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Die Artikel und Berichte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar.

Quelle: http://www.rohstoff-investingnews.de/rohstoffe/der-gebeutelt…

bs

18. Juni 2012 um 20:14 von Oliver Groß

m kanadischen Yukon ist die Exploration von Rohstoffprojekten aufgrund des langen und harten Winters lediglich auf ein paar Monate im Jahr begrenzt. Gewöhnlich werden die ersten Explorationstätigkeiten erst im Mai aufgenommen, die letzten bereits im September beendet. Es gibt nur wenige Projekte, die ganzjährig exploriert und entwickelt werden können. Meistens liegen diese Projekte im Süden oder in einer vorteilhaften Region, die den Wetterkonditionen etwas trotzen kann.

Die im Yukon aktiven Rohstoffunternehmen stehen deswegen jedes Jahr vor einer neuen Herausforderung, da sie die relativ kurze Saison besonders effektiv nutzen müssen. Über den Winter sollte daher so umfassend und detailliert geplant werden, dass während der Sommermonate alles problemlos verlaufen kann. Hierbei sind das Management und das Board gefordert, die Hand in Hand diszipliniert und professionell koordinieren müssen. Das setzt nicht nur fachliche Kompetenz voraus, sondern auch spezielle Kenntnisse und Erfahrungen mit den außergewöhnlichen klimatischen Bedingungen. Die Verantwortlichen müssen sich ebenfalls mit anderen, geologischen Begebenheiten auseinandersetzen.

Arbeitsabläufe, die sich in der Theorie einfach anhören, sind bekanntermaßen schwieriger als erwartet. So stehen auch die Unternehmen oft vor Problemen, an denen sie nicht schuld sein müssen und auch keinen Einfluss darauf haben. Eine Komplikation ergibt sich z.B. dadurch, dass es aufgrund der konzentrierten Explorationssaison zu Überlastungen und Engpässen bei den Geologie-Laboren kommen kann. Diese werten bekanntlich die Bohrkerne aus und geben den Unternehmen viele der wichtigsten Informationen zurück. Ein anderes Problem tritt auf, wenn die Bohrkerne z.B. aufgrund von anhaltenden Permafrostböden nur eine geringe Ausbeute vorweisen oder nur teilweise verwertet werden können (schlechte Recovery).

Ein weiteres Problem stellen der Zugang zu den Rohstoffprojekten und die benötigten infrastrukturellen Anbindungen dar. Da der Yukon über Jahrzehnte nur wenig Interesse bei den Rohstoffunternehmen fand, sind Großteile der Liegenschaften mitten im Nirvana, d.h. es sind nur wenig gute Straßen, Flugplätze und relevante Zugänge zu Energie und Wasser vorhanden. Zudem gibt es im Yukon noch keine großen, aktiven Minenbezirke. Diese Tatsachen lassen die Explorations- und Bohrkosten signifikant ansteigen.

Aus welchen Gründen entstand überhaupt der Yukon-Hype?

Seniorproduzent Kinross Gold (WKN A0DM94) sorgte im März 2010 für Aufsehen, als sie einen kleinen Rohstoffexplorer namens Underworld Resources für 140 Millionen USD übernahmen. Underworld nahm an einigen Projektausschreibungen im Jahr 2007 teil und sicherte sich etliche Konzessionen, die ca. 90km südlich von Dawson City lokalisiert waren. Das ambitionierte Management schaffte es, trotz der Finanzkrise und mit der tatkräftigen Unterstützung von Kinross, signifikante Summen für Explorationsprogramme einzunehmen. Bereits 2008 konnte Underworld eine erste relevante Entdeckung erzielen und außergewöhnlich gute Bohrergebnisse auf ihrem Hauptprojekt White Gold vermelden. Es folgten kontinuierliche Bohrerfolge, die das Potential des Projektes auf ein signifikantes Goldverkommen, stark anstiegen ließen. Underworld sicherte sich in 2009 viele weitere Rechte an nahegelegenen Liegenschaften. Der Erfolg von Underworld sorgte für einen wahren Kaufrausch, in dem zahlreiche Edelmetall-Explorer nahezu alle kaufbaren Projekte rund um Underworld’s Konzessionen erwarben.

