Mason Graphite-V.LLG --High-Grade Graphite Project !! - 500 Beiträge pro Seite

eröffnet am 07.12.12 20:27:54 von

neuester Beitrag 16.12.14 00:36:26 von

neuester Beitrag 16.12.14 00:36:26 von

Beiträge: 57

ID: 1.178.220

ID: 1.178.220

Aufrufe heute: 0

Gesamt: 16.216

Gesamt: 16.216

Aktive User: 0

ISIN: CA57532C1005 · WKN: A3EWCM · Symbol: LLG

0,1300

CAD

0,00 %

0,0000 CAD

Letzter Kurs 17.04.24 TSX Venture

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 1,2900 | +36,33 | |

| 3,8600 | +15,57 | |

| 2,3900 | +14,35 | |

| 2,1800 | +8,46 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0800 | -11,83 | |

| 9,8500 | -17,92 | |

| 3,20 | -17,95 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 |

Servus,

ein sehr interessanter Explorer,mit sehr gutem Projekt!

http://www.masongraphite.com/about/company-overview/default.…

Mason Graphite is a Canadian mining company focused on the exploration and development of one of the highest grade graphite deposits known in the world. Its 100% owned Lac Guéret graphite property is located in northeastern Québec near the main service center of Baie-Comeau and currently hosts a NI 43-101 compliant Measured & Indicated mineral resource of 7.6 million tonnes grading 20.4% Cg (carbon as graphite). 20.4% Cgr is the equivalent to about 9.1 g/t gold (assuming graphite price of $1,750 and gold price of $1,250. Source: Craig Miller at TD Securities). Tremendous exploration potential exists on the property with the current mineral resource based on exploration of only 17% of one well defined zone. By the end of 2015, the Company intends to have developed the Lac Guéret project into one of the world’s highest grade graphite producers. Mason Graphite is led by Benoit Gascon, CA CMA, who has held 20 years of executive positions at Timcal, including over 6 years as CEO. Timcal, now owned by Imerys, is the largest graphite producer in the world.

http://www.masongraphite.com/projects/lac-gueret-graphite-pr…

A National Instrument 43-101 compliant mineral resource estimate for the Lac Guéret property was completed in July 2012, which was based on the 24 drill holes completed by Quinto in 2006 (for a total of 2,284 metres cored). The results, using a cut-off grade of 4% carbon as graphite (Cgr), were as follows:

Measured & Indicated mineral resources

Approximately 7.6 million tonnes grading 20.40% Cgr

Inferred mineral resources

Approximately 2.8 million tonnes grading 17.29% Cgr

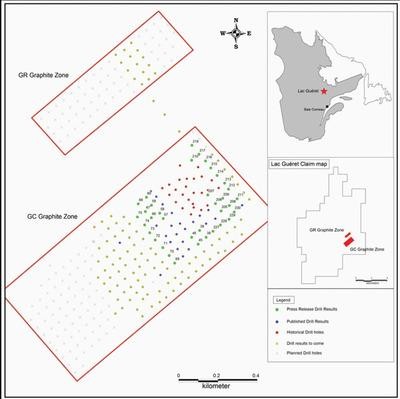

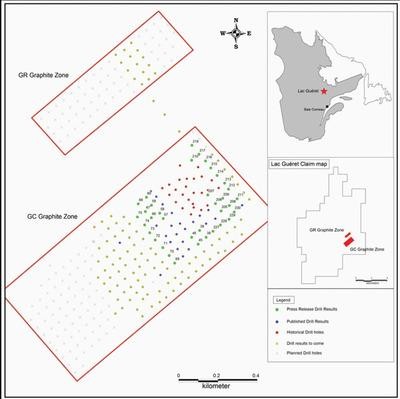

The graphite occurrence on the Lac Guéret property occurs in two zones, the GC zone and the GR zone.

GC Zone - Graphite mineralization in the GC zone has been mapped on strike up to 1.2 km and at width up to 240 metres. The current NI 43-101 mineral resource estimate is based on the exploration of only 17% of the GC zone area. An initial +/- 18,000 metre drilling program targeting the full length of this zone was initiated in July 2012 and is expected to translate into mineral growth in an updated mineral resource estimate targeted for the end of 2012.

GR Zone - Graphite mineralization in the GR zone has been identified on an area of up to 1 kilometre and up to 110 metres wide. The company intends to conduct a drilling program in this zone following proper definition drilling of the GC zone.

2012 Exploration Program

+/- 18,000 metre drilling program on the GC Zone initiated in July 2012

12,500 metres completed as at September 18, 2012

Completion of program expected by the end of 2012

Results are expected to translate into mineral growth in an updated mineral resource calculation expected by the end of 2012

http://www.masongraphite.com/news/news-details/2012/Mason-Gr…

TORONTO, Nov. 21, 2012 /CNW/ - Mason Graphite Inc. (TSX.V: LLG) ("Mason Graphite" or the "Company") reports assay results for 23 drill holes (4,355 metres) from the mineral resource expansion program at its Lac Guéret project in northeastern Quebec. Results and the corresponding map are presented below. These holes are part of a drilling program initiated in July 2012 that was designed to delineate additional mineral resources along strike of the GC zone, which hosts the current National Instrument 43-101 mineral resource of about 300,000 tonnes at 24.4% Carbon as Graphite ("Cgr") in the Measured category and 7.3 million tonnes at 20.2% Cgr in the Indicated category (effective as of June 22, 2012). The Company is awaiting results from an additional 34 drill holes (about 6,500 metres), which along with the 23 holes presented below will be included in its database to calculate an updated mineral resource estimate that is planned for completion in early 2013.

Significant graphite intercepts in this round of results, include:

Hole LG-44 intersected 96.0 metres at 16.9% Cgr

Hole LG-50 intersected 52.3 metres at 22.4% Cgr and 12.4 metres at 17.5% Cgr

Hole LG-53 intersected 43.5 metres at 20.0% Cgr, 16.5 metres at 15.7% and 88.5 metres at 21.0% Cgr

Hole LG-61 intersected 13.5 metres at 20.2% Cgr, 13.5 metres at 17.5% Cgr and 13.5 metres at 24.7% Cgr

Hole LG-231 intersected 33.0 metres at 19.1% Cgr

Benoît Gascon, CEO of Mason Graphite commented, "We are very pleased with the progression of our drilling program with over 26,600 metres completed since July. We plan to include approximately 11,000 metres of this program in an updated mineral resource which is expected for completion in early 2013, and the remaining results will be included in a second mineral resource update later in the first quarter of 2013. The initial results from 23 holes were all drilled at the border and beyond the boundaries of the July 2012 mineral resource calculation and we are very encouraged by the apparent continuity of high quality graphite mineralization extending to the south-east and south-west of this area."

Roche Ltd. Consulting Group, who completed the Company's National Instrument 43-101 mineral resource estimate in July 2012, has been retained to complete the upcoming mineral resource update.

See "Technical Report on the Lac Guéret Graphite Project" dated July 3, 2012 under Mason Graphite's profile on SEDAR at www.sedar.com for additional information, including exploration information and data verification.

Table 1 - Best results from each of 23 drill holes (4,355 metres)

Hole From

(m) To

(m) Width

(m) Carbon as Graphite

(Cgr) (%)

LG-40 90.45 143.35 52.9 11.6

LG-41 23.75 34.6 10.85 17.1

62.4 119.2 56.8 11.8

LG-42 37 46.3 9.3 12.2

78.55 102.1 23.55 12.2

108.2 139.85 31.65 16.5

LG-43 46.5 58.5 12 15.8

108 132 24 18.1

LG-44 40.5 136.5 96 16.9

LG-47 17.2 22.55 5.35 21.1

120.25 145.8 25.55 16.5

LG-48 18.1 38.7 20.6 14

97.5 133.8 36.3 10

153.25 159.1 5.85 14.4

LG-49 4.95 19.4 14.45 12.3

57.65 151 93.35 17.1

LG-50 16.5 68.75 52.25 22.4

100.5 112.85 12.35 17.5

LG-51 32.3 43.6 11.3 13.3

72 95.7 23.7 20.6

LG-52 30 49.5 19.5 10.4

LG-53 16.5 60 43.5 20

106.5 123 16.5 15.7

144 232.5 88.5 21

LG-54 37.5 48 10.5 14.7

58.5 67.5 9 14.6

165 180 15 12.1

LG-55 51 79.5 28.5 14.6

127.5 157.5 30 11

168 175.5 7.5 19.3

LG-56 25.4 33.2 7.8 11.5

59.55 69.65 10.1 14.5

141 154 13 16.4

LG-61 15 28.5 13.5 20.2

36 49.5 13.5 17.5

57 69 12 8.3

103.5 129 25.5 14

171 184.5 13.5 24.7

LG-62 11.6 17.85 6.25 14.8

43.5 50.8 7.3 13.3

70.35 96 25.65 13.2

LG-63 38.5 52.25 13.75 14.3

74.8 83.6 8.8 14.3

151.3 165.45 14.15 12

LG-64 9.8 15.95 6.15 11.3

42.65 52.1 9.45 32.1

66 76.5 10.5 11.8

129.9 142.85 12.95 14.5

LG-65 44.1 53.85 9.75 13.3

57.5 65.4 7.9 24.2

137.7 161.35 23.65 19

LG-84 94.5 100.5 6 17.9

109.5 117 7.5 16.5

172.5 187.5 15 28.3

LG-97 78 88.5 10.5 20.2

94.5 105 10.5 11.7

LG-231 31.5 64.5 33 19.1

ein sehr interessanter Explorer,mit sehr gutem Projekt!

