Triton Minerals Ltd. (Seite 36)

eröffnet am 06.07.12 13:33:23 von

neuester Beitrag 02.12.22 08:09:44 von

neuester Beitrag 02.12.22 08:09:44 von

Beiträge: 495

ID: 1.175.377

ID: 1.175.377

Aufrufe heute: 0

Gesamt: 25.419

Gesamt: 25.419

Aktive User: 0

ISIN: AU000000TON7 · WKN: A0NGHD · Symbol: 1TG

0,0070

EUR

-12,50 %

-0,0010 EUR

Letzter Kurs 24.04.24 Tradegate

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 0,7999 | +14,27 | |

| 28,87 | +13,30 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7122 | -9,53 | |

| 17,310 | -9,98 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 | |

| 0,5550 | -29,30 |

Beitrag zu dieser Diskussion schreiben

Und hier noch der aktuelle Webcast...

11.05.2015 - Triton completes $12m raising to advance Mozambique projects

http://www.brrmedia.com/event/137705/brad-boyle-ceo--managin…

TRITON COMPLETES $12 MILLION

PLACEMENT TO PROGRESS

DEVELOPMENT AT TRITON’S

MOZAMBIQUE GRAPHITE PROJECTS

HIGHLIGHTS

Triton completes an oversubscribed single tranche $12.0 million placement to a Hong Kong cornerstone investor, institutional groups and sophisticated investors.

Funding will enable Triton to rapid progress the Definitive Feasibility Study at Nicanda Hill and commence its pre- development early works program.

Funding will also allow Triton to undertake an initial drilling program at the Ancuabe project.

************************

Wie immer werden in dem "Interview" einige Zusatzinformationen zu dem Announcement geliefert.

1) Ursprünglich beabsichtige man eine KE über $10 Millionen durchzuführen, diese war aber mehrfach überzeichnet und man hat sich entschieden auf die besagten $12 Millionen zu erhöhen. Man wäre aber auch in der Lage gewesen noch mehr Geld einzusammeln.

2) Man hat sich entschiedene jetzt eine KE durchzuführen, obwohl möglicherweise bis zu $ 200 Millionen zu einem Ausgabepreis größer gleich AUD $0,50 durch den Shenzhen Deal zur Verfügung hätte, da man keine Zeit verlieren möchte und die DFS noch bis Jahresende zum Abschluss bringen möchte. Der Deal ist ja noch bis max. 30.06. im Schwebezustand und selbst danach kann es noch bis zu 30 Tagen dauern, bis man auf Mittel zugreifen könnte. Auf diese Weise hat man bis zu 2 Monaten und 3 Wochen an Zeit gespart.

***

Interessant finde ich auch, dass der besagte Cornerstone Investor eng mit "Shenzhen Qianhai Zhangjin Group Co,. Ltd." in Verbindung steht. Jeder ist eingeladen sich seine Gedanken hierzu zu machen und zu teilen. Der springende Punkt könnte aus meiner Sicht sein, dass sich chinesische Investoren gerne einen großen Teil vom Kuchen sichern, SQZG selbst jedoch zu keinem Zeitpunkt mehr als 19,9 % an TON halten darf, wenn der Vertrag wie geplant geschlossen wird. So könnte man sich theoretisch indirekt mehr Mitsprache sichern. Kann natürlich auch einen ganz anderen Grund haben!

***

Wir haben bei AUD 0,42 heute auf Tageshoch geschlossen!

***

BB ist auch in diesem Interview wie immer positiv gestimmt, allerdings klingt es für mich nicht so, als hätte er zu diesem Zeitpunkt schon gewusst, dass er nach Börsenschluss den nächsten TH für TON ausrufen muss.

TON ist bis maximal zum Handelsbeginn am 14.05. vom Handel ausgesetzt.

"Triton Minerals Limited (Triton or Company) hereby requests a trading halt from the ASX pending an announcement regarding executing agreements to form strategic relationships.

Triton requests the trading halt to last from commencement of trading on Tuesday, 12 May 2015 until the release of the announcement, in any case no later than the commencement of trading on Thursday, 14 May 2015."

Aus einem anderen Form stammt folgende Information aus einem Telefonat mit BB

"The countries mentioned when I spoke to BB on 28/4/15 and posted at #: 15175031 were China, Japan, Singapore, Mozambique and the UK."

Gut möglich, dass es ein Off-Take Agreement mit einer Partei außerhalb von China ist, welches zu dem TH geführt hat. Ein Gegengewicht zu China könnte nicht schaden, Japan wäre auf meiner persönlichen Wunschliste weit vorne.