Dadurch entstand der sogenannte White Gold District, welcher nach dem früheren Hauptprojekt von Underworld benannt wurde. Die große Nachfrage nach Liegenschaften hält aufgrund anhaltender Explorationserfolge im Yukon bis heute an. Andere bedeutende Entdeckungen in dieser Region, wurden in den letzten Jahren z.B. von Kaminak Gold (WKN A0Q5PQ), Golden Predator (A1CYK1) oder Western Copper & Gold (WKN A1JMCZ) erzielt. Viele Experten spekulieren darauf, dass einige der historischen Goldvorkommen im Yukon – während des Goldrauschs Ende des 19. Jahrhundert – nur an der Oberfläche und überwiegend mit schlechten Hilfsmitteln und wenig Fachkompetenz exploriert wurden. Weiter haben sich die heutigen Explorationsmöglichkeiten und Instrumente massiv verbessert.

Dennoch geben all die guten Indikationen und sehenswerte Bohrerfolge noch keine Gewissheit darüber, ob in diesen Regionen wirklich profitabel gefördert werden kann. So hat z.B. zur Verwunderung vieler Beobachter, Senior Kinross Gold die Explorationsausgaben im White Gold District vorerst stark heruntergefahren und viele Programme auf Eis gelegt. Diese Vorgehensweise lässt darauf schließen, dass die erzielten Bohrerfolge alleine oft nicht ausreichen, eine ökonomische Ressource zu definieren.

Die Explorationsausgaben werden auf einem Rekordhoch bleiben

Wie nahezu alle Explorationsunternehmen, kamen auch die im Yukon aktiven Rohstoffgesellschaften während der letzten 12 Monate stark unter Druck. So fiel z.B. der Kurs von Atac Resources (WKN A0BKZG), die signifikante Entdeckungen im benannten Rackla Gold Belt erzielen konnte, von über 10 CAD auf zeitweise 2 CAD zurück. Trotz der teils drastischen Kursverlusten und vielen, operativen Komplikationen scheint der Investitionshunger aber weiter ungebremst. Das ist ein bedeutendes Vertrauenszeichen, das die Juniorunternehmen gerade mehr denn je benötigen.

Mit einem Paukenschlag hat die kanadische Rohstoffbehörde vor einigen Wochen für Aufsehen gesorgt: Nach den jüngsten Schätzungen werden Rohstoffunternehmen dieses Jahr bis zu 320 Millionen USD im Yukon investieren (optimistisches Szenario). Diese Summe würde die letztjährigen Investitionen von 307 Millionen USD nochmals übersteigen. Die anhaltende Investitionsflut lässt erkennen, dass trotz der schwierigen Lage im Explorationssektor, die langfristigen Interessen untermauert werden. Ein erfreuliches Zeichen in einem schwierigen Markt.

In welche Projekte fließen größere Investitionen?

Viele Unternehmen haben erfolgreich vorgesorgt und konnten größere Finanzierungen in den letzten 3 Jahren stemmen. So sitzt Atac Resources z.B. noch auf Cashreserven von rund 20 Millionen USD. Das diesjährige Explorationsprogramm soll 15.000 Bohrmeter auf dem Flaggschiffprojekt Rackla Gold betragen. Atac hat für einen Projektteil bereits eine Goldressource definiert. Sie explorieren auf der riesigen Rackla Liegenschaft aber nicht nur noch Gold. Letztes Jahr konnte Atac auch eine erste Silber-, Blei- und Zink-Discovery erzielen. Das Rackla Gold Projekt wird wegen den geologischen Ähnlichkeiten schon längere Zeit als einziger, potentieller Goldbezirk gehandelt, der einen neuen ‚Carlin District‘ formen könnte (vgl. den ruhmreichen Carlin District in Nevada). Sollten sich die Spekulationen über einen neuen Carlin Trend aufgrund weiterer, herausragender Entdeckungen verdichten, könnte Atac Resources auf einem der begehrtesten Rohstoffprojekte der Welt sitzen.

Wenige Kilometer südlich der Entdeckungen durch die ehemalige Underworld Resources, hat Kaminak Gold bedeutende Bohrerfolge erzielen können. Kaminak besitzt das Coffee Gold Projekt. Das Unternehmen ist in mehreren Projektteilen auf ansehnliche, goldreiche Mineralstrukturen gestoßen, das hat die Chance auf ein großes Goldvorkommen stark erhöht. Mit prall gefüllten Kassen von 25 Millionen USD sollen dieses Jahr erstmals 50.000 Bohrmeter absolviert werden. Die erste Ressourcenschätzung wird nach Saisonabschluss mit Spannung erwartet.