http://www.masongraphite.com/about/company-overview/default.…

Mason Graphite is a Canadian mining company focused on the exploration and development of one of the highest grade graphite deposits known in the world. Its 100% owned Lac Guéret graphite property is located in northeastern Québec near the main service center of Baie-Comeau and currently hosts a NI 43-101 compliant Measured & Indicated mineral resource of 7.6 million tonnes grading 20.4% Cg (carbon as graphite). 20.4% Cgr is the equivalent to about 9.1 g/t gold (assuming graphite price of $1,750 and gold price of $1,250. Source: Craig Miller at TD Securities). Tremendous exploration potential exists on the property with the current mineral resource based on exploration of only 17% of one well defined zone. By the end of 2015, the Company intends to have developed the Lac Guéret project into one of the world’s highest grade graphite producers. Mason Graphite is led by Benoit Gascon, CA CMA, who has held 20 years of executive positions at Timcal, including over 6 years as CEO. Timcal, now owned by Imerys, is the largest graphite producer in the world.

http://www.masongraphite.com/projects/lac-gueret-graphite-pr…

A National Instrument 43-101 compliant mineral resource estimate for the Lac Guéret property was completed in July 2012, which was based on the 24 drill holes completed by Quinto in 2006 (for a total of 2,284 metres cored). The results, using a cut-off grade of 4% carbon as graphite (Cgr), were as follows:

Measured & Indicated mineral resources

Approximately 7.6 million tonnes grading 20.40% Cgr

Inferred mineral resources

Approximately 2.8 million tonnes grading 17.29% Cgr

The graphite occurrence on the Lac Guéret property occurs in two zones, the GC zone and the GR zone.

GC Zone - Graphite mineralization in the GC zone has been mapped on strike up to 1.2 km and at width up to 240 metres. The current NI 43-101 mineral resource estimate is based on the exploration of only 17% of the GC zone area. An initial +/- 18,000 metre drilling program targeting the full length of this zone was initiated in July 2012 and is expected to translate into mineral growth in an updated mineral resource estimate targeted for the end of 2012.

GR Zone - Graphite mineralization in the GR zone has been identified on an area of up to 1 kilometre and up to 110 metres wide. The company intends to conduct a drilling program in this zone following proper definition drilling of the GC zone.

2012 Exploration Program

+/- 18,000 metre drilling program on the GC Zone initiated in July 2012

12,500 metres completed as at September 18, 2012

Completion of program expected by the end of 2012

Results are expected to translate into mineral growth in an updated mineral resource calculation expected by the end of 2012

http://www.masongraphite.com/news/news-details/2012/Mason-Gr…

TORONTO, Nov. 21, 2012 /CNW/ - Mason Graphite Inc. (TSX.V: LLG) ("Mason Graphite" or the "Company") reports assay results for 23 drill holes (4,355 metres) from the mineral resource expansion program at its Lac Guéret project in northeastern Quebec. Results and the corresponding map are presented below. These holes are part of a drilling program initiated in July 2012 that was designed to delineate additional mineral resources along strike of the GC zone, which hosts the current National Instrument 43-101 mineral resource of about 300,000 tonnes at 24.4% Carbon as Graphite ("Cgr") in the Measured category and 7.3 million tonnes at 20.2% Cgr in the Indicated category (effective as of June 22, 2012). The Company is awaiting results from an additional 34 drill holes (about 6,500 metres), which along with the 23 holes presented below will be included in its database to calculate an updated mineral resource estimate that is planned for completion in early 2013.

Significant graphite intercepts in this round of results, include:

Hole LG-44 intersected 96.0 metres at 16.9% Cgr

Hole LG-50 intersected 52.3 metres at 22.4% Cgr and 12.4 metres at 17.5% Cgr

Hole LG-53 intersected 43.5 metres at 20.0% Cgr, 16.5 metres at 15.7% and 88.5 metres at 21.0% Cgr

Hole LG-61 intersected 13.5 metres at 20.2% Cgr, 13.5 metres at 17.5% Cgr and 13.5 metres at 24.7% Cgr

Hole LG-231 intersected 33.0 metres at 19.1% Cgr

Benoît Gascon, CEO of Mason Graphite commented, "We are very pleased with the progression of our drilling program with over 26,600 metres completed since July. We plan to include approximately 11,000 metres of this program in an updated mineral resource which is expected for completion in early 2013, and the remaining results will be included in a second mineral resource update later in the first quarter of 2013. The initial results from 23 holes were all drilled at the border and beyond the boundaries of the July 2012 mineral resource calculation and we are very encouraged by the apparent continuity of high quality graphite mineralization extending to the south-east and south-west of this area."

Roche Ltd. Consulting Group, who completed the Company's National Instrument 43-101 mineral resource estimate in July 2012, has been retained to complete the upcoming mineral resource update.

See "Technical Report on the Lac Guéret Graphite Project" dated July 3, 2012 under Mason Graphite's profile on SEDAR at www.sedar.com for additional information, including exploration information and data verification.

Table 1 - Best results from each of 23 drill holes (4,355 metres)

Hole From

(m) To

(m) Width

(m) Carbon as Graphite

(Cgr) (%)

LG-40 90.45 143.35 52.9 11.6

LG-41 23.75 34.6 10.85 17.1

62.4 119.2 56.8 11.8

LG-42 37 46.3 9.3 12.2

78.55 102.1 23.55 12.2

108.2 139.85 31.65 16.5

LG-43 46.5 58.5 12 15.8

108 132 24 18.1

LG-44 40.5 136.5 96 16.9

LG-47 17.2 22.55 5.35 21.1

120.25 145.8 25.55 16.5

LG-48 18.1 38.7 20.6 14

97.5 133.8 36.3 10

153.25 159.1 5.85 14.4

LG-49 4.95 19.4 14.45 12.3

57.65 151 93.35 17.1

LG-50 16.5 68.75 52.25 22.4

100.5 112.85 12.35 17.5

LG-51 32.3 43.6 11.3 13.3

72 95.7 23.7 20.6

LG-52 30 49.5 19.5 10.4

LG-53 16.5 60 43.5 20

106.5 123 16.5 15.7

144 232.5 88.5 21

LG-54 37.5 48 10.5 14.7

58.5 67.5 9 14.6

165 180 15 12.1

LG-55 51 79.5 28.5 14.6

127.5 157.5 30 11

168 175.5 7.5 19.3

LG-56 25.4 33.2 7.8 11.5

59.55 69.65 10.1 14.5

141 154 13 16.4

LG-61 15 28.5 13.5 20.2

36 49.5 13.5 17.5

57 69 12 8.3

103.5 129 25.5 14

171 184.5 13.5 24.7

LG-62 11.6 17.85 6.25 14.8

43.5 50.8 7.3 13.3

70.35 96 25.65 13.2

LG-63 38.5 52.25 13.75 14.3

74.8 83.6 8.8 14.3

151.3 165.45 14.15 12

LG-64 9.8 15.95 6.15 11.3

42.65 52.1 9.45 32.1

66 76.5 10.5 11.8

129.9 142.85 12.95 14.5

LG-65 44.1 53.85 9.75 13.3

57.5 65.4 7.9 24.2

137.7 161.35 23.65 19

LG-84 94.5 100.5 6 17.9

109.5 117 7.5 16.5

172.5 187.5 15 28.3

LG-97 78 88.5 10.5 20.2

94.5 105 10.5 11.7

LG-231 31.5 64.5 33 19.1

http://www.investmentpitch.com/video/0_13xvxegn/StoneCap-Sec…

Stonecap gives the company an outperform recommendation and a $1.40 target price, which would give investors a projected return of 100% from the $0.70 price at the time the report was issued

Stonecap gives the company an outperform recommendation and a $1.40 target price, which would give investors a projected return of 100% from the $0.70 price at the time the report was issued

Upcoming Key Milestones:

1) Q3 2012 – ± 18,000 metres of definition drilling on the GC Zone will aim to outline more than 50 Mt of graphite ore

2) October 30, 2012 - Mason Graphite begins trading on the TSX Venture under symbol “LLG”

3) Q4 2012 – Completion of preliminary metallurgical studies on 500 kg of material (Met-Chem)

4) Q1 2013 – Publication of 1st

Mineral Resource Update

5) Q4 2012 – Publication of PEA (Met-Chem) on the current 7.6 Mt portion of the GC Zone

6) Q1 2013 – Updated Mineral Resource

7) Ongoing – Baseline Environmental Studies in Q4 2012. See complete environmental permitting schedule in the Appendices.

8) Q3 2013 – Completion of feasibility-level metallurgical testing

9) Q3 2014 – Completion of a Bankable Feasibility Study

10) Q4 2015 – Expected graphite production at the Lac Guéret Project

1) Q3 2012 – ± 18,000 metres of definition drilling on the GC Zone will aim to outline more than 50 Mt of graphite ore

2) October 30, 2012 - Mason Graphite begins trading on the TSX Venture under symbol “LLG”

3) Q4 2012 – Completion of preliminary metallurgical studies on 500 kg of material (Met-Chem)

4) Q1 2013 – Publication of 1st

Mineral Resource Update

5) Q4 2012 – Publication of PEA (Met-Chem) on the current 7.6 Mt portion of the GC Zone

6) Q1 2013 – Updated Mineral Resource

7) Ongoing – Baseline Environmental Studies in Q4 2012. See complete environmental permitting schedule in the Appendices.

