Columbus Gold Ventures -- Riesen Goldvorkommen in Französisch-Guayana ! - 500 Beiträge pro Seite

eröffnet am 25.04.13 21:24:48 von

neuester Beitrag 15.07.21 06:28:50 von

neuester Beitrag 15.07.21 06:28:50 von

Beiträge: 170

ID: 1.181.271

ID: 1.181.271

Aufrufe heute: 0

Gesamt: 17.546

Gesamt: 17.546

Aktive User: 0

ISIN: CA6857821046 · WKN: A2P6H4 · Symbol: OREAF

0,0000

USD

0,00 %

0,0000 USD

Letzter Kurs 17:10:51 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | +14,29 | |

| 37,18 | +10,00 | |

| 6,7700 | +9,90 | |

| 2,4000 | +9,89 | |

| 15.700,00 | +9,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,7400 | -10,01 | |

| 6,3600 | -10,04 | |

| 1,2000 | -10,45 | |

| 0,7696 | -13,53 | |

| 47,96 | -97,97 |

An alle die einen Explorer mit großem Potential suchen...

ich präsentiere, Columbus Gold!

Fakten:

->Das Unternehmen befindet sich in Französisch-Guayana, das ein vollintegrierter Teil des französischen Staates und damit auch Teil der Europäischen Union und der NATO ist. Der Euro ist gesetzliches Zahlungsmittel.

->Hat laut dem derzeitigen NI 43-101, Ressourcen von 117,1 Mio. tonnes@1.43 Gramm pro Tonne Gold (5.370.000 Unzen ) im Boden.

) im Boden.

-> Columbus hat derzeit noch um die 4.4 Millionen Dollar an Barvermögen, obwohl es sich bereits in der II. Drillingphase befindet .

-> Hat nur eine Marktkapitalisierung von nur 30 Millionen Dollar. (Kurs: 0,30$)

Um es zusammenzufassen:

- Es liegt in einem Land mit stabiler Regierung und Währung.

- Unmittelbare Risiken sind, durch die relativ große Bargeldmenge, gering.

- Das Unternehmen ist meiner Meinung nach stark unterbewertet da, allein die "Paul Isnard"- Mine mindestens einen Kapitalwert (npv), von 900 Millionen Dollar hat.

Schaut euch dieses Unternehmen einmal selber an und teilt eure Meinungen!

Gruß

ich präsentiere, Columbus Gold!

Fakten:

->Das Unternehmen befindet sich in Französisch-Guayana, das ein vollintegrierter Teil des französischen Staates und damit auch Teil der Europäischen Union und der NATO ist. Der Euro ist gesetzliches Zahlungsmittel.

->Hat laut dem derzeitigen NI 43-101, Ressourcen von 117,1 Mio. tonnes@1.43 Gramm pro Tonne Gold (5.370.000 Unzen

) im Boden.

) im Boden.-> Columbus hat derzeit noch um die 4.4 Millionen Dollar an Barvermögen, obwohl es sich bereits in der II. Drillingphase befindet .

-> Hat nur eine Marktkapitalisierung von nur 30 Millionen Dollar. (Kurs: 0,30$)

Um es zusammenzufassen:

- Es liegt in einem Land mit stabiler Regierung und Währung.

- Unmittelbare Risiken sind, durch die relativ große Bargeldmenge, gering.

- Das Unternehmen ist meiner Meinung nach stark unterbewertet da, allein die "Paul Isnard"- Mine mindestens einen Kapitalwert (npv), von 900 Millionen Dollar hat.

Schaut euch dieses Unternehmen einmal selber an und teilt eure Meinungen!

Gruß

Antwort auf Beitrag Nr.: 44.515.485 von Kabum am 25.04.13 21:24:48ein paar Anmerkungen bzw. Auszüge ausm MD&A und dem letzten technical Report:

1. die Ressource ist aktuell lediglich inferred! Für die nächste Phase wird in etwa ein Budget von 6M$ benötigt!

http://www.columbusgoldcorp.com/i/pdf/techrep-2013-03-15-Pau…

2. MK fully diluted: 117,55 Millionen Shares x 0,28CAD = ~33M$

At the date of this MD&A, the Company had 102,825,156 shares issued and outstanding. In addition, there were 6,233,000

share purchase options outstanding with exercise prices ranging from $0.25 to $1.68 per share. In addition, the Company

presently has 5,700,000 warrants outstanding with exercise prices ranging from $0.55 to $0.65 per share.

3. zum Cash-Bestand:

At December 31, 2012 the Company had cash of $3,209,352 and working capital of $5,806,123, compared to $4,401,356 and

$6,697,923 respectively at September 30, 2012. The decrease in liquidity resulted from outlays in the normal course of

business. The Company also invested $556,247 in mineral property acquisition and exploration costs during the quarter.

As at December 31, 2012, the Company had current liabilities of $570,994 and non-current liabilities of $442,465. The

Company has sufficient working capital to meet these obligations as they become due.

4. eine Frage meinerseits:

Wenn ich das richtig sehe, dann hat man zig noch Claims in Nevada, wovon man auf einigen in 2013 explorieren will?

D.h. man wird wohl einiges an Cash brauchen und da bin ich mal gespannt, ob der aktuelle Cash-Bestand reichen wird.

Aber die Claims in Nevada klingen aufm Papier nicht so uninteressant. Wer weiß, vielleicht ist der große Wurf dabei.

Kann man mal auf die WL packen, aber aktuell gibt es imho interessantere Werte (mit M&I-Ressourcen), die auf dem selben Niveau bewertet sind!

1. die Ressource ist aktuell lediglich inferred! Für die nächste Phase wird in etwa ein Budget von 6M$ benötigt!

http://www.columbusgoldcorp.com/i/pdf/techrep-2013-03-15-Pau…

2. MK fully diluted: 117,55 Millionen Shares x 0,28CAD = ~33M$

At the date of this MD&A, the Company had 102,825,156 shares issued and outstanding. In addition, there were 6,233,000

share purchase options outstanding with exercise prices ranging from $0.25 to $1.68 per share. In addition, the Company

presently has 5,700,000 warrants outstanding with exercise prices ranging from $0.55 to $0.65 per share.

3. zum Cash-Bestand:

At December 31, 2012 the Company had cash of $3,209,352 and working capital of $5,806,123, compared to $4,401,356 and

$6,697,923 respectively at September 30, 2012. The decrease in liquidity resulted from outlays in the normal course of

business. The Company also invested $556,247 in mineral property acquisition and exploration costs during the quarter.

As at December 31, 2012, the Company had current liabilities of $570,994 and non-current liabilities of $442,465. The

Company has sufficient working capital to meet these obligations as they become due.

4. eine Frage meinerseits:

Wenn ich das richtig sehe, dann hat man zig noch Claims in Nevada, wovon man auf einigen in 2013 explorieren will?

D.h. man wird wohl einiges an Cash brauchen und da bin ich mal gespannt, ob der aktuelle Cash-Bestand reichen wird.

Aber die Claims in Nevada klingen aufm Papier nicht so uninteressant. Wer weiß, vielleicht ist der große Wurf dabei.

Kann man mal auf die WL packen, aber aktuell gibt es imho interessantere Werte (mit M&I-Ressourcen), die auf dem selben Niveau bewertet sind!

Danke für deine schnelle Antwort!

ad 1) Sorry, das "inferred" habe ich vergessen; deswegen die angesprochene Phase II: The proposed Phase II drilling program is designed to add additional ounces by closing large gaps within the deposit envelope. Tighter drilling on 50 metre spacing is planned to upgrade much of the 5.37 million ounce inferred resource to the indicated category.

ad 3) Sie haben kürzlich, 2,2 Mio. bekommen, was hier genauer erklär wird: http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=578057&_Type=News-Releases&_Title=Columbus-Gold-Receives-2.2-Million-Option-Termination-Refund

=> das cash vom 31 Dezember-> 3,2 Mio. + die 2,2 Mio. = 5,4 Mio... von denen sie sicher schon etwas ausgegeben haben =>4,4 Mio.

*Die 5,4 Mio sind dann gar nicht mehr so weit vom Budget für Phase II weg

ad 4) Die Projekte in Nevada sind sicher nicht uninteressant, da es auch bereits zu mehreren joint ventures gekommen ist. Aber, dass sie noch in diesem Jahr auf eigene Faust explorieren werden, bezweifle ich.

->Columbus Gold has 26 gold projects in Nevada, 12 of which are joint ventured to mining companies, such as Agnico-Eagle. The Guild gold project is located approximately 120 kilometer northeast of Tonopah, in Nye County, Nevada.(Reuters)

Ich stimme dir aber trotzdem zu, dass man die Aktie im Moment noch auf der WL lassen kann.

Gruß

ad 1) Sorry, das "inferred" habe ich vergessen; deswegen die angesprochene Phase II: The proposed Phase II drilling program is designed to add additional ounces by closing large gaps within the deposit envelope. Tighter drilling on 50 metre spacing is planned to upgrade much of the 5.37 million ounce inferred resource to the indicated category.

ad 3) Sie haben kürzlich, 2,2 Mio. bekommen, was hier genauer erklär wird: http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=578057&_Type=News-Releases&_Title=Columbus-Gold-Receives-2.2-Million-Option-Termination-Refund

=> das cash vom 31 Dezember-> 3,2 Mio. + die 2,2 Mio. = 5,4 Mio... von denen sie sicher schon etwas ausgegeben haben =>4,4 Mio.

*Die 5,4 Mio sind dann gar nicht mehr so weit vom Budget für Phase II weg

ad 4) Die Projekte in Nevada sind sicher nicht uninteressant, da es auch bereits zu mehreren joint ventures gekommen ist. Aber, dass sie noch in diesem Jahr auf eigene Faust explorieren werden, bezweifle ich.

->Columbus Gold has 26 gold projects in Nevada, 12 of which are joint ventured to mining companies, such as Agnico-Eagle. The Guild gold project is located approximately 120 kilometer northeast of Tonopah, in Nye County, Nevada.(Reuters)

Ich stimme dir aber trotzdem zu, dass man die Aktie im Moment noch auf der WL lassen kann.

Gruß

Antwort auf Beitrag Nr.: 44.515.979 von Kabum am 25.04.13 22:49:20Danke für die Info bzgl. des Cash-Bestandes.

Hatte in meinem jugendlichen Leichtsinn nur das MD&A angeschaut.

Aber im MD&A stand was, dass man auf den Claims in Nevada explorieren will, wenn ich mich recht entsinne.

Ich schaue heute Abend nochmal nach. Vielleicht hab ich es in der Eile auch versemmelt.