Golden Predator ist ein weiteres Unternehmen, das schon lange Zeit im Yukon aktiv ist. Die Gesellschaft ist der mit Abstand größte Besitzer von Explorationsprojekten im Yukon (> 5.700 km²). Das lukrative Business-Model als Projekt-Generator, hat Golden Predator dazu verholfen, sich in etlichen aussichtsreichen Projekten zu beteiligen. Die Pipeline an attraktiven Rohstoffprojekten ist eine Augenweide und auf ihrem Hauptprojekt Brewery Creek (ehemalige Mine) verzeichneten sie während der letzten 24 Monate gute Fortschritte. Golden Predator plant das Flaggschiff-Projekt in den nächsten Jahren in Produktion zu bringen, um mit dem zukünftigen Cashflow eine intensive Exploration auf anderen Projekten zu ermöglichen. Aufgrund von stetigen Einnahmen aus Beteiligungen an aktiven Minen, können Teile der Exploration und Entwicklung der fokussierten Projekte, ohne zusätzliche Kapitalmaßnahmen finanziert werden. Diese Tatsache macht Golden Predator zunehmend attraktiv, da die Aktienstruktur infolgedessen geschont werden kann (Eindämmung der Verwässerung).

Weitere Unternehmen, die im Yukon dieses Jahr signifikante Kapitalsummen investieren: Ryan Gold (WKN A1H4UR), gegründet durch den bekannten Prospektor Shawn Ryan (Drahtzieher hinter der Discovery von Underworld und Kaminak, Prospector of the Year 2010), verfügt über einen Kassenbestand von ca. 43 Millionen USD. Zu den größeren Explorationsinvestoren zählen auch fortgeschrittene Unternehmen. So wird Silberproduzent Alexco Resources (WKN A0JKUP) z.B. für 12 Millionen USD Bohrprogramme mit über 30.000 Metern durchführen. Der Basismetallproduzent Capstone Mining (WKN A0JDER) wird die Liegenschaften rund um seine Mine im Yukon, nördlich von Carmacks, intensiv mit mehr wie 5 Millionen USD explorieren.

Eine alte Weisheit rückt wieder in den Fokus: Grade is King

Aufgrund der genannten Nachteile, die im Yukon Jahr für Jahr festzustellen sind, werden nur wenige Rohstoffprojekte langfristig das Interesse von den großen Produzenten wecken. Schon heute kann mit Gewissheit gesagt werden: Rohstoffprojekte im Yukon müssen besonders solide und ökonomische Kennzahlen vorweisen, um überhaupt als mögliche Mine eingestuft zu werden. In vielen Fällen müssen deswegen die Rohstoffgehalte stimmen (d.h. relativ hoch sein), und der mineralisierte Erzkörper sollte nicht zu tief liegen (Mining-Methode ‚Open-Pit‘ wird anvisiert). Außerdem sollten die indizierten Vorkommen eine attraktive Größe vorweisen, da die Kapitalkosten einer Mine verhältnismäßig hoch sein werden. Diese Voraussetzungen führen dazu, dass nur ein Bruchteil der gegenwärtig aktiven Explorations- und Entwicklungsunternehmen im Yukon nachhaltig erfolgreich sein wird.

Die hier angebotenen Artikel stellen keine Kauf- bzw. Verkaufsempfehlungen dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Die Artikel und Berichte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar.

Quelle: http://www.rohstoff-investingnews.de/rohstoffe/der-gebeutelt…

bs

Sehr interessanter Fondseinstieg....

DMP Resource Class hält jetzt 3 Millionen Aktien an AML

bs

DMP Resource Class hält jetzt 3 Millionen Aktien an AML

bs

Curry mal wieder....

Jun 22/12 Jun 19/12 Curry, Nancy Direct Ownership Common Shares 10 - Disposition in the public market -160,000 $0.080

Jun 22/12 Jun 18/12 Curry, Nancy Direct Ownership Common Shares 10 - Disposition in the public market -40,000 $0.080

Jun 22/12 Apr 23/12 Curry, Nancy Direct Ownership Warrants 55 - Expiration of warrants -50,000

Quelle: http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

Jun 22/12 Jun 19/12 Curry, Nancy Direct Ownership Common Shares 10 - Disposition in the public market -160,000 $0.080

Jun 22/12 Jun 18/12 Curry, Nancy Direct Ownership Common Shares 10 - Disposition in the public market -40,000 $0.080

Jun 22/12 Apr 23/12 Curry, Nancy Direct Ownership Warrants 55 - Expiration of warrants -50,000

Quelle: http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

Moin,

mal wieder was positives.....