8) Q3 2013 – Completion of feasibility-level metallurgical testing

9) Q3 2014 – Completion of a Bankable Feasibility Study

10) Q4 2015 – Expected graphite production at the Lac Guéret Project

Shares: ~57 Millionen

MK aktuell: ~37.55M$

Cash (Ende September 2012): 565 000$

Kurs:

MK aktuell: ~37.55M$

Cash (Ende September 2012): 565 000$

Kurs:

Antwort auf Beitrag Nr.: 43.905.060 von Kongo-Otto am 07.12.12 23:12:09Servus Otto

die LLG ist nur auf meine WL,finde sie sehr interessant,auf die PEA bin ich sehr gespannt. Ein gewaltiges Resources Update steht noch vor der Tür,erwarte ca.30Mil.t high grade(ca.15%) das Management sieht sehr kompetent aus,vor allen Benoît Gascon!Mal sehen, wo "die Reise" hingeht!

Benoît Gascon, CEO

Over 20 yrs of experience in the Graphite & Carbon industries. He was the CEO of Stratmin Graphite which operates the Lac-des-Iles deposit;

one of North America's only producing graphite mines. He was responsible for negotiating the complete take-over of Stratmin Graphite by Imerys SA, a world leader in Industrial Minerals, to form Timcal Graphite & Carbon.

Corporate Structure (November 01, 2012)

Stock Symbol V.LLG

Shares Outstanding 56,896,645

Options 500,000

Warrants 16,627,653

Fully Diluted 74,024,298

Market Cap ~$39M

Cash Position ~$6 M

Major Shareholders

F&M & Insiders ~20M shares

Institutions ~25M shares

GCIC Ltd -5.0M

PowerOne -Capital 2.7M

Fahad Tamimi ~8,634,000 shares

LG

SEPPi

die LLG ist nur auf meine WL,finde sie sehr interessant,auf die PEA bin ich sehr gespannt. Ein gewaltiges Resources Update steht noch vor der Tür,erwarte ca.30Mil.t high grade(ca.15%) das Management sieht sehr kompetent aus,vor allen Benoît Gascon!Mal sehen, wo "die Reise" hingeht!

Benoît Gascon, CEO

Over 20 yrs of experience in the Graphite & Carbon industries. He was the CEO of Stratmin Graphite which operates the Lac-des-Iles deposit;

one of North America's only producing graphite mines. He was responsible for negotiating the complete take-over of Stratmin Graphite by Imerys SA, a world leader in Industrial Minerals, to form Timcal Graphite & Carbon.

Corporate Structure (November 01, 2012)

Stock Symbol V.LLG

Shares Outstanding 56,896,645

Options 500,000

Warrants 16,627,653

Fully Diluted 74,024,298

Market Cap ~$39M

Cash Position ~$6 M

Major Shareholders

F&M & Insiders ~20M shares

Institutions ~25M shares

GCIC Ltd -5.0M

PowerOne -Capital 2.7M

Fahad Tamimi ~8,634,000 shares

LG

SEPPi

Antwort auf Beitrag Nr.: 43.905.394 von SEPP_EIXLBERGER am 08.12.12 09:18:31Hallo Sepp,

wie sind eigentlich die Resourcen zu bewerten? fairer Wert/Potenzial?

Thx!

Gruß

reini81

wie sind eigentlich die Resourcen zu bewerten? fairer Wert/Potenzial?

Thx!

Gruß

reini81

Zitat von reini81: Hallo Sepp,

wie sind eigentlich die Resourcen zu bewerten? fairer Wert/Potenzial?

Thx!

Gruß

reini81

Servus "Alter",

Vergleiche Focus PEA mit LLG Resourcen!LLG hat grössere Resourcen höheren Grades 7,6 Mil.t a.20.40%(Resource Update Q1/13)

http://www.proactiveinvestors.co.uk/companies/news/49681/foc…

"Lac Knife is a world-class resource and the publication of our Preliminary Economic Assessment confirms Focus has the potential to become one of the highest-grade lowest-cost producers of graphite in the world.

"We enter a new phase now, where we can expedite our financing, advance customer off-take agreements, and construction of our purification and anode facilities."

The proposed life-of-mine production is seen at of 6.0 million tonnes of mill feed at a grade of 15.66% graphitic carbon, based on the initial mineral resource estimate disclosed in January.

With a mine life of 20 years, the open pit operation is seen yielding 300,000 tonnes per year, with life-of-mine production of 928,000 tonnes of concentrate at 92% graphitic carbon on average, or approximately 46,600 tonnes of concentrate per year.

Pre-tax net present value - at a 10% discount rate - is seen at $246 million with a 32% pre-tax internal rate of return and pre-tax payback period of 2.8 years.

Initial capital cost is seen at $154 million, inclusive of $33 million and $24 million in working capital and contingency (25 per cent), respectively.

Focus Graphite's PEA also showed an undiscounted pre-tax cash flow of $926 million, $3.7 billion total net revenue and average unit operating cost of $68 per tonne, rising to $435 per tonne assuming thermal purification on a contract basis.

Noch ein interessanter Punkt;

Laut StonCap ist LLG mit $14.42 per tonne of contained graphite bewertet und die Konkurrenz mit ca.$72.55 per tonne."

http://finance.yahoo.com/news/stonecap-securities-initiates-…

Hallo Sepp,

vielen Dank für die Infos zu Mason. Das liest sich schon sehr interessant!

Vorgestern kam die News, dass sie ihr Managementteam weiter ausbauen:

http://www.masongraphite.com/about/company-overview/default.…

Grundsätzlich ein gutes Zeichen, da es dokumentiert, dass es vorangeht.

Nachdenklich stimmt mich der relativ niedrige Cashbestand von ca. 6 $Mio. In den nächsten Monaten müssten laut Planung einige Kosten auf Mason zukommen. Weißt du von Überlegungen zur Finanzierung der nächsten Schritte?

vielen Dank für die Infos zu Mason. Das liest sich schon sehr interessant!

Vorgestern kam die News, dass sie ihr Managementteam weiter ausbauen:

http://www.masongraphite.com/about/company-overview/default.…

Grundsätzlich ein gutes Zeichen, da es dokumentiert, dass es vorangeht.

Nachdenklich stimmt mich der relativ niedrige Cashbestand von ca. 6 $Mio. In den nächsten Monaten müssten laut Planung einige Kosten auf Mason zukommen. Weißt du von Überlegungen zur Finanzierung der nächsten Schritte?

Servus tpnl,

LLG ist nur auf meiner WL,mMn gehört sie zu den top 5 in diesem Sektor.Die 6 Mil.$ + Warrants müssten reichen dieses Jahr,danach wird sicherlich ein PP kommen.

Warrants: 16,627,654 warrants are outstanding with exercise prices ranging from $0.20 to $1.00, with expiry dates ranging between July 18, 2013 to April 5, 2014. If exercised, 16,627,653 common shares would be issued for proceeds of $15,511,737.

P&L

SEPPi

LLG ist nur auf meiner WL,mMn gehört sie zu den top 5 in diesem Sektor.Die 6 Mil.$ + Warrants müssten reichen dieses Jahr,danach wird sicherlich ein PP kommen.

Warrants: 16,627,654 warrants are outstanding with exercise prices ranging from $0.20 to $1.00, with expiry dates ranging between July 18, 2013 to April 5, 2014. If exercised, 16,627,653 common shares would be issued for proceeds of $15,511,737.

P&L

SEPPi

Hallo Sepp,

vielen Dank für die schnelle Antwort!

Habe inzwischen noch eine Info gefunden, die mir eher weniger gefällt, wenn ich die folgende Passage richtig verstehe, kommen noch einige Meilensteinzahlungen auf Mason zu:

Mason Graphite is a private company incorporated pursuant to the Business Corporations Act (Ontario). Mason Graphite owns a 100% interest in the Lac Guéret graphite property (the "Lac Guéret Property") consisting of 11,630.34 hectares, which is located in the Côte-Nord-Nouveau-Québec region in northeastern Québec, which it acquired from Cliffs Natural Resources Inc. through its wholly-owned subsidiary Quinto Mining Corporation ("Quinto") pursuant to an asset purchase agreement dated April 5, 2012. The total purchase price for the acquisition was US$15,000,000 in cash, payable in instalments based on the achievement of certain milestones over a five year period and the issuance of 2,041,571 warrants to Quinto, each warrant being exercisable for one Mason Share at an exercise price of $0.75 until April 5, 2014. An aggregate of US$7,500,000 was paid on closing, with US$2,500,000 due following the completion of a feasibility study and US$5,000,000 due on achievement of commercial production. If the feasibility study is not completed by April 5, 2015, Mason Graphite is required to pay (a) US$1,250,000 on April 5, 2015, and (b) US$1,250,000 on the earlier of (i) the fifth business day following the day on which a feasibility study is completed; and (ii) October 5, 2015. If commercial production is not achieved by October 5, 2016, Mason Graphite is required to pay (a) US$2,500,000 on October 5, 2016; and (b) US$2,500,000 on the earlier of (i) the fifth business day following the day on which commercial production is achieved; and (ii) April 5, 2017. Pursuant to a general security agreement dated April 5, 2012, Quinto holds a security interest over all of Mason Graphite's personal and real property, including the mining claims that comprise the Lac Guéret Property, to secure payment of the balance of the purchase price and the performance of Mason Graphite's obligations under the asset purchase agreement.

http://www.marketwire.com/press-release/pocml-1-inc-and-maso…

vielen Dank für die schnelle Antwort!

