HPQ Silicon, ehemals URAGOLD, v.ubr, sehr interessanter gold mining explorer - 500 Beiträge pro Seite

eröffnet am 30.11.12 16:06:13 von

neuester Beitrag 31.01.20 10:04:33 von

neuester Beitrag 31.01.20 10:04:33 von

Beiträge: 176

ID: 1.178.094

ID: 1.178.094

Aufrufe heute: 0

Gesamt: 18.381

Gesamt: 18.381

Aktive User: 0

ISIN: CA40444L1031 · WKN: A3DQZ3

0,1355

EUR

+0,74 %

+0,0010 EUR

Letzter Kurs 08:04:09 Lang & Schwarz

Werte aus der Branche Halbleiter

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9000 | +1.536,36 | |

| 9,1941 | +52,98 | |

| 44,92 | +20,01 | |

| 13,220 | +19,96 | |

| 89,00 | +17,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 22,800 | -10,24 | |

| 2,9800 | -10,24 | |

| 14,400 | -10,97 | |

| 6,3200 | -23,75 | |

| 1.000,00 | -66,67 |

Obwohl leider immer noch sehr unbekannt, meines Erachtens eine super buying opportunity.

Solltet ihr euch anschauen. UBR hat vom Venture kürzlich ein optionaler, 20 jähriger Mining lease (anstelle eines Pulk sampling) erhalten. Wurde bisher vom Markt noch nicht erkannt und Aktie ist auch viel zu unbekannt.

Schaut es euch an.

Gruss

Mo

Solltet ihr euch anschauen. UBR hat vom Venture kürzlich ein optionaler, 20 jähriger Mining lease (anstelle eines Pulk sampling) erhalten. Wurde bisher vom Markt noch nicht erkannt und Aktie ist auch viel zu unbekannt.

Schaut es euch an.

Gruss

Mo

Antwort auf Beitrag Nr.: 43.880.291 von glennmorrison am 30.11.12 16:06:13wäre nett, wenn man zur Thread-Eröffnung auch was zum Unternehmen postet.

z.B. Homepage, Heimatbörse, Symbol, Kurs, Standort der Ressource, bisherige Explorationsergebnisse, aktueller Cash-Bestand/letzter Finanzbericht, Anzahl Shares, Marktkapitalisierung, Share Structure, offizielle Studien/Berichte (sofern vorhanden) etc. etc.....

dann würde man nämlich gleich einen guten Überblick bekommen und man hätte alles auf der ersten Seite zusammen.

So muss sich jeder selbst raussuchen, dass die MK von Uragold aktuell 2.7M$ beträgt, man 5 Projekte in Kanada (Quebec) bestitz, die insgesamt eine historische Ressource von 520 000 Unzen Gold und 60 000 Tonnen Graphite vorzuweisen haben.

Ebenso würde man sehen, dass das Hauptprojekt Moe Rivers allein eine historische Ressource von 400 000 Unzen Gold besitzt.

Und evtl. würde sich interessierte Leser auch dafür interessieren, dass die Firma Ende Juni lediglich einen Cash-Bestand von 210 000$ aufzuweisen hatte.

.....

z.B. Homepage, Heimatbörse, Symbol, Kurs, Standort der Ressource, bisherige Explorationsergebnisse, aktueller Cash-Bestand/letzter Finanzbericht, Anzahl Shares, Marktkapitalisierung, Share Structure, offizielle Studien/Berichte (sofern vorhanden) etc. etc.....

dann würde man nämlich gleich einen guten Überblick bekommen und man hätte alles auf der ersten Seite zusammen.

So muss sich jeder selbst raussuchen, dass die MK von Uragold aktuell 2.7M$ beträgt, man 5 Projekte in Kanada (Quebec) bestitz, die insgesamt eine historische Ressource von 520 000 Unzen Gold und 60 000 Tonnen Graphite vorzuweisen haben.

Ebenso würde man sehen, dass das Hauptprojekt Moe Rivers allein eine historische Ressource von 400 000 Unzen Gold besitzt.

Und evtl. würde sich interessierte Leser auch dafür interessieren, dass die Firma Ende Juni lediglich einen Cash-Bestand von 210 000$ aufzuweisen hatte.

.....

P.S.: Der Thread von UBR.V wäre auch besser im Rohstoff-Forum aufgehoben gewesen.

Antwort auf Beitrag Nr.: 43.880.291 von glennmorrison am 30.11.12 16:06:13kaum Umsatz, ich weiss nicht, solche Buden gibt es wie Sand am Meer

Antwort auf Beitrag Nr.: 43.882.107 von Keilfleckbarbe am 30.11.12 23:48:39hmmmmmmmmmmm..........denke mit heutiger PR düfte sich dieses baby schon

mal abisl UPPP- heben können.........von div. andren ´buden´

Uragold Receives Environmental Permits to Start Trial Mining : A Milestone has Been Reached Towards Extracting Gold from the Beauce Placer Gold Project

MONTREAL, QUEBEC--(Marketwire - Feb. 7, 2013) - Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR) is pleased to announce that the MDDEP(Ministère du Développement durable de l'environnement et des parcs) has issued Uragold the required Certificate of Authorization (CA) allowing the start of trial mining activities on the Rang Chaussegros of the Beauce Placer Gold project.

The CA holds Uragold to adhere to agreed environmental control standards in regards to water quality controls, sedimentation pools, overburden deposits, derivation canals and restoration plans.

With this CA, Uragold can now excavate a first 209,000 M3 of overburden and trial mine up to 50,000 M3 of auriferous basal till and saprolite.

Trial mining will allow Uragold to: extract gold while bulk sampling the historical placer deposit; validate planned mining methods and increase the concession's potential. As per standard operational procedures, amended CA applications will be submitted on an ongoing basis to further expand the size of the mining project.

Patrick Levasseur, president and COO of Uragold stated. "We are very proud that after twelve months of hard work obtaining the necessary permits, we can now focus our energy towards extracting gold and generating cash flow."......

http://tmx.quotemedia.com/article.php?newsid=57831316&qm_sym…

RT....cad 0,065

mal abisl UPPP- heben können.........von div. andren ´buden´

Uragold Receives Environmental Permits to Start Trial Mining : A Milestone has Been Reached Towards Extracting Gold from the Beauce Placer Gold Project

MONTREAL, QUEBEC--(Marketwire - Feb. 7, 2013) - Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR) is pleased to announce that the MDDEP(Ministère du Développement durable de l'environnement et des parcs) has issued Uragold the required Certificate of Authorization (CA) allowing the start of trial mining activities on the Rang Chaussegros of the Beauce Placer Gold project.

The CA holds Uragold to adhere to agreed environmental control standards in regards to water quality controls, sedimentation pools, overburden deposits, derivation canals and restoration plans.

With this CA, Uragold can now excavate a first 209,000 M3 of overburden and trial mine up to 50,000 M3 of auriferous basal till and saprolite.

Trial mining will allow Uragold to: extract gold while bulk sampling the historical placer deposit; validate planned mining methods and increase the concession's potential. As per standard operational procedures, amended CA applications will be submitted on an ongoing basis to further expand the size of the mining project.

Patrick Levasseur, president and COO of Uragold stated. "We are very proud that after twelve months of hard work obtaining the necessary permits, we can now focus our energy towards extracting gold and generating cash flow."......

http://tmx.quotemedia.com/article.php?newsid=57831316&qm_sym…

RT....cad 0,065

Antwort auf Beitrag Nr.: 44.115.992 von hbg55 am 07.02.13 18:51:43

ne erste reaktion ist heute schon zu sehen - doch denke, daß wir in den

nächsten tagen noch nen spürbareren move sehen werden.........

ne erste reaktion ist heute schon zu sehen - doch denke, daß wir in den

nächsten tagen noch nen spürbareren move sehen werden.........

Antwort auf Beitrag Nr.: 44.115.992 von hbg55 am 07.02.13 18:51:43VIIIIEL ist seither passiert - gaaaaanz besonders ist die beteiligung

an einem HOCH- int. graphit- projekt, welches man in 12.12 an CCB

veräussert hat.............

Uragold Closes the Sale of the Asbury Graphite Property to Canada Carbons

MONTREAL, QUEBEC--(Marketwire - Dec. 4, 2012) - Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR), is pleased to announce that it has closed the previously announced agreement to sell 100% of the Asbury mining claims to Canada Carbon (TSX VENTURE:CCB).

Pursuant to the terms of the agreement dated August 29th, 2012 Uragold received a total cash payment of $300,000 CDN and 5,000,000 common shares of Canada Carbon Inc.

Furthermore, Canada Carbon will pay to Uragold a yearly royalty of 0.75% on the net production cost for a period of 10 years after the start of graphite production.

On closing of the transaction contemplated by the Agreement, Uragold entered into a voting and standstill agreement whereby Uragold agreed not to sell more than ten percent (10%) of Canada Carbon Common Shares through the facilities of any stock exchange on which Canada Carbon Common Shares are listed during 36 months from the date of the closing and also agreed that for a period of two (2) years after the date hereof, at any meeting of Canada Carbon, it shall vote all its Canada Carbon shares in accordance with any motion carried by the Canada Carbon Management with respect to the election of Directors of Canada Carbon. This agreement shall be valid as long as Uragold holdings in Canada Carbon is at least 5% of the issued and outstanding share capital of Canada Carbon calculated on a fully diluted basis.

Patrick Levasseur, president and COO of Uragold stated. "As a large shareholder of Canada Carbons, Uragold supports Canada Carbon management's objective of re-opening the Asbury Graphite mine. With this transaction now completed, Uragold is now well position to reap the benefice of Canada Carbon growth strategy. Uragold will focus on developing the cash generating potential of our Beauce Placer Gold project, a project that is at its final permitting stage. " .........

http://web.tmxmoney.com/article.php?newsid=56372485&qm_symbo…

denke mal, daß mit diesem deal im wahrsten sinne des wortes shareholder

value betrieben wurde/ wird, was sich eindrucksvoll beim betrachten des

entspr. CCb- charts offenbart........