Argus Closes Oversubscribed Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - June 29, 2012) - Further to its news release dated May 15, 2012, Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) announces that it has received TSX Venture Exchange approval to the closing of its private placement. The Company has raised an aggregate $388,470 via two tranche closings through issuance of 2,559,400 units at a price of $0.05 per unit ("Unit") in the first tranche and issuance of 5,210,000 Units in the second tranche closing.

Each Unit consists of one common share and one common share purchase warrant (a "Warrant"). Each Warrant will entitle the holder to purchase one common share of the Company for a period of twelve months from the closing date at a price of $0.10 per share.

A finder's fee of $15,260, 7,000 Units and 340,200 finder's warrants of the Company were paid in connection with the private placement closing. The finder's warrants have the same terms as the Warrants. The securities issued in relation to this private placement are subject to regulatory four-month hold period expiring October 13, 2012, and October 27, 2012.

The proceeds from the private placement will be used to continue exploration on the Company's Kaituma, Guyana uranium/gold exploration project and for general working capital purposes.

About Argus

Argus Metals is a Vancouver based exploration and development company with a strong portfolio of assets focused on gold in the Yukon and uranium/gold in Guyana. The 100% owned Hyland project in the Yukon is a highly prospective gold project with the potential to substantially increase its existing NI 43-101 Au Eq resource.

The Company's directors and officers are a geologically focused team whose objective is to build shareholder value through exploration and development of existing projects and through identifying assets with company making potential.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Collins, President and CEO

Quelle: www.stockhouse.com

bs

mal wieder was positives.....

Argus Closes Oversubscribed Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - June 29, 2012) - Further to its news release dated May 15, 2012, Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) announces that it has received TSX Venture Exchange approval to the closing of its private placement. The Company has raised an aggregate $388,470 via two tranche closings through issuance of 2,559,400 units at a price of $0.05 per unit ("Unit") in the first tranche and issuance of 5,210,000 Units in the second tranche closing.

Each Unit consists of one common share and one common share purchase warrant (a "Warrant"). Each Warrant will entitle the holder to purchase one common share of the Company for a period of twelve months from the closing date at a price of $0.10 per share.

A finder's fee of $15,260, 7,000 Units and 340,200 finder's warrants of the Company were paid in connection with the private placement closing. The finder's warrants have the same terms as the Warrants. The securities issued in relation to this private placement are subject to regulatory four-month hold period expiring October 13, 2012, and October 27, 2012.

The proceeds from the private placement will be used to continue exploration on the Company's Kaituma, Guyana uranium/gold exploration project and for general working capital purposes.

About Argus

Argus Metals is a Vancouver based exploration and development company with a strong portfolio of assets focused on gold in the Yukon and uranium/gold in Guyana. The 100% owned Hyland project in the Yukon is a highly prospective gold project with the potential to substantially increase its existing NI 43-101 Au Eq resource.

The Company's directors and officers are a geologically focused team whose objective is to build shareholder value through exploration and development of existing projects and through identifying assets with company making potential.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Collins, President and CEO

Quelle: www.stockhouse.com

bs

Damit ist auch der Verkauf der 200K durch Currywurst erklärt...

Jul 3/12 Jun 29/12 Anderson, Simon Indirect Ownership Warrants 53 - Grant of warrants 200,000 $0.100

Jul 3/12 Jun 29/12 Anderson, Simon Indirect Ownership Common Shares 16 - Acquisition under a prospectus exemption 200,000 $0.050

Jul 4/12 Jun 28/12 Curry, Nancy Direct Ownership Warrants 11 - Acquisition carried out privately 200,000

Jul 4/12 Jun 28/12 Curry, Nancy Direct Ownership Common Shares 11 - Acquisition carried out privately 200,000 $0.050

Quelle:http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

Jul 3/12 Jun 29/12 Anderson, Simon Indirect Ownership Warrants 53 - Grant of warrants 200,000 $0.100

Jul 3/12 Jun 29/12 Anderson, Simon Indirect Ownership Common Shares 16 - Acquisition under a prospectus exemption 200,000 $0.050

Jul 4/12 Jun 28/12 Curry, Nancy Direct Ownership Warrants 11 - Acquisition carried out privately 200,000

Jul 4/12 Jun 28/12 Curry, Nancy Direct Ownership Common Shares 11 - Acquisition carried out privately 200,000 $0.050

Quelle:http://canadianinsider.com/node/7?menu_tickersearch=aml

bs

Moin,

July 09, 2012 09:00 ET

Argus Completes Drill Program on Kaituma Uranium/Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 9, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) announces that, further to the Company's news release dated May 22, 2012, the Company has successfully completed its 2012 drill program on the Kaituma Uranium/Gold Project in north-west Guyana.