Habe inzwischen noch eine Info gefunden, die mir eher weniger gefällt, wenn ich die folgende Passage richtig verstehe, kommen noch einige Meilensteinzahlungen auf Mason zu:

Mason Graphite is a private company incorporated pursuant to the Business Corporations Act (Ontario). Mason Graphite owns a 100% interest in the Lac Guéret graphite property (the "Lac Guéret Property") consisting of 11,630.34 hectares, which is located in the Côte-Nord-Nouveau-Québec region in northeastern Québec, which it acquired from Cliffs Natural Resources Inc. through its wholly-owned subsidiary Quinto Mining Corporation ("Quinto") pursuant to an asset purchase agreement dated April 5, 2012. The total purchase price for the acquisition was US$15,000,000 in cash, payable in instalments based on the achievement of certain milestones over a five year period and the issuance of 2,041,571 warrants to Quinto, each warrant being exercisable for one Mason Share at an exercise price of $0.75 until April 5, 2014. An aggregate of US$7,500,000 was paid on closing, with US$2,500,000 due following the completion of a feasibility study and US$5,000,000 due on achievement of commercial production. If the feasibility study is not completed by April 5, 2015, Mason Graphite is required to pay (a) US$1,250,000 on April 5, 2015, and (b) US$1,250,000 on the earlier of (i) the fifth business day following the day on which a feasibility study is completed; and (ii) October 5, 2015. If commercial production is not achieved by October 5, 2016, Mason Graphite is required to pay (a) US$2,500,000 on October 5, 2016; and (b) US$2,500,000 on the earlier of (i) the fifth business day following the day on which commercial production is achieved; and (ii) April 5, 2017. Pursuant to a general security agreement dated April 5, 2012, Quinto holds a security interest over all of Mason Graphite's personal and real property, including the mining claims that comprise the Lac Guéret Property, to secure payment of the balance of the purchase price and the performance of Mason Graphite's obligations under the asset purchase agreement.

http://www.marketwire.com/press-release/pocml-1-inc-and-maso…

Ist die PEA schon fertig?Was kommt am Montag oder nächste Woche?

Im Vergleich zu den Tagen davor,gestern ein deutlicher Umsatzanstieg!

Price Change % Change Volume

0.80 +0.00 +0.00% 1,122,100

http://ca.finance.yahoo.com/q/hp?s=LLG.V&a=00&b=1&c=2013&d=0…

Prices at 01.01.13

Date Open High Low Close Volume Adj Close*

Jan 25, 2013 0.80 0.82 0.79 0.80 1,122,10 0.80

Jan 24, 2013 0.81 0.81 0.78 0.80 396,400 0.80

Jan 23, 2013 0.79 0.84 0.79 0.82 295,100 0.82

Jan 22, 2013 0.80 0.81 0.79 0.80 341,700 0.80

Jan 21, 2013 0.83 0.83 0.80 0.80 218,000 0.80

Jan 18, 2013 0.81 0.83 0.80 0.82 418,700 0.82

Jan 17, 2013 0.80 0.80 0.79 0.79 64,500 0.79

Jan 16, 2013 0.80 0.80 0.79 0.79 53,200 0.79

Jan 15, 2013 0.82 0.83 0.78 0.78 81,100 0.78

Jan 14, 2013 0.82 0.88 0.79 0.79 159,000 0.79

Jan 11, 2013 0.75 0.78 0.73 0.76 77,000 0.76

Jan 10, 2013 0.73 0.73 0.73 0.73 107,600 0.73

Jan 9, 2013 0.71 0.73 0.70 0.73 71,500 0.73

Jan 8, 2013 0.73 0.74 0.72 0.73 144,300 0.73

Jan 7, 2013 0.75 0.75 0.74 0.74 120,300 0.74

Jan 4, 2013 0.76 0.76 0.75 0.75 263,500 0.75

Jan 3, 2013 0.73 0.75 0.73 0.75 44,700 0.75

Jan 2, 2013 0.70 0.73 0.70 0.73 41,600 0.73

Benoit Gascon: An Insider's Take on the Complicated Graphite Market

http://www.theaureport.com/pub/na/14956?utm_source=delivra&u…

Source: Brian Sylvester of The Metals Report (1/29/13)

Ten years ago, Benoit Gascon would have said there's no money in graphite investment. But the former CEO of the only North American graphite producer to survive Chinese competition has changed his tune, thanks to increasing graphite consumption in China and India. Gascon, who argues that the graphite markets of the 1990s are gone for good, has thrown his hat back into the ring, this time as CEO of a junior player, Mason Graphite. In this interview with The Metals Report, Gascon gives us an inside look at the graphite space and explains why the cliché "the customer is always right" has extra resonance in this "inverted" market.

The Metals Report: Describe the typical relationship between a graphite producer and a graphite buyer.

Benoit Gascon: Graphite is an additive used in a myriad of products. Therefore, the graphite producer needs to have a close and continuous relationship with the customer in order to understand its current and future needs. Producers have to essentially partner with the buyers. They not only need to know the specific properties of the graphite needed, but also the logistics in getting the material to the buyers in a timely manner. Every producer-buyer relationship is unique.

TMR: Doesn't that limit the ability of junior graphite companies to create offtake agreements with buyers? If buyers are looking for something very specific and very consistent and junior companies have never produced anything, then is it too much of a risk for the companies to take?

BG: Yes, most firms won't take the risk. Traditional offtake agreements do not work in the industrial minerals in general and in the flake graphite sector specifically. [Editor's note: offtake agreements are typically formed prior to the construction of a mine or other facility to secure future production.] I've been in that business of producing and selling graphite for over 20 years; I never had one offtake partnership in place. Revenues will come when a company is already in production, has found customers and agreed with them on the specifications, pricing and logistics.

TMR: What should potential investors in the graphite space be watching for when evaluating a company's business plan?

BG: A company's business plan should focus on the traditional market that exists today. Traditional applications include refractories, carbon raisers, foils, thermal management, friction, lubricants, processors and, with additional processing, batteries, powder metallurgy, pencils, packaging and more. What they need to look at is time to money ratio in terms of when and where it will sell its graphite. Companies need to know specifically how many tons will be sold for a specific application. There has to be an understanding of the end-users and their particular needs.

TMR: The business is a lot more than mining, is that what you're saying?

BG: Yes—mining is the easy part. You have the market on the other end, where you're given a specification that you have to meet if you want to sell your graphite. Firms have to adapt their ore processing to make sure they can meet the customer requirements. It's not ore to market; it's market to ore. It's an inverted model.

TMR: How can a new graphite mining company break into the market?

BG: New companies will have to learn about the end-users/buyers. Companies will need to meet with buyers and show that they know exactly what the customer wants, what the needs are in terms of specifications and grade, and they must demonstrate sound logistics and a valuable deposit that will enable a close, reliable long-term relationship. At the same time, companies need to know what their competitors are doing in the graphite space so they can make potential customers a better offer.

TMR: What are some ways graphite producers can boost their profit margins?

BG: Again, I cannot stress enough the ongoing relationship with your customers. Firms need to tailor-make product for their customers. Chinese graphite producers do not have very close connections with North American end-users or European end-users, so that is an opening where North American companies can build a competitive advantage. That's what we did at my company, Stratin Graphite, in the 1990s. We evolved into a customer-oriented operation from top to bottom. That means selecting management with the right mindset, introducing flexibility in the production process and, as always, understanding the markets/industries of your customers and adapting to meet their requirements. The customer is king.

TMR: What's the biggest cost in jurisdictions like Québec? Is it labor, given the skill level required to meet very specific customer needs?

BG: Even though the business is not overly labor intensive, labor still is a high cost. You do need to find the right people, such as metallurgists and engineers, with a customer-oriented approach. Production personnel also need to be ready and to switch production campaign patterns because you have to be flexible to succeed in the natural graphite space.

TMR: Is it difficult to find those people these days?

BG: Yes, it is difficult because there are not a lot of people with this type of experience. Attracting them is not only a matter of writing a big check. Companies have to also offer them the opportunity to do something innovative and exciting in a new environment.

TMR: As an investor, what should I be most concerned about when I start to look into a junior graphite company?

BG: Grade is certainly one important long-term factor because the higher the grade in the ore, the lower production cost will be because a plant won't need to process as much ore to meet its production targets. The plant itself, given a high-grade ore body, could be smaller and cheaper. Production costs are especially important because companies need to weather the up and down cycles of the global economy.

The second factor is, as we discussed previously, management. Management needs to have experience dealing with graphite buyers first and foremost. They need to show that they understand the market, who the end-users are, what they need, what they're using today and where they're going. Customers need to be up there on the front stage and everything has to be aligned in order that producers meet their exact needs.

TMR: How much does the jurisdiction matter? Does, for instance, Québec—the graphite producing hub of North America—offer a better chance of success than other places in North America?

BG: Québec has very good history of graphite production since 1990 with high-grade deposits that carry a high proportion of large flakes. A lot of experienced professionals live there too. Québec is also close to the large U.S. market, so logistics are great, with the Port of Montreal offering shipping to anywhere in the world. Being close to end-users is the first step in building a close and continuous relationship, and there are also transportation costs to consider.