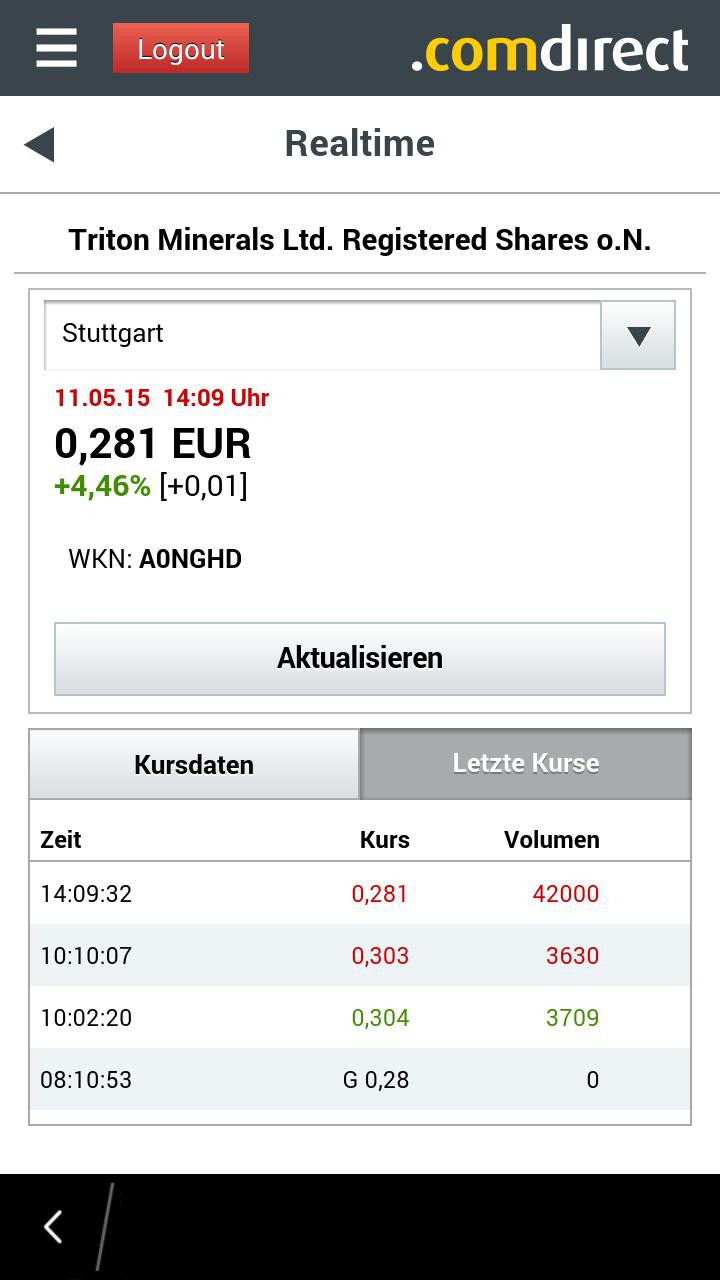

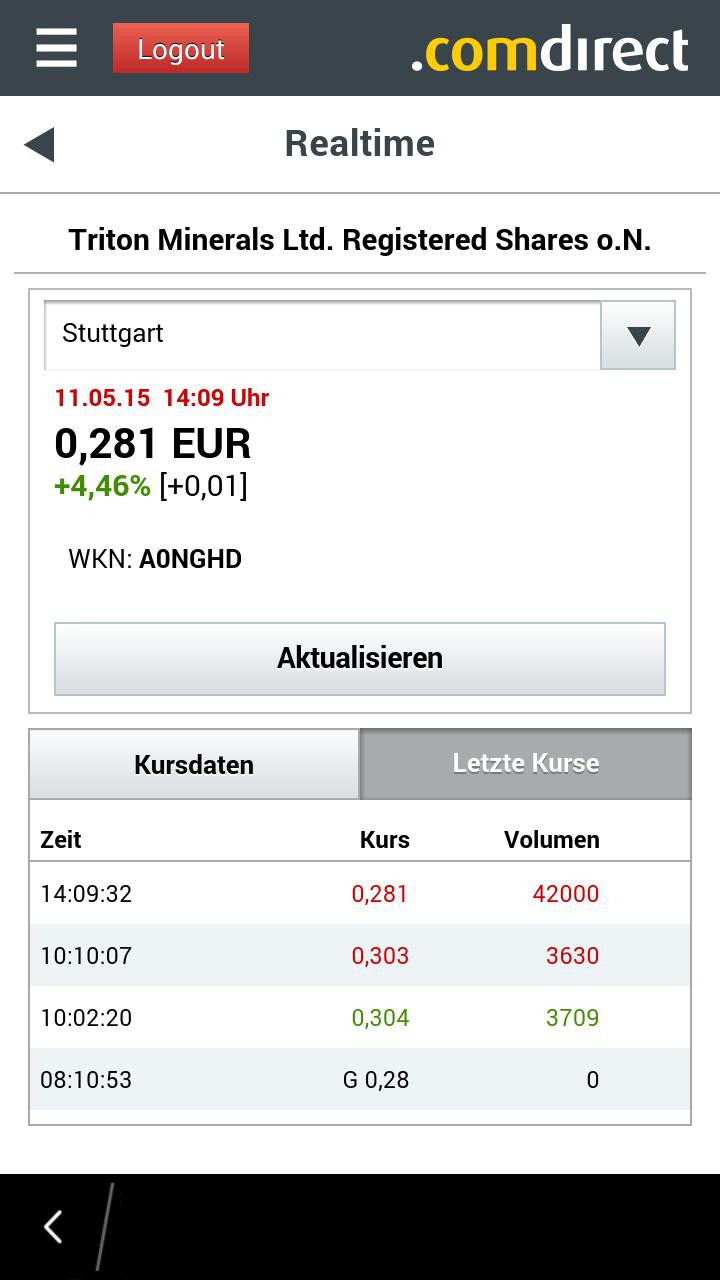

Offensichtlich hat die Handelsaussetzung heute in Stuttgart nicht so ganz gegriffen.

Jedenfalls gab es heute 3 Trades.

3709 zu 0,304 EUR

3630 zu 0,303 EUR

42000 zu 0,281 EUR

Pari wäre zum heutigen Wechselkurs von 1,4113 AUD zum EURO 0,2976 EUR gewesen.

In anderen Worten trotz der zu erwartenden guten News hat jemand diese Anzahl 5,572% unter Parikurs verkauft.

***

Ich hoffe ich habe niemanden gelangweilt.

Schönen Feierabend.

Gruß phobieeee

11.05.2015 - Triton completes $12m raising to advance Mozambique projects

http://www.brrmedia.com/event/137705/brad-boyle-ceo--managin…

TRITON COMPLETES $12 MILLION

PLACEMENT TO PROGRESS

DEVELOPMENT AT TRITON’S

MOZAMBIQUE GRAPHITE PROJECTS

HIGHLIGHTS

Triton completes an oversubscribed single tranche $12.0 million placement to a Hong Kong cornerstone investor, institutional groups and sophisticated investors.

Funding will enable Triton to rapid progress the Definitive Feasibility Study at Nicanda Hill and commence its pre- development early works program.

Funding will also allow Triton to undertake an initial drilling program at the Ancuabe project.

************************

Wie immer werden in dem "Interview" einige Zusatzinformationen zu dem Announcement geliefert.

1) Ursprünglich beabsichtige man eine KE über $10 Millionen durchzuführen, diese war aber mehrfach überzeichnet und man hat sich entschieden auf die besagten $12 Millionen zu erhöhen. Man wäre aber auch in der Lage gewesen noch mehr Geld einzusammeln.

2) Man hat sich entschiedene jetzt eine KE durchzuführen, obwohl möglicherweise bis zu $ 200 Millionen zu einem Ausgabepreis größer gleich AUD $0,50 durch den Shenzhen Deal zur Verfügung hätte, da man keine Zeit verlieren möchte und die DFS noch bis Jahresende zum Abschluss bringen möchte. Der Deal ist ja noch bis max. 30.06. im Schwebezustand und selbst danach kann es noch bis zu 30 Tagen dauern, bis man auf Mittel zugreifen könnte. Auf diese Weise hat man bis zu 2 Monaten und 3 Wochen an Zeit gespart.

***

Interessant finde ich auch, dass der besagte Cornerstone Investor eng mit "Shenzhen Qianhai Zhangjin Group Co,. Ltd." in Verbindung steht. Jeder ist eingeladen sich seine Gedanken hierzu zu machen und zu teilen. Der springende Punkt könnte aus meiner Sicht sein, dass sich chinesische Investoren gerne einen großen Teil vom Kuchen sichern, SQZG selbst jedoch zu keinem Zeitpunkt mehr als 19,9 % an TON halten darf, wenn der Vertrag wie geplant geschlossen wird. So könnte man sich theoretisch indirekt mehr Mitsprache sichern. Kann natürlich auch einen ganz anderen Grund haben!

***

Wir haben bei AUD 0,42 heute auf Tageshoch geschlossen!

***

BB ist auch in diesem Interview wie immer positiv gestimmt, allerdings klingt es für mich nicht so, als hätte er zu diesem Zeitpunkt schon gewusst, dass er nach Börsenschluss den nächsten TH für TON ausrufen muss.

TON ist bis maximal zum Handelsbeginn am 14.05. vom Handel ausgesetzt.

"Triton Minerals Limited (Triton or Company) hereby requests a trading halt from the ASX pending an announcement regarding executing agreements to form strategic relationships.

Triton requests the trading halt to last from commencement of trading on Tuesday, 12 May 2015 until the release of the announcement, in any case no later than the commencement of trading on Thursday, 14 May 2015."

Aus einem anderen Form stammt folgende Information aus einem Telefonat mit BB

"The countries mentioned when I spoke to BB on 28/4/15 and posted at #: 15175031 were China, Japan, Singapore, Mozambique and the UK."

Gut möglich, dass es ein Off-Take Agreement mit einer Partei außerhalb von China ist, welches zu dem TH geführt hat. Ein Gegengewicht zu China könnte nicht schaden, Japan wäre auf meiner persönlichen Wunschliste weit vorne.

Offensichtlich hat die Handelsaussetzung heute in Stuttgart nicht so ganz gegriffen.

Jedenfalls gab es heute 3 Trades.

3709 zu 0,304 EUR

3630 zu 0,303 EUR

42000 zu 0,281 EUR

Pari wäre zum heutigen Wechselkurs von 1,4113 AUD zum EURO 0,2976 EUR gewesen.

In anderen Worten trotz der zu erwartenden guten News hat jemand diese Anzahl 5,572% unter Parikurs verkauft.

***

Ich hoffe ich habe niemanden gelangweilt.

Schönen Feierabend.

Gruß phobieeee

11.05.2015 - Triton Completes $12 Million Placement

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

11.05.2015 - Triton Mozambique Graphite Projects Update

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

11.05.2015 - Trading Halt

http://www.tritonmineralsltd.com.au/attachments/article/56/4…

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

11.05.2015 - Triton Mozambique Graphite Projects Update

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

11.05.2015 - Trading Halt

http://www.tritonmineralsltd.com.au/attachments/article/56/4…

Ich bin auch noch dabei ... Und das schon ne ganze Weile ... Mein EK liegt bei 0,09 und hatte auch den Weg bis auf die 0,80CAD gemacht und wieder zurück ... Ich nachhinen hätte man natürlich in bisschen besser verkaufen und wieder kaufen können, aber das weiss nunmal keiner vorher ... Aber für mich stand von Anfang an fest: Entweder es geht hier mit nem ordentlich Batzen raus oder halt nicht ... Daher wartet ich geduldig auf Kurse > 1,00CAD ... Und bis dahin schaue ich mir das entspannt an und harre der Dinge, die da hoffentlich noch kommen werden ...

Großen Danke an dich, Phobieeee, für die regelmäßigen News, die du hier jedes Mal reinstellst und mir langes Suchen spare ... *Daumen hoch* ...

Großen Danke an dich, Phobieeee, für die regelmäßigen News, die du hier jedes Mal reinstellst und mir langes Suchen spare ... *Daumen hoch* ...

Hier der aktuelle Webcast ...

01 May 2015 - Triton impressed by Ancuabe met work

http://www.brrmedia.com/event/137705/brad-boyle-ceo--managin…

01 May 2015 - Triton impressed by Ancuabe met work

http://www.brrmedia.com/event/137705/brad-boyle-ceo--managin…

30 Apr 2015 - Quarterly Cashflow Report

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

30 Apr 2015 - Quarterly Activities Report

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

30 Apr 2015 - Quarterly Activities Report

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

29 Apr 2015 - Triton Minerals Corporate Presentation

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

+ viel wichtiger !!!

29 Apr 2015 - Extraordinary Metallurgical Results - Ancuabe Project

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

"Triton Minerals Ltd. (ASX:TON) (Triton, Company) is pleased to confirm receipt of further assays and particle size distribution results for the Ancuabe prospect.

- Additional metallurgical investigations confirm the substantial presence of large particle size (>590µm) up to 3350µm (in excess of 6 mesh) in the Ancuabe samples.

- Flotation tests confirm 92% of the discrete mass particles in the samples were larger than 150µm (+100 mesh).

- Total graphitic carbon ("TGC") recovery of up to 96.1% in the rougher flotation.

- Graphitic carbon grades of 96.4% achieved in the primary cleaner at a yield of 15.1% and recovery of 91.0%.

- Graphite concentrate grade of 98.7% TGC was achieved after single bead mill regrind and four cleaner stages.