Übrigens, es gab auch ein paar Insiderkäufe im April:

http://canadianinsider.com/node/7?menu_tickersearch=Columbus…

Hatte in meinem jugendlichen Leichtsinn nur das MD&A angeschaut.

Aber im MD&A stand was, dass man auf den Claims in Nevada explorieren will, wenn ich mich recht entsinne.

Ich schaue heute Abend nochmal nach. Vielleicht hab ich es in der Eile auch versemmelt.

Übrigens, es gab auch ein paar Insiderkäufe im April:

http://canadianinsider.com/node/7?menu_tickersearch=Columbus…

Ich habs jetzt auch nicht gefunden, aber das mit den Joint Ventures in Nevada ist ganz interessant.

Auf der Website von "Sniper Resources" (ein Partner) sind einige Projekte ganz gut beschrieben: http://www.sniperresources.com/projects/

Der andere Partner ist "Navaho Gold", der an den Projekten Utah Clipper und Whitehorse Flats interessiert ist.

http://www.navahogold.com/index.php?option=com_content&view=…

Gruß

Auf der Website von "Sniper Resources" (ein Partner) sind einige Projekte ganz gut beschrieben: http://www.sniperresources.com/projects/

Der andere Partner ist "Navaho Gold", der an den Projekten Utah Clipper und Whitehorse Flats interessiert ist.

http://www.navahogold.com/index.php?option=com_content&view=…

Gruß

Otto weißt du was es mit den fast 5 Mio. Stück auf sich haben könnte, die vor ein paar Tagen in Kanada gehandelt wurden ?

Gruß

Gruß

Hier mal die Infos ausm MD&A von Ende Februar zu den anderen Claims:

[...]In total, approximately 25 properties located in Nevada and

Arizona have been optioned by Columbus Gold to Columbus Exploration.[...]

[...]Sixty-seven claims have been staked by the Company at the Big Lime gold project, located in Lincoln County, Nevada, 113

km (70 miles) north-northeast of Las Vegas.

A trenching program, likely to be followed by drilling with positive results, has been permitted and will be completed in 2013.

[...]

The Bolo gold project is located 60 km (38 miles) northeast of Tonopah, Nevada.

[...]

Drilling is scheduled to commence in May, 2012. [Anm.von mir: Ist das ein Tippfehler und soll das 2013 heißen? Denn es steht als Ankündigung da!]

[...]

The Hughes Canyon Property is located 48 km (30 miles) east-southeast of Lovelock, Nevada.

[...]

Columbus Gold has received drill permits for 16 drill holes for an initial drill program at Hughes Canyon, and drilling is

planned for 2013.

[...]

The Eastside gold project is located approximately 40 km (25 miles) west of Tonopah, Nevada.

[...]

The Company has received drill permits for a second

phase of drilling at Eastside, and a bond has been placed. Drilling is planned for 2013.

[...]

The Company has 106 unpatented lode mining claims fifteen miles southeast of Tonopah, in Nye County, Nevada.

[...]

Geologic mapping is in progress at Monitor Hills which will be followed by a sizable program of grid geochemical sampling.

If results are favourable, the project will be drilled in early 2014.

[...]

The Petes Summit gold project is located at the north end of the Shoshone Range, 32 km (20 miles) southeast of Austin, Nevada.

[...]

Drilling has been approved, a bond is being placed, and drilling of 10-12 holes is scheduled for 2013.

[...]

Das sind jetzt nur die Projekte, bei denen Columbus Gold selbst exploriert!

Die Claims, auf denen Sniper oder Navaho explorieren habe ich weggelassen!

Es steht zwar nicht dabei, wieviel man jeweils bohren oder explorieren will, aber wird jedenfalls ne Stange Geld kosten.

Und wie gesagt, die veranschlagten 6M$ für Phase II auf Paul Isnard stehen auch noch aus!

Sollte man das wirklich alles durchziehen, dann wird dieses Jahr noch das ein oder andere PP anstehen.

Da müsste man dann wirklich hoffen, dass auf einem der Claims der dicke Treffer dabei ist oder man bei Paul Isnard einen Großteil der Inferred-Ressource in Richtung M&I bringt.

Was es mit dem hohen Volumen aufsich hat kann ich dir nicht sagen.

War auf jedenfall wirklich außergewöhnlich, wenn man sich das Wochenvolumen der letzten Jahre anschaut oder wenn man bedenkt, dass das durchschnittliche Tagesvolumen der letzten 3 Monate bei 212 000 Sharee liegt.

Realtime-Kurs:

[...]In total, approximately 25 properties located in Nevada and

Arizona have been optioned by Columbus Gold to Columbus Exploration.[...]

[...]Sixty-seven claims have been staked by the Company at the Big Lime gold project, located in Lincoln County, Nevada, 113

km (70 miles) north-northeast of Las Vegas.

A trenching program, likely to be followed by drilling with positive results, has been permitted and will be completed in 2013.

[...]

The Bolo gold project is located 60 km (38 miles) northeast of Tonopah, Nevada.

[...]

Drilling is scheduled to commence in May, 2012. [Anm.von mir: Ist das ein Tippfehler und soll das 2013 heißen? Denn es steht als Ankündigung da!]

[...]

The Hughes Canyon Property is located 48 km (30 miles) east-southeast of Lovelock, Nevada.

[...]

Columbus Gold has received drill permits for 16 drill holes for an initial drill program at Hughes Canyon, and drilling is

planned for 2013.

[...]

The Eastside gold project is located approximately 40 km (25 miles) west of Tonopah, Nevada.

[...]

The Company has received drill permits for a second

phase of drilling at Eastside, and a bond has been placed. Drilling is planned for 2013.

[...]

The Company has 106 unpatented lode mining claims fifteen miles southeast of Tonopah, in Nye County, Nevada.

[...]

Geologic mapping is in progress at Monitor Hills which will be followed by a sizable program of grid geochemical sampling.

If results are favourable, the project will be drilled in early 2014.

[...]

The Petes Summit gold project is located at the north end of the Shoshone Range, 32 km (20 miles) southeast of Austin, Nevada.

[...]

Drilling has been approved, a bond is being placed, and drilling of 10-12 holes is scheduled for 2013.

[...]

Das sind jetzt nur die Projekte, bei denen Columbus Gold selbst exploriert!

Die Claims, auf denen Sniper oder Navaho explorieren habe ich weggelassen!

Es steht zwar nicht dabei, wieviel man jeweils bohren oder explorieren will, aber wird jedenfalls ne Stange Geld kosten.

Und wie gesagt, die veranschlagten 6M$ für Phase II auf Paul Isnard stehen auch noch aus!

Sollte man das wirklich alles durchziehen, dann wird dieses Jahr noch das ein oder andere PP anstehen.

Da müsste man dann wirklich hoffen, dass auf einem der Claims der dicke Treffer dabei ist oder man bei Paul Isnard einen Großteil der Inferred-Ressource in Richtung M&I bringt.

Was es mit dem hohen Volumen aufsich hat kann ich dir nicht sagen.

War auf jedenfall wirklich außergewöhnlich, wenn man sich das Wochenvolumen der letzten Jahre anschaut oder wenn man bedenkt, dass das durchschnittliche Tagesvolumen der letzten 3 Monate bei 212 000 Sharee liegt.

Realtime-Kurs:

Columbus Gold Corp. has completed the sale of a 1-per-cent net smelter returns royalty on production from its 100-per-cent-owned Paul Isnard gold project in French Guiana. The transaction has been completed with a royalty company for proceeds of $5-million (U.S.) cash, which has been received by Columbus Gold.

Robert Giustra, chief executive officer of Columbus Gold, commented: "Despite the prevailing inhospitable market conditions characterizing the mining sector, we have not only generated significant capital; we have done so without issuing any shares. This transaction clearly demonstrates our continued dedication to protecting our shareholders from dilution." Mr. Giustra further added, "With the proceeds of the royalty sale, Columbus Gold now has some $8.5-million in treasury, placing us in a favourable position respecting the advancement of our Paul Isnard gold project."

Mit diesem Geldbestand kann nun Phase II ohne Probleme abgeschlossen werden!

Robert Giustra, chief executive officer of Columbus Gold, commented: "Despite the prevailing inhospitable market conditions characterizing the mining sector, we have not only generated significant capital; we have done so without issuing any shares. This transaction clearly demonstrates our continued dedication to protecting our shareholders from dilution." Mr. Giustra further added, "With the proceeds of the royalty sale, Columbus Gold now has some $8.5-million in treasury, placing us in a favourable position respecting the advancement of our Paul Isnard gold project."

Mit diesem Geldbestand kann nun Phase II ohne Probleme abgeschlossen werden!

Ich bin heute hier eingestiegen.

Mir gefällt, daß die viele Projekte haben und lieber Anteile abgeben, statt neue Aktien auf den Markt zu werfen.

Mit Nordgold haben die einen weiteren starken Partner.

Isi

Mir gefällt, daß die viele Projekte haben und lieber Anteile abgeben, statt neue Aktien auf den Markt zu werfen.

Mit Nordgold haben die einen weiteren starken Partner.

Isi

Antwort auf Beitrag Nr.: 45.708.319 von Isengrad am 28.10.13 16:01:36auf Paul Isnard soll ja im November gebohrt werden.

Weißt du, wann es dann eine neue, aktualisierte NI 43-101 geben wird?

Denn ich nehme an, dass man so langsam damit anfangen will, die inferred Ressource in eine indicated zu überführen?

Weißt du, wann es dann eine neue, aktualisierte NI 43-101 geben wird?

Denn ich nehme an, dass man so langsam damit anfangen will, die inferred Ressource in eine indicated zu überführen?

Antwort auf Beitrag Nr.: 45.812.962 von Kongo-Otto am 12.11.13 10:45:26Nein, weiß ich nicht. Aber das hat sich wohl zu Nordgold verlagert. Und die haben genug Geld, dies zügig durchzuziehen.

Wobei dann allerdings fraglich ist, ob die dann auch in Produktion gehen. Dies hängt sicherlich von dem Goldpreis dann ab.

Es gibt aber noch zwölf JV in Nevada. Besteht da die Möglichkeit, daß da eines von in 2014 in Produktion geht?

Isi

Wobei dann allerdings fraglich ist, ob die dann auch in Produktion gehen. Dies hängt sicherlich von dem Goldpreis dann ab.

Es gibt aber noch zwölf JV in Nevada. Besteht da die Möglichkeit, daß da eines von in 2014 in Produktion geht?