TMR: One of the topics that comes up when graphite is discussed is graphene. That's a single layer of graphite that is used in high-tech applications. So far, graphene has only been manufactured on a commercial level using synthetic graphite, which is made using petroleum coke or a petroleum byproduct. Do you believe graphene will ever be commercially produced using mined graphite?

BG: It's possible to produce graphene with natural flake graphite. But right now, the manufacturing process is still not commercially viable. That will happen eventually, but right now it is in the very early stages. It will take a lot of time before there is meaningful volume of graphene produced from natural flake graphite, but it could eventually be an attractive business that will have a material impact on bottom lines, the driving factors being increased volume and demand from new applications.

TMR: So if a company is now touting graphene as a revenue stream, it's something of a red flag.

BG: Absolutely. We go back to the basics: time to money, time to market. Is there a market today? You'll have to base your business on the market that actually exists today, not on some dream about a future market.

TMR: Are there too many graphite companies competing right now?

BG: Absolutely; not all of them can be put into production. If 75% of the gold juniors are successful in finding a deposit that is economically viable, they can go into production because their gold will be sold at whatever the market price is. This isn't the case at all in the graphite space. Even ten producers within the next two years would be too many, because the market will not be able to absorb that much added production right away.

TMR: Where are we in the graphite cycle?

BG: From 1990 to the beginning of the 2000s, the only thing we saw was increased competition from China and declining prices year over year. But while the Chinese had the production, they had virtually no internal demand. These conditions led to the shutdown of all the operations elsewhere that tried to start in the 1990s, except the one in Québec I was running.

But beginning in 2000, internal demand in China started to increase. Ever since, thanks to China's rapid economic growth, graphite demand has continued to increase every year. India's growth has also been a major factor.

The dynamics of the market really changed in 2008–2009. Prices increased significantly and have remained high, though they did decrease a bit this past year because of the state of the global economy.

The key point is that there is a continuing imbalance between supply and demand worldwide. That's kept prices from retreating back to those lower levels. My feeling is that prices will never go back to that level. That is due not only to demand from traditional applications, but also new applications for graphite coming online in the next 5–10 years.

So, to summarize, we bottomed up, increased a bit, and now I would say we have plateaued over the past year. But demand will continue to grow 2013, 2014, 2015 and beyond.

TMR: What's to keep the industry from replaying the 1990s again?

BG: The market dynamics are completely different from the nineties. Again, the internal demand in China that was not there in the nineties is there today. In the nineties, the Chinese were selling their minerals and then buying the magnesia carbon bricks, the steel, all those value-added products. Today, China is producing its own steel and will continue to do so.

China was also not producing cars in the nineties. Now it's the largest car market in the world. You need graphite for carbon brush in a car, for brake pads and for clutch facings, to name a few applications. China is also producing a lot of electronics, which need graphite for anti-static packaging material.

Don't forget: India is coming onstream too. India will grow as China has. Globally, the market for graphite is growing. Looking at the supply side, over the past twenty some years there was only one addition to supplies outside of China. The only supply source that survived the 90s is Stratmin Graphite. [Editor's note: Stratmin was acquired by Imerys (NK:PA) in 1996.] All the others shut down except for one in Brazil that mainly supplied the country's domestic market, which experienced strong growth over the past years. The bottom line is that you have increased demand worldwide particularly in China, meaning they have less graphite to export to buyers around the globe. There is room for additional supply—the market will dictate how much. Those companies with the right relationships will have the clear advantage.

TMR: How sensitive are graphite prices to global economic growth?

BG: It depends on the application. Steel demand is closely linked to economic growth, so in a slow economy, steel manufacturers need less graphite. But on a smaller scale, demand heavily depends on the agreement that a company has with its customer. One-year agreements are standard, so a company can enjoy some stability depending where it is between its contract renewal dates. But if that customer needs less graphite, the company will then need to find a new buyer for that excess supply.

TMR: Do you have any words of wisdom for anybody looking to invest some money into this sector?

BG: Do your homework. Be selective. Don't look at it like it's the usual mining or junior mining company. The market is quite different. You need to understand the market. You need to be close to it so look at management, grades. Grade is key because of the long-term potential of being a low-cost producer.

TMR: Can investors make money in this sector?

BG: I believe so. If you would have asked me the same question 10 years ago, I would have said no, because the industry was close to rock bottom. It was very difficult—but it is still a difficult industry.

Benoit Gascon of Mason Graphite Inc. has over 20 years of experience in the graphite and carbon industries. He was the CEO of Stratmin Graphite, which operates the Lac-des-Iles deposit, one of North America's only producing graphite mines. Gascon was responsible for the complete takeover of Stratmin Graphite by Imerys SA, a world leader in industrial minerals, to form Timcal Graphite and Carbon.

http://www.theaureport.com/pub/na/14956?utm_source=delivra&u…

Source: Brian Sylvester of The Metals Report (1/29/13)

Ten years ago, Benoit Gascon would have said there's no money in graphite investment. But the former CEO of the only North American graphite producer to survive Chinese competition has changed his tune, thanks to increasing graphite consumption in China and India. Gascon, who argues that the graphite markets of the 1990s are gone for good, has thrown his hat back into the ring, this time as CEO of a junior player, Mason Graphite. In this interview with The Metals Report, Gascon gives us an inside look at the graphite space and explains why the cliché "the customer is always right" has extra resonance in this "inverted" market.

The Metals Report: Describe the typical relationship between a graphite producer and a graphite buyer.

Benoit Gascon: Graphite is an additive used in a myriad of products. Therefore, the graphite producer needs to have a close and continuous relationship with the customer in order to understand its current and future needs. Producers have to essentially partner with the buyers. They not only need to know the specific properties of the graphite needed, but also the logistics in getting the material to the buyers in a timely manner. Every producer-buyer relationship is unique.

TMR: Doesn't that limit the ability of junior graphite companies to create offtake agreements with buyers? If buyers are looking for something very specific and very consistent and junior companies have never produced anything, then is it too much of a risk for the companies to take?

BG: Yes, most firms won't take the risk. Traditional offtake agreements do not work in the industrial minerals in general and in the flake graphite sector specifically. [Editor's note: offtake agreements are typically formed prior to the construction of a mine or other facility to secure future production.] I've been in that business of producing and selling graphite for over 20 years; I never had one offtake partnership in place. Revenues will come when a company is already in production, has found customers and agreed with them on the specifications, pricing and logistics.

TMR: What should potential investors in the graphite space be watching for when evaluating a company's business plan?

BG: A company's business plan should focus on the traditional market that exists today. Traditional applications include refractories, carbon raisers, foils, thermal management, friction, lubricants, processors and, with additional processing, batteries, powder metallurgy, pencils, packaging and more. What they need to look at is time to money ratio in terms of when and where it will sell its graphite. Companies need to know specifically how many tons will be sold for a specific application. There has to be an understanding of the end-users and their particular needs.

TMR: The business is a lot more than mining, is that what you're saying?

BG: Yes—mining is the easy part. You have the market on the other end, where you're given a specification that you have to meet if you want to sell your graphite. Firms have to adapt their ore processing to make sure they can meet the customer requirements. It's not ore to market; it's market to ore. It's an inverted model.

TMR: How can a new graphite mining company break into the market?

BG: New companies will have to learn about the end-users/buyers. Companies will need to meet with buyers and show that they know exactly what the customer wants, what the needs are in terms of specifications and grade, and they must demonstrate sound logistics and a valuable deposit that will enable a close, reliable long-term relationship. At the same time, companies need to know what their competitors are doing in the graphite space so they can make potential customers a better offer.

TMR: What are some ways graphite producers can boost their profit margins?

BG: Again, I cannot stress enough the ongoing relationship with your customers. Firms need to tailor-make product for their customers. Chinese graphite producers do not have very close connections with North American end-users or European end-users, so that is an opening where North American companies can build a competitive advantage. That's what we did at my company, Stratin Graphite, in the 1990s. We evolved into a customer-oriented operation from top to bottom. That means selecting management with the right mindset, introducing flexibility in the production process and, as always, understanding the markets/industries of your customers and adapting to meet their requirements. The customer is king.

TMR: What's the biggest cost in jurisdictions like Québec? Is it labor, given the skill level required to meet very specific customer needs?

BG: Even though the business is not overly labor intensive, labor still is a high cost. You do need to find the right people, such as metallurgists and engineers, with a customer-oriented approach. Production personnel also need to be ready and to switch production campaign patterns because you have to be flexible to succeed in the natural graphite space.

TMR: Is it difficult to find those people these days?

BG: Yes, it is difficult because there are not a lot of people with this type of experience. Attracting them is not only a matter of writing a big check. Companies have to also offer them the opportunity to do something innovative and exciting in a new environment.

TMR: As an investor, what should I be most concerned about when I start to look into a junior graphite company?

BG: Grade is certainly one important long-term factor because the higher the grade in the ore, the lower production cost will be because a plant won't need to process as much ore to meet its production targets. The plant itself, given a high-grade ore body, could be smaller and cheaper. Production costs are especially important because companies need to weather the up and down cycles of the global economy.

The second factor is, as we discussed previously, management. Management needs to have experience dealing with graphite buyers first and foremost. They need to show that they understand the market, who the end-users are, what they need, what they're using today and where they're going. Customers need to be up there on the front stage and everything has to be aligned in order that producers meet their exact needs.

TMR: How much does the jurisdiction matter? Does, for instance, Québec—the graphite producing hub of North America—offer a better chance of success than other places in North America?