- Highest head grade of 24% TGC occurs in the -600+425µm size fraction.

- The graphite is readily liberated by crushing, grinding, rougher and cleaner flotation, with no additional regrind required.

- Further tests to optimize the graphite flake recovery process are continuing.

Triton Minerals' Managing Director & CEO Brad Boyle said: "Triton is extremely pleased to announce that an initial sighter test of Ancuabe bulk sample material that at the very least, has produced positive and encouraging metallurgical results.

However, these early results are, in my opinion, quite extraordinary and bode well for establishing a new benchmark for the highest quality graphite products available from Mozambique.

The tests confirm grades of up to 98.7% TGC after only 4 cleaner stages after a single bead mill regrind. Achieving such high grades and recoveries at very coarse particle sizes with a yield or mass pull of only 15% has very positive implications for potential downstream economics.

Due to the high graphite grades of around 98% TGC, which were obtained in just two minutes of flotation, we can safely assume that the particles comprises dominantly graphite flake. The concentrate flake size distribution data will be forthcoming shortly.

These results support the concurrent advancement of the Ancuabe project which is expected to provide Triton with the ability to provide greater flexibility in the range of TMG products, for a wide range of clients, this would place Triton in an extremely unique and advantageous position in comparison to its peers."

Metallurgical Results Recovers Jumbo Graphite Flakes

Initial mineralogical and metallurgical test work on the Ancuabe sample by Mintek (Johannesburg) confirms the strong presence and recovery of jumbo graphite flakes, including graphite flakes in excess of 3mm being identified during the flotation process.

Mintek flotation tests and feed particle size distribution results confirms 92% of the graphitic particles in the samples were larger than 150µm including:

- 86% larger than 177µm (+80 mesh)

- 73% larger than 300µm (+50 mesh)

- 46% larger than 590µm (+32 mesh)

- 20% larger than 850 µm (+20 mesh)

Micron Mesh Discrete Mass (%) Grade (%TGC)

>590 32 46.0 98.1

>300 50 26.6 97.0

>177 80 13.4 95.1

>150 100 6.0 94.0

>75 200 8.0 92.7

Table 1. Ancuabe - size by assay

of flotation feed (target 80% - 850µ)

The confirmation of the very large size fractions of high graphite grade recovered from flotation is consistent with the mineralogical observations and is considered an extremely positive result for Triton, with potentially positive economic implications.

These outstanding results have been obtained from the rougher stages only, in a flotation testing program undertaken at the Mintek Laboratories on the 100kg sample.

Triton confirms the preliminary metallurgical results shows the total carbon ("TC") recovery of 96.1% in the rougher flotation of the Ancuabe samples. A primary cleaner grade of 96.4%TGC was achieved.

Prior to the flotation process the initial average measured graphite head grade for the Ancuabe samples was 14.4% TGC. Triton notes that with limited processing graphite head grades were upgraded to an average of 15.8% TGC. Further, the results show the graphite grades in the partial size range of the 300µm -1180µm substantially exceed the overall average graphite head grade (Figure 2 in link below).

These results confirm the high value potential of the Ancuabe project, with high graphite grades of up to 24%TGC obtained and the majority of the partial sizes contained within the jumbo and super jumbo flake range, any graphite concentrate produced in this partial size range is likely to sell for in excess of US$2,000 or more per tonne. The combination of high graphite grades and jumbo graphite flakes would provide very strong economics of any future graphite production at the Ancuabe project.

The very high graphite grades were obtained through the standard methods of crushing, grinding, rougher and cleaner flotation, without the need to complete a regrind of the graphite concentrate and demonstrates how readily the graphite flakes can be separated during the flotation process, which are strong indicators of the high quality nature of the Ancuabe project. The reduced processing requirements during the graphite flotation will likely have a positive impact for Triton reducing the time and energy needed to complete the process.

Ongoing optimization of the metallurgical process is expected to further enhance the quality of the final product concentrate. The Company is also reviewing options to see if the graphite concentrate can be further upgraded using supplementary treatments.

Triton considers these initial results to be an encouraging outcome, and are consistent with results from the first crush as announced by the Company on 26 February 2015. These flotation tests confirm the majority of the graphite can be liberated cleanly from the surrounding gangue material during the initial crushing, without the need for additional processing.

Triton notes that the liberation of a large portion of the graphite flakes by crushing only, significantly reduces the time and cost of extraction whilst achieving the preservation of the larger flake size fractions. The Company is optimistic of further encouraging results with the completion of additional metallurgical test work.

CONCLUSIONS

The latest metallurgical results from Ancuabe confirms the very high quality nature of the Ancuabe graphite project and signify positive implications for potential downstream economics.

Should Triton be able to demonstrate production of economic quantities of large and jumbo flake graphite at Ancuabe, it could complement the TMG products range and provide the Company with the potential to produce large volumes of high grade (high value) graphite in the full range of flake sizes, thereby accommodating a wider range of end-user requirements.

To view tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-TON-717225.pd…

About Triton Minerals Limited:

Triton Minerals Ltd. (ASX:TON) is an ASX listed, responsible mineral explorer and resource management company headquartered in Perth, Australia.

Led by a highly experienced management team, Triton Minerals' vision is to grow shareholder's value through discovery or development of base metal, gold and other precious metal deposits.

Triton has made excellent progress with its three Graphite projects located in the Cabo Delgado Province in Mozambique, with the program successfully identifying a number of graphitic exposures.

It is the Company's belief that the Mozambique, Balama North Project could host multiple and very substantial world class graphite deposits.

Source:

Triton Minerals Ltd.

Contact:

Triton Minerals Ltd. Brad Boyle T: +61-8-6489-2555 F: +61-8-9388-1252 WWW: www.tritonmineralsltd.com.au"

***

Für mich ist es unbegreiflich, wie sich der Kurs bei TON bewegt und das ist glaube ich auch das große Problem.

Das Phänomen, dass alle guten News abgekauft werden oder ein großes GAP bilden um es dann postwendend wieder zu schließen.

Sobald der LOI in ein bindendes Agreement gewandelt wird (Entscheidung bis max. 30 Juni), MUSS eine wirkliche Neubewertung erfolgen.

Wichtig wäre es natürlich auch entsprechendes Backup durch Instos zu erhalten und dies dürfte nur eine Frage der Zeit sein, bei dem rasanten Tempo in welchem das Management arbeiten.

Laut den Kommentaren auf HC wird Brad diese Woche noch mehrere Präsentationstermine mit Analysten in Australien haben. Hierzu würde die neue Präsentation passen.

Etwas mehr Aktivität auch in diesem Forum wäre sehr wünschenswert,

aber vermutlich haben sich bereits einige die Finger verbrannt im letzten Jahr (mich eingeschlossen).

Schönen Mittwoch.

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

+ viel wichtiger !!!

29 Apr 2015 - Extraordinary Metallurgical Results - Ancuabe Project

http://www.tritonmineralsltd.com.au/attachments/article/56/1…

"Triton Minerals Ltd. (ASX:TON) (Triton, Company) is pleased to confirm receipt of further assays and particle size distribution results for the Ancuabe prospect.

- Additional metallurgical investigations confirm the substantial presence of large particle size (>590µm) up to 3350µm (in excess of 6 mesh) in the Ancuabe samples.

- Flotation tests confirm 92% of the discrete mass particles in the samples were larger than 150µm (+100 mesh).

- Total graphitic carbon ("TGC") recovery of up to 96.1% in the rougher flotation.

- Graphitic carbon grades of 96.4% achieved in the primary cleaner at a yield of 15.1% and recovery of 91.0%.

- Graphite concentrate grade of 98.7% TGC was achieved after single bead mill regrind and four cleaner stages.

- Highest head grade of 24% TGC occurs in the -600+425µm size fraction.

- The graphite is readily liberated by crushing, grinding, rougher and cleaner flotation, with no additional regrind required.

- Further tests to optimize the graphite flake recovery process are continuing.

Triton Minerals' Managing Director & CEO Brad Boyle said: "Triton is extremely pleased to announce that an initial sighter test of Ancuabe bulk sample material that at the very least, has produced positive and encouraging metallurgical results.

However, these early results are, in my opinion, quite extraordinary and bode well for establishing a new benchmark for the highest quality graphite products available from Mozambique.

The tests confirm grades of up to 98.7% TGC after only 4 cleaner stages after a single bead mill regrind. Achieving such high grades and recoveries at very coarse particle sizes with a yield or mass pull of only 15% has very positive implications for potential downstream economics.

Due to the high graphite grades of around 98% TGC, which were obtained in just two minutes of flotation, we can safely assume that the particles comprises dominantly graphite flake. The concentrate flake size distribution data will be forthcoming shortly.

These results support the concurrent advancement of the Ancuabe project which is expected to provide Triton with the ability to provide greater flexibility in the range of TMG products, for a wide range of clients, this would place Triton in an extremely unique and advantageous position in comparison to its peers."