Isi

http://www.wallstreet-online.de/nachricht/6419534-follow-up-…

Es wird auch woanders gebohrt.

Vermutlich wird dies auch in einem JV enden.

Isi

Es wird auch woanders gebohrt.

Vermutlich wird dies auch in einem JV enden.

Isi

Noch ein Wert für meine engere Watchlist

Antwort auf Beitrag Nr.: 45.812.962 von Kongo-Otto am 12.11.13 10:45:26Columbus bohrt selber, Nordgold übernimmt die Finanzierung.

1. Bohrprogramm ist auf 14 Monate ausgelegt.

2. soll Anfang 2014 starten.

Ich hoffe, die kommen zügig voran.

Isi

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

1. Bohrprogramm ist auf 14 Monate ausgelegt.

2. soll Anfang 2014 starten.

Ich hoffe, die kommen zügig voran.

Isi

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Columbus Gold gehört zu meinen TOP5-Favoriten für 2014, hier haben wir das Unternehmen erstmals erwähnt: http://www.wallstreet-online.de/nachricht/6469004-minen-gold…

Antwort auf Beitrag Nr.: 46.069.684 von Rockstone am 18.12.13 08:22:11Du stellst dort nur auf Paul Isnard ab.

Dort wird die Produktion aber noch Jahre dauern, erstmal wird

weiter exploriert.

Erste Erträge können aber bald kommen, wenn eines der zwölf JVs in Produktion geht. Auch für die weiteren 14 Liegenschaften wird ja gebohrt und ein JV angestrebt. Dort könnten also auch kleinere Zahlungen an Columbus anfallen, die die Explorationskosten übersteigen.

Columbus kann also steigen, obgleich der Goldpreis ziemlich unten ist.

Isi

Dort wird die Produktion aber noch Jahre dauern, erstmal wird

weiter exploriert.

Erste Erträge können aber bald kommen, wenn eines der zwölf JVs in Produktion geht. Auch für die weiteren 14 Liegenschaften wird ja gebohrt und ein JV angestrebt. Dort könnten also auch kleinere Zahlungen an Columbus anfallen, die die Explorationskosten übersteigen.

Columbus kann also steigen, obgleich der Goldpreis ziemlich unten ist.

Isi

Ja, ist denn schon wieder Weihnachten?

Isi

Börse Nasdaq other OTC

Aktuell 0,32 USD

Zeit 26.12.13 17:27

Diff. Vortag +15,90%

Tages-Vol. 18.460,36

Gehandelte Stück 60.000

Isi

Börse Nasdaq other OTC

Aktuell 0,32 USD

Zeit 26.12.13 17:27

Diff. Vortag +15,90%

Tages-Vol. 18.460,36

Gehandelte Stück 60.000

bin letzte woche eingestiegen

Antwort auf Beitrag Nr.: 46.114.617 von Rokky100 am 26.12.13 19:18:30Dann sei willkommen in diesem Kreis, zu dem ich ja auch noch nicht lange gehöre.

Aus meiner Sicht sei gesagt, daß Columbus nicht der "Bringer" der nächsten zwei Jahre sein wird. Ausschließen würde ich dies allerdings nicht vollständig.

Columbus ist aus meiner Sicht ein Stabilisator für das Depot.

Es gehen wohl viele Explorer/Jungproduzenten in den nächsten zwei Jahren pleite. Columbus wird sicherlich nicht dazu gehören, das MM ist zu clever und hat zu viele Projekte.

Paul Isnard wird wohl kaum vor 2018 in Produktion gehen. Aber gute Zahlen von dort und auch der Produktionsbeginn bei einem der 12 JVs werden den Kurs wohl stützen.

Vermutlich wird es ja weitere JVs geben, auch da könnte Geld fließen, so daß keine weiteren Aktien ausgegeben werden müssen.

Alles meine Einschätzung, wie es kommt, weiß man nicht.

Isi

Aus meiner Sicht sei gesagt, daß Columbus nicht der "Bringer" der nächsten zwei Jahre sein wird. Ausschließen würde ich dies allerdings nicht vollständig.

Columbus ist aus meiner Sicht ein Stabilisator für das Depot.

Es gehen wohl viele Explorer/Jungproduzenten in den nächsten zwei Jahren pleite. Columbus wird sicherlich nicht dazu gehören, das MM ist zu clever und hat zu viele Projekte.

Paul Isnard wird wohl kaum vor 2018 in Produktion gehen. Aber gute Zahlen von dort und auch der Produktionsbeginn bei einem der 12 JVs werden den Kurs wohl stützen.

Vermutlich wird es ja weitere JVs geben, auch da könnte Geld fließen, so daß keine weiteren Aktien ausgegeben werden müssen.

Alles meine Einschätzung, wie es kommt, weiß man nicht.

Isi

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:CGT-2134004

Columbus Gold grants options for 2.12 million shares

2013-12-20 09:33 ET - News ReleaseMr. Robert Giustra reportsCOLUMBUS GOLD CORP. ISSUES OPTIONSColumbus Gold Corp. has granted incentive stock options to certain of its directors, officers, consultants and employees to purchase up to an aggregate of 2,125,000 common shares at an exercise price of 35 cents per share. One million two hundred thousand of the options vest immediately. Seven hundred seventy-five thousand of the options vest as to one-third on June 18, 2014, and one-third at the end of each of the next two six-month periods. One hundred fifty thousand of the options vest as to 50 per cent on Dec. 18, 2014, and the remaining 50 per cent on Dec. 18, 2015. All of the foregoing options expire on Dec. 18, 2018

Columbus Gold grants options for 2.12 million shares

2013-12-20 09:33 ET - News ReleaseMr. Robert Giustra reportsCOLUMBUS GOLD CORP. ISSUES OPTIONSColumbus Gold Corp. has granted incentive stock options to certain of its directors, officers, consultants and employees to purchase up to an aggregate of 2,125,000 common shares at an exercise price of 35 cents per share. One million two hundred thousand of the options vest immediately. Seven hundred seventy-five thousand of the options vest as to one-third on June 18, 2014, and one-third at the end of each of the next two six-month periods. One hundred fifty thousand of the options vest as to 50 per cent on Dec. 18, 2014, and the remaining 50 per cent on Dec. 18, 2015. All of the foregoing options expire on Dec. 18, 2018

Thu Jan 16, 2014Columbus Gold Appoints Andy Wallace to the Board of Directors

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Gegen eine Zahlung von 30 Mio. Dollar und eine bankable FS könnte Nord Gold an 50,01% der Hauptclaims von paul isnard zu gelangen.

Columbus Gold 0,39 CAD

Columbus Gold 0,39 CAD

Columbus Gold drills 64 m of 1.43 g/t Au at Eastside

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:CGT-2147404

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:CGT-2147404

Columbus Gold Announces Initial Results of Phase II Drilling at 5.4 Million Once Montagne d'Or Gold Deposit

http://www.theaureport.com/pub/qmdata/30771?utm_source=deliv…

http://www.theaureport.com/pub/qmdata/30771?utm_source=deliv…

hab, jetzt, keine Aktien:

Cyanide Authorized for Use in French Guiana, Where Columbus Gold is Advancing 5.370.000 oz. Gold Deposit - Feb 28, 2014

www.marketwired.com/press-release/cyanide-authorized-use-fre…

"VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 28, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce two very positive recent developments in French Guiana where it is currently advancing its 5.37 million ounce Montagne d'Or gold deposit, which forms part of its Paul Isnard Project.

French gold producer Auplata SA announced on February 25, 2014, that it has received the required authorizations to construct and operate a centralized cyanide plant to treat gold gravity concentrates from its various mines and mining sites in French Guiana. Auplata reports that it ultimately intends to implement cyanide plants directly at its mine sites in due-course.

On February 24, 2014, the French government announced that it plans to invest up to EUR400 million (US$548 million) in a new state owned mining company to explore for gold in French Guiana and for rare earths and specialty metals in France and around the globe. The objective is for the new company to be built around the same model as Japan's JOGMEC, which was established to offer financial support for private sector Japanese resource ventures worldwide.

Robert Giustra, CEO of Columbus Gold, commented: "These recent developments are a clear message from the French Government that it is committed to developing the vast mineral wealth potential of French Guiana, particularly gold mining. It's an essential and very positive development for Columbus Gold in particular, as it greatly increases the level of confidence with respect to the development of our Montagne d'Or gold deposit."

The Montagne d'Or deposit contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 grams per tonne gold of 5.37 million ounces within 117.1 million tonnes at an average grade of 1.43 grams per tonne gold. Using a cut-off of 1 gram per tonne gold a resource of 4.15 million ounces within 58.1 million tonnes at an average grade of 2.22 grams per tonne gold. The resources are defined within a gold mineralized area of 2,250 meters by 400 meters and to an average depth of 250 meters from surface. The mineralized zones remain open in part along strike and at depth. Please refer to Columbus Gold's news release of February 26, 2014 for further details.

Drilling is currently underway at Montagne d'Or and is being funded by Nord Gold N.V. as part of a 3 year minimum US$30 million exploration and development program pursuant to which Nord Gold can earn a 50.01% interest in Montagne d'Or and certain Paul Isnard mineral claims, by completing a bankable feasibility study.

Rock Lefrançois, P.Geo. (OGQ), Chief Operating Officer for Columbus Gold and Qualified Person under National Instrument 43-101 has reviewed the technical information in this news release and is responsible for the technical information reported herein.

ON BEHALF OF THE BOARD,

Robert F. Giustra, Chairman & CEO

Contact Information

Columbus Gold Corporation

Investor Relations

604-634-0970 or 1-888-818-1364

604-634-0971 (FAX)

info@columbusgroup.com

www.columbusgroup.com "

Cyanide Authorized for Use in French Guiana, Where Columbus Gold is Advancing 5.370.000 oz. Gold Deposit - Feb 28, 2014

www.marketwired.com/press-release/cyanide-authorized-use-fre…

"VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 28, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce two very positive recent developments in French Guiana where it is currently advancing its 5.37 million ounce Montagne d'Or gold deposit, which forms part of its Paul Isnard Project.

French gold producer Auplata SA announced on February 25, 2014, that it has received the required authorizations to construct and operate a centralized cyanide plant to treat gold gravity concentrates from its various mines and mining sites in French Guiana. Auplata reports that it ultimately intends to implement cyanide plants directly at its mine sites in due-course.

On February 24, 2014, the French government announced that it plans to invest up to EUR400 million (US$548 million) in a new state owned mining company to explore for gold in French Guiana and for rare earths and specialty metals in France and around the globe. The objective is for the new company to be built around the same model as Japan's JOGMEC, which was established to offer financial support for private sector Japanese resource ventures worldwide.