BG: Québec has very good history of graphite production since 1990 with high-grade deposits that carry a high proportion of large flakes. A lot of experienced professionals live there too. Québec is also close to the large U.S. market, so logistics are great, with the Port of Montreal offering shipping to anywhere in the world. Being close to end-users is the first step in building a close and continuous relationship, and there are also transportation costs to consider.

TMR: One of the topics that comes up when graphite is discussed is graphene. That's a single layer of graphite that is used in high-tech applications. So far, graphene has only been manufactured on a commercial level using synthetic graphite, which is made using petroleum coke or a petroleum byproduct. Do you believe graphene will ever be commercially produced using mined graphite?

BG: It's possible to produce graphene with natural flake graphite. But right now, the manufacturing process is still not commercially viable. That will happen eventually, but right now it is in the very early stages. It will take a lot of time before there is meaningful volume of graphene produced from natural flake graphite, but it could eventually be an attractive business that will have a material impact on bottom lines, the driving factors being increased volume and demand from new applications.

TMR: So if a company is now touting graphene as a revenue stream, it's something of a red flag.

BG: Absolutely. We go back to the basics: time to money, time to market. Is there a market today? You'll have to base your business on the market that actually exists today, not on some dream about a future market.

TMR: Are there too many graphite companies competing right now?

BG: Absolutely; not all of them can be put into production. If 75% of the gold juniors are successful in finding a deposit that is economically viable, they can go into production because their gold will be sold at whatever the market price is. This isn't the case at all in the graphite space. Even ten producers within the next two years would be too many, because the market will not be able to absorb that much added production right away.

TMR: Where are we in the graphite cycle?

BG: From 1990 to the beginning of the 2000s, the only thing we saw was increased competition from China and declining prices year over year. But while the Chinese had the production, they had virtually no internal demand. These conditions led to the shutdown of all the operations elsewhere that tried to start in the 1990s, except the one in Québec I was running.

But beginning in 2000, internal demand in China started to increase. Ever since, thanks to China's rapid economic growth, graphite demand has continued to increase every year. India's growth has also been a major factor.

The dynamics of the market really changed in 2008–2009. Prices increased significantly and have remained high, though they did decrease a bit this past year because of the state of the global economy.

The key point is that there is a continuing imbalance between supply and demand worldwide. That's kept prices from retreating back to those lower levels. My feeling is that prices will never go back to that level. That is due not only to demand from traditional applications, but also new applications for graphite coming online in the next 5–10 years.

So, to summarize, we bottomed up, increased a bit, and now I would say we have plateaued over the past year. But demand will continue to grow 2013, 2014, 2015 and beyond.

TMR: What's to keep the industry from replaying the 1990s again?

BG: The market dynamics are completely different from the nineties. Again, the internal demand in China that was not there in the nineties is there today. In the nineties, the Chinese were selling their minerals and then buying the magnesia carbon bricks, the steel, all those value-added products. Today, China is producing its own steel and will continue to do so.

China was also not producing cars in the nineties. Now it's the largest car market in the world. You need graphite for carbon brush in a car, for brake pads and for clutch facings, to name a few applications. China is also producing a lot of electronics, which need graphite for anti-static packaging material.

Don't forget: India is coming onstream too. India will grow as China has. Globally, the market for graphite is growing. Looking at the supply side, over the past twenty some years there was only one addition to supplies outside of China. The only supply source that survived the 90s is Stratmin Graphite. [Editor's note: Stratmin was acquired by Imerys (NK:PA) in 1996.] All the others shut down except for one in Brazil that mainly supplied the country's domestic market, which experienced strong growth over the past years. The bottom line is that you have increased demand worldwide particularly in China, meaning they have less graphite to export to buyers around the globe. There is room for additional supply—the market will dictate how much. Those companies with the right relationships will have the clear advantage.

TMR: How sensitive are graphite prices to global economic growth?

BG: It depends on the application. Steel demand is closely linked to economic growth, so in a slow economy, steel manufacturers need less graphite. But on a smaller scale, demand heavily depends on the agreement that a company has with its customer. One-year agreements are standard, so a company can enjoy some stability depending where it is between its contract renewal dates. But if that customer needs less graphite, the company will then need to find a new buyer for that excess supply.

TMR: Do you have any words of wisdom for anybody looking to invest some money into this sector?

BG: Do your homework. Be selective. Don't look at it like it's the usual mining or junior mining company. The market is quite different. You need to understand the market. You need to be close to it so look at management, grades. Grade is key because of the long-term potential of being a low-cost producer.

TMR: Can investors make money in this sector?

BG: I believe so. If you would have asked me the same question 10 years ago, I would have said no, because the industry was close to rock bottom. It was very difficult—but it is still a difficult industry.

Benoit Gascon of Mason Graphite Inc. has over 20 years of experience in the graphite and carbon industries. He was the CEO of Stratmin Graphite, which operates the Lac-des-Iles deposit, one of North America's only producing graphite mines. Gascon was responsible for the complete takeover of Stratmin Graphite by Imerys SA, a world leader in industrial minerals, to form Timcal Graphite and Carbon.

Hallo Sepp, hallo tpnl,

bin seit gestern neu dabei mit einer kleinen Position.

Heute gings mit 16% ja schon gut nach oben - ohne neue Nachrichten, oder sehe ich das falsch?

Ich würde mal spekulieren, dass das erste Ressource Update nächste Wochen kommt und schon vorab etwas durchgesickert ist.

Ingesamt eine sehr spannendes Investment. Da die Aktie erst seit Kurzem gelistet ist, baut sich bei Anstiegen nicht so schnell ein Verkaufsdruck auf, da es keine Aktionäre mit höheren Einkaufskursen gibt, wie bei anderen Graphite-Aktien. Zu dem ist Mason generell noch nicht so bekannt, so dass ich da noch viel Potenzial sehe, vor allem mit einhergehenden anstehenden Nachrichten.

Außerdem finde ich die Besetzung des Managements hervorragend. Der CEO hat alle Qualifikationen um aus Mason einen Produzenten zu machen.

Gruß Flow23

bin seit gestern neu dabei mit einer kleinen Position.

Heute gings mit 16% ja schon gut nach oben - ohne neue Nachrichten, oder sehe ich das falsch?

Ich würde mal spekulieren, dass das erste Ressource Update nächste Wochen kommt und schon vorab etwas durchgesickert ist.

Ingesamt eine sehr spannendes Investment. Da die Aktie erst seit Kurzem gelistet ist, baut sich bei Anstiegen nicht so schnell ein Verkaufsdruck auf, da es keine Aktionäre mit höheren Einkaufskursen gibt, wie bei anderen Graphite-Aktien. Zu dem ist Mason generell noch nicht so bekannt, so dass ich da noch viel Potenzial sehe, vor allem mit einhergehenden anstehenden Nachrichten.

Außerdem finde ich die Besetzung des Managements hervorragend. Der CEO hat alle Qualifikationen um aus Mason einen Produzenten zu machen.

Gruß Flow23

Hallo Flow23,

in den letzten zwei Tagen habe viele kanadische Graphitexplorer einen enormen Satz nach oben gemacht.

Mit Mason hast du dir einen guten Wert ausgesucht. Ich bleibe noch in der Warteschleife, tendiere aktuell jedoch eher zu Stratmin Global Resources, da die Produktion bereits anläuft und sie von daher einfach zwei-drei Jahre Vorsprung vor der großen Masse haben.

Dir viel Erfolg und vielleicht bin ich ja auch bald dabei.

in den letzten zwei Tagen habe viele kanadische Graphitexplorer einen enormen Satz nach oben gemacht.

Mit Mason hast du dir einen guten Wert ausgesucht. Ich bleibe noch in der Warteschleife, tendiere aktuell jedoch eher zu Stratmin Global Resources, da die Produktion bereits anläuft und sie von daher einfach zwei-drei Jahre Vorsprung vor der großen Masse haben.

Dir viel Erfolg und vielleicht bin ich ja auch bald dabei.

Mason Graphite reports excellent metallurgical test results

http://www.newswire.ca/en/story/1118789/mason-graphite-repor…

MONTREAL, Feb. 22, 2013 /CNW/ - Mason Graphite Inc. (TSXV: LLG) ("Mason Graphite" or the "Company") is pleased to report the completion of metallurgical tests on its Lac Guéret graphite deposit in Quebec that highlight exceptional graphite recovery, excellent concentrate purity and very good particle size distribution. Result highlights include:

Graphite recoveries in excess of 96%

Concentrate purity of 96.3% for the +150 mesh cumulative

29% of +80 mesh cumulative, including 16% of +50 mesh

Approximately 1,400 kg of graphite-bearing mineralization were taken from across the different domains of the GC Zone of the Lac Guéret mineral deposit and sent to the independant laboratory, SGS Minerals Services in Lakefield, Ontario for testing. Priority zones were selected and composite samples were prepared for the tests.

A proposed flowsheet was developed and evaluated in two Locked Cycle Tests in order to demonstrate its robustness.

Lock Cycle Test #2 Results

Flake Size Distribution

(%) Carbon Content

(% Cg)

+50 mesh 16% 96.3%

+80 mesh 13% 96.4%

+150 mesh 14% 96.2%

-150 mesh 57% 91.7%

Total / Average 100% 92.6%

The Company will continue to test these minerals in order to further optimize the flowsheet and will also test other zones of the deposit in order to increase its understanding of the mineralization and validate the flowsheet accordingly.