Metallurgical Results Recovers Jumbo Graphite Flakes

Initial mineralogical and metallurgical test work on the Ancuabe sample by Mintek (Johannesburg) confirms the strong presence and recovery of jumbo graphite flakes, including graphite flakes in excess of 3mm being identified during the flotation process.

Mintek flotation tests and feed particle size distribution results confirms 92% of the graphitic particles in the samples were larger than 150µm including:

- 86% larger than 177µm (+80 mesh)

- 73% larger than 300µm (+50 mesh)

- 46% larger than 590µm (+32 mesh)

- 20% larger than 850 µm (+20 mesh)

Micron Mesh Discrete Mass (%) Grade (%TGC)

>590 32 46.0 98.1

>300 50 26.6 97.0

>177 80 13.4 95.1

>150 100 6.0 94.0

>75 200 8.0 92.7

Table 1. Ancuabe - size by assay

of flotation feed (target 80% - 850µ)

The confirmation of the very large size fractions of high graphite grade recovered from flotation is consistent with the mineralogical observations and is considered an extremely positive result for Triton, with potentially positive economic implications.

These outstanding results have been obtained from the rougher stages only, in a flotation testing program undertaken at the Mintek Laboratories on the 100kg sample.

Triton confirms the preliminary metallurgical results shows the total carbon ("TC") recovery of 96.1% in the rougher flotation of the Ancuabe samples. A primary cleaner grade of 96.4%TGC was achieved.

Prior to the flotation process the initial average measured graphite head grade for the Ancuabe samples was 14.4% TGC. Triton notes that with limited processing graphite head grades were upgraded to an average of 15.8% TGC. Further, the results show the graphite grades in the partial size range of the 300µm -1180µm substantially exceed the overall average graphite head grade (Figure 2 in link below).

These results confirm the high value potential of the Ancuabe project, with high graphite grades of up to 24%TGC obtained and the majority of the partial sizes contained within the jumbo and super jumbo flake range, any graphite concentrate produced in this partial size range is likely to sell for in excess of US$2,000 or more per tonne. The combination of high graphite grades and jumbo graphite flakes would provide very strong economics of any future graphite production at the Ancuabe project.

The very high graphite grades were obtained through the standard methods of crushing, grinding, rougher and cleaner flotation, without the need to complete a regrind of the graphite concentrate and demonstrates how readily the graphite flakes can be separated during the flotation process, which are strong indicators of the high quality nature of the Ancuabe project. The reduced processing requirements during the graphite flotation will likely have a positive impact for Triton reducing the time and energy needed to complete the process.

Ongoing optimization of the metallurgical process is expected to further enhance the quality of the final product concentrate. The Company is also reviewing options to see if the graphite concentrate can be further upgraded using supplementary treatments.

Triton considers these initial results to be an encouraging outcome, and are consistent with results from the first crush as announced by the Company on 26 February 2015. These flotation tests confirm the majority of the graphite can be liberated cleanly from the surrounding gangue material during the initial crushing, without the need for additional processing.

Triton notes that the liberation of a large portion of the graphite flakes by crushing only, significantly reduces the time and cost of extraction whilst achieving the preservation of the larger flake size fractions. The Company is optimistic of further encouraging results with the completion of additional metallurgical test work.

CONCLUSIONS

The latest metallurgical results from Ancuabe confirms the very high quality nature of the Ancuabe graphite project and signify positive implications for potential downstream economics.

Should Triton be able to demonstrate production of economic quantities of large and jumbo flake graphite at Ancuabe, it could complement the TMG products range and provide the Company with the potential to produce large volumes of high grade (high value) graphite in the full range of flake sizes, thereby accommodating a wider range of end-user requirements.

To view tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-TON-717225.pd…

About Triton Minerals Limited:

Triton Minerals Ltd. (ASX:TON) is an ASX listed, responsible mineral explorer and resource management company headquartered in Perth, Australia.

Led by a highly experienced management team, Triton Minerals' vision is to grow shareholder's value through discovery or development of base metal, gold and other precious metal deposits.

Triton has made excellent progress with its three Graphite projects located in the Cabo Delgado Province in Mozambique, with the program successfully identifying a number of graphitic exposures.

It is the Company's belief that the Mozambique, Balama North Project could host multiple and very substantial world class graphite deposits.

Source:

Triton Minerals Ltd.

Contact:

Triton Minerals Ltd. Brad Boyle T: +61-8-6489-2555 F: +61-8-9388-1252 WWW: www.tritonmineralsltd.com.au"

***

Für mich ist es unbegreiflich, wie sich der Kurs bei TON bewegt und das ist glaube ich auch das große Problem.

Das Phänomen, dass alle guten News abgekauft werden oder ein großes GAP bilden um es dann postwendend wieder zu schließen.

Sobald der LOI in ein bindendes Agreement gewandelt wird (Entscheidung bis max. 30 Juni), MUSS eine wirkliche Neubewertung erfolgen.

Wichtig wäre es natürlich auch entsprechendes Backup durch Instos zu erhalten und dies dürfte nur eine Frage der Zeit sein, bei dem rasanten Tempo in welchem das Management arbeiten.

Laut den Kommentaren auf HC wird Brad diese Woche noch mehrere Präsentationstermine mit Analysten in Australien haben. Hierzu würde die neue Präsentation passen.

Etwas mehr Aktivität auch in diesem Forum wäre sehr wünschenswert,

aber vermutlich haben sich bereits einige die Finger verbrannt im letzten Jahr (mich eingeschlossen).

Schönen Mittwoch.

Und hier noch ein sehr guter Userbeitrag (von ozpolarbear mit dessen Erlaubnis) zu diesem LOI aus einem anderen Forum. Geschrieben am 27/04/15 um 19:17:24

(quote)

Hi guys,

I gave my first glance quick understanding earlier today and will now try to present my best understand of today’s developments in better detail. Note that as always, my comments and mainly from longer term angle, and I don’t pay much attention to shorter term movements. Note obviously that today’s announcement is LOI and obviously SQZG need to satisfactorily complete their DD for everything to go through.

1) Funding – Risk management point 1 - I’ve mentioned earlier many times that funding is one of the most important points. I said yesterday that I'd rate funding very highly and I definitely do. Triton has managed to secure funding of 200 million US$ which is very creditable. This is exactly what I was hoping for and IMHO, one of TON's biggest issues is out of the way. One of the biggest risks for all explorers is funding as lack of funding often means that they will never make it into production. This risk has now been addressed. IMHO, there has to be some give and take. Maybe, we could have gotten a better deal or maybe not, but if I’m looking at things from a longer term risk management issue, then this is one of the best announcements till date, as it ensures that we get the ball rolling

2) No crushing debt burden in future –Risk management point 2 – I’m again looking at how this deal ensures that there is no crushing debt burden for future. One of the major risks for all companies at any stage of their life cycle is debt management. Companies that do not manage their debt effectively eventually collapse under the weight of their debt and end up in admin or liquidation. I also mentioned earlier that I have certain overall global macro concerns in the years to come which could include a liquidity crunch for all companies. TON has now addressed this issue very well. I’ll explain further – Careful reading of the announcement indicates that there are more sales besides the 10 year contract. Note that the term of the loan is maximum 5 years. Note that offake agreement starts after the debt is paid. Note that there are more sales while the debt agreement is in force albeit at a good price to SQZG – 875 USD and upto 200,000 tonnes of graphite. One year of these sales would mean revenue of 175 million USD, and so on till the debt is repaid. This is a win-win for both TON and SQZG as it gives us more revenue and them a good price, all in the meantime ensuring that debt will eventually get repaid comfortably. And the fun finally starts once the debt is repaid with a huge 10 year offtake.

3) Cornerstone investor – Risk management point 3 – While I agree that dilution is not the best scenario, I always mentioned that I’m hoping for a cornerstone investor. SQZG has indicated that it is keen to get on board as an investor, funder, customer, etc. and we might just have a cornerstone investor on board, folks. This could in the long run be even better than having an insto as a cornerstone investor as SQZG’s interests are aligned with us from many angles. One the things I loved about management is that they have skin in the game and their interests are aligned with ours. I’m happy that this could also apply to our major customer now. Hopefully, we can also have cornerstone instos in future who I hope will see the great value TON offers.

4) Floor price – Just like the YXGC offtake, we have a floor price here too. This is a major positive in the case of a collapse in graphite prices. I’ve explained this in my analysis of the YXGC offtake agreement. Note that the minimum contract revenue is 1.5 billion USD and this takes into account the minimum or floor price. Actual price is likely to be much higher.

5) Key wordings from announcement – I’ll copy and paste 3 paras which I found interesting in today’s announcement -

Point 1 – “The Company’s focus is to rapidly develop the TMG projects into production and maintain a secure revenue stream to create genuine long term value for Triton’s shareholders, the execution of this LOI is another key milestone in achieving this goal”

Point 2 – “Successful finalisation of definitive agreements that may result from the LOI will secure full funding for the Nicanda Hill deposit, together with a 10 year 200,000 tonnes off-take of Nicanda Hill TMG concentrate. In such a case, Triton anticipates that many of the key development milestones at the Nicanda Hill will be expedited and the expected large-scale commercial graphite production may be achieved earlier than originally scheduled. This would allow Triton to establish and secure a substantial and expanding market presence ahead of many other peer companies in the graphite sector.”