...seit abschluss des deals hat sich CCB- paket bis zum heutigen tage

mehr als verdreifacht - weist akt. nen wert von cad- mios 1,4 auf !!!!!

SK von CCB heute.....cad 0,28

an einem HOCH- int. graphit- projekt, welches man in 12.12 an CCB

veräussert hat.............

Uragold Closes the Sale of the Asbury Graphite Property to Canada Carbons

MONTREAL, QUEBEC--(Marketwire - Dec. 4, 2012) - Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR), is pleased to announce that it has closed the previously announced agreement to sell 100% of the Asbury mining claims to Canada Carbon (TSX VENTURE:CCB).

Pursuant to the terms of the agreement dated August 29th, 2012 Uragold received a total cash payment of $300,000 CDN and 5,000,000 common shares of Canada Carbon Inc.

Furthermore, Canada Carbon will pay to Uragold a yearly royalty of 0.75% on the net production cost for a period of 10 years after the start of graphite production.

On closing of the transaction contemplated by the Agreement, Uragold entered into a voting and standstill agreement whereby Uragold agreed not to sell more than ten percent (10%) of Canada Carbon Common Shares through the facilities of any stock exchange on which Canada Carbon Common Shares are listed during 36 months from the date of the closing and also agreed that for a period of two (2) years after the date hereof, at any meeting of Canada Carbon, it shall vote all its Canada Carbon shares in accordance with any motion carried by the Canada Carbon Management with respect to the election of Directors of Canada Carbon. This agreement shall be valid as long as Uragold holdings in Canada Carbon is at least 5% of the issued and outstanding share capital of Canada Carbon calculated on a fully diluted basis.

Patrick Levasseur, president and COO of Uragold stated. "As a large shareholder of Canada Carbons, Uragold supports Canada Carbon management's objective of re-opening the Asbury Graphite mine. With this transaction now completed, Uragold is now well position to reap the benefice of Canada Carbon growth strategy. Uragold will focus on developing the cash generating potential of our Beauce Placer Gold project, a project that is at its final permitting stage. " .........

http://web.tmxmoney.com/article.php?newsid=56372485&qm_symbo…

denke mal, daß mit diesem deal im wahrsten sinne des wortes shareholder

value betrieben wurde/ wird, was sich eindrucksvoll beim betrachten des

entspr. CCb- charts offenbart........

...seit abschluss des deals hat sich CCB- paket bis zum heutigen tage

mehr als verdreifacht - weist akt. nen wert von cad- mios 1,4 auf !!!!!

SK von CCB heute.....cad 0,28

Antwort auf Beitrag Nr.: 45.447.643 von hbg55 am 13.09.13 22:19:00

grad vergangene woche dann die folg. meldung..........

Uragold Recovers Pristine Gold/Silver Grains & Gold Nuggets From Barren Washed Gravel While Evaluating the Aggregate Potential & Scale Testing its Mining Plant on the Beauce Placer Property

MONTRÉAL, QUÉBEC--(Marketwired - Sept. 10, 2013) -

Editors' Note: There are three photos associated with this press release.

Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR), is pleased to announce that it has completed a successful scale testing/ sampling program in the washed gravels from the former 1960's placer gold dredging operation on the Rang Chaussegros claims of Uragold's Beauce Placer Gold property located in the municipality of Saint-Simon-les-Mines in the Beauce region of southern Quebec.

Explolab of Val d'Or, Quebec completed the program under the supervision of Robert Gagnon, P. Geo. The objectives were to evaluate the by-product content of essentially barren washed gravel for its aggregate content and to test for the presence of gold while scale testing the efficiency of the planned gold recovery methods for Uragold's upcoming bulk sampling and trial mining program, using essentially barren washed gravels from past gold mining operations......

http://web.tmxmoney.com/article.php?newsid=62576223&qm_symbo…

goldpreis konnte sich derweil von seiner jüngsten schwäche

abissl stabilisieren und kletterte zum WE auf.........usd 1327,90 oz

grad vergangene woche dann die folg. meldung..........

Uragold Recovers Pristine Gold/Silver Grains & Gold Nuggets From Barren Washed Gravel While Evaluating the Aggregate Potential & Scale Testing its Mining Plant on the Beauce Placer Property

MONTRÉAL, QUÉBEC--(Marketwired - Sept. 10, 2013) -

Editors' Note: There are three photos associated with this press release.

Uragold Bay Resources Inc. ("Uragold") (TSX VENTURE:UBR), is pleased to announce that it has completed a successful scale testing/ sampling program in the washed gravels from the former 1960's placer gold dredging operation on the Rang Chaussegros claims of Uragold's Beauce Placer Gold property located in the municipality of Saint-Simon-les-Mines in the Beauce region of southern Quebec.

Explolab of Val d'Or, Quebec completed the program under the supervision of Robert Gagnon, P. Geo. The objectives were to evaluate the by-product content of essentially barren washed gravel for its aggregate content and to test for the presence of gold while scale testing the efficiency of the planned gold recovery methods for Uragold's upcoming bulk sampling and trial mining program, using essentially barren washed gravels from past gold mining operations......

http://web.tmxmoney.com/article.php?newsid=62576223&qm_symbo…

goldpreis konnte sich derweil von seiner jüngsten schwäche

abissl stabilisieren und kletterte zum WE auf.........usd 1327,90 oz

Antwort auf Beitrag Nr.: 45.447.643 von hbg55 am 13.09.13 22:19:00

....und dieses CCB- paket wird immer wertvoller - mit akt. 0,32

sinds jetzt schon cad-mios 1,6

....und dieses CCB- paket wird immer wertvoller - mit akt. 0,32

sinds jetzt schon cad-mios 1,6

Antwort auf Beitrag Nr.: 45.460.371 von hbg55 am 16.09.13 20:37:32

für div. infos nachfolg. mal der link zum CCB- thr........

http://www.wallstreet-online.de/diskussion/1178440-31-40/tea…

für div. infos nachfolg. mal der link zum CCB- thr........

http://www.wallstreet-online.de/diskussion/1178440-31-40/tea…

Danke für den Tipp

Shares Out: 54,339,743

5,000,000 common shares of Canada Carbon Inc

aber fast kein cash, oder?

Shares Out: 54,339,743

5,000,000 common shares of Canada Carbon Inc

aber fast kein cash, oder?

Antwort auf Beitrag Nr.: 45.462.987 von Jon_Schnee am 17.09.13 10:36:01

moin JS,

nunja, VOLLLLE kasse sieht anders aus, abbbba dramatisch, wie bei manch

andrem expl. ists hier aus meiner sicht auch nicht - allein schon nicht

ob des int. deals mit CCB !!!!

dieser sollte noch weiter an bedeutung gewinnen und so ein stetiges

vorankommen der comp., auch durch akt. schwere zeiten, sicherstellen

......und zuletzt sei noch auf den in 07.13 erfolgreichen PP- abschluss

hingewiesen, der bei geringer verwässerung immerhin 0,35 cad-mios herein

spülte.....

http://web.tmxmoney.com/article.php?newsid=61232325&qm_symbo…

moin JS,

nunja, VOLLLLE kasse sieht anders aus, abbbba dramatisch, wie bei manch

andrem expl. ists hier aus meiner sicht auch nicht - allein schon nicht

ob des int. deals mit CCB !!!!

dieser sollte noch weiter an bedeutung gewinnen und so ein stetiges

vorankommen der comp., auch durch akt. schwere zeiten, sicherstellen

......und zuletzt sei noch auf den in 07.13 erfolgreichen PP- abschluss

hingewiesen, der bei geringer verwässerung immerhin 0,35 cad-mios herein

spülte.....

http://web.tmxmoney.com/article.php?newsid=61232325&qm_symbo…

Antwort auf Beitrag Nr.: 45.463.105 von hbg55 am 17.09.13 10:49:15Kommt auf die Watch Liste

Muss mal schlau machen was die Goldprojekte so auf sich haben

Muss mal schlau machen was die Goldprojekte so auf sich haben

Antwort auf Beitrag Nr.: 45.463.105 von hbg55 am 17.09.13 10:49:15

hmmmmm, da hat heute jemand gefallen gefunden.........

Recent Trades - Last 10 of 11

Time ET Ex Price Change Volume Buyer Seller Markers

11:50:39 V 0.075 0.01 25,000 85 Scotia 7 TD Sec W

11:50:39 V 0.075 0.01 2,000 85 Scotia 85 Scotia W

11:50:39 V 0.075 0.01 10,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 5,000 85 Scotia 1 Anonymous W

11:50:39 V 0.07 0.005 10,000 85 Scotia 7 TD Sec W

11:50:39 V 0.07 0.005 2,000 85 Scotia 1 Anonymous W

11:50:39 V 0.07 0.005 5,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 2,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 2,000 85 Scotia 85 Scotia W

11:16:09 V 0.07 0.005 1,000 85 Scotia 85 Scotia

.....evtl. ja auch weitere insider, die auf schnäppchenjagd sind.

fakt ist, daß der jüngste wertanstieg des stattl. CCB- pakets noch in

keinster weise im UBR- kurs nachgebildet ist.........IMO

hmmmmm, da hat heute jemand gefallen gefunden.........

Recent Trades - Last 10 of 11

Time ET Ex Price Change Volume Buyer Seller Markers

11:50:39 V 0.075 0.01 25,000 85 Scotia 7 TD Sec W

11:50:39 V 0.075 0.01 2,000 85 Scotia 85 Scotia W

11:50:39 V 0.075 0.01 10,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 5,000 85 Scotia 1 Anonymous W

11:50:39 V 0.07 0.005 10,000 85 Scotia 7 TD Sec W

11:50:39 V 0.07 0.005 2,000 85 Scotia 1 Anonymous W

11:50:39 V 0.07 0.005 5,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 2,000 85 Scotia 85 Scotia W

11:50:39 V 0.07 0.005 2,000 85 Scotia 85 Scotia W

11:16:09 V 0.07 0.005 1,000 85 Scotia 85 Scotia

.....evtl. ja auch weitere insider, die auf schnäppchenjagd sind.

fakt ist, daß der jüngste wertanstieg des stattl. CCB- pakets noch in

keinster weise im UBR- kurs nachgebildet ist.........IMO

Antwort auf Beitrag Nr.: 45.491.313 von hbg55 am 20.09.13 19:49:10Ich werde nicht schau aus dem "Beauce Placer property".