Robert Giustra, CEO of Columbus Gold, commented: "These recent developments are a clear message from the French Government that it is committed to developing the vast mineral wealth potential of French Guiana, particularly gold mining. It's an essential and very positive development for Columbus Gold in particular, as it greatly increases the level of confidence with respect to the development of our Montagne d'Or gold deposit."

The Montagne d'Or deposit contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 grams per tonne gold of 5.37 million ounces within 117.1 million tonnes at an average grade of 1.43 grams per tonne gold. Using a cut-off of 1 gram per tonne gold a resource of 4.15 million ounces within 58.1 million tonnes at an average grade of 2.22 grams per tonne gold. The resources are defined within a gold mineralized area of 2,250 meters by 400 meters and to an average depth of 250 meters from surface. The mineralized zones remain open in part along strike and at depth. Please refer to Columbus Gold's news release of February 26, 2014 for further details.

Drilling is currently underway at Montagne d'Or and is being funded by Nord Gold N.V. as part of a 3 year minimum US$30 million exploration and development program pursuant to which Nord Gold can earn a 50.01% interest in Montagne d'Or and certain Paul Isnard mineral claims, by completing a bankable feasibility study.

Rock Lefrançois, P.Geo. (OGQ), Chief Operating Officer for Columbus Gold and Qualified Person under National Instrument 43-101 has reviewed the technical information in this news release and is responsible for the technical information reported herein.

ON BEHALF OF THE BOARD,

Robert F. Giustra, Chairman & CEO

Contact Information

Columbus Gold Corporation

Investor Relations

604-634-0970 or 1-888-818-1364

604-634-0971 (FAX)

info@columbusgroup.com

www.columbusgroup.com "

http://mobile.tmxmoney.com/quote/readnews/?id=66353935&symbo…

Columbus Gold Announces Additional Drilling Results from Montagne d'Or; Including 2.74 g/t Gold over 12.1 Meters

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 12, 2014)

Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports on the progress of the Phase II diamond drilling campaign currently underway at its 5.37 million ounce Montagne d'Or gold deposit, Paul Isnard Project, French Guiana.Forty (40) drill holes have been completed to date, for a total of 4,882 metres, as part as of a 26,600 metre (135 holes) drilling program under the terms of the Nord Gold earn-in option.

Columbus Gold Announces Additional Drilling Results from Montagne d'Or; Including 2.74 g/t Gold over 12.1 Meters

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 12, 2014)

Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports on the progress of the Phase II diamond drilling campaign currently underway at its 5.37 million ounce Montagne d'Or gold deposit, Paul Isnard Project, French Guiana.Forty (40) drill holes have been completed to date, for a total of 4,882 metres, as part as of a 26,600 metre (135 holes) drilling program under the terms of the Nord Gold earn-in option.

http://mobile.tmxmoney.com/quote/readnews/?id=66386847&symbo…

Columbus Gold Announces Tendering of Contracts for PEA and EIA on Montagne d'Or Gold Deposit, French Guiana

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 13, 2014)

Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it and its partner Nord Gold N.V. have completed the evaluation of tenders for the commissioning of a NI 43-101 compliant resource update (post-Phase II drilling) and a preliminary economic assessment ("PEA") on the Montagne d'Or gold deposit, Paul Isnard Project, French Guiana. In parallel, an evaluation of associated tenders for an environmental impact assessment (EIA) to support the PEA and an eventual bankable feasibility study is nearing completion. An announcement declaring the successful bids is expected in coming weeks.Proposals to prepare the resource update and the PEA were received from all 7 of the international mining consulting firms invited to submit bids. Regarding the EIA tenders, 6 of an original 10 invited companies submitted bids to complete a preliminary environmental assessment by the end of 2014 followed by submission of a final EIA within three years to the French government Ministry for Ecology, Sustainable Development and Energy.The principal objective of the PEA is to complete an initial detailed economic and environmental appraisal of the Montagne d'Or deposit. Completion is targeted for the end of 2014 with an announcement expected in the first quarter of 2015. The PEA will include:26,600 metres of in-fill core drilling (program commenced in late November 2013);Updated resource estimate;1,000 metres of large diameter core drilling for detailed metallurgical testing;Hydrology;Preliminary design of pit(s), tailings dam and mine site;Mining method, equipment, and processing parameters;Environmental impact assessment and socio-economic baseline studies;An economic model.The proposed EIA is intended to be comprehensive in order to fully support the environmental components of a bankable feasibility study.All studies are being funded by Nord Gold as part of a 3 year minimum US$30 million exploration and development program pursuant to which Nord Gold can earn a 50.01% interest in Montagne d'Or and certain Paul Isnard mineral claims, by completing a bankable feasibility study.The Montagne d'Or deposit contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 grams per tonne gold for 5.37 million ounces within 117.1 million tonnes at an average grade of 1.43 grams per tonne gold. Using a cut-off of 1 gram per tonne gold the deposit hosts a resource of 4.15 million ounces within 58.1 million tonnes at an average grade of 2.22 grams per tonne gold. The resources are defined within a gold mineralized area of 2,250 meters by 400 meters and to an average depth of 250 meters from surface. The mineralized zones remain open between widely spaced holes internally, at depth and in part along strike

Columbus Gold Announces Tendering of Contracts for PEA and EIA on Montagne d'Or Gold Deposit, French Guiana

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 13, 2014)

Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it and its partner Nord Gold N.V. have completed the evaluation of tenders for the commissioning of a NI 43-101 compliant resource update (post-Phase II drilling) and a preliminary economic assessment ("PEA") on the Montagne d'Or gold deposit, Paul Isnard Project, French Guiana. In parallel, an evaluation of associated tenders for an environmental impact assessment (EIA) to support the PEA and an eventual bankable feasibility study is nearing completion. An announcement declaring the successful bids is expected in coming weeks.Proposals to prepare the resource update and the PEA were received from all 7 of the international mining consulting firms invited to submit bids. Regarding the EIA tenders, 6 of an original 10 invited companies submitted bids to complete a preliminary environmental assessment by the end of 2014 followed by submission of a final EIA within three years to the French government Ministry for Ecology, Sustainable Development and Energy.The principal objective of the PEA is to complete an initial detailed economic and environmental appraisal of the Montagne d'Or deposit. Completion is targeted for the end of 2014 with an announcement expected in the first quarter of 2015. The PEA will include:26,600 metres of in-fill core drilling (program commenced in late November 2013);Updated resource estimate;1,000 metres of large diameter core drilling for detailed metallurgical testing;Hydrology;Preliminary design of pit(s), tailings dam and mine site;Mining method, equipment, and processing parameters;Environmental impact assessment and socio-economic baseline studies;An economic model.The proposed EIA is intended to be comprehensive in order to fully support the environmental components of a bankable feasibility study.All studies are being funded by Nord Gold as part of a 3 year minimum US$30 million exploration and development program pursuant to which Nord Gold can earn a 50.01% interest in Montagne d'Or and certain Paul Isnard mineral claims, by completing a bankable feasibility study.The Montagne d'Or deposit contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 grams per tonne gold for 5.37 million ounces within 117.1 million tonnes at an average grade of 1.43 grams per tonne gold. Using a cut-off of 1 gram per tonne gold the deposit hosts a resource of 4.15 million ounces within 58.1 million tonnes at an average grade of 2.22 grams per tonne gold. The resources are defined within a gold mineralized area of 2,250 meters by 400 meters and to an average depth of 250 meters from surface. The mineralized zones remain open between widely spaced holes internally, at depth and in part along strike

Columbus Gold Signs US$30 Million Definitive Option Agreement With Nord Gold on 5.37 Million Oz. Montagne d'Or Gold Deposit, French Guiana

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 14, 2014) - Columbus Gold Corp. (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it has executed the definitive option agreement (the "Agreement") with major gold producer Nord Gold N.V. contemplated in the binding letter of intent dated September 17, 2013 under which Nord Gold has been granted the right to earn a 50.01% interest in certain licences at Columbus Gold's 100% owned Paul Isnard gold project in French Guiana, which host the 5.37 million ounce Montagne d'Or gold deposit (the "Project").

Pursuant to the terms, Nord Gold must pay US$4.2 million in cash to Columbus Gold no later than May 21, 2014. The US$4.2 million payment is mandatory and is not subject to any conditions. In addition, during the earn-in period, Columbus Gold is the operator and benefits from a 10% management fee on certain expenditures; the 2014 work program at the project is budgeted at US$11.8 million.

Robert Giustra, CEO of Columbus Gold, commented on the terms of the deal in September 2013: "This agreement is exceptional not only by its requirement for an experienced and world class mine developer to fund a considerable amount of spending but also for the fact that Columbus Gold shareholders retain half the project at feasibility. In addition, the deal provides Columbus Gold with the option to participate in mine construction or to delegate it to Nord Gold for a resulting significant and valuable equity interest for Columbus Gold shareholders in a large producing mine."

A 26,600 meter, 135 hole drilling program is currently underway at Montagne d'Or which contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 g/t of 5.37 million ounces of gold within 117.1 million tonnes at an average grade of 1.43 g/t. Using a cut-off of 1 g/t the deposit hosts 4.15 million ounces of gold within 58.1 million tonnes at an average grade of 2.22 g/t. For additional details, please refer to the Technical Report (as defined below).

Nord Gold may earn a 50.01% interest in the Project by completing a bankable feasibility study (the "BFS") and by expending not less than US$30 million in 3 years in staged work expenditures, which includes the requirement for Nord Gold to pay Columbus Gold US$4.2 million in cash no later than May 21, 2014. If Nord Gold earns its interest it will take ownership of 50.01% of the shares of SOTRAPMAG S.A.S. ("SOTRAPMAG"), the wholly owned French subsidiary of Columbus Gold that owns the Project and Columbus Gold will retain a 49.99% interest. SOTRAPMAG will be the joint venture company. In the event that SOTRAPMAG decides to advance the Project to mine construction and commercial production, Columbus Gold may elect to fund SOTRAPMAG pro-rated to its 49.99% interest or allow Nord Gold to solely fund, whereby Columbus Gold's interest would be diluted pursuant to a straight-line formula. The initial deemed value of each party's interest in SOTRAPMAG, which affects the rate of dilution, will vary based on the ounces of proven & probable reserves estimated in the BFS (the "Ounces"). For example, pursuant to the formula, 2 million Ounces would require Nord Gold to spend approximately US$160 million to dilute Columbus Gold to a 25% interest; 3 million Ounces would require Nord Gold to spend approximately US$210 million to dilute Columbus Gold to a 25% interest; and 4.5 million Ounces would require Nord Gold to spend approximately US$270 million to dilute Columbus Gold to a 25% interest. In the event that SOTRAPMAG decides not to move forward to mine construction and commercial production within 4.5 months after completion of the BFS, Nord Gold must offer 0.01% of SOTRAPMAG to Columbus Gold for a determinable price and each party will then hold 50% of SOTRAPMAG.