Point 3 – “The signing of this LOI demonstrates the strategic importance of graphite-based technologies and global growth potential of the graphite material market into which Triton is well positioned to supply.”

"Go into production, maintain secure revenue stream, full funding for Nicanda, expedite key milestones, production earlier than originally scheduled, establish and secure a substantial and expanding market presence ahead of peers, global growth potential of the graphite material market into which Triton is well positioned to supply" – These are some of the key points I gained from above. This deal is a strategic deal folks, and the sum of the individual parts of this deal is multiples higher than benefits of each individual deal. BB and team are clearly looking much ahead, and this deal is just a stepping stone on to greater things to come.

6) Negative comments – As expected, we had our fair share of critics as usual. I’ve actually written 1-2 points on negative comments, downramping vs upramping debate, etc. in the past and it has helped me personally to be very cool and relaxed today as someone with a longer time frame. I hope people read those comments of mine, which might explain the negative comments to some extent.

7) SQZG a Solid company - SQZG would be a good cornerstone investor IMHO. Please read the end of the investment – Around 1000 staff, lots of branches, listed Chinese company and TON with assistance of independent advisors has already done their DD on SQZG

8) Share price dump – One the biggest headaches in the past for TON was the “sell the fact” phenomenon. To a certain extent, it might have been the case today too. But this is now of zero concern to long term investors. It might have been of some importance in the past due to the fact that capital raise was always due to come later and this is dependent on share price. But we are in a unique position now with SQZG getting on board as a potential cornerstone investor.

9) Revenue – There is a lot of revenue due for the coming years. Let us take a quick look. Note that the amounts took into account floor price and not actual value. Current price when I saw an article recently was around 1500 USD. I think I've linked that article in an earlier comment. Let us assume that we sell to YXGC at 1500 and to SQZG at 1400 (mentioned in LOI that there would be some discount to market price).Let us assume AUD vs conversion rate at a conservative 0.75 rate

So we have 100,000 tonnes * 1500 or 150 million USD which gives us 200 million AUD per year sales to YXGC

And we have 200,000 tonnes *1400 or 280 million USD which gives us an additional 373 million AUD per year sales to SQZG.

We thus have 573 million AUD per year revenue, and we are just getting started folks. Do the math. Of course, the discount to SQZG is still to be finalised. Imagine if graphite ever goes into a bubble with tech developments.

10) DT vs STT vs long term – I’ve mentioned it before and will mention it again. Please decide at the start whether you are entering as DT, STT or long term as dynamics change completely. I haven’t a clue about short term price fluctuations but today’s announcement is possibly the best one to date IMHO from longer term angle. Like I said earlier today, I don't think long termers are concerned with today’s price. Importantly, there has been much less frenzy today. I think inexperienced traders have burnt their fingers badly in the previous spikes and probably kept out completely today. This is all good for TON in longer run, with less volatility and spreads, and more solidity, as value investors step on board.

11) BB factor – I mentioned it today morning that people who have not met Brad underestimate his charisma, likeability and ability to influence people. In what was supposed to be a limited market, he has already secured some huge agreements, and in just 1 month, and I don't this is the end, but just the start. BB and management are one of our greatest assets and maybe even a bigger asset than our massive deposit

12) Plant design and future – Great point today by @dixi normass below

http://hotcopper.com.au/threads/ann...icanda-hill.2502678/pa…

It is great to see people like dixi take the initiative and call BB to address queries. Dixi notes that after the initial scaling up the plant design output would be greater then 400 000 T/A. Please also read subsequent points by Dixi which indicate that it could be 500,000 but the line was not clear. In any case, it is just further reassurance that management has given due thought to further expansion and further offtakes

13) Further demand from SQZG – Great point by @Milanese68 below

http://hotcopper.com.au/threads/ann...icanda-hill.2502678/pa…

Again great to see holders call BB, and Milanese rightly advises everyone to call BB to address their queries. Milanese pointed out a great point that SQZG wanted to go ahead with 400,000 tonnes per year but BB scaled it back to 200,000 tonnes as a starting point. “Starting point” is a key word here folks. Like I mentioned earlier, this deal is a stepping stone onto greater things in future. I trust BB to properly assess the risks vs benefits of expansion and make the best decisions that will benefit us all in the time to come. Milanese rightly points out that this shows how serious SQZG are as customers.

14) SYR up - SYR has quietly moved up some 30 c in the past 2 sessions. If there is some good news for SYR, I welcome it, and treat it as good news for the sector.SYR could also be up due to TON's good news and it is inevitable that TON will soon lead to lead the industry sentiment jointly with SYR or separately.

Like I’ve mentioned in the past, I see SYR’s market cap as our first major target and IMHO, once the market caps have more parity, I feel that investors in the coming years will eventually see the benefits of a merger. This is obviously some years ahead and may or may not happen, but I see tremendous synergies and great things that could happen for a combined company. In any case, congrats in advance to any SYR shareholders if some good news is coming your way.

15) Peer’s hands tied up – Having praised our peer, I must now point out what could be one of their major mistakes. I pointed this out earlier too in my upramping vs downramping comment. Our peer might have made a major mistake of tying their own hands up for 3 years and agreeing not to sell to any other customer. In the meantime, TON has the ability to simply race ahead and soak up all the demand in the graphite industry.

16) Equity agreement with SQZG- TON will be issuing shares at a minimum of 50c which is above the current price. So this is a decent price for both parties. TON has a lot of flexibility in allotting the shares – up to 100 million (and not necessarily 100 million), shares to be issues in multiple (3 or more) tranches, SQZG would hold less than 20% equity holding of TON at any time, TON to decide value and amount issued each time, etc. So we have some guaranteed funding at a good price. This means that shares could also be issued at 1$ or 1.5$ or anything. I guess it just depends on how much TON needs the funds. SQZG holding less than 20% could mean much less dilution than we anticipate. I’ll leave BB to decide the best possible options of equity vs debt, etc.I'm just happy that we have both equity and debt funding and lots of options.

17) Huge graphite market – I mentioned earlier that BB has managed to pull 2 rabbits (elephant sized rabbits) out of the hat when people are saying that the graphite market is small. Imagine if graphite ever goes into a bubble in the years to come, and just think what BB will manage to achieve then. The YXGC and SQZG deals show that there could be much more to come in the following years and TON’s market leading deposit can set the tone of the entire industry. These deals are a great indication of the future of the industry and TON’s massive role in the years to come.

18) SQZG comments on TON – Please read the announcement folks. They consider Triton as the premier future developer and producer, TON as the industry leader and believe that they are aligning their company with TON in a strategic long term relationship. This is a glowing tribute and IMHO with this deal, TON is now truly the market leader

19) Strategic long term relationship – It is fascinating to see how TON has gone about its 2 major offtakes. While other graphite companies have looked for customers, TON has looked for strategic long term relationships. While other companies have sold graphite, TON has sold the story. This ties in with what I’ve mentioned about BB before, and his ability to influence people.

20) Conclusion – What more can I say guys? No elaborate conclusion from me today. I'm exhausted with all that typing and not typing anymore for the rest of today

Facts speak for themselves,and people are free to buy or sell as they choose. If it falls, then it just means that we are moving on to stronger hands. Like I said earlier today, with all due respect to our peer, we have hit far more goal posts in every respect and are better in almost each and every respect. Our market cap should reflect this in the time to come. I don’t have a clue about short term price fluctuations but on pure fundamentals, TON could be a long term absolute gem.

(unqote)

Bitte bildet euch eure eigene Meinung hierzu.

Gruß phobieeee

(quote)

Hi guys,

I gave my first glance quick understanding earlier today and will now try to present my best understand of today’s developments in better detail. Note that as always, my comments and mainly from longer term angle, and I don’t pay much attention to shorter term movements. Note obviously that today’s announcement is LOI and obviously SQZG need to satisfactorily complete their DD for everything to go through.

1) Funding – Risk management point 1 - I’ve mentioned earlier many times that funding is one of the most important points. I said yesterday that I'd rate funding very highly and I definitely do. Triton has managed to secure funding of 200 million US$ which is very creditable. This is exactly what I was hoping for and IMHO, one of TON's biggest issues is out of the way. One of the biggest risks for all explorers is funding as lack of funding often means that they will never make it into production. This risk has now been addressed. IMHO, there has to be some give and take. Maybe, we could have gotten a better deal or maybe not, but if I’m looking at things from a longer term risk management issue, then this is one of the best announcements till date, as it ensures that we get the ball rolling

2) No crushing debt burden in future –Risk management point 2 – I’m again looking at how this deal ensures that there is no crushing debt burden for future. One of the major risks for all companies at any stage of their life cycle is debt management. Companies that do not manage their debt effectively eventually collapse under the weight of their debt and end up in admin or liquidation. I also mentioned earlier that I have certain overall global macro concerns in the years to come which could include a liquidity crunch for all companies. TON has now addressed this issue very well. I’ll explain further – Careful reading of the announcement indicates that there are more sales besides the 10 year contract. Note that the term of the loan is maximum 5 years. Note that offake agreement starts after the debt is paid. Note that there are more sales while the debt agreement is in force albeit at a good price to SQZG – 875 USD and upto 200,000 tonnes of graphite. One year of these sales would mean revenue of 175 million USD, and so on till the debt is repaid. This is a win-win for both TON and SQZG as it gives us more revenue and them a good price, all in the meantime ensuring that debt will eventually get repaid comfortably. And the fun finally starts once the debt is repaid with a huge 10 year offtake.