The graphitic carbon and total carbon content of the head samples were quantified by Leco at 22.0% and 22.7%, respectively. The Carbon Grade was performed by Loss on Ignition (LOI) analysis at 1,000 °C.

"The results from these preliminary metallurgical tests along with the mineral resource estimate published last year confirms to us the robust nature of the Lac Guéret graphite deposit." said Benoît Gascon, CEO of Mason Graphite. "We are very pleased with the fact that our graphite deposit possesses key elements for mining, processing, and commercial viability; these being high grade, high recovery and flake size. These long-term factors generally contribute materially to the success of a graphite company by delivering a more efficient process and lower production costs."

Results from these preliminary metallurgical tests will be included in the Preliminary Economic Assessment, scheduled for completion in the coming months.....

http://www.newswire.ca/en/story/1118789/mason-graphite-repor…

MONTREAL, Feb. 22, 2013 /CNW/ - Mason Graphite Inc. (TSXV: LLG) ("Mason Graphite" or the "Company") is pleased to report the completion of metallurgical tests on its Lac Guéret graphite deposit in Quebec that highlight exceptional graphite recovery, excellent concentrate purity and very good particle size distribution. Result highlights include:

Graphite recoveries in excess of 96%

Concentrate purity of 96.3% for the +150 mesh cumulative

29% of +80 mesh cumulative, including 16% of +50 mesh

Approximately 1,400 kg of graphite-bearing mineralization were taken from across the different domains of the GC Zone of the Lac Guéret mineral deposit and sent to the independant laboratory, SGS Minerals Services in Lakefield, Ontario for testing. Priority zones were selected and composite samples were prepared for the tests.

A proposed flowsheet was developed and evaluated in two Locked Cycle Tests in order to demonstrate its robustness.

Lock Cycle Test #2 Results

Flake Size Distribution

(%) Carbon Content

(% Cg)

+50 mesh 16% 96.3%

+80 mesh 13% 96.4%

+150 mesh 14% 96.2%

-150 mesh 57% 91.7%

Total / Average 100% 92.6%

The Company will continue to test these minerals in order to further optimize the flowsheet and will also test other zones of the deposit in order to increase its understanding of the mineralization and validate the flowsheet accordingly.

The graphitic carbon and total carbon content of the head samples were quantified by Leco at 22.0% and 22.7%, respectively. The Carbon Grade was performed by Loss on Ignition (LOI) analysis at 1,000 °C.

"The results from these preliminary metallurgical tests along with the mineral resource estimate published last year confirms to us the robust nature of the Lac Guéret graphite deposit." said Benoît Gascon, CEO of Mason Graphite. "We are very pleased with the fact that our graphite deposit possesses key elements for mining, processing, and commercial viability; these being high grade, high recovery and flake size. These long-term factors generally contribute materially to the success of a graphite company by delivering a more efficient process and lower production costs."

Results from these preliminary metallurgical tests will be included in the Preliminary Economic Assessment, scheduled for completion in the coming months.....

Mason Graphite Announces Positive Drill Results including 31 meters at 24.3 % Cgr and 113 meters at 15.5 % Cgr

http://www.stockhouse.com/companies/stories/v.llg/8749987

MONTREAL, Feb. 28, 2013 /CNW/ - Mason Graphite Inc. ("Mason Graphite" or the "Company") (TSX.V: LLG) reports assay results for 36 new drill holes (6,830 meters) from the mineral resource expansion program at its Lac Guéret project in northeastern Quebec. Significant drill intercepts in this group of results include:

Hole LG-038 intersected 60 meters at 13.2% Cgr and 36 meters at 15.8% Cgr

Hole LG-039 intersected 113 meters at 15.5% Cgr (including 11 meters at 38.7% Cgr)

Hole LG-057 intersected 55 meters at 16.4% Cgr (including 16 meters at 27.1% Cgr)

Hole LG-207 intersected 44 meters at 17.1% Cgr (including 12 meters at 31.4 % Cgr) and 28 meters at 16.9% Cgr (including 13 meters at 27.2% Cgr)

Hole LG-213 intersected 26 meters at 18.1% Cgr and 63 meters at 15.4% Cgr

Hole LG-215 intersected 31 meters at 24.3% Cgr and 17 meters at 18.3% Cgr

Hole LG-227 intersected 33 meters at 13.3% Cgr and 76 meters at 12.0% Cgr

Benoît Gascon, CEO of Mason Graphite commented, "We are very pleased by the consistently high grade intercepts in this group of results. The mineralized intersections to the South, South-West and North-East of the current mineral resource demonstrate strong potential for continued growth beyond the current resource envelope and we look forward to including these results in the calculation of an upcoming mineral resource update."

The 36 assay results reported below are part of an exploration program that was initiated in July 2012 and completed last November. This drill program consisted of 163 drill holes totaling approximately 26,500 meters and was designed to delineate mineral continuity primarily in the GC zone. This zone hosts a National Instrument 43-101 mineral resource of 300,000 tonnes at 24.4% Carbon as Graphite ("Cgr") in the Measured category and 7.3 million tonnes at 20.2% Cgr in the Indicated category (see Technical Report dated July 3 2012 for details). Complete results and the corresponding collar location map are presented below. Results for the remaining 104 drill holes will be published as soon as the data is compiled.

Roche Ltd. Consulting Group, who completed the Company's National Instrument 43-101 mineral resource estimates in July 2012, has been retained to complete the upcoming mineral resource update.

Table 1 - Best drill intercepts from each of the 36 drill holes (6,830 meters)

Drill hole From

(m) To

(m) Length1,2

(m) Graphite

(Cgr %) Drill hole From

(m) To

(m) Length1,2

(m) Graphite

(Cgr %)

LG-038 39 99 60 13.2 LG-073 4 21 18 13.4

incl. 80 93 13 25.1 52 65 13 16.0

114 150 36 15.8 72 86 15 16.9

LG-039 25 35 10 15.3 141 161 20 19.5

70 183 113 15.5 LG-074 18 63 45 10.3

incl. 115 126 11 38.7 110 129 20 14.2

LG-045 17 52 35 12.2 LG-075 51 70 19 15.5

60 102 42 13.7 LG-205 4 77 72 8.7

incl. 65 75 10 22.4 LG-206 45 96 51 10.9

125 150 25 12.3 139 152 13 17.4

LG-046 73 110 37 11.5 LG-207 26 70 44 17.1

incl. 92 101 9 20.3 incl. 40 52 12 31.4

125 149 24 11.7 89 116 28 16.9

LG-057 25 89 64 10.9 incl. 100 113 13 27.2

110 165 55 16.4 LG-208 6 23 18 16.2

incl. 143 159 16 27.1 LG-209 8 22 14 9.9

LG-058 5 13 8 14.4 164 181 17 12.0

93 136 43 13.6 LG-210 22 28 7 11.0

incl. 118 130 12 25.7 LG-211 4 11 7 11.1

165 176 11 14.2 LG-212 No significant mineralization

LG-059 58 68 10 9.2 LG-213 15 41 26 18.1

83 100 16 15.3 102 165 63 15.4

LG-060 26 54 29 16.3 LG-214 57 89 32 26.5

LG-066 5 21 16 16.0 incl. 73 87 14 31.9

38 63 25 11.2 157 169 12 9.9

120 138 18 14.7 LG-215 5 26 21 13.3

LG-067 81 106 25 19.2 34 65 31 24.3

LG-068 15 36 21 10.3 incl. 47 65 19 30.9

LG-069 28 76 48 12.6 171 188 17 18.3

incl. 29 37 8 27.3 202 218 16 16.1

119 131 12 12.5 LG-216 4 27 22 10.2

LG-070 5 23 18 21.0 169 175 6 22.7

29 37 8 12.4 LG-217 No significant mineralization

42 49 7 21.6 LG-218 No significant mineralization

92 138 46 12.6 LG-227 50 82 33 13.3

LG-071 26 35 10 14.3 110 186 76 12.0

182 188 7 12.2 incl. 132 149 17 22.5

LG-072 9 29 20 17.6 LG-228 43 89 46 13.9

45 77 32 10.5 incl. 60 70 10 28.6

83 108 25 16.1 LG-229 44 68 24 12.5

145 165 20 14.7 75 96 21 10.7

LG-230 36 65 29 16.1

http://www.stockhouse.com/companies/stories/v.llg/8749987

MONTREAL, Feb. 28, 2013 /CNW/ - Mason Graphite Inc. ("Mason Graphite" or the "Company") (TSX.V: LLG) reports assay results for 36 new drill holes (6,830 meters) from the mineral resource expansion program at its Lac Guéret project in northeastern Quebec. Significant drill intercepts in this group of results include:

Hole LG-038 intersected 60 meters at 13.2% Cgr and 36 meters at 15.8% Cgr

Hole LG-039 intersected 113 meters at 15.5% Cgr (including 11 meters at 38.7% Cgr)

Hole LG-057 intersected 55 meters at 16.4% Cgr (including 16 meters at 27.1% Cgr)

Hole LG-207 intersected 44 meters at 17.1% Cgr (including 12 meters at 31.4 % Cgr) and 28 meters at 16.9% Cgr (including 13 meters at 27.2% Cgr)

Hole LG-213 intersected 26 meters at 18.1% Cgr and 63 meters at 15.4% Cgr

Hole LG-215 intersected 31 meters at 24.3% Cgr and 17 meters at 18.3% Cgr

Hole LG-227 intersected 33 meters at 13.3% Cgr and 76 meters at 12.0% Cgr

Benoît Gascon, CEO of Mason Graphite commented, "We are very pleased by the consistently high grade intercepts in this group of results. The mineralized intersections to the South, South-West and North-East of the current mineral resource demonstrate strong potential for continued growth beyond the current resource envelope and we look forward to including these results in the calculation of an upcoming mineral resource update."