During the option period, Nord Gold has agreed to a standstill under which it will not obtain 20% or greater of the outstanding voting securities of Columbus Gold, will not solicit proxies from Columbus Gold's shareholders, will not attempt to engage in discussions respecting fundamental transactions involving Columbus Gold, and will vote any securities it holds in favour of management proposals put forward by Columbus Gold.

The Agreement is subject to receiving confirmation from the French government that it has no objection to the option. The Agreement contains other provisions standard for an option agreement, including an area of interest, force majeure extensions and termination provisions. A copy of the Agreement will be available in due course on Columbus Gold's SEDAR profile at www.sedar.com.

Read more at http://www.stockhouse.com/news/press-releases/2014/03/14/col…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 14, 2014) - Columbus Gold Corp. (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it has executed the definitive option agreement (the "Agreement") with major gold producer Nord Gold N.V. contemplated in the binding letter of intent dated September 17, 2013 under which Nord Gold has been granted the right to earn a 50.01% interest in certain licences at Columbus Gold's 100% owned Paul Isnard gold project in French Guiana, which host the 5.37 million ounce Montagne d'Or gold deposit (the "Project").

Pursuant to the terms, Nord Gold must pay US$4.2 million in cash to Columbus Gold no later than May 21, 2014. The US$4.2 million payment is mandatory and is not subject to any conditions. In addition, during the earn-in period, Columbus Gold is the operator and benefits from a 10% management fee on certain expenditures; the 2014 work program at the project is budgeted at US$11.8 million.

Robert Giustra, CEO of Columbus Gold, commented on the terms of the deal in September 2013: "This agreement is exceptional not only by its requirement for an experienced and world class mine developer to fund a considerable amount of spending but also for the fact that Columbus Gold shareholders retain half the project at feasibility. In addition, the deal provides Columbus Gold with the option to participate in mine construction or to delegate it to Nord Gold for a resulting significant and valuable equity interest for Columbus Gold shareholders in a large producing mine."

A 26,600 meter, 135 hole drilling program is currently underway at Montagne d'Or which contains a NI 43-101 compliant inferred gold resource using a cut-off grade of 0.3 g/t of 5.37 million ounces of gold within 117.1 million tonnes at an average grade of 1.43 g/t. Using a cut-off of 1 g/t the deposit hosts 4.15 million ounces of gold within 58.1 million tonnes at an average grade of 2.22 g/t. For additional details, please refer to the Technical Report (as defined below).

Nord Gold may earn a 50.01% interest in the Project by completing a bankable feasibility study (the "BFS") and by expending not less than US$30 million in 3 years in staged work expenditures, which includes the requirement for Nord Gold to pay Columbus Gold US$4.2 million in cash no later than May 21, 2014. If Nord Gold earns its interest it will take ownership of 50.01% of the shares of SOTRAPMAG S.A.S. ("SOTRAPMAG"), the wholly owned French subsidiary of Columbus Gold that owns the Project and Columbus Gold will retain a 49.99% interest. SOTRAPMAG will be the joint venture company. In the event that SOTRAPMAG decides to advance the Project to mine construction and commercial production, Columbus Gold may elect to fund SOTRAPMAG pro-rated to its 49.99% interest or allow Nord Gold to solely fund, whereby Columbus Gold's interest would be diluted pursuant to a straight-line formula. The initial deemed value of each party's interest in SOTRAPMAG, which affects the rate of dilution, will vary based on the ounces of proven & probable reserves estimated in the BFS (the "Ounces"). For example, pursuant to the formula, 2 million Ounces would require Nord Gold to spend approximately US$160 million to dilute Columbus Gold to a 25% interest; 3 million Ounces would require Nord Gold to spend approximately US$210 million to dilute Columbus Gold to a 25% interest; and 4.5 million Ounces would require Nord Gold to spend approximately US$270 million to dilute Columbus Gold to a 25% interest. In the event that SOTRAPMAG decides not to move forward to mine construction and commercial production within 4.5 months after completion of the BFS, Nord Gold must offer 0.01% of SOTRAPMAG to Columbus Gold for a determinable price and each party will then hold 50% of SOTRAPMAG.

During the option period, Nord Gold has agreed to a standstill under which it will not obtain 20% or greater of the outstanding voting securities of Columbus Gold, will not solicit proxies from Columbus Gold's shareholders, will not attempt to engage in discussions respecting fundamental transactions involving Columbus Gold, and will vote any securities it holds in favour of management proposals put forward by Columbus Gold.

The Agreement is subject to receiving confirmation from the French government that it has no objection to the option. The Agreement contains other provisions standard for an option agreement, including an area of interest, force majeure extensions and termination provisions. A copy of the Agreement will be available in due course on Columbus Gold's SEDAR profile at www.sedar.com.

Read more at http://www.stockhouse.com/news/press-releases/2014/03/14/col…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Mon May 5, 2014

Columbus Gold to Re-evaluate Resource Estimate at Montagne d'Or; Paul Isnard Project, French Guiana

Vancouver, BC, Canada, May 5th, 2014. Columbus Gold Corporation (CGT: TSX-V) ("Columbus Gold") reports that, further to its March 13, 2014 news release respecting the evaluation of bids pursuant to a formal tender, SRK Consulting (U.S.), Inc. ("SRK") was awarded the contract to complete a preliminary economic assessment ("PEA") of Columbus Gold's Montagne D'Or gold deposit. As part of SRK's engagement and the ongoing development of the project, SRK reviewed the inferred gold resource estimate prepared by Coffey Mining Pty Ltd ("Coffey"), which was set out in their NI 43-101-compliant technical report dated effective November 23, 2012 and filed on SEDAR on March 14, 2013. In the process, SRK identified issues with respect to certain estimation methodologies employed by Coffey which SRK believes materially overstate grade and contained ounces.

Mine Development Associates ("MDA") was subsequently engaged by Columbus Gold in an effort to resolve the differences in the methodologies used by Coffey and those considered appropriate by SRK, both internationally respected and recognized independent mining consultancies. MDA's conclusion supports SRK's recommended methodology.

In the interest of providing timely public disclosure, Columbus Gold has not yet had the opportunity to obtain comment from Coffey on their choice of methodologies used in their resource estimate.

Columbus Gold will provide conclusive clarity on the matter by obtaining comments from Coffey and commissioning a new independent NI 43-101 compliant resource update on the Montagne d'Or deposit with a target completion date of May 30, 2014. The resource update will also include holes for which assays have been received to date in the current Phase II drilling campaign.

Rock Lefrançois, P.Geo. (OGQ), Columbus Gold's COO and Qualified Person has reviewed and approved the technical content of this news release.

Mon May 5, 2014

Columbus Gold to Re-evaluate Resource Estimate at Montagne d'Or; Paul Isnard Project, French Guiana

Vancouver, BC, Canada, May 5th, 2014. Columbus Gold Corporation (CGT: TSX-V) ("Columbus Gold") reports that, further to its March 13, 2014 news release respecting the evaluation of bids pursuant to a formal tender, SRK Consulting (U.S.), Inc. ("SRK") was awarded the contract to complete a preliminary economic assessment ("PEA") of Columbus Gold's Montagne D'Or gold deposit. As part of SRK's engagement and the ongoing development of the project, SRK reviewed the inferred gold resource estimate prepared by Coffey Mining Pty Ltd ("Coffey"), which was set out in their NI 43-101-compliant technical report dated effective November 23, 2012 and filed on SEDAR on March 14, 2013. In the process, SRK identified issues with respect to certain estimation methodologies employed by Coffey which SRK believes materially overstate grade and contained ounces.

Mine Development Associates ("MDA") was subsequently engaged by Columbus Gold in an effort to resolve the differences in the methodologies used by Coffey and those considered appropriate by SRK, both internationally respected and recognized independent mining consultancies. MDA's conclusion supports SRK's recommended methodology.

In the interest of providing timely public disclosure, Columbus Gold has not yet had the opportunity to obtain comment from Coffey on their choice of methodologies used in their resource estimate.

Columbus Gold will provide conclusive clarity on the matter by obtaining comments from Coffey and commissioning a new independent NI 43-101 compliant resource update on the Montagne d'Or deposit with a target completion date of May 30, 2014. The resource update will also include holes for which assays have been received to date in the current Phase II drilling campaign.

Rock Lefrançois, P.Geo. (OGQ), Columbus Gold's COO and Qualified Person has reviewed and approved the technical content of this news release.

http://mobile.tmxmoney.com/quote/readnews/?id=67645511&symbo…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 8, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to provide the following update on its 100% controlled Eastside gold project in Esmeralda County, Nevada.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 8, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to provide the following update on its 100% controlled Eastside gold project in Esmeralda County, Nevada.

http://mobile.tmxmoney.com/quote/readnews/?id=68000141&symbo…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 23, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it has received the US$4.2 million payment from Nord Gold N.V. ("Nord Gold") required to be paid pursuant to their option to earn a 50.01% interest in certain licences at Columbus Gold's 100% owned Paul Isnard Gold Project in French Guiana, that host the Montagne d'Or gold deposit (the "Project").

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 23, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce that it has received the US$4.2 million payment from Nord Gold N.V. ("Nord Gold") required to be paid pursuant to their option to earn a 50.01% interest in certain licences at Columbus Gold's 100% owned Paul Isnard Gold Project in French Guiana, that host the Montagne d'Or gold deposit (the "Project").

http://mobile.tmxmoney.com/quote/readnews/?id=68102937&symbo…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 29, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports on the progress of the Phase II diamond drilling campaign currently underway at its Montagne d'Or gold deposit, Paul Isnard Project, French Guiana.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 29, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports on the progress of the Phase II diamond drilling campaign currently underway at its Montagne d'Or gold deposit, Paul Isnard Project, French Guiana.

http://www.theaureport.com/pub/qmdata/32386?utm_source=deliv…

Columbus Gold Hires Coffey for New Resource Estimate at Montagne d'Or

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 30, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports the signing of a contract with Coffey Mining Pty Ltd ("Coffey") to complete a new NI 43-101 compliant resource estimate of Columbus Gold's Montagne d'Or gold deposit, as a result of reservations expressed by SRK Consulting (U.S.), Inc. ("SRK"), and supported by Mine Development Associates, respecting certain methodologies previously employed by Coffey in their NI 43-101-compliant 2012 technical report on Montagne d'Or (see May 5th, 2014 press release).Although SRK's reservations were not expressed in a NI 43-101 compliant report, in the interest of providing timely public disclosure, Columbus Gold issued the May 5th press release, indicating that it had not yet had the opportunity to obtain comment from Coffey on their choice of methodologies used in their resource estimate and that it would provide conclusive clarity on the matter by obtaining comment from Coffey and commissioning a new independent NI 43-101 compliant resource update.Pursuant to the terms of the contract signed with Coffey, it is anticipated that a new resource estimate can be announced during the month of June. The resource estimate will also include assays from the current Phase II drilling campaign received as at May 24th, 2014.