3) Cornerstone investor – Risk management point 3 – While I agree that dilution is not the best scenario, I always mentioned that I’m hoping for a cornerstone investor. SQZG has indicated that it is keen to get on board as an investor, funder, customer, etc. and we might just have a cornerstone investor on board, folks. This could in the long run be even better than having an insto as a cornerstone investor as SQZG’s interests are aligned with us from many angles. One the things I loved about management is that they have skin in the game and their interests are aligned with ours. I’m happy that this could also apply to our major customer now. Hopefully, we can also have cornerstone instos in future who I hope will see the great value TON offers.

4) Floor price – Just like the YXGC offtake, we have a floor price here too. This is a major positive in the case of a collapse in graphite prices. I’ve explained this in my analysis of the YXGC offtake agreement. Note that the minimum contract revenue is 1.5 billion USD and this takes into account the minimum or floor price. Actual price is likely to be much higher.

5) Key wordings from announcement – I’ll copy and paste 3 paras which I found interesting in today’s announcement -

Point 1 – “The Company’s focus is to rapidly develop the TMG projects into production and maintain a secure revenue stream to create genuine long term value for Triton’s shareholders, the execution of this LOI is another key milestone in achieving this goal”

Point 2 – “Successful finalisation of definitive agreements that may result from the LOI will secure full funding for the Nicanda Hill deposit, together with a 10 year 200,000 tonnes off-take of Nicanda Hill TMG concentrate. In such a case, Triton anticipates that many of the key development milestones at the Nicanda Hill will be expedited and the expected large-scale commercial graphite production may be achieved earlier than originally scheduled. This would allow Triton to establish and secure a substantial and expanding market presence ahead of many other peer companies in the graphite sector.”

Point 3 – “The signing of this LOI demonstrates the strategic importance of graphite-based technologies and global growth potential of the graphite material market into which Triton is well positioned to supply.”

"Go into production, maintain secure revenue stream, full funding for Nicanda, expedite key milestones, production earlier than originally scheduled, establish and secure a substantial and expanding market presence ahead of peers, global growth potential of the graphite material market into which Triton is well positioned to supply" – These are some of the key points I gained from above. This deal is a strategic deal folks, and the sum of the individual parts of this deal is multiples higher than benefits of each individual deal. BB and team are clearly looking much ahead, and this deal is just a stepping stone on to greater things to come.

6) Negative comments – As expected, we had our fair share of critics as usual. I’ve actually written 1-2 points on negative comments, downramping vs upramping debate, etc. in the past and it has helped me personally to be very cool and relaxed today as someone with a longer time frame. I hope people read those comments of mine, which might explain the negative comments to some extent.

7) SQZG a Solid company - SQZG would be a good cornerstone investor IMHO. Please read the end of the investment – Around 1000 staff, lots of branches, listed Chinese company and TON with assistance of independent advisors has already done their DD on SQZG

8) Share price dump – One the biggest headaches in the past for TON was the “sell the fact” phenomenon. To a certain extent, it might have been the case today too. But this is now of zero concern to long term investors. It might have been of some importance in the past due to the fact that capital raise was always due to come later and this is dependent on share price. But we are in a unique position now with SQZG getting on board as a potential cornerstone investor.

9) Revenue – There is a lot of revenue due for the coming years. Let us take a quick look. Note that the amounts took into account floor price and not actual value. Current price when I saw an article recently was around 1500 USD. I think I've linked that article in an earlier comment. Let us assume that we sell to YXGC at 1500 and to SQZG at 1400 (mentioned in LOI that there would be some discount to market price).Let us assume AUD vs conversion rate at a conservative 0.75 rate

So we have 100,000 tonnes * 1500 or 150 million USD which gives us 200 million AUD per year sales to YXGC

And we have 200,000 tonnes *1400 or 280 million USD which gives us an additional 373 million AUD per year sales to SQZG.

We thus have 573 million AUD per year revenue, and we are just getting started folks. Do the math. Of course, the discount to SQZG is still to be finalised. Imagine if graphite ever goes into a bubble with tech developments.

10) DT vs STT vs long term – I’ve mentioned it before and will mention it again. Please decide at the start whether you are entering as DT, STT or long term as dynamics change completely. I haven’t a clue about short term price fluctuations but today’s announcement is possibly the best one to date IMHO from longer term angle. Like I said earlier today, I don't think long termers are concerned with today’s price. Importantly, there has been much less frenzy today. I think inexperienced traders have burnt their fingers badly in the previous spikes and probably kept out completely today. This is all good for TON in longer run, with less volatility and spreads, and more solidity, as value investors step on board.

11) BB factor – I mentioned it today morning that people who have not met Brad underestimate his charisma, likeability and ability to influence people. In what was supposed to be a limited market, he has already secured some huge agreements, and in just 1 month, and I don't this is the end, but just the start. BB and management are one of our greatest assets and maybe even a bigger asset than our massive deposit

12) Plant design and future – Great point today by @dixi normass below

http://hotcopper.com.au/threads/ann...icanda-hill.2502678/pa…

It is great to see people like dixi take the initiative and call BB to address queries. Dixi notes that after the initial scaling up the plant design output would be greater then 400 000 T/A. Please also read subsequent points by Dixi which indicate that it could be 500,000 but the line was not clear. In any case, it is just further reassurance that management has given due thought to further expansion and further offtakes

13) Further demand from SQZG – Great point by @Milanese68 below

http://hotcopper.com.au/threads/ann...icanda-hill.2502678/pa…

Again great to see holders call BB, and Milanese rightly advises everyone to call BB to address their queries. Milanese pointed out a great point that SQZG wanted to go ahead with 400,000 tonnes per year but BB scaled it back to 200,000 tonnes as a starting point. “Starting point” is a key word here folks. Like I mentioned earlier, this deal is a stepping stone onto greater things in future. I trust BB to properly assess the risks vs benefits of expansion and make the best decisions that will benefit us all in the time to come. Milanese rightly points out that this shows how serious SQZG are as customers.

14) SYR up - SYR has quietly moved up some 30 c in the past 2 sessions. If there is some good news for SYR, I welcome it, and treat it as good news for the sector.SYR could also be up due to TON's good news and it is inevitable that TON will soon lead to lead the industry sentiment jointly with SYR or separately.

Like I’ve mentioned in the past, I see SYR’s market cap as our first major target and IMHO, once the market caps have more parity, I feel that investors in the coming years will eventually see the benefits of a merger. This is obviously some years ahead and may or may not happen, but I see tremendous synergies and great things that could happen for a combined company. In any case, congrats in advance to any SYR shareholders if some good news is coming your way.

15) Peer’s hands tied up – Having praised our peer, I must now point out what could be one of their major mistakes. I pointed this out earlier too in my upramping vs downramping comment. Our peer might have made a major mistake of tying their own hands up for 3 years and agreeing not to sell to any other customer. In the meantime, TON has the ability to simply race ahead and soak up all the demand in the graphite industry.

16) Equity agreement with SQZG- TON will be issuing shares at a minimum of 50c which is above the current price. So this is a decent price for both parties. TON has a lot of flexibility in allotting the shares – up to 100 million (and not necessarily 100 million), shares to be issues in multiple (3 or more) tranches, SQZG would hold less than 20% equity holding of TON at any time, TON to decide value and amount issued each time, etc. So we have some guaranteed funding at a good price. This means that shares could also be issued at 1$ or 1.5$ or anything. I guess it just depends on how much TON needs the funds. SQZG holding less than 20% could mean much less dilution than we anticipate. I’ll leave BB to decide the best possible options of equity vs debt, etc.I'm just happy that we have both equity and debt funding and lots of options.

17) Huge graphite market – I mentioned earlier that BB has managed to pull 2 rabbits (elephant sized rabbits) out of the hat when people are saying that the graphite market is small. Imagine if graphite ever goes into a bubble in the years to come, and just think what BB will manage to achieve then. The YXGC and SQZG deals show that there could be much more to come in the following years and TON’s market leading deposit can set the tone of the entire industry. These deals are a great indication of the future of the industry and TON’s massive role in the years to come.

18) SQZG comments on TON – Please read the announcement folks. They consider Triton as the premier future developer and producer, TON as the industry leader and believe that they are aligning their company with TON in a strategic long term relationship. This is a glowing tribute and IMHO with this deal, TON is now truly the market leader

19) Strategic long term relationship – It is fascinating to see how TON has gone about its 2 major offtakes. While other graphite companies have looked for customers, TON has looked for strategic long term relationships. While other companies have sold graphite, TON has sold the story. This ties in with what I’ve mentioned about BB before, and his ability to influence people.