President Michael Collins stated, "The Kaituma uranium/gold project has been, up until now, one of the few undrilled uranium exploration targets with the scale necessary for a large scale discovery. With exceptional infrastructure in place, Argus' 2012 drilling program has quickly and efficiently tested this outstanding uranium target."

The Kaituma Uranium/Gold Project represents a geophysical/geochemical uranium target within an episyenite/leucogranite intrusive in Guyana Shield Greenstone Belt with similar geological model as deposits such as the alaskite hosted Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the metasomatic albite hosted Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The Kaituma geology model will become clearer with the chemical assay results and analysis of geology of this drill program. The high priority Kaituma uranium target has a strike of over 10 kilometres and a width of approximately one kilometre punctuated by grades from trace up to 0.23% U in saprolite trenches and from trace up to 0.0948% eU in weathered outcrop.

The reverse circulation drill program comprised 2,300 metres of a series of 17, ~150 metres deep drill holes over five north-south oriented fences that targeted uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP Billiton ("BHP"), AREVA SA ("AREVA") (previously Cogema) and confirmed by the Company's own ground-based exploration programs in 2010. The drilling program tested approximately 8 kilometres of the strike length of the Kaituma radiometric anomaly over both the Kaituma West (PL 29/2011) and Kaituma East (PL 35/2010).

In total, 1,601 samples, including QA/QC standard and blank insertions, were collected during the reverse circulation drill program and delivered to Acme Analytical Laboratories preparation facility in Georgetown, Guyana by early July 2012. Chemical assays from the Kaituma 2012 drilling program are expected by August 2012.

Historically, the Kaituma Project has been explored by various companies including AREVA and BHP, with exploration work including airborne geophysics, ground-based geophysics, soil sampling and trenching. The Kaituma East and West PLs cover a suite of coincident radiometric/geochemical anomalies defined by a 1982 Cogema soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. The results of these programs have demonstrated a high level of correlation of results among operators and survey techniques.

Past work on the Kaituma West PL (PL29/2011) also identified three gold anomalies with grades from trace and up to 827 ppb Au (averaging 9 ppb) and demonstrates an association with both hydrothermal alteration in greenstones on the margins of the intrusive (Anomalies #1 and 2), and also shear related mineralization internal to the intrusive rock (Anomaly #3).

The Kaituma project is subject a 2% NSR with a provisional buy back of 0.75% of the NSR for $1,250,000 USD.

QA/QC

All samples were split on site at the Kaituma exploration camp, with A splits shipped to Acme Analytical Laboratories preparation facility in Georgetown, Guyana where samples were sorted and crushed to appropriate particle size (pulp) and representatively split to a smaller size for shipment to Acme's Santiago analysis facility for final assay via ACME Group 1EX 46-element ICP-MS analysis with a Multi-acid (HCl, HF, HNO3, HClO4) digestion. A comprehensive system of standards and blanks was implemented in the 2012 exploration drilling program and will be analyzed as chemical assay data become available. Paul D. Gray, P.Geo. is the Company's Qualified Person with respect to the Kaituma Project and has reviewed and approved this press release.

Quelle:http://www.marketwire.com/press-release/argus-completes-dril…

bs

July 09, 2012 09:00 ET

Argus Completes Drill Program on Kaituma Uranium/Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 9, 2012) - Argus Metals Corp. (the "Company" or "Argus") (TSX VENTURE:AML) announces that, further to the Company's news release dated May 22, 2012, the Company has successfully completed its 2012 drill program on the Kaituma Uranium/Gold Project in north-west Guyana.

President Michael Collins stated, "The Kaituma uranium/gold project has been, up until now, one of the few undrilled uranium exploration targets with the scale necessary for a large scale discovery. With exceptional infrastructure in place, Argus' 2012 drilling program has quickly and efficiently tested this outstanding uranium target."