Wie viel Unzen können Produziert insgesamt produziert werden?

Wie viele Unzen könnten sie pro Jahr produzieren?

Cash Cost?

Wie viel Unzen können Produziert insgesamt produziert werden?

Wie viele Unzen könnten sie pro Jahr produzieren?

Cash Cost?

Antwort auf Beitrag Nr.: 45.493.239 von Jon_Schnee am 21.09.13 07:52:57

hmmmmmmmm..........schau dir dann doch noch mal #8- meldung genauer an -

da ists doch eigentl. ziemlich gut umschrieben

hmmmmmmmm..........schau dir dann doch noch mal #8- meldung genauer an -

da ists doch eigentl. ziemlich gut umschrieben

Antwort auf Beitrag Nr.: 45.491.313 von hbg55 am 20.09.13 19:49:10

zum wochenstart geht CCB- rally weiter - grad sehen wir neues TH

mit cad 0,037 womit UBRs- 5mio- paket schon nen wert von

cad-mios 1,85 aufweist

zum wochenstart geht CCB- rally weiter - grad sehen wir neues TH

mit cad 0,037 womit UBRs- 5mio- paket schon nen wert von

cad-mios 1,85 aufweist

Glaubwürdig? Posting aus SH.

An email response from Patrick

I emailed Patrick a couple of days ago with the following:

Two months ago in an email to me, you indicated that financing was still being worked on and there had been a delay due to the summer holiday period. Are you able to say how close we might be to some sort of news on financing? Questions have been asked on the boards about the ability to operate a placer mine during the winter in Quebec after freeze-up. Is this possible, and if so, how will this be accomplished? The news release about the aggregate was interesting. Once permits for sale have come through(how close are we to these permits, by the way?), will Uragold be trucking the aggregate material or will the buyers come to the property for pick-up? I tried to find it online, but was unable to...how much does aggregate sell for in Quebec at this time? Is it enough to sustain mining operations? I know the focus has been on the Beauce property, but was anything being done on the Moe/McDonald claims this summer?

Here is his response:

Hi XXX,

We are still in the process of structuring a financing with the same group as this summer. (yes, really!) At this time, I can’t disclose all the back room details as to why it takes so long, but it’s moving forward.

We have been told by engineers and contractors that excavating in winter is the preferred time. Actually, it’s the winter thaw in the spring that could require higher water management costs. We believe a future placer mining operation would be year round. It’s only after the bulk sampling/trial mining that a final mining plan and a placer plant circuit will be designed.

Aggregates will be a by product from the placer plant. Many factors such as size, quality, volume and distance affects the price. Our gravel will already be washed and sorted. This adds a premium. There is a high demand for this type of gravel in the Beauce. We have been quoted prices of up to $4 to $6 per ton.

We did some minor follow-up work on the Moe River property in order to hold some claims. We also just recently removed three beaver dams. Even this required a permit! One dam was over eight feet high! It’s just amazing what those beavers can do. Besides staking additional gold and gold placer claims, all work was concentrated on the Beauce Placer property for the financing.

Read more at http://www.stockhouse.com/companies/bullboard/v.ubr/uragold-…

An email response from Patrick

I emailed Patrick a couple of days ago with the following:

Two months ago in an email to me, you indicated that financing was still being worked on and there had been a delay due to the summer holiday period. Are you able to say how close we might be to some sort of news on financing? Questions have been asked on the boards about the ability to operate a placer mine during the winter in Quebec after freeze-up. Is this possible, and if so, how will this be accomplished? The news release about the aggregate was interesting. Once permits for sale have come through(how close are we to these permits, by the way?), will Uragold be trucking the aggregate material or will the buyers come to the property for pick-up? I tried to find it online, but was unable to...how much does aggregate sell for in Quebec at this time? Is it enough to sustain mining operations? I know the focus has been on the Beauce property, but was anything being done on the Moe/McDonald claims this summer?

Here is his response:

Hi XXX,

We are still in the process of structuring a financing with the same group as this summer. (yes, really!) At this time, I can’t disclose all the back room details as to why it takes so long, but it’s moving forward.

We have been told by engineers and contractors that excavating in winter is the preferred time. Actually, it’s the winter thaw in the spring that could require higher water management costs. We believe a future placer mining operation would be year round. It’s only after the bulk sampling/trial mining that a final mining plan and a placer plant circuit will be designed.

Aggregates will be a by product from the placer plant. Many factors such as size, quality, volume and distance affects the price. Our gravel will already be washed and sorted. This adds a premium. There is a high demand for this type of gravel in the Beauce. We have been quoted prices of up to $4 to $6 per ton.

We did some minor follow-up work on the Moe River property in order to hold some claims. We also just recently removed three beaver dams. Even this required a permit! One dam was over eight feet high! It’s just amazing what those beavers can do. Besides staking additional gold and gold placer claims, all work was concentrated on the Beauce Placer property for the financing.

Read more at http://www.stockhouse.com/companies/bullboard/v.ubr/uragold-…

Uragold Bay Resources: Topnews über Abnehmer für Quarzsand

14.04.2015 - 08:58 | Quelle: miningscout.de

Für jedes Unternehmen in der Bergbaubranche ist es ein wichtiger Schritt in der Unternehmensentwicklung, wenn er für seine zukünftigen Produkte bereits frühzeitig Abnehmer zur Verfügung hat.

Das kanadische Unternehmen Uragold Bay Resources (TSX-V: UBR; WKN: A1J2LV; ISIN: CA91689A2039) hat seine Anlegerschaft genau mit so einer positiven Nachricht überrascht. Es betrifft zwar nicht den Golddeveloper Uragold, aber seine direkte Tochtergesellschaft Quebec Quarz, die die im vergangenen Jahr erworbenen Quarzliegenschaften entwickelt.

Gemäß der gestern veröffentlichten Pressemitteilung ist es Uragold gelungen, mit dem deutschen Unternehmen „Dorfner Anzaplan“ ( Hirschau, Deutschland ) eine Vorvereinbarung (MOU=memorandum of understanding) abzuschließen, die für Uragold Weg weisend sein kann.

In dieser Vorvereinbarung ist vorgesehen, dass Uragold als Direktlieferant für Dorfner Anzaplan bei Produktionsaufnahme auftreten kann und ultra hoch reine Quarzsande liefern soll (99,99%+..........

http://www.miningscout.de/unternehmensprofile/uragold-bay-re…

Antwort auf Beitrag Nr.: 49.557.593 von hbg55 am 14.04.15 10:21:07Uragold Bay talks Purevap, arranges $419,800 financing

2015-12-18 11:11 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD NOT AFFECT BY FERROATLANTICA DECISION TO PULL OUT OF PORT CARTIER, QUEBEC PROJECT

Uragold Bay Resources Inc. would like to inform its shareholders that the major silicon metal producer (first producer) that confirmed that its Roncevaux material is highly suited for silicon metal production and that has expressed interest in purchasing 20,000 to 50,000 tons annually of high-purity lump quartz from Roncevaux (see press release from March 2, 2015), as well as the second producer that has requested samples from the Roncevaux property (see press release from Aug. 27, 2015) were not FerroAtlantica.

Bernard Tourillon, chairman and chief executive officer of Uragold, stated: "The decision of FerroAtlantica to cancel its development projects in Port Cartier, Que., has no bearing on Uragold business model based on developing our quartz deposits and the implementation of the Purevap quartz vaporization reactor (QCR) technology for the solar industry."

The Purevap impact -- highest purity.............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23354…

RT.....cad 0,03

2015-12-18 11:11 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD NOT AFFECT BY FERROATLANTICA DECISION TO PULL OUT OF PORT CARTIER, QUEBEC PROJECT

Uragold Bay Resources Inc. would like to inform its shareholders that the major silicon metal producer (first producer) that confirmed that its Roncevaux material is highly suited for silicon metal production and that has expressed interest in purchasing 20,000 to 50,000 tons annually of high-purity lump quartz from Roncevaux (see press release from March 2, 2015), as well as the second producer that has requested samples from the Roncevaux property (see press release from Aug. 27, 2015) were not FerroAtlantica.

Bernard Tourillon, chairman and chief executive officer of Uragold, stated: "The decision of FerroAtlantica to cancel its development projects in Port Cartier, Que., has no bearing on Uragold business model based on developing our quartz deposits and the implementation of the Purevap quartz vaporization reactor (QCR) technology for the solar industry."

The Purevap impact -- highest purity.............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23354…

RT.....cad 0,03

Antwort auf Beitrag Nr.: 51.336.222 von hbg55 am 18.12.15 18:57:48

.....und unter beteiligung ´einiger´ insider ist die PP auch schon geschlossen !!!!

Uragold Bay closes $419,800 private placement

2015-12-24 10:29 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD ANNOUNCES CLOSING OF PRIVATE PLACEMENT

Uragold Bay Resources Inc. has completed its previously announced non-brokered private placement consisting of the issuance and sale of a total amount of 8,396,000 units at five cents per unit for gross proceeds of $419,800. The net proceeds from the private placement will be used for general corporate expenditures and exploration activities.

Each unit comprises one common share and one common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at an exercise price of seven cents during a period of 36 months from the date of closing of the placement. Each share issued pursuant to the placement will have a mandatory four-month holding period from the date of closing of the placement. The placement is subject to standard regulatory approvals.

Bernard Tourillon, the chairman, chief executive officer and director of Uragold, through a wholly owned company, 3245004 Canada Inc., and Patrick Levasseur, the president, chief operating officer and director of Uragold, through a wholly owned company, Ice Age Gold Corp., have subscribed to 1.39 million units and 1.19 million units, respectively. Following the completion of the private placement, Mr. Tourillon and 3245004 Canada, taken together, and Mr. Levasseur and Ice Age Gold, taken together, beneficially own or exercise control or direction over, directly or indirectly, respectively, 5,338,750 common shares and 7,257,250 common shares, representing approximately 4.84 per cent and 6.58 per cent of the issued and outstanding common shares of the company..............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23368…

.....und unter beteiligung ´einiger´ insider ist die PP auch schon geschlossen !!!!