20) Conclusion – What more can I say guys? No elaborate conclusion from me today. I'm exhausted with all that typing and not typing anymore for the rest of today

Facts speak for themselves,and people are free to buy or sell as they choose. If it falls, then it just means that we are moving on to stronger hands. Like I said earlier today, with all due respect to our peer, we have hit far more goal posts in every respect and are better in almost each and every respect. Our market cap should reflect this in the time to come. I don’t have a clue about short term price fluctuations but on pure fundamentals, TON could be a long term absolute gem.

(unqote)

Bitte bildet euch eure eigene Meinung hierzu.

Gruß phobieeee

Hier noch der aktuelle BRR Webcast zu dem letzten Announcement

28 Apr 2015 - Triton signs LOI for Nicanda funding and off-take

28 Apr 2015 - Triton signs LOI for Nicanda funding and off-take

"Triton Minerals Limited - LOI for Project Funding and Off-Take for Nicanda Hill

Triton Minerals Ltd. (ASX:TON) (Triton or Company) is pleased to announce the formal signing of a letter of intent (LOI) with Chinese equity firm and resources trading house, Shenzhen Qianhai Zhongjin Group Co., Ltd (SQZG). Pursuant to the LOI, SQZG have agreed to provide funding of up to US$200 million (A$255m) to build and develop a graphite concentrate operation with initial capacity to produce up to 200,000 tonnes of graphite concentrate per year at Nicanda Hill.

Key Highlights

- Proposed project funding package of 50:50 debt to equity; Up to US$100 million direct equity investment in Triton and up to a US$100 million debt facility.

- An off-take agreement with an initial term of 10 years at 200,000 tonnes of graphite concentrate per year for Triton's Mozambique Graphite (TMG) sourced from Nicanda Hill; and

- Both the project funding agreement and the off-take agreement are conditional on the completion of a formal due diligence by SQZG, to be completed no later than 30 June 2015 and the execution of final binding agreements.

The successful finalisation of subsequent definitive agreements will secure full funding for the Nicanda Hill project, together with a 10 year 200,000 tonnes of graphite concentrate off-take per year of Nicanda Hill TMG concentrate.

The signing of this LOI demonstrates the strategic importance and growth potential of the graphite material supply market and of graphite-based technologies that Triton is well positioned to supply.

Triton's Managing Director & CEO, Brad Boyle said:

"This is yet another outstanding achievement for Triton as this Letter of Intent signifies an important step towards securing complete and comprehensive funding for the development of our flagship Nicanda Hill deposit. Shenzhen Qianhai Zhongjin Group Co., Ltd is a very large, reputable banking, equity and resource trading house.

We are delighted and privileged to be associated with SQZG who are looking to align themselves with Triton as a long term strategic partner, a cornerstone investor, financier and off-take partner."

SQZG's Managing Director, Mr Chen Shaogang said:

"As a result of our detailed analysis of the graphite supply business we have identified Triton as the premier future developer and producer. Considering various aspects such as resource quality, technical expertise, rapid and effective project progression, Board and management team determination and resolve, we view the Nicanda Hill deposit as a justifiably world class deposit and Triton as the industry leader.

As potentially the world's largest and lowest-cost producer, Triton holds a key asset in the graphite and vanadium world. We are delighted to align our Company with the Triton team in a strategic long term relationship and we look forward to working closely together through the due diligence process and hope to finalise a definitive agreement soon to formalise the terms of the LOI"

KEY TERMS OF THE LETTER OF INTENT

The LOI has a project funding component and an offtake component, of which the key terms of each are summarised below.

Project Funding Component

Amount: Up to US$200 million.

Equity:

- Up to US$100 million

- Subject to Triton's placement capacity, Triton will issue SQZG ordinary fully paid shares at the greater price of AUD$0.50 or market price.

- The issue of the equity in Triton may be undertaken in three (3) or more separate tranches, ensure that SQZG do not hold at any one time more than 19.99% equity in Triton.

- The total value and the amount of equity issued in the each tranche to Triton from SQZG is it at the sole discretion of Triton.

Debt:

- Up to US$100 million.

- Triton shall draw down the debt facility for the full construction of the mine at the Nicanda Hill project.

- The total amount of debt obtained by Triton will be at the sole discretion of Triton.

- Unless otherwise agreed in writing between the parties the term of the loan is for a maximum of five (5) years from the date of obtaining the funds from SQZG.

- Triton will repay the principle debt in full plus interest during the term of the loan.

- during the term of the loan and until the debt full is paid in full, Triton agrees to provide SQZG up to 200,000 tonnes of graphite concentrate at a fixed price US$875 per tonne FOB of material for any shipment. Purity of the graphite concentrate not less than 90% and moisture content up to 1%.

Other terms: Full terms and conditions to be specified in a binding funding agreement.

Shareholder approval maybe required to authorise the funding agreement whether or not the debt component of the funding agreement will be, is envisaged to be or may be (following formal negotiation) secured.

Triton notes should the funding agreement be secured following the completion of the due diligence and formal negotiations with SQZG, the issue of any securities pursuant to the equity component of the funding agreement may require shareholder approval. Further, in the event that the debt component of the funding agreement is secured, then this part of the transaction may also require additional shareholder approval.

Off-Take Component

Term: Initial Term of 10 years.

Amount: 200,000 tonnes per year.

Commencement: Once the full debt specified above in Project Funding has been repaid by Triton to SQZG, the parties will then commence the long term graphite concentrate off-take agreement.

Price: Triton will sell Nicanda Hill graphite concentrate to SQZG at a discount (to be agreed) to global graphite market price, but no less than a floor price of US$750 per tonne FOB for any shipment.

Purity: Not less than 90% and moisture content up to 1%.

Other terms: Full terms and conditions to be specified in a binding off-take agreement. Minimum Contract Revenue: US$ 1.5 Billion

The LOI with SQZG is subject to SQZG completing a formal comprehensive due diligence, including a Mozambique project site visit. It is expected the due diligence will be completed by SQZG by no later than 30 June 2015. On the signing of binding agreements the first stage of equity funding to Triton would commence within 30 days of completion of the due diligence (Due Diligence).

Should SQZG determine at the end of the Due Diligence period not to proceed, neither Party will have any legal or financial liability to the other Party arising from the termination of the LOI.

The LOI creates binding legal obligations between Triton and SQZG in accordance with its terms and in the event that SQZG is satisfied with its Due Diligence and a formal agreement is not entered into, the LOI shall represent the definitive agreement between Triton and SQZG.

Triton will provide an update to the market in relation to the Due Diligence being conducted by SQZG together with the negotiation of formal funding and off-take agreements as further information comes to hand.

Should Triton be able to secure the formal off-take agreement with SQZG, this has a potential minimum contract value of at least US$1.5 Billion over the ten year term, which would be in addition to the US$2 Billion minimum contract value contained within the initial 20 year binding off-take agreement executed with Yichang Xincheng Graphite Co., Ltd (YXGC).

The Company's focus is to rapidly develop the TMG projects into production and maintain a secure revenue stream to create genuine long term value for Triton's shareholders, the execution of this LOI is another key milestone in achieving this goal.

ABOUT SHENZHEN QIANHAI ZHONGJIN GROUP CO., LTD

Key Points about SQZG:

- Established and substantial Chinese based resources trading and financial management and equity investment company, with in excess of $10 billion RMB under management.

- Headquartered in Shenzhen and has approximately 35 branches and agency offices located in most of the major cities throughout China, with at least one office in each province. SQZG is aiming to establish 100 offices and branches within the next 3 years.

- Total number of staff is approximately 1,000.

- Recently listed (16 January 2015) on the Qianhai Stock Exchange (listing code number: 660333).

- Holds a valid minerals trading licence.

- Operates three key divisions in China which make up the SQZG Group of companies. The Core Operations are outlined below:

FINANCE

- Capital funding

- Wealth management

- Micro-lending

- Foreign currency trading

- Commodities exchange centre

RETAIL & COMMERCE

- yacht industry

- film industry

- culture base

E-COMMERCE

- internet marketing

- e-business

- internet finance

Additional information can be found at SQZG website (http://www.zhongjin.com.cn).

TRITON and SQZG

Triton, with the assistance of Nexia International (independent advisors) conducted due diligence on SQZG, concluding that SQZG has the financial resources, appropriate industry connections, institutional reputation and corporate and social responsibility profile to be a worthy and qualified strategic partner.

This finding is further supported by the understanding that SQZG is a public company, listed on the Qianhai Stock Exchange and operating under the listing and compliance obligations of this exchange.

Both SQZG and Triton are pleased that SQZG will potentially become a cornerstone investor and strong strategic partner for Triton in the development of the Nicanda Hill graphite and vanadium deposit.

CONCLUSIONS

Successful finalisation of definitive agreements that may result from the LOI will secure full funding for the Nicanda Hill deposit, together with a 10 year 200,000 tonnes off-take of Nicanda Hill TMG concentrate. In such a case, Triton anticipates that many of the key development milestones at the Nicanda Hill will be expedited and the expected large-scale commercial graphite production may be achieved earlier than originally scheduled. This would allow Triton to establish and secure a substantial and expanding market presence ahead of many other peer companies in the graphite sector.