Columbus Gold Hires Coffey for New Resource Estimate at Montagne d'Or

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 30, 2014) - Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") reports the signing of a contract with Coffey Mining Pty Ltd ("Coffey") to complete a new NI 43-101 compliant resource estimate of Columbus Gold's Montagne d'Or gold deposit, as a result of reservations expressed by SRK Consulting (U.S.), Inc. ("SRK"), and supported by Mine Development Associates, respecting certain methodologies previously employed by Coffey in their NI 43-101-compliant 2012 technical report on Montagne d'Or (see May 5th, 2014 press release).Although SRK's reservations were not expressed in a NI 43-101 compliant report, in the interest of providing timely public disclosure, Columbus Gold issued the May 5th press release, indicating that it had not yet had the opportunity to obtain comment from Coffey on their choice of methodologies used in their resource estimate and that it would provide conclusive clarity on the matter by obtaining comment from Coffey and commissioning a new independent NI 43-101 compliant resource update.Pursuant to the terms of the contract signed with Coffey, it is anticipated that a new resource estimate can be announced during the month of June. The resource estimate will also include assays from the current Phase II drilling campaign received as at May 24th, 2014.

scheint bisher nicht gut anzukommen

Columbus Gold Announces Resource Estimate at Montagne d'Or; Obtains Permit For and Commences Drilling on Principal Gold Zone

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jun 30, 2014)

http://web.tmxmoney.com/article.php?newsid=68722898&qm_symbo…

Columbus Gold Announces Resource Estimate at Montagne d'Or; Obtains Permit For and Commences Drilling on Principal Gold Zone

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jun 30, 2014)

http://web.tmxmoney.com/article.php?newsid=68722898&qm_symbo…

Columbus Gold's Eastside Project in Nevada Yields 95% Gold Recoveries from Metallurgical Testing

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Second Rig Commences Drilling at Columbus Gold's Paul Isnard Project in French Guiana; Third Drill in Transit.

http://www.theaureport.com/pub/qmdata/33690?utm_source=deliv…

http://www.theaureport.com/pub/qmdata/33690?utm_source=deliv…

Columbus Gold Announces Private Placement - Sep 2, 2014

www.marketwired.com/press-release/columbus-gold-announces-pr…

"Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce a non-brokered private placement of up to 20,000,000 units of Columbus Gold at a price of $0.50 per unit, for total gross proceeds of up to $10,000,000. Each unit will consist of one common share in the capital of Columbus Gold and one-half of one common share purchase warrant. Each whole common share purchase warrant will entitle the holder to acquire one common share at a price of $0.75 for a period of 12 months from the closing date of the private placement. Finder's fees may be paid in connection with the private placement in accordance with the policies of the TSX Venture Exchange (the "TSXV"). Columbus Gold intends to use the proceeds of the private placement to advance its Eastside gold project in Nevada and for general working capital purposes. The private placement is subject to approval by the TSXV.

ON BEHALF OF THE BOARD,

Robert F. Giustra, President, CEO, and Director "

www.marketwired.com/press-release/columbus-gold-announces-pr…

"Columbus Gold Corporation (TSX VENTURE:CGT) ("Columbus Gold") is pleased to announce a non-brokered private placement of up to 20,000,000 units of Columbus Gold at a price of $0.50 per unit, for total gross proceeds of up to $10,000,000. Each unit will consist of one common share in the capital of Columbus Gold and one-half of one common share purchase warrant. Each whole common share purchase warrant will entitle the holder to acquire one common share at a price of $0.75 for a period of 12 months from the closing date of the private placement. Finder's fees may be paid in connection with the private placement in accordance with the policies of the TSX Venture Exchange (the "TSXV"). Columbus Gold intends to use the proceeds of the private placement to advance its Eastside gold project in Nevada and for general working capital purposes. The private placement is subject to approval by the TSXV.

ON BEHALF OF THE BOARD,

Robert F. Giustra, President, CEO, and Director "