The Kaituma Uranium/Gold Project represents a geophysical/geochemical uranium target within an episyenite/leucogranite intrusive in Guyana Shield Greenstone Belt with similar geological model as deposits such as the alaskite hosted Husab deposit of Extract Resources Ltd. in Namibia, (319.9M lb U3O8 @ 519ppm U3O8) and the metasomatic albite hosted Lago Real Mine in Brazil which has resources of 125M lb U3O8 @ ~0.25% U3O8. The Kaituma geology model will become clearer with the chemical assay results and analysis of geology of this drill program. The high priority Kaituma uranium target has a strike of over 10 kilometres and a width of approximately one kilometre punctuated by grades from trace up to 0.23% U in saprolite trenches and from trace up to 0.0948% eU in weathered outcrop.

The reverse circulation drill program comprised 2,300 metres of a series of 17, ~150 metres deep drill holes over five north-south oriented fences that targeted uranium and gold anomalies identified through airborne and ground-based exploration work conducted by StrataGold, BHP Billiton ("BHP"), AREVA SA ("AREVA") (previously Cogema) and confirmed by the Company's own ground-based exploration programs in 2010. The drilling program tested approximately 8 kilometres of the strike length of the Kaituma radiometric anomaly over both the Kaituma West (PL 29/2011) and Kaituma East (PL 35/2010).

In total, 1,601 samples, including QA/QC standard and blank insertions, were collected during the reverse circulation drill program and delivered to Acme Analytical Laboratories preparation facility in Georgetown, Guyana by early July 2012. Chemical assays from the Kaituma 2012 drilling program are expected by August 2012.

Historically, the Kaituma Project has been explored by various companies including AREVA and BHP, with exploration work including airborne geophysics, ground-based geophysics, soil sampling and trenching. The Kaituma East and West PLs cover a suite of coincident radiometric/geochemical anomalies defined by a 1982 Cogema soil sampling and geophysical program, a 1996 BHP airborne radiometric survey and a StrataGold 2007 stream, soils and trenching program. The results of these programs have demonstrated a high level of correlation of results among operators and survey techniques.

Past work on the Kaituma West PL (PL29/2011) also identified three gold anomalies with grades from trace and up to 827 ppb Au (averaging 9 ppb) and demonstrates an association with both hydrothermal alteration in greenstones on the margins of the intrusive (Anomalies #1 and 2), and also shear related mineralization internal to the intrusive rock (Anomaly #3).

The Kaituma project is subject a 2% NSR with a provisional buy back of 0.75% of the NSR for $1,250,000 USD.

QA/QC

All samples were split on site at the Kaituma exploration camp, with A splits shipped to Acme Analytical Laboratories preparation facility in Georgetown, Guyana where samples were sorted and crushed to appropriate particle size (pulp) and representatively split to a smaller size for shipment to Acme's Santiago analysis facility for final assay via ACME Group 1EX 46-element ICP-MS analysis with a Multi-acid (HCl, HF, HNO3, HClO4) digestion. A comprehensive system of standards and blanks was implemented in the 2012 exploration drilling program and will be analyzed as chemical assay data become available. Paul D. Gray, P.Geo. is the Company's Qualified Person with respect to the Kaituma Project and has reviewed and approved this press release.

Quelle:http://www.marketwire.com/press-release/argus-completes-dril…

bs

In the Field: Argus Metals has Claims In 2 Big Area Plays, Yukon and Guyana

Lawrence Roulston of Resource Opportunities visits Argus Metals Kaituma Project in western Guyana. The Kaituma project is located in NW Guyana, 5km from a deep water port, town and airfield. Topography on the project is rolling with a change in relief of only 100m. Access is defined by an all weather road that runs along a ridge on the center of the project and is augmented by an abandoned railway and secondary logging roads. The project represents a world class target with a low exploration cost, solid infrastructure and a rapid timeline to a conceptual resource definition and development.

Video.......http://www.atto-asia.jp/web_knowledge_xpo/en/v/82935

bs

Lawrence Roulston of Resource Opportunities visits Argus Metals Kaituma Project in western Guyana. The Kaituma project is located in NW Guyana, 5km from a deep water port, town and airfield. Topography on the project is rolling with a change in relief of only 100m. Access is defined by an all weather road that runs along a ridge on the center of the project and is augmented by an abandoned railway and secondary logging roads. The project represents a world class target with a low exploration cost, solid infrastructure and a rapid timeline to a conceptual resource definition and development.

Video.......http://www.atto-asia.jp/web_knowledge_xpo/en/v/82935

bs

Nach der News folgte der Absturz bis auf 0,02 CAD.

Weiterhin hat Grandich seine Dienste für AML eingestellt was den Kursverfall noch beschleunigte.

Argus finds no U mineralization in first Kaituma holes

2012-07-26 09:10 ET - News Release

Mr. Michael Collins reports