Triton is working towards establishing TMG as the global graphite-industry benchmark by aiming to offer the world's lowest cost and most diversified graphite product range, together with the longevity of a reliable supply of high quality flake graphite.

The signing of this LOI demonstrates the strategic importance of graphite-based technologies and global growth potential of the graphite material market into which Triton is well positioned to supply.

To view photographs, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-TON-716896.pd…

About Triton Minerals Limited:

Triton Minerals Ltd. (ASX:TON) is an ASX listed, responsible mineral explorer and resource management company headquartered in Perth, Australia.

Led by a highly experienced management team, Triton Minerals' vision is to grow shareholder's value through discovery or development of base metal, gold and other precious metal deposits.

Triton has made excellent progress with its three Graphite projects located in the Cabo Delgado Province in Mozambique, with the program successfully identifying a number of graphitic exposures.

It is the Company's belief that the Mozambique, Balama North Project could host multiple and very substantial world class graphite deposits.

Contact:

Triton Minerals Ltd.

Brad Boyle, CEO & Managing Director

Tel: + 61 8 6489 2555

Email: bboyle@tritonmineralsltd.com.au

Michael Brady, General Counsel & Company Secretary

Tel: + 61 8 6489 2555

Email: mbrady@tritonmineralsltd.com.au"

Triton Minerals Ltd. (ASX:TON) (Triton or Company) is pleased to announce the formal signing of a letter of intent (LOI) with Chinese equity firm and resources trading house, Shenzhen Qianhai Zhongjin Group Co., Ltd (SQZG). Pursuant to the LOI, SQZG have agreed to provide funding of up to US$200 million (A$255m) to build and develop a graphite concentrate operation with initial capacity to produce up to 200,000 tonnes of graphite concentrate per year at Nicanda Hill.

Key Highlights

- Proposed project funding package of 50:50 debt to equity; Up to US$100 million direct equity investment in Triton and up to a US$100 million debt facility.

- An off-take agreement with an initial term of 10 years at 200,000 tonnes of graphite concentrate per year for Triton's Mozambique Graphite (TMG) sourced from Nicanda Hill; and

- Both the project funding agreement and the off-take agreement are conditional on the completion of a formal due diligence by SQZG, to be completed no later than 30 June 2015 and the execution of final binding agreements.

The successful finalisation of subsequent definitive agreements will secure full funding for the Nicanda Hill project, together with a 10 year 200,000 tonnes of graphite concentrate off-take per year of Nicanda Hill TMG concentrate.

The signing of this LOI demonstrates the strategic importance and growth potential of the graphite material supply market and of graphite-based technologies that Triton is well positioned to supply.

Triton's Managing Director & CEO, Brad Boyle said:

"This is yet another outstanding achievement for Triton as this Letter of Intent signifies an important step towards securing complete and comprehensive funding for the development of our flagship Nicanda Hill deposit. Shenzhen Qianhai Zhongjin Group Co., Ltd is a very large, reputable banking, equity and resource trading house.

We are delighted and privileged to be associated with SQZG who are looking to align themselves with Triton as a long term strategic partner, a cornerstone investor, financier and off-take partner."

SQZG's Managing Director, Mr Chen Shaogang said:

"As a result of our detailed analysis of the graphite supply business we have identified Triton as the premier future developer and producer. Considering various aspects such as resource quality, technical expertise, rapid and effective project progression, Board and management team determination and resolve, we view the Nicanda Hill deposit as a justifiably world class deposit and Triton as the industry leader.

As potentially the world's largest and lowest-cost producer, Triton holds a key asset in the graphite and vanadium world. We are delighted to align our Company with the Triton team in a strategic long term relationship and we look forward to working closely together through the due diligence process and hope to finalise a definitive agreement soon to formalise the terms of the LOI"

KEY TERMS OF THE LETTER OF INTENT

The LOI has a project funding component and an offtake component, of which the key terms of each are summarised below.

Project Funding Component

Amount: Up to US$200 million.

Equity:

- Up to US$100 million

- Subject to Triton's placement capacity, Triton will issue SQZG ordinary fully paid shares at the greater price of AUD$0.50 or market price.

- The issue of the equity in Triton may be undertaken in three (3) or more separate tranches, ensure that SQZG do not hold at any one time more than 19.99% equity in Triton.

- The total value and the amount of equity issued in the each tranche to Triton from SQZG is it at the sole discretion of Triton.

Debt:

- Up to US$100 million.

- Triton shall draw down the debt facility for the full construction of the mine at the Nicanda Hill project.

- The total amount of debt obtained by Triton will be at the sole discretion of Triton.

- Unless otherwise agreed in writing between the parties the term of the loan is for a maximum of five (5) years from the date of obtaining the funds from SQZG.

- Triton will repay the principle debt in full plus interest during the term of the loan.

- during the term of the loan and until the debt full is paid in full, Triton agrees to provide SQZG up to 200,000 tonnes of graphite concentrate at a fixed price US$875 per tonne FOB of material for any shipment. Purity of the graphite concentrate not less than 90% and moisture content up to 1%.

Other terms: Full terms and conditions to be specified in a binding funding agreement.

Shareholder approval maybe required to authorise the funding agreement whether or not the debt component of the funding agreement will be, is envisaged to be or may be (following formal negotiation) secured.

Triton notes should the funding agreement be secured following the completion of the due diligence and formal negotiations with SQZG, the issue of any securities pursuant to the equity component of the funding agreement may require shareholder approval. Further, in the event that the debt component of the funding agreement is secured, then this part of the transaction may also require additional shareholder approval.

Off-Take Component

Term: Initial Term of 10 years.

Amount: 200,000 tonnes per year.

Commencement: Once the full debt specified above in Project Funding has been repaid by Triton to SQZG, the parties will then commence the long term graphite concentrate off-take agreement.

Price: Triton will sell Nicanda Hill graphite concentrate to SQZG at a discount (to be agreed) to global graphite market price, but no less than a floor price of US$750 per tonne FOB for any shipment.

Purity: Not less than 90% and moisture content up to 1%.

Other terms: Full terms and conditions to be specified in a binding off-take agreement. Minimum Contract Revenue: US$ 1.5 Billion

The LOI with SQZG is subject to SQZG completing a formal comprehensive due diligence, including a Mozambique project site visit. It is expected the due diligence will be completed by SQZG by no later than 30 June 2015. On the signing of binding agreements the first stage of equity funding to Triton would commence within 30 days of completion of the due diligence (Due Diligence).

Should SQZG determine at the end of the Due Diligence period not to proceed, neither Party will have any legal or financial liability to the other Party arising from the termination of the LOI.

The LOI creates binding legal obligations between Triton and SQZG in accordance with its terms and in the event that SQZG is satisfied with its Due Diligence and a formal agreement is not entered into, the LOI shall represent the definitive agreement between Triton and SQZG.

Triton will provide an update to the market in relation to the Due Diligence being conducted by SQZG together with the negotiation of formal funding and off-take agreements as further information comes to hand.

Should Triton be able to secure the formal off-take agreement with SQZG, this has a potential minimum contract value of at least US$1.5 Billion over the ten year term, which would be in addition to the US$2 Billion minimum contract value contained within the initial 20 year binding off-take agreement executed with Yichang Xincheng Graphite Co., Ltd (YXGC).

The Company's focus is to rapidly develop the TMG projects into production and maintain a secure revenue stream to create genuine long term value for Triton's shareholders, the execution of this LOI is another key milestone in achieving this goal.

ABOUT SHENZHEN QIANHAI ZHONGJIN GROUP CO., LTD

Key Points about SQZG:

- Established and substantial Chinese based resources trading and financial management and equity investment company, with in excess of $10 billion RMB under management.

- Headquartered in Shenzhen and has approximately 35 branches and agency offices located in most of the major cities throughout China, with at least one office in each province. SQZG is aiming to establish 100 offices and branches within the next 3 years.

- Total number of staff is approximately 1,000.

- Recently listed (16 January 2015) on the Qianhai Stock Exchange (listing code number: 660333).

- Holds a valid minerals trading licence.

- Operates three key divisions in China which make up the SQZG Group of companies. The Core Operations are outlined below:

FINANCE

- Capital funding

- Wealth management

- Micro-lending

- Foreign currency trading

- Commodities exchange centre

RETAIL & COMMERCE

- yacht industry

- film industry

- culture base

E-COMMERCE

- internet marketing

- e-business

- internet finance

Additional information can be found at SQZG website (http://www.zhongjin.com.cn).

TRITON and SQZG

Triton, with the assistance of Nexia International (independent advisors) conducted due diligence on SQZG, concluding that SQZG has the financial resources, appropriate industry connections, institutional reputation and corporate and social responsibility profile to be a worthy and qualified strategic partner.

This finding is further supported by the understanding that SQZG is a public company, listed on the Qianhai Stock Exchange and operating under the listing and compliance obligations of this exchange.