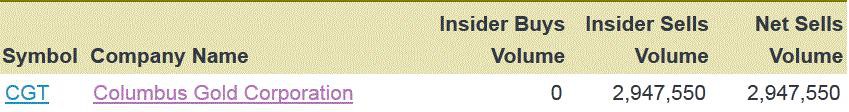

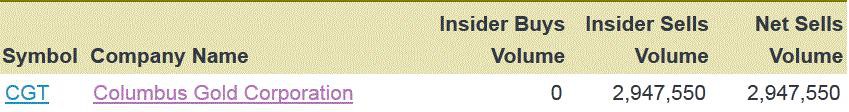

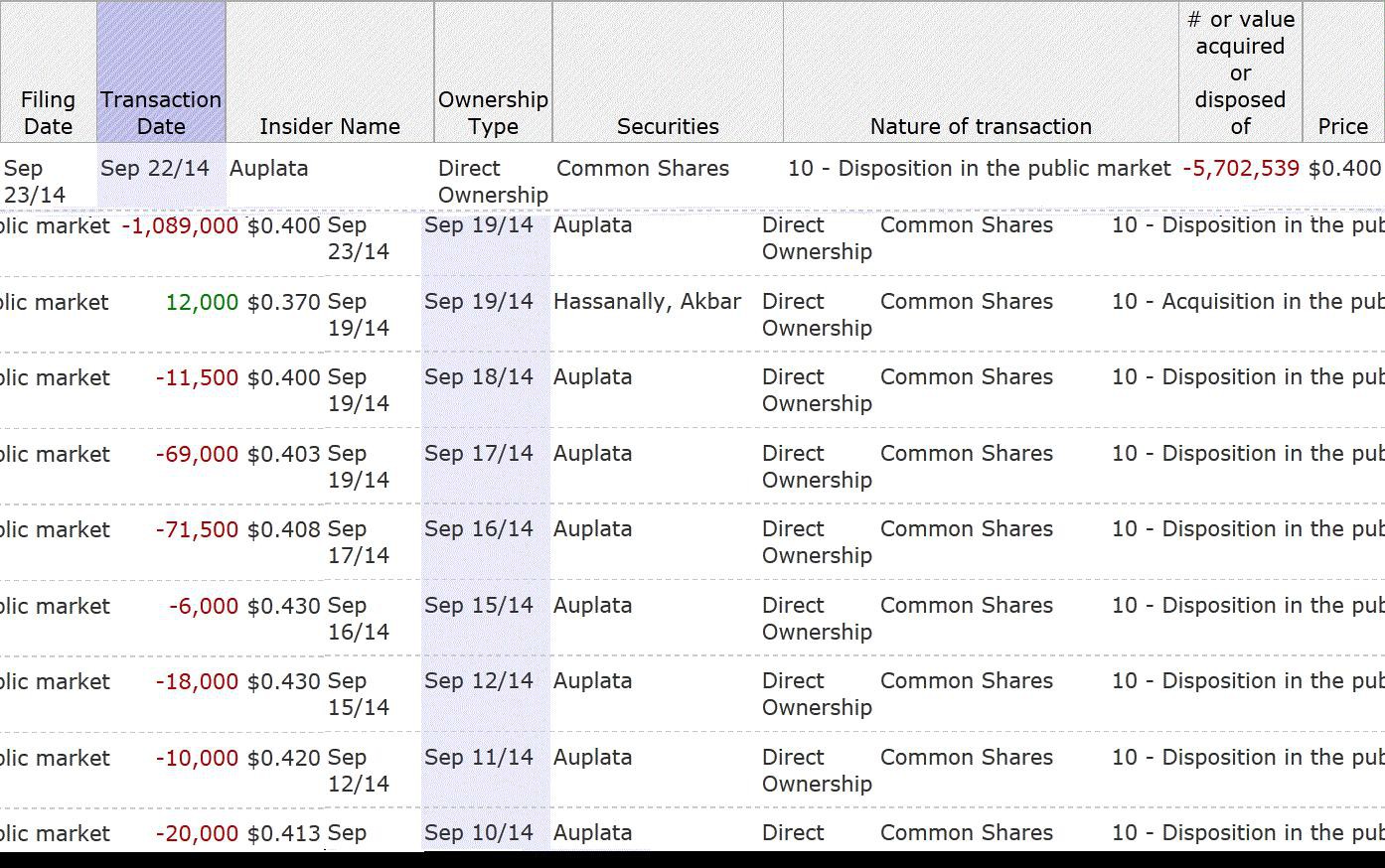

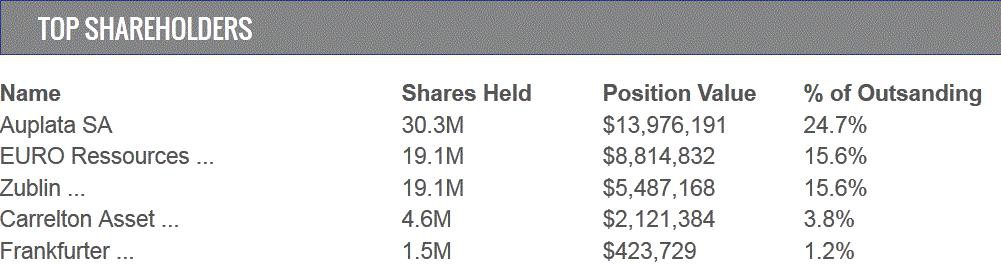

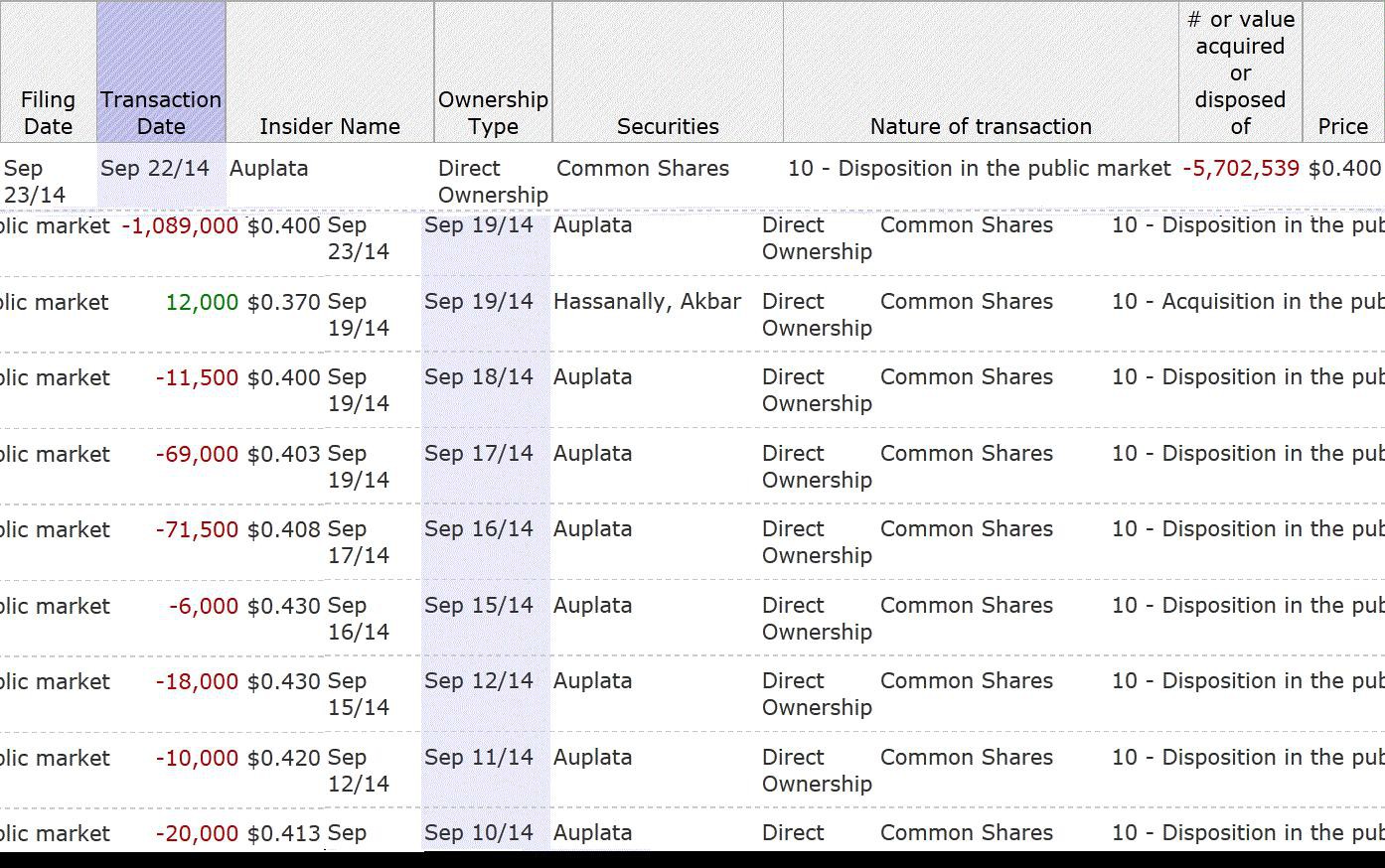

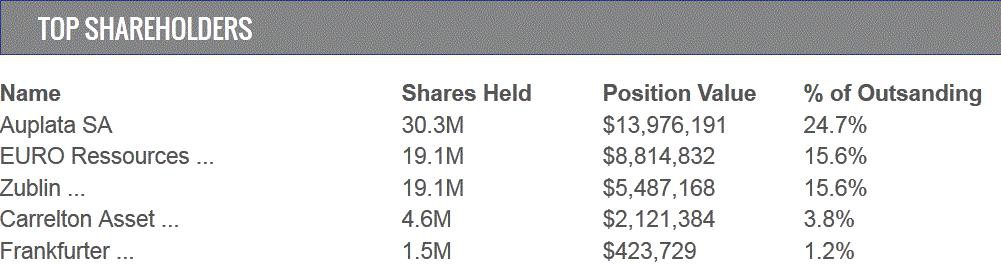

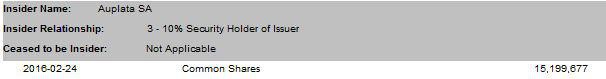

Sep 5/14 Sep 4/14 Auplata Direct Ownership Common Shares 10 - Disposition in the public market -18,000 $0.430

Sep 5/14 Sep 3/14 Auplata Direct Ownership Common Shares 10 - Disposition in the public market -50,000 $0.431

Sep 5/14 Sep 3/14 Auplata Direct Ownership Common Shares 10 - Disposition in the public market -50,000 $0.431

Columbus Gold Drills 3.15 g/t Gold over 33.5 Meters at Montagne d'Or Gold Deposit

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Columbus Gold Drills 4.48 g/t Gold over 38.6 Meters at Montagne d'Or Gold Deposit

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Antwort auf Beitrag Nr.: 47.719.263 von Rokky100 am 08.09.14 09:33:38

Sep 9/14Sep 8/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-32,000$0.412Sep 9/14Sep 5/14Martinez, JorgeDirect OwnershipCommon Shares10 - Acquisition in the public market50,000$0.430Sep 8/14Sep 5/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-10,000$0.405Sep 8/14Sep 5/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-5,000$0.410

Zitat von Rokky100: Sep 5/14 Sep 4/14 Auplata Direct Ownership Common Shares 10 - Disposition in the public market -18,000 $0.430

Sep 5/14 Sep 3/14 Auplata Direct Ownership Common Shares 10 - Disposition in the public market -50,000 $0.431

Sep 9/14Sep 8/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-32,000$0.412Sep 9/14Sep 5/14Martinez, JorgeDirect OwnershipCommon Shares10 - Acquisition in the public market50,000$0.430Sep 8/14Sep 5/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-10,000$0.405Sep 8/14Sep 5/14AuplataDirect OwnershipCommon Shares10 - Disposition in the public market-5,000$0.410

Update: Columbus Gold Releases Excellent Drill Results In French Guiana

http://seekingalpha.com/article/2489735-update-columbus-gold…

http://seekingalpha.com/article/2489735-update-columbus-gold…

The Gold Report Interview with Brien Lundin (9/15/14) "I like Columbus Gold Corp. It is about to get a third drill turning on its Montagne d'Or deposit, part of the Paul Isnard project in French Guiana. Joint-venture partner Nordgold is funding all of the exploration up to $30M or a bankable feasibility study to earn 50.1% of the project. The drill results have been great. One recent hole hit 33.5 meters of 3.15 g/t Au. Essentially, the company is expanding the resource even as they're infill drilling. Columbus also raised some money that will help it advance a great suite of exploration projects in Nevada. It's a company that is going to keep turning out news for the foreseeable future and is a great buy for a long-term investor looking for real value. [In May, Columbus announced that its PEA on the Paul Isnard project in French Guiana overstated the grade and ounces contained in the deposit. A few days later, Nordgold made its scheduled $4.2M payment to Columbus to continue its earn-in.] It's obvious that Nordgold didn't see that hiccup with the resource estimate as an issue. Some of the grades were 'smeared' across areas where there wasn't enough drilling density to support those grades. As the companies continue infill drilling at much tighter drill spacing, they are bringing Inferred ounces into the Indicated category. The deposit is growing because a lot of those ounces were never included in any previous resource estimate. The resource will probably end up significantly larger than it was before that little hiccup. It has a clear path toward production at this point, and it's all paid for." More >

http://www.theaureport.com/pub/co/3373?utm_source=delivra&ut…

http://www.theaureport.com/pub/co/3373?utm_source=delivra&ut…

Columbus Gold: Starker Newsflow – Zwei Company-Maker Projekte jetzt im Fokus

Sieben gute Nachrichten in drei Wochen - da können aktuell wohl nicht viele Firmen aus dem nordamerikanischen Minensektor mithalten.

http://www.rohstoffenews.de/columbus-gold-starker-newsflow-z…

Columbus Gold (TSX-V:CGT) ist ein Junior-Explorer und Projekt-Entwickler, der im Südamerika-Staat Französisch Guyana und im US-Goldminen-Heimatstaat Nevada seine Goldprojekte exploriert und entwickelt.

Der Newsflow während der letzten zwei Wochen ist mehr als ansehnlich und unterstreicht die hohe Qualität der Story, sowie die erstklassigen Perspektiven der Flaggschiff-Assets.

Das Management und die Insider führen aktuell eine sehenswerte Finanzierung über stattliche 10 Mio. CAD durch, die mehr als 20% über dem aktuellen Aktienkurs liegt. Somit liegt großes Vertrauen der Story-Unterstützer und Verantwortlichen vor. Im Hinblick auf die enorm herausfordernde Marktlage im Juniorminen-Sektor und die aktuelle Börsenbewertung ist die oben genannte Summe gewiss beachtlich und spricht für sich.

Das frische Kapital soll für ein umfassendes Explorations- und Bohrprogramm auf dem Nevada-Projekt Eastside verwendet werden, auf dem Columbus im letzten Jahr eine interessante Entdeckung (Gold u. Silber) gelungen ist. Eastside glänzt mit einer herausragenden Infrastruktur und massivem Explorations-Potential.

Parallel treibt die ambitionierte Junior-Firma sein starkes Joint-Venture (50/50) mit dem russischen Goldproduzenten Nordgold (LSE:NORD) in Französisch Guyana voran: Das Paul Isnard Projekt umfasst bereits eine Multi-Millionen Goldunzen schwere Ressource (Montagne D’Or Gold Deposit) und das Projekt besitzt sehr gute Explorations- und Entwicklungs-Perspektiven.

Über einen Zeitraum von 3 Jahren wird Nordgold rund 30 Mio. USD in Columbus’ Hauptprojekt investieren, das Ziel ist die Fertigstellung einer Machbarkeitsstudie. Ein genialer Deal für Columbus, der nicht nur die Qualität und den Top-Ausblick der Story prägnant unterzeichnet, sondern auch gleichzeitig äußerst lukrative Effekte auf der gewöhnlich schmerzhaften Verwässerungs-Seite mit sich bringt.