The 36 assay results reported below are part of an exploration program that was initiated in July 2012 and completed last November. This drill program consisted of 163 drill holes totaling approximately 26,500 meters and was designed to delineate mineral continuity primarily in the GC zone. This zone hosts a National Instrument 43-101 mineral resource of 300,000 tonnes at 24.4% Carbon as Graphite ("Cgr") in the Measured category and 7.3 million tonnes at 20.2% Cgr in the Indicated category (see Technical Report dated July 3 2012 for details). Complete results and the corresponding collar location map are presented below. Results for the remaining 104 drill holes will be published as soon as the data is compiled.

Roche Ltd. Consulting Group, who completed the Company's National Instrument 43-101 mineral resource estimates in July 2012, has been retained to complete the upcoming mineral resource update.

Table 1 - Best drill intercepts from each of the 36 drill holes (6,830 meters)

Drill hole From

(m) To

(m) Length1,2

(m) Graphite

(Cgr %) Drill hole From

(m) To

(m) Length1,2

(m) Graphite

(Cgr %)

LG-038 39 99 60 13.2 LG-073 4 21 18 13.4

incl. 80 93 13 25.1 52 65 13 16.0

114 150 36 15.8 72 86 15 16.9

LG-039 25 35 10 15.3 141 161 20 19.5

70 183 113 15.5 LG-074 18 63 45 10.3

incl. 115 126 11 38.7 110 129 20 14.2

LG-045 17 52 35 12.2 LG-075 51 70 19 15.5

60 102 42 13.7 LG-205 4 77 72 8.7

incl. 65 75 10 22.4 LG-206 45 96 51 10.9

125 150 25 12.3 139 152 13 17.4

LG-046 73 110 37 11.5 LG-207 26 70 44 17.1

incl. 92 101 9 20.3 incl. 40 52 12 31.4

125 149 24 11.7 89 116 28 16.9

LG-057 25 89 64 10.9 incl. 100 113 13 27.2

110 165 55 16.4 LG-208 6 23 18 16.2

incl. 143 159 16 27.1 LG-209 8 22 14 9.9

LG-058 5 13 8 14.4 164 181 17 12.0

93 136 43 13.6 LG-210 22 28 7 11.0

incl. 118 130 12 25.7 LG-211 4 11 7 11.1

165 176 11 14.2 LG-212 No significant mineralization

LG-059 58 68 10 9.2 LG-213 15 41 26 18.1

83 100 16 15.3 102 165 63 15.4

LG-060 26 54 29 16.3 LG-214 57 89 32 26.5

LG-066 5 21 16 16.0 incl. 73 87 14 31.9

38 63 25 11.2 157 169 12 9.9

120 138 18 14.7 LG-215 5 26 21 13.3

LG-067 81 106 25 19.2 34 65 31 24.3

LG-068 15 36 21 10.3 incl. 47 65 19 30.9

LG-069 28 76 48 12.6 171 188 17 18.3

incl. 29 37 8 27.3 202 218 16 16.1

119 131 12 12.5 LG-216 4 27 22 10.2

LG-070 5 23 18 21.0 169 175 6 22.7

29 37 8 12.4 LG-217 No significant mineralization

42 49 7 21.6 LG-218 No significant mineralization

92 138 46 12.6 LG-227 50 82 33 13.3

LG-071 26 35 10 14.3 110 186 76 12.0

182 188 7 12.2 incl. 132 149 17 22.5

LG-072 9 29 20 17.6 LG-228 43 89 46 13.9

45 77 32 10.5 incl. 60 70 10 28.6

83 108 25 16.1 LG-229 44 68 24 12.5

145 165 20 14.7 75 96 21 10.7

LG-230 36 65 29 16.1

Insider Sells Transaction

03/01/2013 LLG 0 63,000 0.00 49,140.00 CAD

http://www.tmxmoney.com/TMX/HttpController?GetPage=SearchIns…

03/01/2013 LLG 0 63,000 0.00 49,140.00 CAD

http://www.tmxmoney.com/TMX/HttpController?GetPage=SearchIns…

Mason Graphite announces robust preliminary economic assessment results, featuring 22 years of production at 27.4% Cgr and an IRR of 33.7%

http://www.newswire.ca/en/story/1150009/mason-graphite-annou…

Financial Highlights

● Initial direct capital costs of $89.9M

● Production costs of $390 per tonne of finished product

of finished product

● $364M pre-tax NPV (8% discount); $283M pre-tax NPV (10% discount)

(8% discount); $283M pre-tax NPV (10% discount)

● 33.7% pre-tax Internal Rate of Return

pre-tax Internal Rate of Return

● Payback period of 2.5 years

● 22-year mine life

● Average sales price of $1,525 per tonne

Operational Highlights

● Annual production of 50,000 tonnes of graphite concentrate

● 27.4% average LOM graphite content in the mineralization

● Graphite recovery above 96%

● Up to 96.4% Cgr of finished product purity

● Stripping ratio of 0.76:1

http://www.newswire.ca/en/story/1150009/mason-graphite-annou…

Financial Highlights

● Initial direct capital costs of $89.9M

● Production costs of $390 per tonne

of finished product

of finished product● $364M pre-tax NPV

(8% discount); $283M pre-tax NPV (10% discount)

(8% discount); $283M pre-tax NPV (10% discount)● 33.7%

pre-tax Internal Rate of Return

pre-tax Internal Rate of Return● Payback period of 2.5 years

● 22-year mine life

● Average sales price of $1,525 per tonne

Operational Highlights

● Annual production of 50,000 tonnes of graphite concentrate

● 27.4% average LOM graphite content in the mineralization

● Graphite recovery above 96%

● Up to 96.4% Cgr of finished product purity

● Stripping ratio of 0.76:1

Mason Graphite initiates new exploration program at Lac Guéret following completion of $5 million private placement financing

http://www.newswire.ca/en/story/1194205/mason-graphite-initi…

http://www.newswire.ca/en/story/1194205/mason-graphite-initi…

Zitat von SEPP_EIXLBERGER: Mason Graphite announces robust preliminary economic assessment results, featuring 22 years of production at 27.4% Cgr and an IRR of 33.7%

http://www.newswire.ca/en/story/1150009/mason-graphite-annou…

Financial Highlights

● Initial direct capital costs of $89.9M

● Production costs of $390 per tonneof finished product

● $364M pre-tax NPV(8% discount); $283M pre-tax NPV (10% discount)

● 33.7%pre-tax Internal Rate of Return

● Payback period of 2.5 years

● 22-year mine life

● Average sales price of $1,525 per tonne

Operational Highlights

● Annual production of 50,000 tonnes of graphite concentrate

● 27.4% average LOM graphite content in the mineralization

● Graphite recovery above 96%

● Up to 96.4% Cgr of finished product purity

● Stripping ratio of 0.76:1

Market Cap: 25,04m , Shares Out: 66,785,283

...als Vergleich,FMS PEA;

http://www.stockhouse.com/news/press-releases/2013/11/07/foc…

Highlights are summarized below:

Pre Tax Value

($ millions) After Tax Value

($ millions)

Net Present Value

8% discount rate 316.9 185.3

10% discount rate 250.1 143.3

12% discount rate 198.4 110.6

Capital Expenditure including a 25% contingency of $24m 125.95

Operating cost per tonne milled $67.61

Operating cost per tonne ofconcentrate produced $458.20

Pre-Tax IRR 36.4% 28.6%

Pre Tax Payback Period 2.4 years

Exchange rate US$1.00 = C$1.00

Strip Ratio 1.12

...base case using a weighted average price of

US$1866 per tonne

US$1866 per tonne of run-of-mine concentrates.

of run-of-mine concentrates.Open pit mine life is 20 years

Market Cap: 32,98m , Shares Out: 106,392,184

........................

NGC-PEA

http://www.stockhouse.com/news/press-releases/2013/10/23/nor…

The PEA estimates the economics of doubling mill throughput after three years of operation and demonstrates that Bissett Creek has very attractive economics even at or below current depressed graphite price levels.

The pre-tax internal rate of return ("IRR") is 26.3% (22.0% after tax)

pre-tax net present value ("NPV") is $231.1 million ($150.0 million after tax) in the base case which uses an 8% discount rate and a

weighted

average price of US$1,800/tonne

average price of US$1,800/tonne of concentrate.

of concentrate.Summary of PEA Results

PEA FS Update

Reserves/resources (million tonnes)* 39.4Mt* 28.3Mt*

Feed Grade (% graphitic carbon) 1.85%* 2.06%*

Waste to ore ratio 0.24 0.79

Processing rate (tonnes per day - 92% availability) 2,670-5,340 2,670

Mine life 22 years 28 years

Mill recovery 94.7% 94.7%

Average annual production 33,183t 20,800t

Initial capital cost ($ millions - including 10% contingency) $101.6M $101.6M

Expansion capital $45.2M NA

Sustaining capital $58.7M $43.0

Cash operating costs ($/tonne of concentrate) $695/t $795/t

Market Cap: 33,41m

Mason Graphite reports 658% increase in measured and indicated mineral resources to 50 million tonnes, including 6.7 million tonnes grading 32.4% Cg