Uragold Bay closes $419,800 private placement

2015-12-24 10:29 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD ANNOUNCES CLOSING OF PRIVATE PLACEMENT

Uragold Bay Resources Inc. has completed its previously announced non-brokered private placement consisting of the issuance and sale of a total amount of 8,396,000 units at five cents per unit for gross proceeds of $419,800. The net proceeds from the private placement will be used for general corporate expenditures and exploration activities.

Each unit comprises one common share and one common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at an exercise price of seven cents during a period of 36 months from the date of closing of the placement. Each share issued pursuant to the placement will have a mandatory four-month holding period from the date of closing of the placement. The placement is subject to standard regulatory approvals.

Bernard Tourillon, the chairman, chief executive officer and director of Uragold, through a wholly owned company, 3245004 Canada Inc., and Patrick Levasseur, the president, chief operating officer and director of Uragold, through a wholly owned company, Ice Age Gold Corp., have subscribed to 1.39 million units and 1.19 million units, respectively. Following the completion of the private placement, Mr. Tourillon and 3245004 Canada, taken together, and Mr. Levasseur and Ice Age Gold, taken together, beneficially own or exercise control or direction over, directly or indirectly, respectively, 5,338,750 common shares and 7,257,250 common shares, representing approximately 4.84 per cent and 6.58 per cent of the issued and outstanding common shares of the company..............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23368…

Antwort auf Beitrag Nr.: 51.381.192 von hbg55 am 29.12.15 17:06:41....und auch nachfolg. meldung kommt GUT an der börse an...........

Uragold Bay 282,500 shares for debt

2015-12-31 16:13 ET - Shares for Debt

The TSX Venture Exchange has accepted for filing the company's proposal to issue 282,500 shares at a deemed price of five cents per share to settle outstanding debts of $14,125, as described in the company's press releases dated Dec. 18, 2015, and Dec. 24, 2015.

Number of creditors: one creditor

The company will issue a press release when the shares are issued and the debt is extinguished.

© 2016 Canjex Publishing Ltd. All rights reserved.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23377…

RT, trotz neg. marktumfeldes, schon gleich angesprungen auf...........6,5ct

Uragold Bay 282,500 shares for debt

2015-12-31 16:13 ET - Shares for Debt

The TSX Venture Exchange has accepted for filing the company's proposal to issue 282,500 shares at a deemed price of five cents per share to settle outstanding debts of $14,125, as described in the company's press releases dated Dec. 18, 2015, and Dec. 24, 2015.

Number of creditors: one creditor

The company will issue a press release when the shares are issued and the debt is extinguished.

© 2016 Canjex Publishing Ltd. All rights reserved.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23377…

RT, trotz neg. marktumfeldes, schon gleich angesprungen auf...........6,5ct

Antwort auf Beitrag Nr.: 51.407.199 von hbg55 am 04.01.16 16:17:30

.....SOOOO gut, daß wit alllllen negativen markt- trends zum trotz, bei MEGA- vol. von über 4,3mios

mit SK von cad 0,07 nicht nur auf tages- sondern auf JAHRES- HOCH aus dem handel gehen............

Recent Trades - Last 10 of 197

Time ET Ex Price Change Volume Buyer Seller Markers

15:59:57 V 0.07 0.02 10,000 85 Scotia 85 Scotia K

15:56:50 V 0.065 0.015 20,000 2 RBC 7 TD Sec K

15:56:32 V 0.065 0.015 25,000 2 RBC 85 Scotia K

15:56:32 V 0.065 0.015 45,000 2 RBC 7 TD Sec K

15:53:28 V 0.065 0.015 3,000 9 BMO Nesbitt 39 Merrill Lynch K

15:53:28 V 0.065 0.015 21,000 9 BMO Nesbitt 85 Scotia K

15:53:23 V 0.065 0.01 600 80 National Bank 36 Latimer

15:52:41 V 0.06 0.01 18,000 80 National Bank 85 Scotia K

15:52:41 V 0.06 0.01 50,000 88 Credential 85 Scotia K

15:52:41 V 0.06 0.01 45,000 7 TD Sec 85 Scotia K

.......hier scheinen MIR schon einige investoren abisl MEHR zu wissen über evtl. prod.- start/

liefer- verinbarungen etc...........z.b. beim lukrativen quarz- proj., wo ein MOU eine liefermenge

von bis zu 70.000 to vorsieht bei marktpreisen zwischen cad 2000,- und 10000,- per to......MEHR

hierzu über nachfolg. link...........

http://www.miningscout.de/unternehmensprofile/uragold-bay-re…

.....SOOOO gut, daß wit alllllen negativen markt- trends zum trotz, bei MEGA- vol. von über 4,3mios

mit SK von cad 0,07 nicht nur auf tages- sondern auf JAHRES- HOCH aus dem handel gehen............

Recent Trades - Last 10 of 197

Time ET Ex Price Change Volume Buyer Seller Markers

15:59:57 V 0.07 0.02 10,000 85 Scotia 85 Scotia K

15:56:50 V 0.065 0.015 20,000 2 RBC 7 TD Sec K

15:56:32 V 0.065 0.015 25,000 2 RBC 85 Scotia K

15:56:32 V 0.065 0.015 45,000 2 RBC 7 TD Sec K

15:53:28 V 0.065 0.015 3,000 9 BMO Nesbitt 39 Merrill Lynch K

15:53:28 V 0.065 0.015 21,000 9 BMO Nesbitt 85 Scotia K

15:53:23 V 0.065 0.01 600 80 National Bank 36 Latimer

15:52:41 V 0.06 0.01 18,000 80 National Bank 85 Scotia K

15:52:41 V 0.06 0.01 50,000 88 Credential 85 Scotia K

15:52:41 V 0.06 0.01 45,000 7 TD Sec 85 Scotia K

.......hier scheinen MIR schon einige investoren abisl MEHR zu wissen über evtl. prod.- start/

liefer- verinbarungen etc...........z.b. beim lukrativen quarz- proj., wo ein MOU eine liefermenge

von bis zu 70.000 to vorsieht bei marktpreisen zwischen cad 2000,- und 10000,- per to......MEHR

hierzu über nachfolg. link...........

http://www.miningscout.de/unternehmensprofile/uragold-bay-re…

Antwort auf Beitrag Nr.: 51.412.056 von hbg55 am 05.01.16 09:36:33zum wiederholten mal, sahen wir in den vergangenen tagen hohes handelsvol..........und DANK

der labilen china- börsen konnte eine reihe investoren von der seitenlinie auch noch günstigen

kursen dazustossen.

SK gestern..........cad 0,055

HEUTE nun, nach aufhebung so manch denkwürdiger massnahme, schlossen china- märkte fett im plus

und dürften damit für eine globale beruhigung sorgen - DAX auch schon mit +2,3% dabei und damit

wieder OBER- halb der 10.000- marke

der labilen china- börsen konnte eine reihe investoren von der seitenlinie auch noch günstigen

kursen dazustossen.

SK gestern..........cad 0,055

HEUTE nun, nach aufhebung so manch denkwürdiger massnahme, schlossen china- märkte fett im plus

und dürften damit für eine globale beruhigung sorgen - DAX auch schon mit +2,3% dabei und damit

wieder OBER- halb der 10.000- marke

Antwort auf Beitrag Nr.: 51.442.446 von hbg55 am 08.01.16 10:12:13

...mit unterstützung von nachfolg. PR übersprangen wir im gestrigen handel ne reihe widerstands-

marken/ jahreshochs etc............

Uragold To Commence Testing Of Process to Convert High Purity Quartz to Solar Grade Silicon Metal

Montreal, Quebec, Canada / TheNewswire / February 17 2016 - Uragold (TSX Venture: UBR) would like to update its shareholders on the advancement of its ongoing metallurgical testing program executed by PyroGenesis Canada Inc. ("PyroGenesis"), (http://pyrogenesis.com) (TSX-V: PYR), a clean-tech company that designs, develops, manufactures and commercializes plasma torch products, from whom Uragold has been granted the worldwide exclusive rights for the One Step Production of Solar Grade Silicon Metal from Quartz.

As previously disclosed, the metallurgical testing will be done using PyroGenesis' PUREVAP(TM) Quartz Vaporization Reactor (QVR), a novel proprietary process (Provisional Patent Filed) that uses a plasma arc within a vacuum furnace for the One Step Production of Silicon Metal (Mg Si), Solar Grade Silicon Metal (Sg Si) and Electronic Grade Silicon Metal (Eg Si) from Quartz.

Following receipt by PyroGenesis of the custom built vacuum furnace, a central component of the PUREVAP(TM) QVR process, Uragold confirms that the project is now entering its final assembly and commissioning phases.

DYNAMIC TESTING PROGRAM TO START IN MARCH 2016

The dynamic testing program, whereby quartz material from Uragold properties is to be processed in PyroGenesis PUREVAP(TM) QVR, will start in March 2016..................

http://web.tmxmoney.com/article.php?newsid=82818043&qm_symbo…

SK gestern bei über 1mio. vol. auf TH von..............cad 0,085

da haben manche BIG player angesichts der glänzenden perspektiven ganz schön appetit

bekommen

...mit unterstützung von nachfolg. PR übersprangen wir im gestrigen handel ne reihe widerstands-

marken/ jahreshochs etc............

Uragold To Commence Testing Of Process to Convert High Purity Quartz to Solar Grade Silicon Metal

Montreal, Quebec, Canada / TheNewswire / February 17 2016 - Uragold (TSX Venture: UBR) would like to update its shareholders on the advancement of its ongoing metallurgical testing program executed by PyroGenesis Canada Inc. ("PyroGenesis"), (http://pyrogenesis.com) (TSX-V: PYR), a clean-tech company that designs, develops, manufactures and commercializes plasma torch products, from whom Uragold has been granted the worldwide exclusive rights for the One Step Production of Solar Grade Silicon Metal from Quartz.

As previously disclosed, the metallurgical testing will be done using PyroGenesis' PUREVAP(TM) Quartz Vaporization Reactor (QVR), a novel proprietary process (Provisional Patent Filed) that uses a plasma arc within a vacuum furnace for the One Step Production of Silicon Metal (Mg Si), Solar Grade Silicon Metal (Sg Si) and Electronic Grade Silicon Metal (Eg Si) from Quartz.

Following receipt by PyroGenesis of the custom built vacuum furnace, a central component of the PUREVAP(TM) QVR process, Uragold confirms that the project is now entering its final assembly and commissioning phases.

DYNAMIC TESTING PROGRAM TO START IN MARCH 2016

The dynamic testing program, whereby quartz material from Uragold properties is to be processed in PyroGenesis PUREVAP(TM) QVR, will start in March 2016..................

http://web.tmxmoney.com/article.php?newsid=82818043&qm_symbo…

SK gestern bei über 1mio. vol. auf TH von..............cad 0,085

da haben manche BIG player angesichts der glänzenden perspektiven ganz schön appetit

bekommen

Antwort auf Beitrag Nr.: 51.813.739 von hbg55 am 23.02.16 12:11:57

....und mit jüngst erzielten test- ergebnissesn, die reinheitswerte von nahezu 100% erzielten

kann man weiter punkten...................

Uragold Raw Quartz Assays As High As 4N Purity (99.99% SiO2) Prior To Commencement Of Testing

Montreal, Quebec, Canada / TheNewswire / March 3, 2016 - Uragold (TSX Venture: UBR) is pleased to announce that pre-testing analysis of its Raw Quartz material has yielded purity levels as high as 4N (99.99%) SiO2.

Bernard Tourillon, Chairman and CEO Of Uragold Stated: "Using these new results, Theoretical modeling of PyroGenesis PUREVAP(TM) Quartz Vaporization Reactor (QVR) process seem to indicate that transforming Raw Quartz into High Purity Silicon metals with a minimum purity of 4N (99.99 %) is within reach and with anticipated process improvements further testing could achieve purity of 5N (99.999 %) and even further to 6N (99.9999 %)".

The Raw Quartz material was taken from Uragold's 100% Owned Martinville property, located in the Eastern Townships region of Quebec. The analysis completed at the INRS - ETE (Institut National de la Recherche Scientifique, Eau Terre Environnement) laboratory in Quebec City were required for theoretical modeling purposes of PyroGenesis PUREVAP(TM) QVR process.

Martinville Raw Quartz Results Indicate That Even Before Any Benefaction The Material Meets Industry Standards For Ultra High Purity Quartz...........

http://web.tmxmoney.com/article.php?newsid=83281720&qm_symbo…

DAMIT konnte nicht nur widerstand bei cad 0,10 geknackt, sondern ebenfalls ein

neues 3- jahres- HOCH erzielt werden - und die NEU- bewertung dieser angehenden perle

dürfte damit noch NICHT ihr ende gefunden haben.........IMO

SK gestern auf TH von...........cad 0,135

....und mit jüngst erzielten test- ergebnissesn, die reinheitswerte von nahezu 100% erzielten

kann man weiter punkten...................

Uragold Raw Quartz Assays As High As 4N Purity (99.99% SiO2) Prior To Commencement Of Testing

Montreal, Quebec, Canada / TheNewswire / March 3, 2016 - Uragold (TSX Venture: UBR) is pleased to announce that pre-testing analysis of its Raw Quartz material has yielded purity levels as high as 4N (99.99%) SiO2.

Bernard Tourillon, Chairman and CEO Of Uragold Stated: "Using these new results, Theoretical modeling of PyroGenesis PUREVAP(TM) Quartz Vaporization Reactor (QVR) process seem to indicate that transforming Raw Quartz into High Purity Silicon metals with a minimum purity of 4N (99.99 %) is within reach and with anticipated process improvements further testing could achieve purity of 5N (99.999 %) and even further to 6N (99.9999 %)".

The Raw Quartz material was taken from Uragold's 100% Owned Martinville property, located in the Eastern Townships region of Quebec. The analysis completed at the INRS - ETE (Institut National de la Recherche Scientifique, Eau Terre Environnement) laboratory in Quebec City were required for theoretical modeling purposes of PyroGenesis PUREVAP(TM) QVR process.

Martinville Raw Quartz Results Indicate That Even Before Any Benefaction The Material Meets Industry Standards For Ultra High Purity Quartz...........

http://web.tmxmoney.com/article.php?newsid=83281720&qm_symbo…

DAMIT konnte nicht nur widerstand bei cad 0,10 geknackt, sondern ebenfalls ein

neues 3- jahres- HOCH erzielt werden - und die NEU- bewertung dieser angehenden perle

dürfte damit noch NICHT ihr ende gefunden haben.........IMO

SK gestern auf TH von...........cad 0,135

Noch interessanter ist der geplante SPIN OUT der gehaltenen Goldprojekte in eine neue Gesellschaft an die derzeitigen URAGOLD - Aktionäre.

2016-03-11 08:48 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD PLANS TO ISSUE DIVIDEND TO SHAREHOLDERS VIA SPIN OUT OF GOLD PROJECTS. EXPLORATION PROGRAM MAJORITY FUNDED BY GOVERNMENT GRANTS SET TO BEGIN AT BEAUCE

Uragold Bay Resources Inc. has started an exploration program focused on the detection of deep sulphide mineralization targets on the company's Beauce gold project located in the Beauce region of Southern Quebec. The research program, approximately 80 per cent of which is funded through governmental grants, will bring together an international world-renowned multidisciplinary geophysical team oriented on studying and identifying the location of potentials hard rock sources of the Beauce gold property.

Gold projects to be spun out to unlock value

Bernard Tourillon, chairman and chief executive officer of Uragold, stated: "Our decision to participate in this government-funded exploration program at this time represents the official start of the company's plan to spin out its gold assets into a separate publicly traded company, first contemplated in our press release of Dec. 1, 2015. We believe the spinout will serve to unlock the true value of our gold assets for our shareholders, all of whom will receive shares in the new company, while allowing each company to focus on their respective core competencies. Details of the spinout, subject to shareholder and regulatory approval, will be provided in due course."

Beauce gold property -- searching the source of the largest placer gold deposit in Eastern North America

The Beauce gold project area hosts a six-kilometre-long unconsolidated gold-bearing sedimentary unit (a lower saprolite and an upper brown diamictite) holding the largest historical placer gold deposit in Eastern North America. Uragold exploration work to date identified delicate gold in saprolite, indicating a close proximity to a bedrock source of gold providing significant potential for further exploration discoveries (please refer to Uragold's National Instrument 43-101 report dated Jan. 8, 2015).

Patrick Levasseur, president and chief operating officer of Uragold, stated: "For the past 150 years, every 50 years has seen the occurrence of major placer gold mining operation on the property. Regardless of this, there have been few attempts made to identify the bedrock source of this prolific historical placer gold deposit. Having such a team of world-renowned professionals working on our project and using the latest in geophysical technology for gold exploration on our Beauce gold property is outstanding."

World-renowned geophysical team

The multidisciplinary geophysical team is composed of members from:

INRS-ETE (Eau Terre et Environnement);

UQAT (Universite du Quebec en Abitibi-Temiscamingue);

The Geological Survey of Canada (GSC);

MERN (Energie et Resources Naturelles du Quebec);

Paris VI -- Sorbonne (Universite Pierre et Marie Curie);

Zonge International from Tucson, Ariz.

The multidisciplinary geophysical survey will take magnetic and gravimetric measurements along different sections, perpendicular to the geology of the St-Simon-les-Mines gold placer area. Subsequently, the team will complete an electromagnetic survey, from zero to 2,000 metres, to document the geoelectric characteristics of Bellechasse gold belt in St-Simon-les-Mines.

The Beauce gold project has been the subject of exploration by UBR and INRS. The INRS electrical resistivity and induced polarization survey demonstrated the presence of strong chargeability anomalies in the bedrock located below the gold placer quaternary units (see news release dated May 23, 2013).

The geophysical and petrophysical study is majority funded through a grant from the FQRNT-Mines (Fonds de recherche du Quebec -- Nature et technologies) (FRQNT) with a contribution from Uragold.

Dr. Marc Richer-Lafleche, PhD, PGeo, is a qualified person as defined by National Instrument 43-101, and has reviewed and approved the technical contents of this press release.

About the Beauce gold project

The Beauce gold project is a unique, historically prolific goldfield located in the municipality of Saint-Simon-les-Mines in the Beauce region of Southern Quebec. Comprising a block of 37 claims 100 per cent owned by Uragold Bay Resources, the project area hosts a six km long unconsolidated gold-bearing sedimentary unit (a lower saprolite and an upper brown diamictite) holding the largest placer gold deposit in Eastern North America. The gold in saprolite indicates a close proximity to a bedrock source of gold providing significant potential for further exploration discoveries.

Vorher noch diese brandheiße SOLAR Story in einer "$12-billion (U.S.) annual industry"

Uragold starts testing quartz-to-silicon process

2016-03-29 07:46 ET - News Release

Mr. Bernard Tourillon reports

URAGOLD COMMENCES TESTING OF PROCESS TO CONVERT HIGH PURITY QUARTZ TO SOLAR GRADE SILICON METAL

Testing of Uragold Bay Resources Inc.'s process to convert high-purity quartz to solar-grade silicon metal will commence today. Testing will be executed by PyroGenesis Canada Inc., a clean-tech company that designs, develops, manufactures and commercializes plasma waste-to-energy systems, plasma torch products and the Purevap quartz vaporization reactor, from which Uragold has been granted the worldwide exclusive rights for the one-step production of solar-grade purity silicon metal from quartz.

Having received confirmation that PyroGenesis has completed installation, assembly and commissioning of the Purevap QVR system, Uragold confirms the dynamic metallurgical testing program will commence today, Tuesday, March 29, 2016.

Bernard Tourillon, chairman and chief executive officer of Uragold, stated: "This is a very exciting day for Uragold and its shareholders. Leading up to this day, we took the extra time and care necessary to insure the best possible results. We are now in the very capable hands of PyroGenesis and look forward with great anticipation to releasing the results to our shareholders in the very near future."

Anticipated timeline for testing, results and next steps

The dynamic test protocols call for a first series of metallurgical tests to be completed at different operational settings. The high-purity silicon metal produced by the reactor during each of these tests will be sent to an independent laboratory for inductively coupled plasma mass spectrometry analysis for validation.

Upon receipt of results, if needed, the operational parameters of the reactor will be adjusted. The process will be rapidly repeated in order to achieve the correct adjustments required for the transformation of Uragold quartz into high purity Si of a minimum of 4N purity (99.99 per cent Si).

Previously disclosed theoretical modelling of the process seems to indicate that transforming raw quartz into high-purity silicon metals with a minimum purity of 4N (99.99 per cent) is within reach and, with anticipated process improvements, further testing could achieve purity of 5N (99.999 per cent) and even further to 6N (99.9999 per cent).

Uragold anticipates announcing results within two to four weeks.

Upon successful validation of the one-step production process, Uragold plans to move forward with the preparation of a preliminary economic assessment for its Roncevaux quartz property as the feed material for the PyroGenesis's Purevap QVR process.

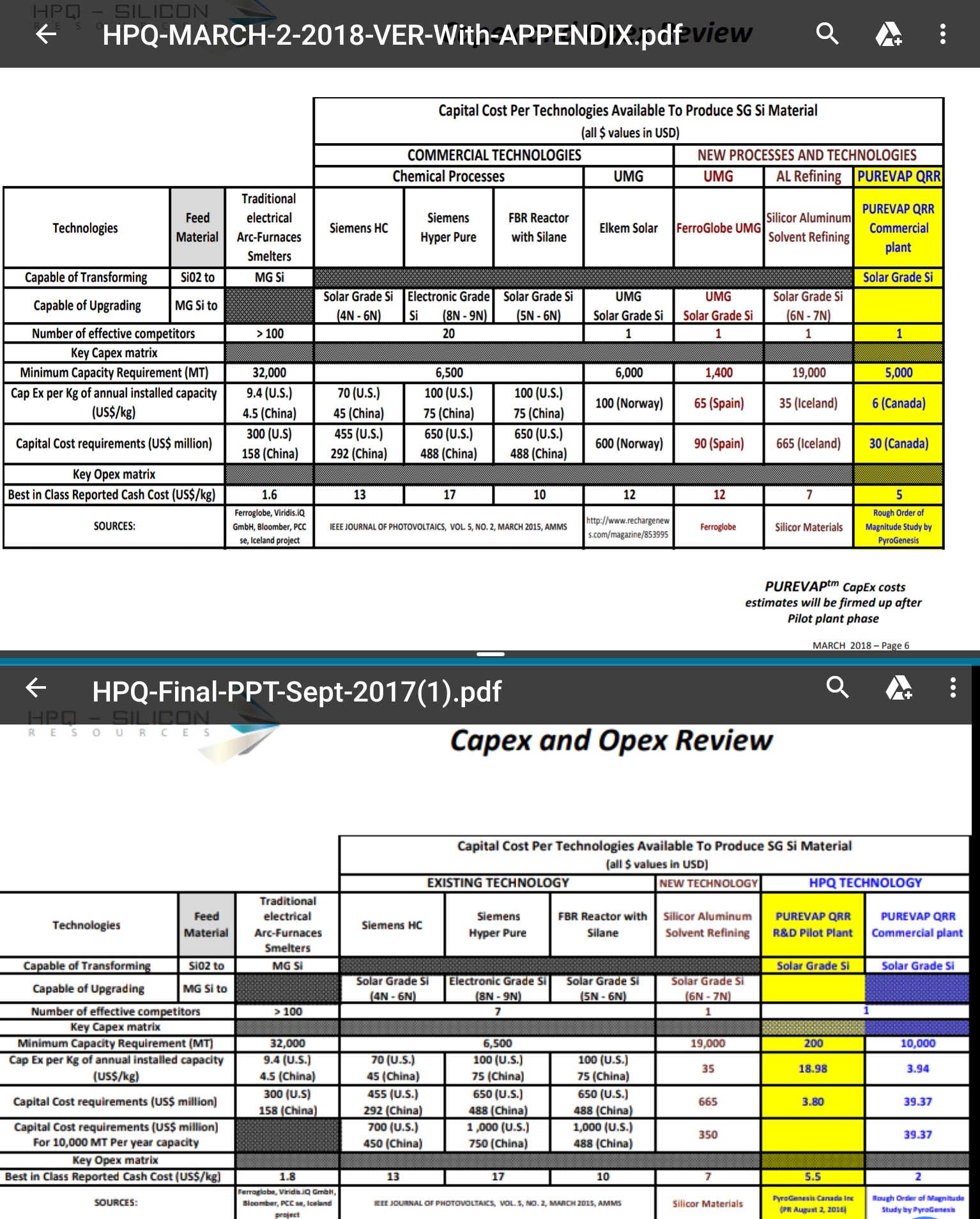

Global competitive advantage for Uragold -- producing solar-grade silicon metal at metallurgical-grade costs

PyroGenesis's Purevap QVR disruptive potential is its one step direct transformation of quartz into solar-grade silicon metal, thereby potentially allowing Uragold to manufacture solar-grade silicon metal (Sg Si) at the same cost as producing metallurgical-grade silicon metal (Mg Si), a much-lower-quality product. Additionally, the company believes the process holds a significant capital cost advantage that will allow a plant to be built at just a fraction of the current manufacturing costs.

Mr. Tourillon further added: "It cannot be understated. Successful testing will provide Uragold with disruptive technology and a very strong competitive advantage over all other solar-grade silicon metal manufacturers. It allows Uragold to go much higher in the high-purity quartz value chain and potentially become the lowest-cost vertically integrated silicon metal, solar-grade silicon metal and higher-value silicon metal producer. Quite simply, this technology has the potential to revolutionize the process of manufacturing silicon metal."

$12-billion (U.S.) annual industry, growth driven by photovoltaic solar demand

The silicon metal, solar-grade silicon metal and electronic-grade silicon metal markets combined were an industry of $12-billion (U.S.) a year in 2014. Metallurgical-grade silicon metal world consumption topped 2.25 million tonnes in 2014, exceeding $6-billion (U.S.) in sales. Propelled by increased demand for photovoltaic solar panels systems, metallurgical-grade silicon metal consumption is expected to grow by over 6 per cent per annum(1).

About 10 per cent of 2014 global metallurgical-grade silicon metal produced was further refined into solar-grade silicon metal and polysilicon, worth another $6-billion (U.S.). GTM Research estimates that installed PV demand will grow 15 per cent to 23 per cent annually, access to solar-grade Si will be the limiting factor in PV growth, the balance of supply and demand for Sg Si demand is expected for year-end 2016 as gigawatts produced by solar panels increase(2).

Notes

(1) Roskill: Silicon and ferrosilicon: global industry markets and outlook report (2014).

(2) PV demand and GTM Research -- October, 2015, plus info from RECSilicon 2015 presentation.

We seek Safe Harbor.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23575…

Antwort auf Beitrag Nr.: 52.075.643 von married am 29.03.16 16:07:18

Heute +30% an der TSX.

Mal sehen wie sich das weiter entwickelt.

Uragold anticipates announcing results within two to four weeks.

.

Heute +30% an der TSX.

Mal sehen wie sich das weiter entwickelt.

Uragold anticipates announcing results within two to four weeks.

.

Antwort auf Beitrag Nr.: 52.078.931 von married am 29.03.16 22:52:36

"Uragold anticipates announcing results within two to four weeks."

Die erste zwei Wochen sind vorbei,

jetzt darf man so langsam damit beginnen täglich rückwärts zu zählen.

Vielleicht gibt es ein Stückchen aus diesem $12-billion (U.S.) - Kuchen:

PyroGenesis's Purevap QVR disruptive potential is its one-step direct transformation of quartz into solar-grade silicon metal, thereby potentially allowing Uragold to manufacture solar-grade silicon metal (Sg Si) at the same cost as producing metallurgical-grade silicon metal (Mg Si), a much-lower-quality product. Additionally, the company believes the process holds a significant capital cost advantage that will allow a plant to be built at just a fraction of the current manufacturing costs.

Mr. Tourillon further added: "It cannot be understated. Successful testing will provide Uragold with disruptive technology and a very strong competitive advantage over all other solar-grade silicon metal manufacturers. It allows Uragold to go much higher in the high-purity quartz value chain and potentially become the lowest-cost vertically integrated silicon metal, solar-grade silicon metal and higher-value silicon metal producer. Quite simply, this technology has the potential to revolutionize the process of manufacturing silicon metal."

$12-billion (U.S.) annual industry, growth driven by photovoltaic solar demand

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23575…

"Uragold anticipates announcing results within two to four weeks."

Die erste zwei Wochen sind vorbei,

jetzt darf man so langsam damit beginnen täglich rückwärts zu zählen.

Vielleicht gibt es ein Stückchen aus diesem $12-billion (U.S.) - Kuchen:

PyroGenesis's Purevap QVR disruptive potential is its one-step direct transformation of quartz into solar-grade silicon metal, thereby potentially allowing Uragold to manufacture solar-grade silicon metal (Sg Si) at the same cost as producing metallurgical-grade silicon metal (Mg Si), a much-lower-quality product. Additionally, the company believes the process holds a significant capital cost advantage that will allow a plant to be built at just a fraction of the current manufacturing costs.

Mr. Tourillon further added: "It cannot be understated. Successful testing will provide Uragold with disruptive technology and a very strong competitive advantage over all other solar-grade silicon metal manufacturers. It allows Uragold to go much higher in the high-purity quartz value chain and potentially become the lowest-cost vertically integrated silicon metal, solar-grade silicon metal and higher-value silicon metal producer. Quite simply, this technology has the potential to revolutionize the process of manufacturing silicon metal."

$12-billion (U.S.) annual industry, growth driven by photovoltaic solar demand

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23575…

Antwort auf Beitrag Nr.: 52.165.396 von married am 11.04.16 22:41:27

"Uragold anticipates announcing results within two to four weeks."

Kennt hier schon jemand ( die ersten ) Ergebnisse :

?

Recent Trades - Last 10 of 15

Time ET Ex Price Change Volume Buyer Seller Markers

09:36:44 V 0.18 0.01 5,000 88 Credential 1 Anonymous

09:36:15 V 0.175 0.005 114,000 2 RBC 1 Anonymous

09:36:15 V 0.175 0.005 114,000 2 RBC 1 Anonymous

09:31:33 V 0.18 0.01 40,000 85 Scotia 1 Anonymous

09:31:33 V 0.18 0.01 25,500 79 CIBC 1 Anonymous

09:30:00 V 0.18 0.01 1,500 79 CIBC 88 Credential

09:30:00 V 0.18 0.01 5,000 1 Anonymous 88 Credential

09:30:00 V 0.18 0.01 5,000 1 Anonymous 88 Credential

09:30:00 V 0.18 0.01 16,000 9 BMO Nesbitt 88 Credential

09:30:00 V 0.18 0.01 5,000 9 BMO Nesbitt 58 Qtrade

"Uragold anticipates announcing results within two to four weeks."

Kennt hier schon jemand ( die ersten ) Ergebnisse :

?

Recent Trades - Last 10 of 15

Time ET Ex Price Change Volume Buyer Seller Markers

09:36:44 V 0.18 0.01 5,000 88 Credential 1 Anonymous

09:36:15 V 0.175 0.005 114,000 2 RBC 1 Anonymous

09:36:15 V 0.175 0.005 114,000 2 RBC 1 Anonymous

09:31:33 V 0.18 0.01 40,000 85 Scotia 1 Anonymous

09:31:33 V 0.18 0.01 25,500 79 CIBC 1 Anonymous

09:30:00 V 0.18 0.01 1,500 79 CIBC 88 Credential

09:30:00 V 0.18 0.01 5,000 1 Anonymous 88 Credential

09:30:00 V 0.18 0.01 5,000 1 Anonymous 88 Credential

09:30:00 V 0.18 0.01 16,000 9 BMO Nesbitt 88 Credential

09:30:00 V 0.18 0.01 5,000 9 BMO Nesbitt 58 Qtrade

Antwort auf Beitrag Nr.: 52.214.332 von married am 18.04.16 15:56:21"The silicon metal, solar grade silicon metal and electronic grade silicon metal markets combined formed a US$12B per year industry in 2014".

Vielleicht kann UBR ein großes Stück vom Kuchen abbekommen:

Die frühen Testergebnisse sehen auf jeden Fall erfolgversprechend aus:

PyroGenesis's Purevap transforms quartz to silicon

2016-04-19 09:05 ET - News Release

See News Release (C-PYR) PyroGenesis Canada Inc

Mr. Peter Pascali of PyroGenesis reports

PYROGENESIS ANNOUNCES PUREVAP(TM) PROCESS BREAKTHROUGH

The early test results of PyroGenesis Canada Inc.'s Purevap quartz vaporization reactor have demonstrated that it can transform high-purity quartz into silicon metal.

As previously noted, Purevap is a proprietary process that uses a plasma arc within a vacuum furnace to produce high-purity, metallurgical-grade silicon (MG Si), solar-grade silicon (UMG Si) and polysilicon from quartz in just one step.

In September, 2015, PyroGenesis announced that it had filed for a provisional patent for the Purevap process, which it noted was able to produce silicon, at a lower cost, while generating less CO2 emissions than current processes.

"We are very pleased by these early results," said Pierre Carabin, Director of Engineering of PyroGenesis. "Our ability to demonstrate that our process can produce metal at such an early stage is encouraging and is the first step towards the Company's objective to produce a silicon product of solar grade purity."

The silicon metal, solar grade silicon metal and electronic grade silicon metal markets combined formed a US$12B per year industry in 2014. Metallurgical grade silicon metal world consumption topped 2.25 million tonnes in 2014, exceeding US$6B in sales. Propelled by increased demand for photovoltaic (PV) solar panels systems, metallurgical grade silicon metal consumption is expected to grow by over six percent (6%) per annum(1).

In 2014, nearly ten percent (10%) of the global metallurgical grade silicon metal produced was further refined into solar grade silicon metal and polysilicon, worth an additional US$6B. GTM Research estimates that installed PV demand will grow 15 % - 23 % annually and access to solar grade Si will be a limiting factor in PV growth(2).

"PyroGenesis' PUREVAP(TM) is a disruptive process that has the ability to revolutionize the way the mining & metallurgy industry produces metals," said P. Peter Pascali, President and CEO of PyroGenesis. "PyroGenesis has once again demonstrated its ability to use plasma as a solution in industries that have not yet had the luxury to consider its many benefits. We look forward to the final results of our testing program and advancing to the pilot stage with Uragold."

We seek Safe Harbor.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23636…

Vielleicht kann UBR ein großes Stück vom Kuchen abbekommen:

Die frühen Testergebnisse sehen auf jeden Fall erfolgversprechend aus:

PyroGenesis's Purevap transforms quartz to silicon

2016-04-19 09:05 ET - News Release

See News Release (C-PYR) PyroGenesis Canada Inc

Mr. Peter Pascali of PyroGenesis reports

PYROGENESIS ANNOUNCES PUREVAP(TM) PROCESS BREAKTHROUGH

The early test results of PyroGenesis Canada Inc.'s Purevap quartz vaporization reactor have demonstrated that it can transform high-purity quartz into silicon metal.

As previously noted, Purevap is a proprietary process that uses a plasma arc within a vacuum furnace to produce high-purity, metallurgical-grade silicon (MG Si), solar-grade silicon (UMG Si) and polysilicon from quartz in just one step.

In September, 2015, PyroGenesis announced that it had filed for a provisional patent for the Purevap process, which it noted was able to produce silicon, at a lower cost, while generating less CO2 emissions than current processes.

"We are very pleased by these early results," said Pierre Carabin, Director of Engineering of PyroGenesis. "Our ability to demonstrate that our process can produce metal at such an early stage is encouraging and is the first step towards the Company's objective to produce a silicon product of solar grade purity."

The silicon metal, solar grade silicon metal and electronic grade silicon metal markets combined formed a US$12B per year industry in 2014. Metallurgical grade silicon metal world consumption topped 2.25 million tonnes in 2014, exceeding US$6B in sales. Propelled by increased demand for photovoltaic (PV) solar panels systems, metallurgical grade silicon metal consumption is expected to grow by over six percent (6%) per annum(1).

In 2014, nearly ten percent (10%) of the global metallurgical grade silicon metal produced was further refined into solar grade silicon metal and polysilicon, worth an additional US$6B. GTM Research estimates that installed PV demand will grow 15 % - 23 % annually and access to solar grade Si will be a limiting factor in PV growth(2).

"PyroGenesis' PUREVAP(TM) is a disruptive process that has the ability to revolutionize the way the mining & metallurgy industry produces metals," said P. Peter Pascali, President and CEO of PyroGenesis. "PyroGenesis has once again demonstrated its ability to use plasma as a solution in industries that have not yet had the luxury to consider its many benefits. We look forward to the final results of our testing program and advancing to the pilot stage with Uragold."

We seek Safe Harbor.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23636…

Antwort auf Beitrag Nr.: 52.225.504 von married am 19.04.16 16:33:26

... und die Anleger honorieren das Testergebnis:

... und die Anleger honorieren das Testergebnis:

... und die Anleger honorieren das Testergebnis:

... und die Anleger honorieren das Testergebnis:

Antwort auf Beitrag Nr.: 52.228.993 von married am 19.04.16 22:13:56

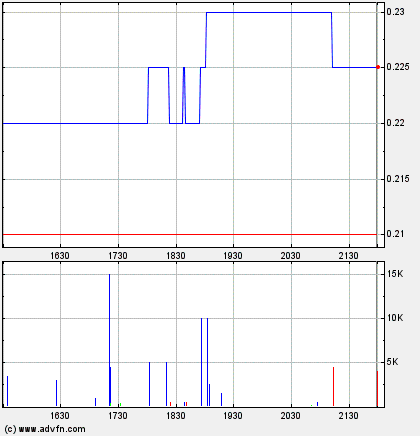

+ 35,3 % heute und

bis in die letzten Handelsminuten weiterhin gute Umsätze:

15:59:57 V 0.23 0.06 10,000 85 Scotia 79 CIBC

15:59:57 V 0.23 0.06 470 7 TD Sec 36 Latimer

15:59:57 V 0.23 0.06 16,000 7 TD Sec 79 CIBC

15:59:57 V 0.23 0.06 500 7 TD Sec 85 Scotia

15:58:37 V 0.23 0.06 4,500 7 TD Sec 85 Scotia

15:58:21 V 0.23 0.06 500 7 TD Sec 88 Credential

15:58:07 V 0.23 0.06 4,500 85 Scotia 88 Credential

15:58:07 V 0.23 0.06 20,000 85 Scotia 2 RBC

15:58:07 V 0.23 0.06 5,000 85 Scotia 85 Scotia

.

+ 35,3 % heute und

bis in die letzten Handelsminuten weiterhin gute Umsätze:

15:59:57 V 0.23 0.06 10,000 85 Scotia 79 CIBC

15:59:57 V 0.23 0.06 470 7 TD Sec 36 Latimer

15:59:57 V 0.23 0.06 16,000 7 TD Sec 79 CIBC

15:59:57 V 0.23 0.06 500 7 TD Sec 85 Scotia

15:58:37 V 0.23 0.06 4,500 7 TD Sec 85 Scotia

15:58:21 V 0.23 0.06 500 7 TD Sec 88 Credential

15:58:07 V 0.23 0.06 4,500 85 Scotia 88 Credential

15:58:07 V 0.23 0.06 20,000 85 Scotia 2 RBC

15:58:07 V 0.23 0.06 5,000 85 Scotia 85 Scotia

.

Das kann wirklich groß werden, die genauen Testergebnisse stehen noch aus. Welche Reinheit erreicht wird ist entscheidend (4N, 6N, 9N).

Gerade eben habe ich einen PRUEVAP Artikel im Forum für Grüne Aktien verfasst, da aus meiner Sicht die Chancen für die Solarindustrie groß und auch die Einsparung an CO2 für die Umwelt sehr wichtig sind.

Gerade eben habe ich einen PRUEVAP Artikel im Forum für Grüne Aktien verfasst, da aus meiner Sicht die Chancen für die Solarindustrie groß und auch die Einsparung an CO2 für die Umwelt sehr wichtig sind.

Antwort auf Beitrag Nr.: 52.232.986 von Diphutri am 20.04.16 11:58:20Und darauf dürfen wir uns auch freuen, vor allem weil der spin out als "gratis - Dividende" an die Aktionäre von Uragold erfolgen soll:

-Once Uragold as issues the press release confirming the successful metallurgical testing, and the Investors have released the escrowed $250,000 to Uragold, Uragold shall start the process required to spin out the Gold assets of the Corporation into a separate Company.

-Once Uragold as issues the press release confirming the successful metallurgical testing, and the Investors have released the escrowed $250,000 to Uragold, Uragold shall start the process required to spin out the Gold assets of the Corporation into a separate Company.

Antwort auf Beitrag Nr.: 52.232.986 von Diphutri am 20.04.16 11:58:20

Hast du mir einen link für das genannte Forum ?

Hast du mir einen link für das genannte Forum ?

Antwort auf Beitrag Nr.: 52.234.162 von married am 20.04.16 13:39:52http://www.wallstreet-online.de/diskussion/1230334-1-10/pure… hab ich doch glatt vergessen

Das sieht doch Mal schon sehr gut aus

und die vor wenigen Tagen beschlossene Ausgliederung der gold assets wird für zusätzliche Phantasie sorgen.

Uragold tests confirm Purevap produces high-purity Si

2016-06-29 08:43 ET - News Release

Mr. Bernard Tourillon reports

PUREVAP PRODUCES PURE SILICON METAL MATERIAL THAT EXCEEDS 1ST LAB THRESHOLD; MATERIAL BEING SENT TO 2ND SPECIALIZED LAB IN UNITED STATES FOR DETAILED ANALYSIS

INRS-ETE (Institut National de la Recherche Scientifique, Eau Terre Environnement) Laboratory in Quebec City has advised Uragold Bay Resources Inc. that the first batch of samples produced by the Purevap quartz vaporization reactor (QVR) following restart (see May 25, 2016, press release) has been analyzed.

ANALYSIS CONFIRMS PRODUCTION OF HIGH PURITY SILICON METAL IN ALL TESTS

Multiple surface readings were completed using a Scanning Electron Microscope (SEM) associated with Energy Dispersive X-ray Spectroscopy (EDX) on samples T6, T7 and T9. The analyses confirm production of High Purity Silicon Metal (Si) by the PUREVAP(TM) QVR during all of the tests but the final purity level in ppb (parts per billion) is yet to be determined.

EXTREMELY LOW IMPURITY LEVELS EXCEED LAB DETECTION CAPABILITIES

Of significant interest is the fact that 22 different readings of 100% Si were observed. This can be attributed to the fact the impurity levels of the samples are so low that they were below the impurity detection level of the method utilized by INRS - ETE (1,000 ppm). As such, the method used detected purity levels greater than 99.9% Si and were rounded up to 100%. This first pass analytical process confirms the ability of the PUREVAP(TM) process to create high purity silicon metal exceeding 99.9% and the samples will now been sent to a specialized laboratory in the United States to determine the precise purity levels of the Silicon Metal.

"We are encouraged by these results as they confirm our expectations of our PUREVAP(TM) process," said Pierre Carabin, Director of Engineering of PyroGenesis. "We are looking forward to receiving the additional tests results from the specialized laboratory in the US. In the meantime, we continue to pursue our testing program."

Bernard Tourillon, Chairman and CEO of Uragold stated, "These test results represent a significant milestone as one of the key goals of our project has been reached - the establishment of a high purity (99.9+%) baseline for the material produced by the reactor. Reaching our goal of transforming Uragold Quartz into Solar Grade Purity Silicon seems even more attainable."

RESULTS ENTER PROJECT INTO NEXT PHASE

At the outset, theoretical modeling of the process indicated that transforming Uragold Martinville Raw Quartz into High Purity Silicon Metal was feasible. Today's results now validate this. Therefore, the program is now moving beyond the metallurgical testing phase into an R&D program strictly focused on improving the PUREVAP(TM) QVR beneficiation capability for the express purpose of determining maximum purity and advancing to the pilot plant stage.

TESTING PROTOCOL MOVING FORWARD

The original test protocols called for any material that exceeded the lower limit of detection of the SEM-EDX to be further tested using Laser Ablation Inductively Coupled Plasma Mass Spectrometry (LA-ICP-MS) analysis. The Lab has advised the INRS that it lacked a High Purity Silicon Quality Assurance Standards for LA-ICP-MS analysis in order to validate results. Furthermore, because of contamination risk associated with the Inductively Coupled Plasma Mass Spectrometry testing, it was decided the material should be sent to a specialised laboratory in the US for neutron activation analysis (NAA) testing.

Testing Methodology:

The SEM-EDX analysis were completed at the INRS - ETE laboratory in Quebec City.

The scanning electron micrographs (SEM) USED are Carl Zeiss EVOtrademark 50 smart SEM equipped with a range of imaging detectors, including: an Everhart-Thornley Secondary Electron Detector, for topographic image.

Backscattered electron (BSE) images allow the viewing of images in chemical contrast, depending of the mean atomic number of the specimen. The systems use a 4 Quadrant backscattered electron detector (QBSD).

The elemental analysis of the particles present on the surface is enabled by an energy dispersive X-ray spectrometry (EDS) Microanalysis System (model: Oxford Instruments, INCAx-sight EDS Detectors). This EDS is a Lithium drifted Silicon detector Si (Li). EDS can detect element from Beryllium (z=4) to Uranium (z=92). This detector must be operated at liquid nitrogen temperatures.

-- EDS Resolution: 133 eV. -- Detection limits: 1,000 ppm

Settings used for the analysis: Accelerating voltage usually used is 20 kV, Working distance: WD: 8.5 mm for EDS analysis, for image in SE.

Sample preparation

1. The samples were mounted on conventional 12.7 mm diameter aluminum stubs using double sided adhesive carbon discs. The all is clamped in a multi- stub holder. 2. The samples were coated with a thin layer (20-30 nm) of conductive medium, such as gold, to increase conductivity and thus to minimise sample charge up.

Pierre Carabin, Eng., M. Eng., has reviewed and approved the technical contents of this press release.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aUBR-23862…

und die vor wenigen Tagen beschlossene Ausgliederung der gold assets wird für zusätzliche Phantasie sorgen.

Uragold tests confirm Purevap produces high-purity Si

2016-06-29 08:43 ET - News Release

Mr. Bernard Tourillon reports

PUREVAP PRODUCES PURE SILICON METAL MATERIAL THAT EXCEEDS 1ST LAB THRESHOLD; MATERIAL BEING SENT TO 2ND SPECIALIZED LAB IN UNITED STATES FOR DETAILED ANALYSIS

INRS-ETE (Institut National de la Recherche Scientifique, Eau Terre Environnement) Laboratory in Quebec City has advised Uragold Bay Resources Inc. that the first batch of samples produced by the Purevap quartz vaporization reactor (QVR) following restart (see May 25, 2016, press release) has been analyzed.

ANALYSIS CONFIRMS PRODUCTION OF HIGH PURITY SILICON METAL IN ALL TESTS

Multiple surface readings were completed using a Scanning Electron Microscope (SEM) associated with Energy Dispersive X-ray Spectroscopy (EDX) on samples T6, T7 and T9. The analyses confirm production of High Purity Silicon Metal (Si) by the PUREVAP(TM) QVR during all of the tests but the final purity level in ppb (parts per billion) is yet to be determined.

EXTREMELY LOW IMPURITY LEVELS EXCEED LAB DETECTION CAPABILITIES

Of significant interest is the fact that 22 different readings of 100% Si were observed. This can be attributed to the fact the impurity levels of the samples are so low that they were below the impurity detection level of the method utilized by INRS - ETE (1,000 ppm). As such, the method used detected purity levels greater than 99.9% Si and were rounded up to 100%. This first pass analytical process confirms the ability of the PUREVAP(TM) process to create high purity silicon metal exceeding 99.9% and the samples will now been sent to a specialized laboratory in the United States to determine the precise purity levels of the Silicon Metal.

"We are encouraged by these results as they confirm our expectations of our PUREVAP(TM) process," said Pierre Carabin, Director of Engineering of PyroGenesis. "We are looking forward to receiving the additional tests results from the specialized laboratory in the US. In the meantime, we continue to pursue our testing program."

Bernard Tourillon, Chairman and CEO of Uragold stated, "These test results represent a significant milestone as one of the key goals of our project has been reached - the establishment of a high purity (99.9+%) baseline for the material produced by the reactor. Reaching our goal of transforming Uragold Quartz into Solar Grade Purity Silicon seems even more attainable."

RESULTS ENTER PROJECT INTO NEXT PHASE

At the outset, theoretical modeling of the process indicated that transforming Uragold Martinville Raw Quartz into High Purity Silicon Metal was feasible. Today's results now validate this. Therefore, the program is now moving beyond the metallurgical testing phase into an R&D program strictly focused on improving the PUREVAP(TM) QVR beneficiation capability for the express purpose of determining maximum purity and advancing to the pilot plant stage.

TESTING PROTOCOL MOVING FORWARD