Das aktuelle Bohrprogramm auf Paul Isnard läuft nach Vorstellung und liefert erfreuliche Ergebnisse und Fortschritte. Erst diese Woche ist Columbus eine weitere Expansions-Bohrung erfolgreich gelungen (step-out discovery). Hier Grafiken.

Neben den operativen Fortschritten legte Columbus zwei weitere gute Neuigkeiten vor. Zum einen erfolgte die Durchführung des Börsen-Listings in den USA, das im Hinblick auf das starke zukünftige Engagement in Nevada definitiv sinnvoll ist. Zum anderen wurde das Experten-Team sehenswert mit einem neuen Vize-Präsidenten verstärkt.

Sieben gute Nachrichten in drei Wochen - da können aktuell wohl nicht viele Firmen aus dem nordamerikanischen Minensektor mithalten.

http://www.rohstoffenews.de/columbus-gold-starker-newsflow-z…

Columbus Gold (TSX-V:CGT) ist ein Junior-Explorer und Projekt-Entwickler, der im Südamerika-Staat Französisch Guyana und im US-Goldminen-Heimatstaat Nevada seine Goldprojekte exploriert und entwickelt.

Der Newsflow während der letzten zwei Wochen ist mehr als ansehnlich und unterstreicht die hohe Qualität der Story, sowie die erstklassigen Perspektiven der Flaggschiff-Assets.

Das Management und die Insider führen aktuell eine sehenswerte Finanzierung über stattliche 10 Mio. CAD durch, die mehr als 20% über dem aktuellen Aktienkurs liegt. Somit liegt großes Vertrauen der Story-Unterstützer und Verantwortlichen vor. Im Hinblick auf die enorm herausfordernde Marktlage im Juniorminen-Sektor und die aktuelle Börsenbewertung ist die oben genannte Summe gewiss beachtlich und spricht für sich.

Das frische Kapital soll für ein umfassendes Explorations- und Bohrprogramm auf dem Nevada-Projekt Eastside verwendet werden, auf dem Columbus im letzten Jahr eine interessante Entdeckung (Gold u. Silber) gelungen ist. Eastside glänzt mit einer herausragenden Infrastruktur und massivem Explorations-Potential.

Parallel treibt die ambitionierte Junior-Firma sein starkes Joint-Venture (50/50) mit dem russischen Goldproduzenten Nordgold (LSE:NORD) in Französisch Guyana voran: Das Paul Isnard Projekt umfasst bereits eine Multi-Millionen Goldunzen schwere Ressource (Montagne D’Or Gold Deposit) und das Projekt besitzt sehr gute Explorations- und Entwicklungs-Perspektiven.

Über einen Zeitraum von 3 Jahren wird Nordgold rund 30 Mio. USD in Columbus’ Hauptprojekt investieren, das Ziel ist die Fertigstellung einer Machbarkeitsstudie. Ein genialer Deal für Columbus, der nicht nur die Qualität und den Top-Ausblick der Story prägnant unterzeichnet, sondern auch gleichzeitig äußerst lukrative Effekte auf der gewöhnlich schmerzhaften Verwässerungs-Seite mit sich bringt.

Das aktuelle Bohrprogramm auf Paul Isnard läuft nach Vorstellung und liefert erfreuliche Ergebnisse und Fortschritte. Erst diese Woche ist Columbus eine weitere Expansions-Bohrung erfolgreich gelungen (step-out discovery). Hier Grafiken.

Neben den operativen Fortschritten legte Columbus zwei weitere gute Neuigkeiten vor. Zum einen erfolgte die Durchführung des Börsen-Listings in den USA, das im Hinblick auf das starke zukünftige Engagement in Nevada definitiv sinnvoll ist. Zum anderen wurde das Experten-Team sehenswert mit einem neuen Vize-Präsidenten verstärkt.

Columbus Gold Places 9.9% Stake with Prominent US Investor in Amended PP

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Besonders aussichtsreiche und substanzstarke Junior-Stories erhalten auch in dieser enorm schwierigen Marktphase Kapital.

http://www.goldinvest.de/index.php/columbus-gold-prominenter…

Sehr spannende News bei Columbus Gold (TSX-V:CGT). Ein überzeugter und wohlhabender Investor aus den Vereinigten Staaten hat sich mit einer Millionen-Summe (> 5,3 Mio. CAD) eingekauft und hält jetzt rund 10% am Unternehmen.

Columbus Gold Places 9.9% Stake with Prominent US Investor in Amended PP

Es war meines Erachtens genau der richtige Schritt von Columbus, die ursprüngliche Finanzierung zu verringern und nun einen Insider-Deal mit einem starken Investor vorzuziehen. So wandern die neuen Aktien in starke Hände (laut des CEOs Robert Giustra "ein besonnener Langfrist-Anleger") und Columbus erhält das Geld ohne neue Warrants ausgeben zu müssen.

Mit der frischen und für diese Marktverhältnisse definitiv beachtlichen Geldspritze kann auf dem fokussierten Gold/Silber-Projekt in Nevada (Eastside) jetzt ein intensives Bohr- und Explorations-Programm gestartet werden.

Parallel werden die Entwicklungen auf dem Flaggschiff Paul Isnard in Französisch Guyana mit dem Projektpartner Nordgold (LSE:NORD) vorangetrieben. So wird der Newsflow in den nächsten Monaten gewiss nicht abreißen..

http://www.goldinvest.de/index.php/columbus-gold-prominenter…

Sehr spannende News bei Columbus Gold (TSX-V:CGT). Ein überzeugter und wohlhabender Investor aus den Vereinigten Staaten hat sich mit einer Millionen-Summe (> 5,3 Mio. CAD) eingekauft und hält jetzt rund 10% am Unternehmen.

Columbus Gold Places 9.9% Stake with Prominent US Investor in Amended PP

Es war meines Erachtens genau der richtige Schritt von Columbus, die ursprüngliche Finanzierung zu verringern und nun einen Insider-Deal mit einem starken Investor vorzuziehen. So wandern die neuen Aktien in starke Hände (laut des CEOs Robert Giustra "ein besonnener Langfrist-Anleger") und Columbus erhält das Geld ohne neue Warrants ausgeben zu müssen.

Mit der frischen und für diese Marktverhältnisse definitiv beachtlichen Geldspritze kann auf dem fokussierten Gold/Silber-Projekt in Nevada (Eastside) jetzt ein intensives Bohr- und Explorations-Programm gestartet werden.

Parallel werden die Entwicklungen auf dem Flaggschiff Paul Isnard in Französisch Guyana mit dem Projektpartner Nordgold (LSE:NORD) vorangetrieben. So wird der Newsflow in den nächsten Monaten gewiss nicht abreißen..

und zusätzlich haben noch ein paar Aktien den Besitzer gewechselt

zur Zeit gibt es eine Aktienwanderung

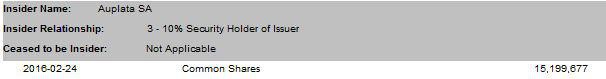

Nordgold Acquires ~9% Stake in Columbus Gold; Appointment of New Director

Vancouver, British Columbia, Canada, October 14, 2014 - Columbus Gold Corporation (CGT: TSX-V; CBGDF: OTCQX) reports that Nord Gold N.V. (LSE: NORD LI) ("Nordgold") has acquired ~9% of Columbus Gold in open market purchases during the period from September 2013 to August 2014 and Mr. Oleg Pelevin, Director of Strategy and Corporate Development for Nordgold, has been appointed to Columbus Gold's board of directors.

Robert F. Giustra, Chairman & CEO of Columbus Gold stated "We're very pleased with the opportunity to benefit from the exclusive insight that comes with the world's fastest growing gold company being a major shareholder and holding a board seat. As Director of Strategy and Corporate Development, Mr. Pelevin has played an instrumental role in Nordgold's success; his unique knowledge and experience are clearly valuable assets for Columbus Gold shareholders."

Mr. Oleg Pelevin holds the position of Director of Strategy and Corporate Development at Nordgold. He has been with Nordgold since its founding in 2007 as the gold mining division of OJSC Severstal, one of the world's leading vertically integrated steel companies. During his tenure, Nordgold has grown aggressively from an ambitious upstart to a major gold producer, and now operates nine gold mines in four countries. In 2013, Nordgold achieved 924,000 ounces of gold production and generated US$1.3 billion in revenue, earning it the distinction of being the world's fastest growing gold company.

The foregoing appointment is subject to TSX Venture exchange approval.

ON BEHALF OF THE BOARD,

Robert F. Giustra

Chairman & CEO

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Vancouver, British Columbia, Canada, October 14, 2014 - Columbus Gold Corporation (CGT: TSX-V; CBGDF: OTCQX) reports that Nord Gold N.V. (LSE: NORD LI) ("Nordgold") has acquired ~9% of Columbus Gold in open market purchases during the period from September 2013 to August 2014 and Mr. Oleg Pelevin, Director of Strategy and Corporate Development for Nordgold, has been appointed to Columbus Gold's board of directors.

Robert F. Giustra, Chairman & CEO of Columbus Gold stated "We're very pleased with the opportunity to benefit from the exclusive insight that comes with the world's fastest growing gold company being a major shareholder and holding a board seat. As Director of Strategy and Corporate Development, Mr. Pelevin has played an instrumental role in Nordgold's success; his unique knowledge and experience are clearly valuable assets for Columbus Gold shareholders."

Mr. Oleg Pelevin holds the position of Director of Strategy and Corporate Development at Nordgold. He has been with Nordgold since its founding in 2007 as the gold mining division of OJSC Severstal, one of the world's leading vertically integrated steel companies. During his tenure, Nordgold has grown aggressively from an ambitious upstart to a major gold producer, and now operates nine gold mines in four countries. In 2013, Nordgold achieved 924,000 ounces of gold production and generated US$1.3 billion in revenue, earning it the distinction of being the world's fastest growing gold company.

The foregoing appointment is subject to TSX Venture exchange approval.

ON BEHALF OF THE BOARD,

Robert F. Giustra

Chairman & CEO

http://www.columbusgoldcorp.com/s/NewsReleases.asp?ReportID=…

Columbus Gold Identifies Four New Targets at Eastside Gold Project, Nevada; Samples up to 24 g/t Gold

http://www.minenportal.de/artikel.php?sid=120229&lang=en#Col…

http://www.minenportal.de/artikel.php?sid=120229&lang=en#Col…

One of the Best Trading Setups I've Seen Since 2008

http://www.growthstockwire.com/3897/one-of-the-best-trading-…

http://www.growthstockwire.com/3897/one-of-the-best-trading-…

Columbus Gold Completes Environmental Baseline Field Studies at Montagne d'Or Gold